Gennaro Cuofano's Blog, page 109

March 19, 2022

Who Owns Uber?

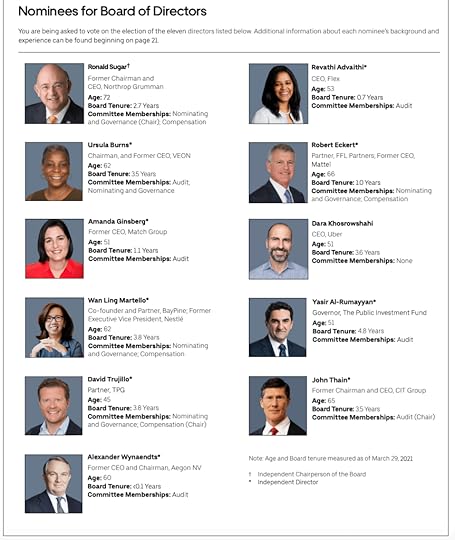

Uber is a two-sided platform where riders can book drivers on-demand. As part of it, Uber Eats Three-Sided Platform enables eaters, restaurants, and food drivers to meet on top of it. Uber’s main shareholders comprise SB Cayman 2 Ltd. (owned by SoftBank Group Corp) with almost 10% of the company’s shares, followed by Morgan Stanley. Individual shareholders comprise Yasir Al-Rumayyan, Governor of the Public Investment Fund, the sovereign wealth fund of the Kingdom of Saudi Arabia, and Dara Khosrowshahi, the founder and CEO of Uber.

Who Owns Uber?Name of Beneficial Owner SharesShares%SB Cayman 2 Ltd. (owned by SoftBank Group Corp)184,228,1789.91%Morgan Stanley109,787,2395.91%Yasir Al-Rumayyan72,971,5503.93%Dara Khosrowshahi1,408,027Nelson Chai189,783Ronald Sugar189,403Ursula Burns147,283John Thain147,022Jill Hazelbaker125,053Tony West123,264Nikki Krishnamurthy70,585Wan Ling Martello60,311Robert Eckert20,837Amanda Ginsberg6,287Revathi Advaithi3,756

Uber Financial Statements.Uber Business ModelUber Eats Business ModelFood Delivery Business ModelsConnected Business Models

Uber Financial Statements.Uber Business ModelUber Eats Business ModelFood Delivery Business ModelsConnected Business Models Uber is a is two-sided marketplace, a platform business model that connects drivers and riders, with an interface that has elements of gamification, that makes it easy for two sides to connect and transact. Uber makes money by collecting fees from the platform’s gross bookings.

Uber is a is two-sided marketplace, a platform business model that connects drivers and riders, with an interface that has elements of gamification, that makes it easy for two sides to connect and transact. Uber makes money by collecting fees from the platform’s gross bookings. DoorDash is a platform business model that enables restaurants to set up at no cost delivery operations. At the same time, customers get their food at home and dashers (delivery people) earn some extra money. DoorDash makes money by markup prices through delivery fees, memberships, and advertising for restaurants on the marketplace.

DoorDash is a platform business model that enables restaurants to set up at no cost delivery operations. At the same time, customers get their food at home and dashers (delivery people) earn some extra money. DoorDash makes money by markup prices through delivery fees, memberships, and advertising for restaurants on the marketplace. Glovo is a Spanish on-demand courier service that purchases and delivers products ordered through a mobile app. Founded in 2015 by Oscar Pierre and Sacha Michaud as a way to “uberize” local services. Glovo makes money via delivery fees, mini-supermarkets (fulfillment centers that Glovo operates in partnership with grocery store chains), and dark kitchens (enabling restaurants to increase their capacity).

Glovo is a Spanish on-demand courier service that purchases and delivers products ordered through a mobile app. Founded in 2015 by Oscar Pierre and Sacha Michaud as a way to “uberize” local services. Glovo makes money via delivery fees, mini-supermarkets (fulfillment centers that Glovo operates in partnership with grocery store chains), and dark kitchens (enabling restaurants to increase their capacity). Grubhub is an online and mobile platform for restaurant pick-up and delivery orders. In 2018 the company connected 95,000 takeout restaurants in over 1,700 U.S. cities and London. The Grubhub portfolio of brands like Seamless, LevelUp, Eat24, AllMenus, MenuPages, andTapingo. The company makes money primarily by charging restaurants a pre-order commission and it generates revenues when diners place an order on its platform. Also, it charges restaurants that use Grubhub delivery services and when diners pay for those services.

Grubhub is an online and mobile platform for restaurant pick-up and delivery orders. In 2018 the company connected 95,000 takeout restaurants in over 1,700 U.S. cities and London. The Grubhub portfolio of brands like Seamless, LevelUp, Eat24, AllMenus, MenuPages, andTapingo. The company makes money primarily by charging restaurants a pre-order commission and it generates revenues when diners place an order on its platform. Also, it charges restaurants that use Grubhub delivery services and when diners pay for those services.  Instacart’s business model relies on enabling an easy set up for grocery stores, the comfort for customers to get their shopping delivered at home, and an additional income stream for personal shoppers. Instacart makes money by charging service fees, via memberships, and by running performance advertising on its platform.

Instacart’s business model relies on enabling an easy set up for grocery stores, the comfort for customers to get their shopping delivered at home, and an additional income stream for personal shoppers. Instacart makes money by charging service fees, via memberships, and by running performance advertising on its platform. Lyft is a transportation-as-a-service marketplace allowing riders to find a driver for a ride. Lyft has also expanded with a multimodal platform that gives more options like bike-sharing or electric scooters. Lyft primary makes money by collecting fees from drivers that complete rides on the platform.

Lyft is a transportation-as-a-service marketplace allowing riders to find a driver for a ride. Lyft has also expanded with a multimodal platform that gives more options like bike-sharing or electric scooters. Lyft primary makes money by collecting fees from drivers that complete rides on the platform. Postmates is a food delivery service built as a last-mile delivery service platform connecting locals with shops. Postmates makes money by collecting fees (commission, delivery, service, cart, and cancellation fees). It also makes money via its subscription service (called Unlimted – $9.99/month or $99.99 annually) giving free delivery on every order of more than $12.

Postmates is a food delivery service built as a last-mile delivery service platform connecting locals with shops. Postmates makes money by collecting fees (commission, delivery, service, cart, and cancellation fees). It also makes money via its subscription service (called Unlimted – $9.99/month or $99.99 annually) giving free delivery on every order of more than $12. Uber Eats is a three-sided marketplace connecting a driver, a restaurant owner and a customer with Uber Eats platform at the center. The three-sided marketplace moves around three players: Restaurants pay commission on the orders to Uber Eats; Customers pay the small delivery charges, and at times, cancellation fee; Drivers earn through making reliable deliveries on time.

Uber Eats is a three-sided marketplace connecting a driver, a restaurant owner and a customer with Uber Eats platform at the center. The three-sided marketplace moves around three players: Restaurants pay commission on the orders to Uber Eats; Customers pay the small delivery charges, and at times, cancellation fee; Drivers earn through making reliable deliveries on time.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post Who Owns Uber? appeared first on FourWeekMBA.

March 18, 2022

The Uber Eats Business Model

Uber Eats is a three-sided marketplace connecting a driver, a restaurant owner and a customer with Uber Eats platform at the center. The three-sided marketplace moves around three players: Restaurants pay commission on the orders to Uber Eats; Customers pay the small delivery charges, and at times, cancellation fee; Drivers earn through making reliable deliveries on time. Uber Eats generated $8.36 billion in revenues in 2021, representing 48% of Uber’s total revenues.

Uber Revenue Breakdown2021% of Total RevenuesMobility$6.9 Billions40%Delivery$8.36 Billions48%Freight$2.1 Billions12%All Other$8 Millions0%Total$17.45 Billions Uber Eats Business Model TodayMobility (Uber Eats) was the fastest growing segment in 202120212020Segment’s GrowthMobility$6.9 Billions$6 Billions14.2% Delivery (Uber Eats) $8.36 Billions $3,9 Billions 114.2% Freight$2.1 Billions$1 Billions110.9%All Other$8 Millions$135 Millions-94.1%Total$17.45 Billions$11.1 Billions56.7%The delivery platform has become a key driver for the overall Uber’s growth. In fact, in 2021 the delivery platform, saw a 114% growth rate!

The delivery platform also passed the gross bookings compared to the mobility platform. This was defenitely an effect of the pandemic. In fact, for the first time, in Q2 2020, gross bookins in delivery passed those of the mobility platform.

Indeed, through the delivery platform there were $6.9 billions, vs. the over $3 billions of the mobility platform.

Thus, the mobility platform was negatively impacted by the pandemic. However, by Q4 2021, even though the mobility platform has gone back to pre-pandemic bookings levels, the delivery platform kept growing at an incredible rate.

By Q4 2021, the mobility platform recorded $11.34 billion in gross bookings, where the delivery platform recorded over $13.4 billion in gross bookings.

Uber Eats Background StoryUber – The world’s largest ride-share company took an interesting turn in 2014 when it gave birth to “Uber Eats,” called initially Uber Fresh.

Getting food delivered from your favorite local restaurants became as easy as requesting a ride!

Fast forward to today, Uber is heavily investing in the Uber Eats model. The food delivery business is growing fast and gaining momentum around the world.

Why is Uber building the world’s largest food delivery platform? Is it valuable for Uber to turn its drivers into a reliable delivery fleet?In this post, you’ll learn why Uber is betting big on the Uber Eats business model, its value proposition, operational components, and what it means for the future of Uber.

Related: How Does Uber Make Money? Uber Business Model In A Nutshell

A 3-sided Marketplace BusinessUber Eats is a three-sided marketplace connecting a driver, a restaurant owner and a customer with Uber Eats platform at the center.

Restaurants pay commission on the orders to Uber Eats.Customers pay the small delivery charges and at times, cancellation fee.Drivers earn through making reliable deliveries on time.

Source: eng.uber.com

(Image credits: Restaurant-Partner: gst/Shutterstock.com, Delivery Partner: Kikuchi/Shutterstock.com, Eater: tigatelu/Depositphotos)A six-point value propositionBlazing fast delivery: Uber Eats promises to deliver within 30 minutes in most of the cities where they are currently operational. It works on the principle that “We don’t want your food traveling halfway across town.”No minimum order concept: The customers can order their favorite snack instead of a full meal. The standard delivery fee ensures that all orders are fulfilled irrespective of the order value.Existing customer base: Probably, the most valuable asset of all. They already have millions of active Uber users across the globe who can be potential Uber Eats users.Better utilization of Uber’s resources: They already have cars/drivers on the road and an effective system to manage it. The inclusion of Uber Eats will only help to increase the utilization across Uber’s different verticals. For example, a cabbie who just finished a trip may handle a food delivery order right afterward.A top class algorithm: The algorithm developed by Uber does a great job in neatly organizing the prime factors in online food delivery system. i.e., order management, order allocation and order dispatch.The global presence: How hard it would be for them to leverage Uber’s global dominance to scale the business of Uber Eats? Not that hard! While they may face local competitors in every market they penetrate, a competitor with such a global stronghold would be hard to beat!

The chart below completely describes the revenue flow in the Uber Eats ecosystem:

Standard Delivery Fee OR Convenience Fee: Uber Eats charges a flat delivery fee from its customers irrespective of the order value. The charges vary from $1 to $5 depending on the market they are operating in.Recurring Revenue Share from Restaurant Partners: Uber Eats takes a cut of 15% to 40% on every order that is fulfilled from the Restaurant partners. Uber Eats decides the percentage of the commission depending on the age and maturity of the market.Marketing & Advertising Fee from Restaurant Partners: Uber Eats is helping their restaurant partners attract more customers and reach a larger customer base by offering customer-facing brand campaigns, relatable social posts and email marketing to Uber’s rider base.How much Uber Eats pay for their delivery partners or drivers?

The delivery partner’s fee is mainly divided into three segments which are pickup fee, delivery fee and per mile fee also referred to as mileage fee.

The exact figures of these charges vary from region to region. A customer can tip the delivery partners if they want to and 100% of this tip would be allocated to the delivery partner only.

Uber Eats’ Cost-Saving FactorsYou’ve heard the saying “Every Penny Saved is Every Penny Earned”? Uber Eats, with its unique three-sided marketplace business model, is both cost-effective and efficient than its competitors.

Lesser Customer Acquisition Cost (CAC) and Shared Marketing Expenses: The current marketing and advertising expense incurred by Uber Eats is comparatively less since it’s getting most of its users through cross-promotion on the Uber App.Shared Network of Drivers & Riders : The drivers and riders on Uber double up to work as the delivery fleet, which eases the pain of setting up a delivery network from scratch.

Savings on Logistics Costs: A well-defined unit economics helps in saving big on the logistics cost as multiple food orders on the same route can be delivered in a single delivery run.Uber Eats’ Unit Economics

YOU ordered an apple-pie from XYZ restaurant that is priced at $50 Order Value $5 Delivery Charges. The order will be delivered by ME at your door and ME is currently 3 miles away from your location.

Approximately, this is how the unit economics should reflect:

Amount paid by YOU: $50 $5 = $55Amount received by XYZ restaurant: $50 – (30% commission on order) = $35Delivery Charges: Pickup Fee Delivery Fee Per Mile Charges = $4 $2 ($2 x 3) = $12Net Revenue for Uber Eats = ($55 – $35) – $12 = $8The Future of Uber EatsCurrently covering 50% of the US population, it is set to cover more than 70% by the end of 2019. Uber Eats holds 27.9% of the revenue share of all top online food delivery services in the USA and is approximately valued at 20 billion USD.

Uber has been doing a great job in innovating and captivating new markets with its exceptional approach.

In a market which is already crowded with online food ordering and delivery platforms, how should we look at Uber’s presence in this space?

Is food delivery the real endgame, or are we witnessing the time-honored “sustaining innovation” curve leading to Uber Everything? Only time will tell!

Connected Business Models And Concepts To Uber Eats Uber is a is two-sided marketplace, a platform business model that connects drivers and riders, with an interface that has elements of gamification, that makes it easy for two sides to connect and transact. Uber makes money by collecting fees from the platform’s gross bookings.

Uber is a is two-sided marketplace, a platform business model that connects drivers and riders, with an interface that has elements of gamification, that makes it easy for two sides to connect and transact. Uber makes money by collecting fees from the platform’s gross bookings.

Lyft is a transportation-as-a-service marketplace allowing riders to find a driver for a ride. Lyft has also expanded with a multimodal platform that gives more options like bike-sharing or electric scooters. Lyft primary makes money by collecting fees from drivers that complete rides on the platform.

Lyft is a transportation-as-a-service marketplace allowing riders to find a driver for a ride. Lyft has also expanded with a multimodal platform that gives more options like bike-sharing or electric scooters. Lyft primary makes money by collecting fees from drivers that complete rides on the platform.

HyreCar is a peer-to-peer marketplace where owners of cars can rent their idle vehicles to drivers that want to make an additional income via ride-sharing services like Uber, and Lyft. As a two-sided marketplace, HyreCar makes money by charging drivers for direct insurance and a 10% fee on the weekly rental expense. And by taking a 15% fee from owners weekly rental income.

HyreCar is a peer-to-peer marketplace where owners of cars can rent their idle vehicles to drivers that want to make an additional income via ride-sharing services like Uber, and Lyft. As a two-sided marketplace, HyreCar makes money by charging drivers for direct insurance and a 10% fee on the weekly rental expense. And by taking a 15% fee from owners weekly rental income.Uber Liquidity Network Effects

In the food delivery business model companies leverage technology to build platforms that enable users to have the food delivered at home. This business model usually is set up as a platform and multi-sided marketplace, where the food delivery company makes money by charging commissions to the restaurant and to the customer.

In the food delivery business model companies leverage technology to build platforms that enable users to have the food delivered at home. This business model usually is set up as a platform and multi-sided marketplace, where the food delivery company makes money by charging commissions to the restaurant and to the customer.

DoorDash is a platform business model that enables restaurants to set up at no cost delivery operations. At the same time, customers get their food at home and dashers (delivery people) earn some extra money. DoorDash makes money by markup prices through delivery fees, memberships, and advertising for restaurants on the marketplace.

DoorDash is a platform business model that enables restaurants to set up at no cost delivery operations. At the same time, customers get their food at home and dashers (delivery people) earn some extra money. DoorDash makes money by markup prices through delivery fees, memberships, and advertising for restaurants on the marketplace.

Instacart’s business model relies on enabling an easy set up for grocery stores, the comfort for customers to get their shopping delivered at home, and an additional income stream for personal shoppers. Instacart makes money by charging service fees, via memberships, and by running performance advertising on its platform.

Instacart’s business model relies on enabling an easy set up for grocery stores, the comfort for customers to get their shopping delivered at home, and an additional income stream for personal shoppers. Instacart makes money by charging service fees, via memberships, and by running performance advertising on its platform.Read next:

How Does Uber Make Money? Uber Business Model In A NutshellLyft Transportation-As-A-Service Business ModelHow Does HyreCar Make Money? HyreCar Business Model In A Nutshell

Related resources:

Successful Types of Business Models You Need to KnowBusiness Strategy: Definition, Examples, And Case StudiesWhat Is a Business Model Canvas? Business Model Canvas ExplainedBlitzscaling Business Model Innovation Canvas In A NutshellWhat Is a Value Proposition? Value Proposition Canvas ExplainedWhat Is a Lean Startup Canvas? Lean Startup Canvas ExplainedWhat Is Market Segmentation? the Ultimate Guide to Market SegmentationMarketing Strategy: Definition, Types, And Examples What type of business model is Uber Eats?Uber Eats is a three-sided marketplace connecting drivers, restaurant owners, and customers. Drivers can leverage the existing Uber platform, to perform additional gigs, and therefore earn extra income on top of Uber. Restaurant owners can amplify their local service reach, by easily setting up delivery operations of food, thus gaining more customers. And customers can leverage the smoothness Uber platform to have the food comfortably delivered at home.

Is Uber Eats a profitable business?The company reported that Uber Eats was profitable during the 2021 Q3, as per its earning calls. As of 2021, this makes Uber Eats the only profitable segment of the company. Indeed, as of 2020, Uber reported net losses were over $6.7 billion.

How does Uber Eats make their money?As a three-sided platform, the company makes money by charging fees on top of the transactions that go through the platform. More precisely Uber Eats charges standard or convenience delivery fees (between $1-5 depending on the market). It also takes a cut on the restaurant owners’ revenues (anywhere between 15-40% of every order depending on the market). And it collects marketing and advertising fees from restaurant partners.

{ "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "What type of business model is Uber Eats? ", "acceptedAnswer": { "@type": "Answer", "text": "<p>Uber Eats is a three-sided marketplace connecting drivers, restaurant owners, and customers. Drivers can leverage the existing Uber platform, to perform additional gigs, and therefore earn extra income on top of Uber. Restaurant owners can amplify their local service reach, by easily setting up delivery operations of food, thus gaining more customers. And customers can leverage the smoothness Uber platform to have the food comfortably delivered at home.</p>" } } , { "@type": "Question", "name": "Is Uber Eats a profitable business? ", "acceptedAnswer": { "@type": "Answer", "text": "<p>The company reported that Uber Eats was profitable during the 2021 Q3, as per its earning calls. As of 2021, this makes Uber Eats the only profitable segment of the company. Indeed, as of 2020, Uber reported net losses were over $6.7 billion.</p>" } } , { "@type": "Question", "name": "How does Uber Eats make their money?", "acceptedAnswer": { "@type": "Answer", "text": "<p>As a three-sided platform, the company makes money by charging fees on top of the transactions that go through the platform. More precisely Uber Eats charges standard or convenience delivery fees (between $1-5 depending on the market). It also takes a cut on the restaurant owners' revenues (anywhere between 15-40% of every order depending on the market). And it collects marketing and advertising fees from restaurant partners.</p>" } } ] }The post The Uber Eats Business Model appeared first on FourWeekMBA.

March 17, 2022

What Is The Wholesale Business Model? Wholesale Business Model In A Nutshell

The wholesale model is a selling model where wholesalers sell their products in bulk to a retailer at a discounted price. The retailer then on-sells the products to consumers at a higher price. In the wholesale model, a wholesaler sells products in bulk to retail outlets for onward sale. Occasionally, the wholesaler sells direct to the consumer, with supermarket giant Costco the most obvious example.

Understanding the wholesale modelWholesalers receive attractive prices from the manufacturer because they deal in large minimum order quantities (MOQs), with larger order quantities reducing handling time and cost and increasing profit. In some cases, the wholesaler and the manufacturer are the same company.

In a traditional wholesale model supply chain, goods may flow from raw material suppliers to manufacturers, distributors, wholesalers, retailers, and finally to consumers. Since most wholesalers do not sell directly to the consumer in small quantities, they sell bulk goods to retail businesses for a profit.

The wholesale model is a business-to-business (B2B) process since wholesalers buy from a manufacturing business and sell to a retail business. This differentiates the model from the retail model, a business-to-consumer (B2C) process where retailers buy from wholesale businesses and sell to individual consumers.

Functions of wholesalers in the wholesale modelMany companies utilize wholesalers and the wholesale model because of the impracticalities of selling direct to consumers. This is particularly true of large retailers, who may operate thousands of stores in hundreds of different regions.

To that end, some wholesalers act as middlemen for retailers and are vital cogs in the supply chain. Here are some of their functions:

Sales and promotions – wholesalers are typically responsible for meeting sales targets for their particular region through promotional campaigns. Inventory management – maintaining sufficient inventory is a critical function of any supply chain. Experienced wholesalers understand that different products sell at different rates. They then use this information to avoid overstocking and understocking issues across the supply chain.Breaking the bulk – when a wholesale company receives a bulk order, it must necessarily break the order down into smaller cartons or consignments ready for delivery to the retailer. Warehousing – to supply a whole region, wholesalers require a large warehouse space to store inventory. Warehouses must be large enough to accommodate the extra demand for stock during holidays such as Christmas. The warehouse itself must also be economical to operate and not eat into margins.Risk management – in most cases, wholesalers are also responsible for inventory losses incurred because of theft, fire, or accidental damage. This makes risk management a priority.Market information – wholesalers have a good understanding of the size and potential of a market and share this information with intermediaries up and down the supply chain. Some may also have information on how strong a competitor’s business is in a specific region, which is valuable information to retailers and other wholesalers alike.The benefits of buying and selling under the wholesale modelLet’s take a look at some of the benefits of buying and selling under the wholesale model.

BuyingCost and time reduction – as mentioned earlier, buying in bulk helps a business save money on most product ranges. For the retailer, the purchasing process is also more efficient. Wholesalers deal with multiple suppliers for every product, but the retailer only needs to do business with one wholesaler.Better deals – dealing with multiple suppliers, the wholesaler can quickly identify reputable companies who deliver high-quality products on time and at a reasonable price. This work also saves the retailer from finding reputable suppliers themselves.SellingHigher margins – selling under the wholesale model may require dealing with multiple suppliers and comparison shopping to get the best deal. However, this allows a business to buy low and sell high. Selling direct to consumers will earn the highest margins, while selling to retailers usually attracts a slightly lower (though still attractive) margin.Responsiveness – sellers also have a better understanding of high-demand products since they work with both retailers and customers. With supplier relationships already in place, wholesale sellers can also launch new products more quickly than competitors. What’s more, some wholesalers have a deep working knowledge of the timing and organization of the entire supply chain, which gives them a competitive edge.Key takeaways:The wholesale model is a selling model where products sell their products in bulk to a retailer at a discounted price. The retailer then on-sells the products to consumers at a higher price.The wholesale model helps larger retailers with the impracticalities of selling direct to consumers. Wholesalers perform several critical functions relating to sales and promotions, inventory management, warehousing, risk management, and the divulging of market information.For buyers, the wholesale model reduces the time and cost associated with securing multiple suppliers. For sellers, the ability to buy in bulk increases margins when dealing directly with the consumer. Wholesale sellers also have a deeper understanding of the market and supply chain itself, which increases competitiveness.Read Also: Costco Business Model

Costco runs a high-quality, low-priced business model powered by its memberships that draw customers’ loyalty and repeat purchases. Top institutional investors comprise The Vanguard Group, with 8.55%, and BlackRock with 5.39%. Top individual shareholders comprise Craig Jelinek, Charles T. Munger (Warren Buffet partner and co-owner of Berkshire Hathaway), James Murphy, and more.

Costco runs a high-quality, low-priced business model powered by its memberships that draw customers’ loyalty and repeat purchases. Top institutional investors comprise The Vanguard Group, with 8.55%, and BlackRock with 5.39%. Top individual shareholders comprise Craig Jelinek, Charles T. Munger (Warren Buffet partner and co-owner of Berkshire Hathaway), James Murphy, and more. Read Also: Marketplace Business Models

A marketplace is a platform where buyers and sellers interact and transact. The platform acts as a marketplace that will generate revenues in fees from one or all the parties involved in the transaction. Usually, marketplaces can be classified in several ways, like those selling services vs. products or those connecting buyers and sellers at B2B, B2C, or C2C level. And those marketplaces connecting two core players, or more.

A marketplace is a platform where buyers and sellers interact and transact. The platform acts as a marketplace that will generate revenues in fees from one or all the parties involved in the transaction. Usually, marketplaces can be classified in several ways, like those selling services vs. products or those connecting buyers and sellers at B2B, B2C, or C2C level. And those marketplaces connecting two core players, or more.Read Also: Food-Delivery Business Models

In the food delivery business model companies leverage technology to build platforms that enable users to have the food delivered at home. This business model usually is set up as a platform and multi-sided marketplace, where the food delivery company makes money by charging commissions to the restaurant and to the customer. Wholesale vs. Retail

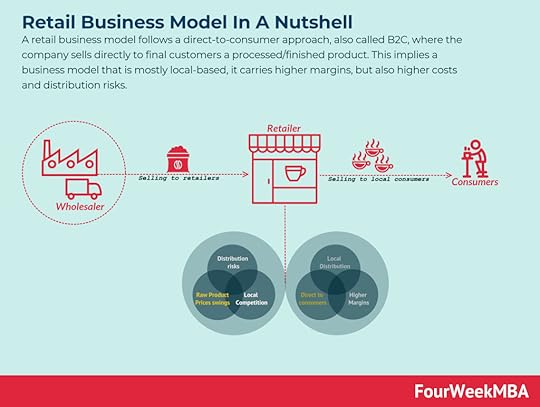

In the food delivery business model companies leverage technology to build platforms that enable users to have the food delivered at home. This business model usually is set up as a platform and multi-sided marketplace, where the food delivery company makes money by charging commissions to the restaurant and to the customer. Wholesale vs. Retail  A retail business model follows a direct-to-consumer approach, also called B2C, where the company sells directly to final customers a processed/finished product. This implies a business model that is mostly local-based, it carries higher margins, but also higher costs and distribution risks.

A retail business model follows a direct-to-consumer approach, also called B2C, where the company sells directly to final customers a processed/finished product. This implies a business model that is mostly local-based, it carries higher margins, but also higher costs and distribution risks. Where the retailer takes the risks of dealing with final customers, the wholesaler primarily deals with intermediaries/retailers that will take care of dealing with the final customers.

This, of course, has an advantage in terms of sales and marketing expenses. As the wholesaler will have fewer business risks, compared to the retailer. However, the wholesaler will need to spend a substantial amount of effort in developing its logistics infrastructure.

On the other hand, as the wholesales deal with the intermediaries, and at higher volume, and in some cases, for raw goods, it will also make fewer margins per product, as its business model will be based on volume.

The retailer, on the other hand, will enjoy wider margins per product, and it will have to carry a higher risk in terms of meeting a wider customer base. Therefore, a good chunk of its efforts will be spent on sales and marketing activities.

Wholesale vs. Direct-to-consumer Direct-to-consumer (D2C) is a business model where companies sell their products directly to the consumer without the assistance of a third-party wholesaler or retailer. In this way, the company can cut through intermediaries and increase its margins. However, to be successful the direct-to-consumers company needs to build its own distribution, which in the short term can be more expensive. Yet in the long-term creates a competitive advantage.

Direct-to-consumer (D2C) is a business model where companies sell their products directly to the consumer without the assistance of a third-party wholesaler or retailer. In this way, the company can cut through intermediaries and increase its margins. However, to be successful the direct-to-consumers company needs to build its own distribution, which in the short term can be more expensive. Yet in the long-term creates a competitive advantage. Similar to the distinction between wholesalers and retailers, the direct-to-consumer business will have to take the risks of dealing with the final customers. Usually, this requires a bigger effort, in securing this customer base, in supporting it before and after the sale.

Thus, the direct-to-consumers expenses related to customer acquisition, retention, and referral will be substantial. Thus, here you’ll see this projected on the balance sheets.

Where the wholesaler will have most of its expenses as “cost of sales” (meaning the costs needed to sustain its infrastructure), the direct-to-consumer might have most of its expenses tied to sales and marketing activities.

Wholesale vs. Private Labeling Private labeling involves one company selling the products of another company using its own branding and packaging. In most instances, a retailer purchases products from a manufacturer that are then sold to consumers with the manufacturer’s brand and packaging visible. In private labeling instead, the retailer might have a third-party manufacturer produce goods and sell them under the retailer’s brand. Therefore the manufacturer acts as a private label, not showing its brand toward consumers.

Private labeling involves one company selling the products of another company using its own branding and packaging. In most instances, a retailer purchases products from a manufacturer that are then sold to consumers with the manufacturer’s brand and packaging visible. In private labeling instead, the retailer might have a third-party manufacturer produce goods and sell them under the retailer’s brand. Therefore the manufacturer acts as a private label, not showing its brand toward consumers.In the case of the private label, the retailer sells to final consumers the products that the manufacturer has passed along with its own labels. The main difference with the wholesaler is that the private labeler does show its brands to final consumers, and therefore there might be some activities of post-sales support who go with the manufacturer.

On the contrary, in most cases, the wholesaler only sends over goods that might be unlabeled or labeled with other brands’ names (related to third-party manufacturers) and therefore, it doesn’t have to carry the expenses related to post-sales support.

Read More:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post What Is The Wholesale Business Model? Wholesale Business Model In A Nutshell appeared first on FourWeekMBA.

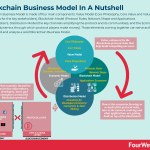

The Blockchain Business Models Complete Guide

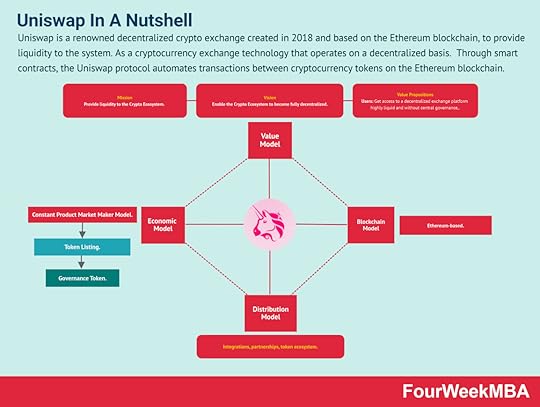

A Blockchain Business Model is made of four main components: Value Model (Core Philosophy, Core Value and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model.

What does a blockchain-business world entail?As more startup are springing up on Blockchain technologies, it is normal to see the proliferation of Blockchain protocols that promise to disrupt any industry. Just like when the web started to become mainstream, thanks to technologies like search engines.

We saw the birth of many search engines that made the search market fragmented; up to when Google became so dominant to tame most of the search market share.

Are we assisting also today to a similar phenomenon? In part. However, to understand the Blockchain Economy and the business models that will spring from it we’ll need a slightly different business playbook!

Business models in the internet eraThe internet gave rise to a whole new set of business models. Not by chance, the term “business model” has become widely adopted throughout the spreading of IT tech companies:

There is one critical point to notice. Where the internet allowed new companies to emerge. That created the rise of business models that before were not possible. One trivial example is Netflix delivery of streaming content via the internet, with a subscription-based business model.

Today that model has become the standard. However, when you start thinking about how value has been created and captured in this internet era, one word comes to mind: data.

When you scroll the Facebook feed, what makes it so addictive is the ability of its algorithms to tap into behavioral data of its users to give more and more “meaningful” suggestions that only make people wanting more.

When you keep watching Netflix, its algorithms learn more about your tastes and preferences to create a stickier experience, that over time makes you wanting more.

Those algorithms learn through data, which might be classified as interactions you have on the platform. All that data is stored and handled by massive databases, called graphs. The access to those graphs isn’t open; it’s proprietary.

Indeed, that data is the main asset of those tech companies. It is what makes them monetize their business models, create unique experiences for their users and retain value in the long-run.

Therefore, even though initially the internet era paved the way for hundreds of new business models. It also created a winner-take-all effect. Where those companies able to capture network effects, would eventually gain a massive competitive advantage.

For instance, according to the Venture Capital Funding Report by CB Insights and PWC, the venture capital deals have increased substantially in 2018, compared to 2017:

However, as pointed out by venture capitalist Fred Wilson, these deals were “fewer and larger.” In short, in the last years of the internet era, investors and existing players are consolidating toward larger deals that are creating more consolidation, winner-take-all effects, and high barriers to entry.

It is true that as of 2019, new internet companies can be born and become the next Facebook or Google. Yet, it might not be as true as it was a decade ago. The tech players dominating the market might use their cash at the bank to buy them up.

In short, the internet seemed to have produced more open business models compared to the past (initially it did). Consolidation kicked in, and new “conglomerates” have formed in the marketplace.

While this process might be normal in a world where applications powered by proprietary data took over, ti might not be so in a blockchain economy, let’s see why.

A blockchain economy based on fat protocols and thin apps

Web3 describes a version of the internet where data will be interconnected in a decentralized way. Web3 is an umbrella that comprises various fields like semantic web, AR/VR, AI at scale, blockchain technologies, and decentralization. The core idea of Web3 moves along the lines of enabling decentralized ownership on the web.

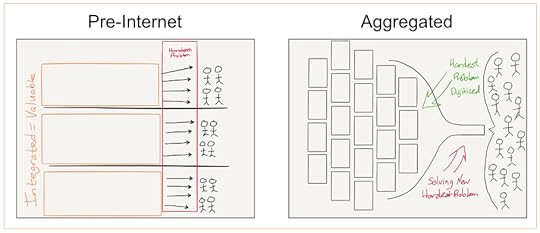

Web3 describes a version of the internet where data will be interconnected in a decentralized way. Web3 is an umbrella that comprises various fields like semantic web, AR/VR, AI at scale, blockchain technologies, and decentralization. The core idea of Web3 moves along the lines of enabling decentralized ownership on the web.Joel Monegro, from USV venture capital firm, pointed out a compelling theory about value creation in a blockchain economy. This is the “fat protocols theory:”

Here’s one way to think about the differences between the Internet and the Blockchain. The previous generation of shared protocols (TCP/IP, HTTP, SMTP, etc.) produced immeasurable amounts of value, but most of it got captured and re-aggregated on top at the applications layer, largely in the form of data (think Google, Facebook and so on).

In other words, the protocols that allowed the web to work in the first place didn’t manage though to capture economic value, which instead went through applications. In a blockchain economy, the opposite happens. Applications become marginal compared to the protocols that make them work (think of Bitcoin or Ethereum).

Joel Monegro – argues – it happens for two reasons:

Shared data layer: in an internet-based business model most of the value is in the data captured from a platform or application. That data is proprietary, so the access to it will be restricted so that the company (think of Facebook, Twitter or Google) can monetize it. On the other hand, in a blockchain-based business model, data can’t be closed, it will be shared. This will reduce the barriers to entry, and will allow new players to come into the market more easilyA cryptographic “access” token with some speculative value: in short according to Monegro, this aspect creates a token feedback loop, where interest in the token creates speculation and increases the value of it, which in turns only attracts more attention. This phenomenon, in turn, makes the value of the protocol grow way faster than the value of the applications built on top of itThis theory has important implications, as it points out how we need to change our way to think about business. That also might imply a new business playbook!

Do we need a new business playbook?If we want to succeed as business persons in a blockchain economy (when and how it will prove to work), we need to change our playbook then.

In an infographic by visualcapitalist.com you can appreciate, how tech players that were dominant by the late 1990s have become marginal today:

For instance, back in 1998, AOL and Yahoo represented the Internet! Most of the web traffic went through those portals. In 2018, Verizon, which had created a business unit called Oath (which comprised Yahoo and AOL acquisition) wrote them off for approximately $4.6 billion!

Twenty years from now, who will still be on that list?

New business models might emerge at the protocol levelWhen Google announced its IPO, back in 2004, the world wanted to know its numbers. Everyone knew Google was a profitable company. Yet when it finally Google opened up the hood, the reality was even better than imagination:

Google made over three billion dollars in revenues and about four hundred million dollars in profits! The web wasn’t just that bubble that burst during the dot-com era. It proved to be a whole new world. Business people took notice.

If a blockchain economy might prove sustainable in the long-term, understanding of how the web evolved and how tech companies became successful will be critical.

However, we’ll need to look at this phenomenon with different eyes. We might want to keep our focus on those protocols that will eventually dominate the blockchain economy as value captured might subsequently be there.

The blockchain as a new business model toolboxWhen the web kept growing at an exponential pace, new companies and innovative business models sprouted up. On this blog, I have spoken at length about the innovation introduced by Google Business Model and why I believe this is what made it so successful.

The paradox though is that what seemed an innovative business model a few years back, it seems has become an accepted and standard business model today. Another paradox is that as those tech giants have taken it all, many business people assume that this is the way it was supposed to be.

When you think about the hidden revenue generation model of Google and Facebook through advertising. This model has worked exceptionally well in the internet era, as Google and Facebook could retain the ownership of the data generated by billions of users around the world.

Another business model would have been too difficult. That is also why managing this data from massive, centralized data centers makes sense.

The blockchain might change that, as it allows finally to control data at the decentralized level. Each user might be able to retain the ownership of the data, while the company will make money based on its protocol.

A few examples and use cases of Blockchain business modelsBelow a few examples of blockchain business models, as analyzed on FourWeekMBA by using the VBDE framework.

Ethereum Ethereum was launched in 2015 with its cryptocurrency, Ether, as an open-source, blockchain-based, decentralized platform software. Smart contracts are enabled, and Distributed Applications (dApps) get built without downtime or third-party disturbance. It also helps developers build and publish applications as it is also a programming language running on a blockchain.The Graph

Ethereum was launched in 2015 with its cryptocurrency, Ether, as an open-source, blockchain-based, decentralized platform software. Smart contracts are enabled, and Distributed Applications (dApps) get built without downtime or third-party disturbance. It also helps developers build and publish applications as it is also a programming language running on a blockchain.The Graph

The Graph is an ERC20 Utility Token (built on top of Ethereum) to enable consumers to freely query the blockchain through a fully decentralized database kept by indexers, incentivized by the payment of tokens (called GRT). The network is also ministered by curators and delegators that help maintain a high-quality index.Ripple

The Graph is an ERC20 Utility Token (built on top of Ethereum) to enable consumers to freely query the blockchain through a fully decentralized database kept by indexers, incentivized by the payment of tokens (called GRT). The network is also ministered by curators and delegators that help maintain a high-quality index.Ripple

In 2012, co-founders Christian Larsen and Jed McCaleb created Ripple, a technology acting as both a pre-mined cryptocurrency called XRP and a digital payment platform enabling monetary transactions. Where Ripple is the tech company, XRP is the decentralized ledger.Stellar

In 2012, co-founders Christian Larsen and Jed McCaleb created Ripple, a technology acting as both a pre-mined cryptocurrency called XRP and a digital payment platform enabling monetary transactions. Where Ripple is the tech company, XRP is the decentralized ledger.Stellar

In 2014, Jed McCaleb – which also played a key role in the development of Ripple – created a cryptocurrency to provide fast, reliable, and affordable money transactions. The same cryptocurrency has considerably grown seven years later. It is now one of the most stellar cryptocurrencies to provide a real-time platform that links banks, payment systems, and people. Meet, Stellar!Monero

In 2014, Jed McCaleb – which also played a key role in the development of Ripple – created a cryptocurrency to provide fast, reliable, and affordable money transactions. The same cryptocurrency has considerably grown seven years later. It is now one of the most stellar cryptocurrencies to provide a real-time platform that links banks, payment systems, and people. Meet, Stellar!Monero

Monero is one of the cryptocurrencies recognized for its privacy-oriented features. When it initially launched in April 2014, Monero was called BitMonero with the symbol XMR which translates to Esperanto.BitTorrent

Monero is one of the cryptocurrencies recognized for its privacy-oriented features. When it initially launched in April 2014, Monero was called BitMonero with the symbol XMR which translates to Esperanto.BitTorrent

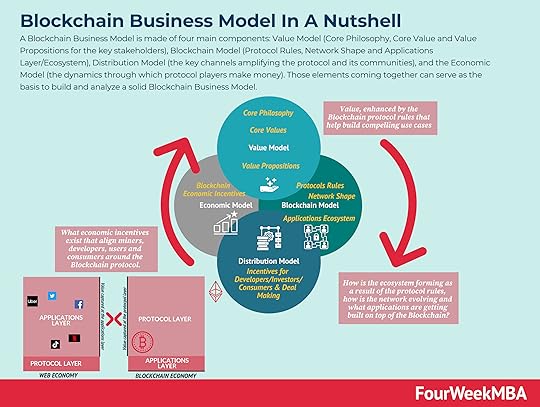

In early 2019, a joint project between TRON and BitTorrent Foundation called BitTorrent Token came to fruition. BitTorrent Token launched to tokenize in-demand file-sharing protocol and enhance content delivery and bandwidth accessibility with blockchain technology.Chainlink

In early 2019, a joint project between TRON and BitTorrent Foundation called BitTorrent Token came to fruition. BitTorrent Token launched to tokenize in-demand file-sharing protocol and enhance content delivery and bandwidth accessibility with blockchain technology.Chainlink

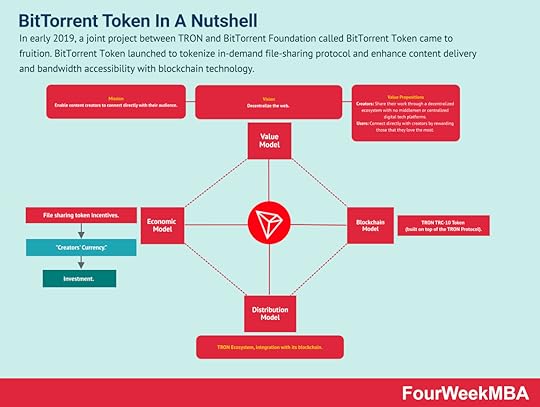

Chainlink is considered the most established decentralized oracle network. As an ecosystem housing several decentralized oracle networks running simultaneously. As a decentralized oracle service built on Ethereum, Chainlink has the power to support the development of blockchain solutions for both traditional businesses and enterprises.Uniswap

Chainlink is considered the most established decentralized oracle network. As an ecosystem housing several decentralized oracle networks running simultaneously. As a decentralized oracle service built on Ethereum, Chainlink has the power to support the development of blockchain solutions for both traditional businesses and enterprises.Uniswap

Uniswap is a renowned decentralized crypto exchange created in 2018 and based on the Ethereum blockchain, to provide liquidity to the system. As a cryptocurrency exchange technology that operates on a decentralized basis. The Uniswap protocol inherited its namesake from the business that created it — Uniswap. Through smart contracts, the Uniswap protocol automates transactions between cryptocurrency tokens on the Ethereum blockchain.Steem

Uniswap is a renowned decentralized crypto exchange created in 2018 and based on the Ethereum blockchain, to provide liquidity to the system. As a cryptocurrency exchange technology that operates on a decentralized basis. The Uniswap protocol inherited its namesake from the business that created it — Uniswap. Through smart contracts, the Uniswap protocol automates transactions between cryptocurrency tokens on the Ethereum blockchain.Steem

In a Blockchain Economy, a good chunk of value is at protocol level. Therefore, you will have a Blockchain Protocol (in this case Steem is the protocol) which has a set of underlying rules. The Steem protocol reaches consensus, and it follows a proof-of-stake (contrary to Bitcoin where there is a proof-of-value mechanism). On top of the Steem protocol, several applications can be freely built. Those applications will be decentralized, as they will be based on a decentralized network in the first place. In the Steem Blockchain context, Steemit is among the largest and most important (Steemit was the first application launched as a use case for the Steem Protocol).A key takeaway and the Blockchain “killer app”

In a Blockchain Economy, a good chunk of value is at protocol level. Therefore, you will have a Blockchain Protocol (in this case Steem is the protocol) which has a set of underlying rules. The Steem protocol reaches consensus, and it follows a proof-of-stake (contrary to Bitcoin where there is a proof-of-value mechanism). On top of the Steem protocol, several applications can be freely built. Those applications will be decentralized, as they will be based on a decentralized network in the first place. In the Steem Blockchain context, Steemit is among the largest and most important (Steemit was the first application launched as a use case for the Steem Protocol).A key takeaway and the Blockchain “killer app”What I find most striking of the new Blockchain protocols that are getting created is that those allow the experimentation of new business models that challenge the old ones created during the web era.

Those business models though might be skewed toward protocols, rather than apps! One thing is clear so far. The blockchain killer app is “decentralized trust.” Where tech companies have proved pretty bad in handling our data (see the Cambridge Analytica scandal).

You won’t have to trust anymore a central authority, driven by business incentives with your data. You will trust a mathematically driven decentralized network. Of course, we don’t have to fall into the “utopian trap” where we think innovation is better than existing ones.

The Blockchain Economy might also allow new centers of power. Also, existing tech companies (Facebook is one) are also investigating a potential way to integrate it into their existing business models!

Read Blockchain Business Models Book

Read Next: Blockchain Business Models Framework Decentralized Finance, Blockchain Economics, Bitcoin.

Read Also: Proof-of-stake, Proof-of-work, Blockchain, ERC-20, DAO, NFT.

Handpicked popular content from the site:

Business Strategy: Definition, Examples, And Case StudiesTypes of Business Models You Need to KnowWhat Is a Business Model Canvas? Business Model Canvas ExplainedThe Power of Google Business Model in a NutshellHow Does Google Make Money? It’s Not Just Advertising!How Does DuckDuckGo Make Money? DuckDuckGo Business Model ExplainedHow Does Twitter Make Money? Twitter Business Model In A NutshellHow Amazon Makes Money: Amazon Business Model in a NutshellHow Does Netflix Make Money? Netflix Business Model Explained

The post The Blockchain Business Models Complete Guide appeared first on FourWeekMBA.

What Is A Franchising Business Model? The Franchising Business Model

Franchising is a business model where the owner (franchisor) of a product, service, or method utilizes the distribution services of an affiliated dealer (franchisee). Usually, the franchisee pays a royalty to the franchisor to be using the brand, process, and product. And the franchisor instead supports the franchisee in starting up the activity and providing a set of services as part of the franchising agreement. Franchising models can be heavy-franchised, heavy-chained, or hybrid (franchained).

A business model or a growth strategy?As the story goes McDonald’s started to use a franchising model to grow its restaurant business, and it became over the 1960s a giant in the restaurant business (or real estate depending on the perspective).

McDonald’s leveraged the existing “Speedy Service System” developed by the McDonald’s brothers (what we would later call “fast food”) which was an incredible process development able to provide an improved product at a faster pace.

The speedy system itself represented the application of the manufacturing process to the restaurant business. Later another important building block was added.

The franchising model really became widely applied during the 1920s and 1930s in the restaurant business. As new physical communication networks (in the US the Interstate Highway System) enabled people to move long distances with their cars.

Later on, Ray Kroc would apply in its most aggressive form the franchising model (different formats already existed centuries before) to McDonald’s existing operation to create one of the most scalable restaurant businesses in the world.

But is franchising a business model, a revenue model, or a growth (expansion) strategy?

Well, franchising alone is just a distribution/growth/expansion strategy.

Yet, franchising combined with a product delivered differently (the “speedy system”) made up a whole new experience, that made it a new business model: the heavy franchised McDonald’s business model.

Therefore, as we’ll see throughout this research, franchising here is considered as a business model, as it embraces product, distribution, and growth, as a whole.

Understanding franchisingModern franchising, as conceived in today’s business world came as a bio-product of the incredible expansion of the restaurants’ chains business across the US, like the automobile, and the infrastructure of highways built around it also enabled people to travel distances to go to their favorite restaurants.

From there, especially after the 1950s, franchising was used as a great way for restaurants to expand their operations across the country. This model today, while has become a standard, it’s all but a unified model. In fact, as we’ll see several companies mastered it and tweaked it, to make it in line with their business philosophy, and growth model, and strategy.

When a business is looking for a cost-effective means of increasing market share or geographical reach, it may opt to franchise its product and brand name.

Franchising is essentially a joint venture between a franchisor and a franchisee. The franchisor is the original business that sells the rights to its name, idea, brand, or systems. The franchisee then buys these rights, which allows it to sell the franchisor’s goods and services under an existing trademark and business model.

The franchise business model itself is an attractive proposition for franchisees, particularly those wanting to leverage the brand equity of a franchisor in a highly competitive market. Franchising is thought to have originated in the United States, with the model first implemented by the Singer sewing machine company in the mid-19th century.

Today, some of the world’s leading fast-food restaurant companies utilize the franchise model. These include McDonald’s, Dairy Queen, Taco Bell, Dunkin’ Donuts, and Jimmy John’s Gourmet Sandwiches. In the United States alone, the franchising industry employs approximately 8.67 million people across more than 785,000 establishments.

Some of the key points to take into account when it comes to franchising:

Growth: franchisning can work for sure as a growth propeller as you can easily increment the speed of opening up new locations, by also reducing initial capital requirements, operational costs, and time to market. Control: while franchising is a great model to speed up operations and test new markets. It also comes with loss of control over product, brand and standards, when executed too fast. As we’ll see throughout this research, different franchising models have come up over the years to make up for the loss of control over speed (like McDonald’s land operations trying in franchisees and making them accountable for the company’s best practices). Speed: the speed of execution is defenitely one of the key advantage of the franchising model. And as the market widens up or shrinks, a franchising model can help the company adapt fast, as locations can be open or closed according to market trends. Product development: while franchising is a great model for increasing the growth of the business. It might also come at the expense of the product development. Imagine the case of a company only running franchised stores, who loses the understanding of the customer. Instead, as we’ll see franchising models have adapted also to leave a small percentage of owned stores, where the francihising company can experiment and test new product lines. Branding: also here, franchising can make or break a whole brand. And this all depends on whether the company has been able to balance out speed and ability of the franchisees to stick with the company’s standards and be true to the company’s mission. How a franchising agreements workLike any agreement between two parties, successful franchising depends on both companies demonstrating professional competence and acting in good faith.

To some extent, this can be facilitated by:

A code of conduct – which sets out how each party must act toward the other. Most codes outline disclosure requirements, a good faith obligation, a predetermined cooling-off period, dispute resolution mechanisms, and procedures for ending the agreement. Legislation – in addition to the code of conduct, franchise parties are also required to act in accordance with laws and regulations. In general terms, franchising agreements must operate within the bounds of fair work legislation, relevant tax laws, state licensing schemes, and anticompetitive conduct guidelines.As we’ll see franchising agreements will take different shapes, according to the franchising model the company operates.

The three main types of franchisingWithin the franchising model itself are three different types:

1 – Traditional franchisingIn traditional franchising, the franchisee sells products manufactured by the franchisor. This arrangement appears at first glance to be rather similar to a supplier-dealer relationship. However, this is not the case. The traditional franchise is more closely associated with the franchisor’s brand and generally receives more services than a dealer would from its supplier.

For example, The Coca-Cola Company manufactures and bottles soft drinks before selling them to franchisees. The Ford Motor Company offers regular maintenance and servicing for Ford vehicles bought at franchise dealerships.

2 – Business-format franchisingThe franchisee under this second model receives a complete system for delivering the product or service of the franchisor. The role of the franchisor is to define the business system and establish the brand standards, while the role of the franchisee is to manage its day-to-day activities within those systems and standards.

Dominoes doesn’t franchise pizza any more than McDonald’s franchises hamburgers. Both companies use business-format franchising to streamline the systems for delivering their branded products and services amongst franchisees.

3 – Social franchisingSocial franchising is the newest franchising type and is the application of business-format franchising techniques in the delivery of products and services to disadvantaged people.

Companies that engage in social franchising provide basic items such as drinking water, pharmaceutical drugs, and other items related to healthcare, education, sanitation, and energy. The franchising arrangement itself is often with a not-for-profit organization, religious institution, or government body.

Other types of franchising based on the FourWeekMBA researchBeyond the classic configuration and categorization of franchising business models, the FourWeekMBA research identified three main types of franchising models, mainly swinging between a model where most restaurants are owned (skewed toward a chain model) or a model where most restaurants are franchised, or a hybrid model.

Heavy-franchised business modelMcDonald’s follows what can be defined as a heavy-franchised business model.

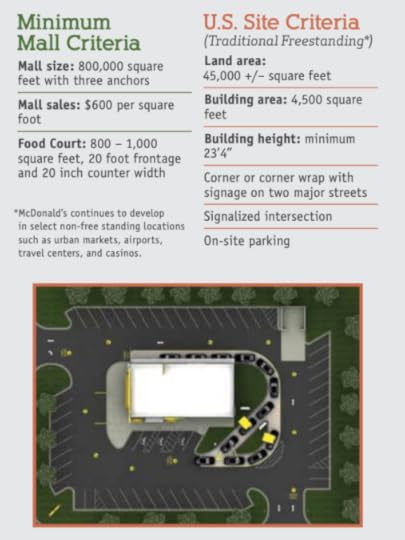

McDonald’s is a heavy-franchised business model. In 2018, of McDonald’s total restaurants, 93% were franchised. The long-term goal of the company is to transition toward 95% of franchised restaurants. The company’s operating income in 2018 was $8.8 billion compared to $9.55 in operating income for 2017.

McDonald’s is a heavy-franchised business model. In 2018, of McDonald’s total restaurants, 93% were franchised. The long-term goal of the company is to transition toward 95% of franchised restaurants. The company’s operating income in 2018 was $8.8 billion compared to $9.55 in operating income for 2017.Many have argued over the years that McDonald’s is more of a real estate company than a restaurant company. Why is it the case? While McDonald’s does use a heavy-franchise model, where most restaurants are franchised (McDonald’s keeps a low ratio of chain restaurants where it can also do product development and discovery, which then gets extended to its franchised restaurants), there is a twist.

McDonald’s secures the land or the rental contract of the land, therefore the franchisee, even if an “independent restaurateur” is locked into McDonald’s growth plan. Indeed, one of the risks of a franchising strategy is the loss of standards, especially related to product quality. To prevent that, McDonald’s controls the land, thus making sure that the franchisee is aligned with the product’s standards.

In addition, starting a McDonald’s franchising operation might be quite expensive, and it might require substantial experience. Therefore, this works as friction at the onset, which should motivate to open McDonald’s restaurants only for those who really have solid growth plans.

In fact, as McDonald’s highlights, an initial investment to open up a restaurant might range from $1,008,000 to $2,214,080 (including a $45,000 franchise fee) and at least half a million of liquidity available to be invested into the business.

Franchisee can’t go on and open a McDonald’s on its own, instead the land lease agreement has to go always thourhg the company. In fact, McDonald’s keeps them separated. On the one side, the land development process; on the other side, the franchisee selection and operations.

On the one hand, the company has a real estate arm dedicated to the selection of lands for developing new restaurants. As the company highlights:

McDonald’s looks for the best locations within the marketplace to provide our customers with convenience. We build quality restaurants in neighborhoods as well as airports, malls, tollways and colleges at a value to our customers.

Some of the key criteria for restaurant development are:

50,000+/- sq. ft.Corner or corner wrap with signage on two major streets.Signalized intersection.Ability to build up to 4,000 sq. ft.Parking to meet all applicable codes.Ability to build to a minimum height of 23′ 4″. Source: McDonald’s

Source: McDonald’sWhen it comes instead to the franchisees, McDonald’s offers a proven playbook and process to create a money-making restaurant machine.

To recap:

McDonald’s does use a heavy-franchised model. However, the company has tweaked the model to quickly expand its operations through franchising, while at the same time keeping control over standards followed by the franchisees, as McDonald’s operates as the landowner/operator. This tweak is extremely important as it helps balance out, the otherwise too aggressive franchising strategy, which is great for growth, but it might result in loss of control over process and product quality standards. For that, McDonald’s has created two separate operations’ arms: one is a real estate development unit, to develop the land for the restaurants; the other is the franchising operations to select franchisees and help them kick off operations.Heavy-chained business modelWhere McDonald’s has found a balance to quick expansion and opening of new franchising by owning the land where franchisees operate and by locking them in through contractual agreements, thus making sure they respect the best practices of the group. Other restaurant chains, like Chick-fil-A use the opposite model.

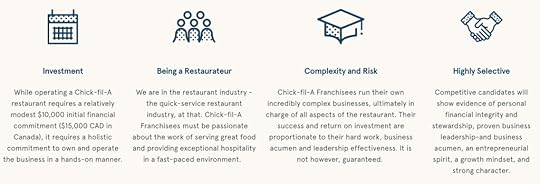

While growth in opening new locations is much slower in comparison to the fast pace. ofplayers like McDonald’s the focus is on making sure the store would be successful. In fact, the initial fee requested to franchisees is way lower compared to McDonald’s ($10,000 vs. $45,000):

While the entry fee is lower, operating a Chick-fil-A franchisees will have to pay a 15% royalty fee. As the company explains it the franchise disclosure document as 15% of franchised restaurant sales, less amounts charged to franchisees for equipment rentals and business services fees and 50% of net profits.

In short, the Chick-fil-A franchising model has the following features:

It doesn’t require a net worth, compared to other franchisng operations as McDonald’s, as its the company who undertakes the expenses to open up a new restaurant.The franchising fee (entry fee) is just $10,000, compared to for instance, the McDonald’s $45,000 fee. However, the franchisee has to pay 15% on the net sales, and 50% on the net sales. This makes sense as the franchisor and not the franchisee is the owner of the business, where the franchisee primarily operates the business. Therefore, the Chick-fil-A franchising operations, looks more like a chain-model, while it skewes its playbook in finding the right people to operate the business. In fact, of the applicants, only a tiny percentage of those make it up to become franchisees. Hybrid or franchained business modelThe Coca-Cola Company, has mastered a franchising model, which also works as a go-to-market strategy, which we defined franchained:

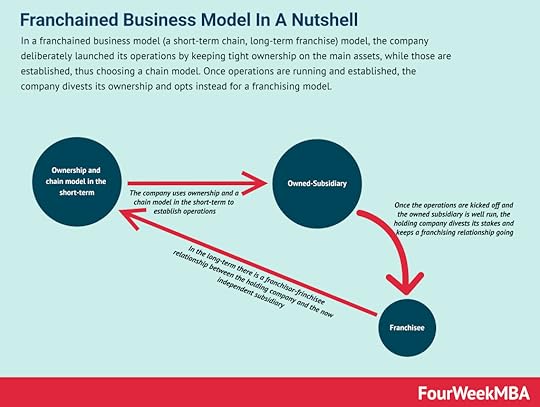

In a franchained business model (a short-term chain, long-term franchise) model, the company deliberately launched its operations by keeping tight ownership on the main assets, while those are established, thus choosing a chain model. Once operations are running and established, the company divests its ownership and opts instead for a franchising model.

In a franchained business model (a short-term chain, long-term franchise) model, the company deliberately launched its operations by keeping tight ownership on the main assets, while those are established, thus choosing a chain model. Once operations are running and established, the company divests its ownership and opts instead for a franchising model. As we highlighted in the Coca-Cola business model analysis:

Coca-Cola follows a business strategy (implemented since 2006) where through its operating arm – the Bottling Investment Group – it invests initially in bottling partners’ operations. As they take off, Coca-Cola divests its equity stakes, and it establishes a franchising model, as long-term growth and distribution strategy.

More precisely:

The Coca-Cola distribution system (source: Coca-Cola Company)

The Coca-Cola distribution system (source: Coca-Cola Company)While in the directly owned bottling facilities Coca-Cola sells directly, in the concentrate operations, independent bottling partners manage distribution. Therefore, Coca-Cola makes money by selling its concentrate to bottling partners (they must place a full order for the concentrate available in that territory as part of the bottling agreement).

As exemplified below, this is how the whole system works:

Coca-Cola follows a business strategy (implemented since 2006) where through its operating arm – the Bottling Investment Group – it invests initially in bottling partners operations. As they take off, Coca-Cola divests its equity stakes, and it establishes a franchising model, as long-term growth and distribution strategy.

Coca-Cola follows a business strategy (implemented since 2006) where through its operating arm – the Bottling Investment Group – it invests initially in bottling partners operations. As they take off, Coca-Cola divests its equity stakes, and it establishes a franchising model, as long-term growth and distribution strategy.An opposite scenario might be that of using the franchising model in the short-term to test whether new markets are profitable, by reducing the operational costs required to open new units, and by speeding up the growth while internalizing them in the long run, if they turn out to be successful and strategic for the company.

This will work as a reverse franchained model.

In a reverse franchained business model, the franchising company can leverage franchising to test whether new markets are profitable, by reducing the operational costs required to open new units, and by speeding up the growth while internalizing them in the long run, if they turn out to be successful and strategic for the company by making it easy and convenient for franchisees to sell back the operations. Key takeawaysFranchising is a business model where the owner (franchisor) of a product, service, or method utilizes the distribution services of an affiliated dealer (franchisee). While most associate franchising with fast-food chains, the model can be traced back to the Singer sewing machine company.Franchising as a business model can be split into three types: traditional, business-format, and social. Most franchising agreements in place today are business-format agreements.Franchising is only successful if both parties act professionally and behave appropriately. This means following guidelines set out in a formal code of conduct or any applicable legislation.Franchising models recapIn a heavy-franchising model like McDonald’s the initial fee, the investment to open up a restaurant and the net worth required to operate the business are quite high. To keep the standards high, McDonald’s has a dedicated arm, which is in charge of land development, and that controls the rental agreement with the franchisees. The franchisees, in turn, own the business and they will pay royalties to the company.In a heavy-chained model, like Chick-fil-A, the initial fee to open up a restaurant, the net worth required to operate and the overall investment required is much smaller. Indeed, the company owns the whole operation, and it accepts applications from thousands of potential franchisees each year. In this franchising model, therefore, the growth of opening new restaurants is much slower compared to the heavy-franchised model. However, the company makes much more money from the franchising operations, as it gets high royalties as a percentage of sales and it also splits profits with franchisees. De facto, in this model the franchisee is more like a high-profile manager than the owner of the business. And in part, this is justified by the fact, that Chick-fil-A bears the costs of opening up these restaurants. In a hybrid model, or what we defined franchained, a company can leverage on a chain model in the short-term and unleash the franchising model, once the operations have been established. The Coca-Cola Company leverages this model to establish new operations. An opposite scenario might be that of using the franchising model in the short-term to test whether new markets are profitable, by reducing the operational costs required to open new units, and by speeding up the growth while internalizing them in the long run, if they turn out to be successful and strategic for the company. Connected Case Studies

In a reverse franchained business model, the franchising company can leverage franchising to test whether new markets are profitable, by reducing the operational costs required to open new units, and by speeding up the growth while internalizing them in the long run, if they turn out to be successful and strategic for the company by making it easy and convenient for franchisees to sell back the operations. Key takeawaysFranchising is a business model where the owner (franchisor) of a product, service, or method utilizes the distribution services of an affiliated dealer (franchisee). While most associate franchising with fast-food chains, the model can be traced back to the Singer sewing machine company.Franchising as a business model can be split into three types: traditional, business-format, and social. Most franchising agreements in place today are business-format agreements.Franchising is only successful if both parties act professionally and behave appropriately. This means following guidelines set out in a formal code of conduct or any applicable legislation.Franchising models recapIn a heavy-franchising model like McDonald’s the initial fee, the investment to open up a restaurant and the net worth required to operate the business are quite high. To keep the standards high, McDonald’s has a dedicated arm, which is in charge of land development, and that controls the rental agreement with the franchisees. The franchisees, in turn, own the business and they will pay royalties to the company.In a heavy-chained model, like Chick-fil-A, the initial fee to open up a restaurant, the net worth required to operate and the overall investment required is much smaller. Indeed, the company owns the whole operation, and it accepts applications from thousands of potential franchisees each year. In this franchising model, therefore, the growth of opening new restaurants is much slower compared to the heavy-franchised model. However, the company makes much more money from the franchising operations, as it gets high royalties as a percentage of sales and it also splits profits with franchisees. De facto, in this model the franchisee is more like a high-profile manager than the owner of the business. And in part, this is justified by the fact, that Chick-fil-A bears the costs of opening up these restaurants. In a hybrid model, or what we defined franchained, a company can leverage on a chain model in the short-term and unleash the franchising model, once the operations have been established. The Coca-Cola Company leverages this model to establish new operations. An opposite scenario might be that of using the franchising model in the short-term to test whether new markets are profitable, by reducing the operational costs required to open new units, and by speeding up the growth while internalizing them in the long run, if they turn out to be successful and strategic for the company. Connected Case Studies McDonald’s is a heavy-franchised business model. In 2018, of McDonald’s total restaurants, 93% were franchised. The long-term goal of the company is to transition toward 95% of franchised restaurants. The company’s operating income in 2018 was $8.8 billion compared to $9.55 in operating income for 2017.

McDonald’s is a heavy-franchised business model. In 2018, of McDonald’s total restaurants, 93% were franchised. The long-term goal of the company is to transition toward 95% of franchised restaurants. The company’s operating income in 2018 was $8.8 billion compared to $9.55 in operating income for 2017. Starbucks is a retail company that sells beverages (primarily consisting of coffee-related drinks) and food. In 2018, Starbucks had 52% of company-operated stores vs. 48% of licensed stores. The revenues for company-operated stores accounted for 80% of total revenues, thus making Starbucks a chain business model.

Starbucks is a retail company that sells beverages (primarily consisting of coffee-related drinks) and food. In 2018, Starbucks had 52% of company-operated stores vs. 48% of licensed stores. The revenues for company-operated stores accounted for 80% of total revenues, thus making Starbucks a chain business model.  IKEA, as a brand comprising two separate owners. INGKA Holding B.V. owns IKEA Group, the holding of the group. At the same time, that is held by the Stichting INGKA Foundation, which is the owner of the whole Group. Thus, IKEA Group is a franchisee that pays 3% royalties to Inter IKEA Systems.