2015: Another Year of Market-Beating Returns

If your investment portfolio didn’t produce a double-digit return for you this year… rest assured, you’re not alone.

If your investment portfolio didn’t produce a double-digit return for you this year… rest assured, you’re not alone.

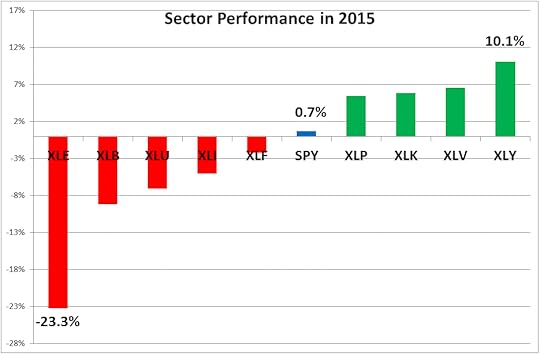

The S&P 500 – otherwise known as “The Market” – has returned a measly 0.7% since January.

Meanwhile, though, there were tens of thousands of dollars’ worth of opportunity in stocks this year.

You see, this was a great year for somesectors of the stock market. It was also a horrible year for some sectors.

Looking at the tops and bottoms… you’ll see the Consumer Discretionary (XLY) sector produced a healthy 10% return this year, while the Energy (XLE) sector suffered a devastating 23% loss.

Take a look…

Now, I think you’ll agree with me that annual returns of 0.7% – as produced by “The Market” – won’t get you anywhere close to your financial goals.

That’s why I’m a huge advocate for running an active portfolio, rather than a passive one. It’s nowhere near as difficult as some think… and the results can be far better than buy-hold-and-hope.

Essentially, I use a time-tested algorithm and data-driven analysis to invest in specific market sectors… but only the ones that are poised to beat The Market. And, instead of tying up capital for a full year, we take a more reasonable and flexible approach – aiming to stay in positions for two to three months at a time.

This approach has worked extremely well since I designed the service in 2011… and this year was no exception.

Since January, I’ve recommended 12 round-turn trades. Of course, we didn’t make money on all of them. And we’re even holding a few underwater positions right now.

Still, we turned a profit on 7 of 12 trades this year, for a win-rate of 58%.

Interestingly, we made investments in just about every sector, including: Consumer Discretionary (XLY), Financials (XLF), Industrials (XLI), Consumer Staples (XLP), Energy (XLE), Materials (XLB), and Health Care (XLV).

Besides those, we also found high-probability opportunities outside the stock market – pocketing 39% on a U.S. dollar position and 165% on a volatility play.

All in all, our average profit on the winning trades came in at 82%. And our average loss on the duds was about half that – at 40%.

Now, consider our bottom line…

Assuming an investment of $10,000 was made in each position, these 12 trades produced a net profit of $37,162.

On a $100,000 portfolio… that’s an annual return of 37%.

On a $50,000 portfolio… it’s 74%!

No matter how you slice it, Cycle 9 Alert subscribers had access to thousands of dollars’ worth of opportunities this year – even as The Market sputtered sideways.

And since my analysis and recommendations are data-driven, not based on gut feel, I’m looking forward to another great year of market-beating in 2016!

Adam O’Dell, CMT

Chief Investment Strategist, Dent Research