Mr. Money Mustache's Blog

October 6, 2025

How Unlimited Free Stuff from Amazon Almost Ruined My Retirement

–

–It all started last winter when I innocently posted a review for a heated vest I had bought on Amazon. I was happy with this fun new way to beat the winter and wanted to share it with others, so I gave it five stars. But soon after I clicked “Submit”, I got an email from Amazon which said something like,

“Congratulations! You’ve been selected to join Amazon Vine for writing helpful reviews!”

I was already aware of the basic idea of Amazon Vine since I had seen product reviews from other people in the program – typically called “Vine Voices.” The basic idea of this program is that you can order stuff from Amazon for free, as long as you agree to review at least 80% of the things you order.

“Hey, that’s cool”, I thought, “Who doesn’t like free stuff?

Especially since I’ve already been writing product reviews out of the goodness of my heart – why not be rewarded for it?”

So without giving it much further thought, I clicked “accept” on their terms and conditions and joined the program.

And so began a saga that has taken me on a surprising journey over the past nine months causing me to:

collect a surprising amount of stuff I wouldn’t have otherwise boughtwaste a surprising amount of time reviewing it alland realize that I actually became a bit addicted to this cycle, despite the fact that I’m already retired and was absolutely not looking for a side hustle.Okay, I’ll admit that there were also some upsides. My original idea was partly to save some money, by getting stuff I genuinely would have bought anyway, in a way that sounded fun. And that did happen – I saved at least a few thousand dollars tools and materials for my construction business and the MMM-HQ Coworking space, for free. Plus, at least some of the motivation for signing up was to put myself through an experiment so I could write this blog article about it. And if you’re reading this, it looks like that happened too.

But I was still surprised at how powerful the combination of small nudges and incentives from Amazon was able to hijack my frugality instincts – and get me to do a bunch of work that wasn’t really the best use of my time.

So I thought if we review my journey and break down with a bit of Behavioral Science, we could all learn a few valuable things by laughing at Mr. Money Mustache’s folly.

Scarcity Brain and the Online Casino Effect

–

–One of the most interesting books I’ve read in recent years is Michael Easter’s Scarcity Brain. It’s an exploration of the sneaky ways that modern gambling platforms, marketing and social media algorithms are all built upon two weaknesses in our evolutionary programming:

Our desire to double down on hunting and gathering when we get even a small taste of success (because it’s a clue that there might be more food in the area, andOur desire to gorge on rich food when it is available and stockpile resources whenever we can, even if we already have more than we need.As I look back now, I realize that I fell straight into those same traps, because the Vine program has some of the properties of a casino or a TikTok feed:

Unpredictable RewardsThe concepts of scarcity and limited timeFresh content every time you check back inEvery time you log into the exclusive “reviewers only” Vine website, you’ll see different stuff available for the taking. Sometimes there is almost nothing worthwhile – you’ll search for “porcelain plates” and get endless pages of pink plastic disposable party plates instead. You go searching for a toaster for your kitchen but instead there will be just a toaster cover with a cat wearing a witch hat. WTF!?

And you thought I made that last one up

And you thought I made that last one upBut occasionally, there will be genuinely useful things like super nice light fixtures, tools and plumbing parts, an EV charger, and even some clothing. My favorite ridiculous Eagle shirt as featured in the Mustachianism music video was an Amazon Vine find.

The Eagle Shirt, in the glorious final scene of Mustachianism.

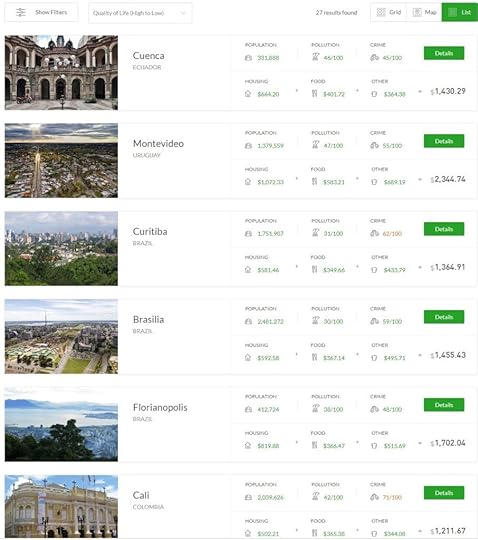

The Eagle Shirt, in the glorious final scene of Mustachianism.As were a whole supply of super-realistic artificial plants, which while tacky in principle, have been amazing for hard-to water courtyard garden areas at the MMM HQ.

Alan Donegan crafts an artificial yet beautiful garden during a visit to the MMM HQ in March

Alan Donegan crafts an artificial yet beautiful garden during a visit to the MMM HQ in MarchI also had a lot of fun roping in friends and coworkers from HQ to help and share in the bounty. I let them help me request and review stuff that they wanted, and then they got to keep it. This seemed like a win/win because we shared the work and the fun of laughing at some of the ridiculous products available.

This totally-not-photoshopped cold plunge was one of the available scores.

This totally-not-photoshopped cold plunge was one of the available scores.Still, as I went through this experiment this spring and summer and allowed the system to coax me into doing 80 reviews so I could upgrade my account from Vine Silver to Vine Gold*, I noticed something didn’t feel quite right.

I was checking the Vine page every day for scores, even when I didn’t actually need anything. It would usually be a bust, but just often enough, something I actually wanted would come up, and I’d order it before it was too late. Scarcity and unpredictable rewards at work.

Then the bounty would come, I’d unpack it and photograph it with assembly-line speed so I could batch-write all the reviews once per week or so. For every review I did, I was spending time I’d rather spend doing something else. And for every questionable item I got, I was creating pollution and trash from its manufacturing and packaging – directly contradicting the main values of my life and my reason for writing this blog. And I saw all of this, yet I kept doing it!

So Was This The Downfall of MMM?

–

–During the worst of this consumerism bender, things were dire. I was getting packages almost every day and my recycling bin was overflowing with cardboard. My son and my girlfriend started laughing at some of my more frivolous purchases, so I found myself discreetly tucking away the boxes when they were around to evade scrutiny.

But eventually, I moved into a recovery stage. I had been letting this habit continue out of laziness and as a form of procrastination: it’s very easy to order shit online and pretend I’m doing something useful, and much more difficult to get moving to do the things that really make my life enjoyable.

But I’m old enough to know that hitting the running trails and the gym for my daily workouts, and making progress on all my construction projects, and focusing on the computer as a creative tool rather than an entertainment device so I can get stuff done like this blog post, are the things that bring me the most joy.

Admittedly, some of the sucky factors of the Vine program helped make it easier to recover too. For every genuinely useful thing I found like a contractor-grade extension cord, I had to scan through endless screens of trinkets which not only wasted my time but actually pissed me off at their very existence.

I also noticed some of the deliberately reviewer-unfriendly features built into the program which reminded me that we reviewers are definitely just low-wage workers rather than any form of VIP. The search functionality is crap, and there is no way to filter or sort the results, because they want you to have to look through everything and they don’t care about the value of your time.

Then there is the hilariously bureaucratic AI-based evaluation system which would occasionally flag my totally tame, factual reviews as “Not meeting our Community Standards” without explaining what the problem was. So I’d have to go in and edit my review, randomly changing a couple of words and maybe some punctuation, and suddenly the AI would be pacified and accept my review. Just dumb.

This is What “Fuck You Money” is For!

It dawned on me that for many people, this is just what “work” looks like. You are given a bunch of tasks and a bunch of rules to follow, in a system you didn’t create and don’t get much say in changing. And then as long as you crank out your TPS Reports without rocking the boat too much, you get your paycheck.

It reminded me of the Uber Driving experiment I did way back in 2017: as soon as I started working as a driver, I could immediately see dozens of improvements that could be made to the system that would make it function better for both drivers and passengers. But since I wasn’t the boss, nobody wanted to hear my ideas.

Experiences like these remind me that while I love hard work and I love learning new things every day, I greatly prefer being the boss. And I’ve gotten pretty damned accustomed to it after 20 years of financial independence, so I see no need to give it up.

Final Numbers

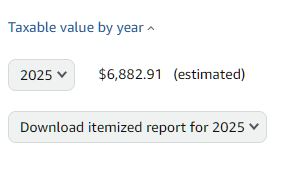

One interesting “gotcha” of the Vine program is that they do keep track of all the free stuff you get and send you a 1099 for its retail value at the end of the year. So it’s not really free, just discounted to whatever your marginal tax rate is (about 25% for me this year). If we peek into my account right now, this is how my 2025 is looking:

So I got about $7000 worth of stuff, and could owe up to $1750 of tax on it. In my case, about 75% of it was “sold” to my business for commercial use (construction supplies which I used on jobs or HQ renovations) so it was effectively converted into real income rather than just tax burden. Some of it was stuff I would have bought anyway for my own house which I’ll gladly pay the taxes on. But there is also probably about $1000 of pure nonsense in there as well, for which I’ll owe a tax bill of $250 as penance for my itchy trigger finger on that “Order” button.

Friends who know me well won’t be surprised that I fell for this USB rechargeable, magnetic EagLamp.

Friends who know me well won’t be surprised that I fell for this USB rechargeable, magnetic EagLamp.Epilogue

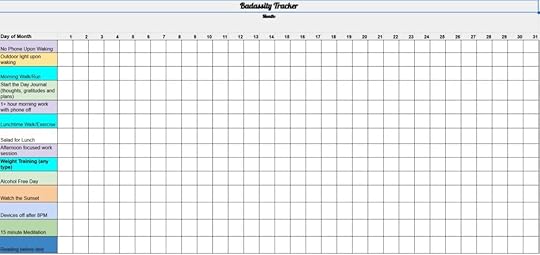

So here we are today. While I admit that I didn’t explicitly cancel my account, I used the “Keystone Habit” trick to override the temptation to view the Vine page – mapping that browser bookmark to my daily habits list instead, a little chart which I call my “Badassity Tracker”. The net result is that every time I click it, I’m taken straight to a reminder to get up from the computer and do a quick round of exercise, so I do that instead.

The Badassity Tracker – click for larger version if you want to save a copy!

The Badassity Tracker – click for larger version if you want to save a copy!And of course my writing of this article may be a violation of the terms and conditions of the program (“the first rule of Vine is to not talk about Vine”), so it might even get canceled on me. (and if so I’ll let you know because that would be funny story as well)

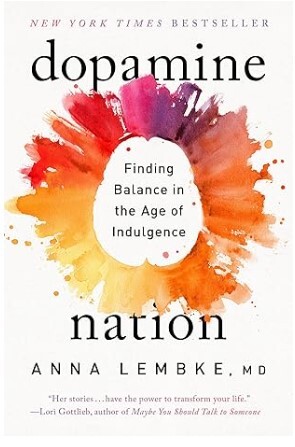

But I learned a lot about habits and addiction, and realized that this same feeling might be what drives people into One More Year Syndrome, as they keep working even when they can afford to quit. I have now coached enough people through this situation to see it is way more common than I would have ever guessed.

As with all MMM articles, there’s a real life lesson in this story. It’s not really about Vine or me or my habits, it’s about you continuing to look at yourself and your life, and always questioning your own assumptions or patterns. And asking the people you trust most for feedback as well:

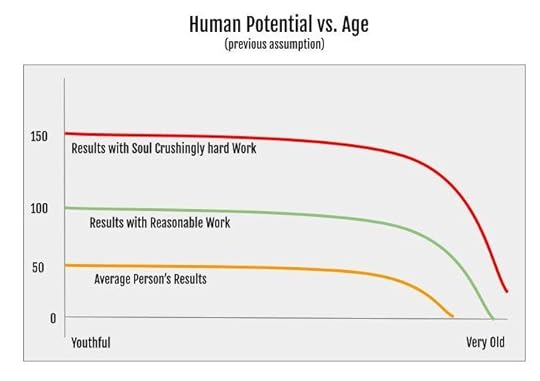

Am I running my life a reasonably optimal manner, given my goals?What would you do differently if you were me?Who are some people that seem to handle these things better than me, and what can I learn from them?We will never be perfect, but the great news is we don’t have to be. All it takes is a little bit of self reflection and putting ourselves on a slightly better path, as often as we can as life goes on. We are all on a very long journey, so even a tiny course correction can make a huge difference in where we end up.

—

*(Vine Gold is not all that useful as it turns out as 99.9% of the available items seem to be the same trinkets you see in the Silver tier)

** What about the Heated Vest that started it all? Well, I still love that thing and now that fall is coming back it is already helping me be warmer in a cooler house. There are lots of good choices on Amazon, here’s one of them. Then pick out any USB battery pack to go with it, which also doubles as a very useful travel phone charger.

June 13, 2025

How to Navigate the Tariff Circus

–

–Quite accidentally, it looks like we timed our last talk about the stock market pretty darned well. Back in February 2025, the market put the perfect cap on a multi year climb before stepping onto the wild roller coaster we’re currently riding. Since then it has seen some of the steepest drops and recoveries in history, losing a full 20% of its value at the bottom while somehow managing to end up right back near the peak as I’m writing this.

And although stock market volatility doesn’t always come with an easily labeled explanation, this time the reason seems pretty clear: it’s the Tariffs.

As our financial world has been whipped around like a circus tent in a hurricane for the last several months, almost everyone who has a stake in this country has been wondering what to make of it.

Can our president really unilaterally impose 145% tariffs on almost everything from our biggest supplier?And if so, is it really going to happen?And if so, what is the point? Aren’t free trade and low prices a good thing?And perhaps most importantly, what would the long-term effects on our economy and stock market be under varying levels of tariffs?As I write this, we still don’t know the outcome of the worldwide tariff and trade battle that our unpredictable government has unleashed upon the world. But we’re already seeing the results: businesses are bracing for massive changes, currencies and interest rates are reacting, and regular investors like you and me are wondering what the future holds for our early retirement funds. Surveying my own group of friends, the reactions span the whole range of emotions from “this is a giant Nothingburger” to “we’re all totally screwed.”

So what’s the real answer? To get closer to that, we should start with the most basic question of:

What is a Tariff?

A tariff is just a sales tax charged by our government on goods which are imported into the country. They are paid by whoever is doing the importing – meaning you if you order something like an e-bike directly from a company in China, or by companies like Amazon, Walmart, or Apple which import products from other countries by the shipload.

But in the end, the tariffs aren’t paid by China or Amazon or Apple. They are paid by you, the end consumer, because if their cost of goods increases, a retailer is of course going to raise their prices to continue to make a profit.

Tariffs also affect companies directly: if Home Depot wants to build a new store or Chevron needs a new oil rig, the tariffs on imported steel, copper, lumber and a million other components will raise the cost of these construction projects. And they raise the cost of housing, because most of the building materials in houses come from multiple countries as well.

On average, tariffs will result in higher prices for everything just like any other broad-based sales tax. And just like most other taxes, the overall effect is to slow the economy and reduce our spending power. On the positive side, all that tax money flows into the government’s pocket which could help fund the national budget and even reduce the deficit.

Of course, every government needs at least some tax revenue to function, so it makes sense to use some mix of sales, income and corporate taxes to get there. The most important part is that the levels need to be as low as possible while still keeping the country running well, and as fair and predictable as possible, so that people and businesses have an incentive to work hard and the ability to plan far into the future.

And that’s where our current tariff regime gets it completely backwards. Donald Trump is throwing around random, extremely high tariff numbers as threats, then walking them back and changing them on an almost daily basis..

Whoa, that Sounds Mostly Bad – Is There a Good Side of Tariffs?

Sometimes, a country will use tariffs to protect their own domestic industries. For example, if you put a tax on imported Hondas, then General Motors cars will gain a competitive advantage – so GM will make more money. In this example, most consumers end up losing due to increased prices and decreased selection. But at least domestic auto manufacturers and their employees are happy.

This can be strategic (for example we might want to slap a tax on imported fighter jets to make sure Boeing and Lockheed can remain in business, for national defense purposes.) Or it can be corrupt (a politician might receive funding from kingpins in the steel industry, and in return then push through tariffs on imported steel to protect the profits of US steelmakers.)

And this isn’t just a Trump or Republican thing either – Joe Biden used tariffs during his terms in an attempt to please swing-state voters. One of the worst examples was a tax on imported solar panel components (which Trump has since raised even further, proving that Boneheadedness can be Bipartisan). These are sheets of cheap glass that literally pump the cheapest energy and easiest wealth into your country for 30 years as soon as you plug them in. Cheap energy lowers everyone’s cost of living while also boosting industry. There is no good reason to block such wealth from flowing across your borders.

Can Tariffs Bring Us More Jobs?

Let’s go back to that hypothetical tax on Hondas, and let’s say it’s a big one like $5000. At that level, many buyers will start heading over to the GM dealer next door to consider what he’s selling. Sure, the GM cars may not be as good, but for five grand some people are going to settle in order to save some money.

Because of this, GM’s sales go up. So they hire more employees and build more factories. They might even develop some new models and new technologies in response to all that new demand. More people learn advanced skills and in the best case it becomes a virtuous circle.

But in exchange for this boom in the auto industry, everyone else has to pay more for slightly shittier cars and trucks. Higher vehicle prices means Amazon will have to spend more on their delivery fleet, so they will raise prices slightly on everything they sell. Somewhere a startup company or a medical breakthrough will be just a bit less likely to happen, because they are operating in an environment that is just a bit more expensive and a bit less efficient.

On top of that, with GM liberated from the hassle of competing with Honda, it will have less incentive to innovate and streamline itself. So its overall trajectory will be slower and less efficient even if its profits are higher.

This big picture effect is why most economists agree that tariffs should be used very sparingly. They almost always cause unexpected damage, decrease overall employment and slow down an economy, but sometimes (like for food security or national defense) those costs are worth paying.

So Why is Donald Trump Throwing Around Tariffs Like They Are The Best Thing Ever?

This has been confusing to almost everyone. If you take him at his word, he appears to have a Bizarro Opposite Universe belief system about economics. Donald has claimed in speeches that the tariffs will somehow make us wealthier. He’s focusing on the first-order effects like GM hiring more workers, while completely ignoring the fact that everything else in the country gets less efficient in exchange.

–

–But when he announces larger tariffs, share prices go down, because everyone who actually runs or invests in US companies knows that of course they will make less money on average. When tariffs are paused or reduced, share prices go back up. Yet he keeps wielding the threats and we go back and forth.

It seems to be obvious to everyone except Donald himself that Tariffs are just a national sales tax rather than some clever sneaky strategic weapon, which leads to various theories that okay, maybe he knows that too but is just pretending in order to gain some influence.

The basic theory goes like this:

Unfettered power: normally, a president can’t impose taxes without the approval of congress. But there’s a loophole to that: a president can unilaterally impose taxes under the disguised name of “tariffs” in the case of an “emergency”. Furthermore, another loophole exists: there’s no strict definition of “emergency” – so if you just invent a fake one you can start imposing tariffs until congress eventually catches up to you. Which may not be for years.As a Negotiating tactic: although the primary victim of tariffs is US consumers and businesses, they can also harm our trading partners, because if you impose a high enough tax on Chinese goods, we’ll buy a lot less of them. So now you have unfettered power which you can wield against your foes, as a way of getting them to do stuff for you.As a way of controlling domestic companies: if you can cut off the lifeblood of any company (their supply chain) with just a quick post on your Truth Social account, you’re suddenly in control of the whole economy. Nobody can oppose you because you can put them out of business immediately.So right now our entire economy is subject to the whims of a single person.. And as long as this is the case, we’re just the same as any other dictatorship – something our constitution was supposed to prevent with the whole “three independent branches of government” thing.

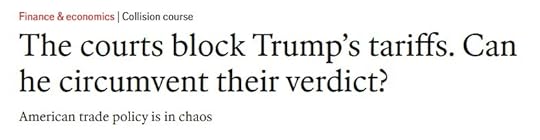

But presidents have tried to break out of their constitutional cage and get more power many times in the past, and this is just the latest example. The real test will be if our system eventually manages to stop this abuse and put itself back in balance as it always has in the past. You can already see this fight beginning to play out in our court system, in this Economist article:

–

–How Big are the Tariffs Right Now?

Even without the 145% nonsense numbers that were thrown around a few months ago, they are still far higher than they have been in the last 75 years or more. While it would be hard to pin down the current numbers in a stationary blog post like this one, the key thing to remember is that our current US economy is built around very low tariffs and relatively free trade.

175 years of Tariff history (source: The Economist)

175 years of Tariff history (source: The Economist)Why haven’t I noticed Prices Going Up Yet?

While the US economy is fueled by a constant stream of cargo ships, as a whole we function like the biggest cargo ship of all: we have a huge inventory and it takes a while to change directions.

So in normal times, we already have several months of inventory of most things in the country. And then when all this drama started, importers started placing even more orders to stockpile things in advance before the tariffs hit. And now that they are in place, we’re importing a lot less stuff.

Source: the super interesting Freightwaves Ocean Shipping index (OSI)

Source: the super interesting Freightwaves Ocean Shipping index (OSI)For now, we’re still using up the stockpiled inventory, but imports have dropped significantly so we’re quickly running out of cheap goods. If that happens, we will probably start seeing shortages and price increases throughout this summer or fall. For some things like plastic party trinkets, we can do just fine without. But if we lose access to core useful things like tools and machinery, the economic consequences will be much less fun.

The Dark Side and the Bright Side

The most important phrase to remember in US politics and economics is the phrase “This too shall pass.” The only mystery right now is that we don’t know exactly how it will pass. So we could sketch out a few scenarios:

1) The current crazy-high tariffs really do stick around:

I personally think this is the less likely scenario because nobody really wants it. But just as a thought experiment, it might go something like this:

2025 inflation would more than double as the tariffs add about 4% to prices(because imports are roughly 25% of our overall spending, and current tariffs are about 16% higher than before. 0.25 * 0.16 = 0.04)Lots of companies will make changes. Those most dependent on cheap imports from China might simply go out of business. Some companies will shift to suppliers in lower-tariff countries.In some cases, US factories will benefit. We’ll produce more steel and certain auto parts here, but you’re not going to see a million factories popping up to make Nike shoes or microwave ovens – those things will just get a lot more expensive to buy. Demand for unpleasant, repetitive low-wage unpleasant factory work will increase, which should help raise the whole lower-income wage pool. But the cost of living for these people might more than outstrip these wage gains. Plus, those jobs will eventually phase back out as manufacturers continue to build robots to automate those jobs.Other countries will continue to retaliate with tariffs on US goods, which means our exporting companies will lose revenue. For just one fun example, Canada recently imposed a 100% tariff on Tesla cars from the US, almost completely destroying that company’s Canadian sales overnight.Government tariff revenue could go up by about $640 billion annually (about 15 percent of our total budget), but the reduction of economic activity and exports would reduce income tax revenue by an unknown amount – possibly an even bigger number.

2) They do end up being just a negotiating tactic and we go back to mostly low tariffs.

The stock market would stage an enormous “relief rally”Companies will gradually start to relax and go back to the way they were, allowing for more planning and hiring to resumeWe will escape with just a few hundred billion dollars of lost economic activity and a moderately large hit to our credibility as a nation, which will fade over time just like everything in politicsSome of the “deals” which are part of the negotiations (for example, lower tariffs in other countries) may have benefits for US exporters, helping boost our future tradeIn other words, the best way to win the tariff game is not to play it.

Just as much of US prosperity is built upon our huge population of 330 million people living in 50 states with open borders and no trade restrictions, all (friendly) countries of the world can benefit from the free exchange of goods, services and even people. We’re all human beings and if we treat each other with a collaborative respect, we all grow richer.

Epilogue: Is it Almost Over Already?

I started writing this article on April 2nd, when Donald announced his “Liberation Day” and the stock market reacted with the biggest drop since 1932. Some people panicked and locked in big losses despite decades of warnings from your favorite financial bloggers, like this unfortunate soul in the comments to a JL Collins post:

Nooooo!

Nooooo!–

But as I watched over the next two months, we have bounced our way back up – with each drop in proposed tariffs triggering a corresponding increase in stock prices (a measure of investor enthusiasm of how bright our future looks).

Right now, the US stock market is just about back to its all-time high. This doesn’t match with our current level of tariffs, which are still about seven times higher than they were before the circus opened. But it shows that investors believe it’s all going to end with a truce and a resumption of free-ish international trade.

If they’re wrong, the roller coaster ride will still have some more fun in store for us. But as long as we eventually end our current experiment in “emergency” tariff dictatorship and get back to functioning as a democracy, things should be just fine in the long run. I’m still 100% invested myself, so that’s where I place my bet.

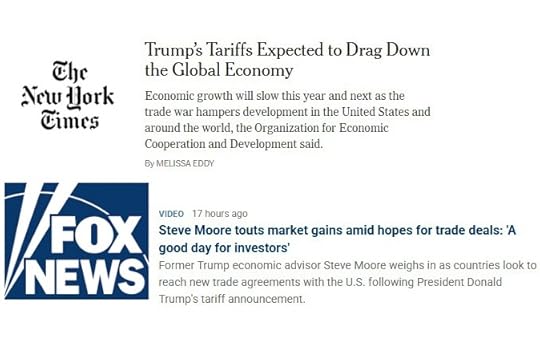

The Biggest Lesson: Don’t Form Your Opinions Based on News Headlines

Decades ago in a brighter age of journalism, there may have been a time when headlines were designed primarily to inform us, with just a bit of sizzle and spice to pull in our attention. Unfortunately, nowadays the priorities have flipped where the primary goal is attention, and accuracy carries little or no weight. Even a totally inaccurate article makes money for the publisher.

Two media outlets, living in two different worlds

Two media outlets, living in two different worlds–

So while Democrats and Republicans like to do battle over which media sources are biased, in reality they’re all wrong: all click-funded commercial media is biased – sometimes politically but even more importantly biased towards generating outrage and fear, because those generate more money.

There are two solutions to this:

1) Either ignore the media completely and focus on your own life, or

2) Become a subject matter expert on things you really care about, and then read the original sources whenever you want to learn about something.

I mostly practice option #1, but as a science and technology nerd I get into #2 in just the areas I find most interesting. And it’s amazing how the more deeply you understand a subject, the more you see just how wrong most media stories are about your area of expertise. Which means they’re probably pretty wrong about almost everything.

So as always, with this lesson learned it’s time to shut down that phone and laptop, exhale all our worries and get back outside with your real-life family and friends. See you in a few months!

Related:

Why We Are Not Really All Doomed – the original all-purpose MMM article which explains why we never really have to worry about the long-term economic future.

February 25, 2025

Wow, have you seen the stock market lately?

–

–And by lately, I mean the past several years or more.

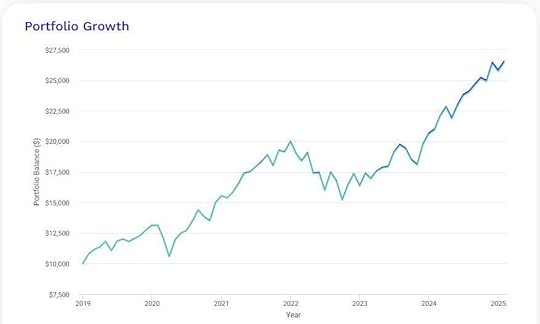

The value of the S&P 500 index of stocks, where most of us hopefully have a good chunk of our retirement savings stashed into index funds, is up about fifty seven percent in just the past two years. And it has more than doubled in the past five.

S&P returns (including dividends) since 2019, graph by the excellent portfolio visualizer website.

S&P returns (including dividends) since 2019, graph by the excellent portfolio visualizer website.This means that on a net worth basis, if you felt like you were only halfway to retirement as recently as the Covid Era, you may have suddenly blown right past the finish line. And some of us who were already retired long before that, may find ourselves eyeing up expensive properties or engaging in other money-burning-a-hole-in-our-pocket behaviors.

Is this real? Or is it all a bubble or some other sort of financial illusion?

As one reader recently asked me in an email:

“The market seems to be in a huge bubble right now due to all sorts of hype around Artificial Intelligence. Does this make it more vulnerable to a huge crash in the future, and will it affect my retirement?”

To answer this question, let’s take a closer look at our current somewhat unprecedented financial world and stock market. And to understand that properly, it helps to go back to the roots of what a stock is:

A stock is a magical business arrangement which is really just a much more convenient version of a rental house.

When you own a rental house, you are entitled to collect rent. After you cover all the expenses related to the house, you get to keep the rest, and this amount is your profit.

If the average sale price of rental houses in your area goes up but the tenant keeps paying you the same amount forever, it may look good on paper but it doesn’t really mean anything unless you sell the house. And then you’d just have to turn around and pay that same higher amount for a different rental house.

Your paycheck remains unchanged unless you can make your little house rental business more profitable. So you might squeeze in a basement apartment, do some renovations, streamline expenses, or do other things to increase your net earnings.

–

–When you eventually sell that house to another investor, the price they are willing to pay should be based on that future stream of income.

For example, if the house brings in $2000 per month ($24,000 each year) and the sale price is $240,000, the next investor is buying a business with a price-to-earnings ratio of 10, because 240k/24k=10.

But if you manage to convince someone to hand over $480,000 for that same house, you’ve sold at a P/E of 20. This is a much better deal for you as the seller, but quite obviously a less rosy future for the investor buying it.

Now back to the stock market. If you put $100,000 in the market in 2019 and reinvested the dividends, today you’d already have an astonishing $256,960 (a 157% gain on your original investment)

But in that same time period, your share of company earnings from that $100,000 basket of stocks has only gone from $5290 to $7540 (a measly 42% gain) – information you can get from handy analysis sites like multpl.com

In other words, the Price-to-earnings ratio has risen from about 20 back then, to about 30 today.

So as stock investors here in 2025, we’re just like rental house investors finding that house prices have more than doubled while rents are only up by a bit. Which makes the landlord business a lot less profitable, and we should expect exactly the same thing as stock investor: lower future profits as a percentage of our portfolio value.

That doesn’t mean it’s unprofitable to own either one of these things – stocks or rental houses. But it does mean that we should expect our future income from buying them at today’s higher price-to-earnings ratio should be lower than if we could get them on sale. It’s just basic math.

But Wait! What if the Earnings are Rising?

Let’s say you’re considering a rental house which is a bit overpriced based on today’s rent, but you happen to know that a big Apple campus is about to get built right nearby. At that point, you expect that rent will start climbing rapidly for many years to come. In this situation, you should be willing to pay more for those future earnings when you buy the house.

This is exactly why the price of an individual company’s stock will tend to rise when some good news comes out about the company. During the Covid era, people started buying more Peloton bikes so they could exercise at home, and investors (foolishly) believed this would be a permanent trend. So Peloton stock went way up. Later, reality sunk in that this was just a fad and Peloton sales returned back to normal levels, and so did the stock.

But what does it mean when the entire market goes up to much higher levels? Does it mean our entire economy is expected to grow much more quickly?

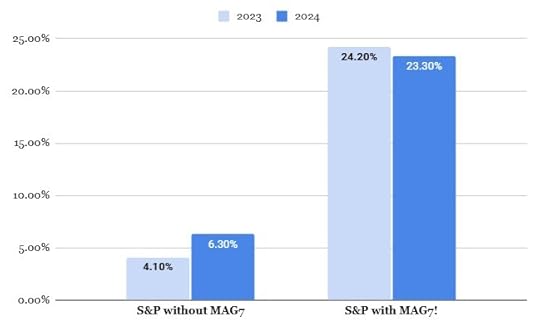

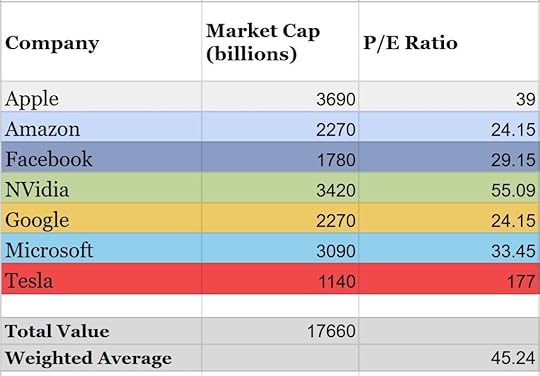

In the case of the current stock market euphoria, not exactly. Because if you dig into the share prices of the 500 big companies that make up our famous S&P 500 index, it turns out that almost all the recent growth – about three quarters of it – came from just the seven biggest companies, known as the Magnificent Seven: Apple, Nvidia, Microsoft, Amazon, Google, Facebook, and sometimes Tesla.

The real cause behind our raging bull market

The real cause behind our raging bull marketThese are all high-flying, super profitable tech companies who have seen a lot of growth and hype recently, which has caused investors to get excited and bid up their share prices in hopes of even more future growth. Collectively, they make up over 25% of the entire market value ($17.66 trillion!) and have much more expensive P/E ratios than the rest of the market (a weighted average of about 45)

The MAG7 companies are expensive, especially Tesla which trades on the hype of possible future earnings rather than current profits.

The MAG7 companies are expensive, especially Tesla which trades on the hype of possible future earnings rather than current profits. If you exclude these seven biggest companies and just consider the remaining 493, you will find a P/E of only 20, which is more reasonable although still much higher than average.

What this tells us is that while investors expect the overall US economy to be fairly healthy in the coming years, they expect the biggest tech companies to continue to enjoy much faster growth.

What Does This Have To Do With Artificial Intelligence?

There’s one common theme in the big tech company boom right now: recent advances in AI have surprised the business world as software is suddenly able to display human-like reasoning in a rapidly growing number of fields. And because of this, the entire business world is fired up into a frenzy.

Six of those Magnificent Seven companies are spending hundreds of billions of dollars to build preposterously large warehouses full of supercomputers, and the lucky seventh (NVidia) is on the receiving end of those billions since they make the supercomputers and the incredible demand allows charge insane prices while still shipping them out by the trainload.

But that’s just the first level of this boom, the AI Infrastructure. As you move down the chain, every other industry hopes we have entered a new era of productivity and thus profits will grow faster than ever.

They may actually be right: You can now do things like feed in an entire novel or legal document or piece of code and ask the AI to answer detailed questions about the characters, or identify loopholes in the contract, or even find and fix bugs for you. AI can also drive cars, identify melanoma from photographs of your skin, design medications thousands of times better than what we’re used to, and even bring humanoid robot bodies to life as mechanical workers.

The idea is that we’re on the verge of having an infinite workforce of highly intelligent AI employees who will work for us for free, eliminating the biggest constraint that humanity has had in the past: a finite supply of both intelligence and labor.

Having followed the field in some detail for a while, I personally think all this will come true, although the timeline is uncertain. And the people bidding the share prices up to these levels obviously believe it too.

But the question is, will the profits of these companies really come through at the levels they forecast? Or will there be surprises down the road: cost overruns, competition, or unexpected disasters as these newly smarter-than-us computers decide that they no longer want to be bossed around?

And what if we end up with massive unemployment and resulting social upheaval if this amazing technology puts us all out of work, leaving only Sam Altman atop his personal mountain of $100 trillion dollars taunting the world forevermore with an annoyingly quiet monotone cackle?

Image generated by AI… of course

Image generated by AI… of courseThere’s Only One Real Answer: Nobody Really Knows!

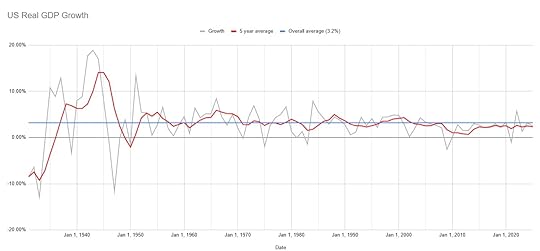

While the future is unknown, it can still be useful to use the past as a guide. After all, if you look at the history of US economic growth over time, it averages out to a surprisingly steady figure, decade after decade: about 3% after inflation.

How our GDP grows: even as the world changes drastically, growth remains remarkably stable over the decades

How our GDP grows: even as the world changes drastically, growth remains remarkably stable over the decadesOne thing I noticed when making this graph: recent decades have actually seen slower than average growth, which is even less reason for the stock market to be priced the way it is.

So What Does it all Mean? Should We Do Anything About It?

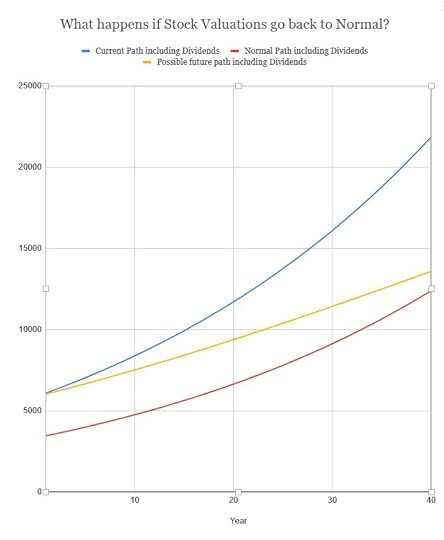

As I said earlier, it’s still going to be profitable to own stocks for the long run, just a bit less profitable than those times when we got to buy our stocks on sale. Of course, there will be occasional manias and panics and crashes. But as always, it will be a losing game to try to time them – for example by selling all your stocks now and hoping to buy them at a cheaper price at some point in the future.

And over the long run, even if stocks return to more typical valuations, the end result would be something like the yellow line in this graph:

While the Blue path would be great, Yellow would be fine too

While the Blue path would be great, Yellow would be fine tooOur economy will continue to grow and company earnings will grow along with it, but future investors might choose to pay a lower multiple for those earnings.

Just like when you eventually sell that rental house, you shouldn’t expect someone to pay you a million dollars for a place that only brings in $3000 of rent.

Final Thoughts And Alternative Strategies

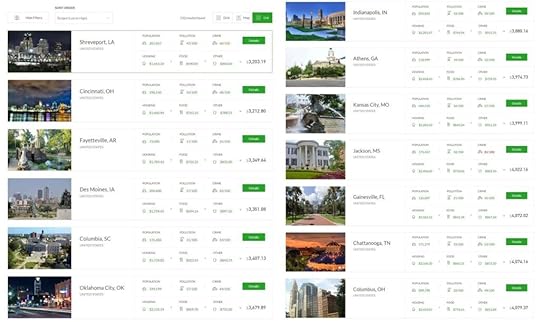

Everything we’ve covered so far is talking about the entire US stock market as a whole. And that’s what I usually focus on most because I still think this country is a uniquely good place to run a business. But what about other investing options? It’s always fun to at least look around and understand the larger investing world.

For starters, there’s Vanguard itself, the bedrock of the index fund world. Every year they gaze out at the investing horizon and make a ten-year forecast (guess) at future returns. This year they came up with these numbers:

Vanguard’s updated 10-year annualized return projections:

Global bonds, non-U.S.: 4.3% – 5.3%U.S. bonds: 4.3% – 5.3%Global equities (ex-U.S., developed): 7.3% – 9.3%Global equities (emerging): 5.2% – 7.2%U.S. equities: 2.8% – 4.8%Wow look at that. Vanguard is forecasting that International stocks of all kinds and even bonds will outperform US stocks in the coming decade.

On the surface, this makes sense because the P/E ratio of the international stocks (for example the VXUS fund) is only 15.9, meaning those European stocks are on sale at almost 50% off compared to ours!

Just one note of caution however: Vanguard has been making this same prediction for several years and just been wrong so far. Part of the reason is that most of the AI boom seems to be happening in the US.

The Betterment Portfolio

Longtime readers know that I’ve had a growing portion of my investments in a Betterment (robo-advisor) account over the past eleven years (see the ongoing report here). I decided to try this for precisely the reasoning above: by allocating money across more categories than just US stocks and automatically rebalancing, we should be able to see slightly higher returns with slightly lower volatility, and some tax advantages as well.

So far, my experiment has drawn some heat because in retrospect, a US-only portfolio has outperformed any other option over this time period. The Betterment portfolio comes close, but the exposure to bonds and businesses in other countries has held it back, just as you’d expect. But if you believe that things will eventually balance out again in the coming decades as the Vanguard analysis suggests above, it still has a chance to catch up.

Looking at my investments there, you can review the betterment core portfolio and calculate that the weighted average of all those holdings gives us a P/E ratio of about 22.

What Does Warren Buffett Say?

It’s always worth checking in with The Oracle on matters of the economy while we’ve still got this wonderful old sage around (see this year’s Berkshire Hathaway Shareholder letter if you want some further deep reading). And Warren is signaling that things are overvalued and bargains are few and far between. So Berkshire is holding $334 billion of uninvested cash for now, not even repurchasing its own shares which it considers slightly overvalued at the current P/E ratio which averages out to about 21 in recent years.

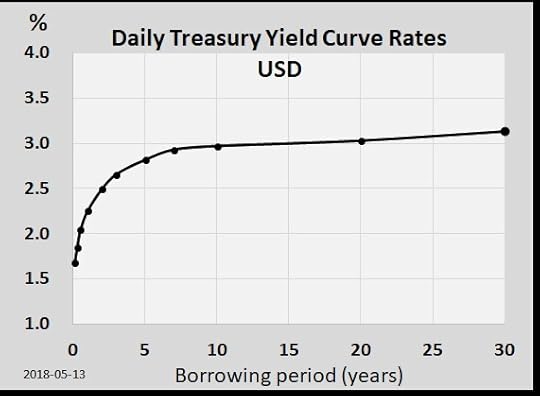

What About Paying Off Your House?

Over the long run, you usually do better if you keep a mortgage on your house and pay it off slowly, while directing all the surplus cash into index funds. But there is some point at which the opposing factors of lower expected stock returns and higher interest rates meet in the middle and this situation flips.

If you have a 7% mortgage right now, it might be a fairly close tradeoff at this point. But the real factor is how you feel about paying off your house. I happen to love being mortgage-free so I paid off my last mortgage over ten years ago and have never looked back.

Another way to think of this is that paying off your house is like buying a 7% bond. Definitely one of the best guaranteed returns around, and much more sensible than leaving tens of thousands of dollars in a checking or savings account unless you have a clear use for that cash.

The Final Word

If you’ve read any of my stock investing articles before, you’ll know that we always end up at the same place: Just relax, enjoy your life, keep investing, ignore the daily news headlines* and don’t worry.

–

–Then reinvest that time that everyone else spends worrying into enjoying more time engaged in hard physical stuff in the great outdoors. That’s the only place where you’ll get guaranteed market-beating returns, every time.

–

–In the Comments: what are your thoughts on the current stock market boom, future crashes and busts, and the role of Artificial Intelligence in our future?

All the other MMM Stock Market Articles from past years:

Finally, a Stock Market Crash!What to Do About This Scary Stock MarketHow About that Stock Market!?Houses and Stocks are Going Up – Who Cares?How to tell when the Stock Market is on SaleSummer Clearance Sale on US Stocks!*although in my opinion it’s okay to check in weekly with The Economist, which has been my favorite source of world economic news for 32 years and counting.

January 16, 2025

Retired Man Tries to Spend More Money, Mostly Fails

–

–A couple of years ago, Mr. Money Mustache lost some credibility among the faithful when he wrote this blog post about actually trying to spend a bit more money, while buying a Tesla as the first step in that program.

“Look at me!”,

I thought to myself at the time,

“I’m such an enlightened middle-aged Badass, adjusting habits and realigning myself at the snap of my fingers. Onward to the next forty eight years of the Good Life!”

So, two years passed with an even greater feeling of abundance. I had a marvelous time traveling everywhere and spending money like I thought a proper wealthy person would do.

I dined out in stylish restaurants, booked hotels based on their niceness rather than their cheapness, paid extra to sit in the “reduced torture” seats of the airplanes, and gave zero fucks about paying double for groceries if I happened to be in a Whole Foods rather than my usual Sam’s Club and Costco (and yes I treat myself to memberships at both warehouse stores!)

–

–Among the highlights, my son and I have worked our way though a nice selection of late night EDM concerts and three Meowwolf art venues including a Christmas Day road trip from our winter home in Tempe Arizona to Las Vegas last year. And having spent much of the year as a single man, I had a wide open schedule to just meet up with friends, explore new places and meet new people as opportunities came up. It felt like a year of adventurous transition, which means it felt like much more than twelve months.

–

–With all this flashy spending, I was sure my budget must have crept back into full American Consumer territory. But I was having too much fun to bother adding it all up to check.

Until recently, when I was doing another round of informal coaching for a friend and we both decided to tally our spending for the past year to compare notes.

When I finally finished sorting all of those transactions into a spreadsheet and hit the “sum” button, the results surprised me.

While my overall spending had indeed increased (especially in travel-related categories), the big-picture effect was still pretty minimal. Depending on how I account for things like the car and my business expenses, my spending went from $20,000 to about $30,000 (plus the usual hidden subsidy of a paid-off house.)

This level could still be sustained by a $1 million investment nest egg. Since my investments are quite a bit higher than that (especially after these recent years of crazy economic growth and the never-ending stock market rally), I’m still way under budget.

Although I still “failed” to really increase my spending to the MMM-recommended levels for old wealthy people, this still makes me happy, because I have genuinely had more fun with the abundance mindset, and I can keep trying more life experiments in the coming years.

As we covered in the 2019 article on the idea of an Optimization Council, it’s always a good idea to compare our spending, tips and tricks on how to get the most out of life. Almost twenty years into early retirement, this is where I have landed so far, although I’m always learning and open to feedback.

Anyway, let’s cut the wistful commentary and get into the budget.

CategoryFrom Personal CardFrom Business CardTotalDetailsGroceries$5,465.56$494.83$5,960.39For me + young adult son about half the time + guestsRestaurants$2,145.11$98.48$2,243.59Restaurants only for special fun rather than just getting foodTravel$3,982.00$2,176.77$6,158.77Business travel is for things like Camp Fi and other fun conferencesUtilities$1,909.510$1,909.51Amazon/House$949.64$2,604.46$3,... 75% of business is actually construction materials for clients (usually friends) which were reimbursed via invoiceBooze$250.670$250.67Wine and other beverages for entertaining.Healthcare$813.20$2,723.46$3,536.66This is cheap thanks to Sedera Health Sharing plus a Direct primary care (DPC subscription)Also paid for some advanced blood tests just for screening and learning purposes.Automobile$2,191.68$233.53$2,425.21This is just car insurance and registration. We could add a “depreciation” figure in here to be more accurate. Phone+Internet$1,410.561410.56$50 Gigabit Internet (!) and about $25-30 for my monthly for Google Fi bill + taxProperty Taxes$2,577.30$2,577.30Surprisingly reasonable given the $500-600k value of houses in my neighborhood.Total$20,284.67$9,742.09$30,026.76–

In summary: Wow, how interesting! When we compare this to my 2019 post on that year’s spending, it’s only a bit higher even after all the inflation we have seen in recent years. I spent more on travel and fun, but less on home renovation – partly because I was away so much I didn’t have as much time to work on my house. The health insurance is a new cost too since I was self-insured back then.

The Biggest Savings:

My budget is notably missing the biggest expense for most people, which is housing costs. This is because I paid off my house long ago, and I also love working on and taking care of my own home, which means there are no bills for lawn mowing, plumbers, tree pruning or handyman services.

This strategy is not for everyone, and it’s not even the optimum financial one for me – I would have been better off taking out the biggest mortgage I could get at 3% back in the sweet borrowing times of 2021, and putting all that principal to work in stock index funds where it would have almost doubled since then. But I still get a great peace of mind from just having no mortgage payment, and there’s really no better way to use your money than to buy such good feelings. Also, I get a secondary benefit of not having to buy house insurance, which saves me another $2000 per year, boosting my effective return on that payoff.

What about Health Insurance?

First of all, the biggest money saving factor of good health and good luck has continued, meaning I’ve still had no actual medical expenses. But I still do maintain two layers of health care support which together feel very much like the ultimate version of health insurance: a membership with a top of the line Direct Primary Care (DPC) medical clinic ($107 per month) plus a high-deductible plan ($201) with a health sharing organization called Sedera.

The combined cost of $308 per month is less than the cheapest Bronze plan in the field of standard health insurance, yet I get personalized support with zero deductible for almost all typical medical needs, plus some protection from larger medical bills if my good luck runs out.

But as a disclaimer, I’m not an expert on medical needs and health insurance because I’ve had so little experience with the system. And the highest priority in my life is arranging my days for maximum health to give me the best chance of keeping it this way.

How could I do better?

When it comes down to it, money is a tool for survival and if we’re lucky, self actualization. So I’m always asking myself if there’s anything I can change or improve to make the most of this good fortune.

I also try to keep in mind an interesting principle of happiness, which says that,

Fixing your persistent problems is more effective than just doubling down on things that are already good in your life.

For me, there are already a lot of good things which don’t need improving. My family, friends, relationships, health, food and daily activities are pretty much as good as I could imagine.

The only annoyance I can think of is physical chaos: I have a lot of space-intensive hobbies like construction and music, and I currently live in a pretty small house which is basically maxed out. I could really use a doubling of my workshop space from the current 2-car, 440 square foot garage to maybe a thousand or so.

But I also love where I live and wouldn’t want to give up my views, neighbors or current place. So I’ll keep optimizing what I’ve got unless some perfect opportunity comes up for a bigger place right on my block.

My future “Friends Mountain Resort” is just an AI generated image…. for now!

My future “Friends Mountain Resort” is just an AI generated image…. for now!In the longer run, a mountain compound with its own cliffs and stream are also on my “maybe” list. But once again, my days and life are already overbooked with joyful things. My existing house and our HQ Coworking space already have long to-do lists. Would I actually be happier if I added another place to my portfolio? So I keep this idea on the shelf until I’m willing to trade it for another existing commitment – like selling my house or the coworking space.

But for now, I’m just extremely excited to blaze into 2025 with loads abundance and piles of challenging stuff on my to-do list. And I wish you the same!

In the Comments: Where are you at on this spectrum of stinginess versus abundance mentality, and fulfilment versus longing in life?

A Temporary Note about Teslas and other electric cars:

Rumor has it that the $7500 EV tax credit might be disappearing when our new president takes over next week, so this might be the cheapest chance to buy what I feel are the best cars on the market: The Model Y, or Model 3.

Both used and new prices are at record lows so shop around and get an additional $1000 off a new one if you use a referral code from a friend or here’s mine if you need one (many thanks!)

Full article here at The Model Y Experiment.

FTC Compliance Note: I use referral links for some products when possible which means the blog may earn a commission if you use them. More details here.

October 13, 2024

Six Dumb Misconceptions About The Economy (that the Politicians Want You To Believe)

–

–Well, it looks like we’re here in another US election year already.

As Advanced Mustachians, we already know that the ongoing battle of Harris vs. Trump should not be consuming much of our time. Sure, we do our research and cast our votes but after that we move right on to focus on other things within our own circle of control.

But out of all the things the politicians like to bicker about, there’s one area where MMM does need to set the record straight, and that area is of course money. Your money, the economy in general, and the overall wealth of the nation.

Politicians are already not known for being the sharpest tools in the shed when it comes to technical stuff like science, technology, or economics. But this year the discourse has become particularly dumb, as our candidates try to manipulate undecided voters in swing states with ideas that are based on irrational emotions rather than sound economic sense.

For one particularly funny example, you may have noticed that the competing party (Trump in this case) is attacking the incumbents (Biden/Harris) over the “bad economy.” When in fact the US economy is stronger than it has ever been, with the lowest unemployment we’ve ever seen as well.

It’s hard to imagine a better situation than we have right now, and in fact the recent bout of higher inflation is a sign that things have been going too well, and we needed to step on the brakes with the help of higher interest rates.

But somehow the people still seem to believe that we have a “bad” economy. Take a look at this Gallup poll showing that while most people (85%) are doing really well right now, they assume that it’s just their own good fortune – only 17% believe the economy is doing well.

This is mathematically impossible, because if most people are doing well, that’s the definition of a good economy! And suspiciously enough, this widespread wrongness correlates quite nicely with the rise of social media misinformation.

–

–So the politicians and the news have been doing the opposite of what they should be doing in an ideal situation (sharing accurate information). And sure, we can always just ignore their speeches and go on with our lives. But when it comes to economics, knowledge is power (and money). The more accurately we understand how things really work, the wealthier we will all become.

So with all that in mind, I hereby present you with my list of the…

Top Dumb Things Politicians Want You To Believe About The Economy

1: The President Controls the Economy

If there’s a recession, the opposition party likes to blame it on the current president. If the economy is booming, the current president likes to give himself (or possibly soon herself) credit for all of that success. But really, the US economy is way too big – and thankfully way too free – for the president to control or really even influence all that strongly.

In reality, our economy is a gigantic machine which converts labor and materials into things like iPhones, hospitals and pumpkin pies. And although we’re the biggest economy at 26% of the planet, we are still heavily influenced by that much bigger 74% of economic activity that the other 7.6 billion people on Earth are busy producing everywhere else.

When we have our inevitable little boom and bust cycles, they are mostly caused by the normal cycle of irrational exuberance (and greed) like the 2007 housing boom, followed by brief periods of extreme fear and pessimism like the 2008-2012 financial and housing crash.

The government does play a role too, by setting tax rates and other rules. But the effects of these policies are usually so delayed and unpredictable, that you can’t draw a straight line between today’s president and today’s economy. In other words, the government does its best to adjust the rudder on our giant ship, but in the short term our economy lurches around on the waves and storms of the ocean.

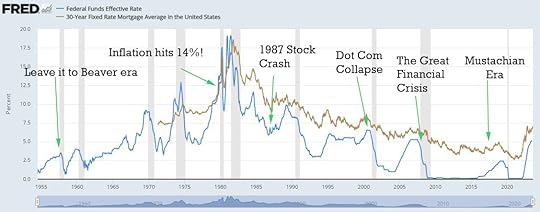

2: The President Controls Interest Rates

This one is especially funny to me, as our candidates feign sympathy for the hard life of middle class Americans, who now face higher borrowing costs on their credit cards and car loans and mortgages. They claim they will fight to bring the interest rates down. Trump even goes as far as bullying our Federal Reserve board members (who can only do their jobs if we allow them to function as independent experts) and suggesting that he would take over the whole department, if elected.

The real story is that while monetary policy would be a terrible tool to leave in the hands of a sitting president (see Argentina), it does function as an excellent set of gas and brake pedals for the economy if used properly. When things slow down and unemployment gets too high, a cut to the interest rates will produce a boost in everything from new jobs to stock prices. But if things get too hot, you get rapid inflation which can mess up the system.

3: Inflation has Made Life Harder for Americans (and the President Can Magically Reverse it)

This line of reasoning is even dumber than the last one. For a couple of years after the Covid era, we had rapid inflation. It was caused by a rare combination of a goods shortage caused by things like factory closures and remote work, plentiful demand from government stimulus spending and low interest rates. These factors have since ironed themselves out, and inflation is back down to an ultra-low 2.4%.

Steve Ballmer explains the inflation vs wages debate in his useful new video series called USA Facts (see note below)

Steve Ballmer explains the inflation vs wages debate in his useful new video series called USA Facts (see note below)But most significantly, wages have still risen faster than inflation so we are all better off than before! Since 2019, overall prices are up 19% and our wages are up 21%. So even after all that inflation, we are still doing just fine. But the candidates are still bickering over inflation as if it’s an actual problem, and even worse promising to “bring prices back down”. And they’ve managed to convince the electorate that “higher wages and prices” is the same thing as “a bad economy”. Which is just plain wrong.

Bonus dumbness: politicians also occasionally blame “greedy corporations” for increasing prices to hoard profits. While price increases are totally acceptable in a market system (as a business owner you are free to set prices wherever you like), in reality it doesn’t usually happen because our markets are too competitive. For example, a recent deep analysis from NPR showed that no, grocery stores haven’t made any windfall profit at all off of this recent bout of Covid-fueled inflation.

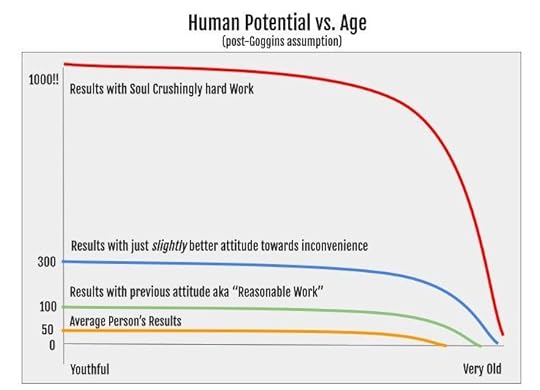

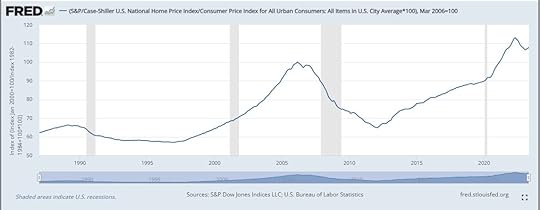

4: The President Controls Housing Prices

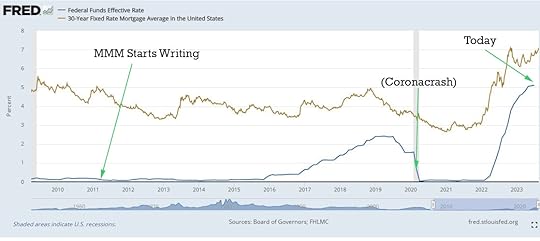

One important thing that has changed over the past ten years is that US house prices and rents have both risen much faster than general inflation and even wages. On the positive side, interest rates have also risen which tends to make houses feel more expensive and is supposed to help bring house prices down. But it hasn’t happened yet which means we have the double whammy of higher prices and higher interest costs for mortgage borrowers.

The dumb part is that our candidates are proposing things that would make the problem even worse, like subsidies for first-time homebuyers or schemes to reduce the interest rates. When really the solution is to increase the supply of housing, which I personally think will happen if we stop putting up roadblocks for homebuilders (myself included) to build housing.

Things like faster and cheaper permits, less onerous and expensive building codes, eliminating suburban-style zoning and setback and car parking rules, and changing laws so that NIMBYs no longer get any say over what other people do with their own land could all help reduce the cost of building a house by about 50%, quickly and permanently.

5: The President Controls Gas Prices, and They Are Currently “High” and We Want Them Lower

Ahh, gasoline! The most ridiculous of things to worry about and the fuel for many of MMM’s rants since 2011.

First of all, on an inflation-adjusted basis, gasoline is still about the same price as it was in 1950: in the $3-4 range per gallon, in today’s dollars.

Secondly, it is so cheap that even with our huge inefficient American vehicles, the average household is still only spending 2.5% of their disposable income on the stuff! (The funny part is that they spend many times more on the rest of the car ownership experience while thinking gas is the part that is expensive)

Third, gasoline has been obsolete for almost a decade now. You can get a used electric car for less than the price of a comparable used gas car, or if you’re a fancypants money waster like me, new EVs are also cheaper than their gas counterparts. You get a faster, nicer car that almost never needs maintenance OR gasoline, and save money.

So why are we even still talking about this antique fuel of a previous era? Why aren’t the candidates also arguing over the price of Kodak film or typewriters or fax machines?

6: The Economy is Something We Should Even Worry About

The funniest part about all this economic talk is that we’re focusing on the wrong thing. While hard work and business and advancing the frontiers of human knowledge are all fun things, the reality is that we passed the point of having “Enough” decades ago. When the American middle class complains about how hard we have it these days, it’s like a bunch of overfed people at a buffet wishing they could just have one more flavor of donuts stacked onto the table.

Yes, we have income and wealth inequality so that the rich tend to get richer more quickly. And yes, we should keep that in check with a somewhat progressive tax system because a more equal society tends to be a more peaceful and happy one.

But have you noticed that as the rich people get richer, they don’t get any happier? It’s because after you pass the point of “Enough”, adding more money doesn’t really help much.

And “Enough” is much more defined by your mindset (and your collection of life skills) than your paycheck. So if the politicians really cared about improving our happiness and wellbeing, they’d be preaching the Principles of Mustachianism rather than pandering to the specific requests of coal miners or billionaires.

But alas, winning an election is a very different thing than proposing stuff that is actually best for the country. And for that reason, we cast our votes for the best party and then tune back out until the next election.

Happy voting!

In the Comments: Has the election season been getting you down, pumping you up, or just giving you a thorough dose of “Meh”?

Further Reading/Watching:

While researching economic stats for this article, I came across a quirky but informative series of videos called USA Facts by none other than Microsoft co-founder Steve Ballmer. It seems that he had the same frustration as me: Americans are fighting over a bunch of opinions and misinformation without even bothering to look up the actual facts. So he made a well-produced series of videos that just share the facts without the baggage of political hype on top of them. I wish our politicians could do the same thing!

Bonus Podcast based on this article!

Thanks to the magic of AI, you can direct the wizardry within Google to generate a custom-made podcast on almost anything on the Internet. A reader just emailed me this take on this episode – remarkably human-like and even entertaining!

https://notebooklm.google.com/notebook/0e1d0af8-8888-466c-abe4-8b1da8986773/audio

July 23, 2024

$656,000 of Frugal Things I Still Love Doing

–

–“I used to read Mr. Money Mustache”,

some people say these days,

“Until he got all rich and fancy so that he no longer understands the common person’s plight.

Stash probably doesn’t even practice any of these money-saving things he preaches any more!”

When I read things like this, I can’t help but laugh. Because on the one hand, when you put a bunch of personal life details online like this, being misunderstood is just part of the package. But on the other hand, if the critics could peek in and see our real lives – not just mine but those of all the Mustachians – they would have to give up their conspiracy theories and accept the fact that this stuff just works.

Because really, not much has changed when it comes to the basics. Like many MMM readers over the past twelve years, my total wealth level has increased pretty regularly. But also like many of us, I haven’t felt the need to change very much about my spending because I was doing my best to live an enjoyable life in the first place.

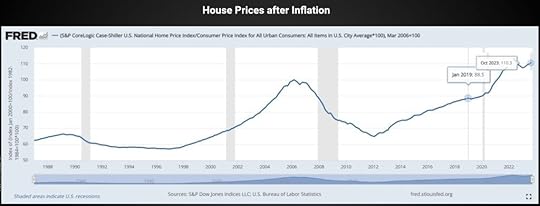

How have so many people found such great success? I think we Mustachians have something that’s a bit more rare and special than standard financial advice, which is what makes it work so well:

Standard Advice:

Slash your spending and make sacrifices until you reach a certain savings percentage, and beyond that it doesn’t matter, it’s all personal choice. More income? Great, that means you don’t have to sacrifice as much! FatFIRE for everyone!

Mustachianism:

Cultivate a love of efficiency, creativity, self awareness, and self improvement. Use this knowledge to improve your life in all ways, including those which help you live better even as your monthly expense rate drops over time.

So what does this mean in practice?

Well, I’ll give you some examples from my own present-day life. Things I do because I happen to enjoy them, which also happen to save a lot of money. Some of these are normal, some are silly and may end up in some future gossip magazine hit piece, but all of them happen to work for me, so the critics can be damned.

As I list each item, I’ll include an estimate of how much the activity saves me per decade, because you should always think at least in terms of decades.

To make that calculation yourself, just use the “rule of 172” – take a monthly expense and multiply it by 172 to estimate how much it would compound into over ten years, if invested.

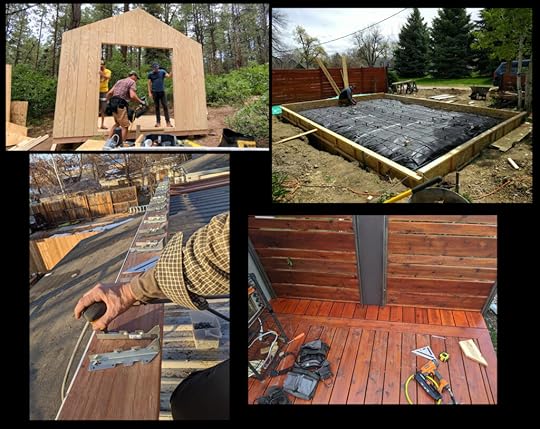

1) Fixing my own House (and everybody else’s too)

Construction projects from recent years, at home and around the state.

Construction projects from recent years, at home and around the state.I’m a big believer in self-sufficiency, and working to build up the skills to manage the most important parts of your own life without depending on too many things (or people) that are outside of your control. In other words, one giant recipe for a happy life is simply to Become a Producer of the Things You Most Enjoy Consuming.

And in my case, I happen to love houses. I like living in beautiful, functional spaces and sharing them with friends. But most houses are ugly and poorly designed when you buy them, so I realized that I also love solving problems and redesigning old buildings to become new again. I enjoy this process so much that I spend most of my free time doing it – on both my own properties and the homes of friends.

And I love teaching other people to gain power over their own houses too. It’s amazing how great people feel as they lose their fear and dependence on outside contractors, and gain the ability to fix and maintain things with their own two hands.

Savings: An average of $20,000 per year = $287,000 per decade

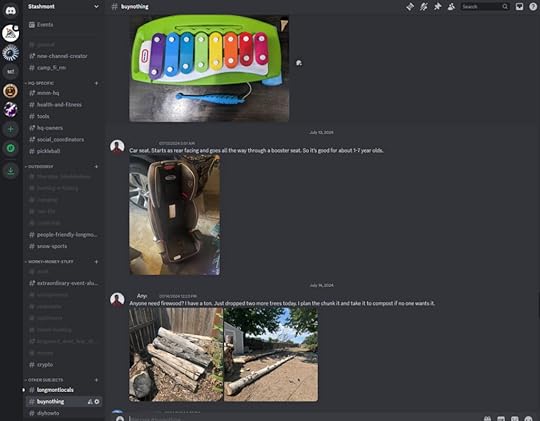

2) Craigslist and Community

Members of our coworking space, swapping valuable free stuff every day.

Members of our coworking space, swapping valuable free stuff every day.You know what’s great? Having so much money that you can buy whatever you want – high quality things which get delivered to your front door the very next day.

You know what’s even better? Not buying some of those new things, and instead finding ways to share, repurpose and buy equally high quality items from other people who don’t need them any more. All while building up your own community and creating new friendships in the process.

Craigslist, Facebook Marketplace, and even NextDoor all have Buy Nothing groups for most areas. In the MMM-HQ community, we run a Discord server with about 200 local people, who chat around the clock on a wide range of subjects. They help each other with major projects in one channel called #diyhowto, and give away and sell things on #forsale and #buynothing.

Although our private Discord group is my favorite, I also use Craigslist regularly, and probably save (and earn) a few thousand every year thanks to the habit:

Savings: About $42,000 per decade

3) Bikes over Cars

Sure glad I’m not stuck in a Jeep on these off-road trails!

Sure glad I’m not stuck in a Jeep on these off-road trails!We all know that Mr. Money Mustache’s biggest contribution to personal finance is to insist that bike transportation is the best way to get around. And I still feel this way. As we learned in The True Cost of Commuting, cars cost at least 50 cents per mile to operate, while bikes are much cheaper, mainly due to reduced depreciation and maintenance costs (which are even bigger than the gas savings).

I do still use bikes (or walking) for at least 95% of my local trips these days, but because I live in the center of a small city, my life is pretty local. So this still only adds up to about 2000 miles per year, a savings of “only” $14,000 per decade.

But when you choose active transportation, there’s much more to the picture than just cutting your car expenses. You’re changing everything about your physical and mental health picture for the better, which brings us to the next point of…

4) Muscle over Motor

Digging out the crappy old window wells to build a bigger terraced garden.

Digging out the crappy old window wells to build a bigger terraced garden.Although I’m no competitive athlete, whenever I see an option to make my body work a bit harder, I usually take it. Stairs instead of elevators, running the golf course instead of using a golf cart, moving my own furniture and appliances instead of calling a mover, shoveling snow and raking leaves instead of using a machine.

When I face a decision like this, I simply ask myself the question:

“Well, Mustache. Do you want MORE health and fitness, or LESS?”

Putting it in that context makes the answer obvious. Every bit helps, because when it comes to your body, the rule is pretty much use it or lose it.

But how much money does this save? There’s no real way to calculate it exactly, but I like to think of it this way: The US average health care spending is about $13,000 per person per year. My lifetime costs due to illness or medication so far have been just about zero, plus I know I’ve had more energy and greater productivity due to being healthy. Let’s just put it very conservatively and set the estimated savings and benefits at $10k per year which means

Estimated Savings: $140,000 per decade.

5) Saving Energy by Running my home like a Glamping Retreat

Outdoor cooking, showering, laundry and even a homemade gym? Why not?!

Outdoor cooking, showering, laundry and even a homemade gym? Why not?!Here’s where things get a bit silly, but my level of joy is actually at its greatest.

My personality type is probably a weird combination of an engineer, a carpenter, an artsy hippie, and a mad scientist. Oh, and a devoted homebody too. Because of this, my favorite activity most days is to just run around my house taking care of things and trying new little experiments and improvements.

Sometimes I’ll cut a few big holes on on the South side of the house and install sliding doors and big windows to allow nice sunbeams and passive solar energy to get into my house and give me free heat in the winters. Other times it’s just smaller things to save energy and live more at at one with the seasons of my area:

optimizing the use of air conditioning by running fans at night and building heat tolerance during the days (we set the A/C to only kick on at about 80F)Enjoying most of my showers outside, with free hot water from the 100 foot garden hose that happens to be coiled in a sunny spot

Cooling myself and get free energy boosts by jumping in the “cold plunge”, which is simply an unheated hot tub I have set up in my back yard

Doing most of my cooking and dining outdoors with an induction cooktop, gas grill, espresso machine, and mini convection toaster oven deal that I keep set up outside during the warmer months of the year

Drying 99% of my loads of laundry out on the line instead of using the clothes dryer

I even charge my car with a little off-grid array of solar panels set up in the driveway (from Craisglist, of course!), which gives me free electricity for driving without going through the permit-hell hassle of a full grid-tied system in my city’s currently solar unfriendly environment.

Even taken all together, these things are pretty small – the average combined gas and electric bill for my area is about $250 per month, while my usage adds up to about $75. So while we’re only saving about $30,000 per decade for what sounds like a lot of work to most people, I consider this to be the biggest win because I enjoy living in “MMM’s Energy Efficiency Playground” so much.

6) Local Living over Constant Travel

This little lake right behind my house is a great daily “vacation” which allows me to savor home life more and travel a bit less.

This little lake right behind my house is a great daily “vacation” which allows me to savor home life more and travel a bit less.“Hey, we’re having a big back yard pool party next weekend to celebrate Amy’s graduation from kindergarten, can you make it?”

“OH NOOOO!!! We will be off in at Disneyland that whole week! We planned the trip months ago, I wish we could make it!

As I type this in the height of the summer season, I really feel this effect at its fullest: almost all of my friends are off on trips, and my guest suite here at home is almost constantly full. People are traveling a lot, and many of them sound like they wish they could spend a few more of their precious summer weeks and weekends at home.

I’ll let you in on a little secret: you can! The trick is saying, “no thanks” more often to plans that involve you being away, and “yes please” to things that let you stay at home. The benefits are numerous: