Mike Moyer's Blog, page 2

July 3, 2023

Double Dipping Doesn’t Work

Occasionally someone will think they found a cash vs. non-cash loophole in the Slicing Pie model. What if, they ponder, instead of not getting paid and adding two slices per dollar I invest cash in the business at four slices per dollar and then draw out a salary in the same amount?

For example: Anson is worth $50 an hour. He works an hour and is not paid thus contributing 100 slices to the Pie. What if he puts $50 cash into the business for 200 slices in the Pie and then draws the $50 back out of the company as salary? This would mean he gets twice as many slices and, in effect, doubles his equity!

Nope.

There are several reasons why this does not work in Slicing Pie.

Lump Sum Payments

The first reason is that drawing money from the company during the Slicing Pie stage is deducted against cash contributions first then non-cash contributions. So, in the example above, Anson has made two contributions. The first is a $50 cash contribution which has not been spent and, therefore, does not convert to slices in the Pie. The cash would be held in the company account until it is needed (see: The Well) The second is an unpaid hour of work which contributes 100 slices to the Pie. When he draws out the $50 in cash the deduction comes from his previous cash contributions before it applies to non-cash contributions. So, taking out $50 is simply taking his money back. This is called a “Lump Sum” payment. After the cash balance is reduced to $0, the hour he worked is left unpaid which is 100 slices in the Pie.

Inefficient Use of Funds

The second reason it doesn’t work is that putting cash in the company as an “investment” and then drawing it out as “compensation” triggers taxes, payroll expenses, and administrative costs that are a waste of time and money for the business. Even if, as a startup, you aren’t processing payroll and just writing checks (which could cause other problems), you still have the added administrative step of writing a check to yourself which is still a bad practice. Businesses should make good decisions when managing money and this kind of robbing Peter to pay Paul behavior should be tolerated.

Gaming the System

The third reason this doesn’t work is that it is essentially an attempt to game the system to benefit one person at the expense of others. This is a moral issue and even if the other two problems above didn’t exist, this kind of behavior would lead to termination for good reason in which case a certain portion of the slices would be removed according to the Recovery Logic of Slicing Pie.

Not Gameable

There are multiple ways Slicing Pie prevents one person from taking advantage of others by trying to trick the system. The Slicing Pie formula simply reflects the logic of fairness based on facts. Tricks aren’t facts so tricks don’t work. Put facts into the model, get fairness out of the model.

June 23, 2023

Slices that Can Survive Separation

The Recovery Logic of Slicing Pie outlines what happens to a person’s slices when they separate from the company. In a nutshell, if a person is terminated for cause or resigns without cause they will lose slices and forfeit their rights to future equity. If, however, he or she is terminated without cause or resigns with cause the slices stay in the Pie and convert to equity along with everyone else.

Survivors

There are some situations that would “survive” termination of employment including ongoing payments like rent and royalties. To account for these situations, you have to think through what’s going on when it comes to what’s at risk.

Landlords

When someone rents you their property that person’s “job” is “landlord” doing whatever landlord stuff you negotiated in the lease. (Often there is no lease because you just decided to park your business in a cofounder’s garage until you could afford office or warehouse space. For this example, don’t overthink it.)

If the landlord is just a landlord and nothing else, the Slicing Pie termination logic applies just as it would to any other Grunt on the team. Being a landlord is the job:

Termination for cause example: the landlord keeps leaving the garage door open exposing you inventory to inclement weather. After two warnings you can “fire” the landlord for good reason. The landlord would lose his non-cash slices.Termination without cause example: you generate enough revenue to move to a more suitable space. The landlord keeps his slices. He didn’t do anything wrong, you just outgrew the space.Resignation with cause example: your team fails to maintain the property as promised and you are evicted. The landlord gets to keep his slices.Resignation without cause example: the landlord wants to use his garage for his collection of classic Mini Coopers and kicks you out, he loses his slices.But what if the landlord is also the CTO? In this case you’ll need to separate the CTO job from the Landlord job. Continued use of the space would preserve the previously allocated slices and new slices would be added on a go-forward basis.

For example, a startup called MosquitOasis is using Jack’s garage to store inventory. Jack is also the CTO. He contributes slices to the Pie as he does work and every month he makes a $500 non-cash contribution which is rent on the garage. Jack gets terminated for cause, but the team wants to continue to use the garage. Jack, having been warned twice before losing his job, is still on good terms with the team and agrees. Per the Recovery Logic of the Slicing Pie model, Jack would lose the slices contributed for everything except rent. And, going forward, he would be entitled to $500 monthly rent payments or contributions to the Pie. In this scenario, the Landlord job survived the CTO job.

If, on the other hand, Jack kicked the team out of his garage he would lose the slices contributed for the past rent in addition to everything else. The Landlord job does not survive because Jack ended it.

Royalties

Similarly, the licensee of intellectual property may have a royalty that survives termination of the individual. If the inventor of a new product is also a participant in the startup formed to market the product separates from the company it is likely that he or she will continue to collect royalties after separation from the firm. In this case, the job is “inventor” or “licensor”. The job is simply to continue to allow the startup to commercialize the innovation in exchange for a royalty payment.

For example, Jill invents a new kind of ski carrying device and secures a patent for the design and a trademark for the name Schlep.Ski®. She then finds a partner to help bring the product to market and, instead of including development costs in the Pie, she and her partner decide that she will receive a 3% royalty on revenues generated in addition to her salary as the VP of Product Development. The royalty, like her salary, is payable in cash if cash is available. If cash is not available, the team will allocate slices in the Pie.

Jill decides one day that she wants to pursue other interests and quits. This is resignation without good reason, and she will lose any slices she contributed to the Pie for her non-cash contributions. However, the license agreement and royalty payments will survive her separation. She will continue to have the Licensor job which will go on until the license terminated (depending on the terms of the license).

If, however, Jill revokes her license upon leaving she would lose any slices associated with royalties earned to date.

On a side note, this is why I’m not a fan of license deals for founders of startups. It’s better to simply include the development costs and time for the IP in the Pie from the beginning and not do a license deal.

Other Survivable Scenarios

There are a few other situations that would have similar treatment. If a Grunt provided use of capital equipment like a truck or a printing press for which they would be due a rent payment continued use of the equipment would extend past the separation of the employee.

Another situation would be if the Grunt used a Slicing Pie loan agreement to loan money to the startup that is still being repaid. The job in this case is “Lender”. The company would continue to pay off the loan or add slices to the Pie according to the terms of the loan. The Lender job, would survive any other jobs held by the individual. Those slices would stay in the Pie.

Note: If the loan was already paid off this would not apply but skipped payments would need to be paid back prior to distributions of dividends.

The goal is to align the interests of the company and the participant. The goal is not to split hairs and try to recapture slices in the event of an unhappy separation. For instance, it would be futile to claim that a company should provide slices in the Pie for random office supplies you left in the office. You need to be careful what survives a separation so think it through or set up a time to discuss the issue with a Slicing Pie expert.

December 1, 2022

A Slicing Pie Thought Experiment

Two entrepreneurs, Parker and Riley, each start their own companies with the goal of hitting $1,000,000 in revenue in 18 months. 18 months later, Parker has generated $500,000 in revenue and Riley has generated $2,000,000 in revenue. Which one is the better entrepreneur?

I would love to know your thoughts and comments. Please post below in the discussion...

November 1, 2022

Slicing Pie: The Best Way to Start Your Dream Business During a Downturn

Many potential clients and current clients have been asking us whether they should pursue their dreams and start their new business despite challenging economic conditions or put their plans on hold. While we understand that it is exceedingly difficult to raise capital and the cost of capital is increasing, we advise everyone to follow their dreams. In fact, in our opinion, challenging economic conditions are the perfect time to start a new business (I have done it) if you are using the right equity allocation model.

What is the right model?

If you are on a limited budget, plan to bootstrap your venture, and are seeking a fair method of sharing equity with your cofounders, dynamic equity is the answer. Mike Moyer, the author of The Slicing Pie Handbook and Will Work For Pie, lays the foundation for perfectly fair equity splits for bootstrapped startups. We have developed a legal framework for limited liability companies that will allow you to start your business with minimal cash investment and fairly and proportionately distribute equity.

How does the model work?

Slicing Pie or dynamic equity provides for both an equity allocation framework as well as a recovery framework. We contractually set initial specific goals for the venture at the outset. Upon founding of the business all uncompensated time, cash contributions, etc. (we call these “Inputs”) that go into the venture are tracked. When the initial specific goals are accomplished we “bake the pie” and enter into a new agreement under which each member’s ownership stake is based on their Inputs as compared to the Inputs provided by everyone.

For example, if Alex and I start a business today and our initial specific goal is to achieve $10k in monthly revenue. Upon reaching said goal, we look at our relative contributions to the venture and determine what percentage of the venture each of us should own at that time.

In other words, instead of the founders of a venture attempting to predict the future (wouldn’t that be nice!), Slicing Pie or dynamic equity provides for a quantitative algorithmic method of equity distribution. This model also provides for a recovery framework in the instance that one of the founders of the venture decides to quit for good reason or no reason at all or is terminated for cause.

Conclusion

There is no time like the present! Slicing Pie and dynamic equity will allow you to follow your dreams and start a new business with a limited amount of cash capital. Schedule a free consultation with us today here to discuss how we can help you make the most of challenging times.

June 28, 2022

Support Ukraine by Buying The Slicing Pie Handbook in Ukrainian

Dmytro Hlazunov is a fellow Grunt and a Ukrainian citizen fighting for his country. He and I have been in touch since 2019 when he approached me about translating The Slicing Pie Handbook into Ukrainian. The translation was completed in 2019 and we even created a special cover for it.

He writes:

I am on frontline with armed forces of Ukraine in the hottest spot for now, Severodonetsk. I am in need of some ammunition and our battalion lacks drones, action cameras for making save viewpoints, radio devices. So, it will be nice if you can post my requisites link pinned in my FB profile . Also, I am with other people starting to organize retreat /research center for people who been affected by the war. We would like to use there all possible methods for psyche recovery, so if you know any lobbyists, people from psychological, psychedelics communities or anyone who will be interested in that kind of project and have ideas how it may look/work it will be nice to connect with them.

To connect with Dimitri on Facebook click here or click his face!

Given the current situation in Ukraine, I am not taking a royalty on the translation so 100% of the revenue from the sale of the Ukrainian version of The Slicing Pie Handbook goes directly to Dimitri to help him and his battalion fight the war. Click on the Ukrainian book cover below to buy a copy. You can name your own price for the book and, again, all of the money goes to Dimitri!

100% of the revenue goes directly to Dimitri!

PS: According to Dimitri the best military/medical organizations to donate to is the Serhiy Prytula Charity Fund

May 20, 2022

Proper Profits Please

One of the most common mistakes that startup founders make, in my experience, is what it means to be profitable. I know this sounds basic, but bear with me and you’ll see what I mean.

Most startup founders—even rookies—understand that Revenue – Expenses = Profit. The mistakes lie with how founders understand revenue and expense.

Consider this scenario: Merrily starts a lemonade stand. Her dad gives her $20 to buy supplies. She spends $15 on cups, lemons and sugar. She sets up a lemonade stand on the front yard and sells 30 glasses of lemonade for $1 each. She counts the money in her pocket and finds $39.50! “Look dad!” She exclaims, “I have almost 40 bucks in profits! I’m going to buy a boatload candy!”

“Good job, honey!” Replies dad, “I’m so proud of you! You’re running your own big-girl profitable company and you’re only 35-years old!”

As you may have already observed, there are a number of problems with how Merrily calculated her profit. The first pertains to how she accounted for her revenue: $30 in drink sales and $9.50 in change from the $20 when she bought supplies that “forgot” to return to dad. The $30 is revenue, the $9.50 is unspent investment capital that should be recorded on the balance sheet, not the income statement.

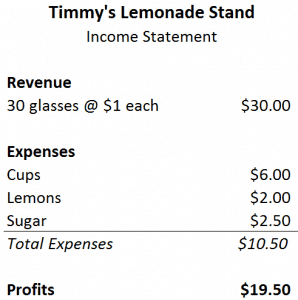

But there is a larger problem: the expenses. Consider this income statement:

So, if you subtract the actual expenses from the actual revenue, it is clear that Merrily’s profits are much lower than $39.50. She was way off.

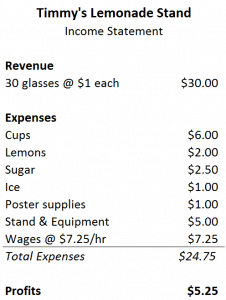

But there’s more, Merrily didn’t include other costs like ice, water, poster board (to make signs) and rent for the stand and equipment which consisted of a card table, a folding chair and a pitcher. She didn’t include these in the costs because her mom and dad provided them at no cost. But, I think this is a mistake, just because she didn’t pay these expenses doesn’t mean they aren’t expenses and ignoring them gives her a false sense of success. By covering these costs, Merrily’s mom and dad have helped her maintain positive cash flow, they did not help her improve her profits. Let’s include these costs.

This gives us a much clearer picture of the actual profitability, but it’s still missing an important element: Merrily’s time. Time is by far the most common omission in startup costs that I have seen. Founders don’t charge the company for their time and, instead, plan to divide up the profits. Unfortunately, unless you account for cost of a person’s time, profits are not clear. Running a lemonade stand is a low-skill job. The fair market rate for a manager’s time is probably minimum wage, currently set at $7.25. Merrily spent an hour setting up and running the stand. So here is what the numbers look like fully-loaded (not including taxes):

Now that all the expenses are accounted for it’s clear that profits are much smaller than Merrily originally thought. Now the question is, who gets the profits? Slicing Pie gives us the answer. Below I’ve color-coded the contributions and converted to Slices using the recommended multipliers. Red is Merrily, Blue is mom and dad:

Dad’s $9.50 in change was never at risk so Merrily just gives it back to dad. When you tally up the results, dad made 79% of the bets and walked away with $4.17. Merrily only made $1.08. Neither partner fared very well on this venture, but each person got what they deserved.

Let’s pretend Merrily used dad’s investment to pay herself $7.25. This would not change the income of the company, but would change the allocation of profits. Dad and mom would have covered 100% of the costs and, therefore, would get all the profits ($5.25). Still not a great venture.

In a startup company, it’s important to keep track of all the expenses, even those you don’t pay—especially fair market salaries. Inaccurate accounting for inputs will lead to an unfair split.

May 19, 2022

Can a Startup Using Slicing Pie Make the S Corporation Election?

The following post is from famed Slicing Pie-friendly lawyer Matt Rossetti , but does not constitute legal advice nor does it necessarily reflect the opinion of other Slicing Pie lawyers. It is however, interesting enough to be included in this Slicing Pie blog!

A common question that I receive from founders is “Can I make the S-Corporation election for my startup if I am using the Slicing Pie model?” The purpose of Slicing Pie and any form of dynamic equity is to fairly and proportionately distribute equity amongst cofounders of a new venture. The Slicing Pie model provides founders with an equity allocation framework and a recovery framework for when parties decide to leave the startup for any number of reasons. Slicing Pie works well for limited liability companies, partnerships, and C Corporations. However, it is not appropriate for ventures that are taxed as S Corporations.

What is an S-Corporation?

According to the Internal Revenue Service, an S Corporation is a company (generally an LLC or a C Corporation) that elects to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Shareholders of S Corporations report flow-through income and losses on their personal tax returns and are assessed tax at their individual income tax rates. This allows S Corporations to avoid double taxation on income at the entity level. However, S Corporations are responsible for tax on certain built-in gains and passive income at the entity level.

To qualify for S corporation status, a company must meet the following requirements:Be a domestic corporationHave only allowable shareholdersMay be individuals, certain trusts, and estates andMay not be partnerships, corporations or non-resident alien shareholdersHave no more than 100 shareholdersHave only one class of stockNot be an ineligible corporation (i.e., certain financial institutions, insurance companies, and domestic international sales corporations).

How does my company become an S Corporation?

In addition to meeting the criteria above and having properly drafted governing legal documents, a company becomes an S Corporation by submitting Form 2553 to the IRS in a timely fashion. To complete Form 2553, the founders must know who the company’s shareholders or members are and exactly how many shares or what percentage of the company that each shareholder or member owns.

Why doesn’t Slicing Pie work for S Corporations?

First and foremost, the Slicing Pie model is, by definition, dynamic. This makes it impossible to properly complete and file Form 2553 with the IRS.

Second, Slicing Pie is appropriate for bootstrapped pre-revenue startups only. Under the Internal Revenue Code, S Corporations are required to pay each shareholder a “reasonable” salary. In order to pay said reasonable salary, the company generally must be profitable. Most accountants will recommend that startup founders make the S Corporation election if and only if their venture will have approximately $80,000.00 per year in top line revenue. Bootstrapped startups generally cannot afford this salary and, if the startup can afford to pay fair market salaries, there is no reason to use a dynamic equity model like Slicing Pie.

Third, many times Slicing Pie ventures have entity and non-resident alien owners. In other words, other companies and parties who are not US citizens or residents choose to work as participants in the Slicing Pie model in the hope of receiving a windfall in the future upon exit. Because S Corporations cannot have entity shareholders (partnerships and corporations), it would be a disadvantage for a Slicing Pie venture to make the S Corporation election. It should also be noted that international contractors (non-resident aliens) cannot be owners of S Corporations which could limit your venture’s access to talent in today’s economy.

All of these matters are easy to navigate with competent legal and tax counsel. If your venture has not retained counsel or your current counsel requires assistance, schedule a free consultation to discuss an engagement with Matt Rossetti now.

Back to TopicsMarch 16, 2022

Finnish Founders Can Use the Slicing Pie Model

Standard slicing pie cofounder agreement templates for pre-incorporation phase is now customised for Finland.

Finland joined as yet another country whose founders are able to use the dynamic equity split based on the slicing pie method, as developed by Mike Moyer.

Dynamic equity split based on the slicing pie method are very popular with founders as an alternative to the traditional fixed equity splits. Why? Because they are transparent, fair and future proof. And to the techies between founders, they provide an understandable methodology. They also accommodate for the uncertain future, which is the main blind spot of the fixed splits

Helsinki: thanks to the efforts of Jon Hautamäki (Mr.), Partner at Nordic Law Ltd, who customised for Finnish founders the Cofounder Agreement template using the dynamic equity split. The dynamic equity split is based on Mike Moyer’s slicing pie method. This is great news for Finnish early stage founders, as it gives them the opportunity to use the ‘fairest equity split tool’ and avoid many potential issues that are caused by fixed equity split in too early stages.

The solution is based on the standardised templates developed by Jana Nevrlka, the founder of Cofounding, who coordinates the development of the slicing pie solution for European founders together with great help and support of Mike Moyer and other local slicing pie experts.

Mike Moyer, the US-based inventor of the Slicing Pie model, was pleased to hear the development “Slicing Pie is used by thousands of companies all over the world and most countries encourage fairness, but it is always nice to give founders that extra certainty that the model is aligned with the local rules and have local Slicing Pie expertise available.”

Jon is Managing Partner as well as the Chairman of the Board of Nordic Law, law firm focused on technology-based business areas. Jon advises clients in complex questions related especially to technology law, cryptocurrencies, M&A as well as growth companies. Furthermore, Jon is a seasoned professional in matters concerning tax and structuring. Jon has also been acting as a member of the board of several growth companies. Jon holds an LL.M. degree from the University of Helsinki. He has taken the Finnish Bar Exam in 2014.

About Cofounding

Cofounding is creating tools and know how for founders, which include cofounder agreement templates, equity split tools and courses, and a proven 7 steps of cofounding the right way methodology, developed by Dr. Jana Nevrlka. It is summarised in an international bestseller, Cofounding The Right Way. Jana is driven by the mission of “No more failed business partnerships!” .. that could have been prevented. She is focused on helping founders build cofounding teams that win and last.

About Slicing Pie

Slicing Pie is a universal, one-size-fits-all solution for the allocation and recovery of equity in an early-stage, bootstrapped company. It is a formula that allows founders to divide equity based on the fair market value of each participant’s contribution. It is a fair, logical and structured way to align everyone’s interests and incentives. Slicing Pie is used all over the world. It is, by far, the fairest way to split equity in an early-stage, bootstrapped startup! Developed by Mike Moyer.

Luxembourg Founders Can Use the Slicing Pie Model

Standard slicing pie cofounder agreement template for pre-incorporation phase is now customized for Luxembourg.

Dynamic equity split based on the slicing pie method is very popular with founders as an alternative to the traditional fixed equity splits. Why? Because it is transparent, fair and future proof. And it provides an understandable and objective methodology. It also accommodates for the uncertain future, which is the main blind spot of the fixed splits.

Luxembourg: thanks to the efforts of Aurélien Hollard, Harrison Dans and Tristan Louet, CMS Luxembourg, who customized for Luxembourg founders the pre-incorporation Cofounder Agreement template using the dynamic equity split! The dynamic equity split is based on Mike Moyer’s slicing pie method. This is great news for Luxembourg early stage founders, as it gives them the opportunity to use the ‘fairest equity split tool’ and avoid many potential issues that are caused by fixed equity split in too early stages.

CMS Luxembourg aims to support all innovative projects, the dynamic equity split based on the slicing pie model being one of them. We were therefore pleased to support Jana Nevrlka in the drafting of the pre-incorporation Cofounder agreement specific to our jurisdiction. We thank Jana Nevrlka for her trust and we are proud to be part of this ambitious project.

The solution is based on the standardized templates developed by Jana Nevrlka, the founder of Cofounding, who coordinates the development of the slicing pie solution for European founders together with great help and support of Mike Moyer and other local slicing pie experts.

Mike Moyer, the US-based inventor of the Slicing Pie model, was pleased to hear the development “Slicing Pie is used by thousands of companies all over the world and most countries encourage fairness, but it is always nice to give founders that extra certainty that the model is aligned with the local rules and have local Slicing Pie expertise available.”

Aurélien Hollard

Triston Louet

Harrison Dans

About Aurélien Hollard

Partner – Attorney at law (avocat à la cour)

Aurélien heads the Investment Funds practice. He is specialised in the formation of alternative investment funds (AIFs) and has significant experience in structuring funds for private equity, venture capital, private debt, real estate and infrastructure. Aurélien assists both local and international clients in the structuring of Luxembourg AIFs, whether organised as unregulated (SV, SCSp, Sàrl), semi-regulated (RAIF) or regulated (SIF, SICAR, Part II) funds. He also advises institutional investors in their investments as well as management companies in their legal and regulatory requirements.

Aurélien also assist local and international clients in their securitisation and capital market transactions, for both debt and equity, whether exempted, publicly authorised and/or listed. Aurélien also leads sustainable and digital campaigns within CMS and is therefore deeply involved in ESG and fund tokenisation. He is a fully qualified lawyer admitted to the Bars of Paris and Luxembourg.

About Harrison Dans

Managing Associate – Attorney at law (avocat à la cour)

Harrison is a Managing Associate in our Investment Funds team. He specialises in the structuring of alternative investment funds (regulated and unregulated) having private equity, real estate, and debt strategies. Harrison has notably been involved in setting up and launching various real estate and private equity funds in the form of investment companies with variable capital – reserved alternative investment funds. He also has buy-side experience, advising institutional, professional and sovereign investors with regard to fund reviews. He has also developed expertise in the field of pension funds.

About Tristan Louet

Associate – Lawyer (juriste d’affaires)

Tristan is an Associate in CMS Luxembourg investment funds practice.

He intervenes on the set-up of Luxembourg alternative investment funds including all related matters such draft and review fund legal documentation.

About Cofounding

Cofounding is creating tools and know how for founders, which include cofounder agreement templates, equity split tools and courses, and a proven 7 steps of cofounding the right way methodology, developed by Dr. Jana Nevrlka. It is summarised in an international bestseller, Cofounding The Right Way. Jana is driven by the mission of “No more failed business partnerships!” .. that could have been prevented. She is focused on helping founders build cofounding teams that win and last.

About Slicing Pie

Slicing Pie is a universal, one-size-fits-all solution for the allocation and recovery of equity in an early-stage, bootstrapped company. It is a formula that allows founders to divide equity based on the fair market value of each participant’s contribution. It is a fair, logical and structured way to align everyone’s interests and incentives. Slicing Pie is used all over the world. It is, by far, the fairest way to split equity in an early-stage, bootstrapped startup! Developed by Mike Moyer.

LUXEMBOURG FOUNDERS CAN USE THE SLICING PIE MODEL

Standard slicing pie cofounder agreement template for pre-incorporation phase is now customized for Luxembourg.

Dynamic equity split based on the slicing pie method is very popular with founders as an alternative to the traditional fixed equity splits. Why? Because it is transparent, fair and future proof. And it provides an understandable and objective methodology. It also accommodates for the uncertain future, which is the main blind spot of the fixed splits.

Luxembourg: thanks to the efforts of Aurélien Hollard, Harrison Dans and Tristan Louet, CMS Luxembourg, who customized for Luxembourg founders the pre-incorporation Cofounder Agreement template using the dynamic equity split! The dynamic equity split is based on Mike Moyer’s slicing pie method. This is great news for Luxembourg early stage founders, as it gives them the opportunity to use the ‘fairest equity split tool’ and avoid many potential issues that are caused by fixed equity split in too early stages.

CMS Luxembourg aims to support all innovative projects, the dynamic equity split based on the slicing pie model being one of them. We were therefore pleased to support Jana Nevrlka in the drafting of the pre-incorporation Cofounder agreement specific to our jurisdiction. We thank Jana Nevrlka for her trust and we are proud to be part of this ambitious project.

The solution is based on the standardized templates developed by Jana Nevrlka, the founder of Cofounding, who coordinates the development of the slicing pie solution for European founders together with great help and support of Mike Moyer and other local slicing pie experts.

Mike Moyer, the US-based inventor of the Slicing Pie model, was pleased to hear the development “Slicing Pie is used by thousands of companies all over the world and most countries encourage fairness, but it is always nice to give founders that extra certainty that the model is aligned with the local rules and have local Slicing Pie expertise available.”

Aurélien Hollard

Triston Louet

Harrison Dans

About Aurélien Hollard

Partner – Attorney at law (avocat à la cour)

Aurélien heads the Investment Funds practice. He is specialised in the formation of alternative investment funds (AIFs) and has significant experience in structuring funds for private equity, venture capital, private debt, real estate and infrastructure. Aurélien assists both local and international clients in the structuring of Luxembourg AIFs, whether organised as unregulated (SV, SCSp, Sàrl), semi-regulated (RAIF) or regulated (SIF, SICAR, Part II) funds. He also advises institutional investors in their investments as well as management companies in their legal and regulatory requirements.

Aurélien also assist local and international clients in their securitisation and capital market transactions, for both debt and equity, whether exempted, publicly authorised and/or listed. Aurélien also leads sustainable and digital campaigns within CMS and is therefore deeply involved in ESG and fund tokenisation. He is a fully qualified lawyer admitted to the Bars of Paris and Luxembourg.

About Harrison Dans

Managing Associate – Attorney at law (avocat à la cour)

Harrison is a Managing Associate in our Investment Funds team. He specialises in the structuring of alternative investment funds (regulated and unregulated) having private equity, real estate, and debt strategies. Harrison has notably been involved in setting up and launching various real estate and private equity funds in the form of investment companies with variable capital – reserved alternative investment funds. He also has buy-side experience, advising institutional, professional and sovereign investors with regard to fund reviews. He has also developed expertise in the field of pension funds.

About Tristan Louet

Associate – Lawyer (juriste d’affaires)

Tristan is an Associate in CMS Luxembourg investment funds practice.

He intervenes on the set-up of Luxembourg alternative investment funds including all related matters such draft and review fund legal documentation.

About Cofounding

Cofounding is creating tools and know how for founders, which include cofounder agreement templates, equity split tools and courses, and a proven 7 steps of cofounding the right way methodology, developed by Dr. Jana Nevrlka. It is summarised in an international bestseller, Cofounding The Right Way. Jana is driven by the mission of “No more failed business partnerships!” .. that could have been prevented. She is focused on helping founders build cofounding teams that win and last.

About Slicing Pie

Slicing Pie is a universal, one-size-fits-all solution for the allocation and recovery of equity in an early-stage, bootstrapped company. It is a formula that allows founders to divide equity based on the fair market value of each participant’s contribution. It is a fair, logical and structured way to align everyone’s interests and incentives. Slicing Pie is used all over the world. It is, by far, the fairest way to split equity in an early-stage, bootstrapped startup! Developed by Mike Moyer.