Steve Bull's Blog, page 1367

May 13, 2017

How to Stick It to Your Banker, the Federal Reserve, and the Whole Doggone Fiat Money System

Bernanke Redux

Somehow, former Federal Reserve Chairman Ben Bernanke found time from his busy hedge fund advisory duties last week to tell his ex-employer how to do its job. Namely, he recommended to his former cohorts at the Fed how much they should reduce the Fed’s balance sheet by. In other words, he told them how to go about cleaning up his mess.

Praise the Lord! The Hero is back to tell us what to do! Why, oh why have you ever left, oh greatest central planner of all time. We are not worthy.

Praise the Lord! The Hero is back to tell us what to do! Why, oh why have you ever left, oh greatest central planner of all time. We are not worthy.

We couldn’t recall the last time we’d seen or heard from Bernanke. But soon it all came back to us. There he was, in the flesh, babbling on Bloomberg and Squawk Box, pushing the new paperback version of his mis-titled memoir “The Courage to Act.” Incidentally, the last time we’d heard much out of the guy was when the hard copy was released in late 2015.

With respect to the Fed’s balance sheet, Bernanke remarked that the Fed should cut it from $4.5 trillion to “something in the vicinity of $2.3 to $2.8 trillion.” What exactly this would achieve Bernanke didn’t say. As far as we can tell, a balance sheet of $2.8 trillion would still be about 300 percent higher than it was prior to the 2008 financial crisis.

Bernanke, by all measures, is an absolute lunatic. He, more than anyone else, is responsible for the utter mess that radical monetary policies have made of the U.S. economy. He’s the one who dropped the federal funds rate to near zero and inflated the Federal Reserve’s balance sheet by over 450 percent.

…click on the above link to read the rest of the article…

Bank of China ATMs Go Dark As Ransomware Attack Cripples China

In the aftermath of the global WannaCry ransomware attack, which has spread around the globe like wildfire, a significant number of corporations and public services have found their infrastructure grinding to a halt, unable to operate with unprotected if mission-critical computers taken offline indefinitely. Some of the more prominent examples so far include:

NHS: The British public health service – the world’s fifth-largest employer, with 1.7 million staff – was badly hit, with interior minister Amber Rudd saying around 45 facilities were affected. Several were forced to cancel or delay treatment for patients.

Germany’s Deutsche Bahn national railway operator was affected, with information screens and ticket machines hit. Travelers tweeted pictures of hijacked departure boards showing the ransom demand instead of train times. But the company insisted that trains were running as normal.

Renault: The French automobile giant was hit, forcing it to halt production at sites in France and its factory in Slovenia as part of measures to stop the spread of the virus.

FedEx: The US package delivery group acknowledged it had been hit by malware and said it was “implementing remediation steps as quickly as possible.” .

Russian banks, ministries, railways: Russia’s central bank was targeted, along with several government ministries and the railway system. The interior ministry said 1,000 of its computers were hit by a virus. Officials played down the incident, saying the attacks had been contained.

Telefonica: The Spanish telephone giant said it was attacked but “the infected equipment is under control and being reinstalled,” said Chema Alonso, the head of the company’s cyber security unit and a former hacker.

Sandvik: Computers handling both administration and production were hit in a number of countries where the company operates, with some production forced to stop. “In some cases the effects were small, in others they were a little larger,” Head of External Communications Par Altan said.

…click on the above link to read the rest of the article…

“Canada Hasn’t Seen A Bank Run Such As This In Decades” – Finance Minister Says Home Capital Bailout Is Possible

When we first said three weeks ago that the spectacular, sudden implosion of Canada’s largest alt-lender Home Capital Group or HCG – whose fate we had followed closely since 2015 – was Canada’s own “New Century Moment“, the parallels were more than just the obvious: like in the US, it took the market nearly a year to realize the full implications of the subprime collapse which first manifested in the failure of New Century and its subprime lender peers. When all was said and done, the world’s central banks had to pump (and still do) trillions into the financial system to stop it from disintegrating.

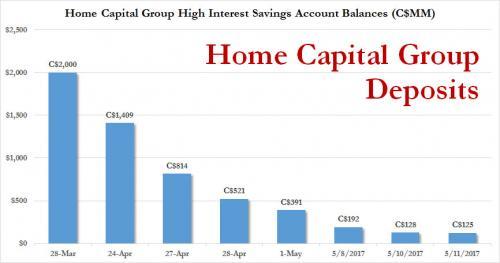

Slowly but surely, Canada is starting to appreciate just how serious the Home Capital failure is, and how the unprecedented bank run that has led to 94% of retail deposits fleeing the troubled lender…

… is just the first step of what will likely be a very painful process, which will likely culminate with either a government bailout, or a financial system on the verge of panic.

Today, the Globe and Mail has published an in-depth report putting the HCG pieces together, or as the G&M itself puts it, the “dramatic story of a financial institution’s near-collapse.”

How quickly can a financial institution go from seemingly healthy and solvent to being on the verge of liquidation? The answer: hours . Here is the background:

It was late in the evening on Sunday, April 30, when lawyers working for Home Capital Group Inc. dialled into a call with lawyers representing the company’s new lending syndicate. The troubled mortgage lender had negotiated a $2-billion credit line just days earlier, emergency money the board felt was needed to survive after a high-profile run on deposits at subsidiary Home Trust. The company planned to draw down the first $1-billion from it the next morning, May 1.

…click on the above link to read the rest of the article…

24 Hours Later: “Unprecedented” Fallout From “Biggest Ransomware Attack In History”

24 hours after it first emerged, it has been called the first global, coordinated ransomware attack using hacking tools developed by the NSA, crippling over a dozen hospitals across the UK, mass transit around Europe, car factories in France and the UK, universities in China, corporations in the US, banks in Russia and countless other mission-critical businesses and infrastructure.

According to experts, “this could be one of the worst-ever recorded attacks of its kind.” The security researcher who tweets and blogs as MalwareTech told The Intercept, “I’ve never seen anything like this with ransomware,” and “the last worm of this degree I can remember is Conficker.” Conficker was a notorious Windows worm first spotted in 2008; it went on to infect over 9 million computers in nearly 200 countries.

The fallout, according to cyber-specialists, has been “unprecedented”: it has left unprepared governments, companies and security experts from China to the United Kingdom on Saturday reeling, and racing to contain the damage from the audacious cyberattack that spread quickly across the globe, raising fears that people would not be able to meet ransom demands before their data are destroyed.

As reported yesterday, the global efforts come less than a day after malicious software, transmitted via email and stolen from the National Security Agency, exposed vulnerabilities in computer systems in almost 100 countries in one of the largest “ransomware” attacks on record. The cyberattackers took over the computers, encrypted the information on them and then demanded payment of $300 or more from users in the form of bitcoin to unlock the devices.

The ransomware was subsequently identified as a new variant of “WannaCry” that had the ability to automatically spread across large networks by exploiting a known bug in Microsoft’s Windows operating system.

…click on the above link to read the rest of the article…

May 12, 2017

Hurricane Bearing Down on the Casino

Hurricane Bearing Down on the Casino

[Urgent Note: The nation’s future and a massive retail apocalypse hang in the balance as Trump pushes beyond his first 100 days. That’s why I’m on a mission to send my new book TRUMPED! A Nation on the Brink of Ruin… and How to Bring It Back to every American who responds, absolutely free. Click here for more details.]

Yesterday I said the Donald was absolutely right in canning the insufferable James Comey, but that he has also has stepped on a terminal political land-mine. And he did.

That’s because the entire Russian meddling and collusion narrative is a ridiculous, evidence-free attempt to re-litigate the last election. And now that the powers that be have all the justification they need. And what is already an irrational witch-hunt will be quickly turned into a scorched-earth assault on a sitting president.

I have no idea how this will play out, but as a youthful witness to history back in 1973-1974 I observed Tricky Dick’s demise in daily slow motion. But the most memorable part of the saga was how incredibly invincible Nixon seemed in early 1973.

Nixon started his second term, in fact, with a massive electoral landslide, strong public opinion polls and a completely functioning government and cabinet.

Even more importantly, he was still basking in the afterglow of his smashing 1972 foreign policy successes in negotiating detente and the anti-ballistic missile (ABM) treaty with Brezhnev and then the historic opening to China on his Beijing trip.

So I’ll take the unders from anyone who gives the Donald even the 19 months that Nixon survived.

…click on the above link to read the rest of the article…

It’s time to become your own banker. Here’s how–

It’s time to become your own banker. Here’s how–

Sometimes I wonder why most of the giant mega-banks are based in New York.

They should be here in Las Vegas, the gambling capital of the world. Because that’s precisely what they’re doing with your money.

Actually it’s not even your money.

From a legal perspective, every single penny you deposit at the bank becomes THEIR money. You’re nothing more than an unsecured creditor of the bank.

And now that they legally own what used to be your money, the bank can gamble it away on whatever crazy investment fad best serves their interests.

Here’s an easy way to understand it:

Imagine you were moving and needed to rent a storage facility for a few months to store your stuff.

You rent a U-Haul and move everything into the storage unit.

The way banking works, the second you drive away, the storage company now owns your furniture. Not you.

And as the brand new owners of what used to be your furniture, the storage company can do whatever they want with it.

They can rent out the furniture to another customer, charging steep fees to let a complete stranger sit on your sofa and watch your TV.

(Naturally you’ll never see a penny of that money.)

Of course, that complete stranger might not treat your furniture all that well. He might even destroy it. No more furniture.

Often the facilities get in on the business together; one storage company will rent your furniture to another company, which rents it to another, and then another.

After a while no one actually knows where your sofa is. But it doesn’t matter because the storage companies are all making lots of money, and few people ever really ask.

Eventually their standards drop so low that they stop performing credit checks altogether when someone wants to rent furniture from them.

…click on the above link to read the rest of the article…

Blood Sports

What you’re seeing in the political miasma of “RussiaGate” is an exercise in nostalgia. Apart from the symbolic feat of getting a “black” president freely elected in 2008 (remember, Mr. Obama is also half-white), the Democratic Party hasn’t enjoyed a political triumph in half a century to match the Watergate extravaganza of 1972-74, which ended in the departure of Mr. Nixon, the designated Prince of Darkness of those dear dead days. Watergate had had a more satisfying finale than The Brides of Dracula.

So, in its current sad state, devoid of useful political ideas, mired in the mostly manufactured conflicts of race and gender, psychologically crippled by the election loss of a miserable candidate to the Golden Golem of Greatness, the Democratic Party is returning full steam to a gambit that worked so well years ago: beating the devil by congressional inquiry.

In President Trump (uccchhh, the concept!), they’ve got a target much juicier even than Old Nixie. It wasn’t for nothing that they called him “Tricky Dick.” He came back from political near-death twice in his career. The first time, running as Dwight Eisenhower’s veep, he was accused of accepting the gift of a vicuna coat for his wife, Pat, and other secret cash emoluments. He overcame that with one of the first epic performances of the TV age, the “Checkers Speech” — Checkers being the family’s cocker spaniel, who Nixon invoked as a proxy for his own guileless innocence. It worked bigly.

The second near-death was his defeat in the California governor’s race of 1962, following his 1960 squeaker presidential election loss to John F. Kennedy. “You won’t have Nixon to kick around anymore…” he told the press. But he rose from the grave in 1968 — after fortifying his bank account in a Wall Street law practice — when the Vietnam War was tearing the country apart (and wrecking the Democratic Party of Lyndon Johnson and Hubert Humphrey).

…click on the above link to read the rest of the article…

“Worst-Ever Recorded” Ransomware Attack Strikes Over 57,000 Users Worldwide, Using NSA-Leaked Tools

The ransomware has been identifed as WannaCry

* * *

Update 4: According to experts tracking and analyzing the worm and its spread, this could be one of the worst-ever recorded attacks of its kind. The security researcher who tweets and blogs as MalwareTech told The Intercept “I’ve never seen anything like this with ransomware,” and “the last worm of this degree I can remember is Conficker.” Conficker was a notorious Windows worm first spotted in 2008; it went on to infect over nine million computers in nearly 200 countries. As The Intercept details,

Today’s WannaCry attack appears to use an NSA exploit codenamed ETERNALBLUE, a software weapon that would have allowed the spy agency’s hackers to break into any of millions of Windows computers by exploiting a flaw in how certain version of Windows implemented a network protocol commonly used to share files and to print. Even though Microsoft fixed the ETERNALBLUE vulnerability in a March software update, the safety provided there relied on computer users keeping their systems current with the most recent updates. Clearly, as has always been the case, many people (including in governments) are not installing updates. Before, there would have been some solace in knowing that only enemies of the NSA would have to fear having ETERNALBLUE used against them–but from the moment the agency lost control of its own exploit last summer, there’s been no such assurance.Today shows exactly what’s at stake when government hackers can’t keep their virtual weapons locked up.

As security researcher Matthew Hickey, who tracked the leaked NSA tools last month, put it, “I am actually surprised that a weaponized malware of this nature didn’t spread sooner.”

Update 3: Microsoft has issued a statement, confirming the status the vulnerability:

Today our engineers added detection and protection against new malicious software known as Ransom:Win32.WannaCrypt.

…click on the above link to read the rest of the article…

May 11, 2017

Brace Yourself For The Coming Economic Transformation

If the average person in the US feels as though they are going nowhere fast, there is a real reason for it.

Federal Reserve data shows people are earning less than they did 17 years ago. But the real story is even worse than that.

The chart below shows that median income in the US is actually down over the last 17 years and is only 3% higher now than it was 30 years ago. Those are inflation-adjusted numbers.

But the reality is that, for the average person, inflation has been much higher than the average of 2% per year over that time. This is because the things that the average person actually buys—like housing and education and health care and all the other necessities of life—are rising at a much faster rate than 2%.

Source: FRED: St. Louis Federal Reserve

So this chart reflects the fact that life has gotten much more difficult for average Americans. If people’s incomes haven’t grown beyond what they were 30 years ago, they struggle just to make ends meet and to maintain the lifestyle they had.

Growth Is An Illusion For More Than Half Of Americans

The Census Bureau updates its income figures about once a year, and the last real update we had was last fall (taking us through 2015).

Doug Short did an analysis of those numbers. He breaks the country into quintiles, calculates the average household income for each quintile, and then also shows the top 5%. Notice that the average income for the top 5% is $350,000.

Source: Advisor Perspectives

It looks like everybody’s income is rising, especially those in the top 20% and 5%. But if we inflation-adjust those numbers, the illusion of growth goes away.

…click on the above link to read the rest of the article…

May 10, 2017

Panic! Like It’s 1837

Panic! Like It’s 1837

180 years ago today, everyone panicked. On May 10, 1837, New York banks finally realized that the easy money they were lending was unsustainable, and demanded payment in “specie,” or hard money like gold and silver coin. They had previously been accepting paper currency that for every $5 was backed by only $1 in silver or gold.

Things culminated to that point after years of borrowing the paper currency to expand west, buy land, and build infrastructure. As silver came in from Mexico, banks lent out five times the amount of their deposits–fractional reserve banking.

At the same time, the value of silver was falling because its supply was increasing in America. Great Britain, which had been lending much of the money, was less interested in silver because they could pay for trade with China in opium. So even though Britain had a year earlier begun demanding payment in specie, the abundant silver in America did not hold the same weight, so to speak, it had previously.

Now, reflect on this for a second. The USA was depending on loans from a country that they had successfully revolted and seceded from fewer than 50 years earlier. Britain had also provoked The War of 1812 just 25 years earlier when they wouldn’t stop attacking American ships. But somehow it still seemed like a good idea to depend on British banks to form the foundation of American development.

So at the same time when American banks had to backstep their risky practices, Britain also just so happened to need 25% less cotton, which was the foundation of the American economy. This only exacerbated the trade deficit.

…click on the above link to read the rest of the article…