Denise Duffield-Thomas's Blog, page 35

January 19, 2022

Roundtable Discussion: How To Overcome with Family Money Blocks + More

Hey friend,

Today we’re talking about what to do when you hit an income plateau. I’ve brought together a group of our Money Bootcamp members from all over the world for a Roundtable discussion all about the mindset shifts and tweaks needed to uplevel your income and business. This is such a thought provoking and inspiring conversation about family, upbringing and overcoming money blocks.

Meet some of the Money Bootcamp members:

Amoya Shante lives in Merida, Mexico. She’s a master NLP practitioner, hypnotherapist, and money mindset coach.

Amoya Shante lives in Merida, Mexico. She’s a master NLP practitioner, hypnotherapist, and money mindset coach. “I started Bootcamp a little over a year ago.”

Gabriella Fotara is from the UK. She is a transformational alignment coach, healer, and spiritual advisor.

Gabriella Fotara is from the UK. She is a transformational alignment coach, healer, and spiritual advisor. “I actually joined Bootcamp in 2020. I had just become self-employed full time, so it was both interesting and perfect timing.”

Suzanne Dinter is a hypnotherapist.

Suzanne Dinter is a hypnotherapist. “I'm British originally, but I've been living in Germany for more than half my life. I help people to clear the blocks of the sabotages on a deep subconscious level. I've been in Money Bootcamp since 2017. It's the best place on the internet.”

Debbie Sassen is originally from Los Angeles, but has lived in Israel for 33 years. She’s a business and money coach for Midlife Entrepreneurs.

“I'm also former financial planner and investment banker. So I bring a lot of practical money skills! I think I've been in Money Bootcamp since 2016.”

Mattia Maurée lives in Philadelphia.

Mattia Maurée lives in Philadelphia. “I just moved here. I grew up in Seattle in the US and I am a composer, a poet and a life coach for neurodivergent queers, helping them do whatever the hell they want. I joined a year ago, last year was my first sixth figure year ever. And it was definitely because of this.”

Mara Kucirek is based in Orlando, Florida in the US.

Mara Kucirek is based in Orlando, Florida in the US. “I've been on Team DDT, I think, two and a half years now.”

Mikala Boon lives in New Zealand and is a clinical psychologist.

Mikala Boon lives in New Zealand and is a clinical psychologist. “I joined Money Bootcamp at the start of last year, January 2021.”

Kat Soper lives in Wellington, NZ and she owns an online training school, called The Helpful Academy.

Kat Soper lives in Wellington, NZ and she owns an online training school, called The Helpful Academy. “I grew up in a really Christian home. My dad in particular had a real scarcity mindset and my mom had a really giving mindset. When I joined Bootcamp, I realized that I had a lot of generational money blocks to clear.”

Watch More Member Roundtables

This is the third roundtable I’ve held recently. Watch the Australian roundtable where we talk mates rates and charging our true worth here. Catch the UK roundtable, all about pricing and imposter syndrome here.

Common Money Blocks and How to Break Through An Income Plateau

One of the blocks that we speak about a lot in Money Bootcamp is this concept that you have to work really hard to make money. This comes up at the very start of your business, but also when you hit an income plateau.

The work hard concept comes from all around us; life, society, culture. Do you remember any of these growing up? Another day another dollar. You don't get something for nothing or Money doesn't grow on trees.

I grew up with a single mom and she took on cash cleaning jobs and waitressing. So for me, my role modeling was working hard for low paid, multiple jobs, where you hustle your butt off.

The work hard thing shows up when you find it difficult to delegate. You might be doing everything yourself. You might be over-delivering with your clients. You have crappy boundaries. At the start of my business I got up at 4:30am to have international client calls, because I felt bad setting boundaries around my time. I used to show up every day in Money Bootcamp, 365 days a year, 24/7 until Mara came along.

How Do Your Family’s Money Values Affect Your Business and Success?

Mattia Maurée: “I grew up poor with musician parents and I think one of the main things that I heard about hard work was, I didn't even know that it was possible to not trade hours for money. I literally didn't know that that was possible. I'd never seen that model. They didn't know wealthy people. I didn't know anybody who didn't work hard.

Where it's shown up for me is probably around boundaries with clients. I’m beginning to condense my clients into three days a week. I’m no longer working late evenings and weekends.

My first paid in full coaching client, which was about a year ago, told me, ‘You should charge more’. I have more than doubled my prices since then.”

Debbie Sassen: “I’m struggling with delegating to my VA and not micromanaging her. She takes what I put on Facebook and puts it up on Instagram. I'm always there checking and not trusting her. This shows up from my childhood. My dad and my mom divorced. My dad worked for his father-in-law and was fired when they divorced. Then he became an entrepreneur. So I saw him hustle and work hard. Later, I worked on Wall Street as an investment banker. You couldn't just finish your work and go home. You had to be there in the office until eight pm. In my business, it’s a habitual pattern. I’m like a mama hen. I watch out for my clients and make sure that I'm always in contact. Not releasing the reins is coming back to bite me.

I’ve gotten way better. I don't work Fridays or Saturdays. I’m learning to let go and trust that my team is going to be okay. And that it doesn't have to be perfect; perfectionism is detrimental to growing a business.”

Mara Kucirek: “My parents come from farming families, although they’re in healthcare. My grandparents were farmers. There's this cycle of having to work super long days. They both worked really hard to be able to live in the city. I feel like I have to put in extra long hours to prove that I’m working hard and I deserve things.”

Suzanne Dinter: “I come from a working class background in London. My nan was one of 11 children in the East End of London. She had a very big influence on me. I heard, ‘Money doesn't grow on trees. You’ve got to work hard for a living.’ There was always us (poor) and them (rich) mentality. Financially, my parents are middle class. My dad went to evening school and became an engineer. He worked really hard - full-time days and studying all night. But he still calls himself working class because that's his roots.

For the first two years of my working life, I commuted up to London for 12 hour says because that's all I knew. Then I got an opportunity to escape. I visited a friend in Liverpool and loved the life there so much that I chucked in my job in London. I decided to go to university, and studied in Germany for a semester and came here the day after my graduation ceremony.

I have been self-employed most of my working life. I taught business English, and then became a hypnotherapist. I joined Money Bootcamp and realized that there was another way of doing things. I was trading time for money, teaching English. I only have so many hours in the week, so my earnings are capped. At the moment, I don't have any passive income products, but I have transitioned from 50 euros a session to high end hypnotherapy packages. That has allowed me to reduce my working hours but have a lot more money. I’m on the cusp of giving more hours to my VA who works for me sporadically. I've moved forwards in leaps and bounds since I started my business and started Money Bootcamp; they were both birthed at the same time in March, 2017.”

Gabriella Fotara: “Growing up was a little complicated - my dad is very abusive and an alcoholic. Basically his dad created a restaurant from scratch, built it from the ground up. We were out in Greece for the first five years of my life. My mum would work from eight in the morning until four in the morning - there were no real breaks. She'd do it all in high heels. She would try and save in the summer and hide the money, because my dad would find it and spend it. We had a lot of struggle growing up there. When we came back to the UK, my mum was a single mum at that point, it's always kind of been paycheck to paycheck since.

The story was, ‘You work really hard and you get nothing, and you're kind of miserable.’ I went straight into work when I was legally allowed to in the UK, corner shop, minimum wage. I started my own business really young, but I had no confidence.

That started to change in around 2019. I had an opportunity to go full-time self-employed in 2020. I trusted my intuition, I just knew it was time. I’m now working on a need to prove myself. That I'm good enough.”

Amoya Shante: “I grew up in a single parent household. My mother was in the military. So I equated money with long hours away from your family for very little pay, and a job that you weren't really happy in. And there was also a lot of struggle, bankruptcy and benefits. That’s my family money story. We lived paycheck to paycheck, trading hours for money. It's shown up in my business as my inability to delegate. Over-delivering on low ticket offers. Keeping my prices low. I'm a money mindset coach now after doing tons of work. Joining Bootcamp gave me permission to invest in myself and release the need to overdeliver. It’s also helped me stop getting too caught up in my clients’ results, feeling as though it's my responsibility for my clients to have transformation.

I have always struggled with an inability to close the laptop down, schedule time off, because my mind goes back to the nine to five, or 40 plus hour, work week.

For the first three years of business I’d only work with single moms, therefore really limiting my audience. There was a lot of guilt around charging in general, because I came from a single mom background. I was a single mom. It's wrong to charge for your gift, right? I wanted to help the world. To provide transformation and growth. I now know that it's important to charge. For one, it holds people accountable. There's an energy exchange that happens.

I've reframed that now, it's an honor to invest in myself. And it makes me accountable.

When I learned this, it was a game changer. I was able to actually help more people by charging higher prices, because then I had the energy to create free content. Right now I'm in the middle of a launch. Launches for me have always been these super stressful events. And this time I decided it will be easy. I don't have to work 50 million hours for a launch. I can go out to dinner. I can go dancing. I can even vacation right now because I've learned how to delegate, automate and really work on that mindset. Sometimes the best thing that you can do to make money is to rest, play and have fun.”

Mikala Boon: “As a psychologist, I got into my profession to help people. The public service model is a lot of work, a lot of stress, a lot of meetings, generally full-time sort of hours. The clients don't pay here in New Zealand, they see me for free, so commitment fluctuates as well.

The shift to working in private was really tough, first in terms of the jump in the hourly rate, feeling like I didn't deserve it. At first, I was over delivering, working way more hours than I would be paid for. And I still wasn't comfortable with the idea of people paying me directly, so I was working on contracts that meant that it wasn't the person seeing me that was paying for the work.

Now I'm putting together my website and have started a direct ADHD service. So people have paid me directly, which is crazy and are really keen. It's taken a lot of hurdles to get here, but I'm really excited because it's less stressful. It'll be better for me and my family as well in terms of the work that I'll be doing.”

What Has Been Your Biggest Takeaway from Money Bootcamp?

Amoya Shante: “A game changer is normalizing talking about money, about what we desire. Before Bootcamp I didn't have a community where I could share this. The act of giving myself permission to share my numbers, to share my wins, to have conversations about money, changed my bank account. Even if you don't do anything in Bootcamp but watch everyone share their wins, it will transform you because it starts to normalize money, desiring money, making money, charging whatever you want to charge and not feeling guilty about it.

I’ve been able to leave my idea of the single mom identity behind as well - struggle, unhappiness and loneliness.

In the past I’ve experienced a lot of guilt around money. It shouldn't be easy to make money. It shouldn't be fun to make money. I had to really work through a lot of guilt around making things easier by delegating, by automating stuff, by having a tech person because I can't stand tech.

Bootcamp has been really transformational for me - having a safe space. A safe space to share where you don't feel like you're going to be judged. And seeing other people who are already earning multi million dollars, and still having money blocks. It just normalizes everything.”

Mikala Boon: “I think one of the big things that came up for me in Bootcamp is ‘I serve, I deserve’. It’s ok for me to do easier work or to get paid more money for the work that I do. It's ok for me to enjoy my work.”

Suzanne Dinter: “I'm getting more and more comfortable with standing out. Clients are coming to me, not through any particular known route. They're just popping up. I’m getting comfortable with being more visible.”

The incremental upgrades in Bootcamp have been fantastic in all areas of my life. I've taken on an office outside of the home. Bootcamp is the only group that I've been in constantly for the whole of my entrepreneurial journey. I have many business besties. The whole community thing has been pivotal in my business journey. Bootcamp has opened my eyes to all these different things.

The whole energy and the vibe in the group is just so positive. We're so supportive of each other. What I love the most about Bootcamp is the community and just seeing what's possible.”

Debbie Sassen: “I love being in a place where I can talk about money... it doesn't matter if you're in debt or if you're making multiple seven figures, the conversation is normal.

When I travel now from Israel to Los Angeles, I fly first class. Because it's a long flight, I always travel business or first because I want to be comfortable. The rising tide lifts all ships.

Being able to talk about money and make money and hire out and realize where we're sabotaging ourselves is so helpful for us as business owners.”

Gabriella Fotara: “The tapping (EFT) in Bootcamp has been a really big thing for me, because it gives me a pattern interrupt. Tracking my money has been a game changer.

Being in a space where people talk about money and their blocks and their stories is so refreshing for me. A space where people, especially in spiritual positions, are having 100K months, earning millions of dollars. There's a scarcity mindset within much of the spiritual community. Here people are healers and making amazing money.”

Mattia Maurée: “One of the things I've gotten through Bootcamp is around visibility. I'm trans and work with a lot of trans people and a lot of queer people and I also have a physical disability. I'm autistic and have ADHD as well. I don't think I've seen anyone quite like me in very many positions of power and wealth. It's just not the norm. Being able to be visible and hopefully be visible for my communities and show them that it's possible. Being able to always give back to my community is really meaningful. There is nothing wrong with being successful.

Kat Soper: “My husband and I started saving for the first time as a result of Bootcamp. We got completely out of debt. It had a really, really big impact in our life. I've been able to earn twice as much working half as hard. I have a full-time assistant and some contractors that work for me on a regular basis now. It's made a huge difference having staff. And not making do.

The Kiwi money mindset is so cheap. We've got a number eight wire mentality - anything can be fixed with a piece of number eight wire or gaffer tape.

It’s Normal to Have Money Blocks and I Can Help You

Well, I knew we were going to talk about money history today but that conversation went in some unexpected directions. Take some time to watch the whole discussion because talking about visibility and birth order was fascinating.

Maybe you’ve realized that you have some money blocks as well. And that is really normal. We all do. I have to work on my money blocks all the time. So if you want this year to be amazing for you, you have to look at your pockets of resistance. You have to look at some of those areas where you're holding yourself back; that's exactly how I can help you in Money Bootcamp.

You can find out more about the 2022 Money Breakthrough special offer here and read 150+ real reviews of Money Bootcamp here.

January 16, 2022

Roundtable Discussion: Does the UK Have Money Blocks?

Hey gorgeous,

Does the UK have blocks and money mindset issues? There's no doubt that the country, the city, the town you live in, impacts and influences your money mindset.

I invited some members of my Money Bootcamp program, from the UK, to join me for a very juicy and real roundtable conversation, about how living in or growing up in the UK has impacted their money mindset.

Meet some of our Money Bootcamp members from the UK:

Jessie Shedden lives in South Wales, and she helps women extract the most potent stories from their life story, and create really compelling content.

Jessie Shedden lives in South Wales, and she helps women extract the most potent stories from their life story, and create really compelling content. “I joined Bootcamp in April, 2020.”

Dana Whiteland is based in Sheffield and her business is called Surprise & Delight.

Dana Whiteland is based in Sheffield and her business is called Surprise & Delight. “It does exactly that for your customers. Think onboarding gifts, or sending out marketing materials. I provide the surprise and delight people. I joined Bootcamp at the end of 2016.

Tanja Hassel is based in London and she’s a drawing coach.

Tanja Hassel is based in London and she’s a drawing coach. “I'm originally from Germany, but I've been in London for 18 years. I'm an artist and a drawing coach. I paint and I do commissions and I help people who've always wanted to draw. I help people demystify the drawing world and discover how fun it is to draw. I joined Bootcamp in January, 2018.

Léa Cléret is based in Ross-on-Wye and is chief executive for a leadership development company.

Léa Cléret is based in Ross-on-Wye and is chief executive for a leadership development company. “I'm French, working in England, and my partner is from South Africa. I joined Money Bootcamp in November 2020.”

Jo Howarth lives just outside Liverpool and she is an advanced hypnotherapist and mindfulness practitioner.

Jo Howarth lives just outside Liverpool and she is an advanced hypnotherapist and mindfulness practitioner.“I run a company called The Happiness Club, and I teach people how to look after their mental health and emotional wellbeing. I joined Money Bootcamp in January 2018.”

The UK’s Money Values and How to Break Through the Money Blocks

Democracy, rule of law, respect and tolerance, and individual liberty are the values of the UK.

Politeness is an unspoken British virtue. The stiff upper lip. The soldier on mentality. Keep calm and carry on. No matter what the weather, we're going to continue. Where in your business do you have the keep calm and carry on mentality? It could be that you don’t allow yourself to hire help, you don't take time off, you work through stress, or it could be that you just get on with it and not make a fuss.

There’s another British value of being restrained, of restraint. Where does that come up in your business?

Another value is tradition. Britain is one of the most traditional cultures in history. Where is that coming up in your business? Do you feel like making more money is against the natural order of things or against tradition in your family? Or are you allowed to be wealthy with your accent, or with your background?

Apologetic, is something that comes up for British people. Where does that show up in your business? Where do you apologize? Where do you feel like you have to hide? Following rules, queuing, for example. Taking your turn. Where are you waiting for your turn and not pushing yourself forward?

How Do the UK’s Money Values Affect Your Business and Success?

Jo Howarth: “The politeness one feels massive. I swear like a trooper but I only ever used to do it in private, and I wouldn't ever have put it in my business. That was kind of like I wasn't being completely myself. Because you said about restraint, I was holding myself back from speaking on social media, for instance, in the way that I would speak normally with my friends and family. So that's actually something that I've only really overcome in the last year or so. And I swear like a trooper on social media now.

The soldier on thing for me, is absolutely part of my upbringing, just shut up and get on with it. That's how I was brought up. Don't whinge, don't complain, just get the fuck on with it. That's a barrier for me with my clients, they don't believe that they're worthy of the kind of help that I offer, because they should just be able to cope with whatever life throws at them.

In terms of restraint, there’s something around selling too much. Hanging back from posting too often on social media. I post at least once a day on my social media with a sales message, and almost every time I do it, there’s a voice in my head, “All she does is sell.”

It’s not polite to talk about money. That's one of the things I love most about the Facebook group - it's the only space where I feel comfortable talking about my financial wins. I wouldn't dream of posting that on my own personal social media, how much money I've made this month.”

Léa Cléret: “In the UK, the class system means there’s still a sense of know your place. I came to the UK after a decade in North America. I started working in this company, and I wanted to change the name of our business development managers to customer success leaders. My colleague just burst out laughing, ‘That is preposterous and it's so American.’

You can't put yourself first and the benefit can never be for you. One thing that struck me when I came to the UK, is the amount of charities that exist here. People will set up charities or if you’re selling something, a percentage has to go to charity.

The company that I run used to be a foundation and it transitioned into a commercial organization. The mindset switch that had to happen was tough for a lot of people. Even though we do the same job, we deliver the same service, the fact that we’re no longer a not-for-profit organisation, is something that was really difficult for my staff.

The UK has an issue with money; just talking about it is a real problem.”

Tanja Hassel: “I am very polite. I love it. However, listening to Jo and Léa talk I realise there’s a lot there. Being self-employed brings up a lot. I have this sense of keep your head down, you're German. Someone's going to attack you for the past. If you get too well known, they're not going to like you because you're not English. You shouldn't really be there, even after all this time. I can have my little tiny group somewhere, but I can't be super successful.

I was one of the first who took life drawing online, during the pandemic. And then all these other people started groups, and they went much bigger. I felt like, ‘but I was here first, you should be queuing!’

From the moment I founded my drawing group, it was the same as everyone else's. The same model, same price structure, etc. I launched at the end of March 2020, and up until this summer, I ran six classes a week, every single week. And it was getting way too much and it wasn't sustainable and it wasn't working, but it was what everyone else was doing. And then I changed everything around to fit me. And I was pretty excited about it for about a month or two. And then all the fears came up of, you're different, you should have just kept going, you're not providing enough value if at the same time it suits you. If I'm not available 24/7 to my clients, then they shouldn't be paying me a monthly fee, because what about all that downtime? I’m working on shifting that.”

Dana Whiteland: “I used to live in London when I first graduated. I was contracting, earning decent money. Once I got married and we decided to have kids, I really wanted to be a stay-at-home mum. I always felt the need to apologize for being a stay-at-home mom. I did that for a few years. We moved back up north because of house prices and put the kids in a private school, which brings up guilt for me. You feel like you have to whisper it to people and you can't really tell them

I started my own business but it really wasn't my passion, so it really never took off. I'm always playing small. I've stopped posting on social media because I thought nobody wants to hear boring and stale. There's a massive social divide in the UK. Especially up north, I'm not in the lower income bracket. I don't want to ruffle people's feathers.

This comes up for me around pricing. I feel I need to give the price for what people can afford, rather naturally what it costs. The truth is, if people can't afford it, they're not my ideal client, and I need to go and find the bigger fish. I've been pricing small.”

Jessie Shedden: “The social class system is not spoken about but is so instrumental in business. My fiance's always lived on a poverty line and I’m upper class. We live in an industrial town, and when we moved I was like, ‘How on earth am I going to become who I want to become in this place?’ I carried a lot of shame about it. One of the Money Bootcampers who lives 40 minutes from me, in a Welsh mining town has done really well. She's into her millions now. There was a sense of if she can, I can. I don't even sell to people locally, I'm selling to people all over the world.

Asking for help has never come easily. There's that kind of die with your boots on attitude, particularly around here. That's what generations of miners did. They got maimed and they went back to work with one less limb.

In the valleys in Wales, you live in that valley and you die in that valley and you don't move outside of it. For me, it's always been a conscious decision to work with coaches and mentors that aren't in the UK. Because I'm like, I need something that gives me the freedom and the creativity that I don't get here, because everything has to be so structured.”

What Has Been Your Biggest Takeaway from Money Bootcamp?

Dana Whiteland: “I always feel that I need to ask for permission. That holds me back from owning my prices. The Facebook group is amazing for this, when I read other people's posts and think, so I've just gotta get out of my own way. I've tried to play small and I need to break free from that. That's how Money Bootcamp helps. Because you can see yourself peeling away these layers and evolving.”

Léa Cléret: “One of the biggest is fear of visibility, and I think it's definitely linked to a gender issue. I've always worked in very male dominated environments, and I'm a woman and a bit of an intellectual. I'm the opposite of what you would normally expect from a leadership development consultant. Bootcamp has helped me grow this new relationship. I'm completely rethinking the business, how we're going to position ourselves in the market. In the UK, there's still very strong gender issues. In North America it's so far ahead when it comes to the gender issues, gender pay gap, gender promotion.”

Jessie Shedden: “What the community has given me, is knowing that I can have authentic wealth, that has been really freeing. There's always more money. I'm seeing the proof that if I do go into some debt, more money just comes in.”

Jo Howarth: “There's so many things, but my biggest one is around not deserving, not being good enough. The biggest thing that Bootcamp has given me is the ability to peel back. At every level of business, of income, it resurfaces and I go back to Bootcamp and work through the BS excuses and the negative consequences and peel more of that back. The Facebook group is so inspiring.”

Tanja Hassel: “When I started Bootcamp I had a really powerful memory. As a child, I was told to save for something. When I finally saved up for it, I went to the shop and it was gone. And I remember thinking, If I wasn't poor, I could have bought it and now it's gone. I went home distraught - I was crying and my mom had bought it, because she was so impressed with how I'd been saving and how good I had been.

I learned that if I'm good enough or if people feel sorry for me enough, then I’ll get what I want. When I shifted the business and I turned it into a membership program, I realized that I do the same thing to my members, which is hugely disruptive to the business. That's the biggest theme I'm working on, taking back my financial power, so that I can give my clients back their autonomy. And we can have this business relationship rather than, please prove that you care about me by giving me money.

For a long time I followed all the free stuff and read the books. But actually joining Bootcamp made me look at things a lot closer. What I love about Bootcamp is the people. Without Bootcamp, I don't think I would be so aware.”

It’s Normal to Have Money Blocks and I Can Help You

There will be money mindset issues that come from your particular family, your profession, etc. This is what we do in Money Bootcamp. If you’re curious about how it works for you, the next step is to come and join us in Money Bootcamp, and work on your money mindset issues as well. We all have them. I have them, you have them, and you will continue having them no matter how much money you make. You can't go and clean up your money stuff before the cleaner comes. It's not how it works. The best time is now to deal with your money mindset issues.

Here’s an invitation. Come and be one of our next UK success stories. I would love to help you. Just go to denisedt.com/bootcamp. You can find out all about our course. You can read even more success stories and you can just come and join us straight away.

Roundtable Discussion: Does Australia Have Money Blocks?

Hey gorgeous,

Does Australia have money blocks? Each country and city has a unique money story. I invited some of my Australian members of Money Bootcamp to come together and talk about how being born, raised or living in Australia has impacted their money mindset. We talk pricing, visibility, confidence, imposter syndrome, and more.

Meet some of our Aussie members:

Natalie Crowe is a WebPress website developer, business mentor and a tech guide.

Natalie Crowe is a WebPress website developer, business mentor and a tech guide. “I help non-techies in business. I’ve been a Bootcamper for three years. I live in the Hunter Valley, New South Wales.

I live here with my wife and my 13 year old daughter. I homeschool. I’ve been running my business for the last 13 years, and I've just had a month off.”

Michelle Wordsworth lives in Melbourne. She’s a mindset and manifestation coach.

Michelle Wordsworth lives in Melbourne. She’s a mindset and manifestation coach. “I help people leave their nine to five job.

I want to help people find their spark and rediscover what it is that they're passionate about.”

Krystal Kleidon lives in a tiny rural town in Queensland called Dalby.

Krystal Kleidon lives in a tiny rural town in Queensland called Dalby. “I'm a blogger and I have multiple websites, but my main one focuses on helping women get their life organized.

I joined Bootcamp in January, 2021. At the time I was still a paramedic. I've actually been able to go full time on my business this year, thanks to all the stuff at Bootcamp, which has been really exciting.”

Sally Porteous lives in Brisbane.

Sally Porteous lives in Brisbane. “I came into Bootcamp in 2019. I’ve just restarted Bootcamp again, and just focusing even more, even stronger into it. I curated my own MBA last year.

I produce events, but I also do event management workshops. Less and less people are hiring professional planners, and just trying to do it themselves. I want to help make it fun.”

Samantha Ferres lives in Sydney, and is a confidence coach and rapid transformational therapist.

Samantha Ferres lives in Sydney, and is a confidence coach and rapid transformational therapist. “I've been in business for a couple of years, and I help female entrepreneurs to move through the doubt, the money blocks, the visibility issues so that they can really smash through their income ceiling. In terms of Bootcamp, I started in January of last year.”

Australia’s Hidden Money Story and How to Break Through the Money Blocks

You’ll notice that each city, each state has a particular money flavor. That doesn't mean that everyone who lives there thinks in the same way, that’s just the overall feel of a place. You either feel you have to comply or you rebel against it.

Australian money values are freedom, respect, fairness, and equality of opportunity. And there’s an unofficial motto too, of mateship and friendliness, and being very egalitarian, and not being too big for your boots.

If we consider friendliness, and being down to earth as unofficial values, there’s an important message there. I had an epiphany about three years ago. I realized that my mateship extended to my pricing; we literally say ‘mates rates’ in Australia.

I had this entrenched sense that it was okay for me to charge Americans, but not okay for me to charge Australians, because they're my mates, they're my family. And I had to really work on that, that it's okay for me to market to Australians.

How Do Australia’s Money Values Affect Your Business and Success?

Natalie Crowe: “Most of my clients are in the UK. So the vast majority of my courses are purchased in the UK. We have a handful of Australian clients. My UK clients look at the prices and go, ‘Oh it's in Aus dollars. It's half the UK amount, I'll pay that, no dramas.’ We had a $25,000 launch recently. I've had more pushback from Australian clients, ‘Oh, that's too expensive.’ I have a lot of people try and barter here in Australia. I recently launched a thousand dollars VIP option, and someone from the UK bought it. Potential clients from Australia tend to ask, ‘I see the prices on the website, but can you give me a better deal?’ It's a culture thing; they expect that.”

To move through this resistance to a particular area, or country, try these affirmations:

It's safe for me to charge Australians.

It's safe for me to sell to Australians.

Australians are my best clients.

Australians are buying my stuff in droves.

Australians can't get enough of my work

Sally Porteous: “My challenge is around charging mates. I engage with my clients for a long period of time. And they often become friends. And the minute they decided that they were ready to work with me, I half the price. I gave them mate's rates.”

To move through the pricing issue around charging friends your actual prices, try these affirmations:

It's safe for me to charge my mates.

It's safe for me to charge my mates the normal price.

It's safe for me to charge my mates full price.

It’s safe for me to receive full price from my friends.

It's safe for me to receive.

It's safe for me to accept my friends' trust in me and my business acumen.

Michelle Wordsworth: “Basically all of my clients are in America. And originally I was charging in Australian dollars, and they didn't get it. I changed my pricing to US dollars to make it easier for them. I’ve found in the personal development industry, that people are comfortable handing over money, particularly Australians, if it’s for something physical. Then they're happy to pay the money. Whereas if it's an online product, like a course or information, they're like, ‘Yeah, but what am I really getting for this?’ And in the spiritual world, people are like, ‘Yeah, but you can't charge for your gifts. You shouldn't be charging for that. You should be giving that away for free.’ I think Aussies are really behind on this aspect of pricing and entrepreneurship in terms of personal development and online courses. Certainly behind the UK and the US.”

If you struggle to charge money for your gifts or feel resistance to your prices when you’re selling in the personal development world, try these affirmations:

It's safe for me to receive

It's safe for me to be compensated for my gifts.

People will pay for my knowledge.

It's safe for me to receive or be compensated for my knowledge.

Krystal Kleidon: “Around 70% of my audience is American - most of my income comes from advertising. For every thousand views from an Australian audience, I get $12. But for a US audience I get $40. I've had to Americanize my copy. It's been a bit of learning around accepting that it's okay to charge US dollars and to target a US audience. 20% of my email list is Australian. And I get a lot of engagement from them, but they don't buy anything. Also, in America I feel like it's okay to be a contributor, but to an Australian audience, I feel like I have to be the guru. And I'm not qualified to be the guru. So I feel safer in an American audience.”

Samantha Ferres: “For me, I felt so uncomfortable marketing to Australians, that a lot of my client base was overseas, but I didn't want to keep working these crazy hours servicing the UK. I made a conscious decision that I wanted to have more Australian clients. I had this crazy pricing system where for Australians I'd charge Australian dollars, for the US I'd charge US, for the UK I'd charge UK. More recently, I decided, ‘I'm just going to charge in Australian dollars. I'm going to focus on Australia.’ And now my client base is 100% Australian. And yes, my clients become my mates. When they finish their program with me, I can't sell them anymore. I feel like everything I give from here on needs to be free.”

If you’re working with being more visible, some affirmations to try are:

It's ok for me to have more success.

It’s ok for me to be visible.

What Has Been Your Biggest Takeaway from Money Bootcamp?

Sally Porteous: “Money mindset work is never really finished. Don't multitask while you're doing it, get really focused. I know I can make money really easily. I just can't keep it. That's the next thing to work on.”

Michelle Wordsworth: “I’m focusing on the mindset work around, ‘it's safe for me to have nice things. It's safe for me to earn money’.”

Krystal Kleidon: “I’m working on visibility. It's safe for me to be visible. I've wanted to do my YouTube channel for so long. But I just feel like I don't have the perfect environment or my hair's not right. I don't look right. Or my accent isn't right. I’m working on being ok with being visible and putting myself out there. I've always been the kind of person who puts everybody else first. Bootcamp has opened up a whole world of other things that I need to work on. Money mindset is the top layer. And then it opens up all this other stuff.

Natalie Crowe: “The best thing about Bootcamp for me is that I can actually see other people making big money. There’s that concept of you making the average of the five people you’re surrounded by. If you're the one making the most, you need a new group. Bootcamp is that for me. I discovered a lot through Bootcamp, and I'll continue to keep going back. There's always another level. Another glass ceiling!

I’ve spent the last decade feeling scared of GST. Recently I decided, ‘I'm just going to register for it, even if I don't hit it.’ The following month I earned 20 grand more than usual and hit $92,000. Denise is the only person I know in actual real life that actually makes a decent amount of money.”

Samantha Ferres: “I’m continuing to work on charging high prices. It's safe for me to charge high prices to everyone, including friends, and to hold onto that money as well. Bootcamp has been the best investment. I think that the material and the actual course itself has been put together so well. The exercises are easy, but really impactful. And the community is brilliant, because there's people just starting out in business, there's people earning multi millions. So there's always a heap of people in there at your stage in business, and have been in your spot that can help you.”

It’s Normal to Have Money Blocks and I Can Help You

It’s Normal to Have Money Blocks and I Can Help YouWell, I knew we were going to talk about mates rates and pricing today but that conversation went in some unexpected directions. Talking about imposter syndrome and confidence issues was fascinating.

Maybe you’ve realized that you have some money blocks as well. And that is really normal. We all do. I have to work on my money blocks all the time. So if you want this year to be amazing for you, you have to look at your pockets of resistance. You have to look at some of those areas where you're holding yourself back; that's exactly how I can help you in Money Bootcamp.

You can find out more, read real reviews and join at denisedt.com/bootcamp or message me on social media to chat about whether Bootcamp is right for you.

January 6, 2022

My Year In Review 2021: Business And Family In The Time Of Covid

I haven’t done a year in review for a couple of years now!

It just felt like another thing on my to-do list but also, I’ll be honest, I felt like I couldn’t share too much of my success because I felt guilty and sad that the world was going through so much.

But I also love transparency so I decided to go for it. After all, I made the money even though I didn’t share about it publicly and I know how much things like this inspire me. So, I hope you enjoy it!

Of course, there have been challenges navigating work, relationships, and kids during the uncertainty but honestly - money makes things so much easier.

It's also what drives me. I want to help other entrepreneurs make money by releasing any fears and stresses holding them back.

My year in review this year is inspired by this Sara Blakely quote:

"Money is fun to make, fun to spend, and fun to give away"

It’s been my touchstone throughout the last two years where… well, you know all the things.

Fun to make

If you like what you do, tell more people about it! Money can be fun to make!

This year we made almost $4.4m (Australian dollars), compared to last year’s $3.4m. We passed $22m in total since I started 10 years ago.

Profit was $2.7m compared to last year’s $1.9m. (approx. figures as December accounts haven’t been finalised). My tax bill for the year will probably be around $650-700k.

Affiliate income was down as we decided to focus more on our own sales. Book sales were up but obviously the bulk of our income comes from one program - my Money Bootcamp.

A few years ago, I decided to go all in on one program. But who knows, I’m considering experimenting soon with a lower cost offer.

This year we welcomed 1,475 new people into our Money Bootcamp, taking the overall membership over 10 years to almost 8,000.

In some ways, I still can’t believe I’ve been doing one program for that long!

I definitely had no idea when I started that I’d be able to help that many people.

The big intakes were during our launches in January and October, but most months we had between 30-100 new people join Bootcamp.

Bootcamp has been evergreen for over 5 years now, meaning that people can join anytime.

There’s always someone who wants it NOW (I’m an instant gratification person myself) and there are people who need the motivation and nudge from a planned launch.

This was a record year for us profit-wise, despite expanding our team significantly at 61% profit before tax. Having a leveraged and profitable business has been so valuable during the last two years of turbulence.

My books sales have been really good this year and I made almost $90k in book royalties. Plus the cool news - Hay House asked me to do a new edition of my book Chillpreneur with more case studies and post-pandemic advice.

I was thrilled! Also, I've honestly never loved the cover and HH never loved the name so we decided to give it a total makeover!

You can pre-order here and hang onto your receipt as I have some book bonuses ahead of its relaunch in July.

The last half of 2021 has been a big writing season for me. I wrote two new books releasing soon - Money Mindset for Writers and Money Mindset for Natural Health Practitioners. They were supposed to be "mini ebooks" but turned into full-fledged books! I'm hoping to do more professions too.

Some key business achievements this year:

Launching my Chill & Prosper podcast in May - I’ve loved learning to batch produce this and the episodes have been really well received. We’re closing in on 250,000 downloads already.

Expanding our team from 4 to 10. This has been huge and allowed us to run a 5 Day Challenge in October and add additional projects and ideas into our business.

Two 7-figure launches with over 25,000 people engaging in our videos and training content.

More revenue from our own business by reducing the number of affiliate promotions we ran. For the couple of affiliate promotions we did do, we earned some great commission and prizes.

Like many people, the biggest challenges for us were around Covid, burnout, and balancing work and family. The lockdown and working from home periods were tough and the last 3 months have been way busier and more stressful than I like.

Fun to spend

You might be curious about what I spend my money on?

I don't have designer tastes at all so fashion, shoes, jewelry etc doesn't float my boat. (No shame, it's just not my thing and I don't go anywhere to need fancy clothes)

Obviously, we haven't been able to travel this year (I had a few speaking gigs and conferences canceled again like everyone).

As a Virgo, I'm always spending money on health upgrades - I'm always up to date on my dental and optical, spend a lot of facials, laser, hair, and beauty treatments.

I also got diagnosed with ADHD this year, and perimenopause! Interesting times and it makes me even more curious and empathetic about how both these things impact people’s income.

We're now two years into living in our dream beach house and renovating our rose farm. And a lot of money goes into both houses. It's true that big houses have big maintenance costs - it's something that people tell me they're scared about. But it’s okay - it’s just part of it.

Most of my profit this year went straight into our rose farm. We've renovated many parts of the farm including the old horse stables and a complete house renovation.

With the pandemic, we haven't been able to host my retreats at the farm and we're still negotiating with our local council to be able to offer public events.

Turns out I'm a terrible rose farmer too - it cost us a lot to sell just $20k of roses in the last year. We may as well make them out of $5 origami notes!

So we've found ways to do local partnerships and it's one of those things where it's a privilege to be able to support it.

A big lesson for me is to be really mindful of where my money comes from.

Not every part of my life has to be monetized - it would take a lot of energy to fully monetize the farm and honestly the red tape around public events is kinda exhausting.

My motto is "there are easier ways to make money" and so while there are bureaucratic and travel delays, we have to accept it and pivot. I always look for YES signals and there have been too many NO ones to force it.

Find out about my private rose farm retreats here.

But the reality is that we're spending a lot of money there! Honestly, I could have retired right now!

During a meeting with our accountant earlier this year, our accountant made noises like "schmoney schpit" so we did a surprise launch in October to pay for the renovation.

He also stressed that it was time to start acquiring more assets or we’d have to keep working forever, so a big deal this year was investing more and buying a few investment properties.

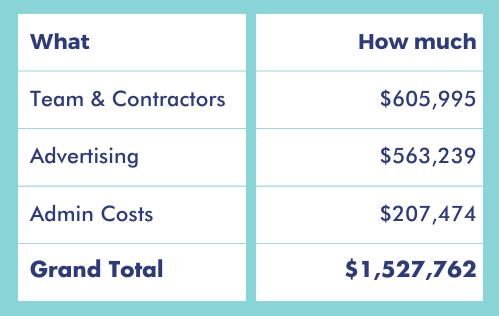

Our top business expenses were:

Advertising: mainly Facebook/Insta

Staff and contractors: wages, pensions, and training

Admin costs: bank fees, accounting, website stuff, subscriptions etc.

Donations (see below)

Fun purchases

I love classic cars and we bought a baby blue MG this year and an old rusty truck called Bonnie. We also got our 1955 Chevy, Rosie, renovated and living at the farm.

I also bought myself a gold coin necklace - a real antique coin from the 1600s.

We also took the kids and my mom to Fiji for Christmas, for our first real overseas holiday in years. Our kids are still at an exhausting age, but there were some really nice fun moments.

Fun to give away

Philanthropy is very important to me and it's something that I sometimes agonize over. How much to give - how much is enough? Who to support?

I actually hired a coach around this a few years ago to make sure I'm doing it smartly and in line with my values.

He asked me about what's important to me - do you want to help people who have just fallen off a cliff or do you want to prevent them from falling off a cliff in the first place?

The answer is both. I know sometimes you just need to give immediate support - when someone is hungry or their house burnt down, they have no bandwidth to "learn to fish"

But I'm also passionate about long-term social change - a change that takes lobbying and advocacy.

A few years ago we started our own mini foundation, a DT family fund, under the Fremantle Foundation. The idea is to one day become self-funding so we can donate from the interest. We put money into it every month and give annual grants to charities in the areas of education, women, democracy, and equal rights.

A dilemma I have sometimes is where to donate to. The majority of my clients are in America, followed by Australia, UK, Canada, NZ, and then .. the rest of the world!

Obviously, my donations are only tax-deductible with Australian charities so we look for ones that have a global focus. We still donate to overseas charities because tax deductibility isn't my only criteria obviously but I want to be smarter about this in the future.

We donated about $142,000 over these charities:

B1G1 (Buy 1 Give 1)

ANTaR

Yalari | Educating & Empowering Indigenous Children

The Smith Family

Hope For Nauru

Blak Business

Common Ground

The Inner Wheel Club

Catherine Hamlin Fistula Foundation

Climate Action Network Australia

Haitian Bridge Alliance

Australian National Research Organisation For Women’s Safety

Beyond Blue

Save The Children

Kurandza

WWF

Australian Flying Doctors

Got Your Back Sista

Hope In A Suitcase

And numerous smaller donations, GoFundMes, and support for causes we care about.

What's ahead of 2022?

I'm feeling 22 but I'm also extremely cautious to make too many plans like overseas travel or hosting too many events.

We're really focused on helping as many people as possible this year, and luckily we can do that from home.

I know my work is important and I don't need to reinvent the wheel. I always think everyone has seen my work and every day I'm reminded that it's powerful work when someone hits a money block and our course can really help people.

Our big goal is to welcome 2,000 new Bootcampers this year while finding ways for our business to be more simple, chilled, and abundant.

Personally, my big goal is to finish the renovations at our rose farm.

Firstly so our family can enjoy this special place, but also so hopefully we can soon welcome the local community and our Lucky B community to events and conferences.

How was 2021 for you?

The last two years have really been a lot. Too much for most people and I know it has pushed a lot of entrepreneurs close to breaking point.

There’s no doubt that things are … let’s call it… weird right now. We’re all trying to run businesses while dealing with ALL THE THINGS.

Maybe you’re juggling kids, parents, and business right now. Maybe you’re just trying to figure out if you should even make plans this year.

I get it.

This is going to be another year of really simplifying.

Getting clear on what works - and leaving what doesn’t. It’s so unknown but within all the uncertainty, we can’t just ditch our business plans.

Your dreams are still so important. And your business can really help people.

And let’s face it - more money makes getting through uncertainty MUCH easier.

I hope we can return to “normal” at some point this year - but to be honest who knows.

In the meantime, I want you to know.

You can still achieve your money goals this year.

This might be a stretch goal year for you - maybe it's the year you break through a symbolic income plateau, like your first 6 figure or even 7 figure year.

That’s still possible.

Maybe you're doing great in your business, but you want more ease, less stress or to try something new this year.

That’s still possible too.

This could be your year to achieve a big personal goal, like buying your first house or getting out of debt.

You might be thinking, “well, I’m just going to manifest it”

Here’s a truth that will change your life.

Money is the best manifesting tool there is.

Manifest just means to “make real”.

And money can solve a lot of problems in your life, and contribute to so much joy.

No matter what’s going on.

Virtually everything you most desire is a buyable experience.

Making more actual, spendable money this year will change your life and have a ripple effect on all the ways you want to contribute to the world.

Even if you don’t have it all figured out right now…

You deserve to get paid for your talents.

You deserve to make money in return for the work you do.

You deserve to thrive.

And I can help. Next week I’ll be hosting my 2022 workshop and masterclass all about breaking through your income plateau in 2022, registration is open here - denisedt.com/workshop

Plus I just created a new worksheet on how to set and actually achieve your money goals in 2022. You can download a free copy here - denisedt.com/goals

However last year was and especially if it didn’t quite go to plan, I’m sending you so much love and luck. This year can be different and I know there are big things just around the corner for you.

xx Denise

December 21, 2021

How To Use My 3 Best Money Affirmations To Change Your Life

Hey gorgeous,

You might know that I absolutely love a good affirmation. I think they can have a really powerful impact on your life and business and can be as powerful as reading a book or taking a course.

Affirmations are a huge part of how I’ve manifested my First Class life and business. I always recommend them as a great starting point if you’re looking to drastically upgrade your life.

I’ve used so many affirmations over the years, depending on what I was trying to manifest, and I ALWAYS get asked what the best affirmations are for specific situations.

Here are three of my best affirmations that can help shift you from feeling negative and frustrated to feeling abundant and deserving really quickly.

Let’s do it.

HOW AFFIRMATIONS CAN IMPACT YOUR MONEY MINDSET

Affirmations are positive, brain-training statements that help to shift your focus from the negative – where a lot of us spend our time – to the positive.

They’re great pattern interrupters as well that can help shift your energy and mood.

What do I mean by “pattern interrupter”?

Well it’s like this:

You’re going about your day and you notice that the negative thoughts about how you’ll never be successful have popped up again.

Your old stories are running… you don’t feel qualified enough, or you don’t have enough experience or you need to lose ten pounds before you get started, etc.

blah blah blah

If you don’t interrupt the negative thought patterns, you’ll probably create a downward spiral that manifests more frustration, lack and negativity.

When you’re feeling crap about yourself, you often miss opportunities, talk yourself out of taking action and get stuck in procrastination.

Why we need to break through negative self-talk

Negative self-talk is one of the biggest sabotaging patterns I see in people who aren’t living their ideal life, and it’s one of the quickest (and cheapest) ways to turn things around.

MY SIGNATURE AFFIRMATION

If you use an affirmation, like my signature affirmation,

“It’s my time, and I’m ready for the next step!”

…it immediately gives your brain something positive to focus on instead of those annoying negative patterns.

This particular affirmation sends the message that you ARE ready, and that it’s only the next step that needs to happen, so it becomes less daunting.

Plus, it gets you out of jealousy that everyone else is getting the opportunities and it reminds you that good things can happen to you too.

When you train your brain to look for the positive, you automatically start to feel better and act in different ways. You might feel more motivated to take action (even a small one), and it has a knock on effect to creating positive outcomes too.

If you use affirmations whenever you notice the negative thoughts come into play, you successfully interrupt the downward spiral before it causes drama in your life.

Do it enough, and you train your brain to manifest awesome things for you!

So what are the best affirmations to use to grow your business and abundance?

Here are the affirmations I’m loving right now:

Affirmation #1. My Face Is My Fortune

I use this one all the time.

This is for all you entrepreneurs out there: don’t hide!

For your customers to connect with you, you need to be seen.

People love connecting with an actual person – and although you think you’re not perfect, that’s exactly what they want to see!

The way to differentiate yourself in a crowded market is to be unapologetically YOU.

Yes, even at your current weight. Even though you think you’re not “ready”.

Even if you worry that you’re not good enough.

I used to think I had to completely change my accent to be successful – which is weird I know, but I hear that all the time from other people.

Your success and abundance will skyrocket when you get ok with being successful, just as you are.

SIX OF MY FAVOURITE WAYS TO GET VISIBLE

Get some new headshots done! Yes, before you’re ready. Every time I get new photos done, I can feel my business going to the next level.

Use your face on your branding – even if you’re a product business. Give yourself permission to be seen as a real life “model” of what you do.

If you make things – show behind the scenes of your workspace and how you create your work.

This also helps for you to charge well for what you do, because your audience starts to appreciate the work that goes into your product.

Be brave to show a mix of photos – the glammed up ones and the “real life” ones. You’ll be surprised what your audience resonates with.

Put a picture of yourself on your about page and on your social media profiles – so many women hide away by using a picture of their animals or a fuzzy, old picture of them wearing sunglasses.

Get on camera – either with live streaming, interviews or pre-recorded videos so your audience can connect with you.

Do what feels comfortable, but…

Basically SHOW UP AND SHOW YOURSELF.

Repeat the affirmation “My face is my fortune” any time you feel like you’re not enough, that you’re not ready, or when you want to hide away from the world.

The connection to the real you is what will grow your audience, and your income.

Affirmation # 2. I Serve, I Deserve

When I first started using this affirmation, it completely changed the way I felt about my impact on the world, and my ability to receive abundance in return.

I used to feel terrible that I couldn’t help everyone, and would constantly feel guilty.

Have you ever had those 3am guilt-trips?

Many heart-centred entrepreneurs go into business to help people, and it feels horrible when you have to refuse free advice requests, or you get customers blaming you for not offering scholarships or discounts.

The truth is, that when you have a business, you could work 24/7 and still not feel like you’re doing enough – there’s no “clock off” time for most of us.

So how do you deal with it?

Think of all the ways you serve people – it could be the hundreds of free articles on your blog, your weekly podcast or the way you help out in business forums.

You’re probably serving all the time.

Well, guess what? You’re allowed to receive abundance in return for all that good you’re putting out into the world.

It’s okay to say no to requests for free advice, it’s okay to steer customers towards your blog, or your paid offerings.

You serve, and you deserve too.

This affirmation will remind you of all the ways you help people, but it also helps you remember that you don’t have to serve in all ways, or be everything to everyone.

You already serve.

Using this affirmation is also your reminder that it is OK to receive good things doing what you do.

You’re entitled to receive abundance in your life from serving people, INCLUDING money.

Ok - here is another life changing affirmation.

Affirmation #3. This Is What A Wealthy Person Looks Like

This one will change your life.

When you think about the stereotypical “wealthy person” – what do you think they look like, sound like, dress like?

Do they look like you?

I used to think I wasn’t allowed to be wealthy because I liked to dress casually and like to eat at Pizza Hut.

Surely, a rich woman had to be fancy all the time, right?

Go look in the mirror, and say this affirmation to yourself.

Point at your face and say “THIS is what a wealthy person looks like”.

It might totally trigger you and challenge your beliefs about your ability to be wealthy.

It will bring your hidden excuses right up to the surface. See what you tell yourself straight afterwards:

Like

“Oh no – I’m not … (whatever)... enough to be wealthy!”

Let them bubble up – how are you not allowed to be wealthy?

This is hugely valuable information about your money blocks, and the stories you tell yourself that will keep you small.

So using this affirmation means that you might need to clear some money blocks that are getting in your way right now.

But if you keep on using it, whenever you catch yourself thinking “I can’t be wealthy because…” then you’ll interrupt the pattern and remind yourself that you CAN be as wealthy as you like. You’ll start to believe that it’s possible for you too, exactly how you are now.

So – which affirmation will YOU use today?

Using affirmations takes a bit of effort to remember, but if you can get into the habit, you’ll see huge results in a very short time.

Remember, you get what you focus on, so training your brain to focus on the positive really boosts your manifesting efforts.

If you need some help starting to work on your money mindset I have a ton of resources to help you.

I've helped thousands of entrepreneurs break through money blocks in my books and my course Money Bootcamp.

My free money blocks workshop can help you identify your most common money blocks and how to clear them, so they don't sabotage your pricing or income.

Watch it today at denisedt.com/blocks

Easy as that!

It’s your time and you’re ready for the next step,

Denise xx

December 20, 2021

Break Through Your Income Plateau in 2022: 9 Money Mindset Tips You Need

Hey gorgeous,

I’m here to show you what to do when you’ve suddenly hit an income plateau. I’m excited to help you make 2022 the year when you break through to the next level.

It’s so frustrating when you hit an income plateau. Everything was going so well, and then it just …. flat lined.

Don’t worry, I’ve got nine money mindset strategies to help you break through your limiting beliefs and sabotage, and get to the next level.

Everybody has humps in business.

It’s super normal. I promise!

Don’t worry about it. Grab your pen and some paper and we’ll get straight into it.

Your income plateau represents your comfort zone.

That’s why it feels so uncomfortable when you want to break through the glass ceiling. And why we often sabotage ourselves.

It doesn’t mean that you’re not meant to be successful in business.

It doesn’t mean that that’s the most you’re ever going to be able to earn.

It really is just representative of where your comfort level is at the moment, how much you believe you can earn and where your mindset is with money right now.

It’s always very telling to see WHERE you’ve hit that income plateau.

Trust me, you will continue to hit other income plateaus as well. I know that this one feels really real, but it really isn’t.

USING MONEY MINDSET TO BREAK THROUGH AN INCOME PLATEAU

Here are my 9 Money Mindset Steps to Increasing Your Income

Get Real About Your Money Blocks

Identify Your Fears About Money

Make Friends with Tax

Upgrade Your Mastermind

Set a New Goal

Acknowledge Your Success

Take a Break

Give Yourself Permission to Earn More

Go To Work

So let’s dig into each of these steps in more detail, starting with the most important – your money mindset work.

1. Have a really honest look at your money blocks.

This is a great opportunity to re-visit your money beliefs.

What are your thoughts and feelings about money right now?

What are you telling yourself about money?

Maybe you’ve slipped into old bad money habits or maybe you’ve forgotten that you need to work on your money mindset all the time.

You have to work on your money mindset on a regular basis.

By the way, I do too. Even though I’m a millionaire and I teach this stuff, I’m constantly working on my blocks.

If I start to think…

“I know everything there is to know about money. I don’t need to worry about this.”

Well, guess what? My income will plateau as well.

2. Identify your fears about money.

Get specific.

What are you actually afraid of if you earned more money?

What would happen, good and bad?

If you’re willing to look at it, it might give you some valuable information to clear it.

3. Make friends with tax.

Now, some entrepreneurs hold themselves back at particular income points because they’re afraid of paying more tax.

Or maybe you’re worried about other financial implications as well:

Maybe you’ll lose particular benefits if you earn more;

Maybe you’ll have to start paying different types of tax;

Maybe you’ll have to start charging different taxes to your clients when you earn more.

Have a look at your fears and see if there’s anything symbolic about this income level for you.

4. Upgrade your mastermind.

Jim Rohn talks about how your income is the average of the people that you spend the most time with.

Look around at your mastermind and be really honest.

Has everyone else’s income plateaued as well?

Have you plateaued to the point where everyone’s income is the same?

If you want to go beyond that income plateau, it might be time for you to move into a mastermind where people are earning more money because then it will inspire you to increase that for yourself as well. Here’s how to create your Million Dollar mastermind.

5. Set a new goal.

Now, this is really funny. Often when entrepreneurs achieve an income goal, they haven’t yet conceptualised the next one.

They’re like, “I don’t know why I’m not earning more.”

It’s like the universe is saying, “You haven’t told us what that next income goal is. What would you like to earn?”

You’re like, “I don’t know. Just more money.”

What does ‘more money’ look like to you?

Make sure that you’re very, very clear on what that next income goal is so then you can actually know when you’ve hit it and you’ve got something to reach for beyond that income plateau.

6. Express Gratitude; Acknowledge How Far You’ve Come

So many of us just go for the next goal, next goal, next goal, and next goal without anything in between. No wonder our successes feel a little bit empty because we’re not acknowledging them.

We’re just like, “That’s not good enough. What’s the next one? That’s not good enough. What’s the next one?”

Sometimes you do need to take stock when you’ve hit an income plateau to go, “You know what? Look how far I’ve come. This is amazing.”

Take a little breather and then you can regroup for the next goal.

7. Have creativity breaks.

What is going to help you go to that next level? Fresh ideas. New products, services and offerings.

Creativity requires getting out of your current environment.

Go somewhere new, spend some time meditating, go to the beach or do something fun so you can refresh your creativity.

You’ll need to revamp your ideas. You’ll need new ones to get you to the next level.

It will take new ideas, new creativity and new brainpower.

Then...

8. Give yourself permission to earn more.

Actually give yourself permission.

It’s safe for me to make more money.

It’s safe for me to go to the next level.

It’s safe for me to out-earn other people.

Give yourself permission to break past this income plateau. I think that is probably more important than anything else: giving yourself permission to earn more.

It might sound really silly because you’re like, “Of course I want to earn more, Denise.” But you need to know that it’s okay for you at a cellular level

It’s okay for you to make more money. Remind yourself constantly.

9. Time to work

What got you to where you are now? Keep the stuff that works and ditch the stuff that doesn’t. Getting to the next income level is worth the work and process of optimising how you run your business.

I know for myself, every time I’ve been at an income plateau, I’m like, “This one’s really real.”

Oh, my God. You start to make up stories about it. “No, this one is really actually real now. The other ones I could get through but this one’s real.”

They’re not.

It’s going to take some new strategies to get to the next level, but don’t forget that consistency is always a great strategy and it will be something that will continue on with your journey.

It’s your time and you’re ready for the next step

I know you can make 2022 the year when you move beyond your limiting beliefs and sabotage, and break through to the next income level!

Denise xx

December 17, 2021

Set an Income Goal for Next Year and You’ll Earn More (and Work Less!)

Hey gorgeous,

When it comes to setting income goals, it’s really common to get blocked, or feel like you’re not doing it right.

Do you set a BIG STRETCH goal?

Do you add up some realistic numbers on what you know you can achieve?

Or will you put out mixed messages to the Universe if you change it too often?

For a lot of entrepreneurs, picking a number can feel really hard, and many people are scared to commit to a number in case they get it wrong.

So today, I’ve got some income goal setting tips for you, and a resource to help you overcome your resistance to making more money.

Why Set an Income Goal

Setting an income goal is a really important part of being in business - this alone will help you

Stay focused

Make decisions

Reach the next level

Save time, energy and money!

How to Set your Income Goal

Firstly, don’t overthink it

The most important thing is this: don’t overthink your goal setting to the point that you NEVER do it.

You can just pick a number, and it’s not set in concrete. Goal setting is free – you can do it as many times as you like, and change it whenever. It doesn’t cost you anything to set a goal.

How Perfectionism Gets in the Way of Goal Setting

Don’t procrastinate with the belief that you’ve only got one shot at it. That’s perfectionism getting in the way, and it’s the single biggest block to becoming a good goal setter.

Why do you even need an income goal? Can’t you just wing it?

Sure you can!

However, setting an income goal will focus you, and help you make decisions in your business.

When you’re weighing up ideas, you can look at your goal to help you decide which direction will best serve your overall goals. This can save you a lot of time and wasted effort, too, so you don’t go off in random business directions (been there!).

Should your goal feel like a massive stretch?

For some people, that’s motivating. I personally like to set big goals and achieve them. But if it’s going to freak you out, setting a more achievable goal for yourself will make sense.

There’s no perfect way to do it

The next thing to know is that there is NO perfect way to set your income goals. (Or any goals, for that matter!)

I wish I could tell you that there was one right way to set your goals – it’d make life so much easier!

But there’s not.

The big secret is that your INTENTION and CLARITY are the most important things and a goal that you change over time, is better than no goal at all.

Four Strategies to Set Your Income Goal

Here are some of the ways that you could set your goal for the coming year. It’ll help you earn more and work less!

1) Income Plus a Percentage

2) Calculate a Goal Based on your Lifestyle Costs

3) Get Strategic

4) Just Pick a Number!

Let’s take a closer look at each of these strategies so that you can pick the perfect one for you to uplevel your income over the next year and give you more financial freedom.

1) Income Plus a Percentage

One of the simplest ways to set your income goal for the year is to take your income for the past year and add a percentage.

The percentage you choose could be based on how much you want your business to grow, or you could choose a number that feels good to you.

Would 20% feel good to you?

Again, it should be an exciting stretch, but realistic enough to believe it’s possible.

2) Calculate your Lifestyle Costs

Another way to set an income goal is to think about the lifestyle you would like to have in the next year, and calculate how much it costs. That will give you a profit figure that’s based on your goals and dreams.

When you can see it on paper, it makes it more real and possible. Somehow, numbers translated into massages, organic food and travel plans (or whatever lifestyle choices you make) makes it real in a way that numbers on a page sometimes just can’t do.

3) Get Strategic

Think about the products and services that you offer, and how many of each you’d like to sell.

Then look at how much money that will make you, and whether that’s a goal you’re happy with. If you are, then great! Your goal is made.

If you’re not, then you might need to look at raising your prices or creating something different to sell.

4) Pick a Number, Any Number

In reality, your goal is just a number, so it’s perfectly fine if you want to just pick a number out of your butt and use that as your goal. Really!

Loads of successful people do it this way, and it works just fine for them.

Remember, it’s the clarity and intention that really matter, so as long as your goal is believable and stretches you a bit, it’s the right goal for you. Here’s how I came up with my prices!

Money Blocks Around Setting an Income Goal

If you feel like setting a goal is too hard right now, or you’ve set one and can’t believe you’ll make it, then you’ve probably hit some money mindset blocks.

That’s really common, and nothing to worry about. I’ve been helping entrepreneurs like you clear money blocks for over a decade now, and it’s honestly the fastest way, not only to increase your income, but to expand your belief of what’s even possible for you.

Setting goals can be easy and fun when you let go of having to do it perfectly.

It’s your time, and you’re ready for the next step,

Denise xx

P.S. It can feel really frustrating when your income stalls. Maybe you’ve hit an income plateau and you’re struggling to imagine breaking free without working harder.

In 2022 my focus will be on helping you to break through the blocks and negative beliefs that cause these plateaus and help you take your income to a new height.

I’ve got a new workshop coming in January all about how to break through your income plateau and your best ever money year.

We’ll be launching in a few weeks so watch this space if you’re ready to start a new money chapter in the new year.

6 tips for success in 2022 without setting New Year’s Resolutions

Hey gorgeous,

I have a confession to make.

I'm not that into making New Year's resolutions.

I know, shocking right? You'd think it would be such a manifesting and mindset thing to do, but I actually think that New Year is the worst time to set goals.