Steve Blank's Blog, page 36

July 23, 2014

Getting Lean in Education – By Getting Out of the Classroom

This week the National Science Foundation goes Lean on education by providing $1.2 million to educators who want to bring their classroom innovations to a wider audience.

——–

——–

The I-Corps program started when the U.S. National Science Foundation adopted my Lean LaunchPad class. Their goal was to train University scientists and researchers to use Lean Startup methods (business model design, customer development and agile engineering) to commercialize their science. Earlier this month the National Institutes of Health announced I-Corps @ NIH, to help scientists doing medical research take their innovations from the lab-bench to the bedside and accelerate translational medicine.

This week, the NSF is announcing the next step in the I-Corps program– I-Corps for Learning (I-Corps L). This version of I-Corps is for STEM educators – anyone who teaches Science, Technology, Engineering and Math from kindergarten to graduate school, and wants to learn how to bring an innovative teaching strategy, technology, or set of curriculum materials to a wider audience. Following a successful pilot program, the NSF is backing the class with $1.2 million to fund the next 24 teams.

The Problem in the Classroom

A frustration common to both educators and policymakers is how difficult it has been to get new, innovative, education approaches into widespread use in classrooms where they can influence large numbers of students. While the federal government and corporations have dumped a ton of money into STEM education research, a disappointing few of these brave new ideas have made it into practice. These classroom innovations often remain effectively a secret – unknown to most STEM educators or the research community at large.

It turns out that on the whole educators are great innovators but have had a hard time translating their ideas into widespread adoption. What we had was a very slow classroom innovation diffusion rate. Was there any was to speed this up?

A year ago Don Millard of the National Science Foundation (who in a previous life had been a STEM Educator) approached me with a hypothesis that possibly could solve this problem. Don observed that educators with innovative ideas who actively got out of their classrooms and tested their innovations with other educators/institutions/students had a much better adoption rate.

Up until now there was no formal way to replicate the skills of the educators who successfully evangelized their new concepts. Don’s insight was that the I-Corps model being rolled out for scientists might work equally well for educators/teachers. He pointed out that there was a close analogy between scientists trying to bring product discoveries to market and educators getting learning innovations into broad practice. Don thought that a formal Lean LaunchPad/I-Corps methodology might be exactly what educators needed to understand how their classroom innovations could be used, how to get other educators and institutions to adopt them, and how to articulate their value to potential investors .

Don then recruited Karl Smith from the University of Minnesota to pilot a class of 9 teams made up of STEM educators. Karl recruited a teaching team (Ann McKenna, Chris Swan, Russ Korte, Shawn Jordan, Micah Lande and Bob MacNeal) and Jerry Engel trained them. The team ran their first I-Corps for Learning class earlier this year.

Karl and his teaching team really nailed it. So much so that the NSF is now rolling out I-Corps for Learning on a larger scale.

I-Corps for Learning Details

NSF will provide up to $1.2 million to support 24 teams. The I-Corps L cohort teams will receive additional support — in the form of mentoring and funding — to accelerate innovation in learning that can be successfully scaled, in a sustainable manner.

To be eligible to pursue funding, applicants must have received a prior award from NSF (in a STEM education field relevant to the proposed innovation) that is currently active or that has been active within five years from the date of the proposal submission. Consideration will be given to projects that address K-12, undergraduate, graduate, and postdoctoral research, as well as learning in informal science education environments.

Each team will consist of:

The principal investigator (who received the prior award);

An entrepreneurial lead (who is committed to investigate the landscape surrounding the innovation); and

A mentor (who understands the evidence concerning promise, e.g., from an institutional education-focused center or commercial background that will help inform the efforts)

The outcomes of the pilot projects are expected to be threefold:

A clear go/no go decision concerning the viability and effectiveness of the learning-oriented resources/products, practices and services,

An implementation “product” and process for potential partners/adopters, and

A transition plan to move the effort forward and bring the innovation to scale

Proposals from potential I-Corps L teams will be accepted through September 30, 2014. Class starts January 2015.

Check out the I-Corps for Learning website here.

Lessons Learned

The diffusion of STEM classroom innovations is excruciatingly slow

The Lean LaunchPad/I-Corps model may accelerate that process

I-Corps for Learning is accepting applications

Filed under: Lean LaunchPad, National Science Foundation, Teaching

July 21, 2014

What Job Needs to be Done? 2 Minutes to Find Out Why

If you can’t see the video click here

Subscribe for more videos than you can ever watch here

Filed under: 2 Minute Lessons, Customer Development

July 10, 2014

How Big Is It Really? 2 Minutes to Find Out Why

If you can’t see the video click here

Subscribe for more videos than you can ever watch here

Filed under: 2 Minute Lessons, Customer Development

July 8, 2014

The Path of Our Lives

“Some men see things as they are and say, why;

I dream things that never were and say, why not?”

Robert Kennedy/Bernard Shaw

I got a call that reminded me that most people live their life as if it’s predestined – but some live theirs fighting to change it.

At 19 I joined the Air Force during the Vietnam War. Out of electronics school my first assignment was to a fighter base in Florida. My roommate, Glen, would become my best friend in Florida and Thailand as we were sent to different air bases in Southeast Asia.

An Enemy Attack May Make Your Stay Here Unpleasant

On the surface, Glen and I couldn’t have been more different. He grew up in Nebraska, had a bucolic childhood that sounded like he was raised by parents from Leave it to Beaver. I didn’t, growing up in a New York City apartment that seemed more like an outpatient clinic. Yet somehow we connected on a level that only 19-year-olds can. I introduced him to Richard Brautigan and together we puzzled through R.D. Laing’s The Politics of Experience. We explored the Everglades (and discovered first-hand that the then-new national park didn’t have any protective barriers on their new boardwalks into the swamps and that alligators sunning themselves on a boardwalk look exactly like stuffed ones – until you reach out to touch them.) In Thailand I even figured out how to sneak off base for a few days, cross Thailand via train, visit him in his airbase and convince everyone I had been assigned to do so (not that easy with a war on.) The chaos, the war, our age and our interests bonded us in a way that was deep and heartfelt.

Yet when the Vietnam War wound down, we were both sent to bases in different parts of the U.S. And as these things happen, as we grew older, more people and places came between us, and we went on with our lives and lost touch.

Yet when the Vietnam War wound down, we were both sent to bases in different parts of the U.S. And as these things happen, as we grew older, more people and places came between us, and we went on with our lives and lost touch.

Four Decades Later

Last week I got an email with a subject line that only someone who knew me in the Air Force could have sent. While that caught my attention, the brief note underneath stopped me in my tracks. It read, “You have crossed my thoughts through the years. The other night you appeared in my dreams. I actually remembered it in the morning and googled your name. By God, there you were. A bit overwhelming…”

You bet it was overwhelming, it’s been 40 years since I last heard from Glen.

On the phone together, I spent an hour with an ear-to-ear grin as both of us recounted, “when we were young, crazy and stupid” stories, stories I still won’t tell my children (which makes me grateful it was life before social media documented every youthful indiscretion.) Glen even reminded me of my nickname (which still makes me cringe.) The feel of long forgotten camaraderie let me wallow in nostalgia for a while. But as Glen began to catch me up with the four decades of his life, it was clear that while we both had the same type of advanced electronics training, both had been on the same airbases, and essentially both had been given the same opportunities, our careers and lives had taken much different paths. As he talked, I puzzled over why our lives ended up so different. Listening to him, I realized I was hearing a word I would never use to describe my life. Glen used the word “predestined” multiple times to describe his choices in life. His job choices were “predestined,” where he lived was “predestined,” who he married and divorced had been “predestined.” I realized that our world views and how we lived our lives differed on that one single word.

“Predestined.”

The path of our lives

While the call brought me back to when we were foolish and fearless, thinking about how Glen lived his life troubled me. It took me awhile to figure out why. I wasn’t bothered about anything that Glen did or didn’t accomplish. It was his life and he seemed happy with it. Hearing his voice brought back those days of enthusiasm, exploration, adventure and unlimited horizons. But listening to forty years of a life lived summed up as “preordained” felt like a sharp reminder of how most people live their lives.

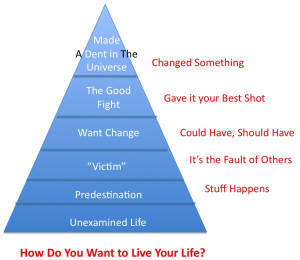

Glen’s worldview wasn’t unique. Most people appear to live an unexamined life, cruising through the years without much reflection about what it means, and/or taking what life hands them and believing it’s all predestined.

As I’ve gotten older I’ve come to grips that the unexamined life is what works for most people. Most take what they learned in school, get a job, marry, buy a house, have a family, become a great parent, serve their god, community and country, hang with friends and live a good life. And for them that’s great.

Some do want more out of life, but blame their circumstances on others – their parents or government or spouse or lack of opportunities, but almost never on their own lack of initiative. Initiative means change and change is hard for most. (Clearly there are still pockets in the world where opportunities and choice are limited but they are shrinking daily.)

Perhaps the most painful to watch are those who wake up later in life thinking, “I could have or I should have.”

Pushing the Human Race Forward

Whether we have free will or whether our lives are predestined has been argued since humans first pondered their purpose in life. The truth is we won’t know until the second coming or the solution to the many-worlds theory.

But what we know with certainty is that there is a small set of humans who don’t act like their lives are predestined. For better or worse, regardless of circumstances, country or culture they struggle their entire lives wanting to change the outcome. And a small percentage of these translate the “wanting to change” into acting on it. This small group is dissatisfied with waiting for life to hand them their path. They act, they do, they move, they change things.

Those born into poverty actively strive to change their own lives and that of their children. Those who want to start a company or join one quit their job and do it, while others try to change their political system or fight for social or environmental justice.

And the irony is while the individual stories are inspiring they are trying to tell a much bigger story. These misfits, rebels and troublemakers have been popping up in stories for thousands of years. Every culture has myths about larger than life heroes who rose from nothing. This archetype is a recessive gene common to all cultures. They are the ones that make things happen, they’re the ones that push the human race forward.

This is what makes and drives entrepreneurs. Our heads are just wired differently.

You Are Master of Your Own Fate

The world is much different then when Glen and I were young and foolish. In the past, even if you did feel this spirit of adventure, you had no idea how and where to apply it. Barriers of race, gender or location threw up roadblocks that seemed insurmountable.

The world is much smaller now. The obstacles aren’t gone but are greatly diminished. Everyone within reach of a smartphone, tablet or computer knows more about entrepreneurship and opportunity and where to get it then all of Silicon Valley did 40 years ago. There’s no longer an excuse not to grab it with both hands.

As far as we know, this life isn’t practice for the next one. For entrepreneurs the key to living this one to the fullest is the understanding that you can choose – that you do have a choice to effect the journey and change the rules, that you can decide to give it your best shot to do something, something extraordinary.

If your passion is startups and innovation, and your community, region or country doesn’t have an entrepreneurial culture and community – help start one. If there’s no funding for startups in your community - get up and move to where it is. If you’re in a company frustrated with the lack of opportunity - change jobs.

You are master of your own fate. Act like it.

Lessons Learned

The same destiny overtakes us all

It’s what you choose to do with your life in between that makes the difference

Filed under: Air Force, Family/Career/Culture

July 3, 2014

Validation: Be Sure Your Startup Vision Isn’t a Hallucination. 2 Minutes to See Why

If you can’t see the video click here

Filed under: 2 Minute Lessons, Business Model versus Business Plan, Customer Development, Lean LaunchPad, Teaching

July 1, 2014

How Investors Make Better Decisions: The Investment Readiness Level

Investors sitting through Incubator or Accelerator demo days have three metrics to judge fledgling startups – 1) great looking product demos, 2) compelling PowerPoint slides, and 3) a world-class team. Other than “I’ll know it when I see it”, there’s no formal way for an investor to assess project maturity or quantify risks. Other than measuring engineering progress, there’s no standard language to communicate progress.

What’s been missing for everyone is:

a common language for investors to communicate objectives to startups

a language corporate innovation groups can use to communicate to business units and finance

data that investors, accelerators and incubators can use to inform selection

Teams can prove their competence and validate their ideas by showing investors evidence that there’s a repeatable and scalable business model. While it doesn’t eliminate great investor judgment, pattern recognition skills and mentoring, we’ve developed an Investment Readiness Level tool that fills in these missing pieces. Background about the Investment Readiness Level here and here.

While the posts were theory I was a bit surprised when John Selep, an early-stage investor, approached me and said he was actually using the Investment Readiness Level (IRL) in practice.

Here’s John’s story.

—

As Selections Committee chair for our Sacramento Angels investor group, I review applications from dozens of startup entrepreneurs looking for investment. I also mentor at our local university, and guest-lecture at a number of Entrepreneurship courses on how to pitch to investors, so the task of helping students and entrepreneurs visualize the process of investor decision-making has often been a challenge.

When I first read about the Investment Readiness Level (IRL) on Steve’s blog, I was excited by Steve’s attempt to bridge the capital-efficient Lean Startup process for founders with the capital-raising process for funders. But the ‘ah-hah!’ moment for me was the realization that I could apply the IRL framework to dramatically improve the guidance and mentorship I was providing to startup company founders .

Prior to having the Investment Readiness Level framework, this “how to get ready for an investor” discussion had been a “soft” conceptual discussion. The Investment Readiness Level makes the stages of development for the business very tangible. Achieving company milestones associated with the next level on the Investment Readiness Level framework is directly relevant to the capital-raising process.

I use the Investment Readiness Level as part of my sessions to help the students understand that being ready for investment means that besides having a pretty PowerPoint, they need to do real work and show Customer Development progress.

Since I began incorporating the Investment Readiness Level framework I’ve made three observations. The Investment Readiness Level (IRL):

Ties the Lean methodology (and capital efficiency) directly to the capital-raising process – closing the loop and tying these two processes together.

Is Prescriptive – offers founders a “what-you-need-to-do-next” framework to reach a higher level of readiness.

Enables better mentoring. The IRL provides a vocabulary and framework for shifting the conversation between investors and entrepreneurs from simply “No”, to the much-more-helpful “Not yet – but here’s what you can do…”.

Tying Fundraising to the Lean Startup

Tying Fundraising to the Lean Startup

The premise of the Lean Startup is that a startup’s initial vision is really just a series of untested hypotheses, and that the Customer Development process is a systematic approach to ‘getting out of the building’ and testing and validating each of those hypotheses to discover a repeatable, scalable business model. The Investment Readiness Level adds to this methodology by tying each phase of this discovery process or ‘hypothesis-validation’ to milestones representing a startup’s increasing readiness for investor support and capital investment. For investors this is a big idea.

I remind entrepreneurs that investors are implicitly seeking evidence of progress and milestones (but until the Investment Readiness Level never knew how to ask for it). Entrepreneurs should always communicate their business’ very latest stage of customer development as part of their investor presentation. Given that a startup is continually learning weekly, the entrepreneur’s investor presentation will evolve on a weekly basis as well, reflecting their latest progress.

In our Angel investor group, our Applicant Selections process ranks applicant companies relative to the other applicants. In the past, the ranking process relied on our Selection Committee members having an intuitive “feel” for whether a startup was worth considering for investment.

As part of our screening process, I’ve embraced the Investment Readiness Level (IRL) framework as a more-precise way to think through where applicant companies would rank. (BTW, this does not mean that the IRL framework has been embraced by rest of our Selections committee – organizational adoption is a lot more complicated than an individual adopting a framework.) I believe the IRL framework offers a more-precise method to discuss and describe ‘maturity’, and will likely become a more explicit part of our selections discussion in the year ahead.

Investment Readiness Level is Prescriptive

At first blush the Investment Readiness Level framework is a diagnostic tool – it can be used to gauge how far a business has progressed in its Customer Development process. A supposition is that startups that have validated hypotheses about key elements of their business have reduced the risks in launching their new business and are more ready for investment.

But the IRL is more than a diagnostic. It enables a much richer investor -> founder dialog about exactly what milestones a startup has actually achieved, and ties that discussion to the stages of the business’ Customer Development and business development progress. In the same way that Osterwalder’s Business Model Canvas provides a common vocabulary and enables a rich discussion and understanding of exactly what comprises the business’ design and business model, the IRL provides a common set of metrics and enables a rich discussion and understanding of just where the startup is in the maturity of its processes.

This means the IRL is also a Prescriptive tool. No matter where a startup is in its stage of development, the immediate next stage milestone – where the entrepreneurs should focus their attention next – is immediately clear. Although every business is unique, and every business model emerges and evolves in its own unique way, the logical sequencing of incremental discovery and validation implicit in the IRL framework is very clear. No ambiguity. Clarity is good.

Investment Readiness Level Enables Better Mentoring

As you might imagine, our Angel group receives applications for funding from a wide, wide variety of businesses, with highly variable quality of the businesses and their applications, and highly variable levels of maturity of those businesses. Some of our applicants are not scalable, high-growth businesses, and we tell them quickly if they don’t fit our profile. Others have the potential to be scalable, high-growth businesses, but simply aren’t as compelling or as mature as better candidates in our funnel. During every Selections cycle, as we refine our applicant funnel to select the entrepreneurs to present to our membership, I obviously have to say “No” to far more entrepreneurs than those to whom I can say “Yes”.

The Investment Readiness Level adds a new dimension to those conversations, providing a vocabulary and framework for shifting the conversation from simply ‘No’, to the much-more-helpful “Not yet – but here’s what you can do…”. It has completely changed the nature of the conversations I have with applicants. The prescriptive nature of the IRL means that wherever a business is in its current state of development, the next step on the ladder is nearly always pretty obvious. Of course, there should always be a little latitude for the unique nature of each business, but the IRL framework is a good guidepost. So the “here’s what you can do…” recommendations are clear, logical, and situationally-relevant to the entrepreneur’s business.

I would estimate that perhaps half of the applicants we see have heard of and use some form of Lean Startup or Customer Development methodology. The idea of a “Minimum Viable Product” is something that has entered the general vernacular, but I’m sure that not all of the businesses tossing the term around truly understand the Lean Startup teachings.

So when I’m providing feedback to an entrepreneur applying to our group for funding, I leverage the IRL framework to guide the feedback that I give. I don’t refer to the framework explicitly, but I provide feedback based on where I assess the company to be in their development, and what steps they’d need to pursue to get another rung or two up the ladder.

For example, I might say “The Sacramento Angels have decided that your firm isn’t quite ready for us to consider for potential investment at this point, but if you were able to discuss your prototype with 50-to-100 potential customers and get their feedback, this might help you identify the specific segments that care most-deeply about the advantages you’re offering over the existing alternative. We’d like to stay in touch with you and hear more from you once you’ve identified your initial target segment and how you are going to reach and service them …”

I’ve almost universally found that the entrepreneurs I’m discussing these recommendations with are pleased to have the feedback, even if they’re disappointed that we may not be funding them. For an entrepreneur, receiving guidance of “Not now, but here’s what you can do…” is better than getting a flat, directionless “No”. For me, the ability to articulate the concept of maturity, and investment readiness as a continuum, is extremely helpful. Being able to articulate that an applicant’s current stage of development, along that continuum, is not aligned with our group’s investment goals but that with further progress on their part, there may be alignment – this is a fundamentally superior message.

The Investment Readiness Level has given me the tools to engage in a consultative, coaching and mentoring conversation that provides much more value to entrepreneurs, resulting in a much more-enjoyable conversation for all involved.

Lessons Learned:

Investment Readiness ties capital-raising to the capital-efficient Lean Startup methodology

The Investment Readiness Level is Prescriptive

The Investment Readiness Level enables better mentoring

Filed under: Customer Development Manifesto, Investment Readiness Level, Venture Capital

June 28, 2014

Customer Discovery: The Search for Product/Market Fit. 2 Minutes to See Why

If you can’t see the video click here

Filed under: 2 Minute Lessons, Business Model versus Business Plan, Customer Development, Lean LaunchPad, Teaching

June 26, 2014

I-Corps @ NIH – Pivoting the Curriculum

We’ve pivoted our Lean LaunchPad / I-Corps curriculum. We’re changing the order in which we teach the business model canvas and customer development to better-fit therapeutics, diagnostics and medical devices.

—

Over the last three years the Lean LaunchPad class has started to replace the last century’s “how to write a business plan” classes as the foundation for entrepreneurial education. The Lean LaunchPad class uses the three “Lean Startup” principles:

Alexander Osterwalders “business model canvas” to frame hypotheses

“Customer Development” to test the hypotheses outside the building and

“Agile Engineering” to have teams prototype, test, and iterate their idea while discovering if they have a profitable business model.

Teams talk to 10-15 customers a week and make a minimum of 100 customer visits. The Lean LaunchPad is now being taught in over 100 universities. Three years ago the class was adopted by the National Science Foundation and has become their standard for commercializing science. Today the National Institutes of Health announced their I-Corps @ NIH program.

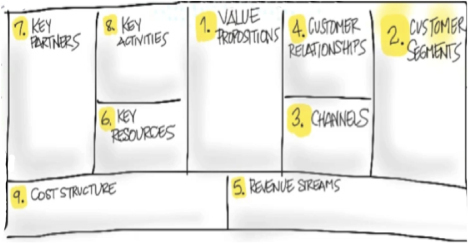

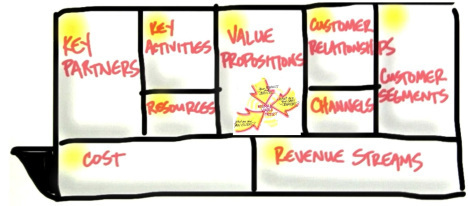

The one constant in all versions of the Lean LaunchPad / I-Corps class has been the order in which we teach the business model canvas.

Value Propositions and Customer Segments are covered in weeks 1 and 2, emphasizing the search for problem/solution and then product/market fit. Next we teach Distribution Channels (how are you going to sell the product) and Customer Relationships (how do you Get/Keep/Grow customers) and Revenue Streams (what’s the Revenue Model strategy and pricing tactics.) Finally we move to the left side of the canvas to teach the supporting elements of Resources, Partners, Activities and Costs.

Teaching the class lectures in this order worked great, it helped the teams understand that the right-side of the canvas was where the action was. The left- hand side had the supporting elements of the business that you needed to test and validate, but only after you made sure the hypotheses on the right were correct.

This lecture order was embedded in the Udacity Lectures, the syllabi and educators guide I open-sourced. Hundreds of teams in the NSF, and my Stanford, Berkeley, Columbia, and UCSF classes learned to search for a repeatable and scalable business model in this way.

It’s consistency was the reason that the NSF was able to scale the I-Corps from 15 to 30 University sites.

So why change something that worked so well?

Rationale

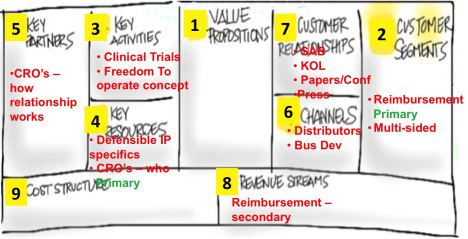

Last fall at UCSF we taught 125 researchers and clinicians in therapeutics, diagnostics, medical devices and digital health in a Lean LaunchPad for Life Sciences class. While the teaching team made heroic efforts to adapt their lectures to our “standard” canvas teaching order, it was clear that for therapeutics, diagnostics and medical devices the order was wrong. Hypotheses about Intellectual Property, Reimbursement, Regulation and Clinical Trials found on the left side of canvas are as, or more important than those on the right side of the canvas.

I realized we were trying to conform to a lecture order optimized for web, mobile, hardware. We needed to cover Intellectual Property, Reimbursement, Regulation and Clinical Trials a month earlier in the class than in the current format.

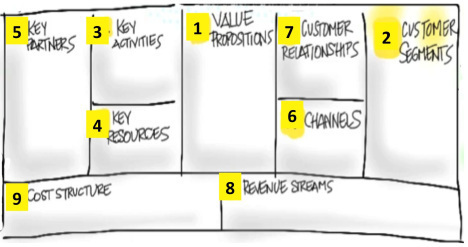

The National Institutes of Health has adopted our class for its I-Corps @ NIH program starting this October. Most teams will be in therapeutics, diagnostics and medical devices. Therefore we’re going to teach the class in the following order:

1) value proposition, 2) customer segments, 3) activities, 4) resources, 5) partners, 6) channel, 7) customer relationships, 8) revenue/costs

I-Corps @ NIH Lecture Order Details

Customer Segments change over time. CROs or Payers may ultimately be a resource, a partner or a revenue source, but until you get them signed up they’re first a customer. Your potential exit partners are also a customer. And most importantly, who reimburses you is a customer. (You get an introduction to reimbursement early here, while the details are described later in the “Revenue” lecture.)

Activities are the key things you need to do to make the rest of the business model (value proposition, distribution channel, revenue) work. Activities cover clinical trials, FDA approvals, Freedom to Operate (IP, Licenses) software development, drug or device design, etc.

Activities are not the product/service described in the value prop, they are the unique expertise that the company needs to deliver the value proposition. In this week we generally describe the business rationale of why you need these. The specifics of who they are and how to work with them are covered in the “Resource” and “Partners” lectures.

Resources - Once you establish what activities you need to do, the next question is, “how do these activities get accomplished?” I.e. what resources do I need to make the activities happen. The answer is what goes in the Resources box (and if necessary, the Partners box.) Resources may be CRO’s, CPT consultants, IP, Financial or Human resources (regardless of whether they’re consultants or employees.)

Partners are external resources necessary to execute the Activities. You’ve identified the “class of partner” in the Resources box. This lecture talks about specifics – who are they, what deals work with them, how to get them, how to work with them.

Customer Relationships is what we think of as traditional sales and marketing; assembling a SAB, getting the KOL’s, conferences, articles, etc. Customer Relationships answers the question, “How will we create demand and drive it to our channel?”

We think we now have a syllabus that will better fit a Life Science audience. Once the syllabus stops moving around we’ll open source it along with the educators guide this fall.

Lessons Learned

The Lean LaunchPad class has started to replace the last century’s “how to write a business plan” classes

The lecture order emphasizes testing the right-side of the canvas first

That works for almost all markets

However, for life sciences hypotheses about Intellectual Property, Reimbursement, Regulation and Clinical Trials are critical to test early

Therefore we created a more effective lecture order for Life Sciences

Filed under: Lean LaunchPad, Life Sciences, Teaching

June 23, 2014

Keep Calm and Test the Hypothesis. 2 Minutes to See Why

June 19, 2014

Why Lean May Save Your Life – The I-Corps @ NIH

Today the National Institutes of Health announced they are offering my Lean LaunchPad class (I-Corps @ NIH ) to commercialize Life Science.

There may come a day that one of these teams makes a drug, diagnostic or medical device that saves your life.

—-

Over the last two and a half years the National Science Foundation I-Corps has taught over 300 teams of scientists how to commercialize their technology and how to fail less, increasing their odds for commercial success.

After seeing the process work so well for scientists and engineers in the NSF, we hypothesized that we could increase productivity and stave the capital flight by helping Life Sciences startups build their companies more efficiently.

So last fall we taught 26 life science and health care teams at UCSF in therapeutics, diagnostics and medical devices. 110 researchers and clinicians, and Principal Investigators got out of the lab and hospital, and talked to 2,355 customers, tested 947 hypotheses and invalidated 423 of them. The class had 1,145 engagements with instructors and mentors.

The results from the UCSF Lean LaunchPad Life Science class showed us that the future of commercialization in Life Sciences is Lean – it’s fast, it works and it’s unlike anything else ever done. It’s going to get research from the lab to the bedside cheaper and faster.

Translational Medicine

In life sciences the process of moving commercializing research –moving it from the lab bench to the bedside – is called Translational Medicine.

The traditional model of how to turn scientific discovery into a business has been:

1) make a substantive discovery, 2) write a business plan/grant application, 3) raise funding, 4) execute the plan, 5) reap the financial reward.

For example, in therapeutics the implicit assumption has been that the primary focus of the venture was to validate the biological and clinical hypotheses. (i.e. What buttons does this molecule push in target cells and what happens when these buttons are pushed? What biological pathways respond?) and then when these pathways are impacted, why do we believe it will matter to patients and physicians?

We assumed that for commercial hypotheses (clinical utility, who the customer is, data and quality of data, how reimbursement works, what parts of the product are valuable, roles of partners, etc.) if enough knowledge was gathered through proxies or research a positive outcome could be precomputed. And that with sufficient planning successful commercialization was simply an execution problem. This process built a false sense of certainty, in an environment that is fundamentally uncertain.

We now know the traditional translational medicine model of commercialization is wrong.

The reality is that as you validate the commercial hypotheses (i.e. clinical utility, customer, quality of data, reimbursement, what parts of the product are valuable, roles of CRO’s, and partners, etc.,) you make substantive changes to one or more parts of your initial business model, and this new data affects your biological and clinical hypotheses.

We believe that a much more efficient commercialization process recognizes that 1) there needs to be a separate, parallel path to validate the commercial hypotheses and 2) the answers to the key commercialization questions are outside the lab and cannot be done by proxies. The key members of the team CEO, CTO, Principal investigator, need to be actively engaged talking to customers, partners, regulators, etc.

And that’s just what we’re doing at the National Institutes of Health.

Join the I-Corps @ NIH

Today the National Institutes of Health announced the I-Corps at NIH.

It’s a collaboration with the National Science Foundation (NSF) to develop NIH-specific version of the Innovation-Corps. (Having these two federal research organizations working together is in itself a big deal.) We’re taking the class we taught at UCSF and creating an even better version for the NIH. (I’ll open source the syllabus and teaching guide later this year.)

The National Cancer Institute SBIR Development Center, is leading the pilot, with participation from the SBIR & STTR Programs at the National Heart, Lung and Blood Institute, the National Institute of Neurological Disorders and Stroke, and the National Center for Advancing Translational Sciences.

The class provides real world, hands-on learning on how to reduce commercialization risk in early stage therapeutics, diagnostics and device ventures. We do this by helping teams rapidly:

The class provides real world, hands-on learning on how to reduce commercialization risk in early stage therapeutics, diagnostics and device ventures. We do this by helping teams rapidly:

define clinical utility now, before spending millions of dollars

understand the core customers and the sales and marketing process required for initial clinical sales and downstream commercialization

assess intellectual property and regulatory risk before they design and build

gather data essential to customer partnerships/collaboration/purchases before doing the science

identify financing vehicles before you need them

Like my Stanford/Berkeley and NSF classes, the I-Corps @ NIH is a nine-week course. It’s open to NIH SBIR/STTR Phase 1 grantees.

The class is team based. To participate grantees assemble three-member teams that include:

C-Level Corporate Officer: A high-level company executive with decision-making authority;

Industry Expert: An individual with a prior business development background in the target industry; and

Program Director/Principal Investigator (PD/PI): The assigned PD/PI on the SBIR/STTR Phase I award.

Space is limited to 25 of the best teams with NIH Phase 1 grants. Application are due by August 7th (details are here.)

If you’re attending the BIO Conference join our teaching team (me, Karl Handelsman, Todd Morrill and Alan May) at the NIH Booth Wednesday June 25th at 2pm for more details. Or sign up for the webinar on July 2nd here.

—

This class takes a village: Michael Weingarten and Andrew Kurtz at the NIH, the teaching team: Karl Handelsman, Todd Morrill and Alan May, Babu DasGupat and Don Millard at the NSF, Erik Lium and Stephanie Marrus at UCSF, Jerry Engel and Abhas Gupta, Errol Arkilic at M34 Capital and our secret supporters; Congressman Dan Lipinski and Tom Kalil and Doug Rand at the OSTP and tons more.

Lessons Learned

There needs to be a separate, parallel path to validate the commercial hypotheses

The answers to commercialization questions are outside the lab

They cannot be done by proxies

Commercial validation affects biological and clinical hypotheses

Filed under: Customer Development, Lean LaunchPad, Life Sciences, National Science Foundation

Steve Blank's Blog

- Steve Blank's profile

- 381 followers