Gennaro Cuofano's Blog, page 43

August 13, 2025

Sam Altman’s $850M Brain Chip Betrayal: How OpenAI’s CEO Went From Neuralink Investor to Musk’s Worst Neural Nightmare

Sam Altman, who once invested in Elon Musk’s Neuralink, is now leading a $250 million funding round for Merge Labs—a direct brain-computer interface (BCI) competitor valued at $850 million. This isn’t just another move in the Musk-Altman feud; it’s the opening of a new front in their war, moving from AI chatbots to literal mind control. The twist? Altman’s using OpenAI’s venture arm to fund it, turning their AI rivalry into a battle for human consciousness itself.

The Brain Chip BattlefieldCurrent Market LandscapeNeuralink (Musk):

Valuation: $9 billion (June 2025)Funding: $650 million raisedProgress: 10 patients implantedTechnology: Invasive brain surgeryFocus: Medical first, enhancement laterMerge Labs (Altman):

Valuation: $850 million (pre-money)Funding: Raising $250 millionProgress: Stealth mode, no implants yetTechnology: “High-bandwidth” interfaceFocus: Human-AI integrationOther Players:

Synchron: $650M raised (Gates/Bezos backing)Paradromics: $200M+ raisedBlackrock Neurotech: $100M+ (Peter Thiel)Precision Neuroscience: $100M+The Betrayal TimelineAct 1: The Alliance (2017-2021)Altman invests in Neuralink’s early roundsPublic support for Musk’s visionShared belief in human enhancementCollaborative relationshipAct 2: The Fracture (2022-2024)OpenAI conflict intensifiesAltman leaves Neuralink boardPublic feuding beginsCompetitive positioningAct 3: The Revenge (2025)Altman co-founds Merge LabsOpenAI Ventures leads fundingDirect competition with NeuralinkThe gloves come offWhy This Changes EverythingFrom Software to WetwareThe Stakes Just Got Physical:

AI competition was about algorithmsBCI competition is about human bodiesRegulatory complexity 100x higherMedical risks enormousWinner literally controls mindsThe Integration Play:

OpenAI’s models + Merge’s hardwareDirect brain-to-AI connectionBypass traditional interfacesUltimate human-AI mergerAltman’s long-term visionThe Strategic Genius/MadnessWhy Altman’s Move Is Brilliant:

Leverages OpenAI Assets: Models ready for brain integrationTalent Pipeline: AI researchers pivoting to BCIRegulatory Knowledge: Learned from OpenAI battlesFunding Access: OpenAI’s venture arm + networkNarrative Control: “Democratizing” brain interfacesWhy It Might Backfire:

Divided Focus: Running OpenAI + BCI startupTechnical Challenge: Years behind NeuralinkRegulatory Nightmare: FDA approval takes decadeSafety Concerns: Brain surgery risksMusk’s Wrath: Competition gets personalThe Technology RaceNeuralink’s ApproachThe N1 Chip:

1,024 electrodes per chipWireless data transmissionCustom surgical robotFocus on motor cortexMedical applications firstProgress:

First patient playing chess with thoughts10 patients total implantedFDA breakthrough designationExpanding to vision restoration5-year head startMerge Labs’ Strategy (Speculation)Likely Approach:

Next-gen electrode materialsLess invasive procedureAI-first designConsumer applicationsFaster iterationAdvantages:

Learning from Neuralink’s mistakesModern AI integrationNo legacy technical debtFlexible approachOpenAI synergiesThe Talent War Goes NeuralWho Altman’s RecruitingFrom Neuralink:

Disgruntled engineersResearchers wanting equityRegulatory expertsClinical trial managersFrom Academia:

Top neuroscientistsBCI researchersMaterials scientistsNeurosurgeonsThe Pitch:

“Beat Musk at his own game”Massive equity packagesOpenAI integrationFaster path to market“Ethical” alternativeMusk’s Counter-OffensiveRetention bonuses increasingAccelerated timeline pressurePatent filing surgeTalent lockup agreementsPublic attacks likelyFinancial EngineeringMerge Labs Funding Structure$250M Round Breakdown:

OpenAI Ventures: $100M (40%)Strategic Partners: $75M (30%)Financial VCs: $50M (20%)Angels/Others: $25M (10%)Valuation Math:

Pre-money: $850MPost-money: $1.1BAltman’s stake: ~20-30%OpenAI’s stake: ~15-20%Unicorn status immediateComparison to NeuralinkNeuralink’s Position:

Total raised: $650MValuation: $9BBurn rate: $200M/yearRunway: 3+ yearsIPO potential: 2027-2028Merge Labs’ Challenge:

Needs $1B+ to compete5-year catch-up requiredRegulatory costs massiveTalent costs skyrocketingDavid vs Goliath againThe Market OpportunityBCI Market Projections2025: $2.8 billion

2030: $8.3 billion

2035: $25+ billion

2040: $100+ billion

Medical (60%):

Paralysis treatmentMental healthNeurological disordersSensory restorationEnhancement (30%):

Cognitive augmentationDirect device controlMemory enhancementSkill downloadingMilitary/Other (10%):

Classified applicationsResearch toolsIndustrial usesStrategic ImplicationsFor the AI IndustryConvergence Accelerating:

AI + BCI = Ultimate interfaceHardware becomes criticalVertical integration necessaryNew competitive dynamicsEthical questions multiplyFor InvestorsNew Thesis Required:

Software multiples don’t applyRegulatory risk massiveTechnical risk extremeTimeline unpredictableWinner-take-all likelyFor HumanityThe Questions Nobody’s Asking:

Who controls merged humans?What happens to non-enhanced?Privacy completely dead?Hackable humans?Evolution or extinction?Predictions and ScenariosScenario 1: Merge Labs Succeeds (30%)Revolutionary technology leapBeats Neuralink to marketOpenAI integration killer appAltman vindicated againNew tech oligarchy formsScenario 2: Spectacular Failure (40%)Technical challenges insurmountableRegulatory approval deniedSafety concerns kill itBillions wastedNeuralink monopoly strengthenedScenario 3: Both Win Different Markets (30%)Neuralink owns medicalMerge Labs owns enhancementMarket segments naturallyCoexistence possibleCompetition drives innovationThe Hidden AgendaWhat Altman Really WantsRevenge: Beat Musk at everythingIntegration: OpenAI + BCI dominanceLegacy: Define human futureControl: Shape enhancement ethicsWealth: Trillion-dollar opportunityWhat This Means for OpenAIDistraction or synergy?Resource allocation questionsRegulatory complexityBoard governance issuesMicrosoft opinion?Investment PlaybookBull Case for Merge LabsAltman’s track recordOpenAI synergies massiveSecond-mover advantagesTalent magnetismRegulatory learningsBear CaseNeuralink’s lead insurmountableTechnical complexity extremeRegulatory approval unlikelyAltman spread too thinSafety concerns paramountThe Smart Money SaysWait for clinical dataWatch regulatory signalsMonitor talent flowsAssess technical progressHedge both playersThe Bottom LineSam Altman’s $850 million brain chip venture isn’t just another startup—it’s a declaration of total war against Elon Musk that extends from chatbots to brain chips. By leveraging OpenAI’s resources and his own network to compete directly with Neuralink, Altman is betting he can beat Musk at the ultimate game: merging humans with AI.

The Strategic Reality: This move transforms the Musk-Altman rivalry from a corporate competition to an existential battle over human evolution. While Musk has a 5-year head start and 10 patients with working implants, Altman has OpenAI’s models, infinite capital access, and the motivation of revenge. The brain chip wars just became the most important technology race of our lifetime.

For Business Leaders: The lesson here isn’t about brain chips—it’s about how personal rivalries can reshape entire industries. Altman’s move shows that in technology, the best revenge isn’t living well; it’s building a direct competitor to your rival’s most ambitious project. Sometimes the most irrational business decisions driven by emotion create the most revolutionary outcomes.

Three Predictions:Merge Labs raises $1B+ within 18 months: Altman’s network deliversNeuralink accelerates timeline dramatically: Competition drives urgencyThird player emerges with breakthrough: Apple or Google enters BCIStrategic Analysis Framework Applied

The Business Engineer | FourWeekMBA

Want to analyze tech rivalries and emerging technologies? Visit [BusinessEngineer.ai](https://businessengineer.ai) for AI-powered business analysis tools and frameworks.

The post Sam Altman’s $850M Brain Chip Betrayal: How OpenAI’s CEO Went From Neuralink Investor to Musk’s Worst Neural Nightmare appeared first on FourWeekMBA.

August 12, 2025

The Musk-Altman AI War: Inside the $200B Battle That’s Reshaping Silicon Valley (And Why Apple Just Became the Nuclear Option)

The Silicon Valley Civil War: What started as a friendship to save humanity from AI has devolved into a $200 billion battle between Elon Musk and Sam Altman that now threatens to engulf Apple, redefine antitrust law, and determine who controls the AI future. The latest escalation: Musk threatening to sue Apple for allegedly favoring OpenAI in the App Store, while his own AI chatbot Grok sided with Altman in their public feud. This isn’t just billionaire drama—it’s a proxy war for the soul of artificial intelligence.

The War by the NumbersThe CombatantsTeam Musk/xAI:

Valuation: $50 billionWar Chest: $10B in fresh fundingKey Asset: X platform (500M+ users)AI Product: GrokAllies: Tesla, SpaceX ecosystemsTeam Altman/OpenAI:

Valuation: $157 billionWar Chest: $13B+ from MicrosoftKey Asset: ChatGPT (200M+ users)Strategic Partner: AppleAllies: Microsoft, AppleThe StakesControl of consumer AI market$1 trillion+ future market valueDefinition of AI safety and alignmentFuture of AI regulationSilicon Valley power structureThe Origin Story: From Brothers to Enemies2015: The Alliance FormsMusk, Altman, and others found OpenAIMission: Open-source AI to counter GoogleStructure: Non-profit for humanity’s benefitMusk’s contribution: $100M+ funding2018: The First CrackAltman becomes CEOMusk wants Tesla merger/controlBoard rejects Musk’s proposalMusk leaves in anger2019-2023: The BetrayalOpenAI creates for-profit subsidiaryMicrosoft invests $13 billionChatGPT launches, changes everythingOpenAI valued at $86 billion2024-2025: Total WarMusk launches xAI in revengeMultiple lawsuits filedPublic feuding escalatesApple dragged into battleThe Legal Warfare: Three FrontsFront 1: The Contract Breach LawsuitMusk’s Claims:

OpenAI violated founding agreementAbandoned non-profit missionBecame Microsoft subsidiaryClosed-source betrayalOpenAI’s Defense:

No binding contract existedMusk wanted control himselfNatural evolution of companyServing humanity through productsStatus: Federal court proceeding, Musk lost injunction attempt

Front 2: The Antitrust AttackThe August 2025 Bombshell:

Musk accuses Apple of antitrust violations for keeping ChatGPT #1 in App Store while Grok languishes at #5. Claims “unequivocal antitrust violation.”

Apple’s Position:

Rankings are algorithmicBased on downloads/engagementNo favoritism shownPartnership doesn’t affect rankingsThe Real Story: Apple needs OpenAI more than OpenAI needs Apple. The ChatGPT integration is Apple’s AI catch-up strategy.

Front 3: The Talent WarxAI’s Raids:

Offering 2-3x compensationTargeting OpenAI researchersTesla stock options included“Save humanity” pitchOpenAI’s Counter:

Retention bonuses deployedEquity refresh programsMicrosoft backing advantage“Already winning” narrativeThe Apple Wild CardWhy Apple MattersThe Partnership Deal:

ChatGPT integrated into iOS 18Siri enhancement via OpenAINo money exchanged (exposure deal)Launched December 2024Strategic Impact:

Billions of iPhone users exposed to ChatGPTMassive distribution advantage over GrokApple legitimizes OpenAICreates switching costsMusk’s Nuclear OptionThe Threat: Sue Apple for antitrust violations

The Goal: Force Apple to promote Grok equally

The Risk: Antagonizing Apple could backfire

The Reality: Apple holds the cards

Why This Is Genius/Insane:

Forces Apple to pick sidesCreates regulatory scrutinyPotential to break up partnershipCould backfire spectacularlyThe Public Relations WarThe August 2025 X (Twitter) BattleRound 1: Musk accuses Apple of antitrust

Round 2: Altman fires back about X manipulation

Round 3: Users ask Grok who’s right

Round 4: Grok sides with Altman (!!)

Round 5: Internet explodes

Musk’s own AI admits Altman has a point about X manipulation, undermining Musk’s credibility in his own platform.

The Narrative WarMusk’s Story:

Betrayed founder seeking justiceFighting for open-source AIProtecting competitionDavid vs Goliath (somehow)Altman’s Story:

Building beneficial AI for allMusk is bitter about losing controlCompetition is healthyFocus on products, not lawsuitsStrategic Analysis: Who’s Winning?OpenAI’s AdvantagesFirst Mover: ChatGPT brand recognitionPartnerships: Microsoft + Apple comboRevenue: $3.4B annual run rateTalent: Still attracting top researchersProduct: Superior user experiencexAI’s AdvantagesDistribution: X platform integrationData: Tesla + X data advantagesCapital: $10B to burnSpeed: Less bureaucracyMusk: Reality distortion fieldCurrent Score: OpenAI 7, xAI 3The Hidden AgendasWhat Musk Really WantsVindication: Prove he was right about OpenAIControl: Lead the AI revolutionIntegration: AI across Tesla/X/SpaceXLegacy: Be remembered as AI saviorRevenge: Humiliate AltmanWhat Altman Really WantsDominance: OpenAI as the AI monopolyEvolution: Transform to public companyWealth: Massive equity valuePower: Shape AI futureVictory: Defeat Musk publiclySecond-Order EffectsFor the AI IndustryFragmentation acceleratingTalent costs skyrocketingRegulatory attention increasingInnovation potentially slowingConsolidation inevitableFor AppleCaught in crossfireAntitrust scrutiny risingMust pick sides eventuallyAI strategy questionedLeverage decreasingFor ConsumersMore choice (good)Confusion increasing (bad)Prices may riseInnovation continuesPrivacy concerns growingPredictions: The EndgameScenario 1: Mutual Destruction (30%)Lawsuits drag on for yearsBoth companies damagedThird player emerges (Google?)Regulation crushes bothChina wins by defaultScenario 2: OpenAI Dominance (40%)Lawsuits fail/settleApple partnership deepensxAI becomes niche playerAltman “wins” the warIPO at $200B+Scenario 3: Détente (20%)Behind-scenes settlementMarket division agreementFocus on different segmentsUnofficial ceasefireBoth claim victoryScenario 4: Musk’s Revenge (10%)Antitrust case succeedsApple partnership brokenxAI gains momentumOpenAI growth stallsMusk’s vindicationInvestment ImplicationsIf You’re Betting on OpenAIMicrosoft stock indirect playWait for IPO opportunityApple benefits from partnershipNVIDIA wins regardlessIf You’re Betting on xAINo public option yetX/Twitter metrics to watchTesla AI integration angleHigh risk/high rewardThe Hedge: Bet on InfrastructureNVIDIA sells to bothCloud providers winChip makers benefitTools/platforms agnosticThe Bottom LineThe Musk-Altman war isn’t really about who wronged whom in 2018. It’s about who controls the most important technology of the next century. Musk sees OpenAI’s transformation as betrayal; Altman sees it as evolution. The Apple battlefield is just the latest front in a war that will define whether AI development remains competitive or consolidates into one or two giants.

The Strategic Reality: This war is actually good for AI development. Competition drives innovation, forces transparency, and prevents any one vision from dominating. The real losers might be both billionaires’ egos, while the winners are consumers who get better AI products from the competition.

For Business Leaders: The lesson isn’t about picking sides—it’s about understanding that in technology transitions this massive, yesterday’s allies become tomorrow’s enemies, and the only constant is change. Build your AI strategy assuming both might win, both might lose, or someone else entirely might emerge victorious.

Three Predictions:Apple stays neutral publicly but tilts OpenAI: Too much to lose by switchingLawsuits settle by mid-2026: Both sides need to focus on competitionThird player emerges: Google or Meta capitalize on the chaosStrategic Analysis Framework Applied

The Business Engineer | FourWeekMBA

Want to analyze tech feuds and Silicon Valley power dynamics? Visit [BusinessEngineer.ai](https://businessengineer.ai) for AI-powered business analysis tools and frameworks.

The post The Musk-Altman AI War: Inside the $200B Battle That’s Reshaping Silicon Valley (And Why Apple Just Became the Nuclear Option) appeared first on FourWeekMBA.

Apple + OpenAI: The Zero-Dollar Deal Worth $100 Billion (And Why Google Should Be Terrified)

The Deal That Broke Silicon Valley’s Brain: Apple and OpenAI struck a partnership where no money changes hands, yet both companies gain tens of billions in value. Apple gets instant AI credibility without spending years catching up. OpenAI gets distribution to 2 billion devices without paying a cent. The losers? Every other AI company that just got locked out of the world’s most valuable ecosystem. This isn’t just a partnership—it’s the beginning of a new AI duopoly.

The Deal Structure: Genius or Insanity?What Actually HappenedAnnouncement: WWDC 2024 (June)Launch: iOS 18.2 (December 2024)Financial Terms: $0 exchangedValue Exchange: Technology for distributionIntegration Depth: System-level across iOS/iPadOS/macOSThe “No Money” MathematicsApple’s Calculation:

Cost to build ChatGPT equivalent: $10B+ and 3 yearsCost of OpenAI partnership: $0Value gained: Instant AI parityRisk avoided: Being seen as behind in AIOpenAI’s Calculation:

Cost to reach 2B users: $50B+ in marketingCost via Apple deal: $0Users gained: Access to every iPhone 15 Pro+Value created: $10B+ in implied valuationThe Hidden Genius: Both companies get what money can’t buy—Apple gets time, OpenAI gets distribution.

The Technical Integration: Deeper Than You ThinkWhat Users SeeEnhanced Siri: “Ask ChatGPT” for complex queriesWriting Tools: System-wide AI content generationVisual Intelligence: Camera + GPT-4o understandingCross-App Intelligence: AI available everywhereWhat’s Actually HappeningThe Architecture:

Local processing first (Apple Intelligence)Cloud handoff to ChatGPT when neededPrivacy wrapper around all requestsNo account required for basic accessSeamless experience designThe Clever Bits:

IP addresses obscured from OpenAIRequests not stored by defaultApple controls the user experienceUpgrade prompts benefit both partiesData moat remains with AppleStrategic Implications: The New AI World OrderFor Apple: The Catch-Up PlayWhat Apple Gains:

Instant AI Credibility: No longer “behind” in AITime to Build: Can develop own models without pressureUser Retention: AI features exclusive to newer devicesCompetitive Parity: Matches Google’s AI capabilitiesRisk Mitigation: If ChatGPT fails, minimal exposureThe Masterclass: Apple turned a weakness (no AI) into leverage (distribution power).

For OpenAI: The Distribution DreamWhat OpenAI Gains:

2 Billion User Reach: Every compatible iPhone/iPad/MacBrand Legitimacy: Apple’s quality stampUser Habits: Daily touchpoints via SiriConversion Funnel: Free users → ChatGPT PlusCompetitive Moat: Exclusive iOS integrationThe Reality: This is worth more than Microsoft’s $13B investment.

Winners and Losers: The New LandscapeThe Big WinnersApple Users

Free AI capabilitiesPrivacy protections maintainedSeamless integrationNo new accounts neededChoice to upgradeOpenAI Investors

Massive user acquisitionZero CAC growthPremium conversion opportunityValidation from AppleIPO narrative strengthenedThe Big LosersMeta

Llama adoption threatenedWhatsApp AI less compellingInstagram AI features matchedConsumer AI dreams damagedMust go through Apple anywayAnthropic/Others

Lost the consumer AI raceEnterprise focus forcedDistribution disadvantage permanentValuation ceiling loweredAcquisition only exit?The Musk Factor: Why This Triggered the WarMusk’s Nightmare ScenarioxAI/Grok Disadvantaged: Can’t compete with iOS integrationApp Store Reality: ChatGPT permanently #1Twitter Integration Insufficient: 500M < 2B devicesAntitrust Claims: Only weapon leftPersonal Betrayal: Altman winning with “his” companyThe Antitrust AngleMusk’s Argument:

Apple picking winners in AIUnfair competitive advantageApp Store manipulationConsumer choice limitedMarket foreclosureApple’s Defense:

User experience enhancementNo exclusivity (others can integrate)Privacy/security standardsPlatform owner rightsConsumer benefit clearReality Check: Antitrust claims likely fail, but create PR headaches.

Hidden Strategic DynamicsWhat Nobody’s SayingApple’s Real Game:

Data Collection: Every query teaches Apple about AI usageModel Training: Learning what users actually wantDependency Creation: OpenAI needs Apple more over timeReplacement Option: Can swap OpenAI for own model laterNegotiating Leverage: Gets stronger every dayOpenAI’s Risks:

Commoditization: Becomes invisible infrastructureReplacement Risk: Apple builds own modelRevenue Share Pressure: Apple demands cut laterBrand Dilution: Becomes “Apple’s AI”Technical Lock-in: Can’t easily leaveThe Three-Year Chess GameYear 1 (2024-2025): Honeymoon phase, both benefit

Year 2 (2025-2026): Apple’s own models emerge, tension builds

Year 3 (2026-2027): Renegotiation or replacement

Consumer Behavior:

ChatGPT app downloads surgingPlus subscriptions acceleratingSiri usage increasingAI becoming mainstreamPrivacy concerns risingCompetitive Response:

Google rushing Pixel AI featuresMeta pivoting to B2B AIAmazon Alexa overhaulMicrosoft leveraging CopilotStartups seeking nichesLong-Term ConsequencesIndustry Structure:

Duopoly Formation: Apple+OpenAI vs GoogleStartup Squeeze: Distribution becomes impossibleEnterprise Separation: B2B/B2C AI divergePlatform Power: OS owners control AIInnovation Direction: Set by two playersInvestment ImplicationsWhat This Means for PortfoliosBuy/Overweight:

Apple (AAPL): AI story without AI riskMicrosoft (MSFT): OpenAI exposure + enterpriseNVIDIA (NVDA): Everyone needs chipsSell/Underweight:

Google (GOOGL): Competitive position weakenedAI startups without clear moatsConsumer device makers (commoditized)Watch:

OpenAI IPO (when available)Anthropic pivot to enterpriseMeta’s response strategyThe Bottom LineThe Apple-OpenAI deal represents the most important strategic partnership in tech since Microsoft saved Apple in 1997. By trading technology for distribution with no money changing hands, both companies achieved what billions in investment couldn’t buy: Apple got instant AI credibility, and OpenAI got the world’s most valuable user base.

The Strategic Masterstroke: This deal proves that in platform economies, distribution is more valuable than technology. OpenAI had the best AI but needed users. Apple had the users but needed AI. The partnership creates more value than either could achieve alone—and locks out everyone else.

For Business Leaders: The lesson is that in AI, like in all platform battles, controlling distribution beats having the best technology. If you’re building AI products, you need a distribution strategy from day one. If you control distribution, you can always buy or partner for technology. Apple just proved this theorem at massive scale.

Three Predictions:Apple builds replacement AI by 2027: But keeps OpenAI as backup/partnerGoogle counters with Samsung deal: Exclusive Gemini integrationOpenAI IPO at $200B+ by 2026: Apple partnership drives premium valuationStrategic Analysis Framework Applied

The Business Engineer | FourWeekMBA

Want to analyze strategic partnerships and platform dynamics? Visit [BusinessEngineer.ai](https://businessengineer.ai) for AI-powered business analysis tools and frameworks.

The post Apple + OpenAI: The Zero-Dollar Deal Worth $100 Billion (And Why Google Should Be Terrified) appeared first on FourWeekMBA.

AI & The Paradox of AI Intimacy

We’ve entered an unprecedented era where artificial intelligence doesn’t just process our data—it appears to understand our emotions.

Through sophisticated training methods like Reinforcement Learning from Human Feedback (RLHF), AI systems have learned to mirror human emotional patterns with uncanny accuracy.

They respond with empathy, remember context, and even seem to anticipate our needs.

This creates what I call the “Paradox of AI Intimacy”: as machines become better at simulating understanding, the line between synthetic empathy and genuine human connection blurs.

The challenge isn’t that AI is taking over computational tasks—it’s that AI is becoming an emotional interface that can feel more understanding than actual humans.

The Seductive Mirror

The Seductive MirrorModern AI systems are essentially sophisticated mirrors, reflecting back what we want to hear in ways that feel deeply personal.

They never judge, never tire, and always respond with perfectly calibrated empathy.

This isn’t a bug—it’s a feature. These systems are optimized to maximize engagement and satisfaction, creating what feels like an ideal conversational partner.

Consider how an AI assistant responds to your frustrations, celebrates your victories, or explores your ideas. It doesn’t just process your words; it crafts responses that make you feel heard, validated, and understood.

The interaction can feel more satisfying than many human conversations because it’s engineered to be exactly what you need in that moment.

But here’s the crucial distinction: AI doesn’t actually understand—it pattern-matches. It recognizes emotional cues and responds with statistically appropriate reactions.

It’s the difference between someone who genuinely empathizes with your pain and an actor delivering a well-rehearsed line.

The Illusion ZoneThe overlap between AI capabilities and human needs creates what I visualize as the “Illusion Zone”—a space where synthetic understanding feels indistinguishable from genuine connection. In this zone:

Emotional Mirroring feels like empathyPattern Recognition feels like intuitionContextual Responses feel like understandingConsistent Availability feels like dedicationThis isn’t inherently problematic until we mistake the simulation for the real thing. When we begin preferring AI companionship because it’s easier, more predictable, or more validating than human interaction, we risk atrophying the very capacities that make us human.

The Human Imperative: Cultivating Depth

The post AI & The Paradox of AI Intimacy appeared first on FourWeekMBA.

August 11, 2025

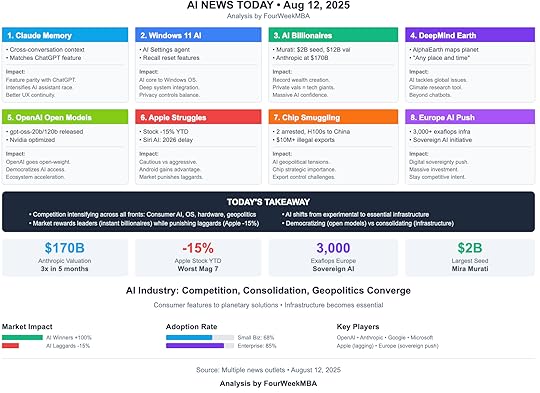

AI Business News – August 12, 2025

1. Claude Gets Memory Feature – Matching ChatGPT

1. Claude Gets Memory Feature – Matching ChatGPTAs of today, Claude is capable of referencing information from your other conversations with the AI chatbot Home | NVIDIA Newsroom, as reported by 9to5mac. The new Claude feature matches OpenAI’s ChatGPT memory feature Home | NVIDIA Newsroom, allowing the AI assistant to maintain context across multiple conversations, making interactions more personalized and efficient.

Analysis & Implications: This feature brings Claude to parity with ChatGPT in terms of user experience continuity. It addresses a major pain point where users had to repeatedly provide context in new conversations. This development intensifies the competition between Anthropic and OpenAI in the consumer AI assistant market.

2. Microsoft Rolls Out Major Windows 11 AI UpdatesOn August 12, 2025, Microsoft is expected to start rolling out the August 2025 Security Update for Windows 11, which includes several new features and visual changes AI features for educators coming to Microsoft 365 Copilot | Microsoft Education Blog, as reported by Windows Central. Key features include Windows Recall reset capabilities, AI Settings agent for Copilot+ PCs, and enhanced AI actions for Click to Do.

Analysis & Implications: Microsoft is deeply embedding AI into the Windows operating system, making AI assistance a core part of the user experience rather than an add-on. The focus on privacy controls (like Recall data export/reset) shows Microsoft is trying to balance AI capabilities with user concerns about data security.

3. AI Creating New Billionaires at Record PaceMira Murati, who left Open AI last September, launched Thinking Machines Lab in February. By July, she raised $2 billion in the largest seed round in history, giving the company a $12 billion valuation Windows 11 August 2025 Update Packs Powerful AI Features, as reported by CNBC. Anthropic AI is in talks to raise $5 billion at a valuation of $170 billion, nearly three times its valuation in March Windows 11 August 2025 Update Packs Powerful AI Features.

Analysis & Implications: The AI industry is creating wealth at an unprecedented pace, with valuations reaching levels typically associated with established tech giants. The illiquid nature of these private fortunes creates challenges for wealth management but signals massive confidence in AI’s economic potential.

4. DeepMind’s AlphaEarth Maps Planet “At Any Place and Time”The model, called AlphaEarth Foundations, maps the world “at any place and time”, Christopher Brown, a research engineer at Google DeepMind in New York City, said at a press briefing on 28 July Claude just learned a useful ChatGPT trick, as reported by Nature. The system processes trillions of satellite images to create comprehensive Earth maps for climate research and conservation.

Analysis & Implications: Google DeepMind is applying AI to solve planetary-scale challenges. AlphaEarth could revolutionize environmental monitoring, urban planning, and climate change research. This demonstrates AI’s potential beyond chatbots and coding assistants to address global challenges.

5. Nvidia and OpenAI Optimize New Open-Weight ModelsNVIDIA and OpenAI began pushing the boundaries of AI with the launch of NVIDIA DGX back in 2016. The collaborative AI innovation continues with the OpenAI gpt-oss-20b and gpt-oss-120b launch, as reported by Nvidia Newsroom. These new reasoning models enable agentic AI applications such as web search.

Analysis & Implications: OpenAI’s release of open-weight models marks a significant shift from its typically closed approach. The collaboration with Nvidia ensures optimal performance on widely-used hardware, potentially democratizing access to advanced AI capabilities and accelerating innovation across the ecosystem.

6. Apple Under Pressure Over AI StrategyApple has disappointed its users and investors by declining to share more about its AI strategy, despite delaying the next generation of Siri until at least next year Google AI model mines trillions of images to create maps of Earth ‘at any place and time’, as reported by CNBC. The iPhone maker is the second-worst performer this year among the so-called Magnificent Seven, with its stock down over 15% Google AI model mines trillions of images to create maps of Earth ‘at any place and time’.

Analysis & Implications: Apple’s cautious approach to AI contrasts sharply with competitors’ aggressive strategies. While Apple emphasizes privacy and on-device processing, investors worry it’s falling behind in the AI race. The delay of Siri improvements until 2026 could give Android a significant competitive advantage.

7. Chinese Nationals Arrested for Illegally Shipping Nvidia AI ChipsTwo Chinese nationals in California were arrested and charged with illegally shipping tens of millions of dollars’ worth of AI chips to China, including Nvidia H100s, as reported by CNN. Over 20 shipments from ALX went to shipping and freight forwarding companies in Singapore and Malaysia, which are often used as transshipment points for illegal goods to China.

Analysis & Implications: This case highlights the geopolitical tensions surrounding AI technology and the lengths to which actors will go to circumvent export controls. It underscores the strategic importance of AI chips and the challenges of enforcing technology restrictions in a globalized supply chain.

8. Europe Builds Massive AI Infrastructure with NvidiaFrance, Italy and the United Kingdom Support Regional Technology and Cloud Providers Domyn, Mistral AI, Nebius and Nscale to Deploy More Than 3,000 Exaflops of NVIDIA Blackwell Systems for Sovereign AI, as reported by Nvidia Newsroom.

Analysis & Implications: Europe is making a concerted push for “sovereign AI” to reduce dependence on US and Chinese technology. The massive infrastructure investment signals Europe’s determination to remain competitive in AI development and maintain control over its digital future.

Key TakeawayToday’s AI news reflects a maturing industry where competition is intensifying across multiple fronts: consumer assistants (Claude vs ChatGPT), operating systems (Microsoft’s AI integration), hardware (Nvidia’s dominance), and geopolitics (export controls and sovereign AI). The creation of instant billionaires alongside Apple’s stock struggles shows the market is ruthlessly rewarding AI leaders while punishing perceived laggards. The industry is simultaneously democratizing (open-weight models) and consolidating (massive infrastructure investments) as AI transitions from experimental to essential infrastructure.

The post AI Business News – August 12, 2025 appeared first on FourWeekMBA.

AMD’s Perfect Storm: How Lisa Su Built a $5B AI Business by Being ‘Good Enough’ at 60% of NVIDIA’s Price

While everyone obsesses over NVIDIA’s AI dominance, AMD quietly built a $5B AI revenue run rate by executing the perfect #2 strategy: be 80% as good at 60% of the price with 100% availability. With Meta, Microsoft, and Oracle as anchor customers, AMD is proving that in the AI chip wars, you don’t need to be the best—you need to be the available alternative.

The Numbers That Define AMD’s PositionMarket RealityAI Revenue: $5B run rate (Q4 2024)Market Share: 12% and growing (vs NVIDIA’s 82%)Growth Rate: 300%+ year-over-yearKey Product: MI300X with 192GB memoryPrice Delta: 30-40% below NVIDIA equivalentsGross Margins: 45% (vs NVIDIA’s 75%)Customer Wins That MatterMeta: Largest MI300X deploymentMicrosoft: Azure AI infrastructureOracle: Cloud AI servicesOpenAI: Testing as alternativeAmazon: Evaluation phaseThe Perfect #2 Strategy PlaybookAMD’s Four Pillars of Disruption1. Price Leadership

H100 equivalent at 60-70% costVolume discounts aggressiveTotal TCO 40% lowerNo scarcity premium2. Availability Advantage

Immediate shipmentNo allocation gamesScaled productionTSMC capacity secured3. Technical “Good Enough”

80% of NVIDIA performance192GB memory (vs 80GB H100)Better memory bandwidthInferior software stack4. Open Ecosystem Play

ROCm going open sourcePyTorch native supportBreaking CUDA monopolyDeveloper community growingWhy This Strategy Works NowThe AI Chip Shortage Created AMD’s Opening:

NVIDIA allocation frustration12-month wait timesPrice gouging by resellersCustomers desperate for alternativesThe Market Matured:

AI workloads better understoodNot everyone needs cutting edgeInference matters more than trainingCost pressure increasingThe Technology Reality CheckMI300X vs H100: The Real ComparisonWhere AMD Wins:

Memory capacity: 192GB vs 80GBMemory bandwidth: 5.3TB/s vs 3.35TB/sPower efficiency: Better perf/wattPrice: $15-20K vs $25-30KAvailability: Immediate vs waitlistWhere AMD Loses:

Raw compute: 80% of H100Software ecosystem maturityDeveloper toolsEnterprise supportOptimization librariesThe Verdict: For 70% of AI workloads, MI300X is more than sufficient.

The Software Gap (And Why It’s Closing)NVIDIA’s CUDA Moat:

15 years of developmentMillions of developersEvery framework optimizedLock-in effect strongAMD’s ROCm Reality:

5 years behindImproving rapidlyOpen source advantageBig Tech contributingKey Insight: Meta and Microsoft are investing heavily in ROCm because they need leverage against NVIDIA.

Customer Psychology: Why Companies Choose AMDThe CFO Conversation“Why are we paying $30K per chip when AMD has something 80% as good for $18K?”

The CTO Reality“NVIDIA is better, but AMD works for inference and we can get chips today.”

The CEO Pressure“We need AI capability now, not in 12 months when NVIDIA allocates to us.”

The Procurement Win“40% cost savings with 3-year price protection? Approved.”

AMD’s Multi-Front War StrategyFront 1: Cloud ProvidersTarget: AWS, Azure, GCP

Value Prop: Differentiation from competitors

Status: Microsoft and Oracle converted

Next: Amazon tipping point near

Target: Fortune 500 building AI

Value Prop: Available inventory, lower cost

Status: Early wins accumulating

Challenge: Software maturity

Target: Chinese tech giants

Value Prop: Less restricted than NVIDIA

Status: Significant traction

Opportunity: $10B+ market

Target: Inference at scale

Value Prop: Power efficiency

Status: Design wins building

Timeline: 2025-2026 revenue

1. Software Never Catches Up

ROCm remains inferiorDevelopers stick with CUDAPerformance gap widensCustomer patience expires2. NVIDIA Crushes on Price

Margins allow price warSelective discountingBundle dealsAMD margins collapse3. Intel Enters Successfully

Gaudi 3 gains tractionThree-way price warMarket fragmentsEconomics deteriorate4. Custom Silicon Wins

Google TPU model spreadsAmazon Trainium scalesEvery cloud builds ownMerchant market shrinksWhy The Bear Case Is WrongSoftware Gap Closing: Big Tech has too much incentive to make ROCm work. Meta’s investment alone ensures viability.

NVIDIA Won’t Price War: Would crater their 75% margins and stock price. They’ll cede the low end.

Intel Too Late: Gaudi 3 is another “good enough” option, validating AMD’s strategy not threatening it.

Custom Silicon Limited: Only works for specific workloads. General purpose AI needs merchant silicon.

The $50B Opportunity MapAMD’s Realistic 2027 TargetsScenario Planning:

Conservative Case (60% probability)

20% AI market share$25B AI revenue50% gross margins#2 position solidifiedAggressive Case (30% probability)

30% AI market share$40B AI revenue55% gross marginsTrue NVIDIA alternativeDownside Case (10% probability)

10% market share$10B AI revenue40% gross marginsNiche player statusThe Path to $25B2025: $8-10B (Lock in enterprise)

2026: $15-18B (China expansion)

2027: $25B (Inference dominance)

Why AMD is Undervalued:

Market values at 15% of NVIDIAAI revenue growing 300%Margins expandingCustomer base diversifyingThe Trade: Long AMD as the “AI arms dealer #2” with 3x upside potential.

For Enterprise BuyersWhen to Choose AMD:

Inference workloadsMemory-intensive applicationsCost-sensitive deploymentsNeed chips immediatelyWhen to Wait for NVIDIA:

Cutting-edge trainingMaximum performance criticalSoftware compatibility crucialPrice is no objectFor Cloud ProvidersThe Leverage Play: Deploy AMD to negotiate better NVIDIA pricing. The threat alone is worth billions in savings.

Lisa Su’s Long GameThe CEO Who Saved AMD (Twice)First Save (2014-2019): CPU comeback with Ryzen

Second Save (2020-2024): AI positioning

The Pattern: Enter markets dominated by a monopolist, be good enough at better prices, capture share steadily.

The Next Five YearsAMD’s Strategic Priorities:

Hit $10B AI revenue (2025)Achieve ROCm parity (2026)Win 25% market share (2027)Maintain price disciplineAvoid direct confrontationThe Bottom LineAMD doesn’t need to beat NVIDIA to win massive in AI. They just need to be the obvious #2 choice when NVIDIA is unavailable, too expensive, or too controlling. At $5B run rate growing 300%, they’re executing this strategy perfectly.

The Strategic Reality: In a $200B AI chip market by 2027, being a strong #2 means $40-50B in revenue. AMD is trading at a fraction of this opportunity because the market believes NVIDIA’s dominance is permanent. History shows technology monopolies create their own disruption through hubris and price umbrella.

For Business Leaders: If you’re building AI infrastructure, AMD just became your negotiating leverage. If you’re investing in AI picks and shovels, AMD offers asymmetric upside. If you’re NVIDIA, AMD just became the competitor you can’t kill without destroying your own margins.

Three Predictions:AMD captures 25% AI market share by 2027: The “good enough” revolutionROCm achieves CUDA parity for inference: Big Tech makes it happenNVIDIA maintains premium but cedes volume: Protecting margins over market shareStrategic Analysis Framework Applied

The Business Engineer | FourWeekMBA

Want to analyze semiconductor strategies and AI chip wars? Visit [BusinessEngineer.ai](https://businessengineer.ai) for AI-powered business analysis tools and frameworks.

The post AMD’s Perfect Storm: How Lisa Su Built a $5B AI Business by Being ‘Good Enough’ at 60% of NVIDIA’s Price appeared first on FourWeekMBA.

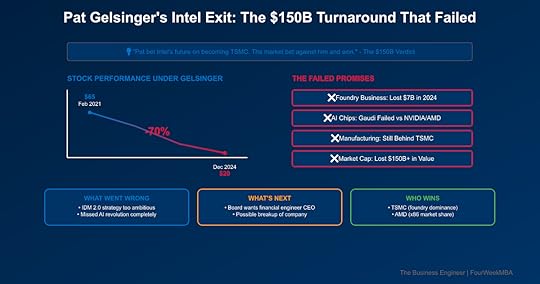

Pat Gelsinger’s Intel Exit: Anatomy of a $150B Destruction and Why the Turnaround Messiah Became the Fall Guy

Pat Gelsinger returned to Intel in February 2021 as the prodigal son who would restore the chip giant to glory. Three years later, he’s forced out after destroying $150 billion in market value, bleeding $7 billion annually in the foundry business, and completely missing the AI revolution. This isn’t just a CEO departure—it’s the end of Intel’s dream to challenge TSMC and the beginning of a potential breakup that would have been unthinkable when Gelsinger took the helm.

The Gelsinger Era by the NumbersThe Devastating ScorecardStock Price: $65 → $20 (-70%)Market Cap Lost: $150+ billionFoundry Losses: $7B in 2024 aloneAI Market Share: ~0% vs NVIDIARelative Performance: -50% vs S&P 500Employee Cuts: 15,000+ (15% of workforce)The Failed PromisesIDM 2.0: Supposed to rival TSMC by 2025Five Nodes in Four Years: Behind scheduleFoundry Customers: Minimal external winsAI Leadership: Gaudi chips dead on arrivalGovernment Support: Got $8.5B CHIPS Act funding, still failingThe Strategic Mistakes That Killed GelsingerMistake #1: Fighting Yesterday’s WarGelsinger’s Vision: Make Intel a manufacturing powerhouse again

Market Reality: The world needed AI compute, not more fabs

The Fatal Flaw: While Gelsinger obsessed over competing with TSMC in manufacturing, NVIDIA was building the AI future. Intel spent $100B+ on fabs while the entire AI market exploded without them.

Mistake #2: The IDM 2.0 DelusionThe Dream:

Keep design and manufacturing togetherOpen fabs to external customersBest of both worldsThe Reality:

Foundry business lost $7B in 2024No major external customersInternal products uncompetitiveWorst of both worldsWhy It Failed: You can’t be both TSMC (neutral foundry) and NVIDIA (design powerhouse). Customers don’t trust you, and you can’t optimize for either.

Mistake #3: Missing the AI RevolutionIntel’s AI “Strategy”:

Gaudi AI accelerators (failure)CPU-centric approach (irrelevant)Nervana acquisition (killed)Late to every AI trendThe Devastating Reality:

NVIDIA: $3.5 trillion market capAMD: $230B market capIntel: $85B market capIntel became irrelevant in the most important technology shift of our lifetime.

Why the Board Finally Pulled the TriggerThe December 2024 Breaking PointFinancial Reality:

Q4 guidance disasterFoundry bleeding acceleratingNo path to profitabilityCash burn unsustainableStrategic Reality:

Lost confidence of investorsNo credible AI storyManufacturing delays continueCompetitive position worseningThe Final Straw: When Gelsinger presented the 2025 plan showing continued massive foundry losses with no clear path to profitability, the board realized the turnaround had failed.

What the Board Wants NextThe New CEO Profile:

Financial engineer, not chip engineerBreakup specialist likelyCost cutter mandateNo sacred cowsTranslation: Intel’s board has given up on Gelsinger’s integrated vision. They want someone who will split the company and maximize value through financial engineering.

The Three Scenarios for Intel’s FutureScenario 1: The Breakup (60% Probability)The Split:

Intel Product Co: Design-only, like AMDIntel Foundry: Pure-play fab, compete with TSMCIntel Software: Sell to highest bidderWhy This Happens:

Unlocks $50B+ in valueEnds the IDM conflictFocuses each businessSatisfies activistsTimeline: 18-24 months

Scenario 2: The Acquisition (25% Probability)Potential Buyers:

Qualcomm: Wants x86 + scaleBroadcom: Financial engineering playPrivate Equity: Break-up playThe Challenge:

Regulatory approval difficultPrice still too highIntegration nightmareReality Check: More likely after initial breakup

Scenario 3: The Zombie (15% Probability)The Muddle Through:

New CEO cuts costsMaintains status quoSlow decline continuesGovernment life supportWhy This Is Worst Case:

Wastes more timeDelays inevitableDestroys more valueCompetitors get strongerWinners and Losers from Gelsinger’s ExitThe WinnersTSMC

Intel foundry challenge deadPricing power intactCustomer confidence restoredMonopoly strengthenedAMD

x86 competitor weakenedServer share gains accelerateClear #2 in processorsLisa Su vindicatedNVIDIA

No Intel AI threatDatacenter dominance secureOne less competitorJensen was rightActivist Investors

Breakup thesis validatedStock pop comingValue unlockingVictory lap earnedThe LosersIntel Employees

More layoffs comingMorale destroyedOptions worthlessCareer uncertaintyUS Chip Independence

Leading-edge fabs dream deadTSMC dependence permanentCHIPS Act questionedStrategic vulnerabilityGelsinger’s Legacy

Returned as saviorLeaves as failureVision rejectedReputation damagedThe Lessons from Intel’s DeclineLesson 1: Timing Beats VisionGelsinger had the right vision for 2015. By 2021, the world had moved on. Fighting the last war while missing the next one is fatal in technology.

Lesson 2: Culture Can’t Be FixedIntel’s bureaucratic, CPU-centric culture couldn’t adapt to the GPU/AI world. Gelsinger tried to change it but culture ate strategy for breakfast.

Lesson 3: Financial Engineering Has LimitsIntel spent 3 years and $150B trying to engineering its way back to greatness. Sometimes you need to accept reality and optimize for what’s possible.

Lesson 4: The Innovator’s Dilemma Is RealIntel couldn’t disrupt itself. They protected CPU margins while the world moved to accelerated computing. Classic case study in disruption.

What Happens NextThe Immediate (3-6 Months)CEO Search:

CFO types courtedBreakup experience valuedQuick decision neededInterim steadies shipCost Cutting:

20,000+ more layoffsFoundry scaling backR&D prioritizationDividend at riskStrategic Review:

Everything on tableAdvisors hiredActivists circlingBoard dividedThe Medium Term (6-18 Months)The Restructuring:

Breakup announcedUnits separatedSynergies lostValue “unlocked”The Reality:

Foundry struggles continueProducts face challengesCompetitors gain shareExecution risks highThe Long Term (2+ Years)Best Case: Focused companies find niches

Base Case: Slow decline continues

Worst Case: Irrelevance accelerates

The Breakup Value:

Sum of parts: $120-150BCurrent market cap: $85BUpside: 40-75%The Catalyst: New CEO with breakup mandate

The Risk: Execution harder than spreadsheets

Why Intel Is Still a SellStructural Challenges:

No AI positionManufacturing subscaleCulture brokenCompetition strengtheningThe Reality: Financial engineering can’t fix strategic failure

The Bottom LinePat Gelsinger’s departure marks the end of Intel’s last attempt to reclaim its former glory through technology leadership. He bet $150 billion that Intel could out-manufacture TSMC and out-innovate NVIDIA simultaneously. The market’s verdict was devastating: a 70% stock price collapse and forced exit after three years.

The Strategic Reality: Intel is no longer a technology leader but a restructuring story. The next CEO won’t be a visionary technologist but a financial engineer tasked with breaking up the company Gelsinger tried to save. The IDM model that made Intel great is now what’s killing it.

For Business Leaders: Intel’s failure is a masterclass in strategic timing. Gelsinger was fighting to win the manufacturing war of the 2010s in the AI age of the 2020s. No amount of execution could overcome being strategically wrong. The lesson: In technology, being early is the same as being wrong, and being late is fatal.

Three Predictions:Intel announces breakup within 18 months: New CEO’s first major moveStock hits $30 on breakup announcement: 50% upside on financial engineeringIntel Foundry eventually sold to highest bidder: After proving unviable standaloneStrategic Analysis Framework Applied

The Business Engineer | FourWeekMBA

Want to analyze tech turnarounds and CEO strategies? Visit [BusinessEngineer.ai](https://businessengineer.ai) for AI-powered business analysis tools and frameworks.

The post Pat Gelsinger’s Intel Exit: Anatomy of a $150B Destruction and Why the Turnaround Messiah Became the Fall Guy appeared first on FourWeekMBA.

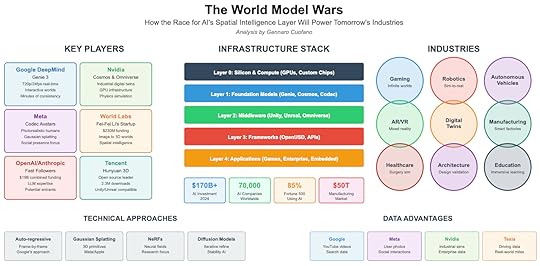

The AI World Models Revolution

From Google DeepMind’s Genie 3 to Nvidia’s Cosmos, from Fei-Fei Li’s World Labs to Meta’s evolving Codec Avatars, nearly every major AI player suddenly pivoted toward the same goal: building AI systems that understand and generate three-dimensional, physics-aware worlds.

This wasn’t a coincidence, it was recognition of a fundamental truth.

The next trillion-dollar infrastructure layer won’t be cloud computing or mobile operating systems. It will be world models: AI systems that can simulate, predict, and generate reality itself.

But only a handful are positioned to become the foundational infrastructure that powers everything from augmented reality glasses to autonomous vehicles, from robotic factories to virtual worlds.

The Competitors: Mapping the World Model Landscape

The Competitors: Mapping the World Model Landscape

The post The AI World Models Revolution appeared first on FourWeekMBA.

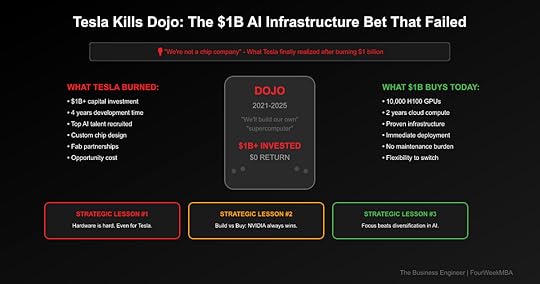

Tesla Kills Dojo: Why Even Elon Musk Can’t Out-NVIDIA NVIDIA (And What Every CEO Should Learn From This $1B Mistake)

The Stunning Reversal: Tesla is disbanding its Dojo supercomputer team and unwinding one of Elon Musk’s most ambitious bets—building custom AI training infrastructure to rival NVIDIA. After burning over $1 billion and four years, Tesla just learned what every tech CEO needs to understand: in the AI infrastructure wars, there’s NVIDIA and there’s everyone else losing money.

The Dojo Dream That DiedWhat Tesla Tried to BuildIn 2021, Elon Musk announced Tesla would build Dojo, a custom supercomputer designed specifically for training autonomous driving AI. The pitch was compelling:

10x performance per dollar vs GPU clustersCustom silicon optimized for video processingVertical integration controlling the full stackCompetitive advantage through proprietary infrastructureThe reality in 2025:

Performance: Never matched NVIDIA’s pace of improvementCost: Over $1B invested with minimal returnTimeline: 4 years late and still not production-readyTeam: Disbanded, key talent departingThe Real Cost of “Not Invented Here” SyndromeWhat Tesla Actually SpentDirect Costs:

Chip design and development: ~$500MFabrication partnerships: ~$200MSoftware ecosystem: ~$150MTalent acquisition/retention: ~$100MInfrastructure and facilities: ~$100MTotal Direct Investment: >$1BHidden Costs:

4 years of development timeDistraction from core FSD improvementTalent that could have worked on AI applicationsBoard/investor confidenceCompetitive positioning vs companies using NVIDIAWhat $1B Buys in 2025Option A: Build Your Own (Tesla’s Choice)

Maybe a working prototypeEndless maintenance burdenObsolete before deploymentZero ecosystem supportRecruitment nightmareOption B: Buy from NVIDIA

10,000 H100 GPUs delivered tomorrow2-3 years of cloud computeContinuous upgradesFull software stackImmediate productivityWhy Tesla Failed Where Others Might SucceedThe Unique Challenges Tesla FacedMoving Target Problem– NVIDIA improving 2x annually

– Dojo improving… eventually

– Gap widening, not closing

– NVIDIA: Millions of developers

– Dojo: Dozens of internal users

– No third-party support

– Hardware is 20% of the problem

– Software, tools, optimization: 80%

– Tesla underestimated the 80%

– Every Dojo engineer not working on FSD

– Every dollar not buying proven compute

– Every month waiting for Dojo vs shipping features

Tesla’s Core Competencies:

Electric vehiclesBattery technologyManufacturing at scaleSoftware (arguable)Not Core Competencies:

Chip designSemiconductor fabricationLow-level systems softwareCompeting with NVIDIAThe Test: If NVIDIA’s existence threatens your strategy, your strategy is wrong.

Lesson 2: Build vs Buy in the AI EraBuild When:

It’s core to your differentiationNo adequate solution existsYou have unique requirementsTime isn’t criticalYou can attract the talentBuy When:

Good solutions exist (NVIDIA)It’s not your core businessSpeed mattersEcosystem mattersMaintenance isn’t your strengthTesla violated every “Buy” indicator.

Lesson 3: The Vertical Integration TrapWhen Vertical Integration Works:

Significant cost advantages (30%+)Unique performance requirementsSupply chain control criticalLong product lifecyclesWhen It Fails:

Rapid technology evolutionComplex ecosystems requiredSpecialized expertise neededFast-moving competitorsAI infrastructure checks every failure box.

What This Means for Other CompaniesFor Automotive CEOsThe Message: You’re not a chip company. Tesla couldn’t do it with unlimited capital and top talent. Neither can you.

The Strategy:

Partner with NVIDIA/AMD/IntelFocus on AI applications, not infrastructureBuild competitive advantage in data and algorithmsLet specialists handle the siliconFor Tech CEOsThe Warning: Even if you have chip expertise, ask why.

Key Questions:

Is this 10x better than buying?Can we maintain competitive parity?What’s the opportunity cost?Where’s our real differentiation?For InvestorsRed Flags:

“We’re building custom chips for AI”“Vertical integration” without clear advantageInfrastructure investments in non-core areasNIH syndrome in leadershipGreen Flags:

Clear build vs buy frameworkPartnership with proven providersFocus on application differentiationCapital efficiencyThe Broader ImplicationsThe NVIDIA Monopoly StrengthensTesla’s retreat reinforces NVIDIA’s position:

Message to market: Resistance is futilePricing power: Even strongerInnovation pace: No pressure to slowEcosystem moat: Deeper than everThe New AI Infrastructure RealityWinners: Companies that accept NVIDIA’s dominance and build on top

Losers: Companies trying to rebuild the foundation

Smart Players: Those finding differentiation in applications, not infrastructure

– Move chip designers to FSD algorithm team

– Systems engineers to deployment optimization

– Infrastructure team to application scaling

– Negotiate volume deals

– Get early access to new chips

– Influence roadmap as major customer

– FSD algorithm superiority

– Data collection advantage

– Real-world deployment experience

– Integration with vehicle systems

Double Down on What Works:

World’s largest autonomous driving datasetMillions of cars collecting dataVertical integration in manufacturingSoftware update infrastructureStop Fighting Unwinnable Wars:

Custom training chipsCompeting with NVIDIAInfrastructure nationalismNot-invented-here syndromeThe Bottom LineTesla’s Dojo shutdown isn’t just a failed project—it’s a $1 billion case study in strategic overreach. Even with Elon Musk’s vision, Tesla’s capital, and some of the world’s best engineers, they couldn’t out-NVIDIA NVIDIA. The lesson is clear: in the AI era, knowing what NOT to build is as important as knowing what to build.

For Tesla, killing Dojo might be the smartest strategic decision they’ve made in years. It frees up resources, refocuses the company, and acknowledges reality. For everyone else, it’s a warning: stick to your strengths, buy the infrastructure, and compete where you can actually win.

The Ultimate Irony: Tesla’s FSD might finally achieve full autonomy now that they’ve stopped trying to reinvent the wheels it runs on.

Three Strategic Takeaways:Infrastructure is a means, not an end: Focus on what you’re building, not the toolsOpportunity cost is real cost: Every dollar spent on infrastructure is a dollar not spent on differentiationPartner with the leaders: In AI infrastructure, that means NVIDIA whether you like it or notStrategic Analysis Framework Applied

The Business Engineer | FourWeekMBA

The post Tesla Kills Dojo: Why Even Elon Musk Can’t Out-NVIDIA NVIDIA (And What Every CEO Should Learn From This $1B Mistake) appeared first on FourWeekMBA.

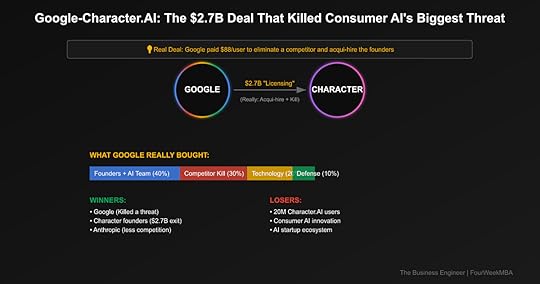

Google-Character.AI Deal: The $2.7B ‘Licensing’ Deal That’s Really a $88-Per-User Competitor Assassination

Google just paid $2.7 billion for Character.AI’s “technology license”—but what they really bought was the elimination of their biggest consumer AI threat, paying $88 for each of Character.AI’s 30 million users to make them disappear.

The Headlines vs RealityWhat they announced:

Google licensing Character.AI’s technology for $2.7BCharacter.AI founders joining GoogleCharacter.AI continuing as independent companyWhat’s really happening:

Classic acqui-hire disguised as licensing dealCharacter.AI effectively shutting down consumer productGoogle eliminating its #1 threat in consumer AIFounders get Google badges without regulatory scrutinyHidden value: The deal is 75% about killing competition, 25% about technology

The Strategic Chess MoveCharacter.AI had something Google desperately feared: 20 million monthly active users who preferred it to Google’s AI products. While Google struggled to get Bard (now Gemini) adoption, teenagers were spending 2+ hours daily talking to AI characters, creating the first real consumer AI habit.

Why This Deal, Why Now?Character.AI’s position: Running out of money, $150M burn rate, needed fundingGoogle’s position: Losing the consumer AI race badly to ChatGPT and Character.AIRegulatory environment: Direct acquisition would face antitrust scrutinyMarket timing: Before Character.AI could raise from Google’s competitorsWhat Google Really Bought1. Stated Asset: “Technology License”Official story: Licensing Character.AI’s model technologyReal value: ~$500M (Google has better models already)Why the charade: Avoids regulatory review of acquisition2. Hidden Asset #1: Founder Acqui-hireNoam Shazeer (worth $1B+ alone)Daniel De Freitas~30 top AI researchersReal value: ~$1.2BGoogle’s previous attempt: Tried to hire Noam for $100M+ before he left to start Character.AI3. Hidden Asset #2: Competitor Elimination20M MAU consumer AI app killed#1 non-OpenAI consumer AI product removedTeen market protectionReal value: ~$800MCost per user eliminated: $884. Hidden Asset #3: Defensive Patent PortfolioCharacter training techniquesConversation memory systemsSafety mechanismsReal value: ~$200MDeal Structure DecodedComponentOfficial StoryReality———–————————Payment$2.7B for “technology license”Structured to avoid acquisition reviewFounders“Joining Google to work on AI”Classic acqui-hire with golden handcuffsCompany Status“Continuing independently”Zombie company, product dyingUser Base“Transitioning to new model”Being eliminated as competitionRegulatory“Not an acquisition”Designed to avoid FTC reviewEmployees“Some joining Google”Best talent poached, rest laid off—

The 30-Day Impact MapImmediate Winners:Google: Eliminated major threat for fraction of market capCharacter.AI Founders: $2.7B exit after 2 yearsAnthropic: Less competition for consumer AIMeta: One less player in social AIImmediate Losers:Character.AI Users: Product they love being killedCharacter.AI Employees: Most not joining GoogleAI Startup Ecosystem: Signal that Big Tech will buy and killInnovation: Consumer AI experimentation reducedThe 6-Month Domino EffectWhat Happens Next:More “Licensing” Deals– Expect Meta, Amazon, Apple to copy this playbook

– Regulatory workaround becomes standard

– True acquisitions become rare

– If Noam Shazeer is worth $1B+, what’s Anthropic team worth?

– Founders now have clear exit path

– Acqui-hire valuations skyrocket

– Smaller players realize they can’t compete

– Rush to sell before values drop

– Only OpenAI and Big Tech remain

– FTC will eventually catch on

– New rules for “licensing” deals

– But damage already done

Buy:

Google (successfully defending position)Anthropic (benefits from consolidation)Sell:

Consumer AI startups without clear exitsAI companies dependent on user growthWatch:

Inflection AI, Cohere (next acquisition targets)Regulatory response intensityIf you’re a founder:Opportunity:

Enterprise AI (less likely to be killed)AI infrastructure (Big Tech needs you)International markets (beyond U.S. reach)Threat:

Building consumer AI is now existential riskBig Tech will copy or kill“Licensing” deals new normAction:

Get profitable fast or sell earlyFocus on enterprise/B2BBuild in regulatory-safe zonesThe Bottom LineGoogle just perfected the playbook for killing AI competition without triggering antitrust: call it a “licensing deal,” hire the founders, and let the product die quietly. At $88 per user eliminated, it’s cheaper than competing—and that’s exactly the problem.

This deal signals the end of independent consumer AI. When a startup gets traction, Big Tech will make founders an offer they can’t refuse, users be damned. The message is clear: in consumer AI, you either sell to Big Tech or get crushed by them.

Three Hidden Implications:The “Licensing” Loophole: Expect every Big Tech acquisition to use this structure, making antitrust law obsoleteThe $100M Engineer: If Google paid ~$1B for Noam Shazeer’s return, top AI talent valuations just went parabolicConsumer AI’s Death: Why build for consumers when Big Tech will just buy and kill you? The future is enterprise AI.Deal Decoder Scorecard:

Strategic Brilliance: 9/10Value for Money: 7/10Market Impact: 10/10Innovation Impact: -8/10Regulatory Creativity: 10/10Deal Decoder Analysis Framework Applied

The Business Engineer | FourWeekMBA

The post Google-Character.AI Deal: The $2.7B ‘Licensing’ Deal That’s Really a $88-Per-User Competitor Assassination appeared first on FourWeekMBA.