Steve Bull's Blog, page 123

March 7, 2023

Central Bank Digital Currency Prison – Catherine Austin Fitts

Catherine Austin Fitts (CAF), Publisher of The Solari Report, financial expert and former Assistant Secretary of Housing (Bush 41 Admin.), says the Central Bank Digital Currency (CBDC) is much easier said than done. There is a monster fight behind the scenes between commercial banks and central banks. CAF explains, “You have bubbled an entire economy, and now you are bringing out something (CBDC) that could shrink the bubble dramatically, and it can put a lot of banks out of the game and out of the business. If the central banks are going to compete directly for retail accounts, it’s going to shrink the fees and business for a lot of banks. You are talking about cutting their income or putting them out of business. So, CBDC is highly controversial. One reason is people are beginning to wake up and realize, oh, I am no longer an insider. CBDC is going to turn me into a slave, and they are going to be able to take all my assets. You think they could lock you down during the pandemic? The CBDC is the ultimate lockdown tool, and they can lock anyone down whenever they feel like it.”

Catherine Austin Fitts (CAF), Publisher of The Solari Report, financial expert and former Assistant Secretary of Housing (Bush 41 Admin.), says the Central Bank Digital Currency (CBDC) is much easier said than done. There is a monster fight behind the scenes between commercial banks and central banks. CAF explains, “You have bubbled an entire economy, and now you are bringing out something (CBDC) that could shrink the bubble dramatically, and it can put a lot of banks out of the game and out of the business. If the central banks are going to compete directly for retail accounts, it’s going to shrink the fees and business for a lot of banks. You are talking about cutting their income or putting them out of business. So, CBDC is highly controversial. One reason is people are beginning to wake up and realize, oh, I am no longer an insider. CBDC is going to turn me into a slave, and they are going to be able to take all my assets. You think they could lock you down during the pandemic? The CBDC is the ultimate lockdown tool, and they can lock anyone down whenever they feel like it.”

The Fed’s biggest fear is losing control of the financial system. CAF says, “The Fed is scared to death of the global debt growth model, and they kept this model going by growing the debt more and more and more. Now, interest rates are accelerating in a way . . . it shrinks your productivity. So, the pie that is supporting the debt, is shrinking. . . . This is a coup model just like in Ukraine. You push all the people out or you kill them. You have war conditions so you can pick everything up cheap. You can do this with government money to ‘help’ Ukraine….

…click on the above link to read the rest…

March 2, 2023

The End of the Oil Age Gets Postponed Again. Really?

Photo by Diyar Al Maamouri on Unsplash

Photo by Diyar Al Maamouri on UnsplashIt looks like we have to wait a little more to see the end of the oil age. Our desire to burn more and more stuff knows no limits — at least not when talking about the foreseeable future. Statements like “oil will be needed for at least another 10 years” or “independent experts agree that global oil and natural gas demand will increase over the next 30 years” suggest that transitioning to ‘renewables’ will have to wait a little. Will we burn as much carbon as we see fit then? Well, as usual, reality will have a thing or two to say in the matter.

Up until the war in Eastern Europe broke out and a wast array of sanctions were unleashed on one of the world’s biggest fossil fuel supplier, the ruling meme on how the oil age would end was called ‘peak oil demand’. According to this myth, pushed by mainstream media, ‘progressive’ oil companies and high tech automakers, we would eventually reach a peak in fossil fuel consumption as we seamlessly transition into an electrified road transport powered by ‘renewables’. Demand increase for oil would thus stop at some point in time, then start to fall gently like a feather on mom’s belly. The climate would be saved, meanwhile everybody could keep on shopping and consuming happily as if nothing happened.

British Petrol (or BP for short) has famously put this ‘peak demand’ date into 2019 — a forecast they would quickly backtrack two years after. A couple of more years into this brave new world, and after years of unprecedented shortages, the world has started to realize that fossil fuels might indeed be needed for a while down the road.

…click on the above link to read the rest…

Animals Dying Across Ohio State Parks After East Palestine Train Derailment

After a catastrophic train derailment in East Palestine, Ohio, early last month, President Biden, Transportation Secretary Pete Buttigieg, corporate media outlets, Ohio Governor Mike DeWine, Environmental Protection Agency, and some local officials have ensured air monitoring and water sample tests show everything is under control.

But is it? Well, not according to the local newspaper Ohio Star. Reporter Hannah Poling said a confidential source told her that a wildlife biologist and consultant for the federal forestry received hundreds of reports over the last several days from forestry workers discovering “hundreds of dead animals in Ohio’s parks.”

Several labs across the country have received specimens of whole minks, deer, elk, worms and livers of such animals, and they are finding toxicities that are off the charts, the source said.

“These highly toxic levels are the exact chemicals that were released from East Palestine. Wayne National Forest and Shawnee State Forest in Ohio, are downriver from East Palestine and are two parks where samples are from,” the source continued.

Meanwhile, the BBC reported:

Nearly 45,000 animals have died as a result of a toxic train crash this month in an Ohio town, environmental officials have said.

The figure from the Ohio Department of Natural Resources updates the initial estimate of 3,500 animals dead after the 3 February derailment.

The source also told the Ohio Star that Governor DeWine attempted to block scientists from entering state parks:

The governor and the railroad were blocking scientists from getting soil samples in East Palestine, but they were able to still grab some for testing. Likewise, the soils are highly contaminated,” the source said.

…click on the above link to read the rest…

The Top 3 Reasons the US Has Entered the Inflation Death Spiral

Rapidly rising food, housing, medical, and tuition prices are squeezing Americans, and many do not understand the real cause of their falling living standards.

That confusion opens the door for opportunistic politicians who promise supposed freebies to ease the pain of inflation. Many, unfortunately, succumb to this siren’s call.

Perverse as it is, the policies offered to people suffering from inflation create even more inflation. In other words, inflation has a way of perpetuating itself, much like a heroin addiction.

We are already seeing cockamamie schemes in the US, like “inflation relief checks,” which attempt to solve the problems of inflation by creating more inflation.

The political-inflation cycle follows a clear pattern:

Step #1: In a fiat currency system, the government will inevitably print an ever-increasing amount of currency to finance itself.

Step #2: This makes prices and living costs rise faster than wages.

Step #3: The average person feels the pain but doesn’t understand what’s happening.

Step #4: More people support politicians who promise freebies to relieve the pain inflation causes.

Step #5: The government prints more currency to pay for the freebies.

Step #6: This creates even more inflation, and the cycle repeats.

At this point, we have to ask ourselves whether the political situation in the US will improve.

Unfortunately, the data points to a troubling but inevitable answer… “no.”

The reason is simple: a growing majority of US voters receive government money.

When you count everyone who lives off political dollars instead of free-market dollars, we’re already well north of 50% of the US population.

In other words, the US has already crossed the Rubicon. There’s no going back.

The growing majority of voters who collect net benefits from the government is a built-in constituency to perpetuate policies financed by ever-increasing inflation. That’s why I think the US has entered an unstoppable inflation death spiral.

…click on the above link to read the rest…

Chris Hedges: The Trump-Russia Saga and the Death Spiral of American Journalism

De-Pressed – Mr. Fish

De-Pressed – Mr. FishReporters make mistakes. It is the nature of the trade. There are always a few stories we wish were reported more carefully. Writing on deadline with often only a few hours before publication is an imperfect art. But when mistakes occur, they must be acknowledged and publicized. To cover them up, to pretend they did not happen, destroys our credibility. Once this credibility is gone, the press becomes nothing more than an echo chamber for a selected demographic. This, unfortunately, is the model that now defines the commerical media.

The failure to report accurately on the Trump-Russia saga for the four years of the Trump presidency is bad enough. What is worse, major media organizations, which produced thousands of stories and reports that were false, refuse to engage in a serious postmortem. The systematic failure was so egregious and widespread that it casts a very troubling shadow over the press. How do CNN, ABC, NBC, CBS, MSNBC, The Washington Post, The New York Times and Mother Jones admit that for four years they reported salacious, unverified gossip as fact? How do they level with viewers and readers that the most basic rules of journalism were ignored to participate in a witch hunt, a virulent New McCarthyism? How do they explain to the public that their hatred for Trump led them to accuse him, for years, of activities and crimes he did not commit? How do they justify their current lack of transparency and dishonesty? It is not a pretty confession, which is why it won’t happen…

…click on the above link to read the rest…

The stage is set for Hybrid World War III

A powerful feeling rhythms your skin and drums up your soul as you’re immersed in a long walk under persistent snow flurries, pinpointed by selected stops and enlightening conversations, crystallizing disparate vectors one year after the start of the accelerated phase of the proxy war between US/NATO and Russia.

That’s how Moscow welcomes you: the undisputed capital of the 21st century multipolar world.

A long, walking meditation impregnates on us how President Putin’s address – rather, a civilizational speech – last week was a game-changer when it comes to the demarcation of the civilizational red lines we are all now facing. It acted like a powerful drill perforating the less than short, actually zero term memory of the Collective West. No wonder it exercised a somewhat sobering effect contrasting the non-stop Russophobia binge of the NATOstan space.

Alexey Dobrinin, Director of the Foreign Policy Planning Department of the Ministry of Foreign Affairs in Russia, has correctly described

Putin’s address as “a methodological basis for understanding, describing and constructing multipolarity.”

For years some of us have been showing how the emerging multipolar world is defined – but goes way beyond – high speed interconnectivity, physical and geoeconomic. Now, as we reach the next stage, it’s as if Putin and Xi Jinping, each in their own way, are conceptualizing the two key civilizational vectors of multipolarity. That’s the deeper meaning of the Russia-China comprehensive strategic partnership, invisible to the naked eye.

Metaphorically, it also speaks volumes that Russia’s pivot to the East, towards the rising sun, now irreversible, was the only logical path to follow as, to quote Dylan, darkness dawns at the break of noon across the West.

…click on the above link to read the rest…

February 27, 2023

Fed Fears Complete Economic Collapse – Peter Schiff

Money manager and economist Peter Schiff said in October the Federal Reserve “could NOT win the fight on inflation by raising interest rates.” As inflation just turned up anew, it looks like he was right—again. Schiff explains, “Based on the recent data we got . . . the inflation curve has bent back up. The months of declining inflation are in the rearview mirror. Now, we are going to see accelerating inflation . . . and I think before the year is over, we are going to take out that 9% inflation high last year in year over year CPI (Consumer price Index) . . . and what that is going to show is what the Fed has done thus far in its inflation fight is completely ineffective. If the Fed is serious about fighting inflation, and I do not believe it is, it’s going to have to fight a lot harder than it has. Interest rates need to go up much higher than anybody thinks, but that alone is not going to do the trick. We also have to see a big contraction in consumer credit and lending standards rising so consumers can’t keep spending. . . . Consumers are running up credit card debt. That is inflationary. That is an expansion of the supply of credit.”

Money manager and economist Peter Schiff said in October the Federal Reserve “could NOT win the fight on inflation by raising interest rates.” As inflation just turned up anew, it looks like he was right—again. Schiff explains, “Based on the recent data we got . . . the inflation curve has bent back up. The months of declining inflation are in the rearview mirror. Now, we are going to see accelerating inflation . . . and I think before the year is over, we are going to take out that 9% inflation high last year in year over year CPI (Consumer price Index) . . . and what that is going to show is what the Fed has done thus far in its inflation fight is completely ineffective. If the Fed is serious about fighting inflation, and I do not believe it is, it’s going to have to fight a lot harder than it has. Interest rates need to go up much higher than anybody thinks, but that alone is not going to do the trick. We also have to see a big contraction in consumer credit and lending standards rising so consumers can’t keep spending. . . . Consumers are running up credit card debt. That is inflationary. That is an expansion of the supply of credit.”

It gets worse when the Fed has to save the economy again. Schiff predicts, “I think the Fed is going to have to throw in the towel on the inflation fight because it will be fighting something it fears more, which is a complete economic collapse. . . .The federal government may be legitimately forced to cut Medicare and Social Security instead of illegitimately cutting it through inflation. . . .We have this collapsing standard of living, but think about it as a tax. This is what Americans are paying…

…click on the above link to read the rest…

February 25, 2023

America’s Largest Power Grid Faces Worsening Reliability Risks

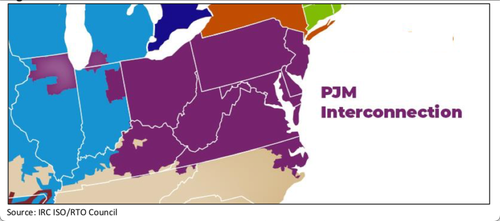

A new report reveals the US’ largest power grid is shuttering power generation units faster than new supply can be brought online, threatening electric reliability in 13 states that stretch from Illinois to New Jersey with over 65 million customers.

PJM Interconnection published a new study Friday that examines the alarming trend of state and federal decarbonization policies across the grid that “present increasing reliability risks during the transition, due to a potential timing mismatch between resource retirements, load growth and the pace of new generation entry.”

Here are the key highlights of the report:

The growth rate of electricity demand is likely to continue to increase from electrification coupled with the proliferation of high-demand data centers in the region.Thermal generators are retiring at a rapid pace due to government and private sector policies as well as economics.Retirements are at risk of outpacing the construction of new resources, due to a combination of industry forces, including siting and supply chain, whose long-term impacts are not fully known.PJM’s interconnection queue is composed primarily of intermittent and limited-duration resources. Given the operating characteristics of these resources, we need multiple megawatts of these resources to replace 1 MW of thermal generation.The report warned:

“For the first time in recent history, PJM could face decreasing reserve margins should these trends continue.”

A significant problem with the ‘green transition’ is adding renewable power, such as solar and wind, are unreliable forms of power generation. Combining this with rapidly retiring fossil fuel power generation units will reduce generating capacity by about 21% through 2030. The report pointed out that the current pace of adding new power generation wouldn’t compensate for the retirement of coal- and natural gas-fired generation amid soaring demand.

Here’s the full report:

What’s clear is PJM’s grid is becoming less dependable (read: here & here) and will probably worsen in the transition to a decarbonized future.

#246: The Surplus Energy Economy, part 1

FROM FIRST PRINCIPLES

Introduction

We have reached a turning-point at which economics and the economy have parted company. Orthodox economics continues to promise growth in perpetuity, but the economy itself is going in the opposite direction.

The explanation for this is simple. Conventional economics assumes that the economy is driven by money, which is entirely under our control. But the economy is, in reality, not a financial system, but a physical one, which uses energy to convert raw materials into the products and services which constitute prosperity. The modern economy has been built on abundant, low-cost energy from fossil fuels, but this dynamic is winding down and, as we shall see in a future instalment, we have no complete (or timely) alternative with which to replace it.

The aim with The Surplus Energy Economy is to set out a comprehensive assessment of the condition and prospects of the world economy and financial system, seen from the perspective that the economy is shaped by energy, not money. This series of articles will be as specific as possible, using data from the SEEDS economic model.

The conclusions reached here necessarily contradict the orthodox line, which is that the supposed ‘normality’ of growth will soon return, and that seamless transition to renewable energy sources will deliver economic expansion in perpetuity.

The economy is analysed here as a material system which has started to contract after reaching physical constraints imposed by the availability and cost of energy. Similar limits apply to environmental tolerance for energy-based economic activity.

Findings will come later in this series, but we are completely unprepared for the reversal of prior growth in the economy. The ending of growth has not arrived without warning, and we can identify a precursor zone, starting in the 1990s, which was characterised by deceleration, followed by stagnation.

…click on the above link to read the rest…

Indigenous knowledge is key to sustainable food systems

Farmer Angelina Monday works on her plot of land in Uganda, where she grows beans and vegetables for her family. Credit: Mads Nissen/Politiken/Panos Pictures

I grew up in Campinas, a city in southeast Brazil. The apples there, cultivated from European varieties since the 1960s, tasted sweet. But, given the choice, I would always pick papayas grown in our garden. My father, who knew that growing a temperate fruit tree in a tropical country seldom worked, instead filled our garden with tropical ones, including two varieties of papaya. Meanwhile, drawing on knowledge from her Indigenous roots, my mother grew all sorts of herbs in pots around the house, which she used to treat ailments such as diarrhoea and indigestion.

Indigenous peoples and other local communities, who might have lived in a region for thousands or hundreds of years, respectively, have long acted as foragers, growers and shapers of nature1. In many parts of the world, the food production systems developed by such communities — from irrigated crops to agroforestry systems — have been the dominant food systems supporting regional economies, and feeding rural and urban areas alike2.

For the past three decades, various efforts involving academic and industrial partners have explored how biodiversity in low- and middle-income countries could be exploited commercially — bioprospected — for new pharmaceuticals and crop varieties, and how benefits could be shared equitably. Yet there are huge power imbalances between the wealthy countries and large corporations seeking the products, and the biodiversity-rich but economically and technologically deprived countries and communities providing them. In practice, the benefits rarely reach the people who are the knowledge holders and guardians of biodiversity and agrobiodiversity3.

…click on the above link to read the rest…