Mike Moyer's Blog, page 15

June 7, 2013

Slicing Pie for Ignite Chicago

I did a five-minute Slicing Pie overview on dynamic equity splits for an audience in Chicago. It wasn’t enough time to do it justice, but I think it’s a good high level overview. For a more detailed overview you can see a recording of my webinar for the Small Business Centr.

June 5, 2013

OwnYourVenture.com

Grunt Funds are perfect for bootstrapped start-up companies who want to use equity when they don’t have cash. If your company has enough money to pay people for their goods and services you won’t have to use equity. One of the best ways to get money is to generate revenues and profits, but you can also go out and raise the money from investors.

When you raise money from investors you can use the money to pay people you might have otherwise given equity to. If you pay them a fair market rate then they should be happy because they are no longer taking risk.

Professional investors may want to use more traditional fixed equity splits when they put in substantial cash. This is fine as long as all the Grunts in the herd are being treated fairly.

OwnYourOwnVenture.com is a site that will help you calculate your pie after significant rounds of investment using a fixed model.

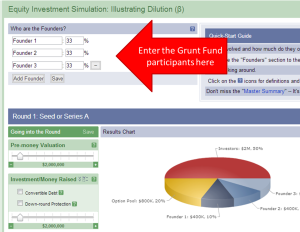

Just enter the results of your Grunt Fund in the “Who are the Founders?” section as shown below:

OwnYourOwnVenture.com

Grunt Funds are perfect for bootstrapped start-up companies who want to use equity when they don’t have cash. If your company has enough money to pay people for their goods and services you won’t have to use equity. One of the best ways to get money is to generate revenues and profits, but you can also go out and raise the money from investors.

When you raise money from investors you can use the money to pay people you might have otherwise given equity to. If you pay them a fair market rate then they should be happy because they are no longer taking risk.

Professional investors may want to use more traditional fixed equity splits when they put in substantial cash. This is fine as long as all the Grunts in the herd are being treated fairly.

OwnYourOwnVenture.com is a site that will help you calculate your pie after significant rounds of investment using a fixed model.

Just enter the results of your Grunt Fund in the “Who are the Founders?” section as shown below:

Time vs. Productivity

Once in a while I’ll get an email or read a review from someone who is skeptical about tracking hours because they are concerned that time alone isn’t a good measure of contribution. They are right. Just because you put time towards something doesn’t mean the time is productive.

Many people want to reward productivity or “value creation.” This would be great but, it’s way too subjective and nearly impossible to track. First you will have to define what it means to be productive or create value. Then you will have to deconstruct your activities to determine which activities were productive or created value. Then you will have to place a theoretical value on it so you can track it relative to other measures.

Count What You Can Count

In a dynamic equity split you have to count what you can count. If it can’t be counted then it’s left out of the model. Not because it’s not important, but because trying to measure things that can’t be consistently measured will lead to arguments and renegotiation that will cause too much damage to the company. You have to create a proxy for what you are trying to measure.

Time is extremely easy to measure and track. To mitigate the risk that the time is unproductive we use the Grunt Hourly Resource Rate (GHRR!) which provides a proxy for productivity and value creation. The best predictor of future behavior is past behavior. People with lots of experience are likely to apply that experience in the future. These people, therefore, would have a higher GHRR! than someone with less experience.

You do run the risk that time will not be productive. However, most time tracking programs give you the ability to track time to specific projects and capture notes about that time. This is one of the most powerful tools available to a start-up company. If you ever suspect that a person’s time is not productive you can simply review the time logs to see what they have been up to.

Not long ago I was working with a Grunt Funded company that was concerned about the lack of sales and sign-ups on their site. We reviewed their time logs and found that nearly all of their time was being spent on development projects. So, they wrapped up their projects and turned their attention to sales. I’ll bet you can guess what happened.

Alternative Calculations

This concern is usually raised by more experienced entrepreneurs. I think it’s because they are afraid their contribution won’t be properly valued. I recently introduced a start-up to a person who can distribute their product on a national basis. It took about five minutes, but the value is huge. Clearly my GHRR! is not a good reflection of my productivity in this particular case. However, the Grunt Fund will accommodate this type of value creation through the use of finder’s fees and commission calculations.

So, I haven’t come up with a better proxy for productive time than the GHRR! (but I’m open to suggestions). At the end of the day, a Grunt Fund is based on rules that the herd can easily agree to. If you want to create a scheme for measuring value creation go for it. And, please let me know how it works!

May 27, 2013

Version 2.0 Notes

I’m happy to announce that Slicing Pie Version 2.0 is available for review by interested Grunts! Click on the book to get your copy!

I’m happy to announce that Slicing Pie Version 2.0 is available for review by interested Grunts! Click on the book to get your copy!

Members of the Free Upgrade List have already received a PDF version of the book.

Most of the updates in Version 2.0 are as a direct result of conversations I have with readers who have questions or comments about the model and how to implement it. The basic concept has not changed since the beginning, but I have provided additional detail and clarification on certain topics.

Version 2.0 contains the following:

Updated dedication (because we had a new baby)

More detail on how to value and provide appropriate rewards for ideas and intellectual property

A new chapter about how to retrofit the model to existing companies

An updated chapter (with a new title: “Legalize It”) on legal issues you will want to discuss with your lawyer

QR Codes that link to A La Mode topics

Grunt Glossary (please let me know if I should add other terms)

A variety of graphical and grammatical edits

A new cartoon at the end

After Version 2.0 has been reviewed and finalized it will replace the current version on Amazon.com.

To keep informed on future updates be sure to sign up for free upgrades. More information on how to do this is provided later in the book.

Grunt Glossary

Fat Grunt: A person who has more than his or her fair share of the equity relative to other participants.

Grunt: a person who works in a startup doing whatever it takes to make the company a success.

Grunt Hourly Resource Rate or GHRR!: the theoretical value of one person’s time relative to another person’s time. It is not an actual value, it is used to calculate an individual’s percent of the pie.

Skinny Grunt: A person who has less than his or her fair share of the equity relative to other participants.

Theoretical Base Value or TBV: because start-up companies are assumed to have no actual value in a Grunt Fund we use theoretical values with allow us to understand how important one contribution is relative to another contribution. The TBV is the sum off all the theoretical values of all contributions from all participants. It is used to calculate an individual’s percent of the pie.

March 16, 2013

Slicing Pie:the Game

The benefits of a dynamic equity split are painfully obvious once you understand the basic concept. However, if you don’t understand the basic concept you will keep making bad mistakes with a fixed equity program.

The benefits of a dynamic equity split are painfully obvious once you understand the basic concept. However, if you don’t understand the basic concept you will keep making bad mistakes with a fixed equity program.

To help people of all ages better understand how dynamic splits work, I have created a board game that takes players through the ups and downs of starting a company from start-up to sale in only a few short minutes! My original plan was to use the game in the entrepreneurship classes that I teach, but even my kids have enjoyed playing even though they are young (six and eight).

The game is available in it’s beta version for current readers of Slicing Pie. If you would like to be a beta tester of the game and provide feedback for its improvement please complete the form below.

Printing the game and cards will require access to a printer that can handle 11 x 17 printing. You will also need a die and some game pieces (I use two-bumped Legos).

February 22, 2013

Slicing Pie for the Small Business Centr

See a complete overview of Slicing Pie and how to implement your very own Grunt Fund. Mike Moyer, the author of Slicing Pie, presents the concept for the Small Business Center.

January 27, 2013

Grunt-Fund Friendly Lawyers

Please contact me if you would like to be connected with a lawyer who understands how to implement a dynamic equity split.

If you are a lawyer who understands how to implement a dynamic equity split please contact me so I can add you to my list!

Advisory Board Member Letter

When inviting a Grunt to join an Advisory Board for a company using a Grunt Fund care must be taken to set expectations about compensation. It’s important that they understand how a Grunt Fund works and that they are not entitled to cash compensation. Click below to download a sample Advisory Board Member letter for a company using a Grunt Fund.