Steve Bull's Blog, page 1374

April 23, 2017

Planning for the “Longpath,” According to Ari Wallach

[image error]

PLANNING FOR THE “LONGPATH,” ACCORDING TO ARI WALLACH

With our attention spans getting shorter and our global, civilization-scale problems growing larger, it’s time we started thinking about the future. In a TED Talk from October 2016, strategic consultant Ari Wallach offered three ways people can develop long-term plans – thinking ten or 20 years out, instead of just six months or only a few weeks.

“Short-termism, for many reasons, has pervaded every nook and cranny of our reality,” he said. “If we want to move forward into a different future than the one we have right now … there’s some more we can do. But my argument is that unless we shift our mental models and our mental maps on how we think about the short, it’s not going to happen.”

Through the practice of what Wallach has termed “longpath,” individuals will be able to more effectively plan for the future by employing three different ways of thinking – for each major decision they make.

TRANSGENERATIONAL THINKING

Rather than using a single lifetime as a unit of measurement for planning, Wallach promotes the idea of making decisions while taking into account the impact your choices will make on future generations – and encouraging them to engage in that process with you.

“What it does is it connects them here in the present, but it also – and this is the crux of transgenerational thinking ethics – it sets them up to how they’re going to interact with their kids and their kids and their kids,” Wallach said.

Via Ted-Ed on Youtube. FUTURES THINKING

This step involves considering all kinds of potential future possibilities – and reflecting on the different kinds of solutions that could be employed to address them. Too often, Wallach said, people make overly optimistic assumptions that most of the planet’s current problems will be resolved in the future, in some “techno-utopia.”

…click on the above link to read the rest of the article…

Legendary technical investor Robert Prechter is awaiting a depression-like shock in the U.S.

He tells Avi Gilburt in a Q&A that today’s mood of optimism will give way to a funk that will rival that of the 1930s

Robert Prechter with the 61,000 sheets of paper generated in the editing process for his new book, “The Socionomic Theory of Finance.”

Robert Prechter with the 61,000 sheets of paper generated in the editing process for his new book, “The Socionomic Theory of Finance.”A June 2015 profile of Robert Prechter, the world’s foremost proponent of Elliott Wave technical analysis, turned out to be the most popular investing story on MarketWatch for the week in which it was published.

One of the reasons is that, at the time, Prechter said the bull market in U.S. stocks was in a “precarious position” as a “mania” gripped investors, who pushed stocks to sky-high levels of overvaluation. The market has only risen since then, and it even got a bump from the November 2016 election of businessman Donald Trump as president.

I recently interviewed Prechter, who released a ground-breaking book, “The Socionomic Theory of Finance,” at the end of December. In the 813-page book, which took 13 years to write, he proposes a cohesive model that takes into account trends in sociology, psychology, politics, economics and finance. I highly recommend the book.

As I’ve explained here, Elliott Wave theory says public sentiment and mass psychology move in five waves within a primary trend, and three waves in a counter-trend. Once a five, or V, wave move (the waves are sometimes described in Roman numerals) in public sentiment is completed, it is time for the subconscious sentiment of the public to shift in the opposite direction, which is simply a natural cause of events in the human psyche, and not the operative effect from some form of “news.”

…click on the above link to read the rest of the article…

“Reform” won’t solve our biggest problems

“You never cure structural defects; you let the system collapse.”

As I contemplated this proposition taken from a recent piece by Nassim Nicholas Taleb, I realized what profound implications accepting it would have for all those engaged in attempting to address our current social, political and environmental ills.

If it is true that modern capitalism is incompatible with effective action on climate change, if it is true that top-heavy, bureaucratic nations always eventually become captive to their wealthy citizens, if it is true that our centralized, complex, tightly networked systems in finance, agriculture, shipping and manufacturing are exceedingly fragile and prone to failure–if these all represent structural defects, then they cannot be addressed by tinkering or “reform.” Those in charge cannot be persuaded to “do something” which is contrary to the structural necessities built into these systems.

The choices then are: 1) Do nothing, 2) insurrection (for which you might be jailed or worse) or 3) start building a decentralized replacement. Since I’m discarding choices one and two, I’ll address choice three.

First, adopting choice three doesn’t mean we should abandon critiquing the current systems under which we live. Quite the contrary. Those systems are where future adopters of decentralized replacements currently do business. They are the Brand X against which new systems can and need to be compared.

Second, we have good evidence that small-scale governments can actually respond to climate change when large-scale governments can’t. Citizens of seaside communities experience the rising ocean waters first hand and have direct access to their elected officials as do those who experience droughts. And those cities have actually taken significant (but still inadequate) steps toward addressing climate change. It is counterintuitive that decentralized governments could act more quickly and effectively on issues of international scope than national governments until we see them in action.

…click on the above link to read the rest of the article…

On Interventionistas and their Mental Defects

Excerpted from the preface of Skin in the Game

Skin in the Game is necessary to reduce the effects of the following divergences that arose mainly as a side effect of civilization: action and cheap talk (tawk), consequence and intention, practice and theory, honor and reputation, expertise and pseudoexpertise, concrete and abstract, ethical and legal, genuine and cosmetic, entrepreneur and bureaucrat, entrepreneur and chief executive, strength and display, love and gold-digging, Coventry and Brussels, Omaha and Washington, D.C., economists and human beings, authors and editors, scholarship and academia, democracy and governance, science and scientism, politics and politicians, love and money, the spirit and the letter, Cato the Elder and Barack Obama, quality and advertising, commitment and signaling, and, centrally, collective and individual.

But, to this author, is mostly about justice, honor, and sacrifice as something existential for humans.

Let us first connect a few dots of items the list above.

Antaeus Whacked

Antaeus was a giant, rather semi-giant of sorts, the literal son of Mother Earth, Gaea, and Poseidon the god of the sea. He had a strange occupation, which consisted of forcing passersby in his country, (Greek) Libya, to wrestle; his trick was to pin his victims to the ground and crush them. This macabre hobby was apparently the expression of filial devotion; Antaeus aimed at building a temple for his father Poseidon, using for material the skulls of his victims.

Antaeus was deemed to be invincible; but there was a trick. He derived his strength from contact with his mother, earth. Physically separated from contact with earth, he lost all his powers. Hercules, as part of his twelve labors (actually in one, not all variations), had for homework to whack Antaeus. He managed to lift him off the ground and terminated him by crushing him as his feet remained out of contact with his mamma.

…click on the above link to read the rest of the article…

Venezuela On The Verge Of Revolution As Hyperinflated Currency Crashes To New Record Low

Venezuela, a country with only $10 billion left in reserves to run on, is in trouble. As the currency hyperinflates to new record lows against the dollar…

James Holbrooks points out that the people are starving. The government has gone full-on authoritarian, and now desperate human beings are dying in the streets. From an Associated Press report on Friday:

“Authorities in Venezuela say 12 people were killed overnight following looting and violence in the South American nation’s capital amid a spiraling political crisis.”

Continuing, the report further highlighted the gravity of the situation:

“Most of the deaths took place in El Valle, where opposition leaders say 13 people were hit with an electrical current while trying to loot a bakery protected by an electric fence.”

These are people without options, forced to turn to thievery to stay alive. And they died because of it.

On April 6, The Economist reported that over the past year, 74 percent of Venezuelans lost an average of 20 pounds. Venezuela, incidentally, has topped Bloomberg’s Economic Misery Index for the past three years.

The country began its slide downward into chaos with the election of President Nicolas Maduro, who immediately began implementing socialist programs and has since taken extreme measures to secure his position.

At the end of March, for instance, Maduro effectively shut down Venezuela’s congress — his primary political opposition — and gave those legislative duties to his puppet Supreme Court.

The latest news coming out of the South American nation — aside from the deaths of people trying to steal bread to live — is that General Motors, whose Venezuelan production facility was overtaken by local authorities, has now ceased all operations in the country.

To put that in perspective, consider that in 2016, only 3,000 vehicles were sold in Venezuela, a country of 30 million people.

…click on the above link to read the rest of the article…

April 22, 2017

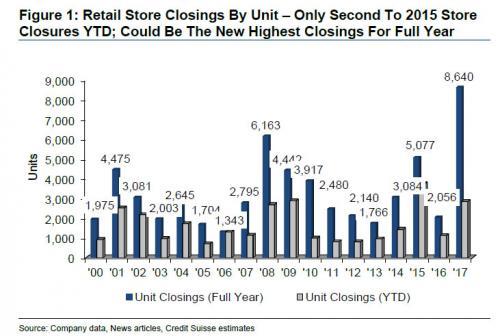

“The Retail Bubble Has Now Burst”: A Record 8,640 Stores Are Closing In 2017

“Thousands of new doors opened and rents soared. This created a bubble, and like housing, that bubble has now burst.”

– Richard Hayne, Urban Outfitters CEO, March 2017

The devastation in the US retail sector is accelerating in 2017, and in addition to the surging number of brick and mortar retail bankruptcies, it is perhaps nowhere more obvious than in the soaring number of store closures.

While the shuttering of retail stores has been a frequent topic on this website, most recently in the context of the next “big short”, namely the ongoing deterioration in the mall REITs and associated Commercial Mortgage-Backed Securities and CDS, here is a stunning fact from Credit Suisse:“Barely a quarter into 2017, year-to-date retail store closings have already surpassed those of 2008.”

According to the Swiss bank’s calculations, on a unit basis, approximately 2,880 store closings were announced YTD, more than twice as many closings as the 1,153 announced during the same period last year. Historically, roughly 60% of store closure announcements occur in the first five months of the year. By extrapolating the year-to-date announcements, CS estimates that there could be more than 8,640 store closings this year, which will be higher than the historical 2008 peak of approximately 6,200 store closings, which suggests that for brick-and-mortar stores stores the current transition period is far worse than the depth of the credit crisis depression.

As the WSJ calculates, at least 10 retailers, including Limited Stores, electronics chain hhgregg and sporting-goods chain Gander Mountain have filed for bankruptcy protection so far this year. That compares with nine retailers that declared bankruptcy, with at least $50 million liabilities, for all of 2016. On Friday, women’s apparel chain Bebe Stores said it would close its remaining 170 shops and sell only online, while teen retailer Rue21 Inc. announced plans to close about 400 of its 1,100 locations.

Broken down by retailer, either in bankruptcy or not yet:

…click on the above link to read the rest of the article…

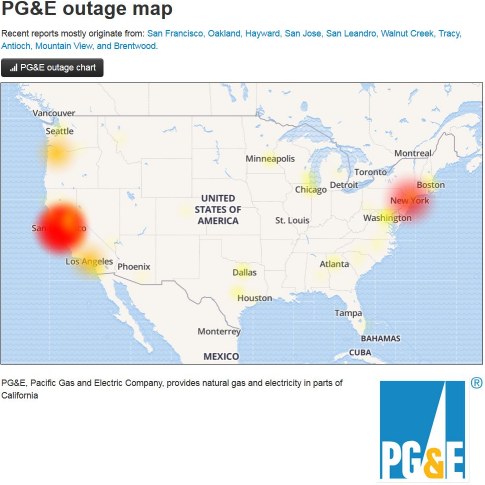

Yesterday’s Broad Power Outage Likely Caused By Geomagnetic Storm

Prior session, a massive US power grid failure was seen across the entire United States in one simultaneous fashion. San Fransisco, New York, and Los Angeles were the three main areas that were hit the hardest. Each of the areas experienced challenges or shut downs in business commerce. Also, basic infrastructure such as communication networks, mass transportation, and supply chains experienced challenges. To many this seemed apocalyptic with anaylst citing possible cyber attacks amid mounting geopolitical turmoil across the globe. We’re shocked that mainstream media didn’t revive the failing Russian narrative for another round of fake news to confuse the masses. Personally, I don’t think it was a cyber attack or the Russians, but more of a Space Weather Event.

Space weather refers to the environmental conditions in Earth’s magnetosphere, ionosphere and thermosphere due to the Sun and the solar wind that can influence the functioning and reliability of spaceborne and ground-based systems and services or endanger property or human health.

Here is PG&E outage map from yesterday’s event. Widespread.

This is the Planetary K-Index, which 5 or greater indicates storm-level geomagnetic activity around earth. The latest space weather data signals a geomagnetic storm rolled in on April 20, 2017. During the elevated K-waves >5, San Fransisco, New York, and Los Angeles experienced power grid failures simultaneously.

LATEST SPACE WEATHER WARNINGS

April 22, 2017 @ 08:40 UTC

Geomagnetic Storm Warning (UPDATED)

A moderate (G2) geomagnetic storm is currently in progress thanks to a high speed solar wind stream above 700 km/s. More storming is expected over the next several days as a coronal hole stream rattles our geomagnetic field. Sky watchers at middle to high latitudes should be alert for visible aurora during the next several nights.ALERT: Geomagnetic K-index of 6

Threshold Reached: 2017 Apr 22 0559 UTC

Synoptic Period: 0300-0600 UTC

Active Warning: Yes

NOAA Scale: G2 – Moderate

…click on the above link to read the rest of the article…

The American Empire Under Donald Trump Has Become Increasingly Desperate, Dangerous & Insecure

My current working hypothesis is that the U.S. is a late-stage empire about to enter a more serious and dangerous period of collapse. In case you missed it, I outlined my broad brush view in the very popular recent post, Prepare for Impact – This is the Beginning of the End for U.S. Empire. Here’s a brief excerpt:

I believe last night’s strike represents the beginning of the end for U.S. empire. Although the U.S. has been declining domestically for this entire century, America has still been calling all the shots on the international front. This makes sense in late-stage empire, as the focus of the fat and happy “elite” becomes singularly obsessed with domination and power, while the situation back home festers and rots.

Trump won on an “America first” platform that promised to emphasize the well-being of American citizens over geopolitical adventurism. We now know for certain he’s been manipulated into the imperial mindset, and his recklessness will merely accelerate U.S. decline on the world stage, and in turn, back home.

When I came across reports yesterday that the U.S. Justice Department is trying to figure out a way to prosecute the world’s most courageous and effective news publisher, Wikileaks’ Julian Assange, I immediately saw it to be further evidence of the incredible insecurity and desperation of the American establishment.

The CIA is particularly enraged at Assange as a result of last month’s initial Vault 7 release. Rather than apologize for allowing zero day exploits in large tech companies to remain open and therefore vulnerable to hacking from anyone with the skills to do so (see: CIA Hacking Tools Allow for an Unaccountable Intelligence Agency Dictatorship), CIA director Mike Pompeo decided to respond with an unhinged nervous breakdown during a recent speech to the Saudi funded Center for Strategic and International Studies (CSIS).

…click on the above link to read the rest of the article…

Prisons of Pleasure or Pain: Huxley’s “Brave New World” vs. Orwell’s “1984”

Prisons of Pleasure or Pain: Huxley’s “Brave New World” vs. Orwell’s “1984”

Definition of UTOPIA

1: an imaginary and indefinitely remote place

2: a place of ideal perfection especially in laws, government, and social conditions

3: an impractical scheme for social improvement

Definition of DYSTOPIA

1: an imaginary place where people lead dehumanized and often fearful lives

2: literature: anti-utopia

Many Americans today would quite possibly consider Aldous Huxley’s “Brave New World” to be a utopia of sorts with its limitless drugs, guilt-free sex, perpetual entertainment and a genetically engineered society designed for maximum economic efficiency and social harmony. Conversely, most free people today would view Orwell’s “1984” as a dystopian nightmare, and shudder to contemplate the terrifying existence under the iron fist of “Big Brother”; the ubiquitous figurehead of a perfectly totalitarian government.

Although both men were of British descent, Huxley was nine years older than Orwell and published Brave New World in 1932, seventeen years before 1984 was released in 1949. Both books are widely considered classics and are included in the Modern Library’s top ten great novels of the twentieth century.

Brave New World

Aldous Huxley was born to academic parents and he was the grandson of Thomas Henry Huxley, a famous biologist and an enthusiastic proponent of Darwin’s Theory of Evolution who was known as “Darwin’s Bulldog”. Huxley’s own father had a well-equipped botanical laboratory where young Aldous began his education. Given the Huxley family’s appreciation for science, it makes perfect sense that Brave New World began in what is called the “Central London Hatchery and Conditioning Centre” where human beings are artificially grown and genetically predestined into five societal castes consisting of: Alpha, Beta, Gamma, Delta and Epsilon.

Initially, the story centers on Bernard Marx, who is a slightly genetically flawed Alpha Plus psychologist with an inferiority complex due to his short stature.

…click on the above link to read the rest of the article…

Cracks in Ponzi-Finance Land

Retail Debt Debacles

The retail sector has replaced the oil sector in a sense, and not in a good way. It is the sector that is most likely to see a large surge in bankruptcies this year. Junk bonds issued by retailers are performing dismally, and within the group the bonds of companies that were subject to leveraged buyouts by private equity firms seem to be doing the worst (a function of their outsized debt loads). Here is a chart showing the y-t-d performance of a number of these bonds as of the end of March:

Returns of several of the worst performing junk bonds issued by retailers in Q1 2017. This is rather impressive value destruction for a single quarter – click to enlarge.

Returns of several of the worst performing junk bonds issued by retailers in Q1 2017. This is rather impressive value destruction for a single quarter – click to enlarge.

Note the stand-out Neiman Marcus, a luxury apparel retailer, the bonds of which have been in free-fall this year. The company was bought out in an LBO and was saddled with a mountain of debt in the process. Investors buying this debt have now come to regret their purchases, particularly as it is debt of the “creative” kind.

Investor demand for junk bonds continues to be brisk, with inflows from retail investors said to be particularly strong. As we have pointed out on previous occasions, this surge in demand has resulted in creditors accepting ever softer loan covenants.

A long period of extremely low interest rates not only leads to a pronounced distortion of relative prices and the associated malinvestment of capital, it also tends to make a growing number of debtors increasingly vulnerable to rising rates and other disruptions. Over time, the number of companies forced to regularly roll over debt if they want to remain among the quick will inevitably increase.

These companies then depend on high investor confidence, which is now faltering in the retail sector. The out look seems appropriately grim: Fitch expects the default rate in the sector to spike to 9% this year.

…click on the above link to read the rest of the article…