Steve Bull's Blog, page 1375

April 22, 2017

You Are Not An Investor

Giotto Legend of St Francis, Exorcism of the Demons at Arezzo c.1297-1299 You are not an investor. One can only be an investor in functioning markets. There have been no functioning markets since at least 2008, and probably much longer. That’s when central banks started purchasing financial assets, for real, which means that is also the point when price discovery died. And without price discovery no market can function.

You are therefore not an investor. Perhaps you are a cheat, perhaps you are a chump, but you are not an investor. If we continue to use terms like ‘investor’ and ‘markets’ for what we see today, we would need to invent new terms for what these words once meant. Because they surely are not the same thing. Even as there are plenty people who would like you to believe they are, because it serves their purposes.

Central banks have become bubble machines, and that is the only function they have left. You could perhaps get away with saying that the dot-com bubble, maybe even the US housing bubble, were not created by central banks, but you can’t do that for the everything bubble of today.

The central banks blow their bubbles in order to allow banks and other financial institutions to first of all not crumble, and second of all even make sizeable profits. They have two instruments to blow their bubbles with, which are used in tandem.

The first one is asset purchases, which props up the prices for these assets, through artificial demand. The second is (ultra-) low interest rates, which allows for more parties -that is, you and mom and pop- to buy more assets, another form of artificial demand.

…click on the above link to read the rest of the article…

Total Chaos: Cyber Attack Fears As MULTIPLE CITIES HIT With Simultaneous Power Grid Failures: Shockwave Of Delays In San Francisco, Los Angeles, New York

The U.S. power grid appears to have been hit with multiple power outages affecting San Francisco, New York and Los Angeles.

Officials report that business, traffic and day-to-day life has come to a standstill in San Francisco, reportedly the worst hit of the three major cities currently experiencing outages.

Power companies in all three regions have yet to elaborate on the cause, though a fire at a substation was the original reason given by San Francisco officials.

A series of subsequent power outages in Los Angeles, San Francisco, and New York City left commuters stranded and traffic backed up on Friday morning. Although the outages occurred around the same time, there is as of yet no evidence that they were connected by anything more than coincidence.

The first outage occurred at around 7:20 a.m. in New York, when the power went down at the 7th Avenue and 53rd Street subway station, which sent a shockwave of significant delays out from the hub and into the rest of the subway system. By 11:30 a.m. the city’s MTA confirmed that generators were running again in the station, although the New York subways were set to run delayed into the afternoon.

Later in the morning, power outages were reported in Los Angeles International Airport, as well as in several other areas around the city.

Via : Inverse

The San Francisco Fire Department was responding to more than 100 calls for service in the Financial District and beyond, including 20 elevators with people stuck inside, but reported no immediate injuries. Everywhere, sirens blared as engines maneuvered along streets jammed with traffic.

Traffic lights were out at scores of intersections, and cars were backing up on downtown streets as drivers grew frustrated and honked at each other.

Via: SF Gate

…click on the above link to read the rest of the article…

Where There’s Smoke…

…There’s central bank manipulation

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we’ll present the data and evidence that they’ve not only done so, but gone too far.

When wee discuss elevated financial asset prices we really are talking about everything.

we’re talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that are linked to them, as well as real estate in dozens of countries and locations. All are intricately linked together. For instance, stocks are elevated, in part, because bond yields are so low. Sam for real estate.

Here are three questions most alert investors are asking:

Question #1: When will financial assets ever ‘correct’ and fall in price?

Question #2: How much does overt propping by the central banks have to do with today’s elevated prices?

Question #3: How much does covert propping by central banks play a role in these inflated markets?

These are important questions to consider because if central banks have been too involved and gotten themselves mixed up in trying to ‘wag the dog’ by using elevated financial asset prices as a means to drive economic expansion — then the risk is a big implosion in financial asset prices if their efforts fail.

The difficulty, as always, is that you can’t print your way to prosperity. It’s never worked in history and it won’t work this time either. You can, however, print (or borrow) to delay a correction, after which a boost in real economic growth (or additional income) had better materialize to save your bacon. But if enough growth does not emerge to both pay back all the old outstanding loans plus all the newly created debt and currency, then you’re going to experience a worse correction than if you had not tried to print/borrow your way to prosperity.

…click on the above link to read the rest of the article…

Fitch Downgrades Italy To BBB From BBB+

Having largely disappeared from the market’s scope for the past 6 months, ever since Europe “bent” its rule allowing the bailout of Monte Paschi and several smaller banks despite Italy having the greatest amount of disclosed NPLs of any European nation, moments ago Fitch decided to drag Italy right back in the spotlight when it downgraded Italy to BBB from BBB+, citing “Italy’s persistent track record of fiscal slippage, back-loading of consolidation, weak economic growth, and resulting failure to bring down the very high level of general government debt has left it more exposed to potential adverse shocks. This is compounded by an increase in political risk, and ongoing weakness in the banking sector which has required planned public intervention in three banks since December.”

And some more:

Italy has missed successive targets for general government debt/GDP, which increased by 0.5pp in 2016 to 132.6%. This is 11.2% of GDP higher than the target in the Stability Programme of 2013, the year Fitch downgraded Italy’s Long-Term IDRs to ‘BBB+’, and compares with the current ‘BBB’ range median of 41.5% of GDP. Fitch forecasts general government debt to peak at 132.7% of GDP in 2017, falling only gradually to 129.3% in 2020 in our debt sensitivity projections.Fitch’s rating Outlook for the Italian banking sector is Negative, primarily reflecting the challenge of reducing the high level of un-provisioned non-performing loans (NPLs), alongside weak profitability and capital generation. The rate of new NPLs edged down to 2.3% in 4Q16, and there is some greater impetus for disposals and write-downs, which has slightly reduced total NPLs. However, sofferenze, the worst category of loans, increased to EUR203 billion in February, from EUR199 billion in October. Total NPLs amount to close to 17.5% of loans and 20% of GDP, and just over half are provided against.

…click on the above link to read the rest of the article…

Our State-Corporate Plantation Economy

We’ve been persuaded that the state-cartel Plantation Economy is “capitalist,” but it isn’t. It’s a rentier skimming machine.

I have often discussed the manner in which the U.S. economy is a Plantation Economy, meaning it has a built-in financial hierarchy with corporations at the top dominating a vast populace of debt-serfs/ wage slaves with little functional freedom to escape the system’s neofeudal bonds.

Since I spent some of my youth in a classic Plantation town (and worked on the plantation as a laborer in summer), the concept of a Plantation Economy is not an abstraction to me, but a living analogy of the way our economy works.

Wal-Mart and the Plantation Economy (August 24, 2010)

Colonizing the Plantation of the Mind (August 25, 2010)

We Need a Social Economy, Not a Hyper-Financialized Plantation Economy (November 12, 2015)

Loving Our Servitude in America’s Plantation Economy (February 10, 2017)

The Plantation Economy is extremely hierarchical. Corporations and the state are both extremely hierarchical.

In the Plantation Economy, the Company has access to nearly unlimited credit.Small businesses serving the employees and the employees have enough credit to live on but not enough to buy productive assets. As a result, the Corporation can always buy up any productive assets, expanding its monopoly.

The state also has an essentially unlimited line of credit which it can use to fund its favored cartels and state fiefdoms.

In the Plantation Economy, the Company suppresses any innovation that threatens its monopoly and the state enforces whatever means the Corporation deploys: buying up patents and small companies, predatory pricing to bankrupt competitors, etc.

The Plantation Economy is a mono-culture of large corporations and their partner in rentier skimming, the state. Our economy is a state-cartel finance-debt system; it’s only capitalist on the margins, that is, in the fringes that aren’t profitable enough for corporations to control.

…click on the above link to read the rest of the article…

April 20, 2017

China Puts Bombers On High Alert “For A Potential North Korea Contingency”

The US has seen evidence that the Chinese military is preparing “for a potential North Korea contingency“, CNN reports citing a US defense official, and adds that Chinese air force land-attack, cruise-missile-capable bombers were put “on high alert” on Wednesday.

The official added that the US has also seen an extraordinary number of Chinese military aircraft being brought up to full readiness through intensified maintenance.

The official said that these recent steps by the Chinese are assessed as part of an effort to “reduce the time to react to a North Korea contingency.”

Among the contingency options listed is the “risk of an armed conflict breaking out as tensions on the peninsula have risen in the wake of multiple North Korean missile tests.”

There has also been ratcheted up rhetoric from the US and Pyongyang, with the latter’s state media warning Thursday that a pre-emptive strike by North Korea would result in the US and South Korea being “completely destroyed in an instant.”Beijing has long been concerned about potential instability in North Korea should the regime in Pyongyang collapse, fearing both an influx of refugees and the potential of reunification under a South Korean government closely allied to the US.

Meanwhile, China remains opposed to the US military’s presence in South Korea, protesting the recent US and South Korea decision to begin deploying elements of the THAAD missile defense system.

Given the close economic links between North Korea and China, US military officials have said that Beijing is critical to solving the North Korean situation, with President Donald Trump recently commending Chinese President Xi Jinping for Chinese efforts to curb Pyongyang’s activities.

Earlier on Thursday, Nikkei reported that as a form of ratcheting up pressure on North Korea, China may halt crude exports to North Korea should Pyongyang conduct its sixth nuclear test, “signalling a tougher attitude by Beijing.”

…click on the above link to read the rest of the article…

The End of Quantitative Easing – Perhaps Now It Will Be Inflationary?

One of the greatest monetary experiments in financial history has been the global central bank buying of government debt. This has been touted as a form of “money printing” that was supposed to produce hyperinflation, which never materialized as predicted by the perpetual pessimists. Nevertheless, the total amount of Quantitative Easing (QE) adding up the balance sheets of the Federal Reserve (Fed), the European Central Bank (ECB) and Bank of Japan (BOJ) is now around $13.5 trillion dollars, which by itself is a sum greater than that of China’s economy or the entire Eurozone for that matter.

If QE failed to produce inflation, then ending QE may actually produce the inflation people previously expected. Where’s the strange logic in that one? Well you see, it really does not matter how much money you print, if it never makes it into the economy, it will not be inflationary. Additionally, even if it makes it into the economy and the people hoard for a rainy day, it still will not be inflationary.

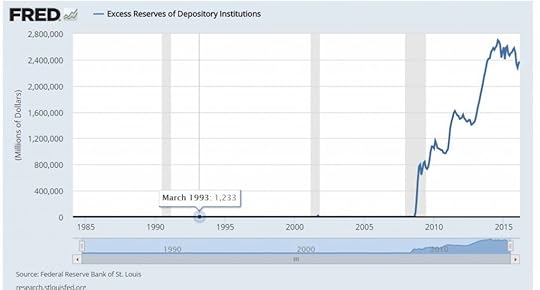

The craziest thing the Fed did was create excess reserves. The bankers complained that the Fed was buying the government debt so they would have no place to park their money. The Fed then accommodated them creating the Excess Reserves facility and paid them interest for absolutely no reason whatsoever. Almost $3 trillion was parked at the Fed collecting interest so that $4.5 trillion of “printing” money never made it out the door. Hence, there was no inflation to speak of (outside of healthcare which always rises no matter what), and people hoarded. The pundit kept calling for a crash in the stock market but overlooked the fact that retail participation was at historic lows. Why? They were hoarding their money.

…click on the above link to read the rest of the article…

The Mystery Behind Economic Growth

With sound money and free markets, the evolving production of businesses increases the purchasing power of money over time.

We learn, out of the blue, that “the Eurozone is performing well, but with opinions divided on the causes, doubts linger over whether it is a sustainable recovery” (Daily Telegraph, 19 April). We are also told that economic growth in the US is stalling, as evidenced by downward revisions by the Atlanta Fed, and the fact that the rate of increase in Loans and Leases by commercial banks is also stalling. The Bank of England was unable to forecast the strength of the UK economy in the wake of Brexit.

This article explains why this confusion occurs. It is clear the economics profession is ill-informed about the one thing it is paid to know about, and the commentary that trickles down to the ordinary person is accordingly incorrect. State-educated and paid-for economists always assume the private sector is the problem, when it is the burden of the state, and the state’s futile attempts to manage the consequences of its actions through the corruption of money.

By misdirecting their attention to the private sector in the search for solutions, economists confuse growth in gross domestic product with progress. Growth is the expansion of a balance sheet total, reflecting an increase in the amount of money spent in the economy between two dates. Progress, on the other hand, is the improvement in living standards we get from more efficient production and technology.

Take Italy as an example. The chart below is of quarterly real GDP. Bear in mind the annualised rate is four times the quarterly figure.

GDP is today’s standard measure of economic performance, and it shows that the volume of consumer transactions in Italy today is well below the record achieved in 2008, before the financial crisis. That’s still down over 7% after eight years.

…click on the above link to read the rest of the article…

Why Trump is Wrong About North Korea

When I think about North Korea, what first comes to my mind is a mist over the calm and majestic surface of the Taedong River near Pyongyang. Next I always recall two lovers, locked in a tender and almost desperate embrace, sitting side by side on the shore. I saw them every day, while taking brisk walks at dawn. Now I don’t know for sure whether they were real or just a product of my fantasy; a sad and gentle reminder of all that has been already lost, as well as of all that should have happened but never really materialized.

Currently, as Donald Trump’s “armada” is speeding towards China and DPRK, I keep recalling those moments: the cliff, the lovers and a lone fisherman with his long rod at the other side of the river. Everything in my memory connected to those dawns is now motionless, serene.

Sometimes I wonder whether words still have the power they once used to have. In the past, a beautiful poem, a confession, or a declaration of love, were capable of changing one’s entire life, and sometimes even the entire destiny of a nation. But is this still the case, in this time and age? As a writer I often feel futility, even despair. Still, as an internationalist, I refuse to succumb to pessimism, and I try to use words as my weapons, again and again.

I have already said a lot about North Korea. I have shown images. I have spoken about the unimaginable pain this country has had to endure. I have spoken broadly about its tremendous gesture – of helping to liberate and then to educate so many parts of the world, including the enormous and devastated continent of Africa.

Still the propaganda against the people of DPRK rules.

…click on the above link to read the rest of the article…

Risk of ‘Accidental’ Nuclear War Growing, UN Research Group Says

The warning comes as the Pentagon begins an extensive review of its nuclear arsenal.

The warning comes as the Pentagon begins an extensive review of its nuclear arsenal.On Sept., 26, 1983, shortly after midnight, the Soviet Oko nuclear early warning system detected five missiles launched from the United States and headed toward Moscow. Stanislav Petrov, a young lieutenant colonel in the Soviet Air Defense Force, was the duty in the Serpukhov-15 bunker that housed the Oko command center. Petrov was the man in charge of alerting the soviets about a nuclear attack, which would trigger a retaliatory strike. He determined that the Oko had likely malfunctioned and the alarm was false. The Americans would not start World War III with a quintet of missiles (risking total annihilation.) It was a daring judgment call. He was, of course, right. As the U.S. prepares to undertake a new nuclear posture review to determine the future direction of the nation’s nuclear weapons, a report from a United Nations research institute warns that the risks of a catastrophic error — like the one that took place that early morning in 1983 — are growing, not shrinking. Next time, there may be no Lt. Col. Petrov in place to avoid a catastrophe.

On Monday, the U.S. Defense Department commenced a new, massive study into its nuclear weapons arsenal, looking at how weapons are kept, how the U.S. would use them in war and whether they present an intimidating enough threat to other countries not to attack us. The review was mandated by President Trump in a Jan 27, memo.

The Pentagon is scheduled to complete the review by the end of the year, an essential step as the military seeks to modernize different aspects of its nuclear deterrent. But a new report from the United Nations Institute for Disarmament Research, or UNIDR, argues that as the modern battlefield becomes more technologically complex, crowded with more sensors, satellites, drones, and interconnected networks, the risks of another nuclear accident are on the rise.

…click on the above link to read the rest of the article…