Steve Bull's Blog, page 1377

April 18, 2017

Brad Birkenfeld: Lucifer’s Banker

A whistle-blower’s account of exposing massive fraud at UBS

Just how bad is the ongoing fraud in the banking system? Get ready for a mind-bowing expose by a former insider at UBS.

Just how bad is the ongoing fraud in the banking system? Get ready for a mind-bowing expose by a former insider at UBS.

Brad Birkenfield, author of Lucifer’s Banker: The Untold Story of How I Destroyed Swiss Bank Secrecy, recounts the efforts he uncovered by his employer to help its clients cheat the US government out of tens of $billions in taxes.

But despite his working with the government closely to expose the gigantic conspiracy between US-based tax cheats and the giant Swiss bank, UBS, the so-called Justice Department went after Mr. Birkenfeld for abetting tax evasion by one of his clients. After spending thirty months in Federal prison, he was released and three weeks later, received a whistle-blower check for $104 million, the largest such check ever from the IRS Whistle-blower Office.

Once again, 300,000,000 Americans-plus got screwed by the corrupt Department of Justice. They’re not about justice, they’re about protecting themselves, trying to take credit, and making everyone else listen to what they say the story is.

We remember the financial crisis of 2008. It was devastating and so many people lost their jobs, lost their homes and so forth. In the entire financial crisis, there was not one banker to go to jail. The only banker to go to jail was the UBS whistleblower who exposed the largest and longest running tax fraud in the world.

Here’s the problem with the system. When you fine UBS you must realize UBS is a Swiss bank, so that means they write off the fine on their taxes. So then, that means the Swiss taxpayers carry the burden. That’s the first thing.

The second thing is go look at the millions and millions of dollars in legal fees spent to defend their conduct. The UBS shareholders pick up that tab.

…click on the above link to read the rest of the article…

The Economy Is Like a Circus

The economy is like a circus. It comes to town, and eventually it leaves town. We get paid in tickets to this circus. As long as the circus stays in town, we can use our tickets. Once the circus leaves town, we are pretty much out of luck.1

The reason the circus stays in town is because the economy stays in sufficient balance that the economy can go on. This is much like the way many other self-organized systems function. For example, our bodies continue to function as long as there are suitable balances in many different areas (oxygen, food, water, air pressure). Ecosystems continue to function as long as there is sufficient rain, adequate temperatures, and enough sunlight.

There are many different views as to what limits we reach in a finite world. Some people think we will “run out” of oil, or of energy products. Some think that the energy return will fall too low, as measured in some manner. I see the adequacy of the energy return as being very much tied to the financial system. Thus, the forecast by US Atlanta Fed GDPNow indicating that first quarter 2017 US GDP growth will only be 0.5% is likely to be a problem, assuming it is correct.

Our economy operates on economies of scale. Once we get too close to shrinking, or actually start shrinking, we reach a point where the economic circus starts to leave town. At some point, we will discover the circus is gone. The economy we thought we had, will have left us. If some people are survivors, they will need to pick up the pieces and start over with an entirely new system.

…click on the above link to read the rest of the article…

So China’s Authorities Crack Down on Housing Speculation?

Who’s Behind China’s Wild House Price Bubble? State-Owned Property Developers, Funded by State-Owned Banks.

Beijing’s municipal government summoned representatives of state-owned property developers on Monday and told them to stop hyping the already overheated housing market, according to the portal, Chinese Real Estate Business (CREB), cited by Reuters.

State-owned property developers, funded by state-owned banks, have been a major force in inflating home prices as they bid aggressively for land to gain market share. According to CREB, state-owned developers bid for nearly half of the most expensive land in China during the first five months of 2016. And that trend has continued. But after the meeting with the municipal government of Beijing, these firms may be forced “to change their land strategy.”

Telling state-owned developers to stop hyping, as CREB put it, “operational and market activities” would be the latest effort to crack down on property speculation gone wild in China. It would come on top of the numerous other ways local and central authorities have tried to curb this speculation, without success so far.

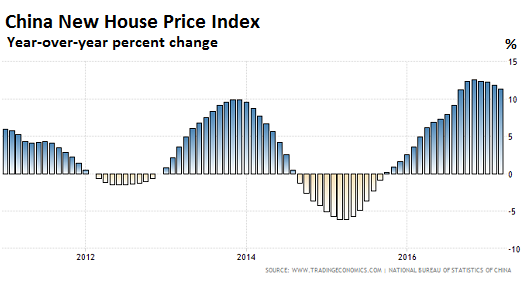

Today, the National Bureau of Statistics reported that new home prices in 70 cities surged 11.3% in March year-over-year. It was the 18th month in a row of year-over-year gains. Prices jumped 19% in Beijing and 16.8% in Shanghai (chart by Trading Economics):

On a monthly basis, new home prices rose 0.6%, the fastest in four months, up from 0.3% in February. Of the 70 cities in the index, 62 experienced a month-to-month price gain, up from 56 cities in February, once again defying expectations of a slowdown. Prices jumped the most in Haikou (2.6%), Sanya (2.5%), and Guangzhou 2.3%), followed by other second- and third-tier cities, to which the speculative fire has been spreading.

…click on the above link to read the rest of the article…

April 17, 2017

Buy the Dip?

The military frolics of spring have distracted the nation’s attention from the economic and financial dynamics that pose the ultimate mortal threat to business as usual. Note the distinction between economic and financial. The first represents real activity in this Land of the Deal: people doing and making. The second, finance, used to be a minor branch — only about five percent — of all the doing in the days of America’s putative bigliest greatitude. The task of finance then was limited and straightforward: to manage the allocation of capital for more doing and making. The profit in that enabled bankers to drive Cadillacs instead of Chevrolets, but not much more.

These days, finance is closer to 40 percent of all the doing in America, and it is not about making anything, but getting more than its share of “money” — whatever that is now — and what “money” mostly is is whatever the people engaged in finance say it is, for instance, Fannie Mae bonds representing millions of sketchy loans for houses of vinyl and strand-board built in places with no future… or stock issued by the Tesla corporation… or the sovereign IOUs of the US Treasury.

The list of things that pretend to be “money” these days would be long and shocking and the sheer churn of these instruments among the banks and markets “produces” the fabled “revenue streams” beloved of The Wall Street Journal. What happens when the world discovers that these instruments (securities and their derivatives) represent falsely? Why, bigly trouble.

And this is the season we’re moving into as the dogwoods blaze: the season of the re-discovery of actual value. For those of you gloating over last week’s demonstrations of US Big Stick-ism, be warned that our military shenanigans have given China and Russia every reason to discipline this country by undermining the international standing of the dollar.

…click on the above link to read the rest of the article…

Bankers, Always the Last to Know

Commercial real estate is starting to cool, with deal volume last year dropping 10% from 2015 to $493.7 billion, while, as Peter Grant reports for the Wall Street Journal and Grant’s Interest Rate Observer, “the early stages of 2017 have delivered even weaker results: $50.3 billion in transaction value through March 1 compared to $80.1 billion in the like period in 2015 (a 37.2% yearly drop).”

One would guess bankers would take notice and turn shy. However, Craig Bender of ING real estate, tells the Wall Street Journal: “The banks are hungry. The life insurance groups are hungry”.

It seems Lord Keynes had one thing right when he wrote, “Banks and bankers are by nature blind. They have not seen what was coming…. A ‘sound banker,’ alas! is not one who foresees danger and avoids it, but one who, when he is ruined, is ruined in a conventional and orthodox way along with his fellows, so that no one can really blame him.”

In America’s hottest commercial market, New York, a veritable magnet for hot, cheap, and foreign funds, the first quarter of 2017 was a bust. Large office property sales (those with over 50,000 square feet) that closed in Q1 2017 plunged 63% year-over-year, from $5.54 billion in Q1 2016 to $2.1 billion. It was the lowest transaction amount in any quarter since Q1 2013, writes Wolf Richter.

Not only did the amount of square footage sold nosedive, but the price per square foot fell as well. Richter points out the commercial property bubble has been inflating unabated since 2009. “The big freeze in New York City may be another sign that this bubble too can only go so far, and that peak craziness has been reached,” he writes. “The Fed is now specifically fretting about this commercial real estate bubble, and how to contain it before it takes down the financial system.”

…click on the above link to read the rest of the article…

What’s Your Plan B?

Although Plan B includes a wide spectrum of options, these three basic categories define three different purposes for having an alternative residence lined up.

We all have a Plan A–continue living just like we’re living now.

Some of us have a Plan B in case Plan A doesn’t work out, and the reasons for a Plan B break out into three general categories:

1. Preppers who foresee the potential for a breakdown in Plan A due to a systemic “perfect storm” of events that could overwhelm the status quo’s ability to supply healthcare, food and transportation fuels for the nation’s heavily urbanized populace.

2. People who understand their employment is precarious and contingent, and they might have to move to another locale if they lose their job and can’t find another equivalent one quickly.

3. Those who tire of the stresses of maintaining Plan A and who long for a less stressful, less complex, cheaper and more fulfilling way of living.

The Fragility and Vulnerability of Highly Optimized Supply Chains

Many people are unaware of the fragility of the supply chains that truck in food, fuel and all the other commodities of industrialized comfort to cities. As a general rule, there are only a few days of food and fuel in a typical city, and any disruption quickly empties existing stocks. (Those interested in learning more might start with the book When Trucks Stop Running: Energy and the Future of Transportation.)

Most residents may not realize that the government’s emergency services are actually quite limited, and that a relatively small number of casualties/injured people (for example, a few thousand) in an urban area would overwhelm services designed to handle a relative handful of the millions of residents.

…click on the above link to read the rest of the article…

Wall Street Is Pouring Money Back Into Shale

With oil prices seemingly on firm footing, Wall Street is pouring money back into the shale sector, expecting profits even at $50 per barrel.

The private equity industry raised an estimated $19.8 billion in funds for energy investment in the first quarter of this year, or about three times as much as the same period in 2016. The figures indicate a more aggressive approach from private equity in shale drilling, and rising expectations that the oil market is set to rebound. The data comes from Preqin, and was reported on by Reuters.

The optimism comes even as oil prices have languished in the $50 per barrel range since November, after briefly dipping into the $40s last month. The hopes of a stronger rebound by now have been dashed, and oil analysts have steadily revised their expectations, pushing out their projections for stronger price gains. The extraordinary gains in U.S. crude oil inventories in the first quarter caught the market – and OPEC – by surprise, killing off hopes of oil heading north of $60 per barrel.

But the new money from Wall Street need not depend on $60+ oil. Lenders are confident that their investments will turn out to be profitable even at the prevailing market price today. That is because shale drillers have dramatically cut their costs, pushing breakeven prices down. “Shale funders look at the economics today and see a lot of projects that work in the $40 to $55 range,” Howard Newman, head of private equity fund Pine Brook Road Partners, told Reuters. His firm dumped $300 million in Permian driller Admiral Permian Resources LLC in March.

…click on the above link to read the rest of the article…

U.S. Propaganda is Embarrassingly Bad (and Why it Matters)

When you want to see what U.S. deep state propagandists are up to, all you have to do is take a glance at what meme corporate media happens to be pushing any given week. It’s been almost a decade since I started observing and analyzing the corporate press on a daily basis, and I can now say unequivocally that the quality of American imperial propaganda has gone completely down the crapper.

The believability of some of the stuff being pushed these days defies all logic and is easily dispelled with an ounce of critical thought, yet there it is, in our face on a daily basis almost taunting the intelligence of the U.S. population. Indeed, it appears the current strategy is no more sophisticated that proclaiming any and all dissent as being the result of “Russia operations.” This is done to prevent any actual debate on subjects of grave national importance since the U.S. government knows its claims don’t hold up to any real scrutiny. Why look into the veracity of a deep state claim when we can just dismiss alternative viewpoints as “Russian operations.”

To see what I mean, take a look at some excerpts from a recent article published by ABC News, Behind #SyriaHoax and the Russian Propaganda Onslaught:

As Syrian president Bashar al-Assad called videos of last week’s chemical attack a “fabrication,” a piece of propaganda promoted by a Russian cyber operation and bearing the hashtag #SyriaHoax has gained traction in the United States, analysts tell ABC News.

Following the chemical weapons attack that killed dozens of civilians on Tuesday, Al-Masdar News, a pro-Assad website based in Beirut, published claims that “something is not adding up in [the] Idlib chemical weapons attack.” Its author cited “holes” in the accounts provided by the “Al-Qaeda affiliated” White Helmets leading to the conclusion that “this is another false chemical attack allegation made against the government.”

…click on the above link to read the rest of the article…

Trump’s Abrupt Regime-Change Pivot Raises Concerns About a ‘Mad Max Syria’ Should Assad Fall

PRESIDENT TRUMP’S CRUISE-MISSILE strike against Syria was celebrated by establishment politicians and media, their glee at striking a blow against Bashar al-Assad swamping any rational discussion of what happens next.

Assad is undoubtedly the most despicable war criminal in power today. His forces have ruthlessly starved and bombed hundreds of thousands of his own people, and tortured and executed thousands more.

But the enthusiasm to take military action against a hated leader is highly reminiscent of the run-up to U.S. interventions in Iraq and Libya. And the U.S. is even less prepared to cope with the potentially disastrous consequences in Syria.

Throughout his campaign, Trump condemned regime change, and it seemed as if he had learned from previous presidents’ mistakes. Even as late as last month, UN Ambassador Nikki Haley told reporters “our priority is no longer to sit and focus on getting Assad out.”

But after the cruise missile attack, the Trump’s administration instantaneously reversed itself. Secretary of State Rex Tillerson has said “steps are underway” to seek Assad’s removal, and Haley told CNN it is “hard to see a government that’s peaceful and stable with Assad [in power].”

What that means in real life is unclear. Trump told Fox Business News that the U.S. is not going to war with Syria, leaving observers to conclude that he either intends to have Assad removed in some other way — or to demand Assad’s removal as a part of peace negotiations like the ones taking place in Geneva.

But swiftly removing the Assad regime would have a dramatic and destabilizing effect on a country that is increasingly governed by local mafias and warlords, and where the largest opposition groups are ISIS and Al Qaeda-connected militias.

…click on the above link to read the rest of the article…

Through the ‘War on Terror’ Looking Glass

Exclusive: The U.S. government’s 15-year-long “global war on terror” has spread death and chaos across entire regions – while also imposing propaganda narratives on Americans – with no end in sight, says Nicolas J S Davies.

The Airwars.org U.K.-based monitoring group reports that 41 U.S-led air strikes targeting ISIS in Iraq and Syria killed at least 296 civilians during the week after the chemical weapons incident on April 4. U.S. cruise missiles reportedly killed another nine civilians in villages near the Shayrat airbase that was targeted on April 7th.

Army CH-47 Chinook helicopter pilots fly near Jalalabad, Afghanistan, April 5, 2017. The pilots are assigned to the 7th Infantry Division’s Task Force, 16th Combat Aviation Brigade.The unit is preparing to support Operation Freedom’s Sentinel and Resolute Support. (Army photo by Capt. Brian Harris)

But the fragmentary reports compiled by Airwars.org can only reveal a fraction of the true numbers of civilians killed by U.S. and allied bombing in Iraq and Syria. These are only the minimum numbers of civilians killed in 41 of the 178 air strikes reported by the U.S military that week.

In other war zones, when such compilations of “passive” reports have been followed up by more comprehensive, scientific mortality studies, the true number of civilians killed has proved to be between 5 and 20 times higher than numbers previously reported by “passive” methods. [For a fuller discussion of the differences between passive reporting of civilian deaths and actual estimates based on scientific mortality studies, see Consortiumnews.com’s “Playing Games With War Deaths.”]

So, based on the fragmentary nature of passive reporting of civilian deaths and the ratios to actual deaths uncovered by more comprehensive studies in other war zones (such as Rwanda, Guatemala, D.R. Congo and U.S.-occupied Iraq), it is likely that U.S.-led air strikes killed at least 1,500 innocent civilians in just this one week, or conceivably as many as 6,000.

…click on the above link to read the rest of the article…