Gennaro Cuofano's Blog, page 112

March 2, 2022

What Is The GROW Model? The GROW Model In A Nutshell

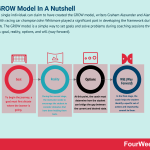

Though no single individual can claim to have created the GROW model, writers Graham Alexander and Alan Fine together with racing car champion John Whitmore played a significant part in developing the framework during the 80s and 90s. The GROW model is a simple way to set goals and solve problems during coaching sessions through four stages: goal, reality, options, and will (way forward).

Understanding the GROW modelThe GROW model helps leaders and managers develop their subordinates or institute behavioral change. Through feedback and positive reinforcement, the simple-to-use model encourages the learner to bridge the gap between their current state and a desired, future state.

Such is the success of the coaching framework that it forms the basis of similar approaches such as the ACHIEVE model and A3 problem-solving.

The four stages of a GROW model coaching sessionGROW is an acronym of four stages the teacher must guide the learner through in a conversation. Collectively, the stages signify a metaphorical journey:

Stage 1 – GoalTo begin the journey, a goal must first dictate where the learner is going. These include short-term goals for every session and longer-term goals that define central themes.

Clarity on goal setting can be enhanced by asking:

What is important to the learner with respect to the overarching theme?What will reaching the goal give them or enable them to do?How will they know when the goal has been achieved? Alternatively, how will they know when the problem has been solved?Stage 2 – RealityDuring the second stage, the instructor needs to encourage the student to consider obstacles that have been holding them back. This phase is important because it can unearth hidden fears or convictions the student may have been unable to previously verbalize. Furthermore, cognitive biases can be debunked using objective evidence or feedback.

Exploratory questions include:

What is happening (to the learner) now?What, when, with whom, and how often?Why is the theme a problem? Include concrete examples as supporting evidence.Is the theme continually a problem, or are there situations where the learner succeeds?What are the defining factors? That is, what are the factors capable of making a difference?Stage 3 – OptionsAt this point, the coach must determine how the student can bridge the gap between the current and desired state. Students ought to be encouraged to think positively about their goals and list multiple ways for achieving them.

In other words:

What options does the learner have?Who could help them achieve their goals?How can they become enthused or motivated to achieve their goals?What might their friends, colleagues, superiors, or significant other suggest?Stage 4 – Will (Way Forward)In the final stage, the coach helps the student identify a specific set of actions and importantly, commit to them. Commitment and success can be increased by the pair working together to accommodate busy schedules or make the tasks more exciting and engaging. Ideally, the student should leave every session with at least one goal.

Stage 4 questions can be adapted from those asked in the previous stage. That is, the teacher can ask the student what they will do instead of what they could do.

Other helpful conversation starters include:

What could the learner do as a first step to get the ball rolling?What actions are non-negotiable and need to be taken?How does the learner feel about their actions? What would it take to get excited?How might commitment be measured and monitored? How will the commitment be maintained during periods of low motivation or distraction?What are three things the learner is willing to do to support themselves?How would they like to be held accountable for their actions?How might the learners sabotage themselves, unintentionally or otherwise?GROW coaching model examplesIn the introduction, we mentioned that the GROW coaching model was used as a personal development tool for subordinates in collaboration with their superiors. In truth, however, the model can be used in many other contexts. Some of these are listed in this section.

Individual goalsThe model can be used by individuals outside the workplace to explore their motivation towards more private goals. For example, someone who has difficulty saving money may use it to help them become enthused and motivated enough to save for a new house.

Similarly, an individual who has made numerous attempts to lose weight in the past can use the GROW model to commit to an exercise plan and overcome certain self-imposed obstacles.

Groups and teamsThe model also works for groups and teams and helps, whether that be teams of employees in an office or a team of professional sports players. Whatever the context, it is very simple to adapt the individual-centric nature of the GROW model to multiple individuals.

This builds teamwork, collaboration, and improves morale since each member is striving toward the same goal and understands their role in helping the team achieve that goal.

Parents and teachersWhile teachers must earn various forms of accreditation before they are qualified, parents often find themselves looking after their children with very little experience in coaching or assisting them in realizing their potential.

To help children identify their values and strive toward meaningful goals, parents can use the GROW model in conjunction with the Socratic questioning technique. This is a form of guided inquiry that encourages parents to ask questions without a personal agenda. Socratic questioning can also be used by teachers in the classroom to better understand their students’ perspectives.

GROW coaching model adaptationsTwo further examples of the CROW coaching model can be provided by looking at how the original model has been adapted.

TGROW modelThe TGROW model is very similar to the GROW model but with one key difference. Before the coachee identifies where they are heading in the goal stage, they are first called upon to define a broad topic (T) they would like to address.

This initial phase is important because it enables the coachee and indeed the coacher to better understand the scale of the topic and why it is important to the coachee’s long-term vision. In some instances, unrelated issues may surface that the coachee did not anticipate and the focus of the entire process may be adapted to suit.

GROWTH modelThe GROWTH model adds Tactics (T) and Habits (H) to the standard GROW model. As you may have guessed, these extra steps increase the likelihood of goal attainment.

Tactics deal with the specific steps the client will need to undertake while habits clarify how success will be maintained and help the coachee avoid complacency. In the best-case scenario, tactics and habits increase buy-in and commitment as the resultant plan is specific, precise, and clarifies incremental actions that help the coachee stay on track.

Key takeaways:The GROW model is a simple yet reflective way for students to set goals and solve problems during coaching sessions.The GROW model is used by managerial staff to develop subordinates and institute behavioral change through positive reinforcement.The GROW model is based on four stages that comprise a metaphorical journey of learning: goal, reality, options, and will. Each works together to help the student determine their future desired state, plan how they will get there, and navigate obstacles.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelThe post What Is The GROW Model? The GROW Model In A Nutshell appeared first on FourWeekMBA.

What happened to Hotmail?

Hotmail was an email service that was launched in 1996 by Sabeer Bhatia and Jack Smith and was one of the first such services on the internet. It was a revolutionary product at a time when users were forced to use email addresses provided by their ISP. What’s more, Hotmail’s inbox was marketed as freely accessible from anywhere in the world provided there was an internet connection. With a sizeable 2MB storage limit, Hotmail was an instant hit with users. The service attracted over 100,000 users in the first month with around 8.5 million by the end of 1997. Despite the overwhelming success of the platform, however, the Hotmail brand was officially retired in October 2011.

Microsoft acquisitionThe near-instant success of Hotmail in 1997 had not gone unnoticed. When Hotmail reached 10 million subscribers and controlled around 25% of the webmail market, the company entered into talks with Microsoft over a possible acquisition.

Bhatia was initially wary of Microsoft’s intentions because of a prevailing industry belief that the company was monopolistic. But in the end, Bhatia was not afraid of being perceived as just another Microsoft victim and considered the deal as validation of his and Smith’s vision.

Money may also have been a motivating factor. When Microsoft acquired Hotmail for $400 million, the co-founders became millionaires.

MSN HotmailPost-acquisition, Hotmail was incorporated under the MSN banner and customized for various markets around the world. In early 1999, the service was adding as many as 150,000 users per day as email became the predominant form of online communication.

With few serious competitors and a fast, free, and intuitive interface, Hotmail had no difficulty surpassing 30 million users before the turn of the millennium.

Security issuesHowever, in 1999, hackers exploited a vulnerability in Hotmail and noted that a user’s private emails could be accessed by entering the password “eh”. Microsoft played down the issue, but Wired called it the most widespread security issue on the web to date.

Two years later, it was discovered that users could access someone else’s account by creating a URL with that account’s username and a valid message number. The number itself could be discovered using software that brute-force guessed the correct sequence.

In addition to the browser wars with Netscape and an impending anticompetitive lawsuit, these security issues distracted Microsoft from a new entrant that was about to emerge.

GmailGoogle’s Gmail launched in 2004 with 1 GB of free storage which made Hotmail’s 2 MB instantly uncompetitive. Microsoft eventually upped the limit to 250 MB, but Google had gained critical early momentum which would prove impossible to arrest.

MSN Hotmail became Windows Live Hotmail in 2007 with subsequent improvements in speed and security implemented over the next few years. However, it took three years for the service to roll out of beta and several more for it to be fully functional. This no doubt helped Gmail start to be considered the preferred email provider.

Migration to OutlookAs we noted in the introduction, the Hotmail name was retired in October 2011. Microsoft believed Hotmail had earned a poor reputation because of its association with hackers and spammers – particularly among the younger and more tech-savvy generation that was starting to become influential at the end of the 2000s decade.

The beta version of Outlook was launched in July 2012 with a cleaner and more modern interface. Hotmail users were given the chance to keep the @hotmail.com extension or use @outlook.com instead.

In May of 2013, Microsoft successfully migrated 300 million active Hotmail users to Outlook.com. Over 150 petabytes of data were added to Outlook’s servers over a period of six weeks. Two years later, Outlook was incorporated into the Office 365 infrastructure.

Today, Hotmail users can still use the @hotmail.com extension to send and receive emails using the Outlook platform if they so prefer.

Key takeaways:Hotmail was an email service that was launched in 1996 by Sabeer Bhatia and Jack Smith and was one of the first such services on the internet. It was a revolutionary product at a time when users were forced to use an email address provided by their ISP. Hotmail secured 10 million users in little more than a year before it was acquired by Microsoft. The platform continued to be popular until security issues and slow beta development caused Hotmail to become less attractive. When Gmail was launched in 2004, it gained critical early momentum that was never arrested.The Hotmail brand was officially retired in 2011 because Microsoft believed a name change would restore some of the reputational damage that had been inflicted by hackers and spammers. Today, Hotmail users can still use the @hotmail.com extension in Outlook.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to Hotmail? appeared first on FourWeekMBA.

March 1, 2022

What happened to Sean Parker?

Sean Parker is an American entrepreneur whom most associate with the music-sharing platform Napster. Parker founded Napster with childhood friend Shawn Fanning and the service was launched in June 1999 while the pair were still teenagers. Napster’s ultimate demise in 2001 is well documented. Parker was forced to step down as Facebook president in 2005 after an arrest for drug possession in North Carolina, but he nonetheless retained a significant shareholding and informal involvement with the company. He then worked with Peter Thiel at his venture capital firm for a time and then moved into philanthropic efforts.

PlaxoParker founded address book and social networking service Plaxo in 2002. The service, which was integrated with Microsoft Outlook, was a forerunner to companies such as Facebook, Zynga, and LinkedIn. It was also one of the first companies to incorporate viral marketing into a product launch, securing 5 million users in the first three years of operation.

Parker was fired from his own company just two years later by Sequoia Capital and Indian-American investor Ram Shriram. The reasons for his ousting have never been fully disclosed. Some posit that it was due to the dot-com bubble downturn, while others believe Parker had a sporadic or erratic interest in Plaxo itself.

FacebookWhatever the reasons for his exit, Parker maintained an interest in social networking and joined a fledgling company called Facebook later in 2004. The company was in those days confined to college students, but as the social platform’s founding president, Parker was one of the main drivers of transforming Facebook into a viable company.

For example, he hired former Napster employee Aaron Sittig to design the Facebook website that most recognize today. He was also responsible for working hard to purchase the Facebook.com domain name and secured Peter Thiel as the company’s first investor.

Parker was forced to step down as Facebook president in 2005 after an arrest for drug possession in North Carolina. He retained a minority stake in Facebook that was worth hundreds of millions of dollars and continued to be informally involved with the company.

Founders FundParker then joined the venture capital firm Founders Fund as a managing partner. There he once more crossed paths with co-founder Peter Thiel, who afforded Parker free reign to invest in any company he saw fit.

Parker stepped down from his role in 2014 to focus on other projects. During his tenure at the company, he made a $15 million investment in Spotify because of a personal desire to see Napster’s music-sharing heritage continue.

PhilanthropyThe Parker Foundation was then established in June 2015, with Parker himself making a $600 million donation to the philanthropic organization that focuses on the areas of art, civic engagement, public health, and life sciences.

He donated a further $250 million to the Parker Institute for Cancer Immunotherapy in April 2016, with the funds disbursed to over 300 scientists across 40 laboratories. The institute has recently found a link between skin cancer and microbial diversity in the gut and has conducted immunotherapy clinical trials for melanoma patients.

Key takeaways:Sean Parker is an American entrepreneur whom most associate with the music-sharing platform Napster. After Napster was shut down, he founded address book and social networking service Plaxo in 2002.Parker then became the founding president of Facebook in 2004 after an acrimonious departure from Plaxo. He was instrumental in transitioning the young social media platform into a viable company.Parker was forced to step down as Facebook president in 2005 after an arrest for drug possession in North Carolina, but he nonetheless retained a significant shareholding and informal involvement with the company. He then worked with Peter Thiel at his venture capital firm for a time and then moved into philanthropic efforts.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to Sean Parker? appeared first on FourWeekMBA.

What Is The Dunning-Kruger effect In Business

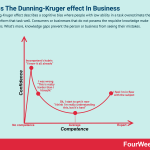

The Dunning-Kruger effect describes a cognitive bias where people with low ability in a task overestimate their ability to perform that task well. Consumers or businesses that do not possess the requisite knowledge make bad decisions. What’s more, knowledge gaps prevent the person or business from seeing their mistakes.

Understanding the Dunning-Kruger effectThe Dunning-Kruger effect was first coined by psychologists David Dunning and Justin Kruger in 1999. They argued that the scope of a person’s ignorance is often invisible to them – particularly in fields where they are underqualified. Dunning and Kruger called this meta-ignorance, or ignorance of ignorance, which can lead to individuals overestimating their abilities.

This ignorance also extends to other people. A person who is ignorant of their shortcomings may simultaneously believe their ability is superior to others. This is in direct contrast to a person with true ability in their chosen field. With increased knowledge, they are humbled by how much they are yet to learn. Indeed, the only way that an ignorant person will acknowledge their lack of ability is when they are alerted to the fact through education.

The Dunning-Kruger effect in businessThe Dunning-Kruger effect can also affect businesses, particularly when new products or concepts are introduced into the market. For example, the introduction of digital currency and blockchain technology resulted in the rapid formation of many new entrepreneurial companies. Unfortunately, many lacked the required knowledge and awareness to understand their mistakes before they impacted their viability.

This initial overconfidence can also affect businesses that are unwilling to take the educated advice of other professionals. Legal representation, accounting, and financial planning are tasks that some businesses attempt to save money on because they genuinely believe they have the required skills. Of course, the consequences of doing so are often financially disastrous.

Addressing the Dunning-Kruger effect in practiceSince individuals and businesses are largely ignorant of the Dunning-Kruger effect, it can be helpful to pause and reflect during day-to-day decision-making. The following points may help stop the effect before it inflicts further damage.

Evaluate all company processes critically. In other words, is there a better, more efficient, or more economical way of doing things? Would a change in supply chain management yield higher profits? What about a change in payroll systems?Consider workplace culture. Managers should put themselves in their employee’s shoes and assess what kind of leadership they provide. Are they approachable, reasonable, fair, and open to solving problems? Would a leadership course broaden their leadership skills?Evaluate the business-to-consumer relationship. Businesses should ask themselves what they are like to work with from the customer’s perspective. Is online and offline communication professional and attentive? Does the business listen to and implement customer recommendations?Ultimately, the Dunning-Kruger effect can be overcome with humility and critical thinking. Businesses and individuals who challenge their assumptions will at worst come away better equipped to improve themselves and their processes.

Dunning-Kruger effect examplesHere are some more examples of the Dunning-Kruger effect in action.

LeadershipEarlier we noted that the effect caused some individuals to believe their performance was superior to others when the opposite was true. This tends to be most associated with one or two employees in a work environment who believe they are better than everyone else.

However, the effect can also impact leadership and cause those in senior positions to misjudge employee performance or their ability to lead. Indeed, in a University of Nebraska study, it was found that 68% of the faculty rated themselves in the top 25% in terms of teaching ability while 90% believed their ability was above average. These mathematical impossibilities demonstrate the power and prevalence of the Dunning-Kruger effect.

Consumer financeConsumers also tend to overestimate their financial nous and ignore obvious discrepancies between their actual and perceived financial performance.

In a National Financial Capability Study conducted in 2012, the United States Treasury found that 23% of the 25,000 participants were recently declared bankrupts who believed they possessed superior financial knowledge.

ProductivityThe Dunning-Kruger effect also impacts employee productivity. Some individuals create daily task lists that are beyond their capabilities and cannot possibly be completed in a single day.

This is caused by the employee overestimating their abilities with a general belief that they need less time to finish their tasks than they actually do. Productivity then decreases as they become disheartened and overwhelmed by their perceived predicament.

Emotional intelligenceVarious studies have also investigated the link between emotional intelligence and the Dunning-Kruger effect. In a 2013 study published in the Journal of Applied Psychology, Dunning together with Oliver J. Sheldon and Daniel R. Ames analyzed emotional intelligence across three studies involving professional students.

The researchers found that the least-skilled students had limited knowledge of deficits in their performance. They were also the most likely to criticize the accuracy or relevance of feedback that could help them improve. The top performers in the studies were the individuals most motivated to improve their emotional intelligence after receiving feedback.

Humour, logical reasoning, and English grammarDunning’s original study in 1999 focused on 84 Cornell University students and how they perceived their abilities in humor, logical reasoning, and English grammar.

To assess grammar ability, for example, the students completed a test to assess their knowledge of American Standard Written English (AWSE). Those who scored lowest tended to overestimate their ability to use grammar correctly. They also overestimated their final test score. On the other hand, those who scored the highest in the grammar test tended to underestimate their ability and test score. These results, as we have learned in the prior examples, have been replicated many times over subsequent years.

Key takeaways:The Dunning-Kruger Effect describes the phenomenon in which low competence individuals or businesses cannot recognize such incompetence.A core component of the Dunning-Kruger effect is meta-ignorance, or ignorance of one’s ignorance. This leads to an overestimation of ability and in some cases, an underestimation of the abilities of others.Critical thinking with the goal of improving is the best way to overcome the Dunning-Kruger effect.Connected Business FrameworksAnsoff Matrix You can use the Ansoff Matrix as a strategic framework to understand what growth strategy is more suited based on the market context. Developed by mathematician and business manager Igor Ansoff, it assumes a growth strategy can be derived by whether the market is new or existing, and the product is new or existing.Five Product Levels

You can use the Ansoff Matrix as a strategic framework to understand what growth strategy is more suited based on the market context. Developed by mathematician and business manager Igor Ansoff, it assumes a growth strategy can be derived by whether the market is new or existing, and the product is new or existing.Five Product Levels Marketing consultant Philip Kotler developed the Five Product Levels model. He asserted that a product was not just a physical object but also something that satisfied a wide range of consumer needs. According to that Kotler identified five types of products: core product, generic product, expected product, augmented product, and potential product.Growth-Share Matrix

Marketing consultant Philip Kotler developed the Five Product Levels model. He asserted that a product was not just a physical object but also something that satisfied a wide range of consumer needs. According to that Kotler identified five types of products: core product, generic product, expected product, augmented product, and potential product.Growth-Share Matrix In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.Read also: Business Strategy, Examples, Case Studies, And ToolsAnsoff Matrix

In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.Read also: Business Strategy, Examples, Case Studies, And ToolsAnsoff Matrix You can use the Ansoff Matrix as a strategic framework to understand what growth strategy is more suited based on the market context. Developed by mathematician and business manager Igor Ansoff, it assumes a growth strategy can be derived by whether the market is new or existing, and the product is new or existing.Blitzscaling Canvas

You can use the Ansoff Matrix as a strategic framework to understand what growth strategy is more suited based on the market context. Developed by mathematician and business manager Igor Ansoff, it assumes a growth strategy can be derived by whether the market is new or existing, and the product is new or existing.Blitzscaling Canvas The Blitzscaling business model canvas is a model based on the concept of Blitzscaling, which is a particular process of massive growth under uncertainty, and that prioritizes speed over efficiency and focuses on market domination to create a first-scaler advantage in a scenario of uncertainty.Business Analysis Framework

The Blitzscaling business model canvas is a model based on the concept of Blitzscaling, which is a particular process of massive growth under uncertainty, and that prioritizes speed over efficiency and focuses on market domination to create a first-scaler advantage in a scenario of uncertainty.Business Analysis Framework Business analysis is a research discipline that helps driving change within an organization by identifying the key elements and processes that drive value. Business analysis can also be used in Identifying new business opportunities or how to take advantage of existing business opportunities to grow your business in the marketplace.Gap Analysis

Business analysis is a research discipline that helps driving change within an organization by identifying the key elements and processes that drive value. Business analysis can also be used in Identifying new business opportunities or how to take advantage of existing business opportunities to grow your business in the marketplace.Gap Analysis A gap analysis helps an organization assess its alignment with strategic objectives to determine whether the current execution is in line with the company’s mission and long-term vision. Gap analyses then help reach a target performance by assisting organizations to use their resources better. A good gap analysis is a powerful tool to improve execution.Business Model Canvas

A gap analysis helps an organization assess its alignment with strategic objectives to determine whether the current execution is in line with the company’s mission and long-term vision. Gap analyses then help reach a target performance by assisting organizations to use their resources better. A good gap analysis is a powerful tool to improve execution.Business Model Canvas The business model canvas is a framework proposed by Alexander Osterwalder and Yves Pigneur in Busines Model Generation enabling the design of business models through nine building blocks comprising: key partners, key activities, value propositions, customer relationships, customer segments, critical resources, channels, cost structure, and revenue streams.Lean Startup Canvas

The business model canvas is a framework proposed by Alexander Osterwalder and Yves Pigneur in Busines Model Generation enabling the design of business models through nine building blocks comprising: key partners, key activities, value propositions, customer relationships, customer segments, critical resources, channels, cost structure, and revenue streams.Lean Startup Canvas The lean startup canvas is an adaptation by Ash Maurya of the business model canvas by Alexander Osterwalder, which adds a layer that focuses on problems, solutions, key metrics, unfair advantage based, and a unique value proposition. Thus, starting from mastering the problem rather than the solution.Digital Marketing Circle

The lean startup canvas is an adaptation by Ash Maurya of the business model canvas by Alexander Osterwalder, which adds a layer that focuses on problems, solutions, key metrics, unfair advantage based, and a unique value proposition. Thus, starting from mastering the problem rather than the solution.Digital Marketing Circle A digital channel is a marketing channel, part of a distribution strategy, helping an organization to reach its potential customers via electronic means. There are several digital marketing channels, usually divided into organic and paid channels. Some organic channels are SEO, SMO, email marketing. And some paid channels comprise SEM, SMM, and display advertising.Blue Ocean Strategy

A digital channel is a marketing channel, part of a distribution strategy, helping an organization to reach its potential customers via electronic means. There are several digital marketing channels, usually divided into organic and paid channels. Some organic channels are SEO, SMO, email marketing. And some paid channels comprise SEM, SMM, and display advertising.Blue Ocean Strategy A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost-value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers.Balanced Scorecard

A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost-value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers.Balanced Scorecard

First proposed by accounting academic Robert Kaplan, the balanced scorecard is a management system that allows an organization to focus on big-picture strategic goals. The four perspectives of the balanced scorecard include financial, customer, business process, and organizational capacity. From there, according to the balanced scorecard, it’s possible to have a holistic view of the business.

First proposed by accounting academic Robert Kaplan, the balanced scorecard is a management system that allows an organization to focus on big-picture strategic goals. The four perspectives of the balanced scorecard include financial, customer, business process, and organizational capacity. From there, according to the balanced scorecard, it’s possible to have a holistic view of the business.Read: Balanced Scorecard

PEST Analysis The PESTEL analysis is a framework that can help marketers assess whether macro-economic factors are affecting an organization. This is a critical step that helps organizations identify potential threats and weaknesses that can be used in other frameworks such as SWOT or to gain a broader and better understanding of the overall marketing environment.

The PESTEL analysis is a framework that can help marketers assess whether macro-economic factors are affecting an organization. This is a critical step that helps organizations identify potential threats and weaknesses that can be used in other frameworks such as SWOT or to gain a broader and better understanding of the overall marketing environment.Read: Pestel Analysis

Scenario Planning Businesses use scenario planning to make assumptions on future events and how their respective business environments may change in response to those future events. Therefore, scenario planning identifies specific uncertainties – or different realities and how they might affect future business operations. Scenario planning attempts at better strategic decision making by avoiding two pitfalls: underprediction, and overprediction.

Businesses use scenario planning to make assumptions on future events and how their respective business environments may change in response to those future events. Therefore, scenario planning identifies specific uncertainties – or different realities and how they might affect future business operations. Scenario planning attempts at better strategic decision making by avoiding two pitfalls: underprediction, and overprediction.Read: Scenario Planning

SWOT Analysis A SWOT Analysis is a framework used for evaluating the business’s Strengths, Weaknesses, Opportunities, and Threats. It can aid in identifying the problematic areas of your business so that you can maximize your opportunities. It will also alert you to the challenges your organization might face in the future.

A SWOT Analysis is a framework used for evaluating the business’s Strengths, Weaknesses, Opportunities, and Threats. It can aid in identifying the problematic areas of your business so that you can maximize your opportunities. It will also alert you to the challenges your organization might face in the future.Read: SWOT Analysis In A Nutshell

Growth Matrix In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling whole new problems for new customers (reinvent mode).

In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling whole new problems for new customers (reinvent mode).Read: Growth Matrix In A Nutshell

Comparable Analysis Framework A comparable company analysis is a process that enables the identification of similar organizations to be used as a comparison to understand the business and financial performance of the target company. To find comparables you can look at two key profiles: the business and financial profile. From the comparable company analysis it is possible to understand the competitive landscape of the target organization.

A comparable company analysis is a process that enables the identification of similar organizations to be used as a comparison to understand the business and financial performance of the target company. To find comparables you can look at two key profiles: the business and financial profile. From the comparable company analysis it is possible to understand the competitive landscape of the target organization.Read: Comparable Analysis Framework In A Nutshell

Learn also:

Bounded RationalityWhat Are BiasesLear more:

Types of Business Models You Need to KnowBusiness Strategy: Definition, Examples, And Case StudiesMarketing Strategy: Definition, Types, And ExamplesPlatform Business Models In A NutshellNetwork Effects In A NutshellGross Margin In A NutshellThe post What Is The Dunning-Kruger effect In Business appeared first on FourWeekMBA.

Cost Structure Business Model Canvas

The Cost Structure building block of the Business Model Canvas details the monetary cost of operating as a business. Cost structure represents all the costs a business will incur under a specific business model, especially those costs to maintain the key resources that make up the core business model.

Understanding cost structure in the Business Model CanvasThis is an important building block in the BMC, with 90% of businesses failing in under three years because they underestimate the cost of creating the goods and services outlined in their value proposition.

Operational costs encompass expenditure related to employees, infrastructure, activities, and partnerships. These costs are defined by three other BMC building blocks: value proposition, revenue streams, and long-term customer relationships. To gain clarity on the exact cost structure, however, it is important businesses also detail key resources, activities, and partnerships.

These are a few of the questions a business must consider when creating its cost structure:

What are the fundamental costs of the business model?Which key activities cost the most to perform? Which key resources cost the most to perform?How do the key activities drive costs?Are key activities matched to the value proposition?Do costs become variable or remain fixed by considering other structures?Cost structure typesWhile minimizing cost is fundamental to good business, organizations nonetheless employ different cost structure strategies. Some are on a dogged mission to reduce costs as much as possible, while others pride themselves on their luxury or bespoke product ranges. In truth, most organizations are somewhere in between.

Various strategies occupy opposite ends of a cost structure spectrum, with a cost-driven structure at one end and a value-driven structure at the other.

With all that said, let’s take a look at both types in more detail:

Value-driven structure – a strategy where there is a complete focus on customer value at the expense of cost. Value is created by customizing the product or service to individual preferences. Hyatt Hotel repeat customers are on a first-name basis with hotel staff and are provided with a personalized room before they arrive.Cost-driven structure – which focuses on minimizing the cost of a product or service wherever possible. Businesses focus on creating a lean cost structure through cheap pricing, automation, and the outsourcing of costly activities. Walmart uses immense economies of scale to reduce costs to a point where other retailers cannot compete. Most budget airlines reduce costs by increasing seat capacity, not offering meals, and limiting luggage size.Cost structure attributesA typical cost structure, regardless of strategy or type, has one or more of the following attributes:

Economies of scale – where a company with a high output quota benefits from a lower cost per unit amount. This occurs because large volume orders spread fixed costs more evenly than smaller orders. Economies of scale are common in large organizations that make bulk purchases from a supplier.Economies of scope – here, costs are reduced when an organization expands its operational scope or invests in multiple markets. To derive maximum benefit from economies of scope, each product should require similar marketing messages or utilize the same distribution channel. Fixed costs – or business expenses that remain constant irrespective of volume. Fixed costs can be time-bound, such as a fortnightly employee salary or monthly rent for an office space. Manufacturing companies are also subject to fixed costs such as equipment and facility rental. Fixed costs do not remain fixed indefinitely and will change over time while remaining relatively stable.Variable costs – these are costs that are heavily dependent on volume output and are influenced by supply and demand. In a production scenario, variable costs may be associated with sourcing raw materials, utility bills, and employee labor. Cost structure examplesIn the final section, let’s take a look at a few cost structure examples from some notable companies.

NetflixThe cost structure of Netflix was significant enough in the company’s early days to impact cash flow and growth. Some of these costs include:

The acquisition, production, delivery, and licensing of streaming content. These are likely to be the largest costs for the company today.Platform maintenance.Software development.Research and patents.Amazon Web Services (AWS) for database, analytics, recommendation engines, and video transcoding, to name a few functions.Data centers to provide streaming content.Marketing, human resources, and related infrastructure.Netflix has also benefitted from economies of scope and key activities that match its value proposition.

NikeThe cost structure of Nike is such that the company pockets a relatively small amount of profit from each item it sells. Costs associated with the sale of a pair of sneakers, for example, include:

Retail markup – this is as high as 50% of the total purchase price in some cases.Sea freight and insurance.Free on Board (FOB) costs, which cover the cost of shipping from the factory.Selling, general, and administrative expenses.Customs duties and taxes.In addition to these costs, Nike spends billions on advertising, marketing, sponsorships, brand presentation, and other promotional costs. In 2021, this amounted to $3.11 billion.

TeslaTesla’s cost structure is characterized by fixed manufacturing costs. For each vehicle that rolls off the production line, these include equipment (20%), body (12%), chassis (7%), drive system (15%), battery (35%), and other (11%).

In addition, Tesla has the following costs:

Research and development – consisting of personnel costs related to engineering, research, prototyping, contract and professional services, and costs from amortized equipment.Selling, general and administrative expenses – personal and facilities related costs such as stores, sales, finances, human resources, information technology, and any fees related to legal or contract services and litigation settlements.Restructuring and others – including employee termination costs, disposal of tangible assets, facility sub-leasing losses, and impairment losses.Interest and taxes.AirbnbAirbnb has a relatively simple cost structure when compared to some of its competitors in the hotel industry. This is because the company does not own the accommodation listed on its website and as a result, avoids the many costs associated with hospitality staff and hotel upkeep.

The company’s cost structure consists of the following:

Cost of revenue – which includes online payment processing fees that are paid to Visa and Mastercard. Cost of revenue also encompasses insurance. In the rare event that a guest, host, or cleaner is injured or has their personal property damaged or stolen, Airbnb is responsible for paying out insurance claims.Sales and marketing – such as customer acquisition, customer retention, discounts, promotions, referral fees, and refunds.Research and development – there are also costs associated with ensuring the Airbnb platform is functional, on-trend, intuitive, and streamlined. Other research and development costs include engineering and product development.General and administration – this includes costs related to administration and employees such as HR and finance, legal fees, executives, general managers, and professional services such as freelance photography.Key takeaways:The Cost Structure building block of the Business Model Canvas details the monetary cost of operating as a business. This block is important to get right since many businesses fail due to misunderstanding or underestimating their costs.Cost-structures may be value-driven or cost-driven. As the name suggests, value-driven structures focus on delivering customer value at the expense of minimizing cost. In a cost-driven structure, the opposite is true.Regardless of type, most cost-structure have one or more of the following attributes: economies of scale, economies of scope, fixed costs, and variable costs.Alternatives to the Business Model Canvas FourWeekMBA Squared Triangle Business ModelThis framework has been thought for any type of business model, be it digital or not. It’s a framework to start mind mapping the key components of your business or how it might look as it grows. Here, as usual, what matters is not the framework itself (let’s prevent to fall trap of the Maslow’s Hammer), what matters is to have a framework that enables you to hold the key components of your business in your mind, and execute fast to prevent running the business on too many untested assumptions, especially about what customers really want. Any framework that helps us test fast, it’s welcomed in our business strategy.

An effective business model has to focus on two dimensions: the people dimension and the financial dimension. The people dimension will allow you to build a product or service that is 10X better than existing ones and a solid brand. The financial dimension will help you develop proper distribution channels by identifying the people that are willing to pay for your product or service and make it financially sustainable in the long run.

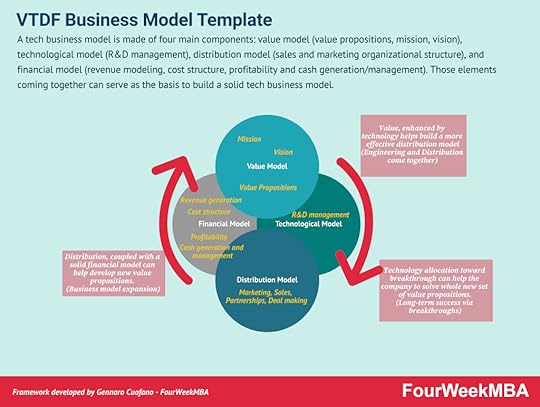

FourWeekMBA VTDF Framework For Tech Business Models

An effective business model has to focus on two dimensions: the people dimension and the financial dimension. The people dimension will allow you to build a product or service that is 10X better than existing ones and a solid brand. The financial dimension will help you develop proper distribution channels by identifying the people that are willing to pay for your product or service and make it financially sustainable in the long run.

FourWeekMBA VTDF Framework For Tech Business Models

This framework is well suited for all these cases where technology plays a key role in enhancing the value proposition for the users and customers. In short, when the company you’re building, analyzing, or looking at is a tech or platform business model, the template below is perfect for the job.

A tech business model is made of four main components: value model (value propositions, mission, vision), technological model (R&D management), distribution model (sales and marketing organizational structure), and financial model (revenue modeling, cost structure, profitability and cash generation/management). Those elements coming together can serve as the basis to build a solid tech business model.

A tech business model is made of four main components: value model (value propositions, mission, vision), technological model (R&D management), distribution model (sales and marketing organizational structure), and financial model (revenue modeling, cost structure, profitability and cash generation/management). Those elements coming together can serve as the basis to build a solid tech business model.

Download The VTDF Framework Template Here

FourWeekMBA VBDE Framework For Blockchain Business ModelsThis framework is well suited to analyze and understand blockchain-based business models. Here, the underlying blockchain protocol, and the token economics behind it play a key role in aligning incentives and also in creating disincentives for the community of developers, individual contributors, entrepreneurs, and investors that enable the whole business model. The blockchain-based model is similar to a platform-based business model, but with an important twist, decentralization should be the key element enabling both decision-making and how incentives are distributed across the network.

[image error]A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model.

Download The VBDE Framework Template Here

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Cost Structure Business Model Canvas appeared first on FourWeekMBA.

February 28, 2022

What are Kroger subsidiaries?

Kroger is an American retail and multi-department store company that operates in the United States. The company was founded in 1883 by Bernard Kroger who used his life savings to open a small grocery store in downtown Cincinnati, Ohio. Over its long and successful history, Kroger has inherited various subsidiaries via mergers and acquisitions. Today, Kroger is the largest true supermarket operator in the United States with over 2,750 stores across 35 states. The company also owns fuel centers, pharmacies, department stores, jewelry stores, and in-store medical clinics.

City MarketCity Market is a supermarket brand that was founded in 1924 by Paul, Frank, Leo, and Clarence Prinster. There are 35 City Market stores in the United States at the time of writing in the states of Colorado, Utah, Wyoming, and New Mexico.

City Market was acquired by the Dillon Companies in 1981, which then became part of Kroger when the two companies merged in 1983.

QFCQuality Food Centers (QFC) is another supermarket chain with a strong presence in Washington state. The company was founded by Jack Croco, a former Albertson’s employee who opened his own grocery store in Bellevue.

Over the 70s, 80s, and 90s, QFC expanded into surrounding counties and states with multiple acquisitions. The company was acquired by Fred Meyer in 1997 that was itself acquired by Kroger the following year.

Smith’s Food and DrugSmith’s Food and Drug, affectionately known as Smith’s, is a regional supermarket chain that was founded in 1911 by Lorenzo Smith.

Smith’s was acquired by Kroger at the same time as QFC as part of the Fred Meyer deal. This deal was the one that elevated Kroger to the largest supermarket chain in the country and also the nation’s largest supplier of milk and eggs. It was estimated that the deal would result in $43 billion in revenue or around $67 billion in today’s money.

Mariano’sMariano’s is a grocery store chain that was founded relatively recently in 2010. The chain sells items such as smoked ribs, oysters, liquor, cheese, sushi, gelato, and smoothies.

Mariano’s expanded quickly in the Chicago area with 34 stores opening in the first five years of operation. When Kroger acquired Milwaukee-based supermarket chain Roundy’s in 2015, it also took control of Mariano’s in a deal worth around $800 million.

Food 4 Less (Foods Co)Food 4 Less and Foods Co are no-frills grocery store chains operating in Illinois, Indiana, and Southern California where customers must bag their own items.

There are also other stores scattered around the country as part of franchise deals with different wholesale food companies.

Home ChefHome Chef is a meal kit and food delivery that provides ingredients and recipes to customers in the United States every week. Each delivery contains fresh and pre-portioned items in recyclable packages that are ready to cook.

In May 2018, Kroger announced the acquisition of Home Chef for $200 million.

Key takeaways:Kroger is an American retail and multi-department store company that operates in the United States. Kroger is the largest true supermarket operator in the United States.Kroger subsidiaries include supermarket chains QFC, City Market, and Smith’s Food and Drug, with all three moving under the Kroger brand after acquisitions of other companies.Kroger also acquired Chicago-centric grocery store chain Mariano’s in 2015 when it purchased Milwaukee-based chain Roundy’s. Kroger also owns discount chain Food 4 Less and food delivery service Home Chef.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What are Kroger subsidiaries? appeared first on FourWeekMBA.

What are the LVMH subsidiaries?

LVMH is a French multinational corporation and conglomerate with a focus on luxury goods. The company, which is officially known as LVMH Moët Hennessy Louis Vuitton, was founded in 1987 by Bernard Arnault, Alain Chevalier, and Henry Racamier. Arnault, a French investor, had the idea to create a luxury brand group from the outset. To realize this vision, he collaborated with the CEO of Moët Hennessy Alain Chevalier and the president of Louis Vuitton Henry Racamier. The integration of these aspirational brands was ultimately successful and has been replicated by other companies in the industry. At the time of writing, LVMH operates 75 subsidiaries which it calls houses across six core sectors: wines and spirits, fashion and leather goods, perfumes and cosmetics, watches and jewelry, selective retailing, and other activities.

Parfums Christian DiorParfums Christian Dior is the perfumery, makeup, and skincare line of French fashion house Christian Dior SE which was founded in 1946 and is now chaired by Bernard Arnault.

The first product to be released was a women’s perfume, but in more recent times the subsidiary has started selling men’s fragrances and a greater variety of cosmetics. These include foundations, concealers, mascara, brushes, and lipstick.

Dom PérignonDom Pérignon is a vintage champagne brand that was named after the Benedictine monk and cellar master who was a pioneer of blending grapes to improve wine quality.

The quality and pedigree of Dom Pérignon are such that the wine will not be produced in years considered to be poor vintages. LMVH assumed control over the company when it acquired fellow wines and spirits house Moët & Chandon.

ChaumetChaumet is a luxury jeweler and watchmaker that was founded in 1780 by Marie-Étienne Nitot. With over 240 years of craftsmanship experience and an impressive list of clientele, the company has seen expansion into Asia with a particular focus on the Chinese market.

LVMH acquired Chaumet in 2012.

DFSOne of the less well-known LVMH subsidiaries is luxury product travel retailer DFS.

The company, which was founded in Hong Kong in 1960, operates over 400 duty-free stores across 15 major airports and 18 popular travel destinations.

In addition to high-end products, DFS also sells premium services such as a beauty concierge and exclusive airport lounge access.

Royal Van LentRoyal Van Lent is a Dutch manufacturer of luxury yachts that was founded as an association of families to revive the industry after World War II. One of these families was the Van Lent family, who owned a shipyard many years beforehand and consistently produced fast yachts that won speed races.

The company was awarded its royal charter in 2001, with LVMH acquiring it seven years later. Royal Van Lent’s signature Feadship Tango superyacht was released in 2011 and retailed for approximately $120 million.

Key takeaways:LVMH is a French multinational corporation and conglomerate with a focus on luxury goods. At the time of writing, LVMH operates 75 subsidiaries which it calls houses across six core sectors.Parfums Christian Dior is a men’s and women’s cosmetic company owned by LVMH, while the famous champagne brand Dom Pérignon also came under the company umbrella after it acquired fellow wines and spirits brand Moët & Chandon.Some lesser-known LVMH subsidiaries include luxury watch and jewelry maker Chaumet, premium duty-free product and service provider DFS, and Dutch yacht manufacturer Royal Van Lent.Read Next: LVMH Business Model, Kering Business Model, Prada Business Model.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What are the LVMH subsidiaries? appeared first on FourWeekMBA.

What is intermodal freight?

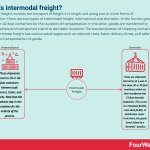

Intermodal freight involves the transport of freight in a single unit using two or more forms of transportation. There are two types of intermodal freight: international and domestic. In the former, goods stay in 20 or 40-foot containers for the duration of transportation. In the latter, goods are transferred to larger containers and transported inland to domestic locations. The standardization of shipping containers means intermodal freight has various advantages such as reduced costs, faster delivery times, and safer and more secure transportation of goods.

Understanding intermodal freightIntermodal freight involves the transport of freight in a single unit using two or more forms of transportation.

Intermodal freight utilizes a combination of two or more transportation modes such as road, rail, air, or sea. In this form of shipping, the goods are sealed in cargo transport units (CTUs) whose dimensions are standardized to allow the goods to remain in the same unit across multiple modes of transportation.

This means that when a CTU is moved from one form of transport to another, it is the CTU itself that is handled and not the goods that are contained within. However, as we will explain later, there are some exceptions to this rule. Transfers occur in an intermodal station or terminal which contains specialized equipment.

It’s also worth noting the difference between the intermodal form of transportation and two related concepts in transloading and multimodal freight:

In general, intermodal transportation does not involve the handling of goods until they arrive at a final destination. During transloading, however, goods are routinely consolidated or reconsolidated as required.In intermodal transportation, there are multiple contracts for each separate carrier. Conversely, multimodal transportation is characterized by a single contract where the same carrier is responsible for moving goods across different transportation modes.According to research conducted by Technavio, the intermodal freight transportation market is expected to grow by $46.55 billion in the four years to 2025.

The two categories of intermodal freightThere are two categories of intermodal freight:

International intermodal – these shipments travel in 20 or 40-foot containers between bulk carriers, trains, and trucks. Note that the products stay in the container for the entirety of the process.Domestic intermodal – these are shipments that arrive at a port in the same 20 or 40-foot containers which are then transferred into 53-foot domestic containers. This occurs at a transload facility, cross-dock facility, or distribution center. From there, the goods travel inland to a “domestic” location.Advantages of intermodal freightThe standardization of shipping container dimensions has clear benefits for companies and the industry as a whole:

Rapid service – containers result in the more efficient transfer of goods from one transport mode to another. Delivery times are reduced since the shipping company needs to spend less time loading and unloading.Lower and more predictable costs – with less time spent on handling, costs tend to be lower. Many shipping companies also utilize rail transport for the longest distances to further reduce costs, with railroads in the United States able to move one tonne of freight more than 470 miles on a single gallon of fuel. Rail transport also tends to make costs more predictable as there are fewer unforeseen delays when compared to transporting goods by road.Safety and security – intermodal rail freight tends to be a safer option for transporting flammable or hazardous materials because there is less chance of an accident. This also contributes to faster delivery as there are fewer restrictions that dictate how these materials can be transported. Intermodal freight is also inherently more secure than some other types. Since there is no requirement to handle individual items, there is less chance for opportunistic theft. What’s more, containers that are loaded onto railway cars are dropped into a well which makes them impossible to open.Read Next: Transloading, Break-Bulk, Cross-Docking, Supply Chain, AI Supply Chain, Metaverse Supply Chain, Costco Business Model.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What is intermodal freight? appeared first on FourWeekMBA.

What is transloading?

Transloading is the process of moving freight from one form of transportation to another as a shipment moves down the supply chain. Transloading facilities are staged areas where freight is swapped from one mode of transportation to another. This may be indoors or outdoors, depending on the transportation modes involved. Deconsolidation and reconsolidation are two key concepts in transloading, where larger freight units are broken down into smaller pieces and vice versa. These processes attract fees that a company pays to maintain the smooth operation of its supply chain and avoid per diem fees.

Understanding transloadingTransloading is the process of moving freight from one form of transportation to another as a shipment moves down the supply chain.

Transloading is a term that describes the transfer of freight from one form of transportation to another while it is en route to its final destination.

The process is used when one transportation mode cannot be used over the entire route. Consider the example of iron ore that needs to be shipped from an inland mine in Brazil to a foundry in China. The iron ore must first be transported to a port by train where it is then transferred to a ship. Once the ship arrives at the Chinese port, it is transferred back to a train where it is taken to the foundry to be processed.

Transloading also encompasses international freight transported by a ship that is transferred to waiting trucks which then transport it to warehouses and distribution centers. In some other instances, freight that is moved by rail for most of the trip is then transferred to trucks for the last-mile delivery. While the process of transloading may seem convoluted, it is important to note that trucks are usually the only form of transportation that can arrive at the final destination. Therefore, it makes sense for truck transport to take over from rail, air, or sea transport no matter how near the final destination may be.

Transloading facilitiesTransloading facilities are staged areas where freight is swapped from one mode of transportation to another. For train and truck transport, these facilities are located in railyards that are themselves near major highways. Railyards are also used for train-to-train transloading where a change in railway gauge makes it impossible for one train to continue to complete the entire journey.

Transloading areas can also be located inside a warehouse or distribution facility – particularly if rail infrastructure is absent or unsuitable. Indoor facilities are also used to unload the contents of a shipping container into a truck for final delivery.

Deconsolidation, reconsolidation, and transload feesDeconsolidation and reconsolidation are two key concepts in transloading:

DeconsolidationThe process of separating a unit of freight into smaller units, can occur right down to the individual component level.

ReconsolidationThe opposite process of combining smaller units into larger units. Shipping companies tend to reconsolidate freight into trucks that are headed to the same or similar destination or region.

If there are multiple final delivery destinations, transload fees apply to cover the cost of deconsolidating the container and then palletizing the freight ready before it is loaded. Similar fees apply to reconsolidation.

Companies are willing to pay these fees to keep their supply chains operational and avoid per diem fees that are charged by the shipping company to rent a container. These fees, which can range anywhere between $50 and $100 per day, apply to containers that sit idle and exceed their allotted rental time. Essentially, per diem fees are charged because the shipping company’s efficiency is reduced when its containers are out of circulation.

Read Next: Break-Bulk, Cross-Docking, Supply Chain, AI Supply Chain, Metaverse Supply Chain, Costco Business Model.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What is transloading? appeared first on FourWeekMBA.

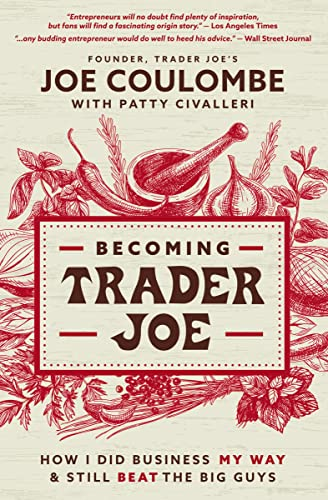

What Is Trader Joe’s? The History of Trader Joe’s With Patty Civalleri [FourWeekMBA Podcast]

For this episode, I interviewed Patty Civalleri, author at 1-TAKE Publishing LLC. She authored many incredible travel guides. And she made sure the memoir of Joe Coulombe could come to life:

Becoming Trader Joe: How I Did Business My Way and Still Beat the Big Guys

Can we get a little bit into the story and the context of how you got into this book and the initial years of Trader Joe’s as a company?

Can we get a little bit into the story and the context of how you got into this book and the initial years of Trader Joe’s as a company?Patty Civalleri:

Yes. I got involved in the stories socially and Joe had written a journal about the founding of Trader Joe’s and he held onto it and made changes over the years, and one day he found it in a box and didn’t know what to do with it, so he gave it to his first employee Mr. Leroy Watson, who is a very close friend of my husband. And because we’ve been friends with Mr. Watson for many, many years, I have met Joe socially, gosh, many times over the last couple decades. So when Joe asked Leroy to do something with this book, Leroy came to me and he said, “Patty, you have published many books, can you help us do something with this book?” And I had written many books about Italy for travelers being a historian and Italy has the coolest history in the world.

I took a look at the manuscript and I fell in love with Joe’s story, what a great story. So I looked at it it was very raw, it needed a lot of work, so I spent many months bringing the manuscript, cleaning it up and making it work and rearranging everything. And I sat down with my agent and said, “Paul, can we sell this manuscript?” And we got several bids for the manuscript, but the winning bid was from HarperCollins, one of the largest American publishers in the world and that’s how we got the story published.

And as soon as we signed the contract with HarperCollins, the following week Joe passed away, which was a very sad event, and left me wondering how on earth I was going to promote this book without Joe, because he is clearly the center pin of all of this. But I realized that since Joe’s passing it’s much more important now to get his story out and get his history out, so that his story is not lost to history and doesn’t get lost. So the book was published late last summer and it’s gone global, we’re so extremely happy with it and it looks like a book that’s going to be around for a long time, so we’re quite happy.

Gennaro:

Yeah. As I was telling you I’m very glad that the book came to life because it’s an evergreen, the story it’s very compelling, it’s contemporary, the way it is written it’s very practical. For a digital entrepreneur as well, looking at the story behind how you create such a valuable brand, it’s incredible, so thanks for putting this together. How were the first and early years before we get to Trader Joe’s because the story before Trader Joe’s would come to life there is an evolution to that?

What’s the story behind Trader Joe’s, especially the story of the man who founded the company. Joe Coulombe?Patty Civalleri:

Joe was born in Southern California on an avocado farm, avocados grow very well here in Southern California, but Joe went to Stanford University and got an MBA at Stanford. And right out of school Joe got his first job with Rexall Drugs, which was a large pharmaceutical retail company here in the United States at the time. And Joe was very bright and had quite a compelling personality, and he got the attention of the executives at Rexall very early when he was working there, and they adopted Joe and took him under their wing and groomed him for executive management, which is incredible because you learn a lot more in real life than you could ever learn in school, in a classroom, and every entrepreneur knows that. Joe was called into the executive offices one day and they said, “Listen, Joe, we have funding for six stores and we don’t know what to do with these six stores, so we want to send you around the United States to go find a model that doesn’t exist here in California, but that could work here in California.”

So Joe set off for a couple of months on a road trip and visited many different types of retail stores. When he finally got to Texas he found a chain of variety stores that were all over Texas and doing very well. For those that don’t know the American definition for a variety store is sort of a small footprint store, that you can just run in real quick and run back out, that you could buy anything from paper towels and toilet paper, to cereal, to olives, to beer, dog food, everything all in one small store, they’re convenience stores basically. And California didn’t have that kind of convenience variety store, so he brought that idea back to Rexall and Rexall said, “Okay, Joe, we can open six stores. We’re going to give you 49%, we’re going to retain 51%, and you open and run and manage and grow those stores.”

So it took Joe a couple of years, but he managed to open all of them and he opened another one, a seventh store, which was 100%, his own store. Those stores were called Pronto markets, pronto meaning fast. And it’s a place you could just run in and get something that you need very quickly and run back out again, so Joe started and ran those, and by 1958, they were open, they were doing well, and Joe had a good plan for them. So Joe went back to Rexall and said, “Hey guys, if you let me buy out your 51% at market cost, I would like to be the owner of 100% of Pronto Markets.” And Pronto responded, “You pay us 10% over the market and they’re yours.” Well, now Joe really didn’t have any money, he didn’t have two nickels to rub together at the time.

And so he went to his employees, he used very creative financing, he got some loans for part of it, bank loans, part of it, he got from his employees where Joe had created tremendous loyalty with his employees. So when Joe went back to his employees and said, “Hey guys, we have the ability to maybe own this company, all of these stores, would you guys like to buy in as my partners?” And he got a lot of partners to step up and put up the money and it was wonderful, because creative financing and employee loyalty is huge. He also got money from a company, a dairy called Adohr Farms. Adohr Farms was a dairy company. Back then the dairy companies had milk trucks and the milk trucks would come to your home and deliver all the dairy products, milk, eggs, cheeses, those kinds of things, and they would deliver them to your home once a week or however often you wanted them to deliver.

And one of the major brands back then was called Adohr Farms, which was run by a guy named Merritt Adamson Jr. And Merritt had been trying to get Joe’s business for several years, he wanted the Pronto Market business, he wanted Joe to carry Adohr Farms on the shelves in Pronto Markets. So when Joe needed this money to buy out Rexall for the Pronto Markets, he went to Merritt and said, “Hey, I need some extra money. I’ll tell you what, let’s make a deal. If you give me a loan I will carry all of your dairy products, so that we can grow together. As my company grows, I’ll be paying back the loans and I’ll be buying your milk products from you.”

And they shook on it, they shook hands and made a deal. And so Joe was able through these various ways to bring the money in to buy out Rexall, which was really great. So now Joe has seven stores. He has seven Pronto Markets, they’re healthy and they’re young and he has a plan. So over the next few years he grows them and grows them more, and in the 1960s he now has 16 stores, this is the late 1960s. He’s up to 16 stores and he’s got a lot of his own blood, sweat, and tears invested in the growth of the company. One day he and Merritt were sitting down having a cocktail and Merritt told Joe that he had bad news for Joe, that the company in Texas that had all of those variety stores found a way to change their policy to be able to open stores in California.

Well, that brought a chill up Joe’s spine because he knew that that company had a giant, giant bank account and a giant marketing budget. And that this company was going to come to California and roll over Joe like a truck and Joe didn’t know what to do, he knew with his little 16 stores that there was no way he could stand up to those stores. So he felt he had two choices, he could either try to stand up to those stores but eventually die a slow, painful death, or he could close his business on Monday morning and call it a day.

Gennaro:

Yeah. And that would’ve been an easy solution also because just to remind the audience, the company that you’re talking about was 7-Eleven, which at the time-

Patty Civalleri:

Yes.

Gennaro:

7-Eleven was a giant. Compared to the Pronto Markets, which was just a bunch of stores, a few stores that of course were successful, and they had grown into also successful customer clients for the company owned by Merritt, which was the first real partnership that Trader Joe… actually Joe Coulombe had in place. But what happened next? Because, okay, as you said we went from the ’50s to the ’60s, there was this idea of Joe Coulombe to start a set of markets based on the idea of 7-Eleven, which was in Texas and other states, but was not yet in California.

Also, it’s important to remember the context we are in after a Second World War period, where there were still a lot of regulations that limited the supply of some of the goods that many retail would be able to sell. So there were a lot of barriers to entering this industry, and this definitely helped initially Joe to get started.

But what was the evolution from Pronto Markets to Trader Joe’s? And What happened next and how did he eventually manage to succeed, even though he experienced many near-death and bankruptcies in the company?Patty Civalleri:

It’s funny, Joe is a very visual man, when you would sit down to have a conversation with Joe, you can see him, he would always look up and you can see that he was envisioning whatever topic you were talking about, you could see that he was watching it in his head, he was a very visual human being and so he would always see pictures and images in his head. Well, this particular weekend when he just didn’t know what to do, and he felt very threatened, and should he close down or die a slow lingering death, he felt those were his two choices. He gathered his wife and children and they got in the car and drove up to a mountain in Southern California for the weekend, and he just closed the door just to think, he just wanted to think.

He was scared to death. He knew he was going to leave everything and he was going to lose his loyal employees, he was going to lose his vendors, he was going to lose everything that he worked so hard for over the last 10, 12, 15 years, and so he was very scared. And as he sat there, he started thinking about a ride that he took at Disneyland with his family. And it was a Pirates of the Caribbean ride, for anybody that’s ever been to Disneyland I’m sure you might have experienced that ride. But that memory came back into his head and he started to think about a movie that he had recently seen about these old ships, these old sailing ships from the 1700s that would travel around the world with their big beautiful sales.