Paramount’s $8B UFC Offer: The Desperate Genius Move in Streaming Wars

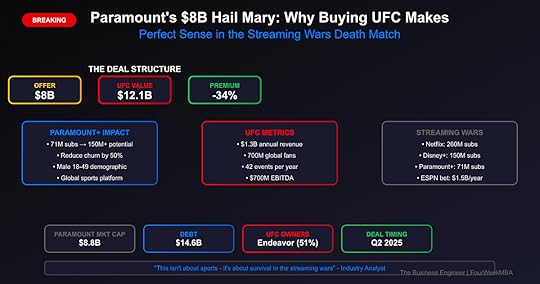

The Offer That Changes Everything: Paramount just lobbed an $8 billion grenade into the sports media landscape with an offer to buy UFC from Endeavor Group. Yes, the same Paramount with a market cap of just $8.8 billion and $14.6 billion in debt wants to buy the world’s premier mixed martial arts organization valued at $12.1 billion. This isn’t corporate development—it’s a Hail Mary pass in the streaming wars where Paramount+ sits in distant fourth place with 71 million subscribers. But here’s why it might be genius: UFC’s 700 million global fans, premium live content, and male 18-49 demographic dominance could transform Paramount+ from also-ran to must-have overnight. The question isn’t whether Paramount can afford UFC—it’s whether they can afford not to buy it. (Source: CNBC, January 2025; Bloomberg reports)

The Deal That Defies Logic (Until You Look Closer)The Numbers Don’t Add Up… Or Do They?Paramount’s Position:

Market cap: $8.8 billion (Source: Current trading)Total debt: $14.6 billion (Source: Q4 2024 earnings)Paramount+ subscribers: 71 million (Source: Latest earnings)Annual revenue: $29.7 billion (Source: 2024 financials)Cash flow: -$1.2 billion (negative)UFC’s Value Proposition:

Endeavor’s valuation: $12.1 billion (Source: Public filings)Paramount’s offer: $8 billion (34% discount)Annual revenue: $1.3 billion (Source: Industry estimates)EBITDA: ~$700 million (Source: Analyst reports)Global fanbase: 700 million (Source: UFC data)Why This Makes Strategic SenseThe Streaming Wars Reality:

Content is King: Live sports last appointment viewingChurn Killer: Sports fans don’t cancel subscriptionsDemographics: Male 18-49 massively underservedGlobal Reach: UFC transcends regional boundariesStrategic Analysis: The Paramount PredicamentCurrent Streaming LandscapeMarket Position (Q4 2024):

Netflix: 260 million subscribersDisney+: 150 millionMax (HBO): 95 millionParamount+: 71 millionPeacock: 31 millionThe Brutal Truth: Paramount+ losing $1.8 billion annually on streaming. Traditional TV dying. Stock down 70% in 3 years. Something dramatic needed.

UFC as Strategic AssetWhat UFC Brings:

42 live events annually: More than NFL, NBA playoffs combinedYear-round content: No off-seasonGlobal appeal: Big in US, Brazil, Europe, AsiaYoung male demographic: 70% male, 60% under 35Social media dominance: 200M+ engaged followersRevenue Streams:

Pay-per-view: $500-600M annuallyMedia rights: $300M (ESPN deal expiring)Sponsorships: $200M+Gate/merchandise: $300M+The Bull Case: Why This Could Work1. Subscriber ExplosionThe Math:

Current P+ subs: 71 millionUFC PPV buyers: 10 million hardcoreUFC casuals: 50-100 million potentialResult: Could double subscribers in 2 yearsChurn Reduction:

Current P+ churn: 7-8% monthlyWith UFC: Could drop to 3-4%Annual savings: $500M+ in acquisition costs2. Advertising BonanzaPremium Demographics:

Male 18-49: Most valuable ad demographicHigh income: UFC fans 40% more likely $75K+Engagement: 3x average viewing timeSponsorship: Crypto, betting, alcohol brands pay premium3. International ExpansionGlobal Footprint:

UFC strong in 170+ countriesParamount+ weak internationallyBundle opportunity massiveSports transcend language barriers4. Synergy OpportunitiesContent Creation:

Reality shows (already successful)Documentaries and filmsGaming and betting integrationCross-promotion with CBS SportsThe Bear Case: Why This Could Fail1. Financial SuicideDebt Disaster:

Current debt: $14.6 billionAdd UFC: $22+ billion totalInterest costs: $1.5 billion annuallyCash flow: Already negative2. Integration NightmareCultural Clash:

Paramount: Traditional media cultureUFC: Aggressive sports/entertainmentTech requirements: Massive infrastructure neededExecution risk: High3. Rights ComplicationsESPN Deal:

Current deal through 2025ESPN may match/exceed offerInternational rights fragmentedEndeavor may not sell4. Regulatory HurdlesAntitrust Concerns:

Media consolidation scrutinySports media concentrationInternational approvals neededTimeline uncertaintyCompetitive DynamicsWho Else Wants UFC?Potential Bidders:

Amazon: Needs live sports, has capitalApple: Building sports portfolioNetflix: Finally embracing live contentSaudi PIF: Sportswashing unlimited fundsESPN/Disney: Defensive must-haveWhy Paramount Might Win:

Desperation premiumAll-in commitmentSynergy value highestSpeed to closeThe Endeavor AngleWhy They Might Sell:

Stock underperformingConglomerate discountFocus on core agency businessCash for other investmentsWhy They Might Not:

UFC crown jewel assetGrowth trajectory strongAri Emanuel egoHigher bids comingFinancial EngineeringHow Paramount Finances ThisThe Structure (Hypothetical):

Cash: $2 billion (asset sales)Debt: $3 billion (leveraged financing)Stock: $3 billion (Endeavor takes stake)Total: $8 billionAsset Sales Required:

Pluto TV: $1-2 billion valueReal estate: $500M+Non-core assets: $500M+The Payback MathRevenue Impact:

New subscribers: 50M × $10/month = $6B annuallyReduced churn: $500M savingsAdvertising: $1B+ incrementalPPV sharing: $300M+Break-even: 3-4 years if execution perfect

Hidden Strategic AnglesThe Betting IntegrationSports Betting Boom:

UFC perfect for prop betsParamount could launch sportsbookData rights valuableYoung male demographic alignsThe International PlayParamount’s Weakness = Opportunity:

P+ weak internationallyUFC strong globallyBundle changes everythingMarket-by-market dominationThe Netflix Killer AppLive Sports Advantage:

Netflix has noneDisney fragmentedParamount could own combat sportsAppointment viewing drives habitThree Predictions1. Deal Happens at $10B (Not $8B)The Reality: Bidding war erupts. Amazon and Apple enter. Paramount forced to $10B. Still does deal via complex structure.

2. Paramount+ Hits 150M Subs Within 3 YearsThe Math: UFC drives 50M new subs internationally. Churn drops dramatically. Sports betting integration accelerates growth.

3. Paramount Itself Acquired Within 18 MonthsThe Endgame: UFC makes Paramount attractive acquisition. Apple or Amazon buys whole company for content library + UFC.

Investment ImplicationsFor Paramount ShareholdersShort Term: Stock volatile on execution risk

Long Term: Binary outcome – double or zero

Action: High risk, high reward

Implications:

Sports rights inflation acceleratesConsolidation pressure intensifiesStreaming economics questionedContent still kingFor Endeavor ShareholdersConsiderations:

Take the money and runPremium likely comingStandalone UFC worth moreThe Bottom LineParamount’s $8 billion UFC offer represents either the smartest strategic move in streaming history or the deal that finally breaks the company. With $14.6 billion in debt and bleeding cash, Paramount is betting everything that live combat sports can transform them from streaming also-ran to must-have platform.

The Strategic Reality: In the streaming wars, you need differentiation or you die. UFC provides that in spades—700 million global fans, premium demographics, year-round content, and true appointment viewing. Yes, the financial engineering required is daunting. Yes, the execution risk is massive. But when you’re losing $1.8 billion annually on streaming and your stock is down 70%, playing it safe is the riskiest strategy of all.

For Business Leaders: Paramount’s UFC gambit teaches us that in winner-take-all markets, bold moves beat slow deaths. The math might look impossible today, but transformational deals often do. The question isn’t whether Paramount can afford to buy UFC—it’s whether any traditional media company can afford to let tech giants monopolize live sports. Sometimes your balance sheet screams no, but your strategic reality demands yes.

Three Key Takeaways:Desperate Times Demand Desperate Measures: When you’re losing the war, change the battlefieldLive Sports = Streaming Moat: Last remaining appointment viewing worth any priceFinancial Engineering Enables Strategy: Creative deal structure can make impossible possibleStrategic Analysis Framework Applied

The Business Engineer | FourWeekMBA

Disclaimer: This analysis is for educational and strategic understanding purposes only. It is not financial advice, investment guidance, or a recommendation to buy or sell any securities. All data points are sourced from public reports and may be subject to change. Readers should conduct their own research and consult with qualified professionals before making any business or investment decisions.

Want to analyze media M&A strategies and streaming wars dynamics? Visit [BusinessEngineer.ai](https://businessengineer.ai) for AI-powered business analysis tools and frameworks.

The post Paramount’s $8B UFC Offer: The Desperate Genius Move in Streaming Wars appeared first on FourWeekMBA.