Harry S. Dent Jr.'s Blog, page 123

December 31, 2015

3 Forecasts for 2016 Are About to Roll In!

As the holidays wind down and a new year begins, the stock market will be chock full of clues as to the future… if you know where to look for them.

As the holidays wind down and a new year begins, the stock market will be chock full of clues as to the future… if you know where to look for them.

And a few of them are literally right around the corner.

The Stock Trader’s Almanac is a popular resource that includes a trove of data-driven forecasting tools I’ve always found useful. Statistical analysis shows these tools have the ability to forecast (likely) future returns – and alert investors to (potential) periods of outperformance and underperformance.

Today, I’m going to dive into three of these – the “Santa Claus Rally,” the “First Five Days” period, and the “January Barometer.”

The so-called Santa Claus Rally spans the last five trading days of December and the first two trading days of January.

The rally is remarkably consistent. It’s occurred nearly 80% of the time over the last five decades. And it’s produced an average return of 1.4% – far better than is typical for any seven day period.

But there’s also a strong forecasting element to this seasonal tendency. Specifically, when a Santa Claus Rally fails to occur… stocks tend to underperform through the first quarter of the new year.

With the appearance of a Santa Claus Rally… stocks gain an average of 1.3% between January and March.

Without the rally… they gain just 0.6%.

So if you’re wondering whether you should get bullish in early January, you should wait to see if a Santa Claus Rally makes an appearance this year. If it does… the odds are on your side.

But after the first quarter, Santa Claus’ forecasting power fizzles out.

Annual returns with the rally are 5.3%, versus 5.1% without it. That’s a slim and meaningless difference. Clearly, this is where the Santa Claus Rally’s forecasting power falls short.

But that’s where the “First Five Days” comes in. This period has the power to forecast returns for the entire year.

Historically, when stocks are up in the first five days of January… they go on to produce an average return of 8% through year end. But when stocks are down for the first five days of the year, they produce a milder 6.3% return – a profit reduction of about 20%.

What’s more, positive annual returns are much more likely when stocks are up during the first five days – with a win-rate of 73% (versus 65% when stocks begin the year weak).

I found another interesting conclusion from my data dive. But it pertains to a shorter, three-month timeframe… the one we target in my Cycle 9 Alert service.

I can’t go into it all the nitty gritty details here, but both the First Five Days period and the January Barometer (which I’ll get to next) can also give profitable clues about how stocks are likely to trade in February, March and April – one of the most favorable times of the year to be in stocks, particularly if we get those early-year signals that I’ll be watching for.

These shorter-term signals are often overlooked by investors, especially ones who are stuck in a long-term mindset. “To each his own,” as they say… but I think it’s a mistake to pass over high-probability opportunities to make a quick buck. And that’s why I’ve designed Cycle 9 Alert to capture those two- to three-month moves.

Finally, there’s the so-called January Barometer, a seasonal pattern that suggests: “As January goes, so goes the year.”

Basically, if stocks are up in January… expect a bullish year. If they’re not, well, brace yourself for a rough year.

By my analysis, annual returns are nearly 70% stronger – 7.9% versus 4.7% – following a positive January.

Plus, positive annual returns occur 75% of the time following a positive January… versus just 54% of the time following a negative January. That’s a huge difference in odds!

Of course, it’ll still be several weeks before all the data comes in… before we know whether the Santa Claus Rally makes it to town this year… and before we have a chance to take the market’s “pulse” in January.

But I’m watching these forecasting tools closely, and I’ll give updates as the data comes in.

Adam O’Dell, CMT

Chief Investment Strategist, Dent Research

December 30, 2015

2015: Another Year of Market-Beating Returns

If your investment portfolio didn’t produce a double-digit return for you this year… rest assured, you’re not alone.

If your investment portfolio didn’t produce a double-digit return for you this year… rest assured, you’re not alone.

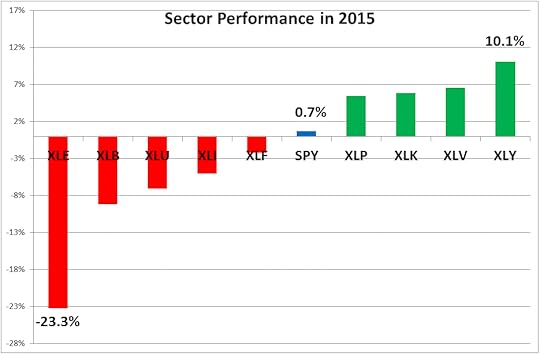

The S&P 500 – otherwise known as “The Market” – has returned a measly 0.7% since January.

Meanwhile, though, there were tens of thousands of dollars’ worth of opportunity in stocks this year.

You see, this was a great year for somesectors of the stock market. It was also a horrible year for some sectors.

Looking at the tops and bottoms… you’ll see the Consumer Discretionary (XLY) sector produced a healthy 10% return this year, while the Energy (XLE) sector suffered a devastating 23% loss.

Take a look…

Now, I think you’ll agree with me that annual returns of 0.7% – as produced by “The Market” – won’t get you anywhere close to your financial goals.

That’s why I’m a huge advocate for running an active portfolio, rather than a passive one. It’s nowhere near as difficult as some think… and the results can be far better than buy-hold-and-hope.

Essentially, I use a time-tested algorithm and data-driven analysis to invest in specific market sectors… but only the ones that are poised to beat The Market. And, instead of tying up capital for a full year, we take a more reasonable and flexible approach – aiming to stay in positions for two to three months at a time.

This approach has worked extremely well since I designed the service in 2011… and this year was no exception.

Since January, I’ve recommended 12 round-turn trades. Of course, we didn’t make money on all of them. And we’re even holding a few underwater positions right now.

Still, we turned a profit on 7 of 12 trades this year, for a win-rate of 58%.

Interestingly, we made investments in just about every sector, including: Consumer Discretionary (XLY), Financials (XLF), Industrials (XLI), Consumer Staples (XLP), Energy (XLE), Materials (XLB), and Health Care (XLV).

Besides those, we also found high-probability opportunities outside the stock market – pocketing 39% on a U.S. dollar position and 165% on a volatility play.

All in all, our average profit on the winning trades came in at 82%. And our average loss on the duds was about half that – at 40%.

Now, consider our bottom line…

Assuming an investment of $10,000 was made in each position, these 12 trades produced a net profit of $37,162.

On a $100,000 portfolio… that’s an annual return of 37%.

On a $50,000 portfolio… it’s 74%!

No matter how you slice it, Cycle 9 Alert subscribers had access to thousands of dollars’ worth of opportunities this year – even as The Market sputtered sideways.

And since my analysis and recommendations are data-driven, not based on gut feel, I’m looking forward to another great year of market-beating in 2016!

Adam O’Dell, CMT

Chief Investment Strategist, Dent Research

The Deadly Truth About the Great Boom and This “Recovery”

December 29, 2015

Health Care Premiums Shooting Through the Roof? Here’s Why

December 28, 2015

2016: You Don’t Want to Buy and Hold This Market!

This year has been called “the year nothing worked.” Stocks, bonds, commodities… emerging markets… real estate investment trusts… pipelines… cash… nothing generated much in the way of returns in 2015.

This year has been called “the year nothing worked.” Stocks, bonds, commodities… emerging markets… real estate investment trusts… pipelines… cash… nothing generated much in the way of returns in 2015.

Many active traders, of course, had a good year, and investors that stuck with a handful of high-octane momentum stocks actually did really well. But in looking at asset classes in general, 2015 was a blasé year for investors.

Well, I have good news and bad news.

The good news is that there are pockets of value out there.

As I’ve written recently in Boom & Bust, many closed-end bond funds are priced to deliver very respectable returns over the next 12 months. And similarly, we’re starting to see some opportunities in the sectors that got hammered the hardest in 2015, such as mortgage REITs and business development companies.

But the bad news is that the broad market is still extremely expensive, and priced to deliver very disappointing returns going forward.

The picture doesn’t look quite that bad when looking at traditional metrics like the price/earnings (P/E) ratio. Since stock prices have basically stayed the same as corporate earnings have dragged, the trailing price/earnings ratio has actually jumped.

Of course, some of this is due to the collapse in oil company profits. Either way, it’s a mistake to fixate too heavily on a single year’s P/E ratio. The earnings half of the equation can fluctuate wildly from year to year.

So instead, let’s use one of my favorite valuation tools, the Cyclically-Adjusted Price/Earnings ratio (CAPE), also called the Shiller P/E Ratio. The CAPE compares today’s prices to a 10-year average of earnings as a way of smoothing out the year-to-year fluctuations.

By this measure, the S&P 500 is wildly expensive today. In fact, it’s only been significantly more expensive one time in history, and that was during the 1990s tech bubble.

Today, the CAPE sits at a nosebleed level of 26.2. Research site GuruFocus ran the numbers and found that today’s valuation puts the S&P 500 at 57% more expensive than the long-term average. If history is any guide, this implies annual returns of just -0.2% over the next eight years.

Now, I don’t for a minute expect stocks to trade sideways for eight years. That’s never happened in history, and I don’t expect it to start today. The market will do what it always does: it will be choppy and volatile, giving us plenty of opportunities to buy dips and sell rallies.

But we’re not likely to see any sustained uptrend, and I expect that, once the numbers are tallied, the returns over the next eight years probably really will look close to the GuruFocus estimates.

The takeaway?

Don’t plan on a buy-and-hold strategy in 2016. Search out the pockets of value as you see them, or even use a momentum strategy if that’s more your style. But be sure to stay active, because a passive buy-and-hold strategy is likely to disappoint.

Charles Sizemore

Editor, Dent 401k Advisor

China’s Unprecedented Real Estate Bubble Is a Ticking Time Bomb

December 25, 2015

Make This Christmas Count, Because Next Year Might Not Be So Jolly

It’s Christmas. It’s the time of year when everyone feels their best. Even the markets tend to perform better (though that isn’t the case this year).

But for the most part, it’s a time of spiritual reflection and giving.

The principle of giving is integral to transcending our most basic mode of survival…

On your death bed you likely won’t be counting your money or possessions. Rather, you’ll be reflecting on your relationship with people and God, whoever that may be for you or however you define it. You’ll remember how you helped and served others.

Of course, giving alone does little more than relieve the ego… it helps us feel connected to others and the greater principle of being. But many forms of giving don’t actually serve others. Give a man a fish… you know.

That’s why, if you’re going to give, do so in a way that actually improves the well-being of the recipient. Don’t just give them temporary pleasure or relief.

For those simply giving to a cause, most of that money filters to the very corrupt political and mafia-like powers that conspire to keep their people poor.

Which reminds me of another saying: “The pathway to Hell is paved with good intentions.”

Just like the failure of most economists, who insist on treating the symptoms rather than the underlying problems, the very act of giving itself only makes the person more dependent and weaker.

And yet that’s the world we live in today.

Since 2009, the Fed and central banks from around the world have been stimulating their economies so no one has to suffer another financial crisis again.

For 2016, economists are giving their year-end predictions, saying the stock market will be marginally higher, that housing will inch higher, and that the Fed will deliver two or three small interest rate hikes.

That’s what everyone wants to hear… but we continue to say the unpopular thing.

You don’t get something for nothing.

That’s what we’ve gotten for several years now: $10 trillion+ in global money printed out of thin air to offset the greatest (and most global) debt crisis, deflation and depression since the 1930s.

Stocks continue to defy gravity, although they have gone nowhere since November 2014 – and that’s what happens. Bubbles keep expanding, overtaking everything in their paths, until they burst so violently that they destroy debt, wealth, businesses and jobs faster than ever.

The markets are on crack, and they will end like every crack addict in history – in detox.

So this Christmas, give the gift of financial wisdom to your loved ones.

Help them to preserve their wealth and income in what could be the greatest financial crisis… and the greatest sale on financial assets… of a lifetime.

If you missed out on the gains of the past several years because you, like me, were wary of the negligent policies of these central banks, don’t worry. Preserving your wealth, income and assets will allow you, your family and business to prosper in their years ahead.

It’s by protecting yourself that you will have a Merry Christmas today and for years to come. And that’s what we wish for you.

So take it in. Give your loved ones a hug, pop the cork, sing a song, or do whatever Christmas ritual you have or make up a new one. Next year I don’t think will be so jolly… but you’ll be prepared.

Harry

December 24, 2015

This Christmas, Celebrate the Imperfections

I’m a Christmas guy. As I’ve written in the past, every year I start playing Christmas music in the car the day after Thanksgiving. I’ve got the usual stuff – seasonal songs, hymns, etc. – but I also play some songs that are, well, different.

I’m a Christmas guy. As I’ve written in the past, every year I start playing Christmas music in the car the day after Thanksgiving. I’ve got the usual stuff – seasonal songs, hymns, etc. – but I also play some songs that are, well, different.

One in particular stands out: “Merry Christmas From the Family.” The original is by Robert Earl Keen, although a more recent, less crude version was recorded by Montgomery Gentry.

For those unfamiliar with the old country tune, it starts off with: “Mom got drunk and dad got drunk, at our Christmas party.” It goes on to recount some colorful encounters with distant relatives and new family members. It might seem out of place with the other songs, but I love the tune for what it is, and for what it isn’t.

At our recent company Christmas get-together, we found out that one member of our team had never heard the song. Since she is young, Jewish, and from New Jersey, maybe that’s not surprising, but a few of us from the South decided she should become acquainted with it.

As we sang the lyrics, she was dismayed. When she finally heard the whole song online, she was even more put off.

I don’t think we did a good job of painting the whole picture.

The point of the tune is that the family isn’t perfect. There are drunk parents of adult kids, divorced people, step children, skepticism about foreigners that is later erased, a struggle to figure out some family relations, and a convenience store shopping list that involves cigarettes.

Granted, the song is meant to be extreme and humorous. I can safely say that the description doesn’t match my family dynamics, but I still get it: in the real world, families are rarely perfect. Very few of us, if any, match the movies we see on Hallmark this time of year or any of those cloying holiday cards.

Not all family members get along. People have bumps and bruises from decades of relationships and simply living. We bring our history to each conversation at the dinner table, which can be awkward at times, if not downright uncomfortable.

But, just as is noted in the song, this is the time of year when we make a point to get together. We are genuinely interested in each other, in renewing our family and friend connections, and doing what we can to strengthen them.

That is how I will spend my Christmas, and it’s my wish for all of us – that no matter how imperfect our personal lives might seem at times, we use this holiday to reconnect with those who are meaningful in our lives, even if we rarely see them and are sometimes annoyed by them.

Who knows, you just might end up sharing a little holiday cheer and then singing a few verses of an off-beat Christmas tune!

Rodney

December 23, 2015

Tall Tales: Two Common Myths You’ll Hear About Trading Options

Options are one of the most misunderstood investment vehicles in all of finance.

Options are one of the most misunderstood investment vehicles in all of finance.

Some think you should avoid them like the plague. Others, like myself, see the tremendous upside.

So today, there are two myths about the dangers of options that I’d like to discount once and for all.

Myth No. 1: “Most options contracts expire worthless.” Heck, some think it’s as high as 90%!

That’s a pure, unadulterated lie.

The Chicago Board Options Exchange has shown that only about 30% of options contracts expire worthless. The 90% figure originally came from an SEC study that was fundamentally flawed.

Still, some investors choose to believe that 90% of options expire worthless. These investors then think that selling options contracts is a better strategy… so that’s what they do, aiming to reap gains when the value of the contract goes to zero.

Yet, this can be a very dangerous strategy… one with unlimited risk. And it’s these “naked selling” option strategies that lead investors to believe another gross generalization…

That brings us to myth no. 2: “My risk is UNLIMITED when trading options.”

This statement is also false (if you trade options the way I recommend).

If you choose to employ a strategy that only purchases options contracts, you’re actually limiting your investment risk.

In fact, buying an options contract is the ONLY way to guarantee you won’t take a loss more than you’re willing to accept at the onset of the investment.

And since you can buy most options contracts for just a few hundred dollars (instead of a few thousand dollars, as with stock shares), you can play the market with only a small amount of capital and risk.

Of course, not all trades go in our favor.

Sometimes we have to take a loss, which can mean a 100% loss of the debit we paid for the call options we purchased. But we’ll lose no more than that, and the upside potential of our option plays is often much greater than 100%.

As you can see, our risk is completely limited, while our profit potential is unlimited!

Many of my current subscribers have admitted that they had no experience with options prior to joining my services, yet feel perfectly comfortable trading options with my guidance. Options “pros” also tell me they find my trades very valuable.

Several of our trading strategies, not just mine, employ the use of options. So keep checking your Cycle 9 Alert and Max Profit Alert emails, as well as those of our other editors, to see how we’re bringing you the best value with this incredibly lucrative investment vehicle.

Best,

Adam O’Dell, CMT

Chief Investment Strategist, Dent Research

Pretty Soon Chancellor Merkel Won’t Be So Popular

The near-bankruptcy of Greece…

The massive influx of refugees from Syria…

And the terror attack on the “City of Light”…

That’s how a video begins on Time Magazine’s website celebrating Angela Merkel, the chancellor of Germany, the de facto leader of Europe, and their “Person of the Year.”

As they put it, 2015 has been the most tumultuous year for Europe in recent memory. And Merkel, for all her “merkeling,” embodies Europe’s ideals of openness and solidarity in a time when both are being tested.

If it’s been said that nobody gets rich off the news, then the same runs true that once the mainstream media catches onto you as a trend, or when your name becomes a verb, it’s over!

By the time everyone and their dog knows a person’s name, the S-Curve has already matured, so to speak. Their popularity is no longer on the upswing – it’s already reached peak saturation. And no one stays on top forever.

It’s like the human model of forecasting:

When everything’s been great for a number of years, everyone thinks the coast is clear and that we’ll never have a recession again.

Then when things start to go topsy-turvy, they all assume it’ll be a soft landing and that no major damage will ensue. How bad could it be?

And then after the demolition when they realize it can and did get pretty bad, they think it’ll never get better. Again, how could it?

People never learn from history and very obvious cycles!

We’re at the top of a very long and massive boom since 1983, thanks to baby boom spending. And you know what that means.

Everyone’s looking for a soft landing here, there, and even in massively overbuilt China.

So for Merkel to be on Time’s cover is like Amazon’s CEO Jeff Bezos being on the cover in 2000 at the top of the tech bubble.

Of course, given that Germany is the economic powerhouse of Europe, nobody sees the trouble brewing. They’re oblivious to the incurable balances the euro has created in trade in Europe…

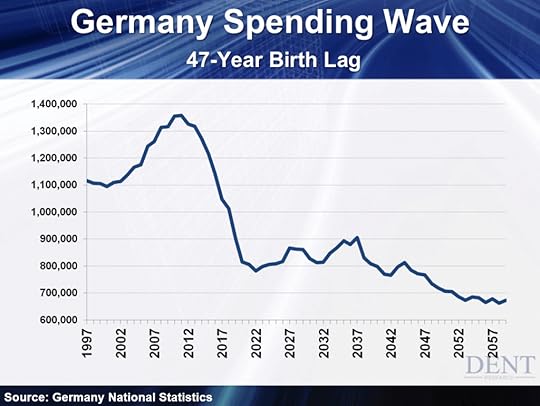

And even more blind to the fact that Germany will have the absolute worst demographic trends between now and 2022 – even worse than Japan from 1990 to 2003!

Look at this chart for Germany’s spending wave ahead…

Now that’s what I call falling off a demographic cliff!

It’s so bad that Germany doesn’t even recover into the next or subsequent generations! And notice this spending wave is already starting to decline.

And then there’s the massive refugee problem which Merkel has had to reverse her position on as, I expected. There have been over 800,000 asylum-seekers this year, and a projected three million more wanting to come to Europe.

These people may one day become productive younger workers, but no time soon. In the meantime, they come at a huge expense to whoever brings them in. I mean nothing by it – it’s just the hard, financial truth!

Then there’s a slew of past due bank loans which I covered recently, and of course southern Europe leads the pack! Nothing has been done to restructure debt except to forgive loans in Greece. And that means Europe’s debt problem is just begging to erupt again.

Make no doubt about it – the U.S. is going to have a major crisis, but nothing compared to what Europe is about to see with its strongest country, Germany, leading the way down in the years ahead.

Let’s see how popular Merkel is then.

Harry

A Yahoo Finance headline this morning

A Yahoo Finance headline this morning