Mr. Money Mustache's Blog, page 3

January 27, 2022

Reader Case Study: Is it Okay to Subsidize my Spendypants Adult Children?

It has been a good while since we’ve done a reader case study here on MMM, but that hasn’t stopped them from arriving in my inbox. And since 2022 is becoming a year of interesting financial changes, it’s time to spark things up again, go back to our roots, and start covering some of the many subjects that are cropping up in this latest incarnation of our economic world.

Today’s case study deals with family wealth, rapidly rising house prices, and a desire to be generous. What would you do in the following situation?

Dear MMM,As long-time readers, we have seen quite a few case studies written up here, but never one addressing the rather common issue of helping out family members.

I am a retired, married Navy veteran living in beautiful (but expensive) San Diego. While we are no great example of financial success, we do own a nice home, have a reasonably sized investment portfolio and receive a solid pension income. We are also fortunate to have our grown kids (and grandkids) living nearby. Which also brings up the problem/question:

Our eldest son is married with two very young children. He and his spouse both work in demanding careers that can sometimes lead to 12-hour days, which means that paid childcare is part of the equation, on top of the child care we are able to contribute as grandparents.

They were living in a very small condo and wanted to upgrade with the arrival of the second child. With house prices in this area skyrocketing, this was an impossibility for them. That’s where we came in.

My spouse and I offered to co-sign a mortgage and contribute a portion of the mortgage payment ($500 per month) until they can manage on their own. Fortunately, that small condo had almost doubled in value such that there would be equity to help with the purchase. So far, so good.

What we didn’t know was:

1. They had taken out a line of credit and spent a good portion of the home equity over these past few years.

2. Instead of transferring their equity from house one to house two, they were planning to spend the rest of it on renovations to the new house. Which means their new place will be almost 100% borrowed money, leaving them vulnerable or even underwater if we see another housing market correction.

Here is the main problem: their lifestyle is pretty much an exact opposite of the MMM way. They consume restaurant food, on average, 7 days a week. They spend thousands per month on daycare. They buy new stuff almost every day for the adults and children alike. I could go on, but in short, for the last few years they have probably been spending even more than they make.

I have tried to speak with them about financial planning, but they really do not want unsolicited advice – particularly from their parents. I should also mention that they are very intelligent, kind and wonderful people.

So, are we crazy to try and help? Thoughts?

Concerned Captain

.

Dear CC,

First of all I hear you! I can imagine your situation perfectly and I can see how frustrating that would feel.

If it’s any consolation at all, you are in very good company because a similar story plays out across the world thousands of times every day. In fact, it’s so common that there are several age-old pieces of wisdom which address it:

“Never Lend Money To A Friend (or Family Member)“

“If you do lend money to someone, think of it in your mind as a gift and kiss that money goodbye in advance.” You can still structure it as a loan and encourage repayment, but this way you won’t throw away the relationship along with the money in the event it doesn’t happen.

“Did you ever notice how banks will only lend you money after they carefully verify that you don’t really need it?“

.

With all that in mind, let’s dig into your situation a bit more.

First of all, as Mr. Money Mustache I may need to set aside my own opinions because they won’t help in this situation. But just to get them out of my system:

“WHAT?!? I can’t believe these people are buying anything other than potatoes, let alone doing $100,000 of renovations and living like multimillionaires in a situation where they are in multiple layers of debt and getting help from retired parents to pay the monthly bills!?

and

AAAUUUUGGGHH!!! With all due respect CC, why did you get into this arrangement in the first place? Adult children don’t need money from their parents except maybe in the case of severe medical emergencies!!!”

Okay, whew. That’s just me, and it’s one of many reasons I don’t even talk about money with friends and family members unless I know they already have the same philosophy as I do: that debt is an emergency, and thus you don’t spend money until you’ve actually got it.

On top of that, I’m a big fan of the idea of preparing for parenthood in advance, if you are young enough to have this luxury. In other words, do the 12-hour days and buckling down and hardcore saving in your 20s as a gift to your future self. That way, when you start a family around 30, both parents can afford to work part-time and share the burden of the real hard work: babies.

With all that off my chest, now for some more practical ideas:

In reality, your situation is not the end of the world, because everybody is going to be just fine in the long run, and family relationships are much more important than a few dollars here and there. On top of that, you’ve made this gesture from a position of love and generosity, which is the best reason to do anything.

What it really sounds like is that the two sides have a difference of expectations. You expected a certain level of military-inspired discipline and efficiency, while your son’s family – perhaps feeling stressed and overloaded by kids and work already – is trying to make life bearable and fun. And for many people, making purchases is a way to try to get that feeling.

So this difference of opinion creates tension between the Saver and the Spender. The Spender feels the judgment of the Saver, even if it is not spoken aloud.

And because of this, they will often try to hide their spending, or justify it based on life’s hardships, or emphasize their frugality – “look I got these baby clothes on Craigslist!” – whenever they do score a good deal on something.

The tricky part of this situation is that as the Saver, you have little to no control over the situation. You generally can’t guilt or shame the Spender into submission – he or she will just fight back. Any change generally has to come from their side, but it’s also entirely possible that it will never come at all, and that is something we Savers need to learn to live with. Or in some cases, live without if you choose to separate your financial lives.

What both sides can do is simply share your feelings in the least threatening way possible. For example:

Parents: “We are proud of your work and happy that we had the chance to support you. But to be honest, I am a bit concerned that you didn’t tell us about this line of credit until after we bought the new house.

Were you afraid that we would judge you and perhaps not help with the deal if we had found out?”

Son: “Yeah, we feel stressed too – I know that I have disappointed you with this support arrangement, but I am stuck between two immovable objects here – my parents, and my spouse and the wants of my family I am raising. Perhaps we could come to some sort of agreement or compromise?”

Parents: “Yeah, that’s a good idea. I want all of your family to know we love and support you, which is why we came up with this idea in the first place. Maybe we could agree that the this financial life support will continue for two years while you get up on your feet in the new house, and then you’ll be on your own. Then, after that period (February 2026), we can end the support payments. And you will have the goal of refinancing the mortgage so that we are no longer co-signers in it?

For our part, we will learn not to judge your lifestyle and spending or compare it to ours, and I hope this will show in the form of less tension between us.“

Son: “Yeah, that works for our family, if you and Mom can handle it!”

—

As long as everyone is an adult in this situation, I think it might give you the best outcome because you are focusing on trust, responsibility and some concrete financial targets (an eventual end of the support and a refinancing), which you can both live with.

A chance to get ahead

On top of this, the great news is that it sounds like there is plenty of room for improvement in your son’s lifestyle. Cutting out restaurants and home food deliveries alone can make a difference of $1000 per month in some food budgets, and other discretionary things can add hundreds or thousands more. In other words, if they choose to read and implement a few things from, say, the MMM Boot Camp series, they can end up with much more money even after cutting out the support money from Mom and Dad.

A Cautionary Tale for Everyone Else

Situations like this happen to almost everyone: you get into a business or financial arrangement with someone, and it turns out you have vastly different expectations.

And people like me are bound to have the worst surprises: as a natural “optimizer” of everything including money, I tend to notice waste a lot more than other people.

Leaving the window open on a winter day or a car idling on the street for half an hour are completely normal for some people, but to me they would feel like !!!BEES JAMMED UNDER MY EYELIDS!!! – it would be hard to even concentrate on anything else before I sprinted over to shut the damn window and turn off the damned car.

So if you are an optimizer, you need to work around this situation. Either don’t get into a relationship with someone on the opposite end of the scale in the first place, or learn to chill – which might be an even better outcome because chilling out is the ultimate life skill for people like us to learn.

License to Chill – What’s the Worst Case Scenario?

One thing that has worked for me is to set aside the buzzing bees of emotion and replace them with some cool, calm numbers. I’m often surprised at how things aren’t as bad as they feel. A few examples:

The open window feels like an emergency, but in reality how bad is it exactly? My calculations indicate that leaving a medium-sized window open for several hours is only about as expensive as choosing to drink one of the beers in your own fridge*.

I used to feel great frustration and rage whenever I saw a car left idling (sometimes even empty!) So I did the math on that too**. And as it turns out, even a full hour of your dumbass neighbor unnecessarily idling his car is only as bad as dumping one beer out onto the driveway. Sure, it’s a big dumb waste, but it’s not worth digging out the sledgehammer.

And back to CC’s situation: sure, you are subsidizing a lifestyle that is less efficient than your own. But $500 per month is still only $6000 per year, or 12 grand if you continue it for two more years.

I’m guessing that $12,000 over two years is not a catastrophic sum to you, and even if we stretch this example out for a decade, $60,000 sounds like a lot of money, but it’s probably only the amount that each your own house and your retirement stock portfolio will increase in value in a single year in the current market conditions.

So the worst case scenario is still not all that bad. Which means it’s not a huge emergency, which means that while the whole family does need to talk things out and come to an agreement, it can all be done from a position of strength and the emotions really don’t need to run all that high.

So, good luck Captain, and please let us know how it all turns out!

In the comments: do you have any similar situations in your own family? How have you been dealing with them? Do you have any advice for the Concerned Captain or would you do things differently?

—

*Open window vs beer calculation: Leaving a window open in winter will roughly double your home’s energy loss for that period it is left open. Since heating a house in a cold climate costs about $4 per day, the open window is actually only wasting about 17 cents per hour of heat! You could leave that sucker open for six hours and you still have only wasted the same amount of money as choosing to drink one of the beers in your fridge.

**Idling car vs beer calculation: If left idling, a mid-sized gasoline car burns about 0.3 gallons of fuel per hour, which is about $1.20 at today’s prices. Electric cars do much better still, keeping you warm (or cool) and entertained for only about 10-20 cents per hour, mostly for the climate control.

January 11, 2022

Inflation – Should We Be Worried?

I’ve been writing about money for almost eleven years now, and in that time the world has become an immensely richer place.

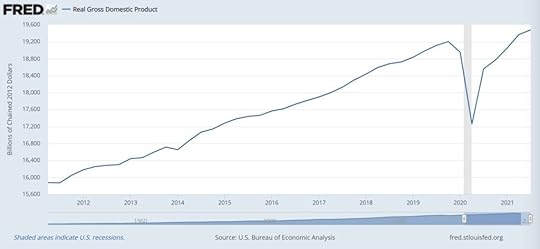

Here in the US, our economy has grown by about 25% even after inflation, world economic output has grown even faster, and the number of people living in extreme poverty has been cut roughly in half.

US Real Economic Growth over the Mustachian Era

US Real Economic Growth over the Mustachian EraIf this seems like just a fluke, you might be happy to learn that it is not. This is just the latest decade in a long era of increasing wealth. Here’s a similar chart, but zoomed out to cover the past 1.2 centuries and include the whole world:

World economic output, even after inflation. What’s your guess at what might happen next? (source: Our World In Data)

World economic output, even after inflation. What’s your guess at what might happen next? (source: Our World In Data)If you’ve been following the Principles of Mustachianism for a while now, you have probably noticed the same thing: “Gosh Darnit, it may just be a long run of good luck, but today I am richer than ever!”

By the Way: Are you new here and ready for the full zero-to-hero program on wealth and less-ridiculous living? I have set up a Free “MMM Bootcamp” email series which you can join here if you click the drop-down box and find the “bonus option”.

No spam, no courses to sell, just the 35-ish most useful articles from the entire history of this blog, spoon-fed to you on a weekly basis until you graduate.

.

For people who have combined solid money habits with this long economic boom, this means that early retirements have come even earlier than expected, and I have noticed the same thing: my own net worth has gone up several hundred percent since officially “retiring” in 2011. Sure, I’ve continued to live a Mustachian lifestyle and spend less than I earn. But most of the boost has come from the increasing value of productive investments including houses, shares in companies, and local businesses.

Still, throughout all this time, as the world churned on and we all got richer, I have received a stream of critical comments like this one claiming that Inflation is the critical flaw that means none of this is real:

Does Nick Have a Point? Is Inflation going to Kill us?

Inflation has been around since the dawn of money, so we know that it can co-exist with an increase in prosperity. But for the past few decades, the rate of inflation in most rich economies has been extremely low, which means it simply hasn’t been at the top of the news headlines.

Until today, when inflation has made a sudden return.

Suddenly, everyone from Ted the Conservative Senator to Chad the Newly minted Bitcoin Bro is going off about about how “The Fed is debasing our currency by printing too much money“, “We’re already seeing hyperinflation” and everything is just about to slide into the shitter.

So should we be worried?

Well, let’s start by ignoring the talking heads and opening up a proper graph of what has actually been happening:

Red line: overall inflation rate over roughly my lifetime.

Red line: overall inflation rate over roughly my lifetime.Blue line: same thing but with volatile food and energy prices stripped out.

Summary: inflation fluctuates, no big deal.

So it looks like this year, we are seeing overall prices rise at a 5-6% rate. More than the 2% we had become accustomed to, but far less than the 70s and 80s. But still, what does this really mean?

As always, Warren Buffett has a wise and concise opinion on the subject, paraphrased as:

“Over my lifetime, the US dollar has lost over ninety percent of its purchasing power. Yet even after adjusting for that inflation, the net output of our economy has grown by over twenty times – over 2000%”

So the opinions vary widely. But in order to form a valid opinion for ourselves, let’s just dive in and understand the underlying big picture. It’s surprisingly simple.

What Causes Inflation?

This part of it is quite intuitive: when too much money is chasing too few goods and services, you get inflation.

For example, If there is only one house for sale in town and you and I both really want it, we are going to place competing bids back and forth, and the seller will let it go to the highest bidder.

Houses are the perfect illustration of supply and demand, because people want them so much that they will go nuts trying to outbid each other, and thus the prices can get high. When this happens, economists say that the demand is inelastic.

Meanwhile, some things are considered less essential, which means our demand for them becomes more elastic. If you’re accustomed to buying bananas at 69 cents per pound and suddenly the price jumps to $2.99, your response is likely to be

“TWO NINETY NINE!!!?? FUCK THAT WHAT KIND OF DAMN FOOL DO YOU TAKE ME FOR? I’ll just skip the bananas this week.”

Demand becomes even more elastic if we have the option of substitute goods. If you have just finished cussing out the $2.99 bananas but then see a pile of 99 cent per pound apples, you will likely just switch to the new fruit this week. And then do the opposite next week if the price trend reverses.

Price Competition

Meanwhile, all of this decision-making goes on in reverse on the other side of the cash register. If Pete’s Grocery store tries to jack up its banana prices to $2.99, but Jill across the street is still offering them for 99 cents, people will just vote with their wallets and Jill will get almost all the business.

Elastic Supply

On the other hand, if there is a worldwide shortage of bananas, then there just aren’t enough to go around. This causes more of that “selling to the highest bidder” we saw with the houses above, which means the wholesale prices that all the grocery stores have to pay goes up. Does this mean $2.99 bananas forever?

In the short term, yes. Bananas take a while to grow, so when you harvest them all, they are gone.

In the long term, no. A tripling of the price of bananas means that the whole banana industry is now more profitable, which means more farmers will choose to plant bananas. Over time, the supply will rise and price competition will work out the kinks of the system.

In other words, in the longer term the supply of almost everything is elastic – if the price of something rises, more of it will eventually be produced. And then even more, and sometimes so much that the prices go back down below where they were in the first place.

The magic of economics is that in the long run, prices for almost anything compete themselves all the way down to the point where it is barely profitable to make a product. And this is why over time, life keeps getting cheaper and our standard of living keeps rising. Despite the fact that inflation keeps happening in the background.

Why Inflation does NOT mean we are getting poorer

If the price of bananas doubles, and your salary doubles, nothing has really changed: you can still afford exactly the same number of them. And with typical inflation, this is exactly what happens: the prices of everything gradually rise, including the price of labor (aka YOU), which means your paycheck rises.

Even if you’re retired and living off of your investments, inflation is typically harmless: the prices of assets (like houses, buildings, or slices of businesses known as “stocks”) also inflate right along with currency, so you are at least as well-off as before.

Even better, if you are a borrower, inflation actually helps you: If you borrowed $300,000 for a house ten years ago that is now worth $600k, the full value of the house is yours but the bank only expects their 300k back.

In the Long Run, Technology And Trade are Deflationary

I bought my first Windows PC (a 486 DX2-80) as an Engineering Student in 1994 at the staggering cost of $2600 ($4800 in today’s dollars!) Today, there is more processing power in a six dollar WiFi smart outlet. And the $1200 high-end laptop I’m using to type this article would run laps around the CIA’s grocery-store-sized mainframe computers from the nineties.

When I was a kid, a gallon of milk cost four dollars (about ten bucks today). But you can still get a gallon for only three of today’s dollars in any grocery store. When my mom took me back-to-school shopping in 1984, I remember her wincing at the forty dollar price tag of Levi’s jeans, and today jeans are often under $20.

On and on the list goes: in the nineties a car that could hit 60 MPH in four seconds was called a “Lamborghini” and cost $250,000. Today that’s a base model Tesla that holds five people, costs five times less, never needs an oil change, and costs about eight bucks to fill up with 360 miles of electricity. Appliances are better and cheaper. Yesterday’s top luxuries are dumped on today’s Craigslist for almost free. University tuition is rising but education is far cheaper than ever. Medical procedures and doctor salaries are going up, but being healthy is cheaper and easier than ever – thanks to the wealth of free knowledge on what’s actually good for us.

And this trend is only getting started – technology is on an exponential curve and we are just starting to see its steepening trajectory right now.

Why S ome Inflation is Good:

So, inflation is good for borrowers, neutral for investors, and it’s only bad for people who are either holding cash, or stuck with an income source that does not keep up with inflation.

But it’s also good for the economy in general. Why? Because if people expect that prices will rise slightly over time, it encourages them to spend and invest right now. If prices are stable or dropping, we have an incentive to wait as long as possible to make a purchase, to get the lowest possible price. This isn’t just hypothetical – deflation has been happening in Japan for over 20 years, and has been a core part of that country’s chronic economic problems.

Because of this, the central bankers that pull the strings behind our economy (Federal Reserve bank and the Treasury) generally work together to engineer a controlled rate of economic expansion and inflation over time. If things get too hot, they slow it down by raising interest rates. If we have a harsh recession, they do the opposite and drop interest rates as well as “printing money” to purchase bonds, loans, sometimes even stocks in order to prop up prices and re-start the economic engine. This practice is controversial at times, but as you can see from stock and house prices, company profits and “Now Hiring” signs everywhere, it does work.

And Then Covid Hit

At last, we’re ready to understand what is happening right now, how we got here, and what will happen next.

So we cruised our way through the 1990s, 2000s, and 2010s with lots of economic growth. There were occasional shocks (the Great Financial Crisis of 2008 comes to mind), and yet somehow the world cranked on.

Until March 2020, when the entire world conducted an unprecedented experiment:

We shut down many of our businesses, factories, and shipping ports.While simultaneously giving everybody free money and lowering interest rates in a (successful) bid to avoid a second Great Depression.Item (1) is still having ripple effects: as different governments impose and lift lockdowns and quarantines, factories and shipping ports are still not up to full speed.

Then item (2) multiplied those effects because we were all stuck at home with extra money, meaning we spent less on restaurants and more on stuff from Amazon, appliances, new cars, and so on.

And on top of that, the low interest rates made house payments more affordable, which allowed people to leverage even further to bid up prices of scarce housing. Businesses did the same, trying to expand and competing for the same scarce supply of products as everyone else.

While the pandemic itself took everyone by surprise, the aftermath has been completely predictable and straight out of an Economics 101 textbook. Which makes me happy, because Economics has always been one of my favorite fields.

So What Happens Now?

The first rule of this situation is the same as all other situations: don’t panic, and enjoy this whole journey as a learning experience. Prices will fluctuate, and the world’s economy will adjust accordingly in the coming years. You and I will continue to prosper.

The big picture magic is already starting to happen: supply chains are starting to untangle themselves, and companies are making big new investments to increase production. Despite the rumors of “all the jobs are going overseas”, the opposite is actually happening. Intel is building $20 billion worth of factories in Arizona to address the world’s semiconductor supply, and Austin Texas is now home to what will soon be the world’s biggest automotive factory. These are just two of thousands of similar projects around the world right now.

Meanwhile, while the big picture sorts things out slowly, you can also make some immediate changes in your personal financial life:

Don’t look at Prices, look at Relative Prices

Don’t get anchored on those 69 cent bananas, because 79 cents today may be exactly equal to 69 cents a few years ago. The real price has not risen, the currency has simply decreased slightly in value. What really matters is the cost of your lifestyle, as a percentage of your total income.

Your salary should also be rising. At least keeping up with inflation but ideally much faster if your skills are growing. If you don’t see this, negotiate a raise and simultaneously start shopping for new jobs.

For retired people like me, it can be helpful to compare the price of necessities to the value of my investments. I happen to have most of my wealth stored in the overall stock market through the VTI index fund, which has risen over 18% in the past year. Since consumer prices are only up about 6%, in reality everything should now feel about twelve percent cheaper to me today than it did even after this record year of inflation!

On top of that, you can always take some steps to lower your own “personal rate of inflation” even more:

Substitute things to create happier days and lower costs.

If steak is getting more expensive, make something else for dinner. If gasoline prices are spiking, just plan your life to include more local activities and less driving. Also, electric cars, electric bikes and regular bikes are a big upgrade over traditional cars in every way, and you’ll never care about the price of gas again.

Delay expensive things.

As a carpenter, my favorite hobby was hit by a massive spike in lumber prices last year. But I happened to have a long list of metalworking projects on my to-do list, and a sizeable pile of steel already sitting around. So I spent 2021 building all of the elaborate fences, balconies, gates and railings that I had been procrastinating on, and now enjoy the results every day. Meanwhile, lumber prices eventually dipped over the summer so I stocked up at that time too – and now I’m good for another year of hard work and creativity.

And so concludes our lesson on the current ‘scare’ of our news cycle. As always, it’s an opportunity for learning rather than worry, and even more importantly: you have more control over it than you might think.

So here’s to 2022 – a year of happy Growth in all dimensions!

In the Comments: Have you been affected or at least concerned by inflation? Are the news headlines or conversations with your friends and colleagues making you feel better, or worse about the current economic trends?

October 5, 2021

Our DIY Heat Pump Install – Free Heating and Cooling for Life?

A work of art.

A work of art.To most of the Internet, Mr. Money Mustache is known as the quirky early retirement financial guy, and this is a blog about Money.

But really, I’m not a finance guy – someone who devotes most of his time to optimizing money. I’m more of a general Life Engineer – someone who tries to optimize everything that is fun and interesting in life, and money is just one of those things.

Optimizing means getting the most good out of something – whether it is money, time, health or happiness, while minimizing waste. This is what allows us to make win/win decisions (for example things that make you richer and healthier and happier), rather than win/lose compromises (giving up something you actually like, just to save or earn more money)

One of these win/win things for me has always been optimizing my own houses and buildings to be more comfortable and stylish, while costing less to own and maintain and heat and cool. After all, out of all possible decisions, your choice of home may have the biggest effect on both your financial and emotional wellbeing. Get a reasonable house that is close to your friends and your work, and you’re off to a great start.

So anyway, this past summer all my favorite factors of optimizing, learning, effort, saving shit-tons of money and reducing loads of waste and pollution came together in the form of a DIY Heat Pump Installation on our commercial building downtown, the home of MMM HQ Coworking.

Why Are Heat Pumps Super Exciting?

Heat pumps are a technology that has recently jumped into prime time and are about to change everything about houses, just as the iPhone did to the tech industry about twelve years ago and just like electric cars are doing to transportation right now. The reason is that they have these fundamental advantages:

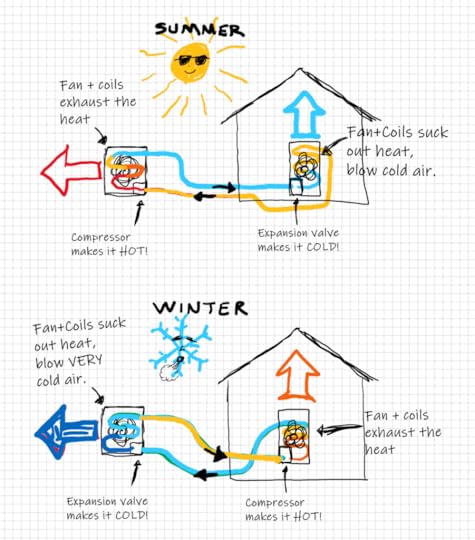

Heat pumps do the double-duty of heating and cooling any building way better than our existing systems do, but with only one machine.They are super easy to install, and way cheaper to run. They also allow houses and buildings to be constructed more cheaply (less materials and labor).They eliminate a big part of the world’s pollution that is caused by burning oil or gas for heat (as long as you get your electricity from clean sources).And yes, nowadays they work in virtually all climates (down to -20F / -29C): tech improvements have shattered the old limitation where they only worked in places without a real winter.How Does a Heat Pump Magically Suck Heat Out of Cold Air?

Heat pumps save money and energy because they aren’t generating heat directly like an old electric baseboard heater. They are mostly just moving heat around – from inside to outside in the summer, and from outside to inside in winter.

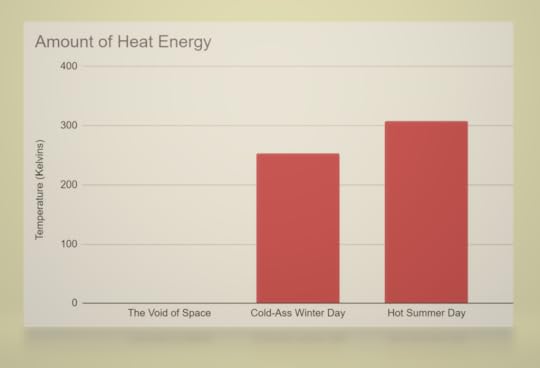

To many people, that second situation sounds like magic, but that’s just because of our skewed perception as human beings – a creature that evolved in the warm tropics of the planet Earth. Really, there is plenty of heat even in winter air – if you view it through the Eyes of Physics:

Every spot on our life-nourishing Earth has loads of heat energy (Kelvins), which means it’s easy to harvest some of it.

Every spot on our life-nourishing Earth has loads of heat energy (Kelvins), which means it’s easy to harvest some of it.So, a modern heat pump can easily suck loads of heat even out of air that feels cold to your skin. It does it like this:

Summer vs. Winter modes of a heat pump. The key to everything – fridges, A/Cs and heat pumps – is that the refrigerant gas gives off heat (gets hot) when you compress it, and absorbs heat (gets cold) when you expand it.

Summer vs. Winter modes of a heat pump. The key to everything – fridges, A/Cs and heat pumps – is that the refrigerant gas gives off heat (gets hot) when you compress it, and absorbs heat (gets cold) when you expand it.You know what else does this exact same trick? Your own FREEZER! Those things typically maintain an inside temperature of about -10F, which means that somehow it is sucking heat out of the air even at sub-zero temperatures, pumping it out to the coils underneath with a fan blowing past them. And if you put your hand there to feel that airflow, what do you feel? Warmth!

Show Me The Money

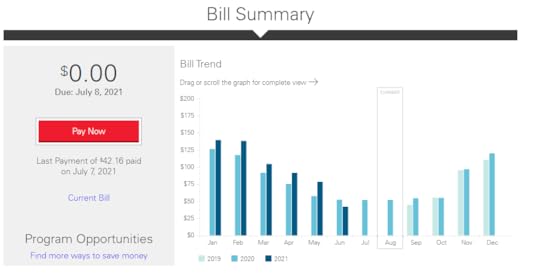

Here’s our gas bill history – Yuck! Most significant is the fact that the monthly fee-for-nothing ALONE had risen to $40. $480 per year before you even get any heat out of it!

Here’s our gas bill history – Yuck! Most significant is the fact that the monthly fee-for-nothing ALONE had risen to $40. $480 per year before you even get any heat out of it!Before we get into the real details, check out the quick numbers for the heat pump I just installed. Note that I live in Colorado, which has lots of heat and a moderate amount of cold – right about what you’d expect from our position halfway between Maine and California.

Cost of the system including all install materials: About $4500My building’s previous annual gas bill: $951Our new annual electric bill for heating and cooling (estimated): $275Annual savings: $676Annual return on investment (ROI) rate: 15%

.

Even better: That $275 annual figure for our electricity consumption is what we would have paid, if we had to buy all our electricity off the grid at 10 cents per kWh. But since we generate a surplus of power from our DIY solar array, our net cost is much less than that.

You could even say that all of our heating and cooling is “free” on an ongoing basis, although we did spend $5000 to build the 5.5 kW solar setup in the first place.

So Is A Heat Pump Really a Do-It-Yourself Project?

Our installation team celebrates at the end of a successful project. To be fair, Mr. 1500 and I are both pretty experienced tradesmen, but this felt like a relatively easy project to us.

Our installation team celebrates at the end of a successful project. To be fair, Mr. 1500 and I are both pretty experienced tradesmen, but this felt like a relatively easy project to us.In a word: Yes, if you are a fairly competent do-it-yourselfer, and you choose a DIY-friendly heat pump kit. It is considerably easier than installing a gas furnace or a metal roof, but not as easy as putting together IKEA furniture.

Our first install took about 16 person-hours of work for the main job (two people working a full day). Plus I spent about another sixteen dusty hours upgrading the duct work and building custom metal shapes to route the air because our coworking building was so old that the original asbestos-and-mouse-shit ducts were just not worth keeping.

Hmm.. Okay yeah I think I’ll go ahead and replace these ducts.

Hmm.. Okay yeah I think I’ll go ahead and replace these ducts.The value of doing it yourself is that furnace work is one of the biggest returns on your time as a homeowner. Where I live, even a gas furnace + air conditioner replacement can cost $10,000. And although a heat pump hardware only costs about the same amount as conventional furnace+AC ($4000), the companies like to charge more for the newer stuff (or even worse, try to convince you that you’re stupid for even asking about it!).

In other words, even conservatively speaking, for a basic installation you are saving about $6000 in exchange for doing that 16 hours of work, which amounts to a solid $375 per hour.

But Wait! Don’t forget about Rebates!Even if you’re not a tinkerer, there are some good programs out there that will help subsidize the cost of an upgrade like this. The US EPA offers federal tax credits for lots of things including heat pumps, and local agencies have their own programs – for example neighboring Fort Collins will chip in $2200 towards a unit like ours, which could cover most of the cost of a professional installation.

.

So if you are ready to upgrade to a heat pump, you either need an honest HVAC company who will install a reasonably-priced machine for you and charge you a reasonable hourly rate. Or, you need to flex your Money Mustache Muscles on the project and do it yourself.

Of course, I chose the latter approach as always, so let’s get into the details of or install!

Step One: Pick a Heat Pump

There are two things you’re looking for here: physical size and heat output.

The size and shape of indoor portion (the air handler) of the new system have to be similar to your old furnace, or you need to have a plan for how to adapt the new one to blow into your old pipes. As you’ll see below, I chose to do the adapting.

As for the heat output, old furnace was a “100,000 BTU” unit, which is a measure of the amount of natural gas it can suck in and burn each hour. Since it was only about 75% efficient, the heat output was about 75,000 BTU (the real units here are the archaic “British Thermal Units Per Hour”, but all you really need to know is that this is still more than enough to keep our leaky, sprawling 2400 square foot brick building warm easily through even the coldest winters.)

In the most extreme situation (for us this would be a 24-hour period where the temperature is barely above 0F, and it typically does happen at least once every few years), I measured that our old furnace was running for about 8 hours per day, which means our average heat loss was about 25,000 BTU on a continuous basis (75k multiplied by ⅓ of the total hours in a day)

On the cooling side, we had virtually no air conditioning. Just a few crappy portable units scattered throughout the building, with a total combined cooling power of about 20,000 BTU. This wasn’t quite enough to beat the heat in the event of a fully occupied building on a 100F day.

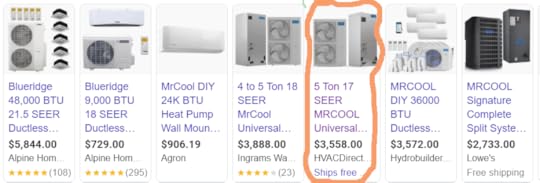

The solution for me was thus pretty simple: the biggest Mr. Cool “Universal” combined heat/cool system, which I started conveniently seeing Google ads for everywhere once I started my research. This beauty is good for about 60,000 BTU of both heating and cooling, which could also be expressed in the even more archaic form of “5 tons”

So I bought the circled option above. In my case, I placed the order through Home Depot website, with the free “ship to store” option, but you could also try your local Lowe’s, Alpine Home Air is good, and Ingrams now sells this unit (including the required 25 ft lineset) through Amazon.

Step Two: Remove your old furnace

This part was pretty easy – except carrying this old block of iron out of the basement.

This part was pretty easy – except carrying this old block of iron out of the basement.Safety tip: Make sure you turn off both the gas and electric supply to your furnace before messing with it, as well as opening some windows and running a fan to clear out any remnants of gas as you disconnect pipes.

But once you have it safely disabled, it is as simple as carefully un-wrenching, unscrewing, and cutting away parts of the old furnace (while carefully preserving your existing ductwork) until you have the old one fully removed. You can sell or give it away on Craigslist, or drop off for free at a metal recycling facility.

Farewell old furnace, may your steel find a fun new life somewhere else.

Farewell old furnace, may your steel find a fun new life somewhere else.Step Two: adapt the ductwork as needed

Top Left: an output air adapter box I made to channel the air out to the right places. Right: A prefab filter/input box I bought off of my neighbor (who is also a builder). Bottom: You can see where the two things fit into place along with the horizontally installed heat pump air handler.

Top Left: an output air adapter box I made to channel the air out to the right places. Right: A prefab filter/input box I bought off of my neighbor (who is also a builder). Bottom: You can see where the two things fit into place along with the horizontally installed heat pump air handler.If you’re lucky (the old furnace and new heat pump are almost the same size), this step will be easy. You just connect the return ductwork to the bottom of the machine, and the supply ducts to the top. However, I was not lucky.

Because our basement ceiling is so low, I had to install the heat pump horizontally (it is designed to allow this), and then build some adapters to allow the air to flow the way I needed. On top of that, most of our ducts were falling apart and poorly shaped and useless – so I repaired or replaced a bunch of them while I was in the process. This took a lot of work, but my biggest allies were a huge roll of wide, reinforced silver tape, and simple sheet metal tools like shears, angle grinder, self-piercing screws, a good breathing mask, headlamp and work gloves.

[image error] Here’s yet another adapter I made to channel some of the air supply. The curvy box below was salvaged from the old ductwork, but I added the end cap and two 7″ air outputs to break this stream of air off to serve two different parts of the building.Step Three: Fit in the new heat pump

Duct fitting in progress. Okay, I admit this is looking a bit patchy, but it works great! Work like this is a tradeoff between time, cost, and beauty. Since this is in an old building that is probably going to be demolished and replaced with a luxury mixed-use apartment complex when we sell it, I try to keep things functional but simple. In a high-end, permanent house, you’d take more time to make the ducts pretty.

Duct fitting in progress. Okay, I admit this is looking a bit patchy, but it works great! Work like this is a tradeoff between time, cost, and beauty. Since this is in an old building that is probably going to be demolished and replaced with a luxury mixed-use apartment complex when we sell it, I try to keep things functional but simple. In a high-end, permanent house, you’d take more time to make the ducts pretty.Aside from the fact that the thing is heavy (ours was around 250 pounds), this connection is surprisingly easy once you have the ducts ready. You just screw and seal the sheet metal boxes to the bottom and the top of the heat pump. And at this point, you should be getting excited because the end is in sight.

Step Four: Place the Outdoor Unit Where You Want It

Since the outdoor unit is another 300 pounds, you’ll want a high quality dolly and some ratcheting straps, as well as a strong friend nearby to help you wrangle it into place. Your goal is to put this thing somewhere beside your house that is out of the way, but also close to wherever you just put the air handler in the basement. Then you need a lineset that is long enough to connect them together – and shorter is generally better for both cost and performance reasons (we used a 35 footer).

We put our condenser on a couple of sturdy, level concrete pads.

Step Five: Run the Lineset

[image error] You need about a 4″ hole in your house in order to feed through the insulated lineset. Since our building is made of brick, I needed this crazy masonry core bit – hopefully yours is easier! NOTE: this is an in-progress pic, later I covered these lines with a protective steel box.The lineset is a pair of flexible copper tubes that are wrapped in insulation. They are bulky, so even our 35-foot set came in a BIG roll the size of a big-screen television box. You need to carefully unroll and straighten it, and feed it in through a roughly 4” hole you drill in the side of your house so you can connect the condenser outside to the air handler unit inside.

We had the added challenge of having to punch through an eight-inch-thick BRICK WALL, so I had to spend some good workout time wrestling with this massive concrete core driller, mounted to a high-torque low speed drill.

Wrenching on the lineset before releasing the gas (and then testing for leaks). There are just two nuts at each side of the line.

Wrenching on the lineset before releasing the gas (and then testing for leaks). There are just two nuts at each side of the line.Once the lineset is in position, the connection is refreshingly easy: you carefully follow the instructions to tighten on the right nuts with a wrench, open some valves with an alan key, and you will hear the refreshing PSSSSssssssshhhhh as the refrigerant is released into the system. (This is the part that an HVAC technician would normally have to do, Mr. Cool gets around the issue by using special valves and having pre-charged linesets. More expensive, but very much worth it for the time and labor savings!)

Final Step: Run the Electrical Wires

Drilling a hole for the electrical wire (which we ran in a conduit, the new 40-amp breaker, inside unit wiring including thermostat, Carl celebrates completion of the outdoor unit wiring.

Drilling a hole for the electrical wire (which we ran in a conduit, the new 40-amp breaker, inside unit wiring including thermostat, Carl celebrates completion of the outdoor unit wiring.This will vary depending on the system, but ours called for the following wiring, which I subcontracted out to my partner Mr. 1500:

A 40 amp / 240 volt circuit to the outdoor unit (which simply means running a length of 8 gauge wire and adding a 40 amp breaker to the box).A 20 amp / 240 volt circuit to the main unitStandard six conductor thermostat wire between indoor and outdoor unitsAnd finally, a run of the same thermostat wire between the indoor unit and your thermostat. We took the opportunity to upgrade to the super-lovely Ecobee Lite smart wifi thermostat , which I now use (and love) in all my projects.The Victory Lap: Fire It Up!

It’s Alive!

It’s Alive!We cranked through all of these steps carefully and then flipped on the breakers with great fanfare: SUCCESS! – The Ecobee lit up and started guiding us through its setup screens. Once complete, we slid the desired temperature way down in hopes of experiencing some much-needed Air Conditioning on this hot July day.

And nothing happened. We ran out to the outdoor unit and found it was just sitting there, with LEDs illuminated but nothing else happening.

We both started sweating bullets. Had we made a foolish mistake and bought a faulty unit? Did we screw something up in the install?

Nope – it turns out there is simply a three-minute delay between that first activation and the time Mr. Cool starts his cooling. Very slowly and with great grace, the big fan blades began to rotate, graaaaadually speeding up, with the hum of the compressor so quiet in the background that I had to press my ear up to the thing just to verify that it was really working.

But boy was it ever working – we ran inside and found that that icy cold air was just blasting out of each of the seven large vents spread throughout our building, and baking hot air was now shooting out of the outdoor unit. We had instantly beat the summer heat and everybody inside raised a cheer to this new luxury.

Epilogue, Three Months Later: How Well Does It Work?

Throughout the rest of the summer, we have had a lot of fun putting this system through its paces, and it has proven itself to be an incredible cooling machine. We had several events with over fifty hot bodies packed in for some of our entrepreneurship and social gatherings while outdoor temperatures were in the 90s – and we were able to maintain comfort effortlessly.

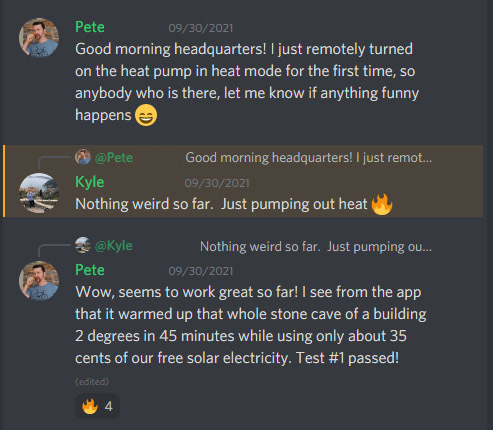

The next test will of course be the winter. Here in early October, we have just turned the corner where the building has required just a bit of heat to start some mornings. With a few taps on the Ecobee phone app, I was able to flip the system over to heating mode and give it a whirl. It worked great – heating the building quickly and quietly.

But I’ll update this article over time as we move through cooler seasons. I expect it to continue to perform just great – but it will be fun to verify and reassuring to skeptics out there once we see it with our own eyes.

Extra Cool Detail: How Much Electricity Does It Use?

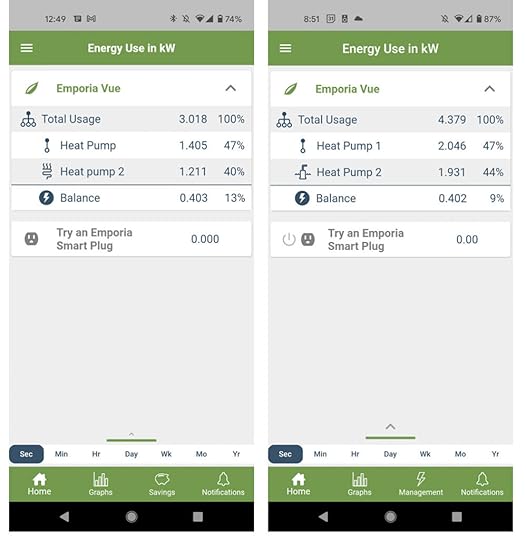

Screenshots from the Emporia energy tracker app

Screenshots from the Emporia energy tracker appOf course, being MMM I was not content to just sit back and soak in the cool breeze of accomplishment just yet. I needed one final bit of data – a record of just how much energy this heat pump was sucking down in both heating and cooling modes, so we can get a better estimate of how much money it is saving us over the years.

So I installed a system called the Emporia Energy Monitor into the circuit panel, which is currently the best value on the market for such a well-designed gadget. This allows me to track and record the full details of the energy flow – through every circuit in the house if I choose to do so. For now, I just have it watching over the heat pump.

What I found is that in cooling mode, the Mr. Cool uses about 2600 watts on an ongoing basis (about the same as two large window air conditioners), which translates to 26 cents per hour of electricity. On the hottest days with the most people, I found the system ran about six hours, meaning our peak electricity use was only about $1.50 per day!

To me, this was pretty remarkable – this was a 95 degree day with 50 people in the building, roughly equivalent to trying to cool a mid-sized restaurant in Texas. Yet even if we repeated this extreme situation every day, we’d rack up an air conditioning bill of only about $45.00 per month!

I found that the heating mode was a bit more thirsty, with consumption at 4000 watts, or 40 cents per hour. Based on my earlier estimates of heat loss on the coldest possible days, we could be in for about 18 hours of runtime per day, which would be $7.20 of electricity. So, if the Headquarters were moved to an extremely cold climate and plunged into neverending 0F / -18C conditions for an entire month (which would make it colder than Duluth Minnesota or Ottawa Canada), we’d still face a heating bill no higher than $210 for the month. But in more realistic conditions for Colorado, we would expect about half of that level of energy consumption. And of course this is only for the month or two of our short cold season. For the rest of the year, heating is even easier.

Conclusion: Heat Pumps Are The Bomb

So there you have it: we dreamed about it for years, finally did it, and I could not be happier. It is such a joy to not even have an account with the gas company, and to know that this part of our expenses will be zero, forever.

And of course it’s even better to know that even the electricity cost numbers in this article are just for your own comparison – in reality, we make more than enough solar electricity run this whole thing for free just from the pretty squares of black glass on the roof. Free heating and cooling for life, with no pollution (with free operation of our laptop computers and beer fridges, and free charging of our electric cars to boot) – This truly is the way of the future!

In The Comments: Do you have any questions about heat pumps or other home efficiency products? And if you have a heat pump of your own, what do you think of it?

July 25, 2021

Three Months of Slacking

Unsuccessfully but Refreshingly trying to climb the local waterfall

Unsuccessfully but Refreshingly trying to climb the local waterfall

“MMM, are you still alive?”

– somebody on Twitter

Holy Shit! I just realized that the last time I wrote a blog post for you was on April 18th, and now it’s late July. That’s an entire quarter of a year that I have let this wonderful, golden field of interesting opportunities and people sit untended.

How could Mr. Money Mustache, a reliable stalwart of bossy financial advice since 2011 and usually good for at least one post per month, have drifted so far from his original dedication? It’s a question that earnest fans have been asking, and that I have even started asking myself.

When you break out of any habit, it can be hard to get back into it: the psychological barriers start to stack up and the pressure rises and you find yourself waiting for more and more unattainably perfect conditions that, surprise surprise, never really come.

If it’s a workout habit that you have broken, you might tell yourself,

“Oh, I just need to get over this injury or this cold… And then my Mom is visiting next week but after that I’ll be ready to get back to the gym.“

With my blog-writing hobby I make excuses like,

“Oh, now that it has been so long, I have to wait until I have something really interesting or worthwhile to say.

And yeah okay, maybe I have a few articles like that in the drafts folder, but those ones take a lot of thinking and focus to write, so I’d better wait until I am feeling really smart and focused to crack into that subject.”

But in both cases, the correct solution is just to say,

“Fuck it. I am going to just do something towards my goal, no matter how tiny.”

To get back in shape, you just need to start with at least a few pushups, which you can do right now on the floor of your office or kitchen. To resurrect the MMM Blog, Mustache just has to type some shit into the computer, and heck, why not just an easy breezy article telling you about some of the interesting things I’ve been doing in lieu of blogging?

Some stories from a real life of early retirement, which may be more relevant than plain old financial analysis and reader case studies anyway. And once we’re all caught up in life, maybe it’ll be easier to keep in touch on a more regular basis henceforth.

So in fairly rapidfire format, here’s what I’ve been up to this spring and summer:

1) Renovating The Shit Out of Our New Two-House Compound

We found the previous shower had been leaking for years and creating the most interesting scene of decay. We tore out and rebuilt the whole area, and cut in a nice window for good measure.

We found the previous shower had been leaking for years and creating the most interesting scene of decay. We tore out and rebuilt the whole area, and cut in a nice window for good measure.You may recall that back in January, I teamed up with a friend to buy the house next door, with cash, at a below-market price. Once she moved in, we realized that it needed even more renovations than we originally planned. So I’ve had a joyful time tearing down walls, framing in new windows and doors, reworking the floorplan and changing the wall surfaces, as well as fixing the shoddy plumbing and electrical work that was found along the way.

On my own house right next door, I’ve been going just a bit wild with metalworking, making all sorts of fences and decks and even a “Juliet Balcony” which features a fireman pole allowing me to slide quickly down from my master bedroom to the ground where we have a shared hot tub between our properties – in case of Hot Tub Emergencies, of course.

Cutting a giant hole in the back of my house (in February!), adding a sliding door where there was previously only a silly little shitty window, then many fun, casual days of metalworking. The last pic is my side deck, which I built mostly out of wood but also features lots of metal and a fun little outdoor kitchen including coffee machine and induction cooktop!

Cutting a giant hole in the back of my house (in February!), adding a sliding door where there was previously only a silly little shitty window, then many fun, casual days of metalworking. The last pic is my side deck, which I built mostly out of wood but also features lots of metal and a fun little outdoor kitchen including coffee machine and induction cooktop!2) Working on a Pretty Big Documentary Project

Hmmm.. something seems different about the HQ kitchen.

Hmmm.. something seems different about the HQ kitchen.I have said for years that I would never do it, but somehow a very persuasive filmmaker who has made some documentaries that I really respect, roped me into helping out with a probably-pretty-big documentary.

I did a casting call in March and found a couple that I am now coaching and working with throughout 2021. The film company doesn’t want me to talk about it much until they are ready to announce it, but suffice it to say that it is taking a lot of my time and energy, which comes out of what would otherwise be my blog-writing time budget.

However, this is the good kind of hardship – forcing me to experience things I wouldn’t otherwise get to do, and the end result will be reaching a lot more people than I could by just writing on this website alone. My fingers are crossed that it will come out the way I hope!

3) Switching 120,000 Underserved MMM Email Subscribers over for Better Newsletters

Easier signups, and better eventual emails.

Easier signups, and better eventual emails.Since the beginning, I’ve mostly ignored the fact that I sorta have a list of email subscribers, with predictable lackluster results. People were able to subscribe and unsubscribe themselves automatically, and the only thing it got them was an automated mailing of any new blog articles on the day that I posted them. The emails were poorly formatted, people who had non-gmail addresses often had trouble subscribing, and many probably wondered why I couldn’t make it work better.

Thankfully, a mini-crisis happened that has forced me to do the work to solve this problem, at last: Google announced that they were shutting down the aging Feedburner email service, so all of the old-school bloggers like me who were still using it were forced to migrate to a more modern platform.

I did some research, and in the end I decided to go with a higher-end option called ConvertKit, which is one of the most popular email services. It can do a lot more cool stuff, and I have taken advantage of this to create an automated (and free of course) “MMM Boot Camp” email series that people can sign up for.

It’s just a curated feed of some of my most useful articles (about 35 out of the 500), which automatically go out to people once per week until they have graduated, so you’d think it would be pretty easy for me to create this.

But as I read through my old stuff, of course I realized that much of it was crappy and outdated so I ended up partially rewriting every one of those 35 posts as I went through, which took some time. The good news is, the updated versions are here on the website as well, so the work should benefit anyone who happens to read them in the future.

4) Having lots of Fun Times (and Hard Times) In Real Life

Just another cool sunset/storm in my back yard, taken during the traditional Evening Walk.

Just another cool sunset/storm in my back yard, taken during the traditional Evening Walk.I’ve had a series of wonderful visitors who came and stayed at my house, sometimes for a week or more. Friends and I have hosted some big events at the HQ Coworking space, which left me both energized and drained at the same time. Then I got Strep Throat in mid-July, which knocked me out for the count for a full week or more – even well after the antibiotics worked their magic, I have still been having some ups and downs with energy.

And then of course there’s the heat – I am always more energetic in cool weather (The typical 50 degree sunny days of a Colorado winter are some of my favorite for outdoor work in t-shirt and jeans). So the summer season here is always a challenge for me, with an endless procession of cloudless 95 degree desert days making me resent the very Sun I normally worship so much. I’ve been taking refuge indoor more than I should, hiding in my air conditioned house and making excuses and accomplishing less because of it. At least this has led me to the keyboard today, to write this blog post.

5) “Cutting the Pipe” at HQ and Installing a Giant Fancy Heat Pump system.

I had fun working alongside my co-owner Mr. 1500 for this work. Everything was easy about this install … except rebuilding some of the filthy century-old ductwork we found once we took out the old furnace.

I had fun working alongside my co-owner Mr. 1500 for this work. Everything was easy about this install … except rebuilding some of the filthy century-old ductwork we found once we took out the old furnace.Since I first bought the building in 2017, the MMM-HQ coworking space has been limping along with a clunky decades-old gas furnace, a gas water heater that was about 20 years overdue to spring a leak, no central air conditioning at all, and very high utility bills due to the way our local gas company charges commercial customers.

When you combine these irritants and contrast them with the fact that we happen to have a glorious DIY solar electric array on the rooftop that makes a surplus of power, you can see why I would be itching to tear out all the gas appliances, cancel the service account permanently, and install all-electric replacements that are more efficient and will also save an estimated shit-ton of money each year.

I’ll save the full details of this for my very next blog article, but as a spoiler: we found and successfully installed a unit that should be able to cool and heat our building year-round, is very DIY-friendly, and cost only about $4000 to buy. It should prove to be a great annual return on investment, and I am excited to start installing these things on all of my properties and those of any friends who are doing upgrades.

And with that, I’d say we are all caught up.

In the comments: what have YOU been up to these past 3 months? And what subjects do you think we should be covering here on MMM in the next three?

April 18, 2021

The Self Educating Child

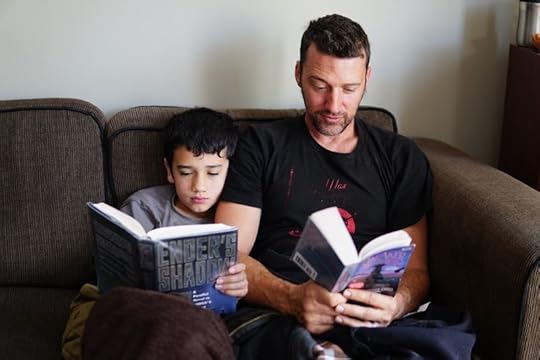

Little MM and me self-educating with some Orson Scott Card, way back in 2017. We’ve come so far together since then!

Little MM and me self-educating with some Orson Scott Card, way back in 2017. We’ve come so far together since then!So it looks like my 15-year-old is officially a high-school dropout.

Halfway through ninth grade, emboldened perhaps by the taste of freedom that Covid-era remote learning had provided, he realized that the whole system was just too slow and inefficient for him, and was “Getting in the way of his work.” So as it looks now, he’ll probably never return to any sort of in-person schooling, and I will be surprised if he ever attends college.

Yes, he is technically “home schooling” and will still end up with a high school diploma of sorts, but in reality he is pretty much winging it. And needless to say, I have mixed feelings about this.

I’ll start with the worries and the negative stuff, because as a parent I of course want the best for my child. And when I look back on my own childhood, it feels like school was a fountain of formative experiences.

Sure, the education itself was slow and crappy – I was always craving more advanced material and more creative learning formats which just weren’t there in my small town high school. But isn’t enduring crappy and antiquated systems a critical part of getting ready to live in a modern society where things don’t always go your way? After all, the only way to renew a drivers license or a passport (or a medical license for that matter) is to dive head first into the ridiculousness and grin and bear it for the sake of the end goal.

And of course there were plenty of good parts: I had so many amazing experiences and friendships and adventures through high school and university. Beginner romances and heartbreaks, brushes with the law, late nights around the campfire, terrible minimum wage jobs at gas stations and convenience stores that I thought were amazing, all bathed in a swirling Marijuana-tinged soundtrack of Red Hot Chili Peppers, Pearl Jam, Soundgarten and Primus and Tool. Doing reverse snow donuts in my mom’s 1988 Dodge Caravan filled with eight friends and then getting out to dance crazily in the headlights to the Wayne’s World soundtrack blasting from the giant stereo system I had built into the minivan with my own 16-year-old hands.

How will my son grow up as a well-adjusted adult without the 2020s equivalent of such experiences?

But when I obsess over these thoughts, I know I am falling into the oldest of parenting traps: assuming I know what’s best for my child, and that his own desires and thoughts are not valid, even though he’s on the verge of adulthood himself. So I remind myself of the positive side of this situation:

The world of 2021 is a very different place from my equivalent perch in 1991. And my son happens to be sitting in an unusual but still promising (I hope) little corner of it.

Because of the Internet, and to be honest a damned large dose of privilege due to having two educated parents always available because we were retired before he was even born, he has been able to feed his thirst for knowledge with incredible efficiency. This is an advantage that is still not available to most people today, let alone to what people of my generation had to work with in 1989. So he has already gone beyond college level in the standard fields that they cover in school.

So of course he has noticed that the existing school system is not as efficient as his custom-crafted alternative. Like me, he feels frustration with many of our institutions. But it’s a frustration born of love and a desire to help out, rather than just a complainypants attitude and a desire to criticize. Public school for all is a great thing and a great idea.

But like everything in life, we can only improve by first acknowledging that we currently suck.

The first thing that little MM did upon retiring from formal schooling, is to create this entire 48 minute mini-documentary about the system he just left:

Seeing him work so hard on this production definitely helped ease my fears about whether or not he will grow up to be a contributing member of society. He spent about three months researching the US school system, writing himself a script, creating a 16-track orchestral music score which is timed to the second to align with the appropriate parts of the film, creating 3-D models and animations in Blender to illustrate the main points, running multiple high-end computers overnight, night after night to render the complex scenes in 4K resolution, turning my house into a miniature version of a Pixar animation studio.

Then he practiced up his reading, set up a bright professional recording studio in my basement, recruited me to help build a teleprompter, and narrated his own script into the camera. And finally brought it all back to the editing software to cut it all together, with pretty stunning results from my admittedly biased perspective as his Dad.

But equally important, the danged kid has a point: schools really could be a lot better.

And it could happen very quickly with just one main change as he explains in the documentary: switching from bland and repetitive teacher-led instruction, to extremely high quality videos instead. This would accelerate learning because the video content could be much more compelling than watching a human stand at the front of a room. But it would also free up the teachers to help individual students rather than just using their valuable time to repeat the same material, year after year.

Even better: most of these videos already exist. Through some sort of miracle, my son has chosen to invest the past five years of his free time seeking out astoundingly good YouTube channels, watching most of their back catalogs, and absorbing the contents of almost every episode.

I’m often shocked at his level of knowledge in so many fields, so I sat him down and interviewed him on his top recommendations in some of the key ones.

The list below is what we came up with. I’ve seen a lot of these myself, and I can vouch for their quality. If you’re looking for places to send your own hungry-brained child, or for things to watch together, check out the following list.

General Science

Vsauce (which has grown to include Vsauce2 and Vsauce3)Physics Girl (fun to watch explorations of a wide range of real-world physics and science things)Thought Emporium (gene editing through both chemical methods and DNA 3-d printers! And art too) Scott Manley (a charming Scottish Astrophysist / Apple engineer with hundreds of great videos on the Kerbal Space Program simulation game, plus now detailed coverage on space and astrophysics) Anton Petrov – daily videos on new discoveries in science (and a fun look at current events from a science perspective too)Kurzgesagt – In a Nutshell Short but intelligent summaries of all sorts of neat things, featuring a dynamic British narrator and fun cartoony graphics. Deep Dive – a relatively new but very promising channel with great big-issue science videos. We are hoping they put out more! Stratzenblitz75 Kerbal Space program videos with nice lessons on the science behind them (like orbital mechanics)Wendover Productions – neat explanations of wide-ranging things, (including transportation logistics!)Inventions and Building Stuff

Colin Furze – crazy, energetic, brilliant videos about building things like a home-made hoverbike, two story bicycle, giant mech robot suit.Simone Giertz – a super clever and witty engineer/builder, perhaps most famous for her DIY conversion of a Tesla model 3 into a badass mini pickup truck. Wintergatan – a hauntingly genius, gentle dude in Sweden who works on a beautiful “marble machine” musical instrument and so many other things. Awesome musician too!Mark Rober (a former Nasa engineer who now makes really fun videos about his complicated and whimsical inventions – best known for the “glitter bomb” anti-theft devices) Styropyro (guy who makes crazy powerful lasers, etc.)Video creation, 3D Animation and Youtubing Strategy

Lazy Tutorials (Ian Huber teaches you 3-D animation with Blender at the speed of thought). He also maintains the Default Cube channel.Blender Guru – personable, easy to watch in-depth blender tutorialsCG Matter – fast, advanced Blender tutorialsCG Geek – longer, more detailed Blender tutorialsCaptain Disillusion (video editing and special effects – this man puts a lot of work into each of his super-entertaining videos)Daniel Krafft – useful blender tips and tutorialsIridesium – tutorials on how to create movie-quality special effects in BlenderCoding and Artificial Intelligence

Two Minute Papers (AI) – super smart guy summarizes academic papers in the Artificial Intelligence field in a really interesting and easy to understand way, with visual examples. Code Bullet (AI) – Software developer incorporates machine learning/AI into his own code and demonstrates the results in a wide variety of contexts.Carykh – AI and building some interesting apps including the famous “size of the universe” interactiveSebastian Lague – The Bob Ross of coding, this young gentleman walks us peacefully through a fun series of iterative improvements on a variety of advanced programming projects.CodeParade – great bits of coding, math, and graphics combinedMath

Vi Hart – the original “Mathemusician”, Vi’s soulfully brilliant explanations of math concepts are great for small kids and adults alike.Zach Star – math puzzles and other interesting stuffNumberphile – another fun math channel – sometimes with fun visuals and special guest experts.History, English, Etc.

Tom Scott – Linguistics and various travel and geography storiesHistory of the Earth – the History Brothers cover multimillion year periods of our planet’s historyHalf as Interesting – light-hearted tidbids of English history and other thingsMusic

Andrew Huang – so clever, so energetic, so talented, and teaches you SO much about music! (his own songs are great too, as are his youtube buddies)Roomie Official – fun to watch, educational, and a ridiculously good and versatile singer.Davie504 – an amazing bass player, and fellow bass enthusiasts might learn a few things too.Adam Neely – fantastic music theory and neat analysis of existing stuff.AU5 – one of my favorite emerging electronic music artists, who also teaches you how to make the stuff in Ableton and related toolsSo, What’s Next?

Like everything in life, I view this as an experiment. It might go well, but there will surely be some pitfalls and downsides as well. Neither of us is perfect and we make errors in judgement sometimes. But this feels right and promising right now, so we are running with it. We will learn from our mistakes and develop ourselves along the way, and make the most of it. Which is really a good plan for life itself.

Congratulations my not-so-little MM, I am proud of you and I wish you the best in this next crazy chapter!

March 26, 2021

Beware of the Bubble

“A Nation Which Forgets Its Past Has No Future”

Those were the words on a 20-foot-long banner that “Mr. Slick”, my high school history teacher, kept carefully pinned across the width of his classroom for the entire four years I had classes with him.

“That makes no sense at all”, I thought to myself when I first read it at age fifteen. “The past is just a fuzzy black-and-white era, with big crude steam-powered factories and tragic wars with brutal low-tech weapons. The future is a land of ever-glossier technology and a peaceful society like the one I’m sitting in today.”

It was only gradually over the next thirty years that I have come to realize what Mr. Slick’s banner was really getting at. And now I can see that the wisdom really was worth 20 feet of classroom space, and its implications are big on both your own bank account and our entire world at large. Because what the banner really says is this:

“Don’t be an Ass: Learn from the Past.”Human nature never changes, so we are bound to repeat our past mistakes. Unless we are smart enough to see the seeds of these same mistakes in our present – and not repeat them.

Read the big books (and podcasts) that cover the longer arc of history. Or at least learn from our elders who are still around to teach us right now.”

The good news is that you can put this lesson to work immediately, because we are living through one of these moments right now. I can tell because of the number of people asking questions like this:

“Hey MMM, I know you’re an index fund investor, but what do you think about Gamestop? And Crypto? I see these things shooting sky high and I’m afraid of being left out! Should I invest?”

Meanwhile, the financial news, which should be a boring place of board appointments and dividend adjustments, has started sounding like a thriller written by a budding novelist who is still in high school. Among the recent stories:

A bunch of kids on Reddit have formed a gang called “Wall Street Bets” to manipulate stock prices in an ongoing series of pump-and-dump schemes. Just like the golden era of financial gangster activity of the 1920s that helped cause the Great Depression!

Last time this happened, we learned from our mistakes. And in 1934, the Securities and Exchange Commission was created to help regulate stock markets, making things like price manipulation and insider trading illegal.

But this obvious clash with previously accepted laws has been strangely absent from most of the financial reporting. The SEC is out of style now, and it’s popular among certain crowds to disparage it – perhaps in part because of an example from a certain role model.

Instead, we get positively framed interviews with the boyish CEO of the Robinhood stock trading app, telling us that this behavior is good, because it’s coming from the little guy.

“We stand in support of you, our customers,” Robinhood co-founder Vlad Tenev tweeted. “Democratizing finance for all means giving more people access, not less.”

“We stand in support of you, our customers,” Robinhood co-founder Vlad Tenev tweeted. “Democratizing finance for all means giving more people access, not less.” Right – finally, we can fight back against the crusty Wall Street Elite and play the stock speculation (and manipulation) game on a level playing field!

Similarly, the chunks of computer data known as “cryptocurrencies” continue to receive widespread hype and religion-like devotion from their fans, coupled with mouth-foaming anger towards anyone who disagrees with the idea of placing speculative bets on their future prices (myself included). To Crypto fans, you are either with them, or you “don’t get it.”

They neglect the obvious and most important third option, an absolutely critical piece of perspective that any expert in any field, including investment, has in abundance: “I might be completely wrong on this.”

A true expert learns the big picture, researches all sides of an argument, and adopts a humble perspective. Experts put their energy into further learning and living by example, rather than participating in Twitter battles.

Real Investment Doesn’t Make Exciting News Headlines

To people who lack the perspective of history, this current fad seems exciting and perhaps like the “new normal”. You simply open a stock trading account and grab a crypto wallet and then just quickly get yourself rich by placing wild bets on recent fads and doubling your money every month.

The people playing this game are calling themselves investors, but in reality this whole situation is just the age-old game of stock speculation based on price momentum – which is in turn just another form of gambling.

Stock speculation is a shittier version of actual long-term investing, which we’ll cover in a minute: with speculation, you get massive highs and crushing lows. You can end up a millionaire or bankrupt, and the main separator between these two is your luck.

When you combine the results of all stock market participants and average them out, you get roughly the index performance. But speculators will tend to pay higher tax and transaction costs, allowing index fund investors to pull ahead.

Further compounding the hazards, the people who are the lucky side of this teeter totter (for example, people currently holding all their wealth in Tesla stock or the cryptocurrency or NFT of the day) will tend to attribute their success to skill, which leads them to become ever more confident and double down without realizing the preposterous risks involved.