Mr. Money Mustache's Blog, page 2

July 23, 2023

The Comfort Crisis

As with many things in life these days, it all started with an episode of the Peter Attia podcast.

In this edition, our nation’s most Badass Doctor was interviewing a guest I initially dismissed as not overly applicable to my own lifestyle. A young,excessively handsome dude who happened to be a writer with a new book out. But the headline of the episode was just intriguing enough to get me to click.

“The Comfort Crisis”

Wow, what an amazing turn of phrase, and what a concise summary of the core of this whole Mustachianism thing I’ve been trying to express for the past dozen years.

While the news headlines cry constantly about our nationwide personal debt crisis or health crisis or any other number of things that suggest that life is so hard these days, I have always seen the opposite: on average, we Americans seem to have a problem of ridiculous overindulgence and easiness in our lives, and our main problem is not recognizing it, and the damage it does to us.

So of course I had to click, and then listen to the whole two hour episode, and then buy the book, and then spend the past month reading and digesting it in small, meaningful chunks like the modern-day chunk of scripture-like wisdom that it is. And wow, am I glad I did so.

The author is Michael Easter, a former writer for Men’s Health magazine was also once catastrophically addicted to alcohol – and descended from a long family line of ancestors with the same affliction.

He was lucky to catch himself from that fall in time to save his own life, and that story alone makes the book worth reading as someone who has stood by helplessly as loved ones battled with addiction. But I think his history with overindulgence in the hollow comforts of alcohol also gives him an edge on writing about the battle between comfort and hardship on the bigger stage of life in general.

So what is The Comfort Crisis about, and how can it make all of our lives better?

The best part about this book is just what a damned good writer this Easter guy is. Like many of the most fun popular science books*, it follows a split narrative which jumps back and forth to interweave the story of an insanely difficult caribou hunting trip he joined in a remote pocket of Alaska, with the appropriate bits of science, psychology and cultural commentary that help us explain and learn from each chapter of the epic shit he had just endured. This allows us to process and apply the lessons in our own lives.

For example, have you ever wondered why the type of bored, rich suburbanites who populate the board of your local Homeowner Association and whine about unacceptably tall weeds or unauthorized skateboarding on Nextdoor are so insufferable?

Why can’t they do something better with their time?

It turns out that there’s a scientific explanation for these unfortunate people, along with most of our other problems:

The tendency of humans to always scan our environment for problems, regardless of how safe and perfect that environment is.

The book cited a study in which researchers told people to look for danger, in an environment which gradually became safer and safer:

“When they ran out of stuff to find they would start looking for a wider range of stuff, even if this was not conscious or intentional, because their job was to look for threats.”

“With that in mind, Levari recently conducted a series of studies to find out if the human brain searches for problems even when problems become infrequent or don’t exist.“

“As we experience fewer problems, we don’t become more satisfied. We just lower our threshold for what we consider a problem.“

In other words, even when our lives are virtually problem free, instead of appreciating our good fortune we just start making up shit that we can complain about instead.

And then our politicians cock their greasy, finely-tuned ears in our direction and make up policies to appease our mostly-insubstantial concerns. And they invent their own trivial “wedge” issues to get us to all bicker about our different cultures and religions, suddenly caring about things that would not have even been problems if nobody told us they were.

And there’s America’s weakness in a nutshell, and meanwhile our strength comes entirely from the times we choose not to waste our time stooping to this level.

Meanwhile, the opposite effect holds true: people who survive in rougher environments than us end up more resilient and less prone to complaining.

In a series of recent interviews, Ukrainian people living in the war zones of their occupied country were asked “is it safe to live where you live?” and a strangely high percentage still said “Yes” – not all that different from the responses of US residents when asked the same question about their own cities.

This adaptation principle also explains why some first generation immigrants tend to build businesses and wealth while their own offspring in second and third generations are more likely to become complacent and spend it down. As an immigrant myself, I can see why this is: conditions were just slightly more harsh and less comfortable and wealthy where I grew up, so I adapted to those conditions as “normal” which made the United States seem posh and easy by comparison. Which made it easier to spend less money and accumulate more.

Tree Therapy

The trap of pointless worry is just one of the many revelations of The Comfort Crisis. It also gives insightful explanations for why spending time in Nature boosts our mental and physical health, while cubicles and car driving grind us down.

There’s something in our biological wiring that responds instantly and powerfully to everything natural, in ways that you can’t get anywhere else.

Even placing a single plant into a hospital room will measurably improve the recovery of almost all patients from almost all ailments. So can you imagine the power of the medicine you are inhaling if you step into a real, living forest? And what if you spent several hours there, or even several days?

Later, we get lessons on our human adaptation towards the ratio of effort to reward:

It’s proven the harder you work for something, the happier you’ll be about it,”

It’s proven the harder you work for something, the happier you’ll be about it,”

And our bizarre natural aversion to physical exertion:

A figure that shows just how predisposed humans are to default to comfort:

A figure that shows just how predisposed humans are to default to comfort:

2 (two).

That’s the percent of people who take the stairs when they also have the option to take an escalator.

Which is remarkable, given the absolutely insane cost this tendency imposes upon us.

Moving your body, even a bit, has enormous benefits – again to almost all people towards reducing the probability and severity of almost all diseases. So can you imagine the benefit of moving your body for several hours per day in a natural environment, and including heavy load bearing and bits of extreme exertion?

These things are not speculative pieces of alternative medicine. They are known, easily and reproducibly tested, and proven to be the most effective things we can possibly do with our time.

So why, the actual fuck, are people still sitting inside, watching Netflix, driving to work, and then driving to the doctor’s office to get deeper and deeper analysis of a neverending series of exotic and mysterious and unsolvable problems with their physical and mental health?

We should at least start with the stuff we know is essential – maximum outdoor time every day, heavy exertion including with weights, minimal time spent sitting and driving, and minimum junk food, sugar, and alcohol. You definitely don’t have to be perfect, but just understand that these are the big levers for physical and mental health.

Only then, once you reach these minimum basic things for human survival, should you expect that more exotic and niche medicines and treatments are the only course of action.

By all means, follow your doctor’s orders and don’t just dump all of your medications down the sink because of this MMM rant. But at the same time, realize that the stuff that is hard and uncomfortable is very likely to be the stuff that improves your life the most.

It’s all the stuff that Mr. Money Mustache has been telling you since 2012, but with more detail and less distraction. This book is a concentrated packet of advice for solid living.

Real Life Inspiration from the Good Book

In a happy coincidence, I happened to be in the middle of some hard stuff** of my own as I worked my way through The Comfort Crisis and I found the perspective quite useful and transformative to apply hot off the press.

Working with a friend to build a cabin.

Working with a friend to build a cabin.Normally somewhat of a homebody, I had embarked on a solo journey for some Carpentourism deep in the mountains of Southwestern Colorado. I had my whole life shrunk down into the new Model Y including food, bed, and the necessary tools and materials to tackle a pretty long laundry list of tasks on two different construction projects (fixing up a mini-resort property in Salida, and starting construction on a small cabin in Durango)

The trip immediately took a turn towards the dramatic as I climbed into the mountains and drove straight into the most torrential rainstorm I have ever seen, then accidentally broke a traffic law in a remote mountain town right in front of both of the local police officers ($115 fine and two points off my license), then five minutes after that had a small pebble hit my brand-new windshield which instantly spread into a crack that spans the whole thing, all before finally limping into Salida to unpack and get started on the work.

“Big deal”, I can already hear you saying, “Retired man experiences two minor incidents while taking a vacation in his luxury car.”

And you’re right, and that is exactly my point.

My life is so stable and comfortable that even these two miniature challenges threw me off balance, and I arrived in a slightly bummed and stressed-out state. But I still knew that in the bigger picture, they are good for me if I accept them as I accept them as the lessons they are rather than choosing to continue to worry about them.

As the trip went on, more things happened, almost as if The Comfort Crisis book were trying to prove a point. I drove three hours deeper into the mountains and up the steep dirt road to arrive at my second friend’s piece of land – a plot of forest in the mountains just outside of Durango.

Pollen

PollenMy work days in that high desert environment in the peak of summer were hot and physically demanding. It was hard to keep my tools, and my food supply in the cooler, and myself protected from the scorching sun (and a strange neverending blizzard of tree pollen) while still getting the job done. There was no indoor plumbing and we had to be very careful with our limited water supply. And then at the end of each day I had to reshuffle everything and set my car back up as a bedroom and crawl in for the night. Alone and far from home.

But instead of feeling depressed as I experienced this constant hardship, the opposite thing was happening: I felt more alive and more badass with each passing day. I got better at being a feral forest man.

One day, my co-builder and I decided to take the afternoon off and head to the wild, remote Lemon Reservoir for some paddleboarding. We didn’t bring our phones or any other conveniences or amenities – just two boards and the minimal clothing required for swimming. And we headed out into a stiff headwind and little whitecap waves, laughing at the freedom of the experience.

Lemon Reservoir

Lemon ReservoirIt was hard, and slightly scary, as we got further and further from the shore. Progress was slow even with serious paddling, and we didn’t have any particular plan beyond the spirit of “let’s GO!”

But again Michael Easter was there whispering in my ear, saying,

“Is this difficult, Mustache? GOOOOoood! Then you’d better keep going!”

So we did. And we got way out into that lake, to a point where the water was shielded from the wind by the mountains on the other side. And it was awesome.

We cruised over to the shore to explore a particularly scenic meadow, coated with the softest green mossy grass and exuberantly colored wildflowers, and set at an impossibly steep angle. And damn I wished that I could have taken pictures, but in a strange way this forced me to burn that spot more thoroughly into my memories using my own senses instead.

Then we headed back out into the center of the lake, set down the paddles, and just laid down on our boards to let the wind and the waves take us back towards the far end of the lake where we had started. And what a strange, serene feeling it was, floating on just a tube of air over two hundred feet of cold blue water, feeling like a jungle man with no cares and no plans and no material possessions. It could have been scary, but instead it was one of the best and most relaxed moments of my life.

Eventually, this week of forest living and exertion had to come to an end so I could get back to my own town to be a Dad again. But it ended with a final reminder of the principles of the Comfort Crisis – after so many days relatively extreme work and a relatively sparse food supply, I had grown used to a healthy background hunger. Which is yet another thing that we are meant to experience as humans – being satisfied and free from hunger all the time is neither normal nor healthy.

But when my hosts took me out on the town for a final night thank you dinner at the Mexican restaurant, the immense Burrito platter I consumed turned out to be the most delicious meal of my life.

The most delicious meal ever (and the most Immense – hand for scale)

The most delicious meal ever (and the most Immense – hand for scale)Purposeful Hardship vs. Purposeful Spending

There has been a lot of talk directed at the FIRE community recently about how bad we are at spending our money, and how we all need to loosen up. And there’s a small amount of truth to it, as my local friends Carl and Mindy recently admitted during a grilling on the Ramit Sethi podcast.

But we also need to keep this whole idea of excessive comfort in mind, and the damage it does to the natural human condition.

It’s great to spend money on adventures and improving yourself, being generous to others, and making the world a better place.

But it’s also way too easy to fool yourself into thinking you “want” things that just make your life easier and easier.

So your job is to catch yourself before this happens, and learn to keep things challenging, even as you upgrade the rest of your life experience.

In other words: buy yourself better tools, not softer chairs.

—-

* Another great book that follows this style is Wired for Love by neruroscientist Stephanie Cacioppo – highly recommended for reading in parallel with a lover, whether new or old.

** not actually hard by reasonable human standards, but it seemed hard by my comfort addicted first world standards

April 27, 2023

Frugal Man Buys $52,000 Car – Why??

This is Midjourney AI’s imagined version of my new car. I’ll update this picture once I take delivery and head out on my first real camping trip!

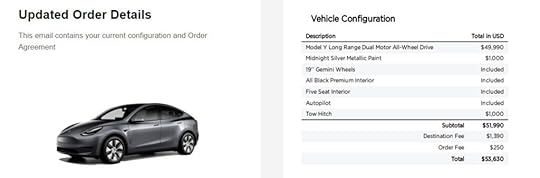

This is Midjourney AI’s imagined version of my new car. I’ll update this picture once I take delivery and head out on my first real camping trip!As I type this, I’m jumping through the various hoops involved in buying a 2023 Tesla Model Y, a spectacularly expensive, large luxury “crossover” that is absolutely loaded to the gills with excess: all wheel drive, faster acceleration than a Lamborghini, enough space for seven people and enough computer gadgetry to function as a small Google data center.

The total net cost of this thing to me after all the taxes and tax credits* will be about $52,000, which is just a stunning amount higher than the Honda van it is replacing. That old classic cost me $4500 when I bought it off of Craigslist twelve years ago, and it had served me dutifully until just last month, crisscrossing the mountains and deserts of this country and also helping to rebuild a considerable swath of houses in my neighborhood.

I’m supposed to be a frugality-oriented financial blogger, and I’m also known for hating car culture – I think most people use cars about ten times more often than they need to, and most people drive cars they can’t afford. So why the hell am I buying a new one?

From those first three paragraphs, you can see I’m feeling plenty of self-mockery and ridicule over this new purchase. If you’re also a naturally frugal person, you can surely relate to the thoughts and you probably also agree with me that I’m off my rocker.

And indeed, I’m still on-board with frugality and healthy self mockery. After all, it was this overall life philosophy that earned me an early retirement 18 years ago, which provides all of the glorious freedom I enjoy now.

It was also the philosophy that allowed me to procrastinate on buying this expensive car for the last four years, even as countless people both close to me and out on the Internet egged me on and told me I should just loosen up and treat myself.

But there’s a classic slogan that applies to many areas of life, and it is something I like to dig up and ponder every now and then:

“What got you here,

Won’t get you where you’re going.”

How does that piece of wisdom apply to frugal living and enjoying a long life of early retirement?

A quick story from a recent run to the grocery store will explain:

I was standing there in the bakery aisle, hoping to restock with a loaf of Dave’s Killer Bread for the next day’s breakfast with some visiting friends. But since this was in a standard grocery store rather than the Costco where I usually shop, the damned stuff was priced at an eye-watering $6.99 per loaf (instead the $4.50 or so I’m accustomed to paying, and even at the bulk store this stuff is about double the price of normal bread).

“DAMN YOU KING SOOPER’S!”

Was my first response.

“WHO THE HELL DO YOU THINK YOU ARE, TRYING TO SELL BREAD FOR SEVEN BUCKS!!!”

Then I went through a whole mental battle of what I call Grocery Shopping With Your Middle Finger:

“Should I just boycott this bullshit?”

“Hmm I wonder if any of the other competing brands are any good?”

“What else is a good substitute for bread for this breakfast?”

And then thankfully, after exhausting all other mental options, I settled on the correct one:

“JUST BUY THE BREAD YOU DUMBASS!”

“Because you are never going to wake up in the future and look at your bank account and think, shit, if only I had an extra $2.49 in there I would be a happier person.”

That night, I came home from the store and shared this funny tale with one of my guests. He understood perfectly because he too had earned his own retirement through a lifetime of grinding in tough jobs and disciplined frugality. And despite the fact that he has a net worth several times higher than mine, he admitted that he faces exactly the same mental battles over splurging on himself.

This same friend gives freely to charitable causes, has supported a local school for decades, and is always the first one to pull out the checkbook if a friend has hit hard times or is looking for a trusted business investor.

But he still has trouble bringing himself to take an Uber to the airport instead of riding the bus which takes an hour longer.

We both realized that we were being too cheap with ourselves, and we needed to work on it. And we came up with a set of three ideas that should hopefully work together to help us have more fun with our life savings, while we are still alive:

the Minimum Spending Budget,the Dedicated Money Wasting Account, and the Splurge Accountability Buddy.Principle #1: The Minimum Spending Budget:

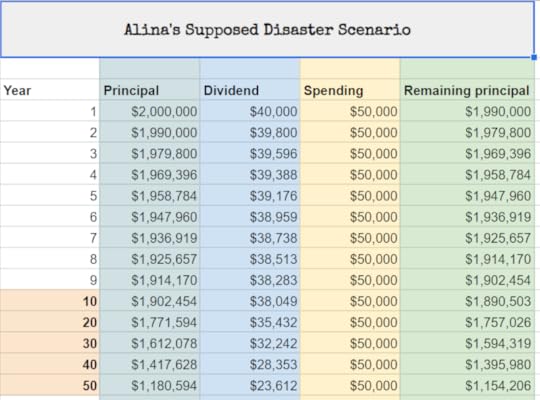

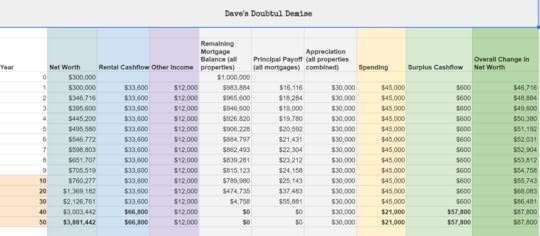

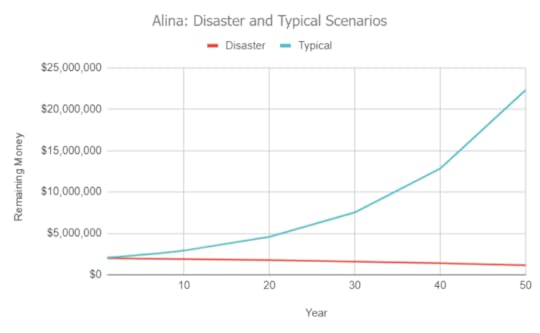

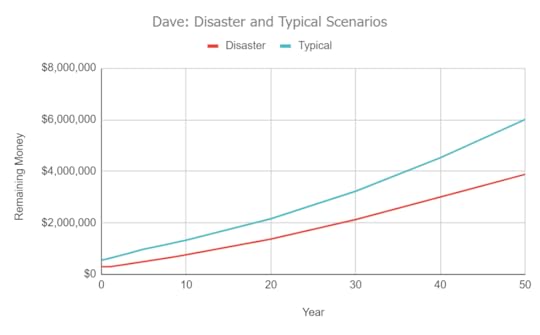

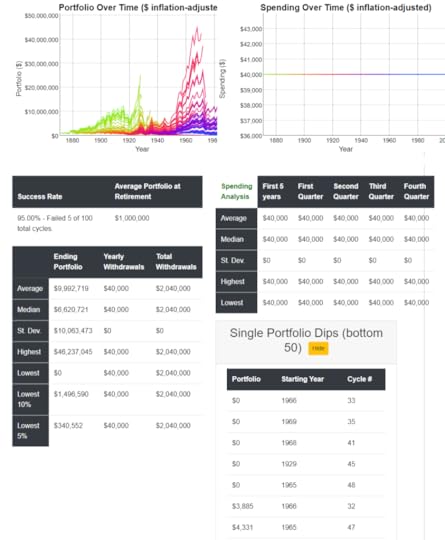

Suppose you’ve done well over the years and amassed a pile of productive investments worth about two million dollars. Yes, this is a lot of money for most people, and that is the point: this hypothetical person truly has it made.

But as it turns out, most Mustachians I know with this level of wealth are still living very efficient lives, usually with a spending level of under $40,000 per year. On top of that, they typically live in a mortgage-free house and still have various forms of side income from a small business or two.

The 4% rule tells us that this person should be fairly safe spending up to about $80,000 per year from that cozy nest egg, even if they never earn any other money.

If this person wanted to be ridiculously conservative and set the spending rate at 3%, that still leaves about $60,000 of fun money every single year.. Plus, again, any side income, future inheritances, and social security income only add to the surplus.

Thus, a reasonable minimum spending level for this person might be $60,000 per year.

And in most cases, they know this, but still go right on living on $40k or less and claim they have everything they could ever want.

But if you watch carefully you’ll still catch them firing up the middle finger at things like $6.99 Dave’s bread or the $14.00 Cabernet at the restaurant or driving around in a gas guzzler even when they would prefer to have a proper, modern electric car.

And whenever these people do get extra money, their first instinct is to stash it away on top of the already-too-big pile. In diagram form, their money flow looks like this:

Note that while this person is great at accumulating money through that big red arrow firing money back into the ‘stash, their “fun stuff” arrow appears quite flaccid and withered.

Which is a perfect segue to ….

Principle #2 – the Dedicated Money Wasting Account

Lifelong habits are hard to break, and it’s sometimes hard to “waste” your own hard-earned money on things that seem frivolous, even when you know intellectually that you have way more money than you’ll ever spend.

But have you ever noticed that if you are spending somebody else’s money, preferably an anonymous corporation, it feels different?

For example, when you’re on a business trip and you just show up at the dining table to eat and drink and you never see the bill, you probably don’t fret about the prices, right?

The key is to make your own money feel like somebody else’s, and you can do it like this:

Re-brand your main bank account – henceforth it is the FREE FUN MONEY account. Set up an auto-deposit of your minimum spending budget that drops in each month (if you suspect that you might currently be too frugal, make this at least $1000 per month higher than your current spending level)The only way you are allowed to use the money in this new account is to spend it on anything and everything, or give it away. It can be used for both necessities like groceries and your utility bill, but also your luxuries like travel and dining and generosity.

Re-brand your main bank account – henceforth it is the FREE FUN MONEY account. Set up an auto-deposit of your minimum spending budget that drops in each month (if you suspect that you might currently be too frugal, make this at least $1000 per month higher than your current spending level)The only way you are allowed to use the money in this new account is to spend it on anything and everything, or give it away. It can be used for both necessities like groceries and your utility bill, but also your luxuries like travel and dining and generosity.But the key rule is this: You are not allowed to follow your old habit of sweeping out the surplus each month to buy more and more index funds as you’ve been doing your whole life.

If the free fun money starts building up, which it probably will because you are way out of spending practice, it will stare you in the face and tell you to do a better job.

And this can and should be FUN! Now you can get the best organic groceries even when the price seems exorbitant. Go out for dinner or order delivery whenever you like. Surprise your loved ones with concert tickets, join your friends on snowboarding or beach trips, or even pay for an entire group vacation, allowing people to go who couldn’t normally afford it so easily.

Technical Note: Some people have income or wealth levels are so high that it would be insane to spend at a 3% rate. For example, a $10M fortune would lead to a $25,000 monthly spending rate, which is obviously ridiculous.

In this situation, you can still leave your dividends reinvesting but still give yourself a bigger, no-saving-allowed budget to get some practice being more relaxed and generous. The real point here is to just stop sweating the details so you can have more fun.

Principle #3 – The Splurge Accountability Buddy

Many of us frugal people tend to stick together. And most of us have different versions of the same problem: we know logically that money is plentiful these days, but our emotions keep us stuck in our old ways of optimizing too much.

But I find that when I team up with local friends who are actually trying to battle these same habits, we can question each other’s decisions, call out cheapness when we see it, and cheer on splurges when we know the other guy would enjoy it.

My super wealthy friend from above has become much better about treating himself (and his family) to quality goods for the home, amazing trips together, and just a general reduction in his stress over being “efficient with money”

My friend and HQ co-owner Carl (Mr. 1500 Days) has finally replaced his beaten-down minivan with a spiffy new Chevrolet Bolt electric car, and is loving that leap into the future.

And of course Mr. Money Mustache, after squeezing one final mountain road trip out of his 23-year-old Honda van, is finally allowing himself to get the Tesla he has been talking about for half a decade.

An early spring Sunrise at our new “Friends Mountain Resort”

An early spring Sunrise at our new “Friends Mountain Resort”A recent life change (becoming a co-owner of a fixer-upper vacation rental compound in beautiful Salida Colorado) has reignited the travel fire in my heart and made me realize how much I do love getting out to distant places for visiting, mountain biking, gathering with groups of friends and my favorite activity of all: Carpentourism.

Running the Numbers: how ridiculously expensive is this car?

This is the perfect start to my experiment in spending more. Realistically, a $50,000 car is going to cost me about $10,000 more per year than my old van was burning. With the biggest costs being these:

Since I personally had a spending deficit of several times more than $10k per year, I figure this is a solid first step. And, since the car’s primary purpose is things like epic camping trips, dream dates, and long adventures around the country, it will definitely help me spend more on experiences, hotels, and go out to dinner a bit more often as well.

“This Privileged Rich Folk Talk is Making Me Sick, why don’t you give your money away to charity, or to me?”

In general, I agree: the world has problems and the richer you are, the more you should consider giving generously.

But also, to be honest, the whiny people who constantly send complaints like this out to strangers on the Internet really need to get a life. It’s great to encourage philanthropy through positive examples, but completely unproductive to send negativity to shame people you don’t even know for not following your own personal value system. The world has seen more than enough of this.

On top of that, this one-sided thinking can be counterproductive. Both of my friends have given generously throughout their lifetimes. In my own case, I have donated over $500,000 to the best causes I could find during the years I’ve been writing this blog, but I was still refusing to let myself replace that 23-year-old van.

And that overthinking was leading to even more of a scarcity mentality, as I compared my own meager spending to these bigger numbers of my donations, and found myself thinking things like,

“Damn, I’m spending $100 on this dinner date which sounds like a lot, but I also spent ONE THOUSAND TIMES more on donations last year, which sounds like even more. Maybe I am spending too much and need to cut back on EVERYTHING!”

And then the fear side of my brain would illogically chime in: “Yeah and you’re going to make us run out of money and be poor forever! waaaah waaaah! Cut back and optimize and conserve!”

I think there is a happy medium here.

Yes – be a super, duper responsible stewart of your life savings.

And yes, give generously with all your heart to charity.

But yes, it’s also okay to set aside a portion of the money you’ve earned, for frivolous spending on yourself and those closest to you. You’re not a bad person for having a few nice things.

It’s okay to pay that extra hundred bucks to sit in the front of the airplane instead of the back if it helps you enjoy your vacation and spend a joyful half hour walking FREE at your destination while the 49 rows of people behind you fuss infuriatingly with their shit in the overhead bins.

It’s okay to buy the frozen berries at Whole Foods even though they cost eight times more than Costco charges, if it spares you from making a second unpleasant trip through parking lot hell.

And as for me, I am calling it okay to, at last, double flip the Autopilot stalk in my new Tesla and lean back as it it shoots me gracefully through even the highest mountain passes, forever leaving the desperately underpowered wheezing and gear shifting and noise* of the gasoline era behind, forever.

Rest in Peace, Vanna – 1999-2023

* A useful tip for more effective splurging:

Try to find the truly negative aspects of your life and focus any additional spending on improving those things. But it’s a subtle art so you have to get it right if you want lasting results in happiness.

You don’t want to just reduce hardship or challenge like hiring someone to take care of every aspect of your house, because overcoming daily hardships and having significant accomplishments provides the very core of our life satisfaction.

You also don’t want to just upgrade the things that are already good in your life. For example, a friend of mine is a gourmet coffee expert, and he suggested that I upgrade my setup at home to include on-the-spot roasting, and fancy grinding and brewing equipment. But I already love the good quality coffee I buy off the shelf from Costco, so it would be counterproductive to invest time or money into changing this part of my life.

But when you have something that causes you regular angst and stress, whether it’s a leaky roof that makes you dread rain, or a long commute that makes you dread the daily traffic jam, or a body that is giving you trouble due to not being in the best of shape – those types of things are probably a good target for improvement.

In the case of my car situation, I had a Nissan Leaf which is wonderful to drive, but doesn’t have the range to travel anywhere outside of the Denver metro area. Then I had the van which is a clunky beast to drive, but is otherwise an amazing road tripper because I could bring along whatever and whoever I wanted. But the van was getting increasingly unreliable in several hard-to-fix ways which was making me nervous every time I thought about long distance travel. Which was causing me to avoid certain trips and miss positive lifetime experiences.

In other words, my lack of a reliable long-range car was a small but consistent source of negative stress.

Finally, Vanna gave me the gift of a final hot and smelly transmission failure on a mountain pass on the way home from my new project in Salida. It was just the nudge that I needed. And now I already feel excitement rather than dread at the prospect of all the road trips in the coming decades!

* Total cost of this Tesla:

Model Y plus options and Tesla fees: $53,630 Subtract $7500 federal EV tax creditSubtract $2000 Colorado EV tax credit(Note: this is equivalent to a $44,150 list price if you are cross shopping with other cars)Add back in $4674 of sales taxAdd in first 3 years of Colorado new-car registration fees: $3000Net cost: about $52,000New Tracker Page!

To go along with this article, I started a new page called “The Model Y Experiment” where I can share ongoing findings and Q&A about the ownership experience. I’ve driven and rented Teslas quite a bit in the past, so most of it will be pretty familiar. But as an owner I’ll get to verify the reliability and the quality of customer service, as well as any quirks and modifications and upgrades I do.

April 7, 2023

Less Cars, More Money: My Visit to the City of the Future

In my role as Mr. Money Mustache, I do my best to be your one-stop-shop for Lifestyle Guru ideas. So over the years we’ve covered not just the Money side of life, but also the even more important stuff like health and fitness and the psychology of better, happier living.

But there’s one single area of life where all of these factors come together with an almost Nuclear Fusion level of synergy and effectiveness. And because of that, if I could have one single wish in the world, this is what I would wish for. It’s a change so massive that it would make every person on the planet better off and fix most of our problems in one grand sweep. And it’s probably not what you’d expect:

That we immediately switch to building our cities and countries around people, instead of cars.

(and then fix all of our existing ones too, so that our entire world is built around person-friendly living.)

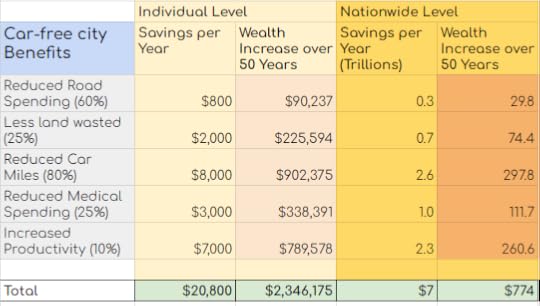

The benefits of this are way bigger than almost anyone can imagine. We’re not just talking about eliminating a bit of pollution or a few traffic jams or car crashes. No. This is about far richer, healthier, and most importantly more fun living for everyone.

To put even conservative numbers to this, we’re talking about a life boost of over $20,000 per person per year, which compounds into well over two million dollars per adult lifetime.

On a nationwide scale, this would boost the wealth of the United States by about seven trillion dollars per year, which would compound into about 770 trillion over the next five decades.

Which happens to be more than the current total amount of human wealth on the entire planet.

City design dictates the biggest numbers in the world.

City design dictates the biggest numbers in the world.You will have a house that is both cheaper and more beautiful and spacious. Your body and brain will be healthier and stronger and sexier and cost a lot less time and healthcare dollars to maintain.

And all of our wallets and investment accounts, both public and private will be absolutely overflowing with surplus income, reduced expenses, and fuel an investment and prosperity boom like the world has never seen.

“WTF?”, you may ask

“Isn’t city planning just a stuffy thing that your city council does in the background while we’re all off living our lives?”

Well, yes it is right now. And that’s the whole problem: cities are built by people whose primary job is to maintain the status quo and prevent disruptions. And those committes are elected and encouraged by crusty old companies and organizations, and plain old grumpy neighbors who just don’t have the vision to see what they are missing.

I’m convinced that if everyone could see through the smoggy haze of the status quo, we would all agree that this idea of a radical change is not only the best idea, but the only reasonable idea to even consider.

So our job is to learn and explain just how big and how easy this is. And what it boils down to is pretty damned simple.

Let’s start with this picture

image credit to the excellent DenverUrbanism website https://denverurbanism.com/2016/12/choosing-to-build-two-parking-spaces-or-two-bedrooms-shouldnt-be-difficult.html

image credit to the excellent DenverUrbanism website https://denverurbanism.com/2016/12/choosing-to-build-two-parking-spaces-or-two-bedrooms-shouldnt-be-difficult.htmlWhoa, that’s a bit of a surprise.

So for the same amount of space you can have an entire pretty nice two bedroom apartment, or you can have just enough space for two (small) cars to park and pull out. But it gets even crazier than this. Check out this random intersection here in my own city:

A big intersection is about 250×250 feet.

A big intersection is about 250×250 feet. On a good traffic day, you’ll blow right through it.

But this is actually 1.5 acres of wasted space, enough to house about 200 people in resort-like comfort!

WHAT?! So every time you have two big car roads intersect, which happens hundreds of times in every big city, you are wasting enough space to build a luxurious, resort-like living area with about one hundred two-bedroom apartments and still have room for a pool, a dog park, a grocery store, a couple of restaurants, and so on.

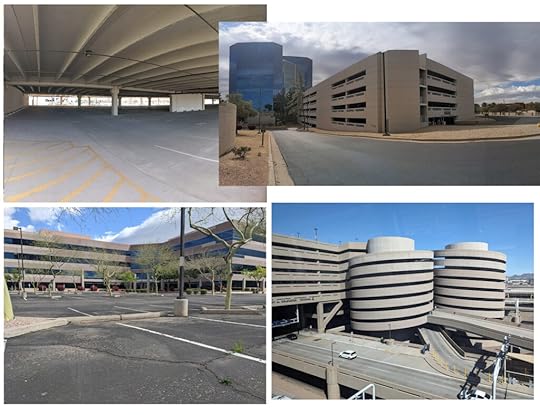

This is just the beginning of the insanity, because I have only shown you two parking spaces and one intersection. The reality is that our entire cities are made almost entirely of stupid, expensive wasted space like this.

Most of the city of Phoenix is OBSESSED with cars. Infinitely large parking garages, parking lots, and of course roads. But most of it is wasted (I took these pictures during a long exploratory walk I took in the middle of a work day.)

Most of the city of Phoenix is OBSESSED with cars. Infinitely large parking garages, parking lots, and of course roads. But most of it is wasted (I took these pictures during a long exploratory walk I took in the middle of a work day.)And the problem is so extreme that the only reason we think we need cars to get around, is because we have wasted most of our space on accommodating cars, which spread everything out so far (and made everything so loud and dangerous) that nobody feels like walking or biking!

Cue the Complaints

Whenever you propose any great new idea, you’ll always get a bunch of smartasses who like to complain and resist change, without even bothering to think it through.

Most of them boil down to,

“But how are we going to keep driving our cars just as much as we do now?”

Which is ridiculous – because the whole point is that as soon as you cut out all the huge wasted spaces we create to accommodate cars, you are suddenly FREE from needing cars so much!

Instead, you can just weave a brand new city, with a bunch of variations of this beautiful resort which also include offices, grocery stores, climbing gyms and every other amenity.

And yes, you’d still have some roads between them, but they would be mostly for deliveries, emergency vehicles and people who need mobility assistance.

I hope you’re not going to make me ride the bus?

Checking out one of the 60+ Electric Bikes at the HQ of the country’s first car-free neighborhood.

Checking out one of the 60+ Electric Bikes at the HQ of the country’s first car-free neighborhood.I am all for public transit in theory, but to be honest I don’t usually have the patience for it. I don’t do lineups, and I don’t like stand around waiting passively for my transportation to arrive – when it’s time to go somewhere, I just want to go, and go now, and get there fast. So my own personal choice is to take a bike for short distances (under 2 miles) or an e-bike for larger ones (up to about 15 miles).

Although this is often news to car drivers, bikes are much faster than cars for urban transport, plus they give me exercise and thrill, which is way better than being stuck at the red light with the cars.

If you take this already-superior method of urban transport and cut out the 90% of the land that we waste on accommodating the inferior cars, then you end up with a revolution: everybody gets where they are going ten times faster, at much lower cost, and has much more fun doing it.

And sure, there will also be light rail and faster buses. And sure, you can still hop in an Uber or even bring your own car into a city like this.But the point is that it will just happen much much less often.

Okay I’m convinced, but how can we actually accomplish this?

Mr. Money Mustache can talk a big game with all these fancy words and pictures, but the truth is that I’m way too impatient to put up with all the bureaucracy and complaints that arise when you try to actually change a city. I’ve been doing my best here in Longmont, and I have gotten just about nowhere. We’re still just stacking on more and more layers of ridiculous car shit where I live.

Thankfully, other people are much more patient and effective than I am at affecting change, and one group has made such incredible progress that you can now go LIVE in their first creation: a 1000-person car-free neighborhood called Culdesac Tempe. And as I write this, I am staying in a hotel right nearby, having spent the past two days touring and visiting and interviewing the founders*.

Clockwise: Culdesac office replaced their own parking lot with a mini-park. Culdesac head of marketing Blythe Ingwersen and co-founders Jeff Berens and Ryan Johnson showed me around and lent me a nice Porsche e-bike for a tour of the city!

Clockwise: Culdesac office replaced their own parking lot with a mini-park. Culdesac head of marketing Blythe Ingwersen and co-founders Jeff Berens and Ryan Johnson showed me around and lent me a nice Porsche e-bike for a tour of the city!While we were at it, my Phoenix-area-house-fixing friend Tracy Royce and I also hosted a meetup for an enthusiastic group of our readers/viewers right there in Culdesac’s emerging central plaza.

Culdesac is Awesome and Could Change Everything

If you only look at the financial spreadsheet, you would think this first Culdesac project is just going to be a highly profitable 1000-person cluster of apartment buildings, spread out across 17 acres of land. And while financial sustainability is indeed a key reason why this model will succeed, the money is the least exciting part.

When you look at these pictures compared to a normal housing complex, the main thing you will notice is that all the space that would normally be wasted on parking lots, is instead used for beautiful walking and gathering areas.

The next big upgrade is that they mixed in the amenities for daily life right into the neighborhood, rather than forcing all the future residents to get into their cars to drive out to find them:

Grocery store, similar in style to a small-ish Trader Joe’sFantastic gym (which I got to tour – it is a beauty!)Coworking space Dog parkPoolOutdoor kitchens and shade structures and garden areas galoreSemi-fancy Mexican restaurant with ample patio spaceAnd lots more retail space also in the construction plansI was also impressed with just the feel of walking the Mediterranean-vibed spaces between the buildings, even at this early stage when everything is still under construction.

Due to the hot desert climate of the region, everything is built around providing shade, breeze, and reflecting heat during the summer, while also maximizing the joyful fact that there is no winter there (the coldest month of the year still has an average daily high of 65F/18C, which means palm trees, leafy gardens and fruits and flowers forever.)

With a setup like this, and 999 new neighbors to meet, I would rarely feel the need to leave the place. Which really cuts down on my desire to use a car. But on top of that, Culdesac has strategically placed itself in Tempe, a city right in the center of the Phoenix metro area, within walking distance of the main university and right on a light rail stop which allows you to reach almost everything (including the airport) for FREE, since an annual pass to the transit system is included with your rent.

But of course, you can also get around on foot, bike, e-bike, scooter, or hop into one of Culdesac’s fleet of rideshare electric cars for a trip to the mountains or whatever else you might want to do that’s outside of bike and transit range.

It’s insane. In fact it’s so good that I am going to attempt to move there myself at the end of 2023, enjoying my first escape from Colorado winter and celebrating the fact that my boy will be a legal adult at that time.

But even this is just a pilot project because Culdesac has much bigger plans.

The Culdesac Master Plan

An early sketch from Culdesac’s architecture firm, Optico Design. Isn’t it amazing what you can fit in a single Big Box shopping center parking lot?

An early sketch from Culdesac’s architecture firm, Optico Design. Isn’t it amazing what you can fit in a single Big Box shopping center parking lot?From my conversations with the founders, I think they want to do this:

Start with this small-scale community of rentals, just because it’s fasterUse this to get the word out and learn from the experience before going biggerMove up to a larger-scale communities which will also include homes for saleGo REALLY big, and make an entire section of a city, then eventually an entire town which grows into an entire cityMeanwhile inspire the rest of the United States to go the same way, once they see that this type of neighborhood is both more desirable for people, and less costly (therefore more profitable) to build.So How Can We Benefit From This, and Support it?

We need MORE of this!If this article gave you any surprising new information or changed your perspective at all, you’ve already made a difference. Because your choices around housing and transportation will probably shift at least a little bit away from cars, which will change our future demand and development patterns to be at least a little bit better. Congratulations!If you’d like to be one of the first residents of this first neighborhood, sign up right on their website at https://culdesac.com/ . There is a waiting list, but it moves faster than you would think – especially if you have a flexible moving date.If you’d like to make your own city a better place to live, just start emailing your own city council, or even better, sign up to serve on your own local planning board or city council yourself, as the heroic gentleman from Twitter did above. The things to push for are: approve more housing and more bike paths, but eliminate minimum parking requirements and above all stop wasting money on road expansions! Every dollar spent on accommodating cars subtracts many dollars from the future wealth of your city.If you are a major investor ($10M+) or land owner (20+ central acres in a high-density city) looking to invest in and boost this effort, email the team directly at investors@culdesac.com – more info on their about page.

We need MORE of this!If this article gave you any surprising new information or changed your perspective at all, you’ve already made a difference. Because your choices around housing and transportation will probably shift at least a little bit away from cars, which will change our future demand and development patterns to be at least a little bit better. Congratulations!If you’d like to be one of the first residents of this first neighborhood, sign up right on their website at https://culdesac.com/ . There is a waiting list, but it moves faster than you would think – especially if you have a flexible moving date.If you’d like to make your own city a better place to live, just start emailing your own city council, or even better, sign up to serve on your own local planning board or city council yourself, as the heroic gentleman from Twitter did above. The things to push for are: approve more housing and more bike paths, but eliminate minimum parking requirements and above all stop wasting money on road expansions! Every dollar spent on accommodating cars subtracts many dollars from the future wealth of your city.If you are a major investor ($10M+) or land owner (20+ central acres in a high-density city) looking to invest in and boost this effort, email the team directly at investors@culdesac.com – more info on their about page.And Then What Will Be Our Payback?

This whole change is exciting, and it is immense.

Understanding these ideas around city planning is the economic and social equivalent to being a doctor, and finding a 35-year-old patient in a hospital who is suffering from every chronic disease, but then discovering that they have been following a diet of Coke and Donuts for their whole lives and never been out on a walk, once.

In other words, the changes are so obvious, and the amount of win/win synergy so great, that every step we take towards making our cities better, and every car trip we eliminate, will absolutely explode our personal and national wealth upwards for generations to come.

The stakes just couldn’t be higher.

Are you in?

Further Reading:

Another collaborator in the overall effort for car free cities is a bank-founding multi entrepreneur local friend named Kevin Dahlstrom. His recent Twitter rant on building car-free cities from the scratch gathered a shocking amount of very positive feedback and interesting comments.

* Despite my positive raving about this neighborhood, I have no financial or business connection with the project or any of the team members. I am just really excited about their work and want them to succeed!

February 26, 2023

How to Build a Kitchen (and Why)

Well, looks like it has happened again.

Since the last time we spoke, I got sucked into building my 17th(?) kitchen, and I have finally emerged from its messy yet addictive grasp as I stand here at the new breakfast bar, typing this report to you.

Why am I so hooked on this strange pastime? And more importantly, why am I so excited to tell you about it, when most MMM readers probably don’t have house building at the top of their list of life priorities?

It’s probably because the concept of home is such a core part of life for me: a place that allows us to take care of our families and ourselves, host friends and build our lives outwards from there. And to me the most important part of a home is the place where you prepare and stash your food supply, which also happens to become the spot where our kids spread out their homework, we have our deep talks, and the natural gathering point for just about every party.

There is of course a money side to all of this too: housing is the most expensive thing in most of our lives (including my own), and this cost has exploded upwards in recent years due to a crazy imbalance of supply and demand.

People want homes with beautiful, highly functional amenities like kitchens and bathrooms, which means those houses get bid up to higher prices by those willing to wildly overpay, which leaves the more investment-minded among us swearing at the irrational market conditions, or buying ugly fixer-uppers as a compromise.

This leads to a second shortage: a shortage of tradespeople like myself, because there are a lot of flimsy little sinks, leaky plastic-handled faucets and fake woodgrain oak cabinets out there, but not a lot of people with the experience to rescue that 1982-style kitchen and bring it into our glorious modern present.

Which means that if you can even find someone willing to build you a new kitchen, you’ll often see quotes from $25,000 to north of $75,000 for the prestigious but not-all-that-difficult job.

As you’ll see below, this translates to an incredibly expensive labor rate of between $100 and $300 per hour, which is money you get to claim for yourself if you are willing to do some of the work. And the rewards can be even higher than that, because when you upgrade a kitchen in an expensive housing market, you typically create even more than $25-75k of additional value. This will flow back to you in the form of more cash when you eventually re-sell, or higher rental income every single month if you are fixing up a rental property.

And one more real estate secret: a kitchen is effectively just a really big fancy version of a bathroom, so if you learn the skills you can do either one. Imagine the God-like power of being able to point your finger and call into existence kitchens and bathrooms where none existed before!

So in this article, I’m going to whisk you through a high-speed tour of the main steps of rebuilding a kitchen, focusing on the things that make the biggest difference in function, cost, and difficulty – in other words, the things I wish I knew 23 years ago when I started working on my first kitchen.

We don’t have space here to cover every detail of every step, but as with any important endeavor, it’s best to start with the big picture anyway. And from there, I hope to leave you with a much more empowered starting point to do one of three things:

To know what to look for (and how to tune your Bullshit Meter) when hiring someone else to build you a kitchen.To strategically break off parts of the work you want to do yourself, to save time and money even if you hire out the rest.Or even to do the whole thing yourself, seeking help from more experienced friends or YouTube videos as needed to get the full details.So let’s get into it! The ten main steps to designing and building the most joyful room in your house.

Step Zero: Do You Need a Permit?

In most areas, this is a “Yes” if you are messing with plumbing and electricity inside the walls, otherwise it’s “maybe”. But rules vary widely around the world – I’ve worked in some places where the inspectors will come knocking if they see so much as a scrap of drywall poking out of your trash can, and others where people build a whole barn without raising the eyebrow of the authorities. But whether you get a permit or not, the most important part is to do the job right – this means tidy, professional work that meets the local building code and would pass an inspection even if nobody will see it. It will allow you to sleep well and avoid troubles down the road.

1: Figure out the Cost

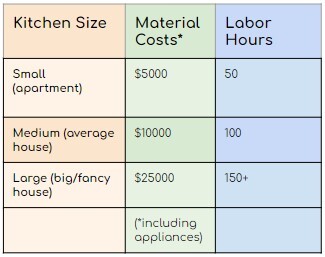

This one is obviously all over the map depending on your tastes, but we can start with the following overly simplified table:

The dollar figures are just for the materials including appliances, and the labor hours are what I’d budget for myself or another professional – you can adjust as needed based on your own skill level. Later we can cover the simple spreadsheet that I used to come up with those numbers.

Super Duper Shopping Pro Tips:

Here’s a recent example – shocked by Home Depot’s sudden price increase on sink traps, I checked Amazon and sure enough they were still the proper price of about three bucks. So I bought five to re-stock my inventory because I just know there are many more kitchens (and bathrooms) in my future.

Here’s a recent example – shocked by Home Depot’s sudden price increase on sink traps, I checked Amazon and sure enough they were still the proper price of about three bucks. So I bought five to re-stock my inventory because I just know there are many more kitchens (and bathrooms) in my future.When it comes to cost-efficient renovations, material sourcing is everything. Here are a few of my own favorite tricks:

Craigslist, Facebook Marketplace and Recycled Building Material stores are amazing. It takes more time and skill to find and use materials from these sources, but in exchange you get your stuff for about 75% less. In the past I’ve bought a $2000 fridge for $500, doors and cabinets and light fixtures for next to nothing, and stocked up on reclaimed wood and steel pieces worth tens of thousands of dollars for free, in exchange for a few hours of my time.But sometimes you have different goals, like faster speed or or the higher-end finishes that are only possible with brand new materials. In this case, you move down the list.Amazon is now better than Home Depot for many things. Light fixtures, sinks and faucets, even saw blades and big rolls of PEX pipe. All with a way wider selection, fast shipping and at lower prices than the older retailers. I’ll still get my lumber and drywall and paint locally of course, but for everything else I check online first. The bonus is that this also cuts down my mid-project trips to the store by about 80%.

IKEA kitchen cabinets usually offer lower cost, easier/faster design, and – surprisingly – better overall quality than what you get with special order cabinets from the home renovation stores. More on this in the cabinets section below.

2: Layout (and knocking down walls!)

Ahhh, my favorite thing ever: removing unnecessary walls!

Ahhh, my favorite thing ever: removing unnecessary walls!The basic principle I like to follow in kitchen design, at least for the smaller and older houses that those of us in the fixer-upper crowd tends to purchase, is MORE:

More floor space and countertopsMore open-ness to the rest of the houseMore storage, especially drawersMost houses from past eras have the kitchen walled off into a tiny booth. And the good news is that you can usually just chop down the unnecessary walls between that booth and the living room, replace one of them with a nice spacious island, and transform your house for the better.

Bonus! How to figure out if a wall is load bearing:

My safe answer here is, “Ask a structural engineer or at least a house builder”, but since I’ve done a lot of both activities, here is a shortcut:

Figure out what’s over top of the wall in question (is it an upper floor or just the roof?)If it’s the roof, peek up into the attic. If the house is a newer design it may have trusses. In smaller houses (up to about 30 feet wide), this usually means all the weight of the roof is resting on the outside walls, meaning most or all the interior walls are just cosmetic.If your kitchen is on the first floor with another level above, the wall may be load bearing, especially if it is perpendicular to the floor joists above it. In this case you can still open up the wall and replace it with a beam and posts. But that’s a task for experienced builders – bring in some help if you don’t know how to do this already.Basic Layout Principles

As a quick example, let’s use a case study of one of my own rebuilds to point out both things I think did work, and other places I made some mistakes and would do things differently next time. (This was in my own house, so you’ll have to forgive my taste for somewhat wild colors!)

Whoo! Okay there’s a lot of info in there, but it’s worth reading through because it captures many of the things I like to cover in a new kitchen. The biggest principle to follow is just to give everything enough space – especially the chefs themselves. This sometimes requires clever space-saving tricks, but it’s also why I end up moving or removing walls so often. Small spaces in your own house suck!

Design Shortcut: The IKEA Kitchen Planner

To figure out how everything will fit (and look), you need at least some scale diagrams, but even better is a 3-D model that you can look around. There are lots of options here ranging from old-fashioned graph paper to sophisticated but sometimes clunky design programs like Sketchup. But one interesting trick is just using the free tool on the IKEA website, which can be useful whether you plan on buying their cabinets or not. https://kitchen.planner.ikea.com/us/en/

For example, take a look at the “before” picture of my old kitchen above. Before building the new kitchen, I spent about 15 minutes on the IKEA kitchen planner website and I already had a pretty close visualization of how my finished kitchen would look and feel.

When I first saw this, I thought “WOW this is so different and so much better than my old kitchen!” Now, sure enough it simply looks like my actual kitchen and it’s even better than I had hoped.

When I first saw this, I thought “WOW this is so different and so much better than my old kitchen!” Now, sure enough it simply looks like my actual kitchen and it’s even better than I had hoped.3: Building new walls

In most cases, you’ll be removing more walls than you build, but sometimes you’ll need to add some as well. The most common situations for me are:

Moving an existing wall back to create more kitchen spaceCreating a “booth” of walls to enclose a refrigerator or build a food storage pantryBuilding the half wall (typical height is 34.5”) that eventually becomes an island.General principles:

It’s way easier to build a new wall than to mess around with too many changes to an old one. So I usually start with a complete demolition of any old walls, then proceed with a clean slate. If you’ve never learned how to frame a wall flat on the ground first, it’s a fun and life-changing skill! Here’s a 52-second summary on YouTube.3: Plumbing (and venting)

In many kitchen remodels, you end up leaving the plumbing fixtures (sink, dishwasher and fridge water line) in roughly the same place, and if so this part of the job is minimal.

But I also want to open your mind to the possibility that these things can be moved without too much trouble, and you can even create brand new ones whenever you need ‘em. While the finer points of code-compliant plumbing are best learned from the book or video of your choice, here are my favorite basic principles and useful shortcuts:

Cut back any obsolete copper plumbing and transition to PEX in a convenient location, which will make all your new work cleaner and easier. In a full house remodel, I usually do this right after the main house shutoff valve so the whole system can be built right from scratch.Sink drain lines are usually done with 1.5” black ABS (plastic) pipe which is quite easy to work with. If you’re doing a big project, grab a few ten-footers of the stuff up front as well as an assortment of fittings and the glue.Drain pipes should slope about ¼” per foot, and if you need to add a new air vent, consider a Studor vent, which saves you the pain of trying to connect your drain to a pipe that runs all the way through your roof. (I also like to minimize roof penetrations because it makes your eventual re-roofing job quicker and more reliable and leaves more room for solar panels)We’ll cover the sink, dishwasher and fridge plumbing separately below.

Related MMM Article from way back in 2012 (but recently updated):

How to Become a Kickass Plumber – with PEX

4: Electrical

Like plumbing, electricity is a whole trade in itself which is not comfortable for everyone. And you can indeed kill yourself if you touch live wires in the wrong way. So if in doubt, hire an electrician.

But since I happen to enjoy this trade myself, I made a point of learning the national electric code (currently called the 2020 NEC) enough to wire a few full houses from scratch and pass several final inspections: everything from digging the trench and running new buried service lines in conduit to the meter box, to subpanels and solar inverters down to the last light switch.

But I’m still not a professional electrician, and codes vary by region – so be sure to double check any ideas you get from me and do not assume anything you read is totally correct.

With all those disclaimers aside, here are the most common situations that come up when renovating a kitchen:

Unwanted electrical lines in a wall you are removing: I label these carefully, turn off the power, then pull everything out until I reach the nearest junction that’s in a wall I am keeping (or sometimes this will be in the ceiling or attic). Once the new walls are in place, you can run fresh wires to the new boxes and fixtures.

Adding new outlets to serve new countertop areas:

The basic requirement is a minimum of two 20 amp circuits, protected by GFCI outlets, with outlets at least every 4 feet along your work space. Plus, ideally the fridge, dishwasher, disposal and microwave are on their own separate circuits which is required in brand new builds. So, your project may be able to tie into the existing circuits or you may need to pull some new ones.

Adding entirely new circuits to your home:

Although this may sound like a black art to non-electricians, it’s actually quite straightforward once you learn how to do it. The hardest part is usually running the wire all the way back to your circuit panel, unless your kitchen is directly over an unfinished basement or crawlspace. So if you find an agreeable electrician willing to give you a discount in exchange for you doing the dirty work of properly routing the wire while they only do the final hookup in the panel, this can be a nice hybrid approach.

If you want to see the details of what’s involved in adding a whole new circuit and breaker to your panel, there are lots of walkthroughs on YouTube including this one I made myself on how to install your own electric car charger.

Other stuff to remember at this stage:

An outlet for your eventual over-the-range microwave (or just a wire if you are using a vent hood), centered about 78” above the floor so it is in the cabinet directly aboveA 4” steel vent pipe that goes from behind that microwave to somewhere outside your house (see your install manual for exact details)An outlet beneath the kitchen sink for the disposal, controlled by a wall switch at a safe distance nearbyPower for your dishwasher (I usually add a standard cord to my dishwasher so I can plug it in to this same outlet under the sink)Maybe even wiring for an outlet inside one of your cabinets, just behind the top drawer, for charging phones and other gadgets nicely out of sight5: Drywall and details

You’re finally ready to cover everything up! This part is relatively easy, but if you’ve never done drywall before, a few things I find helpful to get started:

Buy plenty of supplies (4×8 sheets, mesh tape, boxes of compound (mud), plus a trough and knife set) in advanceWhen installing sheets, use either a roto zip tool or a cordless “buzzer” multi tool to do the cutouts for your outlet boxes. Much better than manual hand saws or trying to do it with knives.As you open each box of mud, dispense it fully into a clean 5-gallon bucket with a lid. Fill up your trough periodically from this bucket. Never work directly from the box, or the bucket.I find that a light layer of spray adhesive before adding the mesh tape helps it stick much betterApply 2-3 coats of increasingly smooth mud before you bother with sanding (experienced drywallers typically only need to sand once at the end)This is the point – after drywall and at least a coat of primer or base white paint – where you would install your flooring if you are changing that out as part of the remodel. These days I’m a big fan of engineered wood or LVP flooring which is easy, tough and attractive. But for ultimate durability in a busy dogs-n-kids-n-giant parties household, floor tiles are still the gold standard.

6: Cabinets

Although this step is the most exciting part, it’s also one of the easiest. You’re just trying to put in a line of giant boxes as strong, straight and square as possible. For conventional cabinets, this means that a level and studfinder and shims are your best friends.

With IKEA cabinets, it’s even easier to get it right, because all of the cabinets (both upper and lower) just hang on their proprietary metal rail system. So if you get the rails right, the cabinets follow naturally. Another huge bonus: it’s easy to slide the cabinets back and forth and make adjustments before locking them into their final positions.

7: Countertops

If your budget will allow the higher cost, a stone countertop (quartz or granite or similar) is usually worth the cost. That cost is currently about $60-120 per square foot which can add up to a few grand for a large kitchen, but in exchange you get something that looks great, lasts forever and cleans up more easily than the other options.

Of course, that high cost (and my dislike of dealing with appointments and outside contractors) has meant that I have experimented with the other alternatives of solid wood and various types of tiles on some projects. They still look nice and function pretty well, but I have always regretted the choice in the long run and wished I had done the quartz. Possibly because of the human psychology factor: a small daily annoyance of worrying about scratching your wood countertop is with you forever. Whereas a one-time expense for the stone countertops quickly recedes into history and you forget about it. And like the rest of a kitchen upgrade, it tends to come back to you in the form of increased resale or rental value anyway.

8: Sink and Faucet

Thankfully, this part is the opposite of the countertops: surprisingly cheap and full of beautiful options depending on your taste.

Way back in 2001, I remember paying $600 for a sink and $300 for a faucet, just to get something substantial and modern that didn’t look like it was from a 1980s Atlanta Georgia suburb (an aesthetic that runs strong in Home Depot products because of the company’s origins in that time and place).

But now, thanks to Amazon we live in a whole different world. You can have your choice of massive, modern sinks in the 200s, and even beautiful faucets are under $100. The prices are sometimes so low that I am nervous about the quality, but so far everything has been a pleasant surprise on the upside. TBD sink drain pic above.

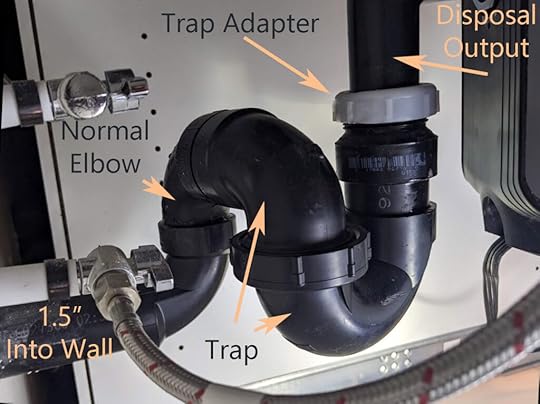

Bonus: How to build a nice new sink drain:

Your old kitchen probably has an ugly nest of pipes under the kitchen sink, and you’ll at least need to rework this part because the new sink will be bigger and in a slightly different place. So we might as well cover this right here:

CORRECTION! (new pic TBD) – a reader pointed out that the “normal elbow” technically should not be there – I should have mounted this trap lower so the trap connects at the same level as the wall pipe. But that would be a shame since then the trap would block the drawer. The solution? Build your wall plumbing higher so it’s right where you want the trap output to be.

CORRECTION! (new pic TBD) – a reader pointed out that the “normal elbow” technically should not be there – I should have mounted this trap lower so the trap connects at the same level as the wall pipe. But that would be a shame since then the trap would block the drawer. The solution? Build your wall plumbing higher so it’s right where you want the trap output to be.Starting with the fancy new sink (which comes right after countertops), you

Install the disposal unit which doubles as the drain as wellLoose-fit a trap adapter to the disposal output and then figure out what direction to angle your trap to create the simplest/tidiest run to the wall pipeAdd elbows and straight bits as needed to get the water to that final destinationOnce you are sure everything fits, mark the joints with tape or a marker, then carefully disassemble, glue, and reassemble/tighten everything. Ready for water within an hour!9: Appliances

This is yet another area where we’ve seen deflation over the years rather than inflation: the quality and features of appliances seems to keep going up, while prices come down. And the used market is even better: appliances have a very low resale value, which means if you shop carefully you can get new-ish units for about 75% less than brand-new ones.

However, a note of caution: Don’t buy used stuff unless you trust the seller and/or get a chance to test it. I’ve been fooled twice buying used seemingly high-end dishwashers that seemed great … but in retrospect the person was selling them because they didn’t work properly.

Me: “Wow, this is a really nice $1500 dishwasher – why are you selling it?”

Seller: “Oh… I was upgrading my kitchen and this one just doesn’t match the new appliances.”

Me: (naively overlooking some other red flags about the seller’s living situation): “Okay here’s my $200 in cash.”

On a third occasion, a friend and I almost made the same mistake when buying an exotic under-counter European fridge, but thankfully noticed that the seller had it sitting in his garage unplugged when we came to pick it up. When I asked to see it running, he pretended to have a shortage of extension cords so I pulled one out of my van. Sure enough, when we plugged it in, the damned thing wasn’t even working. Shady!

Other tips: fridges, microwaves and especially ovens/ranges are a safer bet to buy used because they tend to just work for decades.

Also, if you live in a climate with sub-freezing winters, don’t buy a fridge, dishwasher or washing machine that someone has moved into their shed or garage during the cold season. Because the water in the tubes and valves will probably have frozen and burst without their knowledge, giving you a messy and complex repair job the first time you fire it up.

Because of all this, I have had many success stories with used appliances in the past, but I still tend to buy all new appliances these days now that time has become more scarce than money for me. If you’re younger and still trying to optimize for dollars, you should still check Craigslist and Facebook Marketplace regularly.

10: Finish work!

Despite the very small kitchen, this house in my neighborhood recently sold for a preposterously high price, mainly because of nice touches like this full height backsplash. When renovating, more tiles are usually better.

Despite the very small kitchen, this house in my neighborhood recently sold for a preposterously high price, mainly because of nice touches like this full height backsplash. When renovating, more tiles are usually better.At last, we’re in the home stretch. You can add as many custom flourishes to your kitchen as you like, but just to share a few of my favorites:

An artsy tile backsplash is a great way to make any kitchen way more interesting. I like to tile the entire area from the countertop up to the upper cabinets. In some cases on empty walls, I’ve gone all the way up to the ceiling to create an even bigger feeling of space.Consider hiding a power cord inside a top drawer somewhere, which you can then hook up to a nice multi port USB charger, so you can keep all of the phones, tablets, bike lights out of your precious work area.Stainless steel outlet plates and modern-style grey outlets and switches add a more polished and high-quality look to any area, especially kitchens.Undercabinet lights are worth the effort, as they provide great illumination while cooking and make for beautiful ambience even hosting parties or dinners.Wow, that was a Lot!

This may be the longest MMM article in history, and yet we still only skimmed through it. But I hope this summary gives you at least a peek at the countless fun, useful and profitable skills that you can learn to make your life as a homeowner (or as an occasional contractor) more joyful and satisfying.

If you have more questions about specifics, drop them into the comments section below and everyone can help share some answers. And of course, this article will surely be full of errors and omissions when I first publish it – please feel free to point those out and I’ll make updates as well.

Happy cooking!

December 10, 2022

The California Effect

One of the reasons I don’t write as often these days is that my life has gradually evolved into a Personal Finance Bubble.

The people around me have learned to be purposeful with their money, which means they now have plenty of savings and never have to stress about the stuff. Good ideas have naturally spread between the old group of friends, and new ones with similar values have drifted in over the years.

And it has happened so much that that it’s almost normal for everyone in the neighborhood to have their own CNBC Make It feature*, which they don’t even get around to mentioning because we’re too busy helping each other with bathroom renovations or sharing the latest golden scores from Craigslist.

Because this is my everyday reality, I have mistakenly come to assume that this must be normal, and that perhaps these ideas of Mustachian living have just become universal out there in American life. Job well done MMM, time to hang up the keyboard and retire!

Until last weekend, when I took a short trip out to San Francisco and plunged deep into the astonishing reality of life outside of this bubble. And I realized that wow, we still have so much work to do. And there is so much that both sides – the Ultraconsumers and the Mustachians – can learn about human nature by studying the differences in our lifestyles.

A recent “winter” day at the Bay

A recent “winter” day at the BayThe city of San Francisco is often called “The City” by locals, but it’s really part of a megalopolis known as “The Bay Area”. Both of these nicknames are somewhat telling because they imply that there is only ONE bay and ONE city on the planet, and thus those embody the social and spending norms to which we should all comply.

To outsiders like the rest of us, The Bay Area is a bizarre and wild human science laboratory, in which our most beautiful and most ridiculous traits are simultaneously revealed. Artificial boundaries aside, in reality it’s all one teeming urban area which sprawls across ten thousand square miles and houses eight million people in an incredibly wide range of conditions.

The median house price is about $1.5 million, but that figure masks even more amazing differences because it includes “bad” neighborhoods where you can get in as low as $750k as long as you don’t mind a long commute and/or trash-strewn streets and keeping your house locked behind a steel gate at all times. And nicer ones with where the prices start around $3M.

Locals have become accustomed to $6.00 gasoline over the past year, $7.00 slices of pizza at a grungy restaurant if you shop around, and similarly surprising prices on most other services. One new homeowner lamented the $90-per-hour rate that his housekeeping company was now charging him to clean the house, and I enjoyed the opportunity to pick up a brunch tab for three ($148 including tip) on a nice sunny patio at a modest restaurant. A young single professional in the finance industry asked me whether he should downsize to just one seven-passenger Mercedes SUV to escape the second $1200 per month car payment from his monthly expenses (and free up a $200 parking space to boot).

With stories like these, it’s easy for the average person to just fall in line and repeat the standard Bay Area lament: