Steve Bull's Blog, page 1370

May 5, 2017

The Triumph of Hope over Experience

The Guessers Convocation

On Wednesday the socialist central planning agency that has bedeviled the market economy for more than a century held one of its regular meetings. Thereafter it informed us about its reading of the bird entrails via statement (one could call this a verbose form of groping in the dark).

Modern economic forecasting rituals.

Modern economic forecasting rituals.

A number of people have wondered why the Fed seems so uncommonly eager all of a sudden to keep hiking rates in spite of economic data in Q1 indicating surprising weakness in economic output (of course they once again didn’t hike rates, this time).

We have long suspected that the real reason for the urge to hike is to accumulate “ammunition” for the next downturn. After all, it really shouldn’t make much of a difference where the federal funds rate is; the federal funds market is basically dead anyway, and the Fed continues to refrain from shrinking its balance sheet (i.e., bank reserves will remain elevated, and the Fed won’t actively exert pressure on money supply growth).

Then again, the statement is actually in keeping with the orthodox (largely Keynesian) view of the economy and the central bank’s presumed tasks. There is actually no need to take it at anything but face value. The complete statement can be seen here, but we want to focus on one particular excerpt – which follows an enumeration of various data points in paragraph one:

…click on the above link to read the rest of the article…

President Obama’s team sought NSA intel on thousands of Americans during the 2016 election

WATCH | The Obama administration distributed thousands of intelligence reports with the unredacted names of U.S. residents during the 2016 election.

During his final year in office, President Obama’s team significantly expanded efforts to search National Security Agency intercepts for information about Americans, distributing thousands of intelligence reports across government with the unredacted names of U.S. residents during the midst of a divisive 2016 presidential election. The data, made available this week by the Office of the Director of National Intelligence, provides the clearest evidence to date of how information accidentally collected by the NSA overseas about Americans was subsequently searched and disseminated after President Obama loosened privacy protections to make such sharing easier in 2011 in the name of national security. A court affirmed his order.

The revelations are particularly sensitive since the NSA is legally forbidden from directly spying on Americans and its authority to conduct warrantless searches on foreigners is up for renewal in Congress later this year. And it comes as lawmakers investigate President Trump’s own claims that his privacy was violated by his predecessor during the 2016 election.

In all, government officials conducted 30,355 searches in 2016 seeking information about Americans in NSA intercept metadata, which include telephone numbers and email addresses. The activity amounted to a 27.5 percent increase over the prior year and more than triple the 9,500 such searches that occurred in 2013, the first year such data was kept.

The government in 2016 also scoured the actual contents of NSA intercepted calls and emails for 5,288 Americans, an increase of 13 percent over the prior year and a massive spike from the 198 names searched in 2013.

…click on the above link to read the rest of the article…

The Toronto Housing Market Is About To Collapse By This Measure

With the collapse of Home Capital Group focusing the world’s attention on the Canadian real estate market, nowhere is the subprime debt time bomb more likely to go off than Toronto, which as we recently noted “has gone nuts.”

Even Bank of Canada Governor Stephen Poloz (who declined to comment on questions about Home Capital Group and whether he’s worried about contagion), noted that Toronto is out control tonight while answering questions following a speech in Mexico City…

“pretty sure recent gains in Toronto home prices were not sustainable and that the city’s housing market had elements of speculation““Financial stability is part of the Bank of Canada’s monetary policy decision making, but the central bank’s primary mission is inflation targeting,… it would be odd to use interest rates to target home prices in just one city.”

Perhaps Mr. Poloz… But, as we noted previously, it doesn’t take a genius to figure out that this will end in tears. Even the big Canadian banks are fretting. “Let’s drop the pretense. The Toronto housing market and the many cities surrounding it are in a housing bubble,” Bank of Montreal Chief Economist Doug Porter warned clients. But the bubble’s deflation would push the city into a fiscal and financial sinkhole

Jason Mercer, TREB’s Director of Market Analysis, explained the basic supply and demand problem:

“Annual rates of price growth continued to accelerate in March as growth in sales outstripped growth in listings,” he said.“A substantial period of months in which listings growth is greater than sales growth will be required to bring the GTA housing market back into balance.”

…click on the above link to read the rest of the article…

Earth Overshoot: How Sustainable is Population Growth?

For decades people have been predicting overpopulation would wipe out energy resources if not the entire planet. Every year the population bomb and peak oil crowd have been proven wrong. But how long can the status quo of generating growth by population explosion last?

Every year the population bomb and peak oil crowd have been proven wrong. But how long can the status quo of generating growth by population explosion last?

Reader Rick Mills at Ahead of the Herd addresses the subject in a guest blog that first appeared on his blog as Earth Overshoot Day.

Earth Overshoot Day

The second half of the 20th century saw the biggest increase in the world’s population in human history. Our population surged because of:

Medical advances lessened the mortality rate in many countries

Massive increases in agricultural productivity caused by the “Green Revolution”

The global death rate has dropped almost continuously since the start of the industrial revolution – personal hygiene, improved methods of sanitation and the development of antibiotics all played a major role.

Green Revolution

The term Green Revolution refers to a series of research, development, and technology transfers that happened between the 1940s and the late 1970s.

The initiatives involved:

Development of high-yielding varieties of cereal grains

Expansion of irrigation infrastructure

Modernization of management techniques

Mechanization

Distribution of hybridized seeds, synthetic fertilizers, and pesticides to farmers

Tractors with gasoline powered internal combustion engines (versus steam) became the norm in the 1920s after Henry Ford developed his Fordson in 1917 – the first mass-produced tractor. This new technology was available only to relatively affluent farmers and it was not until the 1940s tractor use became widespread.

…click on the above link to read the rest of the article…

May 2, 2017

Italian Government Approves Alitalia Bankruptcy, Bonds Collapse

Earlier we reported that Italy’s national carrier, Alitalia, did what many expected it to do after last week’s rescue plan, which would have cut 1,700 jobs and slashed pay, failed and filed for bankruptcy. What was less expected is that just hours after filing, the Italian government approved the bankruptcy process following a short cabinet meeting, an outcome that will lead to either Alitalia’s sale or liquidation, raising the possibility that Alitalia it will follow in the path of KLM and Iberia in ending a storied history as one of Europe’s major standalone airlines.

Why the speedy decision to grant administration proceedings caught many investors, and certainly bondholders by surprise, is that as we noted earlier, the carrier is losing about €1 million ($1.1 million) a day and without government support risks running out of cash by the middle of May. The government has already thrown it a short-term lifeline, a bridging loan of up to 600 million euros to see it through the bankruptcy process. Absent a sale – which looks highly unlikely – or a nationalization, up to 12,000 workers are likely to lose their jobs, potentially resulting in another major shock to the Italian economy.

This is precisely the scenario that the Italian Economic Development minister warned about last Sunday: “A [sudden closure] would be a shock for GDP much greater than the scenario that we are looking at: a brief period of six months covered by a bridging loan from the government so as to find a buyer who could provide services that Italians need as travelers,” he said in an interview with Sky TG24 television.

…click on the above link to read the rest of the article…

May 1, 2017

Contagion: Home Capital Bank Run Spreads To Another Canadian Mortgage Lender

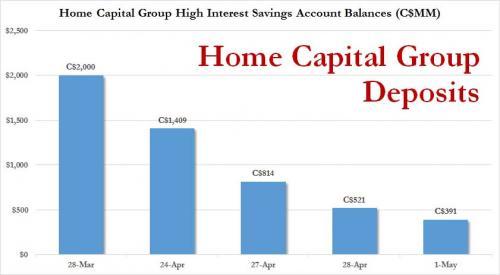

As discussed first thing this morning, the fate of Canada’s largest alternative mortgage lender, Home Capital Group, appears to have been decided over the weekend, when in the span of just one week, over 70% of the company’s deposit base had been withdrawn, effectively mothballing the business, leaving just a sale or liquidation as the two possible outcomes even as a $2 billion emergency line of credit keeps the company afloat, at least until HCG’s $12.8 billion in GICS mature some time over the next 30 to 60 days.

Predictably, the news of the ongoing bank run once again spooked shareholders, who sent its stock sliding by 10%, and wiping out two-thirds of the company’s market cap in under 2 weeks.

A bigger red flag emerged when concerns about possible contagion appeared to have been justified Canada’s Equitable Group, another alternative mortgage lender, said Monday it had started seeing “an elevated but manageable” decrease in deposit balances, traditionally a polite way by management to admit a bank jog is taking place. The company said that customers had withdrawn an average C$75 million each day between Wednesday and Friday, and while the withdrawals so far are modest, and represented 2.4% of the total deposit base, the recent HCG case study showed how quickly such a bank run could escalate. And while liquid assets remained at roughly C$1 billion after the outflows, the company also announced that it had taken out its own C$2 billion credit line with a group of Canadian banks, just in case the bank run was only getting started.

Having taken preemptive action, Equitable’s loans terms were more favorable than Home Capital’s, which as reported last week is paying an effective rate of 22.5% on the first half of the C$2 billion credit line that it tapped Monday from the Healthcare of Ontario Pension Plan.

…click on the above link to read the rest of the article…

Where Do You Go in a Hurricane?

As a West Indian, I’ve lived through quite a few hurricanes in my time. My level of responsibility in each varied quite a bit. I was eight years old in my first hurricane and I thought it was great fun, as it was so exciting during the hurricane and, afterward, the landscape had changed so much that I had lots of new places to play.

On the other end of the scale, in 2004, my country, the Cayman Islands, experienced a Category 5 hurricane, with winds up to 200 miles per hour that sat on us without moving for 36 hours. I was responsible for ensuring that safety be provided for scores of my employees prior to the hurricane. After the storm, one of my companies took on the complete rebuilding of the country’s wholesale and retail food distribution facilities in order to ensure that the country’s population would have the most essential commodities—food and water. (A big change in level of responsibility over the years.)

In addition to having spent decades planning for hurricane damage, I’ve also spent decades as an economist, planning for major economic storms. In 1999, I determined that the world would experience what Doug Casey has termed a Greater Depression that would be more devastating than any economic event the world had ever seen. I predicted that it would happen in stages and that the final stage would be the most devastating. I would have been quite pleased to have been incorrect, but unfortunately, my predictions have come to pass. I believe we’re now quite close to the final destruction stage, a period that will lead to the collapse of many of the world’s formerly strongest economies, coinciding with a period of devastating warfare. In both the economic and warfare cases, those who are the world’s major players will believe that they’ll be able to control the extent of devastation and even profit from it, but events will go beyond their control and take on a life of their own.

…click on the above link to read the rest of the article…

The Existential Question of Whom to Trust

Special Report: An existential question facing humankind is whom can be trusted to describe the world and its conflicts, especially since mainstream experts have surrendered to careerism, writes Robert Parry.

The looming threat of World War III, a potential extermination event for the human species, is made more likely because the world’s public can’t count on supposedly objective experts to ascertain and evaluate facts. Instead, careerism is the order of the day among journalists, intelligence analysts and international monitors – meaning that almost no one who might normally be relied on to tell the truth can be trusted.

Secretary of State Colin Powell addressed the United Nations on Feb. 5. 2003, citing satellite photos which supposedly proved that Iraq had WMD, but the evidence proved bogus. CIA Director George Tenet is behind Powell to the left.

The dangerous reality is that this careerism, which often is expressed by a smug certainty about whatever the prevailing groupthink is, pervades not just the political world, where lies seem to be the common currency, but also the worlds of journalism, intelligence and international oversight, including United Nations agencies that are often granted greater credibility because they are perceived as less beholden to specific governments but in reality have become deeply corrupted, too.

In other words, many professionals who are counted on for digging out the facts and speaking truth to power have sold themselves to those same powerful interests in order to keep high-paying jobs and to not get tossed out onto the street. Many of these self-aggrandizing professionals – caught up in the many accouterments of success – don’t even seem to recognize how far they’ve drifted from principled professionalism.

…click on the above link to read the rest of the article…

The Sound of One Wing Flapping

And suddenly the storms of early Trumptopia subside, or seem to. The surface of things turns eerily placid as the sweets of May sweep away the toils of an elongated mud season. Somebody stuffed Kim Jong Un back in his bunker with a carton of Kools and the Vin Diesel video library. France appears resigned to Hollandaise Lite in the refreshing form of boy wonder Macron. It’s been weeks since The New York Times complained about the Russians stealing Hillary’s turn as leader of the free world. We’re given to understand that Congress managed overnight to cook up a spending bill that will avert a Government shut-down until September. Rest easy America… oh, and buy every dip.

A calm surface is exactly what Black Swans like to land on, though by definition we will not know they’re out there until our reveries are broken by the sound of wings flapping. Some kind of dirty bird showed up on Canada’s thawing pond last week when that country’s biggest home loan lender suffered a 60 percent pukage of shareholder equity and had to be bailed out — not by the Canadian government directly, but by the Ontario Province’s Health Care Workers Pension Fund, a neat bit of hocus pocus that amounts to a one-year emergency loan at ten percent interest.

If that’s a way for insolvent public employee pension plans to find enough “yield” to meet their obligations, then maybe that could be the magic bullet for the USA’s foundering pension funds. The next time Citibank, Goldman Sachs, JP Morgan, and friends get a case of the Vapors, let them be bailed out by the Detroit School Bus Drivers’ Pension Fund at ten percent interest. That ought to work. And let Calpers take care of Wells Fargo.

…click on the above link to read the rest of the article…

Meet Britain’s Nuclear Nutcase: Defense Secretary Micheal Fallon

Michael Fallon’s recent claim that Britain under Theresa May’s leadership would be willing to launch a preemptive nuclear strike confirms what many suspected – namely that the British people are being ruled by a clutch of certifiable fanatics who will get us all destroyed unless they can be reined in, and soon. The Defence Secretary’s stupendously stupid statement came in the same week that the BBC’s Andrew Marr asked Labour’s Jeremy Corbyn in an interview if there were any circumstances in which he would launch nuclear weapons?

Both taken together suggest that the moral sickness that has long pervaded the country’s privately educated elite, when it comes to unleashing wars against poor countries abroad and attacking poor people at home, has progressed into the realms of actual insanity. Have we seriously now entered an age when nuclear weapons are considered anything other than an abomination that no civilized country or non-sociopathic human being would ever contemplate using for more than a second?

If the likes of Michael Fallon and Andrew Marr are to be believed, yes we have.

The willingness to trigger armageddon is, in the run-up to the general election on 8 June, being used as evidence of the Tories’ fitness to rule. In this regard, Mr Fallon wants us to believe that the British public are convinced that North Korea and Russia to be more of a threat to its security than than the Tories are. It really does bespeak ineffable arrogance, recklessness, and irrationality to wave the prospect of launching nuclear weapons as part of an electoral strategy. Within this strategy, the inference that Jeremy Corbyn is weak because he refuses to countenance a first-strike policy vis-a-vis Britain’s Trident nuclear arsenal, is more confirmation of the upside down world that these people inhabit.

…click on the above link to read the rest of the article…