Ruth Soukup's Blog, page 53

November 23, 2016

Turkey & Rice Soup

There’s no better way to keep out the winter chill–or stretch your food budget–than with a pot of steaming hot, hearty soup! This deliciously simple Turkey & Rice Soup is the perfect way to use up all those Thanksgiving leftovers, and with just a few super simple ingredients, comes together in minutes.

And the best part? It’s freezer friendly, which means you can save it to make later (just in case you’ve had enough turkey for now!) To make it as part of a freezer cooking day, just split the soup into multiple bags, then throw it right into the freezer–no cooking required!

Here is what you need:

2-3 cups left over turkey meat, shredded (a rotisserie chicken will work as well!)

1 small onion, chopped

1 bag carrots, chopped

2-4 stalks of celery, chopped

2 cartons chicken stock

1 1/2 cups cooked rice or left over rice stuffing

2-3 springs fresh parsley

salt & pepper

Pecorino Romano, grated

Step 1: Chop onion, celery, parsley and carrots.

Step 2: Add 2 tablespoons of olive oil to pot and saute vegetables.

Step 3: Then add shredded turkey to pot and stir. Season with salt and pepper.

Step 4: Add stock and cooked rice; cook on low for 1-2 hours.

Step 5: Ladle into bowls, top with grated Pecorino Romano and serve with your favorite bread.

*If wanting to freeze, place soup mixture in gallon size freezer bags ( be sure to label bags first). And place in freezer until ready to use. On cooking day, place frozen soup directly into slow cooker. Set to high and cook for 2-3 hours or on low for 4-5 hours.

Print This!

Recipe: Turkey & Rice Soup

Summary: This soup uses your Thanksgiving leftovers to create a hearty meal that can also be frozen.

Ingredients

2-3 cups left over turkey meat, shredded

1 small onion, chopped

1 bag carrots, chopped

2-4 stalks of celery, chopped

2 cartons chicken stock

1 1/2 cups cooked rice or left over rice stuffing

2-3 springs fresh parsley

salt & pepper

Pecorino Romano, grated

Instructions

Chop onion, celery and carrots. Add 2 tablespoons of olive oil to pot and saute vegetables.

Then add shredded turkey to pot and stir. Season with salt and pepper.

Add stock and cooked rice; cook on low for 1-2 hours.

Ladle into bowls, top with grated Pecorino Romano and serve with your favorite bread.

*If wanting to freeze, place soup mixture in gallon size freezer bags ( be sure to label bags first). And place in freezer until ready to use.On cooking day, place frozen soup directly into slow cooker. Set to high and cook for 2-3 hours or on low for 4-5 hours.

Preparation time: 5-7 minutes

Cooking time: 1-2 hours

Number of servings (yield): 4-6

Pin It

The post Turkey & Rice Soup appeared first on Living Well Spending Less®.

November 22, 2016

Don’t Miss Our Black Friday Sale (Starting Today!)

Black Friday has started a few days early at LWSL, and we have some AWESOME promotions happening in the shop right now!

If you haven’t bought your Living Well Planner just yet, NOW is definitely the time to grab it. And if you have already fallen in love with a planner of your own, this is the perfect time to stock up on gifts!

Here’s a rundown of all the specials we’ve got happening in the shop, starting today:

FREE SHIPPING

Get free shipping on all purchases within the continental US, no coupon code required! Want to stock up on stickers, sticky notes, or accessories? Now’s your chance!

BUY 5 PLANNERS, GET 1 FREE

Yep, that’s right—you can stock up on gifts and get one for yourself, or band together with a group of girlfriends and split the difference! Either way, it is an AMAZING deal, and one that won’t last long!

FREE STICKERS WITH PLANNER PURCHASE

Get a FREE sticker set with your purchase of the Living Well Planner. No promo code required–sticker set will automatically be added at checkout Get your planner HERE.

SAVE 15% ON ALL GIFTS, BUNDLES, & ACCESSORIES

It’s your chance to stock up on gifts, plus grab a few goodies for yourself as well! Shop bundles HERE or find our gifts and accessories HERE.

SAVE $10 ON ORDERS OF $100 OR MORE

Use promo code SALE10 to apply this extra discount.

SAVE $20 ON ORDERS OF $200 OR MORE

Use promo code SALE20 to apply this extra discount.

Again, if you haven’t bought your planner yet, this is definitely the time to do it, and you can get early access, starting TODAY. But don’t wait too long—these offers are only good for a limited time, and while supplies last!

SHOP THE SALE HERE

Pin It

The post Don’t Miss Our Black Friday Sale (Starting Today!) appeared first on Living Well Spending Less®.

November 21, 2016

3 Reasons Every Mompreneur Needs the Living Well Planner™

This is a guest post by Rachel of RachelWojo.com

Like many mothers nowadays, I’m not only a wife and mother, but I’m an entrepreneur as well. This means I manage our household and care for the children, but I also earn a business income as part of our family. The combination of being a business owner and a mom is no small task, as you know if you’re in the same boat. For many years, the paid work I did within our home was a set scheduled time every day with no flexibility. Any ol’ calendar or planner would work for our family because our children were small and most of the day was spent caring for them. Due to the structure of our family’s schedule and my available working hours, planning was fairly simple.

Then school schedules and homework came along. Choir concerts and sports activities fired up according to season. I wrote and published One More Step and my business/ministry grew significantly. All of the sudden, I found my life with many detailed facets to life and frankly, all the busyness threatened to overwhelm me. Maybe it’s happened to you too. Businesses and families grow and change. What once worked is no longer working. What once was perfect is now “just ok” or even helping you get by.

Several years ago, I started to use a basic calendaring planner to attempt to organize the chaos. Each year, I discovered things I should be writing down and wasn’t. Or mistakes that were made because I didn’t think ahead. Last year I began using the Living Well Planner and after using it this entire year, the difference this planner has made in my life is phenomenal. Let me share 3 reasons the Living Well Planner rocks for mompreneurs.

The Living Well Planner helps you organize with a whole life approach.

A few years ago, when my business was starting to take off, I continued to keep my family’s event and appointment calendar as I had for many years. To book speaking/business events and track writing deadlines, I used a digital calendaring system. About midway through that year, I found myself quite anxious. Occasionally I was pulling an all-nighter because my family and business organization was not synced. I had failed to examine both my personal schedule and ministry calendar when booking, so I wound up over-scheduled and overwhelmed. I LOVE that the Living Well Planner encourages you to approach your whole life in every aspect, both business and personal. Similar to how a doctor treats the whole body, not just one symptom, Ruth’s system of planning organizes your whole life, not just one aspect. By keeping both family and business events and appointments in one place, I’m able to more effectively manage a balanced schedule.

The Living Well Planner teaches you how to plan proactively instead of reactively.

For many years, I thought that using a planner simply meant tracking the events thrown into your path and writing out things you wanted to remember. Through using the Living Well Planner, I’ve learned how to set goals, choose activities and plan events with purpose. This planner leads you through a step by step process that funnels big dreams into doable action steps. I didn’t hit every goal I set at the beginning of 2016, but I truly learned how to begin making goals that I felt were impossible before walking through this planning system.

The Living Well Planner consistently reminds you to make time decisions wisely.

I confess. I’m a “yes” person. But too many “yes’s” make me a miserable person. The trickle down effect of using this planner daily is that I can align my yes’s to my goals. The big picture remains intact and I can easily decide if this “yes” is timely and seasonal or not. I thoughtfully consider how I’m spending the time I have. If time seems to get away from you or you hear yourself saying “I don’t have enough time,” then completing the exercises in this planner will erase those words from your vocabulary. The time you have is enough time to accomplish your heart’s desires when you spend it wisely. Through analyzing the scope of a year, each month, each week and each day, you’ll learn how to effectively make time management decisions that support your bottom line, whether in your personal or business life.

If you’re a mother and business owner, then you know that being organized is critical to the health of your family and business. I love sharing all that I’ve learned through the consistent use of this planner over the last year, because the success I’ve experienced is priceless. Seeing my family grow and enjoy activities while watching my business and ministry exceed my expectations is something I’ve always dreamed of doing. This planner has helped me rock at being both a mom and business owner. I can’t wait to see how continuing to use these processes will inspire me to new heights in the future!

You can buy the Living Well Planner here.

Rachel “WOJO” Wojnarowski is the author

of One More Step: Finding Strength When You Feel Like Giving up, blogger at RachelWojo.com, wife, and busy mother. In addition to two previous books, she has also written a popular six-week daily Bible reading plan for children, now used by more than 4 million people worldwide. Rachel loves reading, running, and teaching God’s Word. She and her family live in Ohio.

Pin It

The post 3 Reasons Every Mompreneur Needs the Living Well Planner™ appeared first on Living Well Spending Less®.

3 Reasons Every Mompreneur Needs the Living Well Plannerâ¢

This is a guest post by Rachel of RachelWojo.com

Like many mothers nowadays, I’m not only a wife and mother, but I’m an entrepreneur as well. This means I manage our household and care for the children, but I also earn a business income as part of our family. The combination of being a business owner and a mom is no small task, as you know if you’re in the same boat. For many years, the paid work I did within our home was a set scheduled time every day with no flexibility. Any ol’ calendar or planner would work for our family because our children were small and most of the day was spent caring for them. Due to the structure of our family’s schedule and my available working hours, planning was fairly simple.

Then school schedules and homework came along. Choir concerts and sports activities fired up according to season. I wrote and published One More Step and my business/ministry grew significantly. All of the sudden, I found my life with many detailed facets to life and frankly, all the busyness threatened to overwhelm me. Maybe it’s happened to you too. Businesses and families grow and change. What once worked is no longer working. What once was perfect is now “just ok” or even helping you get by.

Several years ago, I started to use a basic calendaring planner to attempt to organize the chaos. Each year, I discovered things I should be writing down and wasn’t. Or mistakes that were made because I didn’t think ahead. Last year I began using the Living Well Planner and after using it this entire year, the difference this planner has made in my life is phenomenal. Let me share 3 reasons the Living Well Planner rocks for mompreneurs.

The Living Well Planner helps you organize with a whole life approach.

A few years ago, when my business was starting to take off, I continued to keep my family’s event and appointment calendar as I had for many years. To book speaking/business events and track writing deadlines, I used a digital calendaring system. About midway through that year, I found myself quite anxious. Occasionally I was pulling an all-nighter because my family and business organization was not synced. I had failed to examine both my personal schedule and ministry calendar when booking, so I wound up over-scheduled and overwhelmed. I LOVE that the Living Well Planner encourages you to approach your whole life in every aspect, both business and personal. Similar to how a doctor treats the whole body, not just one symptom, Ruth’s system of planning organizes your whole life, not just one aspect. By keeping both family and business events and appointments in one place, I’m able to more effectively manage a balanced schedule.

The Living Well Planner teaches you how to plan proactively instead of reactively.

For many years, I thought that using a planner simply meant tracking the events thrown into your path and writing out things you wanted to remember. Through using the Living Well Planner, I’ve learned how to set goals, choose activities and plan events with purpose. This planner leads you through a step by step process that funnels big dreams into doable action steps. I didn’t hit every goal I set at the beginning of 2016, but I truly learned how to begin making goals that I felt were impossible before walking through this planning system.

The Living Well Planner consistently reminds you to make time decisions wisely.

I confess. I’m a “yes” person. But too many “yes’s” make me a miserable person. The trickle down effect of using this planner daily is that I can align my yes’s to my goals. The big picture remains intact and I can easily decide if this “yes” is timely and seasonal or not. I thoughtfully consider how I’m spending the time I have. If time seems to get away from you or you hear yourself saying “I don’t have enough time,” then completing the exercises in this planner will erase those words from your vocabulary. The time you have is enough time to accomplish your heart’s desires when you spend it wisely. Through analyzing the scope of a year, each month, each week and each day, you’ll learn how to effectively make time management decisions that support your bottom line, whether in your personal or business life.

If you’re a mother and business owner, then you know that being organized is critical to the health of your family and business. I love sharing all that I’ve learned through the consistent use of this planner over the last year, because the success I’ve experienced is priceless. Seeing my family grow and enjoy activities while watching my business and ministry exceed my expectations is something I’ve always dreamed of doing. This planner has helped me rock at being both a mom and business owner. I can’t wait to see how continuing to use these processes will inspire me to new heights in the future!

You can buy the Living Well Planner here.

Rachel âWOJOâ Wojnarowski is the author

of One More Step: Finding Strength When You Feel Like Giving up, blogger at RachelWojo.com, wife, and busy mother. In addition to two previous books, she has also written a popular six-week daily Bible reading plan for children, now used by more than 4 million people worldwide. Rachel loves reading, running, and teaching Godâs Word. She and her family live in Ohio.

Pin It

The post 3 Reasons Every Mompreneur Needs the Living Well Planner⢠appeared first on Living Well Spending Less®.

November 18, 2016

Our Kids Need Fewer Critics

This is a guest post from Courtney DeFeo of Lil Light O’ Mine

Be sure to check out this vodcast on the same topic

Have you ever experienced a performance review with a boss or feedback from a coach that felt like a physical punch to your gut? Maybe it’s just me, but receiving criticism of any kind has always been hard for me. You could wrap that comment in 190 positive points and I would walk away replaying your one negative point or “area of improvement.”

Now, let’s think about how this relates to parenting. Does anyone get trapped into criticizing our kids all day long, every day? I do! And my intentions are good. I’m trying to teach and coach these kids into adulthood. I just sucked into a trap of constant criticism where suddenly all they can see (and all I can see) is where they are failing. I often flip right past the 8 awesome homework sheets and grab the one sheet with a 73 on it for discussion. I miss the chance to tell them 8 times, they are amazing. Ugh! Why do I do this to them? I can almost see the life drain from their little faces.

When child psychologist, Dr. Kenneth Barish, was asked, “What is the most common problem you encounter in your work with children and families?” His answer: “As parents, we are unwittingly too critical of our children. (Source)

My sister and I used to tease my brother about a weakness – and I recently learned that our little teasing affected him into his adulthood in this one area. Our tease became a label that he believed his entire life. You see – he didn’t live up to a great compliment. He brought himself down to the very worst we thought about him. Lysa TerKeurst says it best in her new book Uninvited, “Rejection steals the best of who I am by reinforcing the worst of what’s been said to me.”

Another interesting source for this common problem is our own insecurities. Author Melissa Trevathan explains it this way in the book Intentional Parenting:

“Your daughter makes a simple comment, and all of a sudden, you’re transported back to your own childhood. Rather than her words, you hear the words of your mother…critical, demanding and shaming. And your response, in that moment, comes more from the child you were than the parent you are. Rather than speaking like a grown-up, you speak like a 10 or 14 year-old. You go back. The situation triggers an emotion in you that takes you back to a certain place in time…a time in which you have perhaps gotten stuck.”

Our words have incredible power over our kids and their identity. This doesn’t mean that we can’t hold them accountable to bad behavior or help them learn right from wrong. I have read all the articles about praising and creating narcissist kids. I am aware of the other extreme. I’d rather land on the side of cheering my kids on any day.

I watched my mom in the dressing room with my daughter the other day and it was like a flashback in time. I remember so many days with my mom in the dressing room with me. I was staring in the mirror seeing every little piece of my body that I hated and she was building me up – never critiquing. I know she saw what didn’t fit on me and on my daughter – but she found a way to find the good. “That color is amazing on you. Gosh – you look good in those kind of skirts.” I watched a mom with incredible self-control realizing the power of her words for destruction or confidence.

For Ron and I, we are challenged to think about how often are pointing their strengths vs calling out their weaknesses. Between society, their classmates and their own negative voices – they are brought down daily. And we need to be on the cheerleading team responsible for building them up. I’d argue, as their parents, we need to be the captains of their cheerleading team.

I have several products designed to equip parents in the area of faith,virtues and values. I was staring at my Virtue Cards the other day and felt a little bit ashamed. I have used my very own cards to critique my girls. I had my girls “working” on a virtue and actually taped it to their mirror. It’s not bad – it worked. We had great discussions. It really isn’t bad to use tools like this to teach our kids about critical life lessons such as self-control and courage. It’s in the absence of praise and discussion of their strengths – that a child begins to doubt their worth. Don’t we all do this – adults and children alike? We spend seasons of life zoned in on our failures when that’s all we hear or notice.

So, last night, I decided to praise them 10 times louder with those same cards. Ron and I had an impromptu awards ceremony and gave them 5 virtues that we felt described each girl. We agreed quickly on 5 for each kid (out of the group of 25). We called them out loud and they giggled because we were a little dramatic.

LARSON – you are JOY! you are OBEDIENT! you are HUMILITY!

ELLA – you are LOYAL! you are KINDNESS! you are HONESTY!

We shouted each definition on each card and made them come up and accept each card like a Golden Globe. Then we encouraged them to hang their set in their rooms. These virtues are in these girls. This IS who they are – joyful, honest, obedient, kind and more. We see it over and over again, We just forget to point out where they are doing so well. Their hearts got the message. You could tell in their smiles.

Larson proudly taped her 5 cards to her bathroom mirror and Ella pinned hers up in her room.

Let’s commit as a group of intentional parents – to see the good in our kids. Let’s point them to Jesus for their ultimate worth and affirmation. To cast a vision for their lives so big – that they rise up. To speak about them the way Jesus would. To see them the way they were designed. To see them for their potential and not for their mistakes. Let’s spend more time celebrating in the good vs rubbing their nose in the bad.

Let’s work together to build up a generation of confident kids sure in their identity so they can change the world together.

Have I told you lately you are one awesome parent?

Here are 5 other fun ways you can use Virtue Cards to nurture you kids hearts!

Table Talk – Pick one card each week to discuss at Sunday dinners (What does that virtue mean? Recognize ways you’ve seen each other display that. Discuss the verse. What is the opposite of that virtue?)

I Spy Virtues Game – Bring them with you in carpool and challenge the kids to look for someone who displays a virtue (i.e. Humility or Integrity) during the day and come back and report back to the family that afternoon during pickup or at dinner that night.

Memorize For Ice Cream – Our family is all about bribery for hiding great things in our hearts. If our kids memorize 5 of the ABC Scripture Cards or 5 of these Virtue Cards – they get an ice cream treat!

Decorate & Display – Pick a virtue that most describes each child and frame for their room (each card is 5” x 7”)

Monthly Focus – Have a family meeting and pick 5 or more values/virtues that you want to be known for as a family and then talk about them each month. Don’t forget to include a family fun activity. Kids learn much quicker through laughter over lectures. For family fun ideas, see In This House, We Will Giggle.

and pick 5 or more values/virtues that you want to be known for as a family and then talk about them each month. Don’t forget to include a family fun activity. Kids learn much quicker through laughter over lectures. For family fun ideas, see In This House, We Will Giggle.

Courtney DeFeo believes our families can light up the world.

As a former marketing professional, she lives in a constant brainstorm with herself and suspects it’s the route of her migraines. She loves watching Jesus at work. She is the creator of Lil Light O’ Mine – a small business that empowers moms and changes little lives through innovation in the home. Some of her most notable creations are Ella (age 9), Larson (age 6), ABC Scripture Cards, #LightEmUpActs, Conversation Cups and In This House, We Will Giggle. Her house is a wreck and she hates to cook. A graduate of Auburn University, she adores her hot, Georgia Bulldog husband. She posts entirely too many photos of her animated girls on Instagram. Connect with Courtney anytime at CourtneyDeFeo.com.

Pin It

The post Our Kids Need Fewer Critics appeared first on Living Well Spending Less®.

November 16, 2016

Simple Rice Stuffing

I’m sure we all have our own holiday must-haves, but I’ll be the first to admit that I am ALL ABOUT the side dishes! And I’ll be honest–for me it is just doesn’t feel like Thanksgiving without an amazing, super-flavorful stuffing!

I especially love how versatile this recipe is. You can omit the sausage if you would rather a meat free version. You could also add chopped walnuts and dried cranberries for a bit sweeter and crunchier stuffing. Either way, it is delicious and you really can’t go wrong!

Here is what you need:

2 cups cooked rice

1 8oz. package white button mushrooms, cleaned and chopped

1 15oz bag frozen peas

2-3 stalks of celery, chopped

1 medium onion, chopped

4-6 TBS olive oil

3-4 cloves garlic, chopped

fresh parsley

1 1/2 cups Pecronio Romano

1 loaf Italian bread- stale, cubed

1/2 cup milk

1 package chicken and apple sausage, diced

Step 1: Cook rice according to package directions.

Step 2: Chop onions, celery, parsley and garlic; set aside.

Step 3: Clean and chop mushrooms and set aside.

Step 4: Cube bread; and add to bowl of milk seasoned with salt and pepper.

Step 5: Add 2 tablespoons of oil to large frying pan. Then saute 1/2 cup of onion and 2 tablespoons garlic with pinch of parsley.

Step 6: Squeeze milk from bread then add bread to large frying pan with onions and garlic. Mix well. Once a little golden brown remove from heat and transfer to a large bowl.

Step 7: Slice sausage; set aside.

Step 8: Add 2 tablespoons of olive oil to a large pan. Then saute remaining onions, garlic, celery, mushrooms and parsley. Cook till onions, mushrooms and garlic are soft.

Step 9: Then add sausage and frozen peas to pan and mix well. Once peas are cooked remove all vegetables from pan and mix with bread.

Step 10: Then add cooked rice and 1 cup of grated Pecronio Romano to vegetable and bread mixture.

Step 11: Transfer to baking pan top with remaining cheese and bake for 10-15 minutes if serving that day. If making ahead- reheat in covered baking dish for 20-30 minutes or until stuffing mixture is warm.

Step 12: Serve alone or along side your favorite holiday meal.

Print This!

Recipe: Simple Rice Stuffing

Summary: My favorite part of Thanksgiving besides the pie is stuffing. I added chicken sausage to this recipe but you can leave it out for a vegetarian version.

Ingredients

2 cups cooked rice

1 8oz. package white button mushrooms, cleaned and chopped

1 15oz bag frozen peas

2-3 stalks of celery, chopped

1 medium onion, chopped

2 TBS olive oil

3-4 cloves garlic, chopped

fresh parsley

1 1/2 cups Pecronio Romano

1 loaf Italian bread- stale, cubed

1/2 cup milk

1 package chicken and apple sausage, diced

salt & pepper

Instructions

Cook rice according to package directions.

Chop onions, celery, parsley and garlic; set aside.

Clean and chop mushrooms and set aside.

Cube bread; and add to bowl of milk seasoned with salt and pepper.

Add 2 tablespoons of oil to large frying pan. Then saute 1/2 cup of onion and 2 tablespoons garlic.

Squeeze milk from bread then add bread to large frying pan with onions and garlic. Mix well. Once a little golden brown remove from heat and transfer to a large bowl.

Slice sausage; set aside.

Add 2 tablespoons of olive oil to a large pan. Then saute remaining onions, garlic, celery, mushrooms and parsley. Cook till onions, mushrooms and garlic are soft.

Then add sausage and frozen peas to pan and mix well. Once peas are cooked remove all vegetables from pan and mix with bread.

Then add cooked rice and 1 cup of grated Pecronio Romano to vegetable and bread mixture.

Transfer to baking pan top with remaining cheese and bake for 10-15 minutes if serving that day. If making ahead- reheat in covered baking dish for 20-30 minutes or until stuffing mixture is warm.

Serve alone or along side your favorite holiday meal.

Preparation time: 20-40 minutes

Cooking time: 10-30 minute(s)

Number of servings (yield): 10-12

Pin It

The post Simple Rice Stuffing appeared first on Living Well Spending Less®.

November 14, 2016

Give Experiences Instead of Stuff: 10 Ideas to Try

Let’s face it–keeping clutter at bay can often feel like a losing battle. No matter how hard we work at getting “unstuffed,” there are always more things coming back through the door–especially when it comes to kids!

The reality is that we can get rid of things all day long, but without a solid plan for the next holiday or birthday, we’ll be soon faced with another pile of STUFF.

The worst part is that there are often so many gifts and toys and trinkets that our kids become overwhelmed, eventually even forgetting about some of the most awesome new toys they received. All in all, you’re left with more clutter. After just one holiday, gifts are filling up your closets, taking over the toy room, and clogging up the space under your bed.

Discussing the gift situation with relatives and loved ones can be particularly delicate. After all, 99% of the time, their heart is in the right place. They took the time to think of your child, plus, they spent time and money at the store picking out something they feel is special. It’s truly an act of love, one none of us wants to take for granted.

So is there some way to strike a balance? A way to keep the thought without adding more STUFF?

I’d like to think so.

Because in the end, what really matters are the memories—those special things you did with your loved ones. Maybe it was making gingerbread houses with Grandma every Christmas and getting your fingers sticky from licking so much of the candy. Maybe you remember building something with your Dad or helping your Mom work in the garden. Perhaps you can recall a memory of sightseeing with cousins or siblings and being amazed by dinosaurs in a museum or giant roadside attractions on a car trip.

Our memories are made up of experiences and people. They’re rarely made up of “stuff.” Yet we hold on to stuff hoping it will bring us back to our happy memories.

That’s exactly why giving experiences rather than gifts can be so much more meaningful. Take photos and share the photos with the gift-giver after the activity, along with a card letting them know how meaningful and enriching their gift was to your kids and family. And as you shift your philosophy from “stuff” to activities, you might be surprised by how many of your loved ones truly enjoy the switch.

If you’re scratching your head wondering what sorts of special activities you can give (especially those that don’t cost a ton of money), here are a few ideas to get you started:

1. Plan a Special Movie Night

Going to the movies can be a lot of fun—and even with the price of movie tickets these days, it’s still cheaper than another videogame or Lego set. Think outside the box and beyond the theater to make your movie night experience even more fun and less expensive.

You can have an outdoor movie night, which can be as elaborate or as minimal as you like. Set up blankets in the backyard and rent a projector, or try a DIY projector hack. Offer treats and enjoy a movie under the stars.

Another easy idea is to simply host your special movie night at a relative’s or friend’s house. Make it a “movie-a-thon” and show a double feature. Have everyone bring a blanket or sleeping bag. Serve milkshakes and popcorn. How much fun would your kids have watching a favorite movie with their aunt and uncle or their grandparents? It’s all about making it a special and unique event rather than just “popping in a DVD.”

2. Hold Game Day at the Park

Grab a football, Frisbee, beanbag toss or croquet set and head to your local park where everyone can play! Bring your own fixings for subs, chips, veggies and fruit and set up a blanket or picnic table. In the winter, game day can turn into building a snowman, ice skating or sledding together as a family or with friends. Follow it up with a warm treat like hot chocolate or cider.

Most city parks are free and accessible to all. Maybe you’re even fortunate enough to live close to one of our beautiful National Parks. Perhaps Grandpa has some kite flying skills he’d like to share or your cousin loves geocaching. Encourage them to share their knowledge with your kids and add another layer of discovery to the experience.

For younger kids, simply swinging, digging together in the sand, or playing a game of catch can be more meaningful than any number of toys. Bring a game of checkers, Jenga, or another board game you can enjoy on the picnic table together as a family!

3. Become a Local Tourist

Try some urban exploring and find out what your town is really all about. We’ve seen all these fans of Pokémon Go searching out the corners of their town for different creatures. Go old school and mark up a map with various landmarks and sites. Arm your kids with cameras and send them on a hunt to find the features around town.

Check your local paper and visitors’ bureau to see what sort of free activities are offered in your town. You may be surprised by the number of free concerts, local museum and zoo discounts, and other activities offered to residents. If there’s a festival, a fair or a band playing, head out to get involved!

So often we explore new towns when we go on vacations, but when it comes to our home city, we overlook many of the cool features. Find out what your town is truly famous for and spend a day or two making the most of it! Relatives and friends can go along and treat the kids to local cuisine, show them their favorite feature in town, or enjoy a festival together!

4. Get to the Beach

Even if you don’t live on a coast, chances are there’s a river, lake or pond in your area. Time to hit the beach! Grab your flip-flops, sunscreen and water gear and jump (or wade) in!

Spending time at the beach is often refreshing and restful. It offers friends and relatives a chance to really spend quality time with your kiddos and do something together you can all enjoy. Bring along some snacks and stroll along the boardwalk. Ride a Ferris wheel or build a sandcastle. If there’s a tour of a local lighthouse or ship, take it!

Bring a camera along and see if you can take some fun beach pictures of your family. Play with perspective with your kids. See if they can “hold up” the sun or point out a tiny boat in the distance. If you have a fisherman or woman in your family, they can teach your kids how to cast and bait a hook. Your kids will have a memorable day that everyone will enjoy. There’s just something about a beach no one can resist.

5. Go Camping

If your friends and family members are outdoorsy types, why not take everyone on a camping trip for a day or two or plan some outdoor activities? Campgrounds are often very inexpensive to rent and there’s nothing like cooking over a fire, hanging out in a tent, and exploring the wilderness to really bond with your loved ones.

Even if your family isn’t big on roughing it, ask relatives if they’d spend a day with you at a local nature preserve, watching the changing leaves in a nearby forest or even simply taking your kids on a nature walk or scenic drive.

Renting a kayak or canoe can be relatively inexpensive and a lot of family fun. Hike local trails and learn to use a map and compass (the original GPS). Turn off technology and spend time visiting and enjoying the beautiful earth we’re so blessed to live on.

6. Volunteer

Particularly during the holidays, volunteer opportunities abound. Relatives can accompany your family to a local soup kitchen or food pantry to serve those who need some extra help, especially if the weather is cold.

Does your aunt know how to sew or can your friend knit? Have them walk your kids through some simple projects. Make cage comforters for the local humane society, sew dresses from pillowcases for girls in Africa, or create knit hats to donate to a NICU or children’s hospital. Not only will your friend be passing on a talent and skill to your kids, but you’ll also be helping make the world a brighter and better place.

Consider adopting a project as a family. Can you play Secret Santa to a military family or host a coat drive through the Salvation Army? Is there a 5K you’d like to run (or train for) together? In lieu of gifts, ask family members and friends to contribute to your cause and see how much money you can raise. It can be truly heartwarming to see kids get excited about gifts for others rather than wanting more things for themselves.

7. Grow Some Flowers

Know someone with a green thumb? Ask him or her to share their skills with your kids. Instead of a gift, say, “You know, Olivia has been asking me if she could plant a garden. Would you help show her how to get started?” If your child loves butterflies, ask for help selecting the best plants to attract pollinators.

If your kids have an interest in building and you have a pal who’s good with construction, ask him or her to show them how to build a birdhouse, a shelter for mason bees, or a planter box for their yard.

Even in the winter, you can grow a gourmet herb garden, lettuce, or cute succulents in a window. Set up a fairy village from found and handmade items or create a terrarium together—one for your house and one for your friend. They can compare their growth, swap pictures, and keep up on their gardens throughout the year.

8. Throw an Art Party

I don’t know about your kids but mine LOVE those paint-your-own pottery shops. They’re always begging to visit, but the items there can be quite pricy. Host your own “Art Party” or have a friend give an art session as a gift and share their talent with your kids.

Use a Sharpie marker to “paint” mugs from Goodwill or other recycled ceramics. Try a simple canvas with watercolor, chalk or tempera paints. Try some felting and create cute creatures together or use clay to make jewelry and figurines.

Keep it simple but be sure everyone gets to leave with a creation and goes home feeling accomplished. It’s all about letting your artistic side shine!

9. Get Theatrical

Kids love to imagine and act out. Quite honestly, most children would be thrilled to have an afternoon playmate—if Grandpa, Grandma, Auntie or Uncle would just have a tea party or act out a story with them.

To make it truly special, consider letting your kids host a circus, talent show or play. Ask each person to contribute a talent, rather than give a gift for the event. For Halloween, Christmas or Easter, you can try a seasonally appropriate story or theme. For other times of the year, anything goes. You can find scripts online or suggest your kids perform scenes from their favorite movie. (Mary Poppins, Wizard of Oz, or Peter Pan can be great!)

Give out tickets and ask family members to help with costumes, makeup or programs (if they aren’t so into acting). In lieu of gifts, they could also host a refreshment stand and share a favorite treat with the audience. Even an enthusiastic reading of some favorite stories can be a great theatrical treat that almost anyone can get behind.

10. Show Off Your Chef Skills

Host your own version of “Chopped” or fire up a cooking challenge! Use a mystery ingredient and make a meal together or come up with a creative recipe. If your friend or relative loves baking, ask them to decorate some cookies with your kids.

Try a seasonal recipe or favorite dish. Host a potluck party or let family members know that instead of giving gifts, we’d love to have a DIY pizza and game night together. Have everyone bring their favorite toppings and a game.

Food is something almost everyone can enjoy and get behind. If you have a relative who says they’d really like to give a gift, ask them to make a birthday cake or teach a cooking lesson.

When giving experiences rather than gifts, consider your own area of interest, expertise and enjoyment, as well as who you are giving to. Think of a talent you’d love to share, or one they would, or something you really enjoy doing together. Or if, you’re asking other family members to give experiences to your kids, try to think of something they’d enjoy. The idea is to do something special together and share in memories rather than things!

The post Give Experiences Instead of Stuff: 10 Ideas to Try appeared first on Living Well Spending Less®.

November 11, 2016

9 Ways to Think Like a Financial Advisor

Wouldn’t it be nice if we all had a financial advisor in our pocket? Someone who could guide us, direct us, and help us make knowledgeable and sound financial decisions?

Money is hard to deal with sometimes. Just talking about money can be one of the most difficult conversations to have with your spouse, parents or children. Many of us are very private about our finances, so we don’t like to share our fears or even our joys with others.

If we have money now (especially if we haven’t had any in the past), we might feel a sense of embarrassment or a desire to downplay our financial state. We might even feel uncomfortable seeking professional financial advice. Handling a long-term shaky financial status and then pulling ourselves out of it can actually make it harder to share information with a professional—or with anyone, for that matter. There’s almost this feeling of, “If I talk about it, it might disappear.”

On the other hand, if we have debt or if we’re in financial trouble, we may be drowning and too ashamed to call out for a life preserver. We might feel too bad to ask for financial help or advice. We might be afraid to take a realistic look at our finances, even for ourselves.

One of the first steps to getting a handle on your finances is to open up about them! Take a look at those unopened bills or be realistic about what’s in your bank account. Seek the advice of a professional if you need guidance—and, although it can be tough, know that it’s ok to ask for help!

And while we might not have our own personal financial advisor at our beck and call, we can learn a few tips and tricks to learn to think like one and start making wiser choices when it comes to our personal and family finances.

1. Follow a Budget

To truly think like a financial adviser, establishing a clearly defined well-planned budget is key. If you don’t know where to start or if you need a template, try using a budget-planning tool.

When creating your budget, the most important thing is to keep it realistic and set yourself up for success. If you aren’t ready to embark on a month of zero spending or take a break from all luxuries, be sure to include an allowance in your budget. Also include money for your children’s unexpected expenses, like school activities, soccer cleats and ballet shoes, and friends’ birthday parties. These items will inevitably come up, and, as the saying goes: If you fail to plan, you plan to fail.

Keep your budget realistic, but also make it as tight as you can stand. If you’re financially drowning, it’s not the time to figure in a luxury vacation or a major purchase. Your goal is to set a budget you can both afford and follow. Try it for a month or two and make adjustments as you go. If you aren’t sticking to a budget at all, any step is a step in the right direction.

Don’t forget an important part of your budget is to include charity. People who give to charity report greater happiness and a sense of satisfaction, so even if you can’t give a large financial gift, there are many options for giving back in small ways. Look at your budget to determine what you can work in.

2. Keep Your Finances Organized

Setting up your budget is one step in the right direction to financial organization. You can also try other ways to organize your finances (like only using cash or sticking to gift cards) to help you keep a handle on your spending. Watch for opportunities to use bonuses, benefits and rewards to stretch your money even further.

When you do spend, keep track of important receipts, warranties and rebates—and take care of them right away. If you have the opportunity to earn cash-back or reward points for spending, or if you take advantage of special offers like Groupon, always keep track of what you buy and pay close attention to expiration dates and restrictions. Consumers often spend and lose out on savings because they don’t bother to do the follow up.

When looking at your bills and debt, plan to pay them as quickly as possible to avoid late fees and collections. Examine interest rates and consider negotiating better deals on your utilities, phone, and other bills. Sometimes all it takes is a simple phone call.

3. Don’t Take on More Debt

So many of us live beyond our means. Even fifty years ago, a mortgage was the only debt buyers would willingly take on (and sometimes not even that). Nowadays, people spend on credit, take a loan out to get a car, and much of what is owned is bought on promise. We are living in a world of debt.

There’s nothing worse than feeling like you can’t pay off what you’ve taken on. Creditors can become relentless and debt can grow exponentially, quickly becoming insurmountable. If you’re serious about getting a handle on your finances, commit to stop taking on more debt. Live within your means.

Is it easy? No. It can be challenging to turn down credit and to say no to bargains and things we want to spend money on. It can be hard to tell our children no, to talk to our spouse about our spending, and to stop buying things we really want, but it’s often the only way to move forward in a realistic way and bring ourselves financial peace of mind.

4. Use the Debt Snowball to Pay It Off

Finance guru Dave Ramsey proposes using a “debt snowball” to pay off debts as quickly and successfully as possible. This method works surprisingly well, and is fast and satisfying. When paying off your debts, sort them by size, and pay off your smallest debt first. Put as much “extra money” toward your debt as you can and focus the entire extra amount on the smallest bill. When that one’s paid off, move on to the next. As you pay off each bill, the amount you can put toward payment increases, because you have fewer and fewer payments to make.

Other advisors have suggested paying off bills by the size of the interest charged. While this method also works, the debt snowball can be even more satisfying because you can see immediate results and have the satisfaction of seeing your number of bills quickly go down.

If you’re really struggling to make even your minimum payments, you may want to consult with a credit counselor or someone from your local credit union. They may be able to help you identify realistic ways to pay off your debt, work with creditors to adjust your minimum payments, or consolidate your bills into an easier-to-handle format.

5. Keep Enough Savings

Financial advisors tout the benefits of having a savings account that covers your emergency needs. In most cases, a $1,000 emergency savings cushion will help you feel more secure if something unexpected comes up. No longer will you have to scrape together a payment between a few credit cards, take out a temporary loan with high interest, or make hard choices when you can’t afford an emergency.

Having emergency savings is a key part of working toward financial peace. There are many ways to start to seed your emergency savings—you can sell something, pick up a few odd jobs around the neighborhood, take up some freelance work, or adjust your budget to allow you to put a little away each month until you reach your savings goal.

Once your debt is paid off, shoot for saving even more money to help you during tough times like a job loss or sudden financial hardship. Realistically, you should have 3 to 6 months of income put away for a rainy day. Having at least a $1,000 in your savings account will help get you started and keep your family protected.

6. Make Your Money Work for You

Many of us have financial opportunities we don’t take advantage of, either because we aren’t familiar with the product or we’re afraid of losing out (or simply because we forget the option is out there). We have to learn to think like a millionaire and plan ahead, even if we aren’t one. That means getting your money to work harder for you.

If your employer offers any pre-tax savings for retirement, take advantage as fully as possible. If you have the opportunity to participate in a Health Savings Account (HSA) or other vehicles that can help you cover regular bills without paying taxes, participate and save.

One of the easiest ways to make your money work for you is to invest a little each month. Schedule payments to life insurance, 401(k)s, and other investments to be automatically withdrawn. Ask your bank to transfer a small amount into savings on the day you get paid. This way the money is never at your fingertips, so you can resist the temptation to spend it.

When you have a few thousand dollars in savings, roll over the money into a CD, money market account or other savings vehicle where you will receive better returns on your investment. Having money sit in a “regular” savings account isn’t very productive and won’t yield the results you could be getting with a better investment. Ask your bank or a professional financial adviser to recommend a savings platform that offers low risk (if you’re nervous) and shorter terms, so your money is accessible, should the need arise.

7. Don’t Bite Off More than You Can Chew

When it comes to investing, some people want to do it all at once. It can get addicting to see all the ways your money can grow and the great rates of return. Only invest in products you’re familiar with and can handle. Some people love following the stock market and having money they can move quickly. Others prefer mutual funds and CDs, which require less involvement and hands-on activity.

Whatever you choose, pick something you understand. Read all of the fine print and don’t feel bad asking questions or requesting clarification. Financial advisors are there to do just that, and they want you to get the best return for your dollar and have a product you’re happy with. They know you aren’t an expert, so don’t feel silly asking questions you think might be obvious. Chances are they’ve heard it all.

8. Seek Advice & Plan for Life’s Changes

When you face something unexpected or experience a big change like a marriage, divorce, new baby, or inheritance, it’s time to seek the advice of a financial expert. Many of these situations are emotional and stressful (even if it’s a positive stress) and those feelings can cloud your judgment and make it hard to see a clear path.

Financial advisors are prepared to deal with these big changes—they do it every single day. They can help you watch for loopholes and hidden fees, and keep you from making poor choices driven by emotion or fear. They know how to best address life’s big issues from a financial perspective and will guide you through questions you may have.

If you make a major investment, are heading toward retirement, want to return to school or switch from public to private education, these are all times to seek advice. If a relative or parent is moving in with you, you’re company is downsizing, or if you see another issue on the horizon, a financial advisor can help you manage risk and plan for things to be as financially painless as possible.

No one knows what the future holds, but we all can make certain plans for a few expected things. Planning for retirement is vital—even if you love your job, and figure you’ll work until you’re 90; even if your employer doesn’t offer retirement benefits and you don’t know how you can conceivably plan on your own.

Talk to a financial adviser and have them help you figure out a plan that will work for you. Invest in insurance—health, life, and disability. If you or your spouse become injured or worse, you need to have a plan to protect yourself financially. Create a will and set up a trust or savings plan for the care of your children.

It can be hard to address the future and to sit down and do long-term planning, especially if it seems like something far off in the distance. Life is full of unknowns and surprises though, so it’s best to protect yourself by thinking about the future.

9. If You’re Unsure, Call a Professional

In a legal situation, you’d call a lawyer. If you were sick, you’d call a doctor. If your sink were plugged up and flooding, you’d call a plumber. When it comes to financial situations, we often try to go it alone. Yes, we all deal with money every day, but a professional financial advisor can be highly valuable, especially when facing the unknown or dealing with situations that are new and unfamiliar.

When you’re trying to figure out what to do in a financial situation, whether it’s about investing, taxes, or even getting out of debt, chances are there’s someone out there who has experience and the expertise to guide you through it.

Now, financial advisors don’t work for free (which is why we all wish we had a best friend who would advise us instead) but they can be truly worth the cost in terms of your return and assistance. The next time you’re facing a big financial question or need some help, find someone who can advise you and assist so you don’t have to go it alone!

Pin It

The post 9 Ways to Think Like a Financial Advisor appeared first on Living Well Spending Less®.

November 9, 2016

Stuffed Acorn Squash

This is a guest post from Sammi of Grounded & Surrounded

I don’t know about you, but winter squash used to intimidate me. I would warily eye it from across the grocery store and wonder if it was to eat or only to be used as holiday table decor. You see, I didn’t grow up eating winter squash and, to be honest, it has only been within recent years that I even knew what a winter squash was.

Like many of you, I didn’t realize that pumpkins, butternut, spaghetti, and acorn squashes are all considered winter squash. And lo and behold, they can be transformed into the most delicious recipes!

You will find the key to cooking winter squash is patience. Patience peeling (if needed), patience scooping out the seeds, and patience with the longer than normal cooking time. With that said, your patience will not be in vain once you taste your delicious and simple recipes.

This particular acorn squash creation graces our table each Thanksgiving as well as a few other times throughout the year. The filling made of fresh apples, soft pecans, and tart dried cranberries drizzled with sweet maple syrup bake just long enough for the flavors to infuse the squash and produce the most delicious and filling side dish.

As you can see, gone are the days of my winter squash intimidation. My hope is that after trying this simple recipe yourself you will feel the same way too!

Here is what you need:

2 acorn squash, cut in half and seeds scooped out

2 small apples, peeled and diced

1/2 cup pecans, roughly chopped

1/4 cup dried cranberries

2 Tbsp coconut sugar

4 Tbsp butter, divided

2 Tbsp maple syrup, divided

1 tsp cinnamon

1/2 tsp salt

Step 1: Preheat oven to 400F. Cut each acorn squash in half and remove the seeds and stringy bits with a spoon.

Step 2: If the squash does not sit flat, use a large knife to cut the outer skin little by little to create a flat surface on the underside of the rounded squash. Try not to cut to deep as a whole in the bottom would allow all the sweet juices from the filling to leak out.

Step 3: Place each flat bottomed squash half (orange flesh side up) on a piece of parchment paper or aluminum foil lined baking sheet.

Step 4: Next, stir together the filling of diced apples, chopped pecans, dried cranberries, coconut sugar, salt and cinnamon in a medium sized bowl.

Step 5: Then divide the filling between the four squash halves until each squash is heaping full.

Step 6: Top each stuffed squash with a tablespoon of butter divided into quarters. lastly, drizzle the tops of each squash with a 1/2 teaspoon of maple syrup. Bake for 60-75 minutes. After the squash has baked for 30 minutes loosely cover the pan with aluminum foil to prevent the filling from burning. Squash is done when tines of a fork are inserted into the flesh of the squash with ease.

Print This!

Recipe: Stuffed Acorn Squash

Summary: This particular acorn squash creation graces our table each Thanksgiving. The filling made of fresh apples, soft pecans, and tart dried cranberries drizzled with sweet maple syrup bake just long enough for the flavors to infuse the squash and produce the most delicious and filling side dish.

Ingredients

2 acorn squash, cut in half and seeds scooped out

2 small apples, peeled and diced

1/2 cup pecans, roughly chopped

1/4 cup dried cranberries

2 Tbsp coconut sugar

4 Tbsp butter, divided

2 Tbsp maple syrup, divided

1 tsp cinnamon

1/2 tsp salt

Instructions

Preheat oven to 400F. Cut each acorn squash in half and remove the seeds and stringy bits with a spoon.

If the squash does not sit flat, use a large knife to cut the outer skin little by little to create a flat surface on the underside of the rounded squash. Try not to cut to deep as a whole in the bottom would allow all the sweet juices from the filling to leak out.

Place each flat bottomed squash half (orange flesh side up) on a piece of parchment paper or aluminum foil lined baking sheet.

Next, stir together the filling of diced apples, chopped pecans, dried cranberries, coconut sugar, salt and cinnamon in a medium sized bowl.

Then divide the filling between the four squash halves until each squash is heaping full.

Top each stuffed squash with a tablespoon of butter divided into quarters. lastly, drizzle the tops of each squash with a 1/2 teaspoon of maple syrup. Bake for 60-75 minutes. After the squash has baked for 30 minutes loosely cover the pan with aluminum foil to prevent the filling from burning. Squash is done when tines of a fork are inserted into the flesh of the squash with ease.

Preparation time: 5-7 minutes

Cooking time: 60-75 minute(s)

Number of servings (yield): 4

Sammi Ricke likes to keep things simple, delicious, and nutritious in her kitchen.

She enjoys the challenge of finding unique ways to incorporate “just one more whole food” into every meal while leaving just enough room for life’s essentials: chocolate and peanut butter. If you are looking for “healthified” versions of your family’s favorite meals be sure to visit Sammi’s Grounded & Surrounded Blog. You can also find her on Pinterest, Instagram, and Facebook.

Pin It

The post Stuffed Acorn Squash appeared first on Living Well Spending Less®.

November 7, 2016

The Planner that Changed Everything

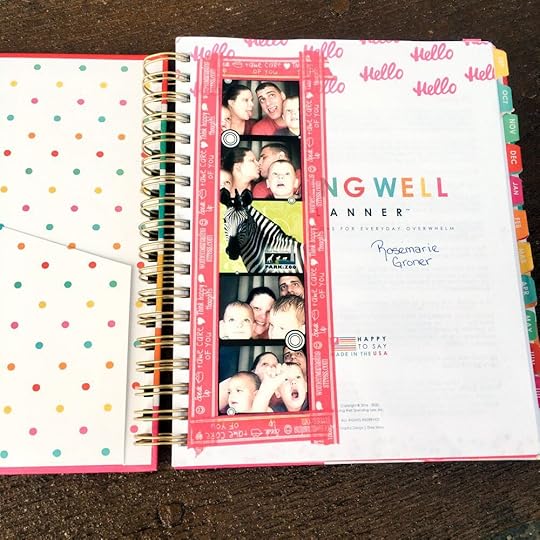

This is a guest post from Rosemarie Groner of The Busy Budgeter

As a long time fan of Erin Condren, I did the unthinkable last year and switched to the Living Well Planner. It was a pretty simple decision because the Living Well Planner had personalized sections on budgeting, menu planning, and goal setting. You can read my full comparison of the two here.

I am so glad that I switched!

I’ve been using the Living Well Planner for over a year now and am still thrilled with it (which as any planner nerd can tell you is a rare find to not have planner regret a year later!)

In fact, as soon as the NEW version came out (with a lot of updates!), I started using it that day. And I’ve been using it for over a month now.

And of course, I’m going to walk you through it step-by-step…

Let’s go!

Already know you want it? You can skip the details and get the planner here.

My personal review on the new Living Well Planner

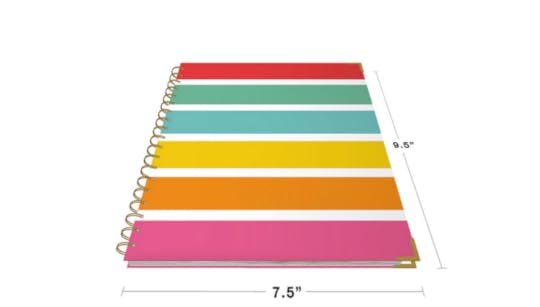

Cover and Binding

The new planner is bright and colorful, it’s extremely thick cardboard, with thick binding. Not even a hint of binding separation and I would call this extremely sturdy.

Bonus points because it’s just gorgeous. I adore this color scheme and I love that it continues throughout the planner.

Room to Personalize

Any planner nerd can tell you that the fun in a planner is to personalize it, I always take a few pages and scrapbook them. I add photos to the front cover and first page for those days that I need a quick pick me up.

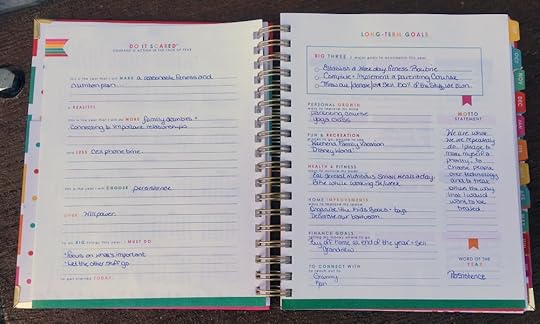

Long Term Goal Planning

The first thing you should know is that this is not just a planner. If you buy the planner and use it as a planner, you’re missing out big time. It’s an extremely effective organization, goal setting, and planning system.

In order to get the results that you’re looking for, you need to learn how to use the planner.

I can’t stress that enough.

If you buy the planner, and use it then you’ll love it. But, if you take the course that goes along with it, and learn the system behind the planner and implement it, you’ll be a raving fan like me.

It makes a huge difference!

You’ll get access to Crushing it Central when you buy the planner. Take advantage of it!

In the long term goals section, you spell out what goals you want to meet at the end of the year.

After you set your goals, you prioritize which goals are most important to you.

My list above got cut down from about 1,000 things that I wanted to do in a year, but when I went through this process, I realized that I would never actually get that much done.

I prioritized to make sure that the things with the biggest impact, or that are the most important things get done first.

Reference pages- there’s also a page for important dates, a year at a glance calendar, important numbers, and notes and ideas.

Monthly Planning Pages

This planner is entirely unique because instead of having sections (like a budgeting section, a weekly section etc), every section is contained within the month. And I absolutely love it.

Everything is easy to find, condensed and works easily.

Pro planner tip– I only use pencil for planning pages. And I always add check marks. I’m not one of those people that makes everything Pinterest perfect, It’s a planner, it’s meant to be used, but I found that my productivity was higher when I switched to all pencil and check marks. Likely because the planner stays neat and clean and inspiring.

My life changes too much for pen.

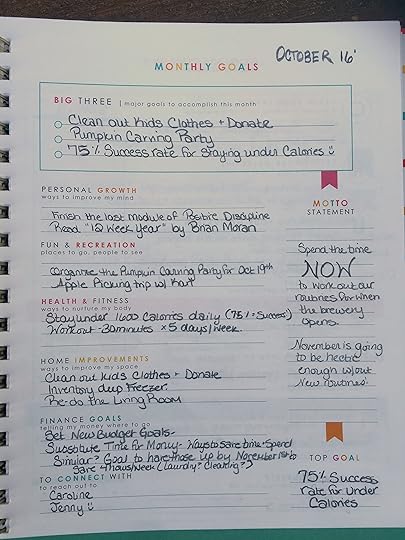

We start off with our monthly goals (incorporating the yearly goals we have and breaking them down into monthly goals).

Under monthly goals, I’m listing all of the things that I’d like to do this month, and then prioritizing that into my top 3 goals and my most important goal.

I like to hack the motto statement and list the why. Why do I want those goals?

For me this month, my husband is opening a brewery at the end of October and early November and life will change a lot in our house (am I the only one that hates change?) I know that if I get routines in place now, this transition will be a lot easier.

And that’s exactly what this planner is about, making your life easier!

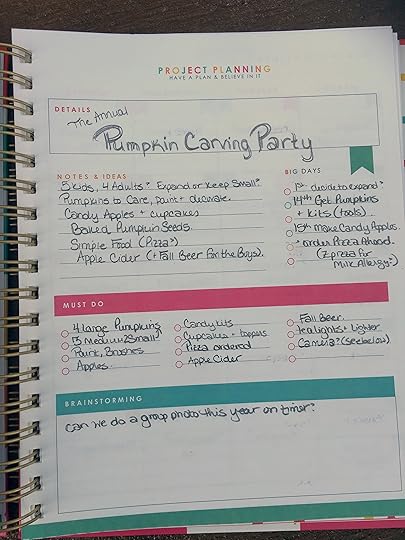

Step It Out

The next pages take your goals and projects and let you step them out one by one so you can see the small steps that need to be taken to accomplish a large project.

I always use goal crushing for my top goal and use the project planner to plan parties, events, or organizing projects.

Month at a Glance

Okay, no judging here, but I mentioned I’m a planner nerd. I’m also an efficiency nerd and I love schedules that allow me to focus my efforts on one major task a day.

Outside of work, each day of the week has a theme (that can be changed in special circumstances), so I’m only focusing on one household area a day. It makes life so much easier. Plus, Tuesday’s are my favorite day ever because I binge watch Netflix all night (which is why my Tuesdays say Reign, it’s my current obsession).

I’ll also list major events on here that will screw up that schedule (like weddings and parties).

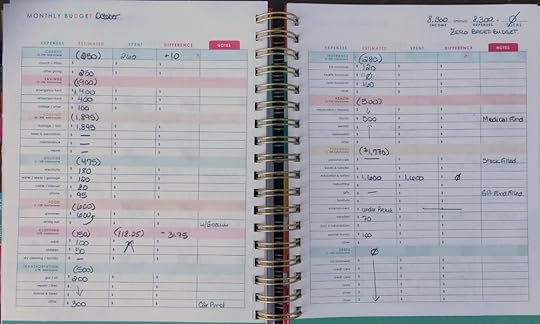

Monthly Budget

We do a Zero Based budget and are one month ahead (so we’re paying this month’s bills, with last month’s income). Depending on where you are in your financial journey, using my photo of budget section as a reference may not help you as much, since this is so different for everyone and we have a weird budget right now.

We paid off over $30,000 of debt and are now debt free, with a relatively high income, and we’re not big spenders on personal stuff. (Thank goodness since we live in a crazy expensive housing market!)

Our focus right now is beefing up our savings and a medical fund (exciting stuff right?). We usually have a lot more in personal money, but this month we decided to reduce that since we had some leftover from last month.

Must Do

You’ll notice that the actions steps to the monthly goals are listed in the planner and assigned times. (See Saturday morning- Going through the kids clothes is on both my monthly goals, and is part of my yearly goals (donate and reduce our stuff by 50%).

I list my weekly tasks (carried over from the monthly at a glance) under the must do section and then add in anything else that comes up. As soon as I think “I need to do this!”, It goes into the calendar and I assign it a day.

Menu Plan

The menu plan is my favorite part of this planner (okay, there’s a few “favorite parts!”), I love that it gives me enough room to spell out each meal. You could, in theory, make a shopping list on the right-hand list side, but I just enter it into the lists app on my phone so I don’t have to carry my planner with me.

List

I use the list section to keep track of anything I end up needing. This week it was a last minute reminder to pack for the wedding. Last week it was a running list of stuff from work that got out of control to see if I could barrel through some of those tasks before the week was up.

Monthly Expenses

I don’t usually use monthly expenses (I categorize the purchases on our banking dashboard) since we’re really used to budgeting by now, but I would have loved this back when we were new!

Thoughts and Thanks

I had a grateful journal that I loved and this has the same effect. As you think good thoughts, you just write it down. It could be anything as silly as “Super happy I married a guy that does the dishes” to “I have super sexy arms”.

It actually flips your life outlook over time as you consistently see the positive in things.

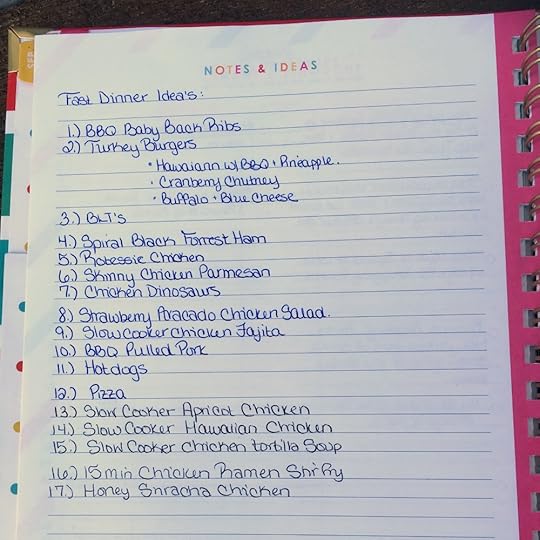

Notes and Ideas

I use the notes and ideas section to keep reference information. So far I’ve done super easy dinner ideas, and work courses I’d like to take.

Each month has a signature motivation page, with colorfully designed quotes.

Cleaning Schedule

There’s a cleaning schedule at the very back of the book, which we don’t currently use. I’m embarrassed to tell you that my husband is usually the cleaner. I love organizing and routines, but I don’t think I’ve ever mopped a floor in my life. Thankfully I married a guy that likes cleaning (I know, weird, right?).

The Verdict:

I love this planner!

I think you will too. It’s hard not to love. I’ve converted all my friends.

And I know we already talked about this, but if you listen to me and take the training on how to use the system before you dive into it, you’ll be thrilled with it!

You can buy the Living Well Planner here.

You can come back and thank me after.