Steve Blank's Blog, page 39

January 20, 2014

Bigger in Bend – Building a Regional Startup Cluster–part 1 of 3

When Customer Development and the Lean Startup were just a sketch on the napkin, Dino Vendetti, a VC at Bay Partners, was one of the first venture capitalists I shared my ideas with.

Dino and I kept in touch as he moved up to Bend, Oregon on a mission to engineer Bend into a regional technology cluster. Over the years we brainstormed about how Lean entrepreneurship would affect regional development.

I visited Bend last year and caught up with his progress.

This post and the two that follow highlight what Dino has learned about the characteristics of the startup and investing landscape in a regional market, and what it takes to intentionally engineer a thriving regional tech cluster.

Part 1: Bend, Oregon Ecosystem and Entrepreneurs

Part 2: Early-stage Regional Venture Funds

Part 3: Engineering a Regional Tech Cluster

Today, with every city, state and country trying to build out a technology cluster, following Dino’s progress can provide others with a roadmap of what’s worked and what has not. Bend, Oregon is an ideal case study because of its size, location and entrepreneurial characteristics.

Here’s Part 1 of Dino’s story…

———

Let’s get right to the point… I fell in love with Bend, Oregon, once a sleepy logging town, now population 79,000. If you like skiing, hiking, biking, rafting, golfing, camping, fishing, picnicking, rock climbing, and startups – you’d like Bend.

Before moving to Bend last year, my career took me from engineering development roles at defense contractors in the 80’s to product management and executive marketing roles in companies like Qualcomm in the 90’s, to the world of venture capital at several firms including Bay Partners, Formative Ventures and Vulcan Ventures.

After several visits skiing here, I had become smitten with the “mojo” of Bend – its superb quality of life, recreational opportunities and proximity to the San Francisco Bay Area. The vibe of Bend is appealing, unique and unpretentious given the number of successful business, tech and professional athlete transplants who call it home. It’s home to a small but growing tech community that has been developing over the past decade, and that’s what piqued my interest.

What’s Different

The differences between the Bend, Oregon region and Silicon Valley are obvious. The sheer density of talent, companies, capital and universities that exist in the Valley are second to none. It truly is the epicenter of the startup world and it’s the regional cluster for innovation and entrepreneurship. Working in the Valley, I took for granted the constant and real time networking opportunities, the volume of deals, and the ability to access nearly every corner of the tech industry – no surprise to anyone who has spent any time in the Valley.

However, what I found in Bend was a deeply entrepreneurial community that is leaps and bounds beyond just a destination resort town. Bend fights way above its weight class and is professional scale for its size. Its ability to do so is tied to the deep entrepreneurial DNA that permeates the region (a very similar characteristic to Silicon Valley), originally out of necessity and now out of strategy.

Job creation in Bend is everyone’s business. People who make the move typically need to start a business to have a job. Bend is the 16th largest metro area in the country for high-tech startup density. Pretty amazing for a town with fewer than 100,000 people.

Startups in Bend

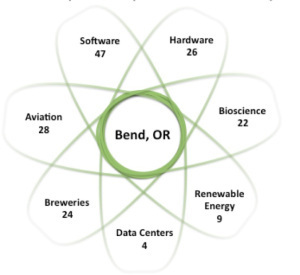

So what types of entrepreneurs and startups exist in Bend? There’s a concentration around several sectors: software, hardware, medical-technology, aviation, and a specialty of Oregon – craft beer brewing. The chart below shows the clustering of startups around these sectors.

Bend Startup Ecosystem

In addition to the four major data centers that include Facebook and Apple, Bend currently boasts 95 startups across multiple technologynsectors: 47 software, 26 hardware/semi and 22 med tech related startups. Nearby Portland Oregon (just 160 miles away) is home to over 300 startups; between the two markets, nearly 80 new startups are forming each year.

Silicon Valley Transplants

In addition to local entrepreneurs building startups, I found something else I wasn’t expecting in Bend: a deep pool of talented Valley transplants who’ve made their way to Bend – either during their careers or after. There are retired Fortune 500 CEOs, senior execs from Valley startups and public companies as well as successful entrepreneurs who exited their companies. These smart, successful transplants have gotten involved with the local business community as mentors, advisors, entrepreneurs, or investors.

But the real surprise was learning that for some Bend is a Silicon Valley bedroom community. A daily direct flight on United can have you in your Bay Area office by 8 a.m. Monday. Every week I meet someone new who just moved to Bend and commutes to work for Google, Facebook, Salesforce, Oracle, Marketo, Workday, and on and on….These people are important and useful in the engineering of a tech cluster; as startup coaches, angel investors and advocates for the community. They communicate and pass on the DNA of how Silicon Valley operates and what level of performance is needed to compete on a global scale.

Entrepreneurs in Bend

Within the Bend tech startup community I found three kinds of startups/entrepreneurs:

Scalable entrepreneurs similar to those you would find in Silicon Valley (although a smaller concentration exists in Bend). These entrepreneurs want to build a big company. They’re typically Silicon Valley transplants who had enough success and experience to know what they were getting themselves into, what it means to raise capital from investors, what it means to scale a company, and how to engineer an exit.

Viable entrepreneurs who think they are building scalable startups but lack either a key element of their business model and/or lack the right team DNA to “go for it..” In this region, these are the majority of new startups I see. They have two limitations, which I help coach to see if they have the capability and desire to become scalable.

They go after a market opportunity that’s too limited to result in a truly scalable business (still might be an M&A candidate, but at the lower end of the range).

Most teams have a reluctance and willingness to “go for it” when they finally do have a scalable business and have validated the key aspects of their business model. This “small business” mindset is a holdover of how capital starved early stage startups are/were in Oregon. Entrepreneurs (and angel investors) prioritize profitability over growth (this is OK for lifestyle startups, but not for scalable startups where capturing market share and thought leadership is vital).

Lifestyle entrepreneurs who are just building a business to make a profit and support their awesome lifestyle (Bend has a lot of these). There is nothing wrong with lifestyle entrepreneurs as they are providing valuable products and services to the local/regional economy, but these do not make for good venture or angel investments under the traditional equity based venture model.

Regional entrepreneurs are at an inherent disadvantage in getting the attention of customers and late stage VCs. Therefore they need to focus on building the most efficiently scalable business model possible. Without focus, it’s difficult to create enough signal to noise ratio to become relevant in their market segment. The good news is that whether you are an investor or accelerator, if your startup is located in an advantageous regional market (defined below) and if you apply lean methodologies, you can improve your on-base and slugging percentage.

The opportunity and challenge in regional markets is to:

Educate the ecosystem about the differences between the three kinds of startups/entrepreneurs

Find, nurture and invest in the truly scalable startups and entrepreneurs, as they will be the ones that have the potential to deliver outsized returns

Fixing the Missing Pieces of Infrastructure

The evolution of very capital efficient business models and Lean Startup methodologies has led to easier paths to funding, launching and growing businesses. With a tech cluster developing in Bend, it was clear that there were four missing pieces in its infrastructure.

I decided to fix each of them.

Bend needed a startup accelerator. While entrepreneurship in Bend was talked about, and everyone read the same blogs, there was no central place founders could get focused and intense coaching and mentorship. So I co-founded the FoundersPad accelerator, a 12-week, Lean Startup program focused on customer development that helps founders develop, refine and grow their business.

Founders Pad

Bend needed its own venture firm. While Silicon Valley and New York are magnets for great startups, our bet is that awesome startups exist in (or can be attracted to) Oregon and Northern California. So I launched Seven Peaks Ventures with a team of investors that includes some of the region’s most active angel investors. We help Oregon-based startups build and scale their businesses by providing highly relevant mentoring and leveraging our deep network in Silicon Valley and beyond.

Bend needs to attract more entrepreneurs. So I launched The Big Bend Theory with Bruce Cleveland. We’ll fly founders and their spouses/significant others along with a team member to Bend to meet local startup executives and community leaders and experience the lifestyle. If they choose to relocate in Bend we’ll offer free temporary office space and help get them funded.

Oregon State University’s new Bend campus didn’t have a Computer Science or User Experience design program. So I helped develop the Computer Science program at Oregon State. (We’re looking for Computer Science professors, so email me if you want to live and teach in Bend!)

Lessons Learned

Bend is a bet on a regional tech cluster

To build a successful regional cluster, look for an eco-system with:

experienced professionals willing to mentor

entrepreneurs with the energy and drive to build businesses

viable startups under development

We are engineering the infrastructure that lacks: accelerator, venture firm, outreach, university and training.

It is critical to understand the types of startups and entrepreneurs in your region and for venture funding

Seek out the truly scalable startups.

Filed under: Customer Development, Lean LaunchPad, Science and Industrial Policy, Venture Capital

January 14, 2014

Do Pivots Matter?

There’s a sign on the wall but she wants to be sure

’

Cause you know sometimes words have two meanings

Led Zeppelin – Stairway to Heaven

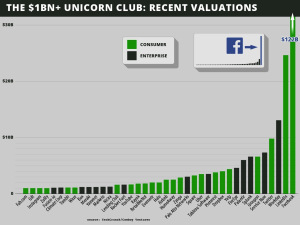

In late 2013 Cowboy Ventures did an analysis of U.S.-based tech companies started in the last 10 years, now valued at $1 billion. They found 39 of these companies. They called them the “Unicorn Club.”

The article summarized 10 key learnings from the Unicorn club. Surprisingly one of the “learnings” said that, “…the “big pivot” after starting with a different initial product is an outlier. Nearly 90 percent of companies are working on their original product vision. The four “pivots” after a different initial product were all in consumer companies (Groupon, Instagram, Pinterest and Fab).”

One of my students sent me the article and asked, “What does this mean?” Good question.

Since the Pivot is one of the core concepts of the Lean Startup I was puzzled. Could I be wrong? Is it possible Pivots really don’t matter if you want to be a Unicorn?

Short answer – almost all the Unicorns pivoted. The authors of the article didn’t understand what a Pivot was.

—

What’s a pivot?

A pivot is a fundamental insight of the Lean Startup. It says on day one, all you have in your new venture is a series of untested hypothesis. Therefore you need to get outside of your building and rapidly test all your assumptions. The odds are that one or more of your hypotheses will be wrong. When you you discovery your error, rather than firing executives and/or creating a crisis, you simply change the hypotheses.

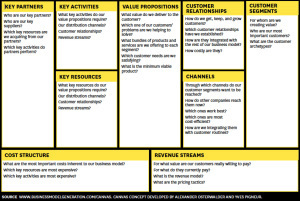

What was lacking in the article was a clear definition of a Pivot. A Pivot is not just changing the product. A pivot can change any of nine different things in your business model. A pivot may mean you changed your customer segment, your channel, revenue model/pricing, resources, activities, costs, partners, customer acquisition – lots of other things than just the product.

Definition: “A pivot is a substantive change to one or more of the 9 business model canvas components.”

Business Model

Ok, but what is a business model?

Think of a business model as a drawing that shows all the flows between the different parts of your company’s strategy. Unlike an organization chart, which is a diagram of how job positions and functions of a company are related, a business model diagrams how a company makes money – without having to go into the complex details of all its strategy, processes, units, rules, hierarchies, workflows, and systems.

Alexander Osterwalder’s Business Model canvas puts all the complicated strategies of your business in one simple diagram. Each of the 9 boxes in the canvas specifies details of your company’s strategy. (The Business Model Canvas is one of the three components of the Lean Startup. See the HBR article here.)

So to answer to my students question, I pointed out that the author of the article had too narrow a definition of what a pivot meant. If you went back and analyzed how many Unicorns pivoted on any of the 9 business model components you’d likely find that the majority did so.

Take a look at the Unicorn club and think about the changes in customer segments, revenue, pricing, channels, all those companies have made since they began: Facebook, LinkedIn – new customer segments, Meraki – new revenue models, new customer segments, Yelp – product pivot, etc. – then you’ll understand the power of the Pivot.

Take a look at the Unicorn club and think about the changes in customer segments, revenue, pricing, channels, all those companies have made since they began: Facebook, LinkedIn – new customer segments, Meraki – new revenue models, new customer segments, Yelp – product pivot, etc. – then you’ll understand the power of the Pivot.

Lessons Learned

A Pivot is not just when you change the product

A pivot is a substantive change to one or more of the 9 business model canvas components

Almost all startups pivot on some part of their business model after founding

Startups focused on just product Pivots will limited their strategic choices – it’s like bringing a knife to a gunfight

Filed under: Business Model versus Business Plan, Customer Development

January 6, 2014

Tesla and Adobe: Why Continuous Deployment May Mean Continuous Customer Disappointment

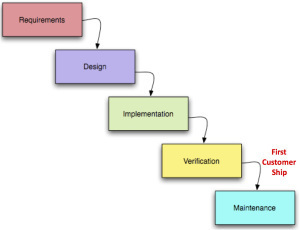

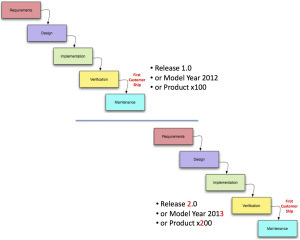

For the last 75 years products (both durable goods and software) were built via Waterfall development. This process forced companies to release and launch products by model years, and market new and “improved” versions.

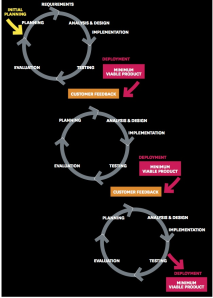

In the last few years Agile and “Continuous Deployment” has replaced Waterfall and transformed how companies big and small build products. Agile is a tremendous advance in reducing time, money and wasted product development effort – and in having products better match customer needs.

But businesses are finding that Continuous Deployment not only changes engineering but has ripple effects on the rest of its business model. And these changes may have unintended consequences leading to customer dissatisfaction and confusion.

Smart companies will figure out how to educate their customers and communicate these changes.

—-

The Old Days – Waterfall Product Development

(skip this part of you’re conversant in Waterfall and Lean.)

In the past both hardware and software were engineered using Waterfall development, a process that moves through new product development one-step-at-a-time.

Marketing delivers a “requirements” document to engineering.

Then engineering develops a functional specification and designs the product.

Next comes the work of actually building the product – implementation.

Then validation ensures the product was built to spec.

After the product ships, it’s maintained by fixing flaws/bugs.

Customers would get their hands on a product only after it had gone through a lengthy cycle that could take years – enterprise software 1-2 years, new microprocessors 2-4 years, automobiles 3-5 years, aircraft a decade.

Waterfall – The Customer View

When customers purchased a product they understood that they were buying this year’s model. When next year’s model arrived, they did not expect that the Ford station wagon or Maytag washer they purchased last year would be updated to match all the features in the new model. (Software at times had an upgrade path, often it required a new purchase.)

Waterfall allowed marketers to sell incremental upgrades to products as new models. First starting in the fashion business, then adopted by General Motors in the 1920’s annual model year changeovers turned into national events. (The same strategy would be embraced 75 years later by Microsoft for Windows and then Apple for the iPhone.)

As the press speculated about new features, companies added to the mystique by guarding the new designs with military secrecy. Consumers counted the days until the new models were “unveiled”.

With its punctuated and delineated release cycles, waterfall development led consumers to understand the limited rights they had to future product upgrades and enhancements (typically none.) In other words, consumer expectations were bounded.

At the same time, manufacturers used new model changeovers to generate excitement over new features/versions convincing consumers to obsolete perfectly functional products and buy new ones.

Agile Development: Continuous Delivery and Deployment

In contrast to Waterfall development, Agile Development delivers incremental and iterative changes on an ongoing basis.

Agile development has upended the familiar consumer expectations and company revenue models designed around the release cycles of Waterfall engineering. In a startup this enables deployment of Minimum Viable products at a rapid pace. For companies already in production, Continuous Deployment can eliminate months or years in between major releases or models. Companies can deliver product improvements via the cloud so that all customers get a better product over time.

While continuous delivery is truly a better development process for engineering, it has profound impacts on a company’s business model and customer expectations.

Continuous Delivery/Deployment – The Marketers View

Cloud based products has offered companies an opportunity to rethink how new business models would work. Adobe and Tesla offer two examples.

Tesla

While most of the literature talks about continuous Delivery/Deployment as a software innovation for web/mobile/cloud apps, Tesla is using it for durable goods – $100,000 cars – in both hardware and software.

First, Tesla’s Model S sedan downloads firmware updates on a regular basis. These software changes go much further than simply changing user interface elements on the dashboard. Instead, they may modify major elements of the car from its suspension to its acceleration and handling characteristics.

Secondly, in a break from traditional automobile practices, rather than waiting a year to roll out annual improvements to its Model S, Tesla has been continuously improving its product each quarter on the assembly line. There are no model years to differentiate a Tesla Model S built in 2012 from one built this year. (The last time this happened in auto manufacturing was the Ford Model T.)

Adobe

Adobe, which for decades sold newer versions of its products – Photoshop, Illustrator, etc. – has now moved all those products to the cloud and labeled them the Adobe Creative Cloud. Instead of paying for new products, customers now buy an annual subscription.

The move to the cloud allowed Adobe to implement continuous delivery and deployment. But more importantly the change from a product sale into a subscription turned their revenue model into a predictable annuity. From an accounting/Wall Street perspective it was a seemingly smart move.

Continuous Delivery/Deployment – The Customer View

But this shift had some surprises for consumers, not all of them good.

As many companies are discovering, incremental improvement doesn’t have the same cachet to a consumer as new and better. While it may seem irrational, inefficient and illogical, the reality is that people like shiny new toys. They want newer things. Often. And they want to be the ones who own them, control them and decide when they want to change them.

Adobe

While creating a predictable revenue stream from high-end users, Adobe has created two problems. First, not all Adobe customers believe that Adobe’s new subscription business model is an improvement for them. If customers stop paying their monthly subscription they don’t just lose access to the Adobe Creative Suite software (Photoshop, Illustrator, etc.) used to create their work, they may lose access to the work they created.

Second, they unintentionally overshot the needs of students, small business and casual users, driving them to “good-enough” replacements like Pixelmator, Acorn, GIMP for PhotoShop and Sketch, iDraw, and ArtBoard for Illustrator.

The consequence of discarding low margin customers and optimizing revenue and margin in the short-term, Adobe risks enabling future competitors. In fact, this revenue model feels awfully close to the strategy of the U.S. integrated steel business when they abandoned their low margin business ot the mini-mills.

Tesla

What could go wrong with making a car incrementally better over time? First, Tesla’s unilateral elimination of features already paid for without consumers consent is a troubling precedent for cloud connected durable goods.

Second, Telsa’s elimination of model years and its aggressive marketing of the benefits of continuous development of hardware and software have set its current customers expectations unreasonably high. Some feel entitled to every new hardware feature rolled into manufacturing, even if the feature (i.e. faster charging, new parking sensors,) was not available when they bought their cars – and even if their car isn’t backwards compatible.

Model years gave consumers an explicit bound of what to expect. This lack of boundaries results in some customer disappointment.

Lessons Learned

Continuous Delivery/Deployment is a major engineering advance

It enables new business models

Customers don’t care about your business model, just it’s effect on them

While irrational, inefficient and illogical, people like shiny new toys

Subscription revenue models versus new purchases require consumer education

If your subscription revenue model “fires” a portion of your customers, it may enable new competitors

Companies need to clearly communicate customer entitlements to future features

Filed under: Customer Development, Marketing, Tesla

January 2, 2014

Lessons Learned in Diagnostics

This post is part of our series on the National Science Foundation I-Corps Lean LaunchPad class in Life Science and Health Care at UCSF. Doctors, researchers and Principal Investigators in this class got out of the lab and hospital talked to 2,355 customers, tested 947 hypotheses and invalidated 423 of them. The class had 1,145 engagements with instructors and mentors. (We kept track of all this data by instrumenting the teams with LaunchPad Central software.)

Part 1: issues in the therapeutics drug discovery pipeline

Part 2: medical devices and digital health

Part 3: described what we’re going to do about it

Part 4: This Will Save us Years – Customer Discovery in Medical Devices

Part 5: Value proposition and customer segments in Life Sciences

Part 6: Distribution channels in Life Sciences

Part 7: Revenue Streams in Life Sciences

Part 8: When Customers Make You Smarter: Customer Discovery in Digital Health

Part 9: We’ve seen the Future of Translational Medicine and it’s Disruptive

Part 10: Lessons Learned in Digital Health

Part 11: Lessons Learned in Medical Devices

Part 12: Lessons Learned in Therapeutics

Mira Medicine is one of the 26 teams in the class. The team members are:

Pierre-Antoine Gourraud – PhD, MPH UCSF neuroscientist and c0-leader of the MS BioScreen project

Jason Crane - PhD UCSF Manager Scientific Software Development

Raphaelle Loren - Managing Director – Health Practice at the Innovation Management Institute

Todd Morrill was the diagnostics cohort instructor. Matt Cooper CEO of Carmenta BioSciences was the Mira Medicine team mentor.

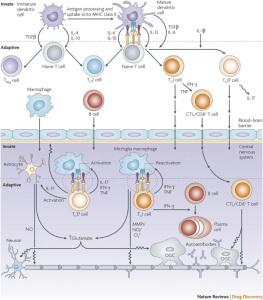

Multiple Sclerosis - MS

Multiple Sclerosis – MS – is an immune system disease that attacks the myelin, the fatty sheath that surrounds and protects nerve fibers of the central nervous system (brain, spinal cord, and optic nerve). T-cells, (a type of white blood cell in the immune system,) become sensitized to myelin and cross the blood-brain barrier into the central nervous system (CNS). Once in the CNS, these T-cells injure myelin, and secrete chemicals that damage nerve fibers (axons) and recruit more damaging immune cells to the site of inflammation.

There are currently ten FDA approved MS medications for use in relapsing forms of MS. None of these drugs is a cure, and no drug is approved to treat the type of MS that shows steady progression at onset. MS disease management decisions are complex and requires a patients neurologist to figure out what drugs to use.

Mira Medicine and Multiple Sclerosis

The team came to class with the thought of commercializing the UCSF Multiple Sclerosis BioScreen Project a

Mira wanted to commercialize the UCSF Multiple Sclerosis Bioscreen project and to add additional neurological diseases which require multiple types of data (including biomarkers, clinical, and imaging). They wanted to help medical centers and large providers assess disease progression to guide therapeutic decision-making. Over the course of the class Mira Medicine team spoke to over 80 customers, partners and payers.

Here’s their 2 minute video summary

If you can’t see the video above, click here.

Then reality hit. First, the team found that their Multiple Sclerosis Bioscreen application (which they used as their MVP) was just a “nice-to-have”, not a “must-have”. In fact, the “must have features” were their future predictive algorithms. Next, they found that if their tool can enable a diagnosis, (even without claiming it could) then it was likely that the FDA would require a 510(k) medical device clearance. Then they found to get reimbursed they need a CPT code (and they had to decide whether to code stack - using multiple codes for “one” diagnosis, and thereby getting multiple reimbursements for one test. (The rules have changed so that code stacking is hard or impossible), Or get a new CPT code, or use miscellaneous code.) To get a new CPT and a 510(k) they would have to perform a some sort of clinical study. At a minimum a 1-year prospective study (a study to see if the neurologists using the application had patients with a better outcome then those who didn’t have access to the app). Getting approval to use an existing (aka old) CPT code means showing equivalence to an existing dx process or test, and the requirements are code-specific. Finally, to get access to data sources of other MS patients they would need to have HIPPA Business Associate Agreement.

Watch their Lessons Learned video below and find out how they pivoted and what happened.

If you can’t see the video above click here

Look at their Lesson Learned slides below If you can’t see the presentation above, click here

Lessons Learned

Researchers and PI’s come in believing “My science/project/data are so good that people will immediately see the value and be willing to pay for it. It will “sell itself”.

A business is much more than just good science: it is about customers seeing value and being willing to pay and proper validation and reimbursement coding and…

A successful business is the sum (and integration!) of all the parts of the business model canvas.

It includes reimbursement, regulation, IP, validation, channel access, etc.

Filed under: Customer Development, Lean LaunchPad, Life Sciences, Teaching

December 26, 2013

Lessons Learned in Therapeutics

This post is part of our series on the National Science Foundation I-Corps Lean LaunchPad class in Life Science and Health Care at UCSF. Doctors, researchers and Principal Investigators in this class got out of the lab and hospital talked to 2,355 customers, tested 947 hypotheses and invalidated 423 of them. The class had 1,145 engagements with instructors and mentors. (We kept track of all this data by instrumenting the teams with LaunchPad Central software.)

Part 1: issues in the therapeutics drug discovery pipeline

Part 2: medical devices and digital health

Part 3: described what we’re going to do about it

Part 4: This Will Save us Years – Customer Discovery in Medical Devices

Part 5: Value proposition and customer segments in Life Sciences

Part 6: Distribution channels in Life Sciences

Part 7: Revenue Streams in Life Sciences

Part 8: When Customers Make You Smarter: Customer Discovery in Digital Health

Part 9: We’ve seen the Future of Translational Medicine and it’s Disruptive

Part 10: Lessons Learned in Digital Health

Part 11: Lessons Learned in Medical Devices

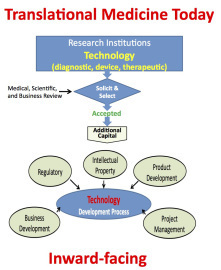

We are redefining how translational medicine is practiced.

We’ve learned that translational medicine is not just about the science.

We’ve learned that translational medicine is not just about the science.

More on this in future blog posts.

Vitruvian Therapeutics is one of the 26 teams in the class. The team members are:

Dr. Hobart Harris Chief of General Surgery, Vice-Chair of the Department of Surgery, and a Professor of Surgery at UCSF.

Dr. David Young, Professor of Plastic Surgery at UCSF. His area of expertise includes wound healing, microsurgery, and reconstruction after burns and trauma.

Cindy Chang is a Enzymologist investigating novel enzymes involved in biofuel and chemical synthesis in microbes at LS9

Karl Handelsman was the therapeutics cohort instructor. Julie Cherrington CEO of Pathway Therapeutics was the team mentor.

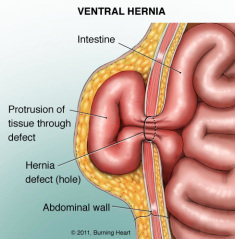

Vitruvian Therapeutics is trying to solve the Incisional hernia problem. An incisional hernia happens in open abdominal surgery when the area of the wound doesnt heal properly and bulges outward. This requires a second operation to fix the hernia.

Hobart Harris’s insight was what was needed wasn’t one more new surgical technique or device to repair the hernias, but something to prevent the hernia from occurring in the first place. Vitruvian Therapeutics first product, MyoSeal, does just that. It promotes wound repair via biocompatible microparticles plus a fibrin tissue sealant. So far in 300 rats it’s been shown to prevent incisional hernias through enhanced wound healing.

Here’s their 2 minute video summary

If you can’t see the video above, click here.

Two weeks into the class and interviews with 14 of their potential customers (surgeons) reality intruded on their vision of how the world should work. We happened to catch that moment in class in this 90 second clip.

Watch and find out how talking to just the first 14 customers in the Lean LaunchPad class saved Hobart Harris and the Vitruvian Therapeutics team years.

If you can’t see the clip above click here.

The Vitruvian Therapeutics Lessons Learned Presentation is a real-eyeopener. Given that this product could solve the incisional hernia problem, Hobart and his team naturally assumed that insurance companies would embrace this and their fellow surgeons viewed the problem as they did and would leap at using the product. Boy were they in for a surprise. After talking to 74 surgeons, insurance companies and partners appeared that no one – insurance companies or surgeons – owned the problem. Listen to their conclusions 8-weeks after the first video.

Watch the video and find out how they pivoted and what happened.

Don’t miss Karl Handelsman comments on their Investment Readiness Level at the end. Vitruvian is a good example of a great early stage therapeutics idea with animal data missing and many key components of the business model still needed to verify.

If you can’t see the video above click here

Look at their Lesson Learned slides below

If you can’t see the presentation above, click here

Market Type

During the class the Vitruvian Therapeutics class struggled with the classic question of visionaries: are we creating a New Market (one which doesn’t exist and has no customers)? In Vitruvian’s case preventive measures to stop incisional hernias before they happen. Or should we position our product as one that’s Resegmenting an Existing Market? i.e. reducing leakage rates. Or is there a way to get proof that the vision of the New Market is the correct path.

When Hobart Harris of Viturvian asked, “… what if you’re a visionary, and no one but you sees the right solution to a problem” we had a great in-class dialog. Karl Handelsman‘s comments at 3:15 and 4:16 and Allan May at 4:35 were incredibly valuable. See the video below for the dialog.

If you can’t see the video above, click here

Further Reading

Fibrinogen and fibrin based micro and nano scaffolds incorporated with drugs, proteins, cells and genes for therapeutic biomedical applications

Enhancement of incisional wound healing by thrombin conjugated iron oxide nanoparticles

Microparticles and their use in wound therapy

Lessons Learned

Principal Investigators, scientists and engineers can’t figure out commercialization sitting in their labs

You can’t outsource commercialization to a proxy (consultants, market researchers, etc.)

Experiential Learning is integral to commercialization

You may be the smartest person in your lab, but your are not smarter than the collective intelligence of your potential customers, partners, payers and regulators

Filed under: Customer Development, Lean LaunchPad, Life Sciences, Teaching

December 21, 2013

Moneyball and the Investment Readiness Level-video

Eric Ries was kind enough to invite me to speak at his Lean Startup Conference.

In the talk I reviewed the basic components of the Lean Startup and described how we teach it. I observed that now that we’ve built software to instrument and monitor the progress of new ventures (using LaunchPad Central), that we are entering the world of evidence-based entrepreneurship and the Investment Readiness Level.

This video is a companion to the blog post here. Read it for context.

If you can’t see the video above, click here

1:25 What is Evidence-based Entrepreneurship?

2:00 Startups are Not Smaller Versions of Large Companies

3:29: What’s a Startup?

3:36 The 3 Components of the Lean Startup

6:00 Teaching startups & companies Lean: The Lean LaunchPad class

11:00 Teaching Educators Lean: The Lean LaunchPad Educators class

11:31 Instrumenting Startups: Via Launchpad Central Software

15:22 NASA and Technology Readiness Level (TRL)

17:20 The Investment Readiness Level (IRL) for new ventures

19:30 The Oakland A’s and Moneyball

22:08 One More Thing – Lean LaunchPad for Life Sciences

You can follow the talk along using the slides below

If you can’t see the slides above, click here

Additional videos here

Startup Tools here

Filed under: Customer Development, Lean LaunchPad, Teaching, Venture Capital

December 20, 2013

Lessons Learned in Medical Devices

This post is part of our series on the National Science Foundation I-Corps Lean LaunchPad class in Life Science and Health Care at UCSF. Doctors, researchers and Principal Investigators in this class got out of the lab and hospital talked to 2,355 customers, tested 947 hypotheses and invalidated 423 of them. The class had 1,145 engagements with instructors and mentors. (We kept track of all this data by instrumenting the teams with LaunchPad Central software.)

We are redefining how translational medicine is practiced. It’s Lean, it’s fast, it works and it’s unlike anything else ever done.

Part 1: issues in the therapeutics drug discovery pipeline

Part 2: medical devices and digital health

Part 3: described what we’re going to do about it.

Part 4: This Will Save us Years – Customer Discovery in Medical Devices

Part 5: Value proposition and customer segments in Life Sciences

Part 6: Distribution channels in Life Sciences

Part 7: Revenue Streams in Life Sciences

Part 8: When Customers Make You Smarter –Customer Discovery in Digital Health

Part 9: We’ve seen the Future of Translational Medicine and it’s Disruptive

Part 10: Lessons Learned in Digital Health

—–

Sometimes teams win when they fail.

Knox Medical Devices was building a Spacer which contained a remote monitoring device to allow for intervention for children with Asthma . (A Spacer is a tube between a container of Asthma medicine (in an inhaler) and a patient’s mouth.The tube turns the Asthma medicine into an aerosol.)

Knox’s spacer had sensors for basic spirometry measurements (the amount of air and how fast it’s inhaled and exhaled) to see how well the lung is working. It also had a Nitrous Oxide sensor to provide data on whether the lungs airways are inflamed, an inhaler attachment and a GPS tracking device.

The Spacer hardware was paired with data analysis software for tracking multiple facets of asthma patients.

The Spacer hardware was paired with data analysis software for tracking multiple facets of asthma patients.

The Knox team members are:

Noel Jee, PhD in Chemical Biology at UCSF

Jingwei Zhang, PhD in BioEngineering at UCSF

Charvi Shetty, MS in BioEngineering, Genentech

Basil Ayish, MBA, Business Development

Clare Pak, Business Development

Allan May founder of Life Science Angels was the Medical Device cohort instructor. Alex DiNello CEO at Relievant Medsystems was their mentor.

The Knox team was a great mix of hands-on device engineers and business development. They used agile engineering perfectly to continually test variants of their Minimum Viable Product (MVP’s) in front of customers often and early to get immediate feedback.

Knox was relentless about understanding whether their device was a business or whether it was technology in search of a market. In 10 weeks they had face-to-face meetings with 117 customers, tested 33 hypotheses, invalidated 19 of them and 53 instructor and mentor interactions.

Here’s Knox Medical’s 2 minute video summary

If you can’t see the video above, click here

Knox was a great example of having a technology in search of a customer. The initial hypothesis of who would pay for the device – parents of children with asthma – was wrong and resulted in Knox’s first pivot in week 4. By week 6 they had discovered that; 1) Peak Flow Meters are not as heavily prescribed as they thought, 2) Insurance company reimbursement is necessary for anything upwards of $15, 3) Nitrous Oxide testing isn’t currently used to measure asthma conditions.

After the pivot they the found that the most likely users of their device would be low income Asthma patients who are treated at Asthma clinics funded by federal, state or county dollars. These clinics reduce hospitalization but Insurers weren’t paying to cover clinic costs nor would they cover the use of the Knox device. The irony was that those who most needed the Knox device were those who could least afford it and wouldn’t be able get it.

Watch their Lesson Learned presentation below. Listen to the comments from Allan May the Device instructor at the end.

If you can’t see the video above, click here

In the end Knox, like a lot of startups in Life Science and Health Care, discovered that they had a multi-sided market. They realized late in the class the patients (and their families) were not their payers - their payers were the insurance companies (and the patients were the users.) If they didn’t have a compelling value proposition for the insurers (cost savings, increased revenue, etc.) it didn’t matter how great the technology was or how much the patients would benefit.

The Knox Medical Device presentation slides are below. Don’t miss the evolution of their business model canvas in the appendix. It’s a film strip of the entrepreneurial process in action.

If you can’t see the slides above, click here

Knox is a great example of how the Lean LaunchPad allows teams to continually test hypotheses and fail fast and inexpensively. They learned a ton. And saved millions.

Lessons Learned

In medical devices, understanding reimbursement, regulation and IP is critical

Sometimes teams win when they fail

Listen to the blog post here

Download: steveblank_clearshore_131220.mp3

Download the podcast here

Filed under: Customer Development, Lean LaunchPad, Life Sciences, Teaching

Lesson Learned in Medical Devices

This post is part of our series on the National Science Foundation I-Corps Lean LaunchPad class in Life Science and Health Care at UCSF. Doctors, researchers and Principal Investigators in this class got out of the lab and hospital talked to 2,355 customers, tested 947 hypotheses and invalidated 423 of them. The class had 1,145 engagements with instructors and mentors. (We kept track of all this data by instrumenting the teams with LaunchPad Central software.)

We are redefining how translational medicine is practiced. It’s Lean, it’s fast, it works and it’s unlike anything else ever done.

Part 1: issues in the therapeutics drug discovery pipeline

Part 2: medical devices and digital health

Part 3: described what we’re going to do about it.

Part 4: This Will Save us Years – Customer Discovery in Medical Devices

Part 5: Value proposition and customer segments in Life Sciences

Part 6: Distribution channels in Life Sciences

Part 7: Revenue Streams in Life Sciences

Part 8: When Customers Make You Smarter –Customer Discovery in Digital Health

Part 9: We’ve seen the Future of Translational Medicine and it’s Disruptive

Part 10: Lessons Learned in Digital Health

—–

Sometimes teams win when they fail.

Knox Medical Devices was building a Spacer which contained a remote monitoring device to allow for intervention for children with Asthma . (A Spacer is a tube between a container of Asthma medicine (in an inhaler) and a patient’s mouth.The tube turns the Asthma medicine into an aerosol.)

Knox’s spacer had sensors for basic spirometry measurements (the amount of air and how fast it’s inhaled and exhaled) to see how well the lung is working. It also had a Nitrous Oxide sensor to provide data on whether the lungs airways are inflamed, an inhaler attachment and a GPS tracking device.

The Spacer hardware was paired with data analysis software for tracking multiple facets of asthma patients.

The Spacer hardware was paired with data analysis software for tracking multiple facets of asthma patients.

The Knox team members are:

Noel Jee, PhD in Chemical Biology at UCSF

Jingwei Zhang, PhD in BioEngineering at UCSF

Charvi Shetty, MS in BioEngineering, Genentech

Basil Ayish, MBA, Business Development

Clare Pak, Business Development

Allan May founder of Life Science Angels was the Medical Device cohort instructor. Alex DiNello CEO at Relievant Medsystems was their mentor.

The Knox team was a great mix of hands-on device engineers and business development. They used agile engineering perfectly to continually test variants of their Minimum Viable Product (MVP’s) in front of customers often and early to get immediate feedback.

Knox was relentless about understanding whether their device was a business or whether it was technology in search of a market. In 10 weeks they had face-to-face meetings with 117 customers, tested 33 hypotheses, invalidated 19 of them and 53 instructor and mentor interactions.

Here’s Knox Medical’s 2 minute video summary

If you can’t see the video above, click here

Knox was a great example of having a technology in search of a customer. The initial hypothesis of who would pay for the device – parents of children with asthma – was wrong and resulted in Knox’s first pivot in week 4. By week 6 they had discovered that; 1) Peak Flow Meters are not as heavily prescribed as they thought, 2) Insurance company reimbursement is necessary for anything upwards of $15, 3) Nitrous Oxide testing isn’t currently used to measure asthma conditions.

After the pivot they the found that the most likely users of their device would be low income Asthma patients who are treated at Asthma clinics funded by federal, state or county dollars. These clinics reduce hospitalization but Insurers weren’t paying to cover clinic costs nor would they cover the use of the Knox device. The irony was that those who most needed the Knox device were those who could least afford it and wouldn’t be able get it.

Watch their Lesson Learned presentation below. Listen to the comments from Allan May the Device instructor at the end.

If you can’t see the video above, click here

In the end Knox, like a lot of startups in Life Science and Health Care, discovered that they had a multi-sided market. They realized late in the class the patients (and their families) were not their payers - their payers were the insurance companies (and the patients were the users.) If they didn’t have a compelling value proposition for the insurers (cost savings, increased revenue, etc.) it didn’t matter how great the technology was or how much the patients would benefit.

The Knox Medical Device presentation slides are below. Don’t miss the evolution of their business model canvas in the appendix. It’s a film strip of the entrepreneurial process in action.

If you can’t see the slides above, click here

Knox is a great example of how the Lean LaunchPad allows teams to continually test hypotheses and fail fast and inexpensively. They learned a ton. And saved millions.

Lessons Learned

In medical devices, understanding reimbursement, regulation and IP is critical

Sometimes teams win when they fail

Filed under: Customer Development, Lean LaunchPad, Life Sciences, Teaching

December 19, 2013

Lessons Learned in Digital Health

This post is part of our series on the National Science Foundation I-Corps Lean LaunchPad class in Life Science and Health Care at UCSF.

Part 1: issues in the therapeutics drug discovery pipeline

Part 2: medical devices and digital health

Part 3: described what we’re going to do about it.

Part 4: This Will Save us Years – Customer Discovery in Medical Devices

Part 5: Value proposition and customer segments in Life Sciences

Part 6: Distribution channels in Life Sciences

Part 7: Revenue Streams in Life Sciences

Part 8: When Customers Make You Smarter –Customer Discovery in Digital Health

Part 9: We’ve seen the Future of Translational Medicine and it’s Disruptive

Our Lean LaunchPad for Life Science class talked to 2,355 customers, tested 947 hypotheses and invalidated 423 of them. They had 1,145 engagements with instructors and mentors. (We kept track of all this data by instrumenting the teams with LaunchPad Central software.)

This post is one of a series of the “Lessons Learned” presentations and videos from our class.

Sometimes a startup results from a technical innovation. Or from a change in regulation, declining costs, changes in consumers needs or an insight about customer needs. Resultcare, one of the 26 teams in the class started when a resident in clinical medicine at UCSF watched her mother die of breast cancer and her husband get critically injured.

The team members are:

Dr. Mima Geere Clinical Medicine at UCSF.

Dr. Arman Jahangiri HHMI medical fellow at UCSF, Department of Neurological Surgery

Dr. Brandi Castro in Neuroscience at UCSF

Mitchell Geere product design

Kristen Bova MBA, MHS

Nima Anari PhD in Data Science

Abhas Gupta was the Digital Health cohort instructor. Richard Caro was their mentor.

ResultCare is a mobile app that helps physicians take the guesswork out of medicine. It enables physicians to practice precision medicine while reducing costs.

Here’s Resultcare’s 2 minute video summary

If you can’t see the video above, click here.

Watch their Lesson Learned presentation below. The first few minutes of the talk is quite personal and describes the experiences that motivated Dr. Geere to address this problem.

If you can’t see the video above, click here

The Resultcare presentation slides are below.

If you can’t see the presentation above, click here

Filed under: Customer Development, Lean LaunchPad, Life Sciences, Technology

December 17, 2013

We’ve seen the Future of Translational Medicine and it’s Disruptive

A team of 110 researchers and clinicians, in therapeutics, diagnostics, devices and digital health in 25 teams at UCSF, has just shown us the future of translational medicine. It’s Lean, it’s fast, it works and it’s unlike anything else ever done.

It’s going to get research from the lab to the bedside cheaper and faster.

Welcome to the Lean LaunchPad for Life Sciences and Healthcare (part of the National Science Foundation I-Corps).

This post is part of our series on the Lean Startup in Life Science and Health Care.

Part 1: issues in the therapeutics drug discovery pipeline

Part 2: medical devices and digital health

Part 3: described what we’re going to do about it.

Part 4: This Will Save us Years – Customer Discovery in Medical Devices

Part 5: Value proposition and customer segments in Life Sciences

Part 6: Distribution channels in Life Sciences

Part 7: Revenue Streams in Life Sciences

Part 8: When Customers Make You Smarter – Customer Discovery in Digital Health

——–

Our class talked to 2,355 customers, tested 947 hypotheses and invalidated 423 of them. They had 1,145 engagements with instructors and mentors. (We kept track of all this data by instrumenting the teams with LaunchPad Central software.)

In a packed auditorium in Genentech Hall at UCSF, the teams summarized what they learned after 10 weeks of getting out of the building. This was our version of Demo Day – we call it “Lessons Learned” Day. Each team make two presentations:

2 minutes YouTube Video: General story of what they learned from the class

8 minute Lessons Learned Presentation: Very specific story about what they learned in 10 weeks about their business model

Each team closed with where they thought they were on the Investment Readiness Level scale

The instructors (all venture capitalists) then followed with their assessment of the teams Investment Readiness Level

In the next few posts I’m going to share a few of the final “Lessons Learned” presentations and videos and then summarize lessons learned from the teaching team.

Magnamosis

Magnamosis is a medical device company that has a new way to create a magnetic compression anastomosis (a surgical connection between two tubular structures like the bowel) with improved outcomes.

Team Members were: Michael Harrison (the father of fetal surgery), Michael Danty, Dillon Kwiat, Elisabeth Leeflang, Matt Clark. Jay Watkins was the team mentor. Allan May and George Taylor were the medical device cohort instructors.

Their initial idea was that making an anastomosis that’s better, faster and cheaper will have surgeons fighting to the death to get a hold of their device.  They quickly found out that wasn’t the case. Leak rates turned out to a bigger issue with surgeons and a much larger market.

They quickly found out that wasn’t the case. Leak rates turned out to a bigger issue with surgeons and a much larger market.

Here’s their 2 minute video summary

If you can’t see the video above, click here.

Look at their Lesson Learned slides below and see how a team of doctors learned about product/market fit, channels and pricing. (Don’t miss the evolution of their business model in the Appendix.)

If you can’t see the presentation above, click here

The best summary of why Scientists, Engineers and Principal Investigators need to get out of the building was summarized by Dr. Harrison below. After working on his product for a decade listen to how 10 weeks of the Lean LaunchPad class radically changed his value proposition and business model.

If you can’t see the video above, click here.

For further reading:

Magnamosis IV: magnetic compression anastomosis for minimally invasive colorectal surgery

Magnamosis III: delivery of a magnetic compression anastomosis device using minimally invasive endoscopic techniques

Magnamosis II: Magnetic compression anastomosis for minimally invasive gastrojejunostomy and jejunojejunostomy

Magnamosis: magnetic compression anastomosis with comparison to suture and staple techniques

Gastro.org 2013 Education Meeting

Filed under: Customer Development, Lean LaunchPad, Life Sciences, National Science Foundation, Teaching

Steve Blank's Blog

- Steve Blank's profile

- 381 followers