Steve Bull's Blog, page 1371

May 1, 2017

Can Anyone Really Save The Economy in a Crash?

QUESTION: Mr. Armstrong; Did anyone ever save the world financial system during the 1998 Crash or the 2008 Crash?Also, you said that government will never heed the advice of anyone. You worked on Capitol Hill and testified before Congress and was called upon to form the G5. Yet you say it is impossible to prevent anything for it always crash and burn. Then anyone who claims they saved the economy or markets cannot be telling the truth. Care to comment?

ANSWER: Back in 1985 when I was called upon with the birth of the G5, it taught me a lesson. They will call people in to PRETEND they have consulted experts, but it is just a dog & pony show. They already predetermined what they will do and absolutely nobody can step up and advise them to prevent any such crash. Absolutely no government will ever take a precautionary action in such a manner. Government only responds to events – they do not prevent them.

There is absolutely nobody who can save the markets or economy in the middle of a crash – NOBODY! Why? Because these type of events are global contagions. First of all, in this case of 1998, it was a contagion that began in Russia and because they could not sell Russian assets, they sold every other market to raise cash to cover losses in Russia. So I fail to see how any person or any single country could stop a crash that is a global contagion. It would require quick action by a single entity that has global power. That does not exist!

Yes, in 1985 they called upon several analysts to pretend they listened to us but nobody directed them to create the G5. I wrote to President Reagan back then detailing why the G5 would increase volatility and fail.

…click on the above link to read the rest of the article…

Neither Le Pen nor Macron: Many French voters refuse to accept their options for president

Two remaining candidates fight for same political terrain as May 7 vote approaches

A man kicks back a tear gas canister at police in Paris on April 27, 2017 during a demonstration against the results of the first round of the presidential election. (Lionel Bonaventure/Getty Images)

Nahlah Ayed is a CBC foreign correspondent based in London. A veteran of foreign reportage, she’s covered major world events: the refugee crisis across Europe, the dying days of Iran under international sanctions, and the conflict in Ukraine. Ayed also spent nearly a decade working in and covering conflicts across the Middle East. Prior to joining CBC News, Ayed was a parliamentary reporter for The Canadian Press.

“Il est un gigolo.”

With that, the waitress dismissed France’s front-runner for president, Emmanuel Macron, as swiftly as she carried away the empty dishes.

Two weeks later, after the results of the first round of voting on April 23 pit centrist Macron head-to-head with far-right candidate Marine Le Pen, the waitress, who gave her name as Lucie, was forced to reconsider.

“It’s not much of a choice,” she said standing among the empty tables of the central Paris restaurant where she works. She wavered repeatedly between putting Macron ahead of Le Pen and not choosing at all.

The historic first round of voting redrew France’s political map and lines are necessarily shifting again. French citizens who may be following the old advice of voting with their hearts in the first round, then with their heads in the second, are now in the fraught process of a quick rethink before the May 7 vote that will determine their country’s next leader.

Emmanuel Macron, left, and Marine Le Pen will go head-to-head in the second round of France’s presidential election on May 7. Many voters aren’t thrilled with their options. (Christian Hartmann/Reuters)

…click on the above link to read the rest of the article…

PBoC Spins China’s Bad-Loan Data

In a recent speech at Bloomberg’s headquarters in New York, People’s Bank of China Deputy Governor Yi Gang reassured his audience on the level of non-performing loans (NPLs) in the Chinese banking sector. It had, he said, “pretty much stabilized after a long period of climbing. That’s a good development in the financial market.”

Yi was referring to NPLs as a share of total loans, which, as shown in the figure above, have stabilized over the past year. But this is misleading. NPLs have actually continued to grow—by RMB 238 billion ($35 billion) in 2016, reaching a total of RMB 1.5 trillion ($220 billion). The reason the NPL ratio has stabilized is that Chinese banks have extended more loans, boosting the denominator—not because they have reduced their exposure to bad loans.

In short, Yi is spinning. China’s bad-debt problem remains serious.

Rules And Dangers When Organizing Security And Survival Groups

For many years I have argued that the single most important preparation any person can make if they are concerned about future social or economic instability is the preparation of community building. It is the one thing that everyone needs for survival, and unfortunately, it is the one thing even many preparedness “experts” ignore.

When I talk about “community,” I am talking about groups in many forms. Sometimes a community is merely a small collection of families or neighbors; sometimes it is an entire town or county. Sometimes it is built around a local church, sometimes it is rooted in an already functioning political activism meet-up. Regardless of the size of your community, the people who are organized within a group for mutual aid, defense and trade are light years ahead of everyone else when it comes to survival. In fact, if a national crisis scenario escalates to the point of the disappearance of the rule of law, I would say that those without community will scramble to find one or probably die.

That said, there are right ways and wrong ways to go about organizing. There are also guidelines and hard rules to follow if you want your community to be an advantage rather than an obstacle. I have had the opportunity over the years to see many preparedness groups and organizations in action. I have gleaned knowledge from their successes, and also their numerous failures. I have also had the privilege of coordinating a preparedness group in my local area which has been active for the past three and a half years. So, I am speaking from personal experience when it comes to this process.

Here is what I have learned so far…

…click on the above link to read the rest of the article…

Korea Times: “China Bracing For Emergency Situation Involving North Korea”

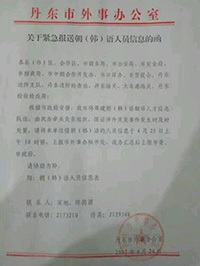

With the North Korean situation tense after Friday’s latest failed missile attempt, the South Korea’s Korea Times reports that a Chinese town near the border with North Korea is “urgently” recruiting Korean-Chinese interpreters, “stirring speculation that China is bracing for an emergency situation involving its nuclear-armed neighbor.”

The Korea Times cites The Oriental Daily, a Hong Kong-based news outlet, which reportedly published the story on Apr. 27, including a photo of a Chinese government document ordering the town of Dandong to recruit an unspecified number of Korean-Chinese interpreters to work at 10 departments in the town, including border security, public security, trade, customs and quarantine.

The document did not specify the reason behind the unusual, large-scale recruiting. But experts and local citizens said the move indicated that China was bracing for a possible military clash between the United States and North Korea.

The Korean outlet goes on to speculate that this “might trigger a huge exodus of North Koreans to border towns in China.”

Whether this dismal scenario will become a reality is largely up to North Korea’s leader Kim Jong-un.

U.S. President Donald Trump has repeatedly warned that the world’s superpower will strike North Korea’s nuclear facilities if Kim proceeds with a sixth nuclear test or test fires an intercontinental ballistic missile.

The Dandong administration also has ordered its officials to work rotating night shifts since April 25, according to South Korea’s news agency Yonhap.

Meanwhile, China has dismissed recent reports that it has sent 150,000 additional troops to its border with the North.

April 30, 2017

Eric Peters: If Rates Ever Rise Above 3.5% “It Would Spark Massive Defaults”

Earlier today in his weekly note, One River CIO Eric Peters explained that in their attempt to overturn the natural order of the global economic “ecosystem”, what central banks have done is “stunning, unprecedented… and arrogant”, and as a result it is only a matter of time before another “peak instability” moment emerges as “it stands to reason that our volatility-selling machine will break one day. We saw a glimpse of this in 2008-09.”

And yet, as Peters concedes in a follow up note, those same central bankers don’t have any other option but to kick the can because as the CIO notes, any attempt to break the current ultra-low rate regime would “spark massive defaults.”

Incidentally, those are the same defaults that should have happened during the “near systemic reset” of 2008/2009 but the Fed, in all its wisdom, decided to kick the can at the cost of trillions in global excess liquidity, and while it bought itself some time – in the process unleashing a global deflation wave thanks to zombie companies that should not exist yet do, and every day try to undercut each other on pricing – nearly ten years later it has discovered that it has no way out, for one simple reason: there is now too accumulated debt.

Here is Peters “modelling” out why the Fed is stuck with no way out:

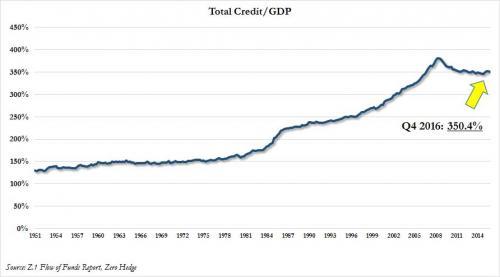

“When debt expands constantly relative to GDP, there’s a limit to how high interest rates can rise without causing massive defaults,” said the Model. “There’s nothing inherently wrong with defaults, they can cleanse a system, but a rise in US defaults from today’s 2.5% to 6.0% would boost unemployment by 3%.”

America’s economy is leveraged to the financial system, which includes non-capitalized liabilities; entitlements, pensions, healthcare. “US total debt/GDP is 300%, but if you include these non-capitalized liabilities, it’s more like 800%.”

…click on the above link to read the rest of the article…

Panic Bank Run Leaves Canada’s Largest Alternative Mortgage Lender On Edge Of Collapse

After two years of recurring warnings (both on this website and elsewhere) that Canada’s largest alternative (i.e., non-bank) mortgage lender is fundamentally insolvent, kept alive only courtesy of the Canadian housing bubble which until last week had managed to lift all boats, Home Capital Group suffered a spectacular spectacular implosion last week when its stock price crashed by the most on record after HCG revealed that it had taken out an emergency $2 billion line of credit from an unnamed counterparty with an effective rate as high as 22.5%, indicative of a business model on the verge of collapse .

Or, as we put it, Canada just experienced its very own “New Century” moment.

One day later, it emerged that the lender behind HCG’s (pre-petition) rescue loan was none other than the Healthcare of Ontario Pension Plan (HOOPP). As Bloomberg reported, the Toronto-based pension plan – which represented more than 321,000 healthcare workers in Ontario – gave the struggling Canadian mortgage lender the loan to shore up liquidity as it faces a run on deposits amid a probe by the provincial securities regulator. Home Capital had also retained RBC Capital Markets and BMO Capital Markets to advise on “strategic options” after it secured the loan.

Why did HOOPP put itself, or rather its constituents in the precarious position of funding what is a very rapidly melting ice cube? The answer to that emerged when we learned that HOOPP President and CEO Jim Keohane also sits on Home Capital’s board and is also a shareholder. But how did regulators allow such a glaring conflict of interest? According to the Canadian press, Keohane had been a director of Home Capital until Thursday, but said he stepped away from the boardroom on Tuesday to remove the conflict of interest when it became clear HOOPP might step in as a lender.

…click on the above link to read the rest of the article…

Ludwig von Mises’ Century of Validation

Seeing the Light

It has been said that “the definition of insanity is doing the same thing over and over again and expecting different results.” No one quite knows who first uttered this remark; it has been attributed to Albert Einstein, Mark Twain, Benjamin Franklin, and has even been said to be an Ancient Chinese Proverb. What is known is that this cliché has been repeated over and over again so often that its mere mention substantiates its own definition.

Several of the ladies and gentlemen above wanted to let us know that they’re merely eccentric, and if they want to do things all over again and again and again, we should let them…

Several of the ladies and gentlemen above wanted to let us know that they’re merely eccentric, and if they want to do things all over again and again and again, we should let them…

Nonetheless, we repeat it again because it’s particularly fitting to today’s deliberations. Here we begin with a look back to the past in search of edification. For the miscalculations of the past continue to dictate the insanity of the present.

Many years ago, a bright minded and well intentioned Italian pursued a devious undertaking. His efforts aimed to conceive a pure theory of a socialist economy. His objective was to take the sordid teachings of Marx and pencil out the mechanics of how a centrally planned economy could bring a life of security and abundance for all. What follows is an approximation of how the dirty deed went down.

In 1908, Italian economist Enrico Barone suffered an abstraction. One late night he skipped a bite of his meatballs and marinara, and gazed into the outer frontiers of deep space. Looking around, he couldn’t believe his eyes. For in this far corner of absolute darkness, he saw something truly amazing. Out in the distant reaches of nothingness, peering into a black hole, he saw not the dark. Rather, he thought he saw the light.

…click on the above link to read the rest of the article…

Central Banks’ Obsession with Price Stability Leads to Economic Instability

For most economists the key factor that sets the foundation for healthy economic fundamentals is a stable price level as depicted by the consumer price index.

According to this way of thinking, a stable price level doesn’t obscure the visibility of the relative changes in the prices of goods and services, and enables businesses to see clearly market signals that are conveyed by the relative changes in the prices of goods and services. Consequently, it is held, this leads to the efficient use of the economy’s scarce resources and hence results in better economic fundamentals.

The Rationale for Price-Stabilization Policies

For instance, let us say that demand increases for potatoes versus tomatoes. This relative strengthening, it is held, is going to be depicted by a greater increase in the price of potatoes than for tomatoes.

Now in an unhampered market, businesses pay attention to consumer wishes as manifested by changes in the relative prices of goods and services. Failing to abide by consumer wishes will lead to the wrong production mix of goods and services and will lead to losses.

Hence in our example, by paying attention to relative changes in prices, businesses are likely to increase the production of potatoes versus tomatoes.

According to this way of thinking, if the price level is not stable, then the visibility of the relative price changes becomes blurred and consequently, businesses cannot ascertain the relative changes in the demand for goods and services and make correct production decisions.

Thus, it is feared that unstable prices will lead to a misallocation of resources and to the weakening of economic fundamentals. Unstable changes in the price level obscure changes in the relative prices of goods and services. Consequently, businesses will find it difficult to recognize a change in relative prices when the price level is unstable.

…click on the above link to read the rest of the article…

Italy Warns Sudden Collapse Of Alitalia Would Lead To “Great Shock” For The Economy

That Italy has a bank solvency problem will not come as a surprise to anyone who has been following events in Europe for the past 7 years.

Just yesterday, Italian daily La Stampa reported that four months after the third government bailout of Italy’s third largest bank in as many years, the Italian government may have to inject even more cash than planned into Monte Paschi, the world’s oldest and apparently always insolvent bank.

Stampa cited the outcome of an ECB inspection, focusing on uncertainties from the bank’s planned bad loan reduction. The Italian daily noted that the ECB had communicated results of its inspection to the bank last week, noting that losses are now expected to be well above those calculated until now. Specifically, while the proposed €8.8BN recapitalization would be sufficient to take the bank’s CET1 above the required regulatory level, it would not be sufficient to meet the ECB SREP requirements, raising the risk the government will have to contribute more than the €6.6BN currently envisaged.

But while Monte Paschi continues to be a perpetual drain of taxpayer funds, the most imminent threat facing the Italian economy comes not from the banking sector, but from its just as troubled national airline carrier. Last week, Alitalia said it had exhausted all options after workers voted against job cuts aimed at salvaging the cash-strapped Italian airline, pushing it toward administration for the second time in a decade.

According to Bloomberg, a €2 billion recapitalization tied to the savings plan is effectively dead and Alitalia would start appropriate “legal procedures” as funds run out, the Rome-based airline said. Chairman Luca Cordero Di Montezemolo “formally” communicated to the Italy aviation authority that the carrier decided to start the process of naming a administrator, the authority said on its website last Tuesday.

…click on the above link to read the rest of the article…