Steve Bull's Blog, page 121

March 18, 2023

Iran-Saudi Rapprochement Will Deal A Deathblow To The Dollar

Jacob Lawrence Struggle: From the History of the American People, Panel 8 1954Eurasia’s geo-economic integration took a great leap forward as a result of the Iranian–Saudi rapprochement, which unlocks the Gulf Cooperation Council’s (GCC) trade potential with Russia and China. Its wealthy members can now tap into two series of Iranian-transiting megaprojects in one fell swoop through this deal, with the North-South Transport Corridor (NSTC) connecting them to Russia while the China-Central Asia-West Asia Economic Corridor (CCAWAEC) will do the same vis-à-vis China.

The bloc’s de facto Saudi leader has been prioritizing a comprehensive economic reform policy known as “Vision 2030” that was introduced by Crown Prince and first-ever Prime Minister Mohammed Bin Salman (MBS) upon his rise to power in 2015. It regrettably stumbled as a result of the disastrous Yemeni War that he’s been waging since that same year, but everything is now back on track and more promising than ever after securing $50 billion worth of investments from China last December.

The People’s Republic regards Vision 2030 as complementary to its Belt & Road Initiative (BRI) due to MBS’ focus on real-sector investments for preemptively diversifying the Saudi economy away from its presently disproportionate dependence on oil exports. His country’s location at the crossroads of Afro-Eurasia also makes investments there extremely attractive from the perspective of China’s logistical interests, hence its massive commitment to his comprehensive economic reform policy.

Without last week’s Beijing-brokered deal, China would have had to rely on maritime routes under the control of the powerful US Navy to facilitate the forthcoming explosion in bilateral real-sector trade, but now everything can be conducted much more securely via the Iranian-transiting CCAWAEC. Looking forward, there’s also a theoretical possibility of Chinese energy investments in Iran connecting the Gulf to Central Asia and thenceforth to the People’s Republic, thus fully securing its strategic interests.

…click on the above link to read the rest…

Peak-Oil Fears Cast Shadow Over US Supply Outlook as Costs Climb

(Bloomberg) — The specter of peak oil that haunted global energy markets during the first decade of the 21st century is once again rearing its head.

Major US oil producers are warning that production from one of the fastest growing sources of supply appears likely to top out by the end of the decade. ConocoPhillips and Pioneer Natural Resources Co. are among those saying the American shale-oil juggernaut soon will be a spent force as the best drilling targets are exhausted and financing new wells gets more difficult.

“You see the plateau on the horizon,” ConocoPhillips Chief Executive Officer Ryan Lance said during a panel discussion at the CERAWeek by S&P Global conference in Houston on Tuesday. Once US crude production peaks around 2030, it’ll plateau for a time before commencing a decline, he added.

Government and private-sector researchers have been cutting forecasts for 2023 US oil-supply growth in the face of surging cost inflation, labor shortages and investor demands that more cash be diverted from drilling to dividends and buybacks. Although output in the world’s biggest economy is set to continue rising for a least a few more years, the zenith is fast approaching, executives and analysts said.

“I wish we could get world leaders to realize that we need hydrocarbons for another 50 years,” said Pioneer CEO Scott Sheffield, who expects US production to peak in five or six years.

Before the dawn of the shale-oil revolution, theorists like the late investment banker Matthew Simmons were issuing dire warnings that the Middle Eastern oil bonanza that fed more than half a century of unprecedented economic expansion across the Western world was unsustainable.

…click on the above link to read the rest…

March 16, 2023

Bargaining and Degrowth

Gazebo at Fort Macon, North Carolina

Once again, new material forces me to write a new article to disclose the new information (OK, honestly, I chose to write this article, but you already knew that). I often simply add updates (both marked and unmarked) to previous articles, but this particular scenario needed its own post as it combines more than just one topic. As is typical with the energy sector, denial of reality and optimism bias is often key as to why people can’t seem to see the writing on the wall that the idea of fossil fuel-derived devices that require the fossil fuel platform in order to continue to be maintained are not items that can exist without the fossil fuel platform; so they do not and can not replace fossil fuels; nor do they accomplish anything to reduce ecological overshoot as Steve Bull points out.

While the typical discussion regarding non-renewable “renewables” continues amassing more evidence that the entire scheme has been nothing more than about money, new material about other angles of the so-called “solutions” typically brought forth are also getting a more critical look from scholars. This is now making it clear that the ideas being marketed to the general public don’t actually solve anything but provide more money to those who will benefit from such ideas in the first place. Chris Hedges discusses some of this with Derrick Jensen and Lierre Keith in this video.

I have covered some of the papers and provided videos from Simon Michaux in the past, and many of these same papers have been criticized, promulgating Michaux to provide a new paper going over these criticisms and his response to those claims (spoiler alert: those claims against his papers are proven to be without merit)…

…click on the above link to read the rest…

Unsound Banking: Why Most of the World’s Banks Are Headed for Collapse

You’re likely thinking that a discussion of “sound banking” will be a bit boring. Well, banking should be boring. And we’re sure officials at central banks all over the world today—many of whom have trouble sleeping—wish it were.

This brief article will explain why the world’s banking system is unsound, and what differentiates a sound from an unsound bank. I suspect not one person in 1,000 actually understands the difference. As a result, the world’s economy is now based upon unsound banks dealing in unsound currencies. Both have degenerated considerably from their origins.

Modern banking emerged from the goldsmithing trade of the Middle Ages. Being a goldsmith required a working inventory of precious metal, and managing that inventory profitably required expertise in buying and selling metal and storing it securely. Those capacities segued easily into the business of lending and borrowing gold, which is to say the business of lending and borrowing money.

Most people today are only dimly aware that until the early 1930s, gold coins were used in everyday commerce by the general public. In addition, gold backed most national currencies at a fixed rate of convertibility. Banks were just another business—nothing special. They were distinguished from other enterprises only by the fact they stored, lent, and borrowed gold coins, not as a sideline but as a primary business. Bankers had become goldsmiths without the hammers.

Bank deposits, until quite recently, fell strictly into two classes, depending on the preference of the depositor and the terms offered by banks: time deposits, and demand deposits. Although the distinction between them has been lost in recent years, respecting the difference is a critical element of sound banking practice.

…click on the above link to read the rest…

‘Some EU Banks May Be Vulnerable’ – ECB Tells Ministers ‘No Room For Complcency’

The world was saved there briefly overnight after SNB’s giant liquidity shot into CS.

But it didn’t take long fort reality to sink in about the band-aid-like nature of this facility.

However, the situation under the hood may in fact be worse than some thought as Bloomberg reports, according to people familiar with the talks, that ECB Vice President Luis de Guindos told finance ministers on Tuesday that some European Union banks could be vulnerable to rising interest rates.

Guindos said that the ECB couldn’t rule out that some lenders might be at risk because of their business models, according to the people.

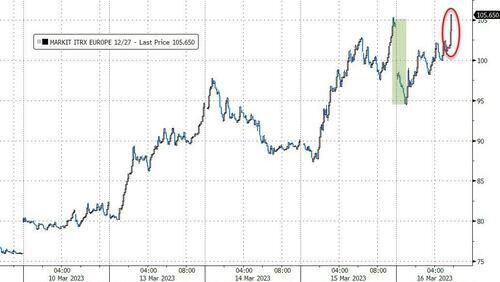

The market did not like that reality check with European IG credit spreads now above yesterday’s highs…

Guindos also cautioned not to be complacent and warned that a lack of confidence could trigger contagion.

Touching on a likely key theme of Thursday’s rate decision, Guindos highlighted the potential conflict between the ECB’s mission to bring down inflation and potential damage to some financial institutions from higher interest rates.

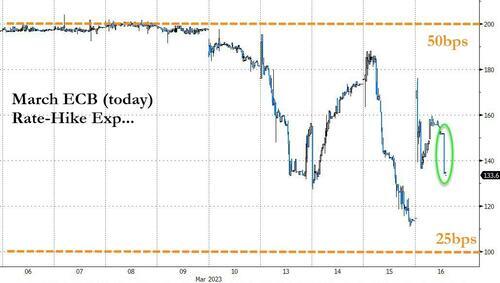

And after that headline on bank vulnerability, the odds of a 50bps hike today have tumbled…

What will Christine do?

Is the U.S. Banking System Safe?–15 Years Later

“We’ve got strong financial institutions…Our markets are the envy of the world. They’re resilient, they’re…innovative, they’re flexible. I think we move very quickly to address situations in this country, and, as I said, our financial institutions are strong.” – Henry Paulson – 3/16/08

“I have full confidence in banking regulators to take appropriate actions in response and noted that the banking system remains resilient and regulators have effective tools to address this type of event. Let me be clear that during the financial crisis, there were investors and owners of systemic large banks that were bailed out . . . and the reforms that have been put in place means we are not going to do that again.” –

Janet Yellen – 3/12/23

With the recent implosion of Silicon Valley Bank and Signature Bank, the largest bank failures since 2008, I had an overwhelming feeling of deja vu. I wrote the article Is the U.S. Banking System Safe on August 3, 2008 for the Seeking Alpha website, one month before the collapse of the global financial system. It was this article, among others, that caught the attention of documentary filmmaker Steve Bannon and convinced him he needed my perspective on the financial crisis for his film Generation Zero. Of course he was pretty unknown in 2009 (not so much anymore) , and I continue to be unknown in 2023.

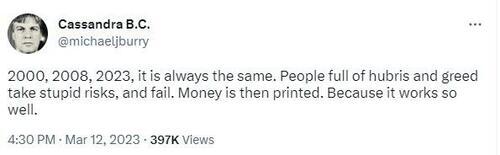

The quotes above by the lying deceitful Wall Street controlled Treasury Secretaries are exactly 15 years apart, but are exactly the same. Their sole job is to keep the confidence game going and to protect their real constituents – the Wall Street bankers. And just as they did fifteen years ago, the powers that be once again used taxpayer funds to bailout reckless bankers. Two hours before the only solution the Feds know – print money and shovel it to the bankers – Michael Burry explained exactly what was about to happen.

…click on the above link to read the rest…

New EIA Report Reveals Massive Downward Reductions In US Shale Oil Output

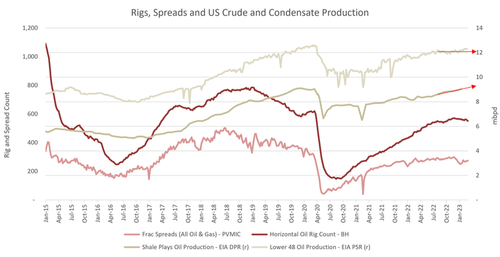

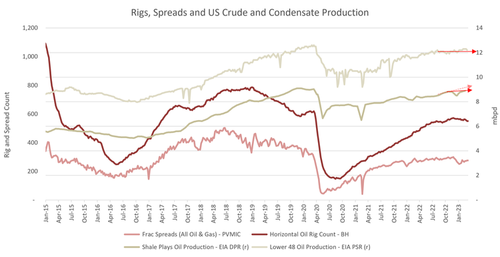

Readers will recall that, for the last several months, I have noted that US oil production per the EIA’s weekly Petroleum Status Report was inconsistent with the data from the EIA’s monthly Drilling Productivity Report (DPR)

The graph below shows that state of play as of last week. The two red arrows at right show the contradictory trends, with total oil production essentially flat while shale oil production is shown rising at a healthy clip. I have noted that this contradiction would have to be resolved by either increasing the weekly numbers or reducing shale oil output.

We now have the answer.

The graph below shows the state of play as of March 14th, when the EIA issued the March DPR. It shows simply massive downward reductions in US shale oil output. In the March report, shale oil output from the key plays is reduced by 443,000 bpd for January and 250,000 bpd for February. If we go back one more month to the January DPR, shale oil production has been reduced by 542,000 bpd for December 2022. This is a huge revision, more than 4% of total US crude and condensate production over a two month period.

With this revision, as the current graph (below) shows, US shale oil production is largely flat over the last four months, and trends in shale oil supply are consistent with the overall US crude oil supply (including conventional onshore wells, Gulf of Mexico offshore, and Alaska). I need hardly point out that this is not good news, as the visible peak of horizontal oil rigs is now beginning to pair up with plateauing oil production, just as we would expect.

…click on the above link to read the rest…

March 14, 2023

For Fed, What Happens Today More Important Than Monday’s Mayhem

It was clear from the get-go that Monday would be mayhem for the markets – and as it turned out, it proved a lot more than that, with two-year Treasury yields collapsing the most in decades.

At stake was not just the integrity of the financial system, but also the availability of liquidity.

Bloomberg cross-asset strategist, Ven Ram, notes that as of the start of the European morning, the markets appear a lot calmer, with Treasury yields having barely moved, the dollar attempting to claw some way back and stock futures a lot less jittery.

Shortly, we get the readout on inflation for February, with the median estimates for on-month and on-year numbers forecast to show a deceleration.

There are two ways this could play out from the Fed’s perspective.

Scenario I:The tumult in the markets continues, centered on concerns about the soundness of other regional US banks, liquidity ebbs – as it always does when the markets need it the most!

In such a scenario, what happens with the February inflation prints becomes a sideshow.

In other words, even a surprise, higher-than-forecast print won’t bother the Fed much.

After all, inflation is a pre-existing problem – and the Fed has time to battle this

Scenario II:If the market jitters calm down, the inflation numbers – together with last week’s payroll data and upcoming retail-sales data – will take regain their predominance.

Even so, the chance of the Fed raising rates by 50 basis points is pretty much zilch.

Calming the markets about the prospect of a systemic crisis towers head and shoulders over inflation fighting from the Fed’s perspective.

After all, when a patient suffering a chronic condition meets with an accident, you treat the patient for life-threatening injuries first.

The long-stay illness isn’t the priority of the hour, as every good doctor knows.

…click on the above link to read the rest…

Bankruptcies Soar Across EU, As Companies Hit Wall At Fastest Rate Since Records Began in 2015

Legions of European companies are succumbing to the final straw of Europe’s largely self-inflicted energy crisis.

Bankruptcy proceedings in the Canary Islands, Spain’s heavily tourism-dependent island chain, soared a whopping 276% year over year in 2022, according to the latest data published by the General Council of the Judiciary (CGPJ) in its report, “The Effects of the Economic Crisis on Judicial Bodies.” The archipelago also saw the highest rate of dismissal claims in Spain, with around 400 of every 100,000 inhabitants losing their jobs.

But this trend is not unique to the Canary Islands, nor indeed Spain. It is happening across large swathes of Europe’s economies, as legions of businesses succumb to the final straw of Europe’s largely self-inflicted energy crisis.

In the EU as a whole the number of bankruptcy declarations initiated by businesses increased substantially (26.8%) quarter-on-quarter in the fourth quarter of 2022, reaching the highest levels on record since Eurostat began collecting EU-wide bankruptcy data in 2015. The number of bankruptcy declarations increased during all four quarters of 2022. As the Eurostat graph below shows, at the current rate of business destruction it won’t be long before businesses are closing at a faster rate than they are opening.

This trend, of course, was not hard to foresee. In August 2022, I warned that the EU’s largely self-inflicted energy crisis and resulting inflation is tipping legions of small businesses over the edge:

After reeling from one crisis to another, Europe’s heavily indebted and deeply debilitated small businesses — the backbone of the economy — face the ultimate threat from energy shortages and soaring prices.

…click on the above link to read the rest…

If You Can’t Hold It, It’s Not Really Yours

The failure of Silicon Valley Bank and Signature Bank reminds us of a very important truth — if you can’t hold it in your hand, you don’t really own it.

That’s why it’s wise to hold at least some of your wealth in hard assets like gold and silver that are in your direct possession or at least stored in a secure, allocated, segregated, and insured storage facility.

The FDIC insures bank deposits up to $250,000. If you have more than that in a financial institution, you could lose everything above that limit if a bank fails.

Depositors at SVB and Signature Bank lucked out. The government has made provisions to cover uninsured deposits. But there’s no guarantee that will happen when the next bank goes under.

And even if you don’t have more than $250,000 in the bank, you could easily find yourself locked out of your account. Just last week, a computer glitch caused money in some Wells Fargo accounts to disappear.

There are also more nefarious reasons you could lose access to funds. The Nigerian central bank recently limited bank withdrawals in order to incentivize people to use its new central bank digital currency. In 2017, India faced cash shortages when the government declared that 1,000 and 500 rupee notes would no longer be valid with just a four-hour notice. And during its crisis, the Greek government shuttered banks and seized some bank deposits.

Most people assume “that can’t happen here” in the US. But as we saw over last week, the US banking system is vulnerable to collapse.

…click on the above link to read the rest…