Harry S. Dent Jr.'s Blog, page 141

August 12, 2015

The Fed Is Starting to Spout Some Pretty Bold Statements!

Here’s a bold statement: Despite weak economic data prior to and since last month’s Fed meeting, Atlanta Fed President Dennis Lockhart unexpectedly disclosed that he would want to raise rates in September. That is, unless there was a “significant deterioration” in the economy before then.

Since Lockhart is neither a hawk nor a dove, analysts look to his opinion as an indicator to what the Fed might be thinking. Sure enough, the markets reacted and interest rates spiked on his comment.

I’ve mentioned before that the Fed has been all talk and no action. Well, here we are again!

I can understand the markets reacting to economic data releases. But for a Fed official – especially a voting member – to start spouting off, causing a market stir? That’s just frustrating.

Was Lockhart trying to talk the market up after the worst quarterly result from the employment cost index’s 33-year history? Of course, his comments were made before Challenger released its job-cut report announcing over 105,500 layoffs last month.

Or, maybe he was trying to brush over our year-over-year inflation reading of 1.3%. After all, we’re still a ways off from the Fed’s target reading of 2% from the Bureau of Economic Analysis PCE Index.

Adding to the picture, Friday’s jobs report went pretty much as expected. The economy added 215,000 jobs. Wages rose 0.2% with the participation rate at 62.6% (again matching the worst level since 1977). And the unemployment rate was 5.3%, again, as expected.

Stocks and bonds didn’t react too much to the jobs report and Treasury yields continued to move slightly lower. Then Monday, the Fed’s Labor Market Conditions Index was weaker than expected, just slightly above last month but still showing very soft employment growth.

On top of a mixed employment picture and near-zero real inflation, Lockhart’s own Atlanta Fed reported a GDPNow forecast of a mere 1% growth rate for the U.S. economy in the 3rd quarter!

That might make Mr. Lockhart’s comments about raising rates seem laughable, but it goes to show you that the Fed can indeed talk the market into action.

For instance, Lockhart spoke again Monday, and while he didn’t mention September, he did say the Fed is “close” to raising rates. Again, Treasuries sold off and yields rose. Lesson learned? If they can’t do anything, they sure can talk.

For now, he’s passed the baton on to William Dudley, another voting member of the FOMC who will be speaking Wednesday. May the drama continue.

Lance Gaitan

Editor, Dent Digest Trader

August 11, 2015

Vancouver’s Revolting! This Is One Housing Bubble Ready to Pop

Vancouver is my favorite city in North America. It’s my second favorite in the world, roughly tied with Capetown, South Africa.

The top spot goes to Sydney, Australia. Then San Francisco and Austin round out my top 5.

That said, I’m not the least bit surprised that Vancouver has become a prime example of the global real estate bubble, and one of the single most bubbly cities on the planet.

The argument is always this: They ain’t making any more real estate. And the people still want what’s there, so the best spots will go up, up, up. Oh, and we’re the best.

I’ve heard the same thing in any bubble city I’ve been to. New York, Miami, San Francisco, L.A., Singapore, Shanghai, Beijing, London, Paris – they all think they’re invincible. And I’m sure Tokyo’s residents said the same at the height of their boom in 1989. Now, 26 years later, their real estate is still down 60%. Commercial real estate, down 80%.

Make no mistake, Vancouver will pop just like all the others.

No bubble lasts forever. Whether it’s stocks or real estate, when it grows so exponentially that it outpaces more fundamental economic growth, there comes a point when almost no one can afford the higher prices.

That’s what’s happening in Vancouver and so many other bubbly cities. Tons of wealthy international immigrants and speculators – and even some national migrants – come in and jack the costs up. Then the locals start demanding that the government restrict these real estate purchases. As citizens, they increasingly demand the government represent them, not these “damn foreigners.”

These “damn foreigners” are primarily wealthy Chinese foreign buyers picking up the nicest real estate – in this case, downtown areas like Vancouver Island and the poshest suburb across the Bay in West Vancouver.

For a coastal city like Vancouver surrounded by water and mountains, there’s already limited land to begin with.

But when real estate gets so expensive that even hardworking, upper-middle-class residents can’t afford to live there? Let alone buy a house? It’s crazy!

I knew Vancouver had issues. I’ve been saying it’s in a bubble for years. But a recent report from Julie Gordon at Reuters tipped us off to the fact that its citizens are literally revolting.

She quotes a recent poll that says 67% of Vancouver’s residents believe foreign investing has caused their homes to become unaffordable, and 70% want the government to do something about it. We followed up and got some more refined numbers from her.

Vancouver West, the most expensive downtown area, has seen prices go up 88% from 2010 to 2015. In Canadian dollars, that’s from $1.58 million to about $2.97 million. Or in U.S. dollars, close to $2.26 million.

West Vancouver, a separate spot across the bay, is nearly as high at $2.37 million Canadian dollars ($1.825 million USD). And the somewhat more affordable east section of downtown has gone from $755,000 to $1.238 million ($953,000 USD). Is that ridiculous or what!?

But this doesn’t just affect the most expensive areas of Vancouver. The whole damn city is inflated! Look:

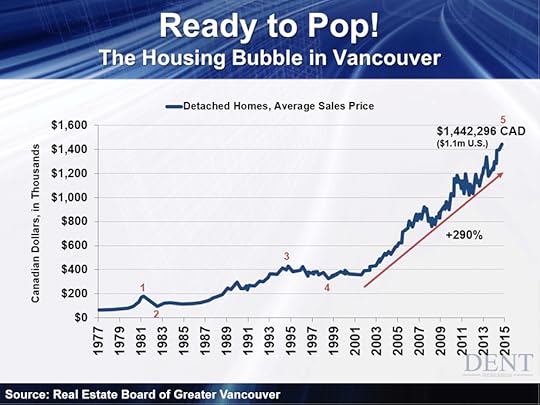

This chart shows the rise in prices for detached, single-family homes across the larger metro area, not just downtown.

You’ll notice by the red arrow that I measure that this bubble started at the beginning of 2002. Home prices have gone up 290%, or 3.9 times since then. This bubble has extended more than nine years after the bubble peak in the U.S.

Part of this is due to the city’s strong economic growth coupled with its limited supply of real estate. That’s fair. But the single biggest reason is this high level of foreign buying, especially affluent Chinese rushing to get their money out of China before the world’s greatest bubble bursts there. It’s gotten completely out of hand!

Compared to Vancouver’s 290%, Canada’s broader six-city index – which measures six of the nation’s wealthiest cities – has only risen 128%. Still a lot, but less than half of Vancouver!

Calgary is next at 133%. Then Montreal at 124%, and Toronto at 115%.

I don’t need to beat this horse to death, but anyone with eyeballs can see that what’s going on in Vancouver is a bubble, plain and simple.

Mind you – this is an issue that extends beyond Canada’s bubbliest city. People have been protesting in San Francisco, arguably the worst bubble in the U.S., for years. Its downtown area and Silicon Valley an hour south are the most expensive places in the entire country, with Manhattan just behind.

And whereas protests in Vancouver focus on affluent Chinese spoiling the party, protests in San Francisco target Google. They see the big tech company as a symbol of the high-earning tech workers coming in from other parts of the U.S. and around the world.

To most, we love Google. To more and more San Francisco residents, it’s a threat to their place of living and very lifestyle.

Elsewhere, there’s Singapore (which I covered back in February), whose citizens became so angry that its government finally slapped a 26% surcharge on all foreign buyers. It also mandated an extra 16% tax if those buyers flipped the property within one year. If within two years, an extra 12%.

And what happened? Real estate prices there are falling substantially!

On the one hand, it’s because citizens revolted. On the other, it’s because every bubble bursts. Always. Period. No question. Regardless of what caused it – be it high natural growth, excess demand, limited supply, government giveaways, absurdly low interest rates – they all end. The bubble eventually defeats itself and causes demand to ultimately fall when there few left that can afford it.

And Vancouver, as bubbly as it is, is just a piece of the global real estate bubble that will start to burst over the next year as more and more cities like Singapore start to crack.

I guarantee it.

Harry

Follow me on Twitter @harrydentjr

401(k) Plan: Check to Make Sure You’re Doing These Two Things

I’m going to go out on a limb here and make an assumption: You haven’t looked at your 401(k) allocation in months.

In fact, if you’re like most Americans, you probably haven’t looked at it once all year.

Don’t feel bad. If it weren’t for the fact that I write about 401(k) allocations professionally, I probably wouldn’t monitor mine as closely as I do. There’s just nothing sexy about an account full of standard mutual funds.

But while your 401(k) plan just doesn’t seem exciting enough to bother watching, you really should take a good 10 minutes today and give it a look.

That’s because the decisions you make with your boring, plain-as-vanilla 401(k) plan are a lot more important to meeting your retirement goals than that sexy options spread or small-cap biotech stock you’ve been eyeing.

As I wrote earlier this year, the humble 401(k) plan is the only investment vehicle I have ever seen that offers returns of up to 46% per year just for showing up… without putting a dollar at risk in the stock market.

So, before you close this article and get on about your day, I want you to log into your 401(k) site and do two things.

First, and most importantly, check your contribution levels. Check to see how much you are putting in per paycheck, and ask yourself – can you afford to chip in more?

You are now able to sock back $18,000 per year – $24,000 if you’re 50 or older.

Imagine all the money you’d be saving in taxes if you contributed that much per year!

If you’re in a high tax bracket, you’re probably paying 40% of your income in taxes. That means if you put $18,000 into your 401(k) plan, which is tax-deferred, you’d effectively save $7,200 a year in taxes alone!

That’s why I recommend maxing out your contribution levels. Hell, I’d go so far as to say you should actually put in more than you can afford.

Given the tax breaks, I’d also consider spending down other savings and stuffing them into the 401(k) plan. By converting your other savings into the 401(k), you’re just saving yourself a bunch in taxes.

Secondly – and this is nearly as important – check your current asset allocation. You don’t necessarily need to make any major allocation changes today. But at least be aware of what you own.

The time is coming when you’re going to want to get defensive and take a little money off the table. The U.S. stock market is broadly overvalued. It’s looking more and more at risk. The last thing you want when the market takes a turn is to have a retirement plan primarily allocated to stocks!

So make sure you scope out a few bond or money market funds. That way, when the time comes, you can switch to cash and avoid suffering a major dent in your portfolio.

Charles Sizemore

Editor, Dent 401k Advisor

August 10, 2015

Muni Mayhem: This Boring Sector Is Starting to Heat Up!

I’m not above keeping the money that I find in the clothes dryer. I’m happy to snag a single or even a five-dollar bill, but coins are also appreciated. The cash usually belongs to one of the kids, and I figure that if they were careless enough to let it go through the laundry, then obviously they don’t miss it.

This collecting of capital is in keeping with how I view the rest of my funds. Not only do I like to grow my assets, but I like to keep them as well, which is why I’m so fond of municipal bonds. These investments are typically tax exempt, so all of my earnings escape the gaze of the taxman, who can’t seem to get enough of what other people have.

This boring corner of the investment arena generally has all the excitement of a pet rock circus, but recently that’s changed. The new worries in the muni market might be troubling for some, but they give the rest of us a chance to snag assets on the cheap.

The long-term default rate in municipal bonds is a fraction of one percent. Only 0.17% of the bonds in the S&P Municipal Bond Index defaulted in 2014. This followed an even lower rate of 0.11% in 2013.

Based on this information, the risk of default appears exceptionally low. But the historical numbers don’t tell the whole story. There are two big caveats.

A spectacular default in one city can cloud the entire market. Besides that, municipalities have new challenges that they have not faced before.

As for big defaults in the news, Detroit comes to mind. I’ve written before that its bondholders were treated worse in the bankruptcy than the letter of the law allowed. They brought home pennies on the dollar, while other creditors that were subordinate were made whole.

This is a recurring theme across the country, so it’s no surprise, but it still serves as a warning to all municipal bond investors.

General obligation bonds state that the payments to bondholders are backed by the full faith and credit of the issuer, but in times of crisis, issuers don’t hold up their end of the bargain.

Bond buyers are forced to accept less than they’re owed, and so far haven’t prevailed when they challenged these outcomes. Creditors of cities like Pritchard, Alabama, Central Falls, Rhode Island, and Stockton, California have all suffered similar fates.

A large bankruptcy on the horizon is Puerto Rico. In fact, it defaulted on its bonds last Monday. The U.S. territory can’t pay its bills, so now it’s calling on all “stakeholders” to negotiate in “good faith.”

In other words, they want bondholders to agree upfront to cut the face value of what the territory owes them. This is despite the fact that many of those bondholders own general obligation bonds – which, again, are backed by full faith and credit of the territory.

Territory officials are putting investors on notice that even though their constitution states debts must be paid before all other creditors, the government won’t cut any operational expenses (salaries, services, etc.) in order to make good on their principal and interest payments.

Adding to the uncertainty unleashed by the proceedings in recent municipal bankruptcies and the developments in Puerto Rico are the ballooning costs of pensions and health care benefits that cities and states around the country are facing.

While unfunded pension liabilities are old news, the accounting board governing these entities only recently required that unfunded health care liabilities be included in city and state calculations of financial health.

The results are ugly. In addition to a trillion-dollar unfunded pension problem, it’s now clear that municipalities in the U.S. also have a trillion-dollar unfunded healthcare problem.

As these figures make it onto the financial statements, the fact that many cities and even a few states are bankrupt on paper will start to sink in with ratings companies, analysts, and investors.

While none of this is good news, it can have a good outcome.

The combination of high-profile bankruptcies, bondholder treatment in bankruptcy proceedings, the direction of negotiations in Puerto Rico, and the sudden addition of a trillion dollars in liabilities to books should produce enough uncertainty and concern in the municipal market to drive prices down and yields higher.

The negative news cycle could even cast a pall over all municipal bonds, giving investors a chance to pick up high quality names on the cheap.

This is where work and patience pay off.

The key to buying municipal bonds is the same as purchasing any other investment. Do your homework. The old way of buying bonds – look at the rating and pull the trigger – is dead. Anyone who trusts a rating deserves the outcome, whatever it is.

Instead, investors can and should review the finances of bond issuers and determine for themselves how likely it is the city or state will make good on its debts. I know the overwhelming majority of them will, but not all.

Once investors have found and purchased bonds issued by solid municipalities, then they must be patient. The negative news over municipal bonds won’t go away anytime soon.

This particular market will likely be roiled by turmoil as the problems in cities and states in tough financial positions, like Chicago and Illinois, come to the surface. But as long as investors did their homework and hold solid bonds, they won’t have to worry.

Their principal and interest will keep landing in their mailbox. And the best part is, they still won’t have to send any of it to the taxman.

Rodney

Follow me on Twitter @RJHSDent

August 8, 2015

One Genetics Company Is Working to Simulate DNA Experimentation

Over the past year, the biotechnology community has become absorbed with the idea of editing genes to eradicate hereditary diseases and cure various forms of cancer.

Our nations’ finest universities developed a new gene-editing system called CRISPR that made this possible.

With great power though, comes great risk. Many scientists have called for heavy regulations in this area. What if a serious genetic mutation gets released into the human population unknowingly? Or worse, what if experiments on live human embryos end up killing them?

These are legitimate concerns. That’s why the biotechnology community was outraged earlier this year when Chinese scientists decided to perform gene-editing experiments on live human embryos. Mind you, these embryos were already terminal. But it crossed a line that many felt the community should stay behind. At least until it can create new safety measures.

One company that hopes to create such measures is a Canadian startup called Deep Genomics. The company feels it can provide a safe alternative to live genetic-editing. How? By using artificial intelligence to predict the results.

Sound crazy? Well, it’s certainly innovative. Doing this means running the characteristics of each gene through a computer. Then, crunching billions of data points to forecast the outcome.

Essentially, this means testing the DNA in question through a virtual simulation of the real thing! If the algorithym shows little risk, then tools like CRISPR could be used on live DNA with a greater likelihood of success.

Deep Genomics’ founder, Brendan Frey – who is the head of the Probabilistic and Statistical Inference Group at the University of Toronto – says: “We can use our system to determine the efficacy of therapies. Whether it’s a drug, or a CRISPR gene editing system – whatever it is, our technology allows us to predict the effects of those modifications.”

The company enters at a time when new initiatives are being developed to offer patients customized diagnosis and treatment options based on their own DNA.

A system like Deep Genomics’ will allow doctors to understand the potential outcomes and side effects of medicine on a patient, before it’s even prescribed!

Hold on to your seats for the rest of 2015 as we continue to see technology roll out that was previously only dreamed about in movies!

Ben Benoy

Editor, BioTech Intel Trader

August 7, 2015

China’s Crooked Government Is Absolutely Lying About Its Economy

I and a few brave experts such as Jim Chanos, Gordon Chang, and David Stockman (speaking at our upcoming IES conference) have been arguing for years that China has the greatest investment and overbuilding bubble in all of modern history.

We’ve also warned that its economic statistics are not real – they are purposefully overstated and then revised later, if at all.

I don’t see how this top-down dinosaur of a centrally planned government can continue in power. I don’t even know how it can exist in a free market/democracy-driven age that already saw the centrally planned economy of the Soviet Union fail miserably.

This is their current strategy to stay in power: Hiring low-skill workers to build more infrastructure and real estate than is actually needed, and keep moving unskilled immigrants from rural to urban areas on a scale never before seen in history…

The demand isn’t even there! They’re just building things no one’s going to use just to keep these people employed and happy. It can’t continue. And when it doesn’t, I don’t see how China will be able to stop these people from revolting.

Since 1983, over half a billion Chinese have moved to the city. 220 million of those just since 2002!

And there are now over 220 million urban residents that are not legal citizens where they live – like illegal aliens from Mexico here in the U.S.

Do you see a problem if this overbuilding and debt-fueled strategy of over-expanding finally ends?

There will be hundreds of millions of unskilled workers stuck in cities. And they won’t even be able to go back to their rice paddies. By now they’re probably paved over with empty condos!

China’s government thinks if it keeps the people employed then they won’t question the corrupt, crony capitalist system in place. So it continues to push its top-down planning through local communist governments that almost totally drive infrastructure and business investment – with no regard whatsoever for free markets!

Sound like a success strategy?

Economists call this an “economic miracle.” The new “state-driven” capitalist model.

I call it absolute BS! Pardon my French.

Adam Smith and the founding fathers of American democracy would have a conniption fit if they heard this!

So let me just add a few charts to the conversation. You might have seen them in other pieces I’ve written. They suggest China’s economy is already failing beyond its recent 35% stock crash – which, by the way, would have been more like 50% if the all-controlling bureaucrats had not totally stepped in and manipulated the markets for their best interest, once again.

Oh… the Mafia would have worshipped the Communist party of China. What’s not to love? Total top-down control and power. Crony wealth in a closed economy. Secrecy. Piracy. I could go on forever. This is heaven for crooks!

China’s Crooked Government Is Absolutely Lying About It Economy

I and a few brave experts such as Jim Chanos, Gordon Chang, and David Stockman (speaking at our upcoming IES conference) have been arguing for years that China has the greatest investment and overbuilding bubble in all of modern history.

We’ve also warned that its economic statistics are not real – they are purposefully overstated and then revised later, if at all.

I don’t see how this top-down dinosaur of a centrally planned government can continue in power. I don’t even know how it can exist in a free market/democracy-driven age that already saw the centrally planned economy of the Soviet Union fail miserably.

This is their current strategy to stay in power: Hiring low-skill workers to build more infrastructure and real estate than is actually needed, and keep moving unskilled immigrants from rural to urban areas on a scale never before seen in history…

The demand isn’t even there! They’re just building things no one’s going to use just to keep these people employed and happy. It can’t continue. And when it doesn’t, I don’t see how China will be able to stop these people from revolting.

Since 1983, over half a billion Chinese have moved to the city. 220 million of those just since 2002!

And there are now over 220 million urban residents that are not legal citizens where they live – like illegal aliens from Mexico here in the U.S.

Do you see a problem if this overbuilding and debt-fueled strategy of over-expanding finally ends?

There will be hundreds of millions of unskilled workers stuck in cities. And they won’t even be able to go back to their rice paddies. By now they’re probably paved over with empty condos!

China’s government thinks if it keeps the people employed then they won’t question the corrupt, crony capitalist system in place. So it continues to push its top-down planning through local communist governments that almost totally drive infrastructure and business investment – with no regard whatsoever for free markets!

Sound like a success strategy?

Economists call this an “economic miracle.” The new “state-driven” capitalist model.

I call it absolute BS! Pardon my French.

Adam Smith and the founding fathers of American democracy would have a conniption fit if they heard this!

So let me just add a few charts to the conversation. You might have seen them in other pieces I’ve written. They suggest China’s economy is already failing beyond its recent 35% stock crash – which, by the way, would have been more like 50% if the all-controlling bureaucrats had not totally stepped in and manipulated the markets for their best interest, once again.

Oh… the Mafia would have worshipped the Communist party of China. What’s not to love? Total top-down control and power. Crony wealth in a closed economy. Secrecy. Piracy. I could go on forever. This is heaven for crooks!

August 6, 2015

Fracking: Not All It’s Cracked Up to Be

Fracking was all the rage between 2009 and 2014.

The euphoria that enshrined this “new” industry was palpable in the wake of the 2008 credit crunch, as investors clamored for the next economic savior. Hydraulic fracturing was supposed to be it.

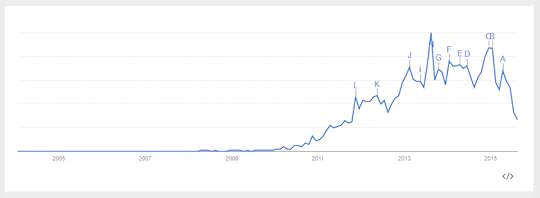

Google Trends shows that internet searches for the term “fracking” peaked in August 2013. That’s about eight months after Matt Damon’s environmentally-bent expose of the industry, Promised Land, was released. Take a look at the epic rise in the popularity of fracking…

We too covered the topic of fracking – coincidentally – in our August 2013 issue of Boom & Bust.

At the time, crude oil prices were hovering around $105 a barrel. Natural gas was dirt cheap, having fallen from roughly $20 in 2008 to $3 by August 2013.

Indeed, there was promise in the drilling technologies that were then going mainstream. And we would have been remiss not to have covered the topic. But, at the same time, we saw a plethora of landmines ahead.

For one, Harry’s long preached of the deflationary forces that drag commodity prices lower. And so hydraulic fracking only stood to make economic sense as long as the price of crude oil was sufficiently high.

Now that crude is trading for under $50 a barrel… fracking just isn’t that great anymore!

In full disclosure, I recommended to Boom & Bust subscribers a way to play the fracking story. But it wasn’t what most expected.

In that August 2013 issue of Boom & Bust, I explained how it was too risky to bet on the price of natural gas directly – via an ETF, such as the United States Natural Gas Fund (NYSE: UNG).

I also warned that exploration and production companies – the operations that find, claim and pull natural gas from the ground – were subject to commodity price risk. And I said those companies were too risky to invest in.

As an alternative to those poor options, I recommended an unlikely stock… one that had been in existence many decades longer than fracking. And one that had all the makings of a “Winter Season Shakeout Winner,” as I called it at the time.

I don’t often write “I told you so” pieces… but that stock I recommended, it’s still in our Boom & Bust portfolio at a 54% profit.

Meanwhile, this chart shows the collapse in oil prices (USO), natural gas prices (UNG) and oil exploration and production companies (XOP). These have all already collapsed, between 32% and 56%.

So while much of the investment world was gravitating to the new and exotic wonder of hydraulic fracking, jumping in head first, risks be damned, we saw the dangers ahead and charted a more prudent, long-term course for profits.

Adam O’Dell

Chief Investment Strategist, Dent Research

August 5, 2015

Oil Prices About to Strike a Death Blow to This American Industry

8 Questions Every Investor Must Ask to Beat the Norm

This past weekend I read through a handy book called The Most Important Thing: Uncommon Sense for the Thoughtful Investor by Howard Marks. Marks is co-founder of Oaktree Capital Management and the book is a collection of memos he has sent to his clients over the years.

One of the more interesting chapters refers to something he calls “second level thinking.” While first level thinkers might buy a stock because the company is good, a second level thinker will realize that many people already think it’s a great company. Therefore, they realize positive sentiment is already priced into the current value, resulting in an overrated stock that should be sold rather than bought.

Since I predominantly short stocks and bet against companies – you might call me a bear – I’ve been performing second level thinking for years. I just never called it that or realized someone had a term for it.

As a short seller, you have to take many variables into account. It’s not enough to think that a stock is overvalued and that you should short it. That’s first level thinking that will lead to average outcomes.

Marks presents a great checklist regarding second level thinking that I plan to incorporate into my own work. So I wanted to share it with you because I think it could be useful in doing your own investment analysis.

These are the variables he suggests second-level thinkers take into account:

What is the range of likely outcomes?

Which outcome do I think will occur?

What’s the probability I’m right?

What does the consensus think?

How do my expectations differ from the consensus?

How does the current price for the asset comport (or behave) with the consensus view of the future, and with mine?

Is the consensus psychology that’s incorporated in the price too bullish or bearish?

What will happen to the asset’s price if the consensus turns out to be right, and what if I’m right?

I think that asking those questions before making an investment, and keeping tabs on them while a trade is in play, can dramatically improve your results!

John Del Vecchio

Contributing Editor, Dent Research