Harry S. Dent Jr.'s Blog, page 128

November 16, 2015

Paris Attacks: There Are Major Implications for Europe

The geopolitical arena keeps getting uglier and uglier.

The geopolitical arena keeps getting uglier and uglier.

Just when we thought we had struck a deadly blow to Al Qaeda, ISIS emerges out of the ashes in Iraq and Syria.

Just when we thought ISIS had been “contained,” ISIS pulls off two attacks outside the Middle East.

First a Russian airliner blows up in mid-air, killing 224.

Then the attack on French soil that has killed at least 129 and wounded 350-plus.

I keep saying it’s going to get worse before it gets better. We’re seeing that now.

At first everyone was in denial when the plane exploded. With the exception of David Cameron, people were slow to state the obvious: it was a terrorist attack.

My source got it right from the beginning. It had to be a bomb – not a missile. A missile could have been tracked by radar.

It’s also incredibly unlikely the engines just blew up given the ways the wings landed largely intact, and that also meant it had to be a bomb in the back part of the plane.

What’s more – the terrorists clearly picked the airport with the lowest security standards. It’s obvious that ISIS wanted to punish Russia for entering the Syrian conflict.

And while the attacks over the weekend are not on the scale of 9/11, they have the same impact: innocent people can get killed or wounded at a concert, a restaurant, a bar, or a mall. This provokes a whole new level of public and political reaction than beheadings of journalists or deaths of soldiers who know they are in harm’s way.

It’s no surprise that French President Francois Hollande called this a declaration of war, bombing the hell out of an ISIS headquarters and training camp at Raqqa over the weekend.

He’s also called for a larger coalition to fight ISIS. This means boots on the ground, after all western leaders swore against it.

All of this only adds to the growing list of problems in Europe…

Most of the EU operates under one currency and open borders.

Given that officials believe the mastermind behind these attacks came from direct neighbor and ally Belgium, France has called for closed borders.

If that wasn’t bad enough, the euro zone has already been struggling to make sense of growing economic disparities.

The northern countries are more economically competitive. They export and lend more. Its southern neighbors, epitomized by Greece, are heavily indebted. They borrow more… export less and import more… and add little to the economic machine.

And it’s threatening everything upon which the economic bloc was founded.

To this point, the euro has fallen from 1.60 dollars down to 1.07 recently. Over the next few years I’ve been forecasting it’ll hit 0.85!

And let’s not forget the refugee crisis.

How willing will Europe now be in housing up to five million refugees forecast to come into Europe from war zones like Syria?

ISIS has warned that they would use the refugee flow to infiltrate its enemies. One of the suicide bombers came in recently on an emergency visa as a refugee with no documentation.

There are 1.9 million refugees in Turkey, a million in Lebanon and 400,000 in Jordan. Lebanon and Jordan are already at the brink. Turkey is nearly maxed out.

With so many turning to Europe… with three million more forecast over the next year or so… what happens if they are increasingly, if not suddenly, shut out?

All of this feeds into the Geopolitical Cycle I discovered now a decade ago.

By late 2005, I had already discovered an economic cycle spanning 80 years. By my configurations the stock bubble that burst in 2007 should’ve been about as strong as the one that burst in 1929.

But it wasn’t… and as I soon realized, it was because geopolitical trends were favorable in the final bubble phase of 1925 and 1929. But from 2003 to 2007, they weren’t.

The Geopolitical Cycle is that simple. For 36 years, it is favorable for 17 to 18 years then unfavorable the other 17 to 18 years – and it’s been that way all the way back to the early 1800s.

Between 1983 and 2000, almost nothing went wrong in the world. The Vietnam and Cold Wars faded rapidly. Then the unfavorable cycle struck in 2001, especially with 9/11. Since then, we’ve had two failed wars, endless civil wars, Russia invading Crimea and threatening to invade Ukraine, the rise of ISIS, the Boston bombing and growing unrest over police brutality in the U.S.

But this negative phase doesn’t bottom until around late 2019 or early 2020. That’s why I’ve been forecasting this geopolitical cycle will only get worse.

Going forward, we will see a stronger coalition against ISIS from the west, possibly with Russia on our side (but that’s tricky as Russia wants to keep Assad in).

Hopefully, more of the boots on the ground will come from the Middle Eastern countries that also need to rid itself of ISIS. We’d provide fewer boots, and more training, weapons and air support…

But make no mistake – we now have a mini World War III here.

And while we will win this war against terrorism, it will likely only get worse for about four years at first.

Hunker down. Stocks and our economy have to fight the perfect storm of worsening demographics, a debt and financial asset bubble that has only grown bigger with more to deleverage, and now an acceleration of geopolitical challenges.

Our sympathies and support should go out to France and Europe, as their proximity to the threat put them at far more risk to terror attacks than us. Although ISIS has warned that D.C. is next.

Mark my words: I believe 2016 will be a worse year and crash than 2008. Everything is starting to go wrong. Protect yourself on any rallies just ahead. Stocks are currently oversold and could bounce, but not likely for more than a week or two before starting to crash again.

Harry

Follow me on Twitter @harrydentjr

November 13, 2015

Insights From London and Marrakech: Global Real Estate to Pop

I’ve been home in Tampa for a few days now, but the past few weeks I’ve done a bit of traveling – in London and in Marrakech, Morocco.

I’ve been home in Tampa for a few days now, but the past few weeks I’ve done a bit of traveling – in London and in Marrakech, Morocco.

Not that I missed much – the market climbed all last month and only now seems to be taking a breather.

The biggest insight of the trip was this: high end real estate in London finally seems to be faltering, as is Singapore, Shanghai, New York and Miami.

But some of the most enjoyable moments were meetings with: Russell Napier, one of my favorite economic analysts; James Cosmo, one of my favorite actors for the “macho” roles he plays; and my favorite cycles guy and close friend, Andy Pancholi and his wife Karen.

I went to Marrakech first to catch the last of its good weather…

Marrakech is a city of contrasts: Arab/Muslim, but very liberal/tolerant with a number of French influences.

The old city and Medina stand in stark contrast to the very modern and quite affluent suburbs in the new city. It’s a near-desert climate, with the Atlas Mountains that supply it with ample water just an hour away, the Atlantic coast two hours, and the Saharan Desert just three.

I had a great guide there given that few people speak English – mostly just Arabic and French. If you ever go there look him up at: zaky@marrakechstg.com. (He was also very intelligent and fun to talk to about global and cultural issues. He invited us to his house for a real Moroccan dinner and took us to a traditional Hammam spa where you get scrubbed to death to exfoliate your skin and doused with unbelievable amounts of water. That was my wife’s highlight of the trip.)

The old city has an endless marketplace or “souk” that no one could ever navigate on their own – that’s why you need a guide.

The old city has an endless marketplace or “souk” that no one could ever navigate on their own – that’s why you need a guide.

There is endless haggling which gets annoying as you never know if you really got a good deal… until you hold out and walk out of the store and they chase you down the street. In the new city and suburbs they have fixed/fair pricing. Haggling there is less common.

I liked the smaller, more quaint hotels there like the funky, artistic El Fenn and the elegant Les Jardins de la Koutoubia, both close to the Medina, and our hotel Les Jardins de la Medina (a bit farther out with great gardens… and quiet!).

I didn’t favor the classic La Mamounia as much. It was too old-fashioned even with a major renovation, and its buffet brunch cost $130 a head.

And though I’m an Aman Resort junkie, I didn’t care for the Amanjena, as it was something like 160 rooms instead of the more typical (and quaint) 40-room ones you can find in other parts of the world. There is a classic Four Seasons in a good location, and a new very elegant and expensive Mandarin Oriental that would be worth considering on the larger and very high end.

The highlight for me was a day trip into the Atlas Mountains (up to 13,000 feet) – a scenic and ancient area where the primitive Berber villages reside.

We also had lunch at Sir Richard Branson’s killer boutique hotel, the Kasbah Tamadot, which was both rustic and extremely elegant. We spent two and a half hours there and were treated like guests and allowed to sit at the pool.

We also had lunch at Sir Richard Branson’s killer boutique hotel, the Kasbah Tamadot, which was both rustic and extremely elegant. We spent two and a half hours there and were treated like guests and allowed to sit at the pool.

The biggest surprise was they had a great gift store with high-quality items at very reasonable prices. My wife bought half the store.

Then it was off to London. My wife has a longtime friend there, and we are both friends with Andy and Karen Pancholi.

I met with Graham Rowan, a leading wealth creation coach in the UK, at a Dan Kennedy seminar I was invited to. Dan Kennedy is a guru in direct-response marketing, who I speak for and promote in my book. He has a great audience of high-growth entrepreneurial businesses.

Graham has founded the Elite Investor Club with offices in London, Beijing and Singapore, and has a global network – similar to the one we have with Dent Research. He said he had to get me out to his conference in London in early November, and seemed to have the right type of innovative high-net-worth audience for my contrary forecasts.

He had me do six interviews with freelance journalists there and then the one-day seminar with his network members. It was a dynamic and receptive audience given my bearish forecasts. I talked with people from Hungary, Sweden, Russia, Singapore, China, India and more.

According to many of these journalists and Graham Rowan, high-end real estate is clearly stalling and starting to fall as Russians and Middle East buyers are getting hurt in their own economies and currencies. These two groups dominate downtown London now. (Our hotel, Adria Boutique, was Arab-owned and very nice and well located for a small inn.)

The Chinese are the last who are still buying – and as I forecast, that won’t last much longer. But they aren’t as dominant in London or the East coast of the U.S. as they are in Canada, California, Singapore and Australia.

Back at a Tony Robbins Platinum meeting years ago, I heard Russell Napier emphasize how much the commodity collapse cycle was impacting the foreign exchange reserves and currencies of emerging countries. I’d been saying the same thing and credited him on pages 189 – 191 of my book.

Ever since I have focused even more on the vicious cycle of China slowing… commodities collapsing… then emerging countries underperforming – the stealth crisis that most aren’t seeing.

Then I spent a day with Andy Pancholi and his wife Karen, who are among the best of our friends. They have a new six-month-old son. He doesn’t look a day under one year old – mature for his age!

They took us to lunch at Great Fosters, an ancient hunting lodge of Henry the 8th.

After lunch, Andy said he had an actor friend coming over. It took me 20 minutes to get who he was talking about, as he had shaved his beard that makes him so notable: the actor James Cosmo, known for his killer Scottish warrior and general roles in movies ranging from Braveheart to Troy (a personal favorite) and more recently the superb HBO series Game of Thrones. He’s presently shooting a remake of Ben Hur, due out in spring.

For a man who plays such bold characters, he was both modest and fully entertaining.

What a treat to end my two-week trip.

Harry

Follow me on Twitter @harrydentjr

The Latest Eye-Tracking Technology Has Unlimited Possibilities

Fifteen years ago, Swedish scientists accidentally came across a method for tracking eye movement, when they noticed a sensor they set up in the lab tracking their eyes.

Fifteen years ago, Swedish scientists accidentally came across a method for tracking eye movement, when they noticed a sensor they set up in the lab tracking their eyes.

Today, this technology is gathering major momentum as the IT and biotech industries look to snatch it up for use in their latest devices.

From helping the disabled operate a computer, to making cars safer by watching the driver’s eye direction, this technology has limitless capabilities. There’s even a major push to integrate it into the video game industry. That could increase the market for eye-tracking by $5 billion.

So how does this all work? Well, the system uses invisible infrared light to light up your eyes, then camera sensors measure the reflection off the retina and cornea to gauge where you’re looking. Pretty cool!

The Swedish scientists who developed this technology finally provided an initial public offering for their company back in April on the Stockholm Stock Exchange (STO). The company is called Tobii (STO: TOBII) and its stock price has already rocketed up 207% since the offering.

In October the company announced a new eye-tracking platform. That sent the stock up 40% in just two weeks.

Other technology companies are starting to jump on the bandwagon as well. The new Samsung Galaxy smartphone can track face movement, which is only a few steps away from tracking eye movement.

Right now the majority of eye-tracking sensors fit in larger hardware devices like laptop computers and vehicles. The industry is working feverishly to overcome size and power requirements for smaller mobile devices.

I’m tracking this technology via my trading system and will watch closely as it begins to saturate the market.

I’ve got my own selfish preferences for where I’d like to see this technology implemented first. With a house with four kids and a big black lab, it sure would be nice to never have to worry about losing the TV remote again.

November 12, 2015

The Ultimate Global Collapse Indicator

“Prices have reached The Promised Land. I can’t imagine it going much higher though. Can you?”

Those are the words of art collector Eli Broad, who was quoted in a Bloomberg piece about yet another Chinese billionaire’s record-breaking auction purchase.

Those are the words of art collector Eli Broad, who was quoted in a Bloomberg piece about yet another Chinese billionaire’s record-breaking auction purchase.

This one – a 1917 painting called Nu Couche – fetched $170.4 million, the most ever for a piece by Italian painter Amedeo Modigliani.

In the art world, record-breaking auctions are cause for cork popping.

But to financial market investors, art auctions gone wild are bad omens.

World-famous auction houses, like Christies and Sotheby’s (NYSE: BID), have been riding high atop a euphoric wave of new-money Chinese millionaires (and billionaires)… who flourished amidst the country’s state-sponsored build-and-urbanize program. And these cash-rich buyers just couldn’t satiate their appetite for high-priced art.

Really, though, it’s not about the art. It’s about the prestige. It’s about the aura of wealth: a because-I-can mentality. As art dealer Andrew Kahane put it: “Chinese buyers want to be seen [that’s key] spending a lot of money. They want to be seen setting world records.”

Of course, there’s a natural correlation between economic growth, wealth creation, disposable income and art collecting. So it’s not that surprising that China’s uber-wealthy property developers are riding the wave of their country’s economic boom… all the way to its bitter end, where a painting is worth something like $200,000 per square inch.

Yet, it’s the “bravado factor” of China’s art buyers that whiffs of bubble-bust euphoria – the kind that’s typically reserved for the very tip of a toppy market.

Among China’s elite, uber-wealthy, it’s less about fine art. It’s more about fine art at any cost! And, many times, simply for the show of it!

But these Chinese bravado-buyers aren’t really unique, from an historical perspective.

Specifics aside, I can’t help but thinking: “Haven’t we seen this before?”

In fact, there are a number of times when newfound wealth blew bubbles in the fine art market, which thrive on the wealth created during above-average economic boom periods.

One look at Sotheby’s stock price tells the story…

The players are different. Yet, the pattern’s the same.

In 1989, it was the Japanese CEOs and corporate titans riding high on the froth of Japan Inc. But when the music stopped… shares of Sotheby’s dropped from $37 to under $9. That’s a 76% loss in just 13 months.

In 1999, it was Silicon Valley’s dot.com wealth that sent Sotheby’s stock just past its 1989 high, to $47 a share. But again, when the euphoria faded … it dropped under $7 by late 2002. 86% of Sotheby’s value vanished in the blink of an eye!

Then, in 2007, as the U.S. property market reached dizzying heights, house-flipping millionaires were pumping air back into Sotheby’s stock, which peaked just above $60 in October 2007. And… once again… the stock plummeted nearly 88% as that bubble burst during the following 12 months!

The point is this: Sotheby’s stock price has acted as a direct link… a finger on the pulse if you will… to the bubbliest pockets of unsustainable wealth creation in the world. And this makes it a great “global collapse” indicator.

I actually began writing about this concept in late 2013. It was featured in our November issue of Boom & Bust. Everything to the right of that red vertical line you see above came after that original publication. And as you can see, Sotheby’s stock never went higher, so we were pretty spot on.

Even so, Chinese collectors have continued buying art. But they’re being more discerning. And that has investors worried.

As such, Sotheby’s stock price has been soft. It’s down nearly 40% since November 2013. And despite the consumer discretionary sector being up 12% year-to-date (the most of any sector), shares of Sotheby’s are down 34% since January 1!

Just days ago, the company announced third-quarter earnings. It wasn’t pretty… with auction revenues falling 9% and a quarterly net loss of $18 million.

This news sent Sotheby’s share price tumbling. It’s down a whopping 16% from last Friday’s close!

More importantly, shares of Sotheby’s now trade under $30. And that means the bearish bet I recommended – against Sotheby’s stock – is beginning to pay out.

Ultimately, though, China’s new-money bubble is still a long way’s away from full deflation. And Sotheby’s stock price, too, has a long way to fall – to as low as $5 a share.

And at that price… my bet against Sotheby’s stock could be worth as much as 400% more than it is today.

Adam O’Dell, CMT

Chief Investment Strategist, Dent Research

A Rate Hike Does Not Bode Well for Stocks

As a short seller by trade, I end up reading. A lot.

As a short seller by trade, I end up reading. A lot.

I’m constantly scouring press releases, earnings statements, balance sheets – you name it. If there’s a red flag and management is doing something to tweak its bottom line, I want to know.

But short selling isn’t the only way you can turn a profit when a stock or asset is going down.

You can put money in an inverse ETF. You can sell put options. You can even practice some good old fashioned patience and wait for a stock to bottom, then pick it up at a reduced price.

It’s just that, what I do is more fun.

There’s something truly satisfying when you catch a company “red-handed” and sticking its greedy paws in the cookie jar.

The funny part is, nothing I read is sealed behind closed doors. Financial statements are available to everybody. They just have to actually read them.

Unfortunately, people focus on the headlines and not the details.

Last week there was a “home run” jobs report that blew away Wall Street’s expectations. The unemployment rate now stands at about 5%, which in economics 101 is full employment.

Sounds great right? Well, under the covers of the jobs report things aren’t that wonderful.

Most of the jobs created were for people 55 years or older. The younger workers who support the economy and its future saw its employment ranks shrink.

What’s worse is over the past several years the labor force participation rate has continued to drop. It’s at about levels seen in 1977. Fewer and fewer people are picking up the slack to help propel the economy forward.

Given this “great” report, we have a few things in store for us…

For one – and most obviously – it’s now much more likely that the Federal Reserve will raise interest rates in December.

That doesn’t bode well for stocks.

The stock market has been on edge every time quantitative easing has been reduced in the past five years.

Now, it will be on edge every time the Federal Reserve makes any sort of indication as to the pace of additional rate increases.

I am dreading that! The fundamentals continue to deteriorate. Revenue and earnings are getting pinched. The U.S. stock market is way overvalued.

A strong U.S. dollar, which could get much stronger, won’t help. Our new normal will be anything but the normal times we experienced in the past.

I long for the days of 2003 to 2007 when the stocks of companies doing well went up, and the stocks of companies faring poorly went down, even as the overall market pushed higher. It was a period of unprecedented low volatility. Things made sense.

You can forget that!

Now, we are likely to see much more volatility, and fast, sharp nosedives in stock prices.

When the unexpected comes, holding stocks will be like a hot potato. Investors will be quick to pass shares off to the next person hoping they’ll be the ones caught with the big decline.

Buckle up; the wild ride is going to continue!

November 11, 2015

Another Government Agency That Broke Free of Its Leash

Everybody likes to get money back from the government. Now there’s a new way to cash in on Uncle Sam.

Everybody likes to get money back from the government. Now there’s a new way to cash in on Uncle Sam.

But like many government programs, this one has a few issues.

If you bought a car in the last few years, you might get a check from the Consumer Finance Protection Bureau(CFPB), as long as you live in the right (or I guess, the wrong) neighborhood and have a certain-sounding last name.

That’s because the watchdog agency started sniffing around the auto industry a couple of years ago and dug up a bone. It might be a synthetic bone that you can see only with x-ray eyes, but hey, they’re the government.

The board demanded that a lending institution, Ally Bank, atone for its theoretical sins – which I’ll detail in a moment – by paying millions of dollars without admitting guilt. Now it’s got to find some victims.

It’s the latest example of a government agency that’s broken free of its leash.

When buying a car, there’s money to be made or lost at each step, depending on whether you are the buyer or seller.

Beyond simply negotiating the cost of the vehicle, buyers must navigate the dealer add-ons, prep charges, and extended warranties.

After all of that is done, buyers have to contend with one more important variable – financing. Dealers take credit applications from borrowers, feed them into their systems, and then get financing offers from lending institutions, which dealers can mark up for more profit.

The CFPB found an ethereal offense in this corner of finance.

The agency sifted through mountains of data and determined that Ally Bank charged different people different rates of interest. Buyers with lower credit scores, smaller down payments, or less income were charged more.

The CFPB knows this for a fact, since the agency reviewed credit applications containing such data. But that’s not the problem.

The CFPB is certain it spotted something else. Racism. The agency socked Ally Bank with an $80 million penalty for the alleged offense.

Unfortunately, they hit a snag. None of the applications identified the borrower’s race.

There’s a good reason for this. It’s illegal for the lenders to collect the race of applicants because that attribute, either consciously or unconsciously, might affect a lending decision.

Ally Bank had no way of knowing any applicant’s race. But such a trivial problem wasn’t about to stop the CFPB.

The agency enlisted the help of some math geeks, who used Bayesian Improved Surname Geocoding (BISG), to guess the consumers’ race.

The model cross-referenced more than 150,000 last names from the 2000 census to determine the likelihood that a last name belongs to a minority.

Then, using the racial composition of neighborhoods based on the 2010 census, the BISG determined if borrowers lived in predominantly minority locations.

By cross-referencing the results, the CFPB developed a guesstimate of which borrowers are most likely minorities. Of course, the CFPB doesn’t know anyone’s race, because no one ever asked. Again, it’s a trivial concern, but it does bring up another problem.

The BISG results aren’t one-size-fits-all. According to the model, some consumers are all but certain to be minorities, while others simply have a better than 50% chance.

The CFPB doesn’t want to send out checks to undeserving people – the ones that aren’t minorities – so it came up with a novel approach.

If the algorithm is 95% certain a borrower is a minority, the CFPB sends a letter explaining the situation – you were probably overcharged and will soon receive a check. The CFPB does ask the consumer to write back if they’re not a minority.

If the algorithm is only between 50% and 95% confident a borrower is a minority, a different letter is sent. This one asks the consumer to write back confirming they are indeed a minority so they can qualify for a check.

All of this brings up a couple of questions.

If the CFPB has to use a complicated algorithm to determine a person’s race, what methodology do they think Ally Bank used?

It’s a bank, after all, not a car dealership. The lender wasn’t sitting in front of the borrowers. They simply received an electronic credit application. If the charge is that the dealership finance officers and not the banks used race when offering finance terms, then why not go after them instead? There could be real issues here, it’s just difficult to see how they reside at the bank.

And if a certain finance charge is excessive, then why is it only excessive for some of the borrowers who paid those rates and not others? If the CFPB identifies certain rates as predatory, don’t all consumers deserve their “protection,” no matter what their race?

I’m no fan of Ally Bank. It’s the old finance arm of GMAC, which got involved in subprime loans and required a taxpayer bailout.

But that doesn’t make extorting money from the lender based on an algorithm acceptable.

There might be areas where the CFPB has done some good, saving consumers from harm or stopping abusive practices, but I haven’t seen one.

So far, it looks like one more agency that’s determined to provide solutions, and then go looking for a problem.

Rodney

Warning: The S&P 500 Is NOT in Good Shape

I got a great question from one of my Cycle 9 Alert subscribers recently. Chuck C. asked:

I got a great question from one of my Cycle 9 Alert subscribers recently. Chuck C. asked:

“It’s been said most stocks are in a correction, so why are the averages near all-time highs?”

Chuck’s right! Most stocks are in a correction. And, yes, the S&P 500 index is also near its all-time highs. (Psst… that’s a warning sign!)

But stock market averages are only “healthy” when a majority of individual stocks are healthy. We have to see both the stock market index rising… and a majority of individual stocks rising to know the market is bullish and healthy.

So if a majority of individual stocks are falling… even if the stock market index is rising…

Then trouble is likely ahead.

This chart shows the percentage of individual stocks in the S&P 500 that are currently above their 50-day and 200-day moving averages.

Prior to the rally of the last six weeks or so, a full 91% of stocks in the S&P 500 were below their 50-day moving average… and 78% were also below their 200-day moving average.

That’s about as bearish as these figures ever get!

Of course, this S&P 500 rally has sent the index back up to 2,100 – near its all-time high.

But it has NOT favored all stocks equally.

Because for the last two weeks, while the S&P 500 index has risen, the percentage of stocks above their 50- and 200-day moving averages has fallen.

What’s more, most stocks in the S&P 500 are still below their 200-day moving average. This suggests that the market’s rally is weak, since it’s being supported by fewer and fewer individual stocks.

We’ve seen this before…

This pattern of (1) a sharp sell-off, followed by (2) a sharp rally, with an overall weakening of individual stocks… is exactly the same pattern we saw in 2011.

Back then, the S&P 500 rallied until about 50% of individual stocks were once again above their 200-day moving average… then it rolled over for the next four weeks, losing 10% in short order.

So if the current market continues to follow the pattern of 2011, we’ll see weaker stock prices over the next two to three weeks.

There’s one key difference this time around.

The current bull market is now almost seven years old. So while stocks ultimately rallied out of the 2011 correction, the bull market was then just over two years old and valuations were much more reasonable than they are today. Bullish investors might not be so lucky this time around.

Either way, I’m finding a number of short-term opportunities right now.

Adam O’Dell, CMT

Chief Investment Strategist, Dent Research

November 10, 2015

It Looks Like a Major Market Top Is Forming

I warned in early October that stocks looked like they were setting up for another sharp crash into the height of the “crash season” in mid-October.

I warned in early October that stocks looked like they were setting up for another sharp crash into the height of the “crash season” in mid-October.

Instead, we got rate cuts in China, rumblings of stronger QE in Europe, and a continued rally at home.

In other words – central banks delayed the inevitable. Again.

So let’s look at where the markets are today…

In the revised paperback version of The Demographic Cliff back in the summer, I gave two scenarios for an impending peak in stocks. The chart gave leeway for a potential new high, which is why you see two large “5’s” at the top there:

In both scenarios, we would see a break of the narrow and bubbly channel that had been rising since late 2011.

We got that.

The question was… how high would they bounce after that initial breakthrough?

The first scenario was the S&P 500 would fall toward 1,800 and then have a two-wave rally back toward 2,000.

That still looked likely at the beginning of October… back when oil and China’s Shanghai Composite Index were trading in a narrow range. That suggested another short crash to follow.

Clearly that wasn’t the case. The S&P 500 breached 2,100 and came to within a percent of its peak.

So, scenario two took the cake… wherein the large cap markets would make slight news highs, or at least come close to retesting those highs. The Nasdaq 100 actually did make a very slight new high last week before pulling back.

If the markets outside of that index fail to make new highs – folks, that’s a bearish signal if I ever saw one.

But even if they do make slight new highs… that would very likely set up a number of major divergences as Adam has been pointing out.

Damned if we do, damned if we don’t.

Either way, it doesn’t look good.

And we’re already seeing such divergences. Over 50% of S&P 500 stocks are trading below their 200-day moving average. Investors have grown very selective, favoring only the largest stocks.

And for the Dow Industrials to make a new high without Dow Transports or Utilities – that’s another divergence! A major one, at that.

Then there’s the advance/decline line – showing how many stocks are rising versus those that are falling. And guess what? Another divergence there! This rally has been very selective to large-cap stocks. To point, the Russell 2000 which lists small-cap stocks is 8% off its high. And it’s increasingly doubtful it’ll make a new one even if the S&P finally does.

Here’s the bigger picture…

It looks like a major top is forming.

Rodney just wrote yesterday about the business cycle of mergers, acquisitions, and borrowing

Earth to Stocks: Fed Likely to Hike

There have been nearly a dozen Fed speeches in the last few days with more scheduled this week. We’ve heard it all before: we know they want to hike rates. Friday though, reality set in with the jobs report.

There have been nearly a dozen Fed speeches in the last few days with more scheduled this week. We’ve heard it all before: we know they want to hike rates. Friday though, reality set in with the jobs report.

The October report came in much stronger than expected with a drop in the unemployment rate to 5% and the non-farm payroll number at 271,000, which was well over the 190,000 expected. Average hourly earnings also moved higher by 0.4% from no change in the previous report.

On the surface, the only negative to this report was the participation rate, which came in unchanged at 62.4%.

Of course, a deeper examination of the numbers, which we covered in a press release Friday, shows most of the jobs were low-paying and not really worth celebrating.

But the point remains – the economy added a bunch of jobs, people think it’s great, and the Fed will likely raise rates.

Yes, yes – there’s a chance the Fed may again delay the hike for the umpteenth time if they think market stability is in danger.

But I couldn’t give a four-letter-word I’m not going to say because you might have kids looking over your shoulder.

The fact is, volatility has returned to an otherwise trendless Treasury bond market.

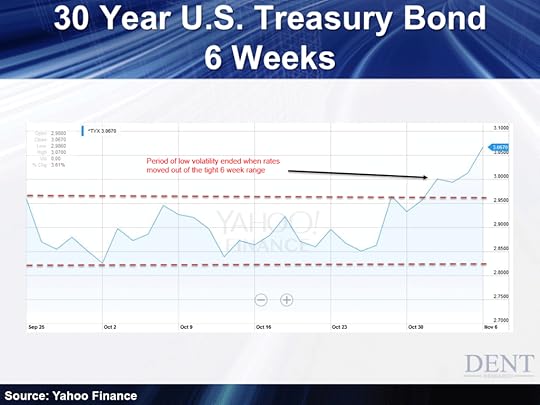

And for that, I’m happy. But first, a chart:

As you see, after 30-Year Treasurys traded basically within a tenth of a percentage point for six long, painfully uneventful weeks, yields broke out of that channel.

Bond traders obviously believe a rate hike is priced in for next month. They don’t want to be stuck holding lower-yielding bonds, so they sold them. Yields went up, and boom – volatility was back in the bond market.

And for me and the system I use in Dent Digest Trader, that’s all that really matters!

My system doesn’t care what the jobs number was.

It sure as hell doesn’t care what the Fed will do or won’t do in December.

Our only concern is what the bond market is doing, and how can we get on the winning side of that.

As I told those readers Friday, my system analyzes volatility in the long-term Treasury bond market. It identifies significant overreactions or divergences in price from the average.

When that happens, it signals an opportunity to position a trade for a “snap-back” to the mean. That’s the short-term strategy in a nutshell.

But we also identify long-term trend changes early on. That gives you an opportunity to position for a longer, potentially high-return trade with risk controls. That’s the long-term strategy.

Thankfully, the low volatility in the Treasury bond market has come to an end, and I expect there will be opportunities to profit in the near future!

It is interesting to note that while the bond market seems to be predicting a rate hike with near certainty, stocks don’t. Stocks actually ended higher Friday. If the Fed is indeed going to hike rates, you would expect the opposite.

Clearly there’s a tug-of-war going on with what the Fed says and what the Fed will actually do. Will they act according to the data? Or will they act to prevent a market sell-off?

I think the Fed should hike. They’re manipulating the markets with all this uncertainty. Just end it already!

But again, my system doesn’t care what anyone thinks or does. It just identifies opportunities to profit. More details here.

November 9, 2015

Grab a Cold One: The Business Cycle Is Winding Down

From April through October, I race a 37-foot sailboat every Thursday night. The course changes weekly, and ranges from three to seven miles long, depending on the wind.

From April through October, I race a 37-foot sailboat every Thursday night. The course changes weekly, and ranges from three to seven miles long, depending on the wind.

Before the race, we review the course and weather conditions and decide our strategy for the starting line. During the race, we generally enjoy the sail and competition, with only the occasional bout of yelling. We also enjoy a good beer, while on the boat and afterwards when we retire to the local Irish pub.

Some of the crew order the same brew every time, while others are always trying something new. As I looked down the row of taps, it struck me that while the beers might taste different, many are owned by the same company.

And it’s about to get worse.

In a deal worth more than $100 billion, two mega-brewers, InBev and SABMiller, are merging. The companies control 45% and 20% of the U.S. beer market respectively, offering more than 350 brands.

In addition to category kings like Budweiser and Miller Lite, they own Goose Island, Corona, Landshark, and 10 Barrel Brewing. While InBev is bigger in the U.S. market, SABMiller has some of the better names, including Australian brews Fat Yak and Dirty Granny.

After more than a decade of consolidation in the beer market, this merger seems like the culmination.

As fast as micro-brews open – and they open every week – big players snap them up. Without additional markets to exploit, or more drinkers buying beer, the entire game boils down to stealing market share from competitors. To grow, the logical path is to buy them out.

In general, mergers and acquisitions have to make financial sense. Perhaps one company is much stronger than another and can produce goods more efficiently.

But more often than not, the acquiring company is simply buying growth instead of creating it because opportunities are limited.

And with low interest rates and high stock prices, it’s been easy.

Using debt issued at a cheap interest cost, highly valued shares of the company’s stock, idle cash, or a combination of the three, the purchaser can vacuum up market share without going through the hard process of expanding organic sales.

When companies go through mergers and acquisitions, they typically talk about the synergies that the resulting combination will achieve. There might be some productivity gains here and there, but most of the time, “synergy” is a euphemism for firing people.

Who needs two accounting departments, or twice the HR staff? Let’s face it, head count is expensive. If you can slash employment costs and keep production the same, then the cost per unit declines, leading to more profit.

If history is any guide, the most deals come just before an economic fall.

The tools used for mergers and acquisitions – cheap debt, high stock prices, and idle cash – typically show up at the end of the business cycle, before everything goes down.

This makes the current cycle look long in the tooth and signals trouble ahead.

Not only are interest rates low, stocks high, and companies flush with cash, but also mergers and acquisitions are on track for a record year in the U.S., and the highest global total since 2007.

Through the first half of the year, over 20,000 deals were announced worldwide, valued at $2.2 trillion.

$1 trillion of that was just in the U.S.

That likely signals we’re closer to an economic decline than many are willing to stomach. If we get higher interest rates in the short term and a selloff in equities, the flow of mergers and acquisitions could dry up quickly, revealing the modest pace of actual growth.

This could lead to a lot more people reaching for a beer to drown their economic woes. By that point, whatever they choose, chances are it will be made by InBev and SABMiller, no matter what the label says.

Rodney