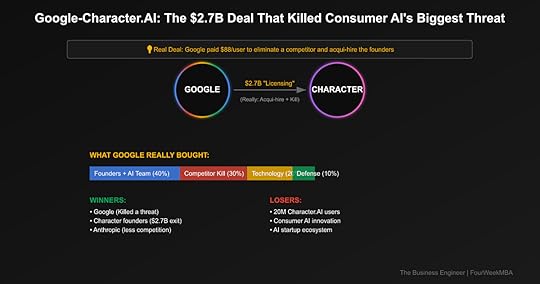

Google-Character.AI Deal: The $2.7B ‘Licensing’ Deal That’s Really a $88-Per-User Competitor Assassination

Google just paid $2.7 billion for Character.AI’s “technology license”—but what they really bought was the elimination of their biggest consumer AI threat, paying $88 for each of Character.AI’s 30 million users to make them disappear.

The Headlines vs RealityWhat they announced:

Google licensing Character.AI’s technology for $2.7BCharacter.AI founders joining GoogleCharacter.AI continuing as independent companyWhat’s really happening:

Classic acqui-hire disguised as licensing dealCharacter.AI effectively shutting down consumer productGoogle eliminating its #1 threat in consumer AIFounders get Google badges without regulatory scrutinyHidden value: The deal is 75% about killing competition, 25% about technology

The Strategic Chess MoveCharacter.AI had something Google desperately feared: 20 million monthly active users who preferred it to Google’s AI products. While Google struggled to get Bard (now Gemini) adoption, teenagers were spending 2+ hours daily talking to AI characters, creating the first real consumer AI habit.

Why This Deal, Why Now?Character.AI’s position: Running out of money, $150M burn rate, needed fundingGoogle’s position: Losing the consumer AI race badly to ChatGPT and Character.AIRegulatory environment: Direct acquisition would face antitrust scrutinyMarket timing: Before Character.AI could raise from Google’s competitorsWhat Google Really Bought1. Stated Asset: “Technology License”Official story: Licensing Character.AI’s model technologyReal value: ~$500M (Google has better models already)Why the charade: Avoids regulatory review of acquisition2. Hidden Asset #1: Founder Acqui-hireNoam Shazeer (worth $1B+ alone)Daniel De Freitas~30 top AI researchersReal value: ~$1.2BGoogle’s previous attempt: Tried to hire Noam for $100M+ before he left to start Character.AI3. Hidden Asset #2: Competitor Elimination20M MAU consumer AI app killed#1 non-OpenAI consumer AI product removedTeen market protectionReal value: ~$800MCost per user eliminated: $884. Hidden Asset #3: Defensive Patent PortfolioCharacter training techniquesConversation memory systemsSafety mechanismsReal value: ~$200MDeal Structure DecodedComponentOfficial StoryReality———–————————Payment$2.7B for “technology license”Structured to avoid acquisition reviewFounders“Joining Google to work on AI”Classic acqui-hire with golden handcuffsCompany Status“Continuing independently”Zombie company, product dyingUser Base“Transitioning to new model”Being eliminated as competitionRegulatory“Not an acquisition”Designed to avoid FTC reviewEmployees“Some joining Google”Best talent poached, rest laid off—

The 30-Day Impact MapImmediate Winners:Google: Eliminated major threat for fraction of market capCharacter.AI Founders: $2.7B exit after 2 yearsAnthropic: Less competition for consumer AIMeta: One less player in social AIImmediate Losers:Character.AI Users: Product they love being killedCharacter.AI Employees: Most not joining GoogleAI Startup Ecosystem: Signal that Big Tech will buy and killInnovation: Consumer AI experimentation reducedThe 6-Month Domino EffectWhat Happens Next:More “Licensing” Deals– Expect Meta, Amazon, Apple to copy this playbook

– Regulatory workaround becomes standard

– True acquisitions become rare

– If Noam Shazeer is worth $1B+, what’s Anthropic team worth?

– Founders now have clear exit path

– Acqui-hire valuations skyrocket

– Smaller players realize they can’t compete

– Rush to sell before values drop

– Only OpenAI and Big Tech remain

– FTC will eventually catch on

– New rules for “licensing” deals

– But damage already done

Buy:

Google (successfully defending position)Anthropic (benefits from consolidation)Sell:

Consumer AI startups without clear exitsAI companies dependent on user growthWatch:

Inflection AI, Cohere (next acquisition targets)Regulatory response intensityIf you’re a founder:Opportunity:

Enterprise AI (less likely to be killed)AI infrastructure (Big Tech needs you)International markets (beyond U.S. reach)Threat:

Building consumer AI is now existential riskBig Tech will copy or kill“Licensing” deals new normAction:

Get profitable fast or sell earlyFocus on enterprise/B2BBuild in regulatory-safe zonesThe Bottom LineGoogle just perfected the playbook for killing AI competition without triggering antitrust: call it a “licensing deal,” hire the founders, and let the product die quietly. At $88 per user eliminated, it’s cheaper than competing—and that’s exactly the problem.

This deal signals the end of independent consumer AI. When a startup gets traction, Big Tech will make founders an offer they can’t refuse, users be damned. The message is clear: in consumer AI, you either sell to Big Tech or get crushed by them.

Three Hidden Implications:The “Licensing” Loophole: Expect every Big Tech acquisition to use this structure, making antitrust law obsoleteThe $100M Engineer: If Google paid ~$1B for Noam Shazeer’s return, top AI talent valuations just went parabolicConsumer AI’s Death: Why build for consumers when Big Tech will just buy and kill you? The future is enterprise AI.Deal Decoder Scorecard:

Strategic Brilliance: 9/10Value for Money: 7/10Market Impact: 10/10Innovation Impact: -8/10Regulatory Creativity: 10/10Deal Decoder Analysis Framework Applied

The Business Engineer | FourWeekMBA

The post Google-Character.AI Deal: The $2.7B ‘Licensing’ Deal That’s Really a $88-Per-User Competitor Assassination appeared first on FourWeekMBA.