Steve Blank's Blog, page 43

May 6, 2013

Free Reprints of “Why the Lean Startup Changes Everything”

The Harvard Business Review is offering free reprints of the May 2013 cover article, “Why the Lean Startup Changes Everything“

Available here

Filed under: Big Companies versus Startups: Durant versus Sloan, Business Model versus Business Plan, Customer Development, Customer Development Manifesto, Lean LaunchPad, Teaching, Venture Capital

April 29, 2013

Fly High

Todd Branchflower was one of my Lean LaunchPad students entrepreneurial enough to convince the Air Force send him to Stanford to get his graduate engineering degree. After watching my Secret History of Silicon Valley talk, he became fascinated by how serendipity created both weapon systems and entrepreneurship in World War II – and brought us federal support of science and Silicon Valley.

In class I would tease Todd that while the Navy had me present the Secret History talk in front of 4,000 cadets at the Naval Post Graduate School, I had yet to hear from the Air Force Academy. He promised that one day he would fix that.

Fast-forward three years and Todd is now Captain Todd Branchflower, teaching electrical engineering at the Air Force Academy. He extended an invitation to me to come out to the Academy in Colorado Springs to address the cadets and meet the faculty.

Fast-forward three years and Todd is now Captain Todd Branchflower, teaching electrical engineering at the Air Force Academy. He extended an invitation to me to come out to the Academy in Colorado Springs to address the cadets and meet the faculty.

Out of the airport the first stop was in Denver – an impromptu meetup at Galvanize and a fireside chat with a roomful of 200 great entrepreneurs.

U.S. Military Academies

Then it was on to Colorado Springs and the Air Force Academy. All officers in the U.S. military need a college degree. The Air Force Academy is one of the four U.S. military service academies (academy is a fancy word for 4-year college.) The oldest is the Army’s U.S. Military Academy at West Point in New York, founded in 1802 to educate Army officers. The next military college was the Naval Academy in Annapolis Maryland, set up in 1845 to train Navy officers. The Coast Guard Academy opened in New London Connecticut in 1876. The Air Force, originally part of the U.S. Army, wasn’t an independent military branch until 1947, set up their academy in 1955 in Colorado Springs. Only ~20% of officers go through a service academy. Over 40% get the military to pay for their college by joining via the Reserve Officers Training Corps (ROTC) program. The rest get their college degree in a civilian college or university and then join their branch of the military after a 10-week Officer Training School.

Secret History

Given my Air Force career I came thinking that sharing the Secret History of Silicon Valley talk with 1000 soon to be Air Force Officers would be the highpoint of the visit. And it was as much fun as I expected – a full auditorium – a standing ovation, great feedback and a trophy – but two other things, completely unexpected, made the visit even more interesting.

First, I got to meet the faculty in both electrical/computer engineering and management and share what I’ve learned about Lean and the Lean LaunchPad class. In their senior year all Air Force cadets on the electrical engineering track have a two-semester “Capstone” class project. They specify, design and build a project that may be of use. Unfortunately the class operates much like the military acquisition system: the project specification has minimal input from real world users, the product gets built with a waterfall engineering process, and there’s no input on whether the product actually meets real world needs until the product is delivered. This means students spend a ton of time and effort to deliver a “final” product release but it’s almost certain that it wouldn’t meet real world users’ needs without extensive rework and modification.

I was surprised how interested the faculty was in exploring whether the Capstone class could be modified to use the Customer Development process to get input from potential “customers” inside the Air Force. And how the engineering process could be turned Agile. with the product built incrementally and iteratively, as students acquire more customer feedback. Success in the Capstone project would not only be measured on the technical basis of “did it work?” but also on how much they learned about the users and their needs. I invited the faculty to attend the Lean LaunchPad educators’ course to learn how we teach the class.

We’ll see if I made a dent.

Table for 4000

In between faculty meetings I got a great tour of the Academy facilities and some of the classes. As on any college campus there are dorms, great sports facilities (sports is not optional), classrooms, etc. The curriculum was definitely oriented to practical science and service. However not on too many other college campuses will you find dorms arranged in squadrons of 40 of 100 students each, where students have to make their beds and have full-time hall monitors, and simultaneously eat lunch with 4,000 other cadets in one dining room (an experience I got to participate in from the guest tower overlooking the dining hall.) All the hierarchal rituals were on display; freshman have to run on the main quad walking on narrow strips, carry their backpacks in their hands, daily room inspections, etc.

And I saw things that made this uniquely an Air Force college – they had their own airfield, flying clubs, the Aero Lab with three wind tunnels, heavy emphasis on , etc. (And it was fun to play “what aircraft is that” with those on static display around the grounds.) But the second surprise for me was the one that made me feel very, very old – it was the Academy’s Cyber Warfare curriculum.

Cyber Warfare

I visited the Cyber 256 class and got a look at the syllabus. Imagine going to college not only to learn how to hack computers but also actually majoring in it. The class consisted of basic networking and administration, network mapping, remote exploits, denial of service, web vulnerabilities, social engineering, password vulnerabilities, wireless network exploitation, persistence, digital media analysis, and cyber mission operations. In addition to the class in Cyber Warfare, there was also a cadet Cyber Warfare Club and an annual National Security Agency Cyber Warfare competition. The Air Force competes with other military branches and National Guard units; the instructor proudly told me that the Air Force has won for the last two years. I only wish I had taken a picture of the huge trophy in the back of the classroom.

We do what?

On the plane ride home I had time to process what I saw.

When I was in the military the battle was just ending between the National Security Agency (NSA) and the military branches over who owned signals and communications intelligence. Was it the military (Air Force, Navy) or was it our intelligence agencies? In the end the NSA became the primary owner, the NRO (National Reconnaissance Office) owned and built the spacecraft that collected the intelligence and the military branches had organizations (Air Force Security Services, Army Security Agency or Naval Security Group) that manned the collection platforms (airplanes, listening posts, etc) which all fed back into the National Security Agency.

Cyber Warfare has been through the same battles. While each of the military branches have Cyber Warfare organizations reporting into a unified military Cyber Command, the head of the National Security Agency is its director, making the NSA the agency that owns Cyber Warfare for the U.S. Cyber Warfare has three components:

1) Computer Network Attack (CNA) – shut down an enemies ability to command and control its weapon systems in a war (i.e. Chinese satellite and over the horizon radar systems targeting U.S. carriers) or prevent potential adversaries from creating weapons of mass destruction, (i.e. Stuxnet targeted at the Iranian nuclear weapons program),

2) Computer Network Defense (CND) – stop potential adversaries from doing the same to you.

3) Computer Network Espionage (CNE) – steal everything you can get your hands (China and RSA’s SecureID breach, hacks of Google and AWS.)

While the U.S. complains about the Chinese military hackers from the PLA’s GSD 3rd Department (the equivalent of our National Security Agency,) and their 2nd Bureau, Unit 61398 tasked euphemistically for “Computer Network Operations,” we’ve done the same.

Unfortunately, potential adversaries have much softer targets in the U.S. While the military is hardening its command and control systems, civilian computer systems are relatively unprotected. Financial institutions have successfully lobbied against the U.S. government forcing them to take responsibility in protecting your data/money. Given our economy is just bits, the outcome of a successful attack will not be pretty.

Summary

Thanks to the Air Force Academy, it’s faculty, cadets and Captain Todd Branchflower for a great visit

The Lean LaunchPad class may find a place in the military

We should be glad that the military is taking Cyber Warfare seriously, you should wish your bank did the same

Filed under: Air Force, Customer Development, Lean LaunchPad

April 16, 2013

When Hell Froze Over – in the Harvard Business Review

“I refuse to join any club that would have me as a member.”

Groucho Marx

In my 21 years as an entrepreneur, I would come up for air once a month to religiously read the Harvard Business Review. It was not only my secret weapon in thinking about new startup strategies, it also gave me a view of the management issues my customers were dealing with. Through HBR I discovered the work of Peter Drucker and first read about management by objective. I learned about Michael Porters’s five forces. But the eye opener for me was reading Clayton Christensen HBR article on disruption in the mid 1990’s and then reading the Innovators Dilemma. Each of these authors (along with others too numerous to mention) profoundly changed my view of management and strategy. All of this in one magazine, with no hype, just a continual stream of great ideas.

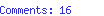

For decades this revered business magazine described management techniques that were developed in and were for large corporations – offering more efficient and creative ways to execute existing business models. As much as I loved the magazine, there was little in it for startups (or new divisions in established companies) searching for a business model. (The articles about innovation and entrepreneurship, while insightful felt like they were variants of the existing processes and techniques developed for running existing businesses.) There was nothing suggesting that startups and new ventures needed their own tools and techniques, different from those written about in HBR or taught in business schools.

To fill this gap I wrote The Four Steps to the Epiphany, a book about the Customer Development process and how it changes the way startups are built. The Four Steps drew the distinction that “startups are not smaller versions of large companies.” It defined a startup as a “temporary organization designed to search for a repeatable and scalable business model.” Today its concepts of “minimum viable product,” “iterate and pivot”, “get out of the building,” and “no business plan survives first contact with customers,” have become part of the entrepreneurial lexicon. My new book, The Startup Owners Manual, outlined the steps of building a startup or new division inside a company in far greater detail.

In the last decade it’s become clear that companies are facing continuous disruption from globalization, technology shifts, rapidly changing consumer tastes, etc. Business-as-usual management techniques focused on efficiency and execution are no longer a credible response. The techniques invented in what has become the Lean Startup movement are now more than ever applicable to reinventing the modern corporation. Large companies like GE, Intuit, Merck, Panasonic, and Qualcomm are leading the charge to adopt the lean approach to drive corporate innovation. And the National Science Foundation and ARPA-E adopted it to accelerate commercialization of new science.

In the last decade it’s become clear that companies are facing continuous disruption from globalization, technology shifts, rapidly changing consumer tastes, etc. Business-as-usual management techniques focused on efficiency and execution are no longer a credible response. The techniques invented in what has become the Lean Startup movement are now more than ever applicable to reinventing the modern corporation. Large companies like GE, Intuit, Merck, Panasonic, and Qualcomm are leading the charge to adopt the lean approach to drive corporate innovation. And the National Science Foundation and ARPA-E adopted it to accelerate commercialization of new science.

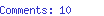

Today, we’ve come full circle as Lean goes mainstream. 250,0000 copies of the May issue of Harvard Business Review go in the mail to corporate and startup executives and investors worldwide. In this month’s issue, I was honored to write the cover story article, “Why the Lean Startup Changes Everything.” The article describes Lean as the search for a repeatable and scalable business model – and business model design, customer development and agile engineering – as the way you implement it.

I’m proud to be called the “father” of the Lean Startup Movement. But I hope at least two—if not fifty—other catalysts of the movement are every bit as proud today. Eric Ries, who took my first Customer Development class at Berkeley, had the insight that Customer Development should be paired with Agile Development. He called the combination “The Lean Startup” and wrote a great book with that name.

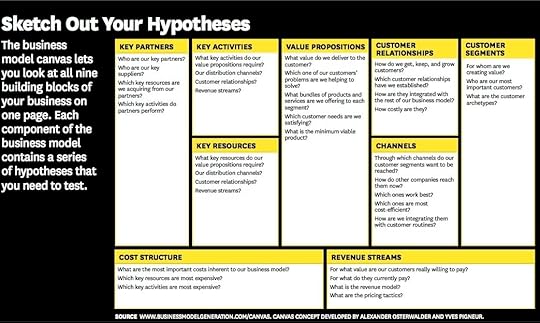

Alexander Osterwalder‘s inspired approach to defining the business model in his book Business Model Generation provide a framework for the Customer Development and the search for facts behind the hypotheses that make up a new venture. Osterwalder’s business model canvas is the starting point for Customer Development, and the “scorecard” that monitors startups’ progress as they turn their hypotheses about what customers want into actionable facts—all before a startup or new division has spent all or most of its capital.

Alexander Osterwalder‘s inspired approach to defining the business model in his book Business Model Generation provide a framework for the Customer Development and the search for facts behind the hypotheses that make up a new venture. Osterwalder’s business model canvas is the starting point for Customer Development, and the “scorecard” that monitors startups’ progress as they turn their hypotheses about what customers want into actionable facts—all before a startup or new division has spent all or most of its capital.

For the next month, The Harvard Business Review is providing free access to the cover story article, “Why the Lean Startup Changes Everything. Go read it.

Then go do it.

Filed under: Big Companies versus Startups: Durant versus Sloan, Business Model versus Business Plan, Customer Development, Customer Development Manifesto, Lean LaunchPad, Teaching, Venture Capital

April 14, 2013

China Startups – The Gold Rush and Fire Extinguishers (Part 5 of 5)

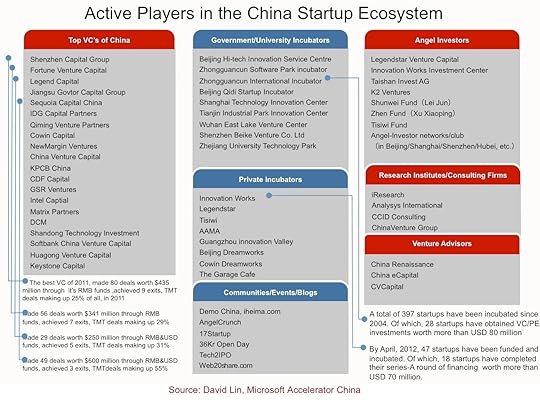

I just spent a few weeks in Japan and China on a book tour for the Japanese and Chinese versions of the Startup Owners Manual. In these series of 5 posts, I thought I’d share what I learned in China. All the usual caveats apply. I was only in China for a week so this a cursory view. Thanks to Kai-Fu Lee of Innovation Works, David Lin of Microsoft Accelerator, Kevin Dewalt and Frank Hawke of the Stanford Center in Beijing, and my publisher China Machine Press.

The previous post, part 4, was about Beijing’s entrepreneurial ecosystem these are my final observations.

Land Rush

For the last 10 years China essentially closed its search, media and social network software market to foreign companies with the result that Google, Facebook, Twitter, YouTube, Dropbox, and 30,000 other websites were not accessible from China. This left an open playing field for Chinese software startups as they “copy to China” existing U.S. business models. Of course “copy” is too strong a word. Adapt, adopt and extend is probably a better description. But for the last decade “innovation” in Chinese software meant something different than it did in Silicon Valley.

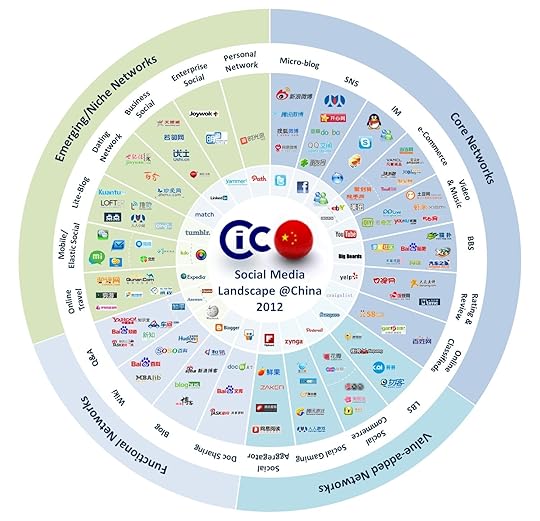

The Chinese Social Media Landscape diagram below from Resonance does a great job of illustrating the players in the Chinese market. (Note that the inner ring shows their global equivalents.)

The downside is that with so much venture and angel capital available, investors have been willing to fund the 10th Groupon clone. For the last few years, there really hasn’t been a demand to innovate on top of the ecosystem that’s been built.

New Rules for China

Not only is the Chinese ecosystem completely different but also the consumer demographics and user expectations are equally unique. 70% of Chinese Internet users are under 30. Instead of email, they’ve grown up with QQ instant messages. They’re used to using the web and increasingly the mobile web for everything, commerce, communication, games, etc. (They also probably haven’t seen a phone that isn’t mobile.) By the end of 2012, there were 85 million iOS and 160 million Android devices in China. And they were increasing at an aggregate 33 million IOS and Android activations per month.

It was interesting to learn about China’s digital divide – the gap between East China and Midwest China, and between urban and rural areas. Internet penetration in Beijing is greater than 70% while it’s less than 25% in Yunnan, Jiangxi, Guizhou and other provinces. While there are 564 million web users with 420 million having mobile web access, 74% of Chinese Internet users make less than $500/month and are students, blue-collar workers or jobless.

Unlike U.S. websites that are sparse and slick, Chinese users currently expect complicated, crowded and busy web pages. However, there’s a growing belief that the “design preferences” of Chinese consumers are just bad design. TenCents WeChat, (designed for an international market) is the first incredibly popular app in China to dramatically raise the bar for what a good user interface and user experience looks and feels like. WeChat may change the game for Chinese U/I and U/X experience. The one caveat about online commerce is that while Chinese users will buy physical goods online (Taobao is huge), they seem to hate to pay for music or software, and the model for games seems to be moving to free play with in-app-purchases for accessories and powers. An interesting consequence of the rigid censoring and control of mainstream media is that blogging – reading and writing – is much higher than U.S.

My guess is the current wave of “copy to China” will burn itself out in the next few years as the smart money starts to move to “innovate in China” (i.e. like WeChat.)

Competition

If you’re a software startup competing in China, the words that come to mind are “ruthless and relentless.” The not so polite ones I’ve heard from others are “vicious, unethical and illegal.” Intellectual property protection is great on paper and “limited” in practice. The large players like Alibaba, Baidu and Tencent historically would be more likely to simply copy a startup’s features than to hire their talent. The large companies strategy seems to be to cover every possible market niche by copying successful models from others.

The slide below from the Zhen Fund shows the breadth of business coverage of each of the Chinese Internet incumbents. Each column represents a company (QQ, Sina, Baidu, Netease, Sohu etc.) and the rows indicates their offerings in open platform, group buying, online games, microblogging, Instant Messaging, BBS, Q&A and E-commerce.

Small startups act the same way, simply cloning each other’s products. Sharing and cooperation is not yet part of the ethos. I can’t imagine a U.S. company setting up some subsidiary here and expecting them to compete while they were following U.S. rules. In some ways, the best description of the market dynamics would be “imagine you were competing with 100 companies who are as rapacious as Microsoft was in the 1980’s and 1990’s.” Eventually, China’s innovation-driven economy needs intellectual property rights and anti-trust laws that are enforced.

Sea Turtles and VPN – the connections to the rest of the world

Entrepreneurs in Beijing were knowledgeable about Silicon Valley, entrepreneurship and the state of software and tools available for two reasons. First, there are continuous stream of “sea turtles”—Chinese who have studied or worked abroad—returning home. (The Chinese government must be laughing hysterically over U.S. immigration policy that’s forcing Chinese grad students out of the U.S.) Many of these returnees have worked in Silicon Valley and startups or went to school at MIT and Stanford. (There is a huge difference between the Chinese who have never left and those who went to school abroad, even for a few months – at least a difference in their ability to relate to me and have a conversation on the same wavelength. It’s clear why families try so hard to send their children abroad. It changes everything for them.)

Second, most websites that a non-Chinese would use are blocked including Facebook, Twitter, Youtube, Google Docs, Scribd, Blogspot, Dropbox, New York Times, etc. Almost every entrepreneur I met was using VPN to circumvent the Great Firewall. When the Chinese government censors (run by their propaganda department) shutdown access to yet another U.S. web site, they create another 100,000 VPN users. And when the government tools to detect encrypted VPN’s get more sophisticated, (as it did last year), Chinese users just use stealthier tools. It’s an amazing cat and mouse system.

(Note to Chinese Communist party – the best name for your propaganda department should probably not be the “Propaganda Department.”)

(Note to Chinese Communist party – the best name for your propaganda department should probably not be the “Propaganda Department.”)

Beijing’s Academic Hub

Right next door to Zhongguancun are China’s top two universities, Peking University and Tsinghua University. Northwest of Beijing is also home to other universities, including technical universities like USTB, BIT, BUPT, and Beihang. Like Silicon Valley, Zhongguancun also has a critical mass of people who are crazy enough to do startups. Equally of interest is a good number of them end up in the PLA’s GSD 3rd Department (the equivalent of our National Security Agency. ) And some of their best and brightest have ended up in the organizations like the 2nd Bureau, Unit 61398 tasked euphemistically for “Computer Network Operations.”

While I didn’t get much time with the academic community, in talking to students, education seems to still be one of China’s bottlenecks – rote lectures, passive learning, follow the process, exam-based performance, etc. And while startups and entrepreneurship courses are now being added to the curriculum, “How to write a business plan” seems to be the state of the art. China’s education system needs to give more attention to fostering students’ innovative thinking, creativity and entrepreneurship.

Entrepreneurial Culture

Fear of Failure

Though they’re familiar with technology in the valley, I picked up some important cultural difference from students and startup engineers I talked to. Even though they’re next to Zhongguancun, the hottest place for startups in China, there seems to be a lower appetite for risk, a lack of interest in equity (instead optimizing for a high salary) and very little loyalty to any one company. The overall culture still has a fear of failure. Most of their parents still tell them to work for the government or a big company.

Talent

I heard from a few investors that as the startup ecosystem is relatively new, there’s a battle for experienced engineering talent and lack of experienced C-level execs. The lack of a previous generation of successful startup CEOs means the current pool of mentors to coach this generation is almost non-existent.

Because salaries are cheap, startups seem to try to solve every problem by throwing bodies at it. Startup teams feel like they are 2-5x the size of American teams. There seems to be little appreciation or interest in multi-skilled people.

Turnover of employees in capital in Beijing is very high. Employees work here for a few months and are suddenly gone. There’s a noticeable lack of tenacity in young, new entrepreneurs. They start a project, and if it isn’t a home run, they’re gone. Perhaps it’s the weather. Silicon Valley has great weather and lifestyle, and nobody wants to leave. Beijing has awful weather and pollution, it’s a temporary place to get rich and then leave.

Management 101

The board/CEO relationship still isn’t clearly understood by either party. I’ve talked to entrepreneurs who view the investors as a “boss.” A good number of startups in Beijing seem driven by the VCs – and not the founders. This might also be a hangover from the command and control system of a state-driven planned economy. Ironically investors told me that the reverse has been true as well. Some startups acted like the VC was a bank. They took the money and then ignored their board. Over time, as investors add more value than writing checks, this relationship will mature.

Creativity

I was surprised that startup teams ask what seems like the kind of questions Americans learn at their first jobs.

Team: ”We keep spending money trying to get people to our web site but they don’t come back. We are almost out of money.”

Me: ”Ok. Why are you still spending money?”

Team: “long…silence…we need people to come to the website.”

On the other hand, for most of them it probably is their first job. And the educational system hasn’t prepared them for executing anything other than a plan. Iterations and pivots are a tough concept if you’ve never been taught to think for yourself. And challenging the system is not something that’s actually encouraged in China.

They also ask questions I just don’t know how to answer. “How do you know how to be creative? What do we have to do to be creative?” ”You Americans just seem to know how to do things even if you’ve never done them – can you show us how to do that?” This seems to be an artifact of the Chinese rote educational system and its current system of government.

Innovation Ecosystem

On the plane ride home I started to think about the similarities and differences between the innovation ecosystems of Silicon Valley and the TMT segment I saw in Beijing. The motivations are the same – profit – driven by entrepreneurs and venture finance. And the infrastructure is close to the same – research universities, predictable economic system, a path to liquidity, a stable legal system and 24/7 utilities. But the differences are worth noting – it’s a young ecosystem, so startup management tools are nearly non-existent. But there’s a difference in the culture of failure and risk taking – the current cultural pressure is to “work for a big company or the government.” Outward facing Universities are just starting to appear, and while there’s a free flow of information inside China, it suffers from the constraints of the Great Firewall.

But there are two striking differences. The first is the lack of creativity. The Beijing software ecosystem I saw has spent the last decade in a protected market copying successful U.S. business models. ”Copying, adopting and adapting,” is not the same as ”competing, innovating and creating” in a global market. Perhaps products like WeChat, designed for an international market, might be the beginning of real innovation.

The second difference in ecosystems – the lack of freedom to dissent – goes deeper to the difference between the two systems. In the U.S. entrepreneurs are encouraged to “Think Different.” Our touchstone for creativity is the Apple ad that said, “Here’s to the crazy ones, the misfits, the rebels, the troublemakers,… the ones who see things differently — they’re not fond of rules… You can quote them, disagree with them, glorify or vilify them, but the only thing you can’t do is ignore them because they change things….” This spirit of rebellion against the status quo got us Steve Jobs. In China the same attitude is likely to get you jail time. Unless you can speak truth to power, you’ll never have an innovation economy.

Conclusion

China is astonishing. The country has risen. Their economy is the envy of the world. The entrepreneurial and “can do” spirit reminds me of what the U.S. was known for. Chinese citizens are proud of their country and believe the world is theirs in the way Americans did in the 1950’s. Their leadership has shown incredible foresight in engineering an amazing economic engine and formidable military. They come so far, and yet…

To take nothing away from what China has accomplished, a visit to Beijing had all the subtle reminders that this version of capitalism has come without democracy or justice; the guards in the Forbidden City armed with fire extinguishers in case more protestors try to set themselves on fire, the security around Tiananmen Square to prevent protestors from gathering, and the “black jails” to keep rural petitioners out of Beijing. And of course the “great firewall,” attempting to keep information about the outside world from reaching inside China.

The bet the government is making is that if they can keep the economy cooking and distract the masses with ever increasing consumer goods and foreign adventures, maybe it can survive.

All of these are signs of a weak China not a strong one. They are the signs of a leadership frightened not by external enemies but by their own people.

It usually doesn’t end well.

Filed under: China, Customer Development, Technology, Venture Capital

April 13, 2013

Zhongguancun in Beijing – China’s Silicon Valley (Part 4 of 5)

I just spent a few weeks in Japan and China on a book tour for the Japanese and Chinese versions of the Startup Owners Manual. In these series of 5 posts, I thought I’d share what I learned in China. All the usual caveats apply. I was only in China for a week so this a cursory view. Thanks to Kai-Fu Lee of Innovation Works, David Lin of Microsoft Accelerator, Frank Hawke of the Stanford Center in Beijing, and my publisher China Machine Press.

The previous post described the evolution of the Chinese Venture Capital system. The next two posts are about what I saw and learned in my short stay exploring Beijing’s entrepreneurial ecosystem.

Entrepreneurship in Beijing

In the few days I was in China I met with several VC’s, angel investors, business press and spoke to hundreds of entrepreneurs. I was blown away by what I saw in Beijing. First, I was amazed by the physical impact of the city itself. This was a modern city in a hurry to make a first impression – think of what Rome looked like in the time of the empire or New York in the 1920’s – now it’s Beijing announcing that China has arrived.

However if you scratch the surface, you can still find a bit of the old Beijing in the hutongs. Drive 50 miles outside the city into the surrounding villages and you see the distance China has to travel to bring the rural areas into the 21st century. In Beijing we hadn’t seen air so badly polluted since we had been in Agra in India in the winter where I swear there was a day you could wave your hand in front of you and see traces of it in the air (and their excuse was they burn dung for heat.)

David Lin and the Microsoft China Accelerator was gracious enough to host two wonderful days of events for me. I trained the Startup Weekend Next Beijing mentors and instructors, presented to several hundred entrepreneurs, and had a great fireside chat with Zhen Fund founding partner Xu Xiaoping in front of another roomful of entrepreneurs.

Kai-fu Lee of Innovation Works was equally generous with his time. We had a fireside chat with a room full of eager entrepreneurs. And he was generous in sharing his insights about the current state of entrepreneurship and investment in China. And through it all Louis Yuan my patient and wonderful publisher from China Machine Press kept me moving through the events.

But what made the overwhelming impression for me was finding an entrepreneurial software cluster on par with the Internet software portion of Silicon Valley. The physical heart of the Beijing startups is in Zhongguancun in the Haidian District, located in the northwest side of Beijing. Startups here are primarily in what they call the TMT (Technology, Media and Telecommunications) segment. Not only does Zhongguancun have Chinese startups, but global technology companies (Nokia, Ericsson, Motorola, Sony Ericsson, Microsoft, IBM, Sun, Oracle, BEA, Alcatel Lucent, Google) all have offices here or elsewhere in Beijing.

If there ever was any question about the value of China’s Torch Program walk around Zhongguancun. It was the first of the 54 Science and Technology Industrial Parks.

China Venture Capital

An entrepreneurial ecosystem is driven one of two ways; either by a crisis (i.e. innovation in the U.S. during World War II,) or during peacetime by profit.

If it’s driven by profit then the ecosystem needs both entrepreneurs as well as Venture Finance.

China now has plenty of both.

China has the biggest Venture Capital industry outside the U.S. To compare the two, in 2011 U.S. venture capitalists invested $26.5 billion in all deals. Out of that total, they funded 967 Internet deals with $6.7 billion.

By comparison, in 2011 Chinese VC’s invested $13 billion in all deals. Out of that total, they funded 268 Internet deals with $3.2 billion. About 1/3 of all China’s Venture Capital investment is made in Beijing and the majority of those investments are in the Technology, Media and Telecommunications (TMT) sector I’ll describe shortly.

As vibrant as the China venture business has been, 2012 was a different story. VC’s pulled back and only invested $3.7 billion in all deals, funding just only 43 deals with $563 million.

Closed for You, Open For Us

First a bit of context in what the VC’s in Beijing are investing in. China has essentially closed its internal search, media and social network software market to foreign companies who wouldn’t play with the government rules on the Great Firewall. (China blocks “objectionable” website content and monitors everyone’s Internet access.)

Google retreated to Hong Kong and Baidu took its place. Facebook was too frightening to Chinese censors, so Renren is the leading social media player. Email? Working professionals/white collar use emails, but most users grew up instant messaging on TenCent’s QQ and most are moving to Weixin/WeChat. Twitter? No, it’s Sina Weibo, and if you want games with your chat – TenCent. Amazon and Ebay? Nope in China it’s Alibaba’s Taobao or 360buy.com. If you’re outside of China, you never hear about these companies or interact with them because they’re geared to serve only Chinese users.

This closed but very large market means that greater than 90% of Chinese software startups focus exclusively on the Chinese market. (The outside of China. Another 10% may try to go global when they’re larger and have the resources for two languages, cultures and regulations. )

This has resulted in a completely different consumer software ecosystem than found elsewhere in the world. Given the closed market to U.S. Internet companies, VC’s in China have guided startups to execute the “copy to China” model. Thinking, if it worked in the U.S., copying a known model is less risky than trying something new and untested. The problem is that this space is getting really crowded – from the bottom up as everyone tries the 200th clone – and from the top down, as the major incumbents try to fill every possible market niche.

The table below maps the type of software in China to their global equivalents in each product category in the Technology, Media and Telecommunications (TMT) sector.

A Huge Market Is Finally Real

For a hundred years the fantasy of global marketers was, “ if only everyone in China would buy one…” That day is final here. The numbers of mobile subscribers are staggering – 1.18 billon, 260 million are 3G. Chinese Internet companies live in a large closed, self-contained ecosystem with 564 million web users with 420 million having mobile web access. 309 million use microblogs and 242 million shop online. (BTW, market research, financial and other statistical information are usually unreliable in China, but even taken with a grain of salt these are staggering numbers.)

The table below from web2asia.com shows the number of users of online social networks as of 2009. Did I mention this is a huge market.

Investment in the Technology, Media and Telecommunications (TMT) sector

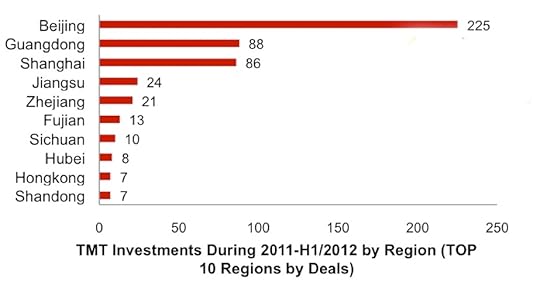

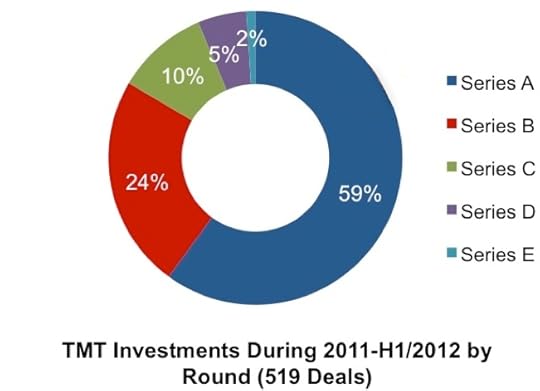

The charts below from David Lin, Microsoft Accelerator detail investments in the Technology, Media and Telecommunications (TMT) sector – almost all of it is centered in Beijing. (Note that these numbers differ from the Zhen Fund data -welcome to statistics in China – but they both provide an overall sense of the market size and direction.)

45% of all Venture Capital Investment in China went into the Technology, Media and Telecommunications (TMT) sector.

The number of deals in Technology, Media and Telecommunications more than doubled in 2011 over the previous five years and slowed back down dramatically in 2012. More than 1,600 VC investments in TMT have been made since 2007, with a record high of 436 in 2011.

Internet investments makes up more than 50% of all the deals in Technology, Media and Telecommunications made since 2011, while, E-commerce investments, in turn, accounts for nearly 50% of the investment deals in Internet. Investments in Mobile Internet makes up roughly 11% of all the deals in Technology, Media and Telecommunications, and have been on the rise since 2011.

Series-A round investments dominates Technology, Media and Telecommunications (TMT) deals, making up 60% of all.

Beijing, Guangdong (including Shenzhen) and Shanghai came out as the most dynamic spots for Technology, Media and Telecommunications (TMT) investments.

Beijing, Guangdong (including Shenzhen) and Shanghai came out as the most dynamic spots for Technology, Media and Telecommunications (TMT) investments.

Beijing Venture/Angel Ecosystem

While Beijing has VC’s and Angel investors happy to write a check there aren’t as many angels/VCs in China versus US per capita. Several VC’s mentioned that there’s a funding gap for seed stage investments. The Angel/Seed network in Beijing feels fragmented and mostly inexperienced (as are a good number of the China VC’s). Kind of reminded me of the drivers in Beijing – they were all driving in a way that made me think they all just got their drivers license – until I remembered that they did. Car sales in China went from 1 million in 2001 to 14 million in 2011.

Other Beijing ecosystem issues I heard about were the things we take for granted: the lack of knowledge sharing (“pay it forward” isn’t part of the culture,) limited mentoring (few experienced mentors,) and a lack of open source education, and no AngelList model. In the U.S. it’s easy to share and browse ideas and deals, but in China there’s a long legacy of guarding knowledge as power, and the justifiable paranoia of someone copying your idea prevents sharing.

Liquidity

Unlike the U.S. there are almost no mergers or acquisitions in this market segment. It’s much easier to just steal their ideas and hire their employees. So big companies rarely acquire startups. Liquidity for most Internet startups happens via IPO’s. 70% of exits in China are via IPO (in the U.S. on NASDAQ or the NYSE or on ChiNext, China’s equivalent of NASDAQ) compared to the 90% of exits in US via mergers or acquisitions. Alibaba (commerce), Tencent (games/chat) and Baidu (search) all have market caps over $40 billion.

The next post, the Gold Rush and Fire Extinguishers – Beijing entrepreneurs, startup culture and some conclusions.

Lessons Learned

China has the biggest Venture Capital industry outside the U.S

For software, the action is in Beijing

China has closed its search, media and social network software market to foreign companies

Beijing’s VC’s primarily invest in the Technology, Media and Telecommunications segment

Liquidity is via IPO’s not buy outs

Filed under: China, Customer Development, Technology, Venture Capital

April 12, 2013

The Rise of Chinese Venture Capital – (Part 3 of 5)

I just spent a few weeks in Japan and China on a book tour for the Japanese and Chinese versions of the Startup Owners Manual. In these series of 5 posts, I thought I’d share what I learned in China. All the usual caveats apply. I was only in China for a week so this a cursory view. Thanks to Kai-Fu Lee of Innovation Works, David Lin of Microsoft Accelerator, Frank Hawke of the Stanford Center in Beijing, and my publisher China Machine Press.

The first post described how China built a science and technology infrastructure to support advanced weapons systems development. The previous post described how the Torch program built China’s innovation clusters. This post is about the rise of Chinese venture capital and how it helped build the countries entrepreneurial ecosystem.

The Rise of Chinese Venture Capital

China’s move away from a state system that solely depended on a command and control economy started in the 1990s. The first wave of startups began when R&D centers and universities began to provide the technology and seed capital for new startups that were spin-outs or spin-offs. This could be a group of individuals leaving a university or research center or an entire department leaving. For example, in the 1990’s 85% of the start-up funds of the new technology companies founded in Beijing came from the research center or university they left.

The second wave of technology investors were Chinese banks, who provided the majority of the later stage investments in the Torch Program. By 1991, 70% of the Torch funded startups were getting bank financing for expansion and later stages of the new ventures, with local governments acting as guarantors. Like the U.S. SBIR and STTR programs, the Torch Program’s funding for new ventures was limited to seed funding the front end. Being designated as a Torch Program startup gave banks comfort to provide loans to these ventures for technology commercialization.

Technology zones with Science and Technology Industrial Parks were the third source of support for new ventures. Inside the zones were Torch Technology Business Incubators with startups licensed by the local governments. These local governments financially supported the startups because, by locating in these zones, the new ventures were seen as contributing to local economic development. This helped the startups qualify for funding from banks and venture capital firms.

By the mid-1990s, Chinese leaders realized that the Torch program couldn’t be the source of all capital for startups. At the same time neither banks nor local governments had the cash to finance startups on the scale the country needed. The problem was that in China the government didn’t recognize venture capital firms as a legitimate organizational type. The founding of domestic VC firms began with the establishment of local government-financed venture capital firms (GVCFs), followed by university-backed VC firms (UVCFs). (The State Science and Technology Commission and the Ministry of Finance formed the China New Technology Venture Investment Corporation in 1986, but it was a government agency supporting national technology venture policy objectives, rather than a profit-oriented private enterprise. It went bankrupt in 1997.)

A few foreign VC firms like IDG Capital Partners entered China in the early 1990s. Gradually, from the mid-1990s, the perception of venture capital shifted from its being a type of government funding to being a commercial activity necessary to support the commercialization of new technology. But it wasn’t until 1998 that corporate-backed VC firms could be established, and that started a wave of VC funds backed by government, corporate and foreign capital.

A great summary diagram below from OECD’s Report on China’s Innovation Policy traces the evolution of China’s Innovation Ecosystem.

Investing in China Today

Fast forward a decade, today the Private Equity and Venture Capital business is booming in China with over 1000 firms actively investing. Most of the early deals were done by offshore venture funds – with their fund registered in countries outside China and using dollars. The latest trends are as Renminbi (“RMB”) funds (the Renminbi is the official currency in China.) In the past foreign funds who wanted to invest in China had to set up funds using dollars with complicated offshore structures with exits through offshore listings. The Renminbi funds have fewer restrictions on what industries the fund can invest in, less regulatory oversight and access to listing a portfolio company in China. There are two types of Renminbi funds: domestic funds and foreign-invested funds. Domestic Renminbi funds are fully owned by Chinese investors, while foreign-invested Renminbi funds may be partially or fully owned by non-Chinese investors. Both types of funds are organized under Chinese law and use Renminbi to invest in Chinese companies.

The other big change was the creation of ChiNext, China’s equivalent of NASDAQ stock exchange for start-ups, in 2009. The market was created to provide startups and their investors liquidity. Over 100 startups were listed on ChiNext the first year of its launch at sky-high valuations (average of 66 times earnings.) About 60% of the startups listed on ChiNext were backed by Renminbi funds, making the investors of these funds one of the main beneficiaries of the exchange.

The next posts Part 4 Zhongguancun in Beijing – China’s Silicon Valley and part 5, the Gold Rush and Fire Extinguishers describe the Beijing entrepreneurship ecosystem.

Lessons Learned

China’s venture capital system has made a remarkable journey from the “state owns everything” to the free market

It’s done it in a series of evolutionary stages, each new one learning from the last

Filed under: China, Customer Development, Technology, Venture Capital

April 11, 2013

China’s Torch Program – the glow that can light the world (Part 2 of 5)

I just spent a few weeks in Japan and China on a book tour for the Japanese and Chinese versions of the Startup Owners Manual. In these series of 5 posts, I thought I’d share what I learned in China. All the usual caveats apply. I was only in China for a week so this a cursory view.Thanks to Kai-Fu Lee of Innovation Works, David Lin of Microsoft Accelerator, Frank Hawke of the Stanford Center in Beijing, and my publisher China Machine Press.

The previous post described how China built its science and technology infrastructure. This post is about the how the Chinese government engineered technology clusters.

–

The Torch Program

In size, scale and commercial results China’s Torch Program from MOST (the Ministry of Science and Technology) is the most successful entrepreneurial program in the world. Of all the Chinese government programs, the Torch Program is the one program that kick-started Chinese high-tech innovation and startups.

In the last decade Torch managed to break free of China’s state central planning bureaucracies. Of all the Chinese innovation programs, Torch is the one that was run like a startup – iterating and pivoting as it learned and discovered. This enabled Torch to evolve with China’s rapidly global economy.

Torch has four major parts: Innovation Clusters, Technology Business Incubators (TBIs), Seed Funding (Innofund) and Venture Guiding Fund.

Innovation Clusters

Industries have a competitive advantage when related companies cluster in a geographical location. Examples are Hollywood for movies, Milan for fashion, New York for finance and today, Silicon Valley for technology entrepreneurship. The early clusters occurred by happenstance of geography or history. But the theory is that you can artificially create a cluster by concentrating resources, finance and competences to a critical threshold, giving the cluster a decisive sustainable competitive advantage over other places. Israel, Singapore and now China are the three countries that have successfully put that theory into practice.

The Torch program created Innovation Clusters by creating national Science and Technology Industrial Parks (STIPs), Software Parks, and Productivity Promotion Centers.

The Torch program created Innovation Clusters by creating national Science and Technology Industrial Parks (STIPs), Software Parks, and Productivity Promotion Centers.

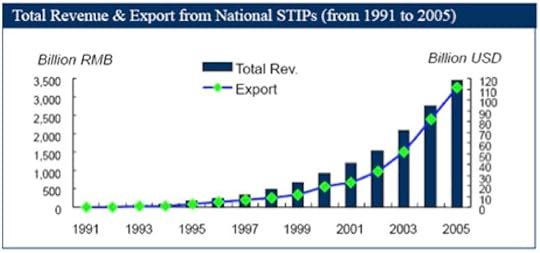

The first Science and Technology Industrial Park was Zhongguancun Science Park in Beijing. It has become China’s Silicon Valley. (This was the area I visited in this trip to China.) In addition to the one in Beijing, China has set up 53 additional industrial parks and in them are ~60,000 companies with 8 million employees. Industry or technology specific versions of these clusters have been set up; for example Donghu in Wuhan – specializing in optoelectronics, Zhangjiang in Shanghai – focusing on integrated circuits and pharmaceuticals, Tianjin – biotech and new energy, Shenzhen – telecommunications and Zhongshan – medical devices and electronics.

The Science and Technology Industrial Parks contributed 7% of China’s GDP and close to 50% of all of China’s R&D spending.

In addition to the 54 Science and Technology Industrial Parks, the Torch program also set up an additional 32 Torch Program Software Parks.

Another key part of China’s cluster strategy was collaboration between research and business, as well as between large enterprises and tech-based small and medium enterprises. It did so by building a national network of a 1,000+ Productivity Promotion Centers. They provide consulting, promotion, product testing, hiring, training and incubation services to startups.

Technology Business Incubators (TBIs)

While the Innovation Clusters designated specific areas of the countries where high tech was to occur, it’s the Technology Business incubators located inside these clusters where the startup companies physically reside. Much like incubators worldwide, they provide startups with office space, free rent, access to university technology transfer, etc.

By 2011, there were a total of 1034 Technology Business Incubators across China, including 336 as National incubators, hosting nearly 60,000 companies. (20% of the National Incubators were privately-run and their percentage is steadily increasing.) In recent years Business Incubators have developed into diverse models. For example, the Ministry of Education and the Ministry of Science and Technology teamed up to put 45 incubators in universities. There are close to 100 specialized incubators for companies founded by returned overseas Chinese scientists and engineers. There are a dozen sector-specific incubators (a Biomedicine Incubator in Shanghai, Advanced Material Incubator in Beijing, a Marine Technology Incubator in Tianjin, etc.) These incubators are mostly clustered in the eastern coastal regions, and disproportionately target TMT (Technology Media and Telecom) and Biotech.

Some of the startups coming out of these incubators have become large international companies including Lenovo, Huawai, Suntech Power, etc.

Seed Funding (Innofund).

The best analog for China’s InnoFund is the U.S. government’s SBIR and STTR programs. Set up in 1999, Innofund offers grants ($150 – $250K), loan interest subsidies and equity investment. Innofund is designed to bridge early stage technology companies that have innovative technology and good market potential but are too early for commercial funding (banks or VCs.) Innofund applicants have to be in high-tech R&D, have less than 500 people, at least 30% of the employees have to be technical and the majority of the company owned by Chinese. The ultimate goal of Innofund is to get the startups far enough along in technology and market validation so other sources of financial capital (banks, VC’s, corporate partners) will invest.

Since its establishment, there’s been over 35,000 applications with 9,000 projects approved and close to a $1 billion allocated.

Most Venture Capitalists in China viewed the Innofund the same way most U.S. VC’s treat the SBIR and STTR programs – they never heard of it, or they think it takes too much time to apply for too little money. And with the same complaints; tedious, relationship driven application process, bureaucratic reporting requirements, and outcomes often measured in quantity and not quality. However, for startups who have gotten an Innofund grant, it does provide the same positive cachet as an SBIR and STTR grant – the government has reviewed your technology and thought it was worthy.

Venture Guiding Fund

In 2007 the Ministries of Science and Finance raised the stakes to get VC’s focused on funneling more VC money into growing startups – they set up a Venture Guiding Fund. The Venture Guiding Fund invests directly into VC funds, co-invests with VC’s, and covers some VC bets. It does this with four programs: 1) A fund of funds, holding < 25% equity in VC firms, requiring only a fixed rate return; 2) the fund will co-invest with other VC firms matching up to 50% of other VC firm’s equity investment or a maximum of $500K; 3) Risk subsidies for VC firms, where the fund will be compensated for the cost and loss of VC firms which have made investments in technology-based startups; and 4) Grants for portfolio reserves, where the fund will provide grants for technology-based startups which are being incubated and coached by VC firms.

Part 3, the next post describes the rise of Chinese venture capital.

Lessons Learned

The Torch Program is the worlds largest “lets engineer entrepreneurial clusters” experiment

Torch has four major parts: Clusters, Business Incubators, Seed Funding, and Funds to support Venture Capital firms

Torch was the rare government program that was run like a startup – iterating and pivoting as it learned and discovered.

Filed under: China, Customer Development, Technology, Venture Capital

April 10, 2013

China – The Sleeper Awakens (Part 1 of 5)

I just spent a few weeks in Japan and China on a book tour for the Japanese  and

and  Chinese versions of the Startup Owners Manual. In these series of 5 posts, I thought I’d share what I learned in China. My post about Japan will follow. All the usual caveats apply. I was only in China for a week so this a cursory view. Thanks to Kai-Fu Lee of Innovation Works, David Lin of Microsoft Accelerator, and my publisher China Machine Press.

Chinese versions of the Startup Owners Manual. In these series of 5 posts, I thought I’d share what I learned in China. My post about Japan will follow. All the usual caveats apply. I was only in China for a week so this a cursory view. Thanks to Kai-Fu Lee of Innovation Works, David Lin of Microsoft Accelerator, and my publisher China Machine Press.

Summary: I’ve lived in Silicon Valley for 35 years, I’ve taught in entrepreneurial clusters in New York, Boston, Helsinki, Santiago Chile, St. Petersburg, Moscow, Prague, and Tokyo, but the visit to the heart of the Beijing startup world Zhongguancun has truly blown me away.

Each of these clusters has wondered how to become the next Silicon Valley. Beijing is already there.

———-

What a long strange trip China has been through. After the creation of the Peoples Republic of China in 1949, all industry was nationalized, agriculture was collectivized, and the private sector was eliminated. All companies were owned by the state, all planning was centralized, and the state determined the allocation of resources. This was the China I grew up with – the one where private enterprise was a crime and marketing wasn’t a profession.

To say China has transformed itself is perhaps the biggest understatement one can make. China has embraced state capitalism in a way Wall Street can only dream about.

Startups, Venture Capital and the Communist Party: how did this happen in China?

The best analogy to describe the relationship of science and technology and the Chinese startup scene is to understand its parallels with the United States during the Cold War with the Soviet Union. During World War II, the U.S. mobilized scientists in a way no other country had. For 45 years – post World War II until the fall of the Soviet Union – the U.S. viewed science and technology as a strategic asset. We made major investments in it, understanding that establishing basic and applied science leadership was necessary for us to build advanced weapons systems to defend our country and deter and if necessary, wage and win a war with the Soviet Union.

These investments took the form of building national research organizations, several for basic science (NSF, NIH) and others for applied weapons research (DOD, DARPA, DOE, etc.) Research universities also became an integral part of the military ecosystem as the federal government pumped billions into supporting science.

Startups, entrepreneurship and commercial applications are happy byproducts of those military investments. For example, as the semiconductor business started, the largest customers for Fairchild’s and Texas Instruments new integrated circuits were the Apollo Guidance Computer and the guidance system for the Minuteman II ICBM.

China is following the same path...

Over the last three decades, to achieve strategic parity with the United States and to construct a modern military, the Chinese have made massive investments in building their science and technology infrastructure. China has gone from a land-based army to one that can support its territorial claims to the South China Sea and Taiwan with anti-access/area-denial weapons. This evolution required a transition, moving from a reliance on the numerical superiority of its land army toward a force boasting sophisticated aircraft and naval platforms, precision- strike weapons, and modern C4SIR (Command, Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance) capabilities. Its Second Artillery Corps not only controls China’s ICBMs, but also its short range missiles pointed at Taiwan, Vietnam, Philippines, and U.S. bases in Guam and Okinawa. And its new terminally guided ICBMs have put U.S. aircraft carriers in harms way in any regional confrontation. Its air force and navy have gone from a self-defense force to one that can project regional power effectively to the first island chain and beyond.

China’s military modernization depends heavily on investments in China’s science and technology infrastructure, reform of its defense industry, and overt and covert procurement of advanced technology and weapons from abroad.

Building China’s Science and Technology infrastructure

Science and startups have come a long way since the 1980’s when the Chinese government owned everything and controlled it through a central planning system. But before startups could happen, China’s basic science, technology and finance infrastructure and ecosystem needed to be built. Here’s how a national policy for science and technology emerged.

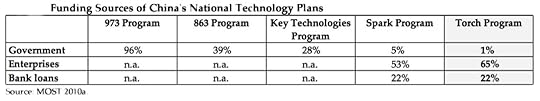

Beginning in the 1982, China started a series of science and technology programs in five areas: support of basic research, high technology R&D, technology innovation and commercialization, construction of scientific research infrastructure, and development of human resources in science and technology.

The majority of the science and technology programs are driven by MOST (Ministry of Science and Technology) and NSFC (National Natural Science Foundation). As we’ll see later, the MOF (Ministry of Finance) also has had a hand in funding new ventures.

The diagram below from OECD’s Report on China’s Innovation Policy puts the ministries involved in science in context. (Note that it does not show the military technology ministries.)

The diagram below from OECD’s Report on China’s Innovation Policy puts the ministries involved in science in context. (Note that it does not show the military technology ministries.)

Basic research: National Natural Science Foundation (equivalent to the U.S. National Science Foundation,) ~$1.75 billion budget. The 973 program (National Basic Research Program) part of the Ministry of Science and Technology.

High technology R&D: 863 Program (State High Technology R&D Program) headed by ex leaders of Chinese strategic weapons programs, and the National Key Technology R&D Program.

Technology innovation and commercialization: National New Product Program, the Spark program for rural innovation, and probably the most important one for startups in China , the Torch Program

Science research infrastructure: National Key Laboratories Program, and the MOST program for the construction of research facilities, R&D databases, and a scientific research network

Development of human resources in science and technology: Programs for attracting returnees or overseas Chinese talent: from the Ministry of Education – the Seed Funds for Returned Overseas Scholars, Chunhui Program, and the Cheung Kong Scholar Program. From the Ministry of Personnel – the Hundred Talents Program. From the National Science Foundation – the National Distinguished Young Scholars Program.

Part two the next post, describes China’s Torch Program, the largest government-run entrepreneurial program in the world.

Lessons Learned

China is working to build basic and applied science and technology leadership

Like the U.S. and the Soviet Union in the Cold War they are using science and technology to build advanced weapons systems

Technology startups are a side effect from these investments

Filed under: China, Customer Development, Technology, Venture Capital

March 2, 2013

The Lean LaunchPad Goes to Middle School

While the Lean LaunchPad class has been adopted by Universities and the National Science Foundation, the question we get is, “Can students in K-12 handle an experiential entrepreneurship class?” Hawken School has now given us an answer.

Hawken is an independent school for grades K-12 in Cleveland, Ohio, committed to the idea that students learn more “by doing than by listening.” Experiential education is threaded in the school’s DNA.

Doris Korda, spent the first 15 years of her career in the high tech industry and is now the Associate Head of School. Natasha Chornesky, who ran a publishing business, is the Director of Entrepreneurial Studies. They both attended our latest Lean LaunchPad Educators Class. These two posts are what they did when they returned.

Part one was about Hawken School’s experience using the Lean LaunchPad curriculum for high school seniors, this post is what happened when they used it for 6th- to 8th-graders.

——

6th to 8th Graders: from Pitch to Prototype

We believed that we could teach entrepreneurship at Hawken to the 6th to the 8th graders, so the week after Christmas Break I taught a 35-hour, one-week course in our Middle School Insights Program. Boys and girls ages 11 -14 pitched ideas on Monday and then worked through the week to pitch their Minimum Viable Products to VCs on Friday — StartUp Weekend style.

Because it is important for kids in North East Ohio to understand what high tech is and why and how a solution may be scalable, students were allowed to pitch any idea that could be solved using a mobile/web solution.

Because it is important for kids in North East Ohio to understand what high tech is and why and how a solution may be scalable, students were allowed to pitch any idea that could be solved using a mobile/web solution.

The Week

Monday students pitched, voted and joined teams. By Tuesday morning, students fleshed out what they believed to be their value proposition and customer segments. We spent a lot of time defining an MVP and steering them away from multiple features for the user. Scrum boards went up detailing everything they needed to accomplish by Friday afternoon. Tuesday afternoon they got out of the building and headed to a local mall to begin the customer validation and development process.

Wednesday morning they tabulated data and brought their original hypotheses to a grinding halt based on what they learned outside the building. With new hypotheses and the help of a local UX Designer from Cleveland’s agile methods experts, LeanDog, the pivots began. Using paper templates, students worked out user experiences and taped them to the wall next to their drawings of customer archetypes. The energy in the room was electrifying.

In addition to regular lunch, the kids consumed 16 boxes of dry cereal, a crate of Clementines and an untold number of juice boxes. On Wednesday and Thursday, splash pages were launched; email addresses captured, cost structures and revenue streams explored. By Thursday noon each team knew, through hypothesis testing and customer interviews, the single feature behind its MVP and they headed out of the building one last time.

Results

Teams conducted 20-40 face-to-face interviews that week. They drew customer archetypes and storyboards, tried emailing, phone scripts and face-to-face conversations. We instituted the “Great Idea Gong” (GIG) that they thwacked every time a teammate wanted to share a “Big Idea” with the rest of the class. We didn’t blog, but kids submitted an exit ticket at the end of each day. They answered Steve’s prompts: “This is what I thought . . . this is what I learned . . . This is what I am doing next . . . This is what I am keeping in mind… “

“I thought everyone at the mall would want to talk to us. I learned that people are in a hurry and busy and they may not care. Next time, I am going to talk to people without my partner so it’s one-to-one. And, I am going to change where I stand,” wrote Max, an 8th-grader.

Students even watched a little Shark Tank, which explains why on Friday, when they pitched local VCs from Cleveland’s business accelerator, JumpStart they declined the celebratory cake and ice cream and spent their last hour of class time grilling the judges not only on what their financial terms were, but about what level of expertise they would bring to the particular team? “If we move forward, we don’t just need a big check, we need someone who is really knowledgeable and experienced in creating partnerships. We don’t know much about that when it comes to clothing brands. Without that help, the money won’t matter,” explained Stephanie, a 7th-grader.

Lessons Learned:

When stuck with “no ideas,” instruct younger students to become detectives and identify the things that bug their friends, family and themselves. Next ask, “What is a possible solution to that problem?”

For each block in the business model canvas, have the students focus on only one or two questions

Reword the questions in age-appropriate language. Asking, “What do we need to do to make our solution a reality?” and “What are the things/people we need to make our solution a reality?” helps students who are stuck completing a business model canvas

Encourage an atmosphere of sharing with everything from food to great ideas

Scrum boards are a huge success for kid teams

Worry less about covering content and more about students developing the skill and willingness to take a risk, fail, makes some changes and try again.

Interrupt work every so often with something physical like dancing to loud music or running around outside. Ask the kids to teach you a new game

Teachers should check their own egos at the door

Summary for the Lean LaunchPad in K-12 Education

We are learning how to use the Lean LaunchPad model to build our entrepreneurial program for high school and middle school students, and will soon use it as the basis for developing an entrepreneurial program for our youngest students as well.

Our educational Goals for Hawken Middle and High School students is to:

Develop and apply an entrepreneurial mindset in all their endeavors (inside and outside of entrepreneurship class):

This is what I thought . . .

This is what I learned . . .

This is what I am doing next . . .

This is what I am keeping in mind . . .

Acquire real-world experience outside the classroom

Identify the key components of high-tech scalable businesses, not common in our geographic region.

Develop project management and team communication skills.

Become better and more empathetic listeners through the customer development process.

Embrace failure as an essential element of success.

Understand the ever-evolving relationships among the 9 BMC blocks.

We are finding the Lean LaunchPad curriculum to be a powerfully relevant and inspiring educational tool for students of all ages.

For additional information and/or resources, contact dkorda@hawken.edu or nchor@hawken.edu

Filed under: Lean LaunchPad, Teaching

February 28, 2013

The Lean LaunchPad Goes to High School

While the Lean LaunchPad class has been adopted by Universities and the National Science Foundation, the question we get is, “Can students in K-12 handle an experiential entrepreneurship class?” Hawken School has now given us an answer.

Hawken is an independent school for grades K-12 in Cleveland, Ohio, committed to the idea that students learn more “by doing than by listening.” Experiential education is threaded in the school’s DNA.

Doris Korda, spent the first 15 years of her career in the high-tech industry and is now the Associate Head of School. Natasha Chornesky, who ran a publishing business, is the Director of Entrepreneurial Studies. They both attended our latest Lean LaunchPad Educators Class. These two posts are what they did when they returned.

Part one is about Hawken School’s experience using the Lean LaunchPad curriculum for high school seniors, part two is what happened when they used it for 6th- to 8th-graders.

——

High School Entrepreneurship: Choosing the Lean LaunchPad over a Mini-MBA Program

Adopting the Lean LaunchPad instead of a “mini MBA program” for Hawken students made good sense pedagogically, (we knew that searching for a viable business model is the core of entrepreneurship,) though it presented some challenges in perception:

None of the neighboring high schools was using the Lean LaunchPad

Most of these schools have entrepreneurship classes focused on students making crafts and selling them

Other schools curricula were steeped in traditional management and economics texts

Having taught grades 6-12, survived two “tours of duty” as a middle school principal, and designed curriculum for grades 3 and up, it was obvious to me that Steve’s Lean LaunchPad provides an accessible framework for young students to search successfully. We started with a few hypotheses, and iterated and pivoted to a successful program.

Hypothesis 1:

High school students will come through the door burning with passion to transform an idea into a business.

Reality: My seniors arrived to class with no ideas and no idea that they needed an idea. They thought they were learning about other people’s ideas in case studies and articles. They didn’t think they’d be doing entrepreneurship.

Practice: We created time in class to share ideas. I framed the search for a viable business model as the focus. We determined as a class that we wouldn’t pass judgment on ideas until we dove into the customer development process. I stressed to the students they would be assessed on their ability to move through the Customer Development process, rather than be graded on an idea’s perceived worth. How quickly can you test hypotheses, learn from the tests, iterate?

Currency in my class became the ability to quickly test hypotheses, iterate and pivot. It would be several months before my seniors, obsessed with college admissions, embraced this methodology, which felt so foreign at the onset.

Still apprehensive about working on their own businesses, I connected them with local entrepreneurs, but with a twist. Following Steve’s Golden Rule that entrepreneurs were not allowed as guest speakers in class, I went out to the community and located entrepreneurs who needed help with their customer discovery process. I worked with the entrepreneurs to craft a deliverable that was both helpful to them and with which my students would be successful. One of the requirements was that my students had to get out of the building and start talking to customers. Students blogged using Steve’s four prompts, below. The more they were out in the field, the stronger their entrepreneurial mindset grew, which was reflected in their posts.

This is what I thought . . .

This is what I learned . . .

This is what I am doing next . . .

This is what I am keeping in mind . . .

Result: By the end of the first semester, the world opened up, questions and opportunities popped up everywhere, even where kids previously had seen failure or disappointment. Students’ entrepreneurial mindsets had permeated the most unlikely places. “I don’t know what is going on in your class, but these kids have changed. Their entire mindset is different and the way they are showing up in the college admissions process is really different—in a great way,” remarked Director of College Admissions, Andrea Hays.

Hypothesis 2:

Hawken’s entrepreneurship class needed to look and feel familiar to students, parents and others in order to be successful.

Reality: A local school that is held as the pinnacle of entrepreneurship education uses Harvard case studies, so I thought we should, too. We were three-quarters of the way through the year and we hadn’t touched one. We didn’t need them.

The customer discovery and development process provides real experience, and real experience trumps case studies. Plus, kids will tell you that the cases are the same old problems and they’ve already been solved. Reading and discussing problems is never as meaningful as experiencing the problem, which can only be achieved by getting out of the building.

Practice: Throughout the entire first semester, I maintained a routine of weekly take-home quizzes. Quiz questions asked students to use their favorite businesses to flush out business models using the Business Model Canvas. While the students aced these quizzes, they quickly forgot the information.

Initially students craved a syllabus, a checklist and the opportunity to easily memorize and regurgitate facts and concepts, and wanted to be told what to do. By second semester, they outgrew these needs. “We’re biased toward action and the action is always changing,” explains senior Peter Labes, adding, “We’ve learned to prioritize based on urgency, which is a lot different than operating off a teacher’s checklist.”

Iteration: I “flipped the classroom” by switched from assigning chapters to read to assigning Steve’s Udacity videos. Understanding, enthusiasm and retention increased. I abandoned the weekly quizzes and instituted weekly “here’s what I learned for customer discovery” presentations from the students , followed with a class Q&A session. The presentations demonstrated their hypotheses tested, results, customer interactions and iterations. I graded the presentations and I graded the verbal feedback students offered one another.

When the quality of the verbal feedback became such that there was too much great information for kids to just remember, I introduced the use of Steve’s live feedback through Google Docs. At first my seniors giggled and snickered and told me I was nuts to put this tool in their hands. We talked about the value of immediate meaningful feedback. They quit giggling. We’re never going back. The quality of feedback and the quality of the presentations has increased exponentially. “I opened up the Google Doc to review the commentary from my classmates about the slide decks. The variety, complexity and creativity of ideas were impressive. Some people touched on concepts that our four-person group hadn’t even thought to consider. There really is strength in numbers,” writes a senior in her blog.

What’s next: Having completed in-depth customer discovery my students will be the first to tell you that “Being an entrepreneur is a TON of work!” Returning from spring break, the entire class will break up into teams and commence their own search for a viable business model for a passion-driven idea. It’s going to be dirty, messy and lots of time outside the building.

Result: “At the beginning of the year, we were scared to commit ourselves,” explains senior Emily Leizman. ”We worked, but not 100%. Now, we’ve worked the customer development process for three companies and we treated them like our own. We’re working at 110% commitment now, so it’s time to do it for ourselves. We’re ready,”

Lessons Learned

The Lean LaunchPad methodology is proven. Go 100% from the start. Don’t phase it in.

Be transparent with your students. Your class is in Startup mode. Embrace failure.

Kids have less to “unlearn” than older students and they are naturally excited by Lean LaunchPad 100% experiential methodology.

Be clear in your mind that the skills acquired through Lean LaunchPad methodology trump content and act accordingly. Act tough, too.

Remind kids that they are being assessed on how quickly they learn from testing their hypotheses and how quickly they iterate and pivot.

Leverage your local entrepreneurship community in meaningful ways, instead of using them as guest speakers.

In the next post, 6-8th graders use the Lean LaunchPad at Hawken School.

Filed under: Lean LaunchPad, Teaching

Steve Blank's Blog

- Steve Blank's profile

- 381 followers