Steve Bull's Blog, page 1365

May 19, 2017

Want to Understand Rising Wealth Inequality? Look at Debt and Interest

“Governments cannot reduce their debt or deficits and central banks cannot taper. Equally, they cannot perpetually borrow exponentially more. This one last bubble cannot end (but it must).”

I often refer to debt serfdom, the servitude debt enforces on borrowers. The mechanism of this servitude is interest, and today I turn to two knowledgeable correspondents for explanations of the consequences of interest.

Correspondent D.L.J. explains how debt/interest is the underlying engine of rising income/wealth disparity:

Here is a table of the growth rate of the GDP.

If we use $16T as the approximate GDP and a growth rate of, say, 3.5%, the total of goods and services would increase one year to the next by about $500B.

Meanwhile, referencing the Grandfather national debt chart with the USDebtClock data, the annual interest bill is $3 trillion ($2.7 trillion year-to-date).

In other words, those receiving interest are getting 5-6 times more than the increase in gross economic activity.

Using your oft-referenced Pareto Principle, about 80% of the population are net payers of interest while the other 20% are net receivers of interest.

Also, keep in mind that one does not have to have an outstanding loan to be a net payer of interest. As I attempted to earlier convey, whenever one buys a product that any part of its production was involving the cost of interest, the final product price included that interest cost. The purchase of that product had the interest cost paid by the purchaser.

Again using the Pareto concept, of the 20% who receive net interest, it can be further divided 80/20 to imply that 4% receive most (64%?) of the interest. This very fact can explain why/how the system (as it stands) produces a widening between the haves and the so-called ‘have nots’.

In other words, the wealthy own interest-yielding assets and the rest of us owe interest on debt.

…click on the above link to read the rest of the article…

May 18, 2017

The Automatic Earth Primer Guide 2017

Pablo Picasso Bull plates I-XI 1945Nicole Foss has completed a huge tour de force with her update of the Automatic Earth Primer Guide. The first update since 2013 is now more like a Primer Library, with close to 160 articles and videos published over the past -almost- 10 years, and Nicole’s words to guide you through it. Here’s Nicole:

The Automatic Earth (TAE) has existed for almost ten years now. That is nearly ten years of exploring and describing the biggest possible big picture of our present predicament. The intention of this post is to gather all of our most fundamental articles in one place, so that readers can access our worldview in its most comprehensive form. For new readers, this is the place to start. The articles are roughly organised into topics, although there is often considerable overlap.

We are reaching limits to growth in so many ways at the same time, but it is not enough to understand which are the limiting factors, but also what time frame each particular subset of reality operates over, and therefore which is the key driver at what time. We can think of the next century as a race of hurdles we need to clear. We need to know how to prepare for each as it approaches, as we need to clear each one in order to be able to stay in the race.

TAE is known primarily as a finance site because finance has the shortest time frame of all. So much of finance exists in a virtual world in which changes can unfold very quickly. There are those who assume that changes in a virtual system can happen without major impact, but this assumption is dangerously misguided.

…click on the above link to read the rest of the article…

Trump Escalates Syrian Proxy War

At the start of the Trump presidency, it looked like the U.S. covert “regime change” war in Syria might be ending, but it has returned, zombie-like, in a slightly different form, reports Steven Chovanec.

Back in February, it was quietly reported that the CIA had discontinued its support program to rebels in Syria. A month later, a knowledgeable source from the region disclosed to me that the Trump administration and the Saudi defense minister, Prince Mohammed bin Salman, had agreed during their meetings in mid-March for the Gulf states to re-open supply channels to their rebel proxies.

Defense Secretary Jim Mattis welcomes Saudi Deputy Crown Prince and Defense Minister Mohammed bin Salman to the Pentagon, March 16, 2017. (DoD photo by Sgt. Amber I. Smith)

This was done, the source said, to keep the Syrian government’s army and its allied Russian air force occupied so that the U.S. and its Kurdish allies could continue dividing northern Syria, establishing a zone-of-influence throughout the lands they recapture from the Islamic State.

Concurrent with this was a similar effort in the southeast, where U.S. and Jordanian backed forces have been battling ISIS while attempting to establish control over the border with Iraq. The strategy was to use the fight against ISIS as a pretext for establishing a de-facto occupation of Syrian territory, where in the Kurdish-held regions the U.S. has already establishedmultiple military bases and airfields.

A major motivation behind Russia’s push to establish de-escalation zones, now implemented after a deal was reached with Iran and Turkey, was to free up the Syrian army and Russian air force to launch operations eastward against ISIS and counter the US efforts.

After the agreement came into effect the Syrian army began operations aimed at reaching the Iraqi border at the al-Tanaf crossing along the Damascus-Baghdad highway and to recapture the ISIS-stronghold of Deir Ezzor further north.

…click on the above link to read the rest of the article…

Cyber Attacks Are The Perfect Trigger For A Stock Market Crash

The world has been stunned over the past few days by the advent of “Ransomware;” the use of sophisticated cyber attacks on vital systems in order to (supposedly) extort capital from target businesses and institutions. I am always highly suspicious whenever a large scale cyber incident occurs, primarily because the manner in which these events are explained to the public does not begin to cover certain important realities. For example, the mainstream media rarely if ever discusses the fact that many digital systems are deliberately designed to be vulnerable.

Software and internet corporate monoliths have long been cooperating with the NSA through programs like PRISM to provide government agencies backdoor access to computer systems worldwide. Edward Snowden vindicated numerous “conspiracy theorists” in 2013 with his comprehensive data dumps, exposing collusion between corporations and the NSA including Microsoft, Skype, Apple, Google, Facebook and Yahoo. And make no mistake, nothing has changed since then.

The level of collusion between major software developers and the establishment might be shocking to some, but it was rather well known to alternative analysts and researchers. The use of legislation like the Foreign Intelligence Surveillance Act (FISA) to skirt Constitutional protections within the 4th Amendment has been open policy for quite some time. It only made sense that government agencies and their corporate partners would use it as a rationale to develop vast protocols for invading people’s privacy, including American citizens.

The issue is, in the process of engineering software and networks with Swiss cheese-like defenses in the name of “national security,” such exploits make vast spreads of infrastructure vulnerable to attack. I think it likely this was the intention all along. That is to say, the NSA and other agencies have created a rather perfect breeding ground for false flag attacks, real attacks and general crisis.

…click on the above link to read the rest of the article…

Venezuela’s Oil Production On The Brink Of Collapse

Desperation is spreading in Venezuela as violent protests continue to paralyze the country, further damaging the country’s shattered economy. Venezuela’s already-decrepit oil industry is deteriorating by the day, and an outright implosion is no longer out of the question.

The inflation rate, according to the IMF, will balloon to 720 percent this year. Food shortages have been common for quite some time, but are deepening and wearing down the population. Three out of four people surveyed by the WSJ reported involuntary weight loss last year. Hospitals have completely broken down.

Venezuela has been crippled by protests since late March, with more than three dozen people having been killed over the past two months, and there is no sign of improvement. This meltdown is taking a toll on Venezuela’s oil production, the last thing keeping the country from becoming a failed state. Venezuela’s oil production has been declining for more than a decade, mainly because oil revenues are used to finance the government, leaving little for state-owned PDVSA to reinvest in its operations.

But things are getting worse. The cash shortage is accelerating the decline. As of April, oil production stood at 1.956 million barrels per day (mb/d), down 10 percent from last year, and down more than 17 percent from 2015 levels – and output continues to trend downward. James Williams, energy economist at WTRG Economics, told Marketwatch in March that he expects Venezuela to lose another 200,000 to 300,000 bpd this year, another 10 to 15 percent decline from 1Q2017 levels.

The problem is downstream as well, as the shortage of refined products worsens. Three out of Venezuela’s four oil refineries are operating significantly below capacity because of the inability to find spare parts for maintenance, according to Reuters.

…click on the above link to read the rest of the article…

Meanwhile… In Greece

You know it’s bad when the police are rioting against the new austerity measures assigned from Brussels…

As KeepTalkingGreece reports, tension between protesters from police, fire brigades and coast guard on one side and riot police on the other side broke out shortly after 8 o’ clock in the evening on Wednesday when the angry protesters tried to break the police cordon and enter the Greek Parliament.

Riot policemen and protesters pushed and shouted at each other, with protesters shouting “Disgrace! Disgrace!”

Members of of the Greek Police, the Fire Brigades and the Coast Guard marched to the Parliament on the general strike day protesting the new austerity package that will be voted on Thursday at the Parliament.

Three squads of riot police were deployed outside the Parliament to prevent their colleagues to enter the House.

…click on the above link to read the rest of the article…

Both ECB And BOJ Are Just Months Away From Running Out Of Bonds To Buy

With the Fed contemplating whether to hike again next month and start “normalizing ” its balance sheet before the end of 2017, the two other major central banks are facing far bigger problems.

* * *

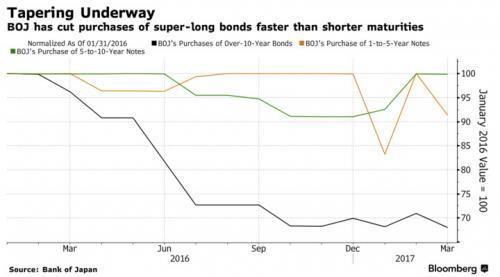

Two months after the BOJ quietly started tapering its QE program, when it also hinted it may purchase 18% less bonds than planned…

… Governor Haruhiko Kuroda admitted last week that the Bank of Japan’s bond holdings are currently growing at an annualized pace of only ¥60 trillion ($527 billion), 25% below the bottom-end of its policy range, and confirming that without making any formal announcement, the BOJ has quietly followed the ECB in aggressively tapering its bond buying program.

Under questioning from opposition party lawmaker Seiji Maehara, who noted that the pace of bond accumulation by the BOJ had slowed, Kuroda said the trend could continue, without elaborating. He noted that the central bank’s target is to control interest rates rather than the amount of bond purchases. “This development signals to me that they are going with rates without talking about a quantitative target,” said Atsushi Takeda, an economist at Itochu Corp. in Tokyo. “That will be better when they think about an exit.”

While the BOJ’s purchase slowdown has been visible for months in data released by the central bank, Kuroda’s confirmation of this reality in parliament last Wednesday marks a stark change. As Bloomberg notes, until now he’d struggled to emphasize that the annual pace could vary from an indicative 80 trillion yen, depending on the state of the economy and financial markets. He now appears to have thrown in the towel. Meanwhile, investors are watching for any hint of tightening in monetary policy amid speculation that the central bank’s bond purchase regime is unsustainable and as consumer prices in Japan are expected to pick up later this year.

…click on the above link to read the rest of the article…

Wall Street Completely Owns the Trump Administration

While America’s corporate press remains singularly obsessed with unproven and likely fabricated Russia-collusion conspiracy theories, Wall Street’s well on its way to getting away with financial murder thanks to an army of cronies embedded within the Trump administration. Indeed, Goldman Sachs running Donald Trump’s economic policy is perhaps the most concerning aspect of his Presidency when it comes to negative impacts on average citizens, yet it’s almost never placed at the forefront of the corporate press narrative.

Many of you probably recall headlines in recent weeks about how Trump might be in favor of “bringing back Glass-Steagall” as well as breaking up the big banks. These are two things I think are extraordinarily necessary and important, but it turns out Trump has no intention of actually doing any such thing.

As the title of Bloomberg’s recent article on the topic so perfectly sums up…

Here are a few excerpts from the extremely disturbing, yet entirely unsurprising piece:

On the first day of May, Donald Trump sat in the Oval Office and declared that his administration was taking a look at breaking up Wall Street’s biggest banks. If they ever took him seriously, it didn’t last.

Instead of cowering, Wall Street executives and lobbyists are crowing, getting more confident about ditching rules that have annoyed them for years. That’s because the Trump administration is appointing friendly regulators and signaling it will make life easier for bankers.

“Break up the banks? That ain’t going to happen,” said Rick Hohlt, who has advised and lobbied for lenders including Citigroup Inc. for three decades. “You need legislation to do that. And the chance of that is about zero.”

…click on the above link to read the rest of the article…

Chinese Insurer Warns Of “Mass Defaults, Social Unrest” Due To “Mass Redemption” Run

One month ago, China came “this close” to the one event which terrifies Beijing more than anything: a run on China’s shadow banks.

As a quick reminder, 150 customers of China’s Mingsheng Bank, the country’s largest private bank, were furious in mid-April when they learned that some 3 trillion yuan invested in Wealth Management Products, the backbone of China’s shadow banking system, had vaporized after bank employees had engaged in fraud and embezzled the funds without ever investing it (later it emerged that Mingsheng employees had put the money into “cultural relics” and jewelry, for their own use).

And while fraud and embezzlement are both endemic in China, the bigger concern raised by the article was the threat of a bank run across China’s massive and unregulated, nearly $10 trillion shadow banking system. Indeed, while there have been numerous allegations and warnings that China’s entire shadow banking facade, dominated by WMPs and other “investment products”, is nothing but a giant ponzi scheme in which recoveries – should there be a bank run, a topic recently discussed on Bloomberg – would be non-existent if there is ever a bank run, defaults of WMPs issued by big banks – and this case an unapproved WMP – are rare, as are shadow bank runs.

For now.

However, in a stunning announcement made by one of China’s largest insurers, Foresea Life has warned of “mass defaults and social unrest” unless China’s regulator lifts a recent ban on its issuance of new products. In a letter to China’s insurance regulator, first reported by the Financial Times, Foresea Life Insurance which is a heavy investor in WMPs, has warned that the company expects “redemptions” of 60 billion yuan, or $8.7 billion, this year and might be unable to meet payouts unless it is able to sell new products.

…click on the above link to read the rest of the article…

May 17, 2017

‘The Everything Bubble’: Why The Coming Collapse Will Be Even Worse Than The Last

The next crash is coming, and the decision by central banks to paper over their economy’s troubles with a massive injection of debt likely means that the next crash is already overdue.

Soon, investors will be forced to reconcile a massive expansion of debt and falling productivity and growth with a host of potentially disruptive crises: The advent of government-sponsored cyberwarfare, followed by the collapse of the global dollar-based monetary system. Whereas the last crisis trigger massive devaluations in the real estate and stock markets, the next crash will be the result of a triple bubble in stocks, real estate and bonds as investors bail out of traditional assets in favor of the safety of gold, silver and – perhaps – cryptocurrencies like bitcoin.

Gold analyst Mike Maloney believes that traditional assets will plunge, and gold, silver and cryptocurrencies like bitcoin will outperform, as investors seek protection from the coming collapse of the global dollar system. Maloney explains his thinking in a new YouTube video “The Everything Bubble.”

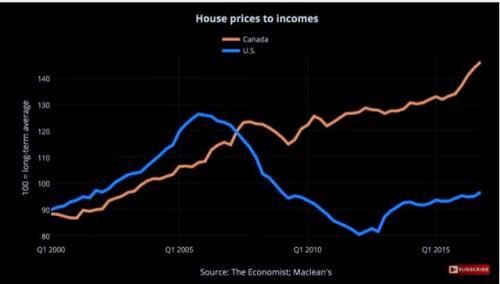

In the U.S., housing prices have experienced a halting recovery since the subprime crisis. But in other markets, like New Zealand, Canada, a frenzy of buying by wealthy Chinese hoping to stash their money abroad kept prices afloat, driving the ratio of home prices to incomes to all time highs. In Canada, the affordability index – the ratio of housing prices to incomes – has risen to an all-time high of 1.4.

In the stock market, a few vulnerabilities have emerged; the ratio of debt borrowed against investors’ brokerage account balances has reached all-time highs, which tells you that recent gains are vulnerable to a short-squeeze – which is when brokerages close clients out of their positions.

…click on the above link to read the rest of the article…