Mike Moyer's Blog, page 16

January 8, 2013

Dilution is not a Four-Letter Word

Few events strike as much fear in the hearts of start-up investors as dilution. Many go through great lengths to include anti-dilution clauses that protect the specific percent share of a company that they signed up for. If they buy or earn 10% of a company then they want to keep 10% of the company, often with little thought to the underlying value of the company. Dilution, however, isn’t necessarily a bad thing. In fact, dilution can be a great sign that your company is growing and doing the right things.

Dilution is a natural adjustment in ownership that occurs when the company distributes more shares to those who deserve it. So, if I own 50 out of 100 shares I own 50% of the company. If it’s a start-up company my 50% is probably worth nothing. However, if the company sells half the company for $1,000,000 and issues another 100 shares my ownership dilutes to 25% instead of 50%. However, the underlying value of my ownership went from being worthless to being worth $250,000. In this case, dilution is a good thing. I never would have built value in the company unless I was willing to be diluted.

Our fear of dilution will often have a negative impact on our ability to succeed. It will prevent us from bringing on valuable partners or employees that might deserve equity in our company. Our inability to realize that a small percent of something is infinitely better than a large percent of nothing holds us back.

The reason people fear dilution is because we don’t want to be taken advantage of by other participants in the company. If I invest in a company and receive 10% of 100 shares (10 shares) what’s to prevent the owners from simply granting more shares to themselves and diluting my shares with no gain in value? In this case other people will benefit at my expense. However, the reverse is also true. If the company has to issue me more stock whenever they issue stock to someone else I am essentially getting more stock for doing nothing. So, I am benefiting at the expense of others. Both scenarios are problematic. However, most of us would rather have the problem of getting more than we deserve.

In an ideal world every participant in the company would get exactly what they deserve—no more and no less. If we are all getting exactly what we deserve then there is no reason to worry about dilution. You can always rest assured that no matter what your share, it is always fair relative to others. The only way to achieve this, however, is through the use of a dynamic equity split program. Dynamic splits are not widely used today because they are not widely understood. Most companies use a fixed or static-split which is very difficult to keep fair. We try to compensate by using vesting programs, options programs and numerous protection clauses like anti-dilution. Equity negotiations are among the most painful and destructive events at a start-up. They pit people against each other who should be working together. It’s every man for himself.

However, in a dynamic equity model everyone is guaranteed to get what they deserve. In a dynamic model a relative value is put on the various contributions people make to the start-up. Contributions can include time, money, ideas, relationships, equipment, faculties and other necessities that help a business grow. You calculate ownership by dividing what you contributed by the total of all the contributions made by everyone on the team. Therefore, your percent ownership is always exactly what you should have. Dynamic models change during the early days of a start-up so dilution is a natural part of the process.

Dilution, under the right circumstances, is a positive sign that everyone in a start-up company is being treated fairly by everyone else. Under the wrong circumstances dilution is a sign of greed, mistrust and ego.

Originally appeared on Under30CEO.com

December 20, 2012

Time Tracking

There are a lot of time-tracking tools available online. Many of them will work just fine. I’ve tried a number of them and I like Harvest (GetHarvest.com) the best. It is easy to use and tracks both time and expenses. It is an invoicing program. When you generate an invoice the time log is locked which will help you avoid the mistake of double-booking time.

Most of these programs are overpriced. Harvest is $5/month/person. This can add up when you have a large team, but I spend the money because it saves a lot of time vs. Excel. It also comes with a phone app that I use regularly.

December 7, 2012

Retrofitting a Grunt Fund- New Chapter Sneak Preview!

If you have already launched your business chances are good that you have already implemented a fixed split that is causing some angst among the founders. You now need to unwind your fixed split so you can get on the right track with your equity. This will require you to retrofit the Grunt Fund. Retrofitting a Grunt Fund is fairly easy as long as everyone is willing to cooperate.

Getting Buy-In from the Herd

The first thing you will need to do is get everyone on board with the program by helping them see the benefit of a dynamic equity split program. To do this, just give them a copy of this book.

The people on your team will fall into two categories:

“Skinny Grunts” are those who have less than they deserve

“Fat Grunts” are those who have more than they deserve

(It is unlikely that anyone will have exactly what they deserve.)

The Skinny Grunts will be easy to convince. They already feel cheated by the Fat Grunts and, as much as they might like the business and believe in the vision, their motivation is probably waning because they feel like they are working for someone else’s benefit.

The Fat Grunts may be harder to convince because the retrofitting of the Grunt Fund will not only re-calibrate their share into a smaller portion, but also they will have to start working to maintain their position in the company. This, of course, is completely fair.

In most cases, if they have this book, they should be on board by the time they read this section. If not, I have a message for them:

Your current share of the company was granted by mistake. The equity that you hold in this business is disproportionate to what you deserve and it is now threatening your relationship with your team members at best, and destroying the company at worst. The company will be more valuable if you realign your interests with the rest of the team. Unless you are willing to be fair about what you and everyone deserves you will limit the chances that your shares will ever be worth anything.

If that doesn’t work, you are probably dealing with someone who has trust or greed issues. Either way they are not properly aligned with the team. This is a good time to fire them.

You need to work with people that you can trust. You can’t trust people who aren’t willing to treat you and the other members of the team fairly. A greedy Fat Grunt is someone who is comfortable benefiting at the expense of others. There is a word for people like this; the word is “Asshole.” It’s is best not to do business with Assholes. You can probably find someone else to do that Grunt’s job

Some Grunts, like those who have controlling interest in the company, own the core intellectual property or have large amounts of cash invested, are difficult to replace.

If you are dealing with an irreplaceable Grunt you may have to cut your losses and leave the company yourself. There are greener pastures for a good Grunt.

Such are the problems with fixed-split equity program. Next time you will be older and wiser and can start a Grunt Fund from the beginning.

The Retrofit

Once you get everyone on board with the program you will have to calculate what the pie would have looked like if you had been using a Grunt Fund from day one. This will require you to do an inventory of the various contributions that people have made and add it all up to determine your TBV. Time will be the most difficult because in most cases people will not have been tracking their time very accurately.

Time Tracking

At this point it will be impractical for everyone to remember how many hours they contributed. It will be easier to divide people into full time, half time and part time.

Count the number of weeks people have been involved and use 40 hours per week for full time employees, 20 hours per week for half time employees and 10 hours per week for part time employees. Do your best, but don’t split hairs—it’s not worth it.

The Pie

Once you figure out what the pie should look like all of the participants in the Grunt Fund will continue earning pie according to the regular rules. Things will proceed as described in this book. At some point you will outgrow the Grunt Fund and you will want to issue actual stock and work with your lawyer to put the right agreements in place.

When you issue stock (in an LLC they may be called “participation shares” or “units” or something like that) you simply issue enough shares to bring everyone to the right percentages.

Example:

Grunt 1 and Grunt 2 start a company together and split the equity “50/50” they authorize 1,000 shares in the company and each take 50 shares.

A few months go by and it becomes obvious that Grunt 1 isn’t very interested in the business. They agree to retrofit a Grunt Fund to solve the problem.

They go back and tally up each of their contributions since the beginning and determine that if they had been using a Grunt Fund from day one Grunt 1 would have about 25% of the pie and Grunt 2 would have 75% of the pie. (At this point it doesn’t really matter what stock has been issued because the stock is worthless anyway.) From that point on they earn pie under the terms of the Grunt Fund.

When Grunt 3 joins the herd she starts earning pie under the terms of the Grunt Fund. Easy as pie.

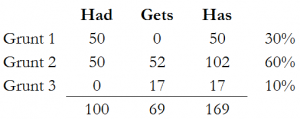

Six months go by and the team is getting some traction in the market. They are generating some nice revenue and they have outgrown the Grunt Fund. Grunt 1 has about 30% of the pie, Grunt 2 has 60% of the pie and Grunt 3 has 10% of the pie. They decide to issue 168 shares of stock to allocate the proper percentages.

Remember, Grunts 1 and 2 already each have 50 shares. So, Grunt 1 gets zero new shares, Grunt 2 gets 52 shares and Grunt 3 (who had zero) gets 17 shares. When the new stock is granted the ownership looks like this:

The Grunt Fund has properly allocated shares to the right people. Each Grunt has a share that is fair relative to the other Grunts. The original allocations had no impact on the outcome because the additional stock grants balanced things out appropriately.

Grunt 2, who originally owned 50% of the company now owns 30%. He has nothing to be sad about; the company is now worth much more than before. If he had decided to be an Asshole the company probably would have fallen apart.

Ideas and Intellectual Property- New Section Sneak Preview!

There are two ways to reward Grunts for business-enabling ideas and related Intellectual property: The first is to calculate the theoretical value of the idea and the second is to provide an ongoing royalty payment (cash or pie) to the inventor.

It’s important to remember that ideas without action are relatively valueless, no matter how good the idea is. In the start-up world, a dozen ideas will cost about a dime, less the cost of the lunch over which the ideas were generated. Generally, ideas should not be taken into account in a Grunt Fund unless they fit the following criteria:

The idea must have existed before the inception of the business

The idea must be original

The idea must be non-obvious

The idea must be “baked” as opposed to “half-baked”.

Selling Halloween costumes in October is obvious and unoriginal. Therefore, it should receive no pie.

That doesn’t mean you can’t make plenty of money with an idea that is as unoriginal and obvious as selling Halloween costumes. Sometimes better execution is all it takes. You could make millions if you have the right people.

In the case of unoriginal and obvious ideas it’s the execution that really counts. Most businesses today are founded on unoriginal and obvious ideas. This is good, these ideas could have a huge market and you won’t have to reinvent the wheel.

A book about implementing a dynamic equity split, however, is both original (there are no others like it) and not obvious. It may be obvious in hindsight, but most entrepreneurs are unaware of the concept until it is brought to their attention (otherwise everybody would be using dynamic splits). This doesn’t mean that nobody has ever used a dynamic equity split before, but the details presented in this book are not widely known (today).

A “baked” idea often comes in the form of a polished concept, a thoughtful business model or legal protection. They require insight, experience and creativity. Baked ideas usually represent the investment of considerable time and money and are often business enablers. This book, for example, is baked.

Ideas that fit the above criteria have value that should be taken into account. Ideas developed during the regular course of business, however, would not be taken into account no matter how good the idea is. It’s the nature of business to generate new, good ideas and it is part of the job of a Grunt to come up with the most awe-inspiring new idea that ever existed.

Calculating the value of ideas and intellectual property can be a challenge because inventors tend to really overestimate the value of their ideas. People tend to say things like, “Michael Dell stole my idea for building computers in my dorm room! That crook made billions! He owes me.” It’s ridiculous.

Don’t get me wrong, ideas are critical to a business’ success. But turning the idea into a reality is usually where the value is built, not in coming up with the idea in the first place. This doesn’t mean you can’t give someone who came up with a great idea some pie as a bonus. But be careful not to put too much emphasis on the idea itself. Ideas, even good ideas, are plentiful. It’s the initiative, passion, action and grit that turn ideas into good businesses.

If the idea is well documented and baked the value is set equal to the amount of time it took to bake the idea times the originator’s GHRR plus the costs of any research or legal protection.

So, if I spend 500 hours developing a business plan around my idea, 200 hours writing and researching a patent and $10,000 hiring a lawyer to file my patent then the idea would be with 700 x my GHRR plus $10,000 or $80,000.

GHRR

$100/hour

Business plan hours

500 hours

Patent research hours

200 hours

Time @ GHRR

$70,000

Legal fees

$10,000

Theoretical Value of the IP

$80,000

In addition to calculating the theoretical value of the intellectual property, it may be appropriate to provide a royalty payment to the inventor as well. Royalties reflect the fact that without the idea the business would not be possible and that the idea itself is generating buzz or recognition for the company.

END OF NEW SECTION

Please provide questions or comments, helpful readers will be acknowledged in the next version of the book!