Mr. Money Mustache's Blog, page 4

August 22, 2020

Socially Responsible Investing: Is It Also More Profitable?

Since the Dawn of Mustachianism in 2011, the same question has come up over and over again:

“MMM,

I see your point that index fund investing is the best option. But when you buy the index, you’re getting oil companies, factory farm slaughterhouses and a million other dirty stories.

How can I get the benefits of investing for early retirement without contributing to the decline of humanity?”

And in these nine years since then, the movement towards socially responsible investing has only grown. Public pension funds have started to “divest” from oil company stocks, and various social issues like human rights, child labor, climate change or corporate corruption have bubbled to the surface at different times.

And all of this has led to the exploding new field of Socially Responsible Investing (SRI), and a growing array of new ways to do it.

So it seems that this is not just a passing trend – people just might be starting to care a bit more. And since capitalism is just an expression of human behavior, the nature of capitalism itself may be starting to change.

This leads us naturally to the question:

What can I do with my money to help fix the world? And even better, is there a way I can make money in the process of fixing it?

The answer is a good, solid “Probably.”

As long as you don’t get too hung up on getting every last detail perfect, because just like real life, investing is a haphazard and approximate and unpredictable thing. But by understanding the big picture, you can make slightly better decisions on average, which lead to slightly better results. And slightly better results, stacked up consistently over time, can lead to a much better life, or even a much better world.

This is true in all of the main areas we care about – personal wealth, fitness and health, even relationships and happiness. And while your money and investments are certainly not the most important thing in life, they are still worthy of a bit of easy and effective optimization.

So anyway, the first thing to understand with SRI is, “what problem am I trying to solve?”

The answer is, “You are trying to make your investing (especially index fund investing) have a better impact on the world.”

On its own, index fund investing is ridiculously simple. You just get an account at any brokerage like Vanguard, Etrade, Schwab or whatever, and dump all your money into one exchange-traded fund: VTI.

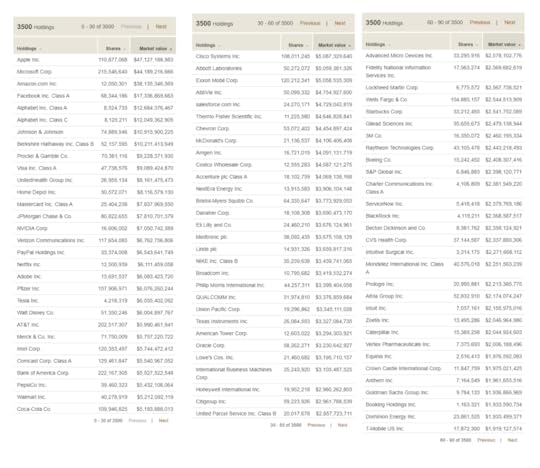

When you do this, you are buying a stake in 3500 companies at once(!), which is both impressive and overwhelming. How do you even know what you are holding?

Well, this is all public information, and easily available with a quick Google search. For example, here’s a list of the top 90 holdings in VTI (click for larger):

Top 90 holdings in Vanguard’s VTI Exchange Traded Fund

Top 90 holdings in Vanguard’s VTI Exchange Traded FundAs you can see, the biggest chunk of money is allocated to today’s tech darlings, because this index fund is weighted according to market value, and these are the most valuable companies in the US today.

Through a convenient coincidence, the total value of the VTI fund happens to be just under $1 trillion dollars, which means you can just throw a decimal point after the ten billions digit of market value to get a percentage. In other words, about 4.7% of your money will go towards Apple stock, 4.4 towards Microsoft, and so on. Together, these top 90 companies are worth more than the remaining 3,410 companies combined, so these are what really drive your retirement account.

And within this list, you will see some of the usual suspects: Exxon and Chevron (oil), Philip Morris (tobacco), Raytheon and Lockheed (bombs), and so on.

But what about the less-usual suspects? For example, I happen to think that sugar, and especially sugar-packed beverages like Coke, is the biggest killer in the developed world – a major contributor to 2 million of the 2.8 million deaths each year in the US alone. Should I exclude that from my portfolio too?

And what about drug and insurance companies – aren’t they behind the political stalemate and high costs of the US healthcare system? Comcast funded some election disinformation campaigns here in my home town in the early 2010s, should I exclude them too? And if you’re part of a religion that is against charging interest on loans, or in favor of pasta and Pirate costumes, or against a spherical Earth, or any number of additional ornate rules, you may have still more preferences.

The higher your desire for perfection, the more difficult this exercise will become. However, if you are like me and you just want to get most of the desired result with minimal effort, you might simply have a look at the Vanguard fund called ESGV.

ESG stands for “Environmental, Social and Governance”, and in practice it just means “We have tried to avoid some of the shittier companies according to some fairly simple rules.”

And the result is this:

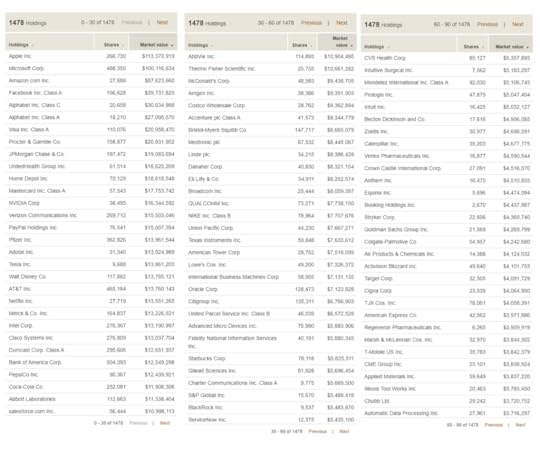

Vanguard’s ESGV Exchange traded fund (ETF) – top 90 holdings

Vanguard’s ESGV Exchange traded fund (ETF) – top 90 holdingsThe first thing you’ll notice is that it’s almost the same. In fact, the top five holdings – Apple, Microsoft, Amazon, Facebook, Alphabet (Google) and Netflix not far behind, collectively referred to as the FAANG stocks – are completely unchanged – and this means that there will be plenty of correlation between these funds.

It’s also the reason that the stock market as a whole has recovered so quickly from this COVID-era recession: small businesses like restaurants and hair salons have been destroyed by the shutdowns, but big companies that benefit from people staying at home and using computers and phones are making more money than ever. The stock market isn’t the whole economy, it’s just the publicly traded companies, which are the big ones.

But let’s look at the biggest differences between the normal index fund versus the social version.

The following large companies listed on the left are missing in the ESGV fund, in order of size. And to make up the difference, the stake in the companies on the right have been boosted up to take their place in your portfolio.

Main differences between VTI and ESGV (source: etfrc)

Main differences between VTI and ESGV (source: etfrc) The omission of Berkshire Hathaway was a bit of a shocker, as it is run with solid ethical principles by Warren Buffett, one of the worlds most generous philanthropists. And in fact the modern day nerd-saint Bill Gates is on the Berkshire board of directors, another person whose work I follow and respect greatly.

(side note: Apparently the company fails on the “independent governance” category. And Buffett disputes this category, but in his characteristic way has decided to say, “Fuck it, I’ma just keep doing my own thing with my half-trillion dollar empire over here and you can have fun with your little committee” – I’m paraphrasing a bit but he totally did say that.)

Furthermore, both funds hold the factory meat king Tyson foods, while neither holds Roundup-happy Monsanto, because it was bought by the German conglomerate Bayer AG a while back. Nextera is a giant electric utility in the Southeastern US that claims to be the world’s largest generator of renewable energy. Some do-gooders are against nuclear power, while others (including me) think it’s the Bee’s Knees and we should keep advancing it. And all this just goes to show how nobody will agree 100% on what makes a good socially responsible fund.

But What About The Performance?

In the past, some investors were nervous about giving up oil companies in their portfolio, because while it was a dirty substance, it was also what made the world go round – which meant it was a cash cow.

Now, however, oil is on its way out as renewable energy and battery storage have crossed the cost parity threshold – meaning it’s cheaper to make power (and vehicles) that don’t use oil. In its place, technology is the new cash cow, and tech is heavily represented in the ESG funds. The result:

Traditional index fund (VTI) vs Socially Responsible equivalent (ESGV)

Traditional index fund (VTI) vs Socially Responsible equivalent (ESGV)As you can see, the performance has been similar but the ESG fund has done significantly better in the (admittedly short) time since it was introduced at Vanguard.

Of course, we have no idea if this will continue, but the point is that at least our thesis is not a ridiculous one – environmentally sustainable companies do have an advantage, if the world gradually starts to care more about these things. And if you look at the share price of Tesla and other companies that surround it in electric transportation and energy storage, you will see that there are many trillions of dollars already lining up to benefit from this transition. And the very presence of so much investment money creates a self-fulfilling prophecy, as Tesla is now building or expanding five of the world’s largest factories on three continents simultaneously.

So What Should You Do? (and what I do myself)

My latest home-brewed ebike project – this one can reach 42MPH / 67km/hr!

First of all, it helps to remember a fundamental piece of economics: your spending dollars will probably have a much bigger impact than your investment dollars. This is because you are sending a direct message to the world rather than an indirect one:

When you buy a new gasoline-powered Subaru (or a tank of gas for your existing guzzler) or a steak at the grocery store, or a plane ticket, you are telling those companies directly that consumers want more of these products, so they will produce more of them immediately.

When you buy shares in Exxon, you are only subtly raising the demand for those shares, which raises the average price, making it ever-so-slightly easier for Exxon to maybe issue more shares in the future. In other words, you are making it easier for them to access capital. But capital is only useful if there is demand for their products. And with oil there is a nearly constant surplus, which is why OPEC and other cartels need to work together to artificially restrict supply, just to keep prices up.

Plus, as a shareholder you are theoretically eligible to place votes and influence the future direction of companies – even companies that you don’t like. If you look up the field of “shareholder activism”, you’ll see this is a tradition that goes way back.

So I have tried to take a few simple steps on the consumer side myself, and I find it quite satisfying: Insulating the shit out of all of my properties, building a DIY solar electric array on one of them, and buying one electric car so far to eliminate local gas burning. And a few electric bikes including a super fast one I made myself.

Each one of these steps has provided a very high economic return, percentage-wise, but that still leaves a lot of money to account for, which brings us back to stock investing.

As someone who loves simplicity, I have done this:

Bought almost entirely VTI (or similar Vanguard funds) from 2000-2015Started experimenting with Betterment in 2015, liked it, and have been adding a percentage of my ongoing savings to that account to that since then. (Note that Betterment now also offers a socially responsible portfolio option.)Switched the dividend re-investing of my old Vanguard VTI over to Vanguard ESGV, to avoid “wash sales” in making the most of Betterment’s tax loss harvesting feature.Bought some shares of Berkshire Hathaway separately, and also make a few sentimental investments in local businesses, including the MMM HQ Coworking space.

But you could choose to be more hardcore in your ESG/SRI investing:

Buy your own basket of stocks based on the index, but with different weighting based on your own valuesSpend more money on other things that generate or save money (a bigger solar array on your house, better insulation, electric car, an ebike to reduce car trips, etc.)Invest in local businesses of your choice, rental real estate, community solar projects, or other things which generate passive income – publicly traded stocks are just one of many ways to fund an early retirement!

Like most areas of life, investing is not something you have to do perfectly in order to succeed – even socially responsible investing. If you apply the 80/20 rule to get the big picture right, you have probably found the Sweet Spot and you can move on to the next area of life to optimize.

In the Comments:

What is your own investment strategy? Have you thought at all about this ESG / SRI stuff? Did this article bring anything new to the table?

August 4, 2020

The Sweet Spot

“Success can get you to the top of a beautiful cliff,

but then propel you right over the edge of it.”

As a Mustachian, there’s a good chance that you are a bit of an overachiever.

Maybe you fought hard to get exceptional grades in school, or perhaps you have always dominated in your career or your Ultramarathon habit or your hobbies – or maybe all of the above.

In the big picture, this usually leads to having a “successful” life, because of this basic math:

Traditional Success

=

How much work you do

x

How much society happens to value your work

The Nitty Gritty of Traditional Success

Now, lest the Internet Privilege Police head straight to Twitter to start writing out citations, Traditional Success is not a measure of your worthiness as a human being. We’re just talking about the old-fashioned, Smiling 1950s Man definition of success.

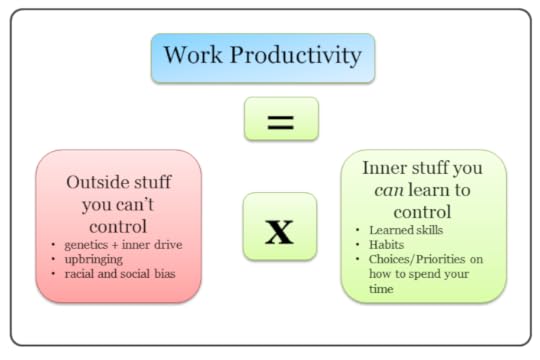

And since we’re all scientists here, we could break the “Work” side of it down a bit further:

And thus, you could say that on average, doing more stuff produces more traditional success.

But then what?

This is the point where a lot of smart, driven, born-lucky people drive themselves up the Winding Road of Challenge and then right off the edge of the Cliff of Success.

If you’re still on the way up, or stuck at the bottom, it is difficult to even imagine the idea of “too much success”. But it’s a real thing, and it happens much more quickly than the modern overachiever would like to admit. Observe the following cautionary tale:

Diana is the director of engineering in a Silicon Valley tech startup. The work is intense, but they are almost over the hump – the company went public last month, and she owns shares that are worth over $10 million at today’s share price. They will vest over the next five years, so she just needs to grind this out and then she will be set for life.

Sounds great, right?

Except this is Diana’s third smashing success. She was already set for life after the second company was acquired, and even before that, her first decade as a rising star at a large company had already left her with over $2 million of investments and a paid-off house in hella expensive Cupertino, California. She had more than enough to retire, twenty years ago!

To many people who are less fortunate, the present situation would still sound like great fortune, and in some ways, it is. Becoming a Director of Engineering is (usually) far better than a punch in the face.

But Diana is now 52 years old, with a collection of increasingly severe back and neck problems and a few medical prescriptions piling up. She has two grown children in their twenties, but wishes she had been able to spend more time with them as they grew up. She has all the money in the world, but still almost no free time, and this next five years is starting to look like an eternity.

What happened here?

Diana is in good company, because many of our hardest-working people fall into this same trap. They have the talent and the great work habits figured out, but they are still missing one last concept – the idea of the sweet spot.

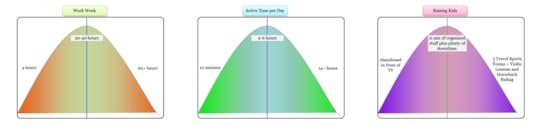

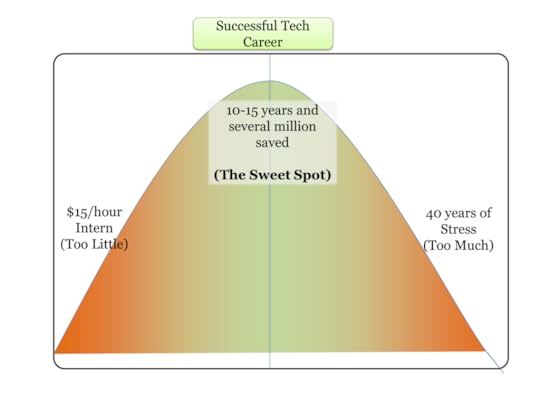

Fig. 1: What is the ideal length of a high-end career?

Diana could have stopped after the first company, or the second, but her career success took on a momentum of its own, so she kept doubling down without stopping to consider why she was doing it – and what she was giving up in exchange.

Once you learn to see the phenomenon of the sweet spot, you will start noticing it everywhere. And it is an amazingly useful thing to start watching and fine-tuning to get the most out of your own life.

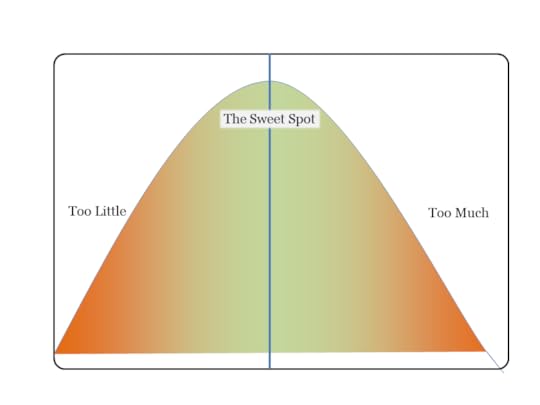

Fig.2: What is the ideal amount of Anything?

The Sweet Spot of Physical Training When a non-runner starts running, they will see immediate benefits. In the process of going from being unable to jog across a parking lot, to being able to easily jog a brisk mile, your entire body will transform for the better. Muscles and bones get stronger, heart and lungs expand and reach out to give your body a healthy embrace, brain functioning and mood and hormones smooth out and normalize.

When a non-runner starts running, they will see immediate benefits. In the process of going from being unable to jog across a parking lot, to being able to easily jog a brisk mile, your entire body will transform for the better. Muscles and bones get stronger, heart and lungs expand and reach out to give your body a healthy embrace, brain functioning and mood and hormones smooth out and normalize.

Training your way up to become a two mile runner still brings great benefits – just slightly smaller. The fifth through twentieth mile turn you into a hyper efficient machine, but some people start seeing joint injuries as they rise through the ranks.

And by the time you reach the fringe world of 100-mile runners, serious injuries and surgeries are completely normal – as well as unexpected organ failures in otherwise young, healthy people. The sweet spot for daily running for maximum health is somewhere the middle.

All around us, seemingly unrelated things follow this same pattern, from career work to physical exertion to parenting strategy.

Fame and Fortune – be careful what you wish for

Fame definitely has a sweet spot. Building up a good reputation in your community can open the door to better friendships, jobs, relationships, and more fun in general.

But as that reputation expands outwards to become fame, you get the “reward” of constant coverage in gossip magazines and waking up to find photographers and news reporters on your front lawn. At the extreme end, you need to mobilize a team of armored vehicles and line your route with snipers every time you leave your well-guarded compound.

Even money, our humble and ever-willing servant is subject to this phenomenon. It certainly helps us meet our basic needs, but there is a certain point at which Mo Money can become Mo Problems.

The first bit of monetary surplus can be fun as you can afford a nice house and good food. Then the next chunk seems fun but also causes distractions as you rack up second and third houses and ever-more elaborate possessions and vacations that take a lot of energy to keep track of.

And from there it goes downhill as tabloids start keeping track of your wealth and scrutinizing your choices, hundreds of people mail in pleas for your generosity, and you end up with a full-time job just making sure that the surplus goes to good use. This life arrangement can still be enjoyable for some people, but I would definitely not wish it upon myself.

On and on this pattern goes. A curve with a sweet spot in the middle. The optimal amount of calories to consume in a day. The volume at which you will enjoy your music most. The right brightness of light to illuminate a room. The number of friends with whom you can have a meaningful relationship.

Why does it occur in so many places? I believe it is because this is how our brains are wired in the first place.

Humans are a ridiculously adaptable creature, but we do still come with limits.

And when you respect those limits and fine-tune your life within the sweet spot for all of the main pillars for happy living, you end up with the best possible chance at living a happy, prosperous life.

A Mid-Roll Advertisement:

Interest rates are still at WTF-low levels, so if you haven’t already done so, I recommend checking your current home mortgage and student loan rates. Either at your local credit union, or online via a service like Credible.

Click Here to open that up in a new tab, and keep reading.

The Curse Of the Overachievers – Revisited

So now you see the problem – overachievers like us tend to get really good at a few things like a career or an athletic pursuit often specializing so much that we neglect other things like overall health or personal relationships.

And our society notices and rewards us for the success, which just reinforces the behavior, so we take things to even higher extremes, often without stopping to think about the reason behind it.

Okay, So What Now?

Once you see the pattern of the sweet spot, it is impossible to un-see it. So it becomes pretty easy to float up and look at your entire life from above, like an outside observer.

And from up there, you can see the areas where you have enough, and places where you may have already gone overboard, and the corresponding things that you have left neglected as the price of that success.

Over the past year I’ve been looking at my own life from this perspective, coming up with quite a few of my own diagnoses:

Money: enough. Additional windfalls don’t seem to bring me any lasting joy, but I also don’t have so much money that it makes me nervous. It’s enough to feel safe and empowered, and that’s all I need. Meanwhile, giving away money has brought me lasting happiness, without creating a feeling of shortage or regret.

Career Success (blog): It Varies. When I was really working on this MMM job in the mid-2010s, it started to take over too much of my life. Emails, opportunities, travel and public attention all reached levels where I actually started to have less fun. So I tried dialing it back, as any long-term readers will have noticed. And sure enough, life improved. But then I went too far and started feeling a loss from letting this valued hobby slip away. I’ve been trying to get back into the groove, which revealed another problem – detailed at the end of this list.

Friendships: Not Enough. I have found myself not being able to keep up with close friends, and had difficulty making or keeping plans, partly out of feeling overwhelmed with life details in general. Still, the opportunities abound here in my local community, and the people are wonderful. So I have the opportunity to keep working at this.

Health and Fitness: Enough. Since I was about fourteen years old, eating well and getting a lot of varied exercise has always been a kind of non-negotiable pillar for me. Nothing extreme, but just very consistent. I think this has been paying off as I feel healthy every day and have never had any physical or health problems in these 30+ years since.

Parenting and Kids: Enough (an A+!) Since 2005 I made “being a Dad” my primary goal in life, quitting my career to do so. It’s the only thing I can truly say I have done the best I could at, and I’m really proud of that. But part of this success came from only having one kid – both of us parents knew we couldn’t handle any more, given the overall conditions of life back then. So for us, the sweet spot was One Child – and absolutely no regrets in that department.

Personal Projects and Daily Habits: Not Enough. I get great satisfaction from working on challenging things and making progress. But far too often, I just can’t get it together and I squander entire days on accidental distractions. Planning to go out for a day of work can lead to searching for lost sunglasses which can lead to finding a lost to-do list which can lead to opening the computer to look something up and several hours disappearing. On and on these tangents can go, often leading to me not getting my primary, happiness-creating goals for the day accomplished.

I discovered that I have a pretty severe and textbook case of Adult Attention Deficit Disorder, which gets magnified if there are any sources of stress in my life. So I’m working on that (keeping stress down and also targeting habits, diet, exercise and even trying some medication), which will hopefully improve all other areas of life as well.

What am I missing? I’m still working on thinking it all through, so this list will surely grow.

Your Turn

Your life surely has a completely different array of surpluses, shortages and sweet spots than mine. Your assignment is therefore to write them all out tonight, and see where you stand in each area, and decide what to change. Many of the changes are quite easy to make, and yet the results are nothing short of life-changing.

In the comments: what are your own areas of surplus and shortage? And what’s your plan to help restore balance to your life?

May 3, 2020

Introducing Coverage Critic: Time to Kill the $80 Mobile Phone Bill Forever

A Quick Foreword: Although the world is still in Pandemic mode, we are shifting gears back to personal finance mode here at MMM. Partly because we could all use a distraction right now, and even more important because forced time off like this is the ideal time to re-invest in optimizing parts of your life such as your fitness, food and finances.

—

Every now and then, I learn to my horror that some people are still paying preposterous amounts for mobile phone service, so I write another article about it.

If we are lucky, a solid number of people make the switch and enjoy increased prosperity, but everyone who didn’t happen to read that article goes on paying and paying, and I see it in the case studies that people email me when looking for advice. Lines like this in their budget:

mobile phone service (2 people): $160

“NO!!!!”

… is all I can say, when I see such unnecessary expenditure. These days, a great nationwide phone service plan costs between and $10-40 per month, depending on how many frills you need.

Why is this a big deal? Just because of this simple fact:

Cutting $100 per month from your budget becomes a $17,000 boost to your wealth every ten years.

And today’s $10-40 phone plans are just great. Anything more than that is just a plain old ripoff, end of story. Just as any phone more expensive than $200* (yes, that includes all new iPhones), is probably a waste of money too.

So today, we are going to take the next step: assigning a permanent inner-circle Mustachian expert to monitor the ever-improving cell phone market, and dispense the latest advice as appropriate. And I happen to know just the guy:

Christian Smith, along with colleagues at GiveWell in San Francisco, circa 2016

Christian Smith, along with colleagues at GiveWell in San Francisco, circa 2016My first contact with Chris was in 2016 when he was working with GiveWell, a super-efficient charitable organization that often tops the list for people looking to maximize the impact of their giving.

But much to my surprise, he showed up in my own HQ coworking space in 2018, and I noticed he was a bit of a mobile phone research addict. He had started an intriguing website called Coverage Critic, and started methodically reviewing every phone plan (and even many handsets) he could get his hands on, and I liked the thorough and open way in which he did it.

This was ideal for me, because frankly I don’t have time to keep pace with ongoing changes in the marketplace. I may be an expert on construction and energy consumption, but I defer to my friend Ben when I have questions about fixing cars, Brandon when I need advice on credit cards, HQ member Dr. D for insider perspectives on the life of a doctor and the medical industry, and now Chris can take on the mobile phone world.

So we decided to team up: Chris will maintain his own list of the best cheap mobile phone plans on a new Coverage Critic page here on MMM. He gets the benefit of more people enjoying his work, and I get the benefit of more useful information on my site. And if it goes well, it will generate savings for you and eventual referral income for us (more on that at the bottom of this article).

So to complete this introduction, I will hand the keyboard over to the man himself.

Meet The Coverage Critic

Chris, engaged in some recent Coverage Criticicism at MMM-HQ

Chris, engaged in some recent Coverage Criticicism at MMM-HQI started my professional life working on cost-effectiveness models for the charity evaluator GiveWell. (The organization is awesome; see MMM’s earlier post.) When I was ready for a career change, I figured I’d like to combine my analytical nature with my knack for cutting through bullshit. That quickly led me to the cell phone industry.

So about a year ago, I created a site called Coverage Critic in the hopes of meeting a need that was being overlooked: detailed mobile phone service reviews, without the common problem of bias due to undisclosed financial arrangements between the phone company and the reviewer.

What’s the Problem with the Cell Phone Industry?

Somehow, every mobile phone network in the U.S. claims to offer the best service. And each network can back up its claims by referencing third-party evaluations.

How is that possible? Bad financial incentives.

Each network wants to claim it is great. Network operators are willing to pay to license reviewers’ “awards”. Consequently, money-hungry reviewers give awards to undeserving, mediocre networks.

On top of this, many phone companies have whipped up combinations of confusing plans, convoluted prices, and misleading claims. Just a few examples:

Coverage maps continue to be wildly inaccurate.Many carriers offer “unlimited” plans that have limits.All of the major U.S. network operators are overhyping next-generation, 5G technologies. AT&T has even started tricking its subscribers by renaming some of its 4G service “5GE.”

However, with enough research and shoveling, I believe it becomes clear which phone companies and plans offer the best bang for the buck. So going forward, MMM and I will be collaborating to share recommended phone plans right here on his website, and adding an automated plan finder tool soon afterwards. I think you’ll find that there are a lot of great, budget-friendly options on the market.

A Few Quick Examples:

T-Mobile Connect: unlimited minutes and texts with 2GB of data for $15 per month

Total Wireless: 4 lines in a combined family plan with unlimited calling, texting, and 100GB of shared data(!) for $100 per month. (runs on Verizon’s extensive network)

Xfinity Mobile: 5 lines with unlimited minutes, unlimited texts, and 10GB of shared data over Verizon’s network for about $12 per line each month (heads up: only Xfinity Internet customers are eligible, and the bring-your-own-device program is fairly restrictive).

Ting: Limited use family plans for under $15 per line each month.

Tello: 100 minutes, unlimited texts, and 1GB of data for $7 per month (on Sprint’s somewhat lousy network).

[MMM note – even as a frequent traveler, serious techie and a “professional blogger”, I rarely use more than 1GB each month on my own Google Fi plan ($20 base cost plus data, then $15 for each additional family member). So some of these are indeed generous plans]

Okay, What About Phones?

With the above carriers, you may be able to bring your existing phone. But if you need a new one, there are some damn good, low-cost options these days. The Moto G7 Play is only $130 and offers outstanding performance despite the low price point. I use it as my personal phone and love it.

If you really want something fancy, consider the Google Pixel 3a or the recently released, second-generation iPhone SE. Both of these are amazing phones and about half as expensive as an iPhone 11.

——————————————-

Mobile Phone Service 101

If you’re looking to save on cell phone service, it’s helpful to have a basic understanding of the industry. For the sake of brevity, I’m going to skip over a lot of nuances in the rest of this post. If you’re a nerd like me and want more technical details, check out my longer, drier article that goes into more depth.

The Wireless Market

There are only four nationwide networks in the U.S. (soon to be three thanks to a merger between T-Mobile and Sprint). They vary in the extent of their coverage:

Verizon (most coverage)AT&T (2nd best coverage)T-Mobile (3rd best coverage)Sprint (worst coverage)

Not everyone needs the most coverage. All four nationwide networks typically offer solid coverage in densely populated areas. Coverage should be a bigger concern for people who regularly find themselves deep in the mountains or cornfields.

While there are only four nationwide networks, there are dozens of carriers offering cell phone service to consumers – offering vastly different pricing and customer service experiences.

Expensive services running over a given network will tend to offer better customer service, more roaming coverage, and better priority during periods of congestion than low-cost carriers using the same network. That said, many people won’t even notice a difference between low-cost and high-cost carriers using the same network.

For most people, the easiest way to figure out whether a low-cost carrier will provide a good experience is to just try one. You can typically sign up for these services without a long-term commitment. If you have a good initial experience with a budget-friendly carrier, you can stick with it and save substantially month after month.

With a good carrier, a budget-friendly phone, and a bit of effort to limit data use, most people can have a great cellular experience while saving a bunch of money.

MMM’s Conclusion

From now on, you can check in on the Coverage Critic’s recommendations at mrmoneymustache.com/coveragecritic, and he will also be issuing occasional clever or wry commentary on Twitter at @Coverage_Critic.

Thanks for joining the team, Chris!

*okay, special exception if you use it for work in video or photography. I paid $299 a year ago for my stupendously fancy Google Pixel 3a phone.. but only because I run this blog and the extra spending is justified by the better camera.

The Full Disclosure: whenever possible, we have signed this blog up for referral programs with any recommended companies that offer them, so we may receive a commission if you sign up for a plan using our research. We aim to avoid letting income (or lack thereof) affect our recommendations, but we still want to be upfront about everything so you can judge for yourself. Specific details about these referral programs is shared on the CC transparency page. MMM explains more about how he handles affiliate arrangements here .

April 14, 2020

The Medicine of Mustachianism (a guest post from Marla)

Camp Mustache Seattle, one of Chancellor Taner’s ongoing assignments.

Camp Mustache Seattle, one of Chancellor Taner’s ongoing assignments.

Foreword from Mr. Money Mustache :

Marla is a long-time friend who I met on one the very first of the Ecuador Chautauqua trips. Since then, she has served as the Chancellor of Fun in the MMM organization, which is an informal and haphazard group of entirely volunteer planners who sometimes create interesting events.

Marla wrote this on March 18th, which makes her optimistic perspective from that moment in time even more appropriate today as we emerge from the chaos.

The Medicine of Mustachianism

By Marla Taner

I love face punches. I love the shockingly simple math of early retirement. I love that we all enjoy debating the merits of financial independence versus retiring early. And I love that in the end, this blog is not really about money.

And it’s not because my portfolio just lost more than 30% and it’s not because my friends and family are enjoying their moment of schadenfreude. I wrote this blog post because when the rest of the world is going crazy all around you and you suddenly realize with clarity what the whole point of Mustachianism is, you want to share it with everyone you care about as soon as possible.

Yes, it’s true. After nearly seven years of “retirement”, and watching When Harry Met Sally* for the 1000th time while self-isolating, it took the Corona Virus to inspire my first blog post.

First, a dose of confession. I don’t always follow MMM’s advice. In particular, I love politics and I watch way too much of the 24 hour news cycle on TV. I justify it with all the usual excuses: it’s important, I want to be informed, this is an incredible time in history. But, as with much of MMM’s sage advice, while I’m doing what he recommends against, his voice is in my head (or his virtual fist is in my face) reminding me why this is a bad idea. I am still a work in progress.

Since the news cycle shifted from those ubiquitous tweets from you-know-who to worldwide calamity, it has become abundantly clear that I need to turn off the news. My palms are sweating, my pulse is racing, it’s hard to sleep. You just might feel this way too. Here’s some medicine for that:

The Low Information Diet

Second, take a a dose from the optimism gun by reading The Practical Benefits of Outrageous Optimism.

Finally, learn what to do (and not to do) in times like these by figuring out How Big Is Your Circle of Control.

We are the lucky ones. What I earned during my career was far greater than the average world income of $5000 per annum. By being frugal and running against the herd, I saved more than 50% of my income over a 15 year career.

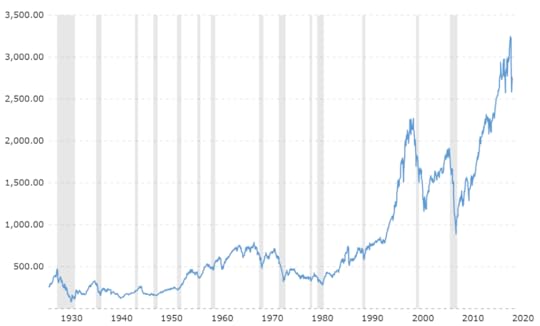

My expenses are low. I can make my expenses lower if I really need to. I have the luxury of staying home and gathering my loved ones close during these difficult times. And even though my net worth is suddenly, shockingly lower; I have time on my side. Let’s remind ourselves of the stock market chart throughout history.

Inflation adjusted S&P500 price, (not even including dividends!) Image source Macrotrends.net

Inflation adjusted S&P500 price, (not even including dividends!) Image source Macrotrends.netYes, I realize that being lucky does not insulate us against hardship. We are not immune to sickness or loss, disability or discrimination, tragedy can still strike. But, let’s be grateful for what we have, and remind ourselves of our resilience. After all, even if the worst happens, we’ll still be okay. In fact, my favorite post was this one that inspired me to pull the trigger on FIRE in 2013:

Finally, a dose of what’s really important. Yes, the whole point of Mustachianism. MMM retired at just 30 years old because he wanted to be the best Dad he could be. He didn’t “retire” to write this blog, start a movement and change the world. He realized his needs and his wants were small. Being a great Dad didn’t mean constantly travelling the world, or competing for the best private schools or private equestrian leagues. It was taking his son on adventures in the neighborhood, teaching him to ride a bike, building forts, playing games, giving him the gift of his time.

And, when you ask MMM now what he’s figured out about happiness, he tells us that to have a great life, you just need to put together a string of enough great days. While everyone’s great day is different, Pete’s includes time outside, exercise, time with family, socializing with friends and some hard work.

And so, as we all face this global pandemic together, let’s think about what makes our own great day. Chances are, it doesn’t cost much. The ones you want to spend it with might be locked inside with you right now. The great outdoors still beckons with singing birds and the first signs of spring. There are great meals to cook, books to read, movies to watch, and chores to catch up on. Our homes have never been this clean. And if we can’t meet up with friends in person, let’s call, text or video chat with each other.

On a final note, let’s thank our amazing health care professionals on the front lines, those that are making sure our shelves are stocked with necessary food and supplies and all the “caremongerers”.

Mustachianism really is the best medicine.**

*thanks Nora Ephron.

**with all due respect to laughter.

My thanks to Mr. Money Mustache for providing his favorite stalker with this platform to share my thoughts. Marla Taner met MMM in Ecuador at the first Chautauqua and has continued to stalk him at Mustachian and FIRE events ever since. You may or may not be able to find her on Facebook.

MMM here again: I am going to try to invite Marla back here to respond to any questions here in the comments. What would you like to ask a 40-something Canadian early retiree who has been at it for so many years, and lives a totally different lifestyle than me? No kids, travels the world freely, not a hardcore bicycle nazi like I am?

April 2, 2020

No, You Didn’t Just Lose Half Of Your Retirement Savings

So here we are just a month later, in a full-blown economic panic, and at the start of the most sudden recession ever.

The pandemic has spread much further and faster than most uninformed people (including me) would have ever guessed, and the whole world is on some form of lockdown. Nothing quite like this has ever happened before in the modern world.

What should we do?

On the financial side, I’ve seen media stories about “The End of FIRE movement”, and a close friend even said to me, “Well, I’ve got to go back to work now because with all my investments down 35%, I’m not financially independent any more.”

And I’ve seen plenty of similar statements out there on the Internet:

Is it time to be worried like this commenter on my last article?

Is it time to be worried like this commenter on my last article? Even worse, some people are trying to time the stock market, selling off their investments at a discount in the hopes of “protecting” them, hoping to subsequently outsmart everyone else and re-buy them at an even lower price just before some future rebound.

On the human side, we have seen a death toll of thousands of people per day in the US alone with best-case forecasts of 200,000 by the time things calm down, which implies several million worldwide.

And so far, we have not been performing like a best-case country so these numbers will probably be higher.

This all sounds terrible, doesn’t it?

It makes sense that many people are fearful and pessimistic. So why is it that I remain as optimistic as ever, with the full expectation that you and I will come through this humbled but also wiser and better than ever?

It’s because I already know how this all ends.

The world will keep rallying and doing its best to slow down contagion. Caring people will keep helping each other. People will stay home and heal, hospitals will expand, nurses and doctors will do their best to save as many lives as possible, and the 80% of us in jobs that allow us to keep working, will keep doing our jobs.

Meanwhile, innovators are still innovating all over the world. People are staying up late working in labs, vaccines are being tested, genes are being sequenced and the current virus will end up beaten and then written up as a very significant chapter in the history books.

But apart from all of this, there is still way more going on out there, which just isn’t making it to the headlines. Engineers and scientists are still inventing things that will drastically improve the future. Solar panels are still streaming out by the trainload and being installed worldwide. Better and better batteries which will eventually displace all fossil fuel use are evolving. The most efficient factories in history are being built. Gene therapies are advancing which will eventually make a mockery of all of our current health conditions. Internet connectivity and education is becoming more widely available and cheaper which is allowing the next generation of brilliant kids to to grow up and learn faster and do more than you or I could have even dreamed. And all this will happen regardless of the course of the current pandemic.

If all that is true, then why is the world so Scary right now?

I get it – never before has something from the daily news come home to affect our daily lives so much. Grocery stores are cleaned out, people are wearing masks, and you probably have friends who are currently unemployed, or sick, or both.

But in this situation, it really helps to understand the big picture of what is actually going on. The world is not ending. The air outside your windows is not a swirling cloud of certain death.

All that has changed is that we are in a self-imposed economic slowdown that has been created purely to save the lives of our most vulnerable people.

Which is one of the most compassionate things our society has ever done. To me, this is a remarkable and wonderful moment and I would not have guessed that such a capitalist country would ever have the balls to do it.

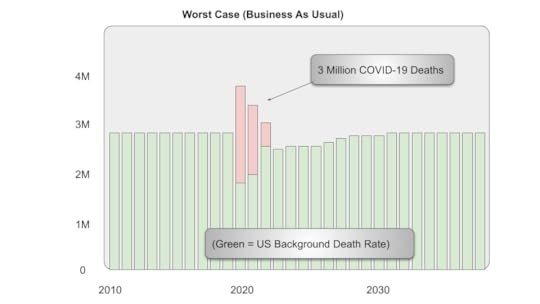

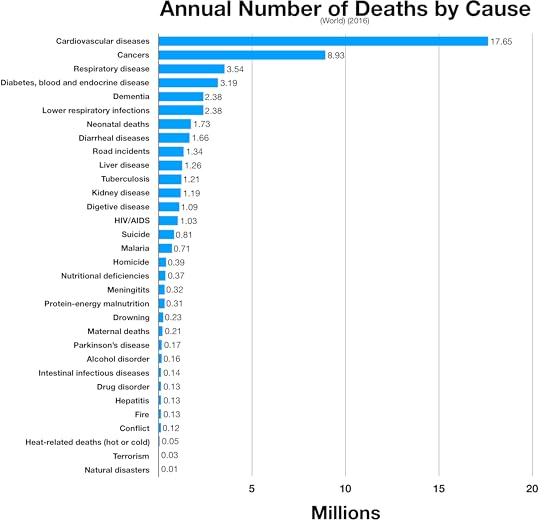

To put it into a visual, we have decided to prevent the following worst-case scenario:

In the worst case, we might lose 1-2% of our people, biased towards the most vulnerable. There is some overlap because this accelerates some other deaths that would have happened this year, and pulls some future deaths into the present, which is why the death rate dips for a while afterwards.

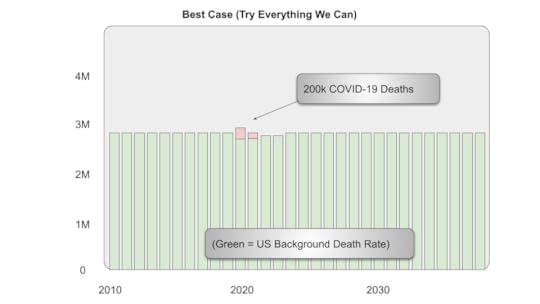

In the worst case, we might lose 1-2% of our people, biased towards the most vulnerable. There is some overlap because this accelerates some other deaths that would have happened this year, and pulls some future deaths into the present, which is why the death rate dips for a while afterwards.And turn it into this:

With enough prevention, we cut the death rate by twentyfold, to about 0.04-0.06%.

With enough prevention, we cut the death rate by twentyfold, to about 0.04-0.06%.200,000 is still an enormous number, but the existing death rate at least puts it into perspective.

In the worst case, our public officials would all downplay the risk of COVID-19, and we’d keep working and traveling and spreading it freely. We’d maximize our economic activity and let the disease run its course.

From the disease models I have seen so far, about 70% of us would eventually contract it. Half of those would have no symptoms or very mild ones, a smaller (but still huge) number would get sick or very sick, 10% might end up in a very overloaded hospital system, and in total about 1-2% of our population would die from complications – partly depending on how quickly we could put up temporary treatment centers to cycle through 30 million people in only a few years.

It would feel cruel and chaotic, but in reality we would still not be even approaching the conditions that people in the developing world deal with every day. Our world has always been cruel and chaotic in so many ways which affect a much larger number of people – we just happen to be used to them. And one thing that humans are exceptionally good at, is getting used to things.

In the more compassionate case which we are currently following, we drastically reduce the amount of contact we have with each other for a few months, which cuts the number of deaths in the US down from 3-6 million, down to perhaps 200,000. In exchange, our economy shrinks by several trillion dollars (it was about 21 trillion in 2019) for a year or more.

Assuming we are preventing 3 million early deaths, this means our society is foregoing about one million dollars of economic activity for each person’s life that we extend and frankly, it makes me happy to know we are capable of that.

So that’s the big picture: we are cautiously and temporarily buckling down and making some sacrifices, in order to help other people.

To me, that is not a cause for panic or fear – it’s a chance to try even harder and be thankful for such a once-in-a-lifetime opportunity.

Meanwhile, some good stuff is happening as a byproduct:

We are driving around and polluting far less. The air is drastically cleaner everywhere.People are out walking with their kids far more. The streets of my town are nearly free from cars, and are being enjoyed by (appropriately spaced) bikes and people for the first time.Our expectations are being reset. Someday soon, it will feel like an absolute joy and privilege to walk into a store and see things fully stocked and prosperous again. And imagine the feeling of taking a vacation or attending a big event or a restaurant or a party!People in rich countries may realize that we can afford to be helpful and compassionate after all – while actually increasing our long term wealth and happiness rather than compromising it.And the world is getting a valuable “practice run” at handling a pandemic, with a relatively mild disease rather than something even more serious.

So How Does This Affect my Retirement?

Once you really get the big picture above, you can see that we are going to come through this better in every way.

Just as with any recession, weaker companies will go bankrupt, stronger ones will streamline their operations and get smarter, and the chaos and broken pieces will become the raw materials from which an enormous batch of brand-new companies will form.

Better ways to track and treat disease, more scalable and less bureaucratic hospitals, more options for remote medicine and more support for remote work and virtual offices and virtual learning in general. More home delivery services and fewer big box stores and wasted parking lots, more support for biking and walking, and a million other things that a billion other people will think of.

The end result will be a better, more resilient and richer world than ever. Yes, that will also eventually mean more money in your retirement account, but more importantly it means better and happier living conditions for every living thing on Earth.

While this all sounds like optimistic magic, it’s actually just a byproduct of human nature. We are a lazy and change-averse creature and we become complacent when our fearful and primitive brains think things are “good enough” for survival and reproduction.

So, oddly enough, we often need a good slap upside the head to get off of our collective asses and actually make some improvements. Observe the wisdom of our elders:

When the going gets tough, the tough get going.Necessity is the Mother of Invention.What doesn’t kill you, makes you stronger.

As old and repeated as these slogans might be, they stick around because they keep proving to be remarkably true. They are the real-world manifestation of a badassity that is built right into our Human DNA, which is why they are some of my favorite phrases in life.

Are things a bit hard right now?

GOOD.

See you in the inevitable and incredible boom-time that will result.

—-

Other Interesting Things That Might Help You Feel Better:

The Simple Path to Wealth, by my longtime author/blogger friend JL Collins, explains long-term investing in the most simple and calm way imaginable.

Towards Rational Exuberance is a more technical and detailed (but still very fun to read) history of the stock market and how the Federal Reserve bank serves to stabilize our system. Although I read this book over fifteen years ago, it has underpinned my understanding and confidence in long-term investing ever since. I would love it if author Mark Smith would add a few chapters to cover the two most recent market crashes as well!

A Guided Meditation for when the Stock Market is Dropping, is Jim’s witty YouTube reminder of the same thing, which he somehow created long before any of this panic started – how could he possibly have known in advance??

Good News, there’s Another Recession Coming is my own magical forecast of the present moment, made over two years ago.

Why We are Not Really All Doomed, my 2014 take on why the world was (and still is) well positioned for many decades of future prosperity.

How To Retire Forever on a Fixed Chunk of Money gets into the reason why stock market drops like the present one don’t really hurt an early retiree (it’s because the vast majority of your shares will be sold several decades from now, when the present panic is barely a blip on the graph.

And finally, just for fun here’s an example of something that is not written to make you feel better. In recent weeks, I spent several hours writing out some interview answers for an article in the New York Times.

I was truly excited to share the details of why the Principles of Mustachianism are more useful than ever in times like these, and it’s quite the opposite of “The End of FIRE” that the silly and financially naive media have been peddling in recent stories.

I was disappointed in the end result. Most of my answers were cut out, and instead the article is focused on “hardships” that other early retirees are currently working through. And the clickbaity title sets the expectations wrong to begin with:

They All Retired Before They Hit 40. And Then This Happened.

(that link will take you to my Twitter post about it, where an interesting discussion has formed in the comments – what do you think?)

March 3, 2020

Lessons in Fear and Wealth from the Coronavirus

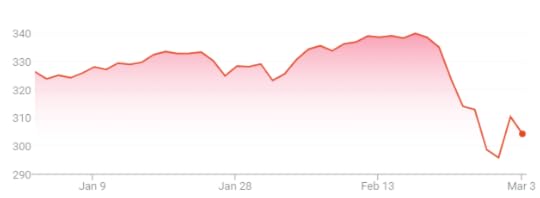

As I write this, the biggest story in the entire world is a virus that is making its way around the planet, leaving a trail of sickness and death in its wake, while sending a much bigger shockwave of fear and uncertainty out front. Last week, the US stock market dropped 15% in just a few days, the most shocking correction since the 2008-2009 financial crisis (and the most interesting drop since the founding of this blog in 2011).

I am sure you’ve been hearing, reading or watching plenty about it already, but the real question is, what should we do about it?

The Scary Side

Is this a screenshot from the fear-mongering TV news? Nope, just a moment from a classic zombie movie, although sometimes it is hard to tell the difference.

Is this a screenshot from the fear-mongering TV news? Nope, just a moment from a classic zombie movie, although sometimes it is hard to tell the difference.The fear and doubt seems to be what the news stories have been emphasizing. The disease is highly contagious, and very sneaky. Each carrier seems to infect 2-3 additional people, which means exponential growth. And with an observed death rate of about 4% so far, it may be about 80 times more deadly than the common flu.

On the news, we see rows of hastily installed hospital beds, people wearing paper face masks even here in our own country, empty supermarket shelves and shuttered factories and public venues.

And we are reminded that we ain’t seen nothing yet, because with mild symptoms that can hide for days, most cases are going unreported and the disease is pumping its toxic tentacles through the arteries of our economy, plotting its attack while we are left POWERLESS UNTIL THE RIOTS IN THE STREET START AND PEOPLE ARE SMASHING THROUGH OUR WINDOWS TO TAKE OUR LAST FEW CANS OF BEANS AFTER WE RUN OUT OF AMMO IN OUR SHOTGUNS.

Some people are just prone to this type of thinking, and I even have a few in my own life. They have warned me to gather “at least a few months worth” of nonperishable food in my pantry and make sure I have a generator and plenty of fuel, at the very least. And to reconsider my stance of not keeping any guns in the house.

The Not-So-Scary Side

I went out on the town at the peak of the scare. The reality is different from the news headlines.

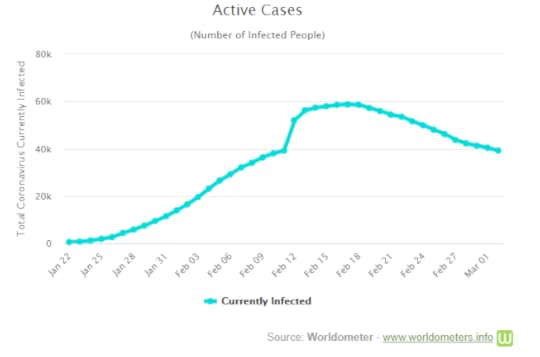

I went out on the town at the peak of the scare. The reality is different from the news headlines.As I write this on March 2nd, there have been about 90,000 confirmed cases of COVID-19. And while the number is still growing rapidly, at the moment it is still a tiny number, about one thousandth of a percent of the world’s population. So even if it multiplies 100-fold, it would be a tenth of one percent. And out of these 90,000 people, about half are already recovered and have moved on with their lives. And the vast majority of the remaining ill, and all those who are so far undetected, and those who are yet to get infected, will also recover.

Past and current status of the outbreak.

Past and current status of the outbreak.But do we have any idea how bad it will get, before it gets better? As it turns out, we do. But first, some perspective.

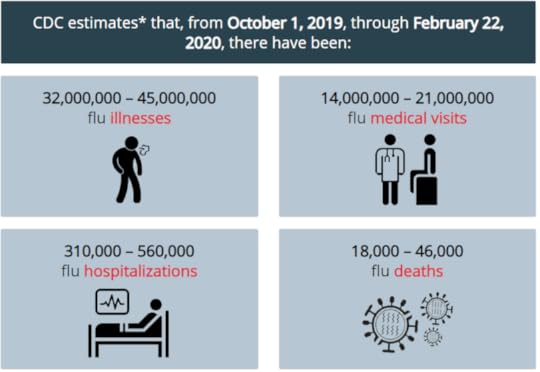

Here are this year’s numbers for the tried-and-true traditional flu for the 2019 flu season in the US alone (and remember the USA is only four percent of the world population):

Wow, 32-45 million cases of the flu already, and tens of thousands of deaths. Even I had no idea it was that serious, and yet the flu is something I don’t even worry about – ever!

Even scarier: every year, about 2.8 million people die in the US alone, and a full 70% of these deaths (over two million people per year) are caused by “lifestyle factors”, which to put it plainly means ignoring Mr. Money Mustache’s advice about bikes, barbells and salads every day.

So if we start with the common flu, which is surprisingly scary, choosing car-based transportation and TV-based entertainment and consuming processed high-carbohydrate food and soft drinks should feel at least an additional hundred times scarier than that.

But do you feel the appropriate ratios of fear in these two situations? And a much smaller amount of fear about the Coronavirus? Probably not, because we humans generally suck at putting numbers, statistics and probabilities into perspective.

We Have Been Here Before

In my lifetime alone, we have seen the rise and decline of quite a list of worldwide health scares, each of which was covered in the news with similar intensity to what we see today. AIDS, Ebola, SARS, Bird Flu, and the 2009 Swine Flu pandemic, also known as H1N1. That one was particularly serious in retrospect, having infected between 11-21% of the world’s population and taking the lives of about 500,000.

Yet here we are, with that fearful event gone from the rearview mirror and a global economy that is far richer than it has ever been. Which is exactly what we will eventually be saying about the present moment in time, from our vantage point in the even more prosperous future.

And Math Can Help Create Perspective

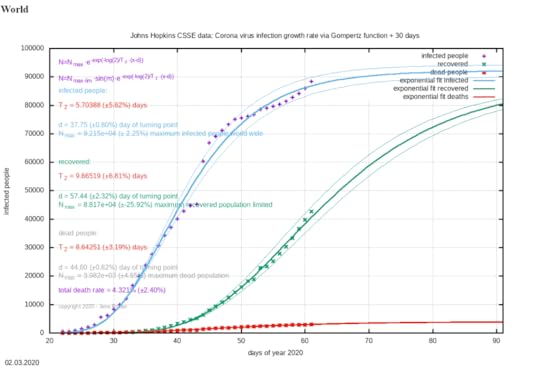

Contagious diseases don’t just grow forever until everybody is dead. They follow an S-curve, like this recent prediction for Covid-19’s spread. It currently estimates that we may see things flatten out fairly soon, but more importantly it continually updates to new information and makes an educated guess – a great strategy for dealing with unknowns in life in general.

One mathematical model that a researcher is updating each day – image source.

One mathematical model that a researcher is updating each day – image source.On the other hand, some estimates are more pessimistic. Disease modelers at Northeastern University uses different assumptions to predict between 550,000 and 4 million cases worldwide*, before we reach the flat top of our “S”. But that’s still only a twentieth of one percent of the world’s population who would even get the disease, and then a further 96-98% of those would recover.

As a final source of information, when it comes to world health issues I always like to see what Bill Gates has to say. And sure enough, he written this great opinion piece in a medical journal. His main point? The damage done by a virus really depends on how well our governments respond to it. Lots of caution and a quick response leads to much better results.

So there’s still a lot of uncertainty. But when faced with a lack of information, we can choose one of two options on where to learn more:

Good looking news anchors with fake tans and no scientific background, who make more money if they generate more viewership hours and advertising revenue, which is proven to multiply if they can cause their viewers to experience fear, or

Scientists and mathematicians who study this stuff for a living, and use incoming data to make a series of continually refined predictions.

As Mustachians, we get our information from scientists rather than news anchors and politicians, and then we choose a course of action based on what is in our circle of control. In the case of the Coronavirus, I would say that means taking the following steps:

Continue the usual program of living a healthy life. Just the incredibly simple steps of cutting cars, sugar and television out of your life as much as possible will virtually eliminate the 70% fatality risk factor of being inactive and unfit – and yet only a tiny percentage of people – even those lucky enough to still have fully able bodies – actually follow this advice. On top of that, this strategy will also greatly boost your immunity to Covid-19, and decrease your chance of serious illness or death if you do catch it.

Don’t try to out-guess the stock market. Just celebrate the fact that we have a temporary sale on stocks. While the endless stream of meaningless market commentary every day means absolutely nothing, one fact remains indisputable: stocks you buy today at a 15% discount from their peak, will be 15% more profitable for you over your lifetime.

And finally, still important but statistically less urgent is taking actual steps related to dodging this and other viral illnesses. Wash your hands a few times a day and avoid unnecessary large gatherings of people in close quarters, until the health organizations tell us we are in the clear.

Guns and ammo and a bunker full of canned beans not required.

* a really interesting quote from that same article about the size of the uncertainty around diseases:

” In the autumn of 2014, modelers at CDC projected that the Ebola outbreak in West Africa could reach 550,000 to 1.4 million cases in Liberia and Sierra Leone by late January if nothing changed. As it happened, heroic efforts to isolate patients, trace contacts, and stop unsafe burial practices kept the number of cases to 28,600 (and 11,325 deaths). “

Advertisement – An MMM-Recommended Bonus as of March 3, 2020:

Today’s somewhat ridiculous 0.5% drop in US interest rates is a pretty rare opportunity to cut down interest costs on any remaining mortgages or student loans you still have. Check out Credible.com for a fast check on whether or not it is worthwhile in your own situation.

Student loans click here ($300 bonus for MMM readers!)

note – Credible has now joined the short list of approved MMM affiliates, see more info here if you are curious how I handle them.

January 27, 2020

Exposed! Mr. Money Mustache’s 2019 Bachelor Spending!

Purchases like this really blow my budget.

Purchases like this really blow my budget.These days, I do a fair amount of informal financial coaching for both old friends and newer acquaintances.

It’s a pretty amazing experience, almost as if I were a real doctor – people let down their guard and talk about the details of their financial lives, without the usual hangups and secrecy that tend to plague our society when it comes to the subject of money.

Often, even taking this first step is a huge leap towards creating a more wealthy and prosperous life. Money conversations are not something we should reserve only for our paid professional advisers. We should speak about it openly with our friends and family, and support each other in a lifelong quest to make the most of our lives.

Through these hundreds of little sessions, I have started seeing a pretty consistent pattern:

People who struggle with money see the whole subject as a swirling, confusing mess. Income and spending, debt and retirement accounts are everywhere. They describe the situation in a long, meandering paragraph.

People who are good with money have this stuff more mentally sorted. They can quickly list their income, their assets and debts, and most importantly they know how much money they spend each year.

People who have been good with money for a long time have moved even further. They might not track it very closely, but they still maintain a growing surplus – because living well within their means is just a natural habit, which means there is no conceivable way they can run out of money in their lifetimes. People in this category sometimes need to be coached away from the habit of being too “cheap”, and towards making the most of the opportunity of a lifetime.

As an MMM reader, you are headed straight for Option #3 above.

But you may have to move through #1 and #2 to get there, which means sorting things out and tracking your spending.

Tracking Your Spending is Fun, Useful, and Easy (Yes, really!)

I can already hear your collective groan as I give you this prescription, but adding up your past year’s spending is one of the most useful things you can do with a Saturday morning, and here’s why:

You can see where your money is going to waste and where you can make really easy improvements that completely change the course of your lifeYou will get the courage to switch jobs, houses, cars, and other life decisions as your fuzzy swirling financial paralysis transforms to a crystal clear understanding of money – one of life’s most useful and fun tools. You can immediately see how much money you will need to retire. (just take your annual spending and multiply it by 25 as recommended by the 4% rule)

I’ll show you my spending if you show me yours.

Road Trippin’ in a Tesla. I keep this cost low by bartering carpentry or business help with Tesla-owning friends, or renting them on Turo.

Road Trippin’ in a Tesla. I keep this cost low by bartering carpentry or business help with Tesla-owning friends, or renting them on Turo.Now for the fun part. I like to think that I live in “Category 3” of that list above – most of my major life expenses (housing, cars, health, food, clothing) are lower than average, because I have simple tastes and I love optimizing things.

Meanwhile, I have several sources of income which add up to many times more than my living expenses (stock index funds, real estate investments, this website, and side hustles like carpentry and operating the MMM HQ coworking space.)

So I haven’t been tracking my spending for a while. But a couple of years ago I went through a major life change – the former Mrs. MM and I split up and moved to separate households in the same neighborhood.

With the old routines shaken up, and new things like hosting more parties, outfitting a new home and increased friend/family/long-distance-relationship travel, how has my bachelor spending been transformed?

It’s time to find out.

How Do You Track Your Spending?

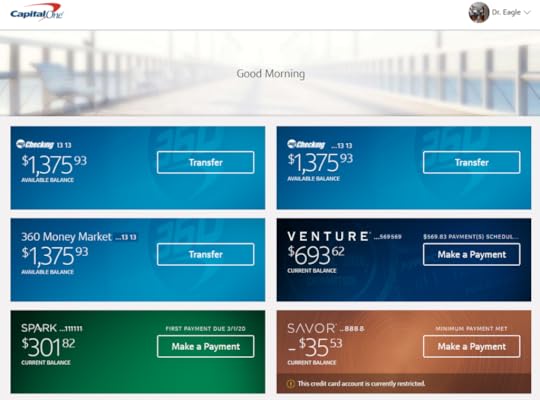

My expenses are really easy to track: I funnel all my spending through a rewards credit card, which saves me about $2000 each year. (in 2019 I used the two highest-paying cards from Capital One which you can find here.)

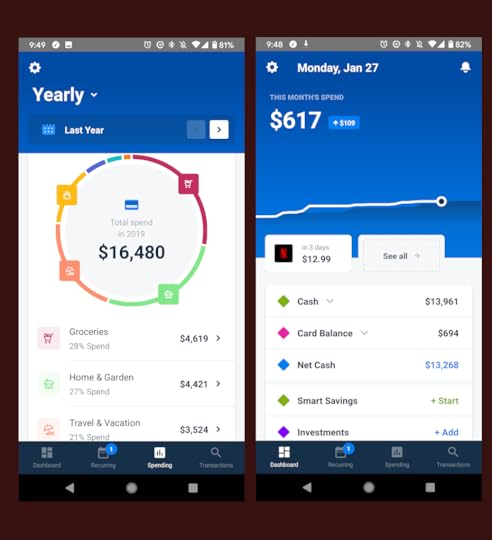

Meanwhile, I hook up a third party financial app to automatically monitor these transactions, alert me to any unusual activity, and – the best part – automatically categorize and add everything up for me. I’ve been using one called Truebill for a couple of years*, and it has the simplest interface of anything I’ve tried – you get results like this:

Recent screenshots from my own Truebill account. (Sorry about all that cash sitting around earning nothing, I will put those little green employees to work ASAP!)

Recent screenshots from my own Truebill account. (Sorry about all that cash sitting around earning nothing, I will put those little green employees to work ASAP!)Truebill is great for tracking and improving spending, and you can also track with Personal Capital, which I have used for the last five years or so mostly for keeping tabs on all my net worth (see my 2013 article on that).

BUT you can also all this quite easily with no apps at all, just by downloading the full list of your 2019 transactions from your bank and opening it up as a spreadsheet. In Capital One (which I also use for my checking account), I just clicked on each account and there is a link for “Download Transactions” right at the top of my transactions list.

For me, it was extra easy because I used the same bank for both checking and credit cards, so everything shows up on a single login screen like this – kudos for Capital One for doing this so well since most banks have pretty bad websites:

Lots of useful stuff on my capital one home screen (don’t worry, balances and account numbers, etc. have been modified for public sharing)

Lots of useful stuff on my capital one home screen (don’t worry, balances and account numbers, etc. have been modified for public sharing)So whether you use an app or a conventional spreadsheet, tracking your spending is quite useful, to know where you are now.

But the biggest message to take home from the result this:

These are not your “living expenses.” This is your current level of spending, something that is entirely under your control.

There is always a trick for everything, and you get to decide how many of these tricks to apply.

For my part, I try to use only the tricks that save me money and make my life better in some way. For example, I do my own carpentry and I use my own legs for transportation, because these are a win/win for me. But I do pay an accountant to do my taxes for me. Your own choices may be completely different, but it’s important and empowering to use that word – choices.

Special Notes Before I Share This

Many fun and even “fancy” things in life don’t have to show up as expenses – like parties at the MMM HQ, which is actually a business rather than an expense.

Many fun and even “fancy” things in life don’t have to show up as expenses – like parties at the MMM HQ, which is actually a business rather than an expense.The table below will shock some, offend others, and hopefully inspire you to at least consider a few new things. But because of my unique life situation, I have made a few unusual choices. I’ll explain them in advance so the table will make more sense.

Do I really have zero medical expenses?

Yes, and I have for my whole life – this is a probably combination of dumb luck (genetics) and hopefully-smart luck (I made a guess that 1-8 hours of outdoor physical work, bikes, barbells and salads every day would be good for my health and so far it seems to be working.) But I know this is not a lifelong guarantee, because there are no guarantees.

What about kid related expenses?

My little 13-year-old is pretty low-maintenance these days: he develops stuff on the computer, plays the bass and rides scooters with friends. When we are together, we do these same things along with hikes and bike rides and the odd road trip. Other kids are into more expensive activities and that is wonderful if they enjoy it and you can afford it. This table includes the half of his food and necessities that I pay for, but does not include any money that changes hands between Former Mrs. MM and myself over these final four years of our co-parenting project. However, I am infinitely grateful for how happy and cooperative our arrangement has become, and suffice it to say that nobody needs to feel sorry for either of us in the financial sense either.

How can you even sleep, with no house insurance and no health insurance?

This really depends on your personality type – and mine may be unusual in this regard. I simply don’t worry much about things like theft, accidents, fires, disasters or anything else. I certainly know they are possible, but my mind thinks in statistics and probabilities rather than emotions or fears. In other words, I’m a bit of a robot. And the robot in me says, “On average you will make a profit and you can afford any worst-case consequences, so why buy insurance?”

For people in situations where losing a material possession would be a big deal, insurance may be appropriate. But I also still like the old-school advice of “don’t buy stuff that you can’t afford to lose, and take really good care of the stuff that you do have.”

But this will all be covered in more detail in an upcoming article about health insurance, including an interesting new option I am just about to try this year.

What Else Are You Hiding From Us?

My businesses pay for some stuff (blog-related trips, this computer, tools, etc.) that happens to be fun for me too – this may prevent me from spending personal money on other fun stuff.

Charitable donations, which now total over $300,000 (see previous article), are also not part of what I consider spending. To me, these are a reallocation of a good part of this website’s income to causes that need it more than me. But I probably wouldn’t be brave or badass enough to give away much money, if I were only earning the bare minimum needed to cover my lifestyle spending in the chart below.

And I don’t include income taxes in my spending, because if someone really lived on a level of retirement income to cover even twice this level of spending they would pay no tax. In my situation, I do earn more than I spend, and pay plenty of tax on it. But much like the charitable donations described in the last article, I think of income tax as just another way of contributing a small portion of this super-lucky surplus back to society.

It’s really not a big deal – and I find that statement to be true in all areas of life: as you get older and your material desires drop away, fewer and fewer things seem like a big deal.

Okay, let’s get into it!

MMM’s 2019 Bachelor Life Spending

(all figures are for the full year)

CategorySpendingCommentsHousingMortgage + Insurance0Bought the current house ($315k) with cash, and I have been self-insured on houses for the last 5 years or so. Not for everyone but it feels right for me.Property Taxes$1735My current place is a 3Br/2Ba home in an “up and coming” (i.e. working class) central area. Downside: pickup trucks everywhere. Upside: cheap to buy, and located on creek and bike path. Walk/ride everywhere!Maintenance and Renovation$4699Renovated my kitchen (IKEA), plus assorted painting + lightsUtilities – City$1227Electric + Water + Trash service. Average electric = $24/month including electric car charging.Utilities – Heat$353Natural Gas service (incl. hot water)Household Items $294Things like lamps, picture frames, vegetable peelers, wine glasses at places like Target.Total Housing$8308FoodGroceries$4615Mostly fresh, organic higher-end stuff. For one active man and 1/2 time of a growing teen boy. Costco/Sam’s whenever possible, plus Whole Foods for more specialized items, and because it’s within walking distance.Restaurants$910Many more nights out in this new life – expensive but fun.Beer/Wine/etc$203Total “Food“$5728Medical CareHealth Insurance$0I decided to self-insure for 2019 as an experiment (because the US coverage mandate was removed), to see if I found it stressful/scary. Article on this to come!Medical Bills$0Had a truly fortunate year again – capping 45 years with just about zero medical costs so far. Will not take this for granted!Dentist$0Confession: I have only been ONCE in the last 25 years. Complacent because I’ve never had a cavity. Teeth are fine and clean. Am I pushing my luck?AutomotiveGasoline$22.621999 Honda Odyssey – used mainly for construction hauling. I do lend it frequently to friends, but they return it full of gas. But I walk and bike for all of my in-town transportation.Maintenance$0She had a perfect year (although with low mileage, car breakages are rare)Car Registration$545For van, cargo trailer, and Nissan Leaf shared with former Mrs. MMInsurance$397Mainly for the Leaf because it includes comprehensive (long story) – this is my half of the shared policy cost. Still using Geico and it’s great.Automotive Total$965Travel Total$3702Plane tickets, car rentals, airport transport. Interestingly, most accommodation was “free” due to staying with friends, credit card points and AirBnb Referrals.Entertainment$400Plays, Books, Netflix, Google Play movie rentals, even a couple Oculus VR video games.Mobile Phone$300I’m still on Google Fi. It’s $20 per month+data, a solid value for lower data users – I like the free international coverage.Internet$600This is expensive because we buy Longmont’s gigabit fiber internet, but well worth it for a household of blogger/video gamer/youtubers.Total$21,470Hey, not bad! Total “Barebones” $13,068My real (still luxurious) living expenses without the travel and $5000 kitchen renovation. Still includes restaurants, booze, cars, gadgets from Amazon, and living in a 3 bedroom detached house!

……………………….……………

So, What Now?

Well, this was a pleasant surprise. I had felt like I was living a total billionaire’s life in 2019, because it has been so packed with interesting people and places and experiences. I always buy whatever I want – after considering whether it will really make me happier – and this leads to a feeling of almost dizzy abundance. But I guess abundance just isn’t that expensive.

2020 is shaping up to be an even bigger year of personal growth and better friendships and hard work. I’m drawing up the plans for an exorbitant second-story deck off of my bedroom. The Tesla Model Y comes out in just a few months, and I am in love with it.

It could get expensive.

Stay tuned and I will let you know how it goes!

In the Comments: do you track your own annual spending? If so, how did you do last year? If not, what is your reason?

*About Truebill: I heard from Haroon Mokharzada as he was just founding the company, and was impressed with his background of seeming to be on the “good guys” team. So I have been a casual user ever since, just to follow their progress. The Truebill service/app is now good enough that I can see it being useful for many people – not just for tracking spending. And they have a sizable development team and a large and growing base of happy users. Nice job y’all!

Affiliate notice: While I have no financial relationship with Truebill, this blog may get a commission for other recommendations within this page, including Personal Capital, Airbnb and the credit card recommendations. And many thanks if you do use them!

December 28, 2019

Let the Roaring 2020s Begin

—

First some great news: because of your support in reading and sharing this blog, it has been able to earn quite a lot of income and give away over $300,000 so far.