Mr. Money Mustache's Blog, page 6

November 8, 2018

An Interview With The Man Who Never Needed a Real Job

I’d like to retire soon. I’ve had a good career and the numbers say I’m just over the threshold, but I’m still afraid.

It would help if I had a solid plan for what to do after retirement – perhaps even make some money eventually. Because I think it would help boost my confidence to pull the plug at the old law office. But as an attorney, I’m trained to see the pitfalls of everything and frankly I’m afraid.

How do all of you fearless Mustachians just go out and start businesses and make money, when it is so hard to get started – so many details and contingencies to account for?

– the Skittish Scottsdale Solicitor

Dear SSS,

To answer a question like yours, it sometimes helps to look at a role model who has some of the traits you would like to cultivate in yourself. So this seems like the perfect time to share a story I have been wanting to tell here on MMM for at least five years. And the funny part about this tale is that it keeps getting more interesting, the longer I wait to share it.

It is the story of my long-time friend Luc, who has earned a reputation in our own community as the honey badger of entrepreneurship.

The Honey Badger

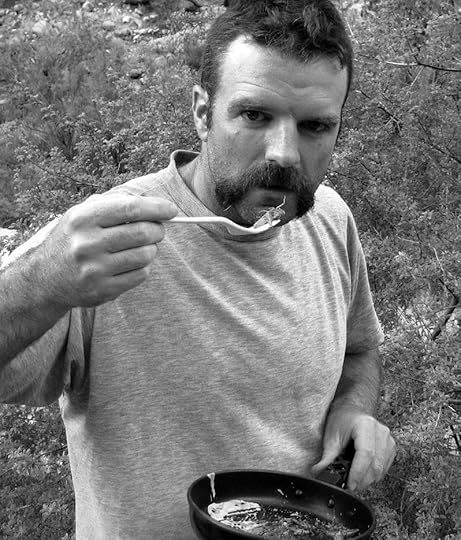

Luc takes a brief rest from digging out 30 tons of dirt from his own basement and hand-pouring a new foundation while his son supervises.

From painting houses to raising edible insects, selling handmade pine coffins to writing and shooting his own feature length film in Scotland, all while never becoming too proud to take a literal Shit Shower while cleaning the sewer lines in his own rental properties, Luc’s story never fails to amaze. And it can be especially useful for those of us on the other end of the spectrum – wannabe entrepreneurs who are still hesitating to open our first small business checking account.

This story is a great financial lesson as well. Luc’s family* has gone from zero to financial independence without the benefit of the easy tech salaries that got my own household there back in the mid 2000s. Like most of us, they have seen windfalls and setbacks over the years, but the biggest factor in getting them to a better financial place has been continuing to get the work done, while choosing not to squander all of the proceeds on an ever bigger lifestyle.

So from this interview I’m hoping you will pick up both some inspiration for continued down-to-earth hard work, and a perspective to just go out and try new things, especially in the area of entrepreneurship.

If you do it right, there is upside waiting around every corner. So let’s get into the questions!

The Man Who Never Got a Real Job

MMM: The first moment we met was in July 2005, when I had just retired and we bought our first house in old-town Longmont, with a baby on the way. Walking through my new backyard, I immediately noticed two thirtysomething dudes in dirty clothes, working up on the roof of the old garage on your side of the fence. And I thought to myself, “These are my type of people!”, and walked over to meet you.

What was going on in your life at that moment, in both life and business?

Luc: Well, considering our daughter was born nine months later, it was near the end of one phase and the beginning of the next. At the time, my primary business was a house painting company that I had started in the late ‘90s, after my biology degree wasn’t enough to get me a job at a pet store (in Boulder you need advanced degrees for that sort of thing).

I had worked pretty hard to get that painting company up and running, starting as a one-man show, then employing as many as 18 people at one point. It was a good gig in that I had a lot of free time to work on other projects in the winters, and even went back and got my Master’s degree along the way.

By 2005, though, I had severely downsized the company and I was back to a small crew. I was beginning to think about what I wanted to be when I grew up.

One project we started that year was buying and quickly fixing up a house a few blocks from our place on a street called Carolina Avenue. This was primarily achieved by leveraging the equity we had built up in our first house. I still own and rent out that place (which you subsequently helped me do a more extensive renovation on).

MMM: So then we both had these children born at almost the same time, and all six people in our two families became friends. We both started helping each other with construction projects, but when Longmont denied my building permit application to expand our tiny 600 square foot house, I decided to move out and turn that one into a rental, and move into a bigger place a few blocks away. What was the catalyst that made you leave the little leafy paradise of that street? (and yes I realize this is a leading question :-))

Luc: The first thing is that old Happy Street is a pretty busy street, and with a young daughter, we thought it might be nice to live on a quieter stretch. One day my wife and I went for a walk and picked our favorite blocks in the neighborhood. There happened to be a “beautiful” old fixer upper for sale on one of those blocks, and within a few days we were under contract.

That we were willing to take the plunge so quickly was largely because of you and your construction company. At the time, I hadn’t done any extensive remodels, but because you were willing to help me out, I figured we could make it work.

At the time, my wife was certain that it would be a fix-and-flip and there was no way she would actually live in the house. Because it started out in such bad shape, it was hard to imagine it ever becoming a nice family home, but it really did in the end. So we we moved in at the beginning of 2008 and here I sit, typing away in the office.

The Rental Real Estate Projects

MMM: So, our biggest collaborations over the years have been in fixing up houses, often rental houses that one of us owned (okay most of them were yours.) We started with The Foreclosure Project in 2011, then went back and did a major upgrade to one of your other places here in town. Most recently we did The Atwood Project, which was the inspiration for my post on Installing your own furnace.

How has your experience been in owning single family rental houses, while doing your own management and maintenance? Is it a reasonable return on your investment and labor?

Luc: There are a lot of real estate/rental experts in the Mustachian fold – I am not one of them, but real estate is the main reason we’re now financially independent.

We bought our first house in 1999 with $5000 from my dad and a $3000 courtesy check from Chase. We chose the house because it had a mother-in-law basement, with its own entry and kitchen – we went from paying over $900/mo in rent to having a tenant and paying around $300/mo toward our own house. We were fortunate enough that soon thereafter Longmont housing prices had a nice little bounce.

In 2003 I took out a home equity line of credit and we bought a condo in Fort Collins. A realtor soccer friend had given me a handy little spreadsheet that detailed all the ways to make money from real estate, and at the time it was hard to find cash flow properties in Longmont.

In hindsight, that first condo was a mistake. It was an hour commute to deal with any issues, it wasn’t a place I had much emotional attachment to, and it didn’t attract tenants who cared about it – it was a soulless investment. Nonetheless, we held it for over ten years, and finally saw some significant appreciation in the last few years (and it gave me my first taste of YouTube success with a video on How To Finish a Subfloor.)

I sold the condominium on Craigslist in 2015 and did a 1031 exchange for the Atwood Project – probably the most soulful investment I’ve made.

The lesson I learned from that first condo was that I wanted properties that were in my neighborhood, that I cared about, and that, when fixed up, made our community nicer. And of course they had to make money, too. Again, I was lucky enough that all those things were achievable here in Old Town Longmont, even through the recession.

Over the years, we leveraged our way into four rental properties in Old Town (moving into our current place along the way and turning that original home into a two-unit rental). The cash flow alone allowed me to spend less time painting and more on other pursuits. And my wife was able to move her teaching career down to half-time.

In 2016, I spent an average of under 10 hours per property – over the whole year – on maintenance and administration. Yes, there are occasional shit showers when cleaning out an old lead P trap, but most of it is more pleasant than that.

After finishing up the remodel work on the fourth and final property, we had 100% occupancy in all places and pulled in about $92,000 in rent; $36,000 after expenses.

Meanwhile, our longer term gamble on the livability of Old Town has paid off, as home prices have more than doubled here in the last several years, leaving us with equity close to $1.5 million (including the home we live in). The best example is the Foreclosure Project, which we bought for $113,500 in 2011, put about $25K into it, and is now worth over $300K.

To take some of that appreciation money off of the table, I chose to sell the most expensive of these houses last year, and re-invest the cash into standard stock market investments.

This is where MMM will probably caution you that not all real estate investment will go so well.

Building DIY Electric Cars

Although it’s no Tesla, this little homemade contraption was my first peek at the world of electric cars.

MMM: One of the most technically impressive things to me, was the time you read a book on converting an old gas-powered GEO Metro econobox car into an electric vehicle (EV), using basically a trunkload of golf cart batteries. And then decided to team up with a friend and try the same thing yourselves.

Not being auto mechanics yourselves, what possessed you to do this? And did it turn out to be a good business idea in the end?

Luc: Ha, this was a terrible business idea. I can remember sitting in the office of the City of Longmont fleet manager, trying to convince him to let us convert some of their gas pickups to electric; Fox News was blaring in the background and he was staring daggers at me. Needless to say, we didn’t get that gig, and that was probably a good thing, considering we didn’t have the expertise or capital to pull off truly decent EV conversions.

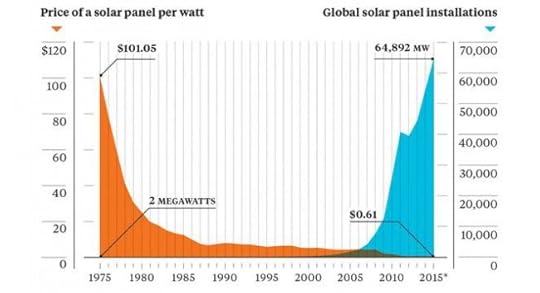

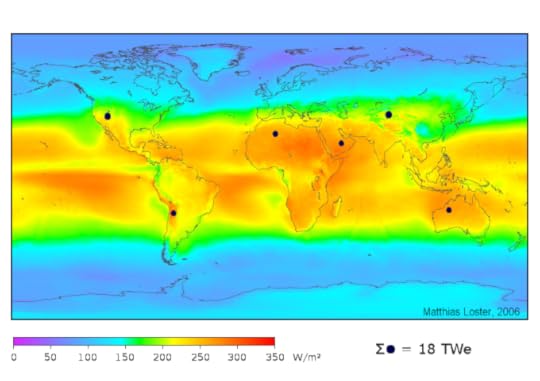

We did do a couple GEO conversions and an old Ford pickup, which was a lot of fun, but they were novelties more than anything. That was 2009, and it was an exciting time in the electric vehicle world. Lithium batteries were becoming more reliable and less expensive, the movie Who Killed The Electric Car? had come out a few years prior, Tesla was starting to make some waves, and of course addressing climate change was becoming more urgent. I wanted to do something meaningful, and I thought electric cars were the future of transportation. The cash flow I was getting from rentals had given me more free time. And I’m slightly crazy, so why not start an EV business?

At the time, Colorado had an amazing incentive for people to buy EVs. One of my favorite parts was arguing with the clueless administrator of the law for months, and then lobbying for sensible changes and clarification when they wrote the new law.

We spun off a new company, Boulder Hybrid Conversions, with two other guys (with more EV expertise), in which we converted Priuses to plug-in hybrids by upgrading them to a larger battery.

Meanwhile, largely thanks to my partner, our original business morphed from being a handcrafted car conversion hobby, to a reseller of electric car batteries and other components. It became one of the larger businesses of this type in the country, grossing over $1 million a year. I had a lot of other ideas for how we could expand the business, but my partner didn’t see it, so he ended up buying me out for about $125,000 (which, for all the time I put into the biz, turned out to be decent but not extravagant hourly compensation).

Boulder Hybrid Conversions became Boulder Hybrids, specializing in hybrid and EV maintenance and repair. One partner bought the rest of us out, and he continues to grow that business. I now own a 2013 Nissan Leaf and a 2015 Prius wagon (my off-road vehicle) and one share of Tesla, and I look forward to the day when I can buy an autonomous mini-van that will safely transport my family and me to Wisconsin overnight while we sleep.

Dead Pine Trees for Dead Bodies

A handcrafted biodegradeable coffin takes shape in the handcrafted workshop. (image credit: Mat Bobby / Longmont Colony)

MMM:

One day, I got an email from you that said, “Well, I’ve done it again – decided to start yet another business. Building coffins from reclaimed beetle-killed pine planks”

So we both reviewed the simple plans from a book you had found in the library, built a prototype of this Dracula-style “toe pincher” coffin, and then you photographed it and put up a website. I gladly worked alongside you because I like hanging out and building things, but I remember thinking, “Luc’s really gone off the deep end here – who is going to buy our DIY coffins??”

What was the motivation and the eventual fate of that coffin venture?

Luc: I started Nature’s Casket in 2009 for the same reasons I started the EV business: to do something meaningful for the environment. And because it was different and exciting. And because I wanted to help my brother with more hours when we had downtime from painting. All the remodel work we had done meant I had most of the woodworking equipment I needed to build coffins. And it was nice to have some technical, logistical, and, hell, labor support from old MMM to get it going.

The green burial movement, already well-established in the U.K., had been growing in the U.S., largely as a result of the Ramsey Creek Preserve, a conservation burial ground that conserves the land in a natural state. Green burial is traditional burial: simple and environmentally friendly (none of the swimming pools full of formaldehyde that are pumped into cadavers, no unsustainably harvested wood, stamped metal caskets, toxic paints, concrete vaults, or pesticides and copious water for manicured cemeteries).

Here in Colorado, the pine beetle epidemic was devastating our lodgepole pine forests, but leaving a lot of dead trees with beautiful blue grain (from a fungus that feeds on the beetle’s waste).

With some support from Karen Van Vuuren, who runs a nonprofit helping families direct their own funerals (and has now started The Natural Funeral), I was able to start getting the word out and selling a few caskets here and there. And it turns out that the media is really interested in things like death and beetlekill wood.

The Denver Post ran a front page article on my business in 2010 – many people saved that article, and when they’re ready, I get a call for a casket (to this day I’m still getting calls from that article). The New York Times mentioned Nature’s Casket (they never contacted me, so my mom was the first one to tell me about that). The Wall Street Journal sent a guy out to do a piece on beetle kill (I wasn’t mentioned in the article, but had a lot of time in the accompanying video). National Geographic sent one of their photographers out to take photos of the caskets at a funeral, but we didn’t make the magazine. There was also a nice story in Longmont’s Times Call newspaper.

Soon I was shipping coffins around the country. One of the most interesting gigs was when we built and reinforced eleven oversized caskets (with MMM on welding and metalworking support) that could hold up to a ton; these were for the reinterment of a 19th Century family cemetery in Virginia that was being moved to make room for a high school football stadium (most of the remains were biodegraded, so they included all the dirt from each plot).

This is where I should mention that I’m kind of success-averse. Nature’s Casket could have been a large business with an industrial shop and a storage warehouse if I had pursued that path. Instead I stopped shipping (too onerous and stressful) and ceased most advertising. Now it’s just a local business, and I average less than one casket a month – it’s still quite rewarding, but there are other projects to focus on.

Miscellaneous Mini Businesses and Pursuits

MMM:

Scattered in among these years were a few smaller things. The time you started designing your own greeting cards and printing them on fancy textured recycled paper. Then there was Simple Brew Kits, which was just assembling the required components for converting good grocery store cider into booze. A photography pursuit that started with just taking your daughter to over twenty of Longmont beautiful parks and ended up culminating in a show at the city’s museum.

Oh! And then of course the time you went to Scotland with two friends and some quickly researched photo equipment and shot a feature length film that ended up in the Front Range Film Festival – despite the fact that none of you had any experience or training in filmmaking. What was that all about?

Luc: Recycled Greeting Cards was actually born in the late ‘90s, around the time I started the painting biz. At one point I had pretty high hopes for RGC, even attending the National Stationery Exhibit in New York. That business was mostly a failure, although I have one loyal business customer who still buys a thousand or so cards a year.

Simple Brew Kits was a business I started for a blog post that I never published titled “How To Start A Business In One Day.” And that’s essentially what I did, filling out all the paperwork and putting up the website in a day. I didn’t sell many, though, until your post about the business, after which I was suddenly inundated with hundreds of orders. That slowly tapered off, and recently I decided to shut it down for good. Again my success aversion won the day. But we made a lot of fun (and some disgusting) drinks out of that whole deal, and I’ll still occasionally bust out some fermented cider or grape juice.

The photography gig was a byproduct of becoming a parent. My daughter was born in the spring of 2006. After my wife’s maternity leave, I became a stay-at-home dad off and on for a couple years. I wanted a project that would get us outside, but that would also provide me with something exciting. I decided we would visit each one of Longmont’s city parks and take pictures. I just had a little point-and-click dealio, but it took decent pictures.

A few years and thousands of pictures later, I chose one photo from each park and submitted the project to the Longmont Museum. To my surprise, they accepted the show, and even helped me publish a book of the photos. It was a gratifying experience and has led to more photography projects – something I’ll continue to pursue.

The Scotland film, Carve The Runes, came from an idea I had many years ago to get a group of friends together, rent a castle in Scotland, and produce a music album (despite having no musical talent). Over time, the idea morphed into making a film instead. I was able to convince my brother Isaac and a good friend, Ian, that this was in fact a realistic and good idea.

And so, in 2015, we spent ten days traveling around Scotland, filming and, well, just filming – we didn’t have time for anything else. I had envisioned some time for fly fishing and golfing in between shoots, but damn, making a movie is hard.

The film is about two brothers, one of whom has a terminal illness and goes to visit his brother in Scotland, where he’s doing climate change-related research. The basic idea for the film was laid out beforehand, but most of the script was written on the fly (I didn’t think we would use a script). Ian was cinematographer/sound guy/key grip/best boy, and maybe more important, moral support. We didn’t sleep much, and we drank a lot of scotch. It took us a couple years, but we finally finished post-production at the beginning of 2018.

We submitted it to a number of film festivals, and were happy to be accepted into our local Front Range Film Festival, where we won Best Feature (out of a limited selection). The acting and cinematography are suspect, but the soundtrack (friends and acquaintances) and screenplay, if I may say so, are legit; I’d love it if we could remake this with some real producers and actors (Francos, Afflecks, are you reading this? Or maybe the leads should be sisters).

A Quixotic Urban Oasis and the Big Dig

A few thousand pounds of concrete? all in a morning’s work.

MMM:

Surely the most concentrated demonstrations of your varied efforts and interests is in your own house. Because we restored it together from its original tippy skeleton into a solid and classy residence. But then a few years later went on to add a two story addition all the way up from the hand-dug structural piers. And then to build the garage workshop which has turned into an enviable hobbit-like enclave of living and productivity, both inside and out.

But all of this pales in comparison to the most recent upgrade, the Big Dig where you hand-dug about 60,000 pounds of concrete and soil out of your own basement (with occasional help from a beer-fueled team of other local Dads) to upgrade it from the typical Victorian house storage cellar into a very functional Man Cave complete with golf simulator and workout room.

What has driven you to go so far, when some people won’t even change a furnace filter? Any downsides and pitfalls?

Luc’s Hobbit-esque backyard oasis and workshop/garage, carved from an area that was originally just weeds and concrete.

Luc: I have labeled myself an eclectic: someone who loves to continually explore new ideas and embark on new adventures. The peril is getting so wrapped up in the novelty component that one never finishes anything – what I call dilettantism. This is part of my success aversion: I love to get a project or a business up and running, but it’s hard to continue to find it rewarding once it becomes quotidian. Routine is anathema to eclectics. Most of my projects reach a level of fruition that’s satisfactory to me, but I still think I can strike a balance that leaves things more complete.

To use my house as a metaphor, I’ve completed a number of satisfying projects (with a lot of help from people like you (mostly you, in fact)), but in the meantime many of the details have been overlooked: we need a new kitchen faucet, a toilet needs to be re-seated, I could organize the cookware situation better (and oh, by the way, I should probably spend a little more time with the family).

In the mid-aughts, I was working on figuring out what I wanted to be when I grew up – I decided to embrace my eclectic nature. Now in the late teens, I’m realizing I need to fine tune that to incorporate more focus, responsibility, meticulousness and perseverance.

Physical Fitness and Doing Experiments On Yourself

MMM: Another unusual trait I’ve noticed is that you seem to operate in extremes. You can eat a plate of cookies or drink a bottle of wine in one sitting, but then also go for three days straight with zero food during a fast. You’ve tried a variety of 30-day experiments in different eating styles, following them up with weigh-ins and blood tests to see how they affect your good and bad cholesterol counts. You adopted weight training and have stuck with it for many years now.

This is different from my own approach, where I eat roughly the same thing year after year, making only small tweaks – like I lift heavier barbells and eat more carbs if I want to gain weight, and cut out beer and go to bed hungry when I need to lose fat.

Have you noticed anything about the Human body and what makes it function best? Any advice for people who are prone to binging, on getting control of their eating and drinking habits?

Luc: Oscar Wilde, perhaps after bingeing on absinthe, said “Everything in moderation, including moderation.” That was kind of my motto for much of my youth, and it fits well with the eclectic personality. But if you only practice moderation in moderation, I discovered, you tend to feel like shit a lot and you weigh about 20 pounds more than you should. I’ve modified the motto to Everything in moderation, including gluttony.

I think everybody’s different in terms of what works best for them to stay in shape and feel healthy, but there are some common threads. In our simple carb-y society, one of the easiest ways to eat better is to cut out most simple carbs (but, if you’re like me, allow yourself an occasional plate of cookies).

After all my fasting and intermittent fasting and super low fat and super low carb and alcohol temperance experimenting (and reading the research), I’ve come to a few fairly simple conclusions. First, a low glycemic diet (like the Mediterranean diet) seems to be the best. And eating within a fairly small window each day, say from noon to 6, is healthy. Of course, less alcohol on a daily basis is good.

With the new gym, I plan to have a regular but varied workout that includes weightlifting and short bursts of intense cardio on the bike. And, for eclectics like me, mixing it up and allowing myself to occasionally break the rules is key to continued success.

The YouTube Channel and Online Pursuits

At some point, I remember you started documenting your projects on YouTube. This has grown into a bit of a “channel” where at least one of your videos has over 100,000 views.

I have always hesitated to put up videos myself, because so much of YouTube is slickly produced and well-edited today and I am shy to put up my amateur work – much like the fearful theme that started us off on this whole article today. But you didn’t seem to care, and you just did it, and now the channel is out there.

How has your YouTubing experience been and do you have advice for anyone else? How hard would it be for a YT channel to become a successful business?

Luc: Ha ha, yes, the YouTube project has been quite an adventure. Currently there are three videos with over 100,000 views, including the Atwood remodel video, with over 750,000 views (you’re in that video – how does it feel to be a rock star?). What’s funny is the Atwood video was really poorly produced, yet it still somehow went semi-viral in the spring of 2017, spiking from an average of about 400 views a day to a peak of 21,000 views. That tapered off over the next year and a half, but I’ve made almost $1500 on that video. I’ve been trying to push the traffic from that vid to an updated and better produced version of the video, with limited success.

Like a lot of my other projects, the YouTube project has been a gung ho endeavor, jumping in with both feet in spite of limited skill and experience. A more well-thought out plan, executed with better focus, may have lead to more success. Then again, it might not have gotten off the ground if I had been too cautious.

In my newly grown up and focused life-phase, I hope to grow the channel into one that attracts more subscribers and maybe even provides enough income to buy more than a meal out on the town every month. Still, I have to keep that eclectic feel – I mean who doesn’t want to see everything from remodel work to creative pumpkin carving to insect eating to casket building to Trump parody to crazy body hair shaving? I have about 30 projects in the can as we speak, just waiting to be edited and uploaded.

(MMM note: did you catch that? Thirty projects we haven’t even mentioned in this article, including the time he tried to earn a Guinness world record by carving a 27 foot “Mustache” into his own body hair?)

The best advice I can give to aspiring YouTubers is don’t have a shaky camera – man does that drive people nuts, as I’ve been told again and again by people who watch the original Atwood video (there’s a lot of anger out there, as you well know, MMM). There’s something to be said for the amateur folksiness of YouTube, but there’s a balance between unwatchability and being too slickly produced (I’m still working on finding it). I’m probably the wrong guy to ask about what people want to see, but I imagine it’s pretty much anything you have an interest in, as long as the video is useful or entertaining.

Financial Independence and What’s Next?

Neighbourhood friends sampling Luc’s Sauteed Crickets at a party

MMM: As the years have gone on, you’ve remained a self-employed person and never stopped working hard on things. But I have noticed your work progressing from hardcore grinding out of professional painting jobs near the beginning, to more eclectic stuff now that is less income oriented. For example, the time you raised edible insects in your basement and researched and wrote an academic paper on how good it would be for the world if we switched some of the rich world’s meat consumption over to nutritionally superior stuff like cricket flour or bee brood. Not a lot of money in that type of thing, at least not to pay this month’s grocery bills.

What has been your secret to this decreased pressure on income making, and would you say you have a better work-life balance now than you had back in 2005?

Luc: Primarily because of my real estate investments, I’m fortunate enough to be in a position where most of my projects don’t need to make money. To me, the end goal in life is fulfillment, and the only way to achieve fulfillment is by making the world a better place, whether through service to the community, producing beautiful works of art, fighting for peace and justice in the world, writing a blog that denounces materialism and promotes sustainable living (wink wink), or just by being a good person to those around you.

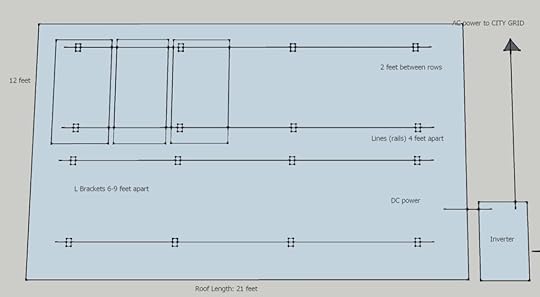

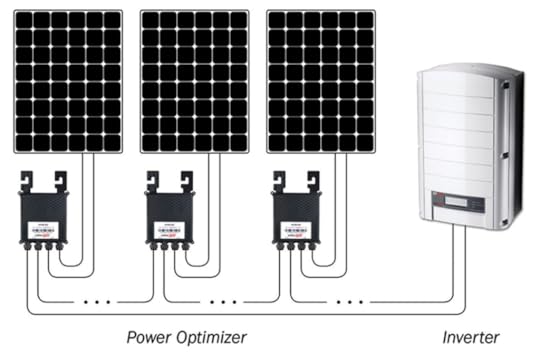

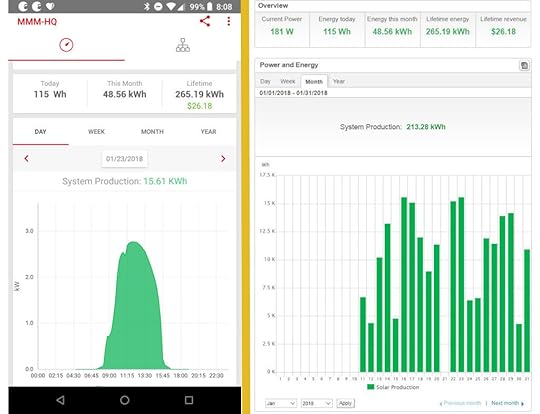

A lot of my projects still focus on things that improve my own life, but more and more I hope to work on projects that help others, from the hyperlocal (being a better father and husband and friend) to the local (being more involved in our community) to the global. On the local front, one project you and I have worked on a little together is trying to get more solar power in Longmont. On the global level, I’ve been working with my father, E.G., on The Cooperative Society Project, a decades-long project that looks at the potential for humans to make the transition to a new stage of human interaction: one driven by cooperation rather than conflict.

The way I see it, the beauty of financial independence isn’t freedom from work, it’s the freedom to work on a fulfilling life.

An Afterword from MMM:

So this is a long article. What does it have to do with YOU and your own financial independence?

I have wanted to share these tales because they’re a great example of the idea of living with less fear. The neat thing about Luc’s entrepreneurial ventures is that he is willing to do things, even if he’s not skilled or experienced at them. They often don’t pan out, and that’s okay, because it’s okay to fail. In most cases, failure is just a lesson that leaves you further ahead than when you started, with some great stories to show for it too.

But to minimize the damage of failure and maximize the chance of success in entrepreneurship, Luc and I have both noticed a pattern over these thirteen years:

Start Small and Just Sell Something – most failed businesses start with borrowing and risk. Instead, you should find a customer first and get them interested in buying your stuff. Only after the sales come, should you reinvest some of this money into a bigger business.

Hard Work Can Save You from your Mistakes – when you’re getting started in anything, you will make expensive mistakes. But you can dig in harder and correct them and learn from them. You need to be willing to launch the business out of your spare room, be your own janitor, and make late night runs to the supply store or the post office to get those shipments out. Plenty of time for kicking back and gathering passive income later on, once the business is profitable

Keep Life Simple, Frugal and Stay Focused – a business takes time to build and it takes a while for it to start producing money. But if you enjoy it as your source of entertainment, it will naturally get the time it needs: Spend your weekends in the workshop instead of the golf course or the ski hill. And if you let go of material desires, you won’t be nearly as hungry for money. So while a $20,000 per year hobby business won’t even cover the lease payments on your neighbour’s pickup trucks, it may be more than enough to keep you well fed and happy, for life.

If you’ve got a lifestyle business that you love, feel free to share it in the comments beow and inspire the other people reading alongside you.

—

* In this article I profile Luc, but he is of course part of a hardworking and resilient family of four. His wife is also a friend of mine and an equally wonderful person, but I have kept this story just focused on Luc in the interest of the privacy of the rest of the family.

Further Reading:

Poppa’s Cottage YouTube Channel

The Potential For Entomophagy To Address Undernutrition

October 5, 2018

What Everybody Is Getting Wrong About FIRE

Fig 1: Suze Orman’s opinion of our lifestyle, as captured in a crazy interview on Paula Pant’s Afford Anything podcast.

In case you hadn’t already noticed it in the news, it seems we are hitting a turning point in how the rest of the world perceives this lifestyle that you and I have been enjoying.

First, we were ignored. Then, there were a few stories that just focused on the strange lives of Mr. Money Mustache a few other freaky magicians, cataloging our feats of extreme frugality like “spending less than 100% of your money on a car” or “occasionally eating food from one’s own kitchen.”

But time went by, and our numbers kept growing. And we weren’t just thirtysomething white male tech workers anymore, we were women and men of all ages and professions in all different countries, absorbing blogs and podcasts from a thousand different sources.

Vicki Robin, author of Your Money Or Your Life came out of retirement to write a new edition of her foundational book on the subject of financial independence* and some prominent filmmakers have spent the past year making a documentary called Playing with FIRE about all of this too.

And suddenly, instead of just a blogger or a few millennials here and there, the media is starting to call it the Financial Independence Movement. And this is a big deal, because when it comes to cultural traditions, perception pretty much defines reality.

But when you look it up by Googling the FIRE Movement, you still get a pretty mixed bag of arguments.

The New York Times article looks very positive. But there’s another one in there called “Why I Hate the FIRE Movement”, another that complains our ideas are a “Massive fallacy of composition”, and any number of others saying that we have got one aspect or another wrong.

There’s a tricky paradox going on here: the more people you reach, the bigger the range of misconceptions that will come up, potentially cockblocking your movement before it really takes off.

So, with that in mind, let’s clean up the biggest bits of WRONG that are preventing the latest round of several million new arrivals from fully enjoying the fruits of their own labor.

Because as soon as you stop making excuses for why these ideas can’t possibly work for you, you can start actually doing them and seeing the benefits – today.

1: This is ALL WINNING and there are NO DOWNSIDES.

If you think there is even the slightest flaw with the ideas behind FIRE, you’re probably just not understanding it correctly. Because the whole reason for doing any of this is to lead the happiest, most satisfying life you can possibly lead.

Sure, there are a few tricks behind the curtain – I’m going to make you occasionally tackle some moderately difficult stuff instead of the lazy, easy things you are accustomed to doing. But this too is a win, because a lazy life is a sad, depressed, unsatisfying life. We are going to lift you up OUT of that bullshit. So from now, you can assume that any objections can be solved. Zero complaints allowed.

2: It Doesn’t Matter How Much Money you Make

Sure, many of the people most passionate about FIRE tend to be tech workers and doctors who happen to make a lot of money. When people with lower salaries notice this fact, they tune out and assume the ideas won’t work for them. When in fact, they work even better, the further down the income scale you go.

Sure, many of the people most passionate about FIRE tend to be tech workers and doctors who happen to make a lot of money. When people with lower salaries notice this fact, they tune out and assume the ideas won’t work for them. When in fact, they work even better, the further down the income scale you go.

When I tell a Google employee earning $200,000 per year that she should not burn through too many $10.00-plus-tip glassses of wine at happy hour, she can rightfully respond that each one represents only about ten minutes of her after-tax pay. But what about the guy getting by on $20k? A ten-dollar expenditure is ten times more of a blow to his finances, and an even bigger portion of his monthly surplus income, if he has any surplus at all.

I’m not telling low-income people that they can retire in five years. I am telling them that they can make their lives better, RIGHT NOW, by spending less money on certain things that don’t improve any of our lives. Ten dollar drinks are one easy example, but there are dozens of other ones that I’m suggesting.

And dozens of ten-dollar bills start to add up to real money pretty quickly, which is something most people don’t realize. The vast majority of wealthy people are the ones who have figured out that a millionaire is made ten bucks at a time.

At the opposite end of the scale, earning more income will rarely solve your financial problems: most high-income people are still within just a few paychecks of insolvency, because it is possible to blow almost any paycheck, simply by adding or upgrading more cars, houses, and vacations.

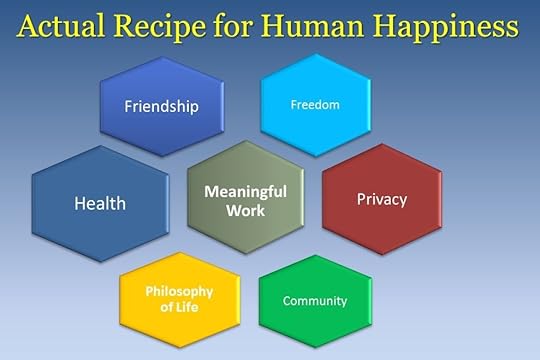

A fundamental truth in society is that most people are pretty bad at math. At the core, these FIRE ideas are simply about taking some solid math, combining it with principles of human happiness, and then distilling it down into a list of simple tactics that will get you way ahead in all areas of life. The benefits go way beyond money.

3: FIRE Is Not Really About Early Retirement

Everybody uses the FIRE acronym because it is catchy and “Early Retirement” sounds desirable. But for most people who get there, Financial Independence does not mean the end of your working career.

Instead it means, “Complete freedom to be the best, most powerful, energetic, happiest and most generous version of You that you can possibly be.”

Does this mean you will quit commuting through traffic into a lame corporate office to sit in meetings about products you don’t really care about? Yes.

But does it mean you won’t work hard at things that are important to you, for the rest of your life? NO!

The people who lob this “retirement is bad” complaint against us are often the lucky ones – a professor who loves researching and teaching, or an established doctor who loves saving lives and happens to enjoy the work environment she has created for herself. But in real life, over half of people are in jobs they genuinely do not enjoy, and which they would immediately quit if they didn’t need the money.

Early retirement means quitting any job that you wouldn’t do for free – but then continuing right ahead with work in something that works for you, even when you don’t need the money.

If you’re lucky enough to find a job this good early on in your career, then congratulations, you can have the benefits of early retirement even before you have the huge nest egg. But don’t fool yourself – having the financial independence side of things is very powerful as well.

And because of this tendency of early retirees to go on through life and keep earning more money – at least occasionally – the issue of running out of money is even more remote. Most of us end up with a higher net worth every single year, even decades after turning in the keys to the cubicle.

4: You Can Be Happy on ANY Level of Spending

As a society, we’ve been trained to assume that having a bigger budget is always better, and cutting back always means some sort of compromise. The Suze Orman interview above is just dripping with that assumption. The amazing news in this department, which will save you millions of dollars, is that this is complete bullshit!

Happiness is your goal in life, and it comes from meeting certain core Human needs. The thing is, that there are many ways to meet each of these needs – some of them free and some of them shockingly expensive.

For example, improving your physical health is one proven way to be happier. But you can accomplish this with a $2500 per month personal trainer or a $100 set of barbells from Craigslist. Same happiness, vastly different cost.

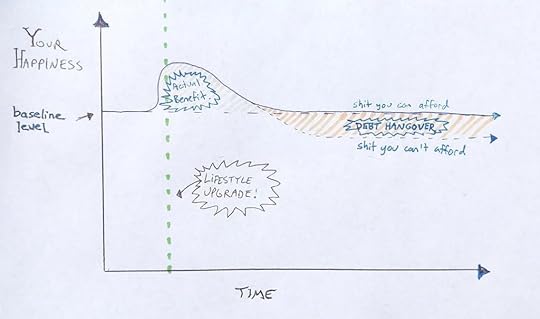

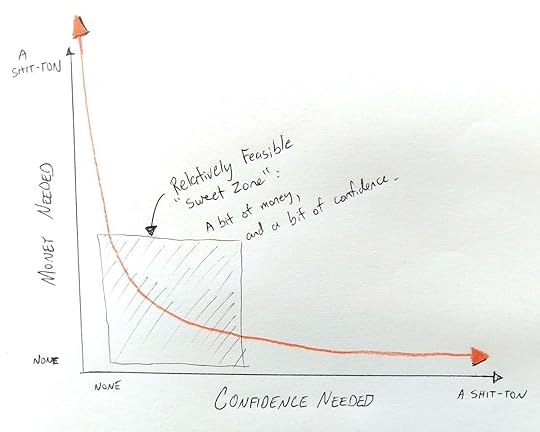

And as it turns out, there is a similar hack for every single one of life’s major expenses. You can meet all your needs at little or zero cost – it just takes a bit of skill. At this level, you would be able to save almost all of your income.

Or, you can substitute a bit more money and a bit less skill to meet those needs in an (only slightly) more efficient lifestyle, like the one I try to lead. This might allow you to save half or two thirds of your income.

Or, you can spray money in every direction randomly, trying to meet an unfiltered list of wants and needs, and end up with a random but very expensive life, while remaining almost broke throughout the entire thing. This is what most people do, and it leads to saving almost none of your income.

All three choices are possible to do with great happiness. But in a bit of a paradox, the last and most expensive choice is the most difficult one in which to find happiness, because you end up with so many distractions and so little free time.

5: It Doesn’t Depend on A Booming Stock Market

I started this blog soon after the crash of 2009. Now we’re in the boom of 2018. Another market crash of epic proportions is coming sometime, probably pretty soon.

Our uninformed opponents think that FIRE-style early retirees are extra vulnerable to this. But in reality, it’s just the opposite: we are on a safe island, far above the choppy seas of the everyday economy. Because here’s how it really works:

We have low and easily controlled expenses – remember, we got here precisely by being good at controlling our spending.

The stock market always fluctuates, and crashes are an expected and healthy part of the system. Then Human ingenuity continues its magic, we keep on striving and inventing great things, and the market goes back up. Stock market volatility is already built into the math we used to design this plan. Relax.

Even in the event of a permanent collapse (for example the end of the US or world economy), the FIRE practitioner would still come out ahead: instead of focusing your energy on leasing BMWs or dressing yourself up fancy, you have learned to live happily and work on your skills, health, and friendships. It’s a package that will make you wealthier in good times and bad.

6: Education, Health Care, or High Cost of Living areas are Comically Tiny Obstacles

FIRE is simply about making smart decisions with your spending so that you waste less money. This means that you have way more money available to work with.

The potentially costly monsters mentioned above are simply things that cost money. So if you get better at managing your money, do you think these problems will loom larger, or smaller, in your life?

For example, my son will be reaching University age in just five more years. I haven’t bothered to set aside any money for this part of his education, because we already had way more than enough before he was born!

On top of that, financial independence gives us many more options to handle any unexpected expense, whether it’s education, health, or anything else. For example, as a team my son and we parents could easily:

shop around to find the most cost-effective way to get any given degree (start with community college for the first two years, compare different schools, etc.)

earn more merit scholarships to get through even an ivy league school for free.

earn more money to pay for any cost shortage

bypass university entirely and simply start a business

move to another state or even country in order to qualify for local tuition rates or more reasonable medical rates

use personal relationships to get cheaper or free education or medical care in exchange for helping teachers and doctors with something they need from us.

These are just a few ideas. The point is, every problem can be solved, and financial independence simply gives you more mental and money power to solve these problems.

7: The Only Thing To Fear, is Fear Itself

In the interview, Suze Orman goes on and on about what might go wrong, and how you need an incredible amount of money saved to protect you, just in case. But this thinking is completely backwards – money will not cure your fear, as megamillionaire Suze proves so clearly.

If you are afraid of what might happen in the future, you have a mental problem rather than a financial problem. So you should work on that first, by training your mind and body:

Start each day with at least a one mile brisk outdoor walk – before you even attempt to work. This drastically improves your hormonal balance and reduces stress and fear.

Read books about managing stress and learn about meditation using something like Headspace or Camp Calm.

Completely avoid the daily news cycle, especially on TV or radio. If you insist on being a world events junkie, just read the Economist once per week. Focus on optimistic sources of information – like this blog!

Seek out and hang out with more optimistic friends. Remove negative or gossipy friends from your daily life.

8: Place Your Bets Where The Odds Are In Your Favor

Because my brain has a math side I can’t turn off, I tend to see the world in terms of numbers rather than just emotions. And this is incredibly helpful, because by understanding probability, it helps me set up my life to ensure a much more joyful stream of those happy emotions.

For example: many people avoid cycling because they have heard from friends that it is very dangerous. But by doing so, they replace bike trips with sedentary car or bus trips, which clog their arteries and compound into fat gain and other medical issues which really are dangerous.

A lifetime of bicycling in average conditions might give you a 0.2% chance of untimely death due to accident – which can be slightly higher or lower than car driving depending on where you live. But a lifetime of drinking soda and skipping your cycling and barbell workouts gives you at least 50% higher chance of dying ten years earlier due to medical complications, while cycling reduces those health risks (and costs) considerably. So which activity is really the dangerous one?

With this in mind, which of these activities is more risky?

working ten extra years in a job you don’t love so you can have an extra million saved up in case you encounter heath problems later.

quitting that job right now and investing those ten years into living a healthier and less stressed life with more exercise, better relationships, and a more diverse range of skills. Focusing on you instead of your bank account.

We’ll skip the spreadsheets for now and just boil this into a list of habits that really do give you the best chance at a good life: more happiness, better health and less negative stress.

Physical health FIRST: your brain is a system of meat and tubes, just like the rest of your body. The whole system will only perform well if you place its wellbeing first, before anything else. Salads and barbells every day, no goddamned excuses.

Mental health NEXT: feed your mind with happy input and learn to practice mindfulness, educational reading, and meditation daily, which is simply a workout for the brain.

Daily hardship and Learning: if you are not sweating and learning and doing something difficult and solving problems, you are not living fully. Find a way to scale back the pampering and achieve more with your own body and mind.

Indulge, but only with Moderation and Self-Mockery: this country is rich enough that you can become wealthy even without perfect self-discipline – even on minimum wage. But the moment you think you deserve or need whatever indulgence you are currently treating yourself to, you have lost the game. Luxuries and treats are just short-term pleasurable distractions, like any other drugs. Indulge if you can afford them, but you’re not missing one ounce of happiness if you choose to go without at any given moment.

So that’s the FIRE movement.

It’s a system of living your best life in all ways rather than just the financial, based on our best understanding of human nature, with a bit of math and science behind it. Like science itself, it’s not a dogma or a religion, but more of a self-aware system that invites questions and experiments. It’s always open for modification or improvement, but like like science itself, there’s nothing for a rational person to hate. Who hates learning?

The reason it has spread to millions of people is that it works. People try it, they like the results, and so they share it with their friends, and the cycle repeats. There’s no stopping an idea or a movement like that.

—

*and guess who had the honor of writing the foreword for the new edition?

Note that I use Amazon affiliate links to point to any Amazon products mentioned, which allows this blog to earn money – so many thanks if you use them.

September 5, 2018

What Really Goes on at MMM Headquarters

First an announcement: The Pop-up Business school is returning to Longmont this year for two golden weeks in September. Although the free in-person tickets are sold out, we are running a free daily live stream of the highlights, and you should definitely sign up here to join us.

…

I’d love to retire early, but then what?

…

Although I retired about thirteen years ago, and continue to be retired, about one year ago I opened up a little business on Main Street here in Longmont, Colorado. It is a multi-purpose gathering space, under the guise of a coworking space, with the typical-for-me grandiose name of “Mr. Money Mustache Headquarters”. Or, MMM-HQ for short.

At the time, I wrote a blog post about it, and promised to keep you updated on how it was going. Since then, many people have been asking for updates. Approximately one group of random roadtripping Mustachian tourists has stopped by each day to peer in the windows*. And several people are considering opening their own coworking spaces in other cities, if the case for it looks good.

Although this HQ is a small scale thing (we are hovering at about 50 members and I’d love to get to 80), it has provided me with some great lessons in both life and business, which are long overdue for sharing.

Plus, I can now fully vouch for the idea as a good one for other people to pursue, given the right situation. Owning a coworking or other community-oriented space can be both a good business and a great life choice, for people before or after the early retirement stage.

So, here’s what I’ve learned after launching into the most unexpected business of my life so far:

1: Owning a business can be like a having mental health therapist that pays YOU:

As I always say, early retirement is great, but it doesn’t mean you’re allowed to stop working. You need to accomplish something meaningful with almost every one of your days, whatever “accomplish” and “meaningful” mean to you. You also need to get out of your house, strain your muscles, have positive interactions with other humans, and experience at least a bit of hardship. These are simply parts of the recipe for Human happiness, like a series of buttons you can press to get more of it.

A therapeutic January morning in the Prisonyard Gym with special guest Jesse Mecham

So in my case, adding HQ to my life has been a very nice way to press more of those buttons. Almost every morning, I walk or bike or jog the 1.2 miles down to the building bright and early, open up all the doors for some fresh air, put on some music, and sweep the floors or make coffee or set things straight in preparation for the day. Then I head out to the patio and the “Prisonyard” outdoor gym beyond to do some basic weight training before I get sucked too deeply into computer work or any to-do lists.

As the day goes on, there will be a random stream of members and conversations and tasks and meetings and errands around town, which is just unpredictable enough to keep each day fun.

And the best part of it all is that it’s completely optional work. I can choose not to visit, and the members take up the slack and care for the place themselves. I can go on vacation and nothing blows up while I’m gone.

Owning a coworking space has all the benefits of having a really good office job where you like all of your coworkers, except without the accompanying obligations or politics. I refer to it as my therapist because a visit never fails to put me in a good mood, no matter how I felt before deciding to head down there. And a healthy and reliable way to make yourself feel great is an important part of any life.

2: It’s easy to arrange big events, but slower to create a consistently buzzing daily scene.

The year started big, with about 90 people crammed in for the first pop-up business school. Then, the vibe flipped around completely as we moved on to just a few people hanging around during normal days, working on laptops or perhaps the squat rack. But there have also been a pretty good series of after-hours events including barbecues, potlucks, regular meetups of the Northern Colorado Mustachians Group, a visit and Q/A session with YNAB founder Jesse Mecham, a Virtual Reality demo night, a music jam or two, and various charity and learning events and markets.

The annual Beer Club charitable meeting, comprised mostly of my neighborhood Dad friends.

On the down side, it takes more work to meet and sign up each new member than I expected, and we tend to lose more than expected, as people who signed up early but realized they don’t really need a coworking space have dropped out. And in the classic Blogger’s Dilemma where the demographic of the audience often reflects that of the writer, we end up with quite a high percentage of well-to-do white males in our 30s and 40s, which could lead to the term “Broworking Space”. But I’m trying to break this trend!

On the upside, the community side has been just as good as I had hoped. Thanks to the magic of our private Slack group, Members of HQ have been helping each other with both business and leisure pursuits on a daily basis and the connection has helped all of us including me. I often joke that my primary purpose for this coworking space is as a “Friend Harvesting Machine”, and it is living up to that promise.

3: The Money Side of Things

In principle, coworking is a good business model because it works a bit like a gym: you can have a large number of members sharing a common space because not everyone is there every day. This is why there are so many companies expanding into the business like WeWork, Regus, Proximity, Galvanize, and a zillion more.

But like any business, your income and spending need to be balanced. I’ve deliberately gone low on both sides, by starting with an affordable building and subsidizing it with my own mostly-unpaid labor. Because of this, the $2500 per month income (50 members at $50 each) is enough to sustain the place including property taxes, utilities, maintenance, beer (and artisinal coffee from one of our own members!) The downside of this approach is that our space is smaller and less fancy than other coworking spots. It was really just one big room until I opened the Tinyhouse conference room in June. Since the space is still way underused on any given workday, we could easily double this to 100 members, which would bring the business up to $60,000 of gross annual income – more than enough to sustain any reasonable lifestyle with very part-time hours.

Normal coworking spaces will tend to have a much larger building, with hundreds of members paying between $150 and $300+ per month for semi-private working spaces, or more for fully dedicated offices. This leads to higher rent and utility costs, plus the need for at least one full-time administrator and even a receptionist (although both can be the same person, which could be you if you are motivated.) The end result is a good income stream, at the expense of a business that requires real work on a fixed schedule.

So you can see why MMM-HQ is taking the slower paced road, for now.

4: So, should I start my own? (or join one?)

If you’ve got the time and energy, hell yes!

If you are thinking of opening a space in roughly the MMM-HQ model (or already have one), feel free to give me the details by dropping me an email via my about->contact form. If you start by putting up a good website with your proposed building/location, amenities, monthly cost and your contact info, I will link to it from my own HQ page, which will then become a directory for a network of community-oriented Mustachian coworking spaces. You can gather interested parties first before taking the plunge, although I would suggest that you only do this if you are financially well established and not overly dependent on the whims of bank financing.

Although I would (of course) charge no franchise fees, we could still set up an informal sharing arrangement where members of any Mustachian Headquarters affiliate location would be free to visit any other one.

And if you are wondering if joining a club like this is a worthwhile use of your own fifty bucks a month, I have to say it’s hard to see the downside as long as you use the amenities and like socializing with other people. If free coffee, beer, work space, an outdoor gym, tool library/workshop and access to fifty local entrepreneurs is not worth it to you, then I’m not sure what is!

—

In The Comments: Do you have any questions or comments about this or any other lifestyle or post-retirement business ideas? I’d be happy to answer them, and hopefully many other entrepreneur-readers will be willing to share their own knowledge and experience as well.

And Once Again: sign up for next week’s live stream series on how to open a Mustachian business, here!

—

*Out of respect to the members who are in there trying to get real work done, please don’t show up unannounced – instead, join one of our public meetups if you happen to be in the area, which I always announce on Twitter and usually Facebook too.

July 25, 2018

The Twenty Dollar Swim

Gratuitous mid-lake selfie from yet another day of nearly-zero-dollar “motor”boating, earlier this week.

It was mid July, and I had just finished a sweaty run on the trails which criscross my older sister’s farm in Canada. I was overheated and heading straight for their swimming pool when she saw me walking across the lawn.

“Oh yeah, please do use the pool! You’ll help get my cost per use down because it’s still way up there in crazy territory”, she joked.

Moments like these are why I love being part of this family. The self-deprecating Spock-like humour where we can make fun of our own flaws and indulgences, while simultaneously enjoying them just as much.

But it also sparked an interesting conversation, because I knew they had been running this pool since the early 2000s, raised their two now-adult water loving boys in the house, and hosted gatherings for family and friends throughout every summer. And it wasn’t an exorbitant pool. Surely this was one of the more affordable indulgences, right?

“Has the cost per swim really been that high?”, I asked.

“Every jump into that pool has cost almost twenty bucks, if you average it out.” she replied.

“Wow, how could that be true?!” I mused.

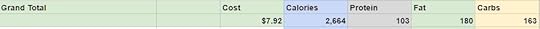

So I did some rough calculations like those you see in the box below, which you can totally skip right over* if you just want the final answer.

The pool originally cost $30,000

But that money could have been invested instead, which would have compounded at 7% for these 18 years.

$30k compounded at 7% (30×1.07^18) is an amazing $101,300!

Electricity at 10 kwh/day x $0.20 at for 100 days per season is $200 per season or $3600 total

Chlorine and other chemicals: $600 per season add to $10,800

Maintenance like vacuums, nets, a new liner: $800 per season $14,400

We’re already at $130,000

Not even counting the hundreds of hours that went into scooping out bugs, spiders, mice, and even raccoons, and potentially higher home insurance premiums and water bills (in my region a 25,000 gallon pool costs $125 in water to fill – once!)

And how many swims were enjoyed in the pool? If every family member swam every day for every season, you’d still only end up at 18 years x 100 days x 4 people = 7200 swims.

$130 grand divided by 7200 is $18.oo

.

So the final number is about 18 bucks per person per swim, just as my sister claimed.

Looking forward to a refreshing dip with Mom and Dad and the kids? That’s $72 bucks that you ended up burning, by the time all the chips fell.

I know this is a strange way to think about a swimming pool. But this is a Mr. Money Mustache article, and this site is all about different ways to think about your life decisions.

Most people just say something like, “Well, we’ve already got it so we might as well enjoy it, right?”

The problem is that they also apply this to other purchases, even those they haven’t made yet. The richer our tastes become, the more likely we are to buy ourselves little upgrades “just because it would be nice”, or “just in case”, or because Joe Jones next door or a magazine article mentioned the idea.

“Okay Mr. Money Mustache, What Are You Taking Away From Me This Time?”

Don’t worry, I’m not necessarily going to strip you of your dreams of that swimming pool, or anything else. But I do want you to start thinking about these costs in a much more visceral and explicit way, so you can really make sure you are not fooling yourself. For example, let’s step through a few more common blunders:

“We had a great time visiting the Smiths in their ski house last weekend – LET’S GET ONE OURSELVES!” – sure, as long as you are ready to devote your financial life to the activity and the activity is worth $890.00 per night you actually spend there. But if this number sounds like anything other than chump change, you and your friends might want to just share an Airbnb for your ski weekends, or even better, take up local mountain biking instead of far-away skiing.

“I like these two houses equally, but one of them has a much bigger yard which is better for Junior to play in. They’re the same price and the bigger yard is just ten miles down the road!” – okay, but make sure that Junior’s time in the extra yard space is worth $150 per hour.

“I’m thinking of springing for the $9000 long-range battery in my upcoming Tesla Model 3 order” – this one strikes straight at my own heart, because I crave a long range Model 3 myself. But even for a serious roadtripper, this works out to $125 per hour of charging time that you manage to avoid. Aren’t you willing to take a few minutes occasionally to walk around and admire your beautiful car if you get paid $125 per hour after tax for it? If you are, standard range will do.

“I live in an area with snowy winters, so I need all-wheel-drive” since we already learned that all-wheel-drive does not make you safer, the only time it actually helps you is when it prevents you from being stuck. But this could work out to between $50 and $500 per time the AWD actually gets you out of a bind. Aren’t you willing to shovel your driveway a bit more thoroughly (or work from home on the worst days) for $500 a pop?

“We’d love to have an extra bedroom as a way of accommodating Grandma’s Annual Visit” Sure, but if you spend $30,000 extra on a slightly larger house and use that guest room 20 nights per year, it’s about $70 per night that you use it.

“I live in Chicago and we just love to spend weekends on the Boat.” Even if you go all-in and give up all your weekend activities on the land to maximize your time down at the marina, those nights in that little wedge-shaped cabin bed will average out to about $500 per night. Or more if you opt for a bigger boat or more time with the motor on.

“We love to explore and be free for a few months each year, so we’re getting an RV and towing the car…” But a three month, 15,000 mile RV trip works out to about $200 per night that you sleep in that vehicle – why not pick up a fairly new Prius and a good tent and hit the road, and treat yourself to beautiful rental accommodation whenever you want it along the way?

We could go on and on with these examples, but the real thing to understand is that making commitments usually comes with a bigger cost than you expect. There are a shitload of dollars at stake, but also a substantial portion of your focus and mental energy which will go into furnishing, maintaining, insuring, and cleaning these pleasant weekend distractions.

“But How Can I do It Better While Keeping My Life Fun?”

As a Mustachian, you have way more options open to you than you realize. But to take advantage of them, you need to stop doing what other people are doing, and live differently.

At the most frugal level, you can just cut yourself off cold turkey. From now on, just start doing all leisure within biking distance of home, and preparing all of your own food – no exceptions. You can still organize and host parties, however.

If you’re in a stressful debt situation right now and want to be out of it, you should just do this right now as a mental reset and watch the incredible results on your wealth. Most people who hit this reset button end up between $20,000 and $100,000 further ahead within just the first year, with many happy stories to share about it, so if you’re in need of a quick life boost, do this instead of dilly-dallying around with my rich person suggestions below.

But if you’re a debt free person with higher income and just want to accelerate your path to financial freedom, you can still dabble in the spendier life and keep up with your peers, by simply shuffling the luxury deck a little bit differently. A few principles that can still cut your budget by 75%:

Prioritize the healthy stuff first: It’s the weekend and you are ready to celebrate. But first, what’s on your to-do list? Are you fully caught up on your workouts, grocery shopping, and various nonsense with the incoming mail? If not, budget a full day for that rather than packing up the car for a road trip. How’s your yard looking? Have you fixed that door that doesn’t latch correctly? Well, look at that, your whole weekend is booked after all and you’ll feel better for it.

Muscle over Motor: If you like being on the slopes, learn to mountain bike. If you like being on the water, try a big, cushy sea kayak complete with cupholders for your sunrise coffee or sunset beer. Invite your fit and funloving friends and start exploring waterways everywhere. Or if you want a night out on the town, choose somewhere close and grab your bike rather than somewhere far and looking for your car keys or your Uber app.

Rent Instead of Buying: With Airbnb or even plain old hotels, you can still have weekend getaways when you truly deserve and can afford them, and yet the cost per use is much lower. The numbers will still look big, and that’s a good thing because you will be reminded that it is always expensive to leave your already-perfectly-good-home and go out to do even fancier things. When you’re living large, it’s best to joyfully acknowledge it rather than pretending it’s normal.

Make Special Arrangements: If you like cottages, make yourself useful to a friend who owns a cottage, by always being the one to bring the food or the wine, or donating your time to help with the maintenance or renovations. I helped build a cottage for my inlaws in Canada a few years back, and have enjoyed the fruits of our combined labor ever since – at no cost to the MMM family. Similarly, if you like boats, volunteer as part of the crew on a real yacht. If you like houses, specialize in building or renovating them, or hosting paying guests in the unused portions. If you like cars, become a car expert rather than just a car consumer.

The Final Word:

If you’re already eating and sleeping well, chances are that you already have all the basic ingredients for a happy life. So as you go on to start adding some spices to the dish as all of us do, just be sure you look at the price tag. The advantage you’ll gain will last a lifetime.

Epilogue: Just this year, after her boys had grown up and flown from the nest and all the fun had been had, they filled in the pool and are in the process of replacing it with trees and other natural landscaping instead. A bold move that few people would be rational enough to take – live long and prosper, Sister.

Extra Credit: Here are a few of the cost-per-use calculations I made for this article. Share some of your own in the comments!

Mountain house: $24,000 per year mortgage and/or capital cost, furnishings, utilities and maintenance divided by 30 nights per year. Plus $90 in car costs per roundtrip drive for a weekend.

Bigger yard: 1 hour per week of activities that really could not have been done in a smaller yard or an outdoor park, compared to 100 miles of extra driving ($50) and 3.5 hours of your time ($100) spent doing that driving.

Tesla Battery Upgrade: The only time you use the longer range is on roadtrips over 230 miles. If you do a 600-mile trip once every month, you have to make two extra 30-minute charging stops per month. Figure the $9000 battery costs you about $1500 in extra capital cost and depreciation per year, or $125 per month. However, if you are a Tesla fan like me and you want the company to make more profit to continue their mission, you may still opt for the extra options since you have nothing better to do with that money anyway.

All wheel drive car: if the car costs $5000 more up-front plus an extra $200 per year in fuel and maintenance, you could estimate it as about $500 per year more expensive to own. Then, how many times do you truly get stuck in a front-wheel drive car with really good dedicated snow tires on winter rims? (because snow tires always come before buying AWD!)

Grandma’s bedroom: a $30k more expensive house might consume about 2% of that extra cost in maintenance and taxes annually ($300), plus $5% annually in financing/capital costs ($1800), for a total of $2100 per year. Strangely enough, this extra bedroom works out to be one of the cheaper indulgences in this list, especially if you can use that room as an office too, or rent it out occasionally.

Boat: It costs about $15,000 per year to own, dock, store, transport, maintain, depreciate, and fuel a 26-foot motorboat with a little sleeper cabin in the front. If you spend each of the sixteen weekends of Chicago’s warm seasons exclusively in the boat, you’ve still done only about 32 days there, which yields the surprisingly high cost of almost $500 per night.

RV: Even a relatively small $50,000 RV depreciates about $0.50 per mile and burns fuel and oil and tires at another fifty cents. And that’s before you even pay for supplies, maintenance and nightly parking fees! Large RV travel is even dumber, financially speaking – note that the fanciest tour-bus-sized RVs you see cost about $500,000! The physics are simply against you if you are trying to travel in your own personal rolling building. Although stationary living in a not-too-expensive RV or trailer can be a highly Mustachian choice.

* I let you skip that one just so you would keep reading and see my point. But now that you see it, hopefully you also see that you do need to look at the numbers in life and figure this stuff for yourself, because it’s a way bigger deal than you might think!

June 30, 2018

My $3500 Tiny House, Explained

Meet “Timothy”, the new tinyhouse-style conference room at MMM HQ.

One of the nicest new trends of recent years is really the revival and rebranding of something very old: the smaller dwelling.

Over the last few months, I have built just such a structure, and it has turned out to be a rather cool experience. In fact, I’m typing this article for you from within its productive new confines.

Technically, it’s just a fancy shed. But it is functioning as a freestanding office building, a sanctuary, and would even make a pretty fine little dwelling for one person, if you were to squeeze in the necessary plumbing. It’s a joyful place to spend time, and yet it only took a moderate amount of work and less than $3500 of cash to create it.

The experience has been so satisfying and empowering, that it has reminded me how much we rich folk are overdoing the whole housing thing.

The latest and most distant Las Vegas Suburbs – still expanding (actual screenshot from Google Maps)

For decades, we have been cranking up household size and amenities in response to increasing productivity and wealth. In the 1940s, the typical US household had four people sharing 1000 square feet, or the equivalent of one large garage bay of space per person. Nowadays, new homes average around 2600 square feet and house only three people, which means each person floats around in almost triple the space. We have also started placing these dwellings in bigger expanses of blank grass and/or asphalt, which separate us further from the people and places we like to visit.

The funny part of all this is that we prioritize size over quality. Houses are sold by the square foot and the bedroom and the bathroom, rather than the more important things like how much daylight the windows let in or how well the spaces all fit together. And we settle for the shittiest of locations, buying houses so far from amenities that we depend on a 4000 pound motorized wheelchair just to go pick up a few salad ingredients.

Meanwhile, smaller houses and mobile and manufactured homes have continued to exist, but they have sprouted an undesireable stigma: those things are only for poor people, so if you can afford it you should get yourself a large, detached house.

My Tinyhouse Dreaming

Ever since my teenage years, I have dreamed of casual, communal living. 1992 still ranks as possibly the Best Summer Of My Life, because my brother and I lived a leisurely existence in the utopian garden-and-forest expanse of our Mom’s half acre backyard complete with swimming pool, fire pit, and pop-up tent trailer.

We lived at the center of small, historic town, with very little for teenagers to do in the summer besides find a way to get beer, and find somewhere to drink it so we could play cards and make jokes and if we were really lucky, find romance. And in these conditions, Mum’s backyard came to the rescue of our whole social group.

People would show up in the morning and just linger and come and go all day, swimming in the pool, grilling up lunches and dinners, playing cards at night or watching movies in the impromptu movie theater I had set up in the old detached garage. There were last-minute multi-person sleepovers every weekend. Leftover spicy bratwurst for breakfast cooked over an open fire in the morning. The fond memories from this early-nineties teen utopia live on in all of us*. So naturally, I have wanted to find ways to recreate that carefree feeling ever since.

According to people who actually study this stuff, the key to a really happy community and warmer friendships seems to be unplanned social interactions: you need to run into people unexpectedly every day, and then do fun stuff with them. To facilitate this, you need to live close enough together that you encounter one another when out for your morning stroll. Smaller, cheaper housing is the key to this, as well as a key to spending a lot less money on isolating yourself from potential new friends.

Weecasa resort (image credit Weecasa)

Need a few real-life examples? Right next to me in Lyons, Colorado, someone (I wish it were me!) thought up the idea of creating a resort out of tinyhouses called WeeCasa. Consuming less space than just the parking lot of a normal hotel, they have a beautiful and now highly popular enclave where the srooms rent for $150-$200+ per night.

Two friends of mine just bought a pair of adjoining renovated cabooses (cabeese?) in a Wisconsin beach town, with plans to create the same thing: a combination of a pleasant and walkable lifestyle with fewer material strings attached, and a stream of rental income when they’re not there.

Another friend built her own tiny house on a flat trailer platform, and has since gone on to live in a beautiful downtown neighborhood, both car-free and mortgage-free except for a small parking fee paid for stationing it in her friend’s back driveway. The monetary impact of making such a bold housing move for even a few years of your youth, is big enough to put you ahead for a lifetime.

Even my neighbourhood of “old-town Longmont” has recently inflated to the point of tiny starter home selling for $500k, for the same reason: people really want walkable, sociable places to live and house size is less important than location. While I’m in favor of this philosophy, I’m not in favor of anyone having to spend $500,000 for a shitty, uninsulated, unrenovated house. So we need a greater supply of smaller, closer dwellings to meet this higher demand.

But that’s all big picture stuff. The real story of this article is a small one – a single 120 square foot structure in the back of one of my own properties right here in downtown Longmont, CO. So let’s get down to it.

The Tinyhouse Conference Room