Steve Bull's Blog, page 119

April 5, 2023

Global Bankruptcy Already Baked In

Global Bankruptcy Already Baked In

Global Bankruptcy Already Baked InScrape away the complexity and every economic crisis and crash boils down to the precarious asymmetry between collateral and the debt secured by that collateral collapsing.

It’s really that simple.

In eras of easy credit, both creditworthy and marginal borrowers are suddenly able to borrow more. This flood of new cash seeking a return fuels red-hot demand for conventional assets considered “safe investments” (real estate, blue chip stocks and bonds), demand of which given the limited supply of “safe” assets pushes valuations of these assets to the moon.

In the euphoric atmosphere generated by easy credit and a soaring asset valuations, some of the easy credit sloshes into marginal investments (farmland that is only briefly productive if it rains enough, for example), high-risk speculative ventures based on sizzle rather than actual steak and outright frauds passed off as legitimate “sure-fire opportunities.”

The price people are willing to pay for all these assets soars as the demand created by easy credit increases. And why does credit continue increasing? The assets rising in value create more collateral, which then supports more credit.

This self-reinforcing feedback appears highly virtuous in the expansion phase: The grazing land bought to put under the plow just doubled in value, so the owners can borrow more and use the cash to expand their purchase of more grazing land.

The same mechanism is at work in every asset: homes, commercial real estate, stocks and bonds. The more the asset gains in value, the more collateral becomes available to support more credit.

The Illusion of Safety

Since there’s plenty of collateral to back up the new loans, both borrowers and lenders see the profitable expansion of credit as “safe.”

…click on the above link to read the rest…

Fake News Curated by the Deep State: Government Spin Doctors Control the News Cycle

“We Americans are the ultimate innocents. We are forever desperate to believe that this time the government is telling us the truth.”—Former New York Times reporter Sydney Schanberg

Let’s talk about fake news stories, shall we?

There’s the garden variety fake news that is not really “news” so much as it is titillating, tabloid-worthy material peddled by anyone with a Twitter account, a Facebook page and an active imagination. These stories run the gamut from the ridiculous and the obviously click-baity to the satirical and politically manipulative.

Anyone with an ounce of sense and access to the Internet should be able to ferret out the truth and lies in these stories with some basic research. That these stories flourish is largely owing to the general gullibility, laziness and media illiteracy of the general public, which through its learned compliance rarely questions, challenges or confronts.

Then there’s the more devious kind of news stories circulated by one of the biggest propagators of fake news: the U.S. government.

In the midst of the government and corporate media’s carefully curated apoplexy over fake news, you won’t hear much about the government’s own role in producing, planting and peddling propaganda-driven fake news—often with the help of the corporate news media—because that’s not how the game works.

Why?

Because the powers-that-be don’t want us skeptical of the government’s message or its corporate accomplices in the mainstream media. They don’t want us to be more discerning when it comes to what information we digest online. They just want us to be leery of independent or alternative news sources while trusting them—and their corporate colleagues—to vet the news for us.

…click on the above link to read the rest…

April 4, 2023

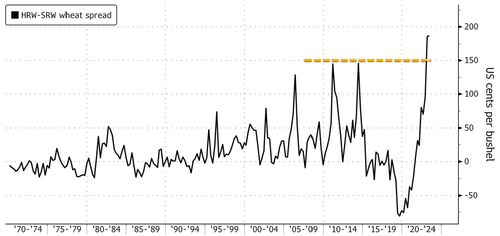

Wheat Spread Hits Record As Drought Plagues Midwest

The spread between hard-red winter wheat and soft-red winter wheat has blown out to a record high as drought threatens crop yields across the Midwest and other major farming regions.

Hard-red winter wheat’s premium over soft-red winter wheat is $1.72 a bushel in Chicago on Tuesday morning, surpassing the 2011 record.

James Bolesworth, managing director at CRM AgriCommodities, told Bloomberg the widening spread is “a factor of the drought in the US Plains which is detrimentally impacting crop conditions.”

The latest report from the US Department of Agriculture found Kansas (top producer) had only 19% of the acreage in good or excellent condition. Agritel analysts pointed out droughts are hitting crops in other states:

“A deterioration of the crop ratings is also visible in Texas and Colorado.”

Simultaneously, drought conditions plague the Canadian Prairies. Farmers in the region are planting in some of the driest conditions in half a century. They need adequate moisture to plant wheat and canola crops, or this might lead to poor crop yields later in the growing season, which could impact global supplies.

“If there isn’t good moisture, those tiny plants are quite susceptible to adverse conditions,” said Bill Prybylski, a farmer and vice president at the Agricultural Producers Association of Saskatchewan.

The possibility of lower US and Canadian wheat production because of persistent drought conditions could exacerbate global food supplies. Already, droughts in Argentina have reduced crop yields, and wartorn Ukraine has forced farmers to reduce plantings.

All of this means that global food inflation will likely remain elevated for the foreseeable future. How to hedge higher costs at the supermarket? Plant a garden.

“Don’t Talk About Nord Stream”: WaPo Report Further Demolishes Official Narrative

German investigators are now expressing severe doubts about the official Nord Stream sabotage narrative that was pushed hard in the aftermath the bombshell Seymour Hersh report which pointed the finger at a joint CIA-US Navy covert operation, with help from Norway. Last month, Hersh published an article on Substack that said the CIA planted a cover story for the Nord Stream bombings that was fed to The New York Times and the German newspaper Die Zeit. Likely this was in direct reaction to Hersh’s findings. A source within the US intelligence community told the famed Pulitzer Prize-winning journalist, “It was a total fabrication by American intelligence that was passed along to the Germans, and aimed at discrediting your story.”

The favored narrative became one that said pro-Ukraine partisans did it in a rogue op. Hersh has maintained this was by design concocted in order to shield the US and Biden administration for ordering the operation. The Die Zeit report cited German officials to assert that the pipeline sabotage bombings were carried out by six people using a yacht rented in Poland that was owned by two Ukrainians. In the days that followed, several Western media outlets seized on that narrative and published similar articles reinforcing the cover story.

But now a fresh, lengthy investigative Washington Post story published Monday is actually confirming many of Hersh’s conclusions. Indeed the ‘cover story’ is already fast unraveling. What’s more is that the WaPo article bluntly states Western officials are not at all eager to talk about the Nord Stream sabotage, suggesting a continued cover-up in progress, or in effect a limited hangout. Also very telling is that Western accusations directed at Russia have long ago quieted down.

…click on the above link to read the rest…

April 3, 2023

No, Nuclear Energy Won’t Save Us

Soon to be mementos of a lost age. Photo by Lukáš Lehotský on Unsplash

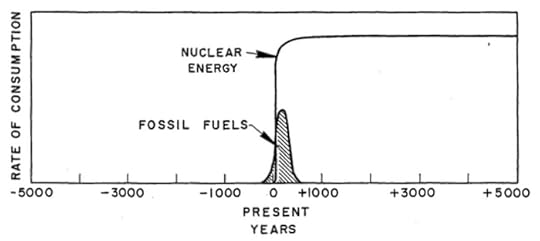

Soon to be mementos of a lost age. Photo by Lukáš Lehotský on UnsplashEver since the first commercial reactors have started to produce electricity for the grid in the 1950’s (um, about 70 years ago now…) we keep hearing how nuclear is the clean, green power of the future. No emissions, no limits, just the infinite power of the atom. Even M. King Hubbert, the renowned petroleum geologist who pointed out the reality of peak oil production , has seen it as an infinite and stable energy source. (Don’t ask me how he could hold these two contradictory thoughts in his head at the same time.)

Today we know — although many still try to deny — that he was spot on with his first observation. Oil is a finite resource and it’s extraction follows a rise, peak, plateau and fall curve. Conventional oil (the scope of Hubbert’s studies) has peaked around 2005, and is on a bumpy plateau ever since, with growth only provided by unconventional and increasingly difficult and energy expensive to get resources. I have wrote many articles on the not so fantastic prospects this has in store for us, so now let’s examine the proposed alternative to fossil fuels: nuclear energy.

Hubbert’s idea about the energy use of humanity. Hubbert, M. King. Nuclear Energy and the Fossil Fuels. American Petroleum Institute. June 1956.

Hubbert’s idea about the energy use of humanity. Hubbert, M. King. Nuclear Energy and the Fossil Fuels. American Petroleum Institute. June 1956.I’ve mentioned in the introduction to this article how Hubbert has presented a glaring contradiction between the reality of peak oil and his expectations towards nuclear power supposedly providing us all the energy we need for countless millennia to come. I say glaring, because as a geologist it should have been obvious to him that nuclear power is coming from Uranium, a mineral found in finite quantities, in finite reserves on this finite planet…

…click on the above link to read the rest…

The schizophrenic understanding of money in economics

One of the great ironies of economics is that, while the public regards economists as experts on money, the issue of how money is created is still not settled within economics.

In 2014, the Bank of England published a landmark paper explicitly rejecting the textbook model of money creation, stating that:

Money creation in practice differs from some popular misconceptions—banks do not act simply as intermediaries, lending out deposits that savers place with them, and nor do they ‘multiply up’ central bank money to create new loans and deposits…

The reality of how money is created today differs from the description found in some economics textbooks: Rather than banks receiving deposits when households save and then lending them out, bank lending creates deposits. In normal times, the central bank does not fix the amount of money in circulation, nor is central bank ‘multiplied up’ into more loans and deposits. (McLeay, Radia, and Thomas 2014, p. 14)

Several other Central Banks published related papers, notably the Bundesbank in 2017, which stated that:

It suffices to look at the creation of (book) money as a set of straightforward accounting entries to grasp that money and credit are created as the result of complex interactions between banks, non- banks and the central bank. And a bank’s ability to grant loans and create money has nothing to do with whether it already has excess reserves or deposits at its disposal (Deutsche Bundesbank 2017, p. 17)

And yet, just five years later, the Nobel Prize in Economics was awarded to Bernanke, Diamond and Dybvig for work which, as the “Scientific Background” to the Prize noted, claimed that banks function as “financial intermediaries” which “channel funds from savers to investors, receiving funds from some customers and using the funds to finance others”….

…click on the above link to read the rest…

“Dr. Doom” Nouriel Roubini Warns Of Stagflationary Megathreat

Though the threat of an exponential liquidity crisis is a conversation that Bloomberg should have been seriously addressing two years ago, it’s good to see that reality is finally hitting the mainstream media. Nouriel Roubini, also known as “Dr. Doom” because he’s one of the few mainstream economists that’s not constantly touting the soft landing narrative, has been rather consistent in terms of covering the clash between credit liquidity, rising inflation and rising interest rates. Now, he’s talking about an incoming stagflationary “megathreat” that will crush credit while prices continue to rise, compelling central bankers to continue raising rates.

The Catch-22 scenario that central banks have triggered should have been obvious to every economist as soon as they began tightening into the financial weakness and instability created by the covid lockdowns. Instead, the narrative has been an ever escalating waiting game – Everyone was simply biding their time until the central bank pivot they assumed was coming. Except, it didn’t happen. As long as interest rates remain higher or continue to climb existing debt and new debt will continue to grow more expensive and less desirable. The lifeblood of markets for the past 14 years has been near-zero interest rates and easy fiat money circulating through banking conduits. Now, the dream is dead.

Roubini addresses the deeper problem in part when he notes the exposure of banks like SVB to bonds with declining value caused by rising rates. What he misses, and it’s surely something Bloomberg does not want to talk about, is the issue of ESG related programs and lending that made up a sizable portion of SVB’s portfolio…

…click on the above link to read the rest…

April 2, 2023

A Guide to Understanding the Hoax of the Century

Thirteen ways of looking at disinformation

ADAM MAIDA

PROLOGUE: THE INFORMATION WAR

In 1950, Sen. Joseph McCarthy claimed that he had proof of a communist spy ring operating inside the government. Overnight, the explosive accusations blew up in the national press, but the details kept changing. Initially, McCarthy said he had a list with the names of 205 communists in the State Department; the next day he revised it to 57. Since he kept the list a secret, the inconsistencies were beside the point. The point was the power of the accusation, which made McCarthy’s name synonymous with the politics of the era.

For more than half a century, McCarthyism stood as a defining chapter in the worldview of American liberals: a warning about the dangerous allure of blacklists, witch hunts, and demagogues.

Until 2017, that is, when another list of alleged Russian agents roiled the American press and political class. A new outfit called Hamilton 68 claimed to have discovered hundreds of Russian-affiliated accounts that had infiltrated Twitter to sow chaos and help Donald Trump win the election. Russia stood accused of hacking social media platforms, the new centers of power, and using them to covertly direct events inside the United States.

None of it was true. After reviewing Hamilton 68’s secret list, Twitter’s safety officer, Yoel Roth, privately admitted that his company was allowing “real people” to be “unilaterally labeled Russian stooges without evidence or recourse.”

The Hamilton 68 episode played out as a nearly shot-for-shot remake of the McCarthy affair, with one important difference: McCarthy faced some resistance from leading journalists as well as from the U.S. intelligence agencies and his fellow members of Congress. In our time, those same groups lined up to support the new secret lists and attack anyone who questioned them.

…click on the above link to read the rest…

April 1, 2023

Doug Casey on How Governments Use Global Crises to Take More Control

International Man: Throughout history, governments have used crises—real or imagined—to eliminate freedoms, expand the power of the State, and justify all sorts of things the populace would never accept in normal times.

After World War II, Winston Churchill famously said, “Never let a good crisis go to waste.”

This was when he and other leaders came together to form the United Nations, which they probably could not have created without the crisis of WWII.

Ever since, it seems that each new supposed crisis causes a further centralization of global power.

The War on (Some) Drugs, the War on Terror, the COVID hysteria, and the so-called climate crisis have all ratcheted up the centralization of power on a global scale.

What do you make of this trend?

Doug Casey: It makes sense that Rahm Emanuel, a sleazy Obama apparatchik, would have stolen the phrase from Churchill. But the statement is quite correct, regardless of the source. Government lives on crisis. As Randolph Bourne said, “War is the health of the State,” and there’s no crisis like a war. But any kind of crisis can work.

Whenever you have a crisis—whether it’s a military, political, economic, financial, or social crisis—the mob calls for strong leaders to kiss it and make it better.

This plays perfectly into the hands of the kind of people who work for the State. As far as I’m concerned, it’s a psychological flaw in humans, stemming from the fact that we’re pack animals.

Pack animals want leaders.

I’m not sure how we solve this problem other than delegitimizing the idea of the State and defanging it as much as possible. And stop lauding, even apotheosizing, its employees…

…click on the above link to read the rest…

‘Wind Power Fails on Every Count’: Oxford Scientist Explains the Math

A wind farm outside of Palm Springs, Calif., on May 26, 2018. (John Fredricks/The Epoch Times)Wind power has been historically and scientifically unreliable, claims an Oxford University mathematician and physicist, with his calculations revealing the government to be pursuing a “bluster of windfarm politics” while discarding numerical evidence.

A wind farm outside of Palm Springs, Calif., on May 26, 2018. (John Fredricks/The Epoch Times)Wind power has been historically and scientifically unreliable, claims an Oxford University mathematician and physicist, with his calculations revealing the government to be pursuing a “bluster of windfarm politics” while discarding numerical evidence.After the decision to cut down on fossil fuels was made at the 2015 United Nations Climate Change Conference in Paris, the “instinctive reaction” around the world was to embrace renewables, Professor Emeritus Wade Allison, who is also a researcher at CERN, said in a 2023 paper (pdf).

Allison noted that because solar power is “extremely weak,” it was inadequate to “sustain even a small global population with an acceptable standard of living” before the Industrial Revolution.

“Today, modern technology is deployed to harvest these weak sources of energy. Vast ‘farms’ that monopolise the natural environment are built, to the detriment of other creatures. Developments are made regardless of the damage wrought. Hydro-electric schemes, enormous turbines and square miles of solar panels are constructed, despite being unreliable and ineffective; even unnecessary,” Allison said in the report, published by the Global Warming Policy Foundation.

“In particular, the generation of electricity by wind tells a disappointing story. The political enthusiasm and the investor hype are not supported by the evidence, even for offshore wind, which can be deployed out of sight of the infamous My Back Yard,” he wrote. “What does such evidence actually say?”

According to the U.S. Department of Energy, wind power generated more than 9 percent of the net total of the country’s energy in 2021 and is the largest source of renewable power in the country. Over 70,000 turbines generate enough power to serve the equivalent of 43 million American homes, the department says.

…click on the above link to read the rest…