Gennaro Cuofano's Blog, page 39

August 20, 2025

The Agentic AI Competitive Map [Video]

The post The Agentic AI Competitive Map [Video] appeared first on FourWeekMBA.

August 19, 2025

The Intel-ARM Convergence: SoftBank’s 4D Chess in the AI Geopolitical War

The Master Plan Nobody Sees Coming: While everyone focuses on SoftBank’s $2 billion Intel investment as a contrarian value play, Masayoshi Son is orchestrating something far more audacious—the potential merger of ARM and Intel architectures under a single umbrella, backed by US government blessing. This isn’t just about rescuing Intel; it’s about creating the first truly global semiconductor superpower that bridges East and West, mobile and desktop, edge and cloud. With ARM worth $140 billion and Intel at $85 billion, Son is positioning to control the entire chip stack that will power the AI revolution. The geopolitical implications are staggering: whoever controls both ARM and x86 controls the future of computing. And with the US government now a stakeholder, this isn’t corporate strategy—it’s the opening move in a new kind of warfare where chips are weapons and architectures are territories. (Source: Financial Times analysis, Nikkei Asia exclusive, semiconductor industry sources, January 2025)

The Geopolitical ChessboardThe New Great GameTraditional Geopolitics (20th Century):

Oil = PowerTerritory = ControlMilitary = InfluenceAlliances = SecurityTech Geopolitics (21st Century):

Semiconductors = PowerArchitectures = ControlAI capabilities = InfluenceTech ecosystems = SecurityThe Paradigm Shift: Intel’s transformation from struggling chipmaker to geopolitical asset represents the militarization of technology supply chains.

The Three-Bloc World EmergingThe American Bloc:

Core: US + Intel/AMD/NVIDIAAllies: Japan, South Korea, TaiwanStrategy: Technological containment of ChinaWeakness: Manufacturing concentration in AsiaThe Chinese Bloc:

Core: China + SMIC/HuaweiAllies: Russia, Iran, select Global SouthStrategy: Self-sufficiency at any costWeakness: Technology gap, equipment accessThe Swing States:

Europe: Trying to stay neutral, failingIndia: Playing all sidesMiddle East: Buying influenceSoftBank/Japan: The crucial bridgeSoftBank’s New AI Geopolitical PlaybookThe Vision Fund 3.0 StrategyEvolution of SoftBank Strategy:

Vision Fund 1 (2017): Spray and pray on unicornsVision Fund 2 (2019): Focus on AI applicationsVision Fund 3 (2025): Control AI infrastructure layerThe New Playbook Elements:

Own the chip layer (ARM + Intel)Control AI compute infrastructureBridge geopolitical dividesBecome indispensable to all sidesThe ARM-Intel Convergence ThesisWhy This Makes Perfect Sense:

Technical Convergence: ARM moving up to servers, Intel moving down to mobileAI Requirements: Need both efficiency (ARM) and power (x86)Manufacturing Synergy: Intel fabs could produce ARM chipsPatent Portfolio: Combined IP creates insurmountable moatThe Master Plan:

Phase 1 (2025): SoftBank invests in Intel, establishes partnershipPhase 2 (2026): Deep technical collaboration, shared roadmapsPhase 3 (2027): Joint ventures in key marketsPhase 4 (2028): Full merger under holding companyPhase 5 (2030): Unified architecture dominates AI eraGeopolitical Leverage MechanicsSoftBank’s Unique Position:

Japanese = Trusted by US (ally) and China (not enemy)ARM = Essential to everyone (Apple, Qualcomm, Samsung)Capital = $200B+ to deploy strategicallyRelationships = Decades of global tech connectionsThe Leverage Play:

Make ARM-Intel combo essential to US AI ambitionsMaintain ARM licenses to Chinese companiesBecome the “Switzerland of semiconductors”Extract value from all sidesThe ARM Factor: The Hidden Crown JewelARM’s Strategic ValueCurrent Position:

95% of smartphones use ARMGrowing server market shareApple Silicon proved desktop viabilityEvery major cloud provider using ARMWith Intel Integration:

Best of both architecturesUnified development platformMigration path between architecturesComplete computing spectrum coverageThe Technical RevolutionUnified Architecture Benefits:

Power Efficiency: ARM’s strengthRaw Performance: x86’s strengthSoftware Compatibility: Run everythingManufacturing Scale: Intel fabs + TSMCAI-Specific Advantages:

Heterogeneous computing (CPU + GPU + NPU)Edge-to-cloud consistencyPower-optimized trainingInference everywhereIntel’s Transformation: From Company to WeaponThe Weaponization ProcessStage 1: Financial Crisis (2023-2024)

Stock collapse creates vulnerabilityNational security concerns raisedGovernment intervention justifiedStage 2: Strategic Investment (2025)

SoftBank provides private capitalGovernment takes equity stakeBoard control shiftsStage 3: Geopolitical Tool (2026+)

Technology export controlsSupply chain weaponAlliance building toolInnovation direction controlThe New Intel DoctrineFrom Business to Statecraft:

Customers → AlliesCompetitors → AdversariesProducts → Strategic assetsProfits → Power projectionOperational Changes:

Security clearances for executivesGovernment liaison officesClassified development programsRestricted customer listsThe US Government’s CalculationWhy This Makes Strategic SenseThe China Challenge:

SMIC advancing rapidlyHuawei designing around sanctionsChina throwing unlimited money at problemTraditional sanctions failingThe Intel Solution:

Direct control over key assetCoordinate with alliesDeny technology to adversariesAccelerate innovation through fundingThe Precedent ProblemWhat’s Been Crossed:

Government as tech investorState capitalism adoptionMarket intervention normalizedPrivate property rights flexibleWhere This Leads:

More strategic tech investmentsQuantum computing nextAI companies after thatBiotech inevitably includedThe Integration ScenariosScenario 1: Soft Integration (Most Likely)Structure:

Joint development programsCross-licensing agreementsShared foundry capacityCoordinated roadmapsSeparate companiesTimeline: 2025-2027

Probability: 60%

Structure:

New holding companyUnified architectureCombined operationsSingle stockGovernment golden shareTimeline: 2027-2030

Probability: 30%

Structure:

China blocks ARM licensesUS blocks Intel exportsArchitecture wars intensifyInnovation slowsEveryone losesTimeline: Could happen anytime

Probability: 10%

Winners:

ASML (everyone needs equipment)Materials suppliersSpecialized chip designersCountries with fabsLosers:

Pure-play competitorsChinese chip ambitionsOpen-source hardwareSmall countries’ tech dreamsFor Global Tech CompetitionNew Dynamics:

Vertical Integration Returns: Controlling full stack mattersGeographic Arbitrage Dies: Choose your blocStandards Fragment: Technical BalkanizationInnovation Vectors Change: Military > ConsumerFor AI DevelopmentAcceleration Factors:

Unlimited government fundingClassified AI projectsMilitary applicationsNo ethical constraintsDeceleration Factors:

Fragmented ecosystemsRestricted collaborationTalent bordersCompliance overheadThe SoftBank EndgameThe Trillion-Dollar VisionStep 1: Control foundational chip layer (ARM + Intel)

Step 2: Build AI compute infrastructure

Step 3: Invest in AI application layer

Step 4: Create vertical AI conglomerate

Step 5: Become AI era’s Standard Oil

Valuation Math:

ARM at $140BIntel at $85B → $200B potentialCombined entity: $500B+AI premium: $1 trillion market capThe Geopolitical ArbitrageEast-West Bridge Value:

License fees from all sidesIndispensable positionRegulatory arbitragePeace dividendRisk Management:

Japanese neutrality shieldUS government partnershipChinese market accessGlobal diversificationThree Predictions1. ARM-Intel Announces “Strategic Partnership” Within 6 MonthsThe Tell: Joint announcement about “AI chip collaboration” that’s obviously more. Technical integration begins immediately. Stock prices soar on synergy potential.

2. China Accelerates RISC-V Development in ResponseThe Counter: Realizing ARM could be weaponized, China goes all-in on open-source RISC-V architecture. New cold war splits along architecture lines.

3. SoftBank Becomes World’s Most Valuable Company by 2030The Outcome: Controlling both major chip architectures during AI revolution = unlimited pricing power. Son’s patient capital approach vindicated spectacularly.

Investment ImplicationsDirect PlaysLong Positions:

SoftBank (9984.T): The orchestratorARM (ARM): The crown jewelIntel (INTC): The transformation playASML (ASML): Sells to everyoneHedge Positions:

AMD: Competitive disadvantageChinese semiconductors: Blocked from ecosystemPure software: Hardware matters againStrategic ThemesInvest In:

Geopolitical arbitrage playsDual-use technologiesCritical infrastructureGovernment contractorsAvoid:

China-dependent techOpen-source hardwareNeutral country techPeace dividendsThe Bottom LineSoftBank’s Intel investment isn’t just a financial bet—it’s the opening move in creating the first truly global semiconductor superpower that transcends geopolitical boundaries. By potentially combining ARM and Intel under a structure blessed by the US government, Masayoshi Son is building something unprecedented: a technology conglomerate that’s too important for any country to attack, too integrated to split apart, and too powerful to compete against.

The Strategic Reality: We’re witnessing the birth of techno-mercantilism where semiconductor architectures become territories, chip designs become weapons, and companies like Intel transform into quasi-state entities. SoftBank’s playbook—controlling critical infrastructure while maintaining strategic ambiguity—represents the evolution of corporate strategy for the geopolitical age. The question isn’t whether technology companies will become arms of state power; it’s how to profit from this transformation.

For Business Leaders: The era of purely commercial technology companies is ending. Every strategic technology company must now consider its geopolitical position, government relationships, and role in great power competition. SoftBank’s model—patient capital, strategic positioning, and geopolitical arbitrage—shows how to thrive in this new world. The winners won’t be the most innovative or efficient; they’ll be the ones who best navigate the intersection of technology, capital, and state power. Plan your architecture accordingly—both technical and geopolitical.

Three Key Takeaways:Architecture = Territory: Control of chip architectures becomes the new geopolitical high groundPublic-Private Fusion: The line between corporations and state power permanently blurredSoftBank’s Playbook: Strategic ambiguity + patient capital + critical assets = unlimited leverageStrategic Analysis Framework Applied

The Business Engineer | FourWeekMBA

Disclaimer: This analysis is for educational and strategic understanding purposes only. It is not financial advice, investment guidance, or a recommendation to buy or sell any securities. All data points are sourced from public reports and may be subject to change. Readers should conduct their own research and consult with qualified professionals before making any business or investment decisions.

Want to analyze geopolitical technology strategies and semiconductor industry dynamics? Visit [BusinessEngineer.ai](https://businessengineer.ai) for AI-powered business analysis tools and frameworks.

The post The Intel-ARM Convergence: SoftBank’s 4D Chess in the AI Geopolitical War appeared first on FourWeekMBA.

The AI Adoption Valley

We’re living through one of the most fascinating productivity paradoxes in modern history.

Despite unprecedented investment and adoption, AI tools are making many workers less productive, not more.

This isn’t a failure of the technology, it’s a predictable pattern that occurs with every transformative innovation.

Welcome to the adoption valley.

The Paradox Playing Out in Real Time

The Paradox Playing Out in Real TimeThe numbers tell a startling story.

MIT research from 2025 found that manufacturing companies adopting industrial AI experienced productivity drops of 1.33 to 60 percentage points before seeing eventual gains. In software development, a rigorous study by METR found that experienced developers using state-of-the-art AI tools like Cursor Pro with Claude 3.5 Sonnet were 19% slower than working without AI—even though they believed they were 20% faster.

Stack Overflow’s 2025 developer survey revealed the heart of the problem: 66% of developers report that “AI solutions that are almost right, but not quite” is their top frustration.

Trust in AI accuracy has plummeted from 43% in 2024 to just 33% in 2025. Meanwhile, 45% say debugging AI-generated code takes more time than expected.

This pattern extends far beyond coding. Across industries, 77% of workers say AI tools have made them less productive while increasing their workload. Nearly half (47%) of workers using AI tools admit they are unsure how to deliver the expected productivity gains their employers demand.

The Historical Pattern: From Steam to SmartphonesThis productivity dip isn’t new—it’s the inevitable first act of every technological revolution.

The adoption valley follows a predictable J-curve: initial excitement, followed by a frustrating dip in productivity, before eventual breakthrough gains emerge.

The Personal Computer Era (1980s-1990s): When PCs first arrived in offices, people used them as expensive typewriters. Productivity initially declined as workers struggled with new interfaces, software crashes, and the complexity of digital workflows. It took years before businesses discovered spreadsheets, databases, and networked collaboration—the native applications that truly unlocked the computer’s potential.The Internet Revolution (1990s-2000s): Early websites were digital brochures—static copies of print materials. Companies spent fortunes building web presences that offered little value beyond what existed in physical form. The breakthrough came when businesses discovered native internet workflows: e-commerce, search engines, social media, and real-time global collaboration.Mobile Technology (2000s-2010s): The first smartphones were positioned as portable phones with email. Companies initially struggled to justify the investment as employees fumbled with tiny keyboards and unreliable connections. The transformation happened when developers created app ecosystems and businesses redesigned their operations around mobile-native experiences.Each revolution followed the same pattern: early adopters tried to force new technology into old workflows, experienced productivity declines, then gradually discovered transformative applications that were impossible to imagine beforehand.

Why We’re Stuck in the ValleyThe METR study reveals two fundamental problems keeping us trapped in the adoption valley:

The Focus ProblemWhen we integrate AI tools into our existing workflows, we lose focus on our core objectives. Instead of concentrating on solving business problems, we become preoccupied with managing the AI itself.

Developers spend mental energy crafting the perfect prompt, reviewing “almost right” code, and debugging AI-generated solutions rather than thinking through architectural decisions or business logic.

This cognitive overhead is invisible but costly.

The study showed that experienced developers—people who should theoretically benefit most from AI assistance—were slowed down because they had to constantly context-switch between their domain expertise and AI management.

The Workflow Mismatch ProblemMore fundamentally, we’re trying to squeeze revolutionary tools into evolutionary processes.

Current AI adoption resembles using a Ferrari to deliver mail—technically possible, but missing the point entirely.

Most organizations are using AI for what researchers call “low-value implementations”: automating customer support responses, generating basic content, or speeding up routine tasks.

These applications produce modest efficiency gains but fail to unlock AI’s transformative potential.

The breakthrough will come when we redesign entirely our workflows around AI’s unique capabilities, rather than bolting AI onto existing processes.

The Path Out of the ValleyHistory suggests three key shifts that mark the transition from the valley to transformative productivity gains:

1. Native Workflow Discovery: Just as spreadsheets weren’t better typewriters but entirely new ways of thinking about data, AI’s true power lies in applications we haven’t fully imagined yet. Early signs include AI agents that can reason across complex workflows, generative design tools that explore thousands of possibilities simultaneously, and collaborative intelligence systems where humans and AI iterate together in real-time.

2. Organizational Restructuring: Companies that successfully climb out of the valley reorganize around the technology’s capabilities. This might mean flatter hierarchies that leverage AI for decision-making, new roles that specialize in human-AI collaboration, or entirely different business models that were impossible without AI.

3. Skill Evolution: The most productive AI users aren’t learning to prompt better—they’re developing new cognitive partnerships with machines. This involves understanding when to rely on AI, when to override it, and how to think in ways that complement rather than compete with artificial intelligence.

Signs of the BreakthroughDespite current struggles, there are encouraging signals that we’re beginning to climb out of the valley:

Workers who use AI daily report 46.2% productivity improvements, suggesting that consistent interaction helps develop native workflows92% of companies plan to increase AI investments over the next three years, indicating long-term commitment despite short-term challengesYounger, more flexible companies are adapting faster than established firms, mirroring historical patterns where newcomers often lead technological transitionsThe productivity gains will likely emerge unevenly. Small, agile companies may discover breakthrough applications first, while large enterprises struggle with legacy systems and organizational inertia—exactly the pattern we saw with previous technological revolutions.

The AI Adoption Matrix: A Framework for Understanding the ValleyTo understand why we’re stuck and how to escape, we need a new framework.

The AI Adoption Matrix maps users across two critical dimensions: AI Productivity Skills and Domain Expertise.

This creates four distinct quadrants that explain where different users land in the adoption valley—and reveals the path to breakthrough productivity.

The post The AI Adoption Valley appeared first on FourWeekMBA.

August 18, 2025

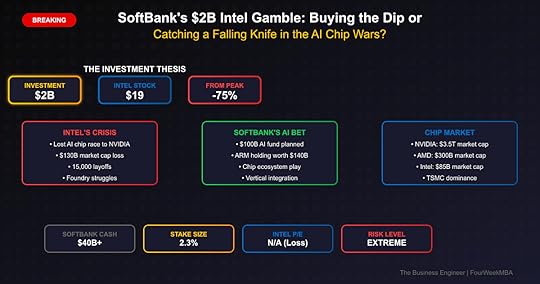

SoftBank’s $2B Intel Bet: Genius Bottom-Fishing or Masa’s Next WeWork?

The Investment That Makes No Sense (Until It Does): Masayoshi Son just did what Masayoshi Son does—placed a massive contrarian bet when everyone else is running. SoftBank is investing $2 billion in Intel, the semiconductor giant that’s lost 75% of its value and watched helplessly as NVIDIA ate its lunch in AI chips. With Intel trading at $19 (down from $68), laying off 15,000 employees, and losing the AI race spectacularly, this looks like catching a falling knife. But here’s what everyone’s missing: Son isn’t betting on Intel’s chip business—he’s betting on America’s inevitable semiconductor reshoring, Intel’s foundry transformation, and a chess move that positions SoftBank at the intersection of ARM (which they own) and x86 architecture. This is either the trade of the decade or Masa’s most expensive mistake yet. (Source: Financial Times, WSJ, January 2025)

The Deal AnatomyInvestment StructureThe Numbers:

Investment size: $2 billionIntel stock price: ~$19Stake acquired: ~2.3% of IntelIntel market cap: $85 billionPeak market cap: $290 billion (2020)Timing Context:

Intel 52-week high: $51Current price: $19 (-63%)All-time high: $68 (2020)Current P/E: N/A (losing money)Book value: $25/shareSoftBank’s PositionCurrent Holdings:

ARM: 90% stake worth $140BAlibaba: Remaining stake ~$30BCash position: $40B+Vision Fund dry powder: $20BTotal firepower: $200B+Why Intel? Why Now?The Contrarian Thesis1. Maximum Pessimism = Maximum Opportunity

Everyone hates IntelPriced for bankruptcySentiment couldn’t be worseClassic Son timing2. Foundry Transformation

Intel Foundry separate business$30B government subsidies comingTSMC alternative needed5-year transformation play3. Geopolitical Necessity

US needs domestic chipsChina tensions escalatingSupply chain reshoringNational security imperative4. AI Inference Play

NVIDIA owns trainingIntel could own inferenceEdge computing growthDifferent market dynamicsThe Hidden StrategyARM + Intel = ?What Son Sees:

ARM dominates mobile/edgeIntel dominates PC/serverConvergence inevitableSoftBank bridges bothPotential Synergies:

ARM designs on Intel foundriesx86/ARM hybrid chipsCross-licensing opportunitiesEcosystem controlThe CHIPS Act ArbitrageGovernment Money Flow:

$52B total CHIPS fundingIntel getting $8.5B grants$11B in loansState incentives additionalTotal: $30B+ subsidiesSon’s Calculation: Buy $2B stake, get $30B government investment = 15x leverage on taxpayer money.

The Foundry BetIntel’s Transformation:

Foundry as separate unitExternal customers growingMicrosoft, Meta interestedCompetition to TSMC$20B revenue potentialIf Successful: Intel Foundry worth $100B+ standalone = 5x on investment.

Market ContextThe Semiconductor LandscapeCurrent Valuations:

NVIDIA: $3.5 trillion (175x earnings)TSMC: $700 billion (25x earnings)AMD: $300 billion (125x earnings)Intel: $85 billion (no earnings)The Disparity: Intel has 75% of AMD revenue but 28% of market cap.

Intel’s ChallengesWhy It’s Cheap:

Lost AI training chip race completelyManufacturing delays (10nm disaster)Apple left for ARMServer share to AMDNo mobile presenceFoundry losses mountingThe Turnaround Requirements:

Execute on Intel 18A nodeWin foundry customersStabilize PC market shareCut costs furtherCapture AI inferenceBull Case: Why This Works1. Valuation ResetThe Math:

Trading below book value10-year low valuationBreakup value higherHidden asset valueUpside: Return to historical 15x P/E = $60 stock = 200% gain.

2. Foundry SuccessThe Opportunity:

Only US advanced foundryGovernment backing massiveCustomers need alternativePricing power emergingPotential: Foundry IPO at $100B valuation = Intel to $40+.

3. AI Inference WinThe Angle:

Inference 10x training marketIntel CPUs everywhereGaudi chips improvingEdge AI growingIf Captured: 20% of inference market = $50B revenue.

4. Geopolitical PremiumThe Reality:

US-China chip warTSMC vulnerabilityReshoring inevitableIntel only optionValue: Strategic premium could be 50%+.

Bear Case: Why This Fails1. Structural DeclineThe Problems:

Technology permanently behindCulture can’t changeTalent fled to NVIDIAInnovation deadResult: Continued share loss = permanent value trap.

2. Foundry FailsThe Risk:

Customers don’t trust IntelTSMC too dominantExecution problems continueLosses mountOutcome: Write-offs and restructuring = stock to $10.

3. Cash BurnThe Numbers:

Losing money currentlyCapex requirements hugeDividend suspendedDebt increasingScenario: Liquidity crisis if downturn = forced asset sales.

4. Competition IntensifiesThe Threats:

AMD taking more shareARM everywhereChinese chips improvingNVIDIA expandingResult: Intel becomes irrelevant = long-term decline.

SoftBank’s Track RecordThe HitsAlibaba: $20M → $130B (6,500x)ARM: $32B → $140B (4x)NVIDIA early investorYahoo Japan dominanceThe MissesWeWork: -$10BWirecard: -$1BGreensill: -$1.5BVarious unicorn lossesThe Pattern: When Son goes contrarian in semiconductors, he usually wins.

Hidden AnglesThe Patent PortfolioIntel’s IP:

90,000+ patentsx86 architecture controlProcess technologyPackaging innovationsValue: Could be worth $20B+ in licensing.

The Real EstateIntel Properties:

Fabs worth billionsPrime locationsDevelopment potentialSale-leaseback optionsHidden Value: $10-15B in real estate.

The Mobileye StakeForgotten Asset:

Intel owns 88% of MobileyeMobileye worth $25BHidden on balance sheetAutonomous vehicle playValue: $22B hidden asset.

Three Predictions1. Intel Foundry Spins Off Within 24 MonthsThe Catalyst: Unlock value, attract customers, government pressure. Foundry IPO at $75B valuation lifts Intel stock 100%.

2. SoftBank Increases Stake to 10%The Move: Son doesn’t do small bets. As Intel bottoms, SoftBank invests another $8B, becomes largest shareholder.

3. ARM-Intel Strategic Partnership AnnouncedThe Synergy: Cross-licensing deal, foundry agreement, hybrid chips. Creates $50B in combined value.

Investment ImplicationsFor Intel ShareholdersThe Dilemma:

SoftBank validation positiveBut confirms desperationVolatility increasingBinary outcome likelyAction: High risk, high reward situation.

For Semiconductor SectorThe Signal:

Bottom might be inSmart money buyingConsolidation comingValuations attractiveOpportunity: Look at beaten-down chip stocks.

For SoftBank WatchersThe Tell:

Son going contrarian againSemiconductor focus clearBig bets returningRisk appetite backImplication: Vision Fund 3 coming with chip focus.

The Bottom LineSoftBank’s $2 billion Intel investment is quintessential Masayoshi Son—a massive contrarian bet when sentiment is most negative. With Intel down 75% from peaks and everyone focused on its failures, Son sees a mispriced option on American semiconductor reshoring, foundry transformation, and potential ARM synergies.

The Strategic Reality: This isn’t about Intel competing with NVIDIA in AI training chips—that war is lost. It’s about three deeper plays: (1) Intel Foundry becoming America’s TSMC with unlimited government support, (2) x86 architecture value in an ARM world, and (3) geopolitical necessity making Intel “too important to fail.” At $19, Intel trades below book value with hidden assets worth more than its market cap.

For Business Leaders: The lesson here isn’t about semiconductor investing—it’s about pattern recognition. The best investments often come when narrative and fundamentals diverge most dramatically. Intel’s narrative is death. Its fundamentals include $100B in revenue, critical infrastructure, and government backing. Sometimes the falling knife is actually a dollar selling for fifty cents. The question isn’t whether Intel can return to glory—it’s whether buying at maximum pessimism provides asymmetric upside. Son’s betting $2 billion the answer is yes.

Three Key Takeaways:Maximum Pessimism = Maximum Opportunity: The best trades happen when everyone agrees something is worthlessHidden Value Matters: Intel’s foundry, IP, and real estate worth more than current market capGeopolitics Trump Economics: US semiconductor independence makes Intel strategic beyond financialsStrategic Analysis Framework Applied

The Business Engineer | FourWeekMBA

Disclaimer: This analysis is for educational and strategic understanding purposes only. It is not financial advice, investment guidance, or a recommendation to buy or sell any securities. All data points are sourced from public reports and may be subject to change. Readers should conduct their own research and consult with qualified professionals before making any business or investment decisions.

Want to analyze contrarian investment strategies and semiconductor industry dynamics? Visit [BusinessEngineer.ai](https://businessengineer.ai) for AI-powered business analysis tools and frameworks.

The post SoftBank’s $2B Intel Bet: Genius Bottom-Fishing or Masa’s Next WeWork? appeared first on FourWeekMBA.

YouTube to Host the Oscars: Hollywood’s Complete Capitulation to Silicon Valley

The Deal That Ends an Era: The Academy of Motion Picture Arts and Sciences just signed Hollywood’s death certificate, and YouTube is the executioner. In a $500+ million multi-year deal, YouTube will exclusively stream the Oscars starting in 2026, ending ABC’s 50-year run and traditional television’s last appointment viewing stronghold. This isn’t just a distribution deal—it’s Hollywood admitting that a platform where teenagers film themselves playing Minecraft has more cultural relevance than the entire film industry. With Oscar viewership down 80% in a decade (from 43.7M in 2014 to 18.7M in 2024) while MrBeast videos routinely hit 200 million views, the Academy had two choices: embrace YouTube or watch the Oscars become as irrelevant as the Golden Globes. They chose survival over pride. (Source: Variety exclusive, Hollywood Reporter, January 2025)

The Numbers That Forced Hollywood’s HandThe Viewership CollapseTraditional TV Death Spiral:

2014 Oscars (ABC): 43.7 million viewers2020 Oscars: 23.6 million (-46%)2024 Oscars: 18.7 million (-57%)2025 projection: <15 millionAverage viewer age: 59 years oldYouTube’s Dominance:

Daily watch time: 1 billion hoursMonthly users: 2.5 billionAverage session: 40 minutesDemographics: 77% of 15-35 year olds dailyTop creator views: 200M+ per videoThe Financial RealityCurrent Oscar Economics:

ABC pays: $100M/year for rightsAd revenue: $120-150M (declining)Production costs: $40-50MProfit margins: Shrinking rapidlyYouTube’s Offer (Reported):

Rights fee: $150M+ annuallyRevenue share: 45% of ad revenueProduction investment: $100MMarketing commitment: $200MTotal package: $500M+ per yearStrategic Analysis: Why This Changes EverythingThe Creator Economy TakeoverOld Model:

Studios → Movies → Stars → Oscars → Prestige → Box OfficeGatekeepers controlled every stepScarcity drove valuePrestige matteredNew Model:

Creators → Content → Audience → Direct monetizationNo gatekeepers neededAbundance of contentEngagement > PrestigeThe Reality: When a 26-year-old YouTuber (MrBeast) has more influence than Leonardo DiCaprio, the game has fundamentally changed.

Platform Power DynamicsYouTube’s Strategic Wins:

Legitimacy: Oscars make YouTube “serious” platformDemographics: Brings older, affluent viewersAdvertiser Magnet: Premium brands follow OscarsGlobal Reach: 100+ countries simultaneouslyData Goldmine: Viewing habits of Hollywood eliteHollywood’s Desperate Gambit:

Relevance: Access to 2.5B potential viewersYouth: Average YouTube user is 25Global: No geographic limitationsInteractive: Real-time engagement possibleSurvival: Only path to next generationThe Hidden Disruptions1. Award Show Format RevolutionTraditional Oscars:

3.5 hour broadcast20+ minutes of adsOne-way communicationStiff, formal presentationLimited audience participationYouTube Oscars (Predicted):

Multiple streams (main show, backstage, commentary)Creator integration (reaction videos, live commentary)Real-time voting elementsClips go viral instantlyAI-powered personalized highlights2. Creator-Celebrity ConvergenceWhat Happens Next:

YouTubers presenting awardsTikTokers on red carpetStreaming metrics matter more than box office“Best YouTube Original Film” categoryTraditional stars forced to become creatorsPower Shift: The Academy needs YouTubers more than YouTubers need the Academy.

3. Advertising RevolutionOld Model:

$2.5M for 30-second spotBroad demographic targetingNo performance metricsBrand awareness focusYouTube Model:

Dynamic ad insertionHyper-targeted audiencesReal-time optimizationDirect response enabledCreator sponsorship integrationResult: 10x more effective advertising at 5x the scale.

Winners and LosersWinnersYouTube/Google:

Kills traditional TV’s last stronghold$2B+ annual ad revenue potentialLegitimizes platform for premium contentData on entertainment industryCreator economy validationYounger Audiences:

Oscars become accessibleInteractive experienceMultiple viewing optionsSocial media integrationActually might watchDigital-First Studios:

Netflix, Apple, Amazon legitimizedStreaming metrics valuedDirect-to-platform releases validatedTraditional theatrical window deadLosersTraditional TV Networks:

Last appointment viewing goneSports all that’s leftAdvertising exodus acceleratesCable subscriptions craterConsolidation inevitableMovie Theater Chains:

Oscars validated theatrical experienceNow validates streaming experienceBox office less relevantPrestige factor eliminatedAcceleration to bankruptcyTraditional Talent Agencies:

Creator economy doesn’t need themDirect-to-fan relationships winCommission model brokenInfluence fragmentedDisruption from every angleThe Broader ImplicationsHollywood’s Business Model CollapseThe Old Formula (Dead):

Make expensive movieTheatrical exclusive windowGenerate buzz/awardsSell to streaming/cableLong-tail revenueThe New Reality:

Create content for platformsDirect to streamingViral marketingGlobal simultaneous releaseData-driven decisionsCultural Power ShiftFrom Hollywood to Silicon Valley:

Algorithms > CriticsViews > ReviewsEngagement > AwardsCreators > CelebritiesPlatforms > StudiosThe Message: When the Oscars need YouTube more than YouTube needs the Oscars, the power center of entertainment has permanently shifted.

The Next DominoesWhat Falls Next:

Emmys: Follow within 2 yearsFilm Festivals: Hybrid/digital firstTalent Contracts: Platform-exclusive dealsStudio Structure: Become content armsTheater Business: Experiential onlyThree Predictions1. YouTube Buys a Major Studio Within 5 YearsThe Logic: With Oscars credibility, YouTube needs premium content pipeline. Paramount or Warner Bros at fire-sale prices. Vertical integration complete.

2. “Creator Oscars” Becomes Bigger Than Traditional OscarsThe Path: YouTube creates parallel awards for digital content. Within 5 years, more viewers, more relevance, more cultural impact than traditional awards.

3. Last Major Theater Chain Bankrupt by 2030The Reality: Oscars on YouTube validates home viewing. Theatrical windows collapse. Only experiential (IMAX/4D) survives. AMC/Regal can’t adapt fast enough.

Investment ImplicationsBuy/LongGoogle/Alphabet:

YouTube dominance cementedAd revenue surge comingPlatform network effectsContent cost leverageWinner takes allStreaming Platforms:

Netflix, Disney+ validatedDirect-to-consumer winsGlobal distribution advantageData-driven contentSell/ShortTraditional Media:

Paramount, Warner Bros DiscoveryLinear TV finishedAsset values plummetingDebt unsustainableTheater Chains:

AMC, Cinemark, RegalBusiness model deadReal estate liabilitiesNo path forwardThe Bottom LineYouTube hosting the Oscars isn’t just a distribution deal—it’s Hollywood’s formal surrender in the content wars. After a century of controlling entertainment through scarcity, gatekeeping, and prestige, Hollywood is handing its crown jewel to a platform that values engagement over artistry and creators over celebrities.

The Strategic Reality: This deal marks the end of Hollywood as we know it. When the Academy Awards—the ultimate symbol of traditional entertainment hierarchy—chooses YouTube over television, it admits that a teenager with a ring light has more cultural relevance than a century-old institution. The $500 million deal isn’t buying distribution; it’s buying relevance, and even that might not be enough.

For Business Leaders: The lesson here transcends entertainment. Every industry built on gatekeeping, scarcity, and institutional prestige faces its YouTube moment. The question isn’t if your industry’s “Oscars” will move to a digital platform—it’s whether you’ll be the one making the move or the one being moved. Hollywood waited too long and had to capitulate. Don’t make their mistake. The future belongs to platforms, not institutions; to creators, not gatekeepers; to engagement, not prestige. Adapt or become a Wikipedia entry.

Three Key Takeaways:Platform > Content: Owning distribution beats owning IP in the digital ageCreators > Celebrities: Individual creators now wield more influence than institutionsEngagement > Prestige: Views, likes, and shares matter more than awards and criticsStrategic Analysis Framework Applied

The Business Engineer | FourWeekMBA

Disclaimer: This analysis is for educational and strategic understanding purposes only. It is not financial advice, investment guidance, or a recommendation to buy or sell any securities. All data points are sourced from public reports and may be subject to change. Readers should conduct their own research and consult with qualified professionals before making any business or investment decisions.

Want to analyze platform dynamics and creator economy strategies? Visit [BusinessEngineer.ai](https://businessengineer.ai) for AI-powered business analysis tools and frameworks.

The post YouTube to Host the Oscars: Hollywood’s Complete Capitulation to Silicon Valley appeared first on FourWeekMBA.

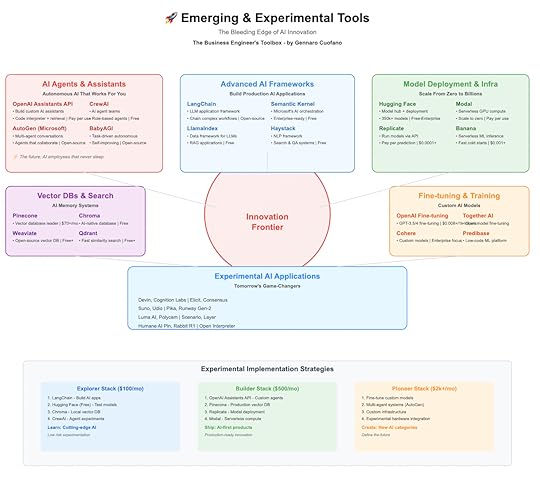

AI Emerging & Experimental Tools

AI Agents & AssistantsOpenAI Assistants API enables custom AI assistant development. Build specialized AI for your use case.LangChain provides the framework for LLM applications. Complex AI systems made simple.AutoGen by Microsoft enables multi-agent conversations. AI agents that collaborate.CrewAI orchestrates AI agent teams for complex tasks. Delegation at AI scale.Advanced AI PlatformsHugging Face hosts and deploys AI models. The GitHub of AI models.Replicate runs AI models in the cloud with simple APIs. Any model, anywhere.Modal provides infrastructure for AI applications. Scale from prototype to production.Banana offers serverless GPU infrastructure for AI. Pay only for what you use.

AI Agents & AssistantsOpenAI Assistants API enables custom AI assistant development. Build specialized AI for your use case.LangChain provides the framework for LLM applications. Complex AI systems made simple.AutoGen by Microsoft enables multi-agent conversations. AI agents that collaborate.CrewAI orchestrates AI agent teams for complex tasks. Delegation at AI scale.Advanced AI PlatformsHugging Face hosts and deploys AI models. The GitHub of AI models.Replicate runs AI models in the cloud with simple APIs. Any model, anywhere.Modal provides infrastructure for AI applications. Scale from prototype to production.Banana offers serverless GPU infrastructure for AI. Pay only for what you use.

The post AI Emerging & Experimental Tools appeared first on FourWeekMBA.

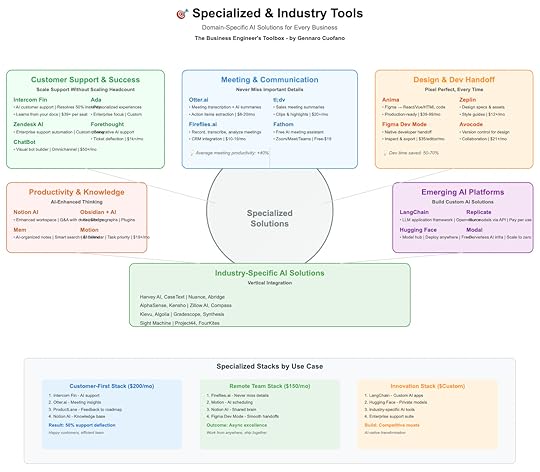

AI Specialized & Industry Tools

Customer Support & SuccessIntercom Fin provides AI-powered customer support. Resolve 50% of tickets instantly.Zendesk AI automates support with deep integrations. Scale support without scaling headcount.ChatBot builds conversational AI for any platform. Be everywhere your customers are.Ada delivers personalized customer experiences with AI. Support that feels human.Forethought resolves tickets with generative AI. Beyond chatbots to true automation.Meeting & CommunicationOtter.ai transcribes meetings with AI summaries. Never miss important details.Fireflies.ai records, transcribes, and analyzes meetings. Your AI meeting assistant.tl;dv provides AI meeting summaries for sales teams. Focus on selling, not note-taking.Fathom offers free AI meeting summaries. Premium features without premium pricing.Gong (mentioned earlier) analyzes sales calls for insights. Understand what wins deals.Voice & PhoneVapi creates voice agents with one click. Replace call centers with AI.Bland AI builds conversational phone agents. Human-like phone conversations at scale.Air AI provides 24/7 AI phone representatives. Never miss a call again.Vocode offers open-source voice agent development. Build custom voice experiences.Design & Development HandoffAnima converts Figma designs to production code. Pixel-perfect implementation guaranteed.Figma Dev Mode streamlines designer-developer collaboration. Smooth handoffs, better products.Zeplin generates specs and assets from designs. No more design interpretation errors.Avocode provides design handoff with version control. Track changes, ship faster.Productivity & Knowledge ManagementNotion AI enhances the popular workspace with AI. Your second brain, now with AI.Mem uses AI to organize and surface knowledge. Never forget anything again.Obsidian with AI plugins creates intelligent knowledge graphs. Connect ideas automatically.Roam Research enables AI-enhanced networked thought. Think better with AI assistance.Motion uses AI to optimize your calendar and tasks. Productivity on autopilot.Reclaim.ai protects focus time with intelligent scheduling. Deep work, guaranteed.

Customer Support & SuccessIntercom Fin provides AI-powered customer support. Resolve 50% of tickets instantly.Zendesk AI automates support with deep integrations. Scale support without scaling headcount.ChatBot builds conversational AI for any platform. Be everywhere your customers are.Ada delivers personalized customer experiences with AI. Support that feels human.Forethought resolves tickets with generative AI. Beyond chatbots to true automation.Meeting & CommunicationOtter.ai transcribes meetings with AI summaries. Never miss important details.Fireflies.ai records, transcribes, and analyzes meetings. Your AI meeting assistant.tl;dv provides AI meeting summaries for sales teams. Focus on selling, not note-taking.Fathom offers free AI meeting summaries. Premium features without premium pricing.Gong (mentioned earlier) analyzes sales calls for insights. Understand what wins deals.Voice & PhoneVapi creates voice agents with one click. Replace call centers with AI.Bland AI builds conversational phone agents. Human-like phone conversations at scale.Air AI provides 24/7 AI phone representatives. Never miss a call again.Vocode offers open-source voice agent development. Build custom voice experiences.Design & Development HandoffAnima converts Figma designs to production code. Pixel-perfect implementation guaranteed.Figma Dev Mode streamlines designer-developer collaboration. Smooth handoffs, better products.Zeplin generates specs and assets from designs. No more design interpretation errors.Avocode provides design handoff with version control. Track changes, ship faster.Productivity & Knowledge ManagementNotion AI enhances the popular workspace with AI. Your second brain, now with AI.Mem uses AI to organize and surface knowledge. Never forget anything again.Obsidian with AI plugins creates intelligent knowledge graphs. Connect ideas automatically.Roam Research enables AI-enhanced networked thought. Think better with AI assistance.Motion uses AI to optimize your calendar and tasks. Productivity on autopilot.Reclaim.ai protects focus time with intelligent scheduling. Deep work, guaranteed.

The post AI Specialized & Industry Tools appeared first on FourWeekMBA.

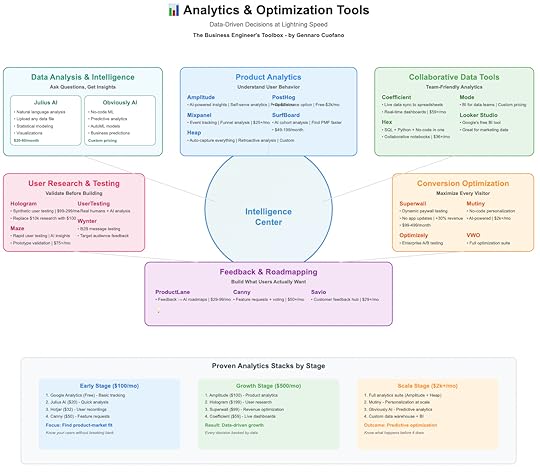

AI Analytics & Optimization Tools

User Research & TestingHologram generates synthetic users for product testing. $10k research studies for $100.Maze enables rapid user testing with AI analysis. Get user insights in hours, not weeks.UserTesting combines human testers with AI insights. Real feedback, faster.Wynter provides B2B message testing with target audiences. Know what resonates before launching.Product AnalyticsSurfBoard uses AI to identify key user behavior patterns. Find product-market fit faster.Amplitude adds AI predictions to product analytics. See the future of user behavior.Mixpanel provides AI-powered insights from user data. Answers before you ask questions.Heap automatically captures all user interactions. Never miss important data again.Conversion OptimizationSuperwall enables dynamic paywall testing without app updates. Optimize revenue in real-time.Mutiny personalizes websites without code using AI. Every visitor sees their perfect website.Optimizely provides enterprise experimentation with AI insights. Test everything, everywhere.VWO combines testing with AI-powered insights. Know not just what works, but why.Feedback & RoadmappingProductLane transforms feedback chaos into clear roadmaps. AI-prioritized product development.Canny aggregates feedback with AI categorization. Find signal in the noise.Savio centralizes feature requests with intelligent grouping. Build what customers actually want.Cycle connects customer feedback to product delivery. Close the loop automatically.

User Research & TestingHologram generates synthetic users for product testing. $10k research studies for $100.Maze enables rapid user testing with AI analysis. Get user insights in hours, not weeks.UserTesting combines human testers with AI insights. Real feedback, faster.Wynter provides B2B message testing with target audiences. Know what resonates before launching.Product AnalyticsSurfBoard uses AI to identify key user behavior patterns. Find product-market fit faster.Amplitude adds AI predictions to product analytics. See the future of user behavior.Mixpanel provides AI-powered insights from user data. Answers before you ask questions.Heap automatically captures all user interactions. Never miss important data again.Conversion OptimizationSuperwall enables dynamic paywall testing without app updates. Optimize revenue in real-time.Mutiny personalizes websites without code using AI. Every visitor sees their perfect website.Optimizely provides enterprise experimentation with AI insights. Test everything, everywhere.VWO combines testing with AI-powered insights. Know not just what works, but why.Feedback & RoadmappingProductLane transforms feedback chaos into clear roadmaps. AI-prioritized product development.Canny aggregates feedback with AI categorization. Find signal in the noise.Savio centralizes feature requests with intelligent grouping. Build what customers actually want.Cycle connects customer feedback to product delivery. Close the loop automatically.

The post AI Analytics & Optimization Tools appeared first on FourWeekMBA.

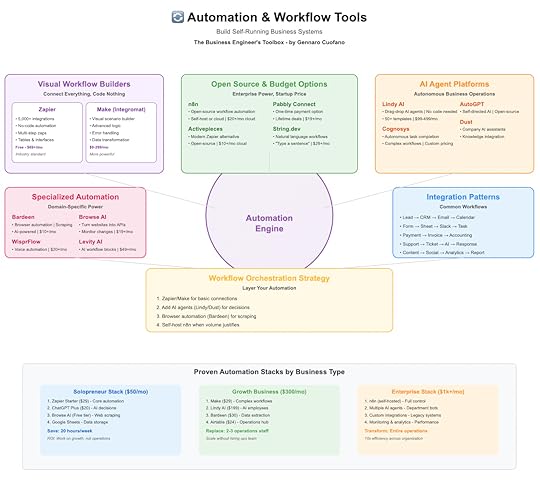

AI Automation & Workflow Tools

Visual Automation BuildersZapier remains the automation standard with 5,000+ app integrations. Connect everything without code.Make (formerly Integromat) offers powerful visual automation with advanced logic. Complex workflows made simple.n8n provides open-source workflow automation with self-hosting options. Full control over your automation.Activepieces delivers open-source automation with modern UI. Zapier alternative without the price tag.Pabbly Connect offers affordable automation with one-time pricing options. Automation without recurring costs.Specialized AutomationString.dev translates natural language into working workflows. Describe it, deploy it.Bardeen automates browser tasks with AI understanding. Your personal web automation assistant.Axiom.ai provides no-code browser automation for scraping and testing. Automate anything you can do in a browser.Browse AI extracts and monitors data from any website. Turn websites into APIs.Levity AI adds AI blocks to your existing workflows. Intelligence for your automations.AI Agent Platforms

Visual Automation BuildersZapier remains the automation standard with 5,000+ app integrations. Connect everything without code.Make (formerly Integromat) offers powerful visual automation with advanced logic. Complex workflows made simple.n8n provides open-source workflow automation with self-hosting options. Full control over your automation.Activepieces delivers open-source automation with modern UI. Zapier alternative without the price tag.Pabbly Connect offers affordable automation with one-time pricing options. Automation without recurring costs.Specialized AutomationString.dev translates natural language into working workflows. Describe it, deploy it.Bardeen automates browser tasks with AI understanding. Your personal web automation assistant.Axiom.ai provides no-code browser automation for scraping and testing. Automate anything you can do in a browser.Browse AI extracts and monitors data from any website. Turn websites into APIs.Levity AI adds AI blocks to your existing workflows. Intelligence for your automations.AI Agent PlatformsDust builds custom AI assistants with your company’s knowledge. AI that knows your business.

Lindy AI offers drag-and-drop AI agent creation. Build AI employees without coding.

Cognosys deploys autonomous AI agents for complex tasks. Delegate work, not just tasks.

AutoGPT pioneered autonomous AI agents. Set goals, let AI figure out how.

BabyAGI creates task-driven autonomous agents. AI that plans and executes independently.

The post AI Automation & Workflow Tools appeared first on FourWeekMBA.

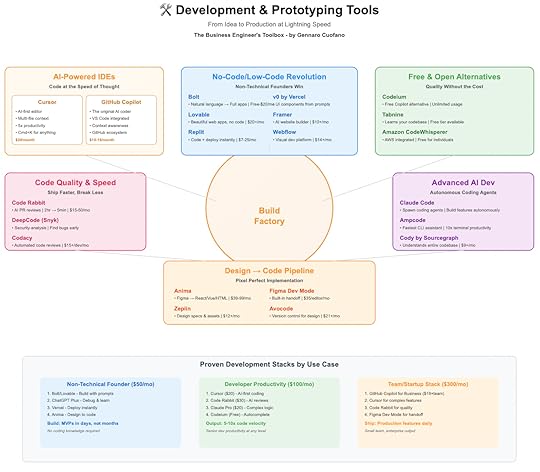

AI Development & Prototyping Tools

AI-Powered IDEs & AssistantsCursor reimagines the IDE with AI-first design. Multi-file understanding and intelligent suggestions boost productivity 5x. The future of coding is here.GitHub Copilot started the AI coding revolution. Autocomplete for code that actually understands context. Your AI pair programmer.Codeium offers free AI code completion rivaling paid alternatives. Enterprise-quality AI without the price tag.Tabnine provides AI completions trained on your codebase. AI that learns your style.Amazon CodeWhisperer integrates with AWS services for cloud-native development. Build on AWS faster.No-Code/Low-Code PlatformsBolt enables natural language app development. Describe what you want, get working code. For founders who think in products, not code.Lovable focuses on beautiful, functional web apps without coding. Design and deploy in one platform.Replit combines AI assistance with instant deployment. From idea to live app in minutes.v0 by Vercel generates UI components from descriptions. Professional React components without the expertise.Framer merges design with AI-powered website building. Websites that look like you hired an agency.Webflow adds AI assistance to its powerful visual development platform. Professional websites without developers.Code Quality & ReviewCode Rabbit automates pull request reviews with AI intelligence. Never miss a bug in code review again.DeepCode (now Snyk Code) finds bugs and security vulnerabilities using AI. Security that scales with your team.Codacy provides automated code reviews with actionable insights. Maintain code quality automatically.Development AccelerationClaude Code spawns autonomous coding agents for complex tasks. Delegate entire features to AI.Ampcode delivers the fastest command-line AI assistance. 10x faster terminal productivity.Cody by Sourcegraph understands your entire codebase for intelligent assistance. AI with perfect context.DevGPT combines multiple AI models for development tasks. The best model for each job.

AI-Powered IDEs & AssistantsCursor reimagines the IDE with AI-first design. Multi-file understanding and intelligent suggestions boost productivity 5x. The future of coding is here.GitHub Copilot started the AI coding revolution. Autocomplete for code that actually understands context. Your AI pair programmer.Codeium offers free AI code completion rivaling paid alternatives. Enterprise-quality AI without the price tag.Tabnine provides AI completions trained on your codebase. AI that learns your style.Amazon CodeWhisperer integrates with AWS services for cloud-native development. Build on AWS faster.No-Code/Low-Code PlatformsBolt enables natural language app development. Describe what you want, get working code. For founders who think in products, not code.Lovable focuses on beautiful, functional web apps without coding. Design and deploy in one platform.Replit combines AI assistance with instant deployment. From idea to live app in minutes.v0 by Vercel generates UI components from descriptions. Professional React components without the expertise.Framer merges design with AI-powered website building. Websites that look like you hired an agency.Webflow adds AI assistance to its powerful visual development platform. Professional websites without developers.Code Quality & ReviewCode Rabbit automates pull request reviews with AI intelligence. Never miss a bug in code review again.DeepCode (now Snyk Code) finds bugs and security vulnerabilities using AI. Security that scales with your team.Codacy provides automated code reviews with actionable insights. Maintain code quality automatically.Development AccelerationClaude Code spawns autonomous coding agents for complex tasks. Delegate entire features to AI.Ampcode delivers the fastest command-line AI assistance. 10x faster terminal productivity.Cody by Sourcegraph understands your entire codebase for intelligent assistance. AI with perfect context.DevGPT combines multiple AI models for development tasks. The best model for each job.

The post AI Development & Prototyping Tools appeared first on FourWeekMBA.