Mr. Money Mustache's Blog, page 7

January 2, 2018

Why Bitcoin is Stupid

Well, shit. I’ve been watching this situation for a few years, and assuming it would just blow over so we wouldn’t have to talk about it here in this place where we are supposed to be busy improving our lives.

Well, shit. I’ve been watching this situation for a few years, and assuming it would just blow over so we wouldn’t have to talk about it here in this place where we are supposed to be busy improving our lives.

But a collective insanity has sprouted around the new field of ‘cryptocurrencies’, causing a totally irrational worldwide gold rush. It has reached the point that a big percentage of stories in the financial news and questions in Mr. Money Mustache’s email inbox are about whether or not we should all ‘invest’ in BitCoin.

We’ll start with the answer: No, you should not invest in Bitcoin. The reason is that it’s not an investment. Just like gold, tulip bulbs, Beanie Babies, 1999 dotcoms without any hope of a product plan, “pre-construction pricing” Toronto condominiums you have no intent to occupy or rent out, and rare baseball cards are not investments.

These are all things that people have bought in the past, and driven to completely irrational prices, not because they did anything useful or produced any money and value to society, but solely because they thought they would be able to sell them to someone else for more in the future.

When you make this kind of purchase, which you should never do, you are speculating, which is not a useful activity. You’re playing a psychological, win-lose battle against other humans with money as the only objective. Even if you win some money through dumb luck, you have lost some time and life energy, which means you have lost.

Noticed this ad on the corner of a website recently … because we ALL need daily updates on an obscure piece of niche software technology!

Investing means buying an asset that actually creates products and services and cashflow for an extended period of time. Like a piece of a profitable business or a rentable piece of real estate. An investment is something that has intrinsic value – that is, it would be worth owning from a financial perspective, even if you could never sell it.

Now, with that moral sermon out of the way, we might as well talk about why Bitcoin has become such a big thing, so we can separate the usefulness of the underlying technology called “Blockchain”, from the mania about how people have turned Bitcoin it into a big dumb lottery.

This separation is important because the usefulness of Blockchain is the primary justification people use for the big dumb Bitcoin lottery.

Once you make this separation in your mind, you can see that Blockchain is a simply a nifty new software invention (which is open-source and free for anyone to use), whereas Bitcoin is just one well-known way to use it.

Blockchain is just a computer protocol, which allows two people (or machines) to do transactions even if they don’t trust each other or the network between them. It can have applications in the monetary system, contracts, and even as a component in higher level protocols like sharing files. But it’s not some spectacular Instant Trillionaire piece of magic.

As a real world comparison, I quote this nifty piece from a reader named The Unassuming Banker:

… imagine that someone had found a cure for cancer and posted the step-by-step instructions on how to make it on-line, freely available for anyone to use.

Now imagine that the same person also created a product called Cancer-Pill using their own instructions, trade marked it, and started selling it to the highest bidders.

I think we can all agree a cure for cancer is immensely valuable to society (blockchain may or may not be, we still have to see), however, how much is a Cancer-Pill worth?

Our Banker friend goes on to explain that the first Cancer-Pill might initially see some great sales. Prices would rise, especially if the supply of these pills was limited (just as an artificial supply limit is built right into the Bitcoin algorithm.)

But since the formula is open and free, other companies would quickly come out with their own cancer pills. Cancer-Away, CancerBgone, CancEthereum, and any other number of competitors would spring up. Anybody can make a pill, and it costs only a few cents per dose.

And yet imagine everybody started bidding up Cancer-Pills, to the point that they cost $17,000 each and fluctuate widely in price, seemingly for no reason. Because of this, newspapers start reporting on prices daily, triggering so many tales of instant riches that you notice even your barber and your massage therapist are offering tips on how to invest in this new “asset class”.

But instead of seeing how ridiculous this is, even more people start piling in and bidding up every new variety of pills (cryptocurrency), over and over and on and on, until they are some of the most “valuable” things on the planet.

NO, right?

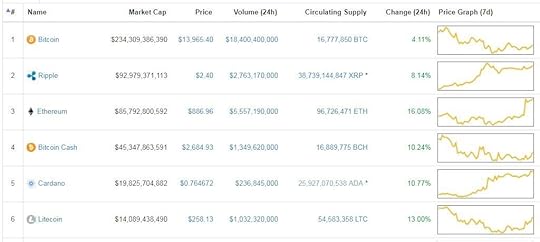

And yet this is exactly what’s happening with Bitcoin. And if you haven’t been digging into the cryptocurrency world much, it gets way weirder than this. Take a look at this shot from the website coinmarketcap.com, and observe the preposterous herd behavior in real life:

Fig.1: Various cryptocurrencies, ranked by how many people have been fooled.

“Holy Shit!” is the only reasonable reaction. You’ve got Bitcoin with a market value of $234 Billion Dollars, then Ripple at $92 billion with Ethereum right behind at $85,792,800,592.

These are preposterous numbers. The imaginary value of these valueless bits of computer data represents enough money to change the course of the entire human race, for example eliminating all poverty or replacing the entire world’s 800 gigawatts of coal power plants with solar generation. Why? WHY???

An Aside: Why should we listen to you, Mustache?

I’m only a mediocre computer scientist. But coincidentally, after I got my computer engineering degree I ended up specializing in security and encryption technologies for most of my career. So I did learn a bit about locking and unlocking information, hacking, and ensuring that independent brains (whether they are two adjacent CPUs on a circuit board or two companies negotiating across the Pacific) can trust each other and coordinate their actions in lockstep. I even read about these things for fun, with Simon Singh’s The Code Book and the Neil Stephenson novel Cryptonomicon being particularly fun shortcuts to pick up some of the workings and the context of cryptography.

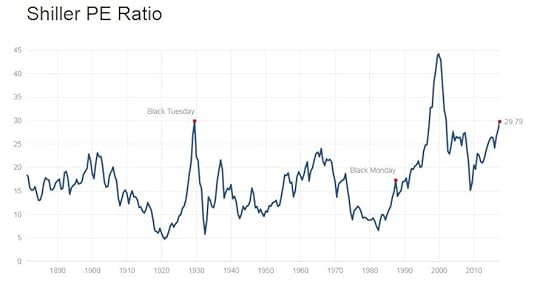

But that’s just the software side (Blockchain). Bitcoin (aka CancerPills) has become an investment bubble, with the complementary forces of Human herd behavior, greed, fear of missing out, and a lack of understanding of past financial bubbles amplifying it.

Mustachianism – the mental training that gets you to very early financial freedom – requires you to evaluate inefficiencies in our culture and call bullshit upon them. Even if you are the only one in the room willing to do it.

In the field of personal wealth, this means walking your children past the idling lineup of your neighbors’ Mercedes SUVs, over the snowy grass and up to the door of the school – and being confident that you are doing the right thing. Even if you’re the only one doing it.

When evaluating investment bubbles, it means looking at where everyone is throwing their money – no matter how many billions – and being willing to say “Bull. Shit. Guys. Not going to do this with you.”

So I also read a lot about investment bubbles and fundamentals and how to tell those apart. One book that I found very useful in understanding the greed-fear cycle (and Central Banking and the Federal Reserve system to boot) is the 2001 classic Towards Rational Exuberance by Mark Smith. For a shortcut to understanding good investing, you can also simply look up Warren Buffet’s thinking on almost any topic – he’s careful enough about offering opinions that by the time he makes a statement on something, you can be pretty sure it will be among the best answers out there.

And of course, the purpose of this whole aside is that I want to establish credibility with you, so you will give this article some consideration. I believe the current Cryptocurrency “investment” mania is a huge waste of human energy, and our rate of waste has been growing exponentially.

The sooner we debunk the myth and come to our senses, the richer our world will be. So we need more credible people to speak out against it. If you’re one of these credible people, please do so in the comments or in a blog post on Medium that we can all read.

Why was Bitcoin Even Invented?

Understanding the motivation is a big part of understanding Bitcoin. As the legend goes, an anonymous developer published this whitepaper in 2008 under the fake name Satoshi Nakamoto. It’s well written and pretty obviously by a real software and math person. But it also has some ideology built in – the assumption that giving national governments the ability to monitor flows of money in the financial system and use it as a form of law enforcement is wrong.

This financial libertarian streak is at the core of Bitcoin, and you’ll hear echoes of that sentiment in all the pro-crypto blogs and podcasts. The sensible-sounding ones will say, “Sure the G20 nations all have stable financial systems, but Bitcoin is a lifesaver in places like Venezuela where the government can vaporize your wealth when you sleep.”

The harder-core pundits say “Even the US Federal Reserve is a bunch ‘a’ CROOKS, stealing your money via INFLATION, and that nasty Fiat Currency they issue is nothing but TOILET PAPER!!”

It’s all the same stuff that people say about Gold, which is also a totally irrational waste of human investment energy.

Government-issued currencies have value because they represent human trust and cooperation. There is no wealth and no trade without these two things, so you might as well go all-in and trust people. There are no financial instruments that will protect you from a world where we no longer trust each other.

So, Bitcoin is a protocol invented to solve a money problem that simply does not exist in the rich countries, which is where most of the money is. Sure, an anonymous way to exchange money and escape the eyes of a corrupt government is a good thing for human rights. But at least 98% of MMM readers do not live in countries where this is an issue.

So just relax, lean into it, and grow rich with me.

OK, But What if Bitcoin Becomes the World Currency?

The other argument for Bitcoin’s “value” is that there will only ever be 21 million of them, and they will eventually replace all other world currencies, or at least become the “new gold”, so the fundamental value is either the entire world’s GDP or at least the total value of all gold, divided by 21 million.

People then go on to say, “If there’s even a ONE PERCENT CHANCE that this happens, Bitcoins are severely undervalued and they should really be worth, like, at least a quadrillion dollars each!!”

This is not going to happen. After all, you could make the same argument about Mr. Money Mustache’s fingernail clippings: they may have no intrinsic value, but at least they are in limited supply so let’s use them as the new world currency!

Why not somebody else’s fingernail clippings? Why not one of the other 1500 cryptocurrencies? Shut up, just send me $100 via PayPal and I’ll send you a bag of my fingernail clippings.

Let’s get this straight: in order for Bitcoin to be a real currency, it needs several things:

easy and frictionless trading between people

to be widely accepted as legal tender for all debts, public and private

a stable value that does not fluctuate (otherwise it’s impossible to set prices)

Bitcoin has none of these things, and even safely storing it is difficult (see Mt. Gox, Bitfinex, and the various wallets and exchanges that have been hacked)

The second point is also critical: Bitcoin is only valuable if it truly becomes a critical world currency. In other words, if you truly need it to buy stuff, and thus you need to buy coins from some other person in order to conduct important bits of world commerce that you can’t do any other way. Right now, the only people driving up the price are other speculators. The bitcoin price isn’t rising because people are buying the coins to conduct real business. It’s rising because people are buying it up, hoping someone else will buy it at an even higher price later. It’s only valuable when you cash it out to a real currency again, like the US dollar, and use it to buy something useful like a nice house or a business. When the supply of foolish speculators dries up, the value evaporates – often very quickly.

Also, a currency should not be artificially sparse. It needs to expand with the supply of goods and services in the world, otherwise we end up with deflation and hoarding. It also helps to have wise, centralized humans (the Federal Reserve system and other central banks) guiding the system. In a world of human trust, putting the wisest and most respected people in a position of Adult Supervision is a useful tactic.

Finally, nothing becomes a good investment just because “it’s been going up in price lately.”

If you disagree with me on that point, the price of my fingernails has just increased by 70,000% and they are now $70,000 per bag. Quick, get me that money on PayPal before you miss out on any more of this incredible “performance!”

Figure 2: Random people on Twitter doing some deep, useful Investment Analysis on Bitcoin.

The world’s governments are not going to let everyone start trading money anonymously and evading taxes using Bitcoin. If cryptocurrency does take off, it will be in a government-backed form, like a new “Fedcoin” or “G20coin.” Full anonymity and government evasion will not be one of its features.

And you don’t want it for this purpose anyway – after all, do you currently hide your money in offshore tax havens and transact your business on black markets? Do you practice illegal tax evasion as your primary wealth strategy? Probably not, because life is better and wealthier when you aren’t living a life of crime.

The Cryptocurrency bubble is really a replay of the past: A good percentage of Humans are prone to mass delusions which lead to irrational behavior. This is a known bug in our operating system, and we have designed some parts of our society to protect us against it.

These days, stocks are regulated by the SEC, precisely because in the olden days, there were many, many stocks issued that were much like Bitcoin. Marketed to unsophisticated investors as a get-rich-quick scheme. The very definition of an unsophisticated investor is “Being more willing to buy something, the more its price goes up.”

Don’t be one of these fools.

Further Notes

This YouTube Video is one of the best shortcuts I found for explaining how Blockchain works.

This Vice article explains yet another ridiculous aspect of Cryptocurrency: running the transaction network (called “Mining”) involves a deliberate computer-intensive crypto challenge syetem called “proof of work”. This inefficient design is now wasting more electricity than many entire countries. Doing one transaction burns 215 kilowatt-hours of electricity, enough to run the entire MMM household for more than a full month, or to power an electric car for more than 800 miles of driving.

Another interesting side-effect of bitcoin mining: big sales of computer graphics cards, and theft of electricity and cloud computer services. One of my coworkers at MMM-HQ works for Nvidia, and part of his job is hunting down the mining thieves. Some of my conversations with him inspired the research in this article.

I enjoyed this analysis by Aswath Damodaran, a thoughtful investor and Professor at NYU school of business

Another intelligent case by highly experienced crypto business lawyer Preston Byrne. Favorite quote:

“Bitcoin’s growth is not based on its technology alone (which, while powerful, is open-source and therefore easily replicable) but rather on the strength of virality, encouraged by the vested interests who held early and invested in marketing it; with no genuine business underlying it, it acquires its (very substantial) memetic potency only from the evangelism of those who hodl and preach.”

December 4, 2017

How to Give Money (and Get Happiness) More Easily

If you have more money than you need, you should start giving some of it away. That’s the lesson I learned about a year ago, when I took a gamble and donated $100,000 to a variety of charities, centered around the Effective Altruism movement.

More on Effective Altruism: The Life You Can Save website, and my earlier article on the subject.

At the time, I had no experience with giving to anyone other than immediate family and friends, so I didn’t know how I would feel about it. But over the course of this past year, I have had many late nights to reflect on life and what it means to live one that feels worthwhile. There are have been successes and failures, mostly happy times but also plenty of sadness shared with my siblings as our Dad made his departure.

During all this questioning of life, I kept thinking back to the times I’ve been less selfish and less fearful, and more willing to help other people. These were the things that reassured me that my life was indeed a good one, and that I wasn’t squandering the opportunity too badly so far. In short, being a good person was by far the most reliable source of happiness.

So. If hard work and generosity are what bring meaning to life, it makes sense to keep at it, even when it seems difficult. With this in mind, I vowed to make another round of donations of equal or greater size this year.

The Tricky Side of Philanthropy

While most people would assume that giving away money is easier than making it, when surveying wealthy people I have found the opposite is often true. After all, once you build a prosperous business or career, the income becomes almost automatic. You indulge in your natural and joyful tendency to work hard every day, and the money keeps flowing in, often faster with each passing year. There are no decisions to be made, and you know every dollar of net income is going somewhere worthwhile: to you.

But to give money away, you have to overcome a whole new set of challenges:

Overcome your fear of having less money.

After all, more is always better – you can always benefit from more security, right? (this is actually wrong, but it can be hard to recognize)

Figure out who is most deserving of your money.

It took so much time to earn the money and overcome the fear of giving – the last thing you want is to see it go to waste.

Figure out how to get that money to the worthwhile recipient.

You have to find their webpage, mail a check so the credit card company doesn’t steal 3% of your donation, and ask politely that they don’t put you on their mailing list and hound you for the rest of your life.

Sort out the tax consequences. In most cases, you can deduct charitable donations on the “itemized” part of your tax return, but until you hit the itemizing threshold of around $10,000 you might not get any benefit. On the other hand, certain charitable expenses are deductible directly from your business income, if you run a business.

“Too confusing already. Forget it, I’ll just keep my money.”

And thus, you end up in the same trap that keeps many people from being generous.

Since I had already pushed through the pain last year, I knew I could handle it and repeat the same thing this year. Just write the same checks and mail them to the same places. Job done.

But then I noticed a few shortcuts that make things even easier:

Betterment Investing just added a spectacular no-cost automatic donation feature. Using their existing tax-optimized system, they allow you to donate your most appreciated shares directly to any of their many connected charities. This gives you the maximum tax deduction right now, while reducing your taxes further when you later withdraw from your account later in life.

Paypal has a similar feature: even from within the minimalist phone app, you can click a “donate” icon and transfer out surplus bits of your balance directly to a large selection of good charities. Paypal does its part by not taking any fee for these donations, no matter how large. You can use up existing paypal balances, or have them draw through your connected checking account – I found this was a very smooth and easy way to try your hand at giving.

MMM Headquarters Becomes an Automatic Philanthropy Machine

MMM Headquarters shows off its holiday style, just last night.

I noticed that PayPal feature because I happen to have a constant, growing surplus in my account these days, as a result of starting the MMM-HQ Coworking space right here in downtown Longmont.

The money side of this situation is pretty interesting:

We bought the property (which now hosts two businesses) for $225,000, which means my half cost me only $112,500.

Then I spent about $30,000 in materials and subcontractors to whip it into shape. (Plus about 700 hours of my own labor, which I happily donated)

We now have about 60 paying members at $50 per month each, for a total of $3000 per month or $36,000 per year.

But the coworking space is still kind of quiet during the days, so we can sign up a few more people and bring this annual number to $50,000.

Property taxes ($4k), Utilities and Beer ($1600), and ongoing upgrades ($10,000) only consume 30% of this budget, leaving a huge surplus, as long as I keep running it myself and don’t draw any salary.

Many people and companies have started donating supplies to us, in an unprompted show of generosity. Authors send us books, Nimbus Roasters keeps our coffee stocked, Urban Tribe sent a fancy electric cargo bike, Aerobis sent some cool strength training equipment all the way from Germany, Flatiron Spice Company brought in red and green chili spices, Lefthand gave us a discount on beer kegs, members are donating useful equipment like 3-D printers and weight training equipment from their homes, and the list goes on.So I figured, in the spirit of all this sharing, why don’t we make this building a philanthropy machine? Its ongoing profits can be donated to charities – both local and international – on a regular basis. Along with doing a lot of good, this will probably give all of us members a stronger sense of belonging.

What if I’m Not Ready to Give?

I’m writing this post to encourage people who have plenty, to consider giving it to help people (and parts of our natural environment) truly in need. If I can prompt you, wealthy person, to decide that giving to the world’s most effective charties, is even better than getting a slightly better car or leaving your children an extra-large estate, then this post might be the most effective one on this whole website.

But I do not want to make anyone feel guilty for not giving away money, when they don’t yet have a surplus. If you’re working hard and saving effectively for financial independence, abundance will come. If you’re not there yet, don’t stress out about it. There is no “tithing” in the imaginary religion of Mustachianism.

Details on Easy Giving

Some of the staff of Givewell in San Francisco office perform the “Mustachian Salute”

As part of writing this article, I made part of my $100,000 donation via Betterment’s new system. I have three accounts with the company (my public Betterment Experiment, a rolled-over IRA, plus a personal taxable account with the largest balance of the three). All three accounts have seen rapid appreciation due to the current boiling-hot stock market, so there are lots of capital gains available to harvest.

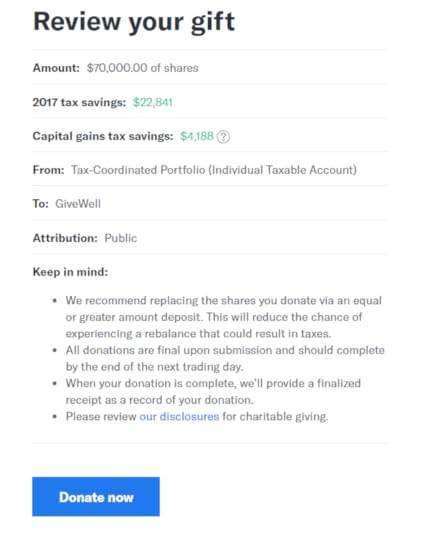

Donating appreciated shares expands the power of your giving compared to just giving cash, which is quite a neat trick. This quick table from Betterment’s new Charitable Giving Explainer page lays it out very simply:

In this example, your donation nets about 19% more tax savings than a direct cash donation.

So I tried the same thing in real life. The largest of my donations this year ($70,000) was to GiveWell, through the Betterment system. As I fired it up, Betterment automatically estimated my tax savings in real time:

This $70,000 donation will cut my 2017 tax bill by $22,841.. AND reduce my eventual capital gains taxes by $4188. This is the true power of donating appreciated shares.

As with last year’s donation, this biggest chunk went to charities based on the Effective Altruism philosophy. What this means in practice is, “Create the best results for humans possible, on a worldwide basis, with each dollar.”

I believe this is both the most humane and the most logical way to donate money, because of the following course of events which has been proven again and again:

Improve developing world health and education

-> these people have better lives immediately

-> but also the more empowered people also choose to have smaller families

-> world population growth slows and eventually reverses -> everybody wins.

So in this round of donations, here is where the money went. You can click each charity name to get to their own website for easier research.

Charity

Amount

Funding Source

Givewell

November 22, 2017

Mr. Money Mustache, UBER Driver

Special Surprise: Did you know there is now an MMM Android App? It’s really good. Beautiful offline reading. Alerts you to new articles automatically, if you want. Thousands of users already. Free. Many more features (plus an Apple version) to come. It’s on the Google Play Store.

—-

About two years ago, I switched from taking my personal car to the airport, to hailing Ubers and Lyfts. The math of it was pretty simple: Uber was cheaper than paying for my driving and parking*. And that was before the considerable joy and time savings of not having to park in the airport lot and cram in among the huddled masses in the shuttle buses. Nowadays I sit in the back and get some work done like an Executive, leaving the driving to someone else.

Once I arrive at my destination city, these ride sharing services have replaced at least 90% of instances where a car rental would be useful. Between walking, renting a bike, public transit and calling a Lyft, a car rental is only useful for destinations deep in the boondocks such as a ski resort or a distant beach cabin. Which is another great improvement, since renting a car at an airport has never been a fun experience.

But during all these Luxury Executive rides, I’d often get to talking with the driver. We would talk about life, family, money and business. I always inquired about their experience with rideshare driving, and the response was inevitably something like this:

UBER DRIVER: “Oh, it’s pretty good. On a good day I’ll make a hundred bucks, sometimes even two hundred if I really work it and stay up late.”

MMM: “Is that your profit after subtracting the cost of driving?”

UBER DRIVER: “No, that doesn’t include gas. But I’ll only use, like, not even a full tank – maybe thirty bucks”

“Hmm”, I would think to myself.

“If this driver is burning through $30 of gas, (twelve gallons), they’re probably covering over 250 miles. Whether they realize it or not, it’s costing them $125 in direct car costs before even accounting to the damage to their health or the risk of injury. Thus, the net profit might be as low as $50 for a big day on the road, or five bucks an hour.”

There’s no way Uber could be such a successful company if the pay rate were really this low. Is there?

But on the other hand, some of my Uber drives to the airport have included a Dodge Ram pickup truck (V-8 engine, fancy wheels, bought brand new on credit), a BMW X5 and even a Hummer H3 (with over 250,000 miles on the odometer). Maybe people really are that uninformed about the cost of driving. As my friend Bill said when we talked about this:

“Imagine developing a company specifically to take advantage of people’s ignorance of how expensive it really is to drive their own car. What would this company look like? “

(the answer is of course that it would look like very much like Uber or any other ridesharing company)

To resolve this mystery (and as a way of getting some test miles on my new electric car), Mr. Money Mustache decided to go deep undercover in September 2016, and sign up as a driver for both Uber and Lyft services.

The Initiation

Using another driver’s referral code, I signed up on the Uber system and started to follow the instructions. I needed a background check, medical exam, car safety inspection and a few other daunting things. Luckily, Uber runs facilities called “Greenlight Centers” which put all this stuff in one place. The closest one to me was about 40 miles away in Denver, so I charged up my new Leaf and headed down.

When I arrived, I found an interesting scene that nicely personifies our new sharing economy. It was a mashup of an Apple Store and the DMV. Modern design and furniture, good music and glossy tablets everywhere, combined with an ocean of slightly desperate and bored looking people waiting to start their new driving careers. And Mr. Money Mustache, trying to blend in.

It was a funny feeling, spending those three precious hours of my Tuesday morning, waiting in queues and filling out forms. I was keen to learn about the driver experience and how things work in the New Economy. But I also felt a bit of the nervous “I’m applying for a new job” energy of the other applicants, and like a bit of a fraud for being here when I had absolutely no interest in truly having a job.

There was a trendy little cafe in the corner of the room, so I strolled over and picked up a Clif bar and a coffee. Due to my naive privilege as a former tech worker, I expected it all to be free – after all, don’t all offices offer free coffee and snacks, along with a keg of local beer and another tap for Kombucha? But a man popped out from around the corner and rung me up for $3.85. On top of that, it was a bland coffee in a small cup. This was an interesting reminder that working in a lower-training job is a different world than the one you and I probably both inhabit, here at the top of the economy.

When the process was finally done, my 25-year-old Uber concierge looked up from his iPad and issued me a genuinely warm congratulations and we shook hands.

“So that’s it?”, I asked

“Yeah! That’s it! You could go out and get in your car start making some money RIGHT NOW!”

“Hmmm…”

“Nah”, I thought to myself. “Eighty miles of driving plus three hours in an office building is more than enough wasted indoor time for me for the next little while.”

The spoiled retiree in me loves hard work, but only the right kind of hard work. The sedentary locked-indoors variety of work always falls to the bottom of the list. As you can tell by the low frequency of these blog posts.

My First Ride

Eventually, I was ready to give it a whirl. I cleaned up my car, stuck the Uber decal on the windshield, put on some nice clothes, mounted my phone on a sturdy dashboard clamp, and fired up the app. Within minutes, I had my first ring.

RIDE REQUESTED! John, 5 minutes away.

The ring was deafeningly loud, because (as I later learned after half an hour of looking unsuccessfully for a way to change it) the Uber app overrides your ring volume setting and sets it to !!MAXIMUM!! I was so startled that I could hardly slide the “accept” button, but I eventually got safely on the road.

I recognized the address as Longmont’s “Pumphouse” brew pub, right downtown. I headed down the hill and scoped the area, and eventually found John. As he hopped in the car I slid the “start trip” button and his destination was revealed as the local Marijuana shop, just 1.9 miles away away.

John and I exchanged pleasant conversation and he was impressed by the quick silence of the electric car. I dropped him off at Native Roots and then parked nearby, expecting another fare to pop up just as quickly.

Ride 1: 5 minutes waiting, 5 minutes driving, 1.2 miles unpaid, 1.9 miles paid. Net fare to me: $3.37

But the second fare wasn’t quite as quick. Fifteen minutes later, the Uber app rang again. It was John, now properly restocked and thrilled that I was still there in the weed shop parking lot. We headed back to the Pumphouse.

Ride 2: 15 minutes waiting, 5 minutes driving, 1.9 miles paid. Net fare to me: $3.37 … plus TIP $5.00!

Hey this wasn’t so bad: that five dollar tip really brought up the average. I was thirty minutes into my career and up about 12 bucks, minus five miles of car costs.

After another five minutes of idle time, the app rang again. This time it was a suburban address listed as 12 minutes (which turned out to be almost four miles) away. I decided to take the ride anyway, in the spirit of experimentation.

I got to the house, but nobody was there. After a minute, I used the Uber app to send the customer a text message. “Oh sorry!”, he said, “My phone GPS isn’t working well because we’re inside so it probably shows us in the wrong place! We’re just on the next street.”

I drove around a bit more and eventually found the young couple, and the app revealed a nice surprise: they were headed all the way to Boulder, which was over 12 miles from this part of Longmont. Surely now I would start earning the big bucks.

After 24 minutes of smooth, expert driving and pleasant conversation, I dropped them off at a restaurant. But I was surprised to see that the total wasn’t that impressive:

Ride 3: 10 minutes waiting, 4 miles unpaid, 12.4 miles paid. Net fare to me: $13.96. No Tip.

Driving in the Happening City

Now I was in Boulder, which has a much bigger scene than Longmont. Everybody is rich, every night is a big night, Colorado University is right downtown and it’s all action – there are no real suburbs. Due to high rider demand, the city operates in a perpetual “Surge Mode” which means Uber Fares are 20-30% more lucrative, and there is virtually no wait time for fares. And now, I was right downtown. So the app shrieked its notification tone immediately.

The customer was only a mile away, but due to the incredible slowness of trying to drive a 14-foot-long, 3300 pound Racing Wheelchair in a dense city it took me a lot of slow gliding in traffic and waiting at long traffic lights to get there. It was a couple of younger guys, heading back downtown.

We slogged through the dense traffic yet again at roughly one third of bicycling speed, and I earned my five dollar fare.

The app rang again, and I saw from the map it was yet another non-downtown person, probably looking for another ride downtown.

I decided not to play this game anymore, contributing to car traffic in a city that needs fewer cars. So I let this ride request go to another driver and set my destination to Longmont, hoping to find a customer heading that way so I could get paid for the ride home. There were none.

So I flew the Leaf back along the highway to home, and stopped at the grocery store to pick up some fresh food and a free battery charge for the car.

Total stats for the day:

4 Rides

1:51 hours

18.6 miles unpaid

17.2 miles paid

$32 including tips

~$18 of car costs

roughly $7 per hour net

Ongoing observations

After joining Uber as a driver, it was easy to add on a Lyft license: you can submit scans or photos of the same examination info to both companies. So over the next few months, I fired up both Uber and Lyft apps to do a bit more driving and collect some more observations. I had a lot of fun, but made very little money.

One time, I was summoned by a 13-year-old girl coming out of the middle school, effectively turning me into Mr. Schoolbus Dad. After finding her in the school lineup, she directed me to the elementary school, where we picked up her little brother. I dropped them both off safely at home in a rusty suburban area nearby.

Another ride was from a college student, deep in the Colorado U campus. It took me forever to navigate the throngs of after school foot and vehicle traffic and find this young lad in the crowd. During the ensuing 3MPH transit of Boulder, I couldn’t help but remark, “Wow! I apologize for how slow this trip is going. I’m usually on my bike when I cross Boulder, which is a lot faster.”

Our final destination was a strip mall, and he directed me meticulously through the entire parking lot so he could be let off within 20 feet of the front door of the restaurant. End fare for about 35 minutes of work, even with surge pricing, was another six bucks. My resolve to avoid driving cars in Boulder was reinforced.

My favorite times to be a driver were Friday nights. It was fun to feel the energy of people going out on the town, and find out what was going on. I could see Uber driving to be a good escape for single people looking to meet new friends (or romances), because I almost always got along well with the customers, often exchanging business cards or email addresses with people when we found something in common.

On longer rides with people over 30, the topic almost invariably led to life, business, and money, which led to Mustachianism, which led to me admitting my secret identity. Thus, some of my past Uber customers may even be reading this article today(?)

But in the end, it was hard to stay motivated to keep doing this experiment. There is just usually something better to do than driving around in a car, and I wasn’t willing to sacrifice too much of my life to gather more data. And with the financial gain of rideshare driving being negligble, I am surprised that there are so many people who do it.

How to Make the Most of a Low-Profit Situation

Still, as with everything in life, I did my best to optimize Uber driving for both fun and money. From my experience as well as reading online forums, the best way you can do it is:

Use the referral and bonus system heavily. Actual driving doesn’t pay well, but I have seen bonuses pop up on my app offering between $100-$500 to refer other drivers. There are also “weekly guarantee” offers that come up occasionally, offering more pay in exchange for meeting a certain threshold.

Use the lowest cost and most fuel-efficient car you can find. Uber requires you to have a fairly new (under 10 years) car, so get something on the older side of that spectrum, but with low miles. A 2009 Prius, for example, uses less than half the fuel of most cars of similar size.

Focus your driving around on “Surge Pricing”. By watching the app throughout the days and months, you will learn when your area enters periods of higher demand. Special events like Halloween, late weekend nights or major league sports events are popular times.

Try to find trips involving highways. Since you get paid mostly by the mile, you earn almost ten times more more money at 60 MPH than you make in on a long trip through central city where you might average only 6 MPH.

Experiment with the “set destination” feature to filter for rides going your way. Taking fares with you on your commute to work or to an airport.

Make the most of your downtime: there will still be lots of waiting between fares. If you bring a book, podcast, laptop or make business-related calls that help you learn a trade that pays more than driving, you can get yourself into a more lucrative trade.

Suggestions for Uber and Lyft

During the course of this experiment, I happened to receive emails from relatively senior people at both Uber and Lyft for unrelated reasons. So I took the opportunity to make some suggestions to make things friendlier for drivers:

Report the total driving time and miles for each ride and each shift, clearly specifying paid and unpaid miles and hours.

Provide an drivers an estimate of the car costs incurred, and estimated hourly earnings after these costs

Allow drivers to specify the types of rides they are willing to accept. For example, “only ring me for riders within 1 mile”, or “I would like to be paid for for both pickup mileage and rider mileage.”

Provide drivers with the details of where the person is going, or at least how long of a ride it is. Right now, Uber has all this incredibly useful information at the time of booking, but deliberately withholds it from the driver.

I was surprised that both companies immediately dismissed all of these suggestions, with a round of vague excuses. This was a disappointment to the Economic Libertarian in me, because it seems obvious that an open market between buyer and seller is the key to more efficiency.

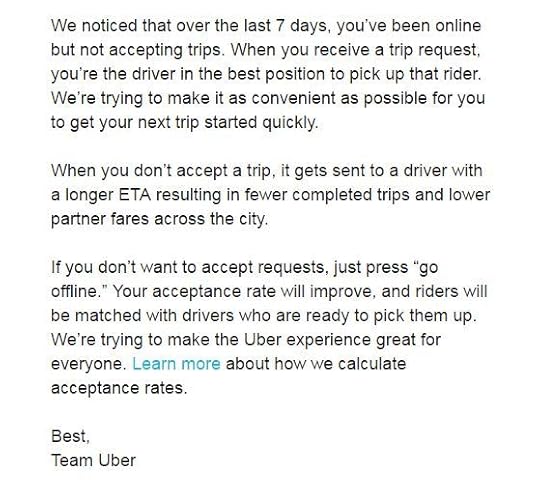

In fact, early in my driving career I learned how much the unpaid driving was hurting my profitability so I stopped accepting distant fares. The app quickly sent me this note:

Yeah, right. How about you just stop ringing me with fares that are ridiculously far away, or give me the opportunity to GET PAID FOR THE DRIVING, instead?

When these companies deliberately tilt the field, they are being sneaky, which causes them to lose public trust, which causes the public to vote in a bunch of sclerotic regulation to protect the drivers and the public. If you, as a company, just avoid being a dick to people in the first place and treat them with complete openness and good old-fashioned honesty, they are more likely to let you run free.

Since I started this experiment a year ago, Uber has fallen into a world of trouble and bad publicity. Their internal culture of sexual harassment was blown wide open, along with the misdeeds of the wild and temperamental former CEO. From specific programs to evade government regulation to annoying treatment of drivers, Uber triggered a widespread backlash which became the #deleteuber campaign. Saying “Uber” is now a bit like uttering the words “ConAgra” or “Philip Morris” or “Exxon”.

Meanwhile, from the very beginning I noticed a friendlier tone in the way Lyft operates – see this 2016 interview with Lyft more laid-back founder John Zimmer.

In the End..

In general, I really want companies like Uber and Lyft (and Tesla, AirBnb, Google, Amazon and many of the other tech companies that have been stirring things up so much lately) to succeed, because the benefits to all of us greatly outweigh the inconvenience of the disruption.

For example, some people worry about what will happen to driving jobs as self-driving vehicles gradually take over. But I’m excited about the ways this can make our lives safer, quieter, and less expensive as we give up on owning personal cars, ride bikes much more, and use automated cars as a service whenever the bike is impractical. Technology provides a lumpy ride, but it also provides change which is an essential ingredient in every human life to avoid getting into a rut. So, share on.

Further Reading: How Big Oil Will Die – an interesting walk through the changes today’s technologies have already set in place – leading us very quickly to a place where nobody in 2010 would have even guessed.

* this sentence surely made you ask, “but what about the BUS, Mustache?!?” – good question. Of course I’d always choose biking, then public transit as the first two options, but the airport is 45 miles away (well over 2 hours by bike) and the bus requires a transfer in Denver, which makes it even slower than biking. Also, both Uber and Lyft have referral programs which give you credit for referring friends – I still have a few credits in my Uber account.

If you want to try Uber or Lyft, sign by randomly choosing one of these codes from friends, and you’ll get $5-10 off of your first ride (and give a small surprise to some of the members of the MMM-HQ coworking space!)

Uber #1 Uber #2 Uber #3 Uber #4 Uber #5

November 5, 2017

When Your Shitty Health Insurance Doubles in Price

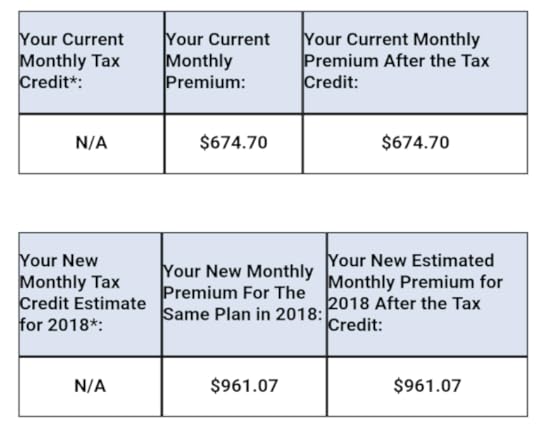

Well, despite Mr. Money Mustache’s outrageous optimism, I think we all saw this coming. I opened up my premium renewal email from Kaiser and saw this:

Well, despite Mr. Money Mustache’s outrageous optimism, I think we all saw this coming. I opened up my premium renewal email from Kaiser and saw this:

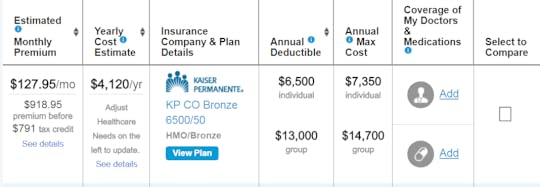

Figure 1: My new insane medical insurance premiums for the minimum available “Bronze” program, with a $6500 deductible.

My family’s monthly health insurance premium, which had already more than doubled in the last few years to $674 per month, was going up a further 44% for the coming year. For no good reason, other than perhaps the the current government’s attempts to kill off the Affordable Care Act. (By cutting various parts of the structure, the insurance market becomes less stable and predictable, and thus more expensive).

Now, before we go any further, I have to note that this is a situation that only affects high income earners. If we were really retired on a $30,000 passive income as we were for some of the decade before this blog started making significant money, our family’s monthly cost would be more like $128, due to tax credits and the Children’s Health Plus plan.:

Figure 2: Net insurance cost for a $30k per year family of three.

But in my email, I just saw the thousand bucks. And if you know how know how I feel about rules, unnecessary costs, and insurance in general, you can probably guess what my initial gut reaction was:

“Fuck. FUCK THAT! This is absolute bullshit. Fuck you, I quit, I’m not paying it.”

But, since I’m not sixteen years old anymore, I was eventually able to get past this first stage of the analysis and think about an actual course of action.

After all, all the power and freedom in the world is of no use at all, if you choose to wallow in your anger rather than taking steps to create the life you want. So I thought about why I was so angry. It boiled down to this:

The premiums are not an accurate representation of my risk.

The value of medical insurance is pretty easy to estimate: the National Institute of Health calculates that the average person consumes about $449,000* in health care spending over an 80-year lifetime, or $5600 per year. This is less than my plan’s deductible alone, which eliminates the value of insurance right off the bat. My plan really only covers catastrophically expensive events, which means it is unlikely that I will ever use it.

Plus, most medical spending is loaded towards the last decades of life, where the Medicare program already picks up the bulk of the costs. And, we are healthier than average – aside from one baby delivery about twelve years ago, none of us have ever actually benefited from health insurance in over nineteen years in the country.

When you add up these factors, it is obvious that the insurance is a bad deal. When presented with overpriced insurance, I always just choose not buy it, which is also called “self-insuring”. But whenever I talk about self-insuring for medical expenses, everyone asks the same question:

“But what if you do get hit by a falling piano and have to spend months in the Intensive Care Unit?”

The answer is that I guess I’d receive some large medical bills!

I’m not denying that an expensive treatment absolutely can never happen to me. I’m just putting an estimate and a limit on how much I am willing to pay for insurance on it.

Remember, health insurance not really health insurance. It’s just “large medical bill insurance” – a shaky precaution against having to pay for expensive procedures, so you can keep your investments instead of using them to pay the bills, perhaps eventually becoming poor enough that you are covered by public health insurance (Medicaid). A better name for it might be wealth insurance.

We have been trained to think that going without medical bill insurance is very risky. But that’s just because the subject appears frequently in the news. If it weren’t such a hot topic these days, the average person without a chronic illness would rarely think about it.

After all, by comparison, what precautions have you taken against being hit by a meteor? There could be one streaking towards you right now. It could kill you, or your children, or it could leave you with lifetime of chronic care costs. Are you telling me you don’t have separate meteor insurance? Why not?

In 2013 a 60-foot chunk of rock came from space and hit Russia with the force of 30 Hiroshimas. The human race escaped with just 1500 injuries, but only because the rock came in at a shallow angle and landed in a very remote area.

If space rocks are too far-fetched, how about motor vehicles? If you choose to drive a car, you are willingly throwing yourself into a far riskier situation than simply self-insuring for medical bills. Even more dangerous, statistically: being inactive and/overweight, a boat in which over 66% of us sail every day.

The point is that while huge, uncovered medical bills are inconvenient, they are rare. Therefore, my willingness to pay for insurance against them must have a limit. I’d definitely pay $50 per month for it, but should I be willing to pay $1000?

What about $2000? $4000? $12,000 or $1 million per month? I think that everyone would hit their “Fuck That” point somewhere in there.

And remember, this problem of expensive medical procedures is unique to the US. You can take your dollars almost anywhere else in the world and pay out-of-pocket to get the same (or better) quality care for a fraction of the cost. At some point, a rational person has to be willing to stop overpaying for this inefficient system.

After doing the math, I decided that my limit is definitely less than $1000, which means I should at least consider other options. So I looked into some of them:

Full Self Insurance

2.9 Months per year of Self Insurance (to avoid IRS penalty)

Medical Tourism

joining a “Healthshare Ministry” like Libertyshare

expat insurance like Cigna

Artificial poverty (reducing my income to a level where we’d qualify for subsidies)

Self Insuring is the easiest choice: you just don’t renew your insurance and start banking that sweet surplus right away. There is a tax penalty for that: $695 per adult, $347 per child, or 2.5 percent of your adjusted gross income – whichever is greater. Thus, a family with $100,000 of income would pay a $2500 fee. With my new premium at $11,500 per year, the penalty would still be cheaper all the way up to $461,000 in income. Plus, there are a surprising number of qualifying exemptions, including a death in the family within the last three years, a category which unfortunately includes me.

A 90 Day Insurance Vacation is the lightweight version of self-insurance. The penalty only applies if you were uninsured for three months or more. So if you set your new insurance to take effect on, say, February 27th, you cut your premiums by about 25% in exchange for the reduced risk protection. Just be sure to postpone your Wingsuit Jumping vacation until at least March.

Medical Tourism is an important thing that every US resident should be aware of. After all, we live in the country with the most overpriced medical procedures in the world – why should we insist on doing 100% of our shopping here? This would be like insisting you buy only US-produced goods and services: no electronics, no shoes, no Amazon and no blueberries in winter. We should all read a book or two on the subject to understand just how easy it is, to free ourselves from the US-centric assumption that doctors are shockingly expensive.

There’s a lightweight version of medical tourism too: simply comparing insurance pricing from one state and city to another. From a quick search I see that Colorado is one of the more expensive states for health insurance, with New York being the worst, and the best three being California, Utah and New Mexico. As with everything, it’s good to shop around when choosing where to live, and regularly challenge yourself by asking, “Is this where I’d settle down if starting from scratch?”

Health Sharing Ministries like Liberty HealthShare looked like the most promising loophole. Due to the strong influence of organized religion in the US, if you can join one of these, you are exempt from the tax penalty. The downside is the same as the upside: these ministries are exempt from ACA rules, which means they can drop you for having a pre-existing condition. And they also want you to affirm their value system, which can range from agreeable stuff like “taking care of your health” to excluding coverage for things that violate religious taboos like abortion or attempted suicide.

Expat Insurance sounded promising when I first heard about it from some fellow Canadian early retirees who write the blog Millennial Revolution. Companies like Cigna will cover you for worldwide medical costs for a fraction of what we pay here in the US. But the hitch is it only applies if you are truly on the road and don’t actually reside here. So it’s not an option for now. But in the long run when I retire to an oceanfront compound (or commune?) in Costa Rica, yes.

Reduced Income is the last and least feasible option on the list for me right now, but it’s genuine and not even artificial in the case of the typical early retiree.

Suppose you are retired with, say, a mortgage-free home and $800,000 in index funds, and living on a plentiful $30,000 per year. Your income tax return will show only about $18,000 in dividends, some of them even tax-exempt. On top of that, you’ll sell just a few shares and pay taxes only on the capital gains. This taxable income in the mid-20s will keep you in a very low tax and health insurance bracket.

So What Path Did the Mustache Family Take?

I brought all this stuff up to Mrs. MM – the other, less morally-outraged, leader of our household. Our conversation brought up a few things:

Although a $12k insurance bill is insane, we would not even notice a $12,000 difference in income taxes if the brackets were to change. We currently have a high income, but this has not caused us to increase our family spending at all. This is because of the magic of living below your means: once you have enough money, the surplus is just that: a big, fat, awesome bonus. Since I want this enormous surplus to go back to society over my lifetime, why should I be upset about some of it paying for other peoples’ health insurance right now?

But, I countered, this doesn’t apply to everyone. The typical MMM reader earns enough money to be hit by these higher premiums, and many are raising families and running small businesses, thus purchasing health insurance on the open market. At the same time, they are trying to save as much money as possible to reach financial independence while they are still young enough to enjoy it. Burning $12,000 per year on mostly-useless insurance can wipe out 25% or more of the amount you could otherwise save for retirement.

Given this, the Healthshare ministry was one of the better compromises. However, she felt that pretending to agree with a religion (especially if it’s one that actively oppose some things we value like same-sex couple equality and women’s reproductive rights) wasn’t worth it for us.

In my own hypothetical pre-retirement situation (a self-employed couple making $200,000) I would probably go for full self-insurance, simply paying the tax penalty whenever necessary and using medical tourism for any expensive procedures.

But also remember that if you’re a high-income business owner, your business can pay for your health insurance with pre-tax money. This cuts your net cost after taxes by 30-40%, making it a subsidized program after all.

So in the end, we’re just letting the policy auto-renew for now, using that last bullet point as a consolation prize. And these premiums will probably remain outrageous, unless we fix the underlying problem in the US: it’s not the insurance, it’s how much money we waste on medical care. If the Medical system could grow a Money Mustache**, I am certain we could cut our costs down by at least 75%, just as the average consumer can cut their costs by a similar portion just by learning to life a joyful and efficient life.

Footnotes:

* I adjusted the NIH paper’s 2000 numbers to 2017 dollars.

** Ideas for making US healthcare less expensive – please critique and add your own in the comments!

Eliminate the 75% of healthcare spending we currently waste on self-imposed lifestyle diseases: eliminate subsidized urban car infrastructure in favor of muscle-powered transportation. Treat soda and products with added sugar in the same way we currently treat liquor. Treat health and fitness (rather than medical treatment) like a human right, instead of a vanity accessory just for rich mountain-dwellers and celebrities.

Make health care purchasing look more like Wal-Mart and Amazon, and less like the DMV. Every standard procedure needs to be listed on a menu with a price, and those need to be on the front door so they are subject to competition. By huge national or even international companies and co-ops.

Drastically increase the supply of doctors, and make the job more enjoyable: Cut mandatory work hours for residents from 80 to 40 per week. Modernize the medical school curriculum to eliminate pointless memorization, reflect current technology and reduce the cost of the degree. Open the borders to qualified doctors from other countries. Allow telemedicine – let doctors in other countries certify easily for US diagnostics and prescriptions.

Elevate nurses to do all the stuff they already do, but in their own clinics without working for a doctor and paying the money up the chains.

Start using search engines and artificial intelligence for diagnosis, rather than flawed and expensive humans.

Open state and national boundaries for insurance and hospital services with only the required regulations for safety as we do with other imports.

Eliminate the right for anybody to sue for medical malpractice, or indeed for pretty much anybody to sue anybody else for anything. Let’s make our professional reputation and our actions public and then just suck it up like adults, reinvesting the enormous proceeds currently wasted on litigation.

Figure out if we can make single-payer health insurance work for us as it already does for most countries. There are many benefits, but the biggest is probably just eliminating all the mental energy we each waste on thinking about this mundane topic. As an analogy, imagine if every citizen had to hire their own police force for personal security – just think of how much energy and fear would be wasted on this topic, which we barely have to think about right now. As it turns out, it works the same way with health insurance.

October 24, 2017

Get Rich With: Conspicuous Consumption

MMM Note: The following is a lesson from our Canadian friend Mr. Frugal Toque, a long-time reader and contributor to this blog, and soon-to-be early retiree.

“This above all: to thine own self be true.”

– Commander Data, probably quoting some old English guy.

I can’t say for certain that we Mustachians need perfect honesty: I’d be lying to you. But if we’re to proceed with the utmost efficiency, we’re going to have to at least cut the crap out of our own lives when we look in the mirror and get down to business.

Do you drive a car? I do. Do you lie to yourself about how much the use of that car costs? I used to.

The Toque family makes an annual visit to Grandpa and Grandma Toque every summer, a family reunion of sorts to meet up with the entire Toque clan. Mrs. Toque and I would always record this journey, 600km in each direction, at a reasonable cost of about $100: billing the whole thing to ourselves as if it were simply the cost of gas.

We’ve made this journey for 18 years, every summer we’ve been married and the one before that, and sometimes more than once per year. To add to the issue, before we’d even met, I’d make that 1200 km round trip several times a year in a small sports car with at most one passenger, always billing it in my head as the price of gas.

I would lie to myself, basically. Even while train rides made themselves available, at something like $70 or so round trip, I’d take my own car because, “Hey, it’s same price, right? Plus, I’d have my car with me when I get there.”

Never mind that the Toque grandparents live within walking distance to everything and had extra space in their car for events farther away. No, I took my turbo-charged sports car on that long journey, never really accounting for the insurance, maintenance and depreciation it cost me.

Nowadays, having chosen the career Software Engineer over Professional Race Car Driver, I got rid of the sports beast and drive a tidy little Nissan Versa. It only burns through my cash at about 20 cents per km. Despite this savings, this past summer, we took the train on our annual sojourn.

First of all, I have to say, “Holy shit! Trains are awesome.”

If we book our train seats all at once, Mrs. Toque and I and get two comfy seats facing our two children. Then, like a particularly fast cloud, we get to drift lazily past all of the highways we’d normally find ourselves jammed up in. I calculate many tens of dollars of benefits associated with the absence of swearing at stupid drivers and worrying about getting ourselves in another highway collision requiring the procurement of a new car.

In my sports car days, my racing vehicle must have burned through at least 40 cents per km, some $500 per round trip, when a VIA train ride would have cost a tiny fraction of that for a single person. Nowadays, with four seats purchased for the entire Toque family, the cost of the equivalent train ride runs up to $360, exactly the cost of taking an average 30 cents/km car on the same trip.

But here’s the thing: the cost of the train ride is honest. Our consumption stares at us, right there when we hand our credit card information over and click “Proceed with Order”. It doesn’t hide away in the depreciation of our car, maintenance costs and insurance. We can’t lie to ourselves that our trip only costs the price of gas.

Yes, nowadays we drive a cheaper car. But taking a car because it’s cheaper is still lying to ourselves. Believe it or not, many of the costs of driving a car are hidden away in road maintenance and pollution, line items we find really hard to quantify. I feel confident, mind you, that if we were to find a way to quantify the damage exhaust fumes do and the subsidies that go into highways versus railroads, we would discover that the train ride costs a lot less.

This is what I mean by saying that we can get richer through the use of Conspicuous Consumption. By putting your consumption out there where you can’t hide it, where you have completely honesty, you’ll find yourself getting richer. If, when I’d driven an Eagle Talon TSi, I’d been honest with myself, I’d have saved over a thousand dollars in wear and tear on my car every year.

Moving on, I’d like to give one more example.

A few years back, Mrs. Toque had lamented that many of the children’s Lego constructions had grown dusty. Since the mini Toques wanted to keep many of their toys in the fully assembled state for playing purposes, they would store their toys on dresser tops and inside bookshelves. Layers of dust had accumulated and become unsightly. Now, you might begin to wonder, how many Lego sets are we talking? Figure for a pair of boys, 9 and 11 years of age, receiving a Lego set for each birthday and Christmas since they turned 4 or so. Add in there Mr. Toque’s own building block stash from his own childhood, and we have a lot of the magical clicky-blocks hanging around.

Mrs. Toque wisely proposed the purchasing of a set of simple glass cabinets, which the children could easily operate to retrieve their toys, but would encourage them to “put things away”, and also keep dust from accumulating on them in an unsightly fashion. As a side note, many of these cabinets can be found cheap, but slightly used, over the Internet.

What does this have to do with Conspicuous Consumption? Behold the image.

This is going to hurt my Frugal cred, I know.

We’ve discovered a delightful side effect of these cabinets, and thus I’m writing to you about it. Whenever the children show interest in acquiring new toys with their allowance, we take a moment and pause in front of the glass cabinets to look at all of the toys currently available. Are you certain this new toy is significantly different from the toys you have here? Isn’t such-and-such just a re-paint of so-and-so? Is the new toy going to increase your happiness enough that it’s worth the allowance money you’ll use up?

Like many other money-related exercises, the goal is to build habits in our children that will serve them for life by preventing them from becoming Clown Consumers looking for happiness at the far end of their credit cards’ limits.

Toque Junior (II)’s custom creations.

It’s not fool proof, mind you. Allowance still flows into toys, but even the younger of the two brothers, at nine years, shows a lot more conscientiousness about it. He has since built a fleet of his own creations, rather than relying on the official designs, and he spends a bit of time disassembling the formal constructions in order to harvest pieces from them.

There you are: a Hot Tip from the man in the Cold North. Make your consumption as conspicuous as possible and learn the very finest lessons from it.

October 6, 2017

Electric Car vs. Winter

Just a few days ago, I got a surprise in the mail. It was a very expensive registration renewal bill* from Boulder County, reminding me that my brand-new 2016 Nissan Leaf was already a whole year old.

The car has now been through the full cycle of Colorado’s interesting driving conditions including blazing sunshine, blowing blizzards, rough roads and high mountain passes. More importantly, it has carried large loads of heavy people and one hatchback-busting load of cargo after another as I used it for endless construction projects as well as shuttling around visitors and even a few paying passengers as part of a related Uber-driving experiment.

Since I bought the car primarily so I could tell you about the experience**, this one year anniversary presents the perfect opportunity.

Electric cars have been getting better and cheaper very quickly. Even a year ago, they were competitive with gas cars (especially after applying the various tax credits available here in the US). And as of late 2017, Nissan has just announced a thoroughly updated 2018 Leaf with longer range, new styling, and even semi-autonomous highway cruising, at the same list price.

Halfway through my time writing this article, General Motors announced that it is totally giving up the gasoline engine and switching to a 100% electric fleet in the foreseeable future.

Changes like these will get even more people asking questions, and it will surely trigger even bigger discounts on the 2017 and earlier models of electric cars. In certain areas, you can get a brand-new 2017 Leaf for well under $14,000 and a 2013 from Craigslist for under $8k.

So let’s get into the report. All year, people have been asking what the electric car experience has been like.

Is the car reliable? Any unexpected hiccups?

How has the range and performance been in various use scenarios?

How good does an electric car like the Nissan Leaf handle in the snow?

Life with a Leaf

If you just want the overall summary, the car has been Excellent. Although I did my best to maximize the mileage we accrued on this car over the year, the total still only added up to 3500 miles (5600 km). But what a blissful 3500 miles those were. The car served us generously, requiring nothing in return beyond refilling the windshield washer fluid once.

It is hard to believe the night and day difference between gasoline cars and electric ones, in terms of sheer driving pleasure and convenience. The difference is so stark, that I now feel utter disbelief that any car company is still making gas-powered cars, and that anyone is buying them for anything other than long roadtrips (and for those, why not just rent a car?) Even the most luxurious gas cars, of which I’ve driven a few, are complete dinosaurs in comparison to an entry-level electric car like Nissan Leaf.

Now, this is definitely my Wussypants Consumer side speaking, displaying signs of Tiny Details Exaggeration Syndrome. Even the cheapest 30-year-old gas car offers incredible speed, comfortable seats and an environmentally controlled seating area. So what’s the point of scaling that ladder of luxury even further?

The short answer is “Car Culture” : the only real purpose of a car is convenience and comfort – people buy them because they can’t or don’t want to do the work of pedaling a bike, and to carry their little kids in safety, and to stay out of the weather. So if you’re going to buy a car, you are presumably looking for those things, which electric cars deliver in exceptional quantity.

The Leaf is Swift. Tight. Precise. It drives like a very sporty car and jumps ahead when you touch the accelerator as if it weighs nothing at all. But it’s also hushed, refined, and serene inside. As you accelerate and leave all the gas cars far behind in your wake of clean swirling air, you hear just a distant whirring turbine sound as the electric motor picks up speed. On the open road even at the vehicle’s RPM-limited top speed of 93 MPH, the ride is quiet and controlled.

The Leaf is also big. It’s relatively long and tall, which makes it roomy inside. I think of it as more of a crossover SUV, with its cabin big enough for five six-foot-tall men, and a hatchback big enough to hold two more of us. If you fold down all the seats, that same area is long enough to close the door on two bikes or numerous ten-foot plumbing pipes. The 17″ wheels are bigger than those on my enormous Honda van, which gives it great rough terrain and snow abilities (a larger wheel diameter improves both traction and obstacle traversal.)

The Stash-inlaws (in Ottawa, Canada) also bought a Leaf after experiencing ours. Their Leaf easily navigates the rough dirt trail to their cottage in Quebec, carrying five people and their gear.

And it’s cheap to operate. Three dollars of electricity fills up my battery, which is good for about 110 miles of mixed driving, or closer to 90 when blazing along at 75MPH on the highway. Charging time (and finding charging stations) is rarely a concern, since the car is always waiting at 100% if you just plug it in when you go to bed.

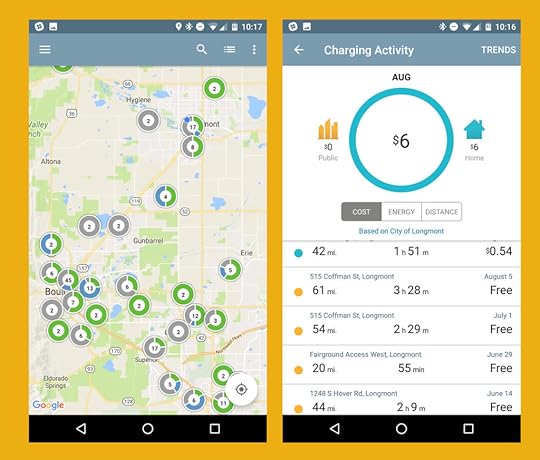

As part of my research on charging efficiency, I bought a (used) Chargepoint 240 volt charger and installed it on my house. This made home charging really fast, but the unit doesn’t get much use: as a form of treasure hunt I still find myself using the many free public stations here in Longmont, to the extent that over 50% of my fuel for the year was free.

Charging map for Longmont+Boulder and some of my recent charging activity (mostly free!). Ignore the charge times – in many cases the car reached 100% and just sat there until I picked it up. You get about 25 miles of charge per hour on public “level 2” stations, and peak rate of almost 200MPH on a Level 3.

Since the first member of my local friends bought a Leaf, the trend has spread through the community and there are now at least a dozen of the things in the area immediately around me. A friend calls the neighborhood ‘Leafmont, Colorado’. The inlaws back in Canada also bought one. People are using these cars for long daily commutes to Boulder and beyond, shuttling kids, shopping, and all the other stuff people shouldn’t really be doing with cars, but are going to regardless of what I say. They love their electric cars. The reviews are almost universally raving.

And all of this is aside from the biggest benefit, which is the hidden one that you’re not burning fossil fuels. The US power grid is down to 30% coal and getting cleaner every day, and you can personally improve that number simply by buying renewable power from your local provider as I do here in Longmont.

So, if you do need to use a car on a regular basis for around-town use, there’s really no reason not to use an electric one.

What about Winter Driving?

Luckily, if you turn off Traction Control, you can still do great Reverse Donuts in snowy parking lots.

The Leaf and other electric cars have big advantages over gas burners in this area as well.

The electronic traction and stability control systems work much better with an electric motor, because it can be controlled more precisely. In practice this means that while a normal car would dig itself into a rut, the Leaf applies just enough power to get through the snowbank. Or it stops the wheel, giving you a chance to reverse and give it another go.

There’s no cold-cranking worries or waiting for a cold engine to warm up. You press the button, the car is on, and cabin heat is instantaneous.

The heated seats and steering wheel make the experience even more luxurious (and reduce the need for cabin heat).

Remote heating with an in-dash timer or from an app on your phone means your car can be heated and defrosted (or cooled in summer) before you even reach it in your driveway. Without even consuming battery power, if you have the car plugged in.

Big wheel diameter, low center of gravity and 50/50 weight balance make for better handling and traction.

Front-wheel drive prevents fishtailing, and is every bit as safe as all-wheel drive. Adding snow tires in winter turns the Leaf into a monster snow crusher.

The Bad Stuff

No story (except perhaps one about bike commuting) could possibly be this universally positive, could it? Does Nissan have Mustache secretly on their payroll? Where’s the real meat of this story?

The only bad side of my experience has been finding that Nissan is a Big, Dumb, Old company to work with. To be fair, this is probably true for all car companies except Tesla, but when it comes to new technologies like electric cars, it helps to have someone who is on the ball.

I get the impression that somewhere, deep in the heart of Japan, there are some clever engineers who designed and built this car. Then their work was wrapped up in a thousand layers of bureaucracy and they were never allowed to talk to customers or improve their product again, until the next “product cycle”.

For example, although I spent $14,000 of my own money and a year of my time to promote their car for free, even helping MarketWatch adapt and re-run the story for free multiple times to their huge nationwide audience, possibly boosting the car’s sales quite noticeably, I couldn’t get access to a single Nissan engineer to discuss the details of the car’s battery management with me. While my local salesman is a rock star, very few other people in the company even know what a kilowatt-hour is. Perhaps they’re still riding the gasoline wave of the Nissan Armada and Titan megatrucks, which provide most of their profits.

Because of this, there are a few obvious brain-dead things about the Leaf:

There’s no battery temperature management. This means that in cold weather (15F), you get about 20% less range, even though you could heat the battery to room temperature with just 0.5 kWh (under 2%) of its energy. Or simply use wall power when it’s plugged in. A 20% penalty in cold climates to avoid adding a $100 heater. Why!??!

The phone app is horrible. I don’t mean this in the snooty way that cell phone review sites compare each year’s identical batch of high-end-phones, it really is bad. On the positive side, you can run a slightly less crappy aftermarket app called “Leaf Manager” which at least makes it usable.

Nissan doesn’t seem to care about its past electric car customers: The 30 kWh battery from 2016 will not fit into a 2015 Leaf, and I’m out of luck if I want to upgrade my car to any of these juicy 2018-and beyond batteries which have been improving at a rapid pace. You can upgrade to a fresh replacement of your current battery, although it’ll cost you $5500.The correct way to handle this (as Tesla does) is to make new batteries backwards-compatible whenever possible, and allow old cars to be upgraded with minimal mark-up on the battery. After all, an electric motor can run for over a million miles with zero maintenance. The rest of the car is rock-solid as well. Why not provide a path for these cars to have a healthy 30-year lifespan, getting a longer range every 10 years or so as the batteries need replacement? There’s still a chance for the company (or the aftermarket) to correct this problem, so I remain hopeful.

The shortcomings of Nissan stir up some real anger in me. But it’s probably because I like the basic car so much. Nissan’s electric car program could capture so many more loving customers, if it were just managed by a charismatic and highly technical leader, rather than a ridiculous pyramid of corporate paper pushers.

If you want a passionate, perfect car and you have unlimited money, there’s only one choice: A Tesla. The Model S right now for $80,000, or a Model 3 next year for $40k.

If you want a passionate, perfect car and you have unlimited money, there’s only one choice: A Tesla. The Model S right now for $80,000, or a Model 3 next year for $40k.

If you want a really good electric car and don’t want to wait for a Tesla model 3, the Chevrolet Bolt is a great car with 240 miles of range, much better software, even faster acceleration and “only” $30k after the $7500 federal tax credit since they haven’t run out yet.

Chevrolet Bolt

But although it’s a better car than the Leaf, I would have a hard time justifying the extra $10,000 cost of the Bolt. The extra range makes no difference for the typical urban and suburban driving cycle. But it’s still no good for cross-country road trips because it will still only fast-charge at 50 kW, the same as a Leaf. If you can even find a fast charger out in rural Wyoming. Compare this to Teslas, which charge at 120 kW with chargers along every highway in many of the world’s rich countries.