Dmitry Orlov's Blog, page 30

November 7, 2011

The Russian Soul and the Collapse of the West

[Guest post by Sandy, ClubOrlov's Siberia correspondent. A version of this article was run in late October in the newspaper Business Biysk, in the Altai Region of Russia.]

[Guest post by Sandy, ClubOrlov's Siberia correspondent. A version of this article was run in late October in the newspaper Business Biysk, in the Altai Region of Russia.] The earliest stirrings of modern industrial society can be traced back to some 6,000 years ago, to the emergence of the first cities, the emergence of agriculture and storage of food surpluses in the Near East. A bit later, analytic and linguistic keys to the forward march of civilization found critical refinement in Aristotle's syllogistic logic and the founding of the sciences. The current trajectory of the West burst into full self-consciousness during the period of European Enlightenment, with the birth of rationalism and the elaboration of the modern scientific method. These, in turn, eventually gave rise to the industrialization, hyper-specialization, technological innovation and increasing commodification of just about everything that we are witnessing today.

With Europe and, more recently, America leading the way, the path charted and engineered by Western civilization spawned a mindset that is rapidly overtaking the globe, socially, economically, and culturally. This ascendancy has unleashed a domination of values, which, unlike political hegemonies of the past, are spreading with lightning speed, virtually unchallenged, and artfully enabled by the very technologies it has spawned.

Many Americans are convinced that their culture represents the apex of this historical legacy, the best in scientific and technological advancement, as well as political and economic leadership. What America has achieved, so they believe, is a dream come true. It was this "American Dream" that has been held out to (or thrust upon) the rest of the world as the ultimate expression of the "good life"—the proper locus of human happiness. However, it was cheap energy, in the form of fossil fuels, that has enabled this cultural and industrial progress, and the recent recognition that world oil extraction has peaked surely signals the prospective collapse of industrial economy, and, with it, the dissolution of its core institutions. The trajectory of Western civilization, now characterized by accelerating energy decline and global climate change—a trajectory that Homo sapiens had set in motion upon excavating the first coal pit—is nearing its end.

There are yet some dreamers and wishful thinkers who tell us of oil extraction technologies and spectacular discoveries of new supplies that will power our future. Overlooking the insidious exaggeration of these claims, the unintended consequences of technologies needed to deliver on them will surely bring substantial ecological fallout, further limiting our access to survival necessities such as clean air, fresh water, and healthy flora and fauna. Likewise, alternate sources of energy will never replace industrial civilization's continuous and ever-growing need for transportation fuels. We are living within an unsustainable bubble that is already deflating, slowly for now, more quickly in the near future. Sustainable human existence will require smaller-scale and more local approaches to just about everything.

With the globe facing epic crises—ecological, financial, economic, political, psychological—at whose feet do we lay the blame? Where do we look to better understand the roots of these crises, or to learn how to outrun their dire consequences? While many have identified pursuit of the American Dream as a proximate cause of this global unraveling, the USA was not alone in its reliance upon certain fundamental assumptions about subjugation and exploitation of nature, ineluctably leading to devastating outcomes. All civilized regimes—from the first empires of ancient Mesopotamia to modern nations such as Russia and China—share the responsibility for the current planetary devastation. Industrial progress, economic growth, technological innovation, political expansion and environmental devastation have been the hallmarks of civilization since the beginning of history.

Not surprisingly, there is now growing disaffection in the West (of all places) with the way things are going. Given a global financial meltdown, high unemployment, austerity, endless war, insurrections popping up everywhere, unparalleled greed, irrational terrorism, the American Dream is fading like like the trace of warm breath on a mirror. Mother nature herself seems to be speaking to us loudly, with more frequent and more brutal natural disasters than at any other time in recorded history. Barely two decades into America's uncontested ascendancy to unipolar imperial power—with the entire planet supposedly globalizing around its neoliberal capitalist dogma—and the whole thing is starting to come apart. If you think this makes the institutional fabric of Western civilization vulnerable, you are right; it does.

Yet do not think for a moment that it is going to come down without a struggle. There are centripetal forces holding this spectacle together as much as there are centrifugal forces pulling it apart. Aside from the greedy and controlling hands of plutocrats, there is too much raw desire out there in the hinterlands, too many people who have been living on the fringes of this "Dream" just waiting for their turn, for a piece of the pie. The entire Soviet Bloc, systematically excluded from all the fun for almost a century, now holds the forbidden fruit firmly within its grasp. These now independent nations are busy chasing the dream as quickly as they can muster the energy and the capital. China has also awakened from its slumber, focused on making up for lost time in securing a position of global prominence. The Indians have decided that they too want to play: Mumbai has made a good beginning in this respect, taking over nearly all customer service functions for major US corporations, siphoning off consumer purchasing power that once went to Americans.

A new generation of Russians is racing to be first at the finish line. The Russian Federation, in concert with its regional administrations, is aggressively stripping forestland, building new roads and expanding old ones, and refurbishing and building-out regional and the international airports. They are doing so with great abandon, as if there is no tomorrow—and perhaps there won't be. Yet no one in Siberia younger than fifty years old seems to want to discuss this possibility. They are having too much fun with their newfound wealth, and are enjoying the spectacle. This is most evident when you look at the younger generation of Siberians and the nouveau riche in Barnaul, Biysk, Belokurikha, and across Altai Krai. They cannot live without their cell phones, their iPods and their credit cards; without their health club memberships, pricey coffee houses and their air conditioners; without their recently financed foreign automobiles and their newly minted driver's licenses. In short, they have tasted the promise of this "society of the spectacle." They are mesmerized by its allure and hooked on its fascinating appeal. It is not just blue jeans they want. They want it all! Short of an abrupt exhaustion of basic vital resources like fossil fuel, clean water, or fresh air, the only way we could see a quick collapse of this "curriculum of the West" as it moves east, is by prying it from the clutching hands of all those who previously had little, but now choose to have hope for more.

But there is also something ancient and primitive pulling at the emotional core of Siberians, something that once spoke clearly to a more archaic need, and perhaps still speaks to the older generations of Siberians even today. I am referring to the thoroughly mythologized Russian soul: a soul that in the mother tongue is feminine in gender—душа [dushá]—and, as such, is intimately connected with the mystery of Mother Earth. Recall Dostoevsky's many references to the Russian soul as a reflection of the people's unfailing and non-negotiable connection to the land from which life springs. There is a well-articulated and indestructible sentiment among our people that does not allow complete separation, physically or emotionally, from the land in which they were born and where they naturally survive and flourish. The Russian people have the greatest appreciation for, love of and attachment to their homeland and families, as well as to the broader ties of kinship these entail. They understand all of this to be intimately connected, as their language makes abundantly clear:

род [rod]: family, kind, sort, genus

родина [ródina]: homeland, motherland

родители [rodíteli]: parents

родить [rodít']: to give birth

роднить [rodnít']: to unite, bring together

родовой [rodovói]: ancestral, tribal

родство [rodstvó]: kinship

Over their historically, Russians have had to endure the hardships and struggles of political turmoil and repeated invasion, and Siberians understand struggle as a given, as part of the cycle of life, death and nature. The normal conditions of existence here, whether in the city or the village, are not what we Americans would consider easy, convenient, or comfortable (although they are improving). Those who live here have preserved some age-old instincts in order to survive, and even to celebrate life in the midst of recurrent hardships and strife. The personal and cultural resolve that personifies this soul has been forged over generations of people facing down aggression, natural and political, then calmly and courageously returning to their roots and rebuilding their lives upon an archaic foundation in which they never lost faith. It is impossible to understand the depth and mystery of this soul separately from its rootedness in the simplicity of the Russian peasantry and the inviolability of the Russian soil. There is an earthly sensuousness that infuses the Russian experience; this culture remains drenched in the primacy of the body and the natural world that nourishes it. This autochthonous connection to the land—the Siberian's more elemental experience of life in wilder, mysterious nature—may still be capable of influencing the future trajectory of both the new Russia and Western civilization.

Perhaps Russia's long-suffering messianic mission still stands firm in the Siberian wilderness, albeit less vociferously than before, quietly recalling humanity from the abyss of alienated spirit that haunts the self-absorbed West with its scientific rationalism, its consumerism and its otherworldly transcendence—a self-misunderstanding that seems to be marching all of us mindlessly toward global collapse. Perhaps the more primal Siberian awareness can summon us back to a feral memory trace, helping us recall our essential rootedness in Mother Earth and the earthly sensuousness of our flesh, the flesh of the world. But the delusion of 'manifest destiny' that drives Western hegemony and its commodity culture is chipping away relentlessly and callously at that archaic Russian soul, perhaps more rapidly than she is able to redirect and dissipate the self-destructive energy of Western imperialism and its global appetite. Siberians, and those of us living here in Altai Krai, must rethink their commitment to this Western curriculum as it continues to lead us relentlessly, mindlessly, toward a precipice.

Published on November 07, 2011 14:09

November 5, 2011

November 4, 2011

Hubbert's Third Prophecy

[A timely guest post from Gary. tl;dn: Hubbert was right. Again.]

In light of recent events such as the Arab Spring and Occupy Wall Street I thought it would be pertinent to review Hubbert's Third Prophecy about the cultural crisis he expected. He wrote about it in the attached article entitled "Exponential Growth as a Transient Phenomenon in Human History". In case you are not familiar with Hubbert's first two prophecies, he predicted both the US and world oil peak very accurately.

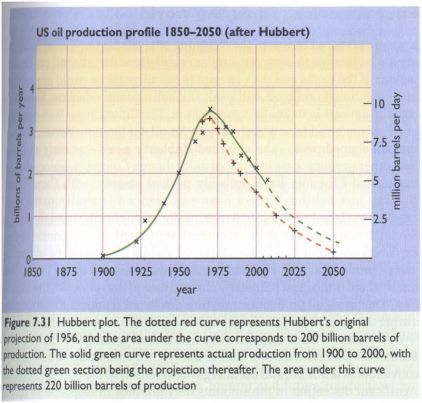

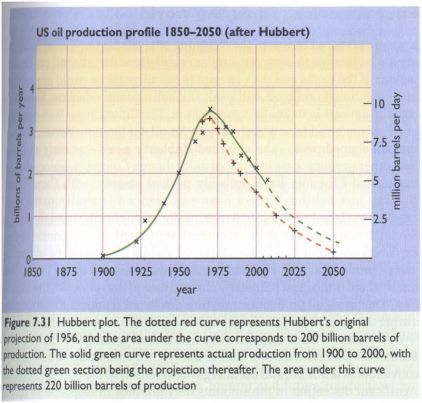

In 1956 Hubbert predicted the US oil peak would be sometime between 1969 and 1971. For this he was ridiculed and laughed off the face of the earth (almost). Turned out the US oil peak was in 1970. This is something the drill-baby-drill, it's all the environmentalists' fault, ditto heads don't know anything about.

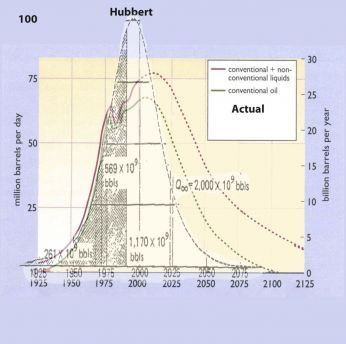

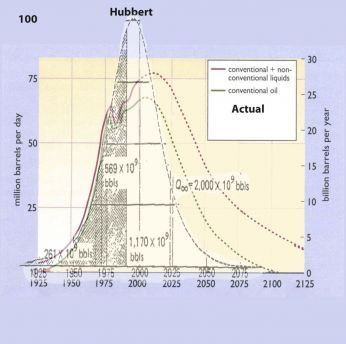

Next in 1974 Hubbert predicted the world oil peak to happen about 1998. However he DID say that if OPEC were to restrict the supply, then the peak would be delayed by 10-15 years which would put it at 2008-2013, or exactly right. Here is what Hubbert's prediction (to scale by MBPD) looks like overlayed onto a reasonably close estimate of the actual global oil peak which started in 2005 and has continued as a plateau up to now.

OK, now is anyone willing to make a bet that Hubbert's THIRD prophecy is wrong? Didn't think so. Here it is:

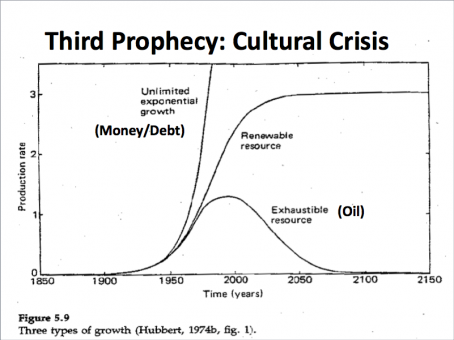

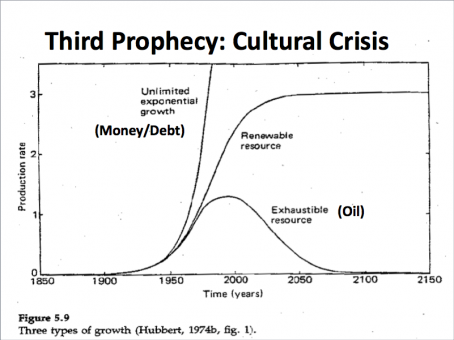

Hubbert said, "The third curve (on the left) is simply the mathematical curve for exponential growth. No physical quantity can follow this curve for more than a brief period of time. However, a sum of money, being of a nonphysical nature and growing according to the rules of compound interest at a fixed interest rate, can follow that curve indefinitely...Our principle constraints are cultural...we have evolved a culture so heavily dependent upon the continuance of exponential growth for its stability that it is incapable of reckoning with problems of non-growth...it behooves us...to begin a serious examination of the...cultural adjustments necessary...before unmanageable crises arise..."

Ok, anyone see any cultural crisis happening? Yeah, what about a worldwide uprising of the 99% against the 1%? What does this have to do with Hubbert's Third Prophecy? EVERYTHING!

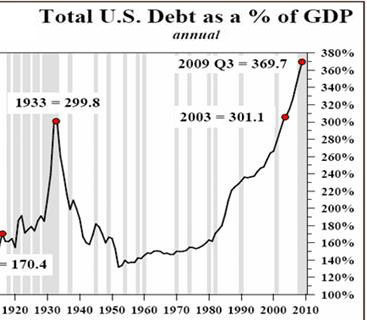

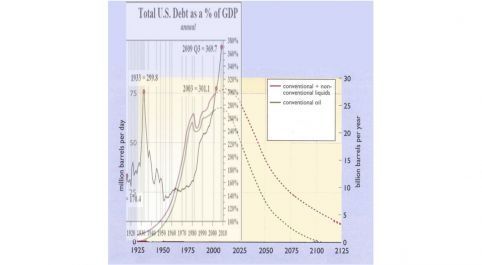

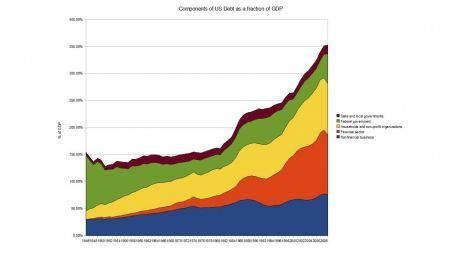

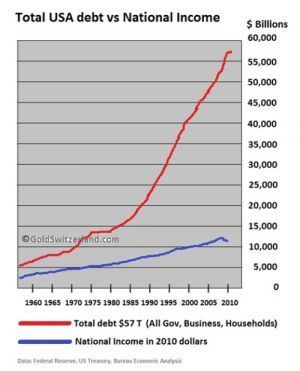

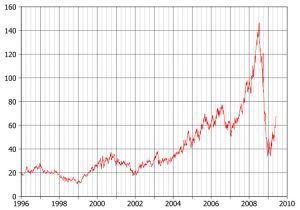

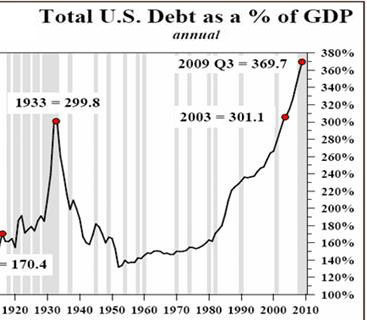

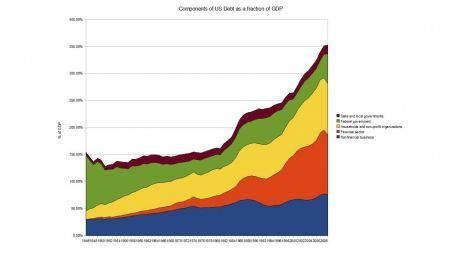

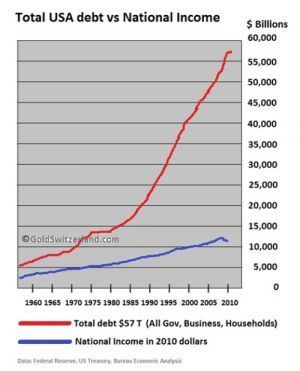

Here is a graph of total US debt in all sectors up to end of 2009:

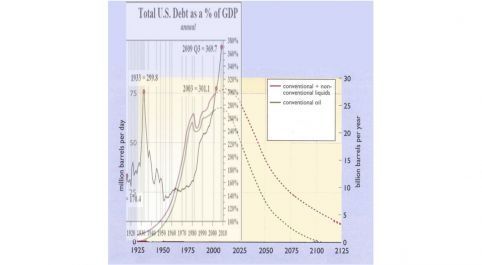

Here is same curve overlayed with same time scale on global oil peak:

Looks kinda like Hubbert's graph above doesn't it? That's because it is. Debt can continue to increase indefinitely, while oil can't. And since our entire money system is based on debt with interest attached there is no way to escape it. All money is debt because we have allowed banks and the fed to create all our money through interest-bearing loans by using the fractional reserve system. The details are unimportant, the main point is that our money supply is created by interest-bearing loans of banks and the fed. Therefore, the economy must always grow in order to pay back the interest. When the economy can't grow anymore...collapse.

Here is what has happened to US debt over the last several years:

2008 US Debt:GDP ratio = 350%

2009 4Q US Debt:GDP ratio = 425%

2011: US Debt:GDP ratio = 475%?

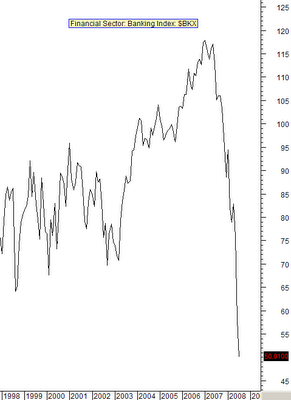

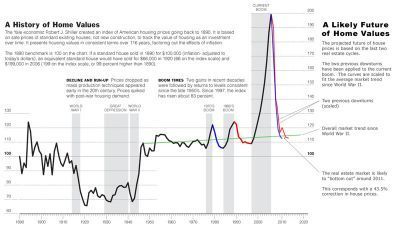

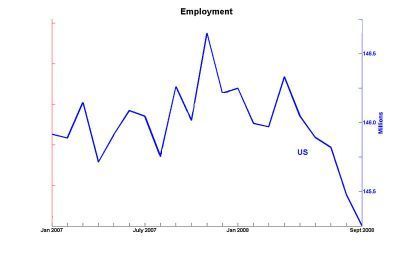

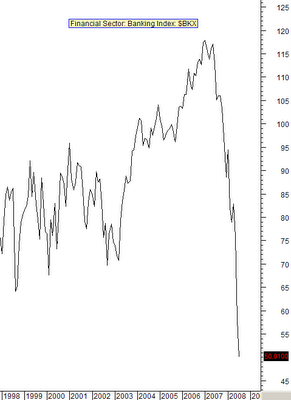

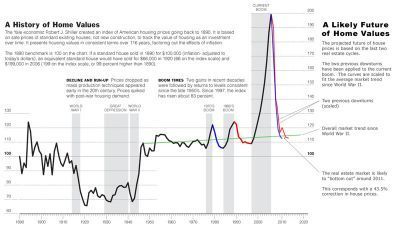

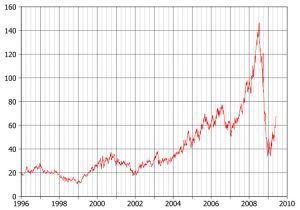

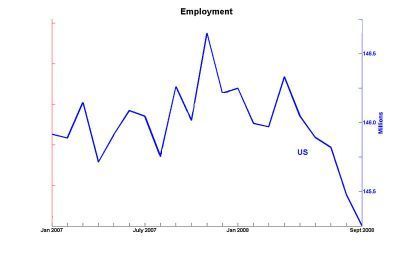

Debt has continued to grow because we don't have a real economy anymore, we have a fictitious funny-money phantom economy of mostly financial speculation. Here is what happened in 2008:

As we all know, we had a stock market crash, a housing crash, an oil price spike and crash, and an employment crash. Because we don't have a real economy any more we have papered over these problems by creating more debt. The taxpayers bailed out the criminal fraudsters on Wall St., taking on more government debt, and the fed bailed out many bankrupt banks internationally ($12 Trillion), indenturing the taxpayers for future debt.

Since debt represents ultimately a claim on real assets, debt cannot continue forever if growth of the real resource based economy has stopped. This is Hubbert's Third Prophecy: When economic growth cannot continue due to the lack of affordable oil, then we will have a cultural crisis. Well here we are folks. The solution of the powers that be? Create more funny money through the fed's "quantitative easing program". The solution of the Keynesian economists? Take on more government debt through interest bearing loans by selling Treasury bonds to the fed, China, and other parties (stimulus). The solution of the right-wing "deficit hawks"? Cut government (social) spending to the bone to "cut the deficit" which they created through monstrous military spending, and tax cuts to themselves. Guess what. None of these are going to work. The solution is structural in the monetary system itself. When all money is debt, there is always interest to pay and growth is required.

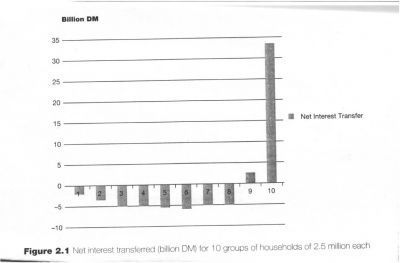

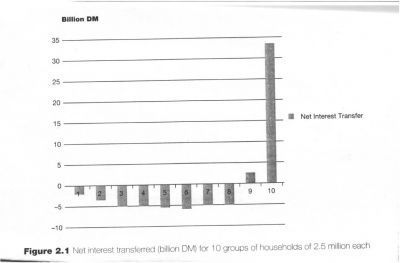

Hubbert didn't mention one other notable feature of a debt-money system. It systematically pumps wealth from the bottom 80% of the population in wealth to the top 20%. The bottom 80% pay interest while the top 20% collects it, and of course most of the interest is collected by the top 10%. When all money is debt, that's a lot of money going to the top. The Occupy Wall Street people aren't stupid. They know the game is rigged.

A SOLUTION

A solution is some form of Public Credit Money. That means that money is issued without interest:

1. 100% reserve requirements (abolish bank money)2. Abolish Federal Reserve notes (end private central banking)3. Issue Treasury Notes INTEREST-FREE (Greenbacks)4. Issue state or local currency (warrants, bills of credit, zero interest bonds) 5. Social Credit (CH Douglas)6. Kucinich NEED Act

Each of these topics could have a separate article, but I will summarize briefly.

1. The small reserve requirement of ~5% means that the banking system can create 1/.05 = 20X the money from deposits on hand. Most people think banks loan out money that people save and deposit, but that isn't how it works. With 100% reserve banks can only loan out money on time that you deposit, and you cannot withdraw it during that period of time, so it is like a CD (certificate of deposit).

2. Abolish the fed or put it under the treasury department.

3. The Treasury department could then issue Treasury bills, not Treasury bonds. Treasury bills are credit money that is spent on public goods, or loaned for projects creating public goods. It is returned to the government through taxes or repayment of low-interest loans. The colonists used colonial scrip, Lincoln issued GREENBACKS, and Kennedy issued Treasury notes. These were all credit money, not debt money.

4. States or local governments could issue warrants, bills of credit, or zero interest bonds. Some people feel the national government is too unaccountable to be trusted with money creation and it should be devolved to lower levels of government.

5. Social Credit (CH Douglas): Part of public credit money could be to resurrect the idea of social credit. Government issues credit directly to the public as a guaranteed minimum income and they spend it on things they need. The fed gave money free to banks. Why not give money free to us? This is similar to the scene in the recent movie "In Time", when they rob the bank and announce to the crowd that the bank is giving zero interest loans, and you don't have to pay it back.

6. Dennis Kucinich has introduced the NEED act which incorporates many of these ideas from the American Monetary Institute.

Debt-based money is incompatible with the post oil-peak world. It's only a matter of time before it collapses in default. For further reading see: http://publicbankinginstitute.org/

http://currencycommonsvt.org/

http://www.monetary.org/

Web of Debt, Ellen Brown

In light of recent events such as the Arab Spring and Occupy Wall Street I thought it would be pertinent to review Hubbert's Third Prophecy about the cultural crisis he expected. He wrote about it in the attached article entitled "Exponential Growth as a Transient Phenomenon in Human History". In case you are not familiar with Hubbert's first two prophecies, he predicted both the US and world oil peak very accurately.

In 1956 Hubbert predicted the US oil peak would be sometime between 1969 and 1971. For this he was ridiculed and laughed off the face of the earth (almost). Turned out the US oil peak was in 1970. This is something the drill-baby-drill, it's all the environmentalists' fault, ditto heads don't know anything about.

Next in 1974 Hubbert predicted the world oil peak to happen about 1998. However he DID say that if OPEC were to restrict the supply, then the peak would be delayed by 10-15 years which would put it at 2008-2013, or exactly right. Here is what Hubbert's prediction (to scale by MBPD) looks like overlayed onto a reasonably close estimate of the actual global oil peak which started in 2005 and has continued as a plateau up to now.

OK, now is anyone willing to make a bet that Hubbert's THIRD prophecy is wrong? Didn't think so. Here it is:

Hubbert said, "The third curve (on the left) is simply the mathematical curve for exponential growth. No physical quantity can follow this curve for more than a brief period of time. However, a sum of money, being of a nonphysical nature and growing according to the rules of compound interest at a fixed interest rate, can follow that curve indefinitely...Our principle constraints are cultural...we have evolved a culture so heavily dependent upon the continuance of exponential growth for its stability that it is incapable of reckoning with problems of non-growth...it behooves us...to begin a serious examination of the...cultural adjustments necessary...before unmanageable crises arise..."

Ok, anyone see any cultural crisis happening? Yeah, what about a worldwide uprising of the 99% against the 1%? What does this have to do with Hubbert's Third Prophecy? EVERYTHING!

Here is a graph of total US debt in all sectors up to end of 2009:

Here is same curve overlayed with same time scale on global oil peak:

Looks kinda like Hubbert's graph above doesn't it? That's because it is. Debt can continue to increase indefinitely, while oil can't. And since our entire money system is based on debt with interest attached there is no way to escape it. All money is debt because we have allowed banks and the fed to create all our money through interest-bearing loans by using the fractional reserve system. The details are unimportant, the main point is that our money supply is created by interest-bearing loans of banks and the fed. Therefore, the economy must always grow in order to pay back the interest. When the economy can't grow anymore...collapse.

Here is what has happened to US debt over the last several years:

2008 US Debt:GDP ratio = 350%

2009 4Q US Debt:GDP ratio = 425%

2011: US Debt:GDP ratio = 475%?

Debt has continued to grow because we don't have a real economy anymore, we have a fictitious funny-money phantom economy of mostly financial speculation. Here is what happened in 2008:

As we all know, we had a stock market crash, a housing crash, an oil price spike and crash, and an employment crash. Because we don't have a real economy any more we have papered over these problems by creating more debt. The taxpayers bailed out the criminal fraudsters on Wall St., taking on more government debt, and the fed bailed out many bankrupt banks internationally ($12 Trillion), indenturing the taxpayers for future debt.

Since debt represents ultimately a claim on real assets, debt cannot continue forever if growth of the real resource based economy has stopped. This is Hubbert's Third Prophecy: When economic growth cannot continue due to the lack of affordable oil, then we will have a cultural crisis. Well here we are folks. The solution of the powers that be? Create more funny money through the fed's "quantitative easing program". The solution of the Keynesian economists? Take on more government debt through interest bearing loans by selling Treasury bonds to the fed, China, and other parties (stimulus). The solution of the right-wing "deficit hawks"? Cut government (social) spending to the bone to "cut the deficit" which they created through monstrous military spending, and tax cuts to themselves. Guess what. None of these are going to work. The solution is structural in the monetary system itself. When all money is debt, there is always interest to pay and growth is required.

Hubbert didn't mention one other notable feature of a debt-money system. It systematically pumps wealth from the bottom 80% of the population in wealth to the top 20%. The bottom 80% pay interest while the top 20% collects it, and of course most of the interest is collected by the top 10%. When all money is debt, that's a lot of money going to the top. The Occupy Wall Street people aren't stupid. They know the game is rigged.

A SOLUTION

A solution is some form of Public Credit Money. That means that money is issued without interest:

1. 100% reserve requirements (abolish bank money)2. Abolish Federal Reserve notes (end private central banking)3. Issue Treasury Notes INTEREST-FREE (Greenbacks)4. Issue state or local currency (warrants, bills of credit, zero interest bonds) 5. Social Credit (CH Douglas)6. Kucinich NEED Act

Each of these topics could have a separate article, but I will summarize briefly.

1. The small reserve requirement of ~5% means that the banking system can create 1/.05 = 20X the money from deposits on hand. Most people think banks loan out money that people save and deposit, but that isn't how it works. With 100% reserve banks can only loan out money on time that you deposit, and you cannot withdraw it during that period of time, so it is like a CD (certificate of deposit).

2. Abolish the fed or put it under the treasury department.

3. The Treasury department could then issue Treasury bills, not Treasury bonds. Treasury bills are credit money that is spent on public goods, or loaned for projects creating public goods. It is returned to the government through taxes or repayment of low-interest loans. The colonists used colonial scrip, Lincoln issued GREENBACKS, and Kennedy issued Treasury notes. These were all credit money, not debt money.

4. States or local governments could issue warrants, bills of credit, or zero interest bonds. Some people feel the national government is too unaccountable to be trusted with money creation and it should be devolved to lower levels of government.

5. Social Credit (CH Douglas): Part of public credit money could be to resurrect the idea of social credit. Government issues credit directly to the public as a guaranteed minimum income and they spend it on things they need. The fed gave money free to banks. Why not give money free to us? This is similar to the scene in the recent movie "In Time", when they rob the bank and announce to the crowd that the bank is giving zero interest loans, and you don't have to pay it back.

6. Dennis Kucinich has introduced the NEED act which incorporates many of these ideas from the American Monetary Institute.

Debt-based money is incompatible with the post oil-peak world. It's only a matter of time before it collapses in default. For further reading see: http://publicbankinginstitute.org/

http://currencycommonsvt.org/

http://www.monetary.org/

Web of Debt, Ellen Brown

Published on November 04, 2011 21:24

November 1, 2011

Stadien des Kollaps Revidiert: „An der Brieftasche verwachsen"

[Auf Englisch]

[Auf Englisch]Meine nette, geordnete Taxonomie des Kollaps, „Die Fünf Stadien des Kollaps", wurde allein auf meinem Blog mehr als 70,000 mal gelesen seit ich ihn im Februar 2008 veröffentlicht habe. Der Artikel ist immer noch populär: alleine in diesem Jahr gab es über 10,000 Hits auf der Seite. Die Leute müssen ihn immer noch für hilfreich halten.

Und doch verläuft der Kollaps bisher nicht nach Plan. Was mich bewog den Artikel zu schreiben war der finanzielle Zusammenbruch von 2008, der zunächst nach einem Schachmatt für die westliche Finanzwelt aussah. Davon gehe ich immer noch aus. Damals schrieb ich über den „credit event" von 2008:

Die Regierung könnte als Reaktion einige hilfreiche Predigten über „der Sünde Lohn" halten und ein paar Suppenküchen und Absteigen an verschiedensten Orten, darunter auch an der Wall Street, eröffnen. Die Nachricht wäre:" Ihr, die ehemals Schuld- und Spielsüchtigen, habt es wie man so sagt 'verbockt' und dies wird euch eine Lange Zeit leidtun. Wir werden euch nie wieder in die Nähe des großen Geldes lassen. Schafft eure Hintern in die Suppenküche und bringt euren eigenen Napf mit, denn wir waschen nicht ab." Das Ergebnis wäre ein stabiler Kollaps im ersten Stadium – die Zweite Große Depression.Ich dachte zwar der Regierungsintervention ins private Finanzwesen die Qualen etwas verlängern würden; doch dass sie sie bis zum Tod der Regierungen selbst verlängern würde hätte ich nicht erwartet.

Das ist allerdings unwahrscheinlich, denn die US Regierung ist nun mal der Schuld- und Spielsüchtige Nummer eins. Als Individuen können wir noch so tugendhaft sein die Regierung wird dennoch exorbitante Schulden in unserem Namen anhäufen. Jede Ebene der Regierung, von lokaler Verwaltungen und Behörden die den Kreditmarkt zum finanzieren öffentlicher Dienstleistungen und Aufträge benötigen, bis hin zur Bundesregierung, die für ihre endlosen Kriege auf Ausländische Investitionen angewiesen ist, ist von privaten Schulden abhängig. Sie wissen dass sie nicht aufhören können Schulden zu machen, also werden sie alles in ihrer Macht tun das Spiel so lange wie möglich am Laufen zu halten.

Der Effekt der Einmischung in den USA und Europa war das Niederreißen jedweden Schutzwalls zwischen privaten und öffentlichen Finanzen, mit dem Ergebnis das wir uns zwei monströsen, furchtbar kranken, siamesischen Zwillingen gegenüber sehen. Der Tod des einen bedeutet den sicheren Tod des anderen. Sie mit einem Hackbeil zu trennen wäre zwecklos: sie würden nur rote Tinte bluten und früher sterben als sie es ohnehin müssen.

Vielleicht wäre ihr frühzeitiger Tod hilfreich. Jetzt, da es mit wirtschaftlichem Wachstum so gut wie aus und vorbei ist, stellt die Großfinanz und hohe Politik nur ein Hindernis dar für ein geordnetes Einschrumpfen der Weltwirtschaft. Was ich mit einem „geordneten Einschrumpfen" meine, ist ein Prozess bei dem die Wirtschaft in einem gesunden Maße schrumpft, bei etwa der Rate, die man einst als gesunde Wachstumsrate bezeichnet hat. Aber auf eine Weise die es den meisten Menschen erlaubt zu überleben, indem man einige Notwendigkeiten zur Verfügung stellt. So etwa Nahrung, Unterkunft, Sicherheit, der Zugang zu Medizinischer Versorgung, die Möglichkeit Kinder groß zuziehen und so weiter.

Die endlosen, leidenschaftlichen Gebete, für nicht existentes und physikalisch unmögliches Wachstum, sind verräterisch: Ohne Wachstum muss man die befristeten Tricks der Regierungen und Geldinstitute die das Spiel am Leben halten als unbefristet erachten, und unbefristet funktionieren sie nicht. Da gäbe es z.B. den „versteckt den Dreck" Trick für die Bilanzen der Zentralbanken. Der würde funktionieren wenn der Dreck irgendwann wieder etwas wert wäre, was mit Wirtschaftswachstum denkbar wäre. Ohne ihn bleibt es Dreck.

Ein anderer Trick ist die massive Aufstockung der Rettungsschirme unter Garantieversprechen seitens der Regierungen; Dieser Trick könnte funktionieren, wenn das Wachstum wieder anziehen würde, denn dann würden die Garantien niemals in Anspruch genommen. So wie es steht werden sie aber garantiert in Anspruch genommen. Und da die öffentlichen Gelder hinter den Garantien nicht existieren, dürfte die Behauptung, dass Billionen von Rettungsgeldern zur Verfügung stehen, sicherlich schnell seine Wirkung verlieren.

Ich hätte mir eine geordnete Kaskade kollabierender Institutionen gewünscht, mit genügend Abstand zwischen den Ereignissen, damit sich allgemeine Psyche und Habitus an die neue Realität anpassen können. Doch die fast vier verschwendeten Jahre, in denen die Finanzwelt und Regierung nun schon auf eine Zukunft setzen die nicht existieren kann, und dabei jeden Einsatz verdoppeln den sie verlieren, haben diese Hoffnung zerschlagen. Ich denke der Effekt wird lediglich der sein, dass sich finanzieller und politischer Kollaps in einer einzigen chaotischen Periode verdichten. Der wirtschaftliche Zusammenbruch wird dann nicht lange auf sich warten lassen, denn der globale Handel ist vom globalen Finanzwesen abhängig, und sobald internationale Kredite austrocknen fahren Tanker und Frachter nicht mehr. Kurz danach gehen die Lichter aus.

„Die Fünf Stadien des Kollaps" war eine nette Theorie. Ach hätten wir doch nur so viel Glück gehabt! Ich schreibe das um Sie zu warnen: erwarten Sie besser nichts derart geordnetes.

Published on November 01, 2011 21:20

October 30, 2011

Stages of Collapse Revised: "Joined at the Wallet"

My neat and tidy taxonomy of collapse, "The Five Stages of Collapse," has been read more than 70,000 times just on my blog alone since I first published it in February of 2008. It continues to be popular: there were over 10,000 hits to the page in the last year alone. People must still be finding it helpful.

My neat and tidy taxonomy of collapse, "The Five Stages of Collapse," has been read more than 70,000 times just on my blog alone since I first published it in February of 2008. It continues to be popular: there were over 10,000 hits to the page in the last year alone. People must still be finding it helpful.And yet collapse has not gone according to plan. What caused me to write the initial article was the financial collapse of 2008, which was shaping up to be a game-ender for Western finance. It still is, I believe. Back then, I wrote of the "credit event" of 2008:

The government response to this could be to offer some helpful homilies about "the wages of sin" and to open a few soup kitchens and flop houses in a variety of locations including Wall Street. The message would be: "You former debt addicts and gamblers, as you say, 'fucked up,' and so this will really hurt for a long time. We will never let you anywhere near big money again. Get yourselves over to the soup kitchen, and bring your own bowl, because we don't do dishes." This would result in a stable Stage 1 collapse - the Second Great Depression.I thought that government interventions in private finance would prolong the agony somewhat; what I didn't think was that they would prolong it even onto the death of the governments themselves! The effect of the interventions since then, in the US and in Europe, have been to knock down every firewall between public and private finance, to the point that now we are faced with two monstrous, and monstrously sick, conjoined twins, and the death any one of them is sure to spell the death of the other. Trying to separate them with a cleaver will be of no use: they will simply hemorrhage red ink and die sooner than they would otherwise.

However, this is unlikely, because in the US the government happens to be debt addict and gambler number one. As individuals, we may have been as virtuous as we wished, but the government will have still run up exorbitant debts on our behalf. Every level of government, from local municipalities and authorities, which need the financial markets to finance their public works and public services, to the federal government, which relies on foreign investment to finance its endless wars, is addicted to public debt. They know they cannot stop borrowing, and so they will do anything they can to keep the game going for as long as possible.

Perhaps their early demise would be useful. Now that economic growth is pretty much over and done with, big finance and big government stand directly in the path of an orderly shriveling-up of the global economy. What I mean when I say "an orderly shriveling-up" is a process by which the economy shrinks at a healthy rate, corresponding to rates that were once considered to be a healthy growth rate, but in a way that allows most people to survive by providing a few essentials, such as food, shelter, security, access to medical care, ability to raise children and so on.

The endless fervent prayers we hear for nonexistent and physically impossible economic growth is telltale: without it the temporary tricks used by government and finance to keep the game going have to be seen as permanent tricks, and as permanent tricks they do not work. There is the trick of "hiding the garbage" on the balance sheet of central banks. It would work if the garbage (loans gone bad) were to some day be worth something, which it might have if there were to be growth. Without it, they remain garbage. Another trick is to extend government guarantees to massively raise the amount of available bail-out funds; this trick would work if growth were to resume, in which case the guarantees would never need to be used. As it is, they are guaranteed to be used, and since the public funds behind these guarantees don't exist, the pretense of there being trillions of bail-out funds available is sure to wear thin quickly.

I wished for an orderly cascade of collapsing institutions, with enough of a gap between them for public psychology and behavior to adjust to the new reality. But almost four lost years of both government and finance betting on a future that cannot exist, doubling down every time they lose again, has dashed those hopes. The effect, I think, will be to compress collapse into a single chaotic episode. Global commerce will not be far behind, because it is dependent on global finance, and if international credit locks up then the tankers and the container ships don't sail. Shortly thereafter it's lights out.

The Five Stages of Collapse was a nice theory. If only we were so lucky! I am writing this to warn you: don't look for anything quite so tidy. Oh, and happy Halloween!

Published on October 30, 2011 10:42

October 18, 2011

Where's Muammar?

p { margin-bottom: 0.08in; }a:link { }

It's been over seven months ago that I commented on the fact that not all is going according to plan in Libya. The Langley, Virginia chapter of Al Qaeda had decided to overthrow Muammar, for all the obvious reasons. The British jumped on board, mostly because they are British. The French jumped on board because Muammar had put up some communications satellites that were undercutting France Telecom's ability to gouge and fleece pour Africans. Everyone else was disgusted.

It's been over seven months ago that I commented on the fact that not all is going according to plan in Libya. The Langley, Virginia chapter of Al Qaeda had decided to overthrow Muammar, for all the obvious reasons. The British jumped on board, mostly because they are British. The French jumped on board because Muammar had put up some communications satellites that were undercutting France Telecom's ability to gouge and fleece pour Africans. Everyone else was disgusted.

They've been overthrowing him continually for seven months now. At this point, he appears to be close to 90% overthrown, but the remaining 10% are proving to be slow going. It remains to be seen whether "Operation Suck 'Em Dry" will go according to plan, or whether it will result in pipelines and installations being blown up sporadically for years on end, as it has in every other oil-producing place that's been bombed into submission, invaded and ransacked.

Also, nobody seems to know where Muammar is. Now, some other overthrown dictator might be feeling low around now, but that's not our Muammar! My feeling is that, wherever he is, he is probably having a good time. But seeing as even his most stalwart supporters are ready to concede that his return to power in Libya is, at this point, unlikely, I thought it would be a good time to share with the world my Muammar scrapbook.

And if he is in your area, please be hospitable. He is not a bad sort. Things got out of hand; he didn't mean it; he is sorry. All he ever wanted was to be a non-pro-Western Arab dictator, for a change. Who can blame him for that?

With Mr. 0

With Mr. 0

Being polite to some sleazebag

Being polite to some sleazebag

With Vova

With Vova

With... WUGGHGHGH!

With... WUGGHGHGH!

Puckering up for Yasser

Puckering up for Yasser

With his good friend Mandela

With his good friend Mandela

It's been over seven months ago that I commented on the fact that not all is going according to plan in Libya. The Langley, Virginia chapter of Al Qaeda had decided to overthrow Muammar, for all the obvious reasons. The British jumped on board, mostly because they are British. The French jumped on board because Muammar had put up some communications satellites that were undercutting France Telecom's ability to gouge and fleece pour Africans. Everyone else was disgusted.

It's been over seven months ago that I commented on the fact that not all is going according to plan in Libya. The Langley, Virginia chapter of Al Qaeda had decided to overthrow Muammar, for all the obvious reasons. The British jumped on board, mostly because they are British. The French jumped on board because Muammar had put up some communications satellites that were undercutting France Telecom's ability to gouge and fleece pour Africans. Everyone else was disgusted.They've been overthrowing him continually for seven months now. At this point, he appears to be close to 90% overthrown, but the remaining 10% are proving to be slow going. It remains to be seen whether "Operation Suck 'Em Dry" will go according to plan, or whether it will result in pipelines and installations being blown up sporadically for years on end, as it has in every other oil-producing place that's been bombed into submission, invaded and ransacked.

Also, nobody seems to know where Muammar is. Now, some other overthrown dictator might be feeling low around now, but that's not our Muammar! My feeling is that, wherever he is, he is probably having a good time. But seeing as even his most stalwart supporters are ready to concede that his return to power in Libya is, at this point, unlikely, I thought it would be a good time to share with the world my Muammar scrapbook.

And if he is in your area, please be hospitable. He is not a bad sort. Things got out of hand; he didn't mean it; he is sorry. All he ever wanted was to be a non-pro-Western Arab dictator, for a change. Who can blame him for that?

With Mr. 0

With Mr. 0 Being polite to some sleazebag

Being polite to some sleazebag With Vova

With Vova With... WUGGHGHGH!

With... WUGGHGHGH! Puckering up for Yasser

Puckering up for Yasser With his good friend Mandela

With his good friend Mandela

Published on October 18, 2011 04:00

October 2, 2011

Crossroads Lecture on "The Fall of the American Empire"

Sunday, October 9 at 2 p.m. at Orcas Center

From the Crossroads Lecture Series Committee

Sunday, October 9 at 2 p.m. at Orcas Center

From the Crossroads Lecture Series Committee

The Orcas Crossroads Lecture Series presents Dmitry Orlov's lecture, Fall of the American Empire next Sunday, October 9, 2 pm at Orcas Center, including a reception and book signing with the speaker following the presentation.

Published on October 02, 2011 11:46

October 1, 2011

Living on Stolen Time

Consider a flame; a jet of methane, forexample, injected into an oxygen-rich atmosphere and set alight. Nowtry to describe the shape and structure of the flame mathematically,in a way that will allow you to accurately predict how its shape andstructure respond to changes in various conditions—oxygenconcentration, gas pressure and so on. You will quickly discover thatthe mathematics of the problem can be derived from basic physicalprinciples but is intractable: there are equations that accuratelydescribe the situation, but they are too difficult to solve. Oftenthe easiest solution, one that is practical in the case of a simplegas jet, is to build a physical model or a prototype, test it, andmake some observations and measurements that characterize the system.But what if that's not possible? Then the usual recourse is to builda computational model that simplifies the physics in various ways andbrute-forces the solution by crunching through lots of numbers.

Consider a flame; a jet of methane, forexample, injected into an oxygen-rich atmosphere and set alight. Nowtry to describe the shape and structure of the flame mathematically,in a way that will allow you to accurately predict how its shape andstructure respond to changes in various conditions—oxygenconcentration, gas pressure and so on. You will quickly discover thatthe mathematics of the problem can be derived from basic physicalprinciples but is intractable: there are equations that accuratelydescribe the situation, but they are too difficult to solve. Oftenthe easiest solution, one that is practical in the case of a simplegas jet, is to build a physical model or a prototype, test it, andmake some observations and measurements that characterize the system.But what if that's not possible? Then the usual recourse is to builda computational model that simplifies the physics in various ways andbrute-forces the solution by crunching through lots of numbers.Now consider that same flame again froma slightly different perspective: what's actually going on? Yes, thecharacter and behavior of the flame are difficult to characterize andpredict with great accuracy, but suppose you already know what a gasflame looks like, and just want to know what it is. Here, theequations are simple. First, methane oxidizes tocarbon monoxide, hydrogen and water vapor, giving off energy (heatand light) in the process:

CH4 + O2 → CO +H2 + H2O

Next, the hydrogen oxidizes, giving offmore water vapor and energy:

2 H2 + O2 → 2H2O

Finally, the carbon monoxide oxidizesas well, producing carbon dioxide and more energy:

2 CO + O2 → 2 CO2

This is quite typical of how we goabout explaining just about everything we encounter. To understandthe flow of traffic, we think about individual vehicles and theinteractions between them. To understand epidemics, we think aboutthe course of the disease in individual patients and the spread ofinfection from patient to patient. To understand how an industrialchemical affects an ecosystem we look at its effect on individualcells in individual organisms. We take a specimen, study itsbehavior, and extrapolate it to the population as a whole. Thisapproach gives at least the illusion of explanatory depth; moreimportantly, it often allows us to establish cause and effectrelationships and, based on them, make constructive changes thatdecisively influence the outcome: impose speed limits, quarantinesand environmental regulations, respectively.

Let us try to apply this same approachto a truly complex system: the economies of US and Europe, in thestate in which we currently find them: raging government deficits,staggering levels of bad debt, continuous government bailouts andinfusions of fiat money by central banks, record levels of povertyand long-term unemployment and underemployment, and a lack of anymeaningful economic growth. Specifically, let us try to characterizethe effect of the continuous monetary infusions, bailouts, andstimulus spending. The economics profession has failed to do this andso amateurs are forced to step into the breach. The economists' usual excuse is that it's allvery complicated; sure it is, so is a gas flame.

All money is debt. It is created whensomeone takes out a loan, promising to repay it (with or withoutinterest) with proceeds from his or her future labor. If that promiseis broken, the money ceases to exist. In the normal course ofaffairs, the lender then "loses" the money. If the lender losesmore money than he happens to have, then the lender is bankruptedand, economically speaking, ceases to exist as well. What happenedduring the financial collapse of 2008 is that the real estate bubbleburst and many loans went bad at the same time. The response was notto liquidate the lenders who lost more than they had, but to propthem up by issuing further loans that were not supported by anyspecific mechanism or realistic chance of repayment—just thecompulsive thought that big financial organizations must not beallowed to fail because that would irreparably damage the system.Propping up bankrupt institutions by issuing fake money (or, moreprecisely, fake debt) has been assumed to be less damaging to thesystem than doing nothing.

This assumption would perhaps have beenjustified if the financial difficulties were, as was once thought,temporary in nature, that the economy would roar back to life andgrowth would resume. Now, three years later, we find ourselves backwhere we started, and this assumption no longer seems tenable. It isnot clear why growth should resume, as many factors, persistentlyhigh energy prices among them, continue to weigh it down. Weshouldn't bet on any more economic expansion, at least not in thedeveloped world. As Richard Heinberg argues persuasively in hislatest book, The End of Growth,growth has reached its limits, which are both numerous and insurmountable.

There is a plain and simple distinctionbetween the two kinds of money: real money, which was lent intoexistence with a specific and realistic promise of repayment by aspecific party, and fake money, which was dreamt into existence by acentral banker without anyone specifically promising to repay it.Suppose a person walks into a grocery with fake money in his wallet,and buys something. This is no different from paying withcounterfeit money: the grocer is getting robbed. But there is also adifference: the officially issued fake money is indistinguishablefrom real money. But just because you can't spot a fake doesn't meanthat you aren't getting robbed. And so the fake money mixes with thereal money and sloshes about the economy, robbing each person whotouches it, until everybody is poor. Since poor people can't pay backbig loans, the central banker's conceit that the fake money is debtseems rather unjustified. It is owed by the central banker to thecentral banker, and it would be foolish of us to expect him to everwork it off.

I am using the word "robbery" here not to indicate moral indignation or feigned umbrage, of the "I am shocked! Shocked to find that gambling is going on in here!" variety. I might even say that sometimes robbery is justified ("expropriation" or "commandeering" are its more polite, civilized variants). I am using it because the trick—paying with a fake—is an obvious one, and the result—the robbed party becomes poorer—is obvious as well. And so whether it is a retiree spending his deficit-financed social security check at the dollar store or a banker spending his bailout-financed bonus on lavish gifts for his trophy girlfriend, or a construction worker drinking his economic stimulus-financed paycheck at the bar, somebody somewhere is getting robbed—and becoming poorer.

Rest assured, I am not advocatingletting people starve or forgo beer or anything of the sort. A warmbed and three squares a day is, to me, a human right. I am notinterested in policy (nor are policymakers interested in me). But Iam interested in making a specific prediction: that government andcentral bank efforts to stabilize the financial system and restarteconomic growth will do the exact opposite: they will destroy thatwhich they are trying to save more completely although a little bitlater. They are living on stolen time.

The alternative (in case policymakers suddenly decided topay attention and were capable of taking on board such a radicalnotion) is a jubilee: full repudiation of all debts public andprivate and a ban on all repayments, repossessions and collectionactivities. This would force a full shutdown and cold restart of thefinancial system. But it will probably have to happen anyway. In themeantime, do your best to avoid getting robbed.

Published on October 01, 2011 16:50

September 24, 2011

Peak Oil: Laherrère responds to Yergin

Daniel YerginBy Matthieu Auzanneau, Le Monde

Daniel YerginBy Matthieu Auzanneau, Le MondeTranslated from French by Natasha

Jean Laherrère, co-founder of the Association for the Study of Peak Oil is a retired expert from Total, picks apart the latest analysis from the champion of optimists, the American Daniel Yergin.

Daniel Yergin is back. The author of The Prize, an oft-cited history of oil which glorified the industry, last week has published an editorial in The Wall Street Journal, in advance of the release of his latest work, The Quest.

Daniel Yergin is the vice-president of IHS, a powerful economic intelligence agency considered to be very close to the major American oil companies. The arguments this first-rank analyst develops in the Wall Street Journal is a long-awaited counterattack on the proliferation of alarming forecasts for the future of global oil production.

Daniel Yergin admits that success in satisfying future demand for petroleum constitutes a "challenge". But he has severe doubts about the credibility of the members of ASPO, the Association for the Study of Peak Oil, who claim that this battle has already been lost, due to lack of sufficient oil reserves that remain to be exploited.

In his portrayal of the current situation, the vice-president of IHS omits a key fact: conventional oil production (the classical liquid oil which comprises 80% of the current crude oil supply) reached its absolute peak in 2006. The date of 2006 was predicted back in 1998 by Colin Campbell and Jean Laherrère, two petroleum geologists who founded ASPO.

And so I have asked Jean Laherrère, the old chief of exploration technology at Total, to react to the key statements contained in the optimistic analysis provied by Daniel Yergin.

Daniel Yergin: "Only From 2007 to 2009, for each barrel of oil produced in the world, 1.6 barrels of new discoveries were added."

Jean Laherrère: Daniel Yergin cites official, political estimates published in the Oil & Gas Journal and by BP. According to these figures, global reserves were at 1253 billion barrels (Gb) in 2007 and at 1333 Gb in 2009, after the addition of 72 Gb of extra-heavy Orinoco oil discovered in Venezuela... in the late 1930s. What is, let us say, astounding about this, is that Mr. Yergin ignores the figures from his own agency, IHS.

These figures, here they are. (They are supposed to be highly confidential, but they have been circulated among us petroleum geologists.) Note that they do not incude the extra-heavy oil

Discoveries (Gb)Production (Gb)200710.026.0200813.026.3200912.425.8Total35.478.1

The reality is that for each barrel produced less than 0.5 barrels have been discovered, and not 1.6! Oil continues to be consumed faster than it is discovered. This situation has lasted for a quarter of a century now.

Daniel Yergin: "Example [of revolutionary technology]: the 'digital oil field', which makes use of sensors distributed throughout the oil field, to improve the data and the communications between it and the technology centers of companies. If it came into widespread use, this technology can could help exploit an enormous quantity of additional oil everywhere across the world—according to one estimate, this represents 125 billion barrels of additional reserves, equal to the actual estimated reserves of Iraq.

Jean Laherrère: It is at present quite fashionable to talk of the "digital oil field" to impress investors. But to this day I have not come across any mature field that has significantly increased its reserves by the use of this technology. To pretend to be able to grow reserves by 125 Mb [sic] thanks to this technology amounts to nothing more than wishful thinking, and does not stand up to any serious study.

How does one increase the size of recoverable reserves of oil fields? Well, first of all, there are secondary recovery techniques: the use of water or gas injection to maintain field pressure. This is a practice that is in actual use from the very begginning on all new oil fields.

Tertiary recovery (in English, EOR, for "enhanced oil recovery") is used to modify the properties of the liquids: thermal methods (by using steam), chemical, or injection of oil-soluble gases such as CO_2. It's in the United States that EOR is most developed. And yet the number of EOR projects has gone down from about 500 in 1986 to only 200 in 2010. They yielded 600000 barrels per day (bpd) in 1986. From 1992 to 2000, they have remained level at around 750000 bpd. In 2010, they produced no more than 650000 bpd, adn this despite high oil prices and the generous easing of environmental regulations of the Bush era.

Technology can do nothing to modify the geology of an oil reservoir! It just allows it to be produced faster, thereby accelerating the decline of mature fields... Here's an example: the very pronounced production declines at the giant Mexican Cantarell field, which made use of massive nitrogen injections.

The rate of recovery of a feld depends above all on the properties of the field and the liquid it contains. This rate can be as high as 80% for sandstone or very porous limestone, and might not exceed 1% for a tight reservoir with isolated pockets.

Daniel Yergin: "A study produced by the US Geological Survey has uncovered evidence that 86% of oil reserves in the United States do not correspond to the what was estimated at the moment of discovery of the fields, but to revisions and additions made after subsequent development.

Jean Laherrère: Evidence that the proven reserves of the United States do not increase: over the last decade, according to the US Department of Energy, the amount of upward revisions of U.S. reserves is roughly equal to the amount of downward revisions [pdf, see column 2: "net revisions"].

What allows Mr. Yergin to believe anything different? In the United States, reserves are reported according to the rules imposed by the SEC, the policeman of Wall Street. From 1977 to 2010, these rules required oil companies to report as "proved" only those reserves that were directly accessible by the wells already in production. The SEC prohibited the reporting of reserves called "probable" and found in the vicinity of these wells, even if the probability was very high.

This misleading rule was designed to protect the bankers who, if a producer went bankrupt, could decide to seize only the producing wells. This very narrow definition was anything but reliable, because it led to an underestimation of the actual reserves of American oil fields at the beginning of production, and their subsequent systematic upward re-evaluation.

Take, for example, the Kern River field, located in California. Since 2000, production from this old field has declined steadily. However, the amount of reserves reported for Kern River rose from 318 million barrels in 2000 to 542 million barrels in 2010. This amazing growth is due to the fact that between 2000 and 2010, 560 new wells were put into production (but failed to halt the decline of Kern River)!

Only the addition of both proven and probable reserves allows a field to be evaluated correctly. This method, called EPS, is now used everywhere the world—I actually participated in its development in 1997. Everywhere ... except in the United States. The growth of U.S. reserves which Mr. Yergin celebrates owes nothing to the advancement of technology: its cause is the incorrect method advocated by the SEC until 2010.

Moreover, since 2010, the SEC has lurched from one extreme to another. It now allows estimates of proved reserves not only from producing wells, but according to an evaluation model of the entire field that companies can keep secret! This new method supports all kinds of excesses and abuses, which have been denounced in the New York Times in particular.

This new SEC rule bore fruit in the form of the considerable growth of U.S. reserves of shale gas. Again, this has nothing to do with the implementation of technologies that are supposedly "new", but which in reality have been perfected thirty years ago, such as horizontal drilling and hydraulic fracturing of rocks. [Editor's note: land speculation fueled by questionable claims for reserves of shale gas is going to feed a large bubble in the U.S., according to an investigation by Ian Urbina New York Times, who is also the author of the article cited above.]

Daniel Yergin lies on reserves, just as Greece has lied about its deficits. Warning: in the world of energy, there are no rules—except to make money, and there are no referees and umpires!

Finally, a little background. In 2005, Daniel Yergin published an editorial in the Washington Post in which he was already mocking the pessimists, and in which he predicted that by 2010 global oil production capacity could increase by 16 million barrels per day (Mb/d) from from 85 to 101 Mb/d. Since then, global production capacity remained on a plateau of about 86 Mb/d... You ought to go back and re-read yourself, Mr. Yergin.

[Daniel Yergin's editorial has elicited other strong reactions among those who support the hypothesis of an imminent decline in the global production of liquid fuels. These include, notably, an on-line article by Professor Kjell Aleklett, president of ASPO International.

In 2008, Glenn Morton, a an American geophysicist and investor, published what he presented as an inventory of the optimistic but incorrect predictions about the state of the oil market provided over the years by Daniel Yergin and IHS.]

Published on September 24, 2011 14:12

Dmitry Orlov's Blog

- Dmitry Orlov's profile

- 48 followers

Dmitry Orlov isn't a Goodreads Author

(yet),

but they

do have a blog,

so here are some recent posts imported from

their feed.