Harry S. Dent Jr.'s Blog, page 127

November 23, 2015

This Sector’s About to Be Turned on Its Head

If you’re looking into buying your dream car in the next few months – think twice!

If you’re looking into buying your dream car in the next few months – think twice!

At the bottom of the stock crash in early 2009, I bought a dream car – a 2008 Maserati GranTurismo – at 22% off. I got the manufacturing margin and the dealer margin completely taken off. Six months earlier, I would’ve paid a slight premium. Instead, I got a discount.

So hear me out – if you’ve really got your eyes on that Chevy Corvette Stingray or Mercedes-Benz convertible or whatever, wait!

Car sales are going to be demolished when they fall off the demographic cliff in the next year or so.

Two of the most successful investors in the world, Warren Buffett and Steve Soros,

November 20, 2015

Ransomware: The Latest Criminal Enterprise

The days of Uncle Vito shaking down local shop owners for protection money are virtually over.

The days of Uncle Vito shaking down local shop owners for protection money are virtually over.

Now, criminals are working smarter, not harder – and if you rely heavily on a medical device, it could affect you.

This Car Company Gave Its Customers the Ultimate Insult

Ten years ago an airline ran a television ad showing weary business travelers, asking the question: “Why do they do it?” Eventually one of the travelers looks up and says: “For the miles!”

At the time, I was part of the bleary-eyed crowd of travelers. I racked up tons of miles, mostly on American Airlines, hopping from one speaking engagement to another, along with conferences and general business meetings.

I remember the first time I saw that ad. I thought: “That’s the stupidest thing I’ve ever heard.” The last thing I wanted after years of flying was… more flying!

I must admit, I enjoyed bumping up to first class on almost every flight. I liked the pre-flight pageantry of offering drinks and warmed, mixed nuts to those of us seated up front, and the chance to nab any overhead space I wanted. But I would’ve gladly traded all of it for less time away from home, fewer dashes to the airport, reduced rental-car travel in unfamiliar cities, and fewer hotel stays.

And yet, offering cheaper travel on future flights is exactly what airlines hold out as the ultimate gift.

Why not give us what we really want – cash!

Beyond the deluge of airline offers that arrive daily in the mail, I was reminded of the TV ad when I read about Volkswagen’s offer to diesel car owners.

The automaker, now famous for systematically defeating pollution tests on its diesel-powered cars, will give every owner of these vehicles a gift card worth $500. It’s a typical pre-loaded debit card, so the money is essentially cash.

But that’s not all. In addition to the gift card, Volkswagen is generously giving each polluting-diesel owner a $500 voucher, good for three years. The catch is that the voucher can only be used on a new Volkswagen.

Someone must have calculated that it will take three years for the current owners to get over the car company lying, cheating, and leaving them with a car marked with a scarlet letter.

I get why American Airlines – and just about every other retailer – holds out more of their own service as a reward. It’s the cheapest thing they can offer. Cash doesn’t have a discount.

But for a company that lied and cheated, it’s the ultimate insult to suggest that current clients, the very ones that suffered, would have to do more business with the company to receive their full offer of restitution.

Of course, few companies – Volkswagen included – provide actual cash. The VW offer is a gift card. To benefit, the consumer must spend the money. Unspent funds remain on the card, presumably sitting in a bank account controlled by the car company. Consumers that don’t spend their full allotment are essentially handing the money back to VW, which is exactly why the offers are structured this way.

Like this settlement, many retailer rebate payments show up in the form of debit cards. Again, the hope is that consumers won’t spend all the funds, in which case the retailer can claim it fulfilled its obligation, and yet gets to keep some of the cash.

Which brings up rebates in general.

Anyone replacing a cell phone most likely has dealt with the tortured instructions of a rebate offer. The 9,000-digit code from the box must be transcribed perfectly into a half-inch space on a piece of receipt paper that smears – along with the address of your house, the store, the factory in China where the phone was made, and your 7th grade English teacher.

Once all of that is completed, the paper must be mailed to a non-descript address in Nebraska, where it will sit for six to eight weeks before anyone bothers to mess with it.

If every digit is in place, and every word properly spelled, then the company might begrudgingly send out the prepaid debit card. But if anything is amiss, then your chance at the money is history!

Which is what retailers want. They can offer you “cash,” or “savings,” or whatever they want to call it, but it’s actually a program designed to make you give up before you complete all the steps.

How many people don’t take the time to fill out all the forms?

How many people fill them out wrong?

How many follow up if their rebate doesn’t appear in their mailbox?

The latest estimate I can find is that $500 million worth of rebates, or 40% of offers, go unclaimed every year. A zillion websites offer consumers advice such as “pay attention to the details of the offer,” and “don’t procrastinate in filling out the forms and mailing them.”

I’ve got a different solution.

As we get ready for the holidays, why don’t we instead tell the manufacturers and retailers what we really want. Not a rebate, not a prepaid card, not a voucher. I’d like cash, please. Or better yet, simply lower the price in the first place.

Rodney

November 19, 2015

Watch Out for These Fun Little Acronyms and Buzzwords

When it comes to the stock market, fun little acronyms and buzzwords make me cringe.

When it comes to the stock market, fun little acronyms and buzzwords make me cringe.

It’s like that grueling sensation when someone runs his or her fingernails along a chalkboard. The reason being – when a phrase becomes so popular that everyone is using it, and when everyone’s hyped about the markets, danger lurks just around the corner.

In the late 1990’s, the popular phrase was the “New Economy.” Stocks were valued based on “eyeballs” and “synergy,” as opposed to… actual revenue? I don’t even know. It was a joke.

Then in 2007 and 2008, it was the “Goldilocks Economy.” Inflation was mild – neither too hot nor too cold – and “green shoots” were touted in August of 2008, like we were supposed to imagine all these little green plants sprouting out of a dried up economy. Ben Bernanke – whom I very openly dislike – loved tossing this propaganda around.

Both times, these buzzwords became popular right before major crashes – the dot-com bust, and the Great Recession – where trillions of dollars in wealth were wiped out in a heartbeat.

Now, another one’s popped up. Today, it’s the “FANGs” market – where Facebook, Amazon, Netflix, and Google are leading the charge! But without these stocks, the major indexes like the S&P 500 would be in big trouble. (Charles talked about this on Monday.)

And like Lance said Tuesday, our group is pretty much in agreement – the stock market is getting narrower and narrower in terms of the number of stocks pushing the indexes higher.

What concerns me is that in 2000, the technology sector led the way. But while it was the main driver, there were still dozens of stocks pushing the market higher.

Then in 2007, it was finance – again, another sector.

Today – it’s less than a handful of stocks.

That’s a major difference from the last two crises in that the leadership of this market is incredibly thin.

So while the indexes look healthy because they’re at all-time highs, the fact that just a few stocks are leading the way means it’s much better to be defensive right here, right now…

Because by the time Facebook, Amazon, Netflix, and Google start to decline in price, many stocks will have already been crushed.

Like we’ve discussed, Rodney is riding the momentum of some of these “FANGs” in his Triple Play Strategy, but the difference here is he isn’t holding them. He swaps them out month-to-month and sells them if it looks like things are about to get ugly.

But the bigger picture is that, with the market’s leadership spread so thin, we have a stealth bear market in the making. And by the time it becomes obvious that the market is in trouble, trillions will have already been lost.

So stay on high alert.

How to Channel Your Inner Warren Buffett

Cliff Asness and Warren Buffett couldn’t be more different.

Cliff Asness and Warren Buffett couldn’t be more different.

Buffett buys companies. Asness trades stocks.

Buffett is a “value” investor. Asness runs a “quant” shop, AQR Capital Management.

Warren Buffett is known for his unassuming, down-home demeanor.

Cliff Asness, meanwhile, has rubbed more than a few people the wrong way with his uber-academic, ego-oozing personality.

(He once told a female Bloomberg TV host, “You’re giving me that look that I get when I talk to women about quant stuff.” Ouch! Bad move, Cliff.)

But I’m convinced that both of these gentlemen, despite their differences, agree with two of my favorite pieces of investment wisdom…

Those being… ignore the news and stick to your game plan.

Like much of the investment wisdom I’ve picked up over the years, I learned these gems by observing what most investors do poorly.

Let’s take the case of obsessive news-watching first.

Most go-it-alone investors read or watch the news… then run to their trading screens to punch in their orders. They react to whatever’s in the news cycle du jour, aiming to reduce risk… when headlines are negative, vowing to not miss out on the next Google… when an “undiscovered” company is touted… and so on.

But this in an awful way to invest.

The financial media exists to entertain and sell advertising. It’s not in the business of forecasting market moves or managing money. So most of the analysis you read is backward looking… anecdotal… or completely worthless blather, just filling time until the next commercial break.

Simply put…

Warren Buffett doesn’t invest on the news. Cliff Asness doesn’t invest on the news.

I mean… I’m sure both Buffett and Asness do read the news. But they sure as anything don’t react to it!

Warren Buffett buys companies for the long haul, so he’s unswayed by daily headlines and short-term price fluctuations.

Cliff Asness is also not influenced by the daily drivel in the financial media. He runs systematic strategies – ones which have proven themselves to be profitable regardless of what’s going on in the news cycle.

You see, systematic strategies – like my own Cycle 9 Alert and Max Profit Alert – can be examined with statistical rigor. This is an invaluable tool because the strategy’s performance characteristics can, essentially, take into account every unpredictable, volatility-stirring event you can imagine: geopolitical flare-ups, disappointing earnings reports, corporate scandals, etc.

You just can’t predict those sorts of things. And by the time the story hits the papers, it’s already too late to make a move.

So any investment strategy worth its salt must be able to “absorb” the noisy impact of the news cycle, rather than react to it. The goal is to develop a systematic investment strategy that can achieve long-term profitability… despite news-cycle surprises.

But that’s only half the battle.

Once you’ve chosen your investment strategy – whether it’s Buffett’s, Asness’, mine or your own – you have to stick to it!

This is a great piece of investment wisdom I’ve learned to live by. And interestingly, Cliff Asness commented on the value of having an undying discipline to your investment strategy.

During a recent Bloomberg TV interview (this one sans sexist remarks), he said:

“I used to think being great at investing long-term was about genius. Genius is still good, but more and more I think it’s about doing something reasonable, something that makes sense, and then sticking to it with incredible fortitude through the tough times. ” [my own emphasis added]

That’s a profound statement – and an especially poignant one coming from the mouth of a self-identified brainiac.

Asness continued the interview by giving a hat tip to Warren Buffett’s undying discipline to his strategy, saying:

“What’s beyond human is that he stuck with it for 35 years and rarely, if ever, really retreated from it.”

Clearly, Buffett’s superhuman ability to show fortitude and discipline – particularly during tough times – paid him back in spades.

And that’s a lesson every investor will do well to learn!

Adam O’Dell, CMT

Chief Investment Strategist, Dent Research

November 18, 2015

What You See Is Not Always What You Get

My parents took the family to a magic show dinner party once when we were kids.

I remember not having a single bite to eat because I was too busy trying to figure out the tricks. I knew the show was based on the magician doing “more than meets the eye.” But I just had to figure out how he was doing it!

That’s the intrigue of magic.

What you see is not always what you get.

And, in a less-entertaining, more-painful way, that’s also true for investing.

Retail Reality: Another Sign a Recession and Crash Are Imminent

November 17, 2015

The Markets Are Intact For Now, But Deflation’s on the Rise

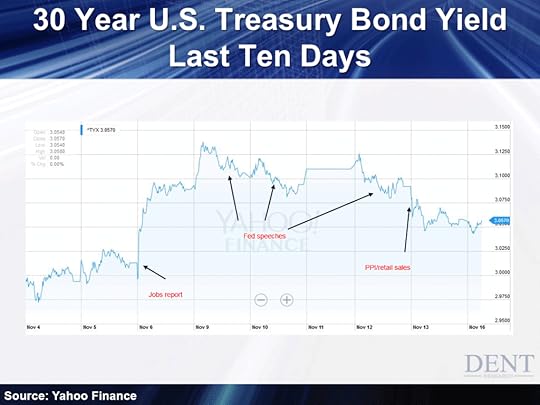

Just in the past week or so, chances of a Fed December rate hike went from a coin toss to over 80%! Last Monday, U.S. Treasury bond yields climbed to over 3.13% from just under 3% the Friday before! That’s a rise of over 4.5% in a couple days.

Just in the past week or so, chances of a Fed December rate hike went from a coin toss to over 80%! Last Monday, U.S. Treasury bond yields climbed to over 3.13% from just under 3% the Friday before! That’s a rise of over 4.5% in a couple days.

Stock prices have moved lower over the past couple days but are still stubbornly close to all-time highs.

The Dent Research investment committee (Harry, Rodney and the gang) met Thursday and we all arrived at the same conclusion: a lot of stocks within the major stock indices are getting creamed, but a few large glamor names are propping up the overall market. Some of those include Google, Netflix and Amazon.

So, lower earnings, revenues and outlooks are affecting individual stocks but not the overall markets… yet.

But as we’ve been writing about for months, the overall economy isn’t all that rosy.

Poor reported earnings over the last quarter is a direct reflection of a poor economy. If corporate earnings are lower, worker paychecks aren’t going up, price aren’t rising, and consumers are probably not spending more.

And guess what? Last month they didn’t spend as much as analysts expected. After no growth in September, October retail sales ended up only 0.1%. Excluding auto sales, they were up just 0.2%, well below estimates (though according to retailers, unseasonably warm weather was the culprit). Friday we saw more even evidence of our shaky situation as producer prices fell again. The October headline number was negative and down 1.6% for the year!

That’s deflation, folks!

If you exclude food and energy, we are up 0.1% in inflation for the year. That isn’t anywhere close to the 2% target the Fed is looking for and could change their mind about hiking, leaving investors even more confused.

Long-term Treasury bond rates did pull back Friday and yesterday after the above reports, along with another shaky manufacturing survey (Empire State). And to pile on more uncertainty, just add in the Paris terrorist attacks!

So at this point, there’s really no telling what the Fed will do next month. But as I’ve written before, it doesn’t really matter.

Here’s a look at the 30-year Treasury bond rate over the past 10 days:

As you can see, yields spiked after the jobs report and Fed speeches supported their mantra of a likely hike in December. Friday’s retail sales and producer prices report took some wind out of the Fed’s sails and were not supportive to a hike.

Since we broke out of the period of low volatility over a week ago, I see a good opportunity for a new position in Dent Digest Trader if yields pop a little higher. We could be helped by a surprise in any one of the important data releases this week. Good things come to those who are patient, or something like that!

One Instance Where We Clearly Need Higher Taxes

There’s a disease going around Washington, probably carried in the water served in the Capitol. It’s called “act like an idiot,” or maybe it’s “I think you’re an idiot.” Whether it’s because of their own shortcomings or their very low esteem for their constituents doesn’t really matter. Either way, the illness makes Congressmen do stupid things.

A case in point is the recent decision by the House of Representatives to sell oil from the Strategic Petroleum Reserve (SPR).

The government established this reserve following the 1973 Oil Crisis in which Middle Eastern countries cut off our oil supply. The goal was to give ourselves a cushion in the event of another supply shock.

By selling it, Congress is choosing to forgo a resource meant to ease the pain of an unexpected setback. That way, they don’t have to do the hard work of raising taxes. Hmmm.

The SPR holds about 720 million barrels of oil. It was declared completely full in December 2009 when oil cost $78 per barrel.

As part of the financing for the Highway Bill, Congress is considering selling 101 barrels of oil from the SPR, or about 15% of our reserves.

We’ve taken oil from our reserves on several occasions, including after Hurricane Katrina wrecked some of our energy infrastructure around New Orleans.

But that’s not the case today. We don’t have a major supply shock.

Quite the opposite, we have something of an oil glut, which has driven prices below $50 per barrel. We don’t have any interruption along the supply chain – no storms or pipeline issues. Instead, we simply need the money.

As I’ve noted in previous articles, the federal tax on gasoline is 18.4 cents per gallon, and the tax on diesel is 24.4 cents. These taxes are flat, not adjusted for inflation, and haven’t changed since 1993, even though the world around us has changed dramatically.

Our cars are much more fuel efficient, so we can drive more miles per gallon. At the same time, inflation has eaten away at the purchasing power of the buck. These two trends mean that we put more wear and tear on our roads and infrastructure, while paying less in taxes at the pump to keep everything in good repair.

It doesn’t work. We need more cash.

As you might expect, the Highway Trust Fund now runs a deficit every year, requiring a bailout from the general fund.

Congress has voted on short-term fixes in the past, but now they are contemplating a deal that will fund our roads for several years. The money comes from the current tax, plus weird things like selling oil from the SPR and requiring the IRS to use outside debt collectors (which should save $2.5 billion).

This is one instance when a clear case can be made for higher taxes.

The money I pay in gasoline tax isn’t enough to support the very infrastructure on which I drive. The roads and bridges that allow fresh produce and meat to reach my grocery store are in disrepair.

It makes sense to charge more for the transport of those goods through higher fuel taxes. And yet, our elected officials are so blinded by partisan politics that they can’t even agree on this!

Lest they be branded as tax-and-spend politicians, they have to pull funds from obscure corners of the government that have nothing to do with roads and bridges. The problem is that taxing and spending is their job.

We don’t send politicians to Washington to refrain from any spending at all. We send them with the directive to wisely consider each tax and every expenditure, making sure we get the most bang for our forcibly collected bucks.

Now, we’re left with a funding mechanism that’s not tied to the service provided.

What happens if more roads need repair, or more bridges need rebuilding? Do we fire the rest of the IRS and put the tax code on an honor system? Do we sell more of the SPR? How about auctioning off national parks or selling a Naval Destroyer?

Maintaining the link between services rendered and the cost of those services allows taxpayers to evaluate where their dollars go. Without the link, some services seem cheap while others cost much more than they are worth. When our politicians blur the lines, they do everyone a disservice, making future adjustments to funding sources more difficult and reformation of the tax code nearly impossible.

Rodney

November 16, 2015

How to Survive the Carnage in the Stock Market

2015 has been the year of the “FANGs.” Investors have fixated on just a handful of glamorous tech stocks – Facebook, Amazon, Netflix and Google (now Alphabet) – that have held the broader market afloat, even while earnings this year overall have been disappointing.

2015 has been the year of the “FANGs.” Investors have fixated on just a handful of glamorous tech stocks – Facebook, Amazon, Netflix and Google (now Alphabet) – that have held the broader market afloat, even while earnings this year overall have been disappointing.

Throughout all this the “average” stock has actually fallen. So for lack of anywhere else to go, the investing public has crowded into a very small handful of recognizable names.

Consider the relative performance of the growth and value segments of the S&P 500.

Standard & Poor’s breaks the S&P 500 into two roughly equal halves based on valuation, momentum and other factors. Year-to-date through November 12, the S&P 500 Growth index – which includes the FANG stocks – was up 3.9%. Its sister, the S&P 500 Value index, was actually down 5.5%.

This is a peculiar market. Cheap stocks are getting cheaper while a handful of extremely expensive names keep getting more expensive.

As a case in point, look at the advance-decline line, a simple measure of market breadth.

Starting in April, the advance-decline line started to trend downwards. Apart from a brief rally in October, it really hasn’t stopped sagging since.

This means that fewer and fewer individual stocks continue to rise, even while the market grinds slowly higher.

In a “healthy” bull market, the advance-decline line rises along with the major stock indexes.

So when you see an “unhealthy” market like this, one of two things has to happen. Either investors start to spread their bets across a wider swath of the market and market breadth improves… or they finally throw in the towel and sell the few remaining leaders.

So, how on earth are we supposed to invest in a market like this?

You really have two options.

The first is the approach Rodney takes in his Triple Play Strategy. Rather than fret about the high valuations, Rodney is simply riding the momentum of some of these glamor names while it lasts.

Sure, the FANGs are expensive. But that doesn’t mean they can’t get a lot more expensive in the short term. So, riding the momentum is a perfectly viable strategy – so long as you’re ready and willing to sell at the first sign of weakness.

The second option is to look for deep values amidst the carnage – stocks that are already so cheap you don’t mind if they get cheaper.

Plenty of stocks are down 30% or more this year, even while the S&P 500 Value index is down only 5.5%. Several midstream oil and gas pipeline stocks are currently sitting at multi-year lows and are sporting cash distribution yields I never expected to see again.

And of course, there is always the third option: stay mostly out of the stock market altogether, and wait for better prices across the board.

My recommendation? Try some combination of the three. Keep your long-term portfolio heavy in cash and deep-value opportunities, but set a portion of your portfolio aside for more aggressive short-term trading.

Charles Sizemore

Editor, Dent 401k Advisor