Steve Bull's Blog, page 120

April 1, 2023

The Energy Transition Is a Delusion Indeed

The “energy transition” continues to receive thunderous applause from all the usual Beltway suspects, an exercise in groupthink fantasy amazing to behold. For those with actual lives to live and thus uninterested in silliness: The “energy transition” is a massive shift, wholly artificial and politicized, from conventional energy inexpensive (Table 1b and here), reliable, and very clean given the proper policy environment, toward such unconventional energy technologies as wind and solar power. They are expensive, unreliable, and deeply problematic environmentally in terms of toxic metal pollution, wildlife destruction, land use massive and unsightly, emissions of conventional pollutants, and in a larger context large and inexorable reductions in aggregate wealth and thus the social willingness to invest in environmental protection.

But the Beltway being what it is, the fantasists are impervious to reality, until the massive costs and dislocations and absurdities become impossible to ignore. (Witness, for example, California.) Even as they backtrack on their confident assertions that a modern economy can be powered with the energy equivalent of pixie dust, they argue that the emerging problems are little more than growing pains attendant upon short run rigidities, and all will be well given some more time, more subsidies, and more magical thinking.

Uh, no. The obstacles confronting the “energy transition” are fundamental — they are caused by the very nature of unconventional energy — driven by massive costs, technical and engineering realities, severe constraints in terms of needed physical inputs, and at a political level growing local opposition to the unconventional energy facilities central to the “transition.”

These realities — there’s that word again — are discussed in detail in a major recent paper by Mark P. Mills of the Manhattan Institute. This brief discussion cannot do it justice, but let us first quote Mills directly:

…click on the above link to read the rest…

March 29, 2023

World Bank Warns Of ‘Lost Economic Decade’ As Turmoil Spreads

The world is in a precarious situation, with the potential for nuclear conflict. Central banks are taking aggressive measures to address decades-high inflation by raising interest rates, which in turn is causing a banking crisis in the Western world. As recession risks surge worldwide and international trade fractures, the future of the global economy appears to be heading down a dark path.

“A lost decade could be in the making for the global economy,” Indermit Gill, the World Bank’s Chief Economist and Senior Vice President for Development Economics, warned in a new report.

The report “Falling Long-Term Growth Prospects: Trends, Expectations, and Policies” reveals new forecasts that show global long-term potential output in growth rates are expected to slide:

Nearly all the economic forces that powered progress and prosperity over the last three decades are fading. As a result, between 2022 and 2030, average global potential GDP growth is expected to decline by roughly a third from the rate that prevailed in the first decade of this century—to 2.2% a year.

For developing economies, the decline will be equally steep: from 6% a year between 2000 and 2010 to 4% a year over the remainder of this decade. These declines would be much steeper in the event of a global financial crisis or a recession .

World Bank’s chief economist continued:

“The ongoing decline in potential growth has serious implications for the world’s ability to tackle the expanding array of challenges unique to our times—stubborn poverty, diverging incomes, and climate change.”

However, he said:

“But this decline is reversible. The global economy’s speed limit can be raised—through policies that incentivize work, increase productivity, and accelerate investment.”

Ayhan Kose, director of the World Bank’s forecasting group, said the fracturing of the global economy implies “the golden era of development appears to be coming to an end.”

…click on the above link to read the rest…

Peter Schiff: Bank Bailouts Will Devalue the Dollar

MARCH 28, 2023 BY SCHIFFGOLD 0 0

MARCH 28, 2023 BY SCHIFFGOLD 0 0Peter Schiff appeared on NTD News to talk about the bank bailout and the March Federal Reserve meeting. During the conversation, Peter explained that everybody is going to pay for these bailouts because they will ultimately devalue the dollar as inflation skyrockets.

During his press conference after the March FOMC meeting, Jerome Powell said the banking system is “sound and resilient.” Peter said it’s not sound at all.

It’s a house of cards that is starting to collapse.”

Peter explained how the banking system became so unsound.

First, the Federal Reserve kept interest rates at zero for over a decade. During that time, banks loaded up on low-yielding, long-term Treasuries and mortgage-backed securities. With interest rates so low, they had to go out further on the yield curve. And the reason they were able to take so much risk is because the government guarantees bank accounts. That created a moral hazard. Customers didn’t care what the banks did with their money because they knew the government would bail them out.

Thanks to the mistakes the Fed has made since the 2008 crisis, we have a much bigger bubble now. The Fed caused the bubble that led to the financial crisis of 2008, and then they inflated a bigger bubble to try to paper over those mistakes and kick the can down the road so that we wouldn’t have to deal with the full consequences of resolving all those mistakes. And of course, we just compounded the problem with bigger mistakes and now the US economy is poised on the biggest economic disaster in its history.”

…click on the above link to read the rest…

EU Members Clash Over Nuclear Energy’s Role In Climate Policy

The European Union needs to work on a divide among its member countries regarding the role of nuclear energy in achieving their renewable energy goals. This disagreement may delay the progress of one of the EU’s primary climate policies.

On Wednesday, negotiators from EU countries and the European Parliament will engage in their final round of discussions to establish more ambitious EU objectives to expand renewable energy throughout the next decade. These goals are crucial for Europe’s commitment to reduce CO2 emissions by 2030 and to become independent of Russian fossil fuels. However, the negotiations have become bogged down by a dispute over whether fossil fuels produced using nuclear power should be considered part of the renewable energy targets.

France is spearheading a push to classify “low-carbon hydrogen” – hydrogen produced from nuclear energy – as equal to hydrogen created from renewable electricity. France is joined by countries such as Romania, Poland, Hungary, and the Czech Republic, all of which seek greater acknowledgment of nuclear energy’s CO2-free contribution to climate objectives.

On the other hand, Germany, Spain, Denmark, Portugal, and Luxembourg oppose this view, arguing that including nuclear power in renewable energy targets would divert attention from the urgent need to expand solar and wind energy across Europe significantly.

…click on the above link to read the rest…

March 25, 2023

Is a full-blown global banking meltdown in the offing?

(Express Illustration)

Financial crashes like revolutions are impossible until they are inevitable. They typically proceed in stages. Since central banks began to increase interest rates in response to rising inflation, financial markets have been under pressure.

In 2022, there was the crypto meltdown (approximately $2 trillion of losses).

The S&P500 index fell about 20 percent. The largest US technology companies, which include Apple, Microsoft, Alphabet and Amazon, lost around $4.6 trillion in market value The September 2022 UK gilt crisis may have cost $500 billion. 30 percent of emerging market countries and 60 percent of low-income nations face a debt crisis. The problems have now reached the financial system, with US, European and Japanese banks losing around $460 billion in market value in March 2023.

While it is too early to say whether a full-fledged financial crisis is imminent, the trajectory is unpromising.

***

The affected US regional banks had specific failings. The collapse of Silicon Valley Bank (“SVB”) highlighted the interest rate risk of financing holdings of long-term fixed-rate securities with short-term deposits. SVB and First Republic Bank (“FRB”) also illustrate the problem of the $250,000 limit on Federal Deposit Insurance Corporation (“FDIC”) coverage. Over 90 percent of failed SVB and Signature Bank as well as two-thirds of FRB deposits were uninsured, creating a predisposition to a liquidity run in periods of financial uncertainty.

The crisis is not exclusively American. Credit Suisse has been, to date, the highest-profile European institution affected. The venerable Swiss bank — which critics dubbed ‘Debit Suisse’ — has a troubled history of banking dictators, money laundering, sanctions breaches, tax evasion and fraud, shredding documents sought by regulators and poor risk management evidenced most recently by high-profile losses associated with hedge fund Archegos and fintech firm Greensill.

…click on the above link to read the rest…

March 23, 2023

The Fed Proposes a 4th Function of Money: Means of Social Control

Image from Federal Reserve website.

Docket No. OP – 1670

Please consider Docket No. OP – 1670 on Interbank Settlement of Faster Payments.

The Federal Reserve Board announced that the Federal Reserve Banks will develop a new round-the-clock real-time payment and settlement service, called the FedNowsm Service, to support faster payments in the United States.

This is a direct response to the threat posed by digital currencies and blockchain. According to one Fed official, “Last summer, the U.S. Treasury recommended that ‘the Federal Reserve move quickly to facilitate a faster retail payments system, such as through the development of a real-time settlement service, that would also allow for more efficient and ubiquitous access to innovative payment capabilities.”‘ We believe this effort requires a proof-of-authority quantum computing based blockchain system.

As we noted in our paper “Blockchain, Cryptocurrency and the Future of Monetary Policy,” confidential, not-for-distribution research sent to select members of the House Financial Services Committee, it is critical to understand that bitcoin was created in direct response to the failure of global regulators to protect the public in the years leading up to the financial crisis of 2007/2008. Thus, the ethical and monetary functionality of cryptocurrency is superior to that of paper money. Eventually, cryptocurrency is going to dominate.

As also noted in our paper, “The main economic attributes of a technically effective currency rests on three functions: as a unit of account, a store of value and as a medium of exchange.”

But there is a fourth function of money: as a means of social control. The centralized monopoly over the functions of money held by sovereign governments and central banks has generated great income and wealth imbalances…

…click on the above link to read the rest…

How Science Caused Climate Collapse

Editor’s note: Science, touted to be objective, is far from so. As Lewis Mumford explains and Derrick writes extensively in Myth of Human Supremacy, any tool cannot be separated from the overall social structure under which it was created and operates. Likewise, science, as a way of thought, was created under a paradigm of dominance of nature. Much of the scientific discoveries have been pursued for the same purpose. Neither climate science, not climate solution is an exception.

The following article is a part of a blog by Indrajit Samarajiva. DGR does not espouse the views express in this article in its entirety.

Coronal Hole ’30 Times Earth’s Size’ Hurls Solar Plasma Towards Earth

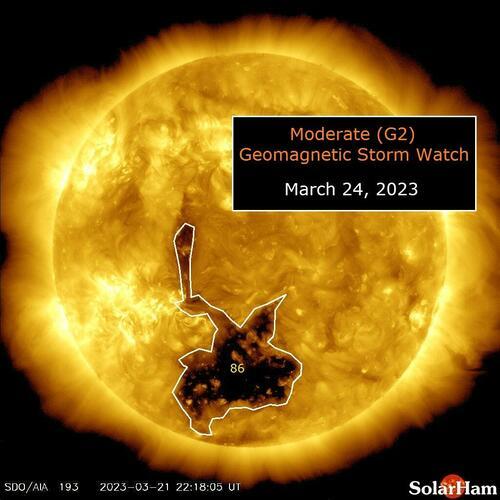

NASA’s Solar Dynamics Observatory released a photo showing a massive coronal hole forming in the sun’s atmosphere, ejecting a stream of fast-moving solar winds toward Earth.

“The current coronal hole, the big one right now, is about 300,000 to 400,000 kilometers across,” Alex Young, the associate director for science at NASA Goddard’s Heliophysics Science Division, told Bussiness Insider. He said, “that’s about 20-30 Earths lined up back-to-back.”

Young said coronal holes unleash solar winds that can travel between 500-800 km per second. He explained the coronal mass ejection would reach Earth by Friday.

“We will probably start seeing the effects of the high-speed wind on March 24.

“When the high-speed wind reaches Earth, the particles and the magnetic field it carries will interact with Earth’s magnetic field, effectively rattling it or like ringing a bell,” he said.

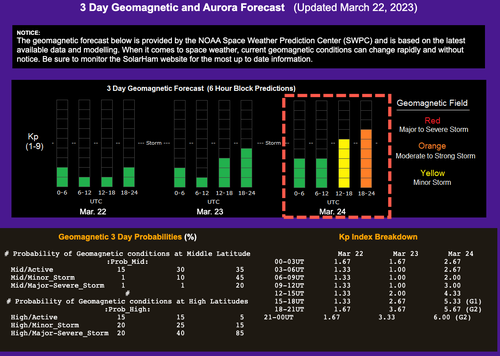

Space Weather website SolarHam said when the solar winds hit Earth, it will produce a moderate (G2) geomagnetic storm.

Here’s a visual of the CME’s impacts on modern society.

In addition to this week’s geomagnetic storm risk, Sunspot Cycle 25 has already started and is anticipated to be active. This could spell trouble for the digital economy, as disruptions caused by solar flares may lead to economic harm.

Last year, Elon Musk’s satellite internet service Starlink lost 40 satellites after a geomagnetic storm knocked them out of orbit.

March 22, 2023

Fed, Central Banks Created the Current Crisis and Are on Course to Making Matters Worse

The incompetence of our financial regulators, most of all the Fed, is breathtaking. The great unwashed public and even wrongly-positioned members of the capitalist classes are suffering the consequences of Fed and other central banks being too fast out of the gate in unwinding years of asset-price goosing policies, namely QE and super low interest rates. The dislocations are proving to be worse than investors anticipated, apparently due to some banks having long-standing risk management and other weaknesses further stressed, and other banks that should have been able to navigate interest rate increases revealing themselves to be managed by monkeys.

What is happening now is the worst sort of policy meets supervisory failure, of not anticipating that the rapid rate increases would break some banks.1 Here we are, in less than two weeks, at close to the same level of bank failures as in the 2007-2008 financial crisis. From CNN:

And even mainstream media outlets are fingering the Fed:

As we’ll explain in due course, the regulators’ habitual “bailout now, think about what if anything to do about taxpayer/systemic protection later” is the worst imaginable response to this mess. For instance, US authorities have put in place what is very close to a full backstop of uninsured deposits (with ironically a first failer, First Republic, with its deviant muni-bond-heavy balance sheet falling between the cracks). But they are not willing to say that. So many uninsured depositors remained in freakout mode, not understanding how the facilities work. Yet the close-to-complete backstop of uninsured deposits amounted to another massive extension of the bank safety net.2

The ultimate reason the Fed did something so dopey as to put through aggressive rate hikes despite obvious bank and financial system exposure was central bank mission creep, of taking up the mantle of economy-minder-in-chief.

…click on the above link to read the rest…

March 18, 2023

‘A Little Book of Insurgent Planning’

As we collapse, this free online book provides examples of what action we can take collectively. Taken from academic literature, it’s about how we struggle together as the world we have depended upon contracts and decays. How will we work together as food and water systems breakdown? How can we act to secure alternate sources? Examples abound of #InsurgentPlanning in cultures and communities around the world. Start planning your #JustCollapse today!

A Little Book of Insurgent PlanningDownload