Mike Moyer's Blog, page 7

April 5, 2018

The Four Horseman of the Equity Apocalypse

Bad equity agreements are extremely common. The prevailing wisdom—worldwide—about how equity is split is virtually guaranteed to cause problems. I take calls and get emails literally every day from people trying to figure out a fair split within the flawed logic of conventional wisdom.

What’s really scary it that the conventional wisdom is perpetuated by smart, well-meaning, experienced people who, at their core, think they are providing good advice. The good news is that there is a founder equity split model that creates a fair split.

There are four major problems with the way most equity splits are created in early-stage, bootstrapped companies. These are the “Four Horseman of the Equity Apocalypse” because the presence of any one of them can easily doom a fledgling startup by causing disputes between founders and other participants that have nothing to do with the actual business. A tragic tale told over and over and over…

If you’re a party to an equity split with any or all of these fatal flaws brace yourself—things are going to get ugly!

Horseman Number One: Fixed Equity Splits

The most common and most dangerous of the Four Horseman is a fixed or static equity split. This is when fixed chunks of equity are doled out in percentages to founders, usually in advance of any real work being done. A chunk for the founder, a chunk for the first few employees, some little nuggets for lawyers and advisors, and a “hold-back” for future employees and investors. The most common type of split is the dreaded even split where the equity is split evenly among the founding team such as “50/50” or “25/25/25/25”.

At the core of the fixed equity split problem is the fact that it will not accommodate unforeseen changes in the team, strategy, funding or any other future events. In other words, getting a fixed equity split right requires the founders to accurately predict the future, which, of course, is impossible. So, when something inevitably changes, the team must renegotiate the split. A painful, often hostile, experience which only leads to yet another fixed split creating a downward spiral that can easily require costly and distracting legal intervention.

Horseman Number Two: Time-Based Vesting Schedules

People implement fixed equity splits with a tacit understanding that things may change even though their fingers are crossed. In an attempt to mitigate the possibility that someone will leave the company with a huge chunk of equity it is quite common to slap on a time-based vesting schedule. The usual terms are a four-year vesting with a one-year cliff. This means the individual receives restricted shares that are subject to forfeiture in the event they leave the company. Unvested shares return to the company’s authorized share pool whereas vested shares are owned by the employee. A portion of the shares (usually 1/48) vest each month except during the first year which is subject to the “cliff”. The cliff means that no shares vest during the first year, but ¼ of the shares will vest on the first anniversary. I’m not sure who came up with this. During the dot-com bubble it seemed that a five-year vesting schedule was more common, but it doesn’t really matter. Time-based vesting schedules do nothing but confuse people’s incentives.

A time-based vesting schedule implies that time is the only thing that really matters with disregard to an individual’s actual contribution during the time period. And, because the commitment levels of early-stage company participants can vary widely, this becomes a real problem. Under this agreement, the only thing that matters is that a person keeps his or her job. It provides no direct incentive to perform well. Sure, people are supposed to do a good job so that their equity will someday be valuable, but the basic terms of the deal do not reflect that sentiment.

The real incentive is for a person to keep his job until the stock vests and then he is free to consider other options. It’s kind of a like a mobile phone contract. Once you’re out of the contract you might stay with the same carrier, but you have no obligation. I once worked for a startup company with a five-year vesting schedule with annual vesting. People routinely quit on their fifth anniversary. It was a sad joke in the company.

To make matters worse, with time-based vesting schedules managers have an incentive to terminate employees before they vest. This, too, is quite common.

Because incentives are conflicting and time-based vesting does no reflect actual contributions conflict often arises when employees separate from the firm. Which leads us to….

Horseman Three: Lopsided Stock Purchase Agreements

Stock purchase agreements are designed to do a number of things that aren’t all bad, but too often they are designed to protect the business and not the employees. For example, many stock purchase agreements allow the company to force a buyback of shares from a departing employee. As stated before, when an employee leaves a company their unvested shares are forfeited. Their vested shares, however, may be subject to a buyback. This means that even after you fully vest, the company can buy your shares back. The price is usually defined by the agreement and not based on current market price. So, if you receive shares with a par value of $0.01, you may be forced to sell the shares back to the company. Imagine you forgo a $100,000 annual salary for four years and fully vest. When you leave, the company buys your shares back for $10,000. Smells like a lawsuit waiting to happen and when it does, the terms of the agreement are pretty clear and employees are the losers. Remember, just because it’s legal and just because you signed it doesn’t mean it’s fair. I’ve been a victim of this before, it’s not pretty.

In an effort to protect against future problems, stock-purchase agreements are often full of terms like anti-dilution, claw-back, right of first refusals and other terms that simply over complicate the deal.

Unfortunately, because most stock purchase agreements are written by the company’s attorney, they usually provide protection for the company interests at the expense of the employee. Most start-ups won’t negotiate terms with individual employees on a one-off basis. These are usually take-it-or-leave-it deals that can easily lead to a destructive dispute.

Horseman Four: Premature Valuations

If founders sell X% of the company to one of their moms for $Y the implied value of the company is $Y/X%. So, if mom buys 10% of the company for $2,000 the implied value of the company is $2,000/10% = $20,000. This is a premature valuation because it was set early on in the company’s life with no grounding in reality. In most cases, a company is worth $0…until it’s not.

Premature valuations cause a number of real problems. Mom get’s a fixed percentage for a fixed dollar amount. Her exposure is limited, yet the founders, who are not getting paid, have unlimited exposure. The more they work, the bigger their investment gets relative to hers, yet her percentage stays the same.

The next problem is one of dilution. Early friends & family deals are notorious for poor documentation so when the next investor comes on board does mom dilute? If so, she might get upset, if not, the investor may walk away.

Yet another problem of premature valuation is that when new shares are issued, the IRS may decide to tax the individuals who receive them even though no cash exchanged hands. And, because most early-stage bootstrapped companies have a $0 valuation, the poor souls are stuck paying taxes on worthless shares.

Premature evaluations lead to disputes because tartup founders are not really qualified to assess an unbiased valuation for their own companies (neither are their mom’s).

Start-up companies should avoid setting a valuation until one of two possible events occur. The first is when the company has reached a breakeven point and can pay salaries and expenses. When this happens, a qualified professional can conduct a 409A valuation based on the revenue, assets, customer base or other observable elements of the company. Additionally, the employees and founders’ exposure is now limited to previously forgone salaries, investments and expenses.

The second possible event is during a Series A investment led by professional investors. Usually a VC or “super angel” these are people who invest other people’s money or have obtained considerable wealth and are in the business of investing. These people will provide enough cash to cover expenses and salaries in the short to medium term (again, limiting the employee’s exposure). They negotiate the valuation and investment terms with the founding team.

Avoiding the Four Horsemen

The only way to completely avoid the Four Horsemen of the Equity Apocalypse is to use the Slicing Pie model for equity allocation and recovery. Slicing Pie is a logical alternative to illogical traditional equity splits.

You avoid the fixed equity horseman because Slicing Pie is a dynamic split model that automatically adjusts based on the relative contributions of each person. This means that no matter what changes, each person is guaranteed to have a fair percentage of the final outstanding shares at breakeven or Series A.

You avoid the time-based vesting horseman because Slicing Pie, in a C-Corp or S-Corp, becomes the basis for vesting removing the arbitrary timeline. This means people’s incentives are aligned and each participant is adequately protected.

You avoid the lopsided stock purchase agreement horseman because the rules of Slicing Pie are perfectly balanced and ensure each participant is treated fairly.

Lastly, you avoid the premature valuation horseman because Slicing Pie works during the bootstrapping stage, before a valuation can be set. Allocations are based on a function of the relative contributions or “bets” placed on the company. Additionally, the Slicing Pie funding strategies, likewise, do not require a formal valuation.

Post Pie

After Slicing Pie terminates, the Four Horsemen of the Equity Apocalypse become friendly little ponies that will help, not hurt, your company. Equity splits naturally become fixed because the company will be able to provide fair market compensation and reimburse expenses to employees. Once everyone is getting paid, a bonus/option incentive program can be put in place and a time-based vesting schedule can help retain key employees. Stock-purchase agreements are replaced by option agreements or cash investors that can provide more logical terms. Finally, valuations can be set by professional investors and the stock price can be used to set the option strike price.

The Four Horseman of the Equity Apocalypse are a danger during the company’s early stage when it is still bootstrapping, the future path is unclear, participants are not compensated and the company is at it’s most vulnerable. It is during this critical time that conventional equity split models simply don’t make sense. Only Slicing Pie can allow your company to create a fair, conflict-free cap table and avoid apocalyptic equity disputes.

March 7, 2018

Avoiding Unnecessary Taxes With Slicing Pie

There is more than one way to make a Pie from a legal standpoint, the big issues relate to how shares are actually issued in a way to avoid unnecessary taxes. All equity-split models create more or less tax exposure depending on how the deal is executed. In some cases, the final split can be adjusted upon termination of the Pie even if shares have already been issued.

For instance, a team may have issued each founder a fixed number of shares at the outset of the venture and would like to make an adjustment to reflect the fair Slicing Pie split. Let’s say Joe and Tom had 500 shares each when they created a 50/50 split. At breakeven, Slicing Pie indicates a fair split of 60/40 based on the actual contributions. Issuing 250 new shares to Joe would mean he has 750 shares and Tom has 500. The new split is now 60/40 because there are now 1,250 outstanding shares. However, the new shares might trigger an income tax for Joe even though he was not paid in cash. Especially if the Pie bakes as the result of a Series A investment which would set a price for the shares that would apply to the new shares.

To avoid the income tax, it would be smarter to buy shares back from Tom at a pre-set value. The stock-purchase agreement could specify a buy back price of a nominal value upon termination of the fund (like a penny). Thus, no new shares would be issued and no tax would apply. Joe would keep his 500 shares, but Joe would sell back 166.67 shares for $1.68 leaving him with 233 shares. Now the outstanding total is 833 and the partners still have a 60/40 split.

The math can get a little tricky when there are multiple contributors who own shares, which is why you can use the Slicing Pie recalibration tool as explained in the video below:

Download the Spreadsheet

Another common scenario would be using Slicing Pie as a vesting tool instead of the traditional unfair time-based vesting. In this scenario, each participant would receive a fixed chunk of restricted shares when they join the team. Let’s say 1,000 shares each. So, Joe and Tom each have 1,000 shares and file an 83(b) election with the IRS. When the Pie terminates, each person would simply vest a number of shares so that it would match the fair Slicing Pie split. If the fair split was 60/40, all of Joe’s 1,000 shares would vest and 666.7 of Tom’s would vest bringing them to the right split.

Both scenarios can use the recalibration calculator and both would avoid unnecessary taxes. Of course, you need to speak with a licensed tax advisor (which I am not) to see which strategy works for you, but there is no reason why Slicing Pie should cause a company or person to pay any more in tax than other equity split models.

February 22, 2018

Do Our Monkey Brains Understand Fairness?

Fairness is a central element of human morality, but it is also an instinct of our primate brethren. An attendee of a Slicing Pie event in Seattle brought this to my attention (thanks Jim!) by sharing a fascinating video of how monkeys behave when they sense unfairness.

In my experience, humans also have an innate sense of what is fair and unfair. This monkey-brain sense is often suppressed by our human-brain rationalization. When it comes to unfair traditional equity splits, people think, “this feels unfair, but everyone else does it this way and my lawyer gave me all these confusing contracts and everyone on the team is on board so it must be fair…or am I getting screwed?”

Unlike the monkey who refuses to cooperate when things are unfair, the human becomes slowly demoralized and unmotivated until one day a fight breaks out because the unfairness is too much to bear.

Slicing Pie, on the other hand, provides a logical, unambiguous model for creating a fair split so out monkey brains are calm allowing our human brains to get to work!

February 1, 2018

2018 Slicing Pie Events

Slicing Pie seminars and workshops are a great way to learn about the power of dynamic equity splits and how to treat everyone in your startup fairly. We are pleased to announce the following US public speaking events:

Presented by: [image error] Sponsored by:[image error]

[image error] [image error]

City

Date

Wednesday, February 14, 2018

Charlotte, NC

Wednesday, March 14, 2018

Chicago, IL

Thursday, April 19, 2018

Philadelphia, PA

Tuesday, May 8, 2018

San Diego, CA

Thursday, May 16, 2018

Fort Lauderdale, FL

Wednesday, June 6, 2018

Madison, WI

Thursday, July 12, 2018

Washington, DC

Thursday, August 9, 2018

New York, NY

Wednesday, September 12, 2018

Boston, MA

Monday, September 17, 2018

Austin, TX

Thursday, October 18, 2018

Los Angeles, CA

Wednesday, November 14, 2018

Enter your name and email below to receive an alert when registration is open for your city:

January 23, 2018

Slicing Pie is Above the Law…But You’re Not, Unfortunately

Sometimes people ask me if Slicing Pie is “legal.” The short answer is: yes, absolutely, Slicing Pie is completely legal and is never illegal. The long answer is slightly more nuanced because Slicing Pie isn’t a legal framework, it’s a moral framework – it’s a way of doing right by those who help you build a valuable business And, just like any other equity model that has ever existed, it is subject to the unique laws of individual countries.

There are almost 200 countries on this planet and countless more throughout the universe (be happy you don’t live on Tatooine). Each has their own governments and legal systems and tax systems and business structures and all sort of other things that apply when you live and/or work there.

Slicing Pie works the same in all of them. No exception. This is because Slicing Pie helps founders make decisions that are fair to everyone involved. Everyone gets what he or she deserves. Based on my experience, fairness is a universal goal and if it’s fair in one place it’s fair in another.

Getting what you deserve and fully realizing the benefits of what you get, however, will vary based on your local laws, taxes, and customs. In the US, for example, non-resident aliens can’t legally own shares in an S-Corp. A non-resident alien might deserve the shares, but the law prohibits him or her from owning them. In these cases, Slicing Pie will do its job of determining a fair split, but the local laws will create a barrier to accessing the rewards of equity ownership. This does not mean there is anything wrong with Slicing Pie. It may mean, however, that there is something wrong with the local laws. In many cases a clever lawyer or accountant can recommend a structure that will work. A US S-Corp could convert to a C-Corp which allows foreign owners. There’s not always a clean solution however, and you may have to find some way to work within a restrictive legal environment. You should never abandon being fair.

Here is another example. Let’s say two partners in different countries split equity using Slicing Pie and subsequently distributes a dividend payment. One partner lives in a high-tax country and the other lives in a low-tax country. Slicing Pie still created a fair split, but the recipient of the income must comply with local laws. Simply granting equity in one country might trigger a tax consequence, but no taxes in another. Those who live in high-tax countries must comply with local laws even if their partners in other countries pay lower taxes. Oppressive tax laws don’t mean you should give up on fairness altogether.

It’s important to note that any legal or tax laws—fair or unfair—apply to every equity split no matter how it is conceived. When you use a conventional fixed split you will not only have an unfair split, but also you’ll still be subject to the same laws. If someone implies that Slicing Pie isn’t “legal” it is the same as saying fairness itself isn’t legal. I can’t imagine living in a country where the intent of fairness is deliberately penalized and citizens are legally required to make foolish, unfair decisions. Even the harshest regimes would at least give lip service to fairness.

Most legal systems, however, were designed with traditional equity split models in mind and are intended to maximize income opportunities for the government. This can make implementing Slicing Pie a little clunky in some places. A good Slicing Pie-friendly attorney will help your team implement as smoothly as possible. Traditional splits, by the way, are clunky too. Just because they are easy to set up, doesn’t mean they work. All equity splits change over time, Slicing Pie simply provides a logical way to make the changes, traditional models must be constantly renegotiated.

Most people want to be treated fairly, but some companies operate in an environment that inhibits and obscures fairness. Slicing Pie provides a logical model that shines a light on fairness and creates a structure to achieve it. It sits on top of the legal structure. Slicing Pie works, but the laws may not.

If you live in a place with a legal system that does not accommodate fairness and logic you have three choices:

Move to a country that does (a popular option for many founders),

Do your best to work within the constraints of your system

Change the laws.

Times are changing and so are laws. As communities continue to embrace entrepreneurship their politicians will create policies that reflect the absence of cash in early-stage startups. The recent US tax reform bill, for instance, alleviates certain tax burdens on vested shares. Australia made similar adjustments a few years ago. Changing the law is a real possibility. Many startup communities are already in discussions with lawmakers who are shaping the future environments for startup companies. Fairness should be a requirement and implementing a legal structure for achieving fairness should be simple and clean.

Slicing Pie is about doing the right thing, do your best to avoid letting local laws hold you back!

December 11, 2017

Let’s Keep It Simple…Oops

Bonus programs are intended to motivate employees, but many of them do just the opposite. Usually coupled with a weak annual review process, the subjectivity puts everyone in an awkward position. Managers avoid arguments by overpaying bonuses, or justify lower bonuses by citing reasons outside their control (“it’s not in the budget!”)

Bonus programs are intended to motivate employees, but many of them do just the opposite. Usually coupled with a weak annual review process, the subjectivity puts everyone in an awkward position. Managers avoid arguments by overpaying bonuses, or justify lower bonuses by citing reasons outside their control (“it’s not in the budget!”)

I once took a job where the hiring manager said, “let’s keep it simple, I’ll pay you 10% of net income above 10% growth next year in my division as a bonus.” He thought he was setting a high bar, but I saw things differently and eagerly agreed. At the end of the first year, I had grown net income by well over 30% and I was due a very large bonus. However, the overall company results were not good. Nobody else was getting a bonus that year. Additionally, part of how I grew net income was to reduce variable expenses, which the management team had not anticipated. So, my manager could not pay my bonus. What could I do? Cry? Sue? I wound up leaving several months later…

Simplicity, as nice as it sounds, should not be the goal of your bonus program. The goal should be to grow the business and reward those individuals who participated in its growth. A good bonus program will align the team, provide motivation, and increase transparency and accountability. A bonus program doesn’t have to be too complex, but there are some important nuances to getting it right.

For instance, corporate goals are very important and are shared throughout the organization. Sometimes managers set “stretch goals” which are so high they are a joke among the rank-and-file. Other times goals are met or exceeded because of some unforeseen event that causes a windfall for employees, but does little to increase the viability of the business. For instance, landing a great big client in the fourth quarter can bring in enough revenue to meet the goal, but the company is vulnerable because it has one large client.

Corporate Goals

A corporate goal should have two parts: 1) a financial goal or productivity goal, and 2) a momentum component. The financial goal is what the company needs to succeed, and the momentum component ensures the goal was met based on the right behaviors of the team. For instance:

Financial Goal: Annual Revenues of $1,000,000

Momentum: 20 new clients in December

in this example, getting to the financial goal is important, but only if it’s building long-term stability for the company. Getting 20 new clients in December implies that the company has been working sales funnel for some time. Without this momentum goal, they could land one huge client in August and rest on their laurels for the rest of the year. This would meet the goal, but leave the company in a precarious position.

Functional Goals

A corporate goal by itself, can do little to impact behavior, and needs be broken down into smaller components. The operations department may not be able to impact revenues, but it can impact the implementation of selling technology. The marketing department may be able to impact revenue, but may not be able to directly control the cost of infrastructure. Functional goals, therefore, need to be set based on the individual’s or team’s ability to have an impact. Additionally, achieving goals may have multiple steps, and each step may have multiple components provided by people or teams from across the organization.

As you can see, keeping it simple is not always possible. The program needs to capture a number of important moving parts. The main moving parts are:

Corporate goals

Functional goals

Milestones for monitoring progress

Bonus compensation program

Structured communication

On top of that, you need to have a way of getting buy-in from team members and documenting the whole process. The good news is that this is all doable and can be applied to any team. It ties nicely into Slicing Pie and that compensation can be paid in cash, if you have cash, if not you can allocate slices.

Don’t be afraid of adding a little complexity to your bonus compensation program. People are pretty smart, and they will buy-in to a structured program that makes logical sense and stimulates the right kind of behaviors from the team.

Join me for a webinar on December 13, 2017: Slicing Pie and Beyond!

Click Here to Register

December 7, 2017

How to Talk About Slicing Pie: The Blackjack Analogy

I spend most of my time thinking about equity splits and helping others create fair splits in their startup companies. In fact, I’d be willing to bet that there isn’t a single person on this planet who has put more thought into fair equity splits. I love the topic and look forward to continuing to pontificate about the virtues of the Slicing Pie model for years to come.

You’re probably not like me in this respect.

You may have other things on your mind, but I hope the importance of creating a fair equity split is one of those things. If you have decided you use Slicing Pie in your business you will need to convince not only your current partners, investors and cofounders, but also future partners, investors and cofounders. Based on my personal experience, one of the best ways to describe the Slicing Pie model is by using the Blackjack analogy. Here is what you say:

You: Imagine that you and I decide to play Blackjack together, as a team, not against each other. We’re going to make the recommended calls and play the typical odds (roughly 50%)

We each bet one chip. If we lose, we will lose it all. If we win, we agree to split the winnings 50/50. We hope we will win, but we don’t know if we’re going to win or how much we will win or how long we will play. The only thing we can know for certainty is that we each bet one chip.

The dealer deals: two aces—niiice!

The recommended call is to split the aces and bet two more chips. But, I’m out of chips and you’re not, so you put down two more. Now you have three chips on the table and I only have one. If we win, does 50/50 sound fair?

Potential partner, investor or cofounder says: No way!

You say: Of course not, if we win we should split the money 25/75. While our future luck in the game is unknowable, the bets are knowable. In this case the fair split is obvious and logical.

Now, you agreed to a 50/50 split before we started playing. I could sue you for half and probably win. But that doesn’t make it fair. What’s fair is that you share of the winnings should be based on your share of the bets.

Startups are the same thing. Instead of betting on cards, however, we are betting on ideas. Every time we contribute anything to a startup and are not paid we are essentially betting that contribution on the future value created by the company. The value of our bet is equal to the fair market value of our contribution. Just like the value of the chip in Blackjack is equal to its cash value. The chip doesn’t magically become more valuable just because it’s part of a game. The value is what it is.

Slicing Pie bases a person’s share of the equity on the person’s share of the bets. Plain, simple, logical, obvious.

That’s the basic analogy and it’s the basic concept behind Slicing Pie, it’s really not that complicated. However, it may be perceived as complicated if you start talking about cash and non-cash multipliers/normalizers and setting a fair market value and keeping track. These things aren’t very complex either once you understand them, but you have to help people understand the basics first.

Here is the video version:

The nice thing about this analogy is that you can come back to it when discussing the model. For instance:

If he asks: what if you take another job?

You: If I leave for my own reasons, I will lose equity for non-cash contributions and l’ll only be entitled to the return of cash investments if and when the company gets the money. If it were Blackjack, then I won’t share in the winnings, but you’ll pay back my bet if you do win. In the Blackjack analogy if I walk away from the table to play a different game, it won’t be fair for me to expect you to keep playing and give me part of the winnings. If you asked me to leave out of the blue, however, I would expect part of the winnings. If I was being a jerk and got booted out of the casino I wouldn’t expect part of the winnings, but I would expect my chips back if you won.

Or here is another example:

If she asks: Can’t we keep 51% and split up the rest using Slicing Pie?

You say: No. If this was a game of Blackjack and I told you that I was going to keep 51% of the winnings and we would split the rest based on our bets would you still want to play?

She says: No.

You say: Of course not, it wouldn’t be fair.

And yet another example:

She says: What if we add more people?

You say: We simply keep track of their bets. If the dealer deals two more aces and we split those we will need four more chips. If we ask a third person to throw in her chips she will have four on the table, I will have one and you will have three. This means she deserves 50% of the winnings, you deserve 37.5% and I deserve 12.5%

She says: But we were there first, don’t we deserve more?

You say: No, chips don’t magically become more valuable because they are sitting on the table longer.

She says: What about risk, blah, blah, time value of money, blah, blah…

If you’re getting too much push-back there is a chapter in The Slicing Pie Handbook that covers overcoming objections in more detail. You can also find it here. Or you can put them in touch with me. Questions and concerns are usually a good sign that the person is trying to fully develop his or her understanding.

The key to using the analogy is to shine a light on the logic behind Slicing Pie and the flaws behind other models. If you can get them on board, all of their concerns can be addressed.

If you’re dealing with someone who gets it, but still wants a fixed split, you can walk away from the table!

November 8, 2017

Initial Slice Offering (ISO)

I’ve been doing a lot of research lately into Blockchain, Bitcoin and Initial Coin Offerings (ICOs) and, like many people, I still find them pretty confusing. I’ve set up trading accounts and wallets and I bought a Bitcoin that I held for about an hour before realizing I hand mistakenly purchased an over-priced Bitcoin fund and not an actual Bitcoin! (Stupid, I know, I lost about $35.) I’ve even set up my web site to accept Bitcoin for books and legal agreements. No Bitcoin buyers yet, but I’ll keep the option up there until I update my shopping cart technology in the next few months.

I’ve been doing a lot of research lately into Blockchain, Bitcoin and Initial Coin Offerings (ICOs) and, like many people, I still find them pretty confusing. I’ve set up trading accounts and wallets and I bought a Bitcoin that I held for about an hour before realizing I hand mistakenly purchased an over-priced Bitcoin fund and not an actual Bitcoin! (Stupid, I know, I lost about $35.) I’ve even set up my web site to accept Bitcoin for books and legal agreements. No Bitcoin buyers yet, but I’ll keep the option up there until I update my shopping cart technology in the next few months.

I’m frequently contacted by Blockchain enthusiasts who want me to build a Slicing Pie calculator with Blockchain, but I have no current plans because 1) the current Pie Slicer program is my primary focus and 2) I don’t have the technical expertise to pull it off and neither does my development team. And, there is a third reason which is that putting The Pie Slicer on Blockchain doesn’t sound very exciting.

But, putting Slices on Blockchain does sound pretty exciting…

Here is what I know:

Blockchain is a decentralized, secure system for peer-to-peer transactions that is very difficult to hack with current technology. This means you can bypass banks (reducing fees) and governments (side-stepping regulations) and transact directly with other people.

Cybercurrencies, like Bitcoin, can be created by anyone using Blockchain technology (as long as they know how). Bitcoin, in other words, is a type of cybercurrency of which there are many.

Often called “tokens,” the rules of cybercurrency are defined by the creator of the token depending on how they want the token to be used and/or valued. Blockchain is the underlying technology that allows people to store and trade tokens. This means anyone can create a token, even you and me.

For instance, I could create a token that you could buy with cash. I could later allow you to exchange that token for access to goods and services that I provide…not very interesting.

Where is does get interesting is if I create a token that includes benefits traditionally associated with equity ownership. For example, I could create a token that provides the owner with the following benefits:

A percentage of divided distributions

A percentage of the proceeds if the company is sold

The ability to trade the token for equity at a later date

Used properly, the token could be used to raise money for the startup without the need for banks and regulators. Unfortunately, used improperly the token could be used to take advantage of or outright defraud investors. The good news is that companies are popping up all over the place to help manage some of this risk. But, there are still many unknowns.

Even with the unknowns, however, I personally believe this is an area worth exploring. Here’s why:

The Slicing Pie model provides a means of creating a perfectly fair equity split during the bootstrapping stage of a company when the company has no actual value. In order to be worth something, the company has to demonstrate its ability to generate revenue, attract customers or create some kind of intellectual property that people want. Getting to this point may require cash investments. The Pie will handle short-term cash from founders, but medium and long-term cash may need to come from outside sources like friends, family, crowds or VCs. Conventional investment tools often require a valuation and expensive financing documents. As I wrote about in a previous post, setting a premature valuation for a company may cause legal, ethical or tax problems and the financing process may be too expensive for smaller rounds.

So…what if the company created a “Pie Token” that could be sold to raise money for the company? These tokens would carry equity-ish benefits as outlined above. The company could sell Pie Tokens as-needed based on the market value of the token at any given time. Companies that showed progress and communicated effectively with token holders may be able to get a higher price.

So…what if the company created a “Pie Token” that could be sold to raise money for the company? These tokens would carry equity-ish benefits as outlined above. The company could sell Pie Tokens as-needed based on the market value of the token at any given time. Companies that showed progress and communicated effectively with token holders may be able to get a higher price.

This could provide easier access to capital without the need to set a company valuation…maybe…I’m still trying to figure this all out.

In order to work, the “slice” offering needs to allow the company to continue using the Slicing Pie model until enough cash is earned or raised to sustain growth. When the Pie bakes, tokens would be converted to actual equity in preparation for an IPO if the company needs more money!

I’m not entirely sure if this would work or how this will work. I welcome your own thoughts and ideas in the comment section below!

October 25, 2017

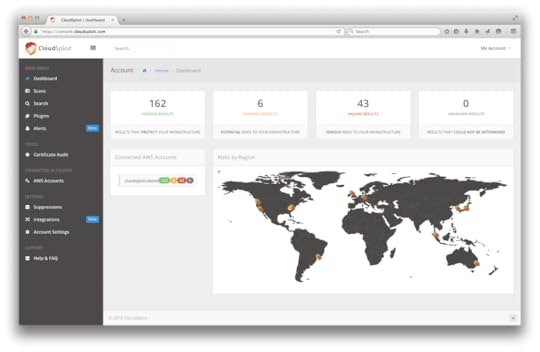

Slicing Pie Case Study: CloudSploit

“That’s an interesting approach,” thought Josh Rosenthal after attending a Slicing Pie seminar at a tech conference. Several years later, the model popped back into his head and allowed him to form a successful partnership with a complete stranger.

“I saw a post on Reddit from a guy who needed help developing an interesting technology,” Josh recalled, “we exchanged a few emails before deciding to work together and use the Slicing Pie model for our equity split.”

Both founders, Josh and Matt, worked part time to develop and market the application, an automated security and configuration monitoring tool for Amazon Web Services (AWS). Matt handled the technology side and Josh took charge of sales and customer success. “We agreed that implementation was more important than the idea alone,” Josh recalled, “we both understood the technology, but had complementary skills. Using Slicing Pie allowed us to work together without worrying about whether we would get our fair share.”

After launching, the team was able to devote more time to the project and had enough revenue to pay other contributors. With cash coming in, they baked their Pie and are now moving forward full-force with their startup, CloudSploit. Josh explained, “We started as an open-source project on GitHub and focused on creating a repository of cloud-security best practices. This attracted DevSecOps experts from around the world. It was a big help and we want to give back to the community by making our offering affordable to everyone who wants to keep their accounts safe. CloudSploit helps to keep customers’ Amazon Web Services (AWS) accounts secure. We run a battery of tests on your account’s configuration, and alert you if something is not following best practices. The program looks only at meta-data, so your contents stay secure. One difference between us and the competition is that we reveal all the tests and the results. It’s the same way you would appreciate your doctor telling you the details of the tests they are going to run to check your health instead of saying ‘I won’t tell you what I’m going to do but I’ll let you know if you are sick.’”

After launching, the team was able to devote more time to the project and had enough revenue to pay other contributors. With cash coming in, they baked their Pie and are now moving forward full-force with their startup, CloudSploit. Josh explained, “We started as an open-source project on GitHub and focused on creating a repository of cloud-security best practices. This attracted DevSecOps experts from around the world. It was a big help and we want to give back to the community by making our offering affordable to everyone who wants to keep their accounts safe. CloudSploit helps to keep customers’ Amazon Web Services (AWS) accounts secure. We run a battery of tests on your account’s configuration, and alert you if something is not following best practices. The program looks only at meta-data, so your contents stay secure. One difference between us and the competition is that we reveal all the tests and the results. It’s the same way you would appreciate your doctor telling you the details of the tests they are going to run to check your health instead of saying ‘I won’t tell you what I’m going to do but I’ll let you know if you are sick.’”

With the service up and running, the CloudSploit team is focused on growth. “Without the Slicing Pie model this probably wouldn’t have happened. It would have been too hard to come to an equity agreement because we didn’t know each other. Slicing Pie took away the risk,” said Josh.

Click here to get a 4-month subscription to CloudSploit using the coupon code SLICINGPIE. Extended subscriptions and upgrades available to companies who practice good karma, like CloudSploit, just reach out to Josh and let him know!

October 24, 2017

Paying for the Pie

There are a number of ways to finance your company. The best way is to start generating revenue as soon as possible. Generating cash early will enable you to not only prove your concept to investors, but also potentially get a better valuation and, therefore, keep more equity. In my experience, startups don’t concentrate on revenue generation early enough. They often spend too much time and money on product development or give early versions of their product or service away for free. If you can’t get someone to pay for your product or service it’s not a good sign!

Of course, some products or services take time to even create a basic offering for which you can start charging. This will require cash and non-cash contributions to allow the team to keep working. Slicing Pie gives you the model to properly account for these inputs and divide equity accordingly. Slicing Pie is based on the fair market values of the various contributions, but there are other, non-pie fair market ways of dealing with investments that will enable you and your team to conserve slices and keep more equity.

There are four basic types of funding:

Revenue- earned

Grants- free

Debt- expected to be paid back, income is from interest

Equity- never actually paid back, income is from dividends or sale

Yes, there are also things like preferred stock (which does get paid back) but these things aren’t practical for bootstrapped startups with limited resources. Putting together special classes of stock, options or other complex investment tools is expensive, time-consuming and unnecessary. If you’re spending time and money setting up complicated stock and option programs you’re probably over-thinking it. Wait for Series A.

Whenever possible, choose the “cheapest” form of funding. Revenue, as mentioned before, has no impact on your Pie and getting it is well-aligned with your company’s purpose. Government grants don’t impact the Pie either, but applying for them may be time-consuming and waiting for them may be impractical.

Debt financing is favored by many because it is easier to understand and predict. In most cases payments must be current before dividend distributions can be made to shareholders and, in the case of a sale, debt obligations must be met before distributions of proceeds can be made to shareholders. This is referred to as “debt preference” because lenders must be satisfied before anyone else. In exchange for this added level of security, lenders are willing to accept a lower return on the investment. In fact, oppressive terms or abnormally high interest rates could be construed as predatory and may be illegal. Another benefit to debt financing is that is cheaper and faster to put together a deal.

Equity financing means you are selling a fixed chunk of equity for a fixed price. This is called a “priced round” and can be suicide for your company unless it is done in the context of a Series A investment or 409A valuation. Read this article for more backstory on why slicing is better than pricing. Unlike debt, equity in the form of common stock is never actually paid back and there is no interest rate or preferential treatment. Equity represents ownership in a company and entitles the owner to dividends or it can be sold.

Before the Priced Round

If your company is worth $0, you can’t use stock price as the basis of your equity split. You can’t divide by zero nor can zero be divided, so it’s worthless as a denominator or a numerator. A non-zero value is useful because you could use stock to pay people based on how much it’s worth. Lacking a reliable valuation, the only fair option is to use Slicing Pie during the bootstrapping stage when the company is worth nothing.

Expenses

The most common funding source for new companies is the founding team who cover expenses directly or by depositing cash into company bank accounts. It doesn’t matter if the team member is draining their personal bank account, racking up credit card debt, or keeping another job for income. What matters is that he or she paid for things and will not be reimbursed. When this happens, the amount of the expense converts directly to slices in the Pie.

Contributions

In the Pie Slicer, team members can log cash expenditures directly for immediate allocation of slices

Short-Term Cash

It’s a better practice for a company to pay expenses directly from corporate accounts. For this to happen, the company must have money in the bank. In the early days, this money is usually provided by founders, team members, advisors, or other people close to the company who deposit money to cover short-term expenses.

For instance, a founder might deposit $5,000 from a personal account into a corporate account from which expenses can be paid. In Slicing Pie, no slices are allocated when money is deposited because it’s not really at risk. However, when the money is consumed it converts to slices. This prevents individuals from “swamping” the Pie simply by making large deposits. It also forces managers to be smart with expenses knowing that every dime converts to slices with the cash multiplier.

The Well

Slicing Pie uses a concept, called the “Well” to manage deposits. Cash contributed by individual team members for future business-related expenses should be put into a corporate savings account (aka “the Well”). When cash is needed, it should be transferred from the Well to the corporate checking account at which point it converts to slices.

Deposits and withdrawals can be logged using the Well feature in the Pie Slicer. Balances are naturally low because the cash is intended to cover expenses in the near term.

Medium-Term Cash

Working with only enough money to cover short-term expenses may not be a practical choice for the team. Raising money from friends and family may be one way to obtain larger amounts that will allow the company to make larger investments and make longer-term commitments. Raising larger amounts from people who may be unaccustomed to making high-risk investments introduces new problems. For instance:

Individual investors may not be comfortable without a clear understanding of payback.

Inconvenience of an inexperienced third-party monitoring your operations as an equity holder.

Potential legal issues the company may face by offering equity to unaccredited investors.

Inability to set a meaningful valuation for equity.

To mitigate these issues, it may be preferable to use debt, rather than equity or slices.

Loans

It is difficult for bootstrapped startups to secure loans from banks because most will require some sort of asset as security. Financing inventory or equipment may be an option, but probably not working capital. Some companies may be able to get working capital loans from the Small Business Association (SBA), but it still may require some sort of security.

A team member can take out a personal loan against his or her home or on a personal credit card, but he or she will be obligated to pay it back even if the company fails. If an individual secures the loan and deposits it in the Well and it will convert to slices when consumed.

However, if the company makes the full payments no slices are allocated. Yes, there is risk associated with the loan, but it’s not put at-risk. The difference is important. The risk associated with the loan is only incurred if the individual has tolerance for the risk. The actual consumed cash is worth what it’s worth no matter where it came from and it’s only at risk when it’s consumed. If the person is asking for regular payments the nature of the money is debt. He or she has borrowed it from the bank and loaned it to the company. It would be fair to charge an interest rate, but if a founder is profiting from the company it may breed animosity from the team.

Slicing Pie Loan

Cash is loaned to the company from people at “arms-reach” from operations like friends and family. The loan carries market-rate interest and repayment terms. The company makes payments to the lender as agreed. However, if the company skips a payment, the amount of the skipped payment converts to slices with the cash multiplier.

Log skipped payments as cash under the “other” contribution type in the Pie Slicer. Upon a formal valuation the remaining balance can be paid back or converted to equity at the same terms as other convertible contracts.

Convertible Debt/Equity

Angel investors are accustomed to providing cash to companies as working capital under the terms of a convertible debt or equity instrument and have no impact on the Pie. Popular formats are SAFE or KISS agreements, but the actual form it takes and the terms in it will be negotiated with the angel or angel group. The nice thing about convertible debt or equity is that it relies on the future valuation set by professionals and does not require complicated legal documentation. This makes it a much more practical tool and represents the fair market for angel investments.

Angel investors will likely ask for a cap table at the time of investment. The summary report from the Pie Slicer will give you a breakdown the current ownership. Be sure to explain that the split will change before Series A or breakeven in response to changes in the team or the individual contributions of team members.

The Priced Round

Using a mix of unreimbursed expenses, the Well, Slicing Pie loans and convertible angel investments you can (hopefully) demonstrate that you have created a sustainable, scalable business that warrants the attention from professional investors. A professional investor invests other people’s money usually in the form of a Venture Capital Fund or some sort of crowdfunding platform.

Cash is provided to the company as working capital in an amount that should allow the company to invest in growth-oriented activities and sustain the spending until the next round of funding (Series B, C, D, etc.) In exchange for the investment, the professional investor takes a fixed equity stake in the company and imposes conditional terms on the founding team (such as reverse-vesting). The price of the equity determines the investors share of the company and is determined through negotiation with the founders and a review of rather extensive documentation including due diligence documents, business plans and a private placement memorandum. This process, combined with the VC’s fiduciary responsibility to his or her investors, allows the company to set a meaningful valuation for the company.

At this point, the company should have enough cash on hand to cover expenses and salaries so the Pie will no longer accumulate slices and the team’s equity will vest or otherwise become fixed and subject to the terms of the professional investment. This is known as “baking” the Pie.

Breakeven – 409(a)

If the company reaches breakeven on its own the Pie will naturally stop accumulating slices and, therefore, the Pie will bake. To convert outstanding KISS, SAFE or convertible investments the company can obtain a 409a valuation from a certified, professional accountant. This will allow the conversion of investments and set a strike price for the creation of an incentive stock option program.

Summary

While there are many ways to fund a company it’s always important to use the most efficient and practical tools available given your circumstances. Unproven, bootstrapped companies must rely on funding from founders and use Slicing Pie. As the company gains traction other funding sources become available and founders can choose those that provide working capital while conserving slices. It’s important to avoid setting a premature valuation.

Model

Slicing Pie

Bake Pie

Fixed Split

Tool

Expenses

The Well

Slicing Pie Loan

Convertible Debt/Equity

Series A

409A

From

Founders

Founders, Participants

Friends and Family

Angels

VC, Crowdfunding

After breakeven

For

Immediate Costs

Short-Term Costs

Short/Medium-Term Costs

Medium-Term Costs

Growth

Lifestyle