Mr. Money Mustache's Blog, page 5

August 22, 2019

How to Make a Thousand Bucks an Hour

Another summer evening skate-n-scoot outing with Mini Me

It’s Back to School time here in Colorado, which means both my son and I will be hanging up the swim shorts and kayak paddles and getting back to more serious business for a while.

It has been a slow and endlessly sunny and leisurely summer, and a nice break for both of us, which has been very relaxing and a great time for bonding.

But relaxation has its limits. At some point all that Chilling Out fades its way into Complacency, and our natural Human nature starts to work against us, telling us to conserve energy and not really do much of anything. And laziness begets more laziness, and life actually becomes less fun.

You can see this effect in our activities. I’ve only completed two blog posts over the entire summer holidays, and together we have put out only two YouTube videos. Spending more time at home and less at the MMM Headquarters squat rack has caused me to lose at least five pounds of leg muscle that I had wanted to keep. Little MM has spent a lot less time practicing on the upright bass and putting out songs, and a lot more time playing video games and getting sucked into the “dank memes” and “Trove” channels on Reddit.

It has been a fun break, but as the freshly polished school buses awaken with the sunrise, it will be even more fun to get our own lives cranking into a higher gear as well. And if you’re reading this, it means I am off to a great start!

Complacency Is Expensive

This laziness was affecting my financial life, and your financial life too. I had let thousands of dollars of uninvested cash build up in my checking account, where it was sitting around earning nothing. My credit card bills had come in, been automatically paid, and filed themselves away without me even reviewing them for fraudulent transactions or wussypants spending on my part. And I had a growing mini-mountain of things I need to do regarding insurance, accounting, and legal stuff in both my personal and business domains.

And yet once I got my act together last week, I cleaned up the whole mess and set things straight in less than an hour.

It’s not Just Me, it’s You

When I talk to friends and family, I notice a common theme: they tend to set up certain “hassle” things once, and then ignore them as long as possible unless some absolute crisis comes along and forces them to make a change.

“Oh, I just do all my insurance stuff with Jim Schmidt’s Insurance office downtown, because my parents referred me to him when I first moved out for college.

Even better, his wife Jane runs a loan brokerage, so she handles all our family’s mortgage needs!”

On this surface, this sounds fun and folksy and like a nice way to do business. And that is exactly the way I like to live: keeping my business relationships as casual and fun as I can. But when it comes to money, complacency can come at a price, so at the bare minimum we should find out exactly what price we are paying.

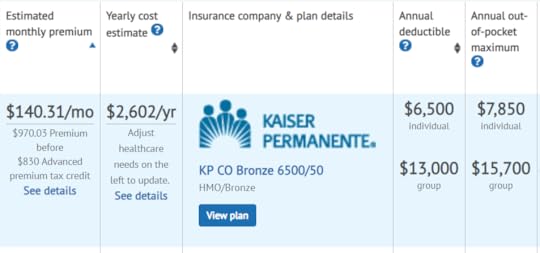

For example, just recently a coworking member came to me and asked for some financial help. And as always, I suggested we start by looking at big recurring expenses. So we dug into the details of her insurance and other major bills streaming in from ol’ Jim and Jane, and found an interesting breakdown:

Required liability coverage on a 2010 Subaru Forester: $580 per year

Optional collision and comprehensive coverage ($500 deductible): $360 per year

Home insurance on a 2000 square foot house ($500 deductible): $1450 per year

Mortgage interest on a $300,000 loan at 4.85%: $14,550 per year

Student Loan interest on an old $35,000 student loan at 5.5%: $1925 per year

Total: $18,865 per year.

It’s no wonder my friend was having financial stress – she had interest and insurance costs that were soaking up half of a reasonable annual budget before she could even buy her first bit of groceries or clothing.

So, right there we did a quick round of phone calls and online quotes, and streamlined a bit of the insurance coverage by increasing the deductibles. Within 90 minutes (she did most of the work while I had a beer and swept the floors of the HQ), we had the following new set of options:

Subaru liability coverage: $380 per year ($200 savings) through Geico

Removal of collision and comprehensive (in the unlikely event of a crash, they could afford to replace the car with less than two months of income) ($360 savings)

Home insurance on a 2000 square foot house ($5000 deductible): $650 per year ($800 savings) through Safeco

Refinanced mortgage to 3.375% through Credible.com *: $10,125 per year ($4,425 savings)

Refinanced Student Loan (also Credible) to 3.85%: $1347 per year ($578 savings)

New total expenses: $12,502 ($6363 per year in savings!!)

It is hard to even express the importance of what just happened here. My friend just did two hours of work in total while drinking a glass of wine, and dropped her annual expenses by over $500 per month, or six thousand dollars per year. And she will of course invest these savings, which will then compound to about to about $86,000 every ten years.

Even if she has to do this annual round of phone calls and websites once per year to maintain the best rates on everything, she will be earning about $3150 per hour for this work. Hence the bold title of this article, which you can now see is very conservative.

The Optimization Council

The first Optimization Council meeting at MMM HQ

So you’re convinced. $3150 is enough to get you to pick up the phone, but how do know who to call? Who is going to be your coach if you don’t live near Longmont and thus can’t just join the HQ and have Mr. Money Mustache tell you what to do?

The great news is that all of this knowledge already exists, right in your own circle of friends. To extract it, you just need to gather them together and get them to talk about it.

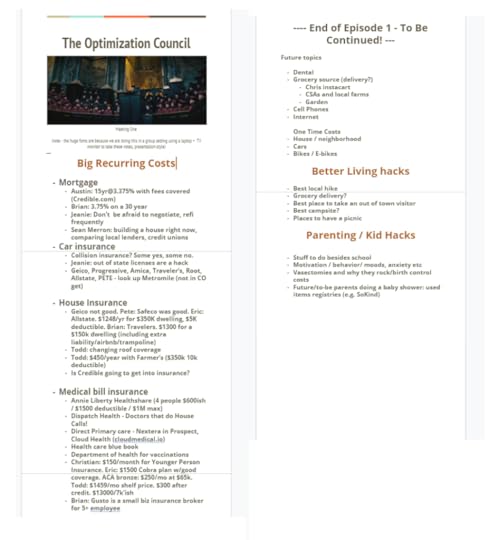

Earlier this month, I floated exactly this idea with the members of my coworking space, proposing that we form a group with the witty name “The Optimization Council.”

The Council would meet every now and then to talk through life’s biggest expenses and opportunities, and harvest the wisdom of the group so we can all benefit from the best ideas in each category.

The response to this idea was overwhelmingly positive. So we called a first “test” meeting earlier this month and a small group of us talked through the first few categories, sharing not just names like “I use Schmidt Insurance”, but details like, “We have $250,000 coverage with a $1,000 deductible and our premium is $589 per year.”

The meeting was so lively that we quickly ran out of time, but resolved to meet again soon to figure out more things together. I served as the scribe using a shared google doc – here’s a snapshot of that to give you an idea of our topics:

So Yes. There is some thinking and work involved. But there’s also an opportunity to drastically improve your short term cashflow and long-term wealth, and break your friends out of their cautious shell to help them get the same benefits.

So Yes. There is some thinking and work involved. But there’s also an opportunity to drastically improve your short term cashflow and long-term wealth, and break your friends out of their cautious shell to help them get the same benefits.

As we learned long ago in Protecting your Money Mustache from Spendy Friends, most people tend towards complacency, and following along with the group. Which leaves a big gaping void at the top of the pyramid where the leadership role waits unfilled.

If you are bold enough to climb into this spot (which really means just sending a few emails and Facebook messages, procuring a box or two of wine, and making a large tray of high-end nachos for your guests), you can all reap the rewards for decades to come.

And instead of avoiding this little chore like a hassle, dive into it like a gigantic shower of fun and wealth. After all, this is pretty much the core attitude of Mustachianism Itself.

In the comments: we can start our own Optimization Council right here. If you have found a good deal on any of the categories of life, feel free to share a quick summary of your location (state), and details of the company and product/service/price that you found is the best. To avoid spam filtering, please use names but not direct links.

A Note about Credible:

Watchful readers may have noticed I also mentioned this company on Twitter recently. After a few months of skepticism that the world needed yet another financial company, I was convinced by some conversations with the people running it and a Zoom video of the customer experience from a senior employee, with some very candid commentary on their design choices.

I like it because they import the lending models from their large supply of hooked-up finance companies, then run the rate comparisons on their own server rather than farming out your personal information to each separate lender. It saves you from filling out multiple applications when collecting rates, and also saves you from getting on everyone’s spam list (they don’t sell your contact information, which is a rare thing among loan search engines).

It was a hard model for them to get going, because the banks naturally want to have your information so they can spam you. But now that they have a growing presence in the market, lenders are forced to come through Credible to get access to this pool of qualified people. After enough testing with people I knew, I found the experience is worth recommending.

So I also signed this blog up with their referral program – please see my Affiliates philosophy if you are curious or skeptical about how any of that works!

With all that said, if you want to try it out, here are the links:

Student Loan Refis – $300 bonus with this link

July 20, 2019

Should We Employ Our Own Kids? (and How Much to Pay Them)

My Brother Wax Mannequin, training the next generation of workforce last summer.

Way back in 2015, I had a nine year old boy. Even back then, I could see him showing some early flashes of adulthood and maturity, and it got me wondering about his future as it relates to money and freedom.

So I wrote a post called What I’m Teaching My Son About Money, which shared some ideas about how we can raise our next generation of kids to be happy masters of money rather than the stressed-out slaves that most people (even those with high incomes) are today. And now, four years later, some of my predictions and questions from that article are starting to come true, and I’m wondering what to do about it.

To me, the biggest question is this:

Where is the balance between giving your kids a helpful boost, and “helping” them so much that you distort their view of the world and create a generation of Whining Complainypants Adults?

Opinions on this subject can vary widely, and in fact even you and I might have rather different views. But hopefully we can at least agree that the whole thing sits on a spectrum, and that even that spectrum itself is slippery because every child and every upbringing is unique.

So let’s get onto the same page with an attractive and scientific-looking diagram.

Almost any parent would agree that the left side of the spectrum is a bad place for kids to be born. Because it affects not just their childhoods, but their entire lives. So we strive to provide a life that is further to the right, keeping our kids fueled with food, love, and opportunities.

Almost any parent would agree that the left side of the spectrum is a bad place for kids to be born. Because it affects not just their childhoods, but their entire lives. So we strive to provide a life that is further to the right, keeping our kids fueled with food, love, and opportunities.

But as with all human pursuits, we have a tendency to go too far and get into the “Too Easy” end of the spectrum. We may be smothering our kids with too much “help”, or perhaps compensating for being so busy with our fancypants careers that we don’t have much time to spend with them.

While this all feels like common sense, there’s also some biology behind it. Babies and young kids who experience a harsh environment during this critical part of development will tend to grow up more optimized for survival and street smarts, with lower levels of trust and a harder time blending in with a peaceful society*.

And on the more fortunate side of the divide, children raised in peace and security will optimize more for “book smarts” intelligence as well as being more trusting and less prone to violence. The entire apparatus of our brain will end up wired differently, based on the experiences we have in early childhood.

The problem for wealthy people is that the human brain is not wired to stop at “enough”, because enough has not been a big part of our shared history.

So we tend to overdo it when creating a comfortable life for our own kids, often justifying it with this exact sentence:

“We work hard, so we can give our kids some of the opportunities and the nice things that we didn’t have in our own childhood.”

It sounds noble and honorable on the surface, but be careful, because we can ratchet that same justification up far beyond any reasonable lifestyles without realizing we are just stoking our own egos or compensating for our own fears (and perhaps battling our peers/competitors in the Who’s-the-Best-Parent Competition on Facebook).

And then these kids respond by developing in a different way that can have its own downsides. Not understanding what it means to be poor. A lack of life’s most valuable skill – the skill of efficiency, optimization and reducing waste. And even a lack of life satisfaction and balance in later adulthood, because of a focus on easy consumption rather than the joy of creation.

So with such a slippery slope and those two pointy arrowheads to navigate, what’s the ideal strategy for us parents?

I don’t have all the answers, but one idea I have been interested in for years seems to have a lot of advantages: Hiring your children to work in your own small business.

Just think about it. You get to do all of these things and more:

help your kids earn their own money

teach them the value of hard work

have more excuses to spend time together solving problems – maybe even as they grow into adults

potentially cut the family’s total tax bill by transferring income from the high tax bracket of the parents, to the low (or zero) bracket of the kids.

Of course, there are also a few traps to watch out for in running a family business:

the job you give them might be better (or worse) than what they could get elsewhere, leading to a distorted view of what it really means to work for a living

if you don’t get along particularly well, tying your fates together even closer in a company will magnify any problems in your relationship

your kids might miss out on other, broader life experiences they could have had out there in the real world (like my own formative jobs in the gas stations and convenience stores of my small town, which are still the source of stories and laughs to this day.)

Still, the potential benefits clearly outweigh the risks to me, so the idea remains an exciting one in my mind.

Little MM and the Budding YouTube Project

I have been dabbling with this with my own son for several years – he helped me with the arduous task of mailing out over 1200 MMM T-shirts a few years ago and occasionally helps his mother in her soap production enterprises. His earnings have typically been on a per-shirt or per-soap basis

I have been dabbling with this with my own son for several years – he helped me with the arduous task of mailing out over 1200 MMM T-shirts a few years ago and occasionally helps his mother in her soap production enterprises. His earnings have typically been on a per-shirt or per-soap basis

But things really took a step up this past January when he talked me into dusting off the neglected MMM YouTube Channel and actually starting to produce some shows together. Because we started with the good luck of a partially established audience and we have put some real effort into it (13 episodes over these first six months), it has taken off a little bit and we now have over 27,000 subscribers and the channel has earned about $1600 in YouTube ad revenue so far.

As a fun incentive, I offered at the beginning to pay him a flat (low) fee for editing and producing each episode, then split the income from this venture equally beyond that. So now, the little dude has made $800 on top of his base fees for the work.

If this continues, it could grow into a real income, which is quite exciting but also brings up some interesting tax questions. After all, right now he is a dependent for tax purposes, which means at least one of his parents get a tax deduction for raising him. But if he earns his own money, he might rise out of this dependence and even start owing taxes on his own. So is it worth it?

Hey, Let’s Ask my Accountant!

Outsourcing my taxes to someone younger and more enthusiastic about it than me has worked wonders.

To get better advice, I decided to run this by my own business and personal tax accountant, Chris Care who runs his own firm called Care CPA. We talked over the ideas of family businesses and employing a child in greater detail.

In summary, the results are better than I expected, which explains why people are so keen to hire their children.

Here’s my brief Q&A with him. Thanks for your help Chris!

MMM – So the first question is, what are the basic rules about employing one’s own child in a family business. My first instinct is that it sounds smart, because you are shifting income from parents in a potentially high tax bracket, to kids in a low tax bracket. So overall as a family, your tax bill falls.

But Is it a good idea? How old do they have to be? Any things to watch out for?

Chris Care: The biggest thing to watch out for is making sure the children are old enough to actually work. A lot of business owners want to pay their 1-year-old $15,000 a year for “modeling” by putting their picture on the company website. To me, this is a stretch.

You also want to make sure you’re paying them in accordance with the tasks they’re doing. If they are 12 years old and filing paperwork for you, or cleaning your office, or other administrative tasks, you probably can’t justify paying them $50 an hour. You should make sure there is a clear job description, and keep an accurate record of the number of hours worked and the tasks performed, just like any other employee does at their job

MMM – What is the current child tax credit amount, and how would it phase out if he started making his own money? And does this scale up and down with the parents income as well?

Chris Care – Currently, the child tax credit is up to $2,000 per child, with up to $1,400 being refundable if the credit exceeds your tax amount.

In general, as long as you can claim the child as a dependent, and your income is below $400k if married filing jointly ($200k otherwise), you can claim the child tax credit no matter how much money your child makes. Above this income, the child tax credit phases out, but it is still not related to the child’s own income.

MMM – Oh wow, I didn’t realize that. And at what level would he need to start incurring his own income taxes? And as an employer, would I be on the hook for stuff like quarterly tax payments, unemployment insurance, worker compensation, and so on? Could he be more like a contractor and avoid these complexities?

Chris Care – It’s unlikely you could classify your own son as a contractor. The IRS used to have a 20-factor test, but recently they have been narrowing and cracking down on this issue – more details here: Behavior, Financial, and Type of Relationship

Aside from that, you’d have to handle things in the standard employee way:

tax withholding from every paycheck, submitted to the government as part of a standard payroll process. (MMM Note – even I have to do this as an employee of my own LLC, I use a provider called ADP and am evaluating a newer one called Gusto).

quarterly payroll taxes for social security and medicare

State unemployment insurance if applicable in your state

FUTA (A form of Federal Unemployment Tax)

Just like any other taxpayer, the child will need to file a federal tax return if their earned income is above the standard deduction ($12,000 for 2018, and $12,200 for 2019). Note that state filing thresholds are often much lower than federal thresholds – check with your own accountant!

MMM – If a kid is living at home with no expenses, he might be wise to put as much of this into retirement accounts and otherwise defer taxes. If my company offered an employee 401k plan, could he put away the full $19,000 per year, or is there an even better option? Maybe his own tax-deferred college savings plan?

Chris Care – As with any other employee, the child can participate in the company’s retirement plan, as long as the plan is written to allow minors to participate. The contribution limits will depend on the type of retirement plan. In your example of a 401k, the child could defer the full employee amount ($19,000 in 2019) as long as wages were at least that amount. He would also get the employer match if your company established one.

College savings plans are an option, though whether or not he can open his own would be a question for your specific provider. Financial service firms tend to get a little hesitant opening accounts for minors. You could always open one, and he could contribute to it.

MMM Summary: Wow, this is much better than I had even hoped. In rough terms terms, it sounds like if I can pay my son $30k from my company’s income, I might save about $10k in marginal income taxes, while his resulting tax bill would be quite minimal.

Thus, it makes sense for me to start paying him as a real employee, rather than just paying all the taxes at my own marginal rate and keeping it in our own family spreadsheet, as I do now.

Chris Care – Yes, there are some good opportunities for tax optimization by hiring kids.

In general, if you can justifiably pay your child a wage from the family business, it is an excellent way to lower the family’s tax burden, and give them a massive boost in retirement savings (since 401k contributions add up way faster than IRA contributions).

Also, by owning the business, you can administer your own 401k plan – which means you don’t have to wonder if your employer’s plan will allow for a mega backdoor Roth, since you can design it that way! Just keep in mind, that 401k plan is for all employees, so any attributes you establish for family members would also be there for non-family members that you may hire.

Another optimization: if you were a sole proprietorship, or a partnership where both partners are parents of the child being employed, the child’s wages would not even be subject to SS/Medicare taxes.

This means you could pay them the $12,000 standard deduction plus $19,000 401k deferral, with zero income tax, zero SS/Medicare taxes, and zero Federal Unemployment tax. They may still be subject to state income tax and state unemployment tax, but those would be relatively minor.

You can essentially shove $31k into a zero tax situation, from potentially a ~35% situation.

This means it may be worth operating the youtube channel as a separate company, and employing your son as a real employee…

MMM – hmmm, lots to consider! For now, YouTube is still only a few hundred bucks per month so we are not there yet. But it sounds like little MM’s future is bright, as long as he remains motivated to work hard and be creative and keep producing.

Which is a good general philosophy for any of us: keep some good hard work as part of every day, whether you’re ten or one hundred years old. Doing good work and producing good things tends to lead to a good life.

A Few More Thoughts and Disclaimers from Mr. Care:

In all of these answers, I have assumed the child is a true employee, where he receives a regular paycheck and a W-2 at the end of the year, and the company is a C Corp or S Corp.

As with all tax planning, tax credits, and personal situations, there are exceptions and limitations. So we’ve made some broad assumptions to answer these questions. For me to post an exhaustive list of these would take an entire blog post of its own. Always check with your tax professional, or make sure you understand the IRS guidance.

generational wealth / inequality / dynasties / buffett

effective altruism

A Final Thought from MMM:

If all this sounds like wishful thinking to you because you don’t own your own business yet, I strongly encourage to start one! For the great majority of early retirees, having a small entrepreneurial pursuit is both a reassuring security blanket and a fascinating and fun way to explore life after the cubicles and commuting stage is over. The Joy Of Self Employment.

* This one of many interesting and sometimes untintuitive insights I got into Human nature when reading the rather excellent book Sapiens.

May 8, 2019

Our Shared Ongoing Battle To Not Buy A Tesla

Like you, I am pretty much resigned to the fact that I’m going to have to buy a Tesla at some point.

Like you, I am pretty much resigned to the fact that I’m going to have to buy a Tesla at some point.

I can tell because I have read every last scrap of Tesla news and inadvertently memorized every last technical detail about the company and their cars and energy storage systems that has ever been printed or YouTubed. Since about 2012. When this happens to me for any product, whether it’s a new laptop or a different vehicle or a house in a certain neighborhood, I usually end up buying it.

The purchase tends to happen when the list of justifications builds up to a tipping point where it starts to seem sensible. For the Tesla, these justifications are things like:

“I strongly support the company and its mission. Unlike almost any other big company on Earth, Tesla exists primarily to help out the human race. Surely worth a few of my spare bucks, right?”

“I can afford to buy it in cash without having to go back to work or anything extreme like that.”

“It’s the best car AND the best piece of technology in the world, and at least ten years ahead of the next best. Shouldn’t a lifelong tech expert like myself be taking a peek at the future?”

“It would be a lower-pollution way to replace some of my air travel, as the only car that can drive itself most of the time on long highway trips. PLUS, imagine the road trips I could take with my son! Mammoth Caves National Park! Lifetime Memories just like I have with my own Dad!”

“They are reasonably priced these days at “only” about $45k for a new Model 3 and even lower for a used Model S.”

In the past, my mind has made up similar justifications for other purchases like, “this lovely camera will help you create more engaging pictures for the blog.”, “this drywall hoist will save you a lot of time”, “you will make a profit by owning this high-end new laptop because it will encourage you to write more.”

And it’s not just me. As I’ve talked to more and more people about this, I find that most of us have some sort of Purchase Justification Machine running in the background of our minds. The PJM’s effects can range from very useful, like a carpenter buying a nailgun which will be used every day to make money, to completely disastrous, like the office worker who buys a $40,000 8-passenger Honda Pilot for his 12,000 annual miles of mostly empty driving on smooth roads, because “I need to make sure I can get to work in the winter, too.”

I like to fancy my own PJM as being at least a bit better than average, after all I have always maintained a slightly-less-ridiculous level of spending than the average middle class worker. Most of the things it has talked me into buying have indeed been things nailguns or reasonably good quality clothing that just happens to be from Costco or the thrift shop.

Yes, there was once a brand-new $13,000* Honda VFR800 sport motorbike which destroys a lot of my credibility, but that was in 2001 long before Mr. Money Mustache was born.

But I can TELL that it is really grasping at straws when it tries to justify that Tesla. And that’s why I thankfully still don’t have a Tesla.

The PJM has done its work well, but I try to stay ahead of it by tossing in my own list of objections, like throwing gnarly stumps into a wood chipping machine to slow it down.

“You don’t even have anywhere to drive that Tesla, dude! If you had a mandatory 20-mile commute and absolutely could not move closer to your six-figure job, that would be one thing. But you’re retired and you bike everywhere, so a car is only for camping and hiking trips. Wait until you are further along in the child-raising project and have more free time to take off for month-long road trips.”

“You can’t just leave a $40,000 car out in the searing Colorado sun to bake and fade and collect birdshit, but you also don’t want to sacrifice an entire bay of your tidy workshop garage for a car. So you need to at least wait until you build that master bedroom deck which doubles as a carport, right? So you’d better get out the post-hole digger before you sign into the Tesla Design Studio.”

“No matter how much you use that car, it will always cost more per mile than cross country air travel even with full carbon offsets. So don’t get lured in by the nearly-free nature of electric car charging.”

“Make sure you try it before you buy it. Rent a Tesla from Turo or from a friend and try your first road trip. If you still crave one after that first thrill wears off, then we can talk.”

See what’s happening here? In order to keep ahead of the relentless efficiency of my Purchase Justification Machine, I just need to throw up nice, rational roadblocks to slow it down.

But the reason this is so effective is that I’m not just flat-out denying myself that Tesla. It’s pretty hard to tell yourself that NO, you can never have what you want. Instead, I’m just telling myself what things need to happen first, before clicking “buy” on the Tesla website.

And if these things are healthy, happy things (raising my son, getting other labor-intensive projects done with my own hands, and planning a great future series of camping and roadtrips), I divert my attention into living a good life right now, instead of doing the easy thing which is just buying myself another treat.

And the further I can delay this or any purchase, the longer my money can remain productively invested in stocks, and the more it prevents my PJM from locking its greedy crosshairs onto the next little lifestyle “upgrade” that it will find.

But this trick is not just for jaw-dropping electric sports cars. You can use it almost anywhere in your own life.

Kicking the Kitchen Down the Road

A friend of mine loves to cook, and has been pining for a kitchen upgrade for many years to make this activity more enjoyable. And I can’t blame him – his kitchen is indeed dated, as is the rest of the house. But he’s also in debt and not climbing out very quickly. And too busy to do the kitchen upgrade work himself, because work and kids suck up all his time. Should he allow himself to upgrade this kitchen?

Yes!

BUT only after meeting a carefully considered list of conditions:

Quit Cable TV, Netflix, Hulu, Facebook, Twitter, video games, and other time drains. Because getting three hours of life back each day will give you more time to address other shortages in life.

Make sure you’re getting in at least an hour of outdoor walking and/or cycling every day. Plus, regular weight training. The joy of a new kitchen is nothing compared to the benefits of getting your heart, muscles and mind in better shape.

Use another hour of each day for cleaning, organizing and optimizing the house you already have. Is every drawer in the kitchen well-organized? Could you get more space by hanging up the pots and pans? Adding one of those large but simple heavy duty rolling islands with butcherblock top from Costco? What about just a super nice faucet for 80 bucks and a couple of nice track lights?**

How about the rest of the house? Are the closets well-organized with optimal shelving? Is the garage spotless? Carpets DIY steam cleaned and rooms patched and painted nicely? Gardens and lawn tidy and peaceful?

How about the finances? Have you checked around for lower mortgage rates, home and car insurance, mobile phone plans, and canceled any unused subscriptions? Ask your friends what rates they are paying for all these things, switch to the best option, and you cut your bills by $500 per month, which will add up to pay for a kitchen pretty quickly.

See, instead of being constantly depressed because it will be years until you can afford that kitchen, you use it as a trigger to get busy and improve your entire life right now. Which gives you the feelings of happiness and control that were making you crave that kitchen in the first place. Or that Tesla.

And on that note, I am going to get out there and start measuring the post locations for my new deck.

In the Comments: what is YOUR Purchase Justification Machine trying to make you buy? Have you already bought the Model 3 or are you still milking the 2010 Prius for all it’s worth? How long are you going to push your current smartphone until you allow yourself to replace it? Sharing your battles will give others the strength to keep their own procrastination game strong.

* I forked over $10,000 of my hard-earned cash as a 26-year-old kid in the year 2001, which is about $14,000 if you adjust it for inflation to 2019. But motor vehicles prices have risen slower than general inflation over recent decades, so I split the difference a bit here. But any way you slice it, this was a foolish purchase on my part!

** I linked to those because I have been using that particular track light everywhere in recent years – headquarters, home, and other projects. Way nicer quality/style than the options at Home Depot despite lower price. These LED bulbs are great for it as well.

April 11, 2019

The Real Benefit of Being Rich

There have been a lot of big bills coming across my kitchen table recently. Property taxes, car registrations, income taxes, things for the school orchestra in which little MM plays the standup bass. Plus the usual credit card bills for all my spending on groceries and not-all-that-rare luxury indulgences. There’s nothing bad or unexpected in this pile of bills, but I still see it adding up to a tidy sum.

There have been a lot of big bills coming across my kitchen table recently. Property taxes, car registrations, income taxes, things for the school orchestra in which little MM plays the standup bass. Plus the usual credit card bills for all my spending on groceries and not-all-that-rare luxury indulgences. There’s nothing bad or unexpected in this pile of bills, but I still see it adding up to a tidy sum.

But this morning as I was looking at the latest one – a bill from the City of Longmont for all the various utilities, I noticed that the same familiar feeling crept across my chest that I had felt for all of these other expenses: a feeling of warmth and reassurance.

The utility bill had a little note on it that said “DON’T PAY – account is being paid by credit card.”

So I can be reassured that whenever the due date comes up, the right amount of money will be sucked out of my credit card account to pay for the electricity and gas and water and trash service. And then whenever that credit card bill is due, another automatic payment will suck the right amount of money out of my checking account, and I’ll remain debt free.

Isn’t this remarkable? I get to frolic around in this super comfortable house of mine, keeping it warm in winter and flipping on lights and stereos and pulling cold beers out of the fridge and hopping into a hot shower whenever I like. Hosting guests and sharing the fresh food and hot showers and cold beers with them too.

Music and movies stream in over the fiber optic internet connection, and my fleet of crisp and well maintained bikes flow in and out of the garage doors in the back without a second thought about how the bills will be paid. In fact, I don’t even know when a single one of my due dates hits during the month, and I also don’t keep track of when my dividends or payments come in from stock investments or my little one-owner business.

Everything is worry free, because I know there’s enough, and the very feeling of knowing that I have enough warms my heart and soul every single day. It is a feeling of liberation and freedom and a glider that keeps me soaring high above the bullshit of worry or having to sell out my free time for activities that aren’t really helping anyone. To me, this feeling is the very core of being a Rich Person.

But now that I’ve got you imagining a glossy and pampered douchebag, barking orders at my live-in assistant and personal stylists before I climb into a white-leather Lexus to roll down to the marina, I should mention a few additional details.

All this incredible luxury occurs within my small house on the train tracks, tucked into a less-than-gentrified neighborhood at the corner of a less-than-world-class city. When I sit at that kitchen table, I gaze out at a shitty pergola structure that really needs the first available appointment with my fire pit, which covers a sadly undersized side patio, which is currently the only outdoor living space on my postage stamp sized lot.

When I ride those wonderful bikes out of that tidy garage, I pedal past my 21-year-old Honda Odyssey, and I’m usually en route to Sam’s Club to pick up another backpack load of discount groceries, or to perform another few hours of dirty manual labor at my always-under-construction coworking space downtown. My flannel shirt may have holes in its sleeves from welding sparks and my jeans may have a ripped seam or two from performing squats without proper workout gear.

The two stories above are two different takes on the exact same life. As a high income professional, you might have shuddered at the second one. Riding a bike during Colorado’s unpredictable snowstorms or searing desert heat, eating at restaurants less than once a month, cutting your own hair, or standing atop a 32 foot ladder to reach the last patch of your house with a paintbrush are surely just the desperate acts of an extremely frugal man, who does them to save money because he needed to escape the corporate world, right?

But unfortunately for my uneasy high income critics, this is just not true. Because of my advancing age, natural growth of the stock market, and ongoing love for work including writing this blog, I can afford to not do any of these things. In fact, depending on how you measure it, last year I spent only about 5% of my income on myself. I could spend twenty times more and still not even have to go back and get a real job!

At the same time, I have a few acquaintances – perfectly wonderful and thoughtful people – who do spend twenty times more and are still struggling to pay the bills and work one last year to get ahead of the treadmill. And they compare themselves to their other CEO peers, noting with relief that at least they spend far less than those crazy spenders and thus are living sensible lives.

Who is the reasonable one here, and who is off with their heads in the clouds? Mr. Money Mustache, or Corporate Chief Christine?

The answer of course is that we are both floating in space. My lifestyle is less expensive, but it’s still way more than almost anyone gets to experience, even in the richest country in the world. A single man in a three bedroom house worth over $350,000, with a seven passenger racing sofa parked out back that can tow 1.5 tons of construction materials in his cargo trailer, both of which he only needs once or twice per month. Plane tickets and parties, nice clothes and Amazon deliveries. It is all stuff that my teenaged self could have never even imagined.

So I could spend more, but I could also spend less, and I could be just as happy at any of those levels. My spending level today is just the result of my own imperfect efforts to build the happiest life I can manage while wasting as little as I can without being overly inconvenienced. And hopefully so is yours.

The trick is in realizing you can always go further while also ending up happier in the process. In not being afraid to add challenge to your life, because the right kind of challenge is a win/win rather than a tradeoff. And to not worry about what experiences you might be missing, but being mindful of the beauty of whatever you are doing right now.

At almost every moment in time, there is always something you could be doing that costs absolutely nothing, but which also makes you absolutely happy.

Your lifetime wealth surplus depends on how often you choose to find these joyful moments.

And only when you go far enough so that your spending is only a small portion of your income, do you become rich. It is at this point that your incoming bills feel like a joy rather than a burden, and your children’s future educations feel like a playground rather than a minefield. Even lurking medical expenses or aging parents who may need your help or the inevitable blow-ups in the economy just become things you are prepared for, but not worried about.

Right now, if you have any sort of income at all, it is probably enough to make you feel rich. The only question is, what changes do you need to make to your life over the next few months to unlock this joyful feeling?

April 1, 2019

How I Sold This Website for $9 Million

I’ve been waiting to tell you this with considerable excitement for a whole year, but the sales contract prevented me from doing so until this moment. And as of April 1st, 2019, I’m officially free to reveal that:

Mr. Money Mustache has been sold!

Yep. I’m not sure if it’s the age-old truism that “Everybody has their price”, or the fact that I got bored after eight years of writing it and just ran out of things to say, but over time I have come to realize that it was time to pass this golden opportunity on to someone else.

The highest bidder in this case was Shamrock Financial Trust*, a financial products company in the Isle of Man, UK that specializes in special premium investments that beat the market while dodging the taxman.

I was unsure of exactly why Shamrock would be willing to pay so much for my collection of five hundred articles mostly about spending less money and investing in index funds. But when you put six zeroes after a number on a check, it is amazing how quickly uncertainty and questions can vanish!

From my understanding, a site like MMM has a certain value just from its ranking in the search engines, and ongoing traffic of several million page views per month and about 33 million unique visitors over its lifetime. But still, those are just numbers on the page and don’t seem real because I haven’t been taking full advantage of the opportunity.

But, the Shamrock leadership team has assured me that the site will take on a vibrant new life, with a team of professional writers churning out fresh content on the daily, and an SEO-optimized stream of monetized offers that deliver maximum value-added solutions to all stakeholders.

And I just thought I’d reach out to see if we could jump on a call to catch up on the bleeding edge of some big data, to see if there’s any Corporate Synergy in our Core Competencies.

Fuck! Don’t you hate corporate bullshit and business buzzwords? Me too.

(thanks to reader Ron Cameron in the comments below for mentioning this incredibly appropriate Weird Al / Crosby Stills and Nash song. It is SO good!)

It was both fun and sickening for me to type that cheerful little story, but hopefully you realized from the title alone that it is April Fool’s Day, and I thought I should play along with a preposterous headline of my own.

In reality, of course I have no desire to sell this website, because doing so would violate some of the core math of early retirement happiness:

It would subtract something from my life that brings me true happiness (the ability to be in touch with you, which in turn brings more friends and lots of challenge and a sense of meaning into my life)

while adding more money, which would make absolutely no improvement to my life because I am not feeling any pain due to a shortage of money.

And that’s the real reason I figured this lame April Fool’s prank also contained a life lesson that was worth sharing as a blog article. Because I am still hearing from people every day who are selling out their own lives for their careers.

So many people are using a successful working career and earning loads of money as an excuse for not facing the realities of life.

Although this is certainly not a gender-specific problem, as a 44-year-old man living in a wealthy area I am surrounded by peers who are afflicted by this disease of Success-itis.

People who are rockstars in the corporate sphere and at the peak of their careers, who have become so addicted to the activity that they can’t see they are just chiseled Kuhl-clad rodents jogging in the latest trail runners on a gilded hamster wheel.

Career success is a very sneaky thing, much like a layered salad of Superfood Greens that gradually devolves into a dessert of Creme Brulee enhanced with crystals of Crack Cocaine as you dig deeper. It starts out with all sorts of self-actualization and personal growth, but as you begin dining you are also hooked up to intravenous feeds of ego stoking and copious income. So even as the worthwhile parts fade, you grow more and more addicted to the superficial rewards.

Of course, the standard American tradition is to spend all of this money as soon as you get it, locking in a lifestyle that is so bloated and inefficient that you “need” to keep earning the enormous bucks to “support your family.”

It becomes very easy to justify career-itis as a noble and selfless thing, rather than the lame indulgence it really is, when you are simultaneously addicted to corporate accomplishment, and bad at managing the veritable shitload of money it generates. If you are making a multiple six figure salary in your 40s and still not even financially independent, please grow up and learn a bit about money beyond just buying yourself nice stuff. It should be embarrassing to be still dependent on a paycheck while sitting in such a privileged position.

But even for those of us who get the money part solved, with investments large enough to see us through several prosperous lifetimes, the career addiction still remains strong. The fact that people still end up on redeye flights, missing their kids’ school performances and barking out buzzwords at underlings during endless conference calls even with tens of millions in the bank, should serve as a real warning of how addictive this disease can really be.

So for this April First, I would like to issue a little reminder, for overly successful men and women of my overly rich country:

A successful career is a fine way to learn some life skills and earn some money. But if you’re still doing it at 40 years old, you are probably sucking at something else.

And if you’re still in the office at 50, you’d better be changing the world and not just a cog in a machine that is doing something you don’t believe in.

Since career-itis is an addiction to success, the easiest way to break free is to give yourself permission to suck for a while.

If you are a Successful Career Man and you want to start a family, there is going to be a 20-year period where you are either a half-assed worker, or a half-assed Dad, or both. But you can’t be amazing at both. And that is totally okay.

Because a good life is one that is well-rounded and nuanced. It’s not about PERFORMANCE at all costs. It’s about being okay with trying new things and making mistakes, and growing as a human in exchange for that.

Your kids don’t care if you make $75,000 or $75 million per year, because either of those numbers is more than enough to have all possible doors to happiness open to them.

So my challenge to you is not to work the longest and most fruitful career possible, but rather to move on to new and bigger challenges as soon as you are strong enough to do so.

Complacency and doubling down on your existing half-satisfying job is a form of weakness. Moving on and trying new things is a sign and source of flexibility and strength. And mental flexibility and strength are the biggest allies you’ll ever find in the long journey through life.

…

Thus, of course I did not sell this website, and of course I’m going to keep occasionally writing things for it, on my own schedule and nobody else’s, while struggling and fighting and learning in all the other areas of life.

It won’t be perfect, but it will be interesting and fulfilling and awesome. I wish you the same in your badass and ever-changing life!

* This is a fictional name that I picked because it contained the word Sham, plus a real financial company from the Isle of Man sent around some bogus legal threats to a few bloggers several years ago so I thought it would be nice to combine the ideas.

February 27, 2019

How to Create Reality

So a funny thing happened on Twitter this week, which almost changed the world a little bit.

So a funny thing happened on Twitter this week, which almost changed the world a little bit.

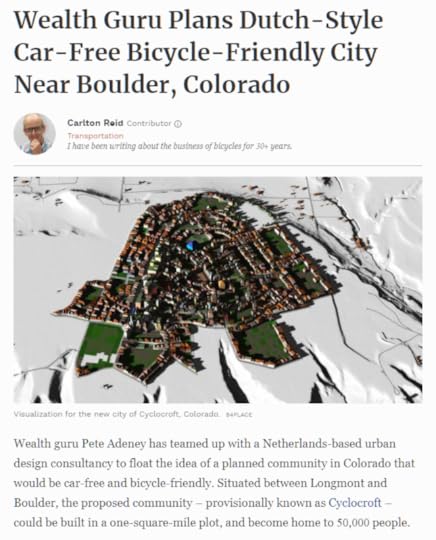

Someone sent me a beautiful 3-D mockup of a fictional, car-free city of 50,000 people, set in the scenic nook of land* between Boulder, Colorado and Longmont, where I live. It came complete with street plans, detailed descriptions and dozens of cool photos, both real and computer-generated, showing how it would feel to live there. They called it Cyclocroft, in honor of the generally pro-bike stance of Mustachian culture.

This was not out of the blue: these plans came from some long-time readers, who have heard me muse about better cities in the past. Over the last few years, I have come to realize that the fastest way to get my fellow Americans into healthier, wealthier lives is probably just to change the way we lay out our living spaces. Instead of wasting trillions of dollars on separating and isolating ourselves just to accommodate giant racetracks for our gas-powered wheelchairs, we could make everything about 75% less expensive (and many times more fun) by making cities that work without cars.

So anyway, these architects sent me the plans, and I put them up on Twitter with a comment about how they’re fictional but boy wouldn’t this be a nice way to use a single square mile compared to what we do right now.

One square mile of suburban Detroit. Note the amount of space wasted on accommodating cars. Without the cars, you could house AND employ about 50,000 people with this much land.

I thought that would complete my social media indulgence for the day, but NO, things were just about to get interesting.

That night, an MMM reader who also happens to write for Forbes, wrote to me asking if he could do a story about Cyclocroft. He also pulled in the designers Tara and John from B4Place. And the next day, this rather racy article showed up in the news:

Whoa there, Forbes!

While the story was technically accurate, calling me a “Wealth Guru” instead of an “Early Retirement Blogger” definitely amped the intensity. And words like “Plans” and “has teamed up with” made it sound like things were very imminent and real, rather the just a set of pretty pictures I was happy to share.

But the world started to react as if Cyclocroft really were real. Twitter responses and emails started coming in from people who would buy properties and move there, if we really built it.

Even more notably, my email inbox and even the voice mail of my supposedly private mobile phone, started filling up with notes from news agencies and big players in finance and real estate, asking if they could do news stories and/or help get involved in building Cyclocroft.

Forbes – Wealth Guru Plans Dutch-Style Car-Free Bicycle-Friendly City Near Boulder, Colorado

Curbed – Could a car-free, Dutch-style city work in Colorado?

The Real Deal – Imagine a city with no cars, free bikes — and 50,000 people in one square mile

The Chief Marketing Officer of the nation’s largest mortgage providers (who I was surprised to learn is also a longtime Mustachian) came to my coworking space and we talked for two hours about whether we could make it a reality. Because, aside from the potential to improve world through better design, residential housing is the world’s largest market, worth trillions of dollars.

Now, just in case you have any illusions about Mr. Money Mustache’s superpowers, it is important to remember the real story. I am a retired, stay-at-home Dad who occasionally types shit into the computer, and that’s the end of it. On the average week my biggest “business” meeting is a Tuesday morning workout in the back yard of the HQ for some squats or deadlifts with a friend or two.

Actual day of work. Does this look like a City Developing Wealth Guru to you?

Now, this Cyclocroft bonanza is still cause for celebration – all this attention and energy will definitely not go to waste. I really do plan to nudge this country towards its rightful status as a Badass Utopia – it’s a lifelong project for me, and we are only about eight years in. It’s just that Starting a City right now does not play well with my other project of Raising a Boy, a contract which still has about five years left on it. I’m not a great multitasker so anything outside of that job has to be low-stakes and with complete flexibility.

But there’s still is a heck of a life lesson in this story, that can help all of us change our lives. It’s on par with the lessons of the Optimism Gun, and the Circle of Control.

The lesson is to Begin with the End in Mind – and Start by Painting a Beautiful Picture of that end destination.

It’s the technique at the core of the world’s best marketing and negotiation strategies, and it works so well because it short circuits the human brain into making everyone – including you – see things in the desired way.

I’ve known this for a long time, and applying it is the reason for most of the successes I’ve had in life so far. Yet I still sometimes get sloppy and fail to use it, and sure enough many of my failures can be tracked back to that sloppiness. Let’s check out a few examples of Painting the Picture in real life so you can see exactly how this works and how powerful it is.

When I started this blog in April of 2011, I didn’t just start rambling about interest rates or student loan debt. And I definitely didn’t mention carbon footprints or get into environmental guilt-tripping. The first sentence of the first post is “What do you mean you retired at 30?”

Retired. At. 30.

It was a simple picture of a very clear end destination that automatically got people’s imagination running and filling in their own details.

Everyone knows that a 30-year-old is a fairly young adult with lots of promising life ahead of them. And everyone knows that “Retired” must mean some unusual financial accomplishment was involved, which makes them imagine what their life would be like with that sort of money.

In retrospect, that marketing decision was the main thing that has made the MMM blog catch the attention of newspapers, which in turn brought in the readers, which in turn kept me motivated to keep writing it. So painting that initial picture was an amazingly big leverage point.

And Cyclocroft worked in exactly the same way. You’ve heard me harping almost daily about “live close to work and ride a bike”, but this produces only small changes in the world. You are still fighting the car-based design of your city, your car-loving spouse, and all of the excuses that pop up from looking at the small day-to-day picture.

But Tara and John bypassed all of those arguments by sharing a simple, beautiful picture of the end lifestyle, with just enough detail to provide a framework that got everyone’s imagination running.

Car-free city. Next to Boulder. 50,000 people.

People read these key points and see the pictures, and in their minds they are already nestled into this bucolic town in the Sunny Western US at the base of the Rocky Mountains. For most people, the sale is already made and now they are ready to hear the details – most importantly “How can I get you my money?!”

Once you go looking for this pattern, you see it everywhere, especially in the most successful bits of persuasion in the world.

Tesla almost completely took over the coveted luxury car market with no paid advertising, even while its competitors fought tooth and nail with their old ads, by painting a clean-slate picture: clean, beautiful, prestigious cars that are the fastest in the world. They were introduced to the world as if they were movie stars, rather than squeezed out through the crusty sphincter of an old corporate marketing department as most cars are. They can even make a commercial hauling appliance into a rockstar that has everyone waiting breathlessly for its world-changing arrival.

So How Can You Use This Amazing Power on Your Own Life?

We can see how this works by painting a few pictures of our own:

You want less money stress in your life:

Describe the picture of your ideal financial life. Your house is paid off, the kids are well cared-for, and you think about money no more than you think about tap water. It’s just there, so instead you spend your time figuring out how to get more fulfillment out of each day.

Then to get there, you suddenly feel the motivation to streamline your spending (and perhaps optimize your earning) today. It’s no sacrifice to skip over a car upgrade, if it rockets you towards this clear picture of your future life, right? And conversely, making the car upgrade is suddenly less appealing if it means you will be extending your time on Cubicle Lockdown by three more years and pushing off the beautiful picture you have painted for yourself.

You wish your spouse was on board with more frugal living:

You won’t get anywhere by nagging your partner that she needs to take shorter showers or telling him to give up his Porsche convertible. The only hope of teamwork is to agree on the end goal: do you want financial freedom more than you want the Porsche, or not?

Well then, what does financial freedom look like? Perhaps it includes being able to stay home to raise children, or to have more time to travel together, or to pursue part-time meaningful work instead of full-time-just-because-I-need-the-money careers. Or something else you can both agree on. This article on Selling the Dream describes a case study where this method worked beautifully for a couple.

Once the dream is there, the daily steps that move you towards it become easy and obvious.

You want to earn your dream job

Rather than sucking up to the company or stepping through your individual qualifications and acronyms of all the programming languages you know, begin your campaign as though you’ve already won.

Describe (with beautiful pictures of your past work and future proposals if appropriate), the way that things will work, once you are working with the company. The ways you are excited to build the culture of the group you will be joining and managing, and why that is destined to influence the entire company over time. This vision of you excelling in this job needs to become a crystal clear anchor in the company manager’s mind, that lodges itself in as the way things are going to be. From there, it becomes difficult to dislodge.

These same principles work in both large and small situations, for persuading any range of people from just you up to the entire Human population. From getting into better physical shape to winning an election.

My own Failures to Paint the Picture

When I look at my own areas of less-than-satisfactory performance in recent years, they all carry the hallmark of scraping along from one daily hardship to the next, while neglecting the big picture.

My former wife and I did not keep our own marriage alive, and it may be partly because we didn’t think of what we wanted a good marriage to look like. We just reacted to the ongoing realities of daily life, doing more damage as time went on.

My son copes with some anxiety and can tend to be an extreme homebody, avoiding all new situations if not challenged to do otherwise. But if you work at it, you can get him out for adventures, and he always has a great time. And his Mom has shown much greater skill than me in making these things happen.

But far too often during our days together, I will make a few offers to go out and do things together, then give up and feel deflated when he rejects them. And I come back the next day and try the same thing, and I usually get the same result.

But if I paint the bigger picture well in advance – for example of a two-night camping trip with his favorite friends and their dads and kayaks and sand dunes – the chance of a breakthrough greatly increases.

The recipe for change is right here in front of all of our faces. It’s up to us if we are bold enough to paint the picture, and then do the work that will become obvious once that picture is hanging on the wall in front of us.

Okay, but When Do We Get To Move to Cyclocroft?

I am happy that this big, beautiful picture of the future of North American city planning is now out there, creating an anchor in the public mind that is bound to stick. That alone is an amazing accomplishment.

For my part, I’d love to help out in many ways. But at the same time, the picture I have painted for my own life does not involve being a property developer. I’ve done that on a small scale in the past and learned there are other people that thrive on the phone calls and meetings and contractor cat-herding much more than I do. So as much as I’d love the results, I’m not willing to do the work. And this is a great thing to know about myself, because chasing accomplishment and prestige and things that seem “important” is not necessarily the path to a happy life, if you don’t enjoy the work along the way.

But with the right group of people working together on the aspects they truly enjoy, it really could happen. Tara and John like designing spaces. I like describing things to the world, but also solving physical and engineering problems. You might like running a restaurant or a bike shop, or playing in a jazz trio. It takes all sorts of people to build a new city and change a culture, but as long as we are all working on the same end goal in mind, we will definitely get there.

——

* Never mind that this particular chunk of beautiful land is currently a NOAA facility! The real point is that when you only need one square mile, you can fit a world-changing city almost anywhere, including into the corner of an existing large family farm.

February 11, 2019

Four Ways We Can Hang Out

A recent campfire at in the back yard of MMM-HQ coworking space.

Hi there.

Don’t get too excited, this isn’t a real blog post. But there were enough things worth sharing that I thought it would be worth sending a little mid-month Hello.

Life has been busy around here, drunkenly walking that fine line between the zones of

“Exciting and stimulating and action packed!”

and

“Way too much overflowing action, how do we turn off this firehose?!”

It’s one of the core Tenets of Mustachianism that too much of a good thing can become a not-so-good thing, so I have been working on stepping back and focusing on the smaller and more personal things with the people who are close to me, even if it means turning down bigger, “important” sounding things out there in the world.

If you are an overdriven and success-oriented career person, you can take the same lesson: your PERFORMANCE out there on the business stage is a lot less important to the world than you imagine it is, so now is a great time to lean back and take a few breaths and turn down that extra work assignment so you can spend Saturday just digging in the sand at the playground with your kids.

Okay, so with that take-it-easy warning aside, here are a few things that have been keeping my local gang and I busy recently:

1: We have expanded the MMM HQ

MMM watches as Alan Donegan’s Charisma steals the show at September’s Pop up Business School

Some adventurous friends decided to dive in with me and team up to buy out the other side* of the building that houses my little coworking space in downtown Longmont. As a result, we have now quadrupled our interior space and are looking for new members!

In the spirit of adventure and growing the community from the current 50-ish to a new goal of two hundred, we are no longer limiting it to people who live right in Longmont – you can be the judge if it’s worth $52 per month to be part of our growing entrepreneurial gang.

You can join here immediately if you are super confident,

or read more about it at mrmoneymustache.com/hq/ or even stalk us by following the new MMM-HQ Twitter and Instagram feeds.

2: I started a YouTube channel with my son!

Over the long holiday season, my 12-year-old son and I were spending a lot of time together. He has become a prolific music composer and video editor and posts something to his own channel almost every day. So he often ribs me about my own neglected MMM YouTube channel, with just a few halfhearted construction videos I had thrown up to illustrate certain things as part of blog posts.

Long story short, we just turned on the camera and started recording some Question and Answer shit and putting it up there, learning as we go. So far, it’s a “He’s the DJ, I’m the Rapper” situation, but I hope to get him to come out from behind the camera one of these days too, at least for a cameo.

The result, our first six figuring-it-out-episodes, is here and we definitely plan to do more:

It has been a lot of fun so far, and an incredible bonding experience for the two of us, to be working on something difficult together. I’m even paying him for his work and we will also split any resulting revenue from YouTube (currently a not-too-bad thirty bucks in the first month!), as I think this is a great way for a kid to learn more about money.

3: I’m part of The FI Summit

One of the members of my coworking space is an enterprising dude named Sean Merron, who also runs a podcast called 2 Frugal Dudes. Over the past year I’ve come to respect his work, so when he invited me along with some other very genuine financial independence writers to join a little online course they are running in March, I was happy to accept. I am going in as a newcomer to such an experience, so it’s an experiment.

One of the members of my coworking space is an enterprising dude named Sean Merron, who also runs a podcast called 2 Frugal Dudes. Over the past year I’ve come to respect his work, so when he invited me along with some other very genuine financial independence writers to join a little online course they are running in March, I was happy to accept. I am going in as a newcomer to such an experience, so it’s an experiment.

The event takes place live on March 5-7, with course material and replays available afterwards.

You can join us (and read all about it) at https://fisummit.2frugaldudes.com/ and get 10% off with their coupon code MMM.

4: Mustachians are Uniting

This isn’t just a website or even a ‘movement’ anymore. There are real-life friends, and potlucks, hikes, local and international trips, and even romances going on out there and I have had great fun watching them all develop over the past few years. A few ways you can get involved in real life:

Camp Mustache was the original meetup – About sixty people in a beautiful rented lodge in the rainforest outsid of Seattle. Five years running now, it is small and well established, so it always sells out much quicker than any resonable person could be expected to buy tickets. It is the only event I’ve attended every year. But it set the stage for its international cousin …

Camp Mustache Toronto is a similar but more Maple-flavored event, also in a lakeside natural area far enough from the concrete jungle that it feels like a genuine camp. This year’s event is in September. But Camp Mustaches are just the start of it all.

Camp Fi is a more ambitious string of events, spawned by an unstoppably friendly and optimistic guy named Stephen who liked Camp Mustache so much that he decided to adopt the principles and take it from coast to coast. They have run something like a dozen already, and there are more coming up on the calendar.

The NoCo Mustachians Meetup Group is a 400-strong club of fun and FI seekers in my own area. There is a nice, sociable overlap between members of MMM-HQ and this larger group, so they often use our building to host their larger events.

The ChooseFI Meetups: if my hobby of “Financial Independence Guru” were an actual business, I would never tell you about this, because these guys would be my toughest competition. Growing from nothing to hundreds of thousands of followers in just the last few years, I have heard about more Choose FI meetups than Mustachian ones in recent times, and some existing MMM groups have even been so bold as to rename themselves from my silly (but more fun) terminology to adopt some version of the more bland and sensible “FI” branding.

Fine, have it your way, FI people – your ability to get together and have fun in the real world is way more important than appeasing Mr. Money Mustache’s ego, so I encourage you to get out there and enjoy it all.

And with that batch of suggestions, the clouds have suddenly cleared up outside my own window, so I am going to fold up this laptop and head out on the town myself.

Have a great week!

*People familiar with the project may be asking “What about the Mud and Madder soap and handcrafted shop that was there before this?”

The answer is that the ladies who owned that side decided to close up their retail experiment and return to the more efficient model of online Etsy-style sales. They offered to sell me their side, so I gladly brought in three new friends to become partners in the newly expanded coworking venture.

January 28, 2019

How To Slow Down Time and Live Longer

“They sure grow up fast, don’t they?”

“The older you get, the faster time flies.”

“You can’t slow down time, so treasure your days because they’ll be gone before you know it.”

We’ve all heard these thoughts, often from the parents of grown children. If you’re part of the older and wiser population, you may have even spoken similar words yourself. And if you’re younger, you may have felt fear well up in your heart as your elders dropped this bit of Bummer Wisdom upon you. The Inevitability of Life Racing By.

But your fear is unfounded.

Because somehow, I seem to have stumbled upon a workaround to the problem of life being too short, and instead I find myself be existing in a different universe of Vampire-like perpetual renewal and the feeling of youth. While other parents of almost-thirteen-year-olds claim the time has gone by in a flash, I feel I’ve had my own son for at least 30 years.

Because somehow, I seem to have stumbled upon a workaround to the problem of life being too short, and instead I find myself be existing in a different universe of Vampire-like perpetual renewal and the feeling of youth. While other parents of almost-thirteen-year-olds claim the time has gone by in a flash, I feel I’ve had my own son for at least 30 years.

And those same thirteen years have since I retired from real work have also been packed with an almost inconceivable variety of experience. Adventures in business, travel, relationships, weddings, funerals, adventures, injuries, growth, definitely at least the recommended minimum dose of pain, but a much bigger amount of joy.

Reflecting back on it all always leaves me shaking my head in a smiling disbelief and muttering at least one involuntary “Holy Shit.” I feel like I have lived an entire human lifetime, or maybe even more than one, in just the years since I hung up the keyboard and walked out of that cubicle.

I look at this strange development with great gratitude. After all, if we are going to assign any purpose to our lives, it’s probably something like “Make the most of the time you are here, and try to do some good while you’re at it.”

So if I feel like I’ve already had a spectacular amount of time and Made the Most of It, you can imagine how lucky I feel to still have so many more decades worth of it potentially still in the tank!

What do you think could be going on here?

As it turns out, I am not the first one to wonder this. And there is some real science that connects a Mustachian Early Retirement to a life that feels much longer and more full, even before we get into the reasons you will probably literally live quite a bit longer as well. The key to this is in the way we perceive the passage of time.

Figure 1: Some of Eagleman’s Intriguing Books I’ve read (click for more.)

A few years ago, I stumbled upon the work of the modern-day Indiana Jones neuroscientist/author/adventurer David Eagleman, immediately developed a Man Crush and started working my way through his books and interviews. It was exactly what I was looking for at the time: a bigger picture on why our brains behave the way they do in many different realms of being alive: emotions, decision making, happiness, and of course our perception of time.

Like many people who were born with an engineering side to their brains, I sometimes feel like I’m standing with half my body outside of the human species, observing with Vulcan-like amusement how crazy we all are, and the other half firmly inside it, being whipped around by all the same joyful and tumultuous and passionate and irrational emotions as everyone else. So it can be very satisfying to try to put it all together, by embracing all that humanity but also understanding it from a bigger perspective. Books like Eagleman’s are a lot of fun and useful in that regard.

So by reading books like Incognito and The Brain (along with this interesting profile on him in the New Yorker), I was able to learn a lot more about the nuts and bolts of my own existence as a creature, which I find is a very useful antidote to prevent me from taking myself and my moods too seriously as a person. And it also helps me get the most of the gigantic arc of a human lifespan with all of its details, without getting too hung up on whether I’m “doing it right” or fussing about our inevitable mortality.

This is your brain on MMM

That compact but powerful brain of yours is more than just your thinking appliance. It’s your entire world, because it controls every bit of your interaction with the world, plus the way you feel about it. And one of its trickiest roles is in sucking up and storing every experience you ever have, and filing those experiences away so that you can recall the most important ones, all while leaving you able to focus on immediate tasks without becoming completely batty from this ever-growing pool of past experiences.

So the brain uses a few tricks in order to keep you sane. And the best way to sum up its approach to its approach to things is this:

To focus on the novel and important-seeming things, and mostly ignore everything else.

We’ve already covered the remarkable subject of human habits, where we learned that our brains tend to click us into little autopilot routines whenever possible to avoid the strain of puzzling consciously through every single moment, of every single day.

So an average person might go through routines like …

“get out of bed”

“make some coffee and breakfast”

“get dressed up and drive to work”

… in an almost unconscious fashion.

Habits like these are convenient, but they can also compromise your full enjoyment of life. Because when you are running on autopilot, you are not forming nearly as many meaningful memories. And if you do it long enough, your brain will also start clumping entire phases of your life into individual thoughts:

“my childhood”

“high school”

“the college years”

“those years I worked in Des Moines as a fertilizer salesman”

“the baby-raising years”

“my 25 year career as a Middle Manager in Megacorp”

“my golf-and-TV retirement to a Florida condo”

If you look back at your own phases so far, which ones do you remember being the longest and most vibrant?

For most of us, it ends up being the ages from about 6 through 21, because these were the times of greatest change, learning, and new firsts in life. Then as we get older, we lock ourselves into family and work routines, including the most time-compressing of all: a multi-decade period of having the same house and the same career. The years go by, but significant new experiences become more and more rare.

Mustachianism (even if you are a long way from early retirement) is thus the perfect antidote to this, because I am always encouraging you to try new things and maintain an eye towards constant optimization.

With practice, you will let go of your natural fear of failure, and start thinking of everything as an opportunity for an experiment. Or as the great Bob Ross would put it, “There are no mistakes in life, just happy accidents.”

Although you will be fighting the very core of your Human nature with this activity, it’s a fight worth picking, because you are immediately rewarded with a life that is wealthier, more satisfying, more interesting, and one that feels much longer.

To put this philosophy into practice immediately, all you need to do is start throwing some changes into your daily routine. A few ideas ranging from beginner to expert: