Chris Dillow's Blog, page 151

April 24, 2013

Unemployment & the free market

Bryan Caplan deserves praise for calling on free market economists to pay more attention to the "grave evil" of unemployment. I fear, though, that he overstates what free market policies can contribute to solving the problem.

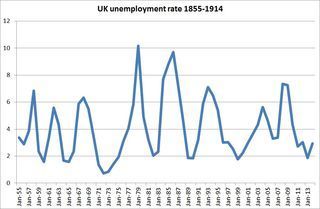

My chart shows the problem. It shows the UK unemployment rate between 1855 (when data begins) and 1914. You can see that the jobless rate was often high - it averaged 4% - and volatile.

And this was during a period of as free markets as one could practically get.

This undermines at least three "free market" explanations for unemployment:

- "Welfare benefits mean the unemployed have little incentive to get work." In the 19th C, though, the only state support the unemployed got was in the Workhouse - and even as late as in my lifetime, this was spoken of with terror.

- "Big government and taxes deter job creation." But public spending in this time averaged only around 10% of GDP, and labour market regulation except for a few Factory Acts was nugatory by modern standards.

- "Wages are too rigid". But wages fell in nominal terms in 13 of the 59 years here, and in real terms in 12 of these years. Average nominal wages fell by 9% between 1874 and 1879, which is consistent with some sectors seeing very large falls.

There is, though, an alternative theory that fits these data. It's that a free market will see large swings in aggregate demand and employment, and that unemployment cannot be prevented by wage reductions alone. This was pointed out most famously - well famous in my house anyway - by Michal Kalecki in 1935:

One of the main features of the capitalist system is the fact that what is to the advantage of a single entrepreneur does not necessarily benefit all entrepreneurs as a class. If one entrepreneur reduces wages he is able ceteris paribus to expand production; but once all entrepreneurs do the same thing - the result will be entirely different.

Let us assume that wages have been in fact generally reduced...and in consequence unemployment vanishes. Has depression thus been overcome? By no means, as the goods produced have still to be sold...A precondition for an equilibrium at this new higher level is that the part of production which is not consumed by workers or by civil servants should be acquired by capitalists for their increased profits;in other words, the capitalists must spend immediately all their additional profits on consumption or investment. It is however most unlikely that this should happen...It is true that increased profitability stimulates investment but this stimulus will not work right away since the entrepreneurs will temporise until they are convinced that higher profitability is going to last...A reduction of wages does not constitute a way out of depression, because the gains are not used immediately by the capitalists for purchase of investment goods. (Selected Essays on the Dynamics of the Capitalist Economy, p26-28).

There's a good reason why almost all major economies abandoned free market economics. It's that such economies didn't and couldn't avoid mass unemployment.

I'll concede - much more than most lefties - that there's a big place for free market economics. But the labour market ain't it.

Note: data comes from the Bank of England.

April 23, 2013

Invisible enemies

Jason Cowley laments the lack today of literary figures who can write seriously about politics.

I don't think this absence is wholly to be regretted; fine writing can easily become mere egomaniac poncery. But there is, I suspect, one reason for it which is largely overlooked. It's that the political enemies today are invisible ones, which don't lend themselves easily to cultural depiction.

To see my point, contrast the (rationalized) Thatcherite analysis of the UK's problems in the 70s and 80s to now. Back then, the "enemy within" was in plain sight. It was unions. Smash these, it was thought, and you'll increase profit margins and management's "right to manage", and this will increase business confidence and hence investment. This worked, sort of, at least for a while.

Today, though, we can't blame a bogeyman for our economic problems. The lack of investment opportunities, slowdown (pdf) in technical progress, collapse in demand for unskilled labour, inability of capitalism to create full and meaningful work, and ideologies that sustain managerialism and inequality are all impersonal problems. You can't solve them by defeating a visible enemy.

In this context, it's no surprise that literature and culture generally have become disengaged from politics. It's possible to make good art about corruption, racism, warmongering or recession. But try doing so about the investment dearth.

Herein, though, lies a problem. Very many people active in politics don't get this. They are still trying to fight a bogeyman - be it immigrants, "scroungers", greedy bankers, or tax-dodging companies. In this sense, it's not just literary figures who are unable to address our political-economic problems. Political figures can't do so either.

April 22, 2013

On disgust

Some of you might find it distasteful to make a link between the Boston bombings and Luis Suarez. But this is precisely the point, because there is indeed a link, and it highlights a difference between two different moral perspectives.

In Suarez's case, many pundits are calling for him to be banned for a long time for biting Branislav Ivanovic.This means he would get a longer ban for doing something which didn't injure his opponent than the three-game bans which are usually given for the sort of reckless tackles that can lead to serious injury. Many might think this inconsistent.

And Michael Cohen points out that Americans' responses to the Boston bombings are also inconsistent. He notes that 11 people were killed by guns on the day of the bombings alone, and that, over a year, thousands more Americans are killed by gun crime than by terrorism. And yet Americans are more willing to sacrifice freedom and money to fight terrorism than gun crime.

There's a common theme here. It's that many people are not utilitarians. Their moral sentiments are based not just upon objective costs and benefits but upon a feeling of disgust. Sure, Suarez imposed less injury upon his opponent than many reckless tackles do. But biting someone is disgusting whilst fouling them is not, and so many feel it deserves greater punishment. Similarly, terrorism evokes disgust to a greater extent than does gun crime, and so justifies a stronger policy response even though the objective costs of gun crime are greater.

This disgust has economic implications because, as Alvin Roth has described (pdf), it can prevent otherwise mutually beneficial trades such as in markets for donor organs.

In this sense, there is a direct conflict between the utilitarianism that is the default position of economists and public opinion. Many economists say "markets facilitate mutually beneficial trade, so we should have free(ish) ones in organs, drugs, prostitution etc." To which non-economists go "yuck, that's disgusting."

Herein lies a reason why, historically, utilitarianism and liberalism have tended to go together - most notably in the person of John Stuart Mill. In considering only objective costs and benefits, utilitarianism discounts disgust. It thus removes a justification for criminalizing "self-regarding" acts such as prostitution, drug-taking or (for many years) homosexuality.

And in this last word lies a problem. Over time, the things that disgust us change. Today, we find the slave trade disgusting but homosexuality not. But there was a time when the opposite was the case. Granted, there seems to be a neurological basis for the feeling of disgust - but the objects which trigger the feeling change over time.

Which raises a problem. Does this show that feelings of disgust are irrational prejudices? If so, should they have weight in policy-making? Or are they instead forms of taboo or social norms which are rationally defensible? If they are, how can utilitarians and liberals better engage with them?

I have no answers here. I'm merely pointing out that we have here two competing moral perspectives, and very often the clash between the two produces merely a sterile slanging match.

Another thing: I'm ignoring here the fact that Suarez has lengthy form and so reactions to his bite are shaped by a form of framing effect.

April 21, 2013

What if demand for graduates falls?

What is university for? I ask this old question because the utilitarian answer which was especially popular in the New Labour years - that the economy needs more graduates - might be becoming less plausible. A new paper by Paul Beaudry and colleagues says (pdf) there has been a "great reversal" in the demand for high cognitive skills in the US since around 2000, and the BLS forecasts that the fastest-growing occupations between now and 2020 will be mostly traditionally non-graduate ones, such as care assistants, fast food workers and truck drivers; Allister Heath thinks a similar thing might be true for the UK.

There are signs of this happening already. ONS data show that employment in professional occupations, having grown 3.1% a year between 2001 and 2007, has grown just 1.2% per year since, whilst overall employment growth hasn't changed much.

And we can tell a futurological story in which high-end work declines: IT could replace accountants and lawyers, not just routine clerical workers; MOOCs could render some college lecturers redundant; a smaller financial and public sector will limit demand for graduates; and the increased supply of graduates from India and China might bid down the wages of their western counterparts.

Now, none of this is at all certain. In 1975 Gary Becker, the founder of human capital theory wrote: "Perhaps the current weak demand for highly skilled manpower is the beginning of a resumption of the earlier [1900-40] decline." (Human Capital, 3rd ed, p9) That was just before a two-decade long increase in demand for graduates.Which tells us that forecasting demand for skills is a mug's game.

Nevertheless,we should ask: what function would universities serve in an economy where demand for higher cognitive skills is declining? There are many possibilities:

- A signaling device. A degree tells prospective employers that its holder is intelligent, hard-working and moderately conventional - all attractive qualities.

- Network effects. University teaches you to associate with the sort of people who might have good jobs in future, and might give you the contacts to get such jobs later.

- A lottery ticket.A degree doesn't guarantee getting a good job. But without one, you have no chance.

- Flexibility. A graduate can stack shelves, and might be more attractive as a shelf-stacker than a non-graduate. Beaudry and colleagues decribe how the falling demand for graduates has caused graduates to displace non-graduates in less skilled jobs.

- Maturation & hidden unemployment. 21-year-olds are more employable than 18-year-olds, simply because they are three years less foolish. In this sense, university lets people pass time without showing up in the unemployment data.

- Consumption benefits. University is a less unpleasant way of spending three years than work. And it can provide a stock of consumption capital which improves the quality of our future leisure. By far the most important thing I learnt at Oxford was a love of Hank Williams and Leonard Cohen.

But are these benefits really worth £27,000. I fear that, in an economy with declining demand for graduates, many will think not. If so, rather than supply much-needed educated workers, universities might merely create a (larger!) mass of disaffected 20-somethings. In this sense, the technical-economic matter of relative demand for skills could have interesting social consequences.

Another thing. It's possible that a society of educated people is likely to be more cultured and scientific-minded than one of non-graduates, and this should have positive externalities in the form of better political discourse and higher culture. There is, however, little evidence of this in practice.

April 18, 2013

Endogenous morality

Recent events pose a challenge to conventional neoclassical economics. I refer not to the financial crisis, but to a fat Geordie's attempt to twat a police horse.

This seems to undermine the standard economics of crime, as developed (pdf) by Gary Becker. This says that people will commit crimes if the expected benefits outweigh the costs. Such a theory, however, doesn't fit two big facts. One is that many crimes, such as twatting p.hs, are just moments of madness. The other is that many people eschew crimes even though they might well get away with them. These two facts can co-exist in the same person; if we take our fat Geordie at his word, he has "never been in trouble before."

However, a new paper by Matteo Cervellati and Paolo Vanin of the University of Bologna helps to explain such behaviour.

They start by recognizing weakness of will, that we are tempted to do things we'll regret. This introduces a role for morality. It works as a self-commitment device; "thou shalt not steal" stops us breaking into people's houses if we see the window open.

Such moral codes can explain our fat Geordie's behaviour. Whilst they can stop us committing otherwise profitable crimes, they don't always prevent us being stupid in the heat of the moment.

So far, so trivial, you might think. No so. Morality has a cost; it can either prevent us committing profitable crimes or it can impose a burden of guilt upon us if we do so. It follows that parents who care for their children's material welfare will not always want to inculcate into them a strong moral code. If you think your children will be so poor they will starve to death unless they steal food, you'll be less keen than others to tell them that theft is wrong. Or if you think your children will be so rich they can do what they like, there'll be no point burdening them with guilt.

Cost-benefit considerations, therefore, tell us that moral codes will be strongest among what used to be called the middling sorts. Parents who feel their children will be sufficiently poor that they'll be tempted to steal, but also sufficiently well-off that they have something to lose, will be most keen to inculcate morality.

This fits historical stereotypes; the feckless underclass, the dissolute aristocrat, the respectable working class man and the priggish bourgeois are all cliches. But they are cliches for a reason. Cervellati and Vanin use people's attitudes to tax-dodging, fare evasion and benefit fraud in the World Values Survey to show that, indeed, middling classes do have a stronger moral code.

We might add that this also explains why bourgeois morality has so often been accused of hypocrisy. It's because such morality was partly cultivated by self-interest. (I nearly wrote "arose out of" but that pitches it too strong.)

Cynics might think all this is yet another exercise in economic imperialism - an attempt to explain everything with the tools of costs and benefits. But it is hinting at something which might be both true and important - that social norms and moral codes are not (just) exogenous constraints, but are instead economically endogenous. In this sense, neoclassical economics and Marxism agree.

April 17, 2013

Reinhart & Rogoff: true Keynesians

Any Keynesians who are rejoicing in the debunking of Ken Rogoff's and Carmen Reinhart's claim that high government debt reduces GDP growth should stop. I suspect Reinhart and Rogoff are, in fact, guilty of a Keynesian error.

To recap, they claimed (pdf) that ratios of government debt to GDP over more than 90% are associated with significantly lower average GDP growth. However, when Thomas Herndon, Michael Ash and Robert Pollin tried to replicate this result, they found that it was due largely to excluding Australian, Canadian and New Zealand experience in the late 40s, and an Excel error - which Reinhart and Rogoff admit was a "significant lapse" - which led to good Belgian growth being excluded.Fixing these errors shows that high government debt has been compatible with decent growth.

So, why do I say Reinhart and Rogoff are Keynesians? Simple. The issue here is not really one of policy; insofar as Reinhart and Rogoff's result has been used by policy-makers, it is in the way that drunks use lamp-posts - as support rather than illumination.

Instead, the issue is about the culture of economics. And here, Keynes (among others) had an unfortunate if perhaps inadvertent effect.

What leaps out of his General Theory is that it is entirely unencumbered by empirical evidence. Keynes thus helped to promote an ideal of the economist as a brilliant man capable of solving problems from his armchair by dint of superb intellect*. What got undervalued in this was the importance of the mundane grunt work of careful fact-gathering.

Reinhart and Rogoff's errors, I suspect, reflect a culture which prizes brilliance - and no-one doubts that Rogoff is brilliant - over dull pedantry.

When I started work, I realized that the job of the practical economist was not so much about theorizing but more concerned with gathering and understanding data - something which academe had wholly unprepared me for. For me, the difference between the professional economist and the amateur is that the former knows the numbers not in the sense of understanding high econometric theory, but in the sense of knowing where they are, what they mean and what they don't. This is no small skill. An ability to navigate the ONS website without recourse to language you wouldn't use in front of your mother requires a mastery of the arcane which is not given to many mortals.

I suspect things have changed a little since I was a student; a lot of good recent work in economics has involved using big data or generating facts by experiment - for example in the work of Mark Grinblatt, Mattias Sutter or Esther Duflo to name but three of many. But I'm not sure it's changing enough. Diane Coyle has reported that many employers want economics students to have "a better practical grasp of quantitative methods including collecting and understanding data (as opposed to more sophisticated econometric techniques)." Perhaps, then, the tendency to elevate the brilliant theorist over the empiricist lingers.

Traditionally, many economists have tried to model themselves on Isaac Newton - albeit emulating his autistic misanthropy better than his genius. But perhaps Darwin would be a better model. His greatness lay not so much in the theory of evolution - something quite trivial he took from economics - but in the years of careful fact-gathering that preceded it. Perhaps if this were so, the sort of mistake made by Reinhart and Rogoff wouldn't have happened.

* There's a contrast here between Keynes and Kalecki; the latter did develop hypotheses which he tested against data, which is is why I hold him in higher esteem than Keynes.

April 16, 2013

Moral panics & the threat to freedom

Bertie Wooster was once fined £5 at Bosher St magistrates for stealing a policeman's helmet on boat race day. However, nobody, except for the Fascist sympathiser Sir Watkyn Bassett, regarded this as a reason to rebuke him.

However, when a Millwall fan did the same at the weekend, we got media outrage and an apology from him - I hope in bad faith - claiming to be "disgusted" at his actions.

It would be tempting to attribute this contrast to the traditional class bias which sees upper class antics as high jinks but similar working class behaviour as thuggish hooliganism.

But I suspect there's more going on. We should interpret the headlines about Millwall fans' scuffling alongside the furore over Paris Brown's tweets and (some) Tories' outrage over the effort to get "Ding Dong the Witch is dead" to the top of the charts. In all three cases we have a moral panic. I reckon there are at least two motives behind this.

One is simple incentives.Newspapers have no incentive to undersell stories, and every incentive to grab eyeballs. So "outrage", "disgust" and "fury" displace mild unease and slight disquiet.

The other is an ahistorical managerialism. Peter Ryley rightly notes that a "raucous irreverance" is a long English tradition. Rather than recognise disorder as normal and inevitable, however, the ruling class seems to aspire to some fictitious ideal in which it is eliminated. But this is pure managerialism - a belief that conflict and disharmony can somehow be managed away. (There is, of course, nothing uniquely Conservative in this; a feature of Blairism was its tendency to moral panics.)

One aspect of this managerialism is a belief in what Richard Sennett called the "myth of a purified community". We want to believe that other people are like us, that there is greater social solidarity than there really is. Disorder challenges this fiction, and we respond by exaggerating the deviance of its perpetrators; football hooligans are always a "tiny minority" and not "real fans." Such deviants then become a threat to society rather than a part of it:

Having so little tolerance for disorder in their own lives, and having shut themselves off so that they have little experience of disorder as well, the eruption of social tension becomes a situation in which the ultimate methods of aggression, violent force and reprisal, seem to become not only justified, but life-preserving. (The Uses of Disorder, p44-45)

And herein lies the danger with moral panics. They are a sign of intolerance, of a lack of the culture of liberty. In this sense, the trash newspapers - and those who share their worldview - are a threat to freedom.

April 15, 2013

In praise of imprecision

"Private firms don't hire people to make DSGE models" says Noah Smith. We should read this alongside Less Wrong's endorsement of Fermi estimates. Both, in different ways, tell us about the virtues of imprecision.

The problem with precision is that it is very often wrong. In economics, this is generally for two reasons: model assumptions don't match reality, which is true by definition of the word "model"; and data are subject to revision or sampling error.

This means there, as Thomas Mayer said, a trade-off between truth and precision. For example, the statement "GDP has been more or less flat (after seasonal adjustment!) recently" is imprecise, but quite possibly truer than the claim "GDP fell by 0.3% in Q4". And in early 2008 it was more useful to have a rough feeling that we were heading for trouble than it was to have a precise solution to a DSGE model which predicted no recession. It's better to be roughly right than precisely wrong.

Of course, economic forecasters provide precise numbers. But we shouldn't read them as being precise. The guy who's forecasting 1.2% growth this year isn't really saying GDP will rise precisely this amount. He's saying there are reasons to be slightly more optimistic than the consensus (pdf), which is forecasting 0.9% growth.

In other contexts, a rough and ready estimate is mostly good enough, at least as a starting point. Here are three examples:

1. How much does welfare scrounging cost the economy? Guesstimate the number of scroungers. Guesstimate the value-added they'd contribute if they were working. Express as a proportion of GDP. For plausible values, it's a small number.

2. What impact will the small uprating in the minimum wage have on jobs? The adult rate will rise by 1.9%. Economists forecast inflation this year of 2.5%, so this is roughly a 0.6% real fall. Let's call the price-elasticity of demand for labour 1.5. The Low Pay Commission estimates (pdf) that 5.3% of jobs are around minimum wage ones. Multiply these three numbers together and we get 0.048%. Multiply by the number of jobs in the economy (29.73m) and we have roughly 14,000.That's roughly one-eleventh of the sampling variability of employment figures.

3. How risky are shares? The long-term standard deviation of UK annual returns has been 20 percentage points. If we assume average annual real returns of 5%, this implies there's a one-in-six chance of losing 15% or more in a 12-month period.If we assume returns are serially uncorrelated, this implies a one-in-six chance of a weekly fall of 2.7% or more, and of a daily fall of 1.2%. What are the chances of a crash - say a 10% in a day? This is an 8.3 standard deviation event, which a normal distribution tells us is vanishingly unlikely. However, we know that a cubic power law fits the data better. And this tells us we should expect such a move once every 3173 days, or about once every 12 years.This isn't intended as a precise number, but an illustration of the sort of risk involved.

You can quibble with all these numbers. But what would be the point? The answers to my three questions would still be: small, small, big. And the implications for economic policy or for your personal financial planning wouldn't change much either. Indeed, we know from the crisis of 2008 that attempts at more precise risk management did not yield better results than would the back of a beermat.

My point here should be a trivial one - that rough numbers and a feel for magnitudes can get us a long way. This shouldn't need saying. But I fear it does, as it's a correction to two vices. One is a statistical fetishism which thinks that numbers must somehow be precise, and which uses them not to illuminate the truth but to hide it. The other is an academic rigour which inculcates in students an ability to give precise answers to irrelevant questions.

April 14, 2013

Thatcherite roots of the crisis

Tim dismisses as "tosh" Owen's claim that the crisis "has roots in the Thatcherite free market experiment." I half agree with both. I suspect the banking crisis does have Thatcherite roots, but they have little to do with free markets.

I'm thinking here of two merchanisms.

First, Thatcher recognized that voters don't just create governments, but governments also create voters. In relaxing mortgage lending controls and in selling off council houses, she created a new class of property owners. This class had a vested interest in high house prices. But high house prices naturally lead to high mortgage debt and thus to banks which lend heavily and are over-extended*.

Secondly, Thatcher helped to spread the ideology of centralized managerialism. We see this, for example, in her assertion of "management's right to manage" against any conception of co-determination, and in the increase in central government control over local authorities. We might add that her image as a domineering "iron lady" helped to glamorous and legitimate an overbearing management style which is intolerant of dissent. This ideology gave us the pig-headed bosses who contributed to the collapse of so many banks. Fred Goodwin and James Crosby, more than most, are Thatcher's children.

This story agrees with Tim, in that it is consistent with the banking crisis being a crisis not of free markets, but of managerialism. The banking crisis shows us not (just) that free markets don't work, but that hierarchical organizations with bullying managers don't work.

But it also agrees with Owen, in claiming that the crisis does have Thatcherite roots.

These two claims are quite consistent, once one recognizes (as Tim and Owen half do in their different ways) that Thatcher was not a free marketeer but a class warrior.

* Intelligent economists of all colours have often called for land value taxes, more housebuilding and monetary policy to pay more attention to asset price bubbles. There's a reason why such policies have little public support. That reason is rooted in Thatcherism.

Another thing: one could also argue that Thatcher's cut in top tax rates helped to incentivize not just good entrepreneurship but also the rent-seeking and excessive risk-taking that contributed to the crisis.

April 11, 2013

Thatcherism & productivity

Simon Wren Lewis, citing John Van Reenen and Nick Crafts, says:

The Thatcher era saw the implementation of supply side reforms that ended and then reversed the relative decline of UK productivity.

That word "relative" is doing some work. Looking solely at UK data on GDP per hour worked, taken from the Bank of England, productivity growth has been slower since Thatcher than it was before.Between 1985 and 2007, productivity grew by 2.1% a year; this time period is as flattering as can be for the pro-Thatcher argument. But in the previous 22 years, it grew by 2.9% a year.

Productivity, then, has grown more slowly in the era of quiescent unions and "neoliberalism" than it did in the social democratic-corporate era.

However, if we look at the UK's performance relative to other major nations, things are kinder to the Thatcher reforms. OECD data shows that UK productivity grew 2.3% a year between 1985 and 2007. That's faster than the average for G7 countries, of 2%. By contrast, in the previous 15 year (the data begin in 1970), UK productivity grew slightly more slowly than the G7 average, by just under 2.7% against just over 2.7%.

What's going on here? There are, I reckon, two competing stories. The pro-Thatcher one is something like this:

After 1973, global growth slowed markedly. This depressed productivity through (at least) two channels. One is that Verdoorn's law - the tendency for strong output growth to generate productivity growth thanks to increasing returns - depressed such growth. The other is that a more sclerotic economy generated increased class conflict as bargaining became more like a zero-sum game. The productivity growth of the 60s, therefore, could not be repeated. We needed a new economic model, and Thatcher provided one. Had we not had the Thatcher revolution, our productivity growth would have been even worse. The fact that productivity growth fell so much in Japan, Germany, Italy and France shows the sort of slowdown we'd have had, had we not had Thatcherism.

The more critical version is something like:

The fact that productivity grew quickly in the 60s shows that strong trades unions are quite compatible with a thriving economy.Productivity slowed globally after the 1970s because macroeconomic policy globally abandoned Keynesian-style reflation in favour of policies which gave us serious recessions in the 80s and 90s and these (via Verdoorn's law) reduced productivity growth. Productivity growth isn't merely a microeconomic phenomenon, but also the product of macro policies. And bad macro policies depressed it.If the UK - and better still world - had had decent macro policies, we could have achieved good productivity growth without the huge social costs involved in bashing the unions.

As a Marxist rather than a Keynesian, I have no dog in this fight.My point is just that if you want to claim that Thatcher did improve the UK's productivity performance, you need to argue for a particular type of counterfactual.

Chris Dillow's Blog

- Chris Dillow's profile

- 2 followers