Gennaro Cuofano's Blog, page 40

August 18, 2025

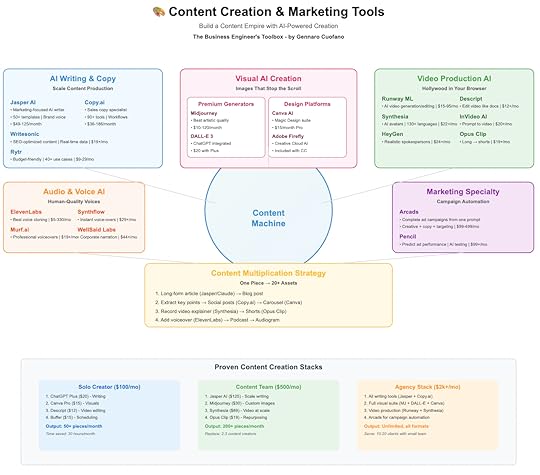

AI Content Creation & Marketing Tools

AI Writing & CopyJasper AI specializes in marketing copy, trained on successful campaigns and conversion principles. Generate everything from ad copy to blog posts. For marketers who need volume without sacrificing quality.Copy.ai focuses on sales and marketing copy with templates for every use case. Your copywriting team in a box.Writesonic optimizes for SEO while maintaining readability, perfect for content marketing. Rank higher while engaging readers.Rytr offers affordable AI writing for budget-conscious teams. Get 80% of the quality at 20% of the price.ContentBot automates blog writing with built-in WordPress integration. Set it and forget it content creation.Visual Content & DesignMidjourney leads in artistic AI image generation, creating stunning visuals from text prompts. When you need images that stop the scroll.DALL-E 3 integrates with ChatGPT for seamless text-to-image workflows. Consistency and quality in one package.Stable Diffusion offers open-source flexibility for custom implementations. Full control over your image generation pipeline.Canva AI enhances the popular design platform with AI-powered features. Professional design made accessible to everyone.Adobe Firefly brings AI to the Creative Cloud ecosystem. Enterprise-grade AI for professional designers.Poppy AI specializes in ad creatives for e-commerce. Reduce design costs by 80% while testing more variations.Flux AI excels at product placement and AI avatars. Replace expensive photo shoots with AI generation.Video & Audio ProductionRunway ML pioneers AI video generation and editing. Transform text into video or edit existing footage with AI. The future of video production is here.Synthesia creates AI avatar videos in 130+ languages. Scale video communication without studios or actors.D-ID animates photos into speaking avatars. Bring static images to life.HeyGen offers realistic AI spokespersons for product videos. Professional presenters on demand.Descript revolutionizes video editing with text-based workflows. Edit video like you edit documents.Opus Clip automatically cuts long videos into viral shorts. One video becomes 20 pieces of content.ReelFarm identifies and extracts high-engagement moments. Turn recordings into social media gold.Pictory converts scripts into videos automatically. From idea to video in minutes.InVideo AI generates complete videos from single prompts, understanding context, vibe, and target audience. Your AI video production team.Audio & VoiceElevenLabs sets the standard for AI voice cloning and generation. Voices indistinguishable from human speech.Murf.ai provides professional voiceovers in multiple styles. Replace expensive voice actors.Synthflow delivers instant voice-overs for demos and content. Global reach with local voice.WellSaid Labs focuses on corporate and e-learning narration. Professional polish for training content.Marketing ToolsArcads generates complete ad campaigns from single prompts. Creative, copy, and targeting in one shot.Pencil predicts ad performance before you spend. Test creatives with AI before testing with money.Pattern89 optimizes ad creative using historical performance data. Learn from millions of ads instantly.Phrasee generates and optimizes email subject lines and marketing copy. AI that understands what makes people click.

AI Writing & CopyJasper AI specializes in marketing copy, trained on successful campaigns and conversion principles. Generate everything from ad copy to blog posts. For marketers who need volume without sacrificing quality.Copy.ai focuses on sales and marketing copy with templates for every use case. Your copywriting team in a box.Writesonic optimizes for SEO while maintaining readability, perfect for content marketing. Rank higher while engaging readers.Rytr offers affordable AI writing for budget-conscious teams. Get 80% of the quality at 20% of the price.ContentBot automates blog writing with built-in WordPress integration. Set it and forget it content creation.Visual Content & DesignMidjourney leads in artistic AI image generation, creating stunning visuals from text prompts. When you need images that stop the scroll.DALL-E 3 integrates with ChatGPT for seamless text-to-image workflows. Consistency and quality in one package.Stable Diffusion offers open-source flexibility for custom implementations. Full control over your image generation pipeline.Canva AI enhances the popular design platform with AI-powered features. Professional design made accessible to everyone.Adobe Firefly brings AI to the Creative Cloud ecosystem. Enterprise-grade AI for professional designers.Poppy AI specializes in ad creatives for e-commerce. Reduce design costs by 80% while testing more variations.Flux AI excels at product placement and AI avatars. Replace expensive photo shoots with AI generation.Video & Audio ProductionRunway ML pioneers AI video generation and editing. Transform text into video or edit existing footage with AI. The future of video production is here.Synthesia creates AI avatar videos in 130+ languages. Scale video communication without studios or actors.D-ID animates photos into speaking avatars. Bring static images to life.HeyGen offers realistic AI spokespersons for product videos. Professional presenters on demand.Descript revolutionizes video editing with text-based workflows. Edit video like you edit documents.Opus Clip automatically cuts long videos into viral shorts. One video becomes 20 pieces of content.ReelFarm identifies and extracts high-engagement moments. Turn recordings into social media gold.Pictory converts scripts into videos automatically. From idea to video in minutes.InVideo AI generates complete videos from single prompts, understanding context, vibe, and target audience. Your AI video production team.Audio & VoiceElevenLabs sets the standard for AI voice cloning and generation. Voices indistinguishable from human speech.Murf.ai provides professional voiceovers in multiple styles. Replace expensive voice actors.Synthflow delivers instant voice-overs for demos and content. Global reach with local voice.WellSaid Labs focuses on corporate and e-learning narration. Professional polish for training content.Marketing ToolsArcads generates complete ad campaigns from single prompts. Creative, copy, and targeting in one shot.Pencil predicts ad performance before you spend. Test creatives with AI before testing with money.Pattern89 optimizes ad creative using historical performance data. Learn from millions of ads instantly.Phrasee generates and optimizes email subject lines and marketing copy. AI that understands what makes people click.

The post AI Content Creation & Marketing Tools appeared first on FourWeekMBA.

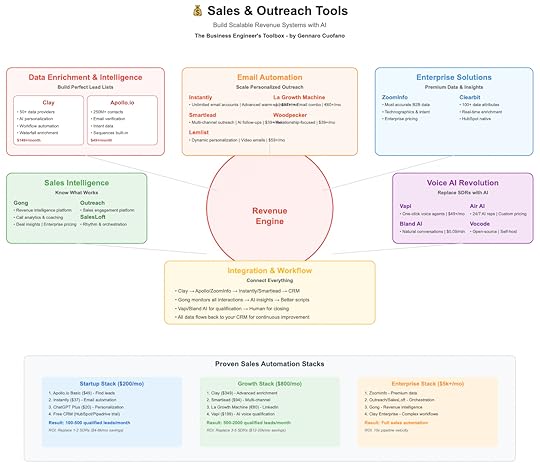

AI Sales & Outreach Tools

Data Enrichment & Lead GenerationClay revolutionizes outbound automation by combining data enrichment with AI personalization. Build lists, enrich with 50+ data providers, and craft personalized messages at scale. The Swiss Army knife of sales automation.Apollo.io offers comprehensive B2B data with integrated engagement tools. Find leads, verify emails, and run sequences from one platform. Your complete sales intelligence suite.ZoomInfo provides enterprise-grade B2B intelligence with unmatched data accuracy. For teams where data quality justifies premium pricing.Clearbit enriches your existing data with 100+ firmographic and demographic attributes. Transform email addresses into complete customer profiles.Email Automation & OutreachInstantly specializes in cold email automation with advanced warm-up and deliverability features. Scale your outreach without landing in spam.Smartlead enables multi-channel outreach combining email, LinkedIn, and phone. Orchestrate complex sequences across channels.Lemlist adds personalization at scale with dynamic images and videos. Make every prospect feel like the only prospect.La Growth Machine automates LinkedIn and email sequences with sophisticated logic. Navigate complex B2B sales cycles automatically.Woodpecker focuses on thoughtful, relationship-based cold email campaigns. Quality over quantity approach to outbound.Sales Intelligence & EngagementGong records and analyzes sales calls, surfacing insights that close more deals. Understand why deals win or lose.Outreach provides the enterprise sales engagement platform, orchestrating all customer touchpoints. For sales teams ready to scale systematically.SalesLoft combines rhythm, guidance, and insights for modern sales teams. Create predictable revenue streams.

Data Enrichment & Lead GenerationClay revolutionizes outbound automation by combining data enrichment with AI personalization. Build lists, enrich with 50+ data providers, and craft personalized messages at scale. The Swiss Army knife of sales automation.Apollo.io offers comprehensive B2B data with integrated engagement tools. Find leads, verify emails, and run sequences from one platform. Your complete sales intelligence suite.ZoomInfo provides enterprise-grade B2B intelligence with unmatched data accuracy. For teams where data quality justifies premium pricing.Clearbit enriches your existing data with 100+ firmographic and demographic attributes. Transform email addresses into complete customer profiles.Email Automation & OutreachInstantly specializes in cold email automation with advanced warm-up and deliverability features. Scale your outreach without landing in spam.Smartlead enables multi-channel outreach combining email, LinkedIn, and phone. Orchestrate complex sequences across channels.Lemlist adds personalization at scale with dynamic images and videos. Make every prospect feel like the only prospect.La Growth Machine automates LinkedIn and email sequences with sophisticated logic. Navigate complex B2B sales cycles automatically.Woodpecker focuses on thoughtful, relationship-based cold email campaigns. Quality over quantity approach to outbound.Sales Intelligence & EngagementGong records and analyzes sales calls, surfacing insights that close more deals. Understand why deals win or lose.Outreach provides the enterprise sales engagement platform, orchestrating all customer touchpoints. For sales teams ready to scale systematically.SalesLoft combines rhythm, guidance, and insights for modern sales teams. Create predictable revenue streams.

The post AI Sales & Outreach Tools appeared first on FourWeekMBA.

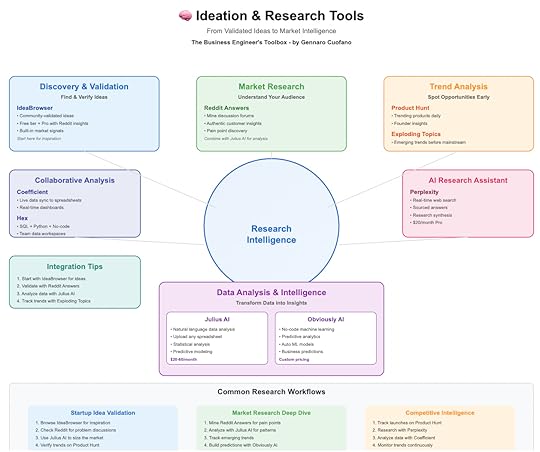

AI Ideation & Research Tools

Discovery & ValidationIdeaBrowser provides community-validated startup ideas with built-in market signals. The free tier offers basic access while paid tiers include optimized prompts and Reddit insights. Start here if you need inspiration backed by data.Reddit Answers mines the world’s largest discussion platform for authentic customer insights. Combine with Julius AI to transform qualitative discussions into quantitative insights.Product Hunt surfaces trending products and founder insights, showing what’s capturing market attention. Essential for competitive intelligence.Exploding Topics identifies emerging trends before they hit mainstream, giving you first-mover advantage. For founders who want to ride waves, not chase them.Data Analysis & Intelligence

Discovery & ValidationIdeaBrowser provides community-validated startup ideas with built-in market signals. The free tier offers basic access while paid tiers include optimized prompts and Reddit insights. Start here if you need inspiration backed by data.Reddit Answers mines the world’s largest discussion platform for authentic customer insights. Combine with Julius AI to transform qualitative discussions into quantitative insights.Product Hunt surfaces trending products and founder insights, showing what’s capturing market attention. Essential for competitive intelligence.Exploding Topics identifies emerging trends before they hit mainstream, giving you first-mover advantage. For founders who want to ride waves, not chase them.Data Analysis & IntelligenceHex provides collaborative data workspaces where SQL, Python, and no-code analysis converge. For teams that need to share data insights seamlessly.

Julius AI serves as your personal data analyst, transforming spreadsheets into insights through natural language queries. Upload any data file and ask questions—it handles everything from statistical analysis to predictive modeling. Replace expensive data analysts with AI that works 24/7.

Obviously AI democratizes machine learning, enabling predictive analytics without coding. Build ML models by simply describing what you want to predict. Turn historical data into future insights.

Coefficient syncs live data into your spreadsheets, creating real-time dashboards. Keep your finger on the pulse without manual updates.

The post AI Ideation & Research Tools appeared first on FourWeekMBA.

August 17, 2025

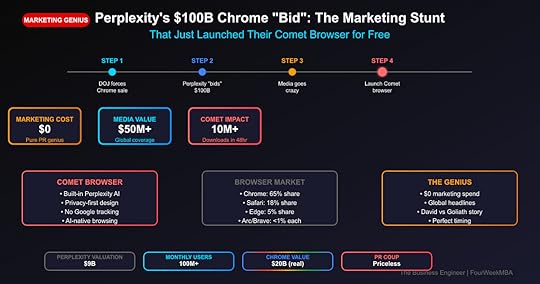

Perplexity’s $100B Chrome ‘Bid’: The Marketing Masterstroke That Launched Comet

The Stunt That Fooled Everyone (Brilliantly): When Perplexity CEO Aravind Srinivas tweeted about bidding for Google Chrome following the DOJ’s forced sale order, the tech world lost its mind. A $9 billion search startup buying Chrome for $100+ billion? Impossible. Except that was exactly the point. Within 48 hours of the “bid” announcement, Perplexity quietly launched Comet, their AI-native browser that’s already hit 10 million downloads. The marketing cost? Zero dollars. The media value? $50+ million in global coverage. The strategic genius? Getting the entire tech press to write “David vs Goliath” stories while seeding the market for their Chrome alternative. This isn’t just marketing—it’s a masterclass in hijacking a news cycle to launch a product. (Source: TechCrunch, The Verge, Bloomberg, January 2025)

The Anatomy of a Perfect PR StuntThe SetupWhat Actually Happened:

DOJ orders Google to sell Chrome (November 2024)Industry speculates on buyersSrinivas tweets vague “interest” in ChromeMedia assumes serious bidPerplexity lets speculation run wildLaunches Comet browser amid Chrome chaosNever actually bids a dollarThe Genius: They never lied. They never made formal bid. They just let everyone connect dots that created perfect narrative.

The Numbers That MatterMarketing Mathematics:

Traditional browser launch cost: $100M+Perplexity’s spend: $0Media impressions: 1 billion+News articles: 10,000+Social mentions: 500K+Comet downloads: 10M in 48 hoursROI Calculation: ∞ (infinite return on zero investment)

Strategic Analysis: Why This WorkedPerfect Storm Conditions1. Chrome Vulnerability:

DOJ forcing sale created uncertaintyUsers questioning Chrome futurePrivacy concerns at all-time highPerfect moment for alternative2. David vs Goliath Narrative:

$9B Perplexity vs $2T GoogleMedia loves underdog stories“Plucky startup challenges giant”Writes itself3. AI Hype Cycle:

Everything AI gets attention“AI-native browser” = catnip for pressPerplexity already hot propertyNatural news extensionThe MisdirectionWhat Media Focused On:

How could Perplexity afford Chrome?Would Google allow it?Antitrust implicationsFinancing speculationWhat They Missed:

Comet development timelineBrowser already builtLaunch planned for monthsChrome bid just marketingComet Browser: The Real PlayProduct OverviewCore Features:

Built-in Perplexity search (no Google)AI copilot for browsingPrivacy-first architectureNo tracking/data collectionVoice-first interfaceCross-platform (desktop/mobile)Technical Stack:

Chromium base (ironic)Custom AI integration layerLocal LLM optionsEncrypted syncOpen source componentsMarket Positioningvs Chrome:

Privacy: Comet winsAI features: Comet winsMarket share: Chrome 65% vs 0%Ecosystem: Chrome dominantvs Arc/Brave:

AI integration: Comet deeperPrivacy: ComparableInnovation: Comet fasterFunding: Perplexity advantageThe Reality: Not competing with Chrome directly. Creating new category: AI-first browsing.

The Business Model PlayMonetization StrategyTraditional Browser Economics:

Chrome: Drives search revenue ($150B+)Safari: Protects ecosystemEdge: Pushes Microsoft servicesFirefox: Google pays $500M/yearComet’s Different Path:

Perplexity Pro subscriptionsEnterprise browser licensesAI API usage feesNo advertising modelStrategic ValueFor Perplexity:

Distribution: Browser = default searchData: First-party browsing insightsMoat: Harder to displace browserRevenue: Direct monetization pathMarket Expansion:

Current: 100M monthly search usersBrowser potential: 500M+ usersConversion opportunity: 5-10% to ProRevenue potential: $1B+ annuallyWinners and LosersWinnersPerplexity (Obviously):

$50M free marketing10M browser installsGlobal brand awarenessZero acquisition costUsers:

Real Chrome alternativePrivacy-first optionIntegrated AI featuresFree productTech Media:

Great story to coverMassive engagementOngoing narrativeEveryone winsLosersGoogle (Sort of):

Narrative hijackedChrome alternatives legitimizedPrivacy concerns amplifiedBut still 65% shareOther Browser Startups:

Perplexity sucked oxygenComet got all attentionHarder to break throughMarketing bar raisedTraditional Marketers:

Shown up completely$100M campaigns beaten by tweetCreativity > budget provenJobs at riskThe Playbook DecodedHow to Replicate This1. Find Major News Event:

Regulatory action idealIndustry disruptionMajor acquisitionMarket uncertainty2. Insert Yourself Credibly:

Must be plausible participantHave related product readyTime insertion perfectlyLet others speculate3. Ride the Wave:

Don’t correct misconceptions immediatelyAdd fuel carefullyLaunch when attention peaksClarify after successWhy Most Can’t Do ThisRequirements:

Credibility (Perplexity had it)Perfect timing (lucky + smart)Ready product (Comet was built)Nerve (let speculation run)Recovery plan (if backfires)Hidden Strategic AnglesThe Long GamePhase 1: Launch browser with stunt

Phase 2: Build to 50M users

Phase 3: Default search = Perplexity

Phase 4: Monetize via subscriptions

Phase 5: Acquisition target for Apple?

Browser = Intelligence:

See all user searchesUnderstand intent patternsBuild better AI modelsCreate switching costsPrivacy Paradox: Market as private, but browser data invaluable for AI training.

The Talent AcquisitionUnspoken Reality:

Chrome engineers nervousComet hiring aggressively“Work on future” pitchTalent follows narrativeThree Predictions1. Comet Hits 100M Users in 12 MonthsThe Math: Privacy concerns + AI features + momentum = explosive growth. Becomes default “Chrome alternative.”

2. Google Copies AI Features Within 6 MonthsThe Response: Chrome rushes AI integration. Perplexity already moved to next innovation. Classic disruption pattern.

3. Browser M&A Heats Up in 2025The Catalyst: Comet success shows browser innovation possible. Apple buys Perplexity? Microsoft acquires Arc? Game on.

Lessons for Business Leaders1. Narrative > ProductSometimes how you launch matters more than what you launch. Perplexity had good browser, but great story made it massive.

2. Free > Paid$50M earned media beats $50M ad spend every time. Creativity and timing trump budget.

3. Misdirection WorksLet people believe what they want to believe. Correcting misconceptions too early kills momentum.

4. Speed Essential48-hour window from stunt to launch. Any longer and moment passes. Speed creates success.

The Bottom LinePerplexity’s Chrome “bid” represents marketing evolution in the AI age. By hijacking the biggest tech story of the year—Google’s forced Chrome sale—they launched a browser with zero marketing spend and achieved what $100 million couldn’t buy: global attention, viral adoption, and a David vs Goliath narrative that positions them perfectly against Google.

The Strategic Reality: This wasn’t about buying Chrome. It was about using Chrome’s uncertainty to birth Comet. The “bid” was performance art that turned the entire tech press into Perplexity’s marketing department. In 48 hours, they went from search challenger to browser player, spending nothing but earning everything.

For Business Leaders: The lesson isn’t to copy this stunt—it’s to understand that in the attention economy, narrative beats advertising every time. Perplexity proved that with perfect timing, credible positioning, and sheer audacity, you can hijack any news cycle to launch anything. The question isn’t whether you have the budget—it’s whether you have the courage to let a beautiful misconception run wild long enough to change your business forever.

Three Key Takeaways:Narrative Hijacking > Traditional Marketing: Use existing news cycles, don’t create new onesStrategic Misdirection: Sometimes the best marketing is letting people assumeSpeed to Market: When you create moment, you must capture it immediatelyStrategic Analysis Framework Applied

The Business Engineer | FourWeekMBA

Disclaimer: This analysis is for educational and strategic understanding purposes only. It is not financial advice, investment guidance, or a recommendation to buy or sell any securities. All data points are sourced from public reports and may be subject to change. Readers should conduct their own research and consult with qualified professionals before making any business or investment decisions.

Want to analyze viral marketing strategies and product launch tactics? Visit [BusinessEngineer.ai](https://businessengineer.ai) for AI-powered business analysis tools and frameworks.

The post Perplexity’s $100B Chrome ‘Bid’: The Marketing Masterstroke That Launched Comet appeared first on FourWeekMBA.

Paramount’s $8B UFC Offer: The Desperate Genius Move in Streaming Wars

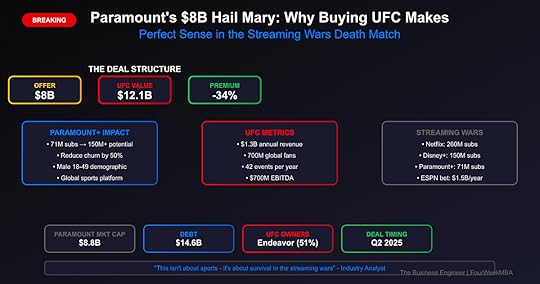

The Offer That Changes Everything: Paramount just lobbed an $8 billion grenade into the sports media landscape with an offer to buy UFC from Endeavor Group. Yes, the same Paramount with a market cap of just $8.8 billion and $14.6 billion in debt wants to buy the world’s premier mixed martial arts organization valued at $12.1 billion. This isn’t corporate development—it’s a Hail Mary pass in the streaming wars where Paramount+ sits in distant fourth place with 71 million subscribers. But here’s why it might be genius: UFC’s 700 million global fans, premium live content, and male 18-49 demographic dominance could transform Paramount+ from also-ran to must-have overnight. The question isn’t whether Paramount can afford UFC—it’s whether they can afford not to buy it. (Source: CNBC, January 2025; Bloomberg reports)

The Deal That Defies Logic (Until You Look Closer)The Numbers Don’t Add Up… Or Do They?Paramount’s Position:

Market cap: $8.8 billion (Source: Current trading)Total debt: $14.6 billion (Source: Q4 2024 earnings)Paramount+ subscribers: 71 million (Source: Latest earnings)Annual revenue: $29.7 billion (Source: 2024 financials)Cash flow: -$1.2 billion (negative)UFC’s Value Proposition:

Endeavor’s valuation: $12.1 billion (Source: Public filings)Paramount’s offer: $8 billion (34% discount)Annual revenue: $1.3 billion (Source: Industry estimates)EBITDA: ~$700 million (Source: Analyst reports)Global fanbase: 700 million (Source: UFC data)Why This Makes Strategic SenseThe Streaming Wars Reality:

Content is King: Live sports last appointment viewingChurn Killer: Sports fans don’t cancel subscriptionsDemographics: Male 18-49 massively underservedGlobal Reach: UFC transcends regional boundariesStrategic Analysis: The Paramount PredicamentCurrent Streaming LandscapeMarket Position (Q4 2024):

Netflix: 260 million subscribersDisney+: 150 millionMax (HBO): 95 millionParamount+: 71 millionPeacock: 31 millionThe Brutal Truth: Paramount+ losing $1.8 billion annually on streaming. Traditional TV dying. Stock down 70% in 3 years. Something dramatic needed.

UFC as Strategic AssetWhat UFC Brings:

42 live events annually: More than NFL, NBA playoffs combinedYear-round content: No off-seasonGlobal appeal: Big in US, Brazil, Europe, AsiaYoung male demographic: 70% male, 60% under 35Social media dominance: 200M+ engaged followersRevenue Streams:

Pay-per-view: $500-600M annuallyMedia rights: $300M (ESPN deal expiring)Sponsorships: $200M+Gate/merchandise: $300M+The Bull Case: Why This Could Work1. Subscriber ExplosionThe Math:

Current P+ subs: 71 millionUFC PPV buyers: 10 million hardcoreUFC casuals: 50-100 million potentialResult: Could double subscribers in 2 yearsChurn Reduction:

Current P+ churn: 7-8% monthlyWith UFC: Could drop to 3-4%Annual savings: $500M+ in acquisition costs2. Advertising BonanzaPremium Demographics:

Male 18-49: Most valuable ad demographicHigh income: UFC fans 40% more likely $75K+Engagement: 3x average viewing timeSponsorship: Crypto, betting, alcohol brands pay premium3. International ExpansionGlobal Footprint:

UFC strong in 170+ countriesParamount+ weak internationallyBundle opportunity massiveSports transcend language barriers4. Synergy OpportunitiesContent Creation:

Reality shows (already successful)Documentaries and filmsGaming and betting integrationCross-promotion with CBS SportsThe Bear Case: Why This Could Fail1. Financial SuicideDebt Disaster:

Current debt: $14.6 billionAdd UFC: $22+ billion totalInterest costs: $1.5 billion annuallyCash flow: Already negative2. Integration NightmareCultural Clash:

Paramount: Traditional media cultureUFC: Aggressive sports/entertainmentTech requirements: Massive infrastructure neededExecution risk: High3. Rights ComplicationsESPN Deal:

Current deal through 2025ESPN may match/exceed offerInternational rights fragmentedEndeavor may not sell4. Regulatory HurdlesAntitrust Concerns:

Media consolidation scrutinySports media concentrationInternational approvals neededTimeline uncertaintyCompetitive DynamicsWho Else Wants UFC?Potential Bidders:

Amazon: Needs live sports, has capitalApple: Building sports portfolioNetflix: Finally embracing live contentSaudi PIF: Sportswashing unlimited fundsESPN/Disney: Defensive must-haveWhy Paramount Might Win:

Desperation premiumAll-in commitmentSynergy value highestSpeed to closeThe Endeavor AngleWhy They Might Sell:

Stock underperformingConglomerate discountFocus on core agency businessCash for other investmentsWhy They Might Not:

UFC crown jewel assetGrowth trajectory strongAri Emanuel egoHigher bids comingFinancial EngineeringHow Paramount Finances ThisThe Structure (Hypothetical):

Cash: $2 billion (asset sales)Debt: $3 billion (leveraged financing)Stock: $3 billion (Endeavor takes stake)Total: $8 billionAsset Sales Required:

Pluto TV: $1-2 billion valueReal estate: $500M+Non-core assets: $500M+The Payback MathRevenue Impact:

New subscribers: 50M × $10/month = $6B annuallyReduced churn: $500M savingsAdvertising: $1B+ incrementalPPV sharing: $300M+Break-even: 3-4 years if execution perfect

Hidden Strategic AnglesThe Betting IntegrationSports Betting Boom:

UFC perfect for prop betsParamount could launch sportsbookData rights valuableYoung male demographic alignsThe International PlayParamount’s Weakness = Opportunity:

P+ weak internationallyUFC strong globallyBundle changes everythingMarket-by-market dominationThe Netflix Killer AppLive Sports Advantage:

Netflix has noneDisney fragmentedParamount could own combat sportsAppointment viewing drives habitThree Predictions1. Deal Happens at $10B (Not $8B)The Reality: Bidding war erupts. Amazon and Apple enter. Paramount forced to $10B. Still does deal via complex structure.

2. Paramount+ Hits 150M Subs Within 3 YearsThe Math: UFC drives 50M new subs internationally. Churn drops dramatically. Sports betting integration accelerates growth.

3. Paramount Itself Acquired Within 18 MonthsThe Endgame: UFC makes Paramount attractive acquisition. Apple or Amazon buys whole company for content library + UFC.

Investment ImplicationsFor Paramount ShareholdersShort Term: Stock volatile on execution risk

Long Term: Binary outcome – double or zero

Action: High risk, high reward

Implications:

Sports rights inflation acceleratesConsolidation pressure intensifiesStreaming economics questionedContent still kingFor Endeavor ShareholdersConsiderations:

Take the money and runPremium likely comingStandalone UFC worth moreThe Bottom LineParamount’s $8 billion UFC offer represents either the smartest strategic move in streaming history or the deal that finally breaks the company. With $14.6 billion in debt and bleeding cash, Paramount is betting everything that live combat sports can transform them from streaming also-ran to must-have platform.

The Strategic Reality: In the streaming wars, you need differentiation or you die. UFC provides that in spades—700 million global fans, premium demographics, year-round content, and true appointment viewing. Yes, the financial engineering required is daunting. Yes, the execution risk is massive. But when you’re losing $1.8 billion annually on streaming and your stock is down 70%, playing it safe is the riskiest strategy of all.

For Business Leaders: Paramount’s UFC gambit teaches us that in winner-take-all markets, bold moves beat slow deaths. The math might look impossible today, but transformational deals often do. The question isn’t whether Paramount can afford to buy UFC—it’s whether any traditional media company can afford to let tech giants monopolize live sports. Sometimes your balance sheet screams no, but your strategic reality demands yes.

Three Key Takeaways:Desperate Times Demand Desperate Measures: When you’re losing the war, change the battlefieldLive Sports = Streaming Moat: Last remaining appointment viewing worth any priceFinancial Engineering Enables Strategy: Creative deal structure can make impossible possibleStrategic Analysis Framework Applied

The Business Engineer | FourWeekMBA

Disclaimer: This analysis is for educational and strategic understanding purposes only. It is not financial advice, investment guidance, or a recommendation to buy or sell any securities. All data points are sourced from public reports and may be subject to change. Readers should conduct their own research and consult with qualified professionals before making any business or investment decisions.

Want to analyze media M&A strategies and streaming wars dynamics? Visit [BusinessEngineer.ai](https://businessengineer.ai) for AI-powered business analysis tools and frameworks.

The post Paramount’s $8B UFC Offer: The Desperate Genius Move in Streaming Wars appeared first on FourWeekMBA.

World Models Infrastructure Stack

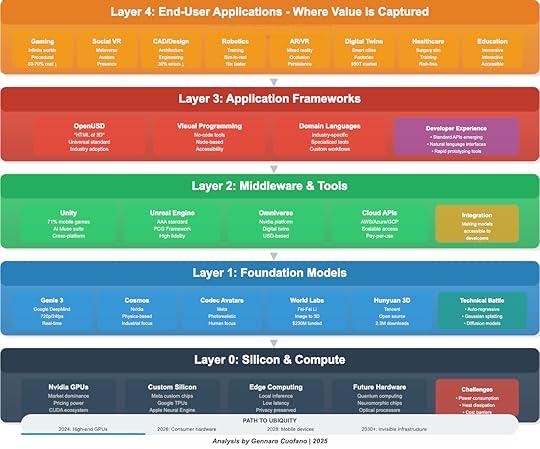

Layer 0: Silicon and Compute

Layer 0: Silicon and ComputeThe foundation requires specialized hardware:

Nvidia’s dominance with GPUs remains unchallenged, giving them pricing powerCustom silicon efforts by Meta, Google, and Apple aim to break this dependencyEdge computing requirements for real-time applications drive innovation in efficient inference chipsLayer 1: Foundation ModelsThis is where the current battle rages:

General-purpose world models (Genie, Cosmos) that work across domainsSpecialized models for specific physics (fluid dynamics, soft body, electromagnetic)Hybrid approaches combining multiple techniquesLayer 2: Middleware and ToolsThe translation layer makes world models usable:

Game engines (Unity, Unreal) as the primary integration pointSimulation platforms (Omniverse, Isaac Sim) for industrial applicationsCloud services packaging world models as APIsLayer 3: Application FrameworkWhere developers build specific solutions:

Domain-specific languages for describing worlds and interactionsVisual programming interfaces for non-technical usersStandard formats (OpenUSD emerging as the HTML of 3D worlds)Layer 4: End-User ApplicationsThe visible layer where value is captured:

Consumer apps (games, social, education)Enterprise software (CAD, simulation, training)Embedded systems (robots, vehicles, AR glasses)

The post World Models Infrastructure Stack appeared first on FourWeekMBA.

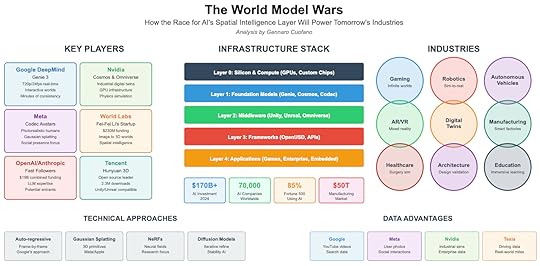

The World Model Landscape

The Next Trillion-Dollar Layer – Tech giants and startups alike are pivoting toward world models — AI that can simulate, predict, and generate 3D, physics-aware environments — positioning them as the foundational infrastructure for AR, robotics, autonomous vehicles, and virtual worlds.Major Players & StrategiesGoogle DeepMind – Genie 3 leads in real-time interactive world generation with long-term consistency and controllable events.Nvidia – Cosmos + Omniverse marry physics-based generation with industrial digital twins, backed by GPU dominance.Meta – Codec Avatars for photorealistic human presence; a social-first foothold in virtual spaces.Microsoft – Enterprise distribution layer, integrating world models via Azure and Microsoft 365.World Labs (Fei-Fei Li) – Single-image-to-3D tech, strong academic credibility, rapid unicorn rise.Tencent – Open-source Hunyuan 3D, compatible with Unity/Unreal, 2.3M+ downloads.Unity & Unreal – Game engine incumbents adding AI-native capabilities.Apple – Silent but investing in spatial computing via Vision Pro and proprietary 3D tech.Technical ApproachesAuto-regressive generation (Google) – strong temporal consistency.Gaussian splatting (Meta/Apple) – efficient 3D rendering.NeRFs – photorealism, but slow rendering.Diffusion models – high controllability, slower for real-time use.Data as the Moat – Scale and quality of spatial data (Google’s YouTube, Tesla’s driving footage, Meta’s social graph, Apple’s LiDAR) will determine who can productionize world models at consumer scale.Early Adoption ZonesGaming – Infinite world generation could cut development costs by 50–70%.Robotics – 10x faster training, 90% less real-world data needed.Autonomous Vehicles – Millions of simulated “edge cases” for safer self-driving.Architecture/Construction – Predictive digital twins reducing costly rework.Manufacturing – Real-time supply chain and factory simulation.Industry StackLayer 0 – Specialized silicon (Nvidia GPUs, custom chips from Meta/Google/Apple).Layer 1 – Foundation models (general-purpose and physics-specialized).Layer 2 – Middleware (Unity, Unreal, Omniverse, Isaac Sim).Layer 3 – Application frameworks (domain-specific languages, OpenUSD standards).Layer 4 – End-user applications (games, industrial control, AR/VR).Timeline2024–2026 – Land grab with proprietary models and VC flood.2026–2028 – Shakeout to a few dominant general models + specialized niches.2028–2030 – Platform wars, ecosystem control, standards battles.2030+ – Invisible infrastructure embedded in every device.Risks & Challenges – Massive compute demands, verification for safety-critical uses, privacy implications of persistent world awareness, creative industry disruption, and authenticity verification in indistinguishable simulated vs real content.Strategic AdviceEnterprises – Audit spatial data, run pilots, build multi-provider relationships.Startups – Focus on niche use cases, tooling, verification, or novel applications; don’t compete on foundation models.Investors – Bet across the stack, prioritize unique data ownership and sustainable compute economics.Societal Impact – Education, accessibility, science, and cultural preservation could leap forward. Risks of reality preference inversion, liability in predictive errors, and deepening simulation dependence loom.Core Insight – World models will be to the next era of computing what the internet was to information and mobile to communication. Whoever wins will control how humanity interacts with, predicts, and creates reality itself. Second place may be irrelevant.

The Next Trillion-Dollar Layer – Tech giants and startups alike are pivoting toward world models — AI that can simulate, predict, and generate 3D, physics-aware environments — positioning them as the foundational infrastructure for AR, robotics, autonomous vehicles, and virtual worlds.Major Players & StrategiesGoogle DeepMind – Genie 3 leads in real-time interactive world generation with long-term consistency and controllable events.Nvidia – Cosmos + Omniverse marry physics-based generation with industrial digital twins, backed by GPU dominance.Meta – Codec Avatars for photorealistic human presence; a social-first foothold in virtual spaces.Microsoft – Enterprise distribution layer, integrating world models via Azure and Microsoft 365.World Labs (Fei-Fei Li) – Single-image-to-3D tech, strong academic credibility, rapid unicorn rise.Tencent – Open-source Hunyuan 3D, compatible with Unity/Unreal, 2.3M+ downloads.Unity & Unreal – Game engine incumbents adding AI-native capabilities.Apple – Silent but investing in spatial computing via Vision Pro and proprietary 3D tech.Technical ApproachesAuto-regressive generation (Google) – strong temporal consistency.Gaussian splatting (Meta/Apple) – efficient 3D rendering.NeRFs – photorealism, but slow rendering.Diffusion models – high controllability, slower for real-time use.Data as the Moat – Scale and quality of spatial data (Google’s YouTube, Tesla’s driving footage, Meta’s social graph, Apple’s LiDAR) will determine who can productionize world models at consumer scale.Early Adoption ZonesGaming – Infinite world generation could cut development costs by 50–70%.Robotics – 10x faster training, 90% less real-world data needed.Autonomous Vehicles – Millions of simulated “edge cases” for safer self-driving.Architecture/Construction – Predictive digital twins reducing costly rework.Manufacturing – Real-time supply chain and factory simulation.Industry StackLayer 0 – Specialized silicon (Nvidia GPUs, custom chips from Meta/Google/Apple).Layer 1 – Foundation models (general-purpose and physics-specialized).Layer 2 – Middleware (Unity, Unreal, Omniverse, Isaac Sim).Layer 3 – Application frameworks (domain-specific languages, OpenUSD standards).Layer 4 – End-user applications (games, industrial control, AR/VR).Timeline2024–2026 – Land grab with proprietary models and VC flood.2026–2028 – Shakeout to a few dominant general models + specialized niches.2028–2030 – Platform wars, ecosystem control, standards battles.2030+ – Invisible infrastructure embedded in every device.Risks & Challenges – Massive compute demands, verification for safety-critical uses, privacy implications of persistent world awareness, creative industry disruption, and authenticity verification in indistinguishable simulated vs real content.Strategic AdviceEnterprises – Audit spatial data, run pilots, build multi-provider relationships.Startups – Focus on niche use cases, tooling, verification, or novel applications; don’t compete on foundation models.Investors – Bet across the stack, prioritize unique data ownership and sustainable compute economics.Societal Impact – Education, accessibility, science, and cultural preservation could leap forward. Risks of reality preference inversion, liability in predictive errors, and deepening simulation dependence loom.Core Insight – World models will be to the next era of computing what the internet was to information and mobile to communication. Whoever wins will control how humanity interacts with, predicts, and creates reality itself. Second place may be irrelevant.

The post The World Model Landscape appeared first on FourWeekMBA.

World Models Competitive Map

The Tech Giants’ PlayGoogle DeepMind – Genie Series. Leading with Genie 3’s real-time interactive world generation at 720p/24fps, Google has demonstrated the most advanced publicly shown world model. Their auto-regressive approach maintains consistency for minutes, not seconds, and their “promptable world events” show unprecedented control. With Google’s massive compute infrastructure and data advantages, they’re positioned to scale faster than competitors.Nvidia – Omniverse and Cosmos. At CES 2025, Nvidia unveiled Cosmos World Foundation Models alongside expanded Omniverse capabilities. Their unique advantage: owning the GPU infrastructure that everyone else depends on. Cosmos can generate physics-based videos from text, images, or robot sensor data, while Omniverse provides the platform for enterprises to build digital twins. With partnerships spanning from Toyota to Continental, Nvidia is embedding itself as the industrial metaverse backbone.Meta – Reality Labs and Codec Avatars. Meta’s decade-long investment in Codec Avatars represents a different approach: ultra-realistic human representation. Their latest research shows photorealistic avatars with changeable hairstyles and Gaussian splatting for real-time rendering. While narrower in scope than full world models, Meta’s focus on social presence could make them the default for human interaction in virtual spaces. Their $4.28 billion quarterly losses in Reality Labs show both commitment and challenge.Microsoft – Industrial Integration. While less visible in pure world model development, Microsoft is aggressively integrating partners’ world models into their ecosystem. With 85% of Fortune 500 companies using Microsoft AI solutions and their Azure infrastructure, they’re positioned as the enterprise distribution layer. Their partnerships with OpenAI and integration of various AI models into Microsoft 365 make them the likely enterprise gateway for world model technologies.The DisruptorsWorld Labs (Fei-Fei Li). Achieving unicorn status in just four months with $230 million in funding, World Labs represents the academic-to-commercial pipeline at its best. Their technology transforms single images into explorable 3D environments with persistent physics. While limited to small explorable areas currently, their focus on spatial intelligence and Li’s credibility could attract the talent needed to compete with tech giants.Anthropic, OpenAI, and the LLM Players. While these companies haven’t announced dedicated world models, their massive funding ($11.3 billion for OpenAI, $7.7 billion for Anthropic) and expertise in large-scale AI training position them as potential fast followers. OpenAI’s work on reasoning models like o1 could translate to physics reasoning, while Anthropic’s focus on safety could appeal to regulated industries.The Open Source MovementTencent – Hunyuan 3D World Model. In a surprising move, Tencent open-sourced Hunyuan 3D World Model 1.0 in July 2025, with over 2.3 million downloads. Their “Semantic Hierarchical 3D Scene Representation” algorithm and compatibility with Unity, Unreal, and Blender positions them as the open-source alternative to proprietary systems.Stability AI and the Community. The open-source community, led by efforts like Stable Diffusion’s success, represents a wildcard. While lacking the compute resources of tech giants, community-driven development could create specialized world models for specific use cases.The Platform PlayersUnity and Unreal Engine. These game engines are rapidly integrating AI capabilities. Unity’s AI suite includes Muse for asset generation and Inference Engine for local AI processing. Unreal’s Procedural Content Generation Framework and partnership with various AI providers position them as the integration layer. With Unity powering 71% of top mobile games and Unreal dominating AAA titles, they’re the incumbent platforms that world models must work with.Apple – The Silent Giant. While Apple hasn’t announced a world model, their Vision Pro’s Gaussian splatting for Personas and massive investment in spatial computing suggest they’re developing proprietary solutions. Their control over the hardware-software stack from chips to displays gives them unique optimization advantages.

The Tech Giants’ PlayGoogle DeepMind – Genie Series. Leading with Genie 3’s real-time interactive world generation at 720p/24fps, Google has demonstrated the most advanced publicly shown world model. Their auto-regressive approach maintains consistency for minutes, not seconds, and their “promptable world events” show unprecedented control. With Google’s massive compute infrastructure and data advantages, they’re positioned to scale faster than competitors.Nvidia – Omniverse and Cosmos. At CES 2025, Nvidia unveiled Cosmos World Foundation Models alongside expanded Omniverse capabilities. Their unique advantage: owning the GPU infrastructure that everyone else depends on. Cosmos can generate physics-based videos from text, images, or robot sensor data, while Omniverse provides the platform for enterprises to build digital twins. With partnerships spanning from Toyota to Continental, Nvidia is embedding itself as the industrial metaverse backbone.Meta – Reality Labs and Codec Avatars. Meta’s decade-long investment in Codec Avatars represents a different approach: ultra-realistic human representation. Their latest research shows photorealistic avatars with changeable hairstyles and Gaussian splatting for real-time rendering. While narrower in scope than full world models, Meta’s focus on social presence could make them the default for human interaction in virtual spaces. Their $4.28 billion quarterly losses in Reality Labs show both commitment and challenge.Microsoft – Industrial Integration. While less visible in pure world model development, Microsoft is aggressively integrating partners’ world models into their ecosystem. With 85% of Fortune 500 companies using Microsoft AI solutions and their Azure infrastructure, they’re positioned as the enterprise distribution layer. Their partnerships with OpenAI and integration of various AI models into Microsoft 365 make them the likely enterprise gateway for world model technologies.The DisruptorsWorld Labs (Fei-Fei Li). Achieving unicorn status in just four months with $230 million in funding, World Labs represents the academic-to-commercial pipeline at its best. Their technology transforms single images into explorable 3D environments with persistent physics. While limited to small explorable areas currently, their focus on spatial intelligence and Li’s credibility could attract the talent needed to compete with tech giants.Anthropic, OpenAI, and the LLM Players. While these companies haven’t announced dedicated world models, their massive funding ($11.3 billion for OpenAI, $7.7 billion for Anthropic) and expertise in large-scale AI training position them as potential fast followers. OpenAI’s work on reasoning models like o1 could translate to physics reasoning, while Anthropic’s focus on safety could appeal to regulated industries.The Open Source MovementTencent – Hunyuan 3D World Model. In a surprising move, Tencent open-sourced Hunyuan 3D World Model 1.0 in July 2025, with over 2.3 million downloads. Their “Semantic Hierarchical 3D Scene Representation” algorithm and compatibility with Unity, Unreal, and Blender positions them as the open-source alternative to proprietary systems.Stability AI and the Community. The open-source community, led by efforts like Stable Diffusion’s success, represents a wildcard. While lacking the compute resources of tech giants, community-driven development could create specialized world models for specific use cases.The Platform PlayersUnity and Unreal Engine. These game engines are rapidly integrating AI capabilities. Unity’s AI suite includes Muse for asset generation and Inference Engine for local AI processing. Unreal’s Procedural Content Generation Framework and partnership with various AI providers position them as the integration layer. With Unity powering 71% of top mobile games and Unreal dominating AAA titles, they’re the incumbent platforms that world models must work with.Apple – The Silent Giant. While Apple hasn’t announced a world model, their Vision Pro’s Gaussian splatting for Personas and massive investment in spatial computing suggest they’re developing proprietary solutions. Their control over the hardware-software stack from chips to displays gives them unique optimization advantages.

The post World Models Competitive Map appeared first on FourWeekMBA.

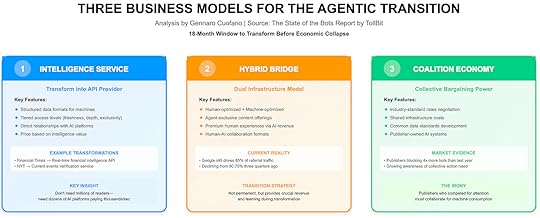

Three Business Models for the Agentic Transition

Model 1: The Intelligence Service Provider

Model 1: The Intelligence Service ProviderPublishers transform from media companies into intelligence services. The Financial Times becomes a real-time financial intelligence API. The New York Times becomes a current events verification service. The brand value shifts from “trusted source” to “verified intelligence.”

This model requires publishers to:

Develop structured data formats optimized for machine consumptionCreate tiered access levels based on freshness, depth, and exclusivityBuild direct relationships with AI platforms rather than hoping for referral trafficPrice based on intelligence value, not advertising potentialThe key insight: in the agentic web, publishers don’t need millions of readers—they need dozens of AI platforms paying thousands of times per second .

Model 2: The Hybrid BridgeNot all traffic will shift to agents immediately.

The report shows Google still drives 85% of referral traffic, though declining from 90.75% just three quarters ago.

Smart publishers will maintain dual infrastructure: human-optimized experiences for traditional traffic, machine-optimized endpoints for the agentic web.

This creates unique opportunities:

Agent-exclusive content that never appears on the human webPremium human experiences subsidized by machine revenueCross-pollination where human insights improve machine intelligence and vice versaNew content formats designed for human-AI collaborationThe bridge model isn’t permanent, but it provides crucial revenue during the transition and learning opportunities for the full transformation.

Model 3: The Coalition EconomyIndividual publishers lack leverage against AI platforms.

But the report’s data showing publishers blocking 4x more bots than a year ago suggests a growing awareness that collective action is necessary.

Publisher coalitions could:

Negotiate industry-standard rates for intelligence accessShare infrastructure costs for AI-specific systemsDevelop common standards for structured data and verificationCreate publisher-owned AI systems that compete with Big TechThe irony is delicious: publishers who competed viciously for human attention must collaborate to survive the age of machine consumption.

The post Three Business Models for the Agentic Transition appeared first on FourWeekMBA.

The Data Layer (Foundation)

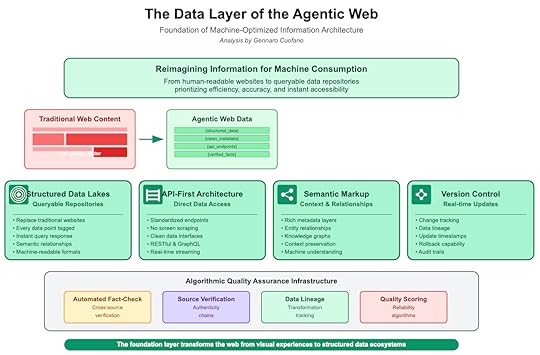

The foundation of the agentic web requires a complete reimagining of how we structure and serve information.

Websites designed for human eyes will give way to machine-optimized data repositories that prioritize efficiency and accuracy over aesthetics.

Structured Data Lakes will replace traditional websites, offering queryable repositories where every piece of information is tagged, categorized, and instantly accessible.

API-First Architecture means every piece of content will be accessible via standardized endpoints—no more screen scraping or brittle integrations.

Semantic Markup will provide rich metadata enabling agents to understand context and relationships, while Version-Controlled Information will track changes and updates in real-time, ensuring agents always work with the latest data.

Quality assurance becomes algorithmic rather than editorial. Automated fact-checking networks will verify information across multiple sources instantly.

Source verification chains will trace data lineage back to its origin, ensuring authenticity. Data lineage tracking will show how information has been transformed or processed, while quality scoring algorithms will rate content based on accuracy, completeness, and reliability.

The post The Data Layer (Foundation) appeared first on FourWeekMBA.