Loren C. Steffy's Blog, page 13

March 25, 2014

Why Oil Drilling Is Both Safer And Riski

March 24, 2014

Why a Houston barge accident may cost yo

Why a Houston barge accident may cost you more at the pump than anything Russia’s doing in Ukraine. http://ow.ly/uTYMQ #energy #oilspill

March 17, 2014

As we debate fracking, consider its world impact

My latest op/ed, from Saturday’s Houston Chronicle:

My latest op/ed, from Saturday’s Houston Chronicle:

If we needed another example of how hydraulic fracturing is changing the world of petro-politics, we have it in Venezuela.

Anti-government protests have erupted in parts of the country, and President Nicolas Maduro has cracked down on social media and threatened to expel journalists for covering the unrest. The protesters’ demands vary, but most are economic in nature. What does all this have to do with fracking? Everything.

For starters, look at what’s happening with oil prices recently: not much. Crude futures have posted some steady gains in the past few weeks, but that has more to do with the unusually cold winter driving up demand for heating oil. Prices remain well below where oil traded last summer.

In other words, political upheaval in a major OPEC country has barely moved the needle on crude prices. We saw much the same reaction from world oil markets last fall, when the civil war in Syria and a possible showdown with Iran over its nuclear program loomed large.

In the past five years, the U.S. has become one of the world’s biggest energy producers, and its new prominence has upended the balance of power in the global oil market. Just as Iran was forced to bargain over its nuclear program, so, too, is Venezuela finding that its oil-fed socialist agenda is crumbling without the influx of U.S. oil dollars.

March 12, 2014

Is Offshore Drilling Getting Safer?

That was the topic of a recent conference I spoke at in Aberdeen, Scotland. The day-long event, sponsored by the Aberdeen chapter of the Society of Petroleum Engineers, included this press conference in which the speakers discussed the themes of our presentations.

After my talk on “Corrosive Corporate Cultures,” a look at how companies’ misplaced incentives can undermine safety, I also signed copies of Drowning in Oil.

SPE Another Perspective on Risk press conference

February 24, 2014

Generation Gap: Texas’ failed experiment with deregulating electricity

In my latest Texas Monthly column, I discuss the long-running problems with Texas’ efforts to deregulate the electricity market. The article hit the news stand just as the bankruptcy of Energy Future Holdings, the state’s biggest utility, appeared imminent. The story provides some context to EFH’s troubles, as well as the ongoing costs, inefficiencies and reliability shortcomings that continue to plague the market:

In my latest Texas Monthly column, I discuss the long-running problems with Texas’ efforts to deregulate the electricity market. The article hit the news stand just as the bankruptcy of Energy Future Holdings, the state’s biggest utility, appeared imminent. The story provides some context to EFH’s troubles, as well as the ongoing costs, inefficiencies and reliability shortcomings that continue to plague the market:

Just after seven a.m. on January 6, as Texans awakened to one of the coldest mornings in years, an email and social media alert went out from the Electric Reliability Council of Texas: “Reduce electric use now. Risk of power outages exist throughout Texas. Power warning in effect.” The last time a hard freeze gripped Texas so tightly, in February 2011, power blackouts rolled across much of the state as ERCOT, which operates the state’s power grid, struggled to meet the demand. Then, just as in January, power plants unexpectedly went offline when the state needed them most. This time blackouts were averted, but barely.

This isn’t the free-market wonderland that lawmakers envisioned back in 1999 when they voted to deregulate electricity, turning most of the state’s power system over to private companies. That decision, which was helped along by some arm-twisting from Houston’s Enron Corporation, was supposed to result in a robust market, thriving with competition, which would drive down prices for consumers, unleash a host of twenty-first-century innovations, and boost reliability by encouraging newer—and greener—generating plants. Texas, it was claimed, would become the envy of the nation for its cheap and abundant power, and the companies involved would make fat profits in the process. “Competition in the electric industry will benefit Texans by reducing monthly rates and offering consumers more choices about the power they use,” said a euphoric Governor George W. Bush.

Yet a dozen years after the launch of deregulation, which affects about 85 percent of the state, the system remains arcane and confusing to many consumers.

February 18, 2014

The Captain & Tennille and oil exports

I had an op/ed in Monday’s Houston Chronicle that drew an analogy between the Captain & Tennille’s recent divorce and our energy policy, which remains stuck in the 1970s:

I had an op/ed in Monday’s Houston Chronicle that drew an analogy between the Captain & Tennille’s recent divorce and our energy policy, which remains stuck in the 1970s:

Love apparently didn’t keep the ’70s pop duo Captain & Tennille together. Last month, filed for divorce from Daryl Dragon after 39 years of marriage. Just as the pair’s most famous standard now rings false, so does our 1970s notion of energy security.

For the past 40 years, U.S. energy policy has been married to the idea of scarcity. Following the oil embargoes of the 1970s, we built policies, from export bans to ethanol mandates, based on the idea that we would forever be at the mercy of other oil-producing nations.

The hydraulic fracturing boom, however, has changed all that. North America is undergoing an energy renaissance.

Domestic crude oil production has reached parity with imports, and the International Energy Agency predicts the U.S. may become the world’s largest energy producer as early as next year. Yet our policies remain stuck in the dark ages of scarcity. Lawmakers on both sides of the aisle are reluctant to consider lifting the 1970s-era ban on crude exports, citing issues of “energy security.”

There’s a difference between ensuring our energy security and hoarding resources. With our newfound abundance, security comes through continued development of domestic reserves.

Forty years of scarcity and fears of being held hostage by unfriendly oil-producing regimes has blinded lawmakers to the obvious: Exporting oil is no different than exporting any other commodity.

During the four decades that the U.S. has banned oil exports, it has worked to expand free trade around the world, and the economic benefits of those efforts has been clear. Free trade has boosted competition on a global scale, encouraged innovation and increased our standard of living at home by driving down prices for a broad range of goods.

February 11, 2014

Greed and consequences: what Hollywood missed

Last month, I wrote about the film “The Wolf of Wall Street” on my Forbes blog. I expanded on that piece for an op/ed that the Houston Chronicle ran over the weekend:

Last month, I wrote about the film “The Wolf of Wall Street” on my Forbes blog. I expanded on that piece for an op/ed that the Houston Chronicle ran over the weekend:

The Oscar buzz this year is dominated by two movies about con men: “American Hustle” and “The Wolf of Wall Street.” “Hustle” is a fictionalized tale about Abscam, the FBI bribery sting in the late 1970s that used a low-level swindler to ensnare a federal and state politicians.

“Wolf” is based on a self-aggrandizing memoir by Jordan Belfort, a penny stock promoter in the 1990s who ran Stratton Oakmont, a Long Island bucket shop. The faux anglophile sophistication of the firm’s name belied the baseness of its actions: Belfort and his cronies stole hundreds of millions from investors, much of which he has yet to repay.

“Hustle” leaves the viewer to ponder the nature of greed – was it Christian Bale’s con man or Bradley Cooper’s FBI agent who was more beholden to it? “Wolf,” by all accounts, is a voyeuristic smorgasbord of excess and debauchery that ignores the pain that Belfort’s fraud inflicts on his victims. Because it’s based on Belfort’s own account, it can’t help but engage in self-promotion. Joel Cohen, who prosecuted Belfort, noted in a recent blog post that the film’s ending is basically an ad for the “motivational speaking” business Belfort started after leaving prison. The wolf, it seems, has conned Martin Scorsese, one of Hollywood’s best living directors, into helping him launch his next scheme.

Leonardo DiCaprio, who portrays the self-styled wolf in the film, has said glorifying the hedonism while ignoring the victims’ plight was deliberate. He told the New York Daily News: “We purposely didn’t show (Belfort’s) victims. We wanted the film to be a hypnotic ride the audience gets on so they get lost in this world and not see the destruction left in the wake of this giant ship of greed.”

Without the victims’ perspective, it’s difficult to put that brutality of Belfort’s actions in focus. Oliver Stone’s “Wall Street,” in contrast, showed the clear consequences of financial fraud. The audience saw the toll that Gordon Gekko’s amoral philosophy had on ordinary people, including Bud Fox’s father.

The excesses of making lots of money are indeed hypnotic. Financial fraud works because money is an end so desirable that we often overlook the means. Few understood that better than Jordan Belfort. In the 1990s, I wrote a lot about penny stock fraud, including some of Belfort’s touts. As a reporter, I wanted to believe I was providing a public service by exposing stock manipulation. Often, though, I found the harshest criticism of my stories came from the victims, the stock buyers who refused to believe, until it was too late, that they were being conned. In some cases, they were so hypnotized by the promise of easy money, they didn’t care.

t’s easy to dismiss victims of fraud as suckers or rubes, people who are so greedy they get what they deserved. But if nothing else, “The Wolf of Wall Street” stands as a reminder, much like Allen Stanford’s far larger swindle a few years ago, that fraud isn’t something that just happens. It’s carefully planned. It’s designed to separate people from their money. Our desire to succeed, our need for financial security, our fear of poverty and failure – all are weapons in the con man’s arsenal.

People like Belfort and Stanford are more comfortable with lies than truth. Lies become the tools that, combined with a lack of conscience, enable them to prey on the fears and desires of unwary investors and separate them from their money. That is an important part of the Jordan Belfort story – in fact, the most important part – but it’s missing from the film. Even as Hollywood is bragging about his exploits, Belfort still owes millions to his victims. Perhaps “The Wolf of Wall Street” will help him recoup some of that, and in that way, perhaps victims will benefit. Belfort has said he plans to use proceeds from his books and the movie to repay them, but that offer came only after the prosecutors in Brooklyn filed a motion to find him in default on his court-ordered restitution. Meanwhile, the film is enabling him to reach a wider audience. It has propelled his book to the top of the best-seller list and the website for his motivational speeches touts the movie as part of its sales pitch.

In an age of “reality TV” in which spoiled children, hairy rednecks and dysfunctional motorcycle mechanics are all stars playing to a voyeuristic audience, “The Wolf of Wall Street” is just one more freak show for the audience to savor. Indeed, Belfort is apparently in talks to host his own “reality” show.

With Hollywood’s help, it may be his greatest con yet.

January 24, 2014

Google, AT&T battle to keep Austin wired

(Illustration: Texas Monthly)

My column in the February issue of Texas Monthly looks at the battle between AT&T and Google to bring super fast Internet service to Austin. The showdown pits an old world telecom giant against an Internet darling, but this fight may not be quite what it seems.

In April, when Google announced that it had decided to bring its superfast Google Fiber Internet service to Austin, you could almost hear the city’s population toggle over to Facebook en masse and click “Like.” Two years earlier, after more than a thousand communities had entered the contest to be the first to get Fiber, the so-called Silicon Hills had lost out to, of all places, Kansas City, Missouri. So the announcement that Austin would receive Fiber in mid-2014—making it the third locale to get the one-gigabit-per-second service, after Kansas City and Provo, Utah—was welcome in the heavily wired tech mecca. Finally, this self-styled city of the twenty-first century was getting some love from the most iconic company of the twenty-first century. “This is the city that has SXSW Interactive and where Twitter blew up,” says Toni Grasso, an administrative manager in the Office of Programs and Partnerships at the Austin Public Library, which is slated to receive free Google Fiber. The service will help transform the library into “a library of the future,” she adds.

But a funny thing happened on the way to the Austin-Google love fest. In October, AT&T—yes, Dallas-based AT&T, a.k.a. your granddaddy’s telecom company—an nounced it would beat Google to the punch by bringing its superfast GigaPower service to select Austin neighborhoods at the tail end of 2013.

January 21, 2014

Upcoming speech in Aberdeen

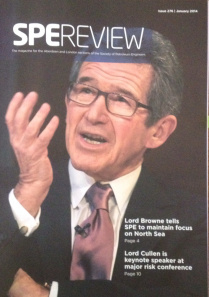

The folks with the London and Aberdeen sections of the Society of Petroleum Engineers sent me a copy of the latest issue of the SPE Review, which mentions my upcoming speech in Aberdeen on March 5. I’ll be talking about corrosive corporate cultures to about 400 attendees at a conference entitled “Another Perspective on Risk — The Next Tipping Point.”

The folks with the London and Aberdeen sections of the Society of Petroleum Engineers sent me a copy of the latest issue of the SPE Review, which mentions my upcoming speech in Aberdeen on March 5. I’ll be talking about corrosive corporate cultures to about 400 attendees at a conference entitled “Another Perspective on Risk — The Next Tipping Point.”

Having former BP chief executive John Browne featured on the cover is a nice touch of irony, because BP’s culture, which Browne largely created, and how it contributed to accidents such as the Deepwater Horizon disaster will be a focus of my talk.

I’ll also be signing copies of Drowning in Oil at the event. For more information on the conference, click here.

January 19, 2014

My return to the pages of the Houston Chronicle

The Houston Chronicle today published my op/ed piece on mounting safety and security issues raised by the hydraulic fracturing boom in the Eagle Ford Shale of South Texas:

The Houston Chronicle today published my op/ed piece on mounting safety and security issues raised by the hydraulic fracturing boom in the Eagle Ford Shale of South Texas:

A few weeks ago, turned off a stretch of road in South Texas and onto a property where crews are drilling five oil wells. Nobody stopped him. Blackwell isn’t a threat. He owns the property, on which he has a second home. The drilling company, though, is supposed to maintain a guard at the entrance.

“Somebody could have driven right up to the house,” he said. “If you have just an open area, people don’t feel particularly constrained – there are no signs, nobody to keep them out.”

In South Texas, in the rejuvenated Permian Basin of West Texas and in other drilling hot spots around the country, landowners are confronting a litany of safety and security concerns – many of which they didn’t anticipate – as they allow hydraulic fracturing on their land.

The oil boom is bringing jobs and wealth to areas such as South Texas that for decades had little of either, but it also is eroding residents’ sense of familiarity, and with it, a sense of security. Towns in which everyone knew everyone else are now seeing a boom in new hotels and restaurants overrun with strangers chasing high-paying jobs in the rejuvenated Oil Patch.

Like Blackwell, many landowners worry that contractors hired by the drilling companies aren’t taking proper care of the land. The number of rig workers – strangers – on their properties overwhelms others.

Property owners aren’t the only ones with concerns. Thanks to the oil boom, drilling companies are facing safety and security issues of their own.

In places like South Texas’ Eagle Ford shale, any drilling in the past 50 years probably involved low-production “stripper” wells that required little monitoring. Because of hydraulic fracturing, oil companies have more at stake in each drilling project. A typical well in the Eagle Ford can cost as much as $7 million to $10 million, and because of the volume of oil produced, companies must do more to protect the value of their production than they did in the old days.