Pat Gelsinger’s Intel Exit: Anatomy of a $150B Destruction and Why the Turnaround Messiah Became the Fall Guy

Pat Gelsinger returned to Intel in February 2021 as the prodigal son who would restore the chip giant to glory. Three years later, he’s forced out after destroying $150 billion in market value, bleeding $7 billion annually in the foundry business, and completely missing the AI revolution. This isn’t just a CEO departure—it’s the end of Intel’s dream to challenge TSMC and the beginning of a potential breakup that would have been unthinkable when Gelsinger took the helm.

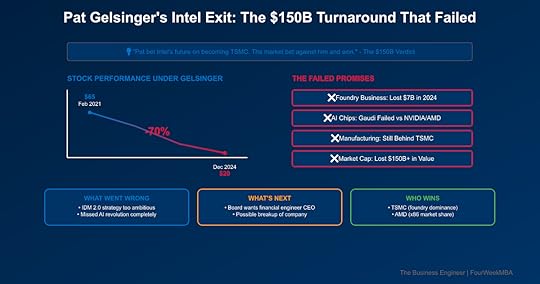

The Gelsinger Era by the NumbersThe Devastating ScorecardStock Price: $65 → $20 (-70%)Market Cap Lost: $150+ billionFoundry Losses: $7B in 2024 aloneAI Market Share: ~0% vs NVIDIARelative Performance: -50% vs S&P 500Employee Cuts: 15,000+ (15% of workforce)The Failed PromisesIDM 2.0: Supposed to rival TSMC by 2025Five Nodes in Four Years: Behind scheduleFoundry Customers: Minimal external winsAI Leadership: Gaudi chips dead on arrivalGovernment Support: Got $8.5B CHIPS Act funding, still failingThe Strategic Mistakes That Killed GelsingerMistake #1: Fighting Yesterday’s WarGelsinger’s Vision: Make Intel a manufacturing powerhouse again

Market Reality: The world needed AI compute, not more fabs

The Fatal Flaw: While Gelsinger obsessed over competing with TSMC in manufacturing, NVIDIA was building the AI future. Intel spent $100B+ on fabs while the entire AI market exploded without them.

Mistake #2: The IDM 2.0 DelusionThe Dream:

Keep design and manufacturing togetherOpen fabs to external customersBest of both worldsThe Reality:

Foundry business lost $7B in 2024No major external customersInternal products uncompetitiveWorst of both worldsWhy It Failed: You can’t be both TSMC (neutral foundry) and NVIDIA (design powerhouse). Customers don’t trust you, and you can’t optimize for either.

Mistake #3: Missing the AI RevolutionIntel’s AI “Strategy”:

Gaudi AI accelerators (failure)CPU-centric approach (irrelevant)Nervana acquisition (killed)Late to every AI trendThe Devastating Reality:

NVIDIA: $3.5 trillion market capAMD: $230B market capIntel: $85B market capIntel became irrelevant in the most important technology shift of our lifetime.

Why the Board Finally Pulled the TriggerThe December 2024 Breaking PointFinancial Reality:

Q4 guidance disasterFoundry bleeding acceleratingNo path to profitabilityCash burn unsustainableStrategic Reality:

Lost confidence of investorsNo credible AI storyManufacturing delays continueCompetitive position worseningThe Final Straw: When Gelsinger presented the 2025 plan showing continued massive foundry losses with no clear path to profitability, the board realized the turnaround had failed.

What the Board Wants NextThe New CEO Profile:

Financial engineer, not chip engineerBreakup specialist likelyCost cutter mandateNo sacred cowsTranslation: Intel’s board has given up on Gelsinger’s integrated vision. They want someone who will split the company and maximize value through financial engineering.

The Three Scenarios for Intel’s FutureScenario 1: The Breakup (60% Probability)The Split:

Intel Product Co: Design-only, like AMDIntel Foundry: Pure-play fab, compete with TSMCIntel Software: Sell to highest bidderWhy This Happens:

Unlocks $50B+ in valueEnds the IDM conflictFocuses each businessSatisfies activistsTimeline: 18-24 months

Scenario 2: The Acquisition (25% Probability)Potential Buyers:

Qualcomm: Wants x86 + scaleBroadcom: Financial engineering playPrivate Equity: Break-up playThe Challenge:

Regulatory approval difficultPrice still too highIntegration nightmareReality Check: More likely after initial breakup

Scenario 3: The Zombie (15% Probability)The Muddle Through:

New CEO cuts costsMaintains status quoSlow decline continuesGovernment life supportWhy This Is Worst Case:

Wastes more timeDelays inevitableDestroys more valueCompetitors get strongerWinners and Losers from Gelsinger’s ExitThe WinnersTSMC

Intel foundry challenge deadPricing power intactCustomer confidence restoredMonopoly strengthenedAMD

x86 competitor weakenedServer share gains accelerateClear #2 in processorsLisa Su vindicatedNVIDIA

No Intel AI threatDatacenter dominance secureOne less competitorJensen was rightActivist Investors

Breakup thesis validatedStock pop comingValue unlockingVictory lap earnedThe LosersIntel Employees

More layoffs comingMorale destroyedOptions worthlessCareer uncertaintyUS Chip Independence

Leading-edge fabs dream deadTSMC dependence permanentCHIPS Act questionedStrategic vulnerabilityGelsinger’s Legacy

Returned as saviorLeaves as failureVision rejectedReputation damagedThe Lessons from Intel’s DeclineLesson 1: Timing Beats VisionGelsinger had the right vision for 2015. By 2021, the world had moved on. Fighting the last war while missing the next one is fatal in technology.

Lesson 2: Culture Can’t Be FixedIntel’s bureaucratic, CPU-centric culture couldn’t adapt to the GPU/AI world. Gelsinger tried to change it but culture ate strategy for breakfast.

Lesson 3: Financial Engineering Has LimitsIntel spent 3 years and $150B trying to engineering its way back to greatness. Sometimes you need to accept reality and optimize for what’s possible.

Lesson 4: The Innovator’s Dilemma Is RealIntel couldn’t disrupt itself. They protected CPU margins while the world moved to accelerated computing. Classic case study in disruption.

What Happens NextThe Immediate (3-6 Months)CEO Search:

CFO types courtedBreakup experience valuedQuick decision neededInterim steadies shipCost Cutting:

20,000+ more layoffsFoundry scaling backR&D prioritizationDividend at riskStrategic Review:

Everything on tableAdvisors hiredActivists circlingBoard dividedThe Medium Term (6-18 Months)The Restructuring:

Breakup announcedUnits separatedSynergies lostValue “unlocked”The Reality:

Foundry struggles continueProducts face challengesCompetitors gain shareExecution risks highThe Long Term (2+ Years)Best Case: Focused companies find niches

Base Case: Slow decline continues

Worst Case: Irrelevance accelerates

The Breakup Value:

Sum of parts: $120-150BCurrent market cap: $85BUpside: 40-75%The Catalyst: New CEO with breakup mandate

The Risk: Execution harder than spreadsheets

Why Intel Is Still a SellStructural Challenges:

No AI positionManufacturing subscaleCulture brokenCompetition strengtheningThe Reality: Financial engineering can’t fix strategic failure

The Bottom LinePat Gelsinger’s departure marks the end of Intel’s last attempt to reclaim its former glory through technology leadership. He bet $150 billion that Intel could out-manufacture TSMC and out-innovate NVIDIA simultaneously. The market’s verdict was devastating: a 70% stock price collapse and forced exit after three years.

The Strategic Reality: Intel is no longer a technology leader but a restructuring story. The next CEO won’t be a visionary technologist but a financial engineer tasked with breaking up the company Gelsinger tried to save. The IDM model that made Intel great is now what’s killing it.

For Business Leaders: Intel’s failure is a masterclass in strategic timing. Gelsinger was fighting to win the manufacturing war of the 2010s in the AI age of the 2020s. No amount of execution could overcome being strategically wrong. The lesson: In technology, being early is the same as being wrong, and being late is fatal.

Three Predictions:Intel announces breakup within 18 months: New CEO’s first major moveStock hits $30 on breakup announcement: 50% upside on financial engineeringIntel Foundry eventually sold to highest bidder: After proving unviable standaloneStrategic Analysis Framework Applied

The Business Engineer | FourWeekMBA

Want to analyze tech turnarounds and CEO strategies? Visit [BusinessEngineer.ai](https://businessengineer.ai) for AI-powered business analysis tools and frameworks.

The post Pat Gelsinger’s Intel Exit: Anatomy of a $150B Destruction and Why the Turnaround Messiah Became the Fall Guy appeared first on FourWeekMBA.