Gennaro Cuofano's Blog, page 108

March 24, 2022

How Much Is Elon Musk Worth Today?

Read Next: Tesla Business Model, Tesla Competitors, Who Owns Tesla, Elon Musk Story, Elon Musk Companies.

The post How Much Is Elon Musk Worth Today? appeared first on FourWeekMBA.

March 23, 2022

Distribution Channels: Types, And Examples – Updated 2022

A distribution channel is the set of steps it takes for a product to get in the hands of the key customer or consumer. Distribution channels can be direct or indirect. Distribution can also be physical or digital, depending on the kind of business and industry.

Distribution Types DatabaseCompanyDistribution TypeDescription Amazon Business Model Hybrid (direct to consumers + digital marketing growth strategy)In the case of Amazon, the company is among the most robust tech brands today, and it follows a hybrid strategy, where hundreds of millions of users go straight to the Amazon brand through its website and apps. On the other hand, Amazon also relies on digital distribution to enhance its visibility. For instance, Google search is also a great contributor to traffic for Amazon and many other digital channels. Apple Business Model Hybrid (direct to consumers + subsidized by mobile carriers)Apple relies both on its stores and on third-party carriers who enhance the distribution of Apple devices across the world. For instance, when it comes to the iPhone, for example, in 2021, Apple’s net sales through its direct and indirect distribution channels accounted for 36% and 64%. The direct channel (Apple’s owned stores) it’s critical to guarantee brand awareness, control over the distribution, customer support & service provisioning. The indirect channel is essential to enhancing the sales of expensive devices like the iPhone. For instance, a good chunk of iPhone sales is subsidized by phone carriers players, who amortize the cost of the phone into the plan, thus enabling more people to afford an expensive smartphone, like the iPhone. Facebook (Meta) Business Model Direct to consumer (Digital)Facebook is a tech player that primarily relies on direct digital distribution. In fact, over the years, the company has managed to first keep a strong brand for its main product (Facebook). After that, Facebook acquired Instagram, WhatsApp, and Oculus. These powerful brands enabled Facebook to get a direct relationship with users. However, it’s worth highlighting that Facebook (Meta) does not own the platform through which users get to the brand (the Apple Store and Google Play). Users can download and experience the brand’s products are owned by Apple and Google, respectively). Thus, its ability to distribute the product is highly reliant on the ability of the company to keep its brand strong. Google (Alphabet) Business Model Digital Vertical IntegrationGoogle (now called Alphabet) is a great example of digital vertical integration. The company follows each step of the data supply chain, from data harvesting to data repackaging and its exchange within Google’s proprietary advertising marketplaces. On the desktop side, Google owns the Chrome browser, the Google search engine, and the advertising platforms (AdSense, Google Ads, and YouTube Ads) to monetize the data. On the mobile side, Google owns the Android operating system, the Google Play Store, and the Google AdMob advertising platform. In this segment, Google also produced smartphone devices, and it’s now revamping its AR glass business segment. Luxottica Business Model Phisical Vertical IntegrationLuxottica is an excellent example of physical vertical integration and complete control over its distribution strategy. The company not only manufactures most eyeglasses frames and lenses but also distributes them across its owned stores and its wholesale distribution. Tesla Business Model Direct to consumer (Physical)Tesla sells its cars directly from its online stores, distributing them directly to customers. The company also owns Tesla physical stores worldwide, where customers can buy cars directly from them. The company has been spending a substantial effort in building its own stores to bypass classic car distributors, which has been a rule of thumb for a long time.Why a distribution channel strategy mattersOften companies undervalue distribution channels as they think that a good product or service will automatically create its distribution.

While this might happen, it is more of a utopia than reality. Distribution needs to be created, at times with sheer force combined with strategic planning and deep understanding of customers’ needs, or desire generation.

A traditional distribution strategy looks at the classic 4 Ps (product, promotion, price, and placement).

Those are the key ingredients to grow the revenues of a business, quickly and sustainably. Thus, a distribution strategy starts from:

Understanding the wants of their customers.Leveraging insights to create a better purchasing experience.Developing new products and services that customers will want to buy.Creating go-to-market strategies that reach the proper customer target.Generating demand for a set of products and services offered.Without an appropriate strategy of distribution, it is hard to have a successful and sustainable business model.

Course: FourWeekMBA Business Model Innovation Flagship Course

Types of distribution channelsAt a higher level, distribution channels can be broken down, in direct channels, and indirect channels. This primarily depends on how long is a chain between who makes the product and the final consumer.

The number of steps it takes will make the distribution channel direct or indirect. Let’s visualize a distribution chain to understand the difference between direct and indirect strategy:

Where in a direct distribution strategy a producer can access the consumer, in an indirect distribution strategy, the producer will meet its consumer demands via third-parties wholesalers or retailers.

Thus, a direct approach makes the value chain shorter and at the same time allows more control by the producer on how the final customer experiences the product or service offered.

At the same time, a direct to consumer strategy is quite expensive and not always effective enough to allow proper distribution. Therefore, companies often use a mixture of direct and indirect distribution strategies, which determine their marketing mix.

Between the direct-to-consumer and entirely indirect distribution strategy (where the producer sells to a wholesaler), there are several indirect variations, based on how many steps it takes to reach the final consumer and how long is the value chain.

For instance, in the scenarios in which a producer sells to a wholesaler, the wholesaler sells to retailers, who reach the final consumers. However, in some other cases, the distribution channels might be shorter.

Think of the Costco business model, where the company purchases a selected variety of goods in bulk from producers. Yet instead of reselling that to retailers, Costco itself acts as a retailer, by leveraging on its membership-based business model and selling those items in bulk quantity directly to consumers, who appreciate the convenience of its prices together with the selection of high-quality products.

Related: Business Strategy Lessons From Costco Business Model

Case study: Apple’s direct and indirect distribution mixIn other cases yet, the distribution channels strategy might be even shorter. Take the example of the Apple business model where the company sells part of its products via its retail stores, which creates a unique experience for Apple‘s consumers and makes the value chain shorter but it also leverages on an indirect strategy, to make those same products (usually quite expensive) more accessible to mass consumers.

Related: What Is a Business Model? 30 Successful Types of Business Models You Need to Know

Distribution channel vs. supply chain In business, vertical integration means a whole supply chain of the company is controlled and owned by the organization. Thus, making it possible to control each step through customers. in the digital world, vertical integration happens when a company can control the primary access points to acquire data from consumers.

In business, vertical integration means a whole supply chain of the company is controlled and owned by the organization. Thus, making it possible to control each step through customers. in the digital world, vertical integration happens when a company can control the primary access points to acquire data from consumers.It is easy to confuse and mix up the definition of distribution channels with the supply chain even though the distribution channels and strategies might sometimes cross with the supply chain.

The distribution strategy concerns primarily on bringing the product in front of customers, and especially customers that are willing and ready to buy it.

Therefore, in some cases, bringing a product in front of the right people might be a matter for the supply chain.

For instance, in the Luxottica business model, vertical integration means the ability to control the full customer experience and to choose also the location of the retail stores.

Thus, this is a case in which supply chain management also becomes a distribution strategy.

It is critical to maintaining a clear difference between supply chain and distribution channel strategy. While the supply chain comprises all the planning, manufacturing, and logistics activities that make the product go from the purchase of raw materials, transformation in a final product that might get delivered to the final customer (Zara business model leverages on supply chain management as a distribution strategy).

In short, where supply chain management concerns itself with integrating supply and demand, a distribution strategy involves itself primarily about the demand chain.

To have a deep understanding of the difference between the supply chain and distribution strategy it is important to consider three main aspects.

Case study: Tesla and Google, from physical to digital integration Tesla is vertically integrated. Therefore, the company runs and operates the Tesla’s plants where cars are manufactured and the Gigafactory which produces the battery packs and stationary storage systems for its electric vehicles, which are sold via direct channels like the Tesla online store and the Tesla physical stores.

Tesla is vertically integrated. Therefore, the company runs and operates the Tesla’s plants where cars are manufactured and the Gigafactory which produces the battery packs and stationary storage systems for its electric vehicles, which are sold via direct channels like the Tesla online store and the Tesla physical stores. In business, vertical integration means a whole supply chain of the company is controlled and owned by the organization. Thus, making it possible to control each step through consumers. in the digital world, vertical integration happens when a company can control the primary access points to acquire data from consumers.Supply chain vs. demand chain

In business, vertical integration means a whole supply chain of the company is controlled and owned by the organization. Thus, making it possible to control each step through consumers. in the digital world, vertical integration happens when a company can control the primary access points to acquire data from consumers.Supply chain vs. demand chainWhere a supply chain seeks efficiencies that can, for instance, reduce the cost of purchasing raw materials, integrating several parts of the supply chain, or at creating better logistics.

Distribution channels and strategy looks more at creating demand for a product or service by leveraging on several strategies. For instance, having insight about potential customers can allow a company to generate demand via distribution and marketing just like in the Nike, business model.

Internal vs. externalA supply chain concerns with all the aspects that begin with sourcing raw materials, production processes, inventory management, and all the other processes that bring a product or service in front of the final customer.

On the other hand, a distribution strategy concerns primarily the demand chain. Therefore, the difference is primarily internal vs. external. Supply chain affects costs and how to reduce them via efficiencies.

Distribution channels and strategy looks at how to grow the demand. Thus, increasing revenues for the business. This distinction is not absolute. As in some cases when a core competence of a company is its supply chain management, then that also becomes a distribution strategy, just like in the Amazon business model case study.

Via efficient inventory management, Amazon can keep large facilities where most tasks are automated. This allows Amazon to host third-party inventories, of sellers that are part of the Amazon network.

That in turn, makes Amazon stores more interesting for final customers as they can find more products they need, they can get then faster and purchase them in a bundle. In this case, the Amazon supply chain strategy in part crosses with its distribution strategy.

Process-centric vs. customer-centricWhere the supply chain is often process-centric. In short, it wants to improve efficiency, reduce steps among several parts of the chain, and make the process as smooth as possible. Distribution channels and strategies focus on the customer.

Where is the customer? How do we get more of them? Is that a matter of price? Value or product? A distribution strategy is obsessed with customers. Once again, this is a rough distinction as in some cases, companies’ have a customer-centric approach at any company’s level.

That’s what Jeff Bezos means when says that successful companies need to stay in “Day One.“

Customer obsession goes beyond quantitative and qualitative data about customers, and it moves around customers’ feedback to gather valuable insights. Those insights start by the entrepreneur’s wandering process, driven by hunch, gut, intuition, curiosity, and a builder mindset. The product discovery moves around a building, reworking, experimenting, and iterating loop.Why you need to understand the demand chain

Customer obsession goes beyond quantitative and qualitative data about customers, and it moves around customers’ feedback to gather valuable insights. Those insights start by the entrepreneur’s wandering process, driven by hunch, gut, intuition, curiosity, and a builder mindset. The product discovery moves around a building, reworking, experimenting, and iterating loop.Why you need to understand the demand chainDemand chain management is a complex endeavor that involves the relations among suppliers and customers and how those interest to grow the demand of the product or service.

At the core, it is about designing a business model that makes it possible for the organization to meet customer needs, create desire and demand with an existing supply chain.

Thus, the demand chain is the value chain from your customers’ perspective. This implies synergies between the supply chain and distribution and marketing to design a business model that delivers the most suited value proposition and generate higher revenues for the business.

It is almost like demand chain management allows supply chain management to look outside the company’s boundaries and understand the market.

Therefore, demand management will primarily understand, generate, and stimulate customer demand and align the supply chain processes with that.

A proper distribution strategy focuses on understanding the supply and value chain to design a sustainable business model, where for instance:

The company has to guarantee enough margins and the proper condition to third-parties distributors to allow them to run sustainable operations.Align the incentives between the company, the distributors, and consumers.Train and educate distributors so that they can offer the best customer experience.Create alignment between distributors to avoid fragmented pricing, placement, and promotion strategy.Understand what products or services might allow the organization to grow its reach.B2B, B2C and distribution channelsA distribution strategy and therefore the distribution channels involved will change based on the target customer. Indeed, selling to a business clientele is not the same thing as selling to consumers.

This implies different capabilities and distribution strategies. For instance, a B2B (business to business) distribution strategy might be shorter, as you might be able to reach directly the businesses that will act as intermediaries between you and the final consumer.

Think of the case of a company selling software as a service (so-called SaaS). If that software is complex and requires a certain degree of expertise, it will be better suited to be sold via other agencies and third-parties, which in turn will have access to the consumer business.

This will imply a distribution strategy focused on acquiring the proper sales force to manage the more complex clients.

On the other hand, if a company sells an app for the iPhone, which doesn’t require any particular expertise from the final user.

The company will have direct access to its consumers and will use marketing channels, which don’t necessarily require a complex salesforce. This is a critical difference between marketing and sales.

B2B2C distribution strategy A B2B2C is a particular kind of business model where a company rather than accessing the consumer market directly it does that via another business. Yet the final consumers will recognize the brand or the service provided by the B2B2C. Therefore, the company offering the service might gain direct access to consumers over time. This kind of model can help build a robust B2B as the foundation of the consumer market. While it makes it less scalable in the short term, if well-executed, it can scale.

A B2B2C is a particular kind of business model where a company rather than accessing the consumer market directly it does that via another business. Yet the final consumers will recognize the brand or the service provided by the B2B2C. Therefore, the company offering the service might gain direct access to consumers over time. This kind of model can help build a robust B2B as the foundation of the consumer market. While it makes it less scalable in the short term, if well-executed, it can scale.Another form of distribution strategy is a B2B2C, where a brand can leverage on existing pipelines to access the market. In this case, the B2B2C strategy to work has to enable the brand to be known by a larger customer base or audience, while it leverages on existing players with an established distribution platform.

That is how you can structure your company’s strategy around a B2B2C business model.

Traditional distribution channels vs. digital distribution channels A digital channel is a marketing channel, part of a distribution strategy, helping an organization to reach its potential customers via electronic means. There are several digital marketing channels, usually divided into organic and paid channels. Some organic channels are SEO, SMO, email marketing. And some paid channels comprise SEM, SMM, and display advertising.

A digital channel is a marketing channel, part of a distribution strategy, helping an organization to reach its potential customers via electronic means. There are several digital marketing channels, usually divided into organic and paid channels. Some organic channels are SEO, SMO, email marketing. And some paid channels comprise SEM, SMM, and display advertising.As consumer behaviors had swiftly changed in the last decades, more and more people purchase via the internet, and they feel more and more comfortable buying expensive items on the web.

For instance, Tesla allows you to order a $65K car directly on its site.

Therefore, digital distribution strategies are critical for any business, also one that has always operated off-line.

As explained by Gabriel Weinberg, CEO, and founder of DuckDuckGo, there are at least 19 distribution channels between online and off-line:

Targeting BlogsPublicityUnconventional PRSearch Engine MarketingSocial and Display AdsOffline AdsSearch Engine OptimizationContent MarketingEmail MarketingViral MarketingEngineering as MarketingBusiness DevelopmentSalesAffiliate ProgramsExisting PlatformsTrade ShowsOffline EventsSpeaking EngagementsCommunity BuildingEach of those channels can be a critical ingredient to enhance the revenues of a business.

Related: Growth Marketing Strategies For Your Online Business

Distribution management: marketing or sales?

Understanding whether distribution management is a matter of sales or marketing is superfluous as it might make us switch the focus from what’s important.

However, it makes sense to draw some lines as this allows proper attribution of responsibility and accountability across the departments of an organization.

Thus, distribution management is typically seen as a marketing function. Yet, once again it depends on the kind of organization you’re running.

Imagine the case of a company that sells to wholesalers or retailers; this means most of the contracts might be managed by salespeople, as they require an understanding of deals terms, relationships and partnerships in place.

In that case, your salesforce will be able to give you insights that can help yo improve the distribution strategy. In the opposite scenario, where the company sells a product directly to consumers, most of the processes might be automated. Thus, most of the insights will be in the hands of the marketing department.

How do you assess the right mix for your distribution strategy? Distribution is one of the key elements to build a viable business model. Indeed, Distribution enables a product to be available to a potential customer base; it can be direct or indirect, and it can leverage on several channels for growth. Finding the right distribution mix also means balancing between owned and non-owned channels.

Distribution is one of the key elements to build a viable business model. Indeed, Distribution enables a product to be available to a potential customer base; it can be direct or indirect, and it can leverage on several channels for growth. Finding the right distribution mix also means balancing between owned and non-owned channels.When building up a distribution strategy, it’s important to balance out between speed and control. And to leverage on those channels that can give momentum to the business.

Yet also, in the long-term prioritize those channels that make the company viable and its business model solid.

Key takeaways and why distribution is your most important assetAt any time, businesses can leverage on open and closed strategies to enhance and create ecosystems that enable the business to thrive.

In short, companies like Google, Amazon, GitHub, Uber, Airbnb, Twitter, Facebook, LinkedIn and many others that we discussed on this blog while growing they managed to create parallel ecosystems of developers, publishers, small businesses, entrepreneurs, and users that are really the base and foundation for those companies business model success.

In short, the turnover those companies make is just the tip of the iceberg of an ecosystem, which is often hard to control. The Internet, enabled ways for these organizations to involve thousands of publishers, developers, and users, where an organization, generating profits, built a strong distribution platform, thus making it compelling to other key players to participate in the growth of the ecosystem.

At the center of those open, and uncontrollable ecosystem, there is a strong distribution network, controlled by the organization in charge of the platform, that is able to monetize the ecosystem. Thus, the distribution network is, in many cases, among the most valuable assets a company has in the long run.

Even if that’s expensive to develop, a distribution network is always worth it, because that is how you build a business you can control and a platform where you make the rules of the game.

Connected Business Concepts To Distribution Channels https://i0.wp.com/fourweekmba.com/wp-... data-large-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2018/12/b2b2c-business-model.jpg?fit=1024%2C772&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>A B2B2C is a particular kind of business model where a company, rather than accessing the consumer market directly, it does that via another business. Yet the final consumers will recognize the brand or the service provided by the B2B2C. The company offering the service might gain direct access to consumers over time.

https://i0.wp.com/fourweekmba.com/wp-... data-large-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2018/12/b2b2c-business-model.jpg?fit=1024%2C772&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>A B2B2C is a particular kind of business model where a company, rather than accessing the consumer market directly, it does that via another business. Yet the final consumers will recognize the brand or the service provided by the B2B2C. The company offering the service might gain direct access to consumers over time. marketing (ABM) is a strategy where the marketing and sales departments come together to create personalized buying experiences for high-value accounts. Account-based marketing is a business-to-business (B2B) approach in which marketing and sales teams work together to target high-value accounts and turn them into customers.

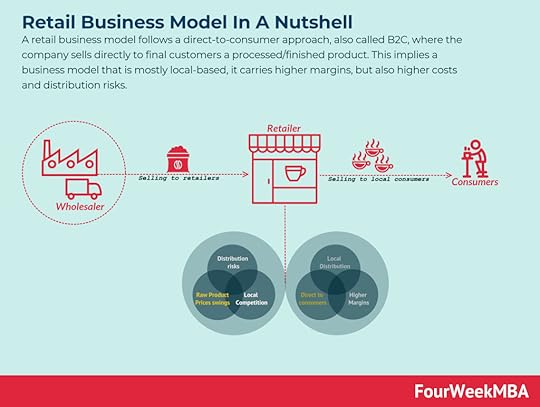

marketing (ABM) is a strategy where the marketing and sales departments come together to create personalized buying experiences for high-value accounts. Account-based marketing is a business-to-business (B2B) approach in which marketing and sales teams work together to target high-value accounts and turn them into customers. business model follows a direct-to-consumer approach, also called B2C, where the company sells directly to final customers a processed/finished product. This implies a business model that is mostly local-based, it carries higher margins, but also higher costs and distribution risks.

business model follows a direct-to-consumer approach, also called B2C, where the company sells directly to final customers a processed/finished product. This implies a business model that is mostly local-based, it carries higher margins, but also higher costs and distribution risks. model is a selling model where wholesalers sell their products in bulk to a retailer at a discounted price. The retailer then on-sells the products to consumers at a higher price. In the wholesale model, a wholesaler sells products in bulk to retail outlets for onward sale. Occasionally, the wholesaler sells direct to the consumer, with supermarket giant Costco the most obvious example.

model is a selling model where wholesalers sell their products in bulk to a retailer at a discounted price. The retailer then on-sells the products to consumers at a higher price. In the wholesale model, a wholesaler sells products in bulk to retail outlets for onward sale. Occasionally, the wholesaler sells direct to the consumer, with supermarket giant Costco the most obvious example.Direct-to-Consumer Business Model

business model where companies sell their products directly to the consumer without the assistance of a third-party wholesaler or retailer. In this way, the company can cut through intermediaries and increase its margins. However, to be successful the direct-to-consumers company needs to build its own distribution, which in the short term can be more expensive. Yet in the long-term creates a competitive advantage.

business model where companies sell their products directly to the consumer without the assistance of a third-party wholesaler or retailer. In this way, the company can cut through intermediaries and increase its margins. However, to be successful the direct-to-consumers company needs to build its own distribution, which in the short term can be more expensive. Yet in the long-term creates a competitive advantage. marketplace is a platform where buyers and sellers interact and transact. The platform acts as a marketplace that will generate revenues in fees from one or all the parties involved in the transaction. Usually, marketplaces can be classified in several ways, like those selling services vs. products or those connecting buyers and sellers at B2B, B2C, or C2C level. And those marketplaces connecting two core players, or more.

marketplace is a platform where buyers and sellers interact and transact. The platform acts as a marketplace that will generate revenues in fees from one or all the parties involved in the transaction. Usually, marketplaces can be classified in several ways, like those selling services vs. products or those connecting buyers and sellers at B2B, B2C, or C2C level. And those marketplaces connecting two core players, or more. business-to-business, where therefore a business sells to another company.

business-to-business, where therefore a business sells to another company.– B2C or business-to-consumer, where a business sells to a final consumer.

– C2C or consumer-to-consume, or more peer-to-peer where consumers sell to each other.

The more you move from consumers to enterprise clients, the more you’ll need a sales force able to manage complex sales. As a rule of thumb, a more expensive product, in B2B or Enterprise, will require an organizational structure around sales. An inexpensive product to be offered to consumers will leverage on marketing.” data-image-caption=”

The more you move from consumers to enterprise clients, the more you’ll need a sales force able to manage complex sales. As a rule of thumb, a more expensive product, in B2B or Enterprise, will require an organizational structure around sales. An inexpensive product to be offered to consumers will leverage on marketing.” data-image-caption=”The more you move from consumers to enterprise clients, the more you’ll need a sales force able to manage complex sales. As a rule of thumb, a more expensive product, in B2B or Enterprise, will require an organizational structure around sales. An inexpensive product to be offered to consumers will leverage on marketing.

” data-medium-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2018/09/copy-marketing-vs-sales.png?fit=300%2C226&ssl=1″ data-large-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2018/09/copy-marketing-vs-sales.png?fit=1024%2C772&ssl=1″ data-ll-status=”loaded” data-lazy-loaded=”1″>The more you move from consumers to enterprise clients, the more you’ll need a sales force able to manage complex sales. As a rule of thumb, a more expensive product, in B2B or Enterprise, will require an organizational structure around sales. An inexpensive product to be offered to consumers will leverage on marketing. Distribution represents the set of tactics, deals, and strategies that enable a company to make a product and service easily reachable and reached by its potential customers. It also serves as the bridge between product and marketing to create a controlled journey of how potential customers perceive a product before buying it.

Distribution represents the set of tactics, deals, and strategies that enable a company to make a product and service easily reachable and reached by its potential customers. It also serves as the bridge between product and marketing to create a controlled journey of how potential customers perceive a product before buying it.

A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model.

A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model.

Dropshipping is a retail business model where the dropshipper externalizes the manufacturing and logistics and focuses only on distribution and customer acquisition. Therefore, the dropshipper collects final customers’ sales orders, sending them over to third-party suppliers, who ship directly to those customers. In this way, through dropshipping, it is possible to run a business without operational costs and logistics management.

Dropshipping is a retail business model where the dropshipper externalizes the manufacturing and logistics and focuses only on distribution and customer acquisition. Therefore, the dropshipper collects final customers’ sales orders, sending them over to third-party suppliers, who ship directly to those customers. In this way, through dropshipping, it is possible to run a business without operational costs and logistics management.

It’s possible to identify the key players that overlap with a company’s business model with a competitor analysis. This overlapping can be analyzed in terms of key customers, technologies, distribution, and financial models. When all those elements are analyzed, it is possible to map all the facets of competition for a tech business model to understand better where a business stands in the marketplace and its possible future developments.

It’s possible to identify the key players that overlap with a company’s business model with a competitor analysis. This overlapping can be analyzed in terms of key customers, technologies, distribution, and financial models. When all those elements are analyzed, it is possible to map all the facets of competition for a tech business model to understand better where a business stands in the marketplace and its possible future developments.

Distribution is one of the key elements to build a viable business model. Indeed, Distribution enables a product to be available to a potential customer base; it can be direct or indirect, and it can leverage on several channels for growth. Finding the right distribution mix also means balancing between owned and non-owned channels.

Distribution is one of the key elements to build a viable business model. Indeed, Distribution enables a product to be available to a potential customer base; it can be direct or indirect, and it can leverage on several channels for growth. Finding the right distribution mix also means balancing between owned and non-owned channels.

Business development comprises a set of strategies and actions to grow a business via a mixture of sales, marketing, and distribution. While marketing usually relies on automation to reach a wider audience, and sales typically leverage on a one-to-one approach. The business development’s role is that of generating distribution.

Business development comprises a set of strategies and actions to grow a business via a mixture of sales, marketing, and distribution. While marketing usually relies on automation to reach a wider audience, and sales typically leverage on a one-to-one approach. The business development’s role is that of generating distribution.Other key resources:

What Is Business Model Innovation And Why It MattersSuccessful Types of Business Models You Need to KnowThe Complete Guide To Business DevelopmentBusiness Strategy: Definition, Examples, And Case StudiesWhat Is a Business Model Canvas? Business Model Canvas ExplainedBlitzscaling Business Model Innovation Canvas In A NutshellWhat Is a Value Proposition? Value Proposition Canvas ExplainedWhat Is a Lean Startup Canvas? Lean Startup Canvas ExplainedWhat Is Market Segmentation? the Ultimate Guide to Market SegmentationMarketing Strategy: Definition, Types, And ExamplesMarketing vs. Sales: How to Use Sales Processes to Grow Your BusinessHow To Write A Mission StatementWhat is Growth Hacking?Growth Hacking Canvas: A Glance At The Tools To Generate Growth IdeasBusiness models case studies:

How Amazon Makes Money: Amazon Business Model in a NutshellHow Does WhatsApp Make Money? WhatsApp Business Model ExplainedHow Does Google Make Money? It’s Not Just Advertising! The Google of China: Baidu Business Model In A NutshellHow Does Twitter Make Money? Twitter Business Model In A NutshellHow Does DuckDuckGo Make Money? DuckDuckGo Business Model ExplainedHow Does Pinterest Work And Make Money? Pinterest Business Model In A NutshellFastly Enterprise Edge Computing Business Model In A NutshellHow Does Slack Make Money? Slack Business Model In A NutshellFastly Enterprise Edge Computing Business Model In A NutshellTripAdvisor Business Model In A NutshellHow Does Fiverr Work And Make Money? Fiverr Business Model In A Nutshell What is distributionDistribution is a process of enabling a product or service to be easily accessible to the critical customer and consumer who needs that kind of product and service. Usually, distribution channels can be direct or indirect depending on the distribution strategy adopted by an organization to grow its profits.

What is direct distribution?In a direct distribution model, a company can get its products directly in the hands of consumers without passing through an intermediary. Think of the case of a company like Apple, which sells its iPhones directly through its owned store thus reaching its key customers.

What is indirect distribution?In an indirect distribution model, a company can get its products in the hands of the final customers, only passing through an intermediary. Think of the case of a company that manufactures a product that then gets sold by a third-party retailer. Thus the company can’t reach its customers directly.

{ "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "What is distribution", "acceptedAnswer": { "@type": "Answer", "text": "<p>Distribution is a process of enabling a product or service to be easily accessible to the critical customer and consumer who needs that kind of product and service. Usually, distribution channels can be direct or indirect depending on the distribution strategy adopted by an organization to grow its profits.</p>" } } , { "@type": "Question", "name": "What is direct distribution?", "acceptedAnswer": { "@type": "Answer", "text": "<p>In a direct distribution model, a company can get its products directly in the hands of consumers without passing through an intermediary. Think of the case of a company like Apple, which sells its iPhones directly through its owned store thus reaching its key customers.</p>" } } , { "@type": "Question", "name": "What is indirect distribution?", "acceptedAnswer": { "@type": "Answer", "text": "<p>In an indirect distribution model, a company can get its products in the hands of the final customers, only passing through an intermediary. Think of the case of a company that manufactures a product that then gets sold by a third-party retailer. Thus the company can't reach its customers directly.</p>" } } ] }The post Distribution Channels: Types, And Examples – Updated 2022 appeared first on FourWeekMBA.

What Is The Wholesale Business Model?

The wholesale model is a selling model where wholesalers sell their products in bulk to a retailer at a discounted price. The retailer then on-sells the products to consumers at a higher price. In the wholesale model, a wholesaler sells products in bulk to retail outlets for onward sale. Occasionally, the wholesaler sells direct to the consumer, with supermarket giant Costco the most obvious example.

Understanding the wholesale modelWholesalers receive attractive prices from the manufacturer because they deal in large minimum order quantities (MOQs), with larger order quantities reducing handling time and cost and increasing profit. In some cases, the wholesaler and the manufacturer are the same company.

In a traditional wholesale model supply chain, goods may flow from raw material suppliers to manufacturers, distributors, wholesalers, retailers, and finally to consumers. Since most wholesalers do not sell directly to the consumer in small quantities, they sell bulk goods to retail businesses for a profit.

The wholesale model is a business-to-business (B2B) process since wholesalers buy from a manufacturing business and sell to a retail business. This differentiates the model from the retail model, a business-to-consumer (B2C) process where retailers buy from wholesale businesses and sell to individual consumers.

Functions of wholesalers in the wholesale modelMany companies utilize wholesalers and the wholesale model because of the impracticalities of selling direct to consumers. This is particularly true of large retailers, who may operate thousands of stores in hundreds of different regions.

To that end, some wholesalers act as middlemen for retailers and are vital cogs in the supply chain. Here are some of their functions:

Sales and promotions – wholesalers are typically responsible for meeting sales targets for their particular region through promotional campaigns. Inventory management – maintaining sufficient inventory is a critical function of any supply chain. Experienced wholesalers understand that different products sell at different rates. They then use this information to avoid overstocking and understocking issues across the supply chain.Breaking the bulk – when a wholesale company receives a bulk order, it must necessarily break the order down into smaller cartons or consignments ready for delivery to the retailer. Warehousing – to supply a whole region, wholesalers require a large warehouse space to store inventory. Warehouses must be large enough to accommodate the extra demand for stock during holidays such as Christmas. The warehouse itself must also be economical to operate and not eat into margins.Risk management – in most cases, wholesalers are also responsible for inventory losses incurred because of theft, fire, or accidental damage. This makes risk management a priority.Market information – wholesalers have a good understanding of the size and potential of a market and share this information with intermediaries up and down the supply chain. Some may also have information on how strong a competitor’s business is in a specific region, which is valuable information to retailers and other wholesalers alike.The benefits of buying and selling under the wholesale modelLet’s take a look at some of the benefits of buying and selling under the wholesale model.

BuyingCost and time reduction – as mentioned earlier, buying in bulk helps a business save money on most product ranges. For the retailer, the purchasing process is also more efficient. Wholesalers deal with multiple suppliers for every product, but the retailer only needs to do business with one wholesaler.Better deals – dealing with multiple suppliers, the wholesaler can quickly identify reputable companies who deliver high-quality products on time and at a reasonable price. This work also saves the retailer from finding reputable suppliers themselves.SellingHigher margins – selling under the wholesale model may require dealing with multiple suppliers and comparison shopping to get the best deal. However, this allows a business to buy low and sell high. Selling direct to consumers will earn the highest margins, while selling to retailers usually attracts a slightly lower (though still attractive) margin.Responsiveness – sellers also have a better understanding of high-demand products since they work with both retailers and customers. With supplier relationships already in place, wholesale sellers can also launch new products more quickly than competitors. What’s more, some wholesalers have a deep working knowledge of the timing and organization of the entire supply chain, which gives them a competitive edge.Key takeaways:The wholesale model is a selling model where products sell their products in bulk to a retailer at a discounted price. The retailer then on-sells the products to consumers at a higher price.The wholesale model helps larger retailers with the impracticalities of selling direct to consumers. Wholesalers perform several critical functions relating to sales and promotions, inventory management, warehousing, risk management, and the divulging of market information.For buyers, the wholesale model reduces the time and cost associated with securing multiple suppliers. For sellers, the ability to buy in bulk increases margins when dealing directly with the consumer. Wholesale sellers also have a deeper understanding of the market and supply chain itself, which increases competitiveness.Read Also: Costco Business Model

Costco runs a high-quality, low-priced business model powered by its memberships that draw customers’ loyalty and repeat purchases. Top institutional investors comprise The Vanguard Group, with 8.55%, and BlackRock with 5.39%. Top individual shareholders comprise Craig Jelinek, Charles T. Munger (Warren Buffet partner and co-owner of Berkshire Hathaway), James Murphy, and more.

Costco runs a high-quality, low-priced business model powered by its memberships that draw customers’ loyalty and repeat purchases. Top institutional investors comprise The Vanguard Group, with 8.55%, and BlackRock with 5.39%. Top individual shareholders comprise Craig Jelinek, Charles T. Munger (Warren Buffet partner and co-owner of Berkshire Hathaway), James Murphy, and more. Read Also: Marketplace Business Models

A marketplace is a platform where buyers and sellers interact and transact. The platform acts as a marketplace that will generate revenues in fees from one or all the parties involved in the transaction. Usually, marketplaces can be classified in several ways, like those selling services vs. products or those connecting buyers and sellers at B2B, B2C, or C2C level. And those marketplaces connecting two core players, or more.

A marketplace is a platform where buyers and sellers interact and transact. The platform acts as a marketplace that will generate revenues in fees from one or all the parties involved in the transaction. Usually, marketplaces can be classified in several ways, like those selling services vs. products or those connecting buyers and sellers at B2B, B2C, or C2C level. And those marketplaces connecting two core players, or more.Read Also: Food-Delivery Business Models

In the food delivery business model companies leverage technology to build platforms that enable users to have the food delivered at home. This business model usually is set up as a platform and multi-sided marketplace, where the food delivery company makes money by charging commissions to the restaurant and to the customer. Wholesale vs. Retail

In the food delivery business model companies leverage technology to build platforms that enable users to have the food delivered at home. This business model usually is set up as a platform and multi-sided marketplace, where the food delivery company makes money by charging commissions to the restaurant and to the customer. Wholesale vs. Retail  A retail business model follows a direct-to-consumer approach, also called B2C, where the company sells directly to final customers a processed/finished product. This implies a business model that is mostly local-based, it carries higher margins, but also higher costs and distribution risks.

A retail business model follows a direct-to-consumer approach, also called B2C, where the company sells directly to final customers a processed/finished product. This implies a business model that is mostly local-based, it carries higher margins, but also higher costs and distribution risks. Where the retailer takes the risks of dealing with final customers, the wholesaler primarily deals with intermediaries/retailers that will take care of dealing with the final customers.

This, of course, has an advantage in terms of sales and marketing expenses. As the wholesaler will have fewer business risks, compared to the retailer. However, the wholesaler will need to spend a substantial amount of effort in developing its logistics infrastructure.

On the other hand, as the wholesales deal with the intermediaries, and at higher volume, and in some cases, for raw goods, it will also make fewer margins per product, as its business model will be based on volume.

The retailer, on the other hand, will enjoy wider margins per product, and it will have to carry a higher risk in terms of meeting a wider customer base. Therefore, a good chunk of its efforts will be spent on sales and marketing activities.

Wholesale vs. Direct-to-consumer Direct-to-consumer (D2C) is a business model where companies sell their products directly to the consumer without the assistance of a third-party wholesaler or retailer. In this way, the company can cut through intermediaries and increase its margins. However, to be successful the direct-to-consumers company needs to build its own distribution, which in the short term can be more expensive. Yet in the long-term creates a competitive advantage.

Direct-to-consumer (D2C) is a business model where companies sell their products directly to the consumer without the assistance of a third-party wholesaler or retailer. In this way, the company can cut through intermediaries and increase its margins. However, to be successful the direct-to-consumers company needs to build its own distribution, which in the short term can be more expensive. Yet in the long-term creates a competitive advantage. Similar to the distinction between wholesalers and retailers, the direct-to-consumer business will have to take the risks of dealing with the final customers. Usually, this requires a bigger effort, in securing this customer base, in supporting it before and after the sale.

Thus, the direct-to-consumers expenses related to customer acquisition, retention, and referral will be substantial. Thus, here you’ll see this projected on the balance sheets.

Where the wholesaler will have most of its expenses as “cost of sales” (meaning the costs needed to sustain its infrastructure), the direct-to-consumer might have most of its expenses tied to sales and marketing activities.

Wholesale vs. Private Labeling Private labeling involves one company selling the products of another company using its own branding and packaging. In most instances, a retailer purchases products from a manufacturer that are then sold to consumers with the manufacturer’s brand and packaging visible. In private labeling instead, the retailer might have a third-party manufacturer produce goods and sell them under the retailer’s brand. Therefore the manufacturer acts as a private label, not showing its brand toward consumers.

Private labeling involves one company selling the products of another company using its own branding and packaging. In most instances, a retailer purchases products from a manufacturer that are then sold to consumers with the manufacturer’s brand and packaging visible. In private labeling instead, the retailer might have a third-party manufacturer produce goods and sell them under the retailer’s brand. Therefore the manufacturer acts as a private label, not showing its brand toward consumers.In the case of the private label, the retailer sells to final consumers the products that the manufacturer has passed along with its own labels. The main difference with the wholesaler is that the private labeler does show its brands to final consumers, and therefore there might be some activities of post-sales support who go with the manufacturer.

On the contrary, in most cases, the wholesaler only sends over goods that might be unlabeled or labeled with other brands’ names (related to third-party manufacturers) and therefore, it doesn’t have to carry the expenses related to post-sales support.

Read More:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post What Is The Wholesale Business Model? appeared first on FourWeekMBA.

Tesla Business Model – Updated 2022

Tesla is vertically integrated. The company runs and operates the Tesla’s plants. Cars are manufactured at the Gigafactory which also produces the battery packs and stationary storage systems for its electric vehicles. These are sold via direct channels (Tesla online store and the Tesla physical stores). In 2021, Tesla generated $53.8 billion in revenues. Automotive sales generated $47.2 billion (almost 88% of the total revenues); services/other genearted $3.8 billion; and energy generation and storage generated about $2.8 billion in revenues.

Revenues breakdown2021%Automotive sales$44.12B81.98%Automotive regulatory credits$1.46B2.72%Automotive leasing$1.64B3.05%Services and other$3.8B7.06%Energy generation and storage segment revenue$2.79B5.18%Total Revenues$53.8B Key Facts FoundersElon Musk, Martin Eberhard, JB Straubel, Marc Tarpenning, Ian WrightYear FoundedJuly 1, 2003, San Carlos, CAYear of IPOJune 29, 2010IPO Price$17.00Total Revenues at IPO$93.35 millions, as of Nine Months EndedSeptember 30 2009, prior to the IPOElon Musk becomes CEO2008Total Revenues in 2021$53.8 BillionEmployees99,290 full-time subsidiaries’ employees worldwideRevenues per Employee$542,079.00Who owns Tesla?Elon Musk is the primary individual shareholder, with 23.1% of the company’s sharesTesla business model quick breakdown

We describe the Tesla business model via the VTDF framework developed by FourWeekMBA.

Tesla Business ModelDescriptionValue Model: Transition to renewable energy.Tesla’s mission is “to accelerate the world’s transition to sustainable energy.” The company does that through mobility products (cars for now) powered by electric engines. And by building the infrastructure to produce energy from renewable sources (solar primarily).Technological Model: Multi-sided network effects. Mass manufacturingAs of now, Tesla is a car company, but it’s also and primarily a software company. When Tesla releases new software updates, these consistently improve its cars (from suspensions to self-driving and more). When it comes to certain features, like self-driving, Tesla enjoys network effects, where the more the software is used to record mileage, the better it gets. And the more Teslas are on the road, the more it creates the infrastructure where these cars understand each other. And the more energy stations are available, the more EVs become convenient vs. gas-powered vehicles. Also, Tesla is one of the few companies that managed to build a sold car business at scale, in the last century.Distribution Model: Direct Distribution. Leasing arm.Tesla leverages its online and physical stores. Since the start, the company opted for a direct approach, bypassing car dealers. In addition, Tesla built, over the years, stores that mimicked Apple successfully. Another important element for distribution over the years will be the company’s leasing arm. Suppose Tesla can make leasing convenient to its customers. In that case, it might be able to exponentially grow its revenues (just like the iPhone was subsidized by mobile carriers, a Tesla should be subsidized through convenient leasing agreements to make it scale at mass level in the US).Financial Model: automotive regulatory credits, leasing, generating margins at mass production for both cars and energy storage.Tesla’s regulatory credits will exponentially grow as the company scales its operations. In fact, those credits are given to Tesla because it produces 100% electric vehicles. Thus, as the production scales, Tesla will get more credits at no additional cost or effort. In addition, as Tesla scales, it might be able to build its leasing arm, which might work as the real cash cow, on the one hand, and also the driver of the company car sales in the future (a Tesla might be too expensive for many, without a lease). In addition, Tesla isn’t just a car company; it’s transitioning to become a major energy producer with its superchargers and electric infrastructure. From energy production to distribution, Tesla might become the Exxon of the future!Tesla founding storyThe electric carmaker company is owned by entrepreneur/visionary Elon Musk. Tesla was founded by Martin Eberhard and Marc Tarpenning in July 2003. Elon Musk entered Tesla in 2006, first as investor and chairman, then he took the role of CEO which he still holds today.

After many delays to the first production of the Tesla Roadster prototype (the first version of the Tesla, which was both a way to validate the market and to generate revenues to be invested in the production of new Tesla models), Martin Eberhard would eventually be ousted, and Musk would, later on, by 2008, become CEO of the compamy.

Who owns Tesla? By 2021, most of Tesla’s shares are still owned by Elon Musk, among the company’s co-founders and currently the CEO. Elon Musk is the top individual investor, with a 23.1% stake in the company, equivalent to over 244 million shares. Musk is followed by Lawrence Ellison (founder of Oracle), with a 1.5% company’s stake. Ellison also sits on Tesla’s board. And Antonio Gracias, among the company’s first investors, has over 1.6 million shares of the company. Other institutional investors and mutual funds like The Vanguard Group, Blackrock, and Capital Ventures International also have a good chunk of the company’s stocks.

By 2021, most of Tesla’s shares are still owned by Elon Musk, among the company’s co-founders and currently the CEO. Elon Musk is the top individual investor, with a 23.1% stake in the company, equivalent to over 244 million shares. Musk is followed by Lawrence Ellison (founder of Oracle), with a 1.5% company’s stake. Ellison also sits on Tesla’s board. And Antonio Gracias, among the company’s first investors, has over 1.6 million shares of the company. Other institutional investors and mutual funds like The Vanguard Group, Blackrock, and Capital Ventures International also have a good chunk of the company’s stocks.As of March 2022, Elon Musk is worth more than $240 billion, and this counting Tesla stocks only.

Understanding Tesla long-term strategyWhile we all know Tesla today, its strategy was shaped already a few years back. Usually effective strategies get rolled out in years, and only after they become successful those become obvious.

Yet, when they are getting rolled out they are not obvious at all. So much so, that those rolling out the unconventional strategy, are getting criticized, ostracized, and only at the end idolized.

This is the case of Tesla’s long-term strategy, which is worth analyzing to understand what entry-strategy Tesla employs, and what its long-term strategy looks like.

Targeting a subsegment of the automotive marketBased on the market context, companies, especially startups have to find ways to enter markets, often dominated by other players, and roll out a temporary business model, which is only viable in the short-term, as it helps the company to transition to a more mature business model, to achieve scale.

When Tesla entered the market, it did it via the launch of the Roadster, a sports electric car, so it could start validating the market gradually, by a sub-segment of the automotive industry.

This enabled Tesla to enter with a product priced competitively (Tesla wasn’t able at the time to offer an electric vehicle at a competitive price). As sports cars are higher-priced, that segment of the market was in fit with Tesla’s temporary business model.

At the same time, the sports car segment also had customers open to more innovative products, as long as they would be highly differentiated.

Yet before transitioning to a new business model, the company will need to validate smaller segments of the market by attracting the psychographic which is ready to take on the new technology.

Yet often new technologies require the development of a whole ecosystem. For instance, in the case, of Tesla, it’s not about convincing people that electric cars are “cool” (not only that).

But also, initially, about providing the infrastructure to make the electric vehicle competitive in terms of everything else (availability of charging stations, charging vs. refilling, cost of batteries, time to recharge, and so on).

Only a few years after, in 2012, Tesla would finally start to roll out a business model based on potential mass adoption of its electric cars:

Only in 2012, Tesla would finally launch its Model S, the electrical sedan, intended to be adopted at mass-level. This strategy is still getting rolled out, and it might still take years to get to the level of mass-production.

Successful strategies take years to become viable, as in some cases, they require the fit between the technology and the ecosystem it encompasses and the market.

When this happens the company rolling out the business model will reach its full potential in terms of scale.

Back in 2012, Elon Musk explained that well:

“In 2006 our plan was to build an electric sports car followed by an affordable electric sedan, and reduce our dependence on oil…delivering Model S is a key part of that plan and represents Tesla’s transition to a mass-production automaker and the most compelling car company of the 21st century.”

Is Tesla profitable yet?Tesla turned a profit for the first time in the third quarter of 2019. Indeed the company posted $143 million in net profits. However, annualized the company net losses were $862 million.

What’s Tesla’s value proposition?As highlighted in its financial statements, Tesla offers three core values to its customers:

Long Range and Recharging FlexibilityHigh-Performance Without Compromised Design or FunctionalityEnergy Efficiency and Cost of OwnershipTesla Core TechnologySource: Tesla Financials

Tesla’s core technology moves around three core parts:

Autopilot & Full Self Driving (FSD).Vehicle Software.Battery & Power train.Breaking down Tesla business modelFor the first time in its history, in January 2020, Tesla passed the $100 billion market capitalization.

By 2022, Tesla passed a trillion dollar market cap, a 10x growth. For some context, in the same period, a company like Ford had a 60-70 billion dollars market cap.

Tesla sells three main products:

Model 3: for mass adoptionA four-door mid-size sedan with a base price for mass-market appeal produced both in the Fremont Factory and. at the Gigafactory in Shanghai.

Model Y: the SUVThat is a compact sport utility vehicle (“SUV”) built on the Model 3 platform with the capability for seating for up to seven adults.

Model S and Model X: the full-size sedanThat is a four-door full-size sedan that features large touchscreens driver interface, Autopilot hardware, over-the-air software updates, and fast charging through our Supercharger network.

Related: What Is a Business Model? Successful Types of Business Models You Need to Know

Elon Musk’s long-term vision for TeslaBack in 2018, Elon Musk highlighted the long-term vision for Tesla:

Our goal is to become the best manufacturer in the automotive industry, and having cutting edge robotic expertise in-house is at the core of that goal. Our recent acquisitions of advanced automation companies have added to our talent base and are helping us increase Model 3 production rates more effectively. We don’t want to simply replicate what we have built previously while designing additional capacity. We want to continuously push the boundaries of mass manufacturing.

Tesla’s mission can be summarized as:

to accelerate the world’s transition to sustainable energy.

As the company highlights:

Tesla builds not only all-electric vehicles but also infinitely scalable clean energy generation and storage products. Tesla believes the faster the world stops relying on fossil fuels and moves towards a zero-emission future, the better.

Elon Musk is getting ready to share a further Master Plan, for Tesla’s coming decade.

Tesla revenue streams explainedMain Tesla subjects will be scaling to extreme size, which is needed to shift humanity away from fossil fuels, and AI.

— Elon Musk (@elonmusk) March 21, 2022

But I will also Include sections about SpaceX, Tesla and The Boring Company.

In 2021, Tesla generated over $53.8 billion in revenues, compared to the $31.5 billion in 2020. The largest segment in the automotive sales (comprising regulatory credits revenues), followed by leasing (as part of the automotive), generated $1.6 billion in 2021. Outside the automotive sales, services (non-warranty after-sales vehicle services, sales of used vehicles, retail merchandise, and more) accounted for $3.8 billion. And energy generation and storage accounted for $2.8 billion. US and China are the primary markets, with almost $24 billion and nearly $14 billion respectively, in 2021. In 2021, Tesla generated $5.6 billion in Net Income, a net margin of over 10%.

In 2021, Tesla generated over $53.8 billion in revenues, compared to the $31.5 billion in 2020. The largest segment in the automotive sales (comprising regulatory credits revenues), followed by leasing (as part of the automotive), generated $1.6 billion in 2021. Outside the automotive sales, services (non-warranty after-sales vehicle services, sales of used vehicles, retail merchandise, and more) accounted for $3.8 billion. And energy generation and storage accounted for $2.8 billion. US and China are the primary markets, with almost $24 billion and nearly $14 billion respectively, in 2021. In 2021, Tesla generated $5.6 billion in Net Income, a net margin of over 10%.Tesla has four main sources of income:

AutomotiveAutomotive leasingServices and otherEnergy generation and storageBased on Tesla’s financial statements, in 2021 the company almost doubled its revenues while improving substantially its bottom line.

The most important revenue stream is the Automotive sales revenue (which includes revenues related to the sale of new Model S, Model X and Model 3 vehicles, including access to Supercharger network, internet connectivity, Autopilot, full self-driving, and over-the-air software updates, as well as sales of regulatory credits to other automotive manufacturers) with over $45 billion, followed by automotive leasing with over $1.6 billion and services and other with over £3.8 billion.

How can we explain such a growth? In 2021, Tesla experienced a 58% growth YoY in automotive revenues. Primarily driven by the ramped up production and deliveries of Model 3 (and Model Y).

For a bit of context, the Fremont factory churned out over 430 thousand vehicles in the last four quarters. And it’s ramping up production of the Model X:

For a bit of context, the Fremont factory churned out over 430 thousand vehicles in the last four quarters. And it’s ramping up production of the Model X:  Here all the key metrics trailing 12 months. With the spiked up sales of vehicles. Improved operating and free cash flows. Together with improved profitability. Therefore, Tesla today is a wholly different company than it was just three years before. As also highlighted by the financial metrics below:

Here all the key metrics trailing 12 months. With the spiked up sales of vehicles. Improved operating and free cash flows. Together with improved profitability. Therefore, Tesla today is a wholly different company than it was just three years before. As also highlighted by the financial metrics below:

And to be sure, this was all but a linear process. As Elon Musk highlighted, Tesla’s success was far from taken for granted. The worst near to death experience was in 2018 when Tesla wasn’t able to hit its production target, in what Musk called a “production hell.”

In a November 2020 Tweet Elon Musk emphasized:That funding round completed 6pm on Christmas Eve in 2008. Last hour of last day possible, as investors were leaving town that night & we were 3 days away from bankruptcy. I put in all money I had, didn’t own a house & had to borrow money from friends to pay rent. Difficult time.Tesla distribution strategy

Tesla is vertically integrated, as its pipeline goes from manufacturing to direct sales of its vehicles.

As highlighted by Tesla “the benefits we receive from distribution ownership enable us to improve the overall customer experience, the speed of product development, and the capital efficiency of our business.”

Even though a vertically integrated network represented a substantial investment in terms of physical assets Tesla can keep control over the experience of its customers. While also being able to retain important feedbacks throughout the supply chain.

Indeed, in a model where the customer is reached via indirect distribution the company might lose control of the customer experience at the last mile, and the valuable feedback it can gather from the marketplace.

Tesla follows an unconventional distribution model compared to other car manufacturers where the final sale is made via car dealerships which not tied to the company.

Why did Tesla use a direct distribution approach?Back in October 2012, Elon Musk explained in a blog post, the whole philosophy around Tesla distribution strategy:

There are reasons why Tesla is pursuing a company owned store and service center model that we feel are really important. In many respects, it would be easier to pursue the traditional franchise dealership model, as we could save a lot of money on construction and gain widespread distribution overnight. Many smart people have argued over the years that we should do this, just like every other manufacturer in the United States, so why have I insisted that we take a unique path?

Some of the key elements that made Tesla go with this strategy, which was way more expensive, and hard in the short-term was:

Conflict of interest of franchise dealersFor traditional car dealers, gasoline cars constituted the vast majority of their business. Thus, the franchise dealer would have been in a conflict of interest in offering a Tesla product, as this would have required them to contrast their core business model.

Ability to educate and channel the customer toward choosing Tesla over established brandsAs Elon Musk highlighted back in 2012: “Tesla, as a new carmaker, would therefore rarely have the opportunity to educate potential customers about Model S if we were positioned in typical auto dealer locations.”

So Tesla built its own stores, located in central places (similar to Apple stores’ distribution or perhaps branding strategy) to educate and enable potential customers to place orders, but primarily as a long-term objective to educate consumers about the brand and the potential of electric vehicles.

Today, after almost a decade of this strategy, Tesla is among the most recognized brands, and its stores are places that people enjoy to visit, as the electric vehicles proposed by Tesla have become iconic.

Freedom to open direct stores anywhereWith a traditional distribution strategy, it would have been easy for Tesla to run in conflict with franchised stores, by opening direct stores in close proximity. By having only a direct distribution, Tesla doesn’t have such a problem.

Does Tesla spend nothing on marketing?Musk is famous for his unconventional stunts. For instance, the stunts of the flamethrowers or the Tesla roadsters sent on space managed to reach hundreds of millions of people worldwide without a dollar spent on ads.

However, this also fueled the myth that Tesla doesn’t spend a dollar on advertising campaigns or marketing.

Like any other company, Tesla has a marketing budget for advertising and marketing campaigns. As an example, in 2018 Tesla reported its “Marketing, Promotional and Advertising Costs:”

Marketing, promotional and advertising costs are expensed as incurred and are included as an element of selling, general and administrative expense in the consolidated statement of operations. We incurred marketing, promotional and advertising costs of $70.0 million, $66.5 million and $48.0 million in the years ended December 31, 2018, 2017 and 2016, respectively.

Thus, even though the former PayPal Mafia member Elon Musk is the master of unconventional PR, Tesla still needs advertising to push its sales.

However, if we compare that to the revenue figures for 2018 (over $21 billion), the spending on marketing activities is around 0,3% which is an incredibly low figure, almost negligible, considering that large companies like Tesla spend billion of dollars in branding campaings!

Based on that, we can indeed affirm, that it’s like Tesla doesn’t have a marketing budget at all! And we’re talking about a company that pased a trillion-dollar in market cap!

Tesla manufacturing explainedThousands of purchased parts sourced from hundreds of suppliers across the world. For the key parts (battery cells, electronics, and complex vehicle assemblies) Tesla developed closed ties.

For most car manufacturers, components to build the cars, are often single-supplied. Other parts are instead available from multiple sources. For as much possible to diversify the suppliers’ components as car manufacturers also Tesla can experience high volatility in sourcing the components for its cars.

To prevent that, Tesla either looks for multiple sources or can stock up inventories of components.

Is Tesla worth more than GM?In January 2020, Tesla passed for the first time in its history the market cap of $100 billion, twice the market cap of GM (about $50 billion) in the same period even though in 2018 GM had 6-7 times the revenues of Tesla. Tesla though is valued as a tech company, which in the future can capture a wider and wider market, thus becoming way more valuable.

By October 2021, Tesla market cap would 10x, reaching over a trillion dollar! This in part, was due to the fact that the company managed to successfully pass the mass manufacturing stage.

Undoubtly, Tesla is getting valued as a tech company, an electric energy platform (not much different from its oil equivalent: Exxon or Chevron), and a company that might generate hundreds of billions in sales in the coming years. This is the bet markets are making.

Tesla as a business platformLooking at Tesla just as a company it’s a limited view. Tesla is much more than that. The company is a business platform, meaning it doesn’t just make and sell cars, but it is also an energy generation and storage platform. So it’s both a pipeline and a platform. To understand that let’s see the various components that make Tesla up as a company.

Breaking down Tesla competitors As an electric automaker and builder of sports cars and now trucks, Tesla’s competitors comprise companies like Ford, Mercedes-Benz, Porsche, Lamborghini, Audi, Rivian Lucid Motors, Toyota, and more. At the same time, Tesla is an electric energy production and storage company (SolarCity); it competes with Sunrun, SunPower, and Vivint Solar. And as an autonomous driving company, it competes with companies like Zoox, Waymo, and Baidu with the self-driving software.

As an electric automaker and builder of sports cars and now trucks, Tesla’s competitors comprise companies like Ford, Mercedes-Benz, Porsche, Lamborghini, Audi, Rivian Lucid Motors, Toyota, and more. At the same time, Tesla is an electric energy production and storage company (SolarCity); it competes with Sunrun, SunPower, and Vivint Solar. And as an autonomous driving company, it competes with companies like Zoox, Waymo, and Baidu with the self-driving software.Tesla isn’t just an automaker; it is an electric-only car automaker, an electric storage company, and an autonomous driving player. For that, we’ll have to analyze Tesla from these three perspectives.

AutomakingWithin the automaking segment, Tesla has over the years diversified its products‘ lines, to cover different segments of the market. When Tesla entered the market, as a go-to-market strategy it had to enter it (nonetheless Elon Musk’s long-term vision to make the electric car available to the masses) with the Roadster model.

While this model is still available, this is the highest-priced model and the product Tesla used to bootstrap its operations. Indeed, at the time, Tesla couldn’t produce a lower-cost electric car (Model 3 will finally achieve this goal), and that is how Tesla made its business model viable as it entered the new market for electric cars. This is what I call a transitional business model:

Note: A transitional business model is used by companies to enter a market (usually a niche) to gain initial traction and prove the idea is sound. The transitional business model helps the company secure the needed capital while having a reality check. It helps shape the long-term vision and scalability.

Over the years, as the market matures, Tesla grew, an electric ecosystem was born, and the technology to enhance battery performance improved, Tesla also expanded its products‘ lines to cover the various segments.

Sport & PerformanceThe primary models covering these segments are:

Roadster: here some of the competitors are Dodge Challenger, Porsche Chiron, and BugattiModel S: in this segment, Tesla competes with players like Mercedes S-Class, BMW 7 Series, Porsche Panamera, Audi A7 & A8, and more.SuvThe primary models covering these segments are:

Model X: here some of the competitors are BMW X5, Mercedes-Benz GLS-Class, Volvo XC90, Porsche Cayenne.Model Y (compact SUV): in this segment, Tesla competes with Renault Zoe, Nissan LEAF, Volksvagen e-Golf, Audi e-tron and more.TruckIn this segment, Tesla just launched the Cybertruck:

Cybertruck’s competitors comprise Rivian, Ford, Bollinger.

City CarTesla has finally its mass-market product, the Model 3. This model competes with models such as BMW Series 2,3,4,5 Mercedes Class C, CLA, CLS, Audi A3, A4, A5, Lexus, ES, GS, and many others.

Energy StorageTesla acquired SolarCity back in 2016, for $2.6 billion, and with that, it competes in the electric production and storage industry with players like SunRun, SunPower, Vivint Sonar, Trinity Solar, and SolarWorld to mention a few.