Loren C. Steffy's Blog, page 14

January 16, 2014

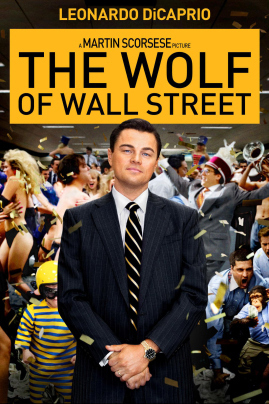

Did ‘The Wolf of Wall Street’ con Martin Scorsese?

This post has been generating a lot of comments over on my Forbes blog, so I thought I’d repost it here. Feel free to weigh in.

This post has been generating a lot of comments over on my Forbes blog, so I thought I’d repost it here. Feel free to weigh in.

There is a cautionary tale for all investors in the events depicted in the film The Wolf of Wall Street, but apparently the movie chooses to ignore them.

This post from Christina McDowell, whose father was an associate of the self-styled wolf, Jordan Belfort, underscores the point that the cost of financial fraud is farther reaching and more personally damaging than a movie can reveal. Movies, after all, thrive on the visual. Antics and debauchery are more visually appealing than heartbreak and despair.

But there’s a bigger problem with the film, as Joel Cohen, who prosecuted Jordan Belfort, points out: the end is basically an ad for Belfort’s “motivational speaking” business. In other words, Belfort conned one of Hollywood’s best living directors into helping him launch his next scheme.

Belfort never cared about his victims, and the movie apparently doesn’t either. Leonardo DiCaprio, who portrays Belfort in the film, has said glorifying the hedonism while ignoring the victims’ plight was deliberate. He told the New York Daily News:

We purposely didn’t show (Belfort’s) victims. We wanted the film to be a hypnotic ride the audience gets on so they get lost in this world and not see the destruction left in the wake of this giant ship of greed.

Without the victims’s perspective, it’s difficult to put that brutality of Belfort’s actions in focus. What made Oliver Stone’s Wall Street a seminal film about financial fraud was that it showed consequences. It showed the toll that Gordon Gekko’s amoral philosophy had on ordinary people, including Bud Fox ’s father.

January 7, 2014

The return of the `friendly lawsuit’

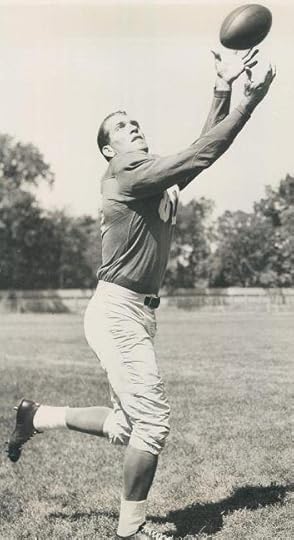

Cloyce Box, as a receiver for the Detroit Lions in the early 1950s.

The shale boom has revived the uniquely Texas tradition of the “friendly lawsuit,” as I discuss in a post on texasmonthly.com:

The oil boom is back, so it stands to reason that other affectations of Oil Patch abundance wouldn’t be far behind. Like the “friendly lawsuit.” Recently, the city of Fort Worth sued Cheasapeake Energy, the Oklahoma City-based natural gas producer that owns about 500 mineral leases on city property. The city claims Chesapeake has been shortchanging it on royalties. It’s the type of dispute that’s almost as old as oil itself. In fact, the neighboring city of Arlington sued Chesapeake in August, seeking $1 million in royalty-related claims, and the company last year settled a royalty dispute with the Dallas/Fort Worth International Airport by agreeing to a $5 million payment.

Chesapeake and Fort Worth have had a close relationship for years, and since 2006, the company has paid the city tens of millions of dollars in royalties. Now, the city claims Chesapeake hasn’t been using the right formulas to calculate those payments. The dispute, though, hasn’t soured the relationship. The city says it has no intention of severing ties with Chesapeake.

While they stopped short of using the term “friendly lawsuit,” it reminded me the wildcatters of old, who could be signing legal documents with one hand, and shaking on a new deal with the other. I first encountered the notion of a friendly lawsuit when I interviewed Cloyce Box, the legendary Dallas wildcatter and former pro football star known for his litigious ways.

January 3, 2014

RT @lsteffy: Landowners, drillers worry

RT @lsteffy: Landowners, drillers worry about safety and security as fracking booms. #energy #fracking http://ow.ly/sfooz

December 20, 2013

Penney, for my thoughts. . .

My take on the stunning demise of J.C. Penney, from the latest issue of Texas Monthly:

My take on the stunning demise of J.C. Penney, from the latest issue of Texas Monthly:

J. C. Penney is the stuff of American business legend. Founded more than a century ago in a small Wyoming town by a man with a name tailor-made for retail—James Cash Penney—it built a reputation for quality and value, weathering the Great Depression and becoming one of the country’s preeminent department stores. The chain, which relocated to Plano in 1992, is the largest Texas-based retailer in the country. It has 1,100 stores nationwide, $13 billion in annual sales, and 116,000 employees. And it now teeters on the verge of financial ruin.

Rarely in the annals of American retail has there been such a swift and devastating collapse of a shopping icon. “Penney’s destroyed themselves,” says Howard Davidowitz, the chairman of Davidowitz & Associates, a national retail consulting and investment banking firm in New York. “You can’t recover from this.”

By “this,” Davidowitz is referring to four factors that have brought the company to the edge of bankruptcy: the collapse of the middle-market retail sector, the recent recession and anemic recovery, the ill-advised actions of an activist shareholder who was out of his element, and the cult of the celebrity chief executive. Penney likely could have survived one or two of these afflictions. But the combination of all four may prove to be more than the company can take; this holiday season is the most crucial in Penney’s 111-year history, and the outlook isn’t good.

Since the story was written, analysts have continued to watch the Christmas season, which looks like it will be a difficult one for Penney’s, as well as its rivals. In an effort to goose sale’s before year’s end, the company is already gearing up for a massive post-Christmas sale. The question, of course, is whether it will be enough to save Penney’s.

December 12, 2013

How many months it takes an average work

December 3, 2013

What Michael Dell knew

Fewer people bought one of these this year. (Photo credit: Wikipedia)

This summer, I wrote a piece for Texas Monthly on the management-led buyout of Dell in which I argued that going private was Dell’s best option for survival. The deal was controversial because some big investors, including Carl Icahn, claimed founder Michael Dell was low-balling shareholders with his $13.88-a-share offer.

Some of them, in fact, are still challenging the buyout price, seeking a judicial review of the deal in Delaware court. That challenge has little chance of success because much of it depends on predictions for personal computer sales. It’s difficult to predict how much PC sales will slip.

However, as we come to the close of the year, we have a better idea of what Michael Dell undoubtedly saw as he looked at the prospects for his company’s biggest revenue-generating product. PCs sales are headed for their worst year ever. They tumbled 10 percent as consumers shifted their purchases to tablets and smart phones, and the slide is expected to continue next year, according to market researcher International Data Corp. These declines follow a 7 percent drop last year.

In other words, things look ugly if your company’s primary business is making PCs, as Dell’s is. The company can’t afford to make a gradual transition to the services business it has long dabbled in. That’s why the buyout made sense, and it’s why, after all the drama surrounding the deal, the price was about as fair as investors could expect.

If the deal had fallen through, shareholders would have been left with a rapidly decaying business and little hope for a turnaround.

November 22, 2013

“Mr. President, you can’t say Dallas does not love you!”

A few weeks ago, I got an email from Anthony Pizzitola, a Houston autograph collector. With the 50th anniversary of the Kennedy assassination coming up, he wanted to share a particular item from his collection with me. I wrote about Pizzitola last year, after the death of astronaut Neil Armstrong. Pizzitola wrote a book about Armstrong’s autograph, among the most sought-after signatures in the world, and he has an extensive collection of them. His collection, though, is far more extensive than just astronauts. He often tries to get famous people to write a quote they’re known for above their signatures.

A few weeks ago, I got an email from Anthony Pizzitola, a Houston autograph collector. With the 50th anniversary of the Kennedy assassination coming up, he wanted to share a particular item from his collection with me. I wrote about Pizzitola last year, after the death of astronaut Neil Armstrong. Pizzitola wrote a book about Armstrong’s autograph, among the most sought-after signatures in the world, and he has an extensive collection of them. His collection, though, is far more extensive than just astronauts. He often tries to get famous people to write a quote they’re known for above their signatures.

He sent me the image above — the autograph of former Texas First Lady Nellie Connally, under the words she spoke to President John F. Kennedy moments before he was shot. They were probably the last words Kennedy ever heard. I was familiar with the quote, but seeing it written in Connally’s own hand gave me chills.

Pizzitola said he wasn’t sure how Connally would react when he approached her at a book signing in 2004 and asked her to write the words. She simply commented that no one had ever asked her for that before and honored his request.

I’m not the only one who found this story interesting. The Houston Chronicle’s Kyrie O’Connor wrote about Pizzitola and his collection today as well.

November 13, 2013

Fracking in New Brunswick

This column appeared last week in the New Brunswick Telegraph Journal. It’s adapted from a blog post I wrote for Forbes.com. The editors asked for permission to run the piece because New Brunswick has become the focal point of the fracking debate in Canada.

October 30, 2013

The Feds and Fracking: A Chicken or Egg Question

A gas drilling rig in the Barnett Shale, where George Mitchell pioneered the hydraulic fracturing techniques (Photo credit: Wikipedia)

My story on Houston oilman George P. Mitchell in the latest issue of Texas Monthly is still behind the paywall, but a sidebar I wrote on the role of the federal government in developing hydraulic fracturing technology is now posted on the magazine’s web site.

I interviewed Dan Steward, one of Mitchell’s former geologists, who inadvertently sparked the controversy with comments he made several years ago. In this piece, Steward sets the record straight.

His conclusion: the feds funded some of the early research that enabled Mitchell to develop commercially successful fracking techniques, but the government’s role wasn’t as great as some federal officials contend.

Steward’s conclusion: “George probably could have done it without the government. The government would not have done it without George.”

October 22, 2013

`The Energy Hunter’ in the next Texas Monthly

Texas Monthly has released its cover for the November issue, which includes my story on how Houston oilman George P. Mitchell changed the world. The issue will be available on newsstands Oct. 24. An online version of the story should be available later this week.

Texas Monthly has released its cover for the November issue, which includes my story on how Houston oilman George P. Mitchell changed the world. The issue will be available on newsstands Oct. 24. An online version of the story should be available later this week.

On Nov. 19, I’ll be moderating a 6 p.m. panel discussion at Rice University on the sustainability of hydraulic fracturing. We’ll discuss how long the shale boom may last and how we should use it to prepare for the future. The panelists are Arthur Berman of Labyrinth Consulting, Kenneth Medlock with the Center for Energy Studies at Rice’s Baker Institute, and Scott Tinker, director of the Bureau of Economic Geology at the University of Texas. If you’d like to attend, RSVP here.