Gennaro Cuofano's Blog, page 110

March 16, 2022

What Is The Organizational Structure of McDonald’s? McDonald’s Organizational Structure In A Nutshell

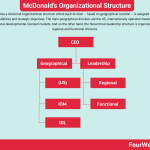

McDonald’s has a divisional organizational structure where each division – based on geographical location – is assigned operational responsibilities and strategic objectives. The main geographical divisions are the US, internationally operated markets, and international developmental licensed markets. And on the other hand, the hierarchical leadership structure is organized around regional and functional divisions.

Understanding the McDonald’s organizational structureThe current organizational structure of McDonald’s was implemented by incoming CEO Steve Easterbrook in 2015. Easterbrook reorganized business units, cut costs, and sold more restaurants to franchisees to make the fast-food chain modern and progressive.

This structure was then refined to comprise of three divisions or business segments:

United States (US) – headed by McDonald’s USA president Joe Erlinger. This is the most important division of McDonald’s since a significant portion of company revenue comes from this region.International operated markets (IOM) – a division encompassing wholly-owned markets and countries such as Australia, Russia, Spain, the United Kingdom, Canada, France, Germany, and Italy. International developmental licensed markets (IDL) – the IDL division covers all remaining McDonald’s markets and corporate activities. There are more than 80 different markets in which the company has licensed its franchise rights.Note that the IOM and IDL divisions are headed by Ian Borden. Both Erlinger and Borden report to current President and CEO Chris Kempczinski under a hierarchical leadership structure which we will analyze in the next section.

McDonald’s leadership structureMcDonald’s hierarchical leadership structure means there are multiple levels of management between the managers of individual stores and the CEO Chris Kempczinski. In other words, directives are passed from the CEO down the hierarchy to vice presidents, regional managers, restaurant managers, franchise owners, and other personnel.

Under the corporate banner, there are various executive vice presidents, senior vice presidents, and other staff in the following disciplines:

Global impact.Strategic alignment.Office of the CEO.Digital customer engagement.Marketing.Finance.IT.Restaurant development and solutions.Customers.Supply chains.RegionalThere are also senior vice presidents in the regional divisions we mentioned in the previous section. For the IOM division, there are two positions:

Chief Marketing Officer and Corporate Vice President, andCorporate Senior Vice President.There is also a Senior Vice President for IDL markets and a Senior Vice President and Chief People Officer for international markets more broadly.

FunctionalMcDonald’s also operates six functional groups, with each group headed by either a senior vice president or vice president. These groups are:

Learning and Development.Compliance.Communications.Technology.Accounting.Diversity, Equity & Inclusion.Key takeaways:McDonald’s has a predominant divisional organizational structure where each division is assigned operational responsibilities and strategic objectives. The current organizational structure of McDonald’s was implemented by CEO Steve Easterbrook in 2015. Primarily, this structure consists of three divisions based on geographical location: United States, international operated markets (IOM), and international developmental licensed locations, which comprise licensed franchises in over 80 markets.McDonald’s also employs a hierarchical leadership structure where a raft of senior and executive vice presidents report to the CEO. In addition to leading regional divisions, these individuals also head various corporate and functional groups such as Global Impact, Strategic Alignment, and Diversity, Equity & Inclusion.Read Next: Organizational Structure.

Read Also: McDonald’s Heavy Franchised Business Model, Who Owns McDonald’s?, McDonald’s PESTEL Analysis, McDonald’s SWOT analysis, What Is A Franchising Business Model?, McDonald’s Speedee System, History Of McDonald’s.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post What Is The Organizational Structure of McDonald’s? McDonald’s Organizational Structure In A Nutshell appeared first on FourWeekMBA.

What is Toyota’s Organizational Structure? Toyota Organizational Structure In A Nutshell

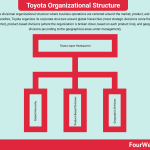

Toyota has a divisional organizational structure where business operations are centered around the market, product, and geographic groups. Therefore, Toyota organizes its corporate structure around global hierarchies (most strategic decisions come from Japan’s headquarter), product-based divisions (where the organization is broken down, based on each product line), and geographical divisions (according to the geographical areas under management).

Understanding Toyota’s organizational structureFor decades, Toyota’s organizational structure was based on a traditional Japanese business hierarchy where only the most senior executives held decision-making power. This structure, which we know today as hierarchical, is characterized by the one-way flow of information from top to bottom and very little subordinate autonomy. However, this structure transformed in 2013 in response to safety issues, product recalls, and a broader strategy to make Toyota more competitive and responsive in the global market.

Efforts were made to streamline the board of directors and scale down the system that allowed executives to make decisions. The company also afforded overseas affiliates more decision-making power, with power until that time concentrated in Toyota’s Japanese headquarters. Finally, Toyota made significant changes to its organizational structure to ensure that outside or external opinions were considered in earnest and, where feasible, incorporated into new management practices.

Today, Toyota has a divisional organizational structure. It retains aspects of its traditional hierarchical structure, but the initiatives mentioned above have decentralized decision-making power to some extent.

Key components of Toyota’s organizational structureToyota’s revised organizational structure now consists of the following three components.

Global hierarchyWhile Toyota headquarters in Japan is responsible for making most decisions, some power was also given to business unit and regional heads. The company’s processes are now more decentralized, but these leaders are nevertheless required to report to headquarters.

Product-based divisionsIn 2016, Toyota made further structural changes to streamline decision-making and increase production efficiency. In essence, the company moved from a function-based strategy to a product-based strategy.

Seven product divisions were created, with each able to collaborate with other divisions while reporting to head office. These divisions, which Toyota calls companies, include:

Innovative R&D and Engineering Company.Toyota Compact Car Company.Mid-size Vehicle Company.CV Company. Lexus International Co.Power Train Company.Connected Company.Full responsibility and authority rest with the president of each company.

Geographic divisionsAs part of the changes made in 2016, Toyota created two more divisions that help it carry out its strategy across nine international regions. These include:

Business Unit Toyota No. 1 – North America, Europe, Africa, and Japan.Business Unit Toyota No. 2 – China, Asia, Middle East & North Africa, East Asia & Oceania, Latin America & Caribbean.Each is run by a divisional head who makes decisions for their respective region while remaining accountable to headquarters.

Key takeaways:Toyota has a divisional organizational structure where business operations are centered around market, product, and geographic groups. For many years, Toyota’s processes were based on a traditional Japanese business hierarchy where only the most senior executives held decision-making powerWhile Toyota headquarters in Japan is responsible for making most decisions, some power now rests with business unit and regional heads. Toyota introduced seven, product-based divisions to increase production efficiency and streamline decision-making.There are also two additional divisions, or business units, which are responsible for managing operations in nine geographic regions around the world.Read Next: Organizational Structure.

Read Also: Toyota Business Model, Toyota Production System, Gemba Walk, Poka-yoke.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post What is Toyota’s Organizational Structure? Toyota Organizational Structure In A Nutshell appeared first on FourWeekMBA.

What is Walmart’s Organizational Structure? The Walmart Organizational Structure In A Nutshell

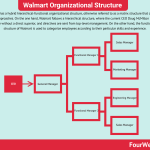

Walmart has a hybrid hierarchical-functional organizational structure, otherwise referred to as a matrix structure that combines multiple approaches. On the one hand, Walmart follows a hierarchical structure, where the current CEO Doug McMillon is the only employee without a direct superior, and directives are sent from top-level management. On the other hand, the function-based structure of Walmart is used to categorize employees according to their particular skills and experience.

Understanding Walmart’s organizational structureWalmart has an organizational structure characterized by the presence of a hierarchy and function-based groups. Since the company combines two different organizational structures, it can be said that Walmart utilizes a matrix organizational structure.

This allows Walmart to operate its vast retail presence in the United States and around the world, with approximately 10,500 stores under 46 banners in 24 countries. In fact, many similar multinational companies use this approach to deal with multiple divisions and functional structures at the same time.

In the following sections, we’ll take a closer look at Walmart’s organizational structure.

Hierarchical structureWalmart utilizes the hierarchical structure which means that current CEO Doug McMillon is the only employee without a direct superior.

Directives are sent from top-level management to regional managers, district managers, middle managers, store managers, and store team members as required. This allows executives to easily exert their influence on the organization and monitor the impacts of decisions. What’s more, the hierarchical structure allows the company to effectively manage its more than 2.3 million associates.

Walmart has a 12-member Board of Directors with members of the founding Walton family and other individuals. Under the Board of Directors is the Executive Committee comprised of executives in roles such as Chief Financial Officer, Chief Technology Officer, and Chief Legal Officer and Corporate Secretary.

On the next level down is Senior Leadership consisting of 39 executives across a diverse range of roles in technology, merchandising, compliance, ethics, health & wellness, and international strategy, to name just a few.

Function-based structureThe function-based structure of Walmart is used to categorize employees according to their particular skills and experience.

For example, function-based groups may include human resources, marketing, customer care, and production. Each group is headed by a manager who liaises with individual store managers to meet company objectives.

Furthermore, different Walmart store formats will be comprised of different departments. The member-only retail warehouse Sam’s Club, for example, will possess some functional groups that are not present in a Walmart Discount Store. Walmart Supercentres that incorporate banks, hairdressers, nail salons, pharmacists, restaurants, and optometrists will also incorporate several departments that are not relevant to a standard Walmart Discount Store.

Key takeaways:Walmart has a hybrid hierarchical-functional organizational structure, otherwise referred to as a matrix structure that combines multiple approaches.Walmart utilizes the hierarchical structure which means that current CEO Doug McMillon is the only employee without a direct superior. Directives are sent from top-level management to regional managers, district managers, middle managers, store managers, and store team members when required.The function-based structure of Walmart is used to categorize employees according to their particular skills and experience. Examples include sales, marketing, human resources, customer care, and production.Read Next: Organizational Structure.

Read Also: Walmart Business Model, Walmart Mission Statement Analysis, Walmart SWOT Analysis, Who Owns Walmart.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post What is Walmart’s Organizational Structure? The Walmart Organizational Structure In A Nutshell appeared first on FourWeekMBA.

March 15, 2022

How To Improve Your Emotional Intelligence Quotient

Emotional intelligence can be defined as the ability to recognize emotions that arise from within to be able to handle them for better decision making. Also, the ability to identify others’ people emotions to be able to handle complex situations in the best possible way.

Origin storyOne question that always puzzled me is: “How to determine whether a person is intelligent?”

I have to confess that I did not know the answer to that question, until recently.

But that inquiry brings us to a deeper one: “how can we measure intelligence?”

The most common metric (IQ) has been a cause of frustration and discomfort for many who found out not to be as smart as they thought. But how reliable is IQ in measuring overall intelligence?

Is it fair to say that a person with a low IQ would get condemned to a useless life?

It leads us to the source of all misunderstandings: Can intelligence and therefore success get relegated to a standardized test such as the IQ?

Two brilliant guysLet me tell you the story of two very “smart” guys: Jeffrey and Kenneth.

Jeffrey was born in 1953, in Pittsburg, Pennsylvania. Second, of four kids, since childhood hour he showed to be smarter than other youngsters.

It became evident when Jeffrey got was finally admitted to the Southern Methodist University in Dallas where he received a full scholarship and eventually studied business.

After graduation and working for a while with a Houston bank, Jeffrey was sent to Harvard Business School graduating in the top 5% of his class (Bio).

Kenneth was born in 1942, in Tyrone, a small town in Missouri, as the only child. As the child, Kenneth showed to be very smart as well.

He worked his tail off by delivering newspapers and mowing lawns. Subsequently, he earned a degree in economics from the University of Missouri and not satisfied yet; he received a Ph.D. in economics from the University of Houston in 1970 (Bio).

What did they have in common?They were both brilliant, successful and wanted to make a lot of money. Their paths crossed when Kenneth hired Jeffrey as the consultant (while working at Mckinsey and Co).

Kenneth’s company operated in the utility industry, and it was one of the biggest and most successful corporations in the US.

Kenneth was impressed by Jeffrey’s performance, and eventually, he hired him as CEO of the Capital & Trade Resources of the organization (the primary division of the company).

Jeffrey’s career was so successful that (by 1997) he was nominated CEO of the whole business. Only Kenneth retained a more influential role within the organization.

It would have been great if the story ended there, but let’s see what happened next!

The story unraveledKenneth and Jeffrey were two brilliant individuals, with MBAs and PhDs, and very high IQs, therefore, destined to succeed. Jeffrey and Kenneth were not the only smart guys in the company.

Ever since Jeffrey became CEO, top graduates were hired to run the business’ operations. The company became so successful that Kenneth and Jeffrey were everywhere: from business magazines to finance newspapers.

Their reputation in Wall Street snowballed. How did the company grow so fast?

Jeffrey had the brilliant idea to use the market to market accounting. It means that the firm was valuing its assets at market value instead of historical cost.

For example, when the company invested in new plants, they could already show its future estimated profits on the balance sheet.

And if the acquired plant did not produce any benefit in the future, the company created ad hoc off-balance sheet financial vehicles to hide the losses.

Therefore the company balance-sheet was always kept “clean” from losses. Those complex operations allowed the company to maintain a high rating, while not risking a dime. Were all those activities legal?

As it turned out, they were not. Indeed, when the operations became too complicated, the company could not hide them anymore, and the financial situation became unbearable.

When voices spread that the firm had billions lost in those operations, it became one of the greatest scandals in American history. The company was Enron, and the two protagonists of the story were: Jeff Skilling and Kenneth Lay.

They were “the smartest guys in the room.” In 2006 both Jeff and Kenneth were convicted of fraud and became the most obvious case of how smart people can do stupid things.

Does a Nobel Prize keep you away from troubles?Let me tell you the story of LTCM (Long-term Capital Management), a hedge fund which eventually collapsed by taking too much risk. LTCM was founded by Robert C. Merton in 1993 and had on its board, Myron S. Scholes.

Who are they? Both Merton and Scholes were Nobel Prizes, awarded in 1997, just one year before LTCM collapsed.

You might think “why is this relevant to our story?” Well, the LTCM firm got founded on the idea that a formula (they won the Nobel Prize thanks to this method), could succeed in all financial circumstances.

That formula worked for a couple of years, until 1997. During that year the firm lost a staggering $4.4bln and had to be bailed out by other institutions (When Genius Failed – The Rise and Fall of Long-Term Capital Management)

Is it possible that two Nobel Prizes, among the smartest persons on the planet, were not able to foresee the risk involved in their operations? Maybe they did understand the risk rationally but not emotionally.

But if that is the case can we still define those people intelligent? Of course, they are among the people with the highest IQ in the world. What is the other aspect of intelligence that goes beyond IQ? Emotions. Indeed, emotions can hijack the intelligence of an individual.

Daniel Goleman calls it “EI” or “Emotional Intelligence.” Although the term “Emotional Intelligence” got used for the first time by psychologists John Mayer and Peter Salovey, Goleman was the one who formulated a systematic approach to EI.

Who is Daniel Goleman?Daniel Goleman is an international psychologist who eventually became famous through the book “Emotional Intelligence.” He was born in Stockton, California, in 1946.

After getting a scholarship to Harvard, he studied clinical psychology. After that, Goleman continued his education in India and Sri-Lanka where he started to investigate the implications of meditation practices on stress reduction.

He then joined the New York Times in 1984, but soon he realized that the topic of emotional intelligence required his attention until the book on the subject came about and sold more than 5 million copies worldwide.

What is Emotional Intelligence (EI)?How many times do you find yourself doing something you promised it wouldn’t happen again?

Saying something in public, you were not supposed to say, falling still into an old bad habit that you were trying to abandon. In all those cases the reason we fall back into the trap is that we lack Emotional Intelligence, or “the capacity to assert self-control, persistence and most of all to motivate oneself.”

Why is it so difficult to change our bad habits or behaviors? Try to stop and think for a few seconds how many times you burst into anger and treated people around you poorly.

Then, a just half-hour later you regret what you did. Why don’t we stop such behaviors when they are happening?

Well, because we lack Emotional Intelligence, or the ability to understand what we are feeling at a particular moment.

In other words, if you are having a dispute with your family and suddenly you are about to “lose your mind” how you can avoid that?

While you talk or listen, try to analyze your internal mental state, assess your body sensations and if you detect some feelings of discomfort get out of the dispute for the half-hour.

This time will give you the chance to make your mind and let the cortisol (a hormone released during stressful situations) to be absorbed by the organism; therefore making you more relaxed.

Of course, this is just one situation you may face in life, but the point is that EI requires a lot of mindfulness and the ability to see oneself from the outside.

It is almost like you are inside your head while you react to something and on the other hand, you are someone else, looking at yourself from the outside! Does it sound crazy?

I know it seems overwhelming and It is not easy since a lot of practice is required. Thereby the next natural question is: why would I waste my time doing so when I could be studying technical staff? Let me answer.

Correlation between IQ and career successOf course, you can spend your whole life studying hard and acquiring technical skills that will make you more successful when it comes to your career advancement.

But will they? As shown in many types of research IQ scores have a weak correlation with professional success. Instead, cognitive ability (EI) resulted from a much more reliable predictor of job performance (IQ correlation with success). In few words, the IQ without the EI does not get you anywhere.

And the reason is pretty simple: do you remember the stories at the beginning of the article? Enron and LTCM are just extreme examples of lack of Emotional Intelligence.

If you compare two individuals, one with a higher IQ and lower EI and another with a more moderate IQ but high EI should not surprise you if the second person will become more successful in life.

Why? Intelligence in standard terms (IQ) gets completely wiped out by emotions. Unless EI gets developed. And in many cases IQ is just an intellectual fraud!

Why do we feel emotions such as anger and fear?Evolutionary speaking those emotions make perfect sense. Imagine a homo sapiens two hundred thousand years ago, in a jungle. The Sapiens is about to be attacked by an old tiger weighing around 150kgs.

Fear strikes, his body freezes (to allow hiding) so that the body will be in a state of max alert and he gets ready for the fight or flight response.

Think of all the times you heard a noise in the middle of the night; something fell, your heart rate increased, you froze. On the other hand, your brain started to scan all the possible scenarios: is it a bird? Is it a thief?

In other words, emotions are a defensive mechanism used by our organism to face dangerous situations.

Indeed, for example, when anger strikes your heart rate increases, the blood is pumped faster and toward areas of the body such as our hands. In turn, this gives you the chance to defend yourself by allowing the energies to flow where needed the most.

If this makes sense when it comes to situations of real danger, it can become counterproductive when it comes to social conditions.

Think of an argument with a co-worker where your anger mounts to the point that you almost physically attack him/her. What just happened to you? Why could you not control that reaction?

Another example: last time you spoke in public your hands sweated, and you could barely open your mouth or move your tongue to articulate a word. How to control that?

To answer, we have to dig deeper and ask: Why do emotions are triggered faster than thoughts? But to respond to this question, we must understand how our brain works.

Our brain is an evolutionary machineIn our head, we have an evolutionary device. What does it mean? Think of when you bought an I-phone for the first time. In the package, you found the phone ready to be used.

The software got installed, and all I-phones come with the same configuration. On the other hand, to make it work properly, you need to install apps.

The apps make your I-phone more functional. Therefore, what will differentiate one I-phone to the next are the apps installed on it.

For example, one I-phone will have ten apps, another twenty and of course, the one with more apps has higher functionality.

I know it may sound very simplistic, but the point is that when humans come to life, they have all the same “package”: our brain (software).

Then later in life, we start to learn many things such as how to talk, walk and so on (apps).

Once reached the mature stage we can learn several languages or play several musical instruments. Those “upgrades” are similar to an I-phone with more apps on it.

Keep in mind though that to preserve the functioning of your I-Phone you must update the software first otherwise, all the apps installed will be worthless.

The same applies to our brain. You can learn all the skills you want, but to be very useful you must learn how to control your emotions first (upgrade your software).

Then it will make more sense to go on and learn ten languages or to play ten musical instruments (apps).

The next thing to figure out is how our brain evolved. It turns out that our mind grew gradually; in other words, it developed one layer at the time.

The new brain has three primary layers or systems: reptilian, limbic and neocortex. The reptilian brain is the oldest. Therefore, it evolved before the other layers.

Indeed, that part of the brain controls vital functions such as breathing, body temperature, heart rate, and balance. The limbic system evolved subsequently, and it is the part related to emotions and memory.

The neocortex, the last to develop played a key role in thoughts, consciousness processes, language and so on.

Keep in mind this is only an (over)simplification of our brain, which is way more complicated than that.

What triggers emotions?The limbic system is the part that plays a vital role when it comes to emotions. And evolutionary speaking emotions are essential for survival.

Also, emotions are crucial because they allow us to form memory. In the limbic system, there are two main parts: the amygdala and the hippocampus.

Those parts are linked, and the activation of the amygdala becomes crucial to allow the hippocampus to form memories to be stored in our brain.

Also, the amygdala is like a “human alarm.”Indeed, it signals all the situations that may be “relevant” to the hippocampus, which in turn stores those memories for future purposes. The issue is that the amygdala continuously scans the surroundings.

Therefore, if it gets over-activated, it may become dysfunctional. Think of a paranoid person that sees danger anywhere. Well, this person’s amygdala is over-stimulated.

Think of your car’s alarm that is too sensitive and gets armed all the time someone passes a few feet away from the vehicle.

How to control emotions? One way to manage your feelings is to tame the amygdala. In other words to make sure you do not get hijacked by it. How to do so?

It comes very handily our neo-cortex area: in particular the left pre-frontal cortex. That is the part related to consciousness, thought, and language.

Many types of research showed that increased activity in this area of the brain inhibits the amygdala; therefore it keeps it under control.

Taming the amygdala is not that easy at first, and the reason stands in the fact that the signals that arrive from the outside world, such as sounds, vision and so on may be acknowledged first by the amygdala, then by other areas of the brain.

Stop victimizing yourself: it is counterproductive!One way to develop Emotional Intelligence is to learn how to use productive self-talk. How many times you did something wrong, and you ended up saying “I always make the same mistakes” “I am a failure” or “It is always my fault.” If you do use such kind of self-talk is time to STOP.

It is the kind of self-talk that allows the amygdala to dominate within your brain, reinforcing itself from time to time until the other parts of the brain become numb.

One key to change self-talk is to modify the perception of things. Anyone knows that if you take two persons looking at a glass of water half empty and half full, the optimist will see the entire half and the pessimist the empty half.

In reality, none of them is right or wrong; their perception is different. To change your opinion of things, you must be aware and conscious throughout your day.

Think of how many times you get caught in thoughts entirely unrelated to the situations you are facing.

For example, you see an object, such as a pen that for some reason reminds you of a person that few days before mistreated you. You get swept by that thought that leads to another view and so on until you become so angry and nervous, although you were having a , day. That train of ideas must be stopped if you want to keep a positive mood throughout the day. But to do that you must be aware, or be able to “think about your thoughts and keep them on track.”

Indeed, the emotional brain, unfortunately, is indiscriminate; it creates links between memories that are not rational or controlled. If you let your emotional mind run undisturbed, this will bring most of the time to unpleasant emotions and feelings.

How to stop it? Use your consciousness and understand what is happening in the background. In other words ask yourself: is it rational what I am thinking? Is this thought useful to the situation I am facing now? Those questions will help to activate the prefrontal cortex while inhibiting the amygdala.

Three advises from Daniel GolemanDaniel Goleman through his writings suggest us to be very careful about many aspects of our personalities such as self-awareness, personal decision-making, managing feeling, handling stress, empathy and so on. Also, he would remind us of three elements that are crucial:

Know thyselfStart to become aware of your thought processes. In any moment of your day, from the smallest errand to the critical meeting try to keep track of your thoughts.

For example, if your boss is mad at you and you start sensing a feeling of fear that kicks in start to tell yourself “I am sensing fear,” such an exercise can be beneficial to detach you from the actual situation and train your left prefrontal cortex to act. Do not let the amygdala dictate your life!

Master thyself:Once you become good at understanding your feelings start to work on your impulses. In other words, if there is any wrong habit that is making you a slave, try to become aware of it, and gradually develop “the capacity to resist that impulse to act” instinctively.

Temperament is not destinyKeep in mind that you choose. Of course, your emotional troubles are coming from a long time ago, most probably when you were just a kid. On the other hand, that does not imply that your personality determines your destiny. Quite the opposite, choose the qualities you would like to have and start to implement them now! (see Warren Buffet on How to develop a character )

Start practicing Emotional IntelligenceIf you are one of those people who think they cannot control their emotions, I hope you changed your mind. In Daniel Goleman’s book: “Emotional Intelligence” you will find useful information that will help you to reduce stress, to reduce impulses and to create more self-awareness.

It is your turn to dedicate some time of your day to nurture the intellectual side of your brain. The most important takeaway from this article is that “you can choose.” Don’t get me wrong, not all emotions are bad! It is amazing to experience positive emotions such as love, compassion, and joy.

On the other hand, if you let yourself get swept by negative emotions such as hatred, envy, and anger you are limiting your life.

In today’s world where social media are intended to make us look perfect and happy, people post beautiful pictures, funny moments, and exotic trips.

It seems almost like unhappiness does not exist. If you dig deeper, you see how things are. Repeat yourself this mantra “I am not alone. I am not different; I am like any other human being, I am facing the same problems other people are facing or that others are already faced”. Once you recite this mantra, your perspective will shift.

You will no longer see yourself as the “victim, ” and suddenly a new world will open to your eyes. Therefore, to be successful in life and business:

Stop personalizing, victimizing and blaming yourself or others. Take charge for your life now:

The biases you need to be aware of to be more conscious

Biases are built in perceptions about things that in many cases help us survive in many others might bring us toward making wrong decisions. Knowing what some of those biases are might be a great starting point.

Intuition IndexDo you know that your intuitive machine works better when in a good mood? Daniel Kahneman in some of his experiments showed that people who were put in a good mood doubled their inherent ability. The opposite is true as well. Many mistakes made by speculators happen either when in an exuberant mood or a terrible mood.

The Illusion of linear PatternsEver since Greek Philosophers (Plato and Aristotle more than anyone) thought us about purpose. Everything in nature must have a goal and therefore be connected by a cause-effect relationship.cause-effect Relationship. Our tendency to look for patterns is in part built-in and partly inherited from ancient philosophy. We love order, it makes us feel safe, and it gives us a sense of self-confidence. The problem is that we go too far with our tendency to look for order. We see patterns where they are non-existent. The investor falls in the same cognitive bias often. In many circumstances, he attributes the rise or fall of stocks to the next market news.

Anchoring Effect The anchoring effect describes the human tendency to rely on an initial piece of information (the “anchor”) to make subsequent judgments or decisions. Price anchoring, then, is the process of establishing a price point that customers can reference when making a buying decision.

The anchoring effect describes the human tendency to rely on an initial piece of information (the “anchor”) to make subsequent judgments or decisions. Price anchoring, then, is the process of establishing a price point that customers can reference when making a buying decision.When someone gives us a certain number (not necessarily related to the transaction) for some reason, we stick to that figure (or we don’t go too far from it). For example, if I were to ask you the age when a person died, and before the question, you were shown a small number (say 25) chances are you will say the person died at a young age. The investor falls into the same trap when dealing with stock price. For such reason, stocks, which tend to be overpriced by the market, are also the most desired. The opposite is true as well.

Outcome Bias Outcome bias describes a tendency to evaluate a decision based on its outcome and not on the process by which the decision was reached. In other words, the quality of a decision is only determined once the outcome is known. Outcome bias occurs when a decision is based on the outcome of previous events without regard for how those events developed.

Outcome bias describes a tendency to evaluate a decision based on its outcome and not on the process by which the decision was reached. In other words, the quality of a decision is only determined once the outcome is known. Outcome bias occurs when a decision is based on the outcome of previous events without regard for how those events developed.Success is a matter of results, isn’t it? We often tend to listen to “successful people,” almost like the outcome of their success is mainly due to their ability to make good decisions. If this can be true in some cases, it can also be incredibly wrong in many other cases. On the other hand, we are inclined to accuse those, which sound decisions didn’t turn out to be also the right ones because of the outcome. The speculator often associates a winning strategy based on its results. The problem lies in the fact that the strategy may have worked out of pure lack. Therefore, once the speculator gets convinced of how sounding the strategy is that is when disasters happen.

Theory-induced blindness“This is just an idea! It isn’t real!” How do you feel about this statement? Although your System 2 may rationally agree, your System 1 seems not to grasp this concept. Indeed, we treat ideas like belongings. We own them, we breathe them, and we would perish or murder for them. Wouldn’t we?

How otherwise can we explain wars fought for religion, power and so on? Wasn’t Descartes who once said, “Cogito Ergo Sum” (I think therefore I am)? We feel alive when we theorize and make sense of the world around us. This isn’t negative in itself. What is negative is the fact that we get devoted to those theories. Many times the investors, which fall in love with their ideas, are the ones who wind up losing money.

A different example of that is investor George Soros. Soros can change opinion very quickly. In other words, if changing view can be seen poorly in politics or any other field, this does not apply to investments. The screwed investor has to be ready to change “idea” very quickly.

Loss Aversion“Losses loom larger than gains. The “loss aversion ratio” has been estimated in several experiments and is usually in the range of 1.5 to 2.5,” says psychologist Daniel Kahneman. The speculator often falls into the trap of opening positions, to recoup the losses or to wait too long before liquidating a losing position, because of the deceiving thought of waiting for the stock to rise again.

Domain DependenceFormulated by Nicholas Nassim Taleb in “Antifragile,” this is a fascinating concept. It consists on the inability of individuals to transfer the knowledge they have in one field to another area. For instance, investors, often make decisions about market moves based on mere superstition. Although, they are “experts” and as such should be able to transfer their financial knowledge to the financial markets, often they are not able to do so.

Learn emotional intelligence from the most successful modern investorWarren Buffet is one of the few men in the Universe who does not need any introduction. Currently, among the wealthiest persons in the globe, Warren Buffet is one of the most sought businessmen alive.

Many love to define him as the “Oracle of Omaha” due to his mythological Midas touch (although he prefers to invest in stocks rather than gold). In one of many speeches, he affirmed to have won the “Ovarian Lottery” because he was born at the right time and place. Besides his modesty Buffet is a wise man before then a wise investor.

For such reasons we deemed compulsory to account here some of the advises that he publicly gave about life and investments. Also, Warren Buffet’s official biography, “The Snowball” by Alice Schroeder is a detailed account of all the principles that served as a guide throughout his life. However the chances to become as wealthy as Warren Buffet are extremely low (maybe you have better chances of winning the lottery);

On the other hand, Buffet’s advice is meant to be a starting point to build a successful career in business. Therefore take these six guidelines as a catalyst to your success:

The future is not the pastFor how petty this point may seem, it is actually very important in Warren Buffet’s world. One of the hardest things to comprehend when dealing with stocks is that we cannot derive from the past future’s stock results.

For such reason Buffet never wasted his time trying to predict financial markets, or how they will react to the next Federal Reserve move. This concept may even be harder to get for those who received formal training in finance. Too often business schools teach how to derive the “future value” of a stock based on the projections of its recent past performance (3-5 years).

The consequence is that the model itself is stunning (excel-psychos make the tool become the end rather than the mean) although worthless.

Beware of the NoiseNewspapers, TV Shows, second by second charts are all engineered to produce a great deal of noise. That sensational clamor is what the wise investor knows how to avoid. The reason to avoid noise is not only psychological but also physiological.

Indeed, not only noise makes us more vulnerable to rumors, but it also makes us more apprehensive and stressed. Our brain is not wired for losses; Cognitive psychologists showed that we perceive losses extremely more than gains.

Consequently, it is wise to reduce the frequency to which we are updated about our portfolio’s performance.

Circle of Competence The circle of competence describes a person’s natural competence in an area that matches their skills and abilities. Beyond this imaginary circle are skills and abilities that a person is naturally less competent at. The concept was popularised by Warren Buffett, who argued that investors should only invest in companies they know and understand. However, the circle of competence applies to any topic and indeed any individual.

The circle of competence describes a person’s natural competence in an area that matches their skills and abilities. Beyond this imaginary circle are skills and abilities that a person is naturally less competent at. The concept was popularised by Warren Buffett, who argued that investors should only invest in companies they know and understand. However, the circle of competence applies to any topic and indeed any individual.This idea is simple but very powerful. Warren Buffet built his life around this concept. To become a successful one must learn how to avoid screw-ups. Many of those come from our tendency to fall into the “mimicry trap.”

In other words, we feel we have to start a venture or invest in the stock just because our neighbor did so. It is essential to draw a line and determine what the things we truly understand are.

For example, as reported in “The Snowball” by Alice Schroeder, Warren Buffet recognized himself as an expert on money, business, and his own life. That is one of the reasons Buffet did not get involved in the dot.com bubble.

He did not necessarily think there weren’t companies worth investing (Buffet is Bill Gates’ good friend); but he did not understand those businesses, and therefore he avoided them because they fell outside his circle of competence.

Don’t go into debtBuffet learned this principle very early in his life. As reported in “The Snowball” by Alice Schroeder “spend less than you make” and “don’t go into debt” represented Buffet’s Family dictum.

While this principle is easy to understand rationally, it is tough to implement practically. When you contract debt and spend more than you earn, for instance, you will stop accumulating and compounding your wealth.

This was the practical reason for which Buffet implemented this principle throughout his life. If many so-called “gurus” do not practice what they preach, conversely Buffet has always done the contrary. For instance, Buffet still pays himself $100,000 per year, a pretty meager salary compared to Wall Street multi-millionaire bonuses.

The main reason for that is not only symbolical but also practical. If management is paid too “generously,” this would divert resources away from the company which to be successful has to keep its compounding growth.

Not in the Game for moneyOne may argue that Buffet is a billionaire and as such of course he loves money. But this isn’t the case. What Buffet loves is “how to make money” but not money itself. Not by accident, the Oracle of Omaha donated over $21bn to charities (Buffet’s Donations to Charity), and it is likely that this amount will considerably grow in the next years. Buffet learned this principle from his mentor, and (super)intelligent investor Benjamin Graham.

Work-Smart not hardEver since childhood, Warren Buffet disliked manual labor but understood that financial freedom was what he wanted in life. Therefore, he started from early experience to create a system to become financially independent. For instance, the system he used already existed, and it was the financial market.

On the other hand, this principle applies to any other aspect of life. This leads to the difference between scalable and not scalable jobs. Although this concept matured from “The Black Swan” by Taleb, it interestingly applies here as well. There are two categories of jobs. The non-scalable, which strictly depend on some hours you put in.

If you are an accountant you will earn per hour, therefore the more you work, the more you make money. And the scalable ones, where there is not the correlation between hard-work and earnings. If you are a writer or an investor the success of the book or investment does not necessarily depend on some hours invested in it. In the non-scalable spectrum, to become rich, you have to work extremely hard.

Also, the level of income is strictly tied to the amount of work. This implies that you will never be free from your job. In other words, your income is your job, but your job is yourself. Therefore you are your income!

As soon as you stop working your income stops as well. On the scalable spectrum, instead, you are not your income. In other words, you depersonalized your job, by creating a system that works for you.

When you stop working, no longer your income will halt. This principle seems to have been instilled in Buffet’s mind at a very early age.

Emotional intelligence componentsAs we saw, so far, Emotional Intelligence, also known as emotional quotient, refers to one’s ability to manage and use emotions in constructive ways. This is a critical skill to possess in both a personal and professional context and can be used to communicate effectively, reduce conflict, overcome difficulties, make better decisions, and build robust relationships.

In truth, there are many components of emotional intelligence, but we have taken the liberty to list the components we consider the most important below.

Self-awarenessSelf-awareness is simply the ability for an individual to first recognize and then understand their own emotions. Self-aware individuals also have the ability to determine the impact of their actions and emotions on others. What’s more, they are aware of how their feelings influence their behavior in a diverse range of situations.

According to psychologist Daniel Goleman, a self-aware individual is also characterized by confidence, a sense of humor, and cognizance of how others perceive them.

Self-regulationSelf-regulation can be defined as the ability of a person to control their impulses. In other words, do they think before they speak or react? Can they appropriately express themselves? This is a component of emotional intelligence that is important for leaders who must be able to make sound decisions and manage conflict in stressful environments.

Many confuse this component with emotional unavailability, but it’s worth noting that self-regulation entails waiting for the correct moment to express an emotion. Individuals with high self-regulation also recognize that they have a choice in how they respond and are skilled at reframing negative thought patterns or responses into something more positive.

MotivationIn the workplace, emotionally intelligent individuals can motivate themselves to reach their goals or meet their needs. This is known as intrinsic motivation because the individual does not chase external benefits such as money, recognition, or status.

Intrinsically motivated individuals tend to find their work more rewarding and meaningful. When some aspect of their position becomes uninteresting, they deliberately introduce a challenge or work with a colleague for accountability.

EmpathyIn complex, frenetic, and high-stress work environments, empathy is the glue that holds organizations and teams together. Empathy is the ability to understand the emotions of others and see the world from their perspective. While empathy does not come naturally to many people, it is a skill that can be developed.

Individuals who display this component of emotional intelligence are active and present listeners and can detect nonverbal forms of communication. They also allow others to finish speaking before considering their response and ask probing questions instead of delivering unwanted advice.

Social skillsLastly, emotionally intelligent people are able to interact with others naturally and build professional networks. They are competent storytellers and can communicate their ideas in such a way that there is no confusion around their message.

Social skills encompass a broad subset of desirable traits such as active listening, eye contact, persuasiveness, leadership, mirroring, and a capacity to develop and maintain close friendships or relationships.

Key takeaways:Emotional intelligence refers to one’s ability to manage and use emotions in constructive ways. This is a critical skill to possess in many personal and professional contexts.Self-awareness is one of the most important components of emotional intelligence. This is defined as an ability to recognize and understand our own emotions in addition to the emotions of others. Related to self-awareness is self-regulation, or the ability to control our emotional impulses. Other components of emotional intelligence include intrinsic motivation, empathy, and a broad set of social skills that allow us to build networks, maintain relationships, and persuade or lead others.Other business resources:

What Is Business Model InnovationWhat Is a Business ModelWhat Is A HeuristicWhat Is Bounded RationalityWhat Is Business DevelopmentWhat Is Business StrategyWhat is BlitzscalingWhat Is a Value PropositionWhat Is a Lean Startup CanvasWhat Is Market SegmentationWhat Is a Marketing StrategyWhat is Growth HackingThe post How To Improve Your Emotional Intelligence Quotient appeared first on FourWeekMBA.

What Is Marketing Mix And Why It Matters In Business

The marketing mix is a term to describe the multi-faceted approach to a complete and effective marketing plan. Traditionally, this plan included the four Ps of marketing: price, product, promotion, and place. But the exact makeup of a marketing mix has undergone various changes in response to new technologies and ways of thinking. Additions to the four Ps include physical evidence, people, process, and even politics.

Understanding marketing mixWhile many understand marketing as “putting the right product in the right place, at the right price, at the right time”, few know how to implement this in practice.

Identifying the individual elements of a marketing mix and then creating robust plans for each allows a business to market accordingly. It also allows a business to market to its strengths while minimizing or eliminating its weaknesses.

At the very least, a marketing mix should include the four Ps of marketing:

ProductThis can include a tangible good or an intangible service. Businesses must understand their product or service in the context of the problem that it aims to solve. If the product does not seem to address any problem, then the potential profitability of the product should be re-analyzed. The target audience, or those who will buy the product, must also be identified.

PricePrice has a direct impact on how well a product will sell and is linked to the perceived value of the product in the mind of a consumer. In other words, price is not related to what the business thinks the product is worth. Thus, it is important to know what the consumer values and price it accordingly. To a lesser extent, price may also be influenced by rival products and value chain costs.

PromotionPromotion includes all marketing communication strategies, such as advertising, sales promotions, and public relations. Irrespective of the channel, communication must be a good fit for the product, price, and the target audience.

PlacePlace describes the physical location in which a customer can use, access, or purchase the end product. Determining where buyers look for a product or service may seem simplistic, but it has implications for marketing and product development.

For example, place determines which distribution methods are most suitable. It also dictates whether a product needs a sales team or whether it should be taken to a trade fair to be sampled and advertised.

Other elements of an effective marketing mixConventional marketing mixes are product-centric, but services and other intangible goods are also commonplace for many businesses. People, process, and physical evidence are three more Ps that these businesses should implement.

PeoplePeople refers to the staff who are directly and indirectly involved in marketing the brand. Employing the best people for the job is crucial since people shape the direction of the brand and therefore the goals and values of the business.

ProcessProcess covers the interface between business and consumer, otherwise known as customer service.

Process is important because customers often give feedback on their service, which enables a business to improve its systems across the board. Effective processes should make purchasing pleasing and simple while simultaneously increasing brand equity.

Physical evidencePhysical evidence describes anything that consumers see when interacting with a brand. Physical evidence can take the form of packaging, branding, and even the physical layout and design of retail spaces and shop fronts.

Physical evidence also extends to how staff dress and interact with customers and the possible impact that this has on sales.

Key highlightsMarketing mix refers to a suite of actions that a business uses to promote its products or services in the market.Marketing mix should as a minimum have strategies devised for product, price, promotion, and place.Service-oriented businesses should adopt a broader marketing mix, otherwise known as the seven Ps of marketing.What is marketing mix modeling and why it matters to understand how to balance your marketing mix?Marketing mix modeling (MMM) is a statistical method for evaluating marketing campaign effectiveness. The method quantifies the impact of multiple marketing inputs on market share or sales which then determines how much to spend on each.

Understanding marketing mix modelingMarketing mix modeling uses statistical analysis to analyze the past and future impact of different marketing tactics on sales or profit. The approach is based on the popular 4 Ps marketing mix theory.

In essence, the purpose of MMM is to measure the past performance of a campaign and improve future marketing return on investment (MROI). Conclusions drawn from the statistical analysis then determine how resources can be better allocated across various tactics, products, segments, and markets.

Marketing mix modeling utilizes the multi-linear regression (MLR) statistical technique to assess the relationship between dependent and independent variables. The dependent variable is normally market share or sales, while the independent variable could be price, distribution, or ad spend for different channels.

The four phases of marketing mix modelingEach MMM project has four distinct phases that we have explained in detail below.

Phase 1: Data collection and integrityIn the first phase, the business collects data on the products to be analyzed, the desired timeframe, and the markets to be modeled. The sales performance metric should also be quantified at this point. Will it be volume, units, sales, or some other metric? Brand margin rates and marketing spend should also be determined so that the MROI can be calculated later on.

MMM also requires the business to use data that will yield the best results. In other words:

Has the best available data been incorporated? Is the data consistent over the entire life cycle?Are there multiple years of data to account for factors such as seasonality?Before moving to the next phase, key project stakeholders should also hold a review session to ensure data integrity. In some cases, data will have to be aggregated or cleansed before moving forward.

Phase 2: ModelingIn the second phase, brand managers must collaborate with their internal analytics staff to discuss statistical details, specifications, and methods. We noted earlier that a multi-linear regression is commonly used, but other methods such as time-series regression are also used.

Ultimately, the method chosen will depend on the organization’s goals, data quality, and in some cases the entity providing the statistical analysis on behalf of the client.

Phase 3: Model-based business measuresOnce the statistical analysis has been performed, it will produce output data that measures how each tactic impacts sales. The data must also answer or address the overarching purpose of the project, with many organizations choosing to frame project purpose as questions such as:

What is the best marketing plan to maximize future net profits with respect to the current and future budget?For a particular demographic, what are the most efficient or effective marketing tactics?What is the impact of advertising on consumer price sensitivity?Which competitor advertising campaign is having the most negative impact on sales?Most MMM projects will also feature a pie chart showing the decomposition of sales where sales volume is broken down according to each tactic. These charts separate two types of tactics:

Core tactics – or those not controlled by the marketing team such as seasonality, distribution, weather, and competitive trade. Core tactics can also encompass the sales that would occur in the total absence of any promotional effort.Incremental tactics – or those that are controlled by the marketing team.Once a decomposition of sales has been performed, the organization can calculate three important metrics:

Effectiveness – which is determined by dividing the number of incremental sales by each marketing effort.Efficiency – where incremental sales are divided by the expenditure of each tactic. This is normally the total media spend, andMarketing return on investment – the MROI can be calculated by dividing the gross profit of each tactic by its total spend.Phase 4: Optimization and simulationIn the final phase, MMM outputs are transformed into inputs for future marketing campaigns.

Simulations help the organization model the impact of a new tactic before it is used in a real-world scenario. They also enable teams to determine the best combination of tactics that will enable them to achieve campaign goals.

Marketing mix modeling examplesIn the past few decades, marketing mix modeling has been adopted by several Fortune 500 companies such as Kraft, The Coca-Cola Company, Pepsi, AT&T, and Proctor & Gamble.

While there has been particular interest from consumer packaged goods (CPG) companies, others now use MMM because of the increased prevalence of companies providing these specialist services. Indeed, marketing mix modeling is popular in the retail and pharmaceutical industries because firms like Nielsen can provide syndicated data on stores, product categories, geographic markets, and distribution channels.

What’s more, the increased availability of time-series data has also seen MMM incorporated into industries such as telecommunications, financial services, hospitality, and automotive. However, in these industries, it is acknowledged that marketing mix modeling is still in its infancy and will require further standardization to be effective.

MMM case study for Facebook advertisersFacebook (now Meta) is one of several modern platforms that offer a family of services and apps that have dynamic and nuanced advertising needs. Since consumer preferences are in a constant state of flux, this makes it difficult for brands to assess the impact of Facebook advertising compared to traditional channels such as television and print.

A standard marketing mix modeling project assesses data from two or three years. But for online social platforms, data over this time span may become outdated. To counteract this tendency, Facebook recommends advertisers analyze data from a 6 to 12 month period. They should then adjust their methods to account for the statistical power that is sacrificed when analyzing a shorter time frame.

Professional services company Accenture ran multiple MMM analyses in 2021 for disruptor brands requiring a reliable and cost-effective system to optimize their promotional efforts and produce results that were both actionable and granular.

How was this achieved?

Tailored data was first sourced from Facebook, Instagram, and Audience Network which considered standard engagement metrics such as clicks but also paid impressions. Data were then integrated with machine learning techniques such as the Bayesian belief network to analyze potential synergies between multiple channels.

In simple terms, this involved analyzing the relationship between six independent variables (video, display, Facebook app, organic search, Instagram, and paid search) and their dependent online and offline channels. The results of the analysis showed how various marketing channels could drive impacts across other channels. A few of the more significant results are listed below:

Drivers of paid search – paid search (78%), offline drivers (10.9%), and organic search (5.5%).Drivers of Facebook app – Facebook app (87.6%), offline drivers (7.4%), and display (4.0%).Drivers of Instagram – Instagram direct (87.9%), video (6.0%), and Facebook app (3.7%).In summary, Accenture found that disruptor brands that focus their resources on social, organic search, and offline channels could better impact paid search and ultimately, increase their web traffic.

Key highlights on marketing mix modeling:Marketing mix modeling uses statistical analysis to analyze the past and future impact of different marketing tactics on sales or profit. The approach is based on the popular 4 Ps marketing mix theory.Each marketing mix modeling project should have four distinct phases: data collection and integrity, modeling, model-based business measures, and optimization and simulation.MMM is popular among consumer packaged goods companies such as Kraft, The Coca-Cola Company, Pepsi. It is also useful for brands advertising on social media platforms such as Facebook where markets and consumer behavior are more dynamic.Connected Marketing Concepts Affiliate marketing describes the process whereby an affiliate earns a commission for selling the products of another person or company. Here, the affiliate is simply an individual who is motivated to promote a particular product through incentivization. The business whose product is being promoted will gain in terms of sales and marketing from affiliates.

Affiliate marketing describes the process whereby an affiliate earns a commission for selling the products of another person or company. Here, the affiliate is simply an individual who is motivated to promote a particular product through incentivization. The business whose product is being promoted will gain in terms of sales and marketing from affiliates.

As the name suggests, ambush marketing raises awareness for brands at events in a covert and unexpected fashion. Ambush marketing takes many forms, one common element, the brand advertising their products or services has not paid for the right to do so. Thus, the business doing the ambushing attempts to capitalize on the efforts made by the business sponsoring the event.

As the name suggests, ambush marketing raises awareness for brands at events in a covert and unexpected fashion. Ambush marketing takes many forms, one common element, the brand advertising their products or services has not paid for the right to do so. Thus, the business doing the ambushing attempts to capitalize on the efforts made by the business sponsoring the event.

Brand building is the set of activities that help companies to build an identity that can be recognized by its audience. Thus, it works as a mechanism of identification through core values that signal trust and that help build long-term relationships between the brand and its key stakeholders.

Brand building is the set of activities that help companies to build an identity that can be recognized by its audience. Thus, it works as a mechanism of identification through core values that signal trust and that help build long-term relationships between the brand and its key stakeholders.

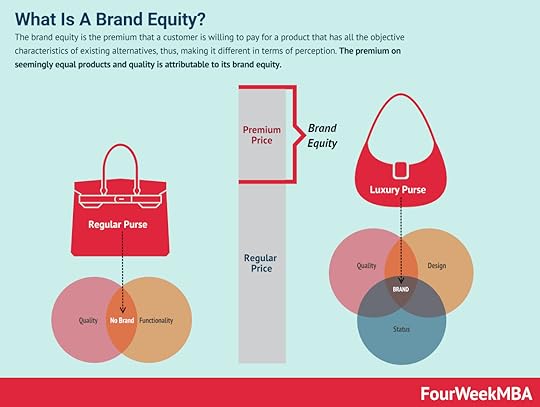

The brand equity is the premium that a customer is willing to pay for a product that has all the objective characteristics of existing alternatives, thus, making it different in terms of perception. The premium on seemingly equal products and quality is attributable to its brand equity.

The brand equity is the premium that a customer is willing to pay for a product that has all the objective characteristics of existing alternatives, thus, making it different in terms of perception. The premium on seemingly equal products and quality is attributable to its brand equity.

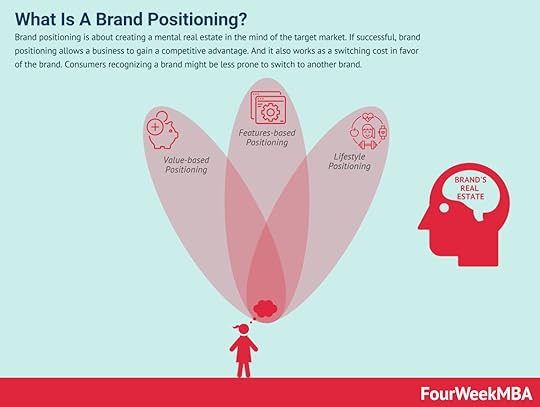

Brand positioning is about creating a mental real estate in the mind of the target market. If successful, brand positioning allows a business to gain a competitive advantage. And it also works as a switching cost in favor of the brand. Consumers recognizing a brand might be less prone to switch to another brand.

Brand positioning is about creating a mental real estate in the mind of the target market. If successful, brand positioning allows a business to gain a competitive advantage. And it also works as a switching cost in favor of the brand. Consumers recognizing a brand might be less prone to switch to another brand.

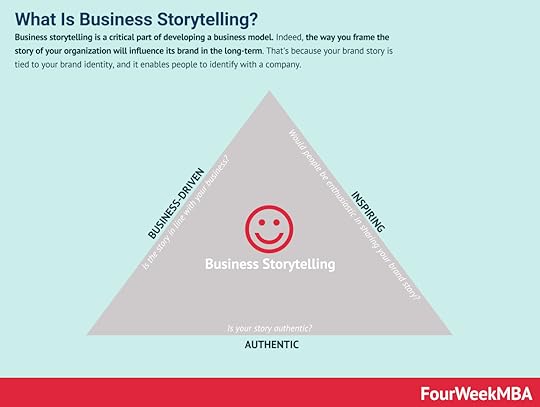

Business storytelling is a critical part of developing a business model. Indeed, the way you frame the story of your organization will influence its brand in the long-term. That’s because your brand story is tied to your brand identity, and it enables people to identify with a company.

Business storytelling is a critical part of developing a business model. Indeed, the way you frame the story of your organization will influence its brand in the long-term. That’s because your brand story is tied to your brand identity, and it enables people to identify with a company.

Content marketing is one of the most powerful commercial activities which focuses on leveraging content production (text, audio, video, or other formats) to attract a targeted audience. Content marketing focuses on building a strong brand, but also to convert part of that targeted audience into potential customers.

Content marketing is one of the most powerful commercial activities which focuses on leveraging content production (text, audio, video, or other formats) to attract a targeted audience. Content marketing focuses on building a strong brand, but also to convert part of that targeted audience into potential customers.

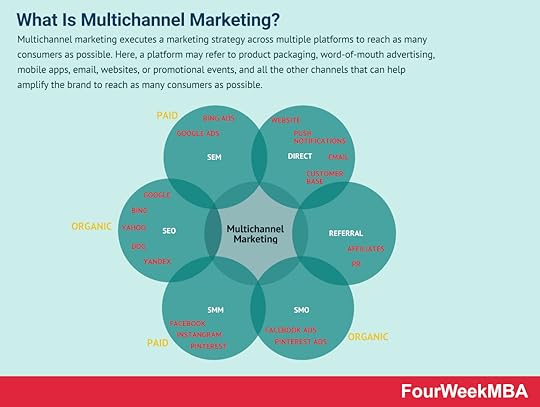

A digital channel is a marketing channel, part of a distribution strategy, helping an organization to reach its potential customers via electronic means. There are several digital marketing channels, usually divided into organic and paid channels. Some organic channels are SEO, SMO, email marketing. And some paid channels comprise SEM, SMM, and display advertising.

A digital channel is a marketing channel, part of a distribution strategy, helping an organization to reach its potential customers via electronic means. There are several digital marketing channels, usually divided into organic and paid channels. Some organic channels are SEO, SMO, email marketing. And some paid channels comprise SEM, SMM, and display advertising.

Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget.

Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget.

Guerrilla marketing is an advertising strategy that seeks to utilize low-cost and sometimes unconventional tactics that are high impact. First coined by Jay Conrad Levinson in his 1984 book of the same title, guerrilla marketing works best on existing customers who are familiar with a brand or product and its particular characteristics.

Guerrilla marketing is an advertising strategy that seeks to utilize low-cost and sometimes unconventional tactics that are high impact. First coined by Jay Conrad Levinson in his 1984 book of the same title, guerrilla marketing works best on existing customers who are familiar with a brand or product and its particular characteristics.

Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered.

Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered.

Integrated marketing describes the process of delivering consistent and relevant content to a target audience across all marketing channels. It is a cohesive, unified, and immersive marketing strategy that is cost-effective and relies on brand identity and storytelling to amplify the brand to a wider and wider audience.

Integrated marketing describes the process of delivering consistent and relevant content to a target audience across all marketing channels. It is a cohesive, unified, and immersive marketing strategy that is cost-effective and relies on brand identity and storytelling to amplify the brand to a wider and wider audience.

The marketing mix is a term to describe the multi-faceted approach to a complete and effective marketing plan. Traditionally, this plan included the four Ps of marketing: price, product, promotion, and place. But the exact makeup of a marketing mix has undergone various changes in response to new technologies and ways of thinking. Additions to the four Ps include physical evidence, people, process, and even politics.

The marketing mix is a term to describe the multi-faceted approach to a complete and effective marketing plan. Traditionally, this plan included the four Ps of marketing: price, product, promotion, and place. But the exact makeup of a marketing mix has undergone various changes in response to new technologies and ways of thinking. Additions to the four Ps include physical evidence, people, process, and even politics.

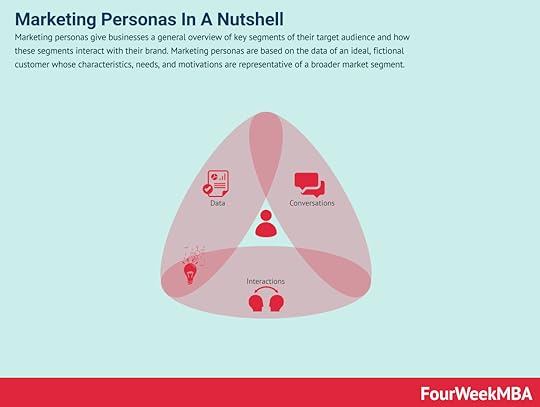

Marketing personas give businesses a general overview of key segments of their target audience and how these segments interact with their brand. Marketing personas are based on the data of an ideal, fictional customer whose characteristics, needs, and motivations are representative of a broader market segment.

Marketing personas give businesses a general overview of key segments of their target audience and how these segments interact with their brand. Marketing personas are based on the data of an ideal, fictional customer whose characteristics, needs, and motivations are representative of a broader market segment.

Multichannel marketing executes a marketing strategy across multiple platforms to reach as many consumers as possible. Here, a platform may refer to product packaging, word-of-mouth advertising, mobile apps, email, websites, or promotional events, and all the other channels that can help amplify the brand to reach as many consumers as possible.

Multichannel marketing executes a marketing strategy across multiple platforms to reach as many consumers as possible. Here, a platform may refer to product packaging, word-of-mouth advertising, mobile apps, email, websites, or promotional events, and all the other channels that can help amplify the brand to reach as many consumers as possible.

Multi-level marketing (MLM), otherwise known as network or referral marketing, is a strategy in which businesses sell their products through person-to-person sales. When consumers join MLM programs, they act as distributors. Distributors make money by selling the product directly to other consumers. They earn a small percentage of sales from those that they recruit to do the same – often referred to as their “downline”.

Multi-level marketing (MLM), otherwise known as network or referral marketing, is a strategy in which businesses sell their products through person-to-person sales. When consumers join MLM programs, they act as distributors. Distributors make money by selling the product directly to other consumers. They earn a small percentage of sales from those that they recruit to do the same – often referred to as their “downline”.

A microniche is a subset of potential customers within a niche. In the era of dominating digital super-platforms, identifying a microniche can kick off the strategy of digital businesses to prevent competition against large platforms. As the microniche becomes a niche, then a market, scale becomes an option.

A microniche is a subset of potential customers within a niche. In the era of dominating digital super-platforms, identifying a microniche can kick off the strategy of digital businesses to prevent competition against large platforms. As the microniche becomes a niche, then a market, scale becomes an option.

Relationship marketing involves businesses and their brands forming long-term relationships with customers. The focus of relationship marketing is to increase customer loyalty and engagement through high-quality products and services. It differs from short-term processes focused solely on customer acquisition and individual sales.

Relationship marketing involves businesses and their brands forming long-term relationships with customers. The focus of relationship marketing is to increase customer loyalty and engagement through high-quality products and services. It differs from short-term processes focused solely on customer acquisition and individual sales.

Sustainable marketing describes how a business will invest in social and environmental initiatives as part of its marketing strategy. Also known as green marketing, it is often used to counteract public criticism around wastage, misleading advertising, and poor quality or unsafe products.

Sustainable marketing describes how a business will invest in social and environmental initiatives as part of its marketing strategy. Also known as green marketing, it is often used to counteract public criticism around wastage, misleading advertising, and poor quality or unsafe products.Read more:

Marketing StrategyMarket SegmentationNiche MarketingBusiness StrategyBusiness ModelsThe post What Is Marketing Mix And Why It Matters In Business appeared first on FourWeekMBA.

March 14, 2022

How Does Google Make Money? It’s Primarily Advertising!

Google (now Alphabet) primarily makes money through advertising. The Google search engine, while free, is monetized with paid advertising. In 2021 Google’s advertising generated over $209 billion (beyond Google Search, this comprises YouTube Ads and the Network Members Sites) compared to $257 billion in net sales. Advertising represented over 81% of net sales, followed by Google Cloud ($19 billion) and Google’s other revenue streams (Google Play, Pixel phones, and YouTube Premium).

Google advertising monetization modelGoogle follows an advertising business model to deliver relevant ads. For relevant ads, Google means those are showing up just at the right time and giving people useful commercial information, regardless of the device they’re using. As of 2017 advertising represented still 86% of the total Google’s revenues.

Also, Google offers advertisers a set of tools that help them better attribute and measure their advertising campaigns across screens.

It does so by running two main kinds of ads:

performance advertisingbrand advertisingPerformance advertisingGoogle creates and delivers relevant ads that users will click on, leading to direct engagement with advertisers. The performance advertisers pay when a user engages in their ads.

AdWords is the primary auction-based advertising program which helps create simple text-based ads that appear on Google properties and the properties of Google Network Members.

Also, Google Network Members use the AdSense program to display relevant ads on their web properties, generating revenues when site visitors view or click on the ads.