Mike Moyer's Blog, page 11

September 3, 2015

Slicing Pie at the International Startup Festival in Montreal

Perfect equity splits for startups

You and a partner go in “50/50” on a new business. You do all the work, he owns half the company. Now what? Traditional equity splits are never fair. Someone always has more than they deserve at the expense of others. Contrary to conventional wisdom, there is a simple method for dividing equity in an early stage company that tells you exactly the right number of shares for each participant. Attendees will learn how to implement a practical dynamic equity split using an allocation framework that tells you how many shares each person gets, and a recovery framework that tells you the fair buyout price (if any) in the event that someone leaves.

July 13, 2015

Bootstrapper Equity: Why Time-Based Vesting is a Waste of Time

Any startup attorney or experienced entrepreneur will prudently recommend a time-based vesting schedule for early-stage employees who accept equity in lieu of cash compensation. A vesting schedule prevents a slacker employee from walking away from your company with a chunk of equity when they quit or fail to perform. In my opinion, such agreements are a waste of time and money because they are simply a Band-Aid over a much larger, gaping wound that is the underlying equity agreement.

A vesting schedule implies that a fixed number of shares were allocated to an individual before any actual work was completed. Once equity is doled out, the owner if the shares can simply walk away and keep the shares. To mitigate this risk, the vesting schedule forces the employee to stick around for specific time intervals before they can keep the shares. For instance, they might get to keep 20% of their shares at the end of each year. At the end of five years they own 100% and are “fully vested.”

Of course, there is nothing to prevent the employee from quitting the day after her shares vest, nor is there anything preventing the employer from firing the employee the day before her shares vest. I’ve seen both scenarios and neither are pretty.

To further mitigate the damage caused by this sort of thing you have founder’s share agreements and buyback agreements and employment agreements and it goes on and on. Lots of money spent on lawyers instead of on marketing. Not a great way to start a company.

The fundamental, underlying issue is the act of doling out a fixed chunk of equity in the first place. Fixed equity splits are akin to paying someone their entire salary on day one. Giving someone a lump-sum salary payment in advance of work getting done sounds stupid because it is stupid. But, so is giving them a fixed chunk of equity. It’s the same thing.

The Slicing Pie model does not use time-based vesting because slices in the pie are only allocated when actual work is performed. This prevents the possibility that someone will have un-deserved shares. Additionally, the Slicing Pie recovery framework dictates the disposition of the shares when someone leaves the company. Consequences are imposed on the party that caused the separation. Getting fired for performance reasons, for instance, is different than being fired for no reason or being laid off.

If you are using or have been offered a time-based vesting program you are dealing with an equity program that is fundamentally flawed. It’s such a common mistake that most people don’t realize they are making it. Use the Slicing Pie model to ensure that everyone gets what they deserve and everyone has the proper protection.

March 18, 2015

Noam Wasserman’s Equity Checklist

Noam is a professor at Harvard University who has studied founder’s issues extensively. His book, The Founder’s Dilemmas, covers the major mistakes that founders make. One of them, of course, is equity splits. In the video below, Noam talks about the main problem with most splits:

February 4, 2015

Slicing Pie in 12 Slides

Here is my attempt to explain Slicing Pie in as few slides as possible:

January 30, 2015

An Infographic for Perfect Equity Splits

January 28, 2015

Executive View: See What the Leader can See

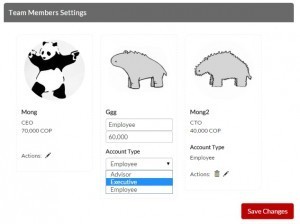

Hi there! We have introduced new views for better management. The Leader’s view, the Executive’s view, and the Employee’s and Adviser’s view.

We’ve got a lot of request lately regarding being able to see everything in the fund even if you are not a leader. The Pie Slicer team now added a new feature for your executives. Executives will now have their view of the Pie similar to what the leader can see! Executives can see everyone in the Fund, what their contributions are, and how much do they own.

For existing members who needs this view, you may want to ask your leader to convert your account to “Executive” from the Team Members Settings page.

Happy Slicing!

January 12, 2015

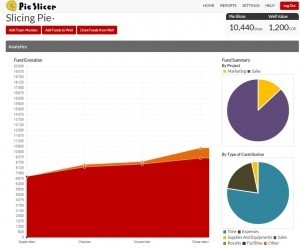

Pie Slicer Analytics is Here!

Good News! Pie Slicer now gives you a better look at your pie. With a visual view of the evolution of your fund, you’ll see who made the most of the month.

If you only have a month record of contributions, you’ll view the Fund Evolution by week instead.

To see your Analytics page, you can go to Reports > Analytics

Happy Slicing!

December 16, 2014

Fair & Square for Pie Slicer Users

As a Pie Slicer user, you are entitled to a free copy of Fair & Square- the Pie Slicer Companion Guide. Fair & Square covers the Slicing Pie model in detail and provides tips and advice for getting the most out of the Pie Slicer application.

As a Pie Slicer user, you are entitled to a free copy of Fair & Square- the Pie Slicer Companion Guide. Fair & Square covers the Slicing Pie model in detail and provides tips and advice for getting the most out of the Pie Slicer application.

DOWNLOAD NOW

If you would like to purchase a print copy of the book please click here and use this discount code: P9QZKW8G

December 2, 2014

Interview with the Growing Entrepreneur with Dave Goodwin

Below is a podcast interview with Dave Goodman from the Growing Entrepreneur.

December 1, 2014

Pie Slicer Beta Ending

Thank you to everyone who participated in the Pie Slicer beta program!

We really appreciated your ideas and feedback, but the program is coming to an end!

The beta site is going to be taken down on December 16th, 2014.

If you are a beta user and you would like to continue to access your Pie, you will need to upgrade to one of our paid subscriptions which start at $5 per month per Pie with unlimited participants.