Steve Bull's Blog, page 1369

May 7, 2017

Canadians fight floods across the country

Thousands in Central Canada, the Atlantic and B.C. spend the weekend struggling with rising water levels

Erick Miner comforts a cat rescued by boat from a home Saturday on Rue Saint-Louis in Gatineau, Que., as rising river levels and heavy rains continue to cause flooding. (Justin Tang/Canadian Press)

Across the country, thousands of Canadians are spending the weekend in a desperate struggle with rising floodwaters caused by unusually persistent rainfall.

More than 400 Canadian Forces personnel were deployed to western and central Quebec on Saturday as high water continued to threaten hundreds of residences, including some in the Montreal area.

Another 800 troops will be added to that total by the end of Sunday, officials have since announced.

More than 130 Quebec communities have been hit by flooding, with an estimated 1,900 homes affected and more than 1,000 people forced to leave.

Floodwaters in Quebec are expected to peak today due to continued rain in most of the affected areas.

Premier visits flooded area

Quebec Premier Philippe Couillard visited the flooded Montreal-area community of Rigaud yesterday and urged people to heed authorities if they recommend they leave their homes.

Rigaud Mayor Hans Gruenwald Jr. declared a state of emergency Sunday morning and ordered a mandatory evacuation of the region’s flood zones, saying authorities could no longer guarantee the safety of residents.

Montreal Mayor Denis Coderre said he is also evaluating whether to declare a state of emergency after three dikes gave way in the Pierrefonds-Roxboro borough, in the city’s north end.

Homes have been evacuated in Pierrefonds, as well as on the two nearby islands, Ile-Bizard and the smaller Ile-Mercier.

Canadian forces have been deployed to help affected communities cope with rising water levels, including 80 soldiers in Gatineau, seen leaving their temporary headquarters here. (Ashley Burke/CBC)

…click on the above link to read the rest of the article…

A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

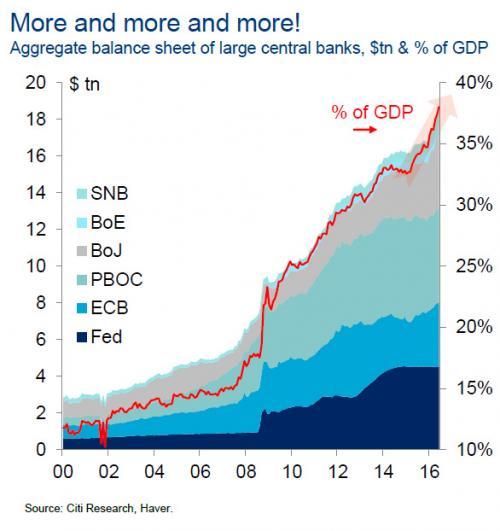

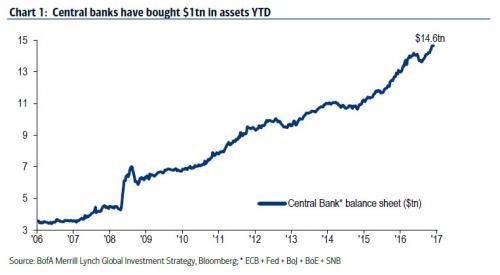

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, “the largest CB buying on record.”

BofA’s Michael Hartnett noted that supersized central bank intervention which he dubbed a “liquidity supernova” is “the best explanation why global stocks & bonds both annualizing double-digit gains YTD despite Trump, Le Pen, China, macro…”

To be sure, Hartnett’s “discovery” did not come as a surprise to regular readers: back in October 2014, Citi’s Matt King calculated that it costs central banks $200 billion per quarter to avoid a market crash, or as he put it:

For over a year now, central banks have quietly being reducing their support. As Figure 7 shows, much of this is down to the Fed, but the contraction in the ECB’s balance sheet has also been significant. Seen from this perspective, a negative reaction in markets was long overdue: very roughly, the charts suggest that zero stimulus would be consistent with 50bp widening in investment grade, or a little over a ten percent quarterly drop in equities. Put differently, it takes around $200bn per quarter just to keep markets from selling off.

Today we showed just what central bank buying looks like in practical terms when we demonstrated that the Swiss national Bank had purchased a record $17 billion in US equities in just the first quarter, bringing its total US equity long holdings to an all time high above $80 billion…

… in the process soaking up nearly 4 million AAPL shares in the first 3 months of the year.

…click on the above link to read the rest of the article…

May 6, 2017

The Horror! The Horror! (Part Two)

In Part One of this article I detailed how propaganda has been utilized by the Deep State for decades to control the minds of the masses and allow those in control to reap the benefits of never ending war. In Part Two I will discuss recent events, false flags, and propaganda campaigns utilized by the Deep State to push the world to the brink of war.

“We penetrated deeper and deeper into the heart of darkness” – Joseph Conrad, Heart of Darkness

The use of graphic images, electronically transmitted across the world in an instant, along with a consistent false narrative promoted by the captured corporate media, is the preferred means of appealing to the emotions of those who want to believe atrocity propaganda. Instigating a march to war through the use of unfounded fear, misinformation, staged photo ops, and appealing to passions and prejudices was as revolting to Albert Einstein in the 1930s as it is today to normal thinking individuals.

“He who joyfully marches to music in rank and file has already earned my contempt. He has been given a large brain by mistake, since for him the spinal cord would fully suffice. This disgrace to civilization should be done away with at once. Heroism at command, senseless brutality, deplorable love-of-country stance, how violently I hate all this, how despicable and ignoble war is; I would rather be torn to shreds than be a part of so base an action! It is my conviction that killing under the cloak of war is nothing but an act of murder.” – Albert Einstein

It seems the level and intensity of the propaganda campaigns has ratcheted up dramatically in the last half dozen years and appears to be reaching a crescendo as we speak.

…click on the above link to read the rest of the article…

Just a quick reminder of who’s really in charge

Just a quick reminder of who’s really in charge

Just a quick reminder of who’s really in chargeToday the world of banking and finance waited with baited breath for the Federal Reserve in the United States to hike… or not to hike… interest rates.

This happens several times each year as the central bank’s Federal Open Market Committee gathers to set monetary policy in the Land of the Free.

To be clear, there is no greater power over a nation than having control of its money supply and interest rates.

Think about it: interest rates influence just about EVERYTHING in the economy.

Changes in interest rates influence housing prices, company stock prices, retail sales, food prices, oil prices, and major business purchases.

Interest rates have a significant impact over employment, business investment, inflation, and the currency’s international exchange rate.

Increases in the interest rate even have the power to bring a government to its knees.

This is pretty extraordinary power. And it has been awarded to an unelected committee that has an astonishing track record of getting it wrong.

Former Fed chair Ben Bernanke famously predicted in January 2008 that “the Federal Reserve is currently NOT forecasting a recession.”

It turns out that the recession had officially started one month before in December 2007.

While that’s just one small example, the numbers show that these guys perpetually miss the mark.

In January 2011 the Fed projected 2011 GDP growth would be 3.7%. It turned out to be 2%. So proportionally speaking they were off by 85%.

In January 2012 they predicted 2.5% growth that year. Actual growth in 2012 was 1.6%, so they were ‘only’ off by 56%.

Their 2016 GDP growth forecast was 2.4%, while actual growth was 1.6%, another 50% error.

And just recently for the first quarter of 2017, the Fed’s predictions were 1.2% growth, while actual GDP growth was just 0.7%… a 70%+ overshoot.

Here’s the funny thing– even the Federal Reserve’s own internal study shows that they consistently miss the mark in their projections.

…click on the above link to read the rest of the article…

May 5, 2017

The Coming Debt Reckoning

American workers, as a whole, are facing a disagreeable disorder. Their debt burdens are increasing. Their incomes are stagnating.

There are many reasons why. In truth, it would take several large volumes to chronicle all of them. But when you get down to the ‘lick log’ of it all, the disorder stems from decades of technocratic intervention that have stripped away any semblance of a free functioning, self-correcting economy.

The financial system circa 2017, and the economy that supports it, has been stretched to the breaking point. Shortsighted fiscal and monetary policies have propagated it. The result is a failing financial order that has become near intolerable for all but the gravy supping political class and their cronies.

Take consumer spending. This is the primary driver of the U.S. economy. Yet it requires vast amounts of credit. In fact, American consumers presently hold $1 trillion in revolving credit. At the same time, they have nowhere near the income needed to finance these debts, let alone pay them off.

Remember, the flipside of credit is debt. Obviously, the divergence of increasing debt and stagnating incomes is a condition that cannot go on forever. But it can go on much longer than any sensible person would consider possible.

Debt Slaves

If you haven’t noticed, the financial services industry is extremely accomplished at compelling people to go whole hog into debt. Moreover, the entire fiat based financial system, which depends on ever increasing issuances of debt, hinges on it. Just a slight contraction of credit, like late 2008, and the whole debt repayment structure breaks down.

On an individual basis, there are only so many credit cards that can be maxed out before the shell game ends. Wolf Richter, of Wolf Street, recently clarified the relationship between the economy and deep consumer debt:

…click on the above link to read the rest of the article…

Stephen Hawking: 100 Years Left for Humans to Escape Earth

(ANTIMEDIA) World-renowned physicist Stephen Hawking has been discussing the impending doom of the human race for several years.

On multiple occasions, he has warned of the likelihood that alien species will act like colonialists if they ever visit Earth, likening extraterrestrials’ tendencies to our own human behavior.

“One day we might receive a signal from a planet like this, but we should be wary of answering back. Meeting an advanced civilization could be like Native Americans encountering Columbus. That didn’t turn out so well,” he has said.

Stephen Hawking has also warned that it’s only a matter of time until Earth is destroyed. “Although the chance of disaster to planet Earth in a given year may be quite low, it adds up over time, and becomes a near certainty in the next 1,000 or 10,000 years,” he said in November.

As a result, he has advocated colonizing both the moon and Mars.

Keeping up with his warnings, Hawking warns in a forthcoming documentary — called Stephen Hawking: Expedition New Earth — that humans should make their exodus from the planet within the next century if they have any hope of surviving. According to the BBC, which is releasing the feature this summer, Hawking discusses his assertion that “the human race only has one hundred years before we need to colonize another planet.”

In the film, set to be released next month, Hawking details why this will be necessary, noting threats facing the planet including epidemics, asteroid strikes, and climate change.

The BBC documentary includes Stephen Hawking and other academics and aims to “… find out if and how humans can reach for the stars and move to different planets,” according to the British network.

BBC asserts Hawkings’ seemingly outlandish predictions and advice about leaving Earth are actually well-founded.

…click on the above link to read the rest of the article…

NYT Cheers the Rise of Censorship Algorithms

Exclusive: The New York Times is cheering on the Orwellian future for Western “democracy” in which algorithms quickly hunt down and eliminate information that the Times and other mainstream outlets don’t like, reports Robert Parry.

Just days after sporting First Amendment pins at the White House Correspondents Dinner – to celebrate freedom of the press – the mainstream U.S. media is back to celebrating a very different idea: how to use algorithms to purge the Internet of what is deemed “fake news,” i.e. what the mainstream judges to be “misinformation.”

New York Times building in New York City. (Photo from Wikipedia)

The New York Times, one of the top promoters of this new Orwellian model for censorship, devoted two-thirds of a page in its Tuesday editions to a laudatory piece about high-tech entrepreneurs refining artificial intelligence that can hunt down and eradicate supposedly “fake news.”

To justify this draconian strategy, the Times cited only a “fake news” report claiming that the French establishment’s preferred presidential candidate Emmanuel Macron had received funding from Saudi Arabia, a bogus story published by a Web site that mimicked the appearance of the newspaper Le Soir and was traced back to a Delaware phone number.

Yet, while such intentionally fabricated articles as well as baseless conspiracy theories are a bane of the Internet – and do deserve hearty condemnation – the Times gives no thought to the potential downside of having a select group of mainstream journalistic entities feeding their judgment about what is true and what is not into some algorithms that would then scrub the Internet of contrary items.

…click on the above link to read the rest of the article…

Does the Price of Oil Determine General Increases in the Prices of Goods and Services?

A very good visual correlation between the yearly percentage change in the consumer price index (CPI) and the yearly percentage change in the price of oil seems to provide support to the popular thinking that future changes in price inflation in the US are likely to be set by the yearly growth rate in the price of oil (see chart).

But is it valid to suggest that a price of an important input such as oil is a key determinant of the prices of goods and services?

Now producers of goods and services set asking prices. It is also true that producers whilst setting prices take into account various production costs including the cost of energy.

Whether the asking price set by producers is going to be realised in the market place hinges on consumers’ acceptance of the price set. Consumers dictate whether the price set by producers is “right”.

On this Mises wrote,

The consumers patronize those shops in which they can buy what they want at the cheapest price. Their buying and their abstention from buying decides who should own and run the plants and the farms. They determine precisely what should be produced, in what quality, and in what quantities.

If consumers don’t have the money to support the prices asked by producers then the prices asked cannot be realised.

What is a price? It is the rate of exchange between goods established in a transaction. The price, or the rate of exchange of one good in terms of another, is the amount of the other good divided by the amount of the first good.

In a money economy, price will be the amount of money divided by the first good. A price is the sum of money paid for a unit of a good.

…click on the above link to read the rest of the article…

Wet weather walloping much of Ontario, Quebec and heading east

Ottawa River, Laurentian communities hit hard; New Brunswick expected to be next

Some Pointe-Gatineau, Que., residents have had to abandon their cars trapped by flooding. Firefighters have gone door-to-door in parts of Gatineau to warn residents of the dangers of staying put as forecasts call for rain throughout the weekend. (CBC)

Heavy rainfall affected airline passengers in Canada’s busiest airport on Friday, while voluntary evacuation orders were in effect in some areas of Ontario and Quebec.

Heavy rainfall affected airline passengers in Canada’s busiest airport on Friday, while voluntary evacuation orders were in effect in some areas of Ontario and Quebec.

Environment Canada has issued a special weather statement for much of Quebec and a rainfall warning for much of southern and eastern Ontario. New Brunswick, particularly the southern part of the province, will be in the crosshairs of the slow-moving system beginning Friday night and into Saturday.

Prime Minister Justin Trudeau, in Montreal on Friday morning, said the federal government is closely monitoring the flood threat.

“Our thoughts are with the families, the communities affected by the severe flooding that’s going on throughout Quebec and indeed across the country,” he said.

He praised the volunteers and first responders helping out and said Ottawa was ready to respond to formal requests for assistance.

“We will, of course, be there as the cleanup continues after the waters recede,” he said.

In all affected areas, residents are being warned to stay away from banks of rivers and streams and low-lying areas and to avoid driving into standing water. Homeowners are advised to ensure valuables aren’t kept in basements, to make sure catch basins and eaves are clear of leaves and debris, and to call 311 to report any flooding issues.

Quebec

The most wide-ranging threats of flooding are in Quebec, with 124 communities in the province affected.

Urgences Québec says more than 1,326 residences in the province have been affected by flooding this week, with at least 700 people forced out of their homes.

…click on the above link to read the rest of the article…

The Hunt for Taxes is Global

Taxes are the root of all evil for this is the confrontation against the people that historically leads to civil unrest and then revolution. The American and French Revolutions were over taxes. Historically, even the Roman Empire was forced from time to time to grant tax amnesty as was the case in 119AD. You even have Roman Emperors such as Trajan (98-117AD) engaging in social legislation known as the Alimenta, which was a welfare program that helped orphans and poor children throughout Italy. The Alimenta provided general funds, food and subsidized education for children. The funding came from the Dacian War booty initially. When that ran out, it was funded by a combination of estate taxes and philanthropy.The state provided loans like Fannie Mae providing mortgages on Italian farms (fundi). The registered landowners in Italy received a lump sum from the imperial treasury. In return, the borrower was expected to pay yearly a given proportion of the loan to the maintenance of an Alimentary Fund – a kickback so to speak. Taxes and social programs have been around a very long time.

Taxes are the root of all evil for this is the confrontation against the people that historically leads to civil unrest and then revolution. The American and French Revolutions were over taxes. Historically, even the Roman Empire was forced from time to time to grant tax amnesty as was the case in 119AD. You even have Roman Emperors such as Trajan (98-117AD) engaging in social legislation known as the Alimenta, which was a welfare program that helped orphans and poor children throughout Italy. The Alimenta provided general funds, food and subsidized education for children. The funding came from the Dacian War booty initially. When that ran out, it was funded by a combination of estate taxes and philanthropy.The state provided loans like Fannie Mae providing mortgages on Italian farms (fundi). The registered landowners in Italy received a lump sum from the imperial treasury. In return, the borrower was expected to pay yearly a given proportion of the loan to the maintenance of an Alimentary Fund – a kickback so to speak. Taxes and social programs have been around a very long time.

Today, debts are never reduced. Consequently, governments only raise taxes continually. We see this in some of the richest countries in the world. Now Singapore is passing three amendments expanding the power of the Ministry of Finance (MOF) under the Property Tax Act. This new legislation is one that will hand the Inland Revenue Authority of Singapore (IRAS) more enforcement and investigative powers. Singapore government is using the law to force people to pay more in taxes. There will be no privacy. Under this legislation, the tax authorities will be able to summon people to appear personally before them and to provide all information. They will be interrogated orally for investigation be it their own taxes, or another person’s property/properties.

…click on the above link to read the rest of the article…