Steve Bull's Blog, page 118

April 12, 2023

Time to trash Triffin

The dollar-based credit bubble is imploding, and emerging economies are seeking protection by accepting trade settlement in other currencies. The US policy of threatening regime change, currency destabilisation, or other means of ensuring nations remain in its sphere of influence are now failing.

Mainstream economists in the West insist the dollar is irreplaceable, and that as a trade settlement medium China’s yuan is strictly limited. Referring to Triffin’s dilemma, China would have to run deficits to provide the necessary currency liquidity. But they ignore the role of bank credit, which can be expanded at will to meet trade settlement demand.

Furthermore, China’s exchanges offer hedging facilities into physical gold, attracting Middle Eastern energy exporters away from petrodollars, until the new trade settlement currency planned by Sergey Glazyev comes into existence.

For evidence of Russia’s intentions to reintroduce gold into trade settlement, a translation of the semi-official position penned by Glazyev jointly with his deputy is appended to this article.

Increasing systemic risk in US, European, and Japanese banking systems is accelerating the movement of international trade settlement away from fiat dollars into safer havens. These are or will be ultimately backed by physical gold.

The world is changing before our eyes…

Quietly, informed opinion is beginning to accept that America has lost its global influence. Even Brazil, Argentina, and Mexico are openly planning for a future where their international trade will turn away from North America and Western Europe to an Asia firmly bound into the rules of China and Russia — rules that insist on evolving payments away from the dollar to their own currencies or into trade settlement currencies being planned.

…click on the above link to read the rest…

April 11, 2023

The Rising Chorus of Renewable Energy Skeptics

The green techno-dream is so vastly destructive, they say, ‘we have to come up with a different plan.’

Cobalt mining in Congo, says journalist Siddharth Kara, ‘drags humanity back to a time when the people of Africa were valued only their replacement cost.’ Photo via Harvard Kennedy School.

Cobalt mining in Congo, says journalist Siddharth Kara, ‘drags humanity back to a time when the people of Africa were valued only their replacement cost.’ Photo via Harvard Kennedy School.“Sometime during this century, it is highly likely that worldwide depletion of natural resources will force an entire reorganization of social and economic structures, perhaps violently.” — Walter Youngquist, ‘Our Plundered Planet’

Help youth imagine their creative future with a course bundle and gift certificate.

We are going to have to dramatically downsize the dream of a future in which we replace 150-year-old fossil fuel infrastructure with “clean energy” by 2050.

That’s the message in a number of recent important reports and books. They underscore a number of problems with the renewables illusion, including the complexity of the task, the toxicity of rare earth mining and the scarcity of critical minerals.

These grounded realists, including the French journalist Guillaume Pitron and the Australian geologist Simon Michaux, all have three basic messages:

There are dramatic limits to growth.

Truth and reality are not linear.

And the world needs a better plan to avoid collapse other than replacing one unsustainable fossil fuel system with another intensive mining system powered by even more extreme energies. In other words, electrifying the Titanic won’t melt the icebergs in its path.

‘Doubling down on the wrong thing’

For largely ideological reasons many greens and “transitionists” have presented the transition to renewables as a smooth road with no potholes.

…click on the above link to read the rest…

April 10, 2023

The Fed Cannot Fix Today’s Energy Inflation Problem

There is a reason for raising interest rates to try to fight inflation. This approach tends to squeeze out the most marginal players in the economy. Such businesses and governments tend to collapse, as interest rates rise, leaving less “demand” for oil and other energy products. The institutions that are squeezed out range from small businesses to financial institutions to governmental organizations. The lower demand tends to reduce inflationary pressure.

The amount of goods and services that the world’s economy can produce is largely determined by fossil fuel supplies, plus our ability to use “complexity” in many forms to produce the items that the world’s growing population requires. Adding debt helps add complexity of various types, such as more international trade, more advanced education, and more specialized tools. For a while, the combination of growing energy supplies and growing complexity have helped pull economies along.

Unfortunately, the world’s oil supply is no longer growing. Without an adequate oil supply, it becomes difficult to maintain complexity because complex solutions, such as international trade, require adequate oil supplies. Inasmuch as we seem to be reaching energy and complexity limits, nothing the regulators try to do to change the debt and money supplies–even reeling them back in–can fix the underlying oil (and total energy) problem.

I expect that the rich parts of the world, including the US, Europe, and Japan, are in line to be adversely affected by high interest rates this time. With their high levels of complexity, they are among the most vulnerable to disruption when there is not enough oil to go around.

Figure 1. World oil consumption divided into consuming areas, based on data of BP’s 2022 Statistical Review of World Energy. Europe excludes Estonia, Latvia, Lithuania, and Ukraine.

Figure 1. World oil consumption divided into consuming areas, based on data of BP’s 2022 Statistical Review of World Energy. Europe excludes Estonia, Latvia, Lithuania, and Ukraine.…click on the above link to read the rest…

Role Reversal: The Collapse of the Dollar-Enforced Empire

The Soviet empire started to crumble around 1989. The time period between the forming of the North Atlantic Treaty Organization (NATO) in the late 1940s and the retreat of Russia from Eastern Europe with the eventual collapse of communism in Russia is known as the Cold War. There was a great power confrontation in Europe that did not result in war.

Essentially, US-led NATO stood its ground to prevent further Soviet expansion from the territory it occupied at the end of World War II and waited for the inevitable collapse. Now, perhaps not everyone saw the collapse of the Soviet empire as inevitable. But all one had to do was view the Soviet empire for oneself, up close and personal, which is what I did in the early 1970s as a young Air Force officer.

The State of the Communist Economy

The Russian economy at that time is painful to describe. Moscow and Leningrad (Saint Petersburg), the so-called jewels of the Soviet Union, were depressing. Everything was shoddily built. There were very few cars on the streets. There were no retail shops deserving of the name. Lines formed in the middle of the night awaiting the opening of the few bakeries. I saw this for myself from my hotel window on the Nevsky Prospekt in Leningrad. GUM, the “world’s largest department store” near Moscow’s Red Square, sold nothing that was equal to what could be found in any garage sale in the West.

Actually, that should not be a surprise since at one time all those garage-sale goods were marketable. I did not visit Berlin, but those who did say that crossing the Brandenburg Gate from West Berlin to East Berlin was shocking…

…click on the above link to read the rest…

April 6, 2023

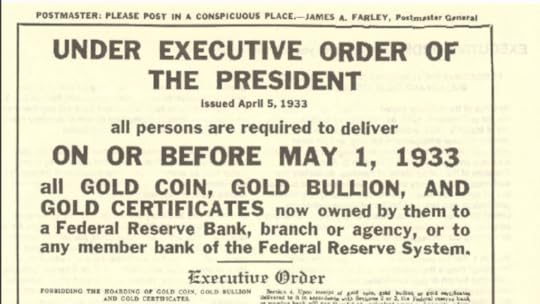

Franklin D. Roosevelt’s Gold Heist

Yesterday (April 5) marked the anniversary 0f the signing of Executive Order 6102 by President Franklin D. Roosevelt. It was touted as a measure to stop gold hoarding, but it was in reality, an attempt to remove gold from public hands.

Many people refer to EO-6102 as a gold confiscation order. But confiscation is probably not the best word for what happened in practice.

The order required private citizens, partnerships, associations and corporations to turn in all but small amounts of gold to the Federal Reserve in exchange for $20.67 per ounce.

The executive order was one of several steps Roosevelt took toward ending the gold standard in the US.

With the dollar tied to gold, the Federal Reserve found it difficult to increase the money supply during the Great Depression. It couldn’t simply fire up the printing press as it can today. The Federal Reserve Act required all notes to have 40% gold backing. But the Fed was low on gold and up against the limit. By enticing the public to give up its gold, the Fed was able to boost its own gold holdings and create more dollars.

EO 6102 followed on the heels of an order Roosevelt issued just weeks before prohibiting banks from paying out or exporting gold. Just two months after the enactment of EO 6102, the US effectively went off the gold standard when Congress enacted a joint resolution erasing the right of creditors to demand payment in gold. Then, in 1934, the government’s fixed price for gold was increased to $35 per ounce. This effectively increased the value of gold on the Federal Reserve’s balance sheet by 69%. By increasing its gold stores through the confiscation of private gold holdings, and declaring a higher exchange rate, the Fed could circulate more notes. In effect, the hoarding of gold by the government allowed it to inflate the money supply.

…click on the above link to read the rest…

“The Last War We Can Afford To Fight”: Tucker Carlson Sounds Alarm Over De-Dollarization, Slams Biden Admin For Pissing Off World

As we’ve noted several times of late, a growing number of countries are threatening the US dollar’s status as the global reserve currency by conducting global trade without it – you know, the thing Saddam and Gaddafi threatened to do before they were ‘liberated’ from their mortal coils for other stated reasons.

Some recent headlines;

“No Reason” For Malaysia To Rely On US Dollar, PM Warns As Yuan Influence GrowsDe-Dollarization Just Got RealHere Are 7 Signs That Global De-Dollarization Has Just Shifted Into OverdriveDe-Dollarization Has BegunFox News host Tucker Carlson has picked up on this, big time, noting that the process began after the Biden administration started wielding the dollar as a political weapon by freezing US dollars held by Russians.

Carlson cites an article from the Daily Caller, in which authors E.J. Antoni and Peter St. Onge write:

A second critical feature of a reserve currency is its apolitical nature. Which Biden is now gutting. After both parties in Washington destroyed the dollar’s stability with inflation, now the Biden administration has chosen to wield the dollar as a weapon. Together, the message to foreigners they should get out while they still can.

In response to Russia’s war with the Ukraine, the US froze the dollar reserves of Russia’s central bank. To be clear, these were not American assets, but were dollars owned by the Russian central bank and the Russian people. The seizure was intended to cause bank runs and collapse Russia’s credit system. It didn’t work.

Instead, it exposed the Biden administration’s willingness to violate the trillions of dollars foreigners rightfully own. The danger of this precedent is difficult to overstate.

This part is a must-hear from Carlson in response to the above (starts at 7:15 in the video below):

…click on the above link to read the rest…

Community, Belonging and the Polycrisis

Image: Ad Parnassum, by Paul Klee

Image: Ad Parnassum, by Paul KleeWherever I go and ask people what is missing from their lives,

the most common answer (if they are not impoverished or seriously ill)is “community.”

— Charles Eisenstein

ChatGPT, the A.I. robot, often gets things badly wrong

It even makes wildly false statements rather routinely. But sometimes I find it useful to ask the bot a question as a very small part of my research process. Today, I’m glad I did. Oddly enough, it gave me the words I found difficult to articulate.

I asked:

Author and speaker, Charles Eisenstein, has said “Wherever I go and ask people what is missing from their lives, the most common answer (if they are not impoverished or seriously ill) is ‘community.’” And yet, in some sense, most people do live in what are called ‘communities’ — be it a village, town or city. It’s not so easy to conceptualize and make explicit what is missing in the lives of people, which is often called “community”. What is this missing element which so many complain about?

The bot said:

The missing element that people often refer to as “community” is a sense of belonging, connectedness, and shared purpose with the people around them. While people may live in the same physical location and interact with others on a daily basis, this does not necessarily translate to a feeling of community.

True community involves a deeper level of connection, where people feel a sense of belonging and are able to create meaningful relationships with others. This can be fostered through shared values, interests, goals, and a sense of mutual support and cooperation. In contrast, many people feel isolated, disconnected, and disengaged from those around them, which can lead to a sense of loneliness, anxiety, and even depression.

…click on the above link to read the rest…

BRICS Nations Developing “New Currency” as Quest for Global De-Dollarization Accelerates

China and Brazil recently finalized a trade deal in their own currencies completely bypassing the dollar, but that’s not the only bad news for the world’s reserve currency.

Last week, a Russian official announced that the BRICS nations are working to develop a “new currency,” yet another sign that dollar dominance is waning.

State Duma (the Russian legislative assembly) deputy chairman Alexander Babakov said the transition to settlements in national currencies is the first step. We’ve already seen this occur with recent oil deals between India and Russia being settled in currencies other than dollars.

The next one is to provide the circulation of digital or any other form of a fundamentally new currency in the nearest future. I think that at the BRICS [leaders’ summit], the readiness to realize this project will be announced, such works are underway.”

That summit is scheduled for August.

Babakov said the BRICS nations are developing a strategy that “does not defend the dollar or euro” and that “a single currency” would likely emerge within BRICS, pegged to gold or “other groups of products, rare-earth elements, or soil.”

Brazil, Russia, India, China, and South Africa make up the BRICS block. It accounts for about 40% of the global population and a quarter of the global GDP.

Last year, Iran officially applied to join BRICS, and according to a report by The Cradle, several nations have expressed interest in joining the bloc, including Saudi Arabia, Algeria, UAE, Egypt, Argentina, Mexico, and Nigeria.

Former Goldman Sachs chief economist Jim O’Neill coined the BRIC acronym. In a recent paper published by Global Policy Journal, he urged the expansion of BRICS.

“The US dollar plays a far too dominant role in global finance,” he wrote. “Whenever the Federal Reserve Board has embarked on periods of monetary tightening, or the opposite, loosening, the consequences on the value of the dollar and the knock-on effects have been dramatic.”

…click on the above link to read the rest…

De-dollarization Has Begun.

Last week, China and Brazil reached an agreement to settle trades in one anothers’ currencies. Over the past 15 years, China has replaced the United States as the main trading partner of resource-rich Brazil, and as such that shift may have been inevitable. But within the context of recent circumstances, this appears to be another in a series of recent blows to the central role of the dollar in global trade.

As the world’s reserve currency, the US dollar is essentially the default currency in international trade and a global unit of account. Because of that, every central bank, Treasury/exchequer, and major firm on Earth keeps a large portion of their foreign exchange holdings in US dollars. And because holders of dollars seek returns on those balances, the ubiquity of dollars drives a substantial portion of the demand for US government bonds in world financial markets.

The switch from dollars to a yuan-real settlement basis in Chinese-Brazilian trade is only the latest in a growing trend. Discussions of a more politically neutral reserve currency have gone on for decades. The profound economic disruption experienced by Iran, and more recently Russia, after being evicted from dollar-based trading systems like SWIFT, however, have led many nations to consider imminent contingency plans. India and Malaysia, for example, have recently begun using the Indian Rupee to settle certain trades, and there have been perennial warnings about Saudi Arabia and other energy exporters moving away from the dollar. On that note, China also recently executed a test trade for natural gas with France settled in yuan.

DXY Index (1980 – present)

(Source: Bloomberg Finance, LP)

(Source: Bloomberg Finance, LP)It’s not just the conscription of the dollar in economic warfare, but increasingly error-fraught monetary policy regimes that are driving various interests away from the greenback…

…click on the above link to read the rest…

April 5, 2023

Overshoot: Cognitive obsolescence and the population conundrum

Abstract The human enterprise is in overshoot; we exceed the long-term carrying capacity of Earth and are degrading the biophysical basis of our own existence. Despite decades of cumulative evidence, the world community has failed dismally in efforts to address this problem. I argue that cultural evolution and global change have outpaced bio-evolution; despite millennia of evolutionary history, the human brain and associated cognitive processes are functionally obsolete to deal with the human eco-crisis. H. sapiens tends to respond to problems in simplistic, reductionist, mechanical ways. Simplistic diagnoses lead to simplistic remedies. Politically acceptable technical ‘solutions’ to global warming assume fossil fuels are the problem, require major capital investment and are promoted on the basis of profit potential, thousands of well-paying jobs and bland assurances that climate change can readily be rectified. If successful, this would merely extend overshoot. Complexity demands a systemic approach; to address overshoot requires unprecedented international cooperation in the design of coordinated policies to ensure a socially-just economic contraction, mostly in high-income countries, and significant population reductions everywhere. The ultimate goal should be a human population in the vicinity of two billion thriving more equitably in ‘steady-state’ within the biophysical means of nature.

Introduction: Evolution and humanity’s eco-predicament This article attempts a more-than-usually systemic assessment of the human eco-predicament. It is inspired by two related facts: First, the human population substantially exceeds the long-term carrying capacity of Earth even at current average material standards. We are in overshoot, a state in which excess consumption and pollution are eroding the biophysical basis of our own existence (GFN, 2022a; Rees, 2020a). Second, national government and international community responses to even the most publicised symptom of overshoot, climate change, have been dismally limited and wholly ineffective (Figure 1).

…click on the above link to read the rest…