Steve Bull's Blog, page 122

March 13, 2023

Peak Oil Gets Admitted?

Denial is like a glacier. At first sight, and to everyone standing on it, it looks rock solid. Then cracks start to develop, and before you know it, a huge chunk breaks off and drifts away — never to be seen again. This is what’s happening to peak oil right in front of our eyes: the denial that it cannot possibly come about has started to develop cracks of its own. Yes, peak oil — supposedly “debunked” by the shale revolution — is slowly getting normalized. OK, not in the mainstream media — still chuck full of lunacy and World War III propaganda — but at least in some of the news sites aimed at energy professionals. Some industry journalists have started to slowly realize that it is a very real thing — not a mere theory — and that it won’t be fun to say the least… But let’s just not get ahead ourselves yet.

Photo by Adriana Lorena Benavides Estrada on Unsplash

Photo by Adriana Lorena Benavides Estrada on UnsplashInmy start of the year essay I predicted how peak oil will be announced in 2023 — only to be buried under a pile of BS. Well, here you go, and it’s only March. Paraphrasing Captain Benjamin L. Willard from the movie Apocalypse Now we could say:

“Oh man… the bullshit piled up so fast [in the energy business], you needed wings to stay above it.”

Before we start flapping our wings, first let’s hear the admission that peak oil is not a crackpot theory. As Mr Kern, the Educated Realist from Oilprice.com — “the no.1 source for oil and energy news” — explained with his own words (my emphasis added in bold):

Peak oil is the point in time when worldwide petroleum production reaches its maximum point and begins to decline. It occurs when reserves of easily accessible oil are depleted, and it becomes increasingly difficult and expensive to extract remaining reserves.

…click on the above link to read the rest…

Silicon Valley Bank Crisis: The Liquidity Crunch We Predicted Has Now Begun

There has been an avalanche of information and numerous theories circulating the past few days about the fate of a bank in California know as SVB (Silicon Valley Bank). SVB was the 16th largest bank in the US until it abruptly failed and went into insolvency on March 10th. The impetus for the collapse of the bank is tied to a $2 billion liquidity loss on bond sales which caused the institution’s stock value to plummet over 60%, triggering a bank run by customers fearful of losing some or most of their deposits.

There are many fine articles out there covering the details of the SVB situation, but what I want to talk about more is the root of it all. The bank’s shortfalls are not really the cause of the crisis, they are a symptom of a wider liquidity drought that I predicted here at Alt-Market months ago, including the timing of the event.

First, though, let’s discuss the core issue, which is fiscal tightening and the Federal Reserve. In my article ‘The Fed’s Catch-22 Taper Is A Weapon, Not A Policy Error’, published in December of 2021, I noted that the Fed was on a clear path towards tightening into economic weakness, very similar to what they did in the early 1980s during the stagflation era and also somewhat similar to what they did at the onset of the Great Depression. Former Fed Chairman Ben Bernanke even openly admitted that the Fed caused the depression to spiral out of control due to their tightening policies.

In that same article I discussed the “yield curve” being a red flag for an incoming crisis:

…click on the above link to read the rest…

March 12, 2023

The 10 Rules of Propaganda

The 10 Rules of Propaganda

The 10 Rules of PropagandaLord Arthur Ponsonby was a British diplomat and politician, dates 1871–1946.

This keen and cagey fellow pinpointed 10 rules of propaganda. They are these:

Just Look at the News

1. We don’t want war, we are only defending ourselves.

2. The other guy is solely responsible for this war.

3. Our adversary’s leader is evil and looks evil.

4. We are defending a noble purpose, not special interest.

5. The enemy is purposefully causing atrocities; we only commit mistakes.

6. The enemy is using unlawful weapons.

7. We have very little losses, the enemy is losing big.

8. Intellectuals and artists support our cause.

9. Our cause is sacred.

10. Those who doubt our propaganda are traitors.

A daily scan of the newswires calls to mind three or more of these propaganda rules. On some days, six or seven. On others still, all 10.

We refer specifically to the conflict presently arage in the eastern European nation of Ukraine.

Let us now consider these rules. We will not take up each of them since some rules relate closely to others. We will instead weld these together. To proceed…

1. We don’t want war, we are only defending ourselves.

2. The other guy is solely responsible for this war.

On how many occasions have you read or heard condemnations of Mr. Putin’s “unprovoked” act of aggression?

To phrase it differently, when has it not been described as unprovoked?

Yet a man can argue very persuasively that Mr. Putin’s war was indeed provoked.

The Russian autocrat warned on several occasions that NATO expansion into Ukraine was a “red line.”

Russia would not abide the NATO dagger pressing against its vitals (parts of Ukraine actually lie east of Moscow).

Yet the NATO alliance had announced its intentions to incorporate Ukraine — despite Vladimir’s moans and grimaces.

…click on the above link to read the rest…

March 11, 2023

The Censorship Industrial Complex

The Censorship Industrial Complex

The Censorship Industrial ComplexI think something is seriously wrong with my brain. Yesterday, I hallucinated that Matt Taibbi and Michael Shellenberger testified before a subcommittee of the US House of Representatives about the Censorship Industrial Complex, i.e., the US arm of the global official propaganda and disinformation apparatus that has been waging an all-out war on dissent for the better part of the last six years.

I know this couldn’t have actually happened, and was just an extended hallucination (probably the result of the copious amount of drugs I consumed in my misspent youth, or the effects of a Commie bio-weapon with a fatality rate of less than one percent, because I’ve been writing about The War on Dissent (2018), and The Criminalization of Dissent (2021), and the global Corporate COINTELPRO op (2017), and The War on Reality (2021), and The Manufacturing of Reality (2021), and Manufacturing Truth (2018), and Manufacturing Normality (2016), and The Road to Totalitarianism (2022), and The Gaslighting of the Masses (2022) … well, for quite some time. So, I’m sure it was just an hallucination, because there’s no way Matt and Shellenberger were actually sitting there talking about how …

“We learned Twitter, Facebook, Google, and other companies developed a formal system for taking in moderation ‘requests’ from every corner of government: the FBI, DHS, HHS, DOD, the Global Engagement Center at State, even the CIA. For every government agency scanning Twitter, there were perhaps 20 quasi-private entities doing the same, including Stanford’s Election Integrity Project, Newsguard, the Global Disinformation Index, and others, many taxpayer-funded.” (Matt Taibbi’s Statement to Congress)

… and documenting the coordinated censorship of sources that interfered with certain official narratives, like “Russiagate” and “The Apocalpytic Virus” …

… because that’s just a crazy “conspiracy theory.”

…click on the above link to read the rest…

Here We Go Again

“I keep hearing about battery innovation, but it never makes it to my phone.” – Evan Spiegel

For those that have been in and around alternative energy research for the better part of long careers, nothing makes the eyes roll harder than loud proclamations of breakthrough advances in battery technology. Consider this fun exercise: open up Google, search “battery breakthrough,” click “News,” and customize the results for any random six-month window in the past 20 years. Select an article that catches your eye and you’ll find exciting claims like this one from 2005 (emphasis added throughout):

“A rechargeable battery that can be fully charged in just 6 minutes, lasts 10 times as long as today’s rechargeables and can provide bursts of electricity up to three times more powerful is showing promise in a Nevada lab.

New types of battery are badly needed. Nokia’s chief technologist Yrjö Neuvo warned last year that batteries are failing to keep up with the demands of the increasingly energy-draining features being crammed into mobile devices.”

And another from 2011, with the humorously ironic title “No joke: This is the biggest battery breakthrough ever”:

“A pioneer in battery research who already successfully launched a $350 million company to supply batteries to the likes of GE and Chrysler has done it again — only this time, ‘it’ represents the complete reinvention of battery technology as we know it.

This technology is in the research phase, but if it can be cost-effectively brought to market — and there’s every reason to believe that it could be — it could revolutionize the way we store and transport energy, in the process fully replacing fossil fuels and especially oil.”

(If you have to forewarn that your article is “no joke,” the odds of it being unserious are, as it turns out, pretty high.)

…click on the above link to read the rest…

March 10, 2023

The War for the Dollar is Over Part II: The Fly or the Windshield?

Live images flashing by

Like windshields towards a fly

Frozen in that fatal climb

But the wheels of time, just pass you by

-RUSH, “Between the Wheels”

In part I of this series I told you the war over the US dollar was over because the bane of domestic monetary policy, Eurodollar futures, lost the battle with SOFR, the new standard for pricing dollars.

The ignominious end of the Eurodollar system is a study in the evolution of markets, as a new system replaces an old one. Old systems don’t die overnight. We don’t flip a switch and wake up in a new reality, unless we are protagonists in a Philip K. Dick novel.

More than a decade ago I looked at the responses to President Obama cutting Iran out of the SWIFT system as the beginning of the end of the petrodollar system. The goal was to take Iran out of the global oil markets by shutting Iran out from the dominant dollar payment system.

Out of necessity Iran opened up trade with its major export partners, most notably India, in something other than dollars. India and Iran started up a ‘goods for oil’ trade, or as Bloomberg called it at the time, “Junk for Oil.”

The stick of sanctions created a new market for pricing Iranian oil and a way around the monopoly of US dollar oil trading. India, struggling with massive current account deficits because of their high energy import bill, welcomed the trade as a way to lessen the pressure on the rupee.

Iran needed goods. They worked out some barter trade and the first shallow cuts into the petrodollar system were made.

…click on the above link to read the rest…

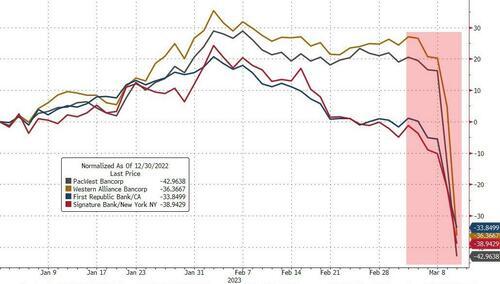

“Worst Since Lehman”: Banks Break The World Again

Last week we detailed BofA’s Michael Hartnett’s warning that “The Fed will tighten until something breaks”.

Well, something just broke…

SVB’s collapse – the second biggest US bank failure in history – dominated any reaction to this morning’s mixed bag from the BLS (hotter than expected earnings growth, rising unemployment (especially for Latinos), better than expected payrolls gains).

Things started off badly as SVB crashed 65% in the pre-market before being halted. SVB bonds were puking hard and when the FDIC headline hit, the bonds collapsed further…

Source: Bloomberg

A number of small/medium sized banks were clubbed like a baby seal…

Source: Bloomberg

And the KBW regional bank index crashed (down 9 of the last 10 days and 20% in that period). The 18% drop this week was the index’s worst drop since Lehman (Sept 2008)…

Source: Bloomberg

And as you’ll see below, that started to have some notable impacts on the most arcane of global systemic risk red flag signals…

TED Spread at YTD highs (systemic risk rising)Global USD Liquidity tightest in 2023 (foreigners paying up for USDollars)Global Bank Credit Risk risingThe worst week for stocks in 2023… On the week, all the US majors were down hard with Small Caps crashing 9%, S&P, Dow, and Nasdaq over 4% lower…

The Dow has been underwater on the year for over a week and is now down 4% in 2023. Today’s ugliness smashed the S&P 500 and Russell 2000 down to unchanged on the year…

Source: Bloomberg

All the US Majors are now back below their 200DMAs…

Unsurprisingly, financials were the week’s biggest sector laggards but all were red on the week…

VIX exploded higher on the day, back above 28 and recoupling with equity weakness…

Source: Bloomberg

…click on the above link to read the rest…

The Weakening Electric Grid: Less Reliable, More Fragile

California Independent System Operator announced a statewide electricity Flex Alert urging conservation to avoid blackouts in El Segundo, Calif., on Aug. 31, 2022. (Photo by Patrick T. Fallon/AFP via Getty Images)

California Independent System Operator announced a statewide electricity Flex Alert urging conservation to avoid blackouts in El Segundo, Calif., on Aug. 31, 2022. (Photo by Patrick T. Fallon/AFP via Getty Images)As more and more irritated customers become certain that power shortages and blackouts have become more common, the electric grid’s problems receive more attention. They should. Shortages and blackouts have in fact become much more common than they once were. The electric power grid has become increasingly fragile and considerably less reliable. This is especially troubling because, at the same time, Washington and several states plan to burden it further with electric cars and an increase in the use of electric appliances. In part, the power problem reflects the increased reliance on inherently intermittent wind and solar sources. But this straightforward fact of life is only part of the story behind the electric grid’s problems. Matters are much more complicated.

Evidence of failure is irrefutable and has sometimes appeared with great drama. A 2021 cold snap in Texas, for example, led to widespread blackouts and the death of 250 people. California has for years regularly imposed rolling brownouts and blackouts on utility customers. Just this past Christmas season, unusually cold weather across the country prompted utilities from Massachusetts and New York across the Midwest and into the south to beg their customers to turn down their thermostats and delay their use of appliances. Millions lost power for days in North Carolina and Tennessee. Downed power lines caused some of the problems, but in many cases electric utilities simply had to cut off power to some in order to a total crash of their systems. The incidence of prolonged blackouts for all reasons has doubled since 2013.

…click on the above link to read the rest…

March 8, 2023

What If There Are No Solutions?

The unencumbered realist concludes that there are no solutions within a status quo structure that is itself the problem.

Realists who question received wisdom and conclude the status quo is untenable are quickly labeled pessimists because the zeitgeist expects a solution is always at hand–preferably a technocratic one that requires zero sacrifice and doesn’t upset the status quo apple cart.

Realists ask “what if” without selecting the “solution” first. The conventional approach is to select the “answer/solution” first and then design the question and cherry-pick the evidence to support the pre-selected “solution.”

What if all the status quo “solutions” don’t actually address the real problems? This line of inquiry is strictly verboten, for there must be a solution that solves everything in one fell swoop.

Examples of this approach abound: a one-size fits all solution that resolves all the systemic problems by itself. All we have to do is implement it.

Replacing fiat currencies is one example that I have explored:

You Want Truly “Sound Money”? A Thought Experiment

Contrarian Thoughts on the Petro-Yuan and Gold-Backed Currencies

I’ve also explored how real change works: it takes many years (or even decades) of sacrifices and high costs with none of the immediate payoff we now expect as a birthright. Real change pits those benefiting from the status quo against those finally grasp that the status quo is the problem, not the solution, and these political/social battles are endless and brutal because any gains come at somebody else’s expense.

The Forgotten History of the 1970s

The 1970s: From Rotting Carcasses Floating in the River to Kayak Races

…click on the above link to read the rest…

Pakistan’s Dystopian Warning to the World

Supporters of former Prime Minister Imran Khan at a rally in Rawalpindi in November. Photographer: Asad Zaidi/Bloomberg

Supporters of former Prime Minister Imran Khan at a rally in Rawalpindi in November. Photographer: Asad Zaidi/BloombergPakistan has touted itself as one of the world’s cradles of civilization, flourishing for thousands of years along ancient trade routes passing through the fertile Indus Valley.

Now it presents a dystopian vision of the future, bankrupt, unstable and threatened by climate catastrophe. Its fate offers a warning to other heavily indebted nations on the precipice, from Sri Lanka to Zambia.

Pakistan is due to hold elections no later than October, and political jostling is narrowing the nuclear-armed nation’s options.

Opposition leader Imran Khan, who was ousted from the premiership last year, is in a bitter standoff with Prime Minister Shehbaz Sharif over control of the country of 230 million. He’s held mass rallies in recent months to pressure the government into an early vote, while the authorities have filed numerous cases against him and issued a warrant for his arrest.

As Islamabad fiddles, the country is burning up its foreign reserves, and investors see a growing risk of default. The government is living hand to mouth, reliant on outside loans from China while negotiating with the International Monetary Fund for the remaining funds in a $6.5 billion bailout — its 13th since the late 1980s.

Pakistan already got a taste of economic disaster last year when deadly floods displaced millions. Such calamities are unlikely to be a one-off, with climate scientists forecasting massive increases in river flows as a result of melting Himalayan glaciers, inundating farmland and obliterating infrastructure — interspersed with drought.

Pakistan could hardly have a more strategic location, lodged between Iran and India and with China and Afghanistan to the north. That, plus its sheer size as the world’s fifth-most populous nation, make it too big to be allowed to fail.

…click on the above link to read the rest…